Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AtriCure, Inc. | atrc-20160111x8k.htm |

| EX-99.1 - EX-99.1 - AtriCure, Inc. | atrc-20160111ex9915fa5b2.htm |

AtriCure, Inc.

Forward Looking Statements/Non-GAAP Measures

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements that address activities, events or developments that AtriCure expects, believes or anticipates will or may occur in the future, such as earnings estimates (including projections and guidance), other predictions of financial performance, launches by AtriCure of new products and market acceptance of AtriCure’s products. Forward-looking statements are based on AtriCure’s experience and perception of current conditions, trends, expected future developments and other factors it believes are appropriate under the circumstances and are subject to numerous risks and uncertainties, many of which are beyond AtriCure’s control. These risks and uncertainties include the rate and degree of market acceptance of AtriCure’s products, AtriCure’s ability to develop and market new and enhanced products, the timing of and ability to obtain and maintain regulatory clearances and approvals for its products, the timing of and ability to obtain reimbursement of procedures utilizing AtriCure’s products, AtriCure’s ability to consummate acquisitions or, if consummated, to successfully integrate acquired businesses into AtriCure’s operations, AtriCure’s ability to recognize the benefits of acquisitions, including potential synergies and cost savings, failure of an acquisition or acquired company to achieve its plans and objectives generally, risk that proposed or consummated acquisitions may disrupt operations or pose difficulties in employee retention or otherwise affect financial or operating results, competition from existing and new products and procedures or AtriCure’s ability to effectively react to other risks and uncertainties described from time to time in AtriCure’s SEC filings, such as fluctuation of quarterly financial results, reliance on third party manufacturers and suppliers, litigation or other proceedings, government regulation, and stock price volatility. AtriCure does not guarantee any forward-looking statements, and actual results may differ materially from those projected. AtriCure undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. A further list and description of risks, uncertainties and other matters can be found in AtriCure’s Annual Report on Form 10-K for the previous year and in AtriCure’s reports on Forms 10-Q and 8-K. This presentation includes the use of non-GAAP measures. Reference AtriCure’s Form 8-K filings which include the furnishing of our earnings releases for a reconciliation to the related GAAP measures.

AtriCure is uniquely positioned to address the growing, global Afib epidemic

The only FDA-approved devices for surgical Afib ablation: 120,000+ cases in 800 US centers

Large Underpenetrated Markets

15M A-Fib patients in developed countries;

Estimated 25% penetrated in cardiac surgery patients

Strong Growth and Pipeline

14 consecutive Q’s of solid growth

Several FDA Clinical trials underway

Strong R&D Pipeline

Expanding sales team

Well-established

Afib Training programs

delivered to 1,500+ surgeons

Let’s Start With A Simple Concept:

Afib is debilitating and with an aging population it is a rapidly growing epidemic

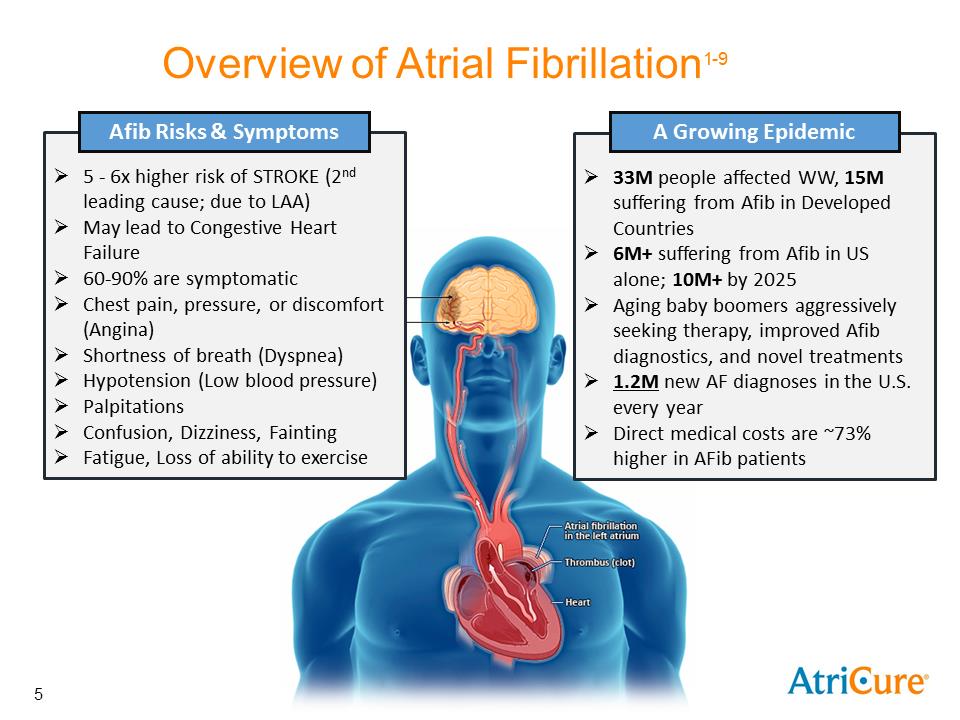

Overview of Atrial Fibrillation1-9

Afib Risks & Symptoms

5 - 6x higher risk of STROKE (2nd leading cause; due to LAA)

May lead to Congestive Heart Failure

60-90% are symptomatic

Chest pain, pressure, or discomfort (Angina)

Shortness of breath (Dyspnea)

Hypotension (Low blood pressure)

Palpitations

Confusion, Dizziness, Fainting

Fatigue, Loss of ability to exercise

A Growing Epidemic

33M people affected WW, 15M suffering from Afib in Developed Countries

6M+ suffering from Afib in US alone; 10M+ by 2025

Aging baby boomers aggressively seeking therapy, improved Afib diagnostics, and novel treatments

1.2M new AF diagnoses in the U.S. every year

Direct medical costs are ~73% higher in AFib patients

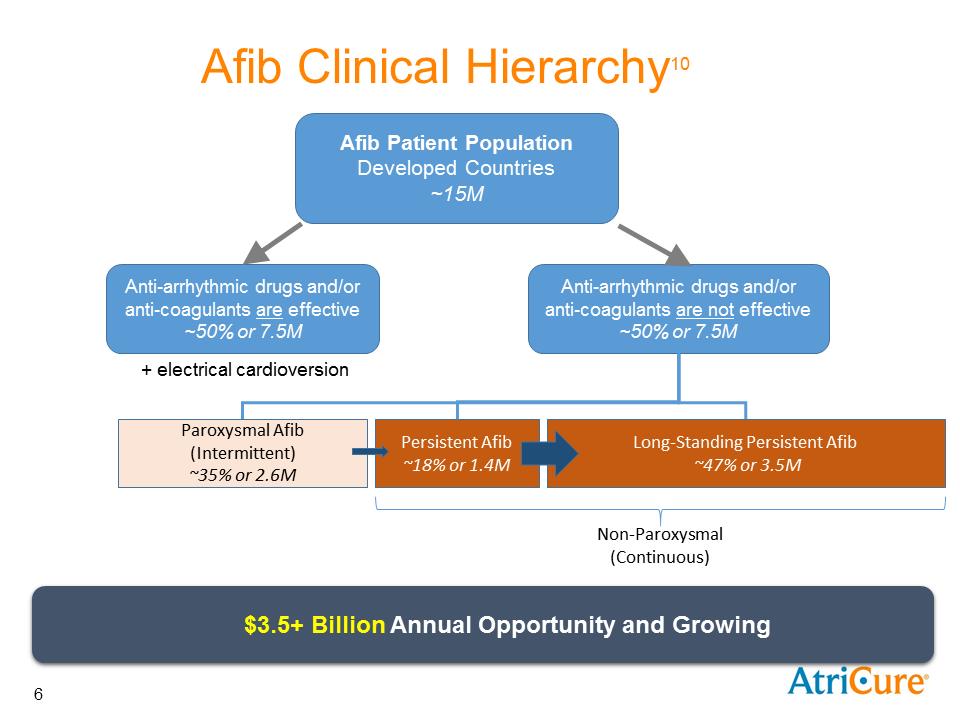

Afib Clinical Hierarchy10

Afib Patient Population

Developed Countries

~15M

Anti-arrhythmic drugs and/or anti-coagulants are effective

~50% or 7.5M

+ electrical cardioversion

Anti-arrhythmic drugs and/or anti-coagulants are not effective

~50% or 7.5M

Paroxysmal Afib

(Intermittent)

~35% or 2.6M

Persistent Afib

~18% or 1.4M

Long-Standing Persistent Afib

~47% or 3.5M

Non-Paroxysmal

(Continuous)

$3.5+ Billion Annual Opportunity and Growing

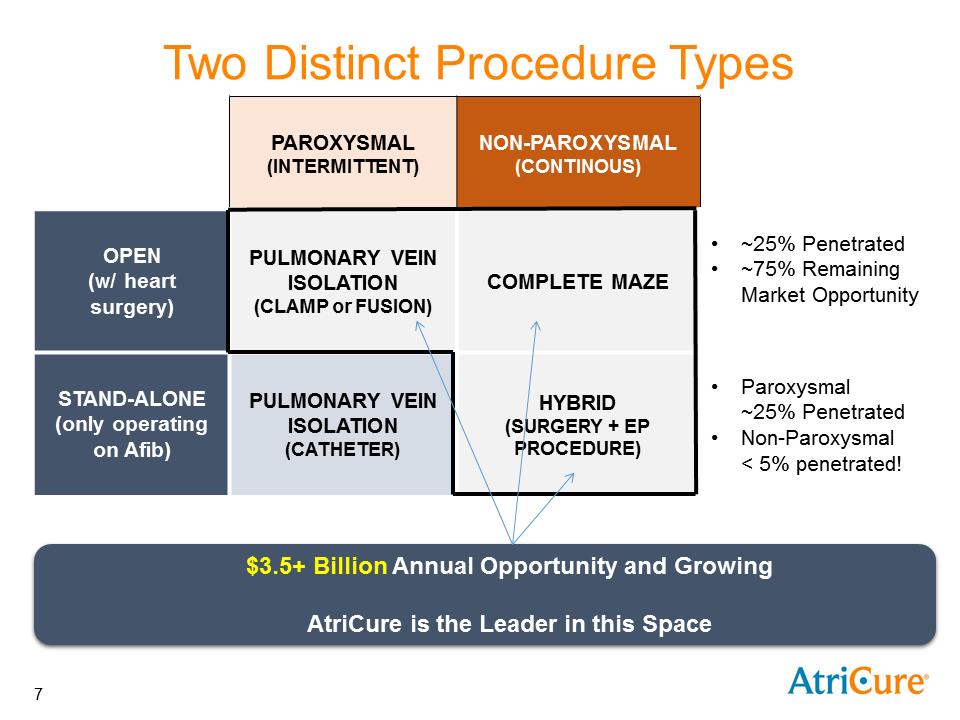

Two Distinct Procedure Types

PAROXYSMAL (INTERMITTENT)

NON-PAROXYSMAL (CONTINOUS)

OPEN (w/ heart surgery)

PULMONARY VEIN ISOLATION

(CLAMP or FUSION)

COMPLETE MAZE

~25% Penetrated

~75% Remaining Market Opportunity

STAND-ALONE

(only operating on Afib)

PULMONARY VEIN ISOLATION

(CATHETER)

HYBRID

(SURGERY + EP PROCEDURE)

Paroxysmal ~25% Penetrated

Non-Paroxysmal < 5% penetrated!

$3.5+ Billion Annual Opportunity and Growing

AtriCure is the Leader in this Space

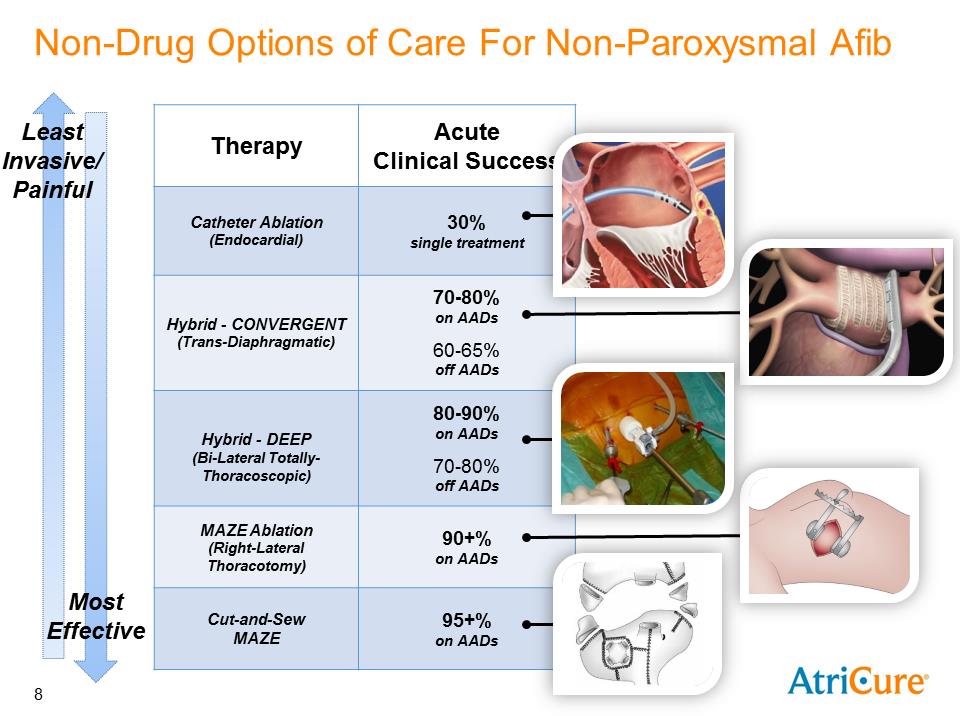

Non-Drug Options of Care For Non-Paroxysmal Afib

Least Invasive/ Painful

Therapy

Acute

Clinical Success

Catheter Ablation

(Endocardial)

30%

single treatment

Hybrid - CONVERGENT

(Trans-Diaphragmatic)

70-80%

on AADs

60-65%

off AADs

Hybrid - DEEP

(Bi-Lateral Totally-Thoracoscopic)

80-90%

on AADs

70-80%

off AADs

MAZE Ablation

(Right-Lateral Thoracotomy)

90+%

on AADs

Cut-and-Sew

MAZE

95+%

on AADs

Most Effective

What Does AtriCure Do?

Provide solutions to treat Atrial Fibrillation (Afib) and resulting complications

Large, underpenetrated market (33M people globally)

Debilitating disease impacting quality of life

Increases stroke risk

AtriCure is the undisputed market leader

Broad and deep product portfolio

Only surgical FDA approval to treat Afib

Strong IP in the field of Afib

Strongest brand with high-quality and innovative products

Leading KOL support and enthusiasm

Dedicated to training and education

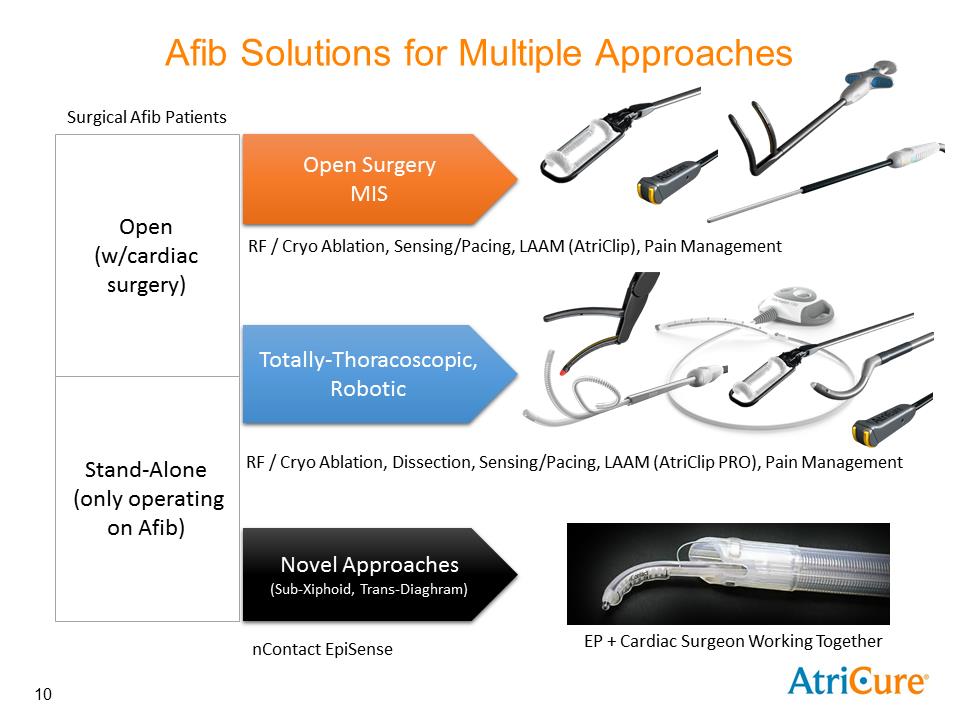

Afib Solutions for Multiple Approaches

Open (w/cardiac surgry)

Open Surgery

MIS

RF / Cryo Ablation, Sensing/Pacing, LAAM (AtriClip), Pain Management

Totally-Thoracoscopic,

Robotic

RF / Cryo Ablation, Dissection, Sensing/Pacing, LAAM (AtriClip PRO), Pain Management

Stand-Alone

(only operating on Afib)

Novel Approaches

(Sub-Xiphoid, Trans-Diaghram)

nContact EpiSense

EP + Cardiac Surgeon Working Together

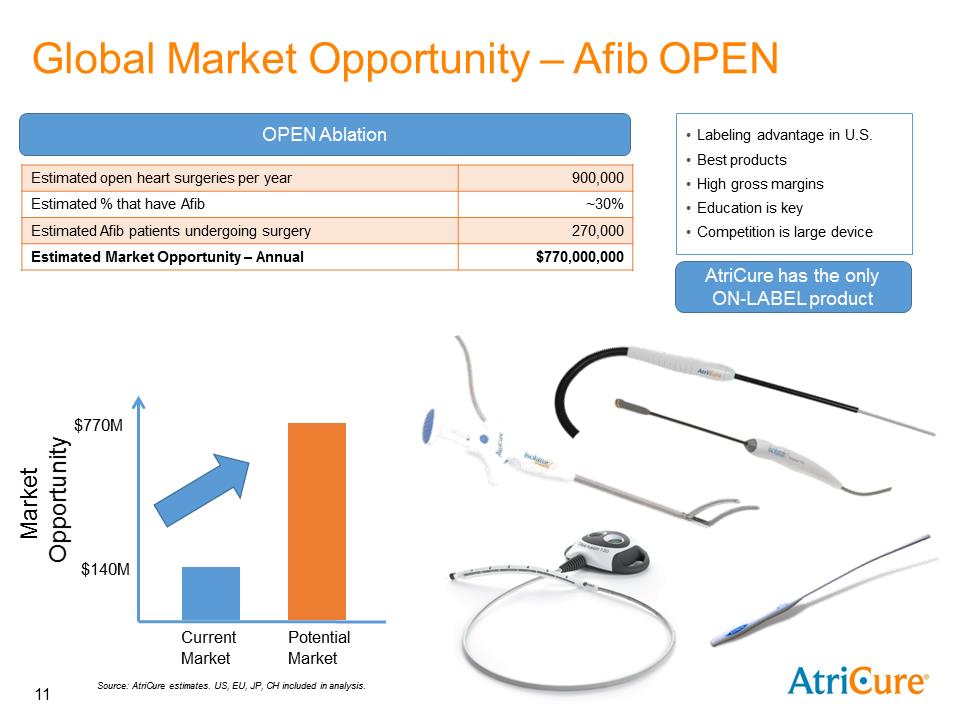

Global Market Opportunity – Afib OPEN

OPEN Ablation

Estimated open heart surgeries per year900,000

Estimated % that have Afib~30%

Estimated Afib patients undergoing surgery270,000

Estimated Market Opportunity – Annual$770,000,000

Labeling advantage in U.S.

Best products

High gross margins

Education is key

Competition is large device

AtriCure has the only

ON-LABEL product

Market

Opportunity

Current

Market

Potential

Market

Source: AtriCure estimates. US, EU, JP, CH included in analysis

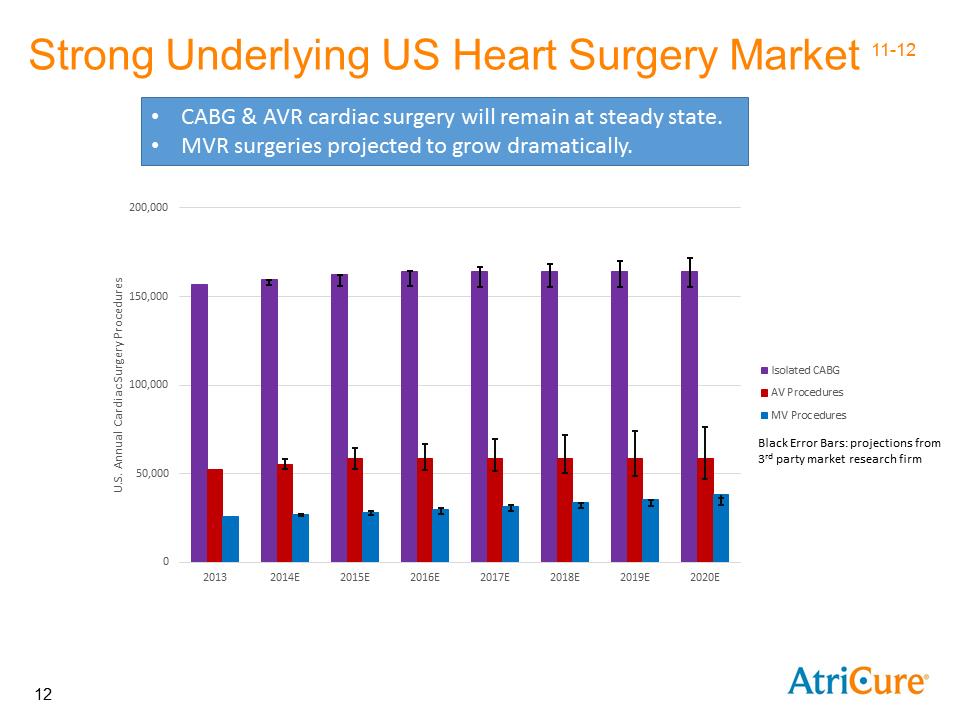

Strong Underlying US Heart Surgery Market 11-12

CABG & AVR cardiac surgery will remain at steady state.

MVR surgeries projected to grow dramatically.

U.S. Annual Cardiac Surgery Procedures

Isolated CABG

AV Procedures

MV Procedures

Black Error Bars: projections from 3rd party market research firm

20132014E2015E2016E2017E2018E2019E2020E

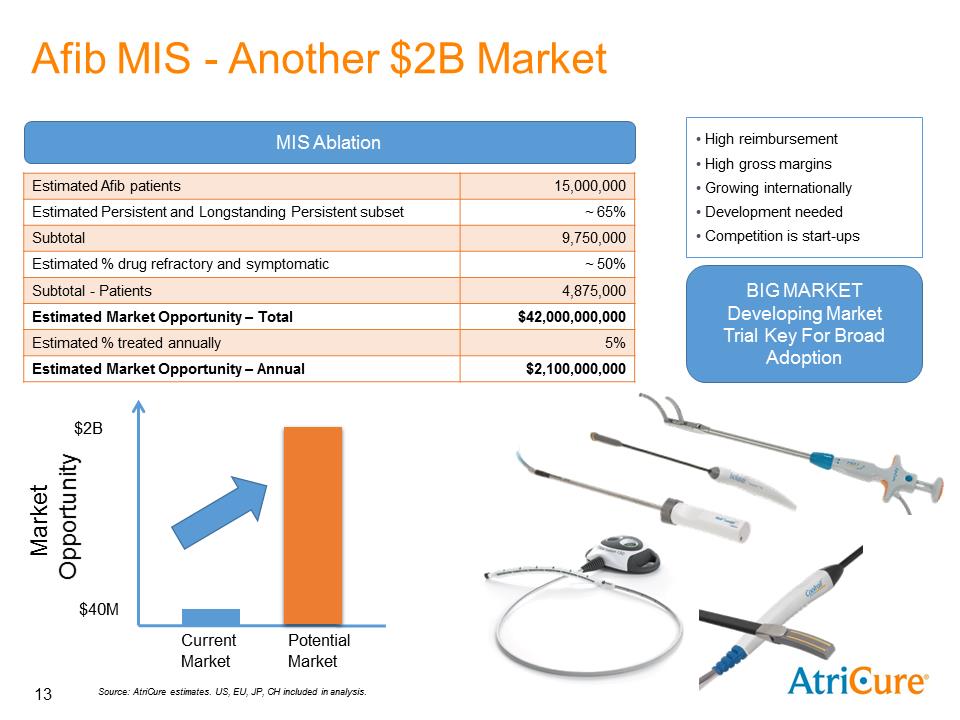

Afib MIS - Another $2B Market

MIS Ablation

Estimated Afib patients15,000,000

Estimated Persistent and Longstanding Persistent subset~ 65%

Subtotal9,750,000

Estimated % drug refractory and symptomatic~ 50%

Subtotal - Patients4,875,000

Estimated Market Opportunity – Total$42,000,000,000

Estimated % treated annually5%

Estimated Market Opportunity – Annual$2,100,000,000

High reimbursement

High gross margins

Growing internationally

Development needed

Competition is start-ups

BIG MARKET Developing Market

Trial Key For Broad Adoption

Market Opportunity

Current Market

Potential Market

Source: AtriCure estimates. US, EU, JP, CH included in analysis.

Global Market Opportunity – LAA OPEN

(AtriClip)

OPEN LAA (AtriClip)

Estimated Open heart surgeries per year900,000

Estimated % that have Afib~30%

Estimated Afib patients undergoing surgery270,000

Estimated Market Opportunity – Annual$275,000,000

Best in class LAA management

Superior safety - No adverse events

Mechanical & Electrical Solution

Competition includes Tiger Paw, staple, suture, ligature (endo loop)

4+ Years of clinical experience

More implants than competition (50K+)

UPSIDE:

Prophylactic treatment could more than double this market

Another $500M market!

Market

Opportunity

Current

Market

Potential

Market

Source: AtriCure estimates. US, EU, JP, CH included in analysis.

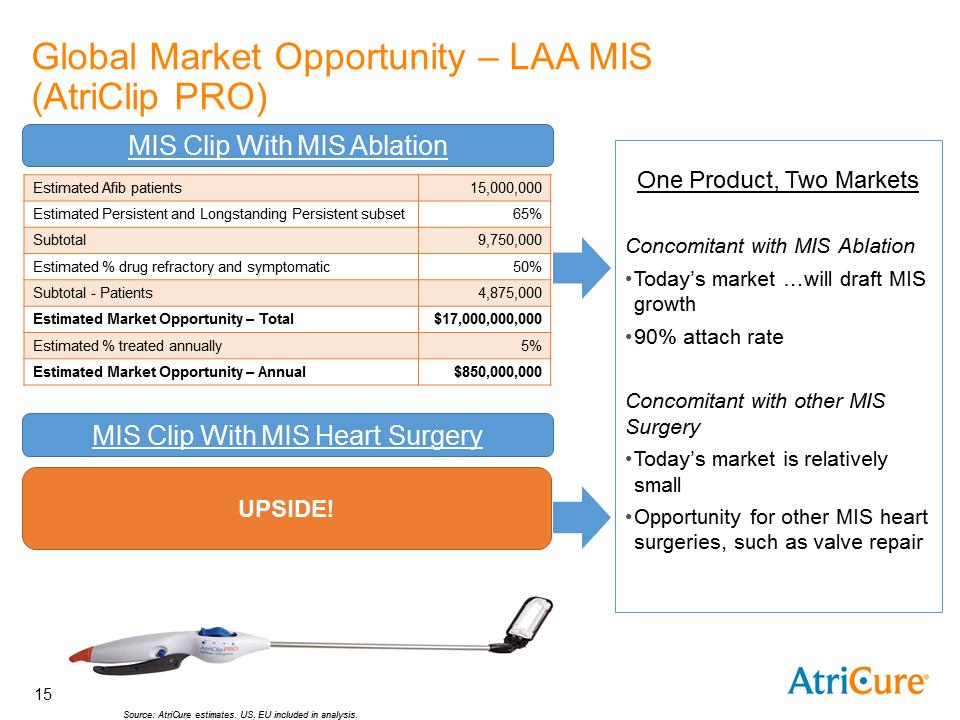

Global Market Opportunity – LAA MIS

(AtriClip PRO)

MIS Clip With MIS Ablation

Estimated Afib patients15,000,000

Estimated Persistent and Longstanding Persistent subset 65%

Subtotal9,750,000

Estimated % drug refractory and symptomatic50%

Subtotal - Patients4,875,000

Estimated Market Opportunity – Total$17,000,000,000

Estimated % treated annually5%

Estimated Market Opportunity – Annual$850,000,000

One Product, Two Markets

Concomitant with MIS Ablation

Today’s market …will draft MIS growth

90% attach rate

MIS Clip With MIS Heart Surgery

Concomitant with other MIS Surgery

Today’s market is relatively small

UPSIDE!

Opportunity for other MIS heart surgeries, such as valve repair

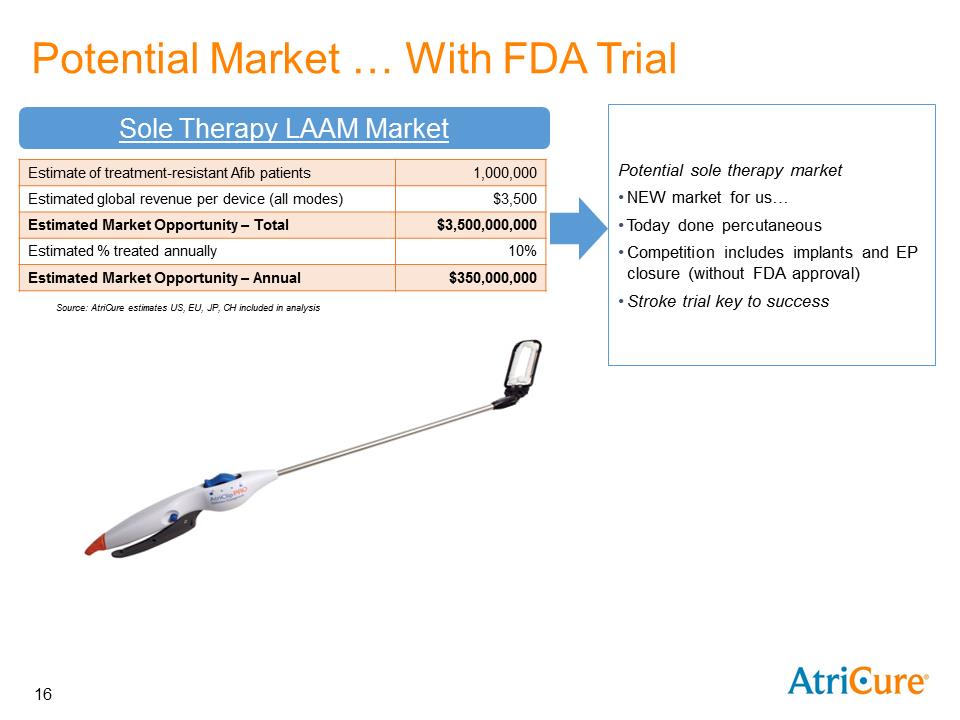

Potential Market … With FDA Trial

Sole Therapy LAAM Market

Estimate of treatment-resistant Afib patients1,000,000

Estimated global revenue per device (all modes)$3,500

Estimated Market Opportunity – Total$3,500,000,000

Estimated % treated annually10%

Estimated Market Opportunity – Annual$350,000,000

Source: AtriCure estimates US, EU, JP, CH included in analysis

Potential sole therapy market

NEW market for us…

Today done percutaneous

Competition includes implants and EP closure (without FDA approval)

Stroke trial key to success

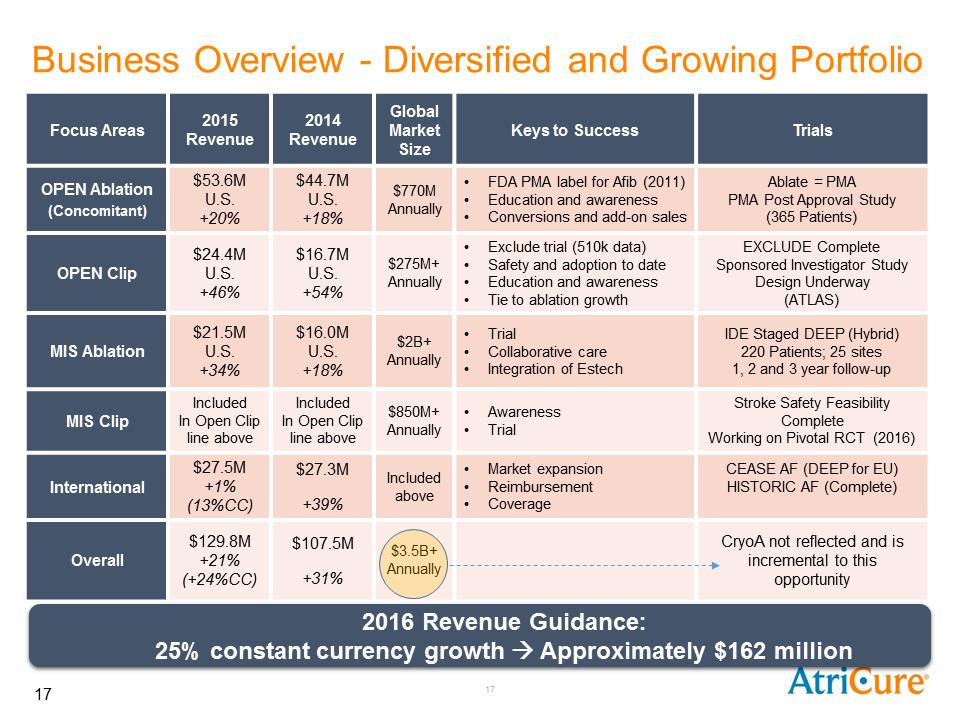

Business Overview - Diversified and Growing Portfolio

Focus Areas2015

Revenue2014 RevenueGlobal Market SizeKeys to SuccessTrials

OPEN Ablation

(Concomitant)$53.6M U.S.

+20%$44.7M U.S.

+18%$770M Annually•FDA PMA label for Afib (2011)

•Education and awareness

•Conversions and add-on salesAblate = PMA

PMA Post Approval Study

(365 Patients)

OPEN Clip$24.4M

U.S.

+46%$16.7M

U.S.

+54%$275M+ Annually•Exclude trial (510k data)

•Safety and adoption to date

•Education and awareness

•Tie to ablation growthEXCLUDE Complete

Sponsored Investigator Study Design Underway

(ATLAS)

MIS Ablation$21.5M U.S.

+34%$16.0M U.S.

+18%$2B+ Annually•Trial

•Collaborative care

•Integration of EstechIDE Staged DEEP (Hybrid)

220 Patients; 25 sites

1, 2 and 3 year follow-up

MIS ClipIncluded

In Open Clip line aboveIncluded

In Open Clip line above$850M+ Annually •Awareness

•TrialStroke Safety Feasibility Complete

Working on Pivotal RCT (2016)

International$27.5M +1% (13%CC)$27.3M

+39%Included above•Market expansion

•Reimbursement

•CoverageCEASE AF (DEEP for EU)

HISTORIC AF (Complete)

Overall$129.8M +21% (+24%CC)$107.5M

+31%$3.5B+ AnnuallyCryoA not reflected and is incremental to this opportunity

2016 Revenue Guidance:

25% constant currency growth Approximately $162 million

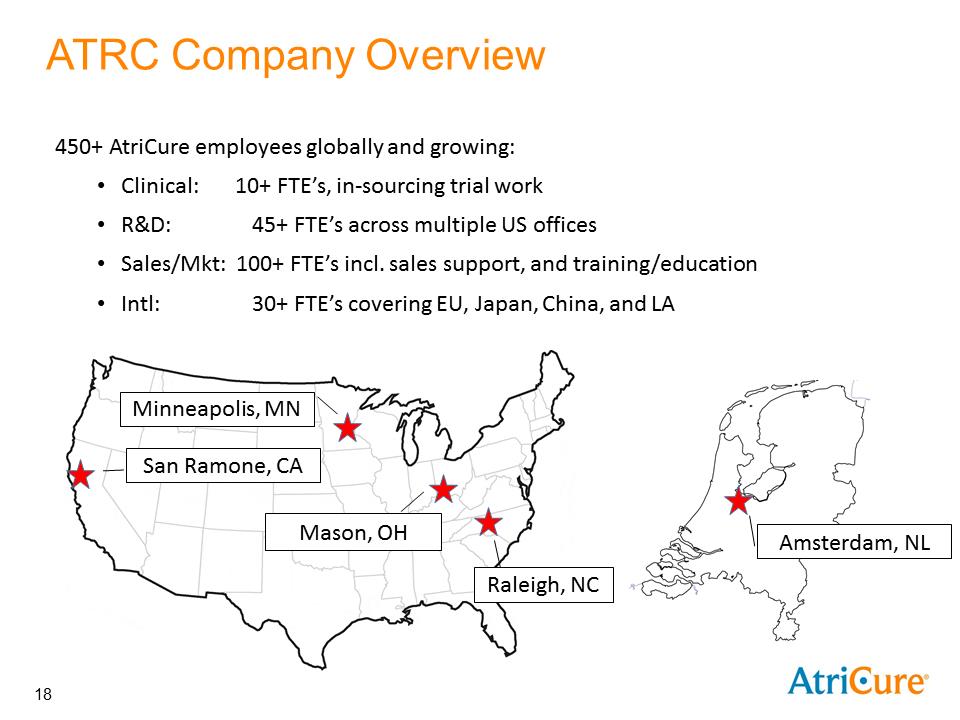

ATRC Company Overview

450+ AtriCure employees globally and growing:

Clinical: 10+ FTE’s, in-sourcing trial work

R&D: 45+ FTE’s across multiple US offices

Sales/Mkt: 100+ FTE’s incl. sales support, and training/education

Intl: 30+ FTE’s covering EU, Japan, China, and LA

Minneapolis, MN

San Ramone, CA

Mason, OH

Raleigh, NC

Amsterdam, NL

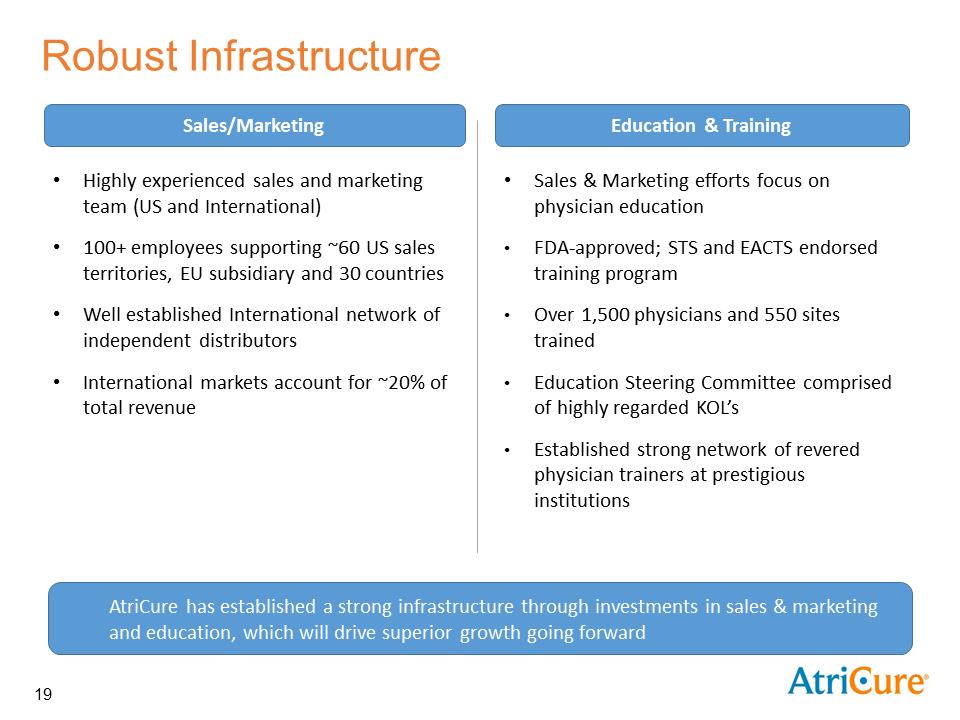

Robust Infrastructure

Sales/Marketing

Highly experienced sales and marketing team (US and International)

100+ employees supporting ~60 US sales territories, EU subsidiary and 30 countries

Well established International network of independent distributors

International markets account for ~20% of total revenue

Education & Training

Sales & Marketing efforts focus on physician education

FDA-approved; STS and EACTS endorsed training program

Over 1,500 physicians and 550 sites trained

Education Steering Committee comprised of highly regarded KOL’s

Established strong network of revered physician trainers at prestigious institutions

AtriCure has established a strong infrastructure through investments in sales & marketing and education, which will drive superior growth going forward

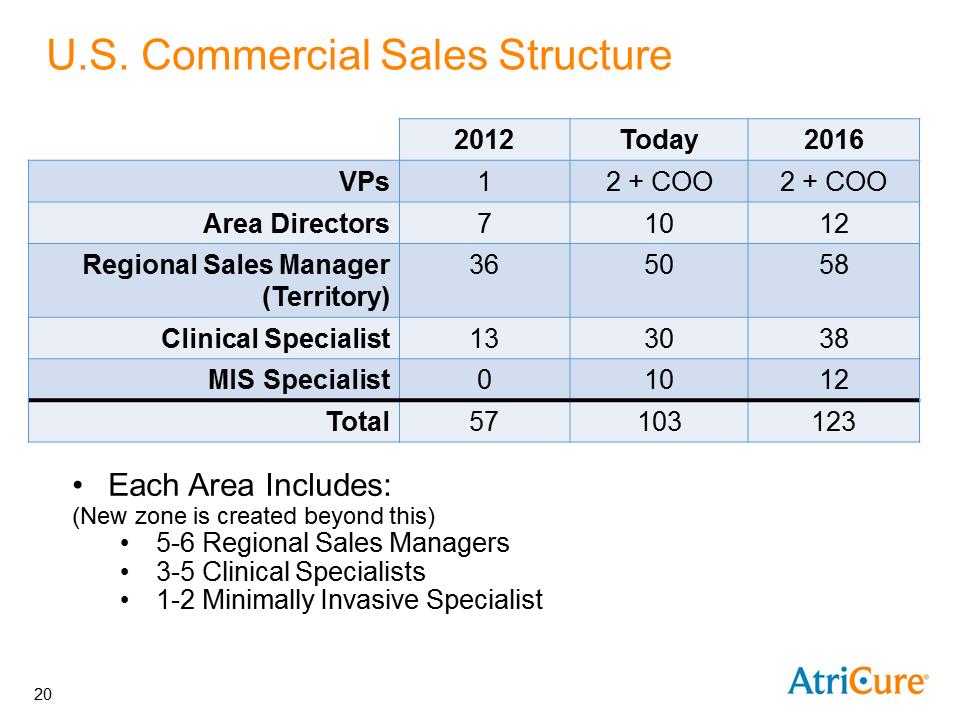

U.S. Commercial Sales Structure

2012Today 2016

VPs12 + COO2 + COO

Area Directors71012

Regional Sales Manager (Territory)365058

Clinical Specialist133038

MIS Specialist01012

Total 57103123

Each Area Includes:

(New zone is created beyond this)

5-6 Regional Sales Managers

3-5 Clinical Specialists

1-2 Minimally Invasive Specialist

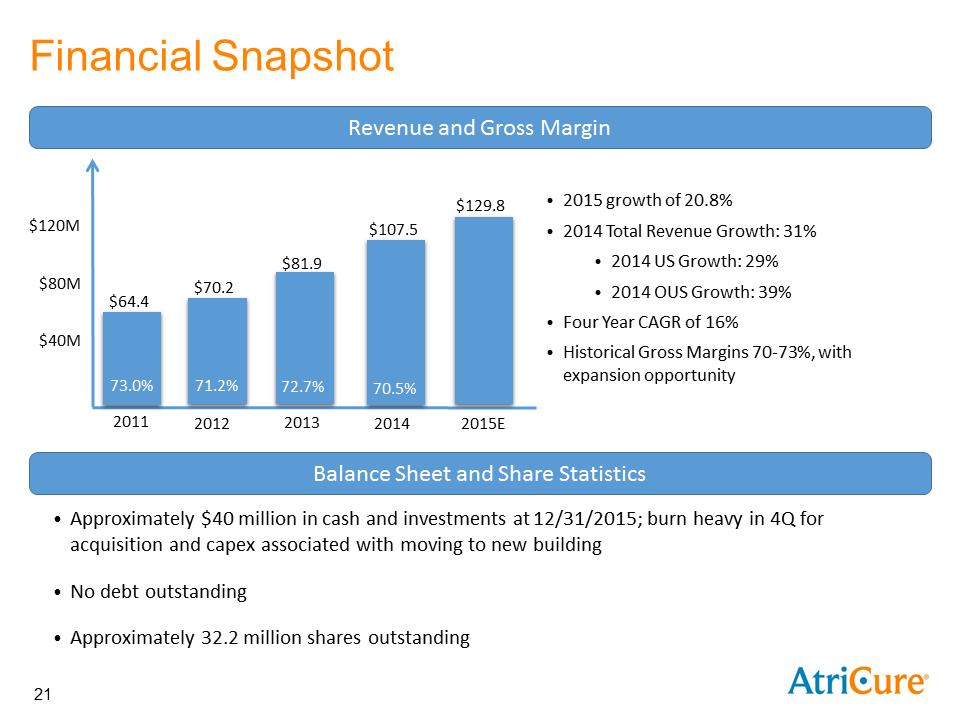

Financial Snapshot

Revenue and Gross Margin

201173.0%$64.4201271.2%$70.2201372.7%$81.9201470.5%$107.52015E$129.8

2015 growth of 20.8%

2014 Total Revenue Growth: 31%

2014 US Growth: 29%

2014 OUS Growth: 39%

Four Year CAGR of 16%

Historical Gross Margins 70-73%, with expansion opportunity

Balance Sheet and Share Statistics

Approximately $40 million in cash and investments at 12/31/2015; burn heavy in 4Q for acquisition and capex associated with moving to new building

No debt outstanding

Approximately 32.2 million shares outstanding

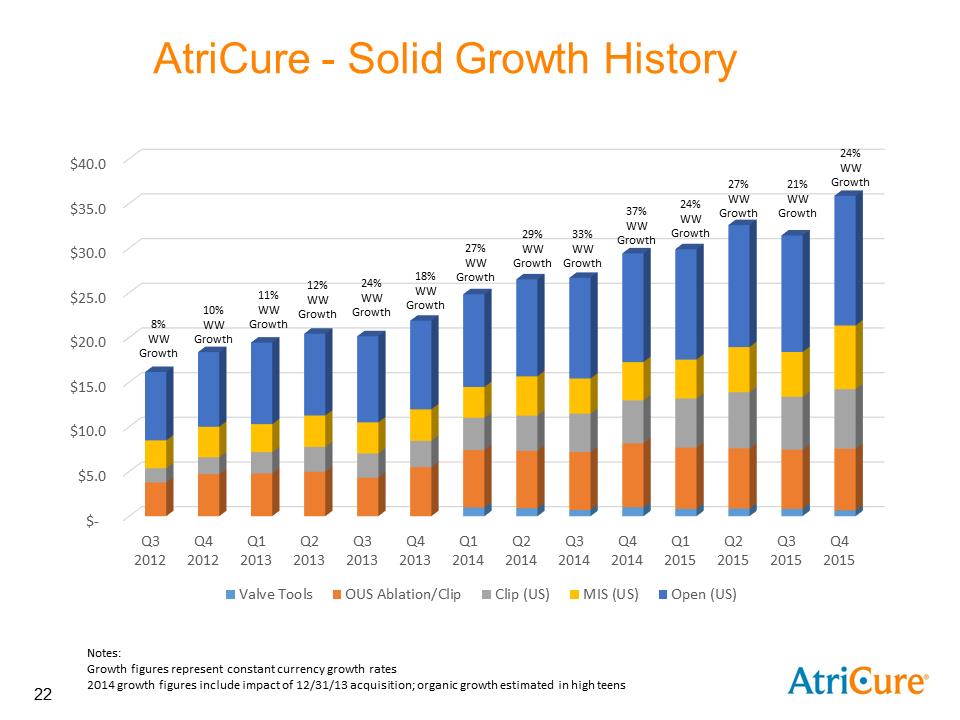

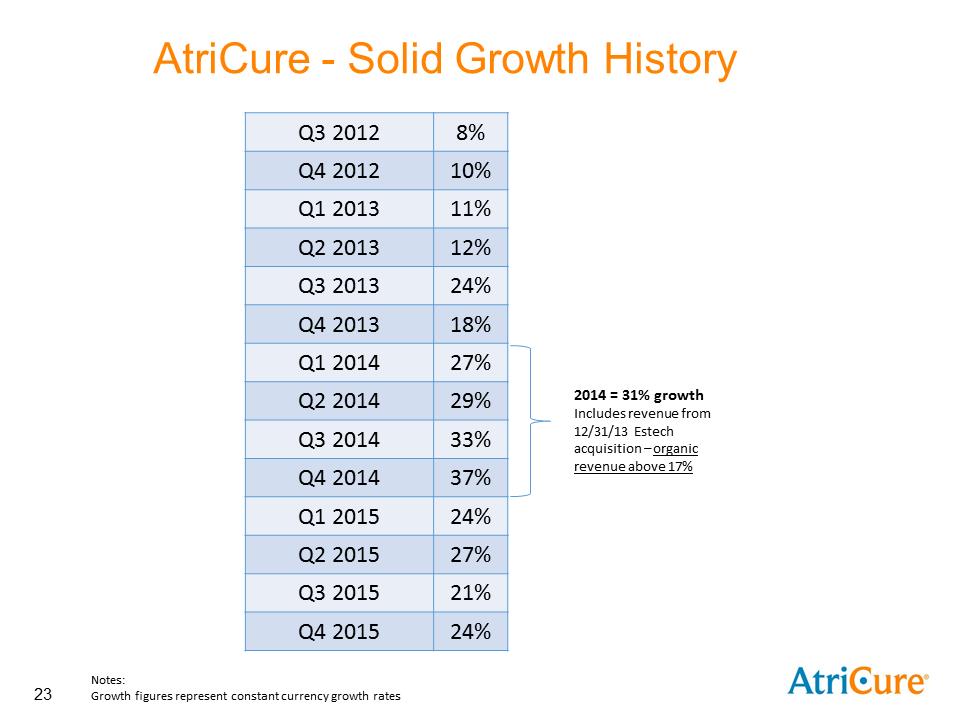

AtriCure - Solid Growth History

Q3 20128% WW GrowthQ4 201210% WW Growth

Q1 201311% WW GrowthQ2 201312% WW GrowthQ3 201324% WW GrowthQ4 201318% WW Growth

Q1 201427% WW GrowthQ2 201429% WW GrowthQ3 201433% WW GrowthQ4 2014 37% WW Growth

Q1 201524% WW GrowthQ2 201527% WW GrowthQ3 201521% WW GrowthQ4201524% WW Growth

Valve ToolsOUS Ablation/ClipClip (US)MIS (US)Open (US)

Notes:

Growth figures represent constant currency growth rates

2014 growth figures include impact of 12/31/13 acquisition; organic growth estimated in high teens

AtriCure - Solid Growth History

Q3 20128%Q4 201210%

Q1 201311%Q2 201312%Q3 201324%Q4 201318%

Q1 201427%Q2 201429%Q3 201433%Q4 201437%

Q1 201524%Q2 201527%Q3 201521Q4 201524%

2014 = 31% growth

Includes revenue from 12/31/13 Estech acquisition – organic revenue above 17%

Notes:

Growth figures represent constant currency growth rates

AtriCure…Positioned for Success

Strong Foundation

Products, Approvals, Brand, Education Platform, Trials and Science, International

+ Strong Revenue Base and Momentum

~20% Revenue Growth in 2013, 2014, 2015

+ Key Investments and Execution

Stroke and DEEP Trial, Cease AF, ATLAS, Education, Product innovation, Commercial Expansion

Will Lead To

500,000 patients served by 2020

15% to 20% consistent growth and 75% Gross Margins by 2019

$300M Revenue by 2020

Better patient care, a rewarding place to work and strong stock price

Market Summary

2015 Revenue

Revenue – $129.8M (24% constant currency)

(up from 9% in 2012, 17% in 2013 and ~20% organic in 2014)

Open Ablation

$770M+ market – 5+ years of strong growth

Stand Alone Ablation

$2B+ Market and trial key

Clip

$1B+ Market and growth accelerating

Cryo A

NEW $100M+ Pain-Management Market and growth accelerating

International

China and Japan are critical to growth

New products

Market penetration

Thank You!

References

|

1. |

Clinical Epidemiology 2014. |

|

2. |

American Col of Card 2013. |

|

3. |

Am J Card 2013, 112: 1142-1147. |

|

4. |

Am J Card. Vol 87. June 1, 2001. |

|

5. |

NIH Incidence Prevalence Chartbook 2006. |

|

6. |

Circulation. 2006;114:119-125. |

|

7. |

Kim M, et al. Circ Cardiovasc Qual Outcomes. 2011; 4:313-320 |

|

8. |

2012 HRS/EHRA/ECAS Expert Consensus Statement on Catheter and Surgical Ablation of Atrial Fibrillation |

|

9. |

www.StopAfib.org |

|

10. |

Meitz A, et al. Europace. 2008;10:674-680. |

|

11. |

2010-2013: STS Adult Cardiac Surgery Database |

|

12. |

2014-2020: MRG, iData, Medtech Insights, The Advisory Board Group

|

Appendix – Afib information

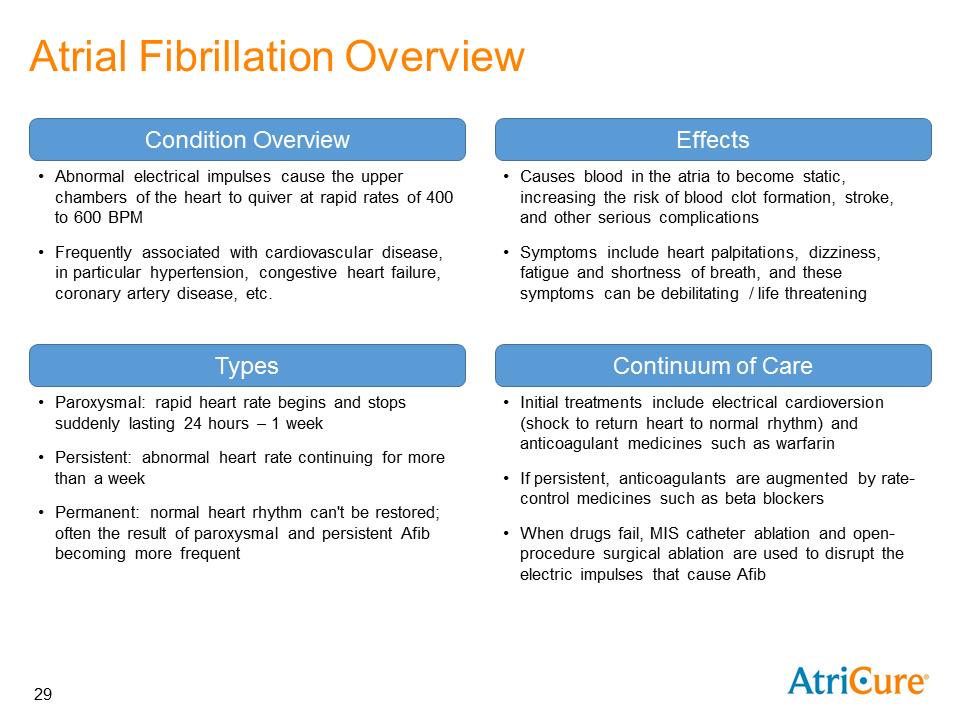

Atrial Fibrillation Overview

Condition Overview

|

· |

Abnormal electrical impulses cause the upper chambers of the heart to quiver at rapid rates of 400 to 600 BPM |

|

· |

Frequently associated with cardiovascular disease, in particular hypertension, congestive heart failure, coronary artery disease, etc. |

Effects

|

· |

Causes blood in the atria to become static, increasing the risk of blood clot formation, stroke, and other serious complications |

|

· |

Symptoms include heart palpitations, dizziness, fatigue and shortness of breath, and these symptoms can be debilitating / life threatening |

Types

|

· |

Paroxysmal: rapid heart rate begins and stops suddenly lasting 24 hours – 1 week |

|

· |

Persistent: abnormal heart rate continuing for more than a week |

|

· |

Permanent: normal heart rhythm can't be restored; often the result of paroxysmal and persistent Afib becoming more frequent |

Continuum of Care

|

· |

Initial treatments include electrical cardioversion (shock to return heart to normal rhythm) and anticoagulant medicines such as warfarin |

|

· |

If persistent, anticoagulants are augmented by rate-control medicines such as beta blockers |

|

· |

When drugs fail, MIS catheter ablation and open-procedure surgical ablation are used to disrupt the electric impulses that cause Afib |

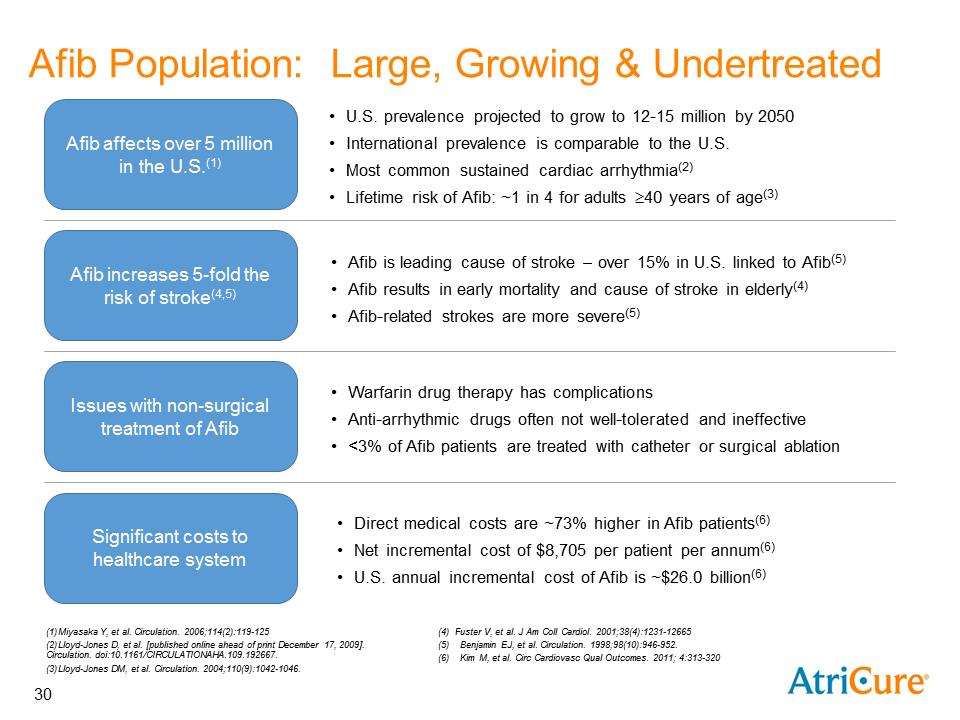

Afib Population: Large, Growing & Undertreated

Afib affects over 5 million in the U.S.(1)

|

· |

U.S. prevalence projected to grow to 12-15 million by 2050 |

|

· |

International prevalence is comparable to the U.S. |

|

· |

Most common sustained cardiac arrhythmia(2) |

|

· |

Lifetime risk of Afib: ~1 in 4 for adults 40 years of age(3) |

Afib increases 5-fold the risk of stroke(4,5)

|

· |

Afib is leading cause of stroke – over 15% in U.S. linked to Afib(5) |

|

· |

Afib results in early mortality and cause of stroke in elderly(4) |

|

· |

Afib-related strokes are more severe(5) |

Issues with non-surgical treatment of Afib

|

· |

Warfarin drug therapy has complications |

|

· |

Anti-arrhythmic drugs often not well-tolerated and ineffective |

|

· |

<3% of Afib patients are treated with catheter or surgical ablation |

Significant costs to healthcare system

|

· |

Direct medical costs are ~73% higher in Afib patients(6) |

|

· |

Net incremental cost of $8,705 per patient per annum(6) |

|

· |

U.S. annual incremental cost of Afib is ~$26.0 billion(6) |

|

(1) |

Miyasaka Y, et al. Circulation. 2006;114(2):119-125 |

|

(2) |

Lloyd-Jones D, et al. [published online ahead of print December 17, 2009]. |

|

(3) |

Lloyd-Jones DM, et al. Circulation. 2004;110(9):1042-1046. |

|

(4) |

Fuster V, et al. J Am Coll Cardiol. 2001;38(4):1231-12665 |

|

(5) |

Benjamin EJ, et al. Circulation. 1998;98(10):946-952. |

|

(6) |

Kim M, et al. Circ Cardiovasc Qual Outcomes. 2011; 4:313-320 |

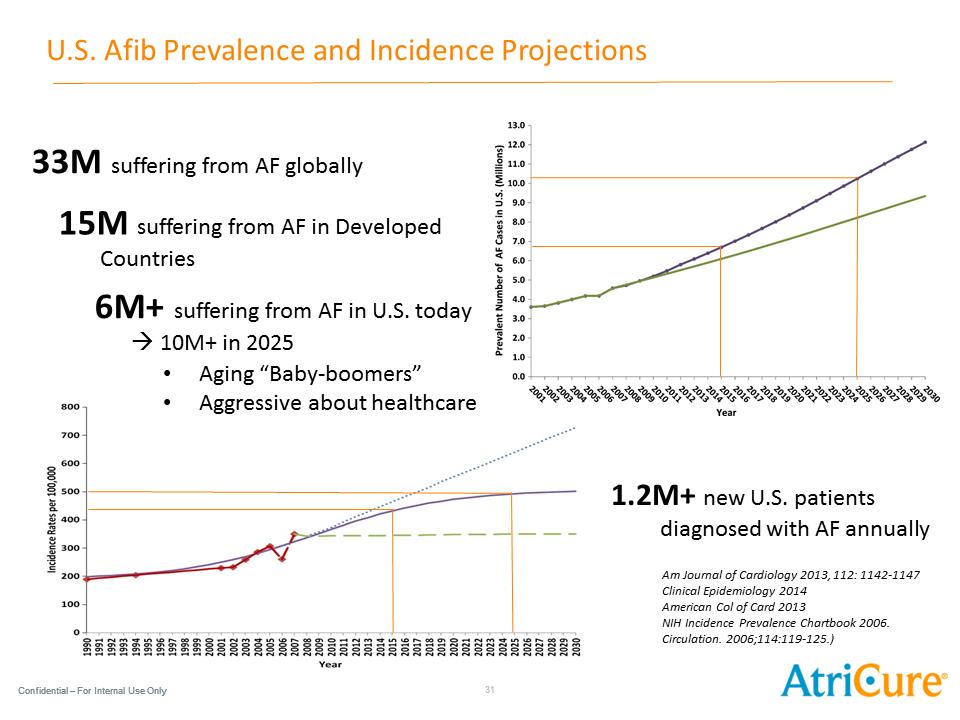

U.S. Afib Prevalence and Incidence Projections

33M suffering from AF globally

15M suffering from AF in Developed Countries

6M+ suffering from AF in U.S. today 10M+ in 2025

Aging “Baby-boomers”

Aggressive about healthcare

1.2M+ new U.S. patients diagnosed with AF annually

Am Journal of Cardiology 2013, 112: 1142-1147

Clinical Epidemiology 2014

American Col of Card 2013

NIH Incidence Prevalence Chartbook 2006.

Circulation. 2006;114:119-125.)

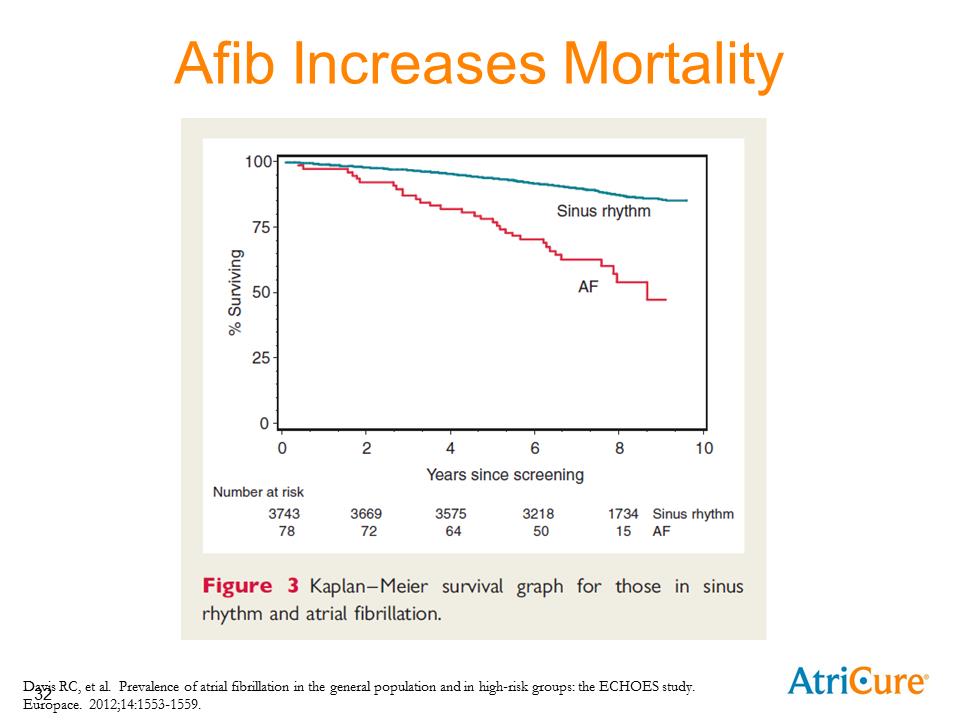

Afib Increases Mortality

Davis RC, et al. Prevalence of atrial fibrillation in the general population and in high-risk groups: the ECHOES study. Europace. 2012;14:1553-1559.

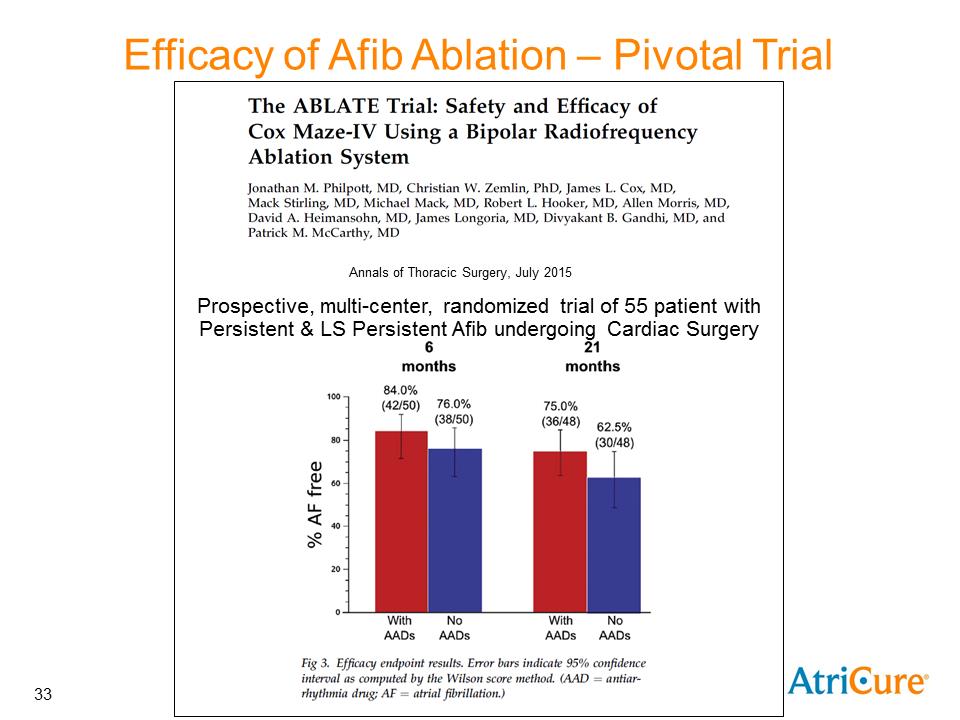

Efficacy of Afib Ablation – Pivotal Trial

Prospective, multi-center, randomized trial of 55 patient with Persistent & LS Persistent Afib undergoing Cardiac Surgery

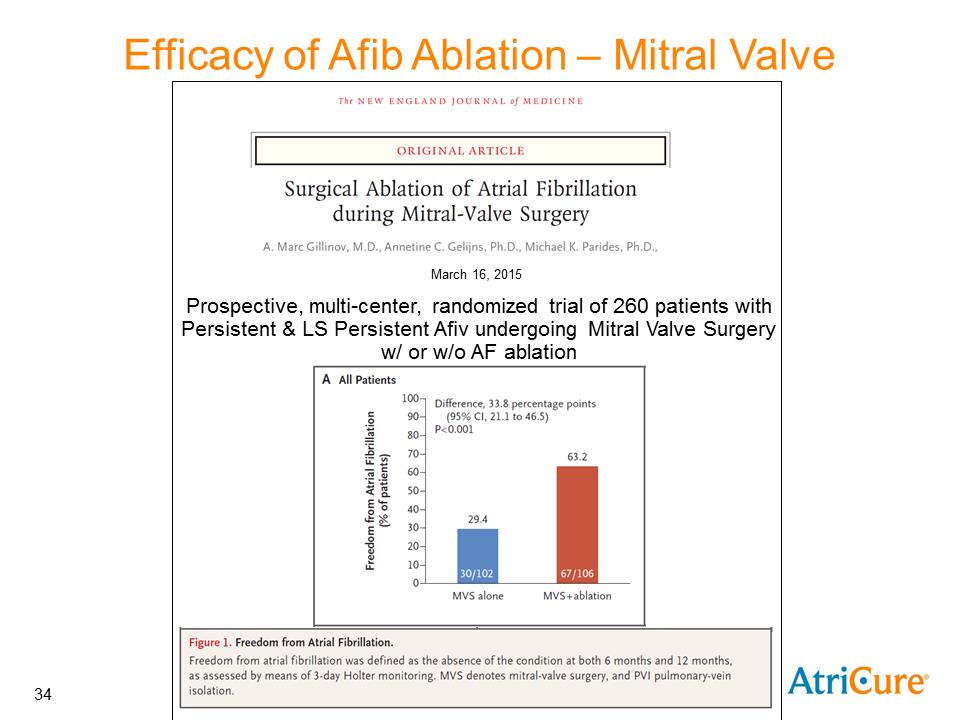

Efficacy of Afib Ablation – Mitral Valve

Prospective, multi-center, randomized trial of 260 patients with Persistent & LS Persistent Afiv undergoing Mitral Valve Surgery w/ or w/o AF ablation

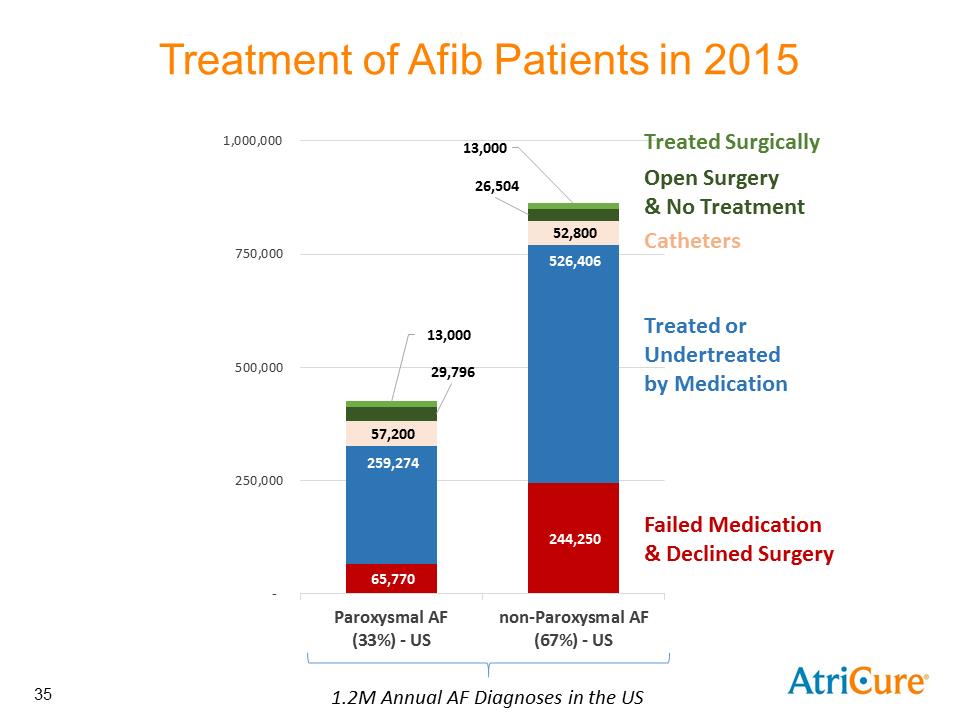

Treatment of Afib Patients in 2015

Treated Surgically

Open Surgery & No Treatment

Catheters

Treated or Undertreated by Medication

Failed Medication & Declined Surgery

Paroxysmal AF (33%) - US13,00029,79657,200259,27465,770

Non-Paroxysmal AF (67%) – US13,00026,50552,800526,406244,250

1.2M Annual AF Diagnoses in the US

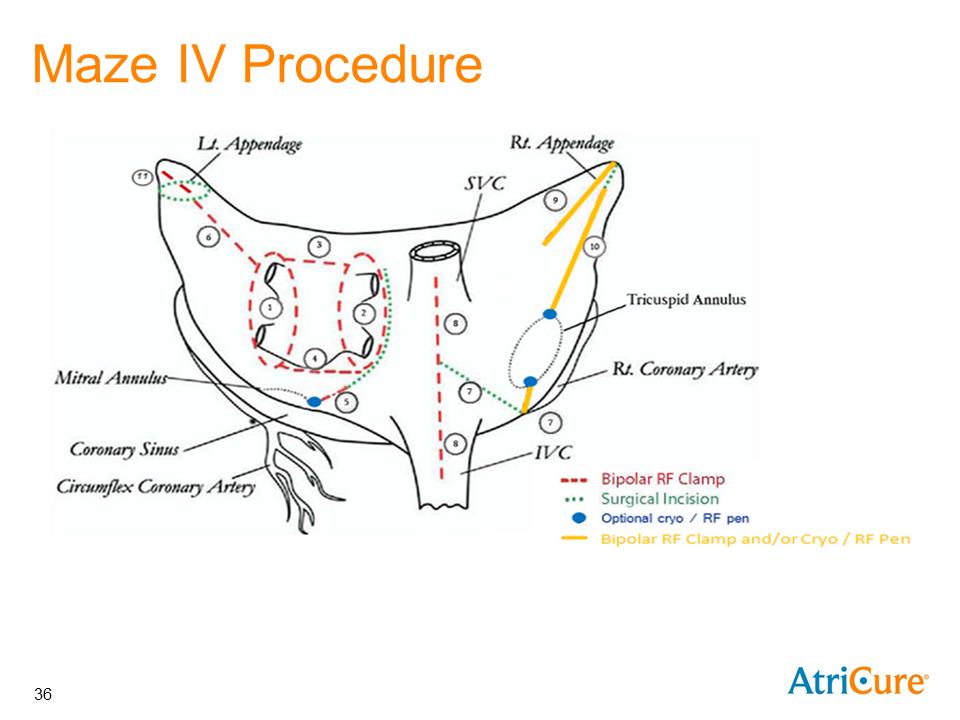

Maze IV Procedure

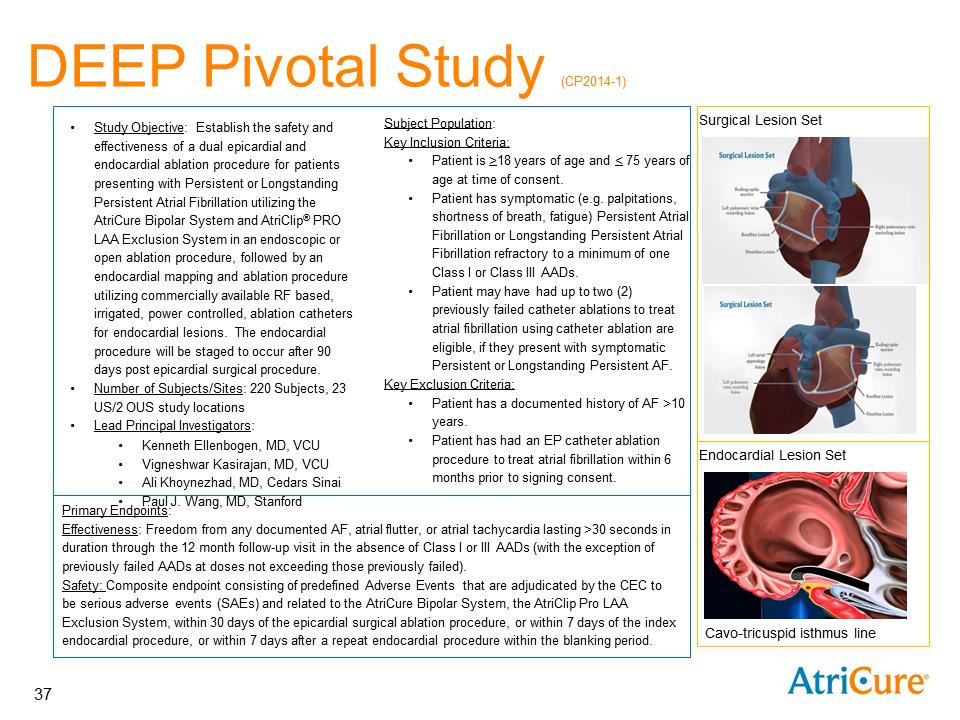

DEEP Pivotal Study (CP2014-1)

Study Objective: Establish the safety and effectiveness of a dual epicardial and endocardial ablation procedure for patients presenting with Persistent or Longstanding Persistent Atrial Fibrillation utilizing the AtriCure Bipolar System and AtriClip® PRO LAA Exclusion System in an endoscopic or open ablation procedure, followed by an endocardial mapping and ablation procedure utilizing commercially available RF based, irrigated, power controlled, ablation catheters for endocardial lesions. The endocardial procedure will be staged to occur after 90 days post epicardial surgical procedure.

Number of Subjects/Sites: 220 Subjects, 23 US/2 OUS study locations

Lead Principal Investigators:

Kenneth Ellenbogen, MD, VCU

Vigneshwar Kasirajan, MD, VCU

Ali Khoynezhad, MD, Cedars Sinai

Paul J. Wang, MD, Stanford

Subject Population:

Key Inclusion Criteria:

Patient is >18 years of age and < 75 years of age at time of consent.

Patient has symptomatic (e.g. palpitations, shortness of breath, fatigue) Persistent Atrial Fibrillation or Longstanding Persistent Atrial Fibrillation refractory to a minimum of one Class I or Class III AADs.

Patient may have had up to two (2) previously failed catheter ablations to treat atrial fibrillation using catheter ablation are eligible, if they present with symptomatic Persistent or Longstanding Persistent AF.

Key Exclusion Criteria:

Patient has a documented history of AF >10 years.

Patient has had an EP catheter ablation procedure to treat atrial fibrillation within 6 months prior to signing consent.

Primary Endpoints:

Effectiveness: Freedom from any documented AF, atrial flutter, or atrial tachycardia lasting >30 seconds in duration through the 12 month follow-up visit in the absence of Class I or III AADs (with the exception of previously failed AADs at doses not exceeding those previously failed).

Safety: Composite endpoint consisting of predefined Adverse Events that are adjudicated by the CEC to be serious adverse events (SAEs) and related to the AtriCure Bipolar System, the AtriClip Pro LAA Exclusion System, within 30 days of the epicardial surgical ablation procedure, or within 7 days of the index endocardial procedure, or within 7 days after a repeat endocardial procedure within the blanking period.