Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - ViewRay, Inc. | d73715dex231.htm |

Table of Contents

Index to Financial Statements

As filed with the Securities and Exchange Commission on December 30, 2015.

Registration No. 333-207347

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ViewRay, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 3845 | 42-1777485 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2 Thermo Fisher Way

Oakwood Village, OH 44146

(440) 703-3210

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Chris A. Raanes

President & Chief Executive Officer

ViewRay, Inc.

2 Thermo Fisher Way

Oakwood Village, OH 44146

(440) 703-3210

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Mark V. Roeder, Esq. Brian D. Paulson, Esq. |

D. David Chandler Chief Financial Officer ViewRay, Inc. 2 Thermo Fisher Way Oakwood Village, OH 44146 Telephone: (440) 703-3210 Facsimile: (800) 417-3459 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee | ||||

| Shares of common stock, par value $0.01 per share |

38,128,672(1) | $5.00(2) | $190,643,360 | $19,254(3) | ||||

|

| ||||||||

| (1) | Consists of (a) 37,929,912 outstanding shares of the registrant’s common stock and (b) 198,760 shares of the registrant’s common stock issuable upon exercise of common stock purchase warrants. Pursuant to Rule 416 under the Securities Act of 1933, as amended, there is also being registered hereby such indeterminate number of additional shares of common stock of the registrant as may be issued or issuable because of stock splits, stock dividends, stock distributions, and similar transactions. |

| (2) | Estimated solely for purposes of calculating the registration fee according to Rule 457(c) under the Securities Act based on the average of the bid and asked price of our common stock quoted on the OTC Markets, OTCQB tier of OTC Markets Group, Inc. on December 15, 2015. |

| (3) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Index to Financial Statements

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PROSPECTUS (Subject to Completion) | Dated December 30, 2015 |

38,128,672 Shares

Common Stock

This prospectus relates to the offering and resale by the selling stockholders identified herein of up to 38,128,672 shares of common stock, par value $0.01 per share, of ViewRay, Inc. Of the shares being offered, 37,929,912 are presently issued and outstanding and 198,760 are issuable upon exercise of common stock purchase warrants. These shares include an aggregate of (i) 5,884,504 shares of common stock issued and sold to accredited investors in a private placement offering in a series of closings on July 23, 2015, August 13, 2015 and August 17, 2015, or the Private Placement, (ii) 770,000 shares of our common stock that were held by one of our stockholders immediately prior to the closing of our merger transaction on July 23, 2015, or the Merger, (iii) 31,275,408 shares of our common stock issued in the Merger to the former stockholders of ViewRay Technologies, Inc. in connection with the closing of the Merger and (iv) 198,760 shares of common stock issuable upon exercise of common stock purchase warrants, or the Placement Agent Warrants, issued as compensation to Northland Securities, Inc., Katalyst Securities LLC, Trout Capital LLC and MLV & Co. LLC, as co-exclusive placement agents and their designees in connection with the Private Placement, or the Placement Agents. All shares of common stock issued in the Private Placement were sold at a purchase price of $5.00 per share.

The selling stockholders may sell the shares of common stock on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale, in the over-the-counter market, in one or more transactions otherwise than on these exchanges or systems, such as privately negotiated transactions, or using a combination of these methods, and at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at negotiated prices. See the disclosure under the heading “Plan of Distribution” elsewhere in this prospectus for more information about how the selling stockholders may sell or otherwise dispose of their shares of common stock hereunder.

The selling stockholders may sell any, all or none of the securities offered by this prospectus and we do not know when or in what amount the selling stockholders may sell their shares of common stock hereunder following the effective date of this registration statement.

We will not receive any proceeds from the sale of our common stock by the selling stockholders in the offering described in this prospectus.

Our common stock is eligible for quotation for trading on the OTCQB tier of OTC Markets Group, Inc. under the symbol “VRAY.” On December 29, 2015, the last quoted sale price for our common stock as reported on the OTCQB was $5.10 per share.

Investing in our common stock involves a high degree of risk. Before making any investment in our common stock, you should read and carefully consider the risks described in this prospectus under “Risk Factors” beginning on page 8 of this prospectus.

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment hereto. We have not authorized anyone to provide you with different information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

, 2015

Table of Contents

Index to Financial Statements

Table of Contents

Index to Financial Statements

You should rely only on the information contained in this prospectus or in any free writing prospectus prepared by us or on our behalf. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Information contained on our website is not part of this prospectus.

ViewRay®, MRIdian® and our logo are some of our trademarks used in this prospectus. This prospectus also includes trademarks, tradenames, and service marks that are the property of other organizations. Solely for convenience, our trademarks and tradenames referred to in this prospectus may appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames.

i

Table of Contents

Index to Financial Statements

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes before deciding to buy shares of our common stock. Unless the context requires otherwise, references in this prospectus to “the company,” “we,” “us” and “our” refer to ViewRay, Inc.

Overview

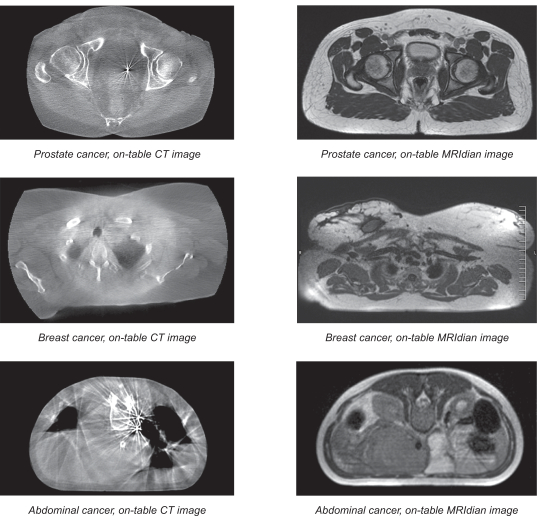

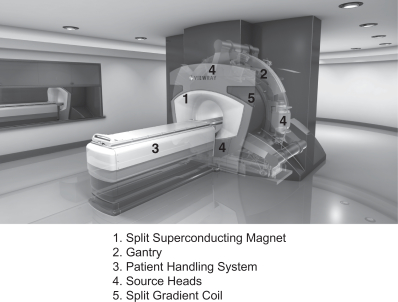

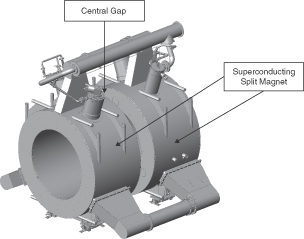

We design, manufacture and market MRIdian, the first and only MRI-guided radiation therapy system that images and treats cancer patients simultaneously. MRI is a broadly used imaging tool which has the ability to differentiate between types of soft tissue clearly, unlike X-ray or computed tomography, or CT, the most commonly used imaging technologies in radiation therapy today. MRIdian integrates MRI technology, radiation delivery and our proprietary software to locate, target and track the position and shape of soft-tissue tumors while radiation is delivered. These capabilities allow MRIdian to deliver radiation to the tumor accurately while delivering less radiation to healthy tissue than existing radiation therapy treatments. We believe this innovation leads to improved patient outcomes and reduced side effects from off-target radiation delivery. We received 510(k) marketing clearance from the U.S. Food and Drug Administration, or FDA, for MRIdian in May 2012 and received permission to affix the CE mark in November 2014. Patients are actively receiving treatment on MRIdian systems at three cancer centers.

Cancer is a leading cause of death globally and the second leading cause of death in the United States. Radiation therapy is a common method used to treat cancer that uses lethal doses of ionizing energy to damage genetic material in cells. Nearly two-thirds of all treated cancer patients in the United States will receive some form of radiation therapy during the course of their illness, according to estimates by the American Society for Radiation Oncology, or ASTRO. In 2013, IMV Medical Information Division, Inc., or IMV, reported that 93% of patients receiving radiation therapy in the United States were treated by a linear accelerator, or linac. The global linac market was $2.8 billion in 2011 and was expected to grow to $3.7 billion by 2016 according to a 2012 Markets and Markets report. IAEA Human Health Campus reported that there are over 11,000 linacs installed at over 7,500 centers worldwide. We believe the addressable market for MRIdian is the annual market for linacs due to MRIdian’s ability to treat a broad spectrum of disease sites. However, we believe that MRIdian may be used more frequently for complex cancer cases that may be difficult to treat on a standard linac due to the location of the tumor in relation to the surrounding soft tissues. We currently estimate the annual market for linacs to be 1,100 units per year globally, the majority of which are replacement units.

Despite the prevalence of MRI for diagnostic purposes and its ability to image soft tissue clearly, the radiation therapy industry has been unable to integrate MRI into external-beam radiation therapy systems. Existing radiation therapy systems use X-ray-based imaging technologies, such as CT, which cannot differentiate between types of soft tissue or provide an accurate visualization of a tumor and its position in relation to critical organs. In addition, existing systems that offer imaging during the course of a treatment are limited by the rate at which they can image due to the level of radiation to which they expose the patient. These constraints make it difficult for a clinician to locate a tumor accurately, track its motion in real-time or adapt treatment as anatomy changes. It is very difficult to irradiate a tumor while minimizing the amount of radiation hitting critical organs without the ability to see the tumor’s exact location and shape. If a tumor is insufficiently irradiated, it may not respond to treatment, resulting in a lower probability of survival for the patient. If organs and other healthy soft tissues are irradiated, side effects can be severe, including organ failure and secondary cancers.

1

Table of Contents

Index to Financial Statements

MRIdian is a next-generation, radiation therapy solution that enables treatment and real-time imaging of a patient’s anatomy simultaneously. The high-quality images that it generates clearly differentiate the targeted tumor, surrounding soft tissue and nearby critical organs. MRIdian also records the level of radiation dose that the treatment area has received, enabling physicians to adapt the prescription between treatments as needed. We believe this improved visualization and accurate dose recording will enable better treatment, improve patient outcomes and reduce side effects. Key benefits to users and patients include improved imaging and patient alignment, on-table adaptive treatment planning, motion management and an accurate recording of the delivered radiation dose. Physicians have already used MRIdian to treat a broad spectrum of radiation therapy patients with more than 20 different types of cancer, as well as patients for whom radiation therapy was previously not an option.

We currently market MRIdian through a direct sales force in the United States and distributors in the rest of the world. At September 30, 2015, we had four MRIdian systems installed and had 14 signed orders for new systems for a backlog value of $78.0 million. We generated revenue of $5.8 million and $5.9 million during the nine months ended September 30, 2015 and 2014 and had net losses of $30.9 million and $24.2 million during the nine months ended September 30, 2015 and 2014. We generated revenue of $3.2 million in 2013 and $6.4 million in 2014 and had net losses of $27.2 million in 2013 and $33.8 million in 2014.

Current Radiation Therapy Process and Limitations

We believe the key limitations of existing radiation therapy technologies are the following:

| • | Inability to accurately locate a tumor for treatment alignment. To locate a tumor, current radiation therapy systems rely on on-table CT scans that are unable to differentiate between types of soft tissue. Therefore, surrogate registration markers, including existing bone structures, external marks and surgically implanted fiducials, are frequently used to align a patient to the treatment beams prior to commencing treatment. By relying on a proxy for tumor location rather than the tumor itself, clinicians risk missing the tumor and risk hitting healthy tissue when they deliver treatment beams into a patient’s body because the spatial relationship between the tumor, healthy tissues and these markers frequently changes. |

| • | Inability to adapt treatment on table. A physician designs a treatment plan based on images that are captured at the beginning of therapy. Creating a treatment plan can take one to two weeks, and treatment itself can take up to seven weeks. However, during the course of therapy, tumors often change size, orientation or shape and patient anatomy can change for reasons including weight loss or gain. Adjusting for these changes would require replanning, which may take several days and is resource intensive. As a result of these limitations, replanning is infrequently performed. |

| • | Inability to track tumor and organ motion accurately. In addition to difficulty locating a tumor accurately in a patient’s body, a further challenge is accounting for ongoing tumor movement during treatment. Tumors have been shown to move multiple centimeters relative to surrogate registration markers over the course of only a few seconds. Although physicians use internal markers and external cameras and blocks to track respiratory and other motion, they are unable to track the tumor itself and its location relative to other soft tissues. This limitation increases the probability of missing the targeted treatment area. As a result, physicians usually enlarge the total region to be radiated, causing an additional risk of side effects. |

| • | Inability to record cumulative radiation delivered. Currently, there are no methods to record the actual dose of radiation delivered to a tumor or surrounding healthy tissue during the course of treatment. Therefore, physicians must assume that the radiation is delivered according to plan, rather than making decisions based on actual dose delivered. |

2

Table of Contents

Index to Financial Statements

Each of these limitations increases the risk of missing a tumor and hitting healthy tissue during treatment. If a tumor is insufficiently irradiated, it may not respond to treatment, resulting in a lower probability of survival for the patient. If organs and other healthy soft tissues are irradiated, side effects can be severe, including organ failure and secondary cancers.

Our Solution

We have developed MRIdian to address the key limitations of existing radiation therapy technologies. We believe that MRIdian provides the following clinical and commercial benefits to physicians, hospitals and patients:

| • | Improved tumor visibility and patient alignment. The soft-tissue contrast of MRIdian’s on-board MRI enables clinicians to locate, target and track the tumor and healthy tissues and accurately align a patient to the treatment beams without the use of surrogate registration markers, X-rays or CT. |

| • | On-table adaptive planning. Using an MR image captured at the beginning of each therapy session, MRIdian automatically maps the patient’s soft tissue anatomy in 3D and calculates the dose that would be delivered using the current treatment plan. If the initial prescribed treatment is not clinically acceptable to the physician, MRIdian has the ability to automatically recalculate and adapt the plan to changing anatomy while the patient is on the table at the time of treatment, a capability unique to MRIdian. We believe hospitals will be able to bill incrementally for this replanning. |

| • | Ability to track tumors and manage patient motion. MRIdian can capture multiple soft-tissue imaging planes concurrently during treatment and refresh the image multiple times per second. This real-time imaging enables the physician to track the movement of the tumor and the surrounding healthy tissue as treatment is delivered. If a tumor or critical organ moves beyond a physician-defined boundary, the treatment beam automatically pauses. This beam control becomes especially important in the situations where a tumor may be in close proximity to a critical organ. |

| • | Record and evaluate the delivered dose. After each treatment MRIdian, calculates the dose delivered using a proprietary algorithm and advanced MR imaging, enabling the physician to review and re-optimize the patient’s treatment sessions if needed. |

| • | Fits into existing treatment paradigms and workflow. MRIdian can be used with standard planning methodologies and is used to treat a broad spectrum of disease sites. In addition, we believe MRIdian’s increased target accuracy will allow physicians to treat with higher doses over fewer treatment fractions and potentially improve patient throughput and efficiency. MRIdian fits inside most standard radiation therapy vaults without significant modifications and is supported by existing codes that are available for linac reimbursement. |

We believe the ability to image with MRI and treat cancer patients simultaneously will lead to improved patient outcomes and reduced side effects from off-target radiation delivery.

Our Strategy

Our objective is to make MRI-guided radiation delivery the standard of care for radiation therapy. To achieve this goal, we intend to do the following:

| • | target top-tier hospitals in initial global sales efforts to influence and increase market adoption; |

| • | commercialize MRIdian with a targeted sales force in the United States and through distributors in international markets; |

3

Table of Contents

Index to Financial Statements

| • | increase broader awareness of MRIdian’s capabilities to expand our share of the radiation therapy market; |

| • | maintain our competitive lead in MRI-guided radiation therapy through continued innovation; |

| • | continue to work with leading hospitals to optimize efficiency and patient throughput; and |

| • | drive cost reductions in the design and manufacture of MRIdian and improve our margins. |

Risks Associated with Our Business

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary. These risks include, but are not limited to, the following:

| • | We have incurred significant losses since our inception and anticipate that we will continue to incur significant losses for the foreseeable future. |

| • | If clinicians do not widely adopt MRI-guided radiation therapy or MRIdian fails to achieve and sustain sufficient market acceptance, we will not generate sufficient revenue and our growth prospects, financial condition and results of operations could be harmed. |

| • | We may not be able to generate sufficient revenue from the commercialization of MRIdian to achieve and maintain profitability. |

| • | We are an early, commercial-stage company and have a limited history commercializing MRIdian, which may make it difficult to evaluate our current business and predict our future performance. |

| • | If third-party payors do not provide coverage and adequate reimbursement to our customers, it could negatively impact sales of MRIdian. |

| • | The long sales cycle and low unit volume sales of MRIdian, as well as other factors, may contribute to substantial fluctuations in our operating results and stock price and make it difficult to compare our results of operations across periods. |

| • | Our ability to achieve and maintain profitability depends substantially on increasing our gross margins by reducing product costs and improving our economies of scale, which we may not be able to achieve or sustain. |

| • | We face competition from numerous companies, many of whom have greater resources than we do or offer alternative technologies at lower prices than our MRIdian systems, which may make it more difficult for us to achieve significant market penetration and profitability. |

| • | We rely on a limited number of third-party suppliers or, in some cases, sole suppliers, for the majority of our components, subassemblies and materials and may not be able to find replacements or immediately transition to alternative suppliers. |

| • | We depend on third-party distributors to market and distribute MRIdian in international markets. If our distributors fail to successfully market and distribute MRIdian, our business will be harmed. |

| • | We may need to raise additional capital to fund our existing commercial operations, develop and commercialize new features for MRIdian and new products and expand our operations. |

| • | If we are unable to adequately protect our proprietary technology or maintain issued patents that are sufficient to protect MRIdian, others could compete against us more directly, which could harm our business, financial condition and results of operations. |

4

Table of Contents

Index to Financial Statements

| • | There is not now, nor has there been since our inception, any significant trading activity in our common stock, and an active trading market for our shares may never develop or be sustained, which may make it difficult for you to sell your shares of our common stock. |

| • | Our share price may be volatile and may be influenced by numerous factors, some of which are beyond our control. |

| • | We may be exposed to additional risks as a result of “going public” by means of a reverse acquisition transaction. |

Corporate Information

We were incorporated in Nevada as Mirax Corp. on September 6, 2013, and reincorporated in Delaware as ViewRay, Inc. on July 21, 2015.

On July 23, 2015, our wholly-owned subsidiary, Vesuvius Acquisition Corp., a corporation formed in the State of Delaware on July 16, 2015, or the Acquisition Sub, merged with and into ViewRay Technologies, Inc., a corporation incorporated in 2004 in the State of Florida originally under the name of ViewRay Incorporated, subsequently reincorporated in the State of Delaware in 2007 as ViewRay Incorporated, and changed its name to ViewRay Technologies Inc. in July 2015, referred to herein as ViewRay. On July 23, 2015, ViewRay, Inc., Acquisition Sub and ViewRay entered into an Agreement and Plan of Merger and Reorganization, or the Merger Agreement, which closed on the same date. Pursuant to the terms of the Merger Agreement, Acquisition Sub merged with and into ViewRay, which was the surviving corporation and thus became our wholly-owned subsidiary. All of the outstanding capital stock of ViewRay was converted into shares of our common stock.

In connection with the Merger and pursuant to the Split-Off Agreement, we transferred our pre-Merger assets and liabilities to our pre-Merger majority stockholder, in exchange for the surrender by her and cancellation of 4,150,171 shares of our common stock, or the Split-Off. Upon the closing of the Merger, we discontinued our pre-Merger business and acquired the business of ViewRay and will continue the existing business operations of ViewRay as a publicly-traded company under the name ViewRay, Inc.

Upon the closing of the Merger, we ceased to be a “shell company” under applicable rules of the Securities and Exchange Commission, or the SEC. On July 23, 2015, in connection with the Merger, our Board of Directors changed our fiscal year from a fiscal year ending on November 30 to one ending on December 31 of each year, which was the fiscal year of ViewRay.

On July 23, 2015, we entered into a securities purchase agreement, or the Securities Purchase Agreement, with certain accredited investors, providing for the issuance and sale to such investors of an aggregate of 5,884,504 shares of common stock issued and sold to accredited investors in a private placement offering in a series of closings on July 23, 2015, August 13, 2015 and August 17, 2015, at a purchase price per share of $5.00 and for aggregate gross proceeds to us of $29.4 million, or the Private Placement. After deducting for placement agent and other fees and expenses, the aggregate net proceeds from the Private Placement were $26.9 million. Northland Securities, Inc., Katalyst Securities LLC, Trout Capital LLC and MLV & Co. LLC, served as co-exclusive placement agents, or, along with their sub-agents, the Placement Agents, for the Private Placement.

The Securities Purchase Agreement also contains certain anti-dilution provisions. Those anti-dilution provisions provide that, subject to certain exceptions, if we issue and sell Common Stock or Common Stock equivalents at a purchase price per share of lower than $5.00 within the six month period following July 23, 2015, each investor in the Private Placement shall be entitled to receive such number of additional shares of our common stock as they would have received had such lower purchase price per share been applicable in the Private Placement.

5

Table of Contents

Index to Financial Statements

At the closings of the Private Placement we issued to the Placement Agents and their designees, warrants, or the Placement Agent Warrants, to acquire up to 198,760 shares of our common stock at an exercise price of $5.00 per share. Each of the Placement Agent Warrants is exercisable at any time at the option of the holder until the five-year anniversary of its date of issuance.Our authorized capital stock currently consists of 300,000,000 shares of common stock, and 10,000,000 shares of the preferred stock. Our common stock is quoted on the OTC Markets (OTCQB) under the symbol “VRAY,” which changed from “MRXC” on July 20, 2015.

Our principal executive offices are located at 2 Thermo Fisher Way, Oakwood Village, Ohio 44146. Our telephone number is (440) 703-3210. Our website address is www.viewray.com. (The information contained on, or that can be accessed through, our website is not a part of this prospectus.)

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. We will remain an emerging growth company until the earlier of December 31, 2019, the end of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement filed under the Securities Act, the last day of the year in which we have total annual gross revenue of at least $1.0 billion, the date on which we are deemed to be a large accelerated filer (this means the market value of our common stock that is held by non-affiliates exceeds $700.0 million at the end of the second quarter of that year), or the date on which we have issued more than $1.0 billion in nonconvertible debt securities during the prior three-year period. An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company, we will:

| • | avail ourselves of the exemption from the requirement to obtain an attestation and report from our auditors on the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; |

| • | provide less extensive disclosure about our executive compensation arrangements; and |

| • | not be required to hold stockholder non-binding advisory votes on executive compensation or golden parachute arrangements. |

However, we are choosing to “opt out” of the extended transition periods available under the JOBS Act for complying with new or revised accounting standards.

6

Table of Contents

Index to Financial Statements

THE OFFERING

This prospectus relates to the resale from time to time by the selling stockholders identified herein of up to 38,128,672 shares of our common stock. We are not offering any shares for sale under the registration statement of which this prospectus is a part.

| Common stock outstanding prior to this offering |

38,200,088 shares(1) |

| Common stock offered by the selling stockholders hereunder |

38,128,672 shares(2) |

| Common stock outstanding after this offering |

38,200,088 shares(3) |

| Use of proceeds |

We will not receive any proceeds from the sale of our common stock offered by the selling stockholders under this prospectus. We may, however, receive proceeds from warrants exercised by selling stockholders in the event that such warrants are exercised for cash. See “Use of Proceeds” beginning on page 70 of this prospectus. |

| Lock-Up Agreements |

Selling stockholders who hold an aggregate of 32,552,131 shares of the common stock included in this offering are subject to lock-up agreements, which restrict the sale of such shares for a period of six (6) months following the consummation of the Merger. See “Market Price of and Dividends on Our Common Stock and Related Stockholder Matters—Lock-Up Agreements.” |

| Risk factors |

See “Risk Factors” beginning on page 8 and other information included in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our common stock. |

| OTC symbol |

VRAY |

| (1) | As of October 1, 2015. |

| (2) | Includes (a) 37,929,912 shares of common stock outstanding and (b) 198,760 shares of common stock issuable upon exercise of the Placement Agent Warrants. |

| (3) | Excludes (a) 9,238,026 shares of our common stock reserved for issuance under our 2008 Stock Option and Incentive Plan, or 2008 Plan, and our 2015 Equity Incentive Award Plan, or 2015 Plan, and (b) 123,231 shares of our common stock issuable upon the exercise of an outstanding warrant with an exercise price of $5.85 per share, which is not being registered pursuant to the registration statement of which this prospectus is a part. As of November 19, 2015, there were outstanding options to purchase 4,313,183 shares of our common stock under our 2008 Plan, with a weighted average exercise price of $0.91 per share, and 1,672,416 shares of our common stock under our 2015 Plan, with a weighted average exercise price of $5.15 per share. |

7

Table of Contents

Index to Financial Statements

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus. While we believe that the risks and uncertainties described below are the material risks currently facing us, additional risks that we do not yet know of or that we currently think are immaterial may also arise and materially affect our business. If any of the following risks are realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that case, the trading price of our common stock could decline.

Risks Related to Our Business and Strategy

We have incurred significant losses since our inception and anticipate that we will continue to incur significant losses for the foreseeable future. These factors raise substantial doubt about our ability to continue as a going concern.

We have historically incurred substantial net losses, including net losses of $10.3 million and $7.6 million during the three months ended September 30, 2015 and 2014, $30.9 million and $24.2 million during the nine months ended September 30, 2015 and 2014, respectively. We expect our net losses to continue as a result of ongoing expansion of our commercial operations, including increased manufacturing, sales and marketing costs. These net losses have had, and will continue to have, a negative impact on our working capital, total assets and stockholders’ equity. Because of the numerous risks and uncertainties associated with our commercialization efforts, we are unable to predict when we will become profitable, and we may never become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our inability to achieve and then maintain profitability could harm our business, financial condition, results of operations and cash flows.

Further, the net losses we incur may fluctuate significantly from quarter-to-quarter and year-to-year, such that a period-to-period comparison of our results of operations may not be a good indication of our future performance quarter-to-quarter and year-to-year, due to factors including the timing of clinical trials, any litigation that we may file or that may be filed against us, the execution of collaboration, licensing or other agreements and the timing of any payments we make or receive thereunder. These factors raise substantial doubt about our ability to continue as a going concern.

Our independent registered public accounting firm has issued an opinion on our 2014 financial statements that included an explanatory paragraph referring to our ability to continue as a going concern. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. We believe the closing of the Private Placement enables us to continue as a going concern.

If clinicians do not widely adopt MRI-guided radiation therapy or MRIdian fails to achieve and sustain sufficient market acceptance, we will not generate sufficient revenue and our growth prospects, financial condition and results of operations could be harmed.

Our MRI-guided radiation therapy system, MRIdian, may never gain significant acceptance in the marketplace and, therefore, may never generate substantial revenue or allow us to achieve or maintain profitability. Widespread adoption of MRI-guided radiation therapy depends on many factors, including acceptance by clinicians that MRI-guided radiation therapy is clinically-effective and cost-effective in treating a wide range of cancers, demand by patients for such treatment, successful education of clinicians on the various aspects of this therapeutic approach and coverage and adequate reimbursement for procedures performed using MRI-guided radiation therapy. If we are not successful in conveying to hospitals that MRI-guided radiation therapy provides equivalent or superior radiation therapy compared to existing technologies, we may experience reluctance or refusal on the part of hospitals to order, and third-party payors to pay for performing, a treatment in which MRIdian is utilized. Our ability to achieve commercial market acceptance for MRIdian or any other future

8

Table of Contents

Index to Financial Statements

products also depends on the strength of our sales, marketing and distribution organizations. In addition, our expectations regarding cost savings from using MRIdian may not be accurate. These hurdles may make it difficult to demonstrate to physicians, hospitals and other healthcare providers that MRIdian is an appropriate option for radiation therapy, may be superior to available radiation therapy systems and may be more cost-effective than alternative technologies.

Furthermore, we may encounter difficulty in gaining inclusion in cancer treatment guidelines and gaining broad market acceptance by healthcare providers, third-party payors and patients. Healthcare providers may have difficulty in obtaining adequate reimbursement from government and/or third-party payors for cancer treatment, which may negatively impact adoption of MRIdian.

We may not be able to generate sufficient revenue from the commercialization of MRIdian to achieve and maintain profitability.

We rely solely on the commercialization of MRIdian to generate revenue, and we expect to generate substantially all of our revenue in the future from sales of MRIdian. We have installed only four systems that are currently treating patients. During the three months and nine months ended September 30, 2015, we recognized revenue of $5.1 million and $5.5 million, respectively, from installed MRIdian systems at Washington University and Siteman Cancer Center at Barnes Jewish Hospital, or Washington University in St. Louis, University of California, Los Angeles and Health System and Jonsson Comprehensive Cancer Center, or UCLA, The University of Wisconsin Carbone Cancer Center, or the University of Wisconsin—Madison, and Seoul National University Hospital, South Korea. In order to successfully commercialize MRIdian, we will need to continue to expand our marketing efforts to develop new relationships and expand existing relationships with customers, to receive clearance or approval for MRIdian in additional countries, to achieve and maintain compliance with all applicable regulatory requirements and to develop and commercialize new features for MRIdian. We cannot assure you that we will be able to achieve or maintain profitability. If we fail to successfully commercialize MRIdian, we may never receive a return on the substantial investments in product development, sales and marketing, regulatory compliance, manufacturing and quality assurance we have made, as well as further investments we intend to make, which may cause us to fail to generate revenue and gain economies of scale from such investments.

In addition, potential customers may decide not to purchase MRIdian, or our customers may decide to cancel orders due to changes in treatment offerings, research and product development plans, difficulties in obtaining coverage or reimbursement for MRI-guided radiation therapy treatment, complications with facility build-outs, utilization of MRI-guided radiation therapy or other cancer treatment methods developed by other parties, lack of financing or the inability to obtain or delay in obtaining a certificate of need from state regulatory agencies or zoning restrictions, all of which are circumstances outside of our control.

In addition, demand for MRIdian systems may not increase as quickly as we predict, and we may be unable to increase our revenue levels as we expect. Even if we succeed in increasing adoption of MRIdian systems by hospitals and other healthcare providers, maintaining and creating relationships with our existing and new customers and developing and commercializing new features for MRIdian, we may not be able to generate sufficient revenue to achieve or maintain profitability.

We are an early, commercial-stage company and have a limited history commercializing MRIdian, which may make it difficult to evaluate our current business and predict our future performance.

We are an early, commercial-stage company and have a limited operating history. We commenced operations as a Florida corporation in 2004 and subsequently reincorporated in Delaware in 2007. However, we did not begin commercial operations until 2013. Our limited history commercializing MRIdian may make it difficult to evaluate our current business and predict our future performance. Any assessment of our profitability or prediction about our future success or viability is subject to significant uncertainty. We have encountered and

9

Table of Contents

Index to Financial Statements

will continue to encounter risks and difficulties frequently experienced by early, commercial-stage companies in rapidly evolving industries. If we do not address these risks successfully, our business could be harmed.

If MRIdian does not perform as expected, or if we are unable to satisfy customers’ demands for additional product features, our reputation, business and results of operations will suffer.

Our success depends on the market’s confidence that MRIdian can provide reliable, high-quality MRI-guided radiation therapy. There are only four MRIdian systems being used in commercial practice, and therefore we have very few statistics regarding the efficacy or reliability of MRIdian. We believe that our customers are likely to be particularly sensitive to product defects and errors, including functional downtime that limits the number of patients that can be treated using the system or a failure that is costly to repair. For example, in January 2014, we initiated a correction of the system at Washington University in St. Louis due to a defect we identified in an advanced software feature in the treatment planning system of MRIdian. We promptly updated our software to resolve this defect and notified the U.S. Food and Drug Administration, or FDA, of this correction. We cannot assure that similar product defects or other errors will not occur in the future. This could also include the mistreatment of a patient with MRIdian caused by human error on the part of MRIdian’s operators or prescribing physicians or as a result of a machine malfunction. We may be subject to regulatory enforcement action or legal claims arising from any defects or errors that may occur. Any failure of MRIdian to perform as expected could harm our reputation, business and results of operations.

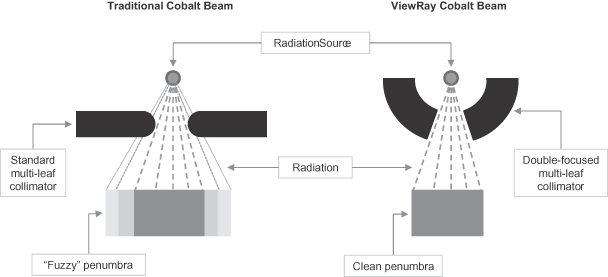

Furthermore, the Cobalt-60 radioactive materials used in MRIdian systems decay over time, which eventually leads to longer treatment times and may have a negative impact on the number of patients a hospital can treat during a day. U.S. regulations require inspection of Cobalt-60 every five years, at which time customers may consider replacing the Cobalt-60 source. This natural decay or a customer’s failure to replace the Cobalt-60 may have a negative impact on MRIdian performance.

In addition, our customers are technologically well informed and at times have specific demands or requests for additional functionality. If we are unable to meet those demands through the development of new features for MRIdian or future products, those new features or products do not function at the level that our customers expect, we are unable to increase throughput as expected or we are unable to obtain regulatory clearance or approval of those new features or products, where applicable, our reputation, business and results of operations could be harmed.

The safety and efficacy of MRIdian for certain uses is not currently supported by long-term clinical data, and MRIdian may therefore be less safe and effective than initially anticipated.

MRIdian has received premarket clearance by the FDA under Section 510(k) of the Federal Food, Drug and Cosmetic Act, or FDCA. In the 510(k) clearance process, the FDA must determine that a proposed device is “substantially equivalent” to a device legally on the market, known as a “predicate” device, with respect to intended use, technology and safety and effectiveness, in order to clear the proposed device for marketing. This process is typically shorter and generally requires the submission of less supporting documentation than the FDA’s premarket approval process and does not always require long-term clinical studies. Additionally, to date, we have not been required to complete long-term clinical studies in connection with the sale of MRIdian outside the United States. As a result, we currently lack the breadth of published long-term clinical data supporting the efficacy of MRIdian and the benefits it offers that might have been generated in connection with other approval processes. In addition, because MRIdian has only been on the market since 2013, we have limited complication or patient survival rate data with respect to treatment using the system. If future patient studies or clinical testing do not support our belief that MRIdian offers a more advantageous treatment for a wide variety of cancer types, market acceptance of the system could fail to increase or could decrease and our business could be harmed.

If we choose to, or are required to, conduct additional studies, such studies or experience could reduce the rate of coverage and reimbursement by both public and private third-party payors for procedures that are performed with

10

Table of Contents

Index to Financial Statements

MRIdian, slow the market adoption of our product by physicians, significantly reduce our ability to achieve expected revenues and prevent us from becoming profitable. In addition, if future studies and experience indicate that MRIdian causes unexpected or serious complications or other unforeseen negative effects, we could be subject to mandatory product recalls or suspension or withdrawal of FDA clearance, and our reputation with physicians, patients and healthcare providers may suffer.

There have been instances of patients’ severe injury or death due to either operator misuse or system malfunction with other radiation therapy systems. If our redundant safety systems do not operate as we expect, or were misused by operators, MRIdian could severely injure or kill a patient. This could result in lawsuits, fines or damage to our reputation.

We may be delayed or prevented from implementing our long-term sales strategy if we fail to educate clinicians and patients about the benefits of MRIdian.

In order to increase revenue, we must increase awareness of the range of benefits that we believe MRIdian offers to both existing and potential customers, primarily cancer clinicians. An important part of our sales strategy involves educating and training clinicians to utilize the entire functionality of MRIdian. In addition, we must further educate clinicians about the ability of MRIdian to treat a wide range of cancer types effectively and efficiently. If clinicians are not properly educated about the use of MRIdian for radiation therapy, they may be unwilling or unable to take advantage of the full range of functionality that we believe MRIdian offers, which could have a negative impact on MRIdian sales. Clinicians may decide that certain tumors can be adequately treated using traditional radiation therapy systems, notwithstanding the benefits of MRIdian. Cobalt-60 systems have historically had certain limitations which have resulted in an increased use of linacs and a decreased use of Cobalt-60 systems. These historical limitations included imprecise radiation dose applications and an unsharp, wide-beam edge. If we do not adequately educate physicians about the functionality of our Cobalt-60 system to address some of the limitations that have affected Cobalt-60 systems, we may be delayed or prevented from implementing our long-term sales strategy. We must also succeed in educating clinicians about the potential for reimbursement for procedures performed using MRIdian. In addition, we need to increase awareness of MRIdian among potential patients, who are increasingly educated about cancer treatment options and therefore impact adoption of new technologies by clinicians. If our efforts to expand sales of MRIdian in the long-term are not successful, our business and results of operations will be harmed.

We may not be able to gain the support of leading hospitals and key opinion leaders, or to publish the results of our clinical trials in peer-reviewed journals, which may make it difficult to establish MRIdian as a standard of care and achieve market acceptance.

Our strategy includes developing relationships with leading hospitals and key opinion leaders in our industry. If these hospitals and key industry thought leaders determine that MRIdian is not clinically effective or that alternative technologies are more effective, or if we encounter difficulty promoting adoption or establishing MRIdian as a standard of care, our ability to achieve market acceptance of MRIdian could be significantly limited.

We believe that publication of scientific and medical results in peer-reviewed journals and presentation of data at leading conferences are critical to the broad adoption of MRIdian. Publication in leading medical journals is subject to a peer-review process, and peer reviewers may not consider the results of studies involving MRIdian sufficiently novel or worthy of publication.

We have a limited history of manufacturing, assembling and installing MRIdian in commercial quantities and may encounter related problems or delays that could result in lost revenue.

The pre-installation manufacturing processes for MRIdian include sourcing components from various third-party suppliers, subassembly, assembly, system integration and testing. We must manufacture and assemble MRIdian in compliance with regulatory requirements and at an acceptable cost in order to achieve and maintain

11

Table of Contents

Index to Financial Statements

profitability. We have only a limited history of manufacturing, assembling and installing MRIdian and, as a result, we may have difficulty manufacturing, assembling and installing MRIdian in sufficient quantities in a timely manner. To manage our manufacturing and operations with our suppliers, we forecast anticipated product orders and material requirements to predict our inventory needs up to a year in advance and enter into purchase orders on the basis of these requirements. Our limited manufacturing history may not provide us with sufficient data to accurately predict future component demand and to anticipate our costs effectively.

Further, we have experienced and may in the future experience delays in obtaining components from suppliers and installing our systems at customer sites associated with contractor timing delays, which could impede our ability to manufacture, assemble and install MRIdian on our expected timeline. Alternatively, delays or postponements of scheduled customer installations could lead to excess inventory due to our limited flexibility to postpone or delay component shipments from suppliers. Accordingly, we may encounter difficulties in production of MRIdian, including problems with quality control and assurance, component supply shortages or surpluses, increased costs, shortages of qualified personnel and difficulties associated with compliance with local, state, federal and foreign regulatory requirements. In addition, if we are unable to maintain larger-scale manufacturing capabilities, our ability to generate revenue will also be limited and our reputation could be harmed. If we cannot achieve the required level and quality of production, we may need to make changes in our supply chain or enter into licensing and other arrangements with third parties who possess sufficient manufacturing facilities and capabilities in compliance with regulatory requirements. Even if we outsource necessary production or enter into licensing or other third-party arrangements, the associated cost could reduce our gross margin and harm our financial condition and results of operations.

We have limited experience in marketing and selling MRIdian, and if we are unable to adequately address our customers’ needs, it could negatively impact sales and market acceptance of MRIdian and we may never generate sufficient revenue to achieve or sustain profitability.

We have limited experience in marketing and selling MRIdian. We have only been selling MRIdian since 2013 and our four MRIdian systems installed have only been used for treating patients since early 2014. In addition, MRIdian is a new technology in the radiation therapy systems sector and our future sales will largely depend on our ability to increase our marketing efforts and adequately address our customers’ needs. We believe it is necessary to maintain a sales force that includes sales representatives with specific technical backgrounds that can support our customers’ needs. We will also need to attract and develop sales and marketing personnel with industry expertise. Competition for such employees is intense and we may not be able to attract and retain sufficient personnel to maintain an effective sales and marketing force. If we are unable to adequately address our customers’ needs, it could negatively impact sales and market acceptance of MRIdian and we may never generate sufficient revenue to achieve or sustain profitability.

The long sales cycle and low unit volume sales of MRIdian, as well as other factors, may contribute to substantial fluctuations in our operating results and stock price and make it difficult to compare our results of operations to prior periods and predict future financial results.

Because of the relatively small number of systems we expect to install in any period, each installation of a MRIdian will represent a significant percentage of our revenue for a particular period. Additionally, customer site construction, certificate of need and additional zoning and licensing permits are often required in connection with the sale of a MRIdian, any of which may further delay the installation process. When we are responsible for installing a system, we only recognize revenue from the sale of a MRIdian after the system has been installed and accepted by the customer. When a qualified third party is responsible for the installation, we only recognize revenue when title is transferred. Therefore, if we do not install a MRIdian or transfer title when anticipated, our operating results will vary significantly from our expectations. We have had experiences with customers postponing installation of MRIdian systems due to delays in facility build-outs, which are often lengthy and costly processes for our existing and potential customers. In addition, if our customers delay or cancel purchases, we may be required to modify or terminate contractual arrangements with our suppliers, which may result in the

12

Table of Contents

Index to Financial Statements

loss of deposits. Due to future fluctuations in revenue and costs, as well as other potential fluctuations, you should not rely upon our operating results in any particular period as an indication of future performance. In addition to the other risks described herein, the following factors may also contribute to these fluctuations:

| • | timing of when we are able to recognize revenue associated with sales of MRIdian; |

| • | actions relating to regulatory matters, including regulatory requirements in some states for a certificate of need prior to the installation of a MRIdian; |

| • | delays in shipment due to, for example, unanticipated construction delays at customer locations where MRIdian is to be installed, labor disturbances or natural disasters; |

| • | delays in our manufacturing processes or unexpected manufacturing difficulties; |

| • | timing of the announcements of contract executions or other customer and commercial developments; |

| • | timing of the announcement, introduction and delivery of new products or product features by us and by our competitors; |

| • | timing and level of expenditures associated with expansion of sales and marketing activities and our overall operations; |

| • | fluctuations in our gross margins and the factors that contribute to such fluctuations, as described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” elsewhere in this prospectus; |

| • | our ability to effectively execute on our strategic and operating plans; |

| • | the extent to which MRIdian gains market acceptance and the timing of customer demand for MRIdian; |

| • | our ability to protect our proprietary rights and defend against third-party challenges; |

| • | disruptions in the supply or changes in the costs of raw materials, labor, product components or transportation services; and |

| • | changes in third-party coverage and reimbursement, government regulation or in a customer’s ability to obtain financing. |

These factors are difficult to forecast and may contribute to fluctuations in our reported revenue and results of operations and variation from our expectations, particularly during the periods in which our sales volume is low. Any such fluctuations in our financial results may cause volatility in our stock price.

Each MRIdian is a major capital equipment item and is subject to a lengthy sales cycle. The time from initial customer contact to execution of a contract can take 18 to 24 months or more. Following execution of a contract, it generally takes nine to 12 months for a customer to customize an existing facility or construct a new vault, which is inclusive of the time from when a customer places the order to when the system is delivered. During this time, facilities support and transitioning, as well as permitting, are typically required, which can take several months. The time required to customize an existing facility, including modifications of a standard vault to accommodate an MRI, is currently three months. If a customer does not have an existing vault available, it may take longer to construct a new vault. Upon the commencement of installation at a customer’s facility, it typically takes two to three months to complete the installation and on-site testing of the system, including the completion of acceptance test procedures. If a small number of customers defer installation of a MRIdian for even a short period, recognition of a significant amount of revenue may be deferred to a subsequent period. Because our operating costs are relatively fixed, our inability to recognize revenue in a particular period may impact our profitability in that period. As a result, the inability to recognize revenue in a particular period may make it difficult to compare our operating results with prior periods. The price of a MRIdian requires a portion of our target customers to obtain outside financing before committing to purchase a MRIdian system. Such financing may be difficult for our customers to obtain in any given period, if at all. The requirement of site-specific

13

Table of Contents

Index to Financial Statements

modifications or construction may also delay adoption or overall demand. In addition, while we believe that our backlog of orders provides a better measure at any particular point in time of the long-term performance prospects of our business than our operating results for a particular period, investors may attribute significant weight to our operating results for a particular period, which may be volatile and as a result cause fluctuations in our stock price.

A large portion of our revenue in any given reporting period will be derived from a small number of contracts.

Given a significant portion of the purchase price for MRIdian will generally be recognized as revenue in a single reporting period, we expect a small number of contracts in any given reporting period to account for a substantial part of our revenue in any such period, and we expect this trend to continue. Any decrease in revenue from these contracts could harm our operating results. Accordingly, our revenue and results of operations may vary from period to period. We are also subject to credit risk associated with the concentration of our accounts receivable from our customers. If one or more of our customers at any given time were either to terminate their contracts with us, cease doing business with us or to fail to pay us on a timely basis, our business, financial condition and results of operations could be harmed.

The payment structure we use in our customer arrangements may lead to fluctuations in operating cash flows in a given period.

While our customers typically provide a deposit upon entering into a sales contract with us, the substantial majority of the payment owed for a MRIdian is not due until the time of shipment of a MRIdian or following final acceptance by the customer upon installation. If we miss targeted shipments or our customers do not actively work towards completing installation, our receipt of payments and our operating cash flows could be impacted. In addition, if customers do not adhere to our payments terms, our operating cash flows could be impacted in any given period. Due to these fluctuations in operating cash flows and other potential fluctuations, you should not rely upon our operating results in any particular period as an indication of future performance.

Amounts included in backlog may not result in actual revenue and are an uncertain indicator of our future earnings.

We define backlog as the accumulation of all orders for which revenue has not been recognized and we consider valid. The determination of backlog includes, among other factors, our subjective judgment about the likelihood of an order becoming revenue and the regulatory approval required in the customer’s jurisdiction, if any. Our judgments in this area have been, and in the future may be, incorrect and we cannot assure you that, for any order included in backlog, we will recognize revenue with respect to such order. In addition, orders can be delayed for a number of reasons, many of which are beyond our control, including supplier delays which may cause delays in our manufacturing process, customer delays in commencing or completing construction of its facility, delays in obtaining zoning or other approvals and delays in obtaining financing. We may not be aware of these delays affecting our suppliers and customers and as a result may not consider them when evaluating the contemporaneous effect on backlog. Moreover, orders generally do not have firm dates by when a customer must take delivery, which could allow a customer to delay the order without cancelling the contract. Further, our backlog could be reduced due to cancellation of orders by customers. Should a cancellation occur, our backlog and anticipated revenue would be reduced unless we were able to replace such order. Reported reductions in our backlog could negatively impact our future results of operations or the price of our common stock.

We evaluate our backlog at least quarterly to determine if the orders continue to meet our criteria for inclusion in backlog. Our criteria include an outstanding and effective written agreement for the delivery of a MRIdian signed by customers, receipt of a minimum customer deposit or a letter of credit, any changes in customer or distributor plans or financial conditions, the customer’s or distributor’s continued intent and ability to fulfill the order contract, changes to regulatory requirements, the status of regulatory approval required in the customer’s

14

Table of Contents

Index to Financial Statements

jurisdiction, if any, or reasons for cancellation of order contracts. We may adjust our reported backlog as a result of these factors and due to changes in our judgment about the timing of shipment of a system for particular projects or the status of our regulatory approval in a particular jurisdiction, where applicable. Projects we once categorized as included within our backlog may be removed if we determine, based on the aforementioned criteria, that a particular order or orders no longer constitute valid backlog. In addition, one or more of our contracts have in the past and may in the future contribute to a material portion of our backlog in any one year. Because revenue will not be recognized until we have fulfilled our obligations to a customer, there may be a significant amount of time from signing a contract with a customer or shipping a system and revenue recognition. We cannot assure you that our backlog will result in revenue on a timely basis or at all, or that any cancelled contracts will be replaced.

Our ability to achieve profitability depends substantially on increasing our gross margins by reducing costs of MRIdian and improving our economies of scale, which we may not be able to achieve.

We are not, and never have been, profitable. The MRIdian purchase contracts we have entered into to date have been at a range of selling prices. Generally, earlier contracts have been at lower prices and more recent contracts have been at higher prices. Our earlier contracts resulted in negative gross margins. In order to become profitable we will need to be able to enter into contracts at increased prices. Our intention is to enter into purchase contracts for MRIdian systems with selling prices that are increasingly closer to our list price of a MRIdian. Our ability to enter into contracts at higher selling prices depends on a number of factors including:

| • | our ability to achieve commercial market acceptance for our system; |

| • | the pricing of competitors’ cancer therapy systems; |

| • | availability of coverage and adequate reimbursement by commercial and government payors; and |

| • | our ability to manufacture and install our systems in a timely and cost-effective manner. |

We bear the risk of warranty claims on all products we supply, including equipment and component parts manufactured by third parties. We cannot assure you that we will be successful in claiming recovery under any warranty or indemnity provided to us by our suppliers or vendors in the event of a successful warranty claim against us by a customer or that any recovery from such vendor or supplier would be adequate. In addition, warranty claims brought by our customers related to third-party components may arise after our ability to bring corresponding warranty claims against such suppliers expires, which could result in additional costs to us. There is a risk that warranty claims made against us will exceed our warranty reserve and our business, financial condition and results of operations could be harmed.

Our customer contracts provide that our customers commit to purchase a MRIdian for a fixed price, and a MRIdian will generally not be delivered for 11 to 15 months. In some circumstances, delivery can be postponed several months due to customer delays related to construction, vault preparation or concurrent facility expansion, and the cost of product supplies may increase significantly in the intervening time period. In addition, inflation may generally reduce the real value of the purchase price payable upon the achievement of future progress payment milestones. Either of these occurrences could cause our gross margins to decline or cause us to lose money on the sale of a MRIdian.

Moreover, our gross margins may decline in a given period due in part to significant replacement rates for components, resulting in increased warranty expense, negative profit margins on service contracts and customer dissatisfaction. If we are unable to reduce our expenses and improve or maintain quality and reliability, our profitability may be negatively impacted. Additionally, we may face increased demands for compensation from customers who are not satisfied with the quality and reliability of MRIdian, which could increase our service costs or require us to issue credits against future service payments and negatively impact future product sales. For example, we may have to extend a warranty period due to our failure to meet up-time requirements. Even if we are able to implement cost reduction and quality improvement efforts successfully, our service operations may

15

Table of Contents

Index to Financial Statements

remain unprofitable given the relatively small size and geographic dispersion of our installed base, which prevents us from achieving significant economies of scale for the provision of services. If we are unable to continue to sell MRIdian at increasingly higher prices that result in higher gross margins, we may never become profitable.

We may not be able to develop new products or enhance the capabilities of MRIdian to keep pace with our industry’s rapidly changing technology and customer requirements.

Our industry is characterized by rapid technological changes, new product introductions and enhancements and evolving industry standards. Our business prospects depend on our ability to develop new products and applications for our technology in new markets that develop as a result of technological and scientific advances, while improving the performance and cost-effectiveness of MRIdian. New technologies, techniques or products could emerge that might offer better combinations of price and performance than MRIdian systems. The market for radiation therapy treatment products is characterized by rapid innovation and advancement in technology. It is important that we anticipate changes in technology and market demand, as well as physician, hospital and healthcare provider practices to successfully develop, obtain clearance or approval, if required, and successfully introduce new, enhanced and competitive technologies to meet our prospective customers’ needs on a timely and cost-effective basis. Nevertheless, we must carefully manage our introduction of new products. If potential customers believe that such products will offer enhanced features or be sold for a more attractive price, they may delay purchases until such products are available. We may also have excess or obsolete inventory as we transition to new products, and we have no experience in managing product transitions. If we do not successfully innovate and introduce new technology into our anticipated product lines or effectively manage the transitions of our technology to new product offerings, our business, financial condition and results of operations could be harmed.

We face competition from numerous companies, many of whom have greater resources than we do or offer alternative technologies at lower prices than our MRIdian systems, which may make it more difficult for us to achieve significant market penetration and profitability.

The market for radiation therapy equipment is characterized by intense competition and pricing pressure. In particular, we compete with a number of existing therapy equipment companies, including Elekta AB, Varian Medical Systems, Inc. and Accuray Incorporated. Many of these competitors are large, well-capitalized companies with significantly greater market share and resources than we have. As a result, these companies may be better positioned than we are to spend more aggressively on marketing, sales, intellectual property and other product initiatives and research and development activities. In addition, we may compete with certain MRI-linear accelerator research projects that are currently in development and may be commercialized, including projects by the University of Alberta’s Cross Cancer Institute and a partnership of the University of Sydney, Ingham Institute and the University of Queensland.

Existing technologies may offer certain advantages compared to the MRI technology used by our MRidian system. For example, computed tomography, or CT, is known to hold certain potential advantages over MRI technology for use in radiation therapy. Diagnostic CT is currently the most widely adopted imaging modality for treatment planning, and can be used to directly measure the electron density of patient tissues, which enables more accurate dose computation. In addition, CT imaging provides superior imaging of bones and boney anatomy than MRI, which is advantageous when imaging those structures for planning and alignment for treatment. Finally, CT is a less expensive technology than MRI and might be preferred by customers seeking a lower cost solution.

Our current competitors or other potential competitors may develop new products for the treatment of cancer at any time. In addition, competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or customer requirements. If we are unable to develop products that compete effectively against the products of existing or future competitors, our future revenue could be

16

Table of Contents

Index to Financial Statements

negatively impacted. Some of our competitors may compete by changing their pricing model or by lowering the price of their therapy systems. If these competitors’ pricing techniques are effective, it could result in downward pressure on the price of all therapy systems. If we are unable to maintain or increase our selling prices in the face of competition, we may not improve our gross margins.

In addition to the competition that we face from technologies performing similar functions to MRIdian, competition also exists for the limited capital expenditure budgets of our customers. A potential purchaser may be forced to choose between two items of capital equipment. Our ability to compete may also be negatively impacted when purchase decisions are based largely upon price, because MRIdian is a premium-priced system relative to other capital expenditures and alternative radiation therapy technologies. In certain circumstances, a purchaser may decide that an alternative radiation therapy system priced below MRIdian may be sufficient for its patient population given the relative upfront cost savings. In addition to the cost of the MRIdian system, U.S. customers are required to inspect the Cobalt-60 every five years, and our customers may incur significant costs associated with the inspection, replacement and disposal of Cobalt-60.

Negative press regarding MRI-guided radiation therapy for the treatment of cancer could harm our business.

The comparative efficacy and overall benefits of MRI-guided radiation therapy are not yet well understood, particularly with respect to certain types of cancer. These types of reports could negatively impact the market’s acceptance of MRI-guided radiation therapy, and therefore our ability to generate revenue could be negatively impacted.

We may acquire other businesses, form joint ventures or make investments in other companies or technologies that could negatively affect our operating results, dilute our stockholders’ ownership, increase our debt or cause us to incur significant expense.