Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - SANCILIO PHARMACEUTICALS COMPANY, INC. | d10059dex11.htm |

| EX-4.1 - EX-4.1 - SANCILIO PHARMACEUTICALS COMPANY, INC. | d10059dex41.htm |

| EX-23.1 - EX-23.1 - SANCILIO PHARMACEUTICALS COMPANY, INC. | d10059dex231.htm |

| EX-10.13 - EX-10.13 - SANCILIO PHARMACEUTICALS COMPANY, INC. | d10059dex1013.htm |

| EX-10.6(A) - EX-10.6(A) - SANCILIO PHARMACEUTICALS COMPANY, INC. | d10059dex106a.htm |

| EX-10.12 - EX-10.12 - SANCILIO PHARMACEUTICALS COMPANY, INC. | d10059dex1012.htm |

| EX-10.11 - EX-10.11 - SANCILIO PHARMACEUTICALS COMPANY, INC. | d10059dex1011.htm |

| EX-10.10 - EX-10.10 - SANCILIO PHARMACEUTICALS COMPANY, INC. | d10059dex1010.htm |

Table of Contents

As filed with the Securities and Exchange Commission on December 30, 2015.

Registration No. 333-206694

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Sancilio Pharmaceuticals Company, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 47-3943353 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2129 N. Congress Avenue

Riviera Beach, FL 33404

(561) 847-2302

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Marc Wolff

Executive Vice President and Chief Financial Officer

Sancilio Pharmaceuticals Company, Inc.

2129 N. Congress Avenue

Riviera Beach, FL 33404

(561) 847-2302

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

| Kara L. MacCullough, Esq. Flora R. Perez, Esq. Greenberg Traurig, P.A. 401 East Las Olas Boulevard, Suite 2000 Fort Lauderdale, FL 33301 Phone: (954) 765-0500/Fax: (954) 765-1477 |

Richard D. Truesdell, Jr. Byron B. Rooney Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | Subject to completion | dated December 30, 2015 |

Shares

Common Stock

This is the initial public offering of our common stock. We are offering all of the shares offered by this prospectus. We expect the initial public offering price to be between $ and $ per share.

Prior to this offering there has been no public market for the common stock. We have applied to list our common stock on The NASDAQ Global Market under the symbol “SPCI.”

We are an “emerging growth company” as defined by the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock involves a high degree of risk. You should carefully consider the matters discussed under the section entitled “Risk Factors” beginning on page 12 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||

| Public offering price | $ | $ | ||

| Underwriting discounts and commissions(1) | $ | $ | ||

| Proceeds to us, before expenses | $ | $ |

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting” beginning on page 190 of this prospectus. |

We have granted the underwriters an option for a period of 30 days to purchase additional shares of our common stock. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $ , and the total proceeds to us, before expenses, will be $ .

The underwriters expect to deliver the shares of common stock on or about , 2016.

| UBS Investment Bank | Piper Jaffray | |

| JMP Securities | FBR | |

Table of Contents

We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus or any free writing prospectus. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of shares of our common stock.

| 1 | ||||

| 7 | ||||

| 9 | ||||

| 12 | ||||

| 57 | ||||

| 60 | ||||

| 62 | ||||

| 63 | ||||

| 66 | ||||

| 68 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

70 | |||

| 95 | ||||

| 150 | ||||

| 164 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

172 | |||

| 175 | ||||

| 177 | ||||

| 184 | ||||

| Material US Federal Income Tax Consequences to Non-US Holders of Our Common Stock |

186 | |||

| 190 | ||||

| 195 | ||||

| 199 | ||||

| 199 | ||||

| 199 | ||||

| 200 | ||||

| F-1 |

For investors outside the United States: neither we nor any of the underwriters have taken any action to permit a public offering of the shares of our common stock or the possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

DEALER PROSPECTUS DELIVERY OBLIGATION

Through and including , 2016 (25 days after the commencement of this offering), all dealers that buy, sell or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

TERMS USED IN THIS PROSPECTUS

Unless the context otherwise requires, in this prospectus, the terms “Sancilio,” the “Company,” “we,” “us” and “our” refer to Sancilio Pharmaceuticals Company, Inc. and its consolidated subsidiaries as a combined entity. Please refer to the Glossary of Certain Scientific Terms on page 200 of this prospectus for definitions of certain technical and scientific terms used throughout this prospectus.

i

Table of Contents

TRADEMARKS AND TRADE NAMES

This prospectus contains some of our trademarks and trade names. All other trademarks or trade names of any other company appearing in this prospectus belong to their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are sometimes referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

INDUSTRY AND MARKET DATA

We obtained the industry, market and competitive position data described or referred to throughout this prospectus from our own internal estimates and research as well as from industry and general publications and research, surveys and studies conducted by third parties. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates.

Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. In some cases, we do not expressly refer to the sources from which this data is derived. In that regard, when we refer to one or more sources of this type of data in any paragraph, you should assume that other data of this type appearing in the same paragraph is derived from the same sources, unless otherwise expressly stated or the context otherwise requires.

ii

Table of Contents

The following summary highlights information appearing elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully. In particular, you should read the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the notes relating to those statements included elsewhere in this prospectus. Some of the statements in this prospectus constitute forward-looking statements. See “Information Regarding Forward-Looking Statements.”

OVERVIEW

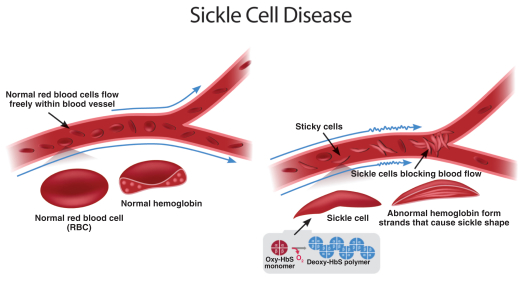

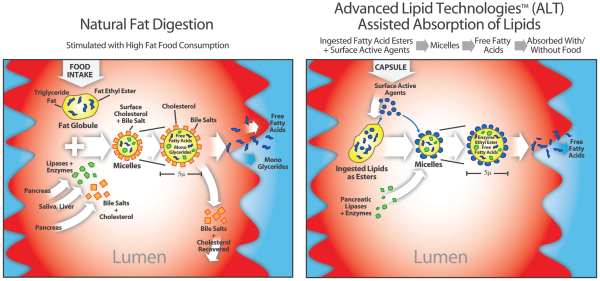

We are an integrated specialty pharmaceutical company focused on developing and, in the future, commercializing products based on our proprietary Advanced Lipid Technologies, or ALT, platform. We intend to utilize our current manufacturing facility to manufacture our proprietary product candidates, if approved. ALT is designed to enhance the bioavailability, reduce the food effect and improve the efficacy of lipids and lipophilic active pharmaceutical ingredients, or APIs. Lipids are hydrophobic or amphipathic molecules and include fatty acids (such as omega-3 fatty acids and omega-6 fatty acids), steroids (including hormones) and fat-soluble vitamins (such as vitamins A, D, E and K). Our business model is to apply our ALT platform to lipids or lipophilic APIs to create unique product candidates that address the disorders and diseases resulting from imbalances of lipids in the body. In addition to our primary focus of developing our proprietary products using our ALT platform, we make use of and license rights to our proprietary ALT platform and our other technologies to third parties as part of our development and manufacture of lipophilic API-based and soft-gelatin products at our facilities.

Our proprietary product pipeline, which has been developed using our proprietary ALT platform, is currently focused on diseases and disorders for which we believe lipids can be used for treatment. We believe that our ALT platform will enable us to utilize our proprietary know-how and expertise in lipids to create unique formulations of clinically proven substances for approved and new indications. Our four lead product candidates are:

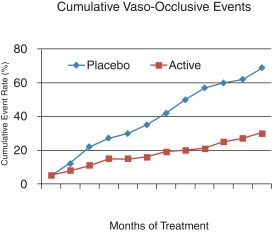

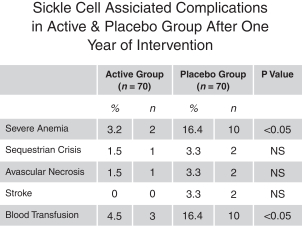

| Ø | SC411—Our proprietary product candidate SC411, which is being developed for the treatment of sickle cell disease, or SCD, has been granted orphan drug designation by the FDA. We held a pre-IND meeting with the US Food and Drug Administration, or FDA, in May 2015, during which the FDA reviewed and provided recommendations for the design of our proposed clinical trial protocol for a pivotal trial of SC411. In December 2015, we submitted an Investigational New Drug Application, or IND, to the FDA. As agreed with the FDA, we submitted the final study protocol and statistical analysis plan to the FDA for its review concurrently with our IND submission. |

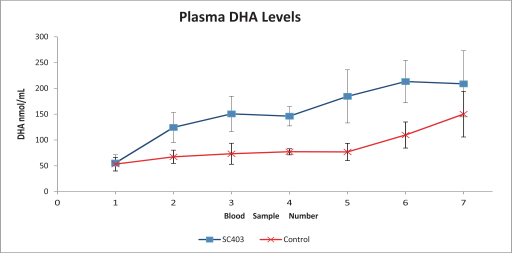

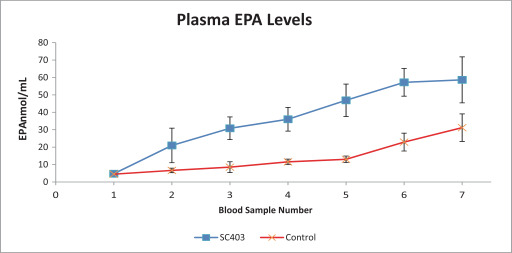

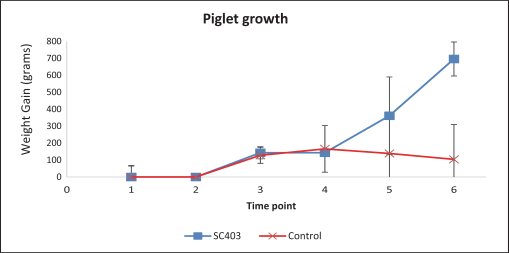

| Ø | SC403—Our proprietary product candidate SC403, which is being developed for the treatment of short bowel syndrome, or SBS, has been granted orphan drug designation by the FDA. We held a pre-IND meeting with the FDA in July 2015, during which the FDA reviewed and provided recommendations for the design of our proposed clinical trial protocol. During that meeting, the FDA requested that we conduct additional toxicology studies on juvenile rats. We are in the process of conducting those studies. We expect to submit an IND to the FDA during the first half of 2016. |

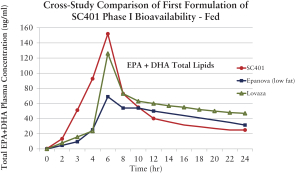

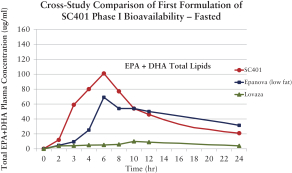

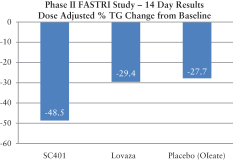

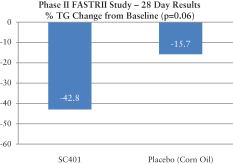

| Ø | SC401—Our proprietary product candidate SC401 is being developed for the treatment of severe hypertriglyceridemia. We submitted an IND in July 2015. We completed the two pivotal pharmacokinetic, or PK, studies that we initiated in August 2015 and are awaiting the final reports. We intend to subsequently initiate a pivotal clinical endpoint study. |

1

Table of Contents

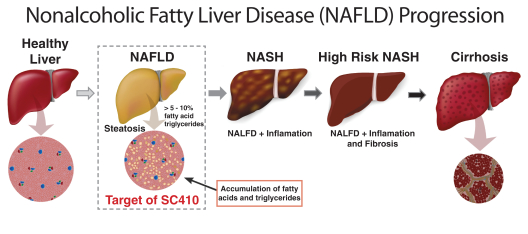

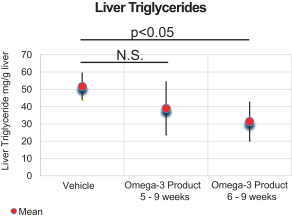

| Ø | SC410—Our proprietary product candidate SC410 is being developed for the treatment of non-alcoholic fatty liver disease, or NAFLD. We completed a preclinical study of SC410 in late 2014. Based on preliminary communications with the FDA, we are in the process of revising our protocol and, based upon further input from the FDA, we expect to submit an IND to the FDA in late 2016. In addition, in our recent pre-IND communications, the FDA has indicated that it will require us to submit both rodent and non-rodent chronic toxicology studies to support our IND for SC410, and that additional non-clinical and clinical studies will be required in an NDA for this product. |

Our regulatory strategy is focused on seeking the most efficient pathway to obtain drug approval while seeking the best available protections for our product candidates. To create our proprietary product candidates, we apply our ALT platform to a combination of lipophilic APIs, each of which is composed of active ingredients already approved by the FDA or active ingredients for which clinical proof of safety or efficacy is available in published literature. As a result, we believe that we are able to utilize the regulatory approval pathway provided in Section 505(b)(2) of the Federal Food, Drug, and Cosmetic Act, or FDCA. A New Drug Application, or NDA, submitted under Section 505(b)(2), referred to as a 505(b)(2) NDA, contains full safety and efficacy reports but allows at least some of the information required for NDA approval, such as safety and efficacy information on the active ingredient, to come from studies not conducted by or for the applicant and for which the applicant has not obtained a right of reference. If the 505(b)(2) NDA applicant can establish that reliance on the FDA’s previous approval or relevant published literature is scientifically appropriate, it may eliminate the need to conduct certain preclinical or clinical studies of the new product. We believe that this streamlined approach will reduce the risks, costs and timing of bringing our product candidates to market.

As part of our strategy to seek the best available protections for our product candidates, we have also sought, and been granted, orphan drug designation for both SC411 and SC403. As a result of this orphan drug designation, upon approval of an NDA for such orphan drug, we may be granted seven years of market exclusivity.

In connection with our licensing and related development and manufacturing services, we provide our customers with assistance throughout all phases of pharmaceutical development and product life cycle management activities, from drug design and development through commercialization. For example, we have commercial relationships with Mylan, Inc., TherapeuticsMD, Inc. and several other pharmaceutical companies. We are currently developing seven Abbreviated New Drug Application, or ANDA, drug products for third parties, four of which have been submitted and are awaiting FDA approval. We are also developing an additional four 505(b)(2) NDA drug products for third parties utilizing our proprietary technologies. We have been named as manufacturer in each of the four ANDAs submitted and expect to be named manufacturer in any future ANDA or NDA submitted by our customers for products we are developing for them.

We also manufacture and market over-the-counter, or OTC, and behind-the-counter lines of dietary supplements. Our dietary supplement portfolio includes highly concentrated omega-3 fatty acid supplements under our brand Ocean Blue®, prenatal vitamins, and dental health products. We market our dietary supplement products internally in the United States; while outside of the United States, we intend to utilize partners for the commercialization of these products.

OUR STRATEGY

We intend to become a leading integrated specialty pharmaceutical company through continued execution and implementation of the following strategies:

| Ø | Advance our four lead product candidates. We intend to rely on the 505(b)(2) regulatory pathway for approval of our four lead product candidates. We believe the 505(b)(2) regulatory pathway will |

2

Table of Contents

| provide us the most cost efficient and expeditious pathway to obtain approval of our product candidates. We were granted orphan drug designation for two of our four lead product candidates and for one of our early stage product candidates. This designation could provide us with seven years of market exclusivity for any product candidate that is approved for the orphan indication. |

| Ø | Commercialize any of our product candidates that are FDA-approved. We intend to leverage our current commercialization experience to create a small, focused sales force to commercialize, upon approval, those product candidates that target a limited, discrete population, such as our SC411 and SC403 product candidates. We may rely on out-licensing or co-promotion arrangements for the marketing of those product candidates that have the potential to treat extensive patient populations such as our SC401 and SC410 product candidates. |

| Ø | Manufacture our proprietary products in our established manufacturing facilities. We believe our manufacturing facilities and years of manufacturing experience provide us with a competitive advantage. We currently manufacture lines of our commercialized branded and co-branded dietary supplements and dental health products, as well as clinical batches of prescription generic and prescription proprietary drugs for our third-party customers and expect to commence manufacturing commercialized levels of these generic and proprietary drugs within the next six months. |

| Ø | Develop additional proprietary products by applying our ALT platform to lipophilic APIs to address unmet medical needs. We have several product candidates formulated using our ALT platform under development that target a range of unmet medical needs in the therapeutic areas of lipid disorders, cardiovascular disease and hematology disorders. We also utilize our proprietary ALT platform in connection with the development and manufacture of lipid-based products for our customers in the hormone area. We believe the mechanism of ALT makes it potentially applicable to expansion into other therapeutic categories. |

| Ø | Evaluate internal and external business development opportunities to accelerate and maximize the potential of our product candidates worldwide. We intend to continue to seek new product candidates that lie within or complement our therapeutic areas of focus to which we can acquire rights through acquisition, in-licensing or co-promotion arrangements. In addition, we currently retain worldwide commercial rights to our product candidates. Consequently, we intend to seek out-licensing or co-promotion opportunities outside of the United States for any of our product candidates. |

OUR PROPRIETARY PRODUCT PIPELINE

Our proprietary product pipeline is focused on developing new or improved therapeutics which utilize lipophilic APIs. Lipids are molecules that include fatty acids, steroids (including hormones), fat-soluble vitamins (such as vitamins A, D, E, and K), monoglycerides, diglycerides and triglycerides. The principal roles of lipids in the body are storing energy, intracellular signaling, and acting as structural components of cell membranes. Imbalances of lipids and lipid disorders are currently linked to numerous diseases. However, we believe the ability to treat these imbalances and disorders has been limited based on the fact that lipids, by themselves, are not readily bioavailable and must be taken with food in order to efficiently pass through the intestinal lining.

We believe that, based upon available scientific studies, currently available treatments of lipid disorders and their related diseases are inconsistently absorbed and less bioavailable, and are impacted by the presence or absence of food in the digestive tract, resulting in inconsistent product efficacy. We believe that our product candidates, which are lipid-based APIs formulated using our proprietary ALT platform, will have greater bioavailability and be more consistently absorbed than existing conventional formulations, potentially improving efficacy and lowering effective doses. Furthermore, we believe that increased consistency and bioavailability of the lipophilic APIs may facilitate the use of these lipophilic APIs for the treatment of diseases and disorders for which there is no current treatment or for which the currently available treatments have significant side effects.

3

Table of Contents

The following table sets forth information on the status of each of our product candidates, each of which is wholly owned by us:

| Product Candidate |

Indication | Regulatory Strategy |

Current Status | Upcoming Milestones | Anticipated Commercialization | |||||

| SC411 |

Sickle Cell Disease | Orphan drug designation granted April 2015.

Pursuing 505(b)(2) NDA. |

Relying on published preclinical studies for IND submission.*

Bridging toxicity study completed July 2015.*

IND submitted December 2015. |

Anticipate commencing pivotal clinical trial in first half of 2016. | In-house. | |||||

| SC403 |

Short Bowel Syndrome | Orphan drug designation granted June 2015.

Pursuing 505(b)(2) NDA. |

Preclinical study completed in early 2015.

Bridging toxicity study completed July 2015.*

Pre-IND meeting with FDA held July 2015. |

Anticipate submitting IND to FDA during the first half of 2016 pending completion of second toxicity study.** | In-house. | |||||

| SC401 |

Severe Hypertriglyceridemia | Pursuing 505(b)(2) NDA. | Relying on preclinical studies for current marketed product.

Bridging toxicity study completed July 2015.*

Pre-IND meeting with FDA held in Oct. 2014.

IND submitted July 2015. |

Completed PK studies and awaiting final reports. | Licensing or partnership arrangement with third parties. | |||||

| SC410 |

Non-Alcoholic Fatty Liver Disease | Pursuing 505(b)(2) NDA. | Preclinical study completed in 2014. | Anticipate finalizing revised protocol and submitting IND to FDA in late 2016 pending completion of chronic toxicology studies. |

Licensing or partnership arrangement with third parties. |

4

Table of Contents

| * | As part of our IND submissions, we conducted a 28-day bridging rat toxicology study using our omega-3-acid ethyl esters formulation and our DHA formulation in direct comparison with an FDA-approved omega-3-acid ethyl ester. The study was completed in early July 2015. |

| ** | As part of our anticipated IND submission for SC403, we are also conducting additional rat toxicology studies on juvenile rats using our omega-3-acid ethyl esters formulation and our DHA formulation in direct comparison with an FDA-approved omega-3-acid ethyl ester. One of these, a 28-day study, will need to be completed before we submit our IND. |

RISKS ASSOCIATED WITH OUR BUSINESS

Our business, financial condition, results of operation and prospects are subject to numerous risks. You should carefully consider such risks before deciding to invest in our company. These risks are more fully described in the section entitled “Risk Factors” immediately following this summary and include the following:

| Ø | Our future growth will depend on our ability to successfully develop, obtain regulatory approval for, and commercialize our product candidates formulated using our ALT platform. Because these processes are complex and costly, we may never obtain regulatory approval for and/or commercialize any of our product candidates. |

| Ø | Clinical trials involve a lengthy and expensive process with uncertain outcomes, and any delays may harm our business, financial condition, results of operations or prospects. |

| Ø | If the FDA does not conclude that our product candidates satisfy the requirements for the 505(b)(2) regulatory approval pathway, or if the requirements for approval of any of our product candidates under Section 505(b)(2) are not as we expect, the approval pathway for our product candidates will likely take significantly longer, cost significantly more and encounter significantly greater complications and risks than anticipated, and in any case may not be successful. |

| Ø | If we are unable to obtain and maintain intellectual property protection for our product candidates, or if the scope of the intellectual property protection obtained is not sufficiently broad, our competitors could develop and commercialize product candidates similar or identical to ours, and our ability to successfully commercialize our product candidates may be impaired. |

| Ø | Our manufacturing activities are subject to ongoing and continued regulatory review; for example, the FDA recently inspected our manufacturing facilities in connection with approval of two ANDAs in which we have been named manufacturer and issued an FDA Form 483 with observations regarding deficiencies in our laboratory equipment and production controls and manufacturing procedures and quality systems, and the FDA may not approve our customer’s pending ANDAs, if at all, until the observations in the FDA Form 483 have been remediated in a manner acceptable to the FDA or at all. |

| Ø | We may not obtain the anticipated benefits of the orphan drug designation granted on product candidates. |

| Ø | Our future results are subject to fluctuation in the cost, availability and suitability of the raw material components of our products, particularly fish oils and gelatin, and any disruptions in the supply of these products could have an adverse effect on our business and results of operation. |

| Ø | Our commercial success depends upon attaining significant market acceptance of our product candidates, if approved, by physicians, pharmacists, patients and the medical community. |

| Ø | We have incurred cumulative losses since our inception and we expect to incur losses for the foreseeable future and may never be profitable at all or on a sustained basis. |

5

Table of Contents

| Ø | We rely on the significant experience and specialized expertise of our Chief Executive Officer and other members of our senior management and scientific team, and we need to hire and retain additional qualified scientists and other highly skilled personnel to maintain and grow our business. |

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

As a company with less than $1.0 billion in revenue during our most recently completed fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are applicable to other companies that are not emerging growth companies. These provisions include:

| Ø | reduced disclosure about our executive compensation arrangements; |

| Ø | exemption from the requirement to have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of Sarbanes-Oxley; |

| Ø | exemption from the requirement to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board, or PCAOB, regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (auditor discussion and analysis); |

| Ø | no non-binding stockholder advisory votes on executive compensation or golden parachute arrangements; and |

| Ø | reduced disclosure of financial information in this prospectus, including only two years of audited financial information and two years of selected financial information. |

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company as of December 31 of a particular year:

| Ø | if we had gross revenue of $1.0 billion or more in such year; |

| Ø | if the market value of our common stock that is held by non-affiliates exceeds $700.0 million as of June 30 in such year; |

| Ø | if at any point in such year, we would have issued more than $1.0 billion of non-convertible debt during the three-year period prior thereto; or |

| Ø | on the date on which we are deemed a “large accelerated issuer” as defined under the federal securities laws. |

The JOBS Act permits an “emerging growth company” like us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We are choosing to “opt out” of this provision and, as a result, we will comply with new or revised accounting standards as required when they are adopted. This decision to opt out of the extended transition period is irrevocable.

CORPORATE INFORMATION

We were originally organized as a corporation in the State of Florida in October 2004. On February 7, 2012, we reincorporated in Delaware through a merger with Sancilio & Company, Inc., a Delaware corporation. On May 13, 2015, we underwent a holding company reorganization resulting in the incorporation of Sancilio Pharmaceuticals Company, Inc. and in Sancilio & Company, Inc. becoming our wholly owned subsidiary. Our principal executive offices are located at 2129 N. Congress Avenue, Riviera Beach, Florida 33404.

6

Table of Contents

| Common stock offered by us |

shares. |

| Option to purchase additional shares |

The underwriters have an option to purchase up to additional shares of our common stock from us. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

| Common stock outstanding after giving effect to this offering |

shares ( shares if the underwriters exercise their option to purchase additional shares in full). |

| Use of proceeds |

We estimate that the net proceeds from this offering, without the exercise of the underwriters’ option to purchase additional shares, will be approximately $ , after deducting the underwriting discounts and commissions and estimated offering expenses payable by us, assuming an initial public offering price of $ per share, which represents the midpoint of the price range set forth on the cover page of this prospectus. If the underwriters exercise in full their option to purchase additional shares, the net proceeds to us will be approximately $ . |

| We intend to use the net proceeds from this offering to fund the cost of clinical trials and related activities of SC411, SC403, SC401 and SC410, and for working capital and other general corporate purposes, including the ramp-up of our senior management team and the continued investment in our research and development pipeline of branded pharmaceutical products. |

| See “Use of Proceeds” for more information on how we intend to use the net proceeds from this offering. |

| Risk factors |

You should carefully read and consider the information set forth under “Risk Factors” beginning on page 12 of this prospectus and all other information set forth in this prospectus before investing in our common stock. |

| Listing |

We have applied to list the common stock on The NASDAQ Global Market under the symbol “SPCI.” |

7

Table of Contents

| Dividend policy |

We currently do not intend to pay dividends following this offering. The credit agreement governing our debt instruments currently limits our ability to pay cash dividends to our stockholders. In addition, any determination to pay dividends in the future will be at the discretion of our board of directors and will depend upon our results of operations, financial condition, contractual restrictions, restrictions imposed by applicable law and other factors that our board of directors deems relevant. See “Dividend Policy.” |

The number of shares of our common stock to be outstanding after giving effect to this offering is based on 21,761,908 shares (on an as-adjusted basis) of our common stock outstanding as of December 11, 2015, assuming the anticipated conversion of all then outstanding shares of Series A convertible preferred stock, Series B convertible preferred stock and Series C convertible preferred stock into common stock, and excludes:

| Ø | 2,101,606 shares of common stock issuable upon exercise of stock options outstanding as of September 30, 2015, at a weighted average exercise price of $0.93 per share; |

| Ø | 2,189,645 shares of common stock reserved for issuance under our 2015 Plan (including shares of common stock which were reserved for issuance under our 2012 Plan and added to the shares reserved under the 2015 Plan when the 2012 Plan was terminated); and |

| Ø | 185,767 shares of common stock issuable upon exercise of warrants to purchase our common stock outstanding as of December 11, 2015, at a weighted average price of $3.64 per share. |

Unless otherwise indicated, all information in this prospectus reflects and assumes the following:

| Ø | the automatic conversion of all outstanding shares of our Series A convertible preferred stock, Series B convertible preferred stock and Series C convertible preferred stock into an aggregate of 17,532,076 shares of our common stock immediately prior to the closing of this offering; |

| Ø | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws immediately prior to the closing of this offering; |

| Ø | no exercise of the underwriters’ over-allotment option to purchase additional shares of our common stock; and |

| Ø | a -for- reverse split of our common stock to be effected prior to the closing of this offering. |

8

Table of Contents

The following table summarizes certain of our financial data. We derived the summary statement of operations data for the years ended December 31, 2013 and 2014 from our audited consolidated financial statements included elsewhere in this prospectus. We derived the summary statement of operations data for the nine months ended September 30, 2014 and 2015 and the summary consolidated balance sheet data as of September 30, 2015 from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. We have prepared the unaudited condensed consolidated financial statements on the same basis as our audited consolidated financial statements and, in our opinion, have included all adjustments, which include only normal recurring adjustments, necessary to present fairly in all material respects our financial position and results of operations. The results for any interim period are not necessarily indicative of the results that may be expected for future interim periods or for the full year. Additionally, historical results are not necessarily indicative of the results expected for any future period.

You should read the summary consolidated financial data below together with our consolidated financial statements included elsewhere in this prospectus including the related notes thereto appearing elsewhere in this prospectus, as well as “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the other financial information included elsewhere in this prospectus.

| Year Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| (in thousands, except share and per share data) | 2013(1) | 2014 | 2014 | 2015 | ||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| Statement of Operations Data: |

||||||||||||||||

| Revenue: |

||||||||||||||||

| Net product sales |

$ | 4,201 | $ | 6,362 | $ | 5,283 | $ | 6,588 | ||||||||

| Technologies and services revenue |

5,274 | 8,847 | 5,852 | 11,552 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

9,475 | 15,209 | 11,135 | 18,140 | ||||||||||||

| Costs and expenses: |

||||||||||||||||

| Direct costs of product sales related to direct material |

1,858 | 2,541 | 2,071 | 1,948 | ||||||||||||

| Direct costs of technologies and services related to direct material and direct laboratory labor |

555 | 1,051 | 664 | 1,475 | ||||||||||||

| Total unallocated costs |

3,337 | 6,167 | 4,130 | 5,782 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of product sales and technologies and services |

5,750 | 9,759 | 6,865 | 9,205 | ||||||||||||

| Sales and marketing |

2,166 | 1,799 | 1,453 | 901 | ||||||||||||

| Research and development |

972 | 2,108 | 1,005 | 3,136 | ||||||||||||

| General and administrative |

2,217 | 8,298 | 5,364 | 7,800 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total costs and expenses |

11,105 | 21,964 | 14,687 | 21,042 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(1,630 | ) | (6,755 | ) | (3,552 | ) | (2,902 | ) | ||||||||

| Other income (expense): |

||||||||||||||||

| Interest income |

6 | 32 | 20 | 20 | ||||||||||||

| Interest expense |

(155 | ) | (201 | ) | (156 | ) | (70 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other expense |

(149 | ) | (169 | ) | (136 | ) | (50 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss before income taxes |

(1,779 | ) | (6,924 | ) | (3,688 | ) | (2,952 | ) | ||||||||

| Benefit for income taxes |

822 | 189 | 612 | 453 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

(957 | ) | (6,735 | ) | (3,076 | ) | (2,499 | ) | ||||||||

| Preferred dividends |

(160 | ) | (1,142 | ) | (698 | ) | (1,316 | ) | ||||||||

| Accretion of preferred stock to redemption value |

— | (1,016 | ) | (592 | ) | (1,315 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss attributable to common stock |

$ | (1,117 | ) | $ | (8,893 | ) | $ | (4,366 | ) | $ | (5,130 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share attributable to common stockholders—basic and diluted |

$ | (0.46 | ) | $ | (2.51 | ) | $ | (1.30 | ) | $ | (1.25 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average number of shares outstanding: |

||||||||||||||||

| Basic and diluted |

2,438,515 | 3,549,984 | 3,364,422 | 4,113,722 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

9

Table of Contents

| As of December 31, 2014 |

As of September 30, 2015 | |||||||||||||||

| (in thousands) | Actual | Pro Forma(2) | Pro Forma As- Adjusted(3)(4) |

|||||||||||||

| (unaudited) | (unaudited) | (unaudited) | ||||||||||||||

| Summary Balance Sheet Data: |

||||||||||||||||

| Cash and cash equivalents |

$ | 12,593 | $ | 4,417 | $ | $ | ||||||||||

| Working capital |

8,472 | 3,623 | ||||||||||||||

| Total assets |

30,432 | 28,980 | ||||||||||||||

| Long-term debt |

2,702 | 803 | ||||||||||||||

| Redeemable convertible preferred stock |

30,726 | 33,357 | ||||||||||||||

| Total stockholders’ deficit |

(15,285 | ) | (18,617 | ) | ||||||||||||

| Year Ended December 31, | Nine Months Ended September 30, |

|||||||||||||||

| (in thousands) | 2013(1) | 2014 | 2014 | 2015 | ||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| Other Financial Data: |

||||||||||||||||

| EBITDA(5) |

$ | (1,126 | ) | $ | (6,109 | ) | $ | (3,094 | ) | $ | (2,223 | ) | ||||

| Adjusted EBITDA(6) |

(1,090 | ) | (3,303 | ) | (1,120 | ) | (1,806 | ) | ||||||||

| Adjusted EBITDA Margin(7) |

(11.5 | )% | (21.7 | )% | (10.1 | )% | (10.0 | )% | ||||||||

| (1) | Our statements of operations data and other financial data for the year ended December 31, 2013 and the financial statements from which the data was derived which are included in this prospectus reflects the impact of the restatement which followed our discovery of errors in the accounting for certain sales agreements with unilateral rights of return related to our over-the-counter products which were entered into with retailers during the year ended December 31, 2013. As a result of the restatement, previously reported amounts were restated as follows: revenue was reduced by approximately $2.9 million, income from operations was reduced by approximately $3.2 million, and net income was reduced by approximately $1.8 million for the year ended December 31, 2013. See “Risk Factors—During 2014, we identified a material weakness in our internal control over financial reporting that resulted in restatements of our prior consolidated financial statements. If we are unable to implement and maintain effective internal control over financial reporting in the future, the accuracy and timeliness of our financial reporting may be adversely affected.” |

| (2) | The pro forma column reflects the filing of our amended and restated certificate of incorporation immediately prior to the closing of this offering and the automatic conversion of all outstanding shares of our Series A convertible preferred stock, Series B convertible preferred stock and Series C convertible preferred stock into an aggregate of 17,532,076 shares of our common stock prior to the closing of this offering, the payment to satisfy the settlement agreement discussed in Note 12 to the December 31, 2014 financial statements and the payment of accumulated dividends to holders of our Series B convertible preferred stock and Series C convertible preferred stock discussed in Note 4 to the September 30, 2015 financial statements, assuming an initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus. |

| (3) | The pro forma as-adjusted column reflects the pro forma adjustments described in footnote (2) above and the sale by us of shares of common stock by us in this offering at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. |

| (4) | Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) the pro forma as-adjusted amount of each of cash and cash equivalents, total stockholders’ equity |

(footnotes continued on following page)

10

Table of Contents

| (deficit) and total capitalization by approximately $ , assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of shares in the number of shares offered by us at the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) the pro forma as-adjusted amount of each of cash and cash equivalents, total stockholders’ equity (deficit) and total capitalization by approximately $ . The pro forma as-adjusted information is illustrative only, and we will adjust this information based on the actual initial public offering price, number of shares offered and other terms of this offering determined at pricing. |

| (5) | EBITDA is a non-GAAP financial measure. We define EBITDA as net (loss) income before income tax (expense) benefit, interest expense, net, and depreciation and amortization. Please see the section entitled “Non-GAAP Financial Measures” for more information as to the limitations of using non-GAAP measures and for the reconciliation of EBITDA to net loss, the most directly comparable financial measure calculated in accordance with GAAP. |

| (6) | Adjusted EBITDA is a non-GAAP financial measure. We define Adjusted EBITDA as EBITDA as further adjusted to exclude legal settlements, stock-based compensation expense and abandoned initial public offering related costs. Please see the section entitled “Non-GAAP Financial Measures” for more information as to the limitations of using non-GAAP measures and for the reconciliation of Adjusted EBITDA to net loss, the most directly comparable financial measure calculated in accordance with GAAP. |

| (7) | Adjusted EBITDA Margin is a non-GAAP financial measure. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by total revenues. Please see the section entitled “Non-GAAP Financial Measures” for more information as to the limitations of using non-GAAP measures and for the reconciliation of Adjusted EBITDA Margin to net loss, the most directly comparable financial measure calculated in accordance with GAAP. |

11

Table of Contents

Any investment in our common stock involves a high degree of risk, including the risks described below. If any of the following risks actually occur, our business, financial condition and results of operations could suffer. As a result, the trading price of our shares could decline, perhaps significantly, and you could lose all or part of your investment. The risks discussed below also include forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements. See the section entitled “Information Regarding Forward-Looking Statements.”

RISKS RELATED TO THE CLINICAL DEVELOPMENT OF OUR PRODUCT CANDIDATES

Our future growth will depend on our ability to successfully develop, obtain regulatory approval for, and commercialize our product candidates formulated using our ALT platform. Because these processes are complex and costly, we may never obtain regulatory approval for and/or commercialize any of our product candidates.

We are actively developing product candidates formulated using our ALT platform. Our future growth depends on our ability to successfully develop, obtain the necessary regulatory approval for and commercialize our product candidates. This process is long, complex and costly. As of the date of this prospectus, none of our product candidates have been approved by the FDA. The clinical trials of our product candidates are, and the manufacturing and marketing of our product candidates will be, subject to extensive and rigorous review and regulation by numerous government authorities in the United States and in other countries where we intend to test and, if approved, market any product candidates. Before obtaining regulatory approval for the commercial sale of any product candidate, we must demonstrate through extensive clinical studies and trials that the product candidate is safe and effective for use in the desired indication. This process can take many years. Of the large number of drugs in development in the United States, only a small percentage successfully complete the FDA regulatory approval process and are commercialized. We do not anticipate generating revenues from sales of our product candidates for the foreseeable future, if ever.

Our ability to generate future revenues from sales of our product candidates depends heavily on our success in:

| Ø | Being permitted by the FDA to commence clinical trials under INDs for each of our product candidates; |

| Ø | obtaining favorable results for and advancing the development of one or more of our product candidates, including initiating and completing successful preclinical studies and pivotal clinical trials; |

| Ø | successfully remediating the observations cited by the FDA in an FDA Form 483 issued on October 2, 2015 in a manner acceptable to the FDA and then maintaining compliance with the FDA’s current Good Manufacturing Practices, or cGMPs regulations; |

| Ø | obtaining US regulatory approval for one or more of our product candidates; |

| Ø | developing and expanding our sales, marketing and distribution capabilities and launching commercial sales of our product candidates, if and when approved, whether alone or in collaboration with others, depending on the product candidate; |

| Ø | achieving broad market acceptance of our product candidates, if and when approved, in the medical community and by third-party payors and patients; |

| Ø | maintaining a continued acceptable safety profile of our products following approval; and |

| Ø | obtaining and maintaining coverage and adequate reimbursement from third-party payors. |

12

Table of Contents

Risk factors

In addition, our product candidates, if approved, may not achieve commercial success. Our commercial revenues from our product candidates, if any, will be derived from sales of products or from licensing agreements for products that we do not expect to be commercially available for several years, if at all. Even if one or more of our product candidates is approved for commercial sale, we anticipate incurring significant costs in connection with commercialization. As a result, we cannot assure you that we will be able to generate revenues or profit from sales of any approved product candidates. Furthermore, we face direct competition from various pharmaceutical companies which have developed or are developing products similar to those we are developing based upon our ALT platform. If we fail to successfully commercialize one or more of our product candidates in development, our business and our results of operations will be adversely affected.

Clinical trials involve a lengthy and expensive process with an uncertain outcome.

Clinical trials are expensive, can take many years to complete and have highly uncertain outcomes. A failure can occur at any time during the clinical trial process as a result of inadequate performance of a drug candidate, inadequate adherence by patients or investigators to clinical trial protocols, or other factors. For example, we are developing some of our product candidates for rare diseases with a heterogeneous patient population, which have not been studied extensively in the past. Consequently, for these product candidates, it can be difficult to design clinical trials to show clinical efficacy. Success in preclinical studies, conducted by us or by other parties, may not be predictive of similar results in humans during clinical trials, and successful results from early or small clinical trials may not be replicated in later and larger clinical trials. Companies in the pharmaceutical industry have suffered significant setbacks in advanced clinical trials as a result of a lack of efficacy or adverse safety profiles, despite promising results in earlier trials. For example, the PK data we generated of an earlier formulation of SC401 may not predict the PK performance of our current formulation of SC401 or the performance in a clinical endpoint trial. In addition, the preclinical results we have obtained for SC403 in piglets, and for SC410 in mice, may not be replicated in humans, or the dose-ranging study we are planning to conduct for each of SC403 and SC410 may not yield interpretable results or any results that would help us plan the respective pivotal clinical trials. Further, the clinical studies of DHA and EPA in SCD and NAFLD were single site studies using similar, but not identical, amounts of DHA and EPA as we are proposing in SC411 and SC403. Larger, multi-site studies of our products may not be successful. Our future clinical trials may not be successful or may be more expensive or time-consuming than we currently expect and we may never generate the necessary data required to obtain regulatory approval and achieve product sales. Our anticipated development costs will likely increase if we do not obtain favorable results or if development of our product candidates is delayed. In particular, we would likely incur higher costs than we currently anticipate if development of our product candidates is delayed because we are required by the FDA to perform studies or trials in addition to those that we currently anticipate. Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to predict the timing or amount of any increase in our anticipated development costs.

If clinical trials for any of our product candidates fail to demonstrate safety or efficacy to the satisfaction of the FDA, the FDA will not approve that product candidate and we would not be able to commercialize it, despite spending significant resources on the product candidate’s development and clinical trial process, which will have a material adverse effect on our business, financial condition, results of operations and prospects.

13

Table of Contents

Risk factors

We may experience delays in clinical studies or clinical trials of our product candidates and we do not know whether currently planned clinical trials will begin on time, need to be redesigned, enroll patients on time or be completed on schedule, if at all.

Clinical trials can be delayed or terminated for a variety of reasons, including:

| Ø | inability to raise or delays in raising funding necessary to initiate or continue a trial; |

| Ø | delays in obtaining regulatory approval to commence a clinical trial; |

| Ø | delays in reaching agreement with the FDA on final trial design; |

| Ø | imposition of a clinical hold for safety reasons or following submission of an IND or an inspection of our clinical trial operations or sites by the FDA or other regulatory authorities; |

| Ø | delays in obtaining required institutional review board, or IRB, approval prior to commencement of clinical trials and IRB approval at each site; |

| Ø | delays in reaching agreement on acceptable terms with prospective contract research organizations, or CROs, and clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites, or failure by such CROs to carry out the clinical trial at each site in accordance with the terms of our agreements with them; |

| Ø | difficulties or delays in having patients complete participation in a trial or return for post-treatment follow-up; |

| Ø | clinical sites electing to terminate their participation in one of our clinical trials, which would likely have a detrimental effect on subject or patient enrollment; |

| Ø | time required to initiate or add a sufficient number of clinical sites; or |

| Ø | delays to produce and deliver sufficient supply of clinical trial materials. |

Our development programs could encounter delays if a clinical trial is suspended or terminated by us, by the relevant IRBs at the sites at which such trials are being conducted or by the FDA or other regulatory authorities. Such authorities may impose such a suspension or termination due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols, inspection of the clinical trial operations or trial site by the FDA or other regulatory authorities resulting in the imposition of a clinical hold, unforeseen safety issues or adverse side effects, changes in laws or regulations, or lack of adequate funding to continue the clinical trial. If we elect or are forced to delay, redesign, suspend or terminate any clinical trial of any product candidate, the commercial prospects of such product candidate will be harmed and our ability to generate product revenue from one or more of our product candidates will be delayed or eliminated. Any of these occurrences may harm our business, financial condition, results of operations and prospects significantly.

We may in the future conduct clinical trials for product candidates at sites outside the United States, and the FDA may not accept data from trials conducted in such locations.

We have conducted, and may in the future choose to conduct, one or more of our clinical trials outside the United States. Although the FDA may accept data from clinical trials conducted outside the United States, acceptance of these data is subject to conditions imposed by the FDA. Any clinical trial conducted outside the United States must be well designed and conducted and performed by qualified investigators in accordance with ethical principles. The trial population must also adequately represent the US population, and the data must be applicable to the US population and US medical practice in ways that the FDA deems clinically meaningful. The FDA’s acceptance of the data will depend on its determination

14

Table of Contents

Risk factors

that the trials also comply with all applicable US laws and regulations and current good clinical practices, or GCPs. The FDA may require on-site inspection of the foreign trial site, or other appropriate means, to validate the data. To the extent we conduct clinical trials outside the United States without prior approval from the FDA, the FDA may not accept the data from these trials. This would likely result in the need for additional trials, which would be costly and time-consuming and delay or permanently halt our development of the applicable product candidates. As a result, we currently do not expect to be able to conduct any of our pivotal trials in support of our 505(b)(2) NDAs for our product candidates in countries other than the United States or Western European countries that the FDA is willing to approve. In addition, clinical trials conducted outside the United States are subject to applicable local laws. To the extent local regulatory laws prevent us from conducting planned clinical trials, we would incur significant additional costs and delays associated with the development of the applicable product candidate.

Other risks inherent in conducting international clinical trials include:

| Ø | foreign regulatory requirements that could restrict or limit our ability to conduct our clinical trials; |

| Ø | administrative burdens of conducting clinical trials under multiple sets of foreign regulations; |

| Ø | failure of enrolled patients to adhere to clinical protocols as a result of differences in healthcare services or cultural customs; |

| Ø | foreign exchange fluctuations; |

| Ø | diminished protection of intellectual property in some countries; and |

| Ø | political and economic risks relevant to foreign countries. |

We have limited experience conducting clinical trials which may cause a delay in any clinical program and in the obtaining of regulatory approvals.

Although we have recruited a team that has significant experience with clinical trials, as a company we have limited experience in conducting clinical trials and no experience in conducting clinical trials through to regulatory approval of any product candidate. Consequently, we cannot be certain that planned clinical trials will begin or be completed on time, if at all. Large-scale trials would require significant additional financial and management resources, and reliance on third-party clinical investigators, CROs or consultants. Relying on third-party clinical investigators or CROs may cause us to encounter delays that are outside of our control.

We expect to rely on third parties to conduct, supervise and monitor certain of our clinical trials, including our pivotal clinical trials, and if these third parties perform in an unsatisfactory manner, it may negatively impact our ability to get FDA approval of our product candidates.

We expect to rely on CROs and clinical trial sites to ensure certain of our clinical trials, including our pivotal clinical trials, are conducted properly and on time and may engage a CRO to conduct these or certain of our other clinical trials. Foreign clinical studies are required to be conducted in accordance with the FDA’s GCP requirements including review and approval by an independent ethics committee and informed consent from subjects and patients. For our early stage or non-pivotal clinical trials conducted in India, we have previously selected, and in the future intend to select, only well-qualified trial sites that comply with the International Conference on Harmonisation, or ICH, GCP guidelines. Clinical trials conducted in India must comply with regulations imposed by India’s Central Drugs Standard Control Organization and the Drug Controller General of India. However, if there are insufficient well-qualified trial sites to conduct our trials, then the timing of our clinical trials could be delayed.

15

Table of Contents

Risk factors

Our reliance on these third parties for research and development activities will reduce our control over these activities but will not relieve us of our responsibilities. For example, the FDA and foreign regulatory authorities require compliance with regulations and standards, including GCP requirements, for designing, conducting, monitoring, recording, analyzing, and reporting the results of clinical trials to ensure that the data and results are credible and accurate and that the rights, integrity, and confidentiality of trial participants are protected. Although we rely on third parties to conduct certain of our clinical trials, we are responsible for ensuring that each of these clinical trials is conducted in accordance with its general investigational plan and protocol under legal and regulatory requirements. Regulatory authorities enforce these GCP requirements through periodic inspections of trial sponsors, principal investigators and trial sites. If we or any of our CROs fail to comply with applicable current GCP requirements, the clinical data generated in our clinical trials may be deemed unreliable and the FDA or other regulatory authorities may require us to perform additional clinical trials before approving our regulatory applications. We cannot assure you that upon inspection by a given regulatory authority, such regulatory authority will determine that any of our clinical trials comply with GCP requirements. In addition, our clinical trials must be conducted with clinical trial materials produced under applicable cGMP regulations. Failure to comply with these regulations may require us to repeat clinical trials, which would delay the regulatory approval process and increase the costs of these trials.

Although we have an employee on-site in India who will have the responsibility of overseeing the operations of our clinical testing sites in the country and providing hands-on support, including oversight of quality control and quality assurance, because the employees of the CROs we are working with are not our employees, we will not be able to directly monitor whether or not they devote sufficient time and resources to our clinical and nonclinical programs. These CROs may also have relationships with other commercial entities, including parties developing potentially competitive products, for whom they may also be conducting clinical trials or other drug development activities that could harm our competitive position. If our CROs do not successfully carry out their contractual duties or obligations, if they fail to meet expected deadlines, or if the quality or accuracy of the clinical data they obtain is compromised due to the failure to adhere to our clinical protocols or regulatory requirements, or for any other reasons, our clinical trials may be extended, delayed or terminated, and we may not be able to obtain regulatory approval for, or successfully commercialize, our product candidates. As a result, the commercial prospects for our product candidates would be harmed, our costs could increase, and our ability to generate revenues could be delayed.

We may find it difficult to enroll patients in our clinical trials, particularly clinical trials of our product candidates for which there is a limited patient population, which could delay or prevent clinical studies of our product candidates.

Identifying and qualifying patients to participate in clinical studies of our product candidates is critical to our success. The timing of our clinical studies depends, in part, on the speed at which we can recruit patients to participate in the testing of our product candidates. Patient enrollment is affected by factors including: severity of the disease under investigation; size and nature of the patient population; eligibility criteria for and design of the clinical trial in question; perceived risks and benefits of the product candidate under study; proximity and availability of clinical trial sites for prospective patients; availability of competing therapies and clinical trials; and clinicians’ and patients’ perceptions as to the potential advantages of our product candidates in relation to available therapies or other products under development. In particular, it may be difficult to locate patients to participate in the testing of our product candidates for which we are seeking or have obtained orphan drug designation. An orphan drug is a product intended to treat a “rare disease or condition,” which generally is a disease or condition that affects fewer than 200,000 individuals in the United States. Given the small patient population for these diseases, there are unique testing and patient recruitment challenges to overcome. Currently two of our four most advanced product candidates target a rare disease or condition and have been designated by the FDA as orphan drugs.

16

Table of Contents

Risk factors

We may not be able to identify, recruit and enroll a sufficient number of patients, or those with the required or desired characteristics to achieve diversity in a trial, to complete our clinical trials in a timely manner. Delays in patient enrollment can result in increased costs, delays in advancing the development of our product candidates or termination of the clinical trials altogether, any of which would have an adverse effect on our business.

If we are not able to use the 505(b)(2) regulatory approval pathway for regulatory approval of our product candidates or if the requirements for approval of any of our product candidates under Section 505(b)(2) are not as we expect, it will likely take significantly longer, cost significantly more and be significantly more complicated to gain FDA approval for our product candidates, and in any case may not be successful.

We intend to seek FDA approval through the 505(b)(2) regulatory pathway for our product candidates, as described in this prospectus. The Drug Price Competition and Patent Term Restoration Act of 1984, also known as the Hatch-Waxman Amendments, added Section 505(b)(2) to the FDCA. Section 505(b)(2) permits the submission of an NDA where at least some of the information required for approval comes from studies that were not conducted by or for the applicant.

If the FDA does not agree that the 505(b)(2) regulatory pathway is appropriate or scientifically justified for one or more of our product candidates, we may need to conduct additional clinical trials, provide additional data and information and meet additional standards for regulatory approval. For example, the FDA (i) has not reviewed or agreed upon the number of patients in the safety database necessary for approval of our product candidates, (ii) has not commented on the adequacy of the non-clinical data relevant to our product candidates, including the excipients in our product candidates and (iii) may not agree that we have provided for formulations of any of our product candidates a scientific bridge, through, for example, comparative bioavailability data, to demonstrate that reliance on the prior findings of safety and/or efficacy for a listed drug is justified. If we are unable to pursue a 505(b)(2) pathway, the time and financial resources required to obtain FDA approval for our product candidates would likely increase substantially. Moreover, the inability to pursue the 505(b)(2) regulatory pathway could result in new competitive products reaching the market faster than our product candidates, which could materially adversely impact our competitive position and prospects. Even if we are allowed to pursue the 505(b)(2) regulatory pathway for a product candidate, we cannot assure you that preclinical studies or clinical trials we currently anticipate conducting will be sufficient for approval or that we will receive the requisite or timely approvals for commercialization of such product candidate. Although the 505(b)(2) pathway allows us to rely in part on the FDA’s prior findings of safety and/or efficacy for approved drugs and/or on published literature, the FDA may determine that prior findings by the FDA and/or the published literature that we believe supports the safety and/or efficacy of one or more of our product candidates is insufficient or not applicable to our application or that additional studies will need to be conducted. For example, the FDA required us to conduct additional rat toxicology studies to demonstrate the safety of certain inactive ingredients that we intend to use in our product candidates. In addition, based on our conversations with the FDA, we believe that the clinical study of DHA and EPA in SCD would provide limited efficacy support but no safety support in a 505(b)(2) NDA for SC411. Finally, we believe that we would need to address the genotoxicity, reproductive toxicity, and carcinogenic potential of SC410 in an NDA for that product and that approval, if granted, would likely be conditioned on a requirement to conduct a post-approval clinical study of five to six years.

To the extent that we are relying on the 505(b)(2) regulatory pathway based on the FDA’s approval of a drug for a similar indication, then the FDA may require that we include in the labeling of our product candidates, if approved, some or all of the safety information that is included in the labeling of the approved drug. For example, unless our clinical studies clearly demonstrate to the contrary, the FDA

17

Table of Contents

Risk factors

may require that the labeling for SC401 include certain safety information from Lovaza’s approved labeling, including information about Lovaza’s side effects—such as eructation, dyspepsia, and taste perversion—and warnings about atrial fibrillation or use in patients with hepatic impairment.

In addition, we expect that our competitors will file citizen petitions with the FDA in an attempt to persuade the FDA that our product candidates, or the clinical studies that support their approval, contain deficiencies or are otherwise ineligible for approval. Such actions by our competitors could delay or even prevent the FDA from approving any NDA that we submit under Section 505(b)(2).

An NDA submitted under Section 505(b)(2) subjects us to the risk that we may be subject to a patent infringement lawsuit or exclusivity period that would delay or prevent the review or approval of our product candidates.

We plan to develop many of our product candidates for approval under Section 505(b)(2) of the FDCA. Section 505(b)(2) permits the submission of an NDA where at least some of the information required for approval comes from studies that were not conducted by, or for, the applicant and/or for which the applicant has not obtained a right of reference. The product that is the subject of these referenced studies is referred to as the listed drug. The 505(b)(2) application would enable us to reference published literature and/or the FDA’s previous findings of safety and/or effectiveness for the listed drug. For NDAs submitted under Section 505(b)(2) of the FDCA, the patent certification and related provisions of the Hatch-Waxman Amendments apply. In accordance with the Hatch-Waxman Amendments, such NDAs may be required to include certifications, known as paragraph IV certifications, that certify that any patents identified in the Patent and Exclusivity Information Addendum of the FDA’s publication, Approved Drug Products with Therapeutic Equivalence Evaluations, commonly known as the Orange Book, with respect to any listed drug referenced in the 505(b)(2) application, are invalid, unenforceable or will not be infringed by the manufacture, use or sale of the product that is the subject of the 505(b)(2) NDA.

Under the Hatch-Waxman Amendments, the holder of patents for the listed drug that the 505(b)(2) application references may file a patent infringement lawsuit after receiving notice of the paragraph IV certification. Filing of a patent infringement lawsuit against the filer of the 505(b)(2) applicant within 45 days of the patent owner’s receipt of notice triggers a one-time, automatic, 30-month stay of the FDA’s ability to approve the 505(b)(2) NDA, unless the patent litigation is resolved in the favor of the paragraph IV filer or the patent expires before that time. Although we do not currently anticipate being required to file any paragraph IV certifications in connection with our four lead product candidates, if additional patents are listed in the Orange Book, or if in the future we pursue a 505(b)(2) application which does require a paragraph IV certification, we may invest a significant amount of time and expense in the development of one or more product candidates only to be subject to significant delay and patent litigation before such product candidates may be commercialized, if at all. In addition, a 505(b)(2) application will not be approved until any non-patent exclusivity, such as exclusivity for obtaining approval of a new chemical entity, or NCE, for the listed drug has expired. The FDA may also require us to perform one or more additional clinical studies or measurements to support the change from the listed drug, which could be time-consuming and could substantially delay our achievement of regulatory approvals for such product candidates. The FDA may also reject our future 505(b)(2) submissions and require us to file such submissions under Section 505(b)(1) of the FDCA, which would require us to provide extensive data to establish safety and effectiveness of the drug for the proposed use and could cause delay and be considerably more expensive and time-consuming. These factors, among others, may limit our ability to successfully commercialize our product candidates.

Companies that produce listed drugs routinely bring litigation against ANDA or 505(b)(2) applicants that seek regulatory approval to manufacture and market generic and reformulated forms of their

18

Table of Contents

Risk factors

branded products. These companies often allege patent infringement or other violations of intellectual property rights as the basis for filing suit against an ANDA or 505(b)(2) applicant. In addition, patent holders may bring patent infringement suits against companies that are currently marketing and selling their approved generic or reformulated products.