Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CNB FINANCIAL CORP/PA | d110446d8k.htm |

| EX-99.1 - EX-99.1 - CNB FINANCIAL CORP/PA | d110446dex991.htm |

| EX-2.1 - EX-2.1 - CNB FINANCIAL CORP/PA | d110446dex21.htm |

| Exhibit 99.2

|

Acquisition of Lake National Bank

December 30, 2015

|

|

Forward-Looking Statements

This investor presentation contains statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, and this statement is included for purposes of complying with these safe harbor provisions. Readers should not place undue reliance on such forward-looking statements, which speak only as of the date made. These forward-looking statements are based on current plans and expectations, which are subject to a number of risk factors and uncertainties that could cause future results to differ materially from historical performance or future expectations. These differences may be the result of various factors, including, among others: (1) failure of the parties to satisfy the closing conditions in the merger agreement in a timely manner or at all; (2) failure of the shareholders of Lake National Bank to approve the merger agreement; (3) failure to obtain governmental approvals for the merger; (4) disruptions to the parties’ businesses as a result of the announcement and pendency of the merger; (5) costs or difficulties related to the integration of the business following the proposed merger; (6) the risk that the anticipated benefits, cost savings and any other savings from the transaction may not be fully realized or may take longer than expected to realize; (7) changes in general business, industry or economic conditions or competition; (8) changes in any applicable law, rule, regulation, policy, guideline or practice governing or affecting financial holding companies and their subsidiaries or with respect to tax or accounting principles or otherwise; (9) adverse changes or conditions in the capital and financial markets; (10) changes in interest rates or credit availability; (11) the inability to realize expected cost savings or achieve other anticipated benefits in connection with the proposed merger; (12) changes in the quality or composition of loan and investment portfolios; (13) adequacy of loan loss reserves and changes in loan default and charge-off rates; (14) increased competition and its effect on pricing, spending, third-party relationships and revenues; (15) loss of certain key officers; (16) continued relationships with major customers; (17) deposit attrition, necessitating increased borrowings to fund loans and investments; (18) rapidly changing technology; (19) unanticipated regulatory or judicial proceedings and liabilities and other costs; (20) changes in the cost of funds, demand for loan products or demand for financial services; and (21) other economic, competitive, governmental or technological factors affecting operations, markets, products, services and prices.

The foregoing list should not be construed as exhaustive, and CNB Financial Corporation and Lake National Bank undertake no obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements, or to reflect the occurrence of anticipated or unanticipated events or circumstances.

For additional factors that could cause actual results to differ materially from those expressed in the forward- looking statements, please see filings by CNB Financial Corporation with the SEC, including CNB Financial Corporation’s Annual Report on Form 10-K for the year ended December 31, 2014.

| 2 |

|

|

|

Forward-Looking Statements

In connection with the proposed transaction, Lake National Bank will distribute a proxy statement to its shareholders in connection with a special meeting of shareholders to be called and held for the purposes of voting on approval of the transaction and related matters.

BEFORE MAKING ANY VOTING OR INVESTMENT DECISIONS REGARDING THE PROPOSED TRANSACTION, LAKE NATIONAL’S SHAREHOLDERS AND INVESTORS ARE URGED TO READ THE PROXY STATEMENT AND ITS EXHIBITS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT LAKE NATIONAL AND THE PROPOSED TRANSACTION.

Copies of the proxy statement will be mailed to all shareholders prior to the special meeting. Shareholders and investors may obtain additional free copies of the proxy statement when it becomes available by directing a request by telephone or mail to Lake National Bank, 7402 Center Street, Mentor, OH 44060, Attention: Andrew L. Meinhold (telephone: 440-205-8100).

Lake National Bank and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Lake National Bank in connection with the special meeting of shareholders. Information about the directors and executive officers of Lake National Bank is set forth in the proxy statement for Lake National Bank’s 2015 annual meeting of shareholders. Additional information regarding the interests of these participants and other persons who may be deemed participants in the proxy solicitation may be obtained by reading the proxy statement for the special meeting of shareholders when it becomes available.

| 3 |

|

|

|

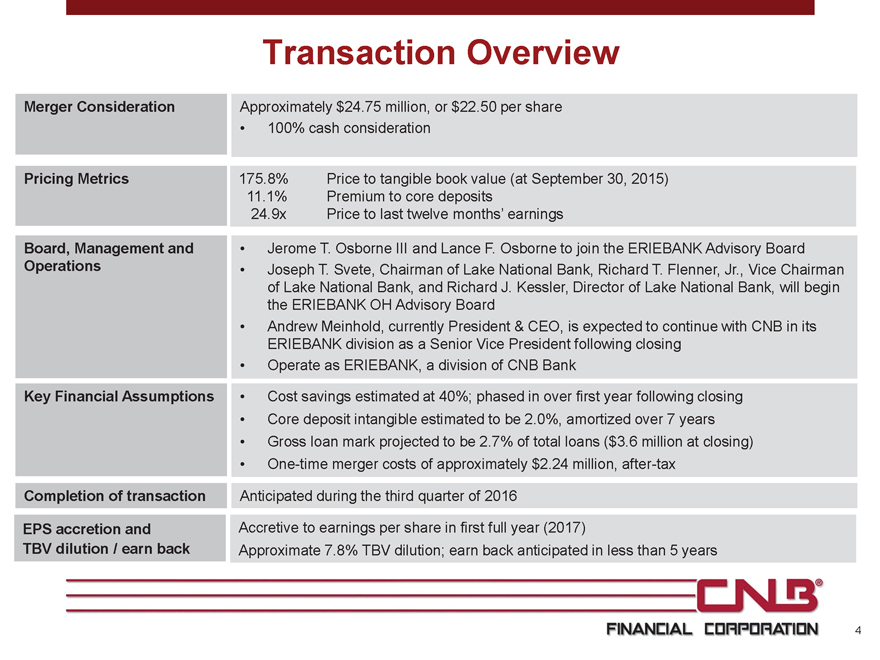

Transaction Overview

Merger Consideration Approximately $24.75 million, or $22.50 per share

100% cash consideration

Pricing Metrics 175.8% Price to tangible book value (at September 30, 2015)

11.1% Premium to core deposits

24.9x Price to last twelve months’ earnings

Board, Management and

Operations Jerome T. Osborne III and Lance F. Osborne to join the ERIEBANK Advisory Board

Joseph T. Svete, Chairman of Lake National Bank, Richard T. Flenner, Jr., Vice Chairman of Lake National Bank, and Richard J. Kessler, Director of Lake National Bank, will begin the ERIEBANK OH Advisory Board

Andrew Meinhold, currently President & CEO, is expected to continue with CNB in its

ERIEBANK division as a Senior Vice President following closing

Operate as ERIEBANK, a division of CNB Bank

Key Financial Assumptions

Cost savings estimated at 40%; phased in over first year following closing

Core deposit intangible estimated to be 2.0%, amortized over 7 years

Gross loan mark projected to be 2.7% of total loans ($3.6 million at closing)

One-time merger costs of approximately $2.24 million, after-tax

Completion of transaction Anticipated during the third quarter of 2016

EPS accretion and

TBV dilution / earn back Accretive to earnings per share in first full year (2017)

Approximate 7.8% TBV dilution; earn back anticipated in less than 5 years

| 4 |

|

|

|

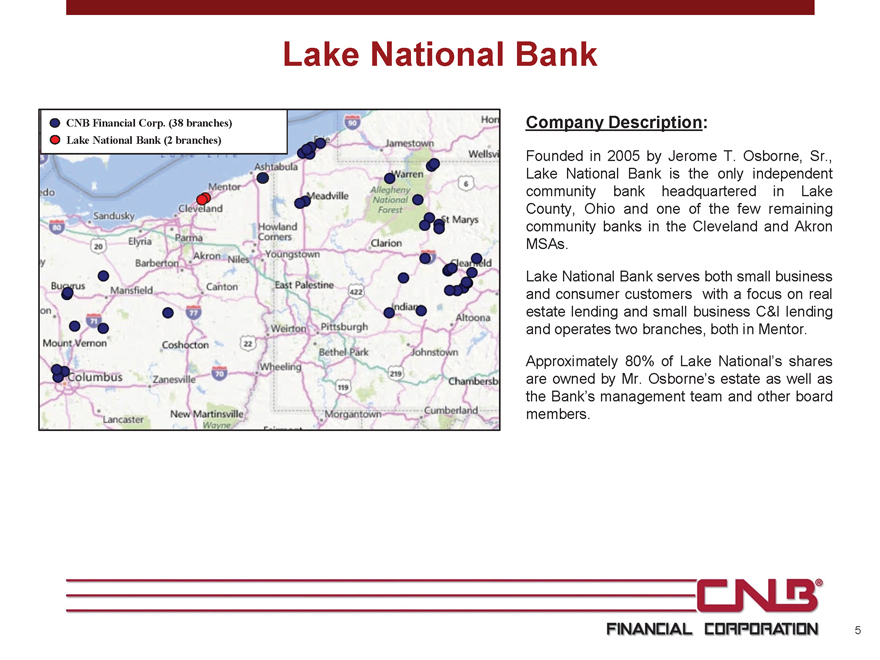

Lake National Bank

CNB Financial Corp. (38 branches) Lake National Bank (2 branches)

Company Description:

Founded in 2005 by Jerome T. Osborne, Sr., Lake National Bank is the only independent community bank headquartered in Lake County, Ohio and one of the few remaining community banks in the Cleveland and Akron MSAs.

Lake National Bank serves both small business and consumer customers with a focus on real estate lending and small business C&I lending and operates two branches, both in Mentor.

Approximately 80% of Lake National’s shares are owned by Mr. Osborne’s estate as well as the Bank’s management team and other board members.

| 5 |

|

|

|

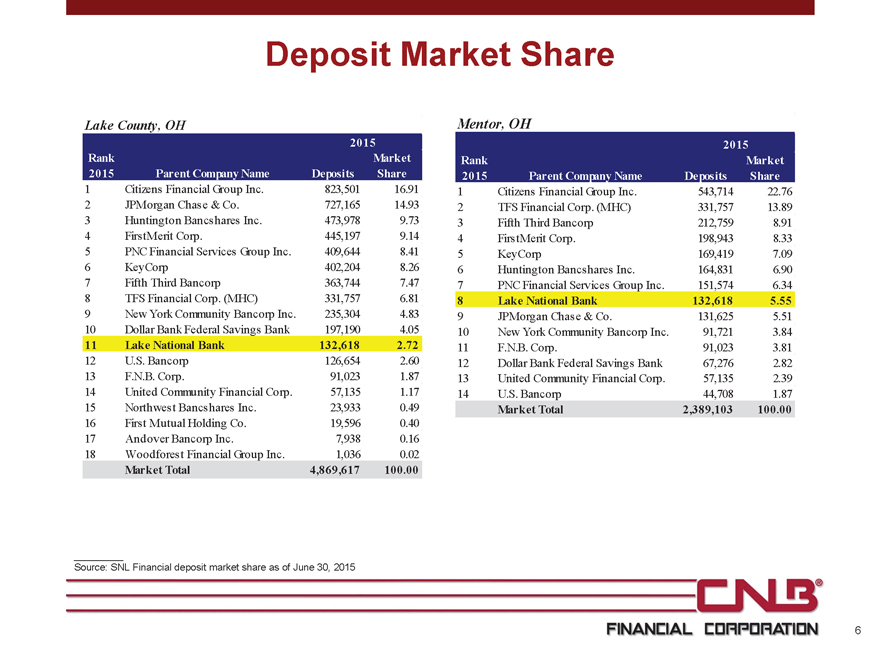

Deposit Market Share

Lake County, OH

Rank

2015

Market

Mentor, OH

Rank

2015

Market

2015 Parent Company Name Deposits

Share

2015 Parent Company Name Deposits

Share

| 1 |

|

Citizens Financial Group Inc. 823,501 16.91 |

| 2 |

|

JPMorgan Chase & Co. 727,165 14.93 |

| 3 |

|

Huntington Bancshares Inc. 473,978 9.73 |

| 4 |

|

FirstMerit Corp. 445,197 9.14 |

| 5 |

|

PNC Financial Services Group Inc. 409,644 8.41 |

| 6 |

|

KeyCorp 402,204 8.26 |

| 7 |

|

Fifth Third Bancorp 363,744 7.47 |

| 8 |

|

TFS Financial Corp. (MHC) 331,757 6.81 |

9 New York Community Bancorp Inc. 235,304 4.83

10 Dollar Bank Federal Savings Bank 197,190 4.05

11 Lake National Bank 132,618 2.72

12 U.S. Bancorp 126,654 2.60

13 F.N.B. Corp. 91,023 1.87

14 United Community Financial Corp. 57,135 1.17

15 Northwest Bancshares Inc. 23,933 0.49

16 First Mutual Holding Co. 19,596 0.40

17 Andover Bancorp Inc. 7,938 0.16

18 Woodforest Financial Group Inc. 1,036 0.02

Market Total 4,869,617 100.00

| 1 |

|

Citizens Financial Group Inc. 543,714 22.76 |

| 2 |

|

TFS Financial Corp. (MHC) 331,757 13.89 |

| 3 |

|

Fifth Third Bancorp 212,759 8.91 |

| 4 |

|

FirstMerit Corp. 198,943 8.33 |

| 5 |

|

KeyCorp 169,419 7.09 |

| 6 |

|

Huntington Bancshares Inc. 164,831 6.90 |

| 7 |

|

PNC Financial Services Group Inc. 151,574 6.34 |

| 8 |

|

Lake National Bank 132,618 5.55 |

9 JPMorgan Chase & Co. 131,625 5.51

10 New York Community Bancorp Inc. 91,721 3.84

11 F.N.B. Corp. 91,023 3.81

12 Dollar Bank Federal Savings Bank 67,276 2.82

13 United Community Financial Corp. 57,135 2.39

14 U.S. Bancorp 44,708 1.87

Market Total 2,389,103 100.00

Source: SNL Financial deposit market share as of June 30, 2015

| 6 |

|

|

|

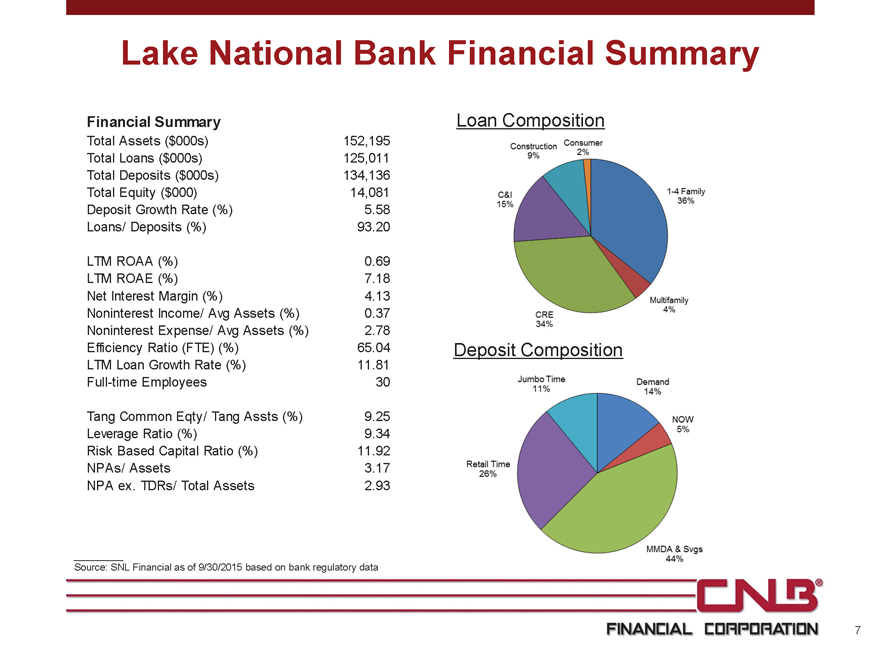

Lake National Bank Financial Summary

Financial Summary

Total Assets ($000s)

152,195

Total Loans ($000s) 125,011

Total Deposits ($000s) 134,136

Total Equity ($000) 14,081

Deposit Growth Rate (%) 5.58

Loans/ Deposits (%) 93.20

LTM ROAA (%)

0.69

LTM ROAE (%) 7.18

Net Interest Margin (%) 4.13

Noninterest Income/ Avg Assets (%) 0.37

Noninterest Expense/ Avg Assets (%) 2.78

Efficiency Ratio (FTE) (%) 65.04

LTM Loan Growth Rate (%) 11.81

Full-time Employees 30

Tang Common Eqty/ Tang Assts (%)

9.25

Leverage Ratio (%) 9.34

Risk Based Capital Ratio (%) 11.92

NPAs/ Assets 3.17

NPA ex. TDRs/ Total Assets 2.93

Loan Composition

Deposit Composition

Source: SNL Financial as of 9/30/2015 based on bank regulatory data

| 7 |

|

|

|

Mentor, Ohio Market Overview

A 25 minute drive from downtown Cleveland on the shores of Lake Erie, Mentor is one of Northeast Ohio’s largest communities and the largest city in Lake County with a population of over 45,000

The city’s median household income of $69,506 is significantly higher than the state median of $50,829

The city was named One of the Best 100 Places to Live by CNN/Money magazine in 2006 and 2010 and one of the Best Places to Retire in Ohio in 2012 by Smart Money magazine

There are approximately 2,570 businesses located in Mentor and more than 34,000 employees working in a diverse range of businesses including major corporations, manufacturers, retailers, specialty shops and small businesses

Mentor, which serves as a retail hub for many of the east side suburbs of Cleveland, ranks seventh in Ohio for total retail sales with 600 stores and 3.3 million square feet of prime retail space

Source: SNL Financial, The City of Mentor.

| 8 |

|

|

|

Osborne Family

Jerome T. Osborne, Sr. founded Lake National Bank in 2005 following the 2003 sale of Great Lakes Bank in Mentor to Sky Financial. As a director of Great Lakes Bank, Mr. Osborne was committed to maintaining a community bank in Lake County to serve the banking needs of consumers and businesses.

Mr. Osborne left a huge legacy in Lake County upon his death in 2014. He owned 19 corporations in the concrete and building supply industry which played a significant role in the development of Lake County over the decades.

In addition to the contributions to the infrastructure of Mentor, Mr. Osborne left a significant mark on educational institutions and other philanthropic endeavors.

Mr. Osborne’s grandsons, Jerome T. Osborne III and Lance F. Osborne, will be joining the

Advisory Board of ERIEBANK.

9

|

|

Transaction Rationale

Acquisition of healthy, well performing institution in major metropolitan market;

Entering greater Cleveland area with small acquisition allows for continued organic growth without needing new acquisitions (similar to our entry into Columbus).

Cash consideration leverages regulatory capital without ownership dilution

Accretive to earnings beginning first full year (2017);

TBV dilution earned back inside 5 years.

Logical market extension of ERIEBANK franchise

Demographically attractive market with significant organic growth potential;

One of very few community banks in a market dominated by larger institutions;

Mentor is known for its mid-sized commercial and industrial businesses, which is a core strength of CNB and a market it knows well.

Leadership team that remains with CNB post transaction:

Andrew Meinhold, President & CEO of Lake National, is expected to continue with CNB in

its ERIEBANK division as a Senior Vice President;

Jerome T. Osborne III and Lance F. Osborne to join the ERIEBANK Advisory Board;

Joseph T. Svete, Chairman of Lake National Bank, Richard T. Flenner, Jr., Vice Chairman of Lake National Bank, and Richard J. Kessler, Director of Lake National Bank, will begin the ERIEBANK OH Advisory Board.

10