Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AVID TECHNOLOGY, INC. | dec2320158-k.htm |

| EX-99.1 - EXHIBIT 99.1 - AVID TECHNOLOGY, INC. | dec2320158-kxexhibit991.htm |

Avid Technology: Key Value Creation Strategy Highlights December 23, 2015

2 Safe Harbor Statement Certain statements made within this presentation contain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, statements regarding our future financial performance or other information based upon or otherwise incorporating judgments or estimates relating to future performance such as future operating expenses; earnings; bookings; backlog; revenue backlog conversion rate; product mix and free cash flow; our cost savings initiatives; our future strategy and business plans as well as transformation; our product plans, including products under development, such as cloud and subscription based offerings; our liquidity; the anticipated benefits of the Orad acquisition, including estimated synergies, and the effects of the transaction, including effects on future financial and operating results; and the anticipated benefits of our agreement with Sinclair, including effects on future bookings, financial and operating results. Forward looking statements are not guarantees of performance and by their nature are subject to inherent uncertainties. Actual results may differ materially. Any forward-looking information relayed in this presentation speaks only as of December 23, 2015, and Avid Technology, Inc. (“the Company”) undertakes no obligation to update that information to reflect changed circumstances other as required by law. Risks and uncertainties include but are not limited to the effect on our sales, operations and financial performance resulting from, among other things, our ability to perform our obligations under our agreement with Sinclair and our ability to realize our expected earnings under that agreement, our liquidity; our ability to execute our strategic plan, including cost savings initiatives, and meet customer needs; our ability to retain and hire key personnel; our ability to produce innovative products in response to changing market demand, particularly in the media industry; our ability to successfully accomplish our product development plans; competitive factors; history of losses; fluctuations in our revenue, based on, among other things, our performance and risks in particular geographies or markets; our higher indebtedness and ability to service it and meet the obligations thereunder; restrictions in our credit facilities; our move to a subscription model and related effect on our revenues and ability to predict future revenues; elongated sales cycles; fluctuations in foreign currency exchange rates; seasonal factors; adverse changes in economic conditions; variances in our revenue backlog and the realization thereof; the identified material weaknesses in our internal control over financial reporting; and the possibility of legal proceedings adverse to our company. Moreover, the business may be adversely affected by future legislative, regulatory or changes, including tax law changes, as well as other economic, business and/or competitive factors. The risks included above are not exhaustive. Additional information concerning these statements is contained in the Risk Factors and Forward-Looking Statements sections of the Company’s 2014 Annual Report on Form 10-K and 2015 Quarterly Reports on Form 10-Q. Copies of these filings are available from the SEC, the Avid Technology web site or the Company’s Investor Relations Department.

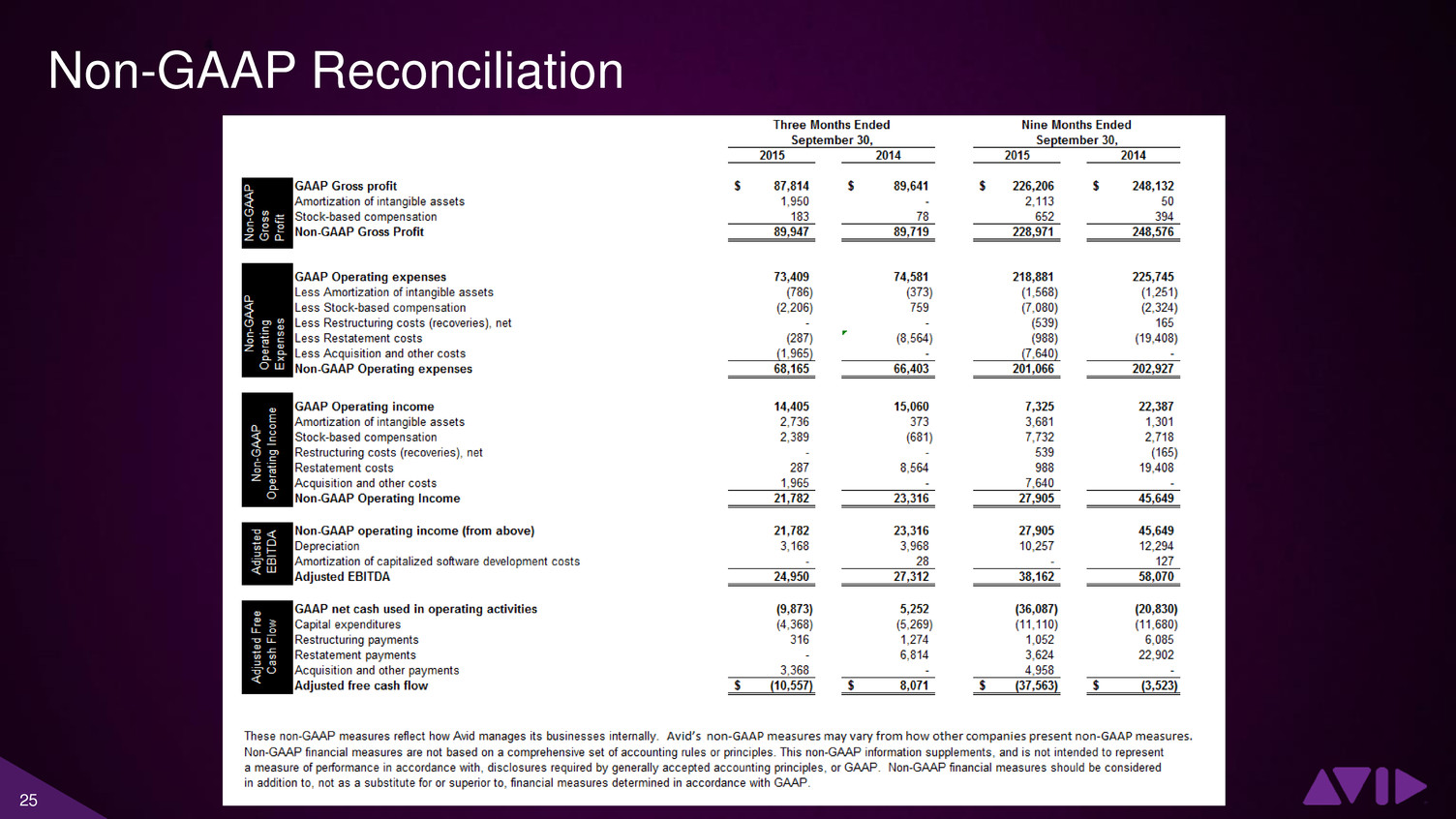

3 Non-GAAP and Operational Measures The following Non-GAAP (Adjusted) Measures and Operational Measures will be used in the presentation: Adjusted EBITDA and Adjusted EBITDA Margin Adjusted Free Cash Flow and Adjusted Free Cash Flow Conversion Non-GAAP Operating Income (loss) Non-GAAP Gross Profit and Non-GAAP Gross Margin Non-GAAP Operating Expenses Bookings, Marketed Bookings, Recurring Revenue Bookings Revenue Backlog These Non-GAAP and operational measures are defined and the Non-GAAP measures are reconciled with GAAP measures in an appendix to this presentation.

4 Avid At-a-Glance Avid Technology, Inc. is the premier provider of technology solutions to media companies to create, manage, distribute and monetize media content Total revenues Over $530M in FY2014 Trusted partner For customers in 140 countries Employees Over 2,100 FTEs in offices located in 26 countries Trades on NASDAQ under the ticker AVID Headquartered in Burlington, MA Category creator with 25-year heritage of innovation and industry leadership Comprehensive media technology suite and leading global brands, including Avid Everywhere

5 Investment Highlights Large and Growing Market in Transition Growing $65B media technology market in transition as spending rapidly shifts to address changing business needs, creating significant opportunities for growth as media companies are forced to quickly adapt Unparalleled Market Position Avid is a trusted market leader and innovator in media technology solutions, with a broad product portfolio and deep distribution reach Clear Path to Value Creation Avid has a clearly articulated platform-based strategy to leverage its market position and capitalize on attractive market growth to create additional value for all shareholders Transformation Well Underway Avid has made and demonstrated significant progress executing against its strategic plan and re-positioning for growth Strengthening Performance Avid’s transformation has already delivered operational improvements and near-term benefits for shareholders

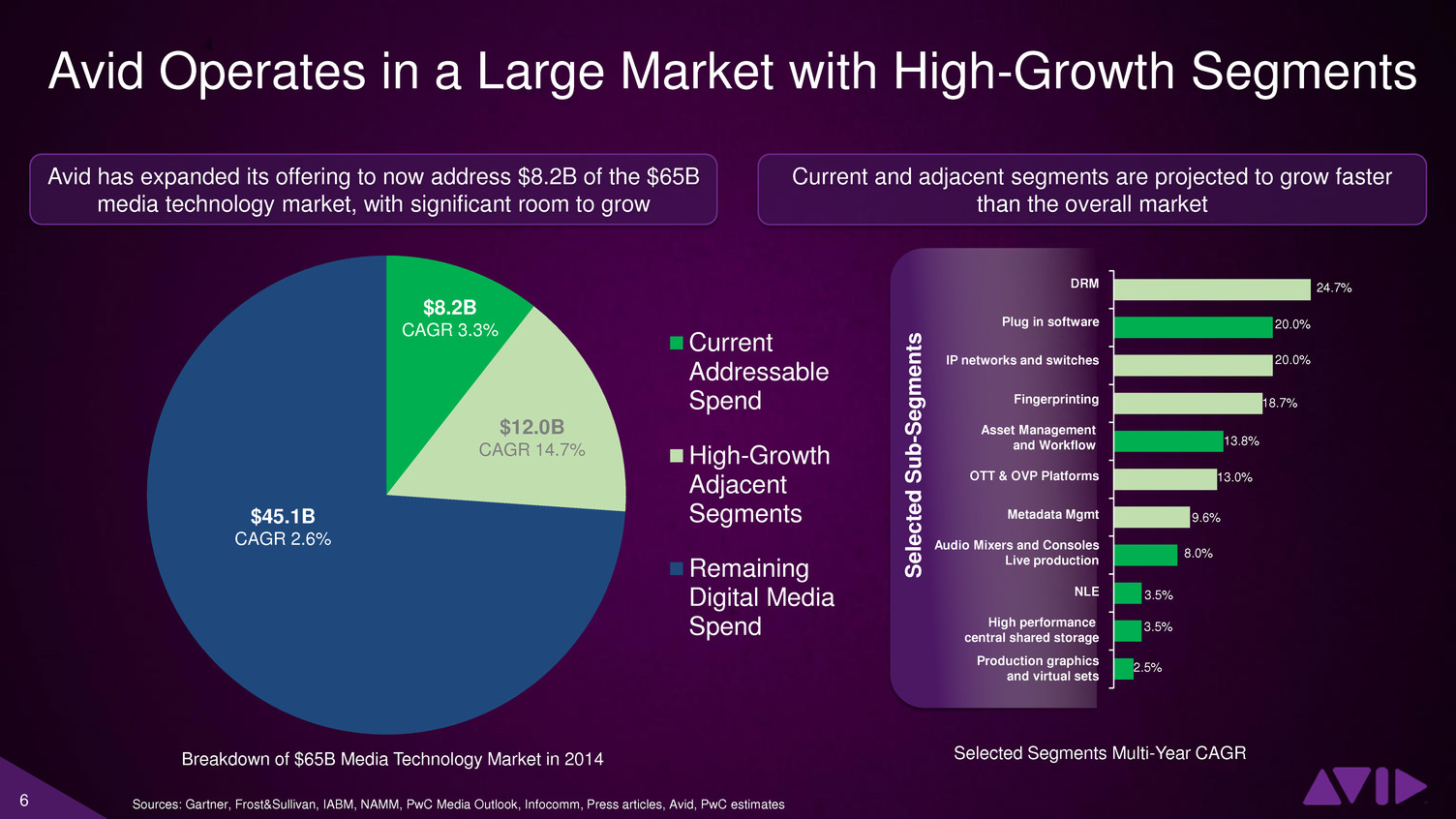

6 Current Addressable Spend High-Growth Adjacent Segments Remaining Digital Media Spend $45.1B CAGR 2.6% $8.2B CAGR 3.3% $12.0B CAGR 14.7% Avid Operates in a Large Market with High-Growth Segments Sources: Gartner, Frost&Sullivan, IABM, NAMM, PwC Media Outlook, Infocomm, Press articles, Avid, PwC estimates Avid has expanded its offering to now address $8.2B of the $65B media technology market, with significant room to grow Current and adjacent segments are projected to grow faster than the overall market Selected S u b -Se g ment s NLE Audio Mixers and Consoles Live production Fingerprinting OTT & OVP Platforms IP networks and switches Asset Management and Workflow High performance central shared storage Metadata Mgmt Plug in software DRM Production graphics and virtual sets 24.7% 20.0% 20.0% 18.7% 13.8% 13.0% 9.6% 8.0% 3.5% 3.5% 2.5% Selected Segments Multi-Year CAGR Breakdown of $65B Media Technology Market in 2014

7 Major Industry Transition is Creating Growth Opportunities Avid’s Solution Designed for the Whole Industry Traditional media companies must: Lower operating costs in traditional areas Reduce interconnectivity friction Invest in growth areas Next-generation media companies must: Invest in growth areas Scale quickly and more efficiently Leverage multiple platforms for distribution Digitization drives growth in content creation, consumption, distribution… Rate of content creation up 2x-4x Number of distribution platforms up > 10x Content consumption up 1.5x Media tech budgets up only 3-4% …But disrupts the traditional, linear media value chain Breaks down siloes Changes channels and formats of distribution Increases emphasis on collaboration, security and measurement Budgets are shifting to higher growth portions of value chain Emerging Industry Trends Industry Constants All media companies still need to: Create high quality content Maximize asset value Ensure efficiency Distribute across multiple devices and channels Do it all in a safe and secure way Source: eMarketer Note: Growth is measured by comparing metric today to 10 years ago

8 Avid is a Trusted Market Leader with Global Reach and Positioned to Lead Industry Revolution Prod u ct Avid has wide product and global customer breadth participating in a majority of broadcast and media technology segments 6 of 6 … of the major film studios use Avid products 9 of 10 … of the leading international news networks use Avid products 4 of 5 … of the largest station group owners use Avid products ~70% … of today’s music commercially published with Avid products 80-90% … of original content from leading streaming providers produced with Avid Solutions Broad and diverse distribution channels Sales into 140 countries Over 55% of revenue originates outside of North and South America More than 550+ channel partners globally Geograph y

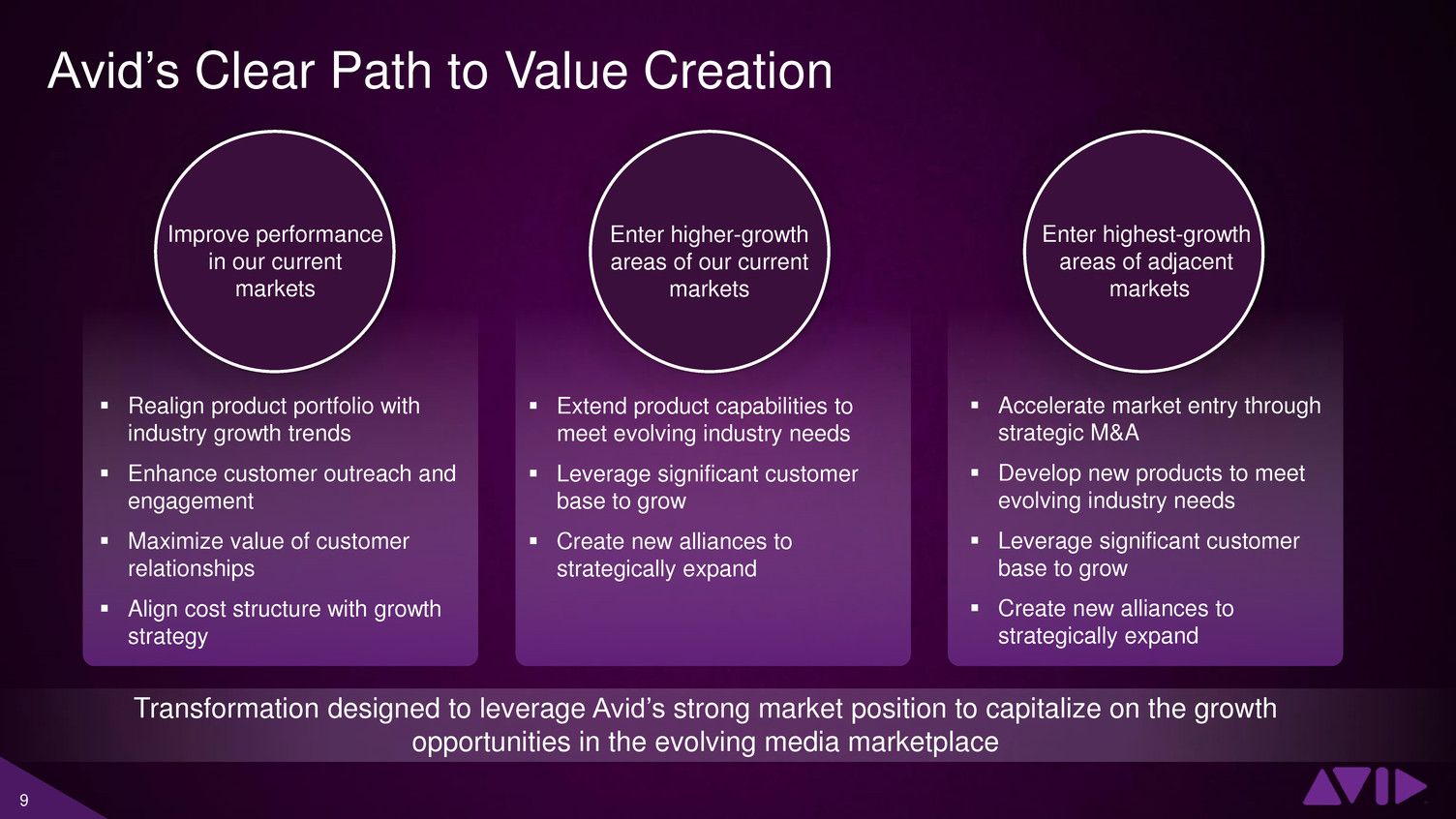

9 Accelerate market entry through strategic M&A Develop new products to meet evolving industry needs Leverage significant customer base to grow Create new alliances to strategically expand Avid’s Clear Path to Value Creation Improve performance in our current markets Enter higher-growth areas of our current markets Enter highest-growth areas of adjacent markets Transformation designed to leverage Avid’s strong market position to capitalize on the growth opportunities in the evolving media marketplace Extend product capabilities to meet evolving industry needs Leverage significant customer base to grow Create new alliances to strategically expand Realign product portfolio with industry growth trends Enhance customer outreach and engagement Maximize value of customer relationships Align cost structure with growth strategy

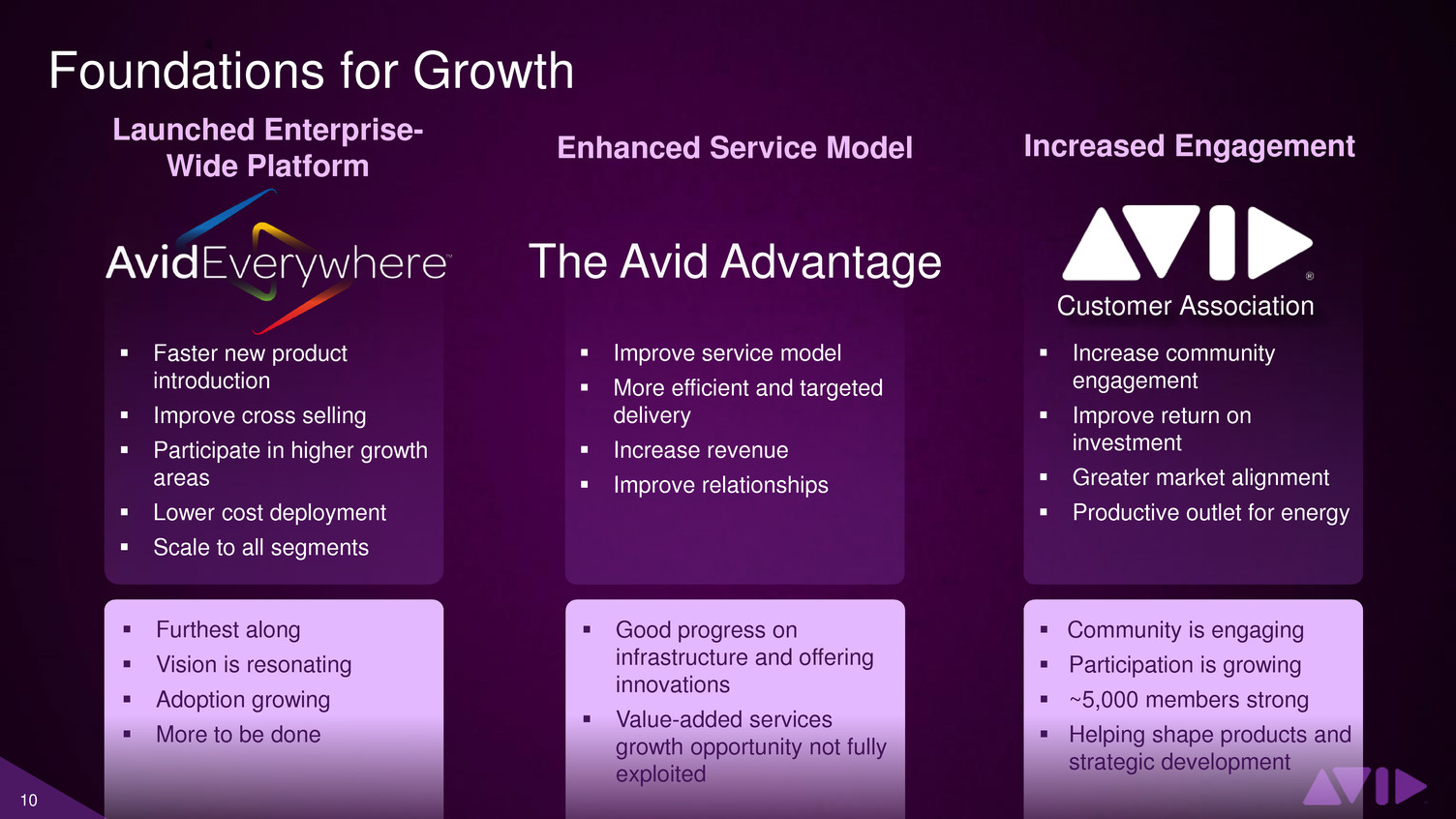

10 The Avid Advantage Faster new product introduction Improve cross selling Participate in higher growth areas Lower cost deployment Scale to all segments Improve service model More efficient and targeted delivery Increase revenue Improve relationships Increase community engagement Improve return on investment Greater market alignment Productive outlet for energy Customer Association Foundations for Growth Launched Enterprise- Wide Platform Enhanced Service Model Increased Engagement Furthest along Vision is resonating Adoption growing More to be done Good progress on infrastructure and offering innovations Value-added services growth opportunity not fully exploited Community is engaging Participation is growing ~5,000 members strong Helping shape products and strategic development

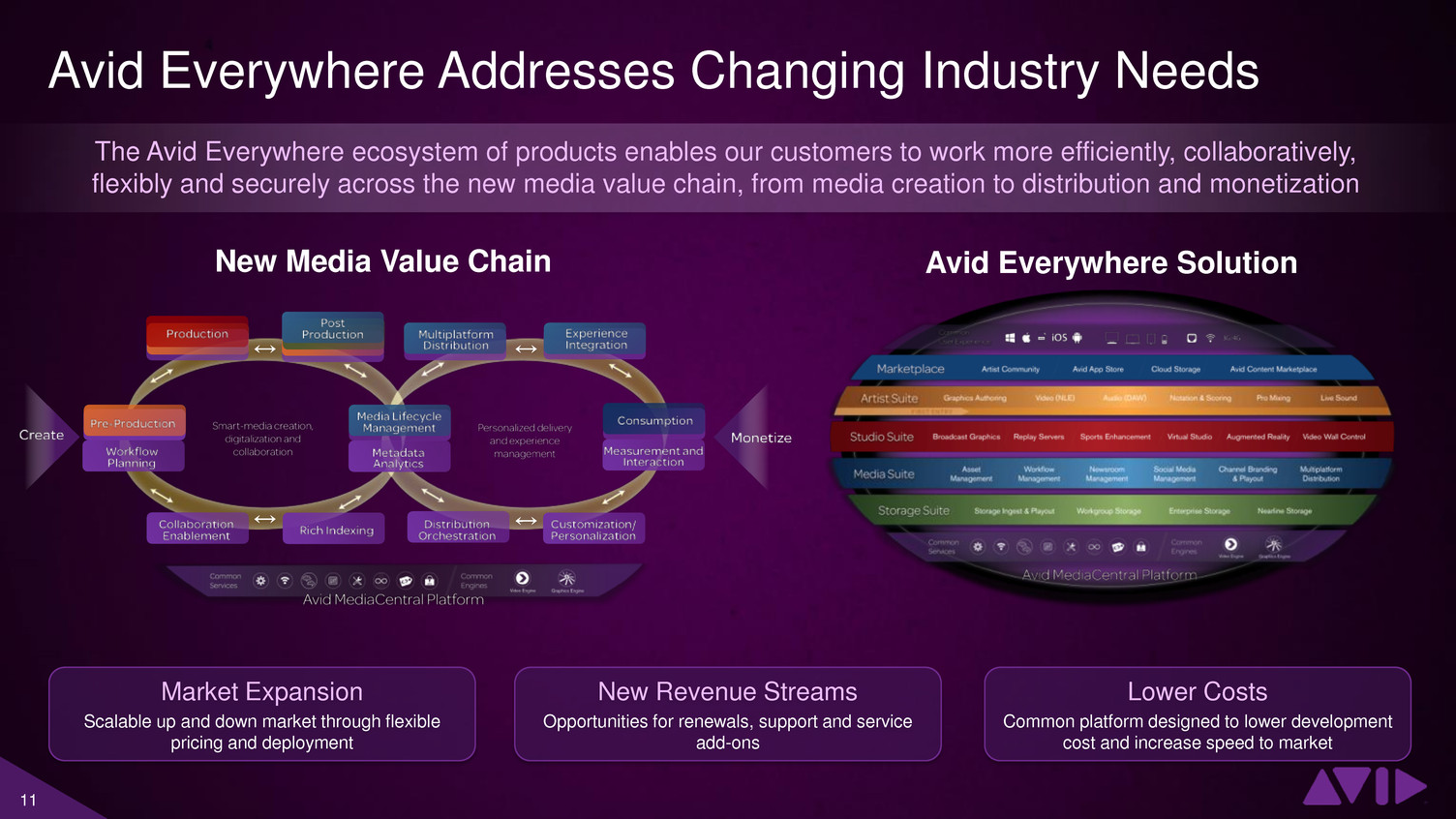

11 Avid Everywhere Addresses Changing Industry Needs New Revenue Streams Opportunities for renewals, support and service add-ons Lower Costs Common platform designed to lower development cost and increase speed to market Market Expansion Scalable up and down market through flexible pricing and deployment New Media Value Chain Avid Everywhere Solution The Avid Everywhere ecosystem of products enables our customers to work more efficiently, collaboratively, flexibly and securely across the new media value chain, from media creation to distribution and monetization

12 Customer Wins Demonstrate Traction of Avid Everywhere Record breaking ten-year Sinclair managed services contract underscores potential of Avid Everywhere: • Avid will provide customized newsroom and media management solutions based on the Avid Everywhere model to all of Sinclair Broadcast Group’s 64 local news producing stations • Innovative commercial approach and unique technology deployment model – made possible by Avid Everywhere – helps Sinclair cost-effectively keep its news operations at the forefront of technology for the next decade • This not only demonstrates Avid’s ability to address the entire workflow, but also expands Avid solutions to include higher growth managed services • Contract expected to have a material positive impact on Q4 bookings and may lead to updated 2015 bookings guidance or pre- release in early January 2016 Note: Avid Everywhere units and subscriptions are cumulative numbers through 11/8/15 Strong adoption of Avid Everywhere with 28,000+ units sold and 20,000+ subscriptions:

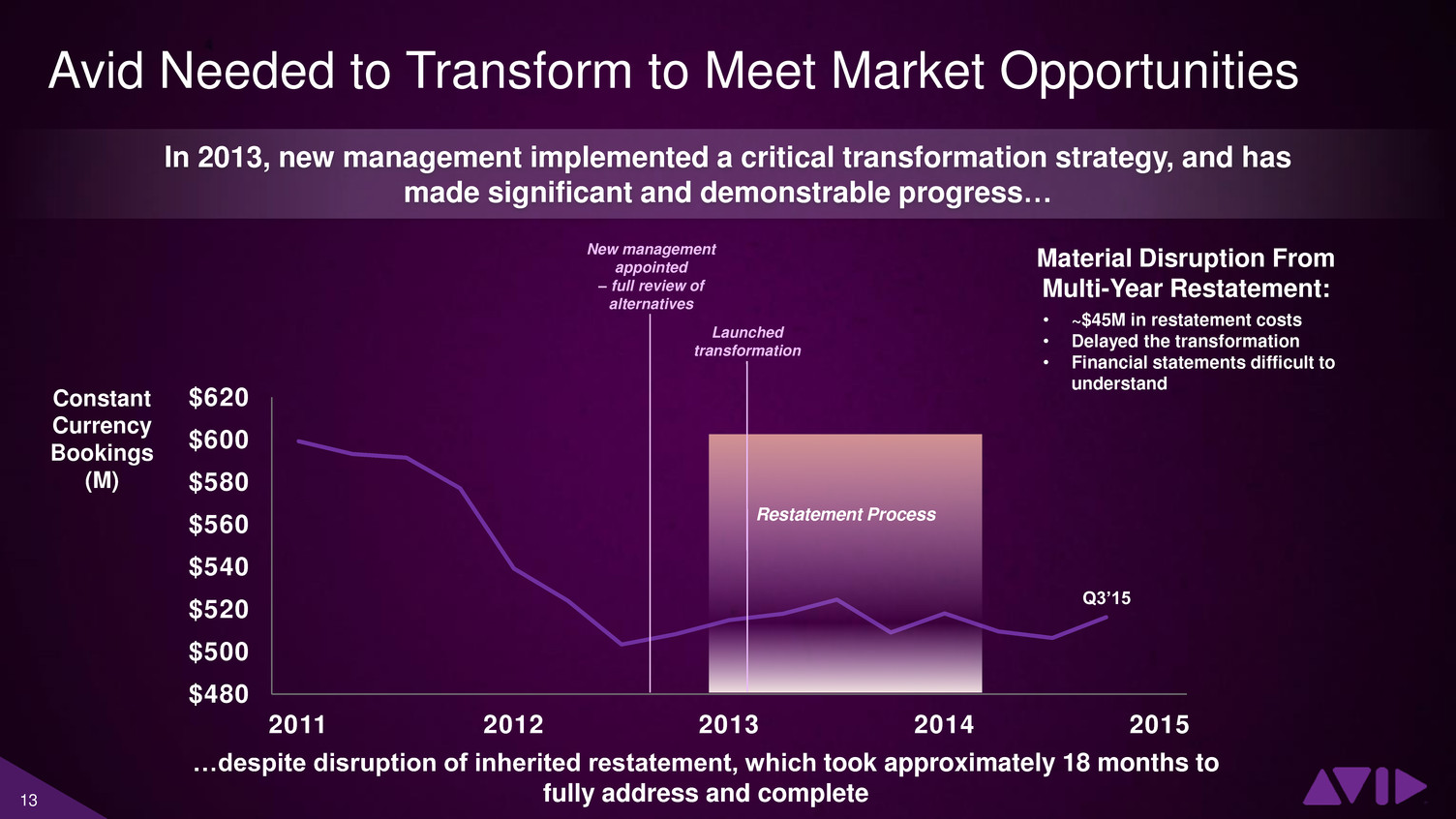

13 Avid Needed to Transform to Meet Market Opportunities $480 $500 $520 $540 $560 $580 $600 $620 2011 2012 2013 2014 2015 New management appointed – full review of alternatives Restatement Process Launched transformation Material Disruption From Multi-Year Restatement: • ~$45M in restatement costs • Delayed the transformation • Financial statements difficult to understand Constant Currency Bookings (M) In 2013, new management implemented a critical transformation strategy, and has made significant and demonstrable progress… …despite disruption of inherited restatement, which took approximately 18 months to fully address and complete Q3’15

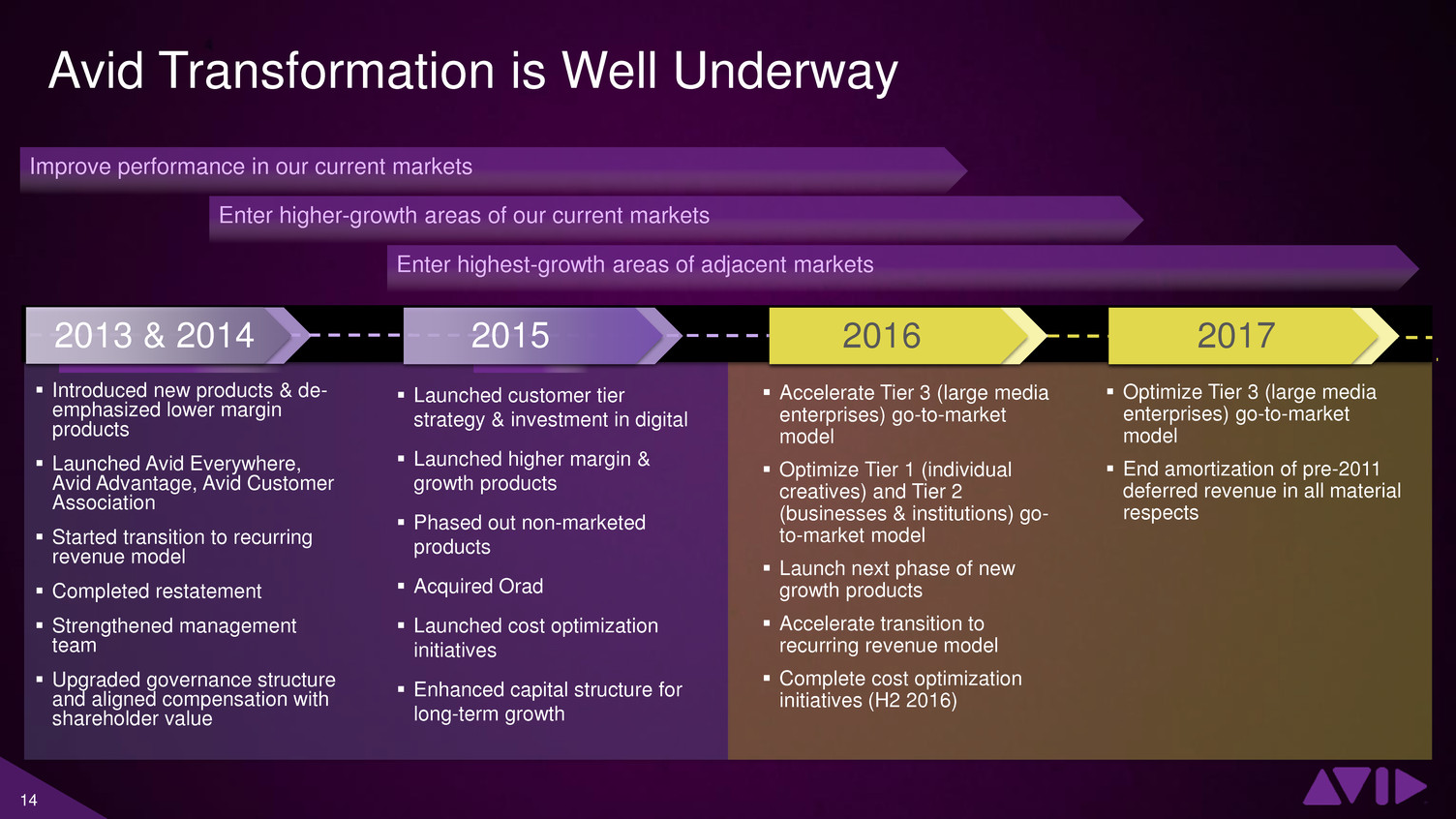

14 Avid Transformation is Well Underway Introduced new products & de- emphasized lower margin products Launched Avid Everywhere, Avid Advantage, Avid Customer Association Started transition to recurring revenue model Completed restatement Strengthened management team Upgraded governance structure and aligned compensation with shareholder value Launched customer tier strategy & investment in digital Launched higher margin & growth products Phased out non-marketed products Acquired Orad Launched cost optimization initiatives Enhanced capital structure for long-term growth Accelerate Tier 3 (large media enterprises) go-to-market model Optimize Tier 1 (individual creatives) and Tier 2 (businesses & institutions) go- to-market model Launch next phase of new growth products Accelerate transition to recurring revenue model Complete cost optimization initiatives (H2 2016) Optimize Tier 3 (large media enterprises) go-to-market model End amortization of pre-2011 deferred revenue in all material respects Improve performance in our current markets Enter higher-growth areas of our current markets Enter highest-growth areas of adjacent markets 2013 & 2014 2015 2017 2016 2013 & 2014 2017 2015 2016

15 Key Accomplishments Since Launch of Transformation Accounting Restatement Completed the financial restatement related to revenue recognition in September 2014 and relisted on the NASDAQ in December 2014 Rollout of Avid Everywhere Launched MediaCentral Platform, which we believe is the most comprehensive media work flow in the industry, and have already grown the installed base to more than 28,000 units Orad Acquisition Addition of Orad strengthened our position as one of the most comprehensive providers of content creation to distribution workflows for broadcast and media customers around the world Convertible Senior Notes Issuance Opportunistic issuance of $125M convertible senior notes due in 2020 to enhanced balance sheet for long-term growth Improved Operating Results Growth in marketed bookings YoY, higher gross margins YoY, improved quality and customer service scores, and shift to recurring / subscription-based model New Management Team Completely overhauled management team and reevaluated governance and compensation practices to best align leadership with shareholder interests

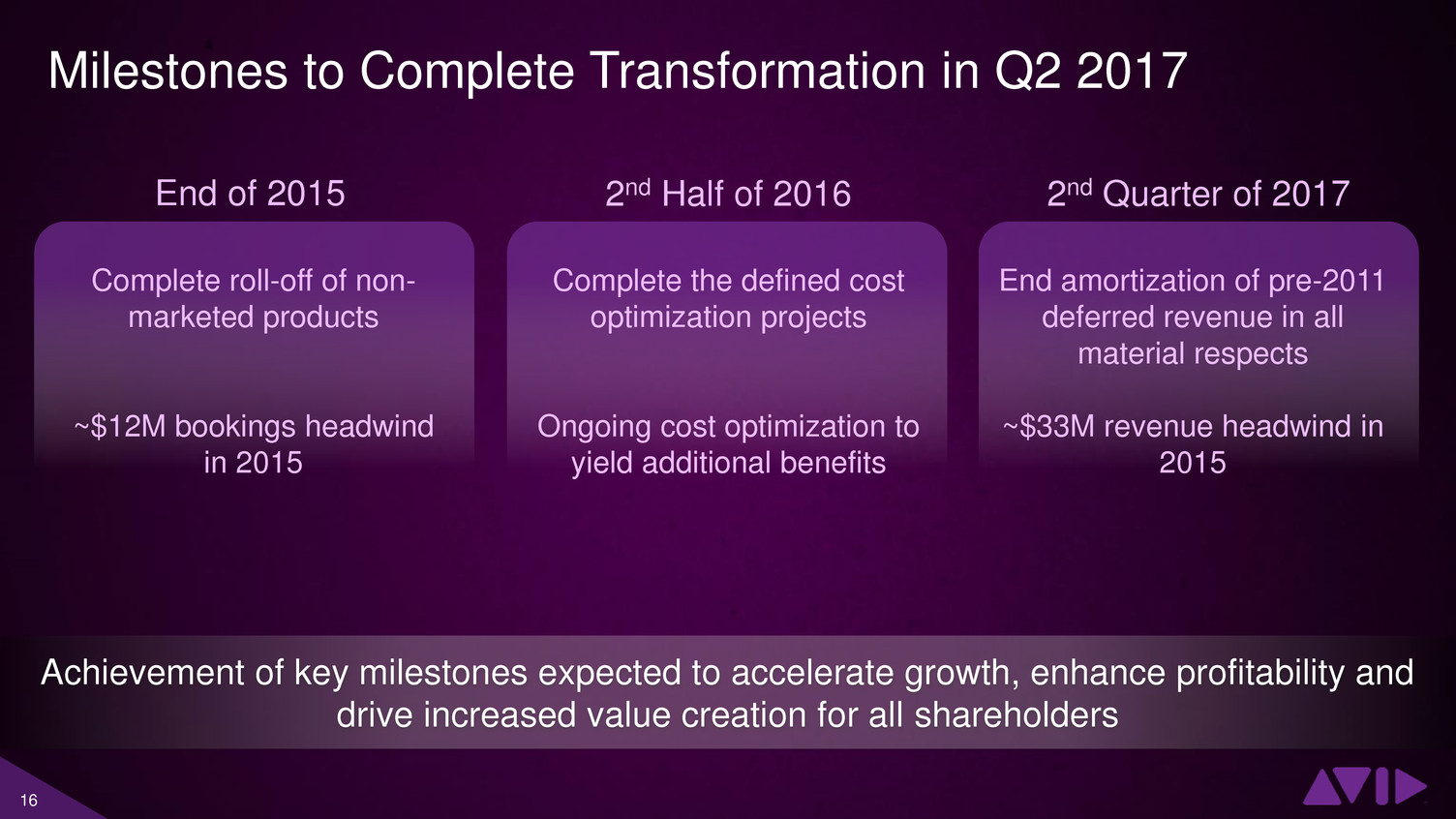

16 Achievement of key milestones expected to accelerate growth, enhance profitability and drive increased value creation for all shareholders Milestones to Complete Transformation in Q2 2017 Complete roll-off of non- marketed products ~$12M bookings headwind in 2015 Complete the defined cost optimization projects Ongoing cost optimization to yield additional benefits End amortization of pre-2011 deferred revenue in all material respects ~$33M revenue headwind in 2015 End of 2015 2nd Half of 2016 2nd Quarter of 2017

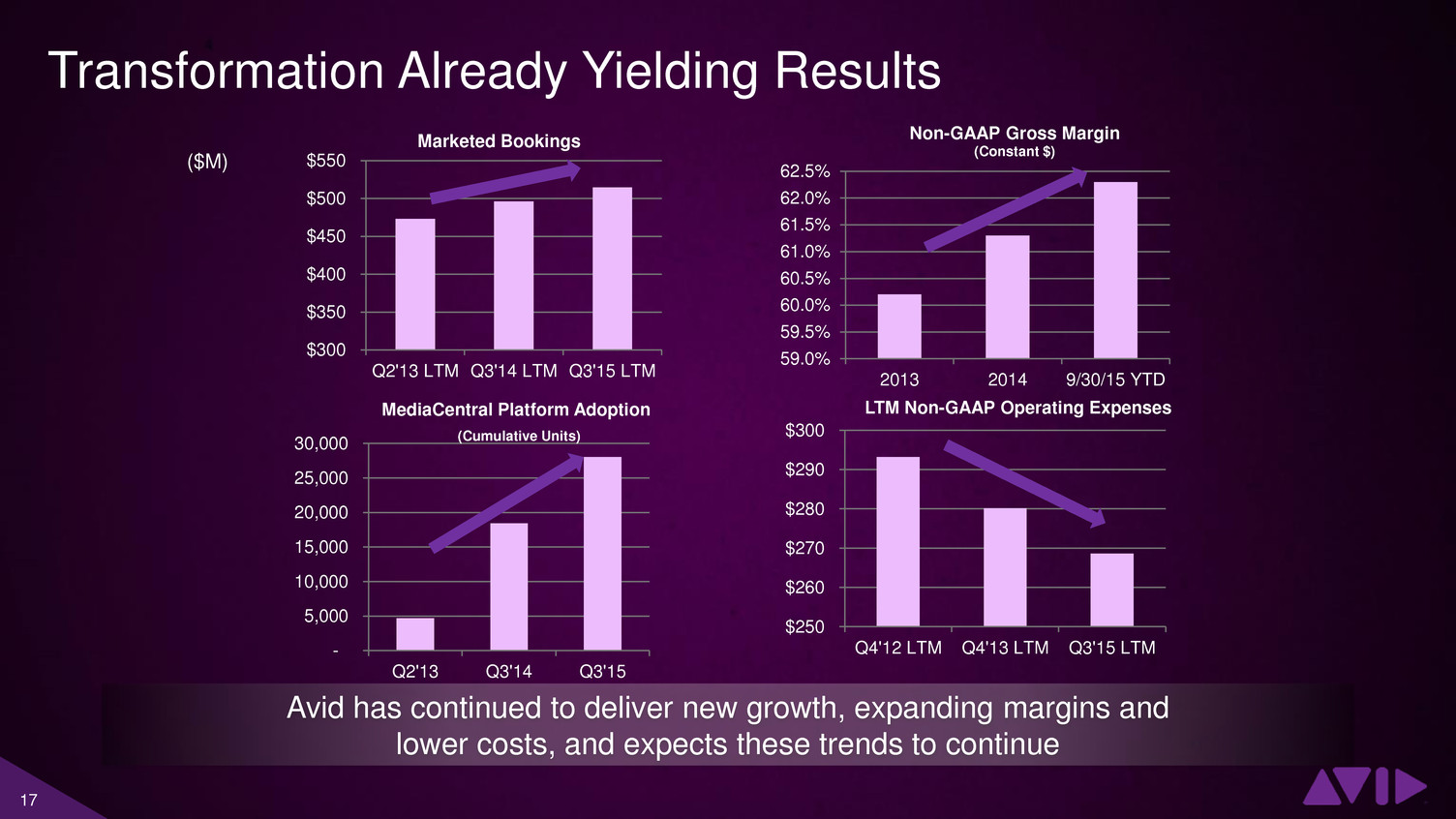

17 Transformation Already Yielding Results $300 $350 $400 $450 $500 $550 Q2'13 LTM Q3'14 LTM Q3'15 LTM Marketed Bookings - 5,000 10,000 15,000 20,000 25,000 30,000 Q2'13 Q3'14 Q3'15 MediaCentral Platform Adoption (Cumulative Units) 59.0% 59.5% 60.0% 60.5% 61.0% 61.5% 62.0% 62.5% 2013 2014 9/30/15 YTD Non-GAAP Gross Margin (Constant $) ($M) $250 $260 $270 $280 $290 $300 Q4'12 LTM Q4'13 LTM Q3'15 LTM LTM Non-GAAP Operating Expenses Avid has continued to deliver new growth, expanding margins and lower costs, and expects these trends to continue

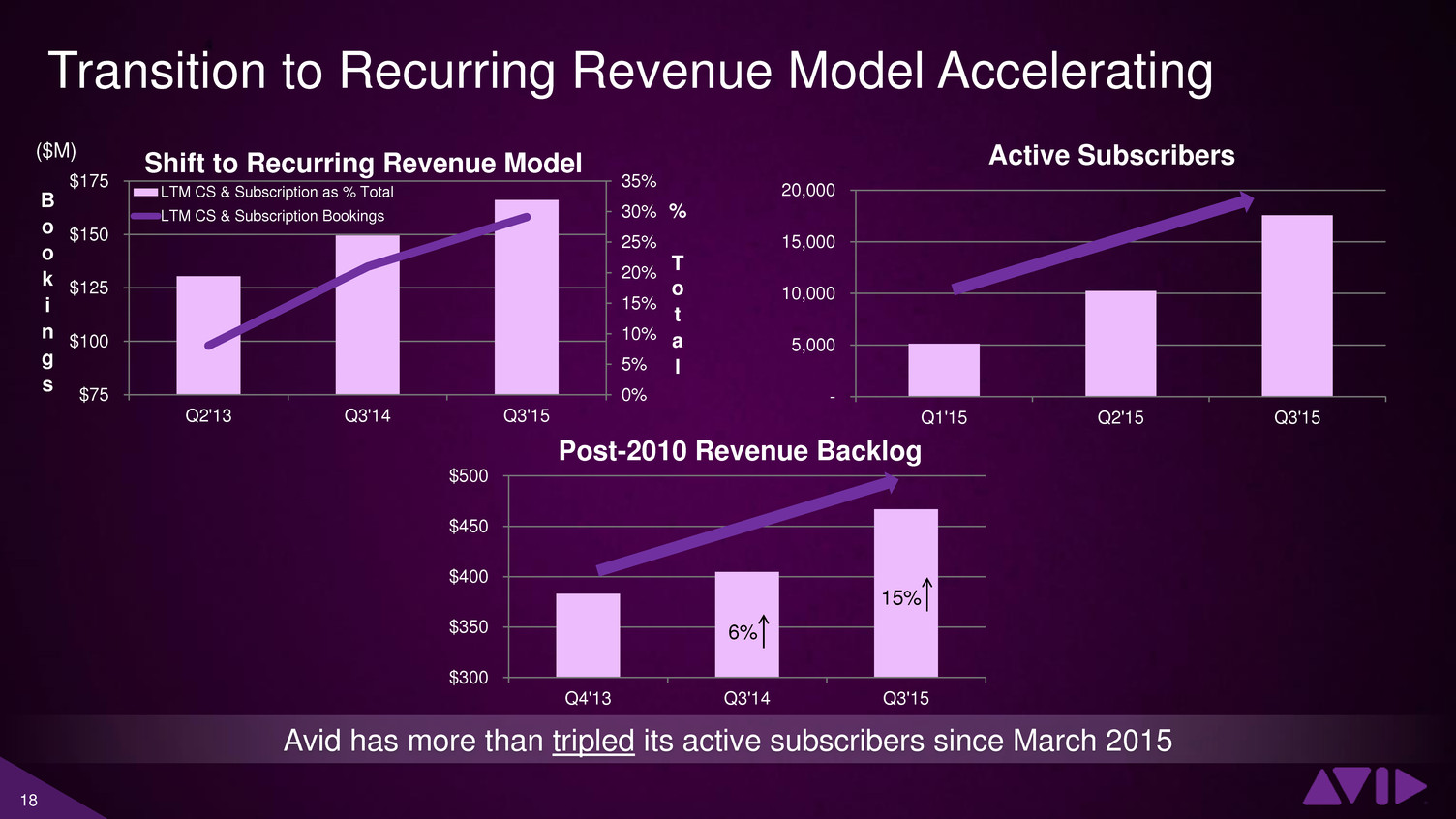

18 Transition to Recurring Revenue Model Accelerating 0% 5% 10% 15% 20% 25% 30% 35% $75 $100 $125 $150 $175 Q2'13 Q3'14 Q3'15 % T o t a l B o o k i n g s Shift to Recurring Revenue Model LTM CS & Subscription as % Total LTM CS & Subscription Bookings - 5,000 10,000 15,000 20,000 Q1'15 Q2'15 Q3'15 Active Subscribers $300 $350 $400 $450 $500 Q4'13 Q3'14 Q3'15 Post-2010 Revenue Backlog ($M) 6% 15% Avid has more than tripled its active subscribers since March 2015

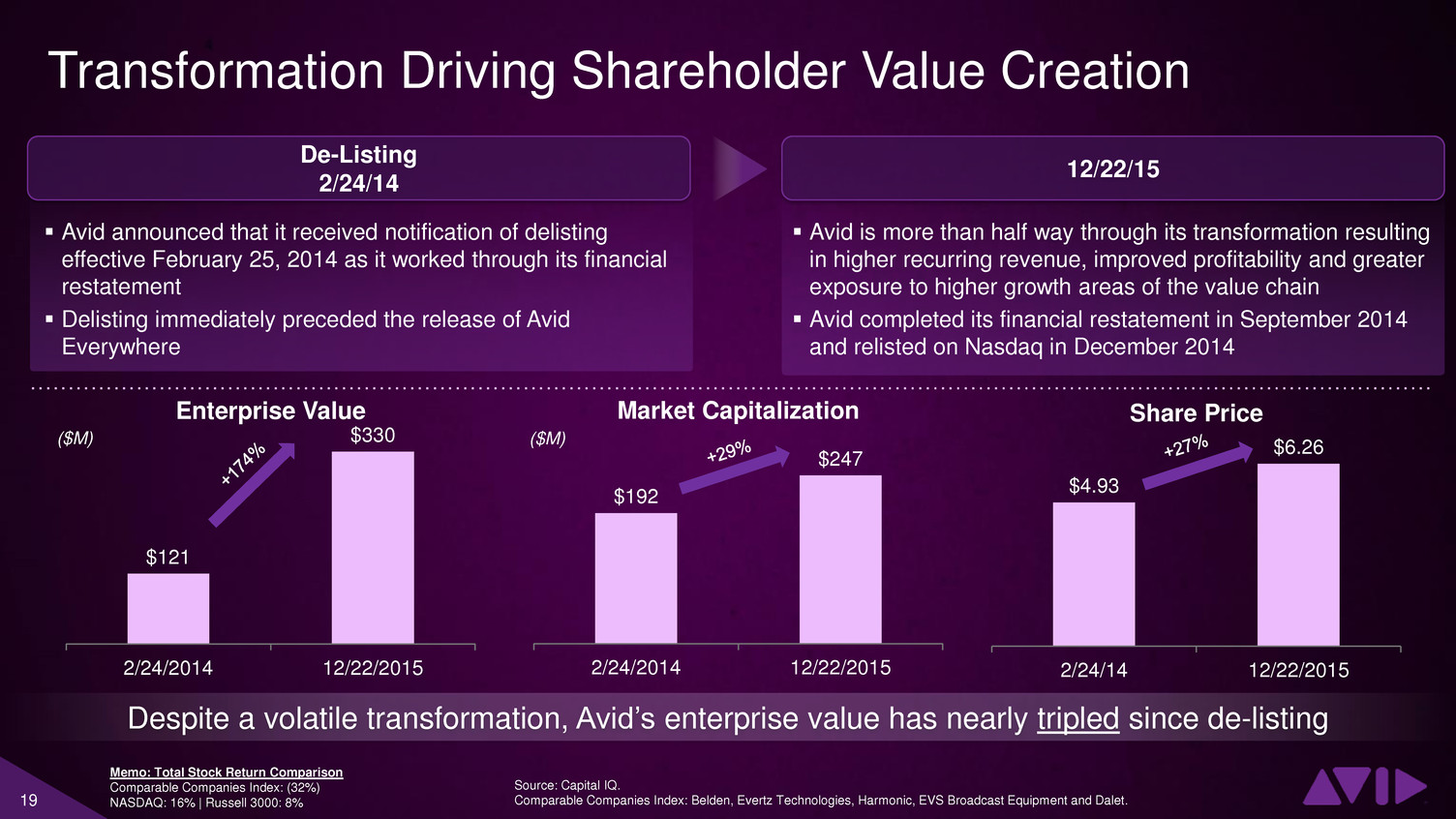

19 $121 $330 2/24/2014 12/22/2015 Enterprise Value Transformation Driving Shareholder Value Creation Source: Capital IQ. Comparable Companies Index: Belden, Evertz Technologies, Harmonic, EVS Broadcast Equipment and Dalet. Avid announced that it received notification of delisting effective February 25, 2014 as it worked through its financial restatement Delisting immediately preceded the release of Avid Everywhere De-Listing 2/24/14 Avid is more than half way through its transformation resulting in higher recurring revenue, improved profitability and greater exposure to higher growth areas of the value chain Avid completed its financial restatement in September 2014 and relisted on Nasdaq in December 2014 12/22/15 $4.93 $6.26 2/24/14 12/22/2015 Share Price ($M) $192 $247 2/24/2014 12/22/2015 Market Capitalization ($M) Memo: Total Stock Return Comparison Comparable Companies Index: (32%) NASDAQ: 16% | Russell 3000: 8% Despite a volatile transformation, Avid’s enterprise value has nearly tripled since de-listing

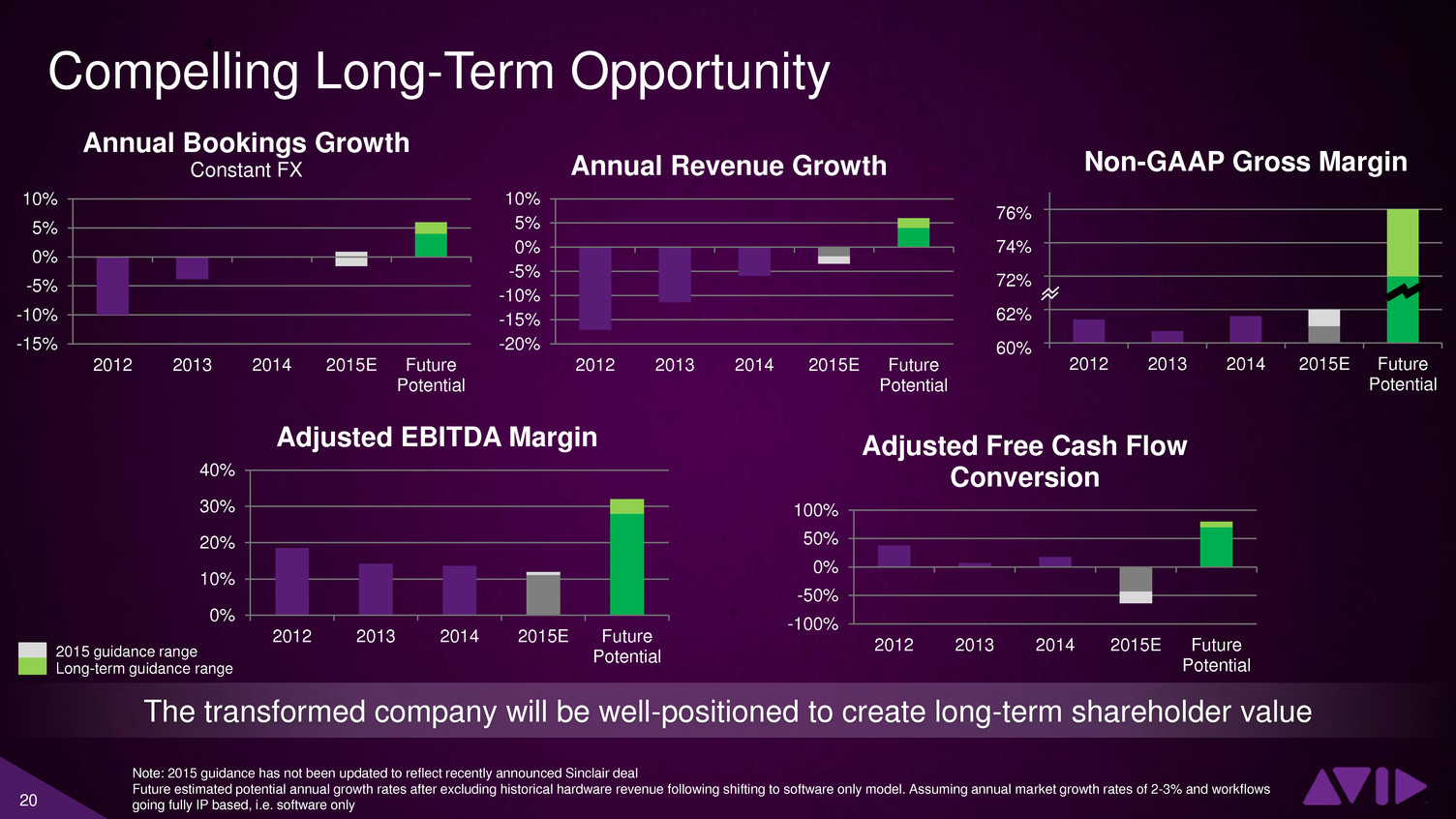

20 Compelling Long-Term Opportunity 0% 10% 20% 30% 40% 2012 2013 2014 2015E Future Potential Adjusted EBITDA Margin -100% -50% 0% 50% 100% 2012 2013 2014 2015E Future Potential Adjusted Free Cash Flow Conversion 2012 2013 2014 2015E Future Potential Non-GAAP Gross Margin -15% -10% -5% 0% 5% 10% 2012 2013 2014 2015E Future Potential Annual Bookings Growth Constant FX -20% -15% -10% -5% 0% 5% 10% 2012 2013 2014 2015E Future Potential Annual Revenue Growth Note: 2015 guidance has not been updated to reflect recently announced Sinclair deal Future estimated potential annual growth rates after excluding historical hardware revenue following shifting to software only model. Assuming annual market growth rates of 2-3% and workflows going fully IP based, i.e. software only The transformed company will be well-positioned to create long-term shareholder value 76% 74% 72% 62% 60% 2015 guidance range Long-term guidance range

21 Investment Highlights Large and Growing Market in Transition Growing $65B media technology market in transition as spending rapidly shifts to address changing business needs, creating significant opportunities for growth as media companies are forced to quickly adapt Unparalleled Market Position Avid is a trusted market leader and innovator in media technology solutions, with a broad product portfolio and deep distribution reach Clear Path to Value Creation Avid has a clearly articulated platform-based strategy to leverage its market position and capitalize on attractive market growth to create additional value for all shareholders Transformation Well Underway Avid has made and demonstrated significant progress executing against its strategic plan and re-positioning for growth Strengthening Performance Avid’s transformation has already delivered operational improvements and near-term benefits for shareholders

Appendix

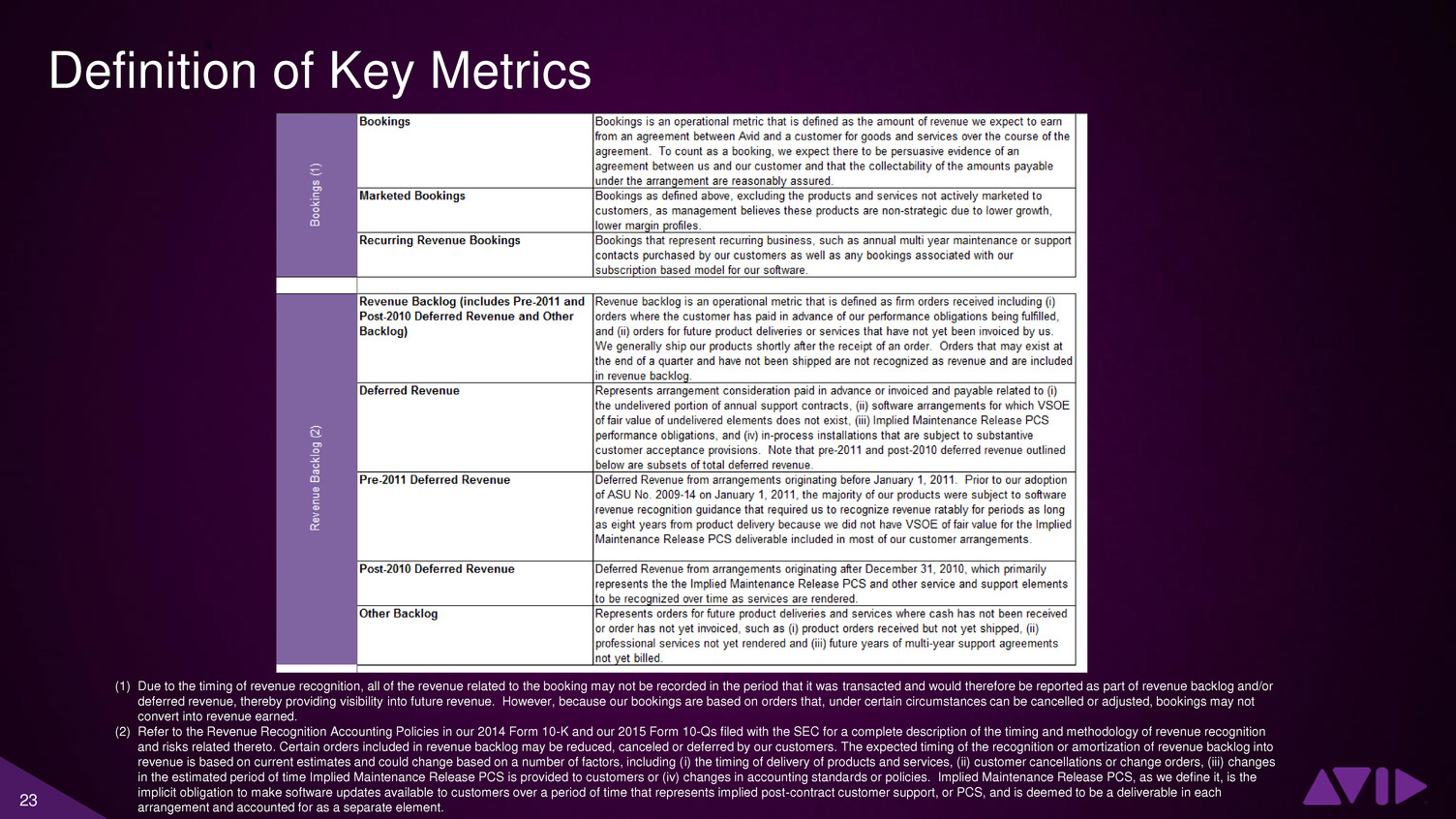

23 Definition of Key Metrics (1) Due to the timing of revenue recognition, all of the revenue related to the booking may not be recorded in the period that it was transacted and would therefore be reported as part of revenue backlog and/or deferred revenue, thereby providing visibility into future revenue. However, because our bookings are based on orders that, under certain circumstances can be cancelled or adjusted, bookings may not convert into revenue earned. (2) Refer to the Revenue Recognition Accounting Policies in our 2014 Form 10-K and our 2015 Form 10-Qs filed with the SEC for a complete description of the timing and methodology of revenue recognition and risks related thereto. Certain orders included in revenue backlog may be reduced, canceled or deferred by our customers. The expected timing of the recognition or amortization of revenue backlog into revenue is based on current estimates and could change based on a number of factors, including (i) the timing of delivery of products and services, (ii) customer cancellations or change orders, (iii) changes in the estimated period of time Implied Maintenance Release PCS is provided to customers or (iv) changes in accounting standards or policies. Implied Maintenance Release PCS, as we define it, is the implicit obligation to make software updates available to customers over a period of time that represents implied post-contract customer support, or PCS, and is deemed to be a deliverable in each arrangement and accounted for as a separate element.

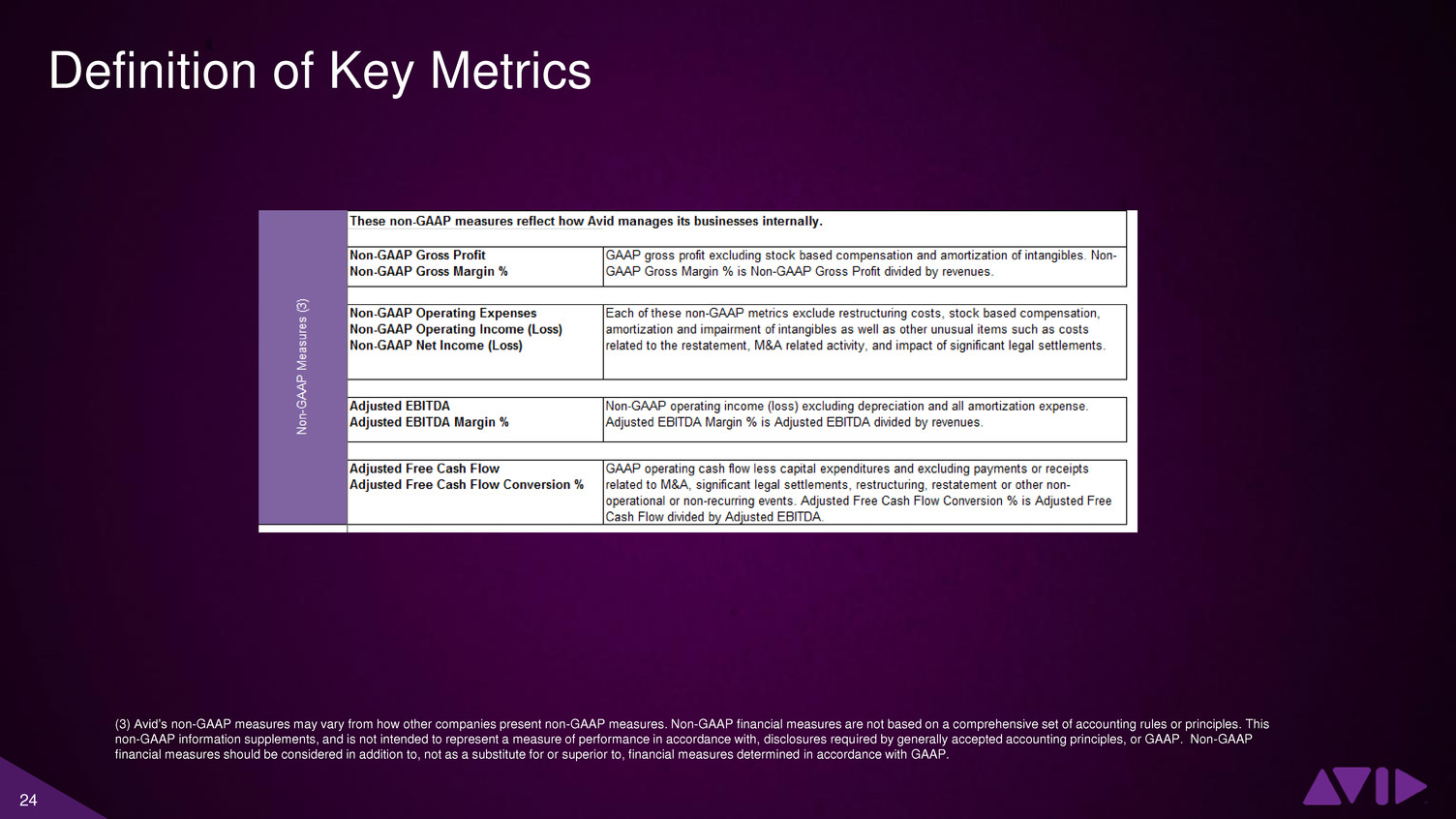

24 Definition of Key Metrics (3) Avid’s non-GAAP measures may vary from how other companies present non-GAAP measures. Non-GAAP financial measures are not based on a comprehensive set of accounting rules or principles. This non-GAAP information supplements, and is not intended to represent a measure of performance in accordance with, disclosures required by generally accepted accounting principles, or GAAP. Non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in accordance with GAAP.

25 Non-GAAP Reconciliation