Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEWMONT Corp /DE/ | d44075d8k.htm |

| EX-10.2 - EX-10.2 - NEWMONT Corp /DE/ | d44075dex102.htm |

Exhibit 10.1

DATED 4TH MAY, 2015

THE REPUBLIC OF GHANA

and

NEWMONT GHANA GOLD LIMITED

REVISED INVESTMENT AGREEMENT

(Government notice of effectiveness received and confirmed by the Company on 17th December 2015.

This revised Investment Agreement is ratified as effective 3rd December 2015.)

TABLE OF CONTENTS

| Clause | Page | |||||

| 1. | Definitions and Interpretation | 1 | ||||

| 2. | Effective Date | 5 | ||||

| 3. | Term of the Agreement | 6 | ||||

| 4. | Stabilisation | 6 | ||||

| 5. | Taxes and Duties | 8 | ||||

| 6. | Government Carried Interest | 12 | ||||

| 7. | Financial Reporting, Currency and Adequate Capital | 15 | ||||

| 8. | Adequate Capital | 16 | ||||

| 9. | Affiliated Company Transactions | 16 | ||||

| 10. | Miscellaneous Provisions | 17 | ||||

| 11. | Periodic Review | 18 | ||||

| 12. | Employment and Training | 18 | ||||

| 13. | Use of Ghanaian Goods and Services | 19 | ||||

| 14. | Incidental Rights | 19 | ||||

| 15. | Undertakings of the Government | 20 | ||||

| 16. | Conduct of Operations | 22 | ||||

| 17. | Land and Facilities | 22 | ||||

| 18. | Health and Safety | 24 | ||||

| 19. | Confidentiality | 24 | ||||

| 20. | Indemnification | 25 | ||||

| 21. | Encumbrance | 25 | ||||

| 22. | Termination | 25 | ||||

| 23. | Disposition of Assets | 27 | ||||

| 24. | Arbitration | 27 | ||||

| 25. | Notices | 30 | ||||

| 26. | Force Majeure | 32 | ||||

| 27. | Entire Agreement - Modifications | 33 | ||||

| 28. | Assignment and Succession | 33 | ||||

| 29. | Survival Provision | 33 | ||||

| 30. | Non-waiver of rights | 33 | ||||

| 31. | Severability | 33 | ||||

Appendix A Ahafo Mining Lease

Appendix B Calculation of Royalty

Appendix C Calculation of Guaranteed Payments to Government

Appendix D Mining List

Appendix E Current VAT MOU

i

THIS AGREEMENT is dated 4th May, 2015 and made

BETWEEN:

| (1) | THE REPUBLIC OF GHANA, represented by the Minister of Lands and Natural Resources and the Minister of Finance and Economic Planning (hereinafter referred to as the “Government”) and |

| (2) | NEWMONT GHANA GOLD LIMITED, a company with limited liability established under the laws of Ghana (hereinafter referred to as “NGGL”) |

BACKGROUND

| (A) | On December 18th, 2003, the Government and NGGL entered into an Investment Agreement (the “2003 Investment Agreement”) under which the Government granted NGGL certain financial and other concessions, warranties and conditions in order to encourage investment by NGGL in Ghana. |

| (B) | NGGL has made significant investment in a gold mining project in the Brong-Ahafo region of Ghana following execution of the 2003 Investment Agreement. |

| (C) | The Government has proposed changes to certain terms of the 2003 Investment Agreement in light of the changes in conditions in Ghana that have occurred since 2003 and in keeping with other objectives and policies that the Government wishes to see realised with respect to the mining industry in Ghana. |

| (D) | NGGL, in a spirit of cooperation and in order to address concerns of each Party, has agreed to revise the terms of the 2003 Investment Agreement as regards the rights of NGGL under that agreement. |

THE PARTIES AGREE AS FOLLOWS each in consideration of the agreement of the others:

| 1. | DEFINITIONS AND INTERPRETATION |

| 1.1 | The following terms wherever used in this Agreement shall have the respective meanings set forth below: |

“Additional Areas” has the meaning set forth in Section 15.10 below.

“Agreement” means this Revised Investment Agreement and includes those provisions of the Ahafo Mining Lease not inconsistent or in conflict with this Revised Investment Agreement.

“2003 Investment Agreement” means the agreement between the Government and NGGL, Rank Mining Company Limited (which has since been merged into NGGL) and Golden Ridge Resources Limited (now called Newmont Golden Ridge Limited) that was ratified by Parliament and became effective on December 18th 2003 and that, as regards NGGL has been revised and replaced by this Agreement.

“Affiliate” means a legal Person that, with respect to NGGL, directly or indirectly controls, is controlled by, or is under common control with NGGL. For purposes of

1

this section, “control” means the possession, directly or indirectly, by one legal Person of more than fifty percent (50%) of the equity of or voting power in another legal Person.

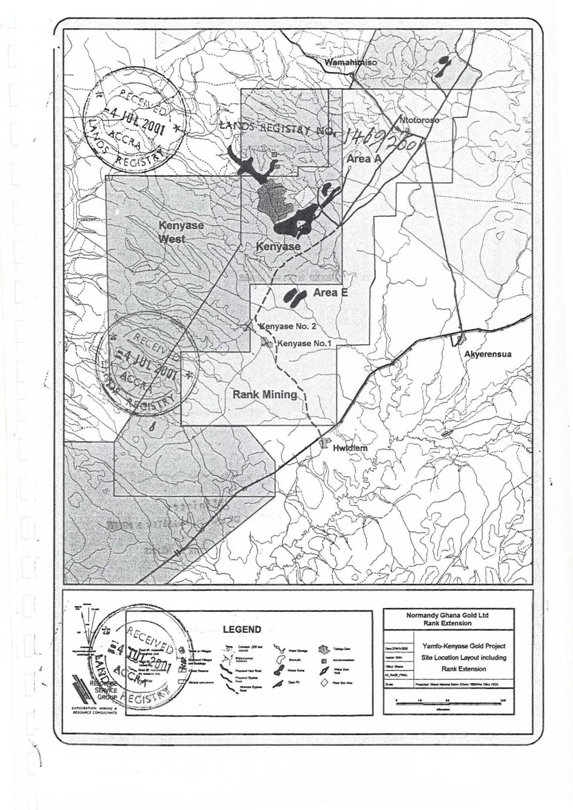

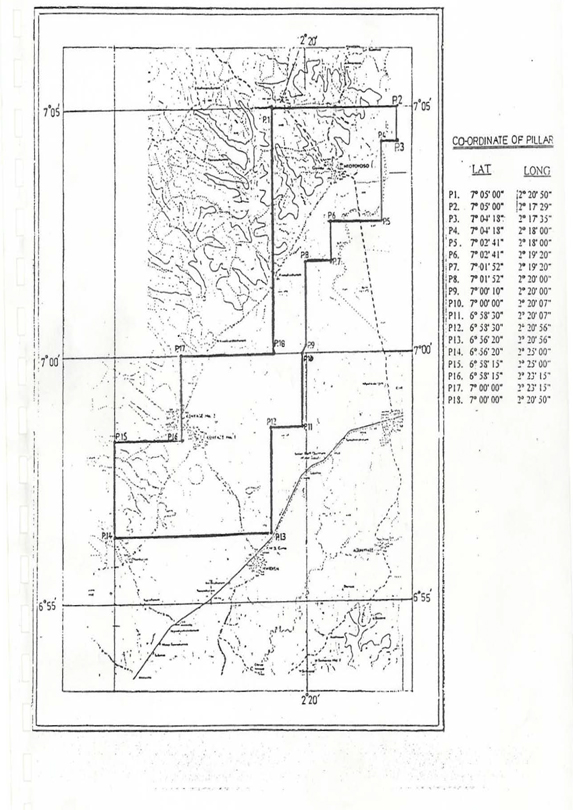

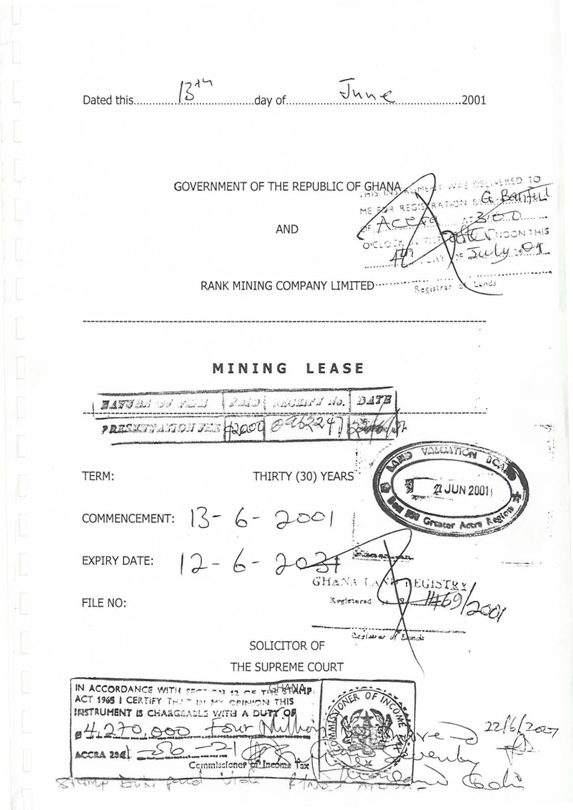

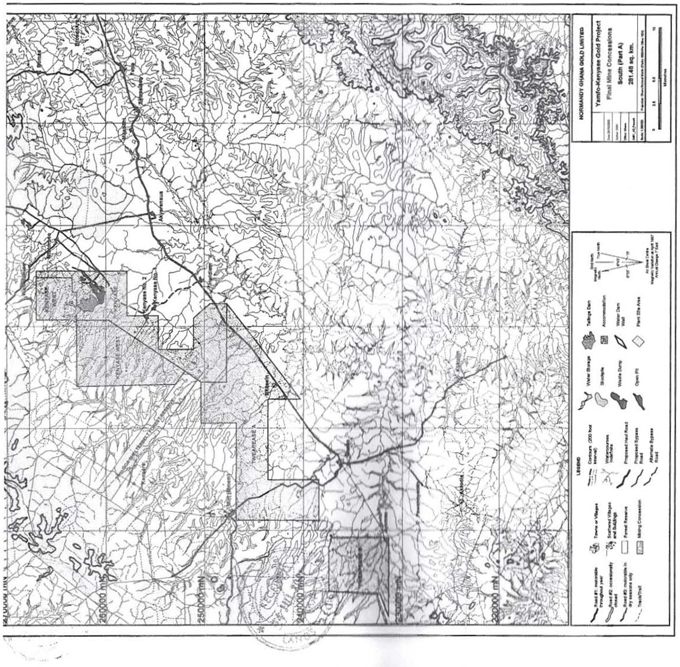

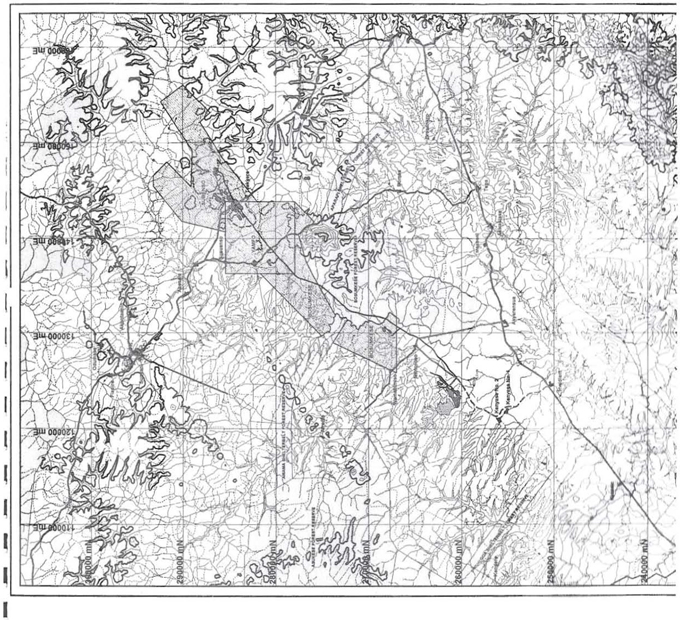

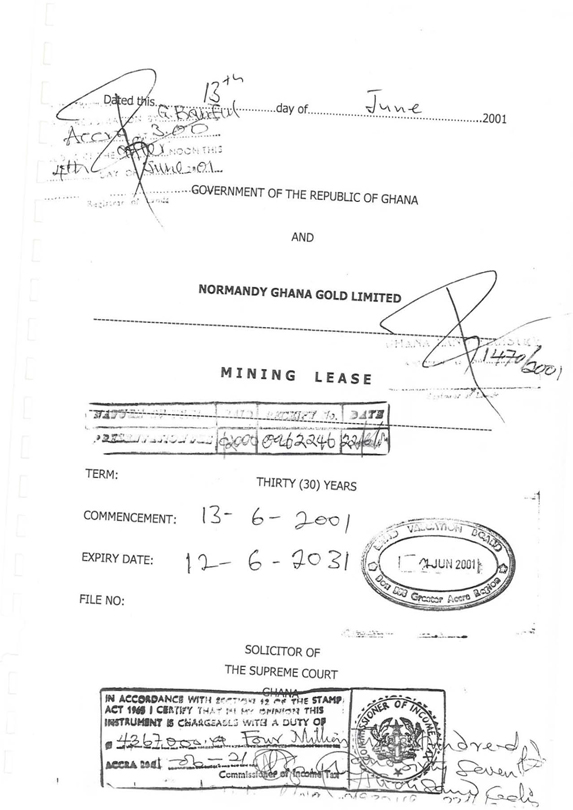

“Ahafo Mining Lease” means collectively each of the Ahafo Mining Lease and the Rank Mining Lease that were each entered into between the Government and NGGL dated 13 June 2001 and the Goa Mining Lease entered into on 7 October 2005, each as attached to this Agreement jointly as Appendix A.

“Akyem Revised Investment Agreement” means the investment agreement to be entered into on or about the date of this Agreement between the Government and Newmont Golden Ridge Limited which pursuant to Section 2.1 below must become effective as a condition of this Agreement becoming effective.

“Basic Stability Period” has the meaning given in Section 4.1.

“Centre” means The International Centre for Settlement of Investment Disputes established under the auspices of the International Bank for Reconstruction and Development.

“Contract Area” means all Production Areas.

“Convention” means the Convention on the Settlement of Investment Disputes between States and Nationals of Other States opened for signature at Washington, D.C., United States of America, on March 18, 1965.

“Development” means all preparation for the removal and recovery of Minerals, including the construction or installation of a mill, a Mining Plant or any other Infrastructure to be used for the mining, handling, milling, beneficiation or other processing of Minerals.

“Dollar” and “US$” mean United States dollars and any other currency that is legal tender in the United States of America.

“Effective Date” means the date described in Section 2.

“Equity Capital” means stockholders’ equity as reflected on the balance sheet of NGGL, the balance sheet having been prepared in accordance with IFRS.

“Events of Default” has the meaning given to such term in Section 22.2.

“Exploration” means activities directed towards ascertaining the existence, location, quantity, quality or commercial value of deposits of Minerals.

“Extended Stability Period” has the meaning given in Section 4.3.

“Extension Plan” has the meaning given to it in Section 4.3(a).

“Financial Year” means January 1 through December 31, or such other period as the Parties may agree.

“Foreign Currency” means Dollars and any other currency except Ghana Cedis.

2

“Ghana Cedi” means the lawful currency of Ghana and any currency that is legal tender in Ghana.

“Government” means the Republic of Ghana, its government, and any political subdivision, region, branch, division, instrumentality, authority and agency thereof.

“IFRS” means International Financial Reporting Standards issued or adopted by the International Accounting Standards Board and consistently applied.

“Indebtedness” means indebtedness for money borrowed from an Affiliate.

“Infrastructure” includes the following:

| (i) | immovable transportation and communication facilities (including roads, bridges, railroads, airports, landing strips and landing pads for aircraft, hangars and other airport facilities, garages, channels, tramways, pipelines and radio, telephone, telegraph, telecommunications, and electronic or other forms of communications facilities); |

| (ii) | immovable port facilities (including docks, harbours, piers, jetties, breakwaters, terminal facilities and warehouses, and loading and unloading facilities); |

| (iii) | immovable power, water and sewerage facilities (including electrical generating plants and transmission lines, dams, water drains, water supply systems and systems for disposing of tailings, plant waste and sewage); |

| (iv) | immovable public welfare facilities (including schools, clinics and public halls); |

| (v) | miscellaneous immovable facilities used primarily in connection with the operation of any of the foregoing (including offices, machine shops, foundries, repair shops and warehouses); |

| (vi) | other immovable facilities used primarily in connection with or as an incident to Operations; and |

| (vii) | movable facilities and equipment used as an integral part of the immovable facilities described above. For purposes of this Agreement, immovable items consist of all tangible items that are securely affixed and attached to the land or to buildings or other structures on the land. All other items are movable items. |

“International Standards” means generally accepted world mining industry standards and procedures, due allowance being made for any special circumstances in Ghana.

“Law” means any constitution, law, statute, decree, rule, regulation, judicial act or decision, judgment, order, proclamation, directive, executive order or other sovereign act of the Government that regulates, controls or relates to NGGL and to its Operations, or that is generally applicable in Ghana.

3

“London Bullion Market Association Gold Fix” and “London PM Fix” have the meaning given in Section 5.2(f)(ii)(A).

“Mineral” means any naturally occurring, inorganic ores with a defined, characteristic chemical composition and physical properties that has economic value, but excluding oil, gas, coal and geothermal resources.

“Mining Lease” means a right and license granted by the Government to mine and produce Minerals in a specified area in Ghana.

“Mining Plant” means any machinery, equipment, vehicle, tool, building, mill and plant, employees’ housing or other Infrastructure whether movable or immovable constructed by NGGL in the Contract Area or acquired by NGGL and used in connection with Operations.

“Minister” means the Minister of Government responsible for mining.

“Notice” means notice given in accordance with Section 25.

“Operations” means any and all activities and transactions conducted by or on behalf of NGGL in connection with Exploration, Development, Production and reclamation and the financing of any of them.

“Parliament” means the Parliament of the Republic of Ghana or any successor legislative entity or authority.

“Party” means the Government and NGGL (as well as any permitted assignee of either of them).

“Permissible Debt” has the meaning given in Section 8.1.

“Person” means any natural person and any legal person. For purposes of this Agreement, a natural person means a human being and a legal person means a partnership, joint venture, corporation, limited liability company, trust, estate, or any entity that is recognized by the laws of any state as a distinct legal entity, as well as a government or state, and any branch, division, political sub-division or region, instrumentality, authority or agency of any government or state.

“Prevailing Market Rate of Exchange” means the predominant rate, expressed in Dollars, on any day during which NGGL engages in a foreign exchange transaction under this Agreement, at which willing sellers and willing buyers, acting at arm’s length, in the ordinary course of business have most recently purchased or sold or agreed to purchase or sell Ghana Cedis or any other currency except Dollars.

“Production” means the commercial exploitation of Minerals found in the Production Area and all other activities wherever performed that are incidental thereto including the design, construction, installation, fabrication, operation, maintenance and repair of Mining Plant or other Infrastructure, facilities and equipment and the mining, excavation, extraction, recovery, handling, beneficiation, processing, milling, stockpiling, transportation, export and sale of Minerals.

4

“Production Area” means any area designated by the Ahafo Mining Lease as the “Lease Area” or a part of the Lease Area.

“Profound Changes in Circumstances” has the meaning given to such term in Section 11.

“Royalty” has the meaning given to such term in Section 5.2(f).

“Signature Date” means the date stated at the beginning of this Agreement.

“Stability Period” means the total of the Basic Stability Period as well as any Extended Stability Period as those terms are defined in Sections 4.1 and 4.3 respectively.

“Taxes and Duties” means any direct and indirect income, profit, excess profit, windfall profit, additional profit, supplementary charge, gains, capital gains, corporation, dividend, interest, financing, net worth, sales, goods, transaction, payroll, import, export, customs, consul, inspection, foreign exchange, value added, consumption, supply, use, turnover, severance, stumpage, cash flow, rental, land rental, surface rental, withholding, property, land, stamp and other taxes, duties, fees, levies, excises, rates, charges, imposts, surcharges, royalties, penalties and any other Government imposed revenue payments of whatever nature and however called, whether paid to the Government or to any other Person at the directive of the Government or under Law and whether similar or dissimilar to any of the foregoing.

“Transition Period” has the meaning given in Section 8.2.

| 1.2 | This Agreement shall be read with such changes in gender and number as the context shall require. Headings to the clauses and sections of this Agreement are inserted for convenience only and shall not affect its construction. |

| 1.3 | Unless otherwise stated, a reference to “hereof”, “hereunder”, “herein” or words of similar meaning, means this Agreement and its appendices. The words “and” and “or” includes the conjunctive and disjunctive, as the context may require or permit. The word “include” (and any variation of that word) means “including but not limited to”. Each of the Parties to this Agreement have participated in the drafting and negotiating of this Agreement and this Agreement shall not be construed against either Party as the drafting Party. |

| 1.4 | This Agreement shall from the Effective Date supersede the 2003 Investment Agreement and shall be the sole agreement between the Government and NGGL in respect of the Ahafo Mining operations. Except as otherwise provided by its terms, this Agreement shall have prospective effect only and the rights and obligations of the parties under the 2003 Agreement as they relate to activities prior to the Effective Date shall remain subject to the terms of the 2003 Agreement. |

| 2. | EFFECTIVE DATE |

| 2.1 | This Agreement shall become effective and binding on the Parties on the latest of: |

| (a) | the date on which it is ratified by Parliament; |

5

| (b) | the date on which the terms of Section 5 of this Agreement are approved by a resolution of Parliament pursuant to Article 174(2) of the Constitution of Ghana; or |

| (c) | the date on which the Akyem Revised Investment Agreement becomes effective. |

| 2.2 | The terms of this Agreement, including the provisions of Sections 22 and 24, shall also control and govern the rights of the Parties under the Ahafo Mining Lease. In the event of any conflict between the terms of this Agreement and the Ahafo Mining Lease, the terms of this Agreement shall prevail. The Parties acknowledge and agree that, other than to the extent of any such conflict, the Ahafo Mining Lease shall remain valid and in full force and effect. |

| 3. | TERM OF THE AGREEMENT |

The original term of this Agreement shall commence on the Effective Date and, unless sooner terminated under Section 22 below shall, subject to Sections 2.2 and 4.1, continue for so long as NGGL (or any assignee) is the holder of the Ahafo Mining Lease and such lease is valid and in good standing.

| 4. | STABILISATION |

| 4.1 | Except as otherwise provided in this Agreement, the Taxes and Duties payable by NGGL as set forth or described in this Agreement or as otherwise required by Law and assessed in keeping with the terms of this Agreement, shall be stabilised up to December 31, 2020 (the “Basic Stability Period”). |

| 4.2 | During the Basic Stability Period and any Extended Stability Period, and except to the extent otherwise provided by the terms of this Agreement, NGGL shall not be affected by any Law enacted after January 1, 2014 or by any changes to any Law in existence as of January 1, 2014 if such new Law or amended Law has the effect either of imposing upon NGGL any new or additional Taxes and Duties or of altering: |

| (a) | the basis for determining or calculating the Taxes and Duties applicable to NGGL; and |

| (b) | the level or rate of Taxes and Duties to which NGGL is subject. |

| 4.3 | The Basic Stability Period shall be extended for a single additional term of five (5) years (the “Extended Stability Period”) after the date of its termination if: |

| (a) | under a plan (the “Extension Plan”), presented to and accepted (for purposes of this Section 4.3) by the Minister, NGGL commits to make an additional investment of at least three hundred million Dollars (US$300,000,000) in the mining project which is the subject of the Ahafo Mining Lease with respect to activities not previously approved by the Government, provided that the period for the completion of the Development in connection with the additional investment described in the Extension Plan shall not exceed four (4) years; and |

6

| (b) | the additional investment is projected under the Extension Plan to result in any one of the following: |

| (i) | an increase in gold production by NGGL of at least ten per cent (10%) when compared to the average of the three (3) calendar years before the completion of the Development described in the Extension Plan and financed by the additional investment; |

| (ii) | an increase by at least three (3) years in the life of the mine which is the subject of the Ahafo Mining Lease; |

| (iii) | an increase of at least ten per cent (10%) in the number of permanent employees who are citizens of Ghana employed by NGGL at the mine which is the subject of the Ahafo Mining Lease when compared to 31 December of the year prior to the year in which NGGL began construction or other activity required to complete the Development described in the Extension Plan and financed by the additional investment; or |

| (iv) | the satisfaction of any other measure approved by the Minister. |

The Minister’s acceptance of the Extension Plan shall not be unreasonably withheld and shall be deemed to have been given if Notice of disapproval has not been received by NGGL within 120 days of delivery of the Extension Plan to the Minister. The Minister shall specify in writing the grounds for non-acceptance of the Extension Plan for purposes of this Section 4.3.

| (c) | Fulfilment of the measures described in Section 4.3(b) and set forth in the Extension Plan shall be deemed to have occurred if, within one (1) year after the completion of Development with respect to an additional investment project, any one of the conditions set forth in Section 4.3(b) and as described in the Extension Plan has been met or, in the case of Section 4.3(b)(ii), it can be demonstrated to the reasonable satisfaction of the Minister that activities have been completed and given effect such as will permit the attainment of that condition. |

| (d) | Should the conditions described in Section 4.3(a) and (b) fail to be satisfied on the basis and within the period described in Sections 4.3(b) and (c) and in the Extension Plan unless such failure is due to Force Majeure or to action taken or inaction by the Government after acceptance of the Extension Plan that prevents the satisfaction of any of the relevant conditions in the Extension Plan, the Government may rescind the Extended Stability Period and NGGL will thereafter become liable for any additional Taxes and Duties that would have accrued but for the extension of the Basic Stability Period. |

| (e) | Any dispute arising out of or in relation to this Section 4.3 shall be subject to the provisions of Section 24. |

7

| 5. | TAXES AND DUTIES |

With effect from the Effective Date and for the duration of the Basic Stability Period and any Extended Stability Period only, the following shall apply:

| 5.1 | General |

NGGL shall be subject to all Taxes and Duties in force in Ghana from time to time under Law except:

| (a) | where NGGL is exempt wholly or partly from the application of a Law relating to Taxes and Duties pursuant to a validly granted authority under any applicable Law; or |

| (b) | as otherwise provided in this Agreement. |

| 5.2 | Stability Regime |

NGGL shall be subject to taxation on its income at the rates and on the basis provided by Law except that during the Basic Stability Period and any Extended Stability Period (notwithstanding the provisions of any Law to the contrary):

| (a) | Corporate Income Tax Rate and Basis |

| (i) | the rate of corporate income tax applicable to the taxable income of NGGL derived from its Operations shall be thirty two and a half per cent (32.5%); |

| (ii) | subject to the other provisions of this Section 5.2 and, except as may be otherwise provided by this Agreement, NGGL’s taxable income shall be determined on the basis stipulated by Law in effect on January 1, 2014 with all write-offs, deductions, reliefs and allowances permitted or allowed by the Law as at that date; |

| (iii) | NGGL may deduct for purposes of determining taxable income a fee for management and technical services provided by an Affiliate in an annual amount that in aggregate shall be 2.25% of either: |

| (A) | total revenues from Production or other Operations in the relevant Financial Year; or |

| (B) | if before the start of Production or during other periods when Production has been substantially interrupted, Development capital expenditures in the relevant Financial Year. |

The management and technical services fee of 2.25% of either total revenues or Development capital expenditure that is permitted under this Section to be paid during each year to an Affiliate shall for purposes of this Agreement be deemed to represent a fair, arm’s length fee as would apply between unrelated parties in the ordinary course of business for the provision of such services.

8

| (iv) | the tax written down value of any capital assets acquired by NGGL before the Effective Date having first been depreciated in accordance with the provisions of the 2003 Investment Agreement (and with the addition of the five per cent (5%) uplift on class three assets) shall be pooled with all capital assets of the same class acquired after the Effective Date and thereafter depreciated as permitted by Law in effect as of January 1, 2014. |

| (v) | Any other income earned by NGGL from activities in Ghana that is not derived directly or indirectly from Operations or Production shall be taxable under Law. |

| (vi) | NGGL’s taxable income shall be determined in Dollars in accordance with Law, except as otherwise provided in this Agreement. |

| (vii) | The payments to be made by NGGL to the Government under Sections 6.1, 6.2 and 6.7 shall not be deductible for the determination of taxable income, but the payment to be made pursuant to Section 6.8 shall be deductible. |

| (b) | Local Taxes and Duties |

NGGL shall pay Taxes and Duties imposed by local or municipal governments under authority granted by Law. NGGL shall not be liable to pay any such Taxes and Duties imposed by local or municipal governments that would impose a disproportionate burden on NGGL when compared to other Persons in the same category, including Persons engaged in exploration or mining operations in Ghana.

| (c) | Withholding Taxes |

NGGL shall withhold tax on any fees paid for management and technical services on the basis and at the rate provided by Law, except that in the case of payment to an Affiliate for such services the rate shall be ten percent (10%) of the amount of the fee paid, and NGGL shall pay all such amounts within the time and in the manner and place required by Law. Except as provided in this Section, no withholding taxes or other Taxes and Duties shall be assessed against NGGL or an Affiliate with respect to (i) dividends paid to that Affiliate; (ii) interest paid to that Affiliate to the extent that such interest is equivalent to the rate that would be charged by a third party lender to a borrower in circumstances substantially the same as those of NGGL; and (iii) any repayment of loan principal paid or payable to that Affiliate.

| (d) | Capital Gains Tax |

Any capital gains realized as a result of the conveyance or transfer of any rights under this Agreement or of the Ahafo Mining Lease shall be subject to Taxes and Duties under Law provided that in the case of (i) capital gains realized by NGGL the provisions of Section 5.1 shall apply; and (ii) no Taxes and Duties shall be imposed upon capital gains accruing to or derived by NGGL or an Affiliate and arising out of the realisation of a chargeable asset

9

from a merger, amalgamation, or re-organisation of NGGL or an Affiliate where the Affiliate (or Affiliates) that owns or controls all other Affiliates involved in such transactions will retain at least a 25% beneficial ownership interest in NGGL when the conveyance or transfer has been completed. For purposes of this Agreement “reorganization” shall mean an internal restructuring or reallocation of the ownership of NGGL such that ownership passes from one Affiliate to another.

| (e) | Import Duties and Excise Taxes |

| (i) | NGGL shall be exempt from Taxes and Duties on the import of plant, machinery, equipment, parts, fuels and petroleum products, supplies and accessories, as well as other items listed in the Mining List (a copy of which is attached hereto as Appendix D), and imported necessarily, specifically and exclusively for Operations. |

| (ii) | Where an item becomes necessary to import for the use of NGGL as a result of advances in technology, or to replace an item on the Mining List that has been rendered obsolete or taken out of production or for any similar reason, NGGL shall make a representation to the Minister as to why such item is necessary for import and should be exempt from customs import duties and the Minister shall give due consideration to such representation in the light of the Mining List and applicable Law. |

| (f) | Royalty |

| (i) | Royalty Rate: |

NGGL shall pay to the Government in Dollars a royalty at the percentage rate specified below on the total revenues received by NGGL from the sale of Minerals obtained from the Production Area during each calendar month (the “Royalty”):

| (A) | gold according to a sliding scale starting at a floor of 3% at a gold price below US$1,300 per ounce, increasing to 3.5% at a gold price between US$1,300 and US$1,449.99 per ounce, to 4% at a gold price between US$1,450 and US$2,299.99 per ounce and to 5% at a gold price of not less than US$2,300 per ounce, as set forth and illustrated in Appendix B; and |

| (B) | all other Minerals, at a rate pursuant to Law and subject to Section 14.1 below. |

In respect of gold mined in a forest reserve area that either (i) is not as of the Effective Date a part of the Contract Area but becomes a part of the Contract Area after the Effective Date, or (ii) is a part of the Contract Area as of the Effective Date and on or before December 18, 2006 had been designated by Law as a forest reserve area, this rate may be increased by the addition of 0.6% as a special fee as set forth and illustrated in Appendix B.

10

The payment of Royalty by NGGL to the Government shall be made within thirty (30) days after the end of the calendar month in which the gold or other Mineral subject to such Royalty was sold. Appendix B hereto illustrates the basis and calculation of the Royalty.

| (ii) | Determination of Gold Price: |

| (A) | For the purposes of Section 5.2(f)(i)(A) above, the price for determining the applicable Royalty rate on the sliding scale shall be the average of the quoted gold price on the daily London Bullion Market Association Gold Fix (the “London PM Fix”) for each calendar month with respect to sales of gold during such month. |

| (B) | Should the London PM Fix cease to exist, then the Parties shall choose an alternative market index as set forth in Section 6.2(d). |

| (iii) | Right to Take Royalty in Kind |

| (A) | The Government, acting through the Minister, may take all or a part of the Royalty to which it is entitled in this Section 5.2(f). in gold that has a value based on the London PM Fix (or an alternative index in the circumstances provided for by this Section 5.2(f) and Section 6.2(d)) equivalent to the Royalty amount in Dollars payable to the Government on the day it is payable |

| (B) | Where the Government desires to take its Royalty share or part thereof for the next Financial Year in gold, the Minister shall elect to do so by giving Notice to NGGL not less than six (6) months prior to the beginning of that Financial Year. Such election may be revoked by mutual agreement between the Parties if the Government gives at least one month’s Notice before any gold to be delivered under this Section 5.2 is scheduled for delivery. |

| (C) | Should the Minister make the election to take all or a part of the Royalty in gold as described in Section 5.2(f)(iii)(A) above, the Parties shall meet to agree upon the specific terms and the process for such transfer or delivery of gold which shall be consistent with standard practice as between buyers and sellers of gold. If the Parties have not agreed on the transfer, delivery and other terms by a date that falls one month prior to the scheduled delivery date for such gold, then the Government shall receive the Royalty in Dollars in accordance with Section 5.2(f)(i)(A) above. |

11

| (g) | Value-Added Tax |

Except as otherwise provided in this Agreement, NGGL shall be exempt from the payment of Value-Added Tax (VAT) on:

| (i) | all items it imports, and |

| (ii) | all local purchases of services, goods and supplies to the extent used in connection with Operations. |

Gold and other Mineral that NGGL may sell for export to Persons outside Ghana, or sell or convey to the Government pursuant to this Agreement, shall be zero rated for VAT purposes.

Notwithstanding the above and for the avoidance of doubt, NGGL shall be subject to VAT on the items listed on Appendix E to this agreement.

The Government is in process of considering certain changes to the administration of the VAT. When such changes are fully implemented, the Parties agree to confer regarding any amendment of this Section 5.2(g) as may be jointly agreed to by them to be appropriate in the light of such changes to the Law governing VAT.

| 5.3 | Integrated Activity |

NGGL’s Operations in respect of the Contract Area shall, for the purposes of any Law relating to the calculation of applicable Taxes and Duties, be deemed to be a single, integrated activity. Accordingly, all write-offs, deductions, reliefs and allowances incurred by or on behalf of NGGL relating to Operations in respect of the Contract Area may be deducted from any income or profits of NGGL arising from the Operations for purposes of determining any applicable Taxes and Duties.

| 6. | GOVERNMENT CARRIED INTEREST |

| 6.1 | Nature of Government Interest |

In satisfaction of the requirements of section 43 of the Minerals and Mining Act, Act 703, or of any other Law that reserves for the Government a ten per cent (10%) free carried, fixed, non-equity interest in NGGL Operations (in respect of which financial contribution shall not be paid by the Government), the Government shall receive and NGGL shall make the following payments:

| (a) | a sum equal to 1/9th of the total amount paid as dividends to the shareholders of NGGL on each occasion when dividends are distributed by NGGL, less any advance payments made pursuant to Section 6.2 below; and |

| (b) | any guaranteed annual advance payments made pursuant to Section 6.2 below. |

For the avoidance of doubt, the Parties affirm that the interest provided to the Government and described above is a non-equity interest in NGGL Operations.

12

| 6.2 | Guaranteed Advance Payments to the Government |

Notwithstanding any other provision of this Agreement, beginning with the calendar year 2011, being the fifth year after the first year during which NGGL produced gold in Ghana under the Ahafo Mining Lease, and for each year thereafter in which the average of the quoted gold price on the London PM Fix for such year was equal to or more than US$1,300 per ounce, NGGL shall pay to the Government, subject to the following conditions having been satisfied, and as an advance against the payments provided for in Section 6.1(a) above, 0.6% of the total revenues received by NGGL from the sale of Minerals obtained from the Production Area by NGGL:

| (a) | at the end of each calendar year, the eligibility of the Government to receive an advance payment shall be determined on the basis set forth above in this Section 6.2, and if any advance payment is due to the Government it shall be made by NGGL not later than June 30th of the calendar year after the calendar year with respect to which the advance payment is due; |

| (b) | any advance payment made at any time to the Government (or to any other Person at the Government’s direction) shall be deducted from any future payments to which the Government is entitled under Section 6.1(a); |

| (c) | upon termination of Operations or mine closure in respect of the Ahafo Mining Lease there shall be no recovery from the Government of the difference between the aggregate advance payments made to the Government under this Section 6.2 and the total amount due to the Government under Sections 6.1(a) and 6.5; and |

| (d) | should the London PM Fix cease to exist or be quoted, or in any case should the Parties so elect in writing, they may by mutual agreement designate another objective market index as the basis for determining the average price during a given year at which willing sellers and willing buyers acting at arm’s length sold and bought gold at specified levels of purity during the year in question. Once they have so agreed, then that price shall be the average price at which for purposes of this section gold shall be deemed to have been bought and sold during the year in question. |

| 6.3 | Permitted Payments and Distributions to NGGL from Operations |

NGGL shall not pay or distribute any amount to an Affiliate other than:

| (a) | to repay the principal of, and to pay interest on, a loan from an Affiliate; |

| (b) | as a distribution of dividends to an Affiliate subject to Section 6.1(a) above; |

| (c) | as payment of management and technical services fees on the basis set forth in this Agreement; |

| (d) | as payment for goods or services provided to NGGL by such Affiliate; and |

| (e) | as reimbursement of costs incurred by an Affiliate on behalf of NGGL and with its authorization, on a Dollar for Dollar basis. |

13

| 6.4 | Entitlement to Section 6.3 Payments |

The Government shall not receive a payment pursuant to this Section 6 with respect to the items specified in Section 6.3(a) to (e).

| 6.5 | Termination Payments |

On termination of Operations or mine closure in respect of the Ahafo Mining Lease, NGGL shall:

| (a) | pay or otherwise satisfy any liabilities including Taxes and Duties and make appropriate provision as required by Law for unknown or contingent liabilities (including reclamation and similar costs not otherwise provided for); and |

| (b) | undertake reasonable efforts to collect all amounts due to NGGL by any Person (or to offset any such amounts due to NGGL from a Person against amounts due to such Person by NGGL as permitted by Law or this Agreement). |

Following settlement of all such payments and offsets referred to in Section 6.5(a) above, NGGL shall pay to the Government ten per cent (10%) of its net remaining cash and may distribute the balance remaining after such payment to the Government as a dividend to its shareholders without further obligation to the Government under Sections 6.1 and 6.2.

| 6.6 | Formula Exhibit |

A formula to illustrate the basis and calculation of the distribution of payments to the Government is contained in Appendix C.

| 6.7 | Payment of Prior Years Entitlements |

The guaranteed annual advance payment payable to the Government under Section 6.2 in respect of the years 2011, 2012, and 2013 shall be paid by NGGL to the Government within thirty (30) days after the Effective Date. If the Effective Date has not occurred by June 30th 2015, any guaranteed annual advance payment payable in respect of 2014 and any subsequent calendar year that ends before the Effective Date shall also be paid by NGGL to the Government within thirty (30) days after the Effective Date.

| 6.8 | Additional Payments to be made to the Government |

NGGL shall pay to the Government an additional amount of eight million Dollars (US$8 million) within thirty (30) days after the Effective Date in consideration of the exemptions from Taxes and Duties and the special treatment of certain items for tax purposes in Section 5 hereof.

14

| 7. | FINANCIAL REPORTING, CURRENCY AND ADEQUATE CAPITAL |

| 7.1 | Currency for Accounting |

Accounting by NGGL under this Agreement shall be in Dollars and any amounts paid or received, and obligations incurred or transactions carried out, in Ghana Cedis or in any Foreign Currency other than Dollars shall be converted to Dollars at the Prevailing Market Rate of Exchange between Dollars and Ghana Cedis or any other Foreign Currency on the date of the applicable transaction in accordance with generally accepted accounting principles based on IFRS standards. Notwithstanding the foregoing, and solely for informational purposes, at the request of the Government with respect to any financial year, NGGL shall also keep a set of books in Ghana Cedis.

| 7.2 | Exchange Control |

| (a) | NGGL may, without restriction, directly or indirectly, of the Government, obtain, hold, deal with and disburse funds in any manner, currencies and places as it chooses, provided that, except during the last two (2) years of Operations when no specific minimum shall apply, NGGL shall return to Ghana a minimum of 30% of its gross proceeds from the sale of gold towards its obligations in Ghana for Taxes and Duties, wages, salaries and employee benefits and other payments for goods and services. If any of the gross sales proceeds of NGGL result from the sale of gold within Ghana (or from the payment of Royalties in gold under Section 5.2(f) and such proceeds are remitted to bank accounts within Ghana or conveyed in gold to the Government, the obligation of NGGL to return a minimum of 30% of its gross sales proceeds to Ghana shall be reduced by such amount or by the value of any gold conveyed to the Government pursuant to Section 5.2(f) or otherwise in an amount mutually agreed by the Parties. |

| (b) | Subject to Section 7.2(a) above, and without limiting the rights granted in that Section, NGGL has the unrestricted and unencumbered right to sell and receive payment for Minerals in any currency and the proceeds from such sales may be deposited in bank accounts outside of Ghana and held there or remitted from there to anywhere in the world, in any currency. |

| (c) | NGGL shall maintain at least one bank account with a commercial bank or financial institution in Ghana and, as soon as is reasonably practicable after a transaction with that bank, shall provide notice to the Bank of Ghana of any dealing in foreign exchange. |

| (d) | NGGL may acquire Ghana Cedis at the Prevailing Market Rate of Exchange, and also exchange Ghana Cedis for Foreign Currency at the Prevailing Market Rate of Exchange provided that any of the above transactions in Ghana shall comply with applicable Law including any requirement that such transactions in Ghana be conducted with Persons authorized by Law to engage in such transactions. Additionally, any and all transactions between the Government and NGGL relating to Taxes and Duties stated in Ghana Cedis will be converted to Dollars at the Prevailing Market Rate of Exchange except for NGGL’s withholding obligations under Law which shall be governed by and subject to Section 7.3. |

15

| 7.3 | Currency of Payment |

Payment of NGGL’s obligations to the Government for Taxes and Duties shall be in Dollars, subject to Section 7.4, unless the Parties otherwise agree. Any obligation originally stated in Ghana Cedis, or in any Foreign Currency other than Dollars, will be converted to Dollars at the Prevailing Market Rate of Exchange. However, NGGL shall pay sums it collects on behalf of the Government, including, but not limited to, Taxes and Duties withheld from the salaries or wages of its employees, and any other sums payable to other Persons from which a portion is required by Law to be withheld or retained by NGGL on behalf of the Government, in the currency in which such salaries or wages or such other sums are paid. NGGL may make all other payments whether to the Government or to other Persons in Ghana Cedis in accordance with Section 7.2(d).

| 7.4 | Right to Remit and Receive Payments |

NGGL may remit and receive in Dollars all payments of dividends, interest, finance charges, principal, management and technical services fees (subject to the limitations set forth in Section 5.2(a)(iii)) and other properly payable items arising from, as a result of, or related to Operations.

| 8. | ADEQUATE CAPITAL |

| 8.1 | NGGL shall maintain a ratio of Indebtedness to Equity Capital of 2:1 or such other higher ratio as may be permitted by Law, excluding for these purposes any Indebtedness that is non-interest bearing (any non-interest bearing Indebtedness and other Indebtedness within the permitted ratios is referred to as “Permissible Debt”). The penalty for failure to maintain a 2.1 ratio of Indebtedness to Equity Capital shall be that any interest or currency exchange losses accrued and attributable to the excess Indebtedness other than Permissible Debt shall not be deductible for the purposes of determining its taxable income. |

| 8.2 | Notwithstanding Section 8.1, NGGL shall have up to December 31st of the second calendar year after the Effective Date to achieve a 2:1 ratio of Indebtedness to Equity Capital or such higher ratio as may be permitted by Law (the “Transition Period”). During the Transition Period any Indebtedness to Equity Capital that does not exceed 4:1 (or that is otherwise permitted by Law) shall be Permissible Debt. The ratio shall be determined annually by reference to the most recent audited financial statement of NGGL and if the audited financial statement should reveal that NGGL is not in compliance with the requirements of this Section 8.2, then the penalty set forth in Section 8.1 shall apply. |

| 9. | AFFILIATED COMPANY TRANSACTIONS |

| 9.1 | Transactions including the purchases of goods and services and the provision of loans and the accrual of interest between NGGL and an Affiliate or any other Person of whom NGGL or an Affiliate of NGGL is a controller shall unless otherwise provided by this Agreement or applicable Law be conducted on an arm’s length basis as would |

16

occur between unrelated parties and as required by Law. On request from the Government, NGGL shall provide documentation of the prices, discounts and commissions and a copy of any contracts and other relevant documentation related to transactions with Affiliates.

| 9.2 | For the purposes of this section, ‘controller’ shall have the meaning given to it by Section 111 of the Minerals and Mining Act, 2003 (Act 703). |

| 10. | MISCELLANEOUS PROVISIONS |

| 10.1 | NGGL Board of Directors |

The Government may nominate a Person chosen in its discretion who is qualified and permitted under Law to serve as a member of the board of directors of NGGL after giving not less than thirty (30) days’ Notice of its intention to do so, and providing the identity of the proposed director and any other information reasonably necessary in order for NGGL and the shareholders of NGGL to take such steps as are necessary to complete such nomination. Such Person upon being duly elected shall be subject to the confidentiality requirements generally applicable to all NGGL directors as regards the disclosure of information obtained in his or her capacity as a director to any Persons other than the Government or NGGL or as required by Law. The director thus appointed may be removed as permitted by Law for cause, in which event the Government may nominate a successor.

| 10.2 | Non-Discrimination |

Except as otherwise expressly provided or permitted herein, the Government affirms that when compared to other Persons engaged in exploration for or mining of gold in Ghana, NGGL shall have fair and equitable treatment and shall not be discriminated against or made uniquely or disproportionately liable to obligations by virtue of any Law or any action taken by the Government.

| 10.3 | Governing Law |

This Agreement shall be construed and interpreted in accordance with the laws of Ghana and by such rules and principles as are generally recognized by international law to be applicable to an investment by nationals of one country in another country.

| 10.4 | Joint Affirmations of the Parties |

NGGL shall in all respects be subject to Law and to each term of this Agreement as regards its presence and activities in Ghana. The Government hereby affirms that it shall also be bound by and shall honour each term of this Agreement, and that NGGL may fully rely on that affirmation. The Parties jointly further affirm that they shall each uphold and honour the rights and remedies provided herein to the other Party including the indemnification provided by Section 20 of this Agreement.

17

| 11. | PERIODIC REVIEW |

| 11.1 | Profound Changes in Circumstances |

For the purpose of considering Profound Changes in Circumstances from those existing on the Effective Date or on the date of the most recent review of this Agreement under this Section 11.1, the Government and NGGL shall at the request of the other consult together. The Parties shall meet to review the matter raised as soon after the request as is reasonably convenient for them both. In case Profound Changes in Circumstances are established to have occurred, the Parties shall effect such change in or clarification of this Agreement as they agree is necessary. For purposes of this Agreement, “Profound Changes in Circumstances” shall mean such changes in the economic conditions of the gold mining industry worldwide or in Ghana, or such changes in the economic, political or social circumstances existing in Ghana or elsewhere in the world at large as to result in such a material and fundamental alteration of the conditions, assumptions and bases relied upon by the Parties at the Effective Date (or the time after any subsequent review pursuant to this Section 11.1) that the overall balance of equities and benefits reasonably anticipated by them will no longer be achievable as a practical matter.

| 11.2 | Other Consultation |

In addition to the consultation provided by Section 11.1, each Party may at any time request a consultation with the other Party with respect to any matter affecting the rights and obligations of the Parties under this Agreement or any matter relating to Operations. The Parties shall meet to review the matter raised as soon after such request as is reasonably convenient for them both. Subsequent to the consultation, the Parties shall take the action, if any, that is mutually agreed to address the matter.

| 12. | EMPLOYMENT AND TRAINING |

| 12.1 | Employment |

To the extent that Persons having the requisite skill and experience are available for and willing to accept employment with NGGL, NGGL shall employ (and shall give preference to the employment of) such qualified Persons who are citizens of Ghana (and to such other Persons as the Law may require) for skilled technical, administrative, financial and managerial positions in accordance with Law for the purpose of ensuring that managerial functions of NGGL at all levels including technical and senior executive levels shall be substantially performed by citizens of Ghana. Notwithstanding the foregoing, NGGL shall have the right freely to appoint and employ as its Chief Executive Officer, Chief Financial Officer and Head of Operations Persons who may be either Ghanaian citizens or citizens of any other nation, except:

| (a) | where any individual may be disqualified by Law from entering or residing in Ghana; or |

| (b) | where an individual is from a nation whose citizens may as a general category be banned by Law from residing or working in Ghana. |

18

NGGL shall, subject to the foregoing, also have the right at all times to choose its employees freely and without restriction. NGGL and the Government shall, from time to time and as permitted by Law, determine how to accomplish the objectives set forth above in this Section which shall guide and control their deliberations and decisions. The Government shall issue such permits as may be required by Law to allow such Persons who are not citizens of Ghana freely to enter into, work and reside in Ghana in connection with Operations, and to depart from Ghana. Any disputes arising under this section shall be considered a dispute subject to resolution pursuant to Section 24.

| 12.2 | Training of Ghanaians |

NGGL among other measures shall provide on a continuing basis for the training of suitable Ghanaian citizens in order to qualify them for skilled, technical, administrative and managerial positions and to meet the objectives set forth in Section 12.1 above. NGGL shall submit to the Minister a detailed program for the recruitment and training of Ghanaian citizens in connection with Operations pursuant to the Ahafo Mining Lease and will update this program as required by Law.

| 13. | USE OF GHANAIAN GOODS AND SERVICES |

| 13.1 | NGGL shall, in accordance with Law and to the maximum extent possible and consistent with safety, efficiency and economy, when purchasing goods and services required with respect to Operations, give preference to materials and goods made in Ghana, and services provided by Ghanaian citizens (and such other Persons as the Law may require) as well as entities incorporated or formed in Ghana and majority owned and controlled by citizens of Ghana (and by such other Persons as the Law may require) who receive a share of the benefits of such entities proportionate to their ownership interest, provided that such goods and services are equal in quality, terms, delivery, service, quantity and price to, or better than, goods and services obtainable outside Ghana. Nothing in this Section 13 shall require NGGL to act upon considerations other than commercial considerations. |

| 14. | INCIDENTAL RIGHTS |

| 14.1 | Use of Resources |

Except as otherwise provided in this Agreement, NGGL may, within the Contract Area and for its own use, remove, extract and use water, gravel, sand, clay, stone, other Minerals (except for gold, diamonds and other precious Minerals) and timber (except for protected species, insofar as they do not interfere with or hinder Operations) in accordance with Law.

| 14.2 | Imports |

NGGL may import and use in respect of Operations, and subject to Section 23 and in accordance with Law, subsequently export, any machinery, equipment, consumable items, fuels, explosives and any other thing whatsoever reasonably required with respect to Operations, including without limitation, the items listed on the Mining List attached hereto as Appendix D. NGGL shall notify the Minerals Commission of the export of any machinery, equipment, consumable items, fuels or explosives and shall at all times comply with Law regarding the safe use, sale, disposal and security of explosives.

19

| 15. | UNDERTAKINGS OF THE GOVERNMENT |

| 15.1 | Electricity Generation and Transmission |

The Government shall not take any action that would in application or effect deprive NGGL of the right, or hamper its ability on the same basis as other industrial users, to purchase or receive electric power sufficient to meet its reasonable needs for the conduct of Operations in Ghana. The foregoing applies to electric power supplied by the Government or other Persons that are providers of electric power in Ghana under license from or authority of the Government. The Government further affirms that NGGL may, at its own cost and in accordance with Law, generate, transmit, use and deal with electricity and lawfully obtain electric power from other Persons who have been so authorized in Ghana by the Government. NGGL may store, treat, use and provide water in connection with Operations. With respect to all of the foregoing, NGGL may construct the necessary Infrastructure and Mining Plant subject to the requirements of any Law regulating the manner in which any of the foregoing rights shall be exercised taking into account the safety of the public and prevention of harm to the environment.

| 15.2 | Issuance of Permits and Necessary Authorization |

Requests for licenses, permits, mining titles, easements, and other authorizations required to permit NGGL to conduct Operations and activities related to Operations shall be dealt with within the period required by Law. In all cases, the decision to grant or deny a request for a permit or other authorization, and any license or title, shall be made in accordance with Law.

| 15.3 | Protection against Nationalization or Expropriation |

Except as permitted and required by Article 20 of the 1992 Constitution of the Republic of Ghana (and subject both to prompt, adequate and effective compensation of the affected Party in Dollars and to the rules and principles of international law as described in Section 10.3 above), the Government undertakes and affirms that it shall not nationalize or expropriate (or with respect to any of the following take any measures equivalent to nationalization or expropriation):

| (a) | any Infrastructure or other property, movable or immovable, owned by NGGL or subject to its right to possess or use, and whether in its possession or in the possession of its Affiliates, agents, representatives or contractors; |

| (b) | minerals in any form resulting from the Operations; |

| (c) | any equity, shares or ownership interests of whatever nature held in or owned or issued by NGGL or its Affiliates; |

| (d) | any structure or entity put in place by NGGL in connection with Production; and |

| (e) | any capital invested by NGGL in Ghana. |

20

Any action taken by the Government pursuant to the Constitution of Ghana as described above, or any other action by the Government in violation of the terms of this Section shall each entitle NGGL in addition to any other remedy provided by Law, international law or otherwise by this Agreement, to prompt payment by the Government equivalent to the fair market value of the investment, asset or property nationalized or expropriated immediately before the nationalization or expropriation (or the measures tantamount to nationalization or expropriation) took place or was announced.

| 15.4 | Peaceful enjoyment |

The Government hereby warrants the title to, possession and peaceful enjoyment by NGGL of all rights granted by this Agreement and all of its property in Ghana in accordance with Law.

| 15.5 | Due Authorization |

Each Party represents and warrants that it has all necessary power and authority to execute and deliver this Agreement.

| 15.6 | Production Area |

The Ahafo Production Area shall be the area covered by and subject to the Ahafo Mining Lease. NGGL may apply for the extension of the term of the Ahafo Mining Lease for such additional term as permitted by Law, and the Government agrees that it will not unreasonably refuse any application for an extension made by NGGL up to the maximum period permitted by Law, upon a showing that sufficient Mineral reserves remain that will permit NGGL to carry out Operations for the additional term requested.

| 15.7 | Right to Export Minerals and Other Rights |

| (a) | Under the Ahafo Mining Lease and under this Agreement, NGGL has the exclusive right, subject to Law, to: |

| (i) | export and sell, without restriction by the Government or any other Person, Minerals obtained from Operations in a Production Area to any Person in any country or state, |

| (ii) | carry on Exploration for Minerals within each Production Area, |

| (iii) | mine Minerals within each such Production Area, |

| (iv) | subject to Section 7.2(a), receive all income and proceeds from the export or sale of Minerals and to deposit them in banks within Ghana and outside of Ghana of its own choosing; and |

| (v) | exercise any other rights provided by Law to the holder of a Mining Lease. |

| (b) | The Government, acting through the Minister, and subject to the agreement of NGGL acting in its sole discretion, may purchase quantities of gold from |

21

| NGGL on a basis to be decided upon by the Parties at such time, provided that the price at which the gold may be purchased shall be based on the London PM Fix on the day of the proposed purchase. |

| 15.8 | Surrender of Production Area |

NGGL may at any time surrender all or part of a Production Area on the terms of the Ahafo Mining Lease, on giving the Minister Notice within the time and in accordance with the process specified by Law. After surrender of all or any part of a Production Area, the Ahafo Mining Lease shall terminate with respect to the area surrendered.

| 15.9 | Environmental Compliance and Reclamation |

NGGL shall conduct Operations in order to limit to the extent practicable, adverse impacts to the environment and to comply with Law.

| 15.10 | Right to Additional Areas |

| (a) | NGGL directly or through an Affiliate, and as permitted by Law, may select as additional areas to the Contract Area (the “Additional Areas”), any unencumbered areas that have a geological relationship to adjoining Production Areas or into which extend geological trends from the Contract Area or from the geographic boundaries of any Mineral body discovered in the Contract Area. |

| (b) | On and from the date of approval by the Minister of the selection, the selected Additional Areas shall become part of the Contract Area and the rights and obligations of NGGL shall be increased proportionately to take into account those Additional Areas. |

| 16. | CONDUCT OF OPERATIONS |

NGGL may conduct Operations by itself or through agents and contractors and shall do so in a manner consistent with Law and as required (a) by the terms of this Agreement and (b) by the terms of the Ahafo Mining Lease, except to the extent that such terms are inconsistent with the terms of this Agreement, in which case the terms of this Agreement shall govern the rights and duties of the Parties.

| 17. | LAND AND FACILITIES |

| 17.1 | Surface Rights |

| (a) | NGGL may, under the Ahafo Mining Lease and subject to the requirements of Law, enter upon and utilize all land within the Contract Area for purposes of and incidental to Operations. |

| (b) | NGGL may, in accordance with Law, acquire private land outside the Contract Area that it intends to use for Operations (any such use for Operations being subject to the Minister’s approval or as provided by Law), and once so acquired any such private land shall be deemed a part of the Contract Area during any period of its occupancy and use by NGGL for Operations. |

22

| (c) | For the purposes of Section 17.1(b), “private land” shall mean any land other than land subject to a lease granted by this Agreement and includes any creeks, streams, rivers, and bodies of water and their residue contained on such land, that is owned by any Person except the Government, or as to which any Person except the Government or NGGL has a right of possession recognized by Law. |

| 17.2 | Limitation on Exploration and Production |

Nothing contained in this Section 17 shall be construed to permit NGGL to explore for Minerals or to produce Minerals found in any land that is not within a Production Area.

| 17.3 | Mining Plant and the use of Public Infrastructure |

| (a) | NGGL may, subject to Law, acquire, construct, install, maintain and operate a Mining Plant and other Infrastructure reasonably required for Operations. |

| (b) | NGGL may use public Infrastructure, owned, operated or provided by the Government, or by any other Person under license or authority of the Government, to the same extent that those facilities may be used by others to meet the needs of NGGL with respect to Operations. The Government shall ensure that any charges for the use by NGGL of public Infrastructure, as well as other terms and conditions for such use, are fair and reasonable and are not more onerous than those that are generally applicable to others using similar public Infrastructure in a similar manner. |

| (c) | To the extent reasonable in connection with Operations, NGGL may integrate any item of Mining Plant with similar items of public Infrastructure, where it is reasonable and lawful to do so, and subject to prior consultation with the Government. |

The Government reserves the right to construct roads, highways, railroads, telegraph and telephone lines and other lines of communication within the Contract Area, on reasonable Notice to and after consultation with NGGL. In the event of such construction, the Government shall, within sixty (60) days after receipt of an invoice from NGGL, compensate it for any damage caused to NGGL property and shall indemnify and hold NGGL harmless from any claims by third parties arising from the construction. The Government shall not engage in such construction if the effect of doing so will be to disrupt or interrupt the conduct of Operations of NGGL.

| 17.4 | Contract Area |

NGGL shall pay ground rent at the rates required by Law for land in a Production Area to the owner of any land subject to a Mineral Lease except for annual ground rent for Stool Lands, which shall be paid to the Person designated by Law. “Stool Lands” shall be lands designated as such by Law.

23

| 17.5 | Payment |

Ground rent shall be payable annually in advance within the time required by Law, and if no such time is specified for payment, then ground rent shall be paid on or before January 15th of the Financial Year for which payment is being made, or, with respect to the first Financial Year after the Effective Date, within ninety (90) days after the Effective Date.

| 18. | HEALTH AND SAFETY |

NGGL shall maintain health and safety standards consistent with International Standards, its own best practices and the requirements of Law (including regular safety training instruction for its employees) iin connection with Operations and shall report to the Government on an incident or periodic basis as may be required by Law.

| 19. | CONFIDENTIALITY |

| 19.1 | Confidential Information |

All information, reports, and documents exchanged between, received or acquired by the Parties in the context of this Agreement, including those conveying geological information, Mineral reserves, sales data, Production data, the amount set aside as a reserve for reclamation, financial information and data and all other information related to Operations shall be considered and treated as confidential information, subject to Section 19.2 below and applicable Law. The Parties agree not to divulge this confidential information to any other Person without the prior written consent of the other Party (which consent shall not be unreasonably withheld) except in the following cases:

| (a) | where the information is used by one Party in the course of arbitration or court proceedings against the other party; |

| (b) | where such information is made available to a third party providing services to either Party if that third party undertakes an obligation to treat the information as confidential and use it only for the specified purposes; |

| (c) | where the information is provided to a bank or another financial organization from which NGGL receives financial assets, under the condition that the bank or financial organization undertakes an obligation to treat the information as confidential and use it only for the specified purposes; |

| (d) | where disclosure of the information is required in accordance with this Agreement or with Law, or with the laws of other jurisdictions applicable to NGGL or its Affiliates (including securities legislation that requires disclosure in the jurisdiction of incorporation of an Affiliate); or |

| (e) | where the information is requested by a third party that is interested in acquiring an interest in NGGL or an Affiliate, subject to the third party undertaking an obligation to be subject to the confidentiality obligation in this Section 19. |

24

| 19.2 | Public Information |

The obligation of confidentiality stipulated in Section 19.1 above shall not apply to information exchanged between the Parties that is in the public domain.

| 20. | INDEMNIFICATION |

Any breach of an obligation in this Agreement by either Party entitles the Party aggrieved by the breach to be indemnified by the other Party in an amount equal to the damage suffered by the aggrieved Party subject to the limitations of Section 24. If a Party is required to make additional payments, including payments of Taxes and Duties, because of an inability by the Government to perform for the reasons set forth in this section or a breach as described in this Section 20, then the Party so required shall, upon an award pursuant to any arbitration under Section 24 with respect to its right to indemnification hereunder, be entitled to set off the amount of such additional payments against any obligation it may have to make any payments to the other Party, including payments of Taxes and Duties.

| 21. | ENCUMBRANCE |

NGGL may mortgage, charge or otherwise encumber all or part of its interest under this Agreement to raise, from one or more Affiliates or third parties, financing for its Operations and other obligations under this Agreement. The Government agrees that in the event of default by NGGL a Person who holds such mortgage, charge or other encumbrance may either conduct Operations to the same extent and on the same basis as NGGL if it is qualified under Law and has demonstrated the technical and financial ability to conduct Operations under this Agreement or, with the prior consent of the Minister, which consent shall not be unreasonably withheld, and as permitted by Law to exercise any power of sale granted by any such mortgage, charge or other encumbrance.

| 22. | TERMINATION |

| 22.1 | Termination by NGGL |

NGGL shall have the right to terminate this Agreement (including the Ahafo Mining Lease) at any time, either in its entirety or as to any part of the Contract Area (the latter as provided for by Section 15.8), provided that in the case of termination of this Agreement in its entirety, such termination will be effective 270 days after giving Notice to the Government. Such termination shall be without prejudice to any obligation or liability incurred by NGGL or an Affiliate hereunder prior to the effective date of such termination.

| 22.2 | Termination by the Government |

The Government shall have the right to terminate this Agreement (including the Ahafo Mining Lease) with respect to NGGL, only as provided herein and subject to the provisions of Section 24, if any of the following events (hereinafter called “Events of Default”) shall occur and continue:

| (a) | NGGL fails in a material way to comply with its obligations under this Agreement and the failure has a materially adverse effect on the Government; |

25

| (b) | NGGL: |

| (i) | voluntarily makes an assignment of all or substantially all of its assets for the benefit of creditors other than an assignment made to secure indebtedness incurred in the ordinary course of business, |

| (ii) | files a petition or application to any tribunal for the appointment of a trustee or receiver for all or any substantial part of its assets, |

| (iii) | files or commences proceedings for its bankruptcy, reorganization, arrangement or insolvency under the laws of any jurisdiction, or if any such petition or application is filed, or any such proceedings are commenced against it, and NGGL indicates its approval thereof, consent thereto or acquiescence therein, or |

| (iv) | if any order is entered appointing a trustee or receiver for NGGL, or adjudicating it bankrupt or insolvent, or approving a petition in any such proceedings, and NGGL permits such order to remain in effect for more than ninety (90) days; or |

| (c) | NGGL ceases Production with respect to all Production Areas, for a period of twenty-four (24) consecutive months unless the failure or cessation is caused by or consented to by the Government or is caused by Force Majeure. |

| 22.3 | Opportunity to Cure |

The Government shall provide Notice to NGGL of an alleged occurrence of an Event of Default on the grounds described in Section 22.2 above and of the Government’s position on the matter and shall offer NGGL a fair opportunity to consult with the Government to resolve the matter. If, after a reasonable period of consultation, the Government is of the opinion that the matter cannot be resolved by further consultation, the Government may send to NGGL Notice of the Government’s intention to terminate this Agreement with respect to NGGL. If the Event of Default is not cured within sixty (60) days after the Notice, or within such longer period as may be necessary to allow a reasonable period of time to effect the cure, then this Agreement shall be terminated with respect to the Party.

| 22.4 | Disputes Regarding Events of Default |

Notwithstanding the provisions of Section 22.3, if NGGL disputes whether there has been an Event of Default and refers such dispute to arbitration in accordance with Section 24, or demands non-binding mediation and/or conciliation as required by Section 24.1, within sixty (60) days after receipt of the Government’s Notice of its intention to terminate, termination of this Agreement shall not take effect until the conclusion of the arbitration or non-binding mediation and/or conciliation processes, and shall be in accordance either with an accord reached by the Parties after any mediation or conciliation or with an arbitration award upholding the Government’s right to terminate.

26

| 23. | DISPOSITION OF ASSETS |

On termination of this Agreement in its entirety, the Mining Plant shall remain the property of NGGL and may be transferred to an Affiliate or to a third party within or outside Ghana in accordance with Law. The Government may also require NGGL to remove from the Contract Area any Mining Plant, including unusable assets, which are within the Contract Area after termination.

| 24. | ARBITRATION |

| 24.1 | Submission to Arbitration |

Any dispute between the Government and NGGL that arises out of, in relation to or in connection with this Agreement or its formation, or the validity, interpretation, performance, termination, enforceability or breach of this Agreement (including any dispute concerning whether the Government or NGGL has violated or is in breach of this Agreement or of any Law affecting the rights, obligations or duties of any Party under this Agreement), for which resolution by submission to an expert is not specifically provided elsewhere in this Agreement shall be exclusively and finally settled by binding arbitration pursuant to the Convention and in accordance with the rules of the Centre in effect on the Effective Date except to the extent in conflict with this Section 24 which shall prevail under those circumstances, provided that in any event the law governing the rights of the Parties under this Agreement shall be determined as set forth in Section 10.3 above. Prior to the submission of any dispute to arbitration the Parties shall consult and negotiate with each other and use any non-binding mediation or conciliation processes available in Ghana and, recognizing their mutual interests, attempt to reach a satisfactory solution, provided that any such procedures need not take place in Ghana but on demand by any Party shall take place in such other venue as the Parties may agree or if they cannot agree then in London, England (provided that the travel and accommodation costs of the other Party shall be borne as provided in Section 24.5 below by the Party making the demand that the mediation or conciliation take place elsewhere than in Accra, Ghana). The Parties agree that the period set aside for mediation shall not however bar a Party from applying for urgent interim relief. In any event if the Parties do not reach settlement within a period of 120 days after the date on which by Notice one Party has informed the other of its intention to seek arbitration of a dispute as provided hereunder, then, upon further Notice by any party to the other, any unresolved claim shall proceed to arbitration pursuant to this Section 24.

The Parties agree that NGGL’s Operations under this Agreement constitute an “investment” due to, inter alia, the expenditure of a considerable amount of money in Ghana, the long term nature of the Agreement and the investment into Ghana’s infrastructure and that for purposes of Article 25(1) of the Convention, any dispute subject to this Section 24 is a legal dispute arising directly out of an investment. Either of the Parties to this dispute may institute arbitration proceedings by giving Notice to the other Party and Notice to the Secretary-General of the Centre including in each a statement of the issues in dispute.

If the Centre refuses to register any Request for Arbitration or a tribunal declines jurisdiction under Article 25 of the Convention, then the Parties agree to arbitrate under the UNCITRAL Rules.

27

| 24.2 | Nationality for Purposes of Arbitration |

Notwithstanding the incorporation in Ghana of NGGL or of any of its successors or assignees, or of any of its other Affiliates, all these entities shall be treated under this Section 24 as if they were nationals of the United States of America for purposes of any arbitration pursuant to the Convention and of this Agreement, provided such entities are or are controlled by nationals of the United States of America, except that NGGL and any other such entity may, alternatively, elect to be treated instead as a national of any other state of which, under the Convention, international law or the law of such state, it is a national.

| 24.3 | Arbitrators |

Any arbitral tribunal constituted pursuant to this Agreement shall consist of one (1) arbitrator to be appointed by the Government, one (1) arbitrator to be appointed by NGGL and one (1) arbitrator, who shall be the president of the tribunal and shall be a citizen neither of Ghana nor of the United States of America (or of any other state of which a Party is a national under Section 24.2), to be appointed by the Secretary-General of the Centre. In making such appointment the Secretary-General shall not be limited to making an appointment from the Panel of Arbitrators. No such arbitrator shall have an interest in the matters in dispute.

| 24.4 | Referee |

At the request of a Party, any matter otherwise subject to arbitration under this Agreement shall instead be referred for resolution to a single referee to be appointed by the Secretary-General of the Centre, or of any successor entity as stipulated in Section 24.10 below, except for any dispute arising out of or related to Sections 2, 3, 4, 5, 5.3, 6, 7.2, 8, 9, 10.2, 10.3, 10.4, 15.3, 15.4, 15.6, 15.7, 15.8, 15.10, 20, 22, 24 or 26 of this Agreement, which must be referred to arbitrators appointed under Section 24.3 above unless the Parties jointly agree that any such dispute is not material, in which event it may be referred to the referee for decision at the option of either party. The referee shall act qua expert determiner and not as arbitrator. The decision of the referee shall be rendered pursuant to Section 24.9 of this Agreement (except as regards the requirement for a decision by majority vote) and shall be final and binding unless appealed by any Party to arbitrators appointed as provided in this Section 24.4 who shall examine the referee’s decision only as to manifest disregard of law, findings of fact that are not supported by any credible evidence, and abuse of authority, misconduct or other unauthorized act by the referee.

| 24.5 | Venue |

Without prejudice to Article 62 of the Convention, and except as the Parties may otherwise agree in writing, the Seat shall be as provided by the Convention. However, the venue of any hearing conducted pursuant to this Agreement shall be Accra, Ghana, provided that at the demand of either Party any such hearing may be held either at a place mutually agreed to by the Parties or in London, England. However, should either party demand that the hearing take place elsewhere than in Accra, Ghana, then the party making that demand shall be responsible to pay the reasonable transport and accommodation costs for the representative of the other Party and of its legal counsel as well for such witnesses resident in Accra, Ghana as

28