Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EMPIRE RESORTS INC | d109069d8k.htm |

| EX-99.2 - EX-99.2 - EMPIRE RESORTS INC | d109069dex992.htm |

Empire Resorts, Inc. Montreign Resort Casino Empire Resorts, Inc. Montreign Resort Casino EXHIBIT 99.1

This presentation contains forward-looking statements. These statements include statements about our plans, strategies, financial performance, prospects or future events and involve known and unknown risks that are difficult to predict. As a result, the actual results, performance or achievements of Empire Resorts, Inc. (“Empire,” “we,” “us,” “our,” and, together with our subsidiaries, the “Company”) may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would,” and variations of these terms and similar expression, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by the Company and its management team based on the experience of management operating other hotel and gaming facilities and gaming industry consultants, are inherently uncertain. Those same experiences which form the basis of many of the assumptions included in the presentation may be inapplicable or simply turn out to be mistaken. All statements in this presentation regarding our business strategy, future operations, financial position, prospects, construction plan, business plans and objectives, as well as information concerning industry trends and expected actions of third parties, are forward-looking statements. All forward-looking statements speak only as of the date as of which they are made. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions concerning future events that are difficult to predict. The following factors, among others, could cause actual results to differ materially from those set forth in this presentation: Levels of spending in business and leisure segments, as well as consumer confidence; Plans for signing and closing on definitive transaction documents relating to the development of the Montreign Resort Casino and Adelaar; The construction commencement date for Montreign Resort Casino and the other areas of Adelaar; Difficulties and/or delays in construction of Montreign Resort Casino and other areas of Adelaar due to inclement weather, shortage and change in price of supplies or labor, changes to plans or specifications, disputes with the construction manager, contractors, unforeseen scheduling, engineering, excavation, environmental or geological problems, among other factors; Failure to maintain and renew, or the loss of, any license or permit required under gaming laws; Failure to obtain and maintain construction or operating permits and approvals required under laws applicable to the development of the Montreign Resort Casino and Adelaar; Assumptions concerning metrics important to the development and operation of Montreign Resort Casino, such as win per slot/table per day, ability to market to high-end patrons, patronage, hotel occupancy and rates, use of conference facilities and other areas of Adelaar may prove incorrect; The ability to retain key employees during the development of Montreign Resort Casino; Relationships with labor unions and other building trades involved in the development of Montreign Resort Casino and Adelaar and changes in labor law; The financial condition of, and relationships with, third-party property owners, the construction manager and contractors, and hospitality venture partners; Risks associated with the introduction of a new casino hotel in an unproven region; Changes in the competitive environment in the hospitality and gaming industries, generally, and our primary market; The effects of local and national economic, credit, project finance, and capital market conditions on the economy, in general, and on the hospitality and gaming industries, in particular; Our levels of leverage and ability to meet our debt service and other obligations; Lack of operating history of Montreign Resort Casino; Our dependence on a single casino gaming site; Changes in, and challenges to, gaming laws or regulations, including their interpretation or application; and Inability to obtain credit financing on terms and conditions acceptable to the Company; A more complete description of these risks and uncertainties can be found in the filings of the Company with the U.S. Securities and Exchange Commission. We caution you not to place undue reliance on any forward-looking statements, which are made as of the date hereof or as otherwise specified herein. The Company undertakes no obligation to update any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. Cautionary Note on Forward-Looking Statements

While a summary of the unaudited financial projections submitted by the Company to the New York State Gaming Commission in September 2015 in connection with its application for a gaming facility license and included in this presentation were prepared in good faith and based on information available at the time of preparation, no assurance can be made regarding future events occurring after the date they were prepared. The estimates and assumptions underlying the unaudited financial projections involve judgments with respect to, among other things, win per slot/table per day, patronage, complimentaries, utilization of available net operating losses, no change to existing tax laws, inability to use tax benefits, delays or cost overruns in the construction of Montreign Resort Casino or Adelaar, future economic, competitive, regulatory and financial market conditions and future business decisions that may not be realized and that are inherently subject to significant uncertainties and contingencies, all of which are difficult to predict and many of which are beyond the control of the Company. There can be no assurance that the underlying assumptions or projected results will be realized, and actual results will likely differ, and may differ materially, from those reflected in the unaudited financial projections. As a result, the unaudited financial projections cannot necessarily be considered predictive of actual future operating results, and this information should not be relied on as such. The unaudited financial projections were prepared solely for internal use by the Company and not with a view toward public disclosure or with a view toward complying with the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of prospective financial data, published guidelines of the Securities and Exchange Commission regarding forward-looking statements and the use of non-GAAP measures or GAAP. The forecasts were prepared by the Company’s management on a reasonable basis based on the best information available to them at the time of their preparation. The unaudited financial projections, however, are not facts and should not be relied upon as being necessarily indicative of actual future results, and readers of this presentation are cautioned not to place undue reliance on this information. The inclusion of the unaudited financial projections in this presentation is not an admission or representation by the Company that such information is material. All of the unaudited financial projections contained in this presentation were prepared by management for purposes of the application for a gaming facility license and are the responsibility of the management of the Company. No independent registered public accounting firm has examined, compiled or otherwise performed any procedures with respect to the prospective financial information contained in these financial forecasts and, accordingly, no independent registered public accounting firm has expressed any opinion or given any other form of assurance with respect thereto and no independent registered public accounting firm assumes any responsibility for the prospective financial information. By including in this presentation a summary of certain of the unaudited financial projections regarding Montreign Resort Casino, neither the Company nor any of its advisors or other representatives has made or makes any representation to any person regarding the ultimate performance of Montreign Resort Casino compared to the information contained in the financial projections. The unaudited financial projections cover multiple years and such information by its nature becomes less predictive with each succeeding year. The Company undertakes no obligation to update or otherwise revise the unaudited financial projections contained in this presentation to reflect circumstances existing since their preparation or to reflect the occurrence of unanticipated events or to reflect changes in general economic or industry conditions, even in the event that any or all of the underlying assumptions are shown to be in error. Important Information about the Unaudited Financial Projections

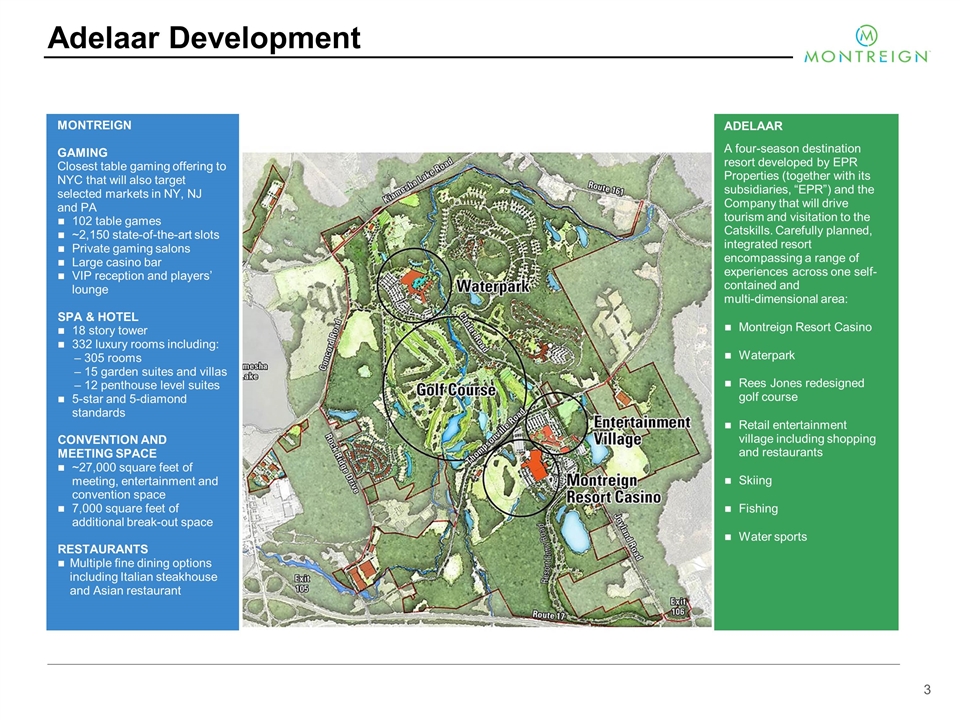

ADELAAR A four-season destination resort developed by EPR Properties (together with its subsidiaries, “EPR”) and the Company that will drive tourism and visitation to the Catskills. Carefully planned, integrated resort encompassing a range of experiences across one self-contained and multi-dimensional area: Montreign Resort Casino Waterpark Rees Jones redesigned golf course Retail entertainment village including shopping and restaurants Skiing Fishing Water sports MONTREIGN GAMING Closest table gaming offering to NYC that will also target selected markets in NY, NJ and PA 102 table games ~2,150 state-of-the-art slots Private gaming salons Large casino bar VIP reception and players’ lounge SPA & HOTEL 18 story tower 332 luxury rooms including: – 305 rooms – 15 garden suites and villas – 12 penthouse level suites 5-star and 5-diamond standards CONVENTION AND MEETING SPACE ~27,000 square feet of meeting, entertainment and convention space 7,000 square feet of additional break-out space RESTAURANTS Multiple fine dining options including Italian steakhouse and Asian restaurant Adelaar Development

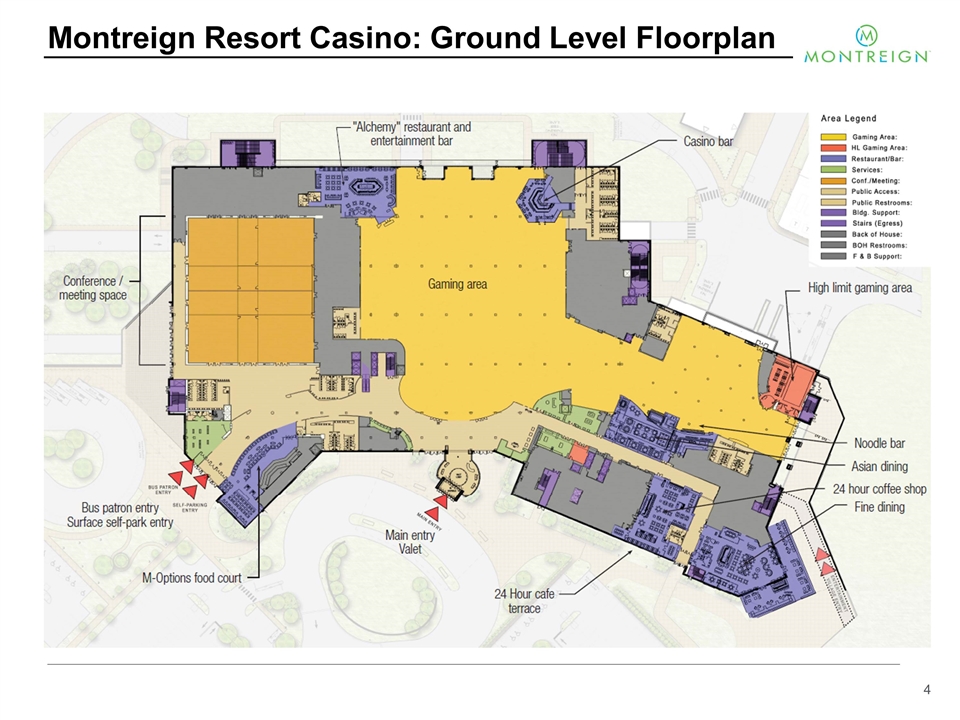

Montreign Resort Casino: Ground Level Floorplan

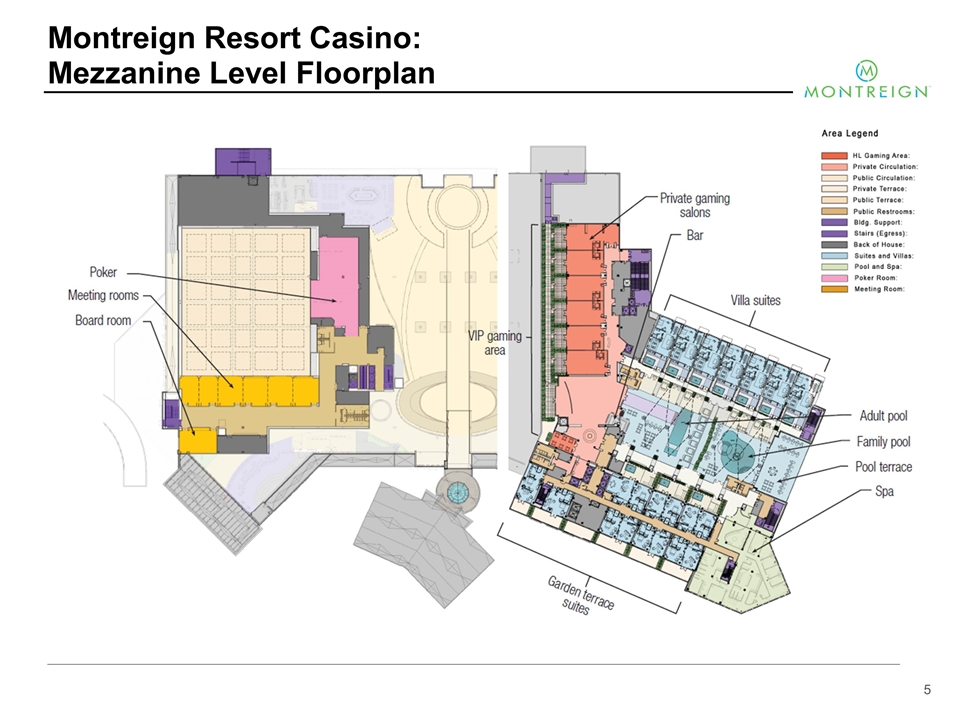

Montreign Resort Casino: Mezzanine Level Floorplan

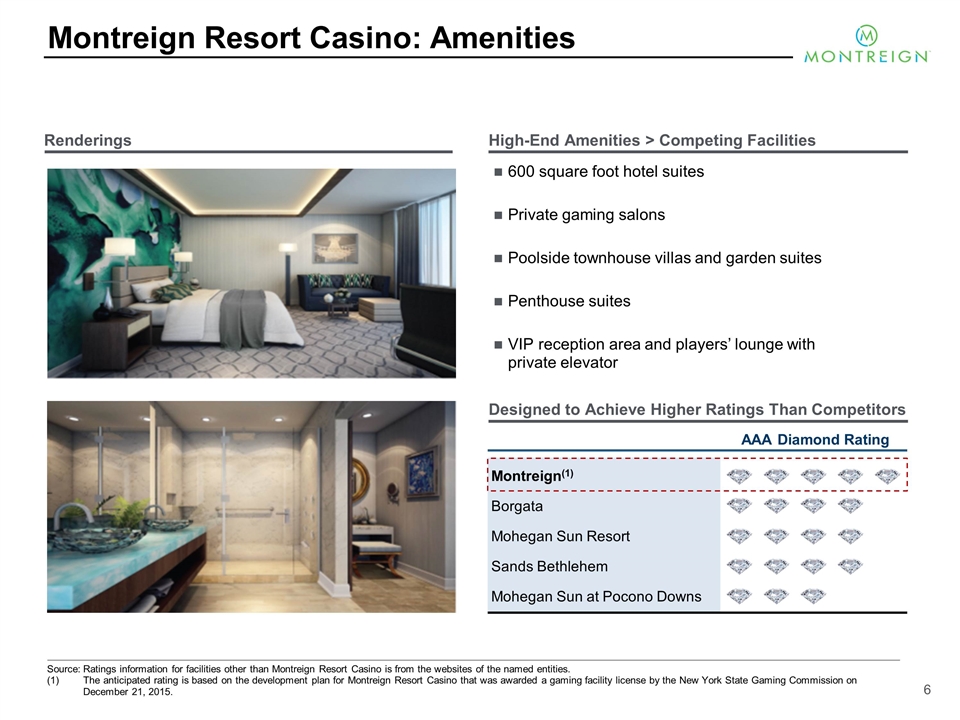

600 square foot hotel suites Private gaming salons Poolside townhouse villas and garden suites Penthouse suites VIP reception area and players’ lounge with private elevator AAA Diamond Rating Borgata Mohegan Sun Resort Sands Bethlehem Mohegan Sun at Pocono Downs Montreign(1) Source:Ratings information for facilities other than Montreign Resort Casino is from the websites of the named entities. (1)The anticipated rating is based on the development plan for Montreign Resort Casino that was awarded a gaming facility license by the New York State Gaming Commission on December 21, 2015. Montreign Resort Casino: Amenities High-End Amenities > Competing Facilities Renderings Designed to Achieve Higher Ratings Than Competitors

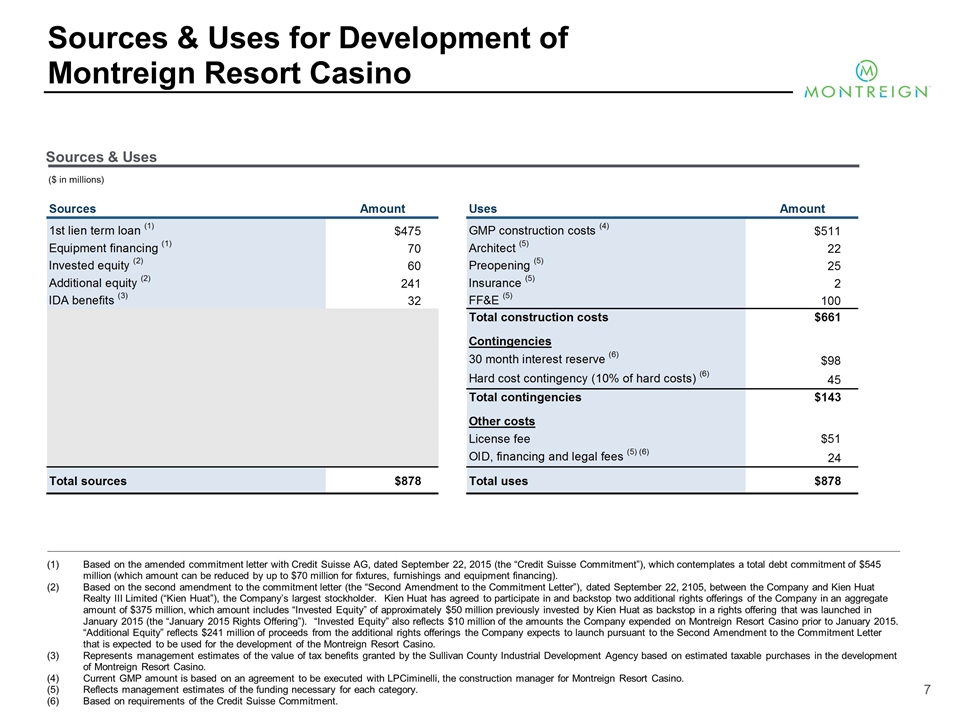

Sources & Uses for Development of Montreign Resort Casino ($ in millions) (1)Based on the amended commitment letter with Credit Suisse AG, dated September 22, 2015 (the “Credit Suisse Commitment”), which contemplates a total debt commitment of $545 million (which amount can be reduced by up to $70 million for fixtures, furnishings and equipment financing). (2)Based on the second amendment to the commitment letter (the “Second Amendment to the Commitment Letter”), dated September 22, 2105, between the Company and Kien Huat Realty III Limited (“Kien Huat”), the Company’s largest stockholder. Kien Huat has agreed to participate in and backstop two additional rights offerings of the Company in an aggregate amount of $375 million, which amount includes “Invested Equity” of approximately $50 million previously invested by Kien Huat as backstop in a rights offering that was launched in January 2015 (the “January 2015 Rights Offering”). “Invested Equity” also reflects $10 million of the amounts the Company expended on Montreign Resort Casino prior to January 2015. “Additional Equity” reflects $241 million of proceeds from the additional rights offerings the Company expects to launch pursuant to the Second Amendment to the Commitment Letter that is expected to be used for the development of the Montreign Resort Casino. Represents management estimates of the value of tax benefits granted by the Sullivan County Industrial Development Agency based on estimated taxable purchases in the development of Montreign Resort Casino. Current GMP amount is based on an agreement to be executed with LPCiminelli, the construction manager for Montreign Resort Casino. Reflects management estimates of the funding necessary for each category. Based on requirements of the Credit Suisse Commitment. Sources & Uses

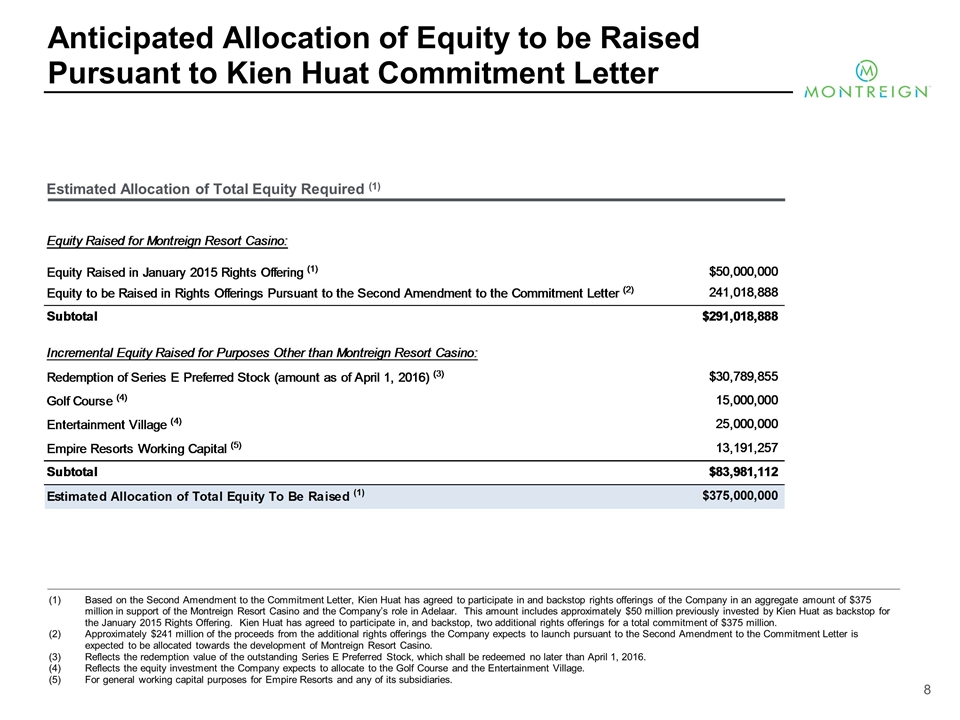

Anticipated Allocation of Equity to be Raised Pursuant to Kien Huat Commitment Letter Based on the Second Amendment to the Commitment Letter, Kien Huat has agreed to participate in and backstop rights offerings of the Company in an aggregate amount of $375 million in support of the Montreign Resort Casino and the Company’s role in Adelaar. This amount includes approximately $50 million previously invested by Kien Huat as backstop for the January 2015 Rights Offering. Kien Huat has agreed to participate in, and backstop, two additional rights offerings for a total commitment of $375 million. Approximately $241 million of the proceeds from the additional rights offerings the Company expects to launch pursuant to the Second Amendment to the Commitment Letter is expected to be allocated towards the development of Montreign Resort Casino. Reflects the redemption value of the outstanding Series E Preferred Stock, which shall be redeemed no later than April 1, 2016. Reflects the equity investment the Company expects to allocate to the Golf Course and the Entertainment Village. For general working capital purposes for Empire Resorts and any of its subsidiaries. Estimated Allocation of Total Equity Required (1)

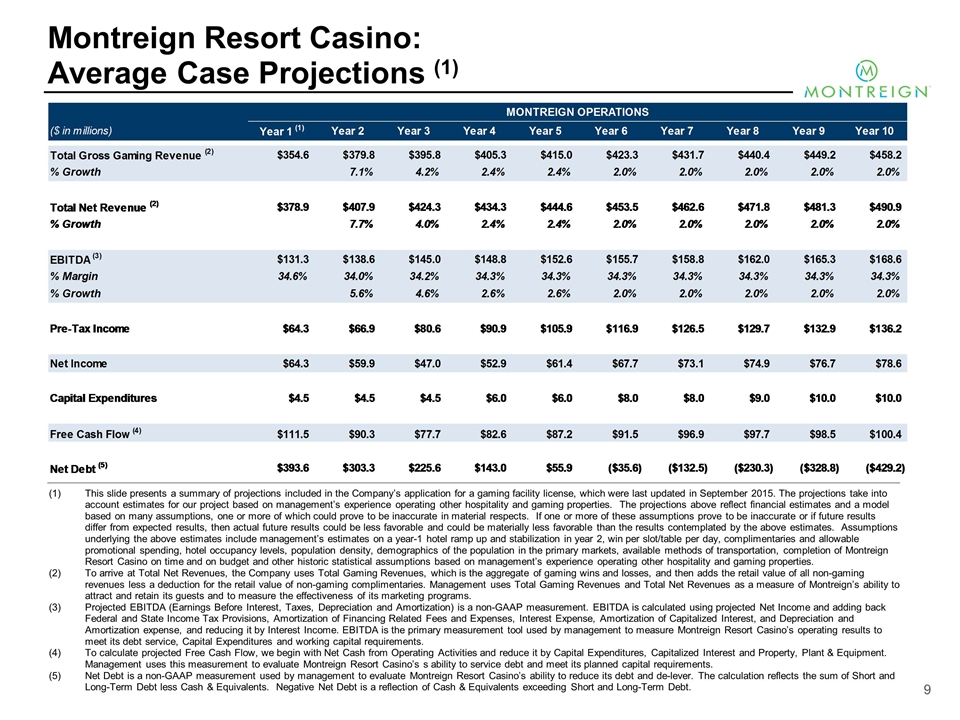

Montreign Resort Casino: Average Case Projections (1) This slide presents a summary of projections included in the Company’s application for a gaming facility license, which were last updated in September 2015. The projections take into account estimates for our project based on management’s experience operating other hospitality and gaming properties. The projections above reflect financial estimates and a model based on many assumptions, one or more of which could prove to be inaccurate in material respects. If one or more of these assumptions prove to be inaccurate or if future results differ from expected results, then actual future results could be less favorable and could be materially less favorable than the results contemplated by the above estimates. Assumptions underlying the above estimates include management’s estimates on a year-1 hotel ramp up and stabilization in year 2, win per slot/table per day, complimentaries and allowable promotional spending, hotel occupancy levels, population density, demographics of the population in the primary markets, available methods of transportation, completion of Montreign Resort Casino on time and on budget and other historic statistical assumptions based on management’s experience operating other hospitality and gaming properties. To arrive at Total Net Revenues, the Company uses Total Gaming Revenues, which is the aggregate of gaming wins and losses, and then adds the retail value of all non-gaming revenues less a deduction for the retail value of non-gaming complimentaries. Management uses Total Gaming Revenues and Total Net Revenues as a measure of Montreign’s ability to attract and retain its guests and to measure the effectiveness of its marketing programs. Projected EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is a non-GAAP measurement. EBITDA is calculated using projected Net Income and adding back Federal and State Income Tax Provisions, Amortization of Financing Related Fees and Expenses, Interest Expense, Amortization of Capitalized Interest, and Depreciation and Amortization expense, and reducing it by Interest Income. EBITDA is the primary measurement tool used by management to measure Montreign Resort Casino’s operating results to meet its debt service, Capital Expenditures and working capital requirements. To calculate projected Free Cash Flow, we begin with Net Cash from Operating Activities and reduce it by Capital Expenditures, Capitalized Interest and Property, Plant & Equipment. Management uses this measurement to evaluate Montreign Resort Casino’s s ability to service debt and meet its planned capital requirements. Net Debt is a non-GAAP measurement used by management to evaluate Montreign Resort Casino’s ability to reduce its debt and de-lever. The calculation reflects the sum of Short and Long-Term Debt less Cash & Equivalents. Negative Net Debt is a reflection of Cash & Equivalents exceeding Short and Long-Term Debt.

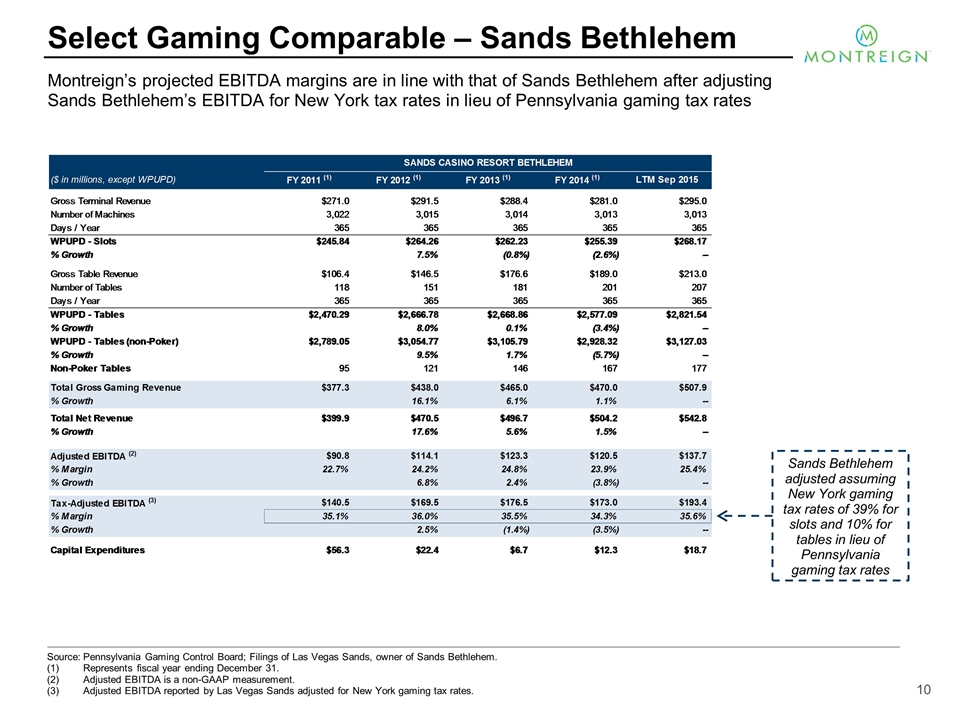

Select Gaming Comparable – Sands Bethlehem Montreign’s projected EBITDA margins are in line with that of Sands Bethlehem after adjusting Sands Bethlehem’s EBITDA for New York tax rates in lieu of Pennsylvania gaming tax rates Sands Bethlehem adjusted assuming New York gaming tax rates of 39% for slots and 10% for tables in lieu of Pennsylvania gaming tax rates Source:Pennsylvania Gaming Control Board; Filings of Las Vegas Sands, owner of Sands Bethlehem. Represents fiscal year ending December 31. Adjusted EBITDA is a non-GAAP measurement. Adjusted EBITDA reported by Las Vegas Sands adjusted for New York gaming tax rates.