Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BOISE CASCADE Co | a8-k121815.htm |

| EX-99.1 - PRESS RELEASE - BOISE CASCADE Co | ex991bcc122115pr.htm |

0 Boise Cascade Company Investor Presentation July 2013 Engineered Lumber Acquisition Overview December 21, 2015

1 ■ This presentation includes statements about our expectations of future operational and financial performance that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The accuracy of such statements is subject to a number of risks, uncertainties, and assumptions that could cause our actual results to differ materially from those projected, including, but not limited to, the integration of the business operations being acquired, prices for building products, the effect of general economic conditions, mortgage rates and availability, housing demand, housing vacancy rates, governmental regulations, unforeseen production disruptions, as well as natural disasters. ■ These and other factors that could cause actual results to differ materially from such forward-looking statements are discussed in greater detail in our filings with the Securities and Exchange Commission. ■ Forward-looking statements speak only as of the date of this presentation. We undertake no obligation to revise them in light of new information. Finally, we undertake no obligation to review or confirm analyst expectations or estimates that might be derived from this presentation. Forward-Looking Statements

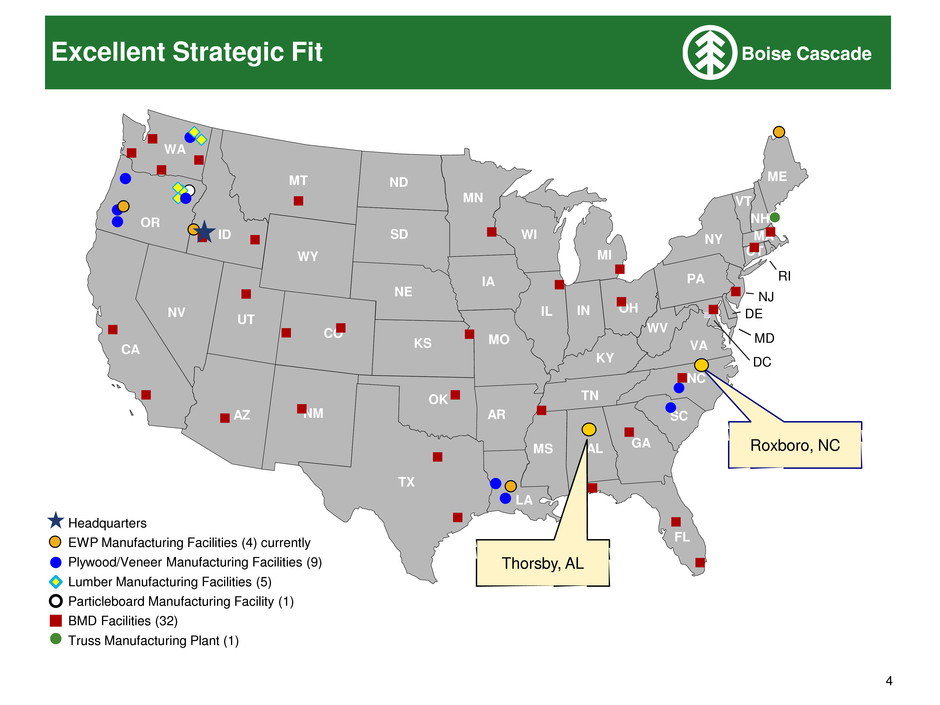

2 Transaction Summary ■ Purchasing Georgia-Pacific’s engineered lumber business for $215 million, which includes targeted working capital of $25 million. ■ Significant underutilized capacity with meaningful synergies within Boise Cascade manufacturing and distribution system: Expect mid-cycle EBITDA impact of $40 million. EPS accretive in 2017 as housing recovery continues. ■ Two manufacturing locations: Thorsby, AL: 4 million cubic feet of laminated veneer lumber (LVL) billet capacity. Roxboro, NC: 80 million lineal feet of I-joist capacity; 5 million cubic feet of LVL billet capacity. Acquired at approximately 65% of replacement cost. ■ Plan to use approximately $90 million of cash together with $130 million of new borrowing. ■ Targeting close in first half 2016, subject to regulatory approval.

3 Strategic Rationale ■ Improves ability to support continued growth in southern and eastern housing construction. ■ Cost-efficient path for adding EWP capacity compared to new construction. ■ Facilities located in cost-competitive wood baskets. ■ Will provide significant freight and other cost synergies. ■ Expected to contribute additional mid-cycle EBITDA of $40 million. ■ Returns expected to exceed cost of capital.

4 Excellent Strategic Fit ID FL NM DE MD TX OK KS NE SD ND MT WY CO UT AZ NV WA CA OR KY ME NY VT NH MA RI CT WV IN IL NC TN SC AL MS AR LA MO IA MN WI NJ GA DC VA MI OH PA Thorsby, AL Roxboro, NC Headquarters EWP Manufacturing Facilities (4) currently Plywood/Veneer Manufacturing Facilities (9) Lumber Manufacturing Facilities (5) Particleboard Manufacturing Facility (1) BMD Facilities (32) Truss Manufacturing Plant (1)

5 Capital Allocation Priorities ■ Accelerate organic growth: Modernization project at Florien, LA plywood operations (estimated completion 2H-2016) ■ Pursue acquisitions: Add value for shareholders as housing recovery continues. Strengthen competitive position through synergies. ■ Repurchase shares opportunistically to deploy free cash flow: Authorization for up to 2 million shares announced March 2015. 1.28 million shares remaining on authorization. Plan to continue repurchase plan as business conditions and other capital allocation opportunities develop in 2016. ■ Maintain strong, flexible balance sheet. Target gross debt-to-EBITDA of 2.5x.