Attached files

| file | filename |

|---|---|

| 8-K - 8-K LINE OF CREDIT AMENDMENT - TALMER BANCORP, INC. | a8kfourthamendmenttolineof.htm |

EXECUTION VERSION KE 38898002.3 FOURTH AMENDMENT to LOAN AGREEMENT between U.S. BANK NATIONAL ASSOCIATION and TALMER BANCORP, INC. Fourth Amendment: Dated December 18, 2015 Third Amendment: Dated as of June 30, 2015 Second Amendment: Dated as of March 26, 2015 First Amendment: Dated as of December 19, 2014 Original Loan Agreement: Dated as of December 20, 2013

FOURTH AMENDMENT TO LOAN AGREEMENT This FOURTH AMENDMENT TO LOAN AGREEMENT (this “Fourth Amendment”) is dated as of December 18, 2015, and is made by and between TALMER BANCORP, INC., a Michigan corporation (“Borrower”), and U.S. BANK NATIONAL ASSOCIATION, a national banking association (“Lender”). R E C I T A L S A. Borrower is a bank holding company that owns 100% of the issued and outstanding capital stock of TALMER BANK AND TRUST, a Michigan chartered state bank. Talmer Bank maintains its principal banking offices in Troy, Michigan. B. Borrower and Lender are party to a Loan Agreement dated as of December 20, 2013 (as amended by that certain First Amendment to Loan Agreement dated December 19, 2014, that certain Second Amendment to Loan Agreement dated March 26, 2015 and that certain Third Amendment to Loan Agreement dated June 30, 2015, collectively, the “Original Agreement”). C. The parties hereto desire to amend and modify the Original Agreement in accordance with the terms and subject to the conditions set forth in this Fourth Amendment. D. Capitalized terms not otherwise defined in this Fourth Amendment shall have the meanings respectively ascribed to them in the Original Agreement. NOW, THEREFORE, in consideration of the mutual covenants, conditions and agreements herein contained, the parties hereto hereby agree as follows: A G R E E M E N T SECTION 1. AMENDMENTS TO THE ORIGINAL AGREEMENT. 1.1 Recitals (Recital A). The first two sentences of Recital A of the Original Agreement are hereby amended and restated in their entirety to read as follows: “A. Borrower is a bank holding company that owns 100% of the issued and outstanding capital stock of TALMER BANK AND TRUST , a Michigan chartered state bank that is not a member of the Federal Reserve (“Talmer Bank” or the “Subsidiary Bank”). Talmer Bank maintains its principal banking offices in Troy, Michigan.” 1.2 Definitions (Section 1.1). The defined term “Maturity Date” in Section 1.1 of the Original Agreement is hereby amended and restated in its entirety to read as follows: ““Maturity Date” means December 17, 2016 in accordance with terms and requirements of Section 2.3.”

2 1.3 Definitions (Section 1.1). The defined term “Subsidiary Banks” in Section 1.1 of the Original Agreement is hereby amended and restated in its entirety to read as follows: ““Subsidiary Bank” has the meaning ascribed to such term in the recitals hereto.” In addition, the reference to “Subsidiary Banks”, “each Subsidiary Bank” and “any Subsidiary Bank”, as applicable, in the Original Agreement, including in Sections 1.1, 3.2, 4.1, 4.4.1, 7.2, and 9.21 of the Original Agreement, shall be read to refer to the Subsidiary Bank. 1.4 Definitions (Section 1.1). The defined term “Talmer West” is hereby deleted. 1.5 The Loan (Section 2.1). The second sentence in Section 2.1 of the Original Agreement shall be amended in its entirety to read as follows: “Interest on each advance hereunder shall accrue at an annual rate equal to 1.75% plus the one-month LIBOR rate quoted by Lender from Reuters Screen LIBOR01 Page or any successor thereto, which shall be that one-month LIBOR rate in effect two New York Banking Days prior to the Reprice Date, adjusted for any reserve requirement and any subsequent costs arising from a change in government regulation, such rate to be reset monthly on each Reprice Date.” 1.6 Facility Fee (Section 2.4). The second sentence in Section 2.4 of the Original Agreement shall be amended in its entirety to read as follows: “Borrower shall pay Lender a fee equal to 0.30% (thirty basis points) per annum (computed on the basis of a 360-day year, actual days elapsed) on the average daily unused amount of the Loan, which fee shall be calculated on a quarterly basis by Lender and shall be due and payable by Borrower on each March 31, June 30, September 30 and December 31, commencing on December 31, 2015. Such fees shall be fully earned when paid and shall not be refunded for any reason.” 1.7 Capitalization (Section 7.1). Section 7.1 of the Original Agreement shall be amended in its entirety to read as follows: “Borrower (on a consolidated basis) shall maintain, and cause each depository institution Subsidiary to maintain, such capital as shall be necessary to permit (a) Borrower to qualify as “well capitalized” and (b) the each depository institution Subsidiary to qualify as “well capitalized” and to permit each depository institution Subsidiary to declare dividends at the discretion of its board of directors, each in accordance with the rules, regulations and applicable guidance of its respective primary federal regulator, as in effect from time to time and consistent with the financial information and reports filed with the appropriate Governmental Agency as contemplated in Section 6 hereof.” 1.8 Risk-Based and Leverage Capital Ratios (Section 7.2). The first sentence of Section 7.2 of the Original Agreement shall be amended in its entirety to read as follows: “Borrower shall cause each depository institution Subsidiary to maintain a “Total Risk- Based Capital Ratio” (Total Capital divided by Total Risk Based Assets) equal to or in

3 excess of twelve percent (12%) as measured as of the last day of each fiscal quarter of the applicable depository institution Subsidiary.” 1.9 Nonperforming Assets to Tangible Capital (Section 7.3). Section 7.3 of the Original Agreement shall be amended in its entirety to read as follows: “Borrower shall cause the Subsidiary Bank to maintain, as of the last day of each fiscal quarter of the Subsidiary Bank, a ratio of Nonperforming Assets to Tangible Primary Capital (Nonperforming Assets divided by Tangible Primary Capital) of not more than 25%. For purposes of this Agreement, (i) “Nonperforming Assets” shall mean the sum of all other real estate owned and repossessed assets, non-accrual loans and loans on which any payment is 90 or more days past due but which continue to accrue interest held by any depository institution Subsidiary, Borrower or any other Subsidiary (but excluding all such loans and other assets that also are (A) expressly guaranteed by a U.S. government entity such as Ginnie Mae or any other similar organization and (B) troubled debt restructurings (so long as the TDR continues to accrue interest)), (ii) “Tangible Primary Capital” shall mean, as reported by the Subsidiary Bank on Schedule RC of its quarterly filing with the applicable primary federal regulator, the total amount of (A) the total equity capital, plus (B) the Allowance for Loan Losses, plus, (C) without duplication, mortgage servicing rights, minus (D) all intangibles and (iii) “Allowance for Loan Losses” shall mean the amount of such balance sheet account of the Subsidiary Bank which, in all cases, shall be derived from the quarterly reports filed with the applicable primary federal regulator and shall be consistent with the financial information and reports contemplated in Section 6 hereof.” 1.10 Reserves to Nonperforming Loans (Section 7.4). Section 7.4 of the Original Agreement shall be amended in its entirety to read as follows: “Borrower shall cause the Subsidiary Bank to maintain, as of the last day of each calendar quarter, a ratio of the Allowances for Loan Losses of the Subsidiary Bank to Nonperforming Loans (Allowance for Loan Losses divided by Nonperforming Loans) of not less than 40%. For purposes of this Agreement, “Nonperforming Loans” shall mean the sum of all non-accrual loans and loans on which any payment is 90 or more days past due but which continue to accrue interest held by any depository institution Subsidiary, Borrower or any other Subsidiary (but excluding all such loans that also are (i) expressly guaranteed by a U.S. government entity such as Ginnie Mae or any other similar organization and (ii) troubled debt restructurings (so long as the TDR continues to accrue interest)) which, in all cases, shall be derived from the quarterly reports filed with the applicable primary federal regulator and shall be consistent with the financial information and reports contemplated in Section 6 hereof.” 1.11 Minimum Fixed Charge Coverage Ratio (Section 7.6). Section 7.6 of the Original Agreement shall be amended in its entirety to read as follows: “Minimum Return on Average Assets. Borrower shall cause Subsidiary Bank to maintain, as measured as of the last day of each fiscal quarter of Borrower on a rolling four quarter basis for the trailing 12-month period ending on the last day of such fiscal

4 quarter (the “Measurement Period”), an annual return on Average Total Assets of at least 0.6%. The covenant set forth in this Section 7.6 shall be calculated quarterly beginning with the Measurement Period ending December 31, 2015, shall be derived from the quarterly report filed by the Subsidiary Bank with its primary federal regulator and shall be consistent with the financial information and reports contemplated in Section 6 of this Agreement. For purposes of this Agreement, “Average Total Assets” shall have the definition provided in, and shall be determined in accordance with, the rules and regulations of the primary federal regulator of the Subsidiary Bank and shall be the same as the number as the Subsidiary Bank uses to calculate its leverage capital ratio in the financial information and reports contemplated in Section 6 of this Agreement.” 1.12 Exhibit D. Exhibit D to the Original Agreement shall be amended to replace Annex A to such Exhibit with the form of Annex A that is attached as Exhibit A to this Fourth Amendment.” SECTION 2. REPRESENTATIONS AND WARRANTIES. Borrower hereby represents and warrants to Lender as of the date hereof as follows: (i) No Event of Default or Unmatured Event of Default has occurred and is continuing, and no Event of Default or Unmatured Event of Default would result from the amendments contemplated hereby. (ii) The execution, delivery and performance by Borrower of this Fourth Amendment have been duly authorized by all necessary corporate and other action and do not and will not require any registration with, consent or approval of, or notice to or action by any Person (including any Governmental Agency) in order to be effective and enforceable. (iii) This Fourth Amendment and the other Transaction Documents (as amended by this Fourth Amendment) constitute the legal, valid and binding obligations of Borrower, enforceable against Borrower in accordance with their respective terms. (iv) All representations and warranties of Borrower in the Original Agreement are true and correct in accordance with the standards and requirements set forth in Section 3.3.3 of the Original Agreement. (v) Borrower’s obligations under the Original Agreement and under the other Transaction Documents are not subject to any defense, counterclaim, set-off, right to recoupment, abatement or other claim. SECTION 3. ADDITIONAL TERMS. 3.1 Acknowledgement of Indebtedness under Agreement. Borrower acknowledges and confirms that, as of the date hereof, Borrower is indebted to Lender, without defense, setoff, or counterclaim, in the aggregate principal amount of Thirty Million Dollars ($30,000,000) under the Original Agreement.

5 3.2 The Agreement. On and after the Effective Date: (i) each reference in the Original Agreement to “this Agreement,” “hereunder,” “hereof,” “herein,” or words of like import shall mean and be a reference to the Original Agreement as amended hereby, (ii) each reference to the Original Agreement in all Transaction Documents shall mean and be a reference to the Original Agreement, as amended hereby, and (iii) this Fourth Amendment shall be deemed a “Transaction Document” for the purposes of the Original Agreement. 3.3 Fourth Amendment and Original Agreement to be Read Together. This Fourth Amendment supplements and is hereby made a part of the Original Agreement, and the Original Agreement and this Fourth Amendment shall from and after the Effective Date be read together and shall constitute one agreement. Except as otherwise set forth herein, the Original Agreement shall remain in full force and effect. 3.4 Acknowledgements. Borrower acknowledges that (i) it has been advised by counsel of its choice of law with respect to this Fourth Amendment, the Original Agreement, the other Transaction Documents and the transactions contemplated hereby and thereby, (ii) any waiver of Borrower set forth herein has been knowingly and voluntarily made, and (iii) the obligations of Lender hereunder shall be strictly construed and shall be expressly subject to Borrower’s compliance in all respects with the terms and conditions of the Original Agreement. 3.5 No Waiver. The execution, delivery and effectiveness of this Fourth Amendment shall not operate as a waiver of any Event of Default (including without limitation any Event of Default existing on the date hereof), nor operate as a waiver of any right, power or remedy of Lender (including without limitation any rights, powers or remedies of Lender with respect to any Event of Default existing on the date hereof), nor constitute a waiver of, or consent to any departure from, any provision of the Original Agreement, or any of the other Transaction Documents. 3.6 No Novation. The terms and conditions of the Original Agreement are amended as set forth in this Fourth Amendment. It is expressly understood and acknowledged that nothing in this Fourth Amendment shall be deemed to cause or otherwise give rise to a novation of the indebtedness contemplated in the agreement. All “Borrower’s Liabilities” under the Original Agreement shall in all respects be continuing and this Fourth Amendment shall not be deemed to evidence or result in a novation or repayment and re-borrowing of such “Borrower’s Liabilities.” SECTION 4. CONDITIONS PRECEDENT. The amendments set forth in SECTION 1 above shall become effective as of the date (the “Effective Date”) on which each of the following conditions shall have been satisfied: (i) Lender shall have received a fully executed Fourth Amendment; (iv) a copy, certified by the Secretary or Assistant Secretary of Borrower, of its Board of Directors’ resolutions authorizing the execution, delivery, and performance, respectively, of this Fourth Amendment and any other documents to be executed, delivered, or performed in connection with this Fourth Amendment; and (iii) Lender shall have received payment from Borrower, in immediately available funds, of an amount sufficient to reimburse Lender for all reasonable out-of-pocket costs, fees and expenses incurred by Lender, or for which Lender has become obligated which have been or will be invoiced to Borrower, in connection

6 with the negotiation, preparation and consummation of this Fourth Amendment, including but not limited to, reasonable attorneys’ fees and expenses. SECTION 5. RELEASE. Borrower, for itself and its successors and assigns, does hereby fully, finally and unconditionally release and forever discharge, and agrees to hold harmless, Lender and each of its equity holders and affiliates, and their respective agents, advisors, managers, parents, subsidiaries, attorneys, representatives, employees, officers and directors, and the successors, assigns, heirs and representatives of each of the foregoing, from any and all debts, claims, counterclaims, setoffs, obligations, damages, costs, attorneys’ fees and expenses, suits, demands, liabilities, actions, proceedings and causes of action, in each case whether known or unknown, contingent or fixed, direct or indirect and of whatever kind, nature or description, and whether in law or in equity, under contract, tort, statute or otherwise, that Borrower has heretofore had or now or hereafter can, shall or may have by reason of any act, omission or thing whatsoever done or omitted to be done on or prior to the Effective Date arising out of, connected with or related in any way to this Fourth Amendment, the Original Agreement, the other Transaction Documents, the transactions described therein, the Loan, Lender’s administration thereof, or the financing or banking relationships of Borrower with Lender. SECTION 6. Miscellaneous. This Fourth Amendment may be executed in any number of counterparts, all of which taken together shall constitute one and the same amendatory instrument and any of the parties hereto may execute this Fourth Amendment by signing any such counterpart. This Fourth Amendment shall be governed by, and construed in accordance with, the internal laws of the State of New York. [Remainder of Page Intentionally Left Blank]

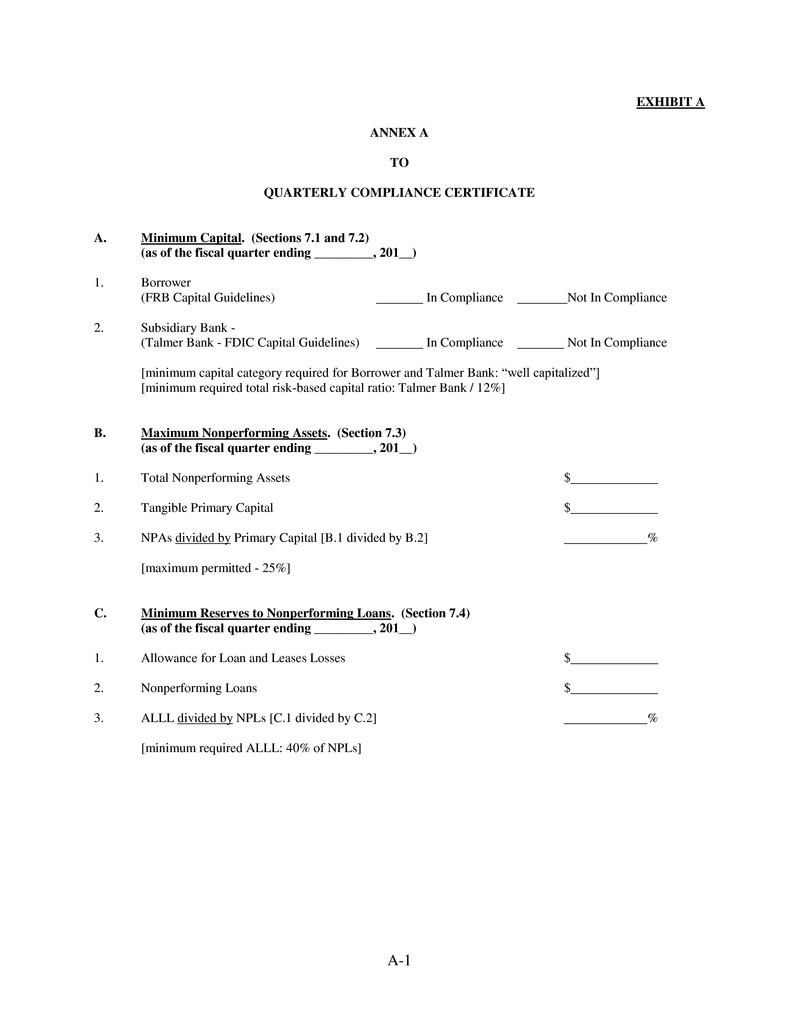

A-1 EXHIBIT A ANNEX A TO QUARTERLY COMPLIANCE CERTIFICATE A. Minimum Capital. (Sections 7.1 and 7.2) (as of the fiscal quarter ending _________, 201__) 1. Borrower (FRB Capital Guidelines) In Compliance Not In Compliance 2. Subsidiary Bank - (Talmer Bank - FDIC Capital Guidelines) In Compliance Not In Compliance [minimum capital category required for Borrower and Talmer Bank: “well capitalized”] [minimum required total risk-based capital ratio: Talmer Bank / 12%] B. Maximum Nonperforming Assets. (Section 7.3) (as of the fiscal quarter ending _________, 201__) 1. Total Nonperforming Assets $ 2. Tangible Primary Capital $ 3. NPAs divided by Primary Capital [B.1 divided by B.2] % [maximum permitted - 25%] C. Minimum Reserves to Nonperforming Loans. (Section 7.4) (as of the fiscal quarter ending _________, 201__) 1. Allowance for Loan and Leases Losses $ 2. Nonperforming Loans $ 3. ALLL divided by NPLs [C.1 divided by C.2] % [minimum required ALLL: 40% of NPLs]

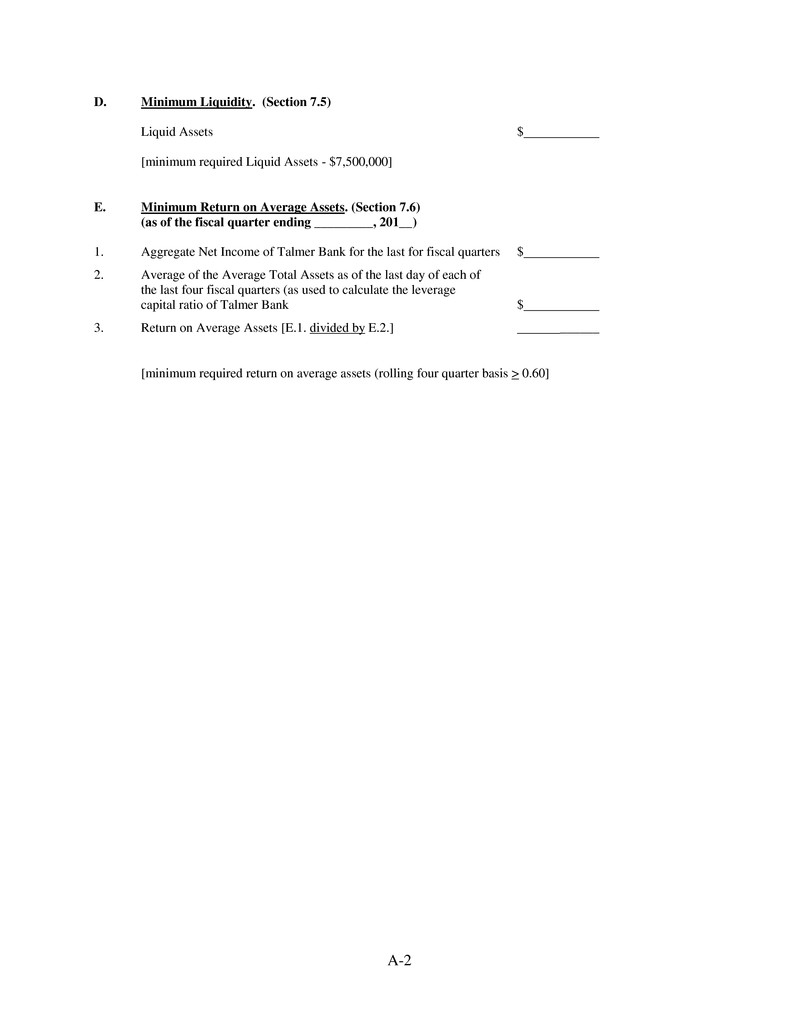

A-2 D. Minimum Liquidity. (Section 7.5) Liquid Assets $ [minimum required Liquid Assets - $7,500,000] E. Minimum Return on Average Assets. (Section 7.6) (as of the fiscal quarter ending _________, 201__) 1. Aggregate Net Income of Talmer Bank for the last for fiscal quarters $ 2. Average of the Average Total Assets as of the last day of each of the last four fiscal quarters (as used to calculate the leverage capital ratio of Talmer Bank $ 3. Return on Average Assets [E.1. divided by E.2.] ______ [minimum required return on average assets (rolling four quarter basis > 0.60]