Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Colfax CORP | a2016financialoutlook.htm |

1 FINANCIAL OUTLOOK & SUMMARY Scott Brannan | SVP and CFO Matt Trerotola | CEO of Colfax & Interim CEO of ESAB

2 Fourth Quarter Update • Maintain guidance of 2015 Adj. EPS of $1.52 to $1.56 • Continued weak end markets • Progress on operational performance and previously announced cost reduction actions • Purchased ~990,000 shares through repurchase authorization to date

3 2016 Outlook • Organic revenue down 3.5% to 6% • FX revenue headwinds of ($140) - ($150) million, resulting in ($15) - ($16) million impact on operating profit • Excludes any accretion from future acquisitions • Includes $14 - $17 million additional adjusted operating profit from the Roots and Simsmart acquisitions • Includes $27 million restructuring benefit in Fabrication Technology and $23 million benefit in Gas and Fluid Handling • Anticipated revenue seasonality (as a % of 2016 guidance) Q1 22% to 23%, Q2 25% to 26%, Q3 24% to 25% and Q4 27% to 28%

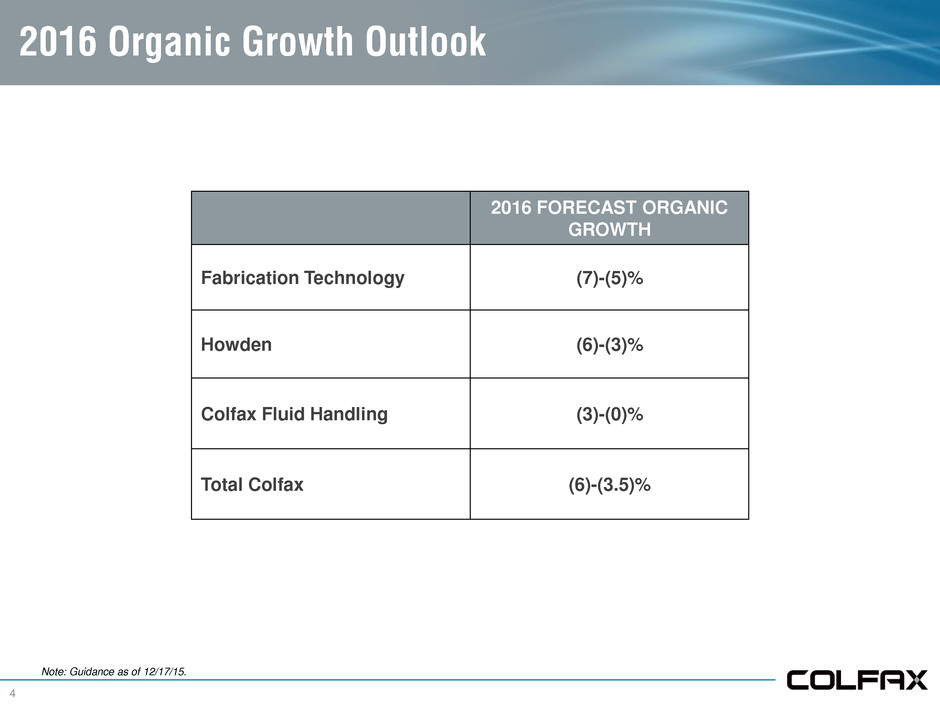

4 2016 Organic Growth Outlook 2016 FORECAST ORGANIC GROWTH Fabrication Technology (7)-(5)% Howden (6)-(3)% Colfax Fluid Handling (3)-(0)% Total Colfax (6)-(3.5)% Note: Guidance as of 12/17/15.

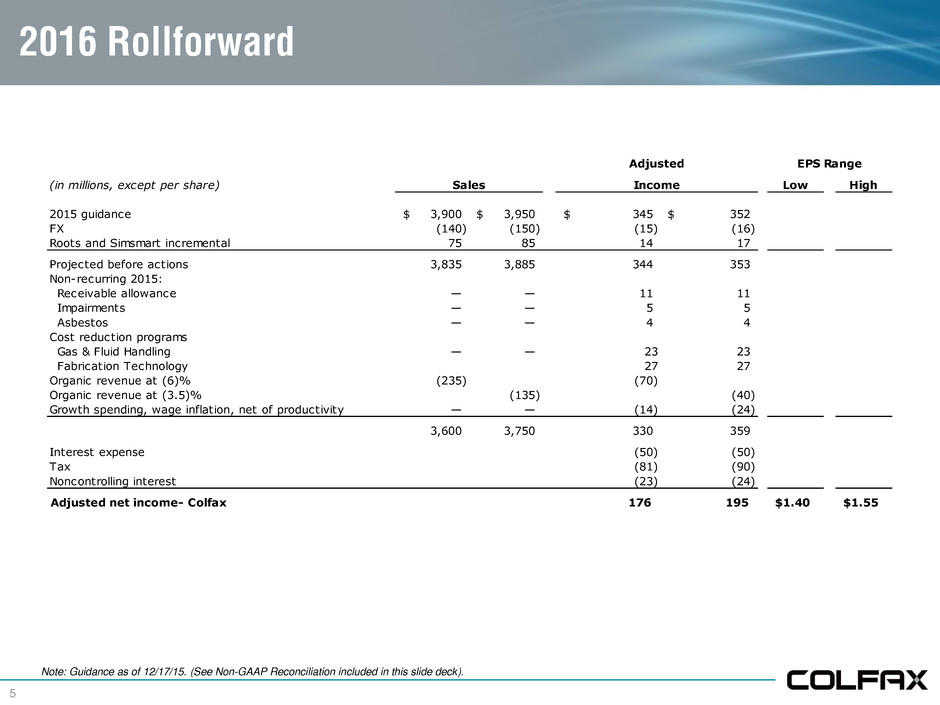

5 2016 Rollforward (in millions, except per share) Low High 2015 guidance 3,900$ 3,950$ 345$ 352$ FX (140) (150) (15) (16) Roots and Simsmart incremental 75 85 14 17 Projected before actions 3,835 3,885 344 353 Non-recurring 2015: Receivable allowance — — 11 11 Impairments — — 5 5 Asbestos — — 4 4 Cost reduction programs Gas & Fluid Handling — — 23 23 Fabrication Technology 27 27 Organic revenue at (6)% (235) (70) Organic revenue at (3.5)% (135) (40) Growth spending, wage inflation, net of productivity — — (14) (24) 3,600 3,750 330 359 Interest expense (50) (50) Tax (81) (90) Noncontrolling interest (23) (24) Adjusted net income- Colfax 176 195 $1.40 $1.55 Adjusted EPS Range Sales Income Note: Guidance as of 12/17/15. (See Non-GAAP Reconciliation included in this slide deck).

6 2016 Outlook Summary REVENUE RANGE 2016 Total $3.60 billion To $3.75 billion EPS AND ADJUSTED NET INCOME RANGE 2016 Net income per share $0.99 To $1.14 Adjusted net income $176 million To $195 million 2016 Adjusted net income per share (1) $1.40 To $1.55 ASSUMPTIONS Restructuring costs $70 million Tax rate - adjusted basis/GAAP 28-30% Outstanding shares 126 million Depreciation $80 million Amortization $50 million Interest expense $50 million Capital expenditures 2.0% of revenue Pension funding in excess of expense $30 million (1) Excludes impact of restructuring charges. Note: Guidance as of 12/17/15. (See Non-GAAP Reconciliation included in this slide deck).

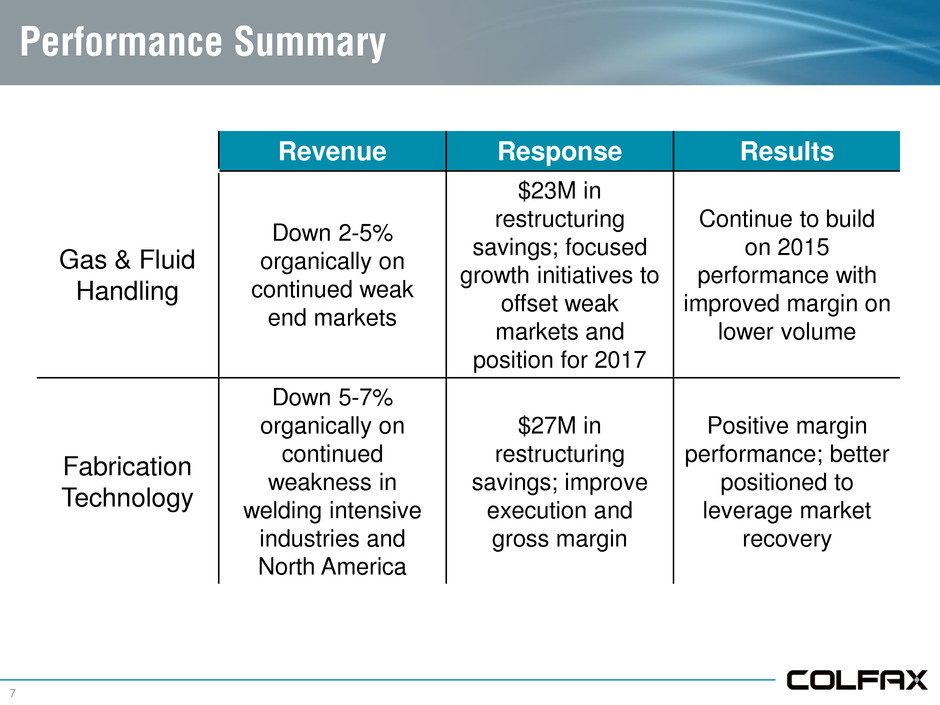

7 Revenue Response Results Gas & Fluid Handling Down 2-5% organically on continued weak end markets $23M in restructuring savings; focused growth initiatives to offset weak markets and position for 2017 Continue to build on 2015 performance with improved margin on lower volume Fabrication Technology Down 5-7% organically on continued weakness in welding intensive industries and North America $27M in restructuring savings; improve execution and gross margin Positive margin performance; better positioned to leverage market recovery Performance Summary

8 NON-GAAP DISCLAIMER Colfax has provided financial information that has not been prepared in accordance with GAAP. These non-GAAP financial measures are adjusted operating income, projected adjusted operating income, projected adjusted net income, projected adjusted net income per share, organic revenue, inorganic revenue and organic sales growth (decline). Adjusted operating income and projected adjusted operating income exclude expenses related to asbestos coverage litigation expense, major restructuring programs, expenses related to the Charter acquisition and significant year-one fair value adjustment amortization expense, and gain recorded on acquisition of remaining ownership interest of Sicelub, a less than wholly owned subsidiary, in which Colfax did not hold a controlling interest, to the extent they impact the periods presented. Projected adjusted net income and projected adjusted net income per share exclude expenses related to major restructuring programs, and to the extent it impacts the period presented, write-off of certain deferred financing fees and original issue discount associated with the refinancing of Colfax’s credit agreement. Organic revenue, organic sales growth (decline) and organic order growth (decline) exclude the impact of acquisitions and foreign exchange rate fluctuations. Inorganic revenue excludes the impact of the change in revenue from existing businesses and foreign exchange rate fluctuations. These non- GAAP financial measures assist Colfax in comparing its operating performance on a consistent basis because, among other things, they remove the impact of expenses related to asbestos coverage litigation expense, major restructuring programs, expenses related to the Charter acquisition and significant year-one fair value adjustment amortization expense, write-off of certain deferred financing fees and original issue discount associated with the refinancing of Colfax’s credit agreement and gain recorded on acquisition of remaining ownership interest of Sicelub, a less than wholly owned subsidiary, in which Colfax did not hold a controlling interest, to the extent they impact the periods presented.

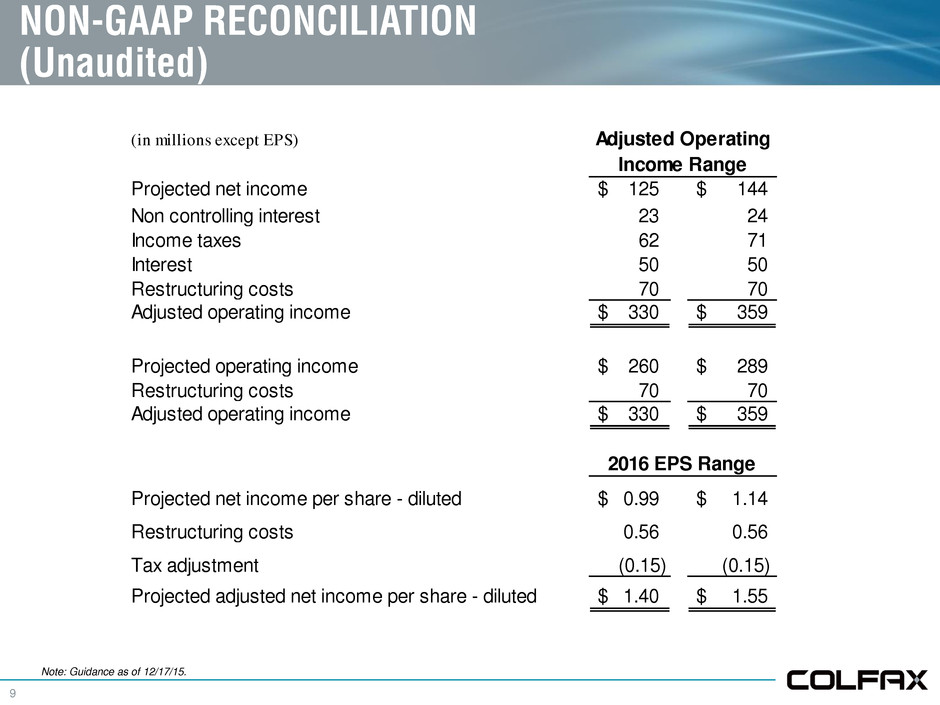

9 NON-GAAP RECONCILIATION (Unaudited) (in millions except EPS) Projected net income $ 125 $ 144 Non controlling interest 23 24 Income taxes 62 71 Interest 50 50 Restructuring costs 70 70 Adjusted operating income $ 330 $ 359 Projected operating income $ 260 $ 289 Restructuring costs 70 70 Adjusted operating income $ 330 $ 359 Projected net income per share - diluted $ 0.99 $ 1.14 Restructuring costs 0.56 0.56 Tax adjustment (0.15) (0.15) Projected adjusted net income per share - diluted $ 1.40 $ 1.55 2016 EPS Range Adjusted Operating Income Range Note: Guidance as of 12/17/15.

10 NON-GAAP RECONCILIATION - ORGANIC REVENUE (Unaudited) $ % (Dollars in millions) For the year ended December 31, 2012 3,913.9$ Components of Change: Existing Businesses 107.5 2.7 % Acquisitions (1) 246.9 6.3 % Foreign Currency Translation (61.1) (1.5)% Total 293.3 7.5 % For the year ended December 31, 2013 4,207.2$ Components of Change: Existing Businesses (79.0) (1.9)% Acquisitions (1) 635.2 15.1 % Foreign Currency Translation (138.9) (3.3)% Total 417.3 9.9 % For the year ended December 31, 2014 4,624.5$ For the nine months ended September 26, 2014 3,418.1$ Components of Change: Existing Businesses (259.2) (7.6)% Acquisitions (1) 147.6 4.3 % Foreign Currency Translation (400.9) (11.7)% Total (512.5) (15.0)% For the nine months ended September 25, 2015 2,905.6$ Calculation of Organic Revenue: Net sales for the year ended December 31, 2012 3,913.9$ Change due to existing business in 2013 107.5 Organic revenues for the year ended December 31, 2013 4,021.4 Change due to existing business in 2014 (79.0) Organic revenues for the year ended December 31, 2014 3,942.4 Change due to existing business during the nine months ended September 25, 2015 (259.2) Annualized (4/3) (345.6) Organic revenues for 2015 annualized (based on YTD September 25, 2015) 3,596.8$ Net Sales Source: Company filings. (1) Represents the incremental sales as a result of acquisitions. The impact related to the Charter Acquisition for 2012 represents the 12 days of activity for ESAB and Howden as the acquisition closed on January 13, 2012.

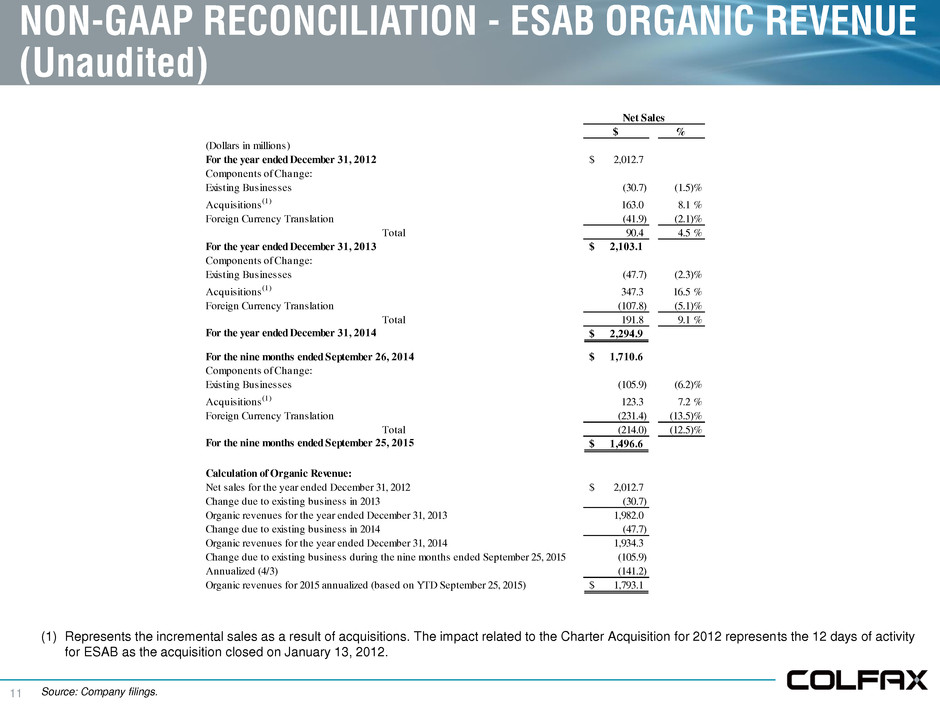

11 NON-GAAP RECONCILIATION - ESAB ORGANIC REVENUE (Unaudited) Source: Company filings. $ % (Dollars in millions) For the year ended December 31, 2012 2,012.7$ Components of Change: Existing Businesses (30.7) (1.5)% Acquisitions (1) 163.0 8.1 % Foreign Currency Translation (41.9) (2.1)% Total 90.4 4.5 % For the year ended December 31, 2013 2,103.1$ Components of Change: Existing Businesses (47.7) (2.3)% Acquisitions (1) 347.3 16.5 % Foreign Currency Translation (107.8) (5.1)% Total 191.8 9.1 % For the year ended December 31, 2014 2,294.9$ For the nine months ended September 26, 2014 1,710.6$ Components of Change: Existing Businesses (105.9) (6.2)% Acquisitions (1) 123.3 7.2 % Foreign Currency Translation (231.4) (13.5)% Total (214.0) (12.5)% For the nine months ended September 25, 2015 1,496.6$ Calculation of Organic Revenue: Net sales for the year ended December 31, 2012 2,012.7$ Change due to existing business in 2013 (30.7) Organic revenues for the year ended December 31, 2013 1,982.0 Change due to existing business in 2014 (47.7) Organic revenues for the year ended December 31, 2014 1,934.3 Change due to existing business during the nine months ended September 25, 2015 (105.9) Annualized (4/3) (141.2) Organic revenues for 2015 annualized (based on YTD September 25, 2015) 1,793.1$ Net Sales (1) Represents the incremental sales as a result of acquisitions. The impact related to the Charter Acquisition for 2012 represents the 12 days of activity for ESAB as the acquisition closed on January 13, 2012.

12 NON-GAAP RECONCILIATION - INORGANIC REVENUE (Unaudited) $ % (Dollars in millions) For the year ended December 31, 2012 3,913.9$ Components of Change: Existing Businesses 107.5 2.7 % Acquisitions (1) 246.9 6.3 % Foreign Currency Translation (61.1) (1.5)% Total 293.3 7.5 % For the year ended December 31, 2013 4,207.2$ Components of Change: Existing Businesses (79.0) (1.9)% Acquisitions (1) 635.2 15.1 % Foreign Currency Translation (138.9) (3.3)% Total 417.3 9.9 % For the year ended December 31, 2014 4,624.5$ For the nine months ended September 26, 2014 3,418.1$ Components of Change: Existing Businesses (259.2) (7.6)% Acquisitions (1) 147.6 4.3 % Foreign Currency Translation (400.9) (11.7)% Total (512.5) (15.0)% For the nine months ended September 25, 2015 2,905.6$ Calculation of Inorganic Revenue: Net sales for the year ended December 31, 2012 3,913.9$ Change due to acquisitions in 2013 246.9 Inorganic revenues for the year ended December 31, 2013 4,160.8 Change due to acquisitions in 2014 635.2 Inorganic revenues for the year ended December 31, 2014 4,796.0 Change due to acquisitions during the nine months ended September 25, 2015 147.6 Annualized (4/3) 196.8 Inorganic revenues for 2015 annualized (based on YTD September 25, 2015) 4,992.8$ Net Sales Source: Company filings. (1) Represents the incremental sales as a result of acquisitions. The impact related to the Charter Acquisition for 2012 represents the 12 days of activity for ESAB and Howden as the acquisition closed on January 13, 2012.

13 NON-GAAP RECONCILIATION (Guidance Unchanged as of October Update) _____________________ Note: Guidance as of October 14, 2015. 2015 EPS Range Low High Projected net income per share - diluted $ 1.20 $ 1.24 Restructuring costs 0.53 0.53 Non-cash charge on debt refinancing (1) 0.04 0.04 Tax adjustment (2) (0.25 ) (0.25 ) Projected adjusted net income per share - diluted $ 1.52 $ 1.56 (1) Reflects the non-cash charge associated with the June 2015 refinancing of the principal credit facility. (2) Excludes gain on tax accrual reversals and tax implication of adjustments above.