Attached files

| file | filename |

|---|---|

| 8-K - CTWS FORM 8-K INVESTOR CALL 12-18-2015 - CONNECTICUT WATER SERVICE INC / CT | form8-kctwsinvestorpresent.htm |

Connecticut Water Service, Inc. NASDAQ: CTWS Investor/Analyst Conference Call December 18, 2015

NASDAQ: CTWS www.ctwater.com 2 CTWS Presenters Eric W. Thornburg President & CEO David C. Benoit Sr. V.P. & CFO Kristen A. Johnson V.P. Human Resources & Corporate Secretary

NASDAQ: CTWS www.ctwater.com 3 Forward-Looking Statements Except for the historical statements and discussions, some statements contained in this presentation constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward- looking statements are based on current expectations and rely on a number of assumptions concerning future events, and are subject to a number of uncertainties and other factors, many of which are outside our control, that could cause actual results to differ materially from such statements. These forward-looking statements speak only as of the date of this presentation. Connecticut Water does not assume any obligation to update or revise any forward-looking statement made in this presentation or that may, from time to time, be made by or on behalf of the Company. Neither this presentation nor any verbal communication shall constitute an invitation or inducement to any person to subscribe for or otherwise acquire any Connecticut Water securities. For further information regarding risks and uncertainties associated with Connecticut Water’s business, please refer to Connecticut Water’s annual, quarterly and periodic SEC filings which can be found on the investor relations page of the Company’s website www.ctwater.com and at www.sec.gov.

NASDAQ: CTWS www.ctwater.com 4 Agenda Eric • Company Introduction • Value Proposition • Growth Strategy • Regulatory Environment • Acquisitions David • Financial Management • Capital Expenditures • WICA/WISC • Tangible Property Repair Tax Regulation • Financial Performance

NASDAQ: CTWS www.ctwater.com 5 Connecticut Water New England’s Largest Publicly Traded Water Utility Market Data As of 12/15/15 unless otherwise noted • $ 589.7 Million Total Enterprise Value1 • $ 411.8 Million Market Capitalization • $ 103.5 Million Total Revenues LTM2 (9/30/15) • 94% Regulated, 6% Non-Regulated • 73.7% 5-Year Total Shareholder Return3 (12/31/14) • 3.0% Dividend Yield • Low Beta of 0.654 • S&P ‘A’ Rating (affirmed February 2015) Resources • 400,000 People Served • 2,100 Miles of Pipeline • 270 Employees • 77 Communities • 123,000 Regulated Customers • $389.1 Million Rate Base5 (9/30/15) CTWS: NASDAQ 1 Total enterprise value is calculated as (Market Cap + Long-Term Debt (including current portion) +Preferred Stock) - Cash (Reconciliation in Appendix). 2 Last Twelve Months (LTM). 3 Total Shareholder Return is the return to an investor that includes stock price change and the reinvestment of dividends over a specific period. 4 Beta measures the volatility of a security relative to the overall market. A beta of less than one indicates lower risk than the market; a beta of more than one indicates higher risk than the market. Source: NASDAQ.com 5 Rate Base value is calculated as (Net Utility Plant + Materials and Supplies + Working Capital Adjustment + certain Deferred Charges and Other Costs) – (Advances for Construction + Unamortized Contributions in Aid of Construction + Deferred Federal and State Income Taxes + Unamortized Investment Tax Credits + certain Other Long-Term Liabilities). Our Mission: Passionate employees delivering life sustaining, high-quality water service to families and communities while providing a fair return to our shareholders.

NASDAQ: CTWS www.ctwater.com 6 Connecticut Water Value Proposition • Regionally focused, regulated water utilities (93% regulated earnings LTM as of 9/30/15) • Maine acquisitions provide diversified, multi-state utility base and greater business scale • Constructive regulatory environment with attractive investment recovery mechanisms Diversified, Regulated Utility Business Conservative growth strategy focused on utility infrastructure investment Proven track record executing accretive acquisitions Complementary, low-risk, non-regulated utility services business Focus on maintaining a strong balance sheet and liquidity “A” credit rating from S&P (as of February 19, 2015) Balanced approach to financing growth and prudent operating cost management Consistently raised dividend payments for 46 consecutive years High-quality, well-maintained asset system Experienced management team with an average of 25 years utility experience ≥ 85% customer satisfaction distinction in each of the last 14 years (GreatBlue – Independent Research Firm) Low Risk, Regulated Growth Plan Strong Financial Profile Operational Excellence

7 • CapEx investment in water utility infrastructure and earning a return “of and on” that investment • Constructive regulatory relations with state commissions to align customer and shareholder interests • Prudent acquisitions of other water systems • Supplement regulated earnings with low risk, core water utility services where a competitive advantage exists Our Growth Strategy NASDAQ: CTWS www.ctwater.com 7

NASDAQ: CTWS www.ctwater.com 8 Regulated Business • 93% of net income attributable to regulated operations (LTM as of 9/30/15) • Core regulated subsidiaries: – Connecticut Water Company (CWC) – Maine Water Company (MWC) • 123,000 utility customers (~90% residential) • 2,100 miles of pipe • 239 active wells / 25 surface water supplies • Safe, dependable yield = 176 million gallons/day • 80% safe yield from surface water supplies • Rate Base $389.1 Million as of 9/30/15 – $332.1 M in Connecticut – $57.0 M in Maine • 270 employees Connecticut Presence Maine Presence

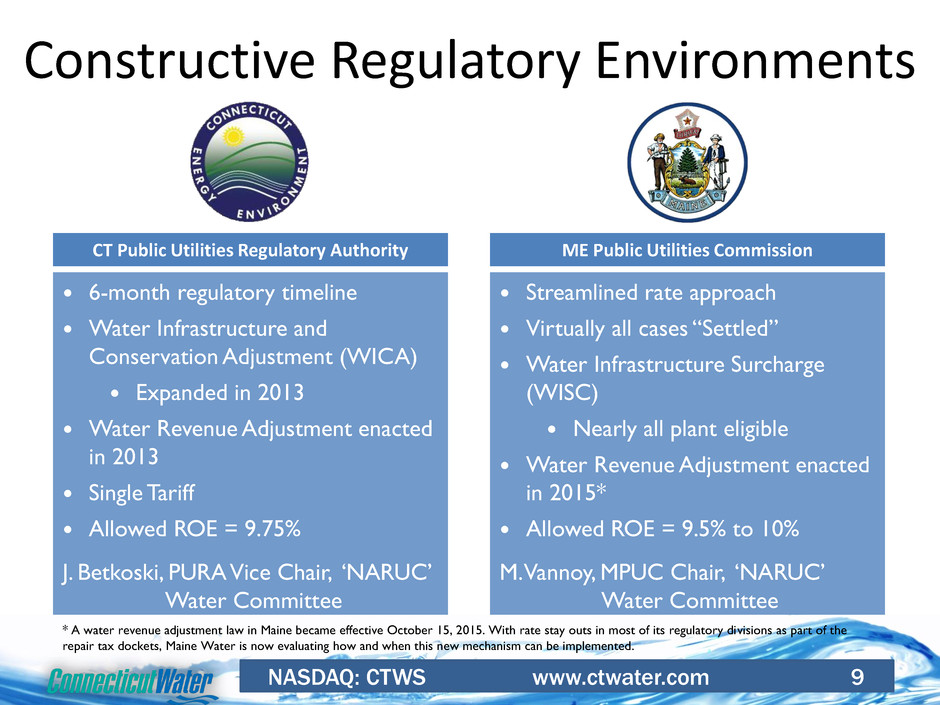

NASDAQ: CTWS www.ctwater.com 9 6-month regulatory timeline Water Infrastructure and Conservation Adjustment (WICA) Expanded in 2013 Water Revenue Adjustment enacted in 2013 Single Tariff Allowed ROE = 9.75% Constructive Regulatory Environments Streamlined rate approach Virtually all cases “Settled” Water Infrastructure Surcharge (WISC) Nearly all plant eligible Water Revenue Adjustment enacted in 2015* Allowed ROE = 9.5% to 10% CT Public Utilities Regulatory Authority ME Public Utilities Commission * A water revenue adjustment law in Maine became effective October 15, 2015. With rate stay outs in most of its regulatory divisions as part of the repair tax dockets, Maine Water is now evaluating how and when this new mechanism can be implemented. J. Betkoski, PURA Vice Chair, „NARUC‟ Water Committee M. Vannoy, MPUC Chair, „NARUC‟ Water Committee

NASDAQ: CTWS www.ctwater.com 10 CTWS Acquisition Track Record Opportunity for Growth • Industry leading acquisitions since 2012 – 35% customer growth • 60 total water system acquisitions in 25 years – over 40 in the past 7 years • Over 800 separate water systems and over 300 wastewater operations in Connecticut and Maine alone

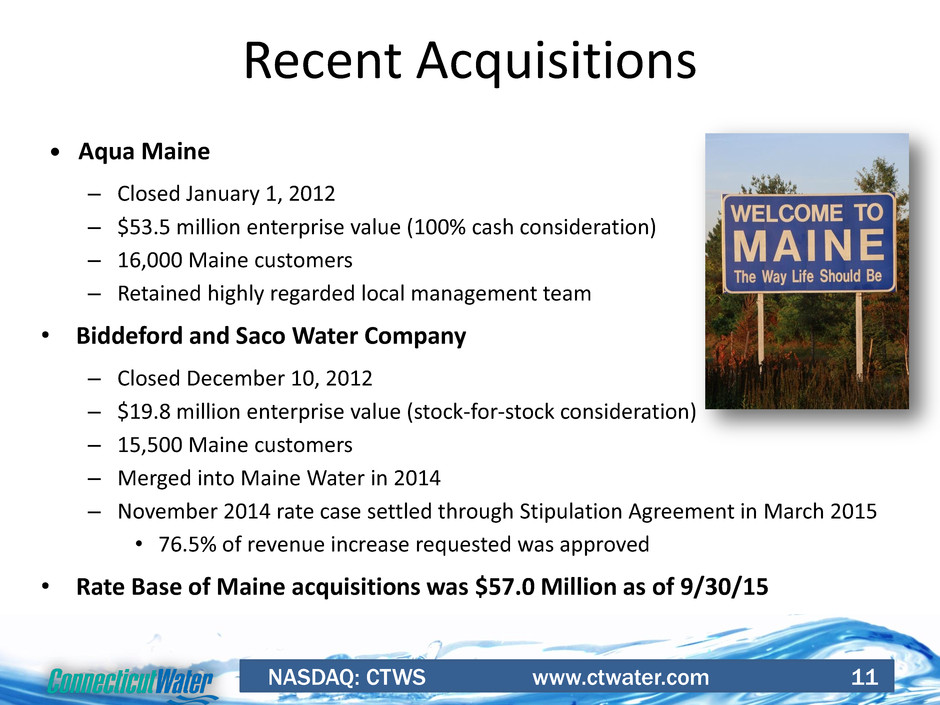

NASDAQ: CTWS www.ctwater.com 11 Recent Acquisitions Aqua Maine – Closed January 1, 2012 – $53.5 million enterprise value (100% cash consideration) – 16,000 Maine customers – Retained highly regarded local management team • Biddeford and Saco Water Company – Closed December 10, 2012 – $19.8 million enterprise value (stock-for-stock consideration) – 15,500 Maine customers – Merged into Maine Water in 2014 – November 2014 rate case settled through Stipulation Agreement in March 2015 • 76.5% of revenue increase requested was approved • Rate Base of Maine acquisitions was $57.0 Million as of 9/30/15

NASDAQ: CTWS www.ctwater.com 12 • Selected as long-term water provider for UConn and surrounding area – Acquiring 150+ off-campus customers – Supplemental source of supply for growing University • All necessary regulatory permits secured • Pipeline construction started July 2015 – 50% complete with 2.8 miles of main installed at December 2015 • Locks in expanded service area Territory Acquisition

NASDAQ: CTWS www.ctwater.com 13 UConn/Mansfield Pipeline CWC’s Northern Service Area UConn

FINANCIAL OVERVIEW

NASDAQ: CTWS www.ctwater.com 15 Financial Management • Maintain continuing improvement to operating margin • Balanced capital structure • Use tools provided by legislation – Maximize rate base in rates (WICA/WISC) – Conservation adjustment • Drive down borrowing costs

NASDAQ: CTWS www.ctwater.com 16 Infrastructure Investment Drives Rate Base Growth • Attractive, near-term regulated growth opportunities through investment in core infrastructure • Strategy to balance investment and rate recovery time • Approximately $150 Million of identified infrastructure investment (2016 – 2018) 2016 Planned Capital Spending Capital Expenditures / WICA & WISC Expenditures ($ in millions) Annual WICA/WISC $10.1 $13.2 $14.0 $13.4 $13.7 $21.4 $15.6 $22.6 $16.2 $18.7 $19.9 $27.6 $26.2 $22.9 $24.7 $32.7 $45.0 $50.2 $65.9 0 18 36 54 72 2006 2006 2007 2009 2010 2011 2012 2013 2014 2015E 2016E WICA/WISC $22.6MM Treatment 24.6MM Non-WICA/WISC $4.9MM IT $4.9MM Other $6.9MM Facilities $2.0MM Total CapEx 10 Year CAGR 14% 5 Year CAGR 21% 2015 & 2016 are projected

NASDAQ: CTWS www.ctwater.com 17 Infrastructure Recovery Mechanisms Connecticut (WICA) Maine (WISC) Water Infrastructure and Conservation Adjustment 1st used in 2009 Eligibility – Infrastructure replacement, meters, hydrants, conservation equipment 5% annual cap 10% maximum adjustment $18.6 Million in 2016 Current cumulative surcharge 4.19% Water Infrastructure Charge 1st used in 2014 Eligibility – Virtually all capital investment Annual Cap 6% to 10% depending on size of water system 10% to 20% maximum adjustment depending on size of water system $4 Million in 2016 Surcharge varies by water system

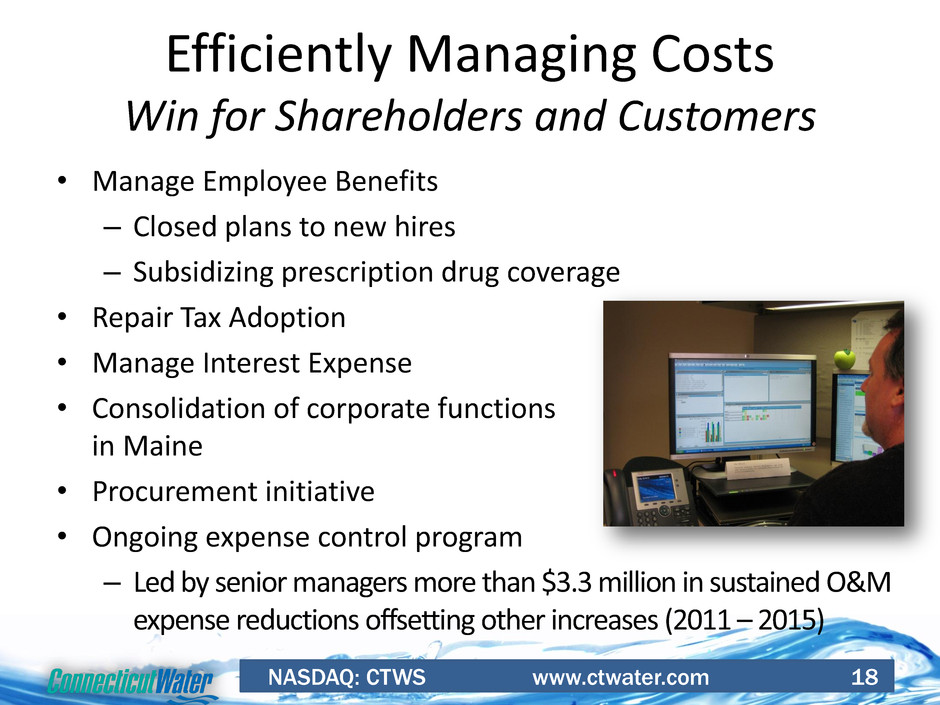

NASDAQ: CTWS www.ctwater.com 18 Efficiently Managing Costs Win for Shareholders and Customers • Manage Employee Benefits – Closed plans to new hires – Subsidizing prescription drug coverage • Repair Tax Adoption • Manage Interest Expense • Consolidation of corporate functions in Maine • Procurement initiative • Ongoing expense control program – Led by senior managers more than $3.3 million in sustained O&M expense reductions offsetting other increases (2011 – 2015)

NASDAQ: CTWS www.ctwater.com 19 Utility Operating Margin Efficiency Measure 16.0% 22.5% 22.8% 22.0% 22.0% 23.6% 24.4% 25.0% 27.7% 31.9% 5% 10% 15% 20% 25% 30% 35% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Utility Operating Income as a percentage of Operating Revenue

NASDAQ: CTWS www.ctwater.com 20 Repair Tax Facts - CTWS • Adopted by CTWS – In Connecticut for 2012 – In Maine for 2014 – Required “flow-through” tax treatment in both states • What it means – Vast majority of annual investment in infrastructure replacement is immediately deductible for tax purposes – The same investment grows rate base as it always has

NASDAQ: CTWS www.ctwater.com 21 Repair Tax Facts - CTWS • It is NOT temporary. Our annual commitment to replacing 1% - 2% of our pipe will continue to generate deductions that significantly lower or eliminate annual tax expense. Single digit effective tax rate expected to be the norm. • Closes rate differential with municipalities • O&M Margins vastly improved due to a lower portion of each dollar collected required to support Operating Costs

NASDAQ: CTWS www.ctwater.com 22 Repair Tax Facts - CTWS • Cash flow improvement allows for increased capital investment with less reliance on financing • We are replacing Operating Expense with Capital Expense (Virtually tripling from 2011 to 2016) • Customers and Regulators will realize the benefits in the form of manageable increases despite level of capital investment

NASDAQ: CTWS www.ctwater.com 23 Price Earnings 15.7 21.9 24.8 17.1 0.0 5.0 10.0 15.0 20.0 25.0 30.0 CTWS Peer Avg Peer High Peer Low Based upon 12 months fully diluted EPS at 9/30/15 and price at close of business on December 14, 2015

NASDAQ: CTWS www.ctwater.com 24 High Quality Earnings $10.2 $9.8 $11.3 $13.6 $18.2 $21.3 $22.9 $5 $10 $15 $20 $25 2009 2010 2011 2012 2013 2014 LTM Net Income $1.19 $1.14 $1.31 $1.55 $1.68 $1.95 $2.16 $0.95 $1.20 $1.45 $1.70 $1.95 $2.20 2009 2010 2011 2012 2013 2014 LTM Earnings Per Share (in millions) CAGR2 16% CAGR2 10% 1 1 1 Last 12 months as of 9/30/15 2 CAGR 2009 - 2014

NASDAQ: CTWS www.ctwater.com 25 New England Water Utility Services (NEWUS) in Connecticut and Maine Water in Maine provide a variety of complementary water- and wastewater-related utility services to residential, commercial, industrial, and municipal clients ◦ Contract operation of water and wastewater systems for other utilities, businesses, municipalities, and the University of Connecticut’s Storrs campus, and related services (37 client contracts) ◦ Linebacker® program (>21,000 residential customers enrolled) Offers basic and expanded plans to include water service line, wastewater line and in-home plumbing Initial expansion to non-customers in 2015 Low Risk Non-Regulated Business Services & Rentals Segment Net Income ($ in millions) Highlights Complementary geographic focus (Connecticut and Maine) Low risk, fee-based revenue No capital at risk $0.9 $1.0 $1.4 $1.5 $1.5 $1.3 $0.0 $0.5 $1.0 $1.5 $2.0 2010 2011 2012 2013 2014 LTM 1 Last 12 months as of 9/30/15 1

NASDAQ: CTWS www.ctwater.com 26 Stable & Growing Dividend • Annual dividend yield 3.0% as of 12/15/15 • Dividend paid without interruption or reduction for 237 consecutive quarters • Board increased dividend on common shares by 4% for third quarter 2015 • Increased dividend payments for 46 consecutive years • 2014 Dividend Payout Ratio = 52% Annual Dividend $0.855 $0.865 $0.88 $0.90 $0.92 $0.94 $0.96 $0.98 $1.01 $1.07 $0.80 $0.90 $1.00 $1.10 2006 2007 2008 2009 2010 2011 2012 2013 2014 Current Annualized On November 20, 2015, the Company’s Board declared a quarterly cash dividend of $0.2675 per common share that was paid on December 15 to the shareholders of record as of December 1, 2015.

NASDAQ: CTWS www.ctwater.com 27 Water, the basic ingredient of Life…

NASDAQ: CTWS www.ctwater.com 29 Our Vision… Serving our Customers, Shareholders and Employees at World Class Levels Appendix

NASDAQ: CTWS www.ctwater.com 30 Performance 11.1% 12.6% 9.8% 0% 2% 4% 6% 8% 10% 12% 14% CTWS S&P Utility Sector Peer Average Average Annual 5-Year Total Shareholder Return @ 12/31/14 1 Connecticut Water delivered an average annual 5-year total return to shareholders (assuming reinvestment of dividends) of 11.1% for the 5-year period 2010–2014 according to Standard & Poor’s. 1 Small Cap peers (ARTNA, MSEX, SJW, YORW)

NASDAQ: CTWS www.ctwater.com 31 Price Earnings 15.0 20.8 22.8 23.0 21.5 21.3 21.3 18.8 24.7 0.0 5.0 10.0 15.0 20.0 25.0 30.0 CTWS MSEX WTR YORW AWK SJW CALW ARTNA AWR Based on price at close of business on December 14, 2015

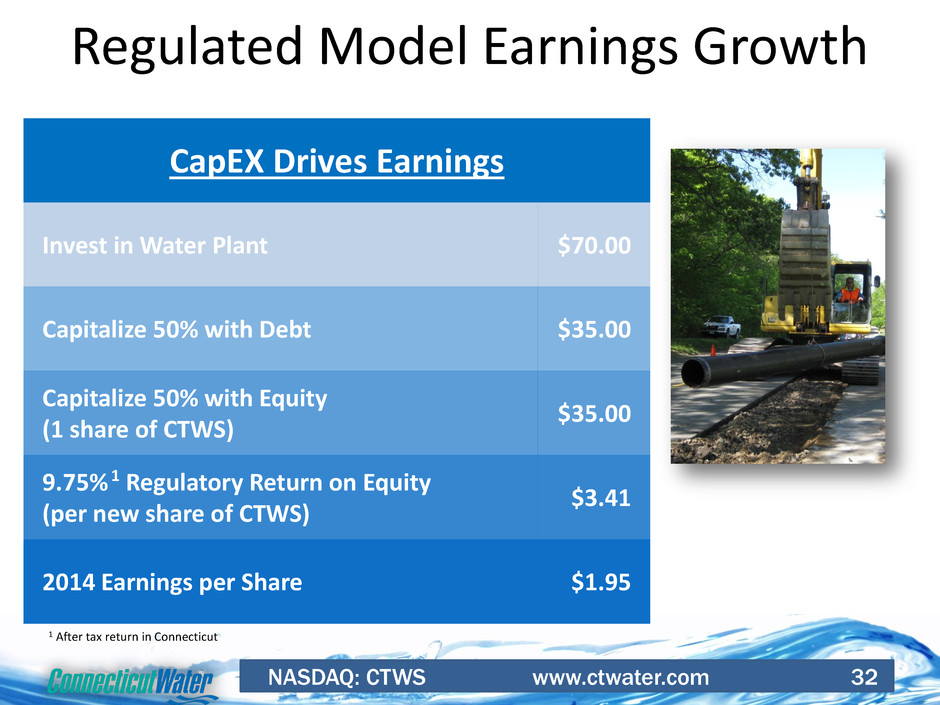

NASDAQ: CTWS www.ctwater.com 32 1 After tax return in Connecticut Regulated Model Earnings Growth CapEX Drives Earnings Invest in Water Plant $70.00 Capitalize 50% with Debt $35.00 Capitalize 50% with Equity (1 share of CTWS) $35.00 9.75% 1 Regulatory Return on Equity (per new share of CTWS) $3.41 2014 Earnings per Share $1.95

NASDAQ: CTWS www.ctwater.com 33 Selected Income Statement Nine Months Ended September 30, 2015 (In thousands except per share amounts) Operating Revenues $75,098 Other Water Activities Revenues 1,129 Real Estate Revenues 6 Service and Rentals Revenues 4,398 Total Revenues $80,631 Operating Expenses $51,730 Other Utility Income, Net of Taxes $615 Total Utility Operating Income $23,983 Gain (Loss) on Property Transactions, Net of Taxes $351 Non-Water Sales Earnings (Services and Rentals), Net of Taxes $1,040 Net Income $20,533 Net Income Applicable to Common Shareholders $20,504 Basic Earnings Per Average Common Share $1.87 Diluted Earnings Per Average Common Share $1.84 Basic Weighted Average Common Shares Outstanding 10,951 Diluted Weighted Average Common Shares Outstanding 11,157 Book Value Per Share $19.95

NASDAQ: CTWS www.ctwater.com 34 Condensed Balance Sheet September 30, 2015 (In thousands) ASSETS Net Utility Plant $528,962 Current Assets 39,258 Other Assets 142,221 Total Assets $710,441 CAPITALIZATION AND LIABILITIES Shareholders’ Equity $223,024 Preferred Stock 772 Long-Term Debt 176,679 Current Liabilities 32,247 Other Liabilities and Deferred Credits 277,719 Total Capitalization and Liabilities $710,441

NASDAQ: CTWS www.ctwater.com 35 Reconciliation of Enterprise Value Market Capitalization 12/15/15 (NASDAQ) $411,799,000 + Long-Term Debt (CTWS Form 10-Q filed 11/6/15) 176,679,000 + Current Portion of Long-Term Debt (CTWS Form 10-Q filed 11/6/15) 2,597,000 + Preferred Stock (CTWS Form 10-Q filed 11/6/15) 772,000 - Cash/Cash Equivalents (CTWS Form 10-Q filed 11/6/15) - 2,186,000 Enterprise Value $589,661,000 Connecticut Water’s annual, quarterly and periodic SEC filings which can be found on the investor relations page of the Company’s website www.ctwater.com and at www.sec.gov under ticker symbol CTWS

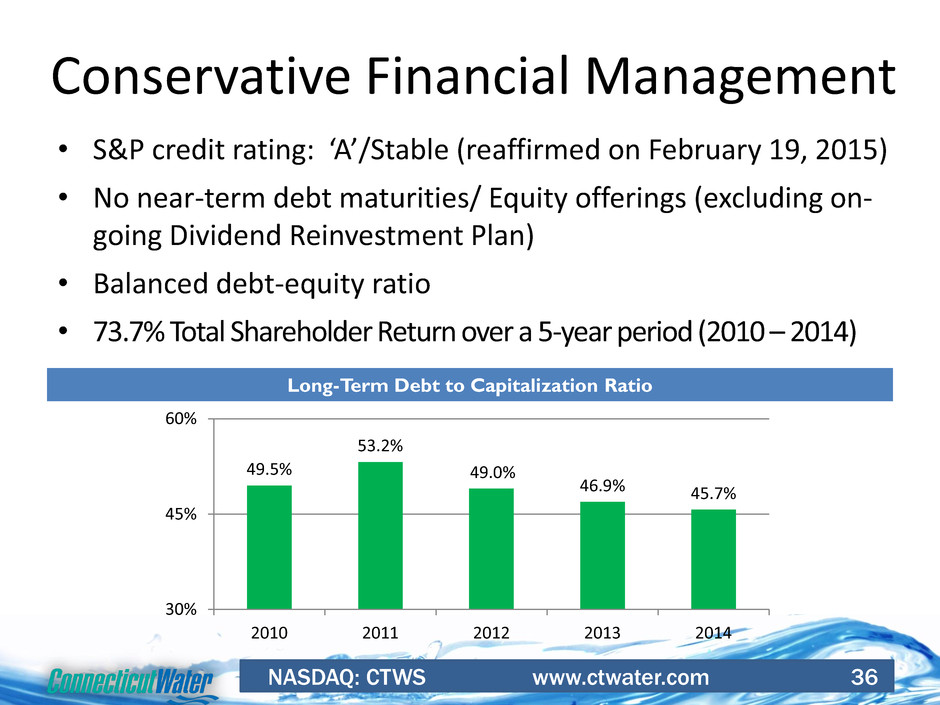

NASDAQ: CTWS www.ctwater.com 36 Conservative Financial Management • S&P credit rating: ‘A’/Stable (reaffirmed on February 19, 2015) • No near-term debt maturities/ Equity offerings (excluding on- going Dividend Reinvestment Plan) • Balanced debt-equity ratio • 73.7% Total Shareholder Return over a 5-year period (2010 – 2014) Long-Term Debt to Capitalization Ratio 49.5% 53.2% 49.0% 46.9% 45.7% 30% 45% 60% 2010 2011 2012 2013 2014

NASDAQ: CTWS www.ctwater.com 37 CTWS Creates Shareholder Value Strong Core Business plus Best-in-Class Tools for Success Strong Predictable Revenue (WRA) Minimal Regulatory Lag (WICA, WISC) Effective Expense Management

NASDAQ: CTWS www.ctwater.com 38 Constructive Regulatory Environment Connecticut Maine Infrastructure Surcharge Program Single Tariff Revenue Decoupling * 6-Month Rate Case Streamlined Rate Case * A water revenue adjustment law in Maine became effective October 15, 2015. With rate stay outs in most of its regulatory divisions as part of the repair tax dockets, the Company is now evaluating how and when this new mechanism can be implemented.

NASDAQ: CTWS www.ctwater.com 39 Company Strategy Environment Shareholders/Growth Customers Employees Passionate about stewardship of water Protect and manage water and watershed for sustainability to serve current and future generations Harness power of WRA to reduce carbon footprint and resource consumption Business is water service – not selling water Leverage regulatory compact Infrastructure investment and earning a return “of and on” investment Low risk, supplemental non-regulated earnings Maintain constructive regulatory relationships Deliver acquisitions that deliver shareholder value Provide high-quality water Responsive and courteous service High level of community engagement Deliver world-class service Customer satisfaction is a compensation metric for all employees Passionate employees delivering a life sustaining service Values-based, team-oriented approach Employee satisfaction is executive compensation metric Safe and secure workplace

NASDAQ: CTWS www.ctwater.com 40 • National Management Innovation Award for Customer Protection Program – Protects customers from utility worker imposters • Invest and maintain infrastructure to deliver high-quality water and reliable service • Assistance Programs for low income/hardship • Responsive and Courteous Service • Leverage technology to drive convenience and efficiency • Customer Satisfaction! – World-Class 14 straight years Customer Strategy

NASDAQ: CTWS www.ctwater.com 41 • Leadership is a privilege • Values-based • Team & service oriented professionals • “Satisfied Employees Satisfy Customers” • Employee Satisfaction – Executive Compensation Metric Employee Strategy

NASDAQ: CTWS www.ctwater.com 42 Environmental Strategy • Leverage CT’s Water Revenue Adjustment (WRA) to promote water conservation • Donate/sell unneeded land as protected open space • Replace aging pipe, valves and pumps to conserve natural resources • Aggressively manage energy usage • Invest in and protect watershed lands