Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Phillips Edison & Company, Inc. | ntrq32015earningreleasecall.htm |

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 0 Phillips Edison Grocery Center REIT I, Inc. Q3 2015 Results

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 1 Agenda • Portfolio & Results • Financials • Strategy R. Mark Addy - Co-President and COO Devin Murphy - CFO Jeff Edison - Chairman and CEO

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 2 Forward-Looking Statement Disclosure This presentation and the corresponding call may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, statements related to the Company’s expectations regarding the performance of its business, its financial results, its liquidity, capital resources and debt profile, the Company’s estimated value per share of its common stock, the funding available under its share repurchase program and other non-historical statements. You can identify these forward- looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, including those described under the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, as such factors may be updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation, the corresponding call and in the Company’s filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 3 Portfolio Highlights • 147 properties • 28 states • 24 leading grocery anchors • $2.2 billion purchase price • 15.5 million square feet • 95.7% occupied • 80.2% of rents from grocer, national and regional tenants

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 4 Q3 2015 Portfolio Results Grocer AER # of Locations Kroger 8.3% 35 Publix 8.1% 31 Albertsons-Safeway 4.6% 12 Ahold USA 3.5% 6 Giant Eagle 3.0% 7 Top 5 Grocers by Annualized Effective Rent Tenant Type by Annualized Effective Rent Grocery 42.7% National and Regional 37.5% Local 19.8% Tenant Industry by Annualized Effective Rent Grocery 42.7% Retail Stores 22.6% Services 21.2% Restaurant 13.5% We calculate annualized effective rent per square foot as monthly contractual rent as of September 30, 2015 multiplied by 12 months, less any tenant concessions, divided by leased square feet.

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 5 Event Highlights • Declared estimated value per share of $10.20 • Share Repurchase Program: Exceeded funding available

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 6 Q3 2015 Financials Strong Growth Three Months Ended September 30, Nine Months Ended September 30, In thousands 2015 2014 2015 2014 Net Income $5,183 $2,143 $15,524 ($159) Funds from Operations (FFO) $30,548 $23,573 $90,180 $55,872 Modified Funds from Operations (MFFO) $29,386 $25,408 $87,997 $65,762 • Substantial growth in net income • MFFO had 16% growth quarter over quarter and 34% year over year

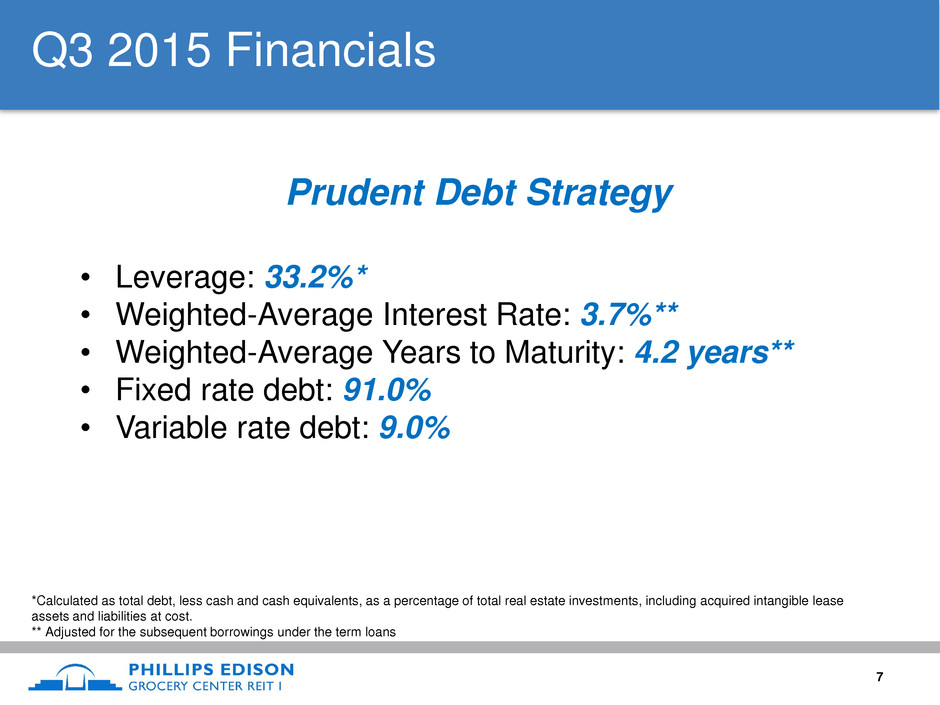

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 7 Q3 2015 Financials Prudent Debt Strategy • Leverage: 33.2%* • Weighted-Average Interest Rate: 3.7%** • Weighted-Average Years to Maturity: 4.2 years** • Fixed rate debt: 91.0% • Variable rate debt: 9.0% *Calculated as total debt, less cash and cash equivalents, as a percentage of total real estate investments, including acquired intangible lease assets and liabilities at cost. ** Adjusted for the subsequent borrowings under the term loans

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 8 Q3 2015 Financials $400 MM Unsecured Term Loan Facility • Three tranches with average term of 4.4 years, or 5.4 years with extension options, as of September 30, 2015 • Proceeds used to pay down the unsecured revolving credit facility • Seeks to appropriately ladder the debt maturity profile • Restores liquidity to the credit facility

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 9 Strategy Update • Independent Company with Independent Board of Directors • Best in class portfolio of grocery-anchored shopping centers • Commitment to maximize value for shareholders

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 10 Reconciliation of Non-GAAP Financials We present Same-Center Net Operating Income (“Same-Center NOI”) as a supplemental measure of our performance. We define Net Operating Income (“NOI”) as total operating revenues less property operating expenses, real estate taxes, and non-cash revenue items. Same-Center NOI represents the NOI for the 83 properties that were operational for the entire portion of both comparable reporting periods and that were not acquired during or subsequent to the comparable reporting periods. We believe that NOI and Same-Center NOI provide useful information to our investors about our financial and operating performance because each provides a performance measure of the revenues and expenses directly involved in owning and operating real estate assets and provides a perspective not immediately apparent from net income. Because Same-Center NOI excludes the change in NOI from properties acquired after December 31, 2013, it highlights operating trends such as occupancy levels, rental rates, and operating costs on properties that were operational for both comparable periods. Other REITs may use different methodologies for calculating Same-Center NOI, and accordingly, our Same-Center NOI may not be comparable to other REITs. Same-Center NOI should not be viewed as an alternative measure of our financial performance since it does not reflect the operations of our entire portfolio, nor does it reflect the impact of general and administrative expenses, acquisition expenses, interest expense, depreciation and amortization, other income, or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties that could materially impact our results from operations. The table below is a comparison of the Same-Center NOI for the nine months ended September 30, 2015 to the nine months ended September 30, 2014 (in thousands):

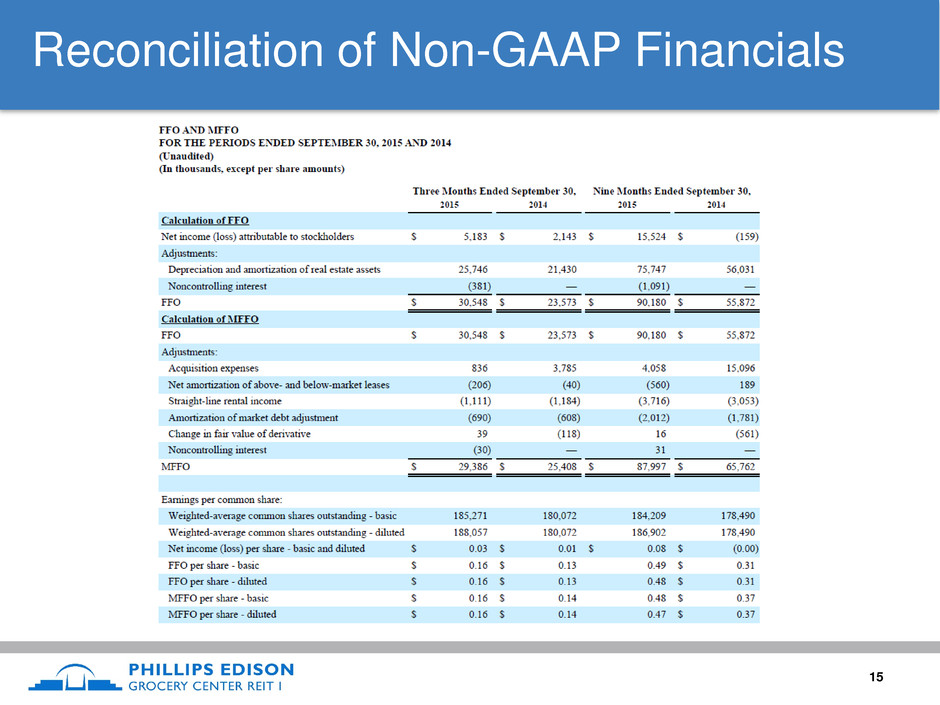

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 11 Reconciliation of Non-GAAP Financials Below is a reconciliation of net income (loss) to Same-Center NOI for the nine months ended September 30, 2015 and 2014 (in thousands): Funds from operations (“FFO”) is a non-GAAP performance financial measure that is widely recognized as a measure of REIT operating performance. We use FFO as defined by the National Association of Real Estate Investment Trusts (“NAREIT”) to be net income (loss), computed in accordance with accounting principles generally accepted in the United States of America (“GAAP”) excluding extraordinary items, as defined by GAAP, and gains (or losses) from sales of real estate property (including deemed sales and settlements of pre- existing relationships), plus depreciation and amortization on real estate assets and impairment charges, and after related adjustments for unconsolidated partnerships, joint ventures and noncontrolling interests. We believe that FFO is helpful to our investors and our management as a measure of operating performance because it excludes real estate-related depreciation and amortization, gains and losses from depreciable property dispositions, impairment charges, and extraordinary items, and as a result, when compared year to year, reflects the impact on operations from trends in occupancy rates, rental rates, operating costs, development activities, general and administrative expenses, and interest costs, which are not immediately apparent from net income. Historical cost accounting for real estate assets in accordance with GAAP implicitly assumes that the value of real estate diminishes predictably over time, especially if such assets are not adequately maintained or repaired and renovated as required by relevant circumstances and/or are requested or required by lessees for operational purposes in order to maintain the value disclosed. Since real estate values have historically risen or fallen with market conditions, including inflation, changes in interest rates, the business cycle, unemployment and consumer spending, many industry investors and analysts have considered the presentation of operating results for real estate companies that use historical cost accounting alone to be insufficient. As a result, our management believes that the use of FFO, together with the required GAAP presentations, is helpful for our investors in understanding our performance. In particular, because GAAP impairment charges are not allowed to be reversed if the underlying fair values improve or because the timing of impairment charges may lag the onset of certain operating consequences, we believe FFO provides useful supplemental information related to current consequences, benefits and sustainability related to rental rate, occupancy and other core operating fundamentals. Additionally, we believe it is appropriate to exclude impairment charges from FFO, as these are fair value adjustments that are largely based on market fluctuations and assessments regarding general market conditions, which can change over time. Factors that impact FFO include start-up costs, fixed costs, delay in buying assets, lower yields on cash held in accounts, income from portfolio properties and other portfolio assets, interest rates on acquisition financing and operating expenses. In addition, FFO will be affected by the types of investments in our portfolio, which will consist primarily of, but is not limited to, necessity-based neighborhood and community shopping centers.

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 12 Reconciliation of Non-GAAP Financials Since the definition of FFO was promulgated by NAREIT, GAAP has expanded to include several new accounting pronouncements, such that management and many investors and analysts have considered the presentation of FFO alone to be insufficient. Accordingly, in addition to FFO, we use modified funds from operations (“MFFO”), which excludes from FFO the following items: • acquisition fees and expenses; • straight-line rent amounts, both income and expense; • amortization of above- or below-market intangible lease assets and liabilities; • amortization of discounts and premiums on debt investments; • gains or losses from the early extinguishment of debt; • gains or losses on the extinguishment of derivatives, except where the trading of such instruments is a fundamental attribute of our operations; • gains or losses related to fair-value adjustments for derivatives not qualifying for hedge accounting; • losses related to the vesting of Class B units issued to PE-NTR and our previous advisor, American Realty Capital II Advisors, LLC (“ARC”), in connection with asset management services provided; and • adjustments related to the above items for joint ventures and noncontrolling interests and unconsolidated entities in the application of equity accounting. We believe that MFFO is helpful in assisting management and investors with the assessment of the sustainability of operating performance in future periods and, in particular, after our acquisition stage is complete, because MFFO excludes acquisition expenses that affect operations only in the period in which the property is acquired. Thus, MFFO provides helpful information relevant to evaluating our operating performance in periods in which there is no acquisition activity. In evaluating investments in real estate, including both business combinations and investments accounted for under the equity method of accounting, management’s investment models and analyses differentiate costs to acquire the investment from the operations derived from the investment. We have funded, and intend to continue to fund, both of these acquisition-related costs from offering proceeds and borrowings and generally not from operations.

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 13 Reconciliation of Non-GAAP Financials Many of the adjustments in arriving at MFFO are not applicable to us. Nevertheless, as explained below, management’s evaluation of our operating performance may also exclude items considered in the calculation of MFFO based on the following economic considerations. • Adjustments for straight-line rents and amortization of discounts and premiums on debt investments—GAAP requires rental receipts and discounts and premiums on debt investments to be recognized using various systematic methodologies. This may result in income recognition that could be significantly different than underlying contract terms. By adjusting for these items, MFFO provides useful supplemental information on the realized economic impact of lease terms and debt investments and aligns results with management’s analysis of operating performance. The adjustment to MFFO for straight-line rents, in particular, is made to reflect rent and lease payments from a GAAP accrual basis to a cash basis. • Adjustments for amortization of above- or below-market intangible lease assets—Similar to depreciation and amortization of other real estate-related assets that are excluded from FFO, GAAP implicitly assumes that the value of intangibles diminishes ratably over the lease term and should be recognized in revenue. Since real estate values and market lease rates in the aggregate have historically risen or fallen with market conditions, and the intangible value is not adjusted to reflect these changes, management believes that by excluding these charges, MFFO provides useful supplemental information on the performance of the real estate. • Gains or losses related to fair-value adjustments for derivatives not qualifying for hedge accounting—This item relates to a fair value adjustment, which is based on the impact of current market fluctuations and underlying assessments of general market conditions and specific performance of the holding, which may not be directly attributable to current operating performance. As these gains or losses relate to underlying long-term assets and liabilities, management believes MFFO provides useful supplemental information by focusing on the changes in core operating fundamentals rather than changes that may reflect anticipated, but unknown, gains or losses. • Adjustment for gains or losses related to early extinguishment of derivatives and debt instruments—Similar to extraordinary items excluded from FFO, these adjustments are not related to continuing operations. By excluding these items, management believes that MFFO provides supplemental information related to sustainable operations that will be more comparable between other reporting periods and to other real estate operators. • Adjustment for losses related to the vesting of Class B units issued to PE-NTR and ARC in connection with asset management services provided—Similar to extraordinary items excluded from FFO, this adjustment is nonrecurring and contingent on several factors outside of our control. Furthermore, the expense recognized in 2014 is a cumulative amount related to compensation for asset management services provided by PE-NTR and ARC since October 1, 2012 and does not relate entirely to the current period in which such loss is recognized. Finally, this expense is a non-cash expense and is not related to our ongoing operating performance.

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 14 Reconciliation of Non-GAAP Financials By providing MFFO, we believe we are presenting useful information that also assists investors and analysts to better assess the sustainability of our operating performance. We also believe that MFFO is a recognized measure of sustainable operating performance by the non-listed REIT (“NTR”) industry, although the particular adjustments we make in calculating MFFO may not be entirely consistent with adjustments made by other NTRs. However, under GAAP, acquisition costs are characterized as operating expenses in determining operating net income (loss). These expenses are paid in cash by us, and therefore such funds will not be available to distribute to investors. All paid and accrued acquisition costs negatively impact our operating performance during the period in which properties are acquired and will have negative effects on returns to investors, the potential for future distributions, and cash flows generated, unless earnings from operations or net sales proceeds from the disposition of other properties are generated to cover the purchase prices of the properties we acquire. Therefore, MFFO may not be an accurate indicator of our operating performance, especially during periods in which properties are being acquired. MFFO that excludes such costs and expenses would only be comparable to that of NTRs that have completed their acquisition activities and have similar operating characteristics as us. The purchase of properties, and the corresponding expenses associated with that process, is a key operational feature of our business plan to generate operational income and cash flows in order to make distributions to investors. Acquisition costs also adversely affect our book value and equity. The additional items that may be excluded from FFO to determine MFFO are cash flow adjustments made to net income (loss) in calculating the cash flows provided by operating activities. Each of these items is considered an important overall operational factor that affects our long-term operational profitability. These items and any other mark-to-market or fair value adjustments may be based on many factors, including current operational or individual property issues or general market or overall industry conditions. While we are responsible for managing interest rate, hedge and foreign exchange risk, we intend to retain an outside consultant to review any hedging agreements that we may enter into in the future. Inasmuch as interest rate hedges are not a fundamental part of our operations, we believe it is appropriate to exclude such gains and losses in calculating MFFO, as such gains and losses are not reflective of ongoing operations. Neither FFO nor MFFO should be considered as an alternative to net income (loss) or income (loss) from continuing operations under GAAP, nor as an indication of our liquidity, nor is any of these measures indicative of funds available to fund our cash needs, including our ability to fund distributions. MFFO may not be a useful measure of the impact of long-term operating performance on value if we do not continue to operate our business plan in the manner currently contemplated. Accordingly, FFO and MFFO should be reviewed in connection with other GAAP measurements. FFO and MFFO should not be viewed as more prominent measures of performance than our net income or cash flows from operations prepared in accordance with GAAP. Our FFO and MFFO as presented may not be comparable to amounts calculated by other REITs. Neither the SEC, NAREIT nor any other regulatory body has passed judgment on the acceptability of the adjustments that we use to calculate MFFO. In the future, the SEC, NAREIT or another regulatory body may decide to standardize the allowable adjustments across the NTR industry, and we may have to adjust our calculation and characterization of FFO or MFFO. The following section presents our calculation of FFO and MFFO and provides additional information related to our operations. As a result of the timing of the commencement of our initial public offering and our active real estate operations, FFO and MFFO are not relevant to a discussion comparing operations for the periods presented.

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 15 Reconciliation of Non-GAAP Financials

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 16 Thank You www.grocerycenterREIT1.com