Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1, DATED DECEMBER 16, 2015 - Associated Capital Group, Inc. | ex32_1093015ac.htm |

| EX-31.1 - EXHIBIT 31.1, DATED DECEMBER 16, 2015 - Associated Capital Group, Inc. | ex31_1093015ac.htm |

| EX-32.2 - EXHIBIT 32.2, DATED DECEMBER 16, 2015 - Associated Capital Group, Inc. | ex32_2093015ac.htm |

| EX-31.2 - EXHIBIT 31.2, DATED DECEMBER 16, 2015 - Associated Capital Group, Inc. | ex31_2093015ac.htm |

SECURITIES & EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2015

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___ to ___

Commission File No. 001-37387

|

ASSOCIATEDCAPITAL GROUP, INC.

|

|

(Exact name of Registrant as specified in its charter)

|

|

Delaware

|

47-3965991

|

|

|

(State of other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

One Corporate Center, Rye, NY

|

10580-1422

|

|

|

(Address of principle executive offices)

|

(Zip Code)

|

|

(203) 629-9595

|

|

Registrant’s telephone number, including area code

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer", "accelerated filer", and "smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

Accelerated filer ☐

|

|

|

Non-accelerated filer

|

Smaller reporting company ☒

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes No

Indicate the number of shares outstanding of each of the Registrant’s classes of Common Stock, as of the latest practical date.

|

Class

|

Outstanding at October 31, 2015

|

|

|

Class A Common Stock, .001 par value

|

(Including 556,100 restricted stock awards)

|

6,247,452

|

|

Class B Common Stock, .001 par value

|

|

19,196,792

|

|

INDEX

|

|||

|

|

|||

|

ASSOCIATED CAPITAL GROUP, INC. AND SUBSIDIARIES

|

|||

|

|

|

||

|

|

|

||

|

PART I.

|

FINANCIAL INFORMATION

|

|

|

|

|

|

||

|

|

|

||

|

Item 1.

|

Unaudited Condensed Combined Financial Statements

|

||

|

|

|

||

|

|

Condensed Combined Statements of Financial Condition:

|

||

|

|

- September 30, 2015

|

||

|

|

- December 31, 2014

|

||

|

|

- September 30, 2014

|

||

|

|

|

||

|

|

Condensed Combined Statements of Operations:

|

||

|

- Three months ended September 30, 2015 and 2014

|

|||

|

- Nine months ended September 30, 2015 and 2014

|

|||

|

|

|

||

|

Condensed Combined Statements of Comprehensive Income:

|

|||

|

- Three months ended September 30, 2015 and 2014

|

|||

|

- Nine months ended September 30, 2015 and 2014

|

|||

|

|

Condensed Combined Statements of Equity:

|

||

|

|

- Nine months ended September 30, 2015 and 2014

|

||

|

|

|

||

|

|

Condensed Combined Statements of Cash Flows:

|

||

|

|

- Nine months ended September 30, 2015 and 2014

|

||

|

|

|

||

|

|

Notes to Unaudited Condensed Combined Financial Statements

|

||

|

|

|

||

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

||

|

|

|

||

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk (Included in Item 2)

|

||

|

|

|

||

|

Item 4.

|

Controls and Procedures

|

||

|

|

|

||

|

PART II.

|

OTHER INFORMATION

|

||

|

|

|

||

|

Item 1.

|

Legal Proceedings

|

||

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

||

|

Item 6.

|

Exhibits

|

||

|

SIGNATURES

|

|

2

ASSOCIATED CAPITAL GROUP, INC. AND SUBSIDIARIES

CONDENSED COMBINED STATEMENTS OF FINANCIAL CONDITION

UNAUDITED

(Dollars in thousands, except per share data)

|

|

September 30,

|

December 31,

|

September 30,

|

|||||||||

|

2015

|

2014

|

2014

|

||||||||||

|

ASSETS

|

||||||||||||

|

Cash and cash equivalents

|

$

|

363,055

|

$

|

285,530

|

$

|

346,239

|

||||||

|

Investments in securities

|

92,822

|

220,595

|

218,250

|

|||||||||

|

Investments in registered investment companies

|

115,046

|

39,537

|

39,520

|

|||||||||

|

Investments in partnerships

|

101,022

|

107,646

|

107,431

|

|||||||||

|

Receivable from brokers

|

52,595

|

74,407

|

79,356

|

|||||||||

|

Investment advisory fees receivable

|

1,991

|

4,145

|

1,375

|

|||||||||

|

Receivable from affiliates

|

202

|

402

|

162

|

|||||||||

|

Goodwill

|

3,254

|

3,254

|

3,254

|

|||||||||

|

Other assets

|

882

|

19,178

|

2,951

|

|||||||||

|

Total assets

|

$

|

730,869

|

$

|

754,694

|

$

|

798,538

|

||||||

|

|

||||||||||||

|

LIABILITIES AND EQUITY

|

||||||||||||

|

Payable to brokers

|

$

|

49,365

|

$

|

43,397

|

$

|

46,237

|

||||||

|

Income taxes payable and deferred tax liabilities

|

8,832

|

16,363

|

20,338

|

|||||||||

|

Compensation payable

|

5,046

|

9,179

|

5,695

|

|||||||||

|

Securities sold, not yet purchased

|

5,577

|

10,595

|

14,180

|

|||||||||

|

Mandatorily redeemable noncontrolling interests

|

1,257

|

1,302

|

1,304

|

|||||||||

|

Payable to affiliates

|

23,369

|

20,733

|

21,445

|

|||||||||

|

Accrued expenses and other liabilities

|

1,846

|

1,864

|

3,028

|

|||||||||

|

Total liabilities

|

95,292

|

103,433

|

112,227

|

|||||||||

|

|

||||||||||||

|

Redeemable noncontrolling interests

|

6,018

|

68,334

|

56,086

|

|||||||||

|

Equity

|

624,792

|

573,749

|

620,725

|

|||||||||

|

Accumulated other comprehensive income

|

4,767

|

9,178

|

9,500

|

|||||||||

|

Total equity

|

629,559

|

582,927

|

630,225

|

|||||||||

|

|

||||||||||||

|

Total liabilities and equity

|

$

|

730,869

|

$

|

754,694

|

$

|

798,538

|

||||||

See accompanying notes.

3

ASSOCIATED CAPITAL GROUP, INC. AND SUBSIDIARIES

CONDENSED COMBINED STATEMENTS OF OPERATIONS

UNAUDITED

(Dollars in thousands, except per share data)

|

|

Three Months Ended

|

Nine Months Ended

|

||||||||||||||

|

September 30,

|

September 30,

|

|||||||||||||||

|

|

2015

|

2014

|

2015

|

2014

|

||||||||||||

|

Revenues

|

||||||||||||||||

|

Investment advisory and incentive fees

|

$

|

2,240

|

$

|

1,832

|

$

|

6,295

|

$

|

5,066

|

||||||||

|

Institutional research services

|

2,063

|

2,540

|

6,130

|

6,720

|

||||||||||||

|

Other

|

387

|

523

|

1,422

|

1,565

|

||||||||||||

|

Total revenues

|

4,690

|

4,895

|

13,847

|

13,351

|

||||||||||||

|

Expenses

|

||||||||||||||||

|

Compensation

|

5,079

|

4,313

|

16,555

|

14,376

|

||||||||||||

|

Management fee

|

(1,374

|

)

|

(1,038

|

)

|

(878

|

)

|

(265

|

)

|

||||||||

|

Stock based compensation

|

630

|

476

|

1,895

|

1,371

|

||||||||||||

|

Other operating expenses

|

1,436

|

1,892

|

4,704

|

5,541

|

||||||||||||

|

Total expenses

|

5,771

|

5,643

|

22,276

|

21,023

|

||||||||||||

|

|

||||||||||||||||

|

Operating loss

|

(1,081

|

)

|

(748

|

)

|

(8,429

|

)

|

(7,672

|

)

|

||||||||

|

Other income (expense)

|

||||||||||||||||

|

Net gain/(loss) from investments

|

(11,539

|

)

|

(9,140

|

)

|

(834

|

)

|

3,561

|

|||||||||

|

Interest and dividend income

|

551

|

805

|

2,303

|

2,694

|

||||||||||||

|

Interest expense

|

(323

|

)

|

(295

|

)

|

(984

|

)

|

(1,022

|

)

|

||||||||

|

Total other income/(expense), net

|

(11,311

|

)

|

(8,630

|

)

|

485

|

5,233

|

||||||||||

|

Income before income taxes

|

(12,392

|

)

|

(9,378

|

)

|

(7,944

|

)

|

(2,439

|

)

|

||||||||

|

Income tax provision/(benefit)

|

(4,388

|

)

|

(2,561

|

)

|

(3,154

|

)

|

(488

|

)

|

||||||||

|

Net loss

|

(8,004

|

)

|

(6,817

|

)

|

(4,790

|

)

|

(1,951

|

)

|

||||||||

|

Net loss attributable to noncontrolling interests

|

(464

|

)

|

(3,034

|

)

|

(490

|

)

|

(2,605

|

)

|

||||||||

|

Net income/(loss) attributable to Associated Capital Group, Inc.'s shareholders

|

$

|

(7,540

|

)

|

$

|

(3,783

|

)

|

$

|

(4,300

|

)

|

$

|

654

|

|||||

|

|

||||||||||||||||

See accompanying notes.

4

ASSOCIATED CAPITAL GROUP, INC. AND SUBSIDIARIES

CONDENSED COMBINED STATEMENTS OF COMPREHENSIVE INCOME

UNAUDITED

(Dollars in thousands, except per share data)

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||||

|

September 30,

|

September 30,

|

|||||||||||||||

|

2015

|

2014

|

2015

|

2014

|

|||||||||||||

|

Net loss

|

$

|

(8,004

|

)

|

$

|

(6,817

|

)

|

$

|

(4,790

|

)

|

$

|

(1,951

|

)

|

||||

|

Other comprehensive loss, net of tax:

|

||||||||||||||||

|

Net unrealized losses on securities available for sale (a)

|

(4,605

|

)

|

(1,039

|

)

|

(4,411

|

)

|

(2,105

|

)

|

||||||||

|

Other comprehensive loss

|

(4,605

|

)

|

(1,039

|

)

|

(4,411

|

)

|

(2,105

|

)

|

||||||||

|

Comprehensive loss

|

(12,609

|

)

|

(7,856

|

)

|

(9,201

|

)

|

(4,056

|

)

|

||||||||

|

Less: Comprehensive loss attributable to noncontrolling interests

|

464

|

3,034

|

490

|

2,605

|

||||||||||||

|

Comprehensive loss attributable to Associated Capital Group, Inc.

|

$

|

(12,145

|

)

|

$

|

(4,822

|

)

|

$

|

(8,711

|

)

|

$

|

(1,451

|

)

|

||||

(a) Net of income tax benefit of ($2,705), ($610), ($2,591) and ($1,235), respectively.

See accompanying notes.

5

ASSOCIATED CAPITAL GROUP, INC. AND SUBSIDIARIES

CONDENSED COMBINED STATEMENTS OF EQUITY

UNAUDITED

(In thousands)

For the Nine months ended September 30, 2015

|

Associated Capital Group, Inc stockholders

|

||||||||||||||||

|

Accumulated

|

||||||||||||||||

|

Other

|

Redeemable

|

|||||||||||||||

|

Comprehensive

|

Noncontrolling

|

|||||||||||||||

|

Equity

|

Income

|

Total

|

Interests

|

|||||||||||||

|

Balance at December 31, 2014

|

$

|

573,749

|

$

|

9,178

|

$

|

582,927

|

$

|

68,334

|

||||||||

|

Redemptions of redeemable

|

||||||||||||||||

|

noncontrolling interests

|

-

|

-

|

-

|

(602

|

)

|

|||||||||||

|

Contributions from redeemable

|

||||||||||||||||

|

noncontrolling interests

|

-

|

-

|

-

|

1,036

|

||||||||||||

|

Consolidation of a consolidated

|

||||||||||||||||

|

feeder fund and a partnership

|

-

|

-

|

-

|

996

|

||||||||||||

|

Deconsolidation of an offshore

|

||||||||||||||||

|

fund

|

-

|

-

|

-

|

(63,256

|

)

|

|||||||||||

|

Net loss

|

(4,300

|

)

|

-

|

(4,300

|

)

|

(490

|

)

|

|||||||||

|

Net unrealized losses on

|

||||||||||||||||

|

securities available for sale,

|

||||||||||||||||

|

net of income tax benefit ($2,637)

|

-

|

(4,490

|

)

|

(4,490

|

)

|

-

|

||||||||||

|

Amounts reclassified from

|

||||||||||||||||

|

accumulated other

|

||||||||||||||||

|

comprehensive income,

|

||||||||||||||||

|

net of income tax ($46)

|

-

|

79

|

79

|

-

|

||||||||||||

|

Stock based compensation

|

||||||||||||||||

|

expense

|

1,895

|

-

|

1,895

|

-

|

||||||||||||

|

Net transfers from Parent

|

53,448

|

-

|

53,448

|

-

|

||||||||||||

|

Balance at September 30, 2015

|

624,792

|

$

|

4,767

|

$

|

629,559

|

$

|

6,018

|

|||||||||

See accompanying notes.

6

ASSOCIATED CAPITAL GROUP, INC. AND SUBSIDIARIES

CONDENSED COMBINED STATEMENTS OF EQUITY

UNAUDITED

(In thousands)

For the NIne months ended September 30, 2014

|

Associated Capital Group, Inc stockholders

|

||||||||||||||||

|

|

Accumulated

|

|||||||||||||||

|

Other

|

Redeemable

|

|||||||||||||||

|

Comprehensive

|

Noncontrolling

|

|||||||||||||||

|

Equity

|

Income

|

Total

|

Interests

|

|||||||||||||

|

Balance at December 31, 2013

|

$

|

483,772

|

$

|

11,605

|

$

|

495,377

|

$

|

6,751

|

||||||||

|

Redemptions of redeemable

|

||||||||||||||||

|

noncontrolling interests

|

-

|

-

|

-

|

(1,666

|

)

|

|||||||||||

|

Contributions from redeemable

|

||||||||||||||||

|

noncontrolling interests

|

-

|

-

|

-

|

53,607

|

||||||||||||

|

Net income (loss)

|

654

|

-

|

654

|

(2,606

|

)

|

|||||||||||

|

Net unrealized losses on

|

||||||||||||||||

|

securities available for sale,

|

||||||||||||||||

|

net of income tax benefit ($328)

|

-

|

(237

|

)

|

(237

|

)

|

-

|

||||||||||

|

Amounts reclassed from

|

||||||||||||||||

|

accumulated other

|

||||||||||||||||

|

comprehensive income,

|

||||||||||||||||

|

net of income tax benefit ($1,094)

|

-

|

(1,868

|

)

|

(1,868

|

)

|

-

|

||||||||||

|

Stock based compensation

|

||||||||||||||||

|

expense

|

1,371

|

-

|

1,371

|

-

|

||||||||||||

|

Net transfers from Parent

|

134,928

|

-

|

134,928

|

-

|

||||||||||||

|

Balance at September 30, 2014

|

$

|

620,725

|

$

|

9,500

|

$

|

630,225

|

$

|

56,086

|

||||||||

See accompanying notes.

7

ASSOCIATED CAPITAL GROUP, INC. AND SUBSIDIARIES

CONDENSED COMBINED STATEMENTS OF CASH FLOWS

UNAUDITED

(In thousands)

|

|

Nine Months Ended

|

|||||||

|

September 30,

|

||||||||

|

|

2015

|

2014

|

||||||

|

Operating activities

|

||||||||

|

Net loss

|

$

|

(4,790

|

)

|

$

|

(1,951

|

)

|

||

|

Adjustments to reconcile net loss to net cash provided by/(used in) operating activities:

|

||||||||

|

Equity in net gains from partnerships

|

(669

|

)

|

(572

|

)

|

||||

|

Depreciation and amortization

|

9

|

11

|

||||||

|

Stock based compensation expense

|

1,895

|

1,371

|

||||||

|

Other-than-temporary loss on available for sale securities

|

150

|

69

|

||||||

|

Cost basis of donated securities

|

73

|

56

|

||||||

|

Net gains on sales of available for sale securities

|

(25

|

)

|

(2,978

|

)

|

||||

|

(Increase) decrease in assets:

|

||||||||

|

Investments in trading securities

|

29,096

|

(22,376

|

)

|

|||||

|

Investments in partnerships:

|

||||||||

|

Contributions to partnerships

|

(15,170

|

)

|

(15,698

|

)

|

||||

|

Distributions from partnerships

|

22,800

|

4,828

|

||||||

|

Receivable from brokers

|

(26,094

|

)

|

(30,506

|

)

|

||||

|

Investment advisory fees receivable

|

1,956

|

3,876

|

||||||

|

Other assets

|

18,421

|

491

|

||||||

|

Increase (decrease) in liabilities:

|

||||||||

|

Payable to brokers

|

43,232

|

36,236

|

||||||

|

Income taxes payable and deferred tax liabilities

|

(4,940

|

)

|

(892

|

)

|

||||

|

Intercompany payable

|

2,636

|

2,099

|

||||||

|

Compensation payable

|

(4,133

|

)

|

(8,762

|

)

|

||||

|

Mandatorily redeemable noncontrolling interests

|

(45

|

)

|

(51

|

)

|

||||

|

Accrued expenses and other liabilities

|

681

|

236

|

||||||

|

Total adjustments

|

69,873

|

(32,562

|

)

|

|||||

|

Net cash provided by/(used in) operating activities

|

$

|

65,083

|

$

|

(34,513

|

)

|

|||

8

ASSOCIATED CAPITAL GROUP, INC. AND SUBSIDIARIES

CONDENSED COMBINED STATEMENTS OF CASH FLOWS

UNAUDITED (continued)

(In thousands)

|

|

Nine Months Ended

|

|||||||

|

September 30,

|

||||||||

|

|

2015

|

2014

|

||||||

|

Investing activities

|

||||||||

|

Purchases of available for sale securities

|

$

|

(43,030

|

)

|

$

|

(1,228

|

)

|

||

|

Proceeds from sales of available for sale securities

|

1,013

|

4,748

|

||||||

|

Return of capital on available for sale securities

|

554

|

827

|

||||||

|

Net cash provided by (used in) provided by investing activities

|

(41,463

|

)

|

4,347

|

|||||

|

|

||||||||

|

Financing activities

|

||||||||

|

Contributions from redeemable noncontrolling interests

|

1,036

|

53,607

|

||||||

|

Redemptions of redeemable noncontrolling interests

|

(602

|

)

|

(1,666

|

)

|

||||

|

Repayment of demand loan

|

-

|

(10,000

|

)

|

|||||

|

Net transfer from Parent

|

53,448

|

134,928

|

||||||

|

Net cash provided by financing activities

|

53,882

|

176,869

|

||||||

|

Net increase in cash and cash equivalents

|

77,502

|

146,703

|

||||||

|

Cash and cash equivalents at beginning of period

|

285,530

|

199,536

|

||||||

|

Increase in cash from consolidation

|

10

|

-

|

||||||

|

Increase in cash from deconsolidation

|

13

|

-

|

||||||

|

Cash and cash equivalents at end of period

|

$

|

363,055

|

$

|

346,239

|

||||

|

Supplemental disclosures of cash flow information:

|

||||||||

|

Cash paid for interest

|

$

|

1,026

|

$

|

1,073

|

||||

|

Cash paid for taxes

|

$

|

2

|

$

|

2

|

||||

|

|

||||||||

|

Non-cash activity:

|

||||||||

|

- On January 1, 2015, Associated Capital Group, Inc. was no longer deemed to have control over a certain offshore fund and a certain consolidated feeder fund which resulted in the deconsolidation of that offshore fund and consolidated feeder fund and an increase of approximately $13 of cash and cash equivalents, a decrease of approximately $63,280 of net assets and a decrease of approximately $63,267 of redeemable noncontrolling interests.

- On April 1, 2015, Associated Capital Group, Inc. was deemed to have control over a certain offshore fund and a certain partnership which resulted in the consolidation of that one offshore fund and one partnership and an increase of approximately $10 of cash and cash equivalents, an increase of approximately $986 of other net assets and an increase of approximately $996 of redeemable noncontrolling interest.

|

||||||||

See accompanying notes.

9

ASSOCIATED CAPITAL GROUP, INC. AND SUBSIDIARIES

NOTES TO CONDENSED COMBINED FINANCIAL STATEMENTS

September 30, 2015

(Unaudited)

A. Basis of Presentation and Significant Accounting Policies

Unless we have indicated otherwise, or the context otherwise requires, references in this report to “Associated Capital Group, Inc.,” “AC Group,” “the Company,” “AC,” “we,” “us” and “our” or similar terms are to Associated Capital Group, Inc., its predecessors and its subsidiaries.

The Spin-off and Related Transactions

We are a newly formed Delaware corporation organized to be the holding company for the spin-off of GAMCO Investors, Inc. (“GAMCO’s”) alternative investment management business, institutional research services business and certain cash and other assets. Our principal executive offices are located at One Corporate Center, Rye, NY 10580.

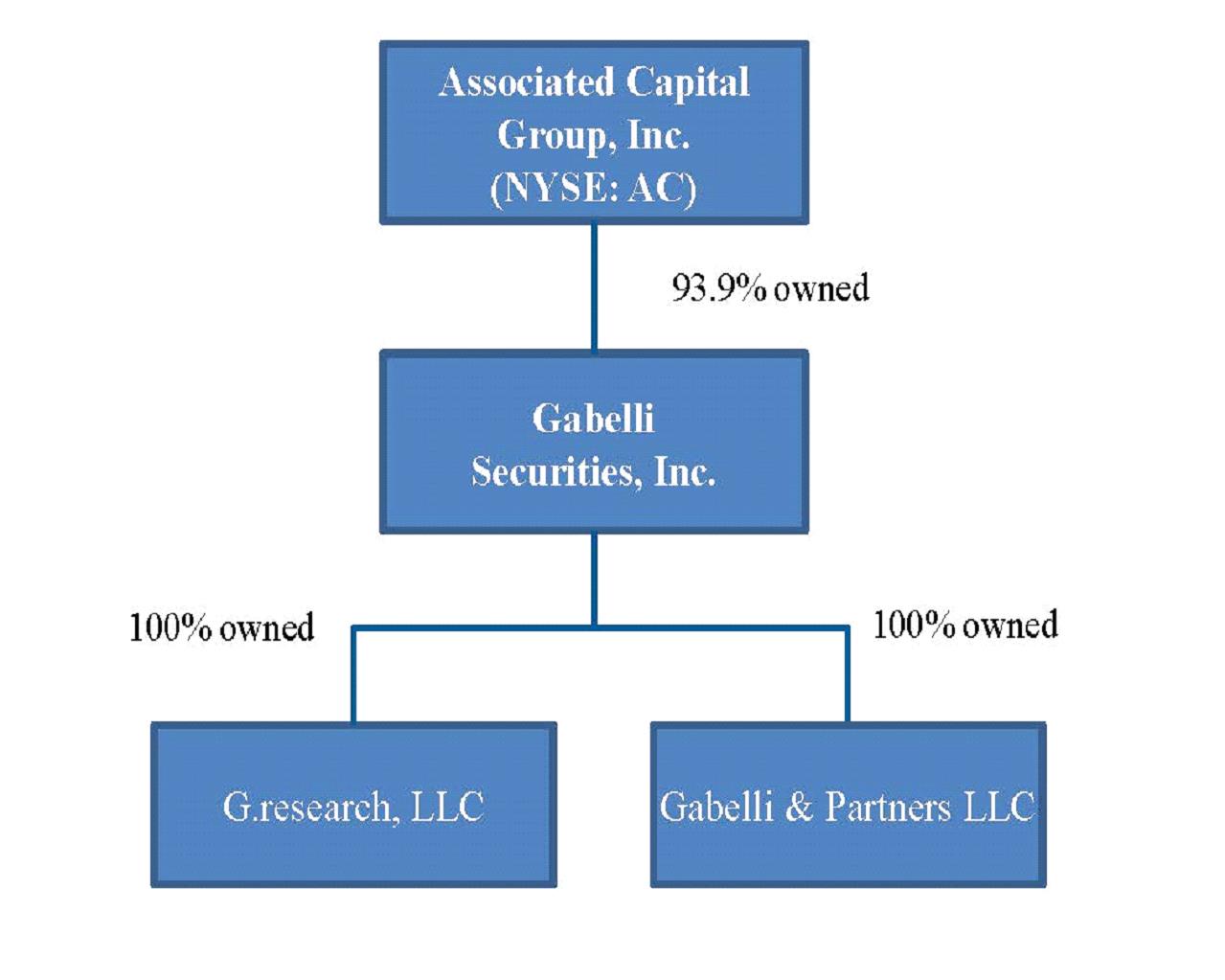

On November 30, 2015, GAMCO distributed all the outstanding shares of each class of common stock of AC Group on a pro rata one-for-one basis to the holders of each class of GAMCO’s common stock. Prior to the distribution, GAMCO contributed the 93.9% interest it held in Gabelli Securities, Inc. (“GSI”) and certain cash and other assets to AC Group. GSI is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940, as amended. GSI and its wholly owned subsidiary, Gabelli & Partners, LLC ("Gabelli & Partners"), collectively serve as general partners or investment managers to investment funds including limited partnerships and offshore companies (collectively, "Investment Partnerships"), and separate accounts. We primarily manage assets in equity event-driven value strategies, across a range of risk and event arbitrage portfolios. The business earns fees from its advisory assets, and income (loss) from trading and investment portfolio activities. The advisory fees include management and incentive fees. Management fees are largely based on a percentage of the portfolios' levels of assets under management. Incentive fees are based on the percentage of profits derived from the investment performance delivered to clients' invested assets. GSI is registered with the Securities and Exchange Commission as an investment advisor under the Investment Advisers Act of 1940, as amended. Certain employees of GAMCO own 1.9% of GSI, and the remaining 4.2% of GSI is owned by individual investors unrelated to GAMCO and AC Group.

We operate our institutional research services business through G.research, LLC ("G.research"), a wholly owned subsidiary of GSI. G.research is a broker-dealer registered under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Through G.research, we provide institutional research services as well as act as an underwriter. G.research is regulated by the Financial Industry Regulatory Authority ("FINRA"). G.research's revenues are derived primarily from institutional research services.

In addition, the following transactions were also undertaken in connection with the spin-off:

GAMCO issued a promissory note (the “GAMCO Note”) to AC Group in the original principal amount of $250.0 million used to partially capitalize the Company in connection with the spin-off. The GAMCO Note bears interest at 4.0% per annum and has a maturity date of November 30, 2020 with respect to the original principal amount of the GAMCO Note. Interest on the GAMCO Note will accrue from the most recent date for which interest has been paid, or if no interest has been paid, from the effective date of the GAMCO Note; provided, however, that at the election of GAMCO, payment of interest on the GAMCO Note may, in lieu of being paid in cash, be paid, in whole or in part, in kind on the then-outstanding principal amount (a “PIK Amount”). GAMCO will repay the original principal amount of the GAMCO Note to AC Group, in cash, in five equal annual installments of $50 million on each interest payment date up to and including the maturity date and will repay all PIK Amounts added to the outstanding principal amount of the GAMCO Note, in cash, on the fifth anniversary of the date on which each such PIK Amount was added to the outstanding principal amount of the GAMCO Note. In no event may any interest be paid in kind subsequent to November 30, 2019. GAMCO may prepay the GAMCO Note prior to maturity without penalty.

In addition, AC Group, through its majority-owned GSI subsidiary, owns 4,393,055 shares of GAMCO Class A common stock (the “Shares”). The sale was made from GAMCO to GSI in advance of the spin-off. GSI paid the purchase price by issuing a note to GAMCO in the principal amount of $150 million (the “GSI Note”). In connection with the spin-off, AC Group received the GSI Note from GAMCO and GSI became a majority-owned subsidiary of AC Group.

10

Basis of Presentation

The unaudited interim condensed combined financial statements of AC Group included herein have been prepared in conformity with generally accepted accounting principles (“GAAP”) in the United States for interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, they do not include all the information and footnotes required by U.S. GAAP in the United States for complete financial statements. In the opinion of management, the unaudited interim condensed Combined financial statements reflect all adjustments, which are of a normal recurring nature, necessary for a fair presentation of financial position, results of operations and cash flows of the Company for the interim periods presented and are not necessarily indicative of a full year’s results.

The interim condensed combined financial statements include the accounts of AC Group and its subsidiaries. Intercompany accounts and transactions are eliminated.

These interim condensed combined financial statements should be read in conjunction with our audited combined financial statements included in our Registration Statement on Form 10 for the year ended December 31, 2014 from which the accompanying condensed combined financial statements were derived.

Use of Estimates

The preparation of the interim condensed combined financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported on the interim condensed combined financial statements and accompanying notes. Actual results could differ from those estimates.

Recent Accounting Developments

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-09, "Revenue from Contracts with Customers," which supersedes the revenue recognition requirements in the Accounting Standards Codification ("Codification") Topic 605, Revenue Recognition, and most industry-specific guidance throughout the industry topics of the Codification. The core principle of the new ASU No. 2014-09 is for companies to recognize revenue from the transfer of goods or services to customers in amounts that reflect the consideration to which the company expects to be entitled in exchange for those goods or services. The new standard provides a five-step approach to be applied to all contracts with customers and also requires expanded disclosures about revenue recognition. The ASU is effective for annual reporting periods beginning after December 15, 2017, including interim periods and is to be retrospectively applied. Early adoption is not permitted. The Company is currently evaluating this guidance and the impact it will have on its combined financial statements.

In June 2014, the FASB issued an accounting update clarifying that entities should treat performance targets that could be met after the requisite service period of a share-based payment award as performance conditions that affect vesting. Therefore, an entity would not record compensation expense (measured as of the grant date) for an award where transfer to the employee is contingent upon satisfaction of the performance target until it becomes probable that the performance target will be met. The guidance is effective for the Company beginning January 1, 2016. Early adoption is permitted. This guidance is not expected to have a material impact on the Company’s combined financial statements.

In February 2015, the FASB issued an accounting update amending the consolidation requirements under GAAP. This guidance is effective for the Company beginning January 1, 2016. Early adoption is permitted. The Company is continuing to analyze the impact, if any, that this update may have on its combined financial statements.

In May 2015, the FASB issued new guidance amending the current disclosure requirements for investments in certain entities that calculate net asset value per share. The guidance requires investments for which fair value is measured using the net asset value per share practical expedient be removed from the fair value hierarchy. Instead, those investment amounts shall be provided as a separate item to permit reconciliation of the fair value of investments included in the fair value hierarchy to the line items presented in the statement of financial condition. This new guidance will be effective for the Company’s first quarter of 2016. The Company is currently evaluating the potential impact on its combined financial statements and related disclosures.

11

B. Investment in Securities

Investments in securities at September 30, 2015, December 31, 2014 and September 30, 2014 consisted of the following:

|

|

September 30, 2015

|

December 31, 2014

|

September 30, 2014

|

|||||||||||||||||||||

|

|

Cost

|

Fair Value

|

Cost

|

Fair Value

|

Cost

|

Fair Value

|

||||||||||||||||||

|

|

(In thousands)

|

|||||||||||||||||||||||

|

Trading securities:

|

||||||||||||||||||||||||

|

Government obligations

|

$

|

-

|

$

|

-

|

$

|

18,994

|

$

|

18,996

|

$

|

20,995

|

$

|

20,999

|

||||||||||||

|

Common stocks

|

78,025

|

87,745

|

170,977

|

195,029

|

167,714

|

190,939

|

||||||||||||||||||

|

Mutual funds

|

2,504

|

3,180

|

2,432

|

3,498

|

2,416

|

3,373

|

||||||||||||||||||

|

Other investments

|

505

|

723

|

743

|

1,704

|

753

|

1,550

|

||||||||||||||||||

|

Total trading securities

|

81,034

|

91,648

|

193,146

|

219,227

|

191,878

|

216,861

|

||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Available for sale securities:

|

||||||||||||||||||||||||

|

Mutual funds

|

627

|

1,174

|

681

|

1,368

|

681

|

1,389

|

||||||||||||||||||

|

Total available for sale securities

|

627

|

1,174

|

681

|

1,368

|

681

|

1,389

|

||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Total investments in securities

|

$

|

81,661

|

$

|

92,822

|

$

|

193,827

|

$

|

220,595

|

$

|

192,559

|

$

|

218,250

|

||||||||||||

Securities sold, not yet purchased at September 30, 2015, December 31, 2014 and September 30, 2014 consisted of the following:

|

|

September 30, 2015

|

December 31, 2014

|

September 30, 2014

|

|||||||||||||||||||||

|

|

Proceeds

|

Fair Value

|

Proceeds

|

Fair Value

|

Proceeds

|

Fair Value

|

||||||||||||||||||

|

Trading securities:

|

(In thousands)

|

|||||||||||||||||||||||

|

Common stocks

|

$

|

6,123

|

$

|

5,482

|

$

|

9,835

|

$

|

9,960

|

$

|

11,699

|

$

|

13,514

|

||||||||||||

|

Other investments

|

8

|

95

|

1

|

635

|

71

|

666

|

||||||||||||||||||

|

Total securities sold, not yet purchased

|

$

|

6,131

|

$

|

5,577

|

$

|

9,836

|

$

|

10,595

|

$

|

11,770

|

$

|

14,180

|

||||||||||||

Investments in sponsored registered investment companies at September 30, 2015, December 31,2014 and September 30, 2014 consisted of the following:

|

|

September 30, 2015

|

December 31, 2014

|

September 30, 2014

|

|||||||||||||||||||||

|

|

Cost

|

Fair Value

|

Cost

|

Fair Value

|

Cost

|

Fair Value

|

||||||||||||||||||

|

|

(In thousands)

|

|||||||||||||||||||||||

|

Trading securities:

|

||||||||||||||||||||||||

|

Mutual funds

|

$

|

40,097

|

$

|

41,820

|

$

|

1

|

$

|

1

|

$

|

1

|

$

|

1

|

||||||||||||

|

Total trading securities

|

40,097

|

41,820

|

1

|

1

|

1

|

1

|

||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Available for sale securities:

|

||||||||||||||||||||||||

|

Closed-end funds

|

63,068

|

70,349

|

21,962

|

36,323

|

21,819

|

36,142

|

||||||||||||||||||

|

Mutual funds

|

1,883

|

2,877

|

1,898

|

3,213

|

1,922

|

3,377

|

||||||||||||||||||

|

Total available for sale securities

|

64,951

|

73,226

|

23,860

|

39,536

|

23,741

|

39,519

|

||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Total investments in registered

|

||||||||||||||||||||||||

|

investment companies

|

$

|

105,048

|

$

|

115,046

|

$

|

23,861

|

$

|

39,537

|

$

|

23,742

|

$

|

39,520

|

||||||||||||

Management determines the appropriate classification of debt and equity securities at the time of purchase and reevaluates such designation as of the date of each combined statement of financial condition. Investments in United States Treasury Bills and Notes with maturities of greater than three months at the time of purchase are classified as investments in securities, and those with maturities of three months or less at the time of purchase are classified as cash equivalents. The portion of investments in securities held for resale in anticipation of short-term market movements are classified as trading securities. Trading securities are stated at fair value, with any unrealized gains or losses reported in current period earnings. Available for sale (“AFS”) investments are stated at fair value, with any unrealized gains or losses, net of taxes, reported as a component of equity except for losses deemed to be other than temporary (“OTT”) which are recorded as realized losses in the condensed combined statements of operations.

12

The following table identifies all reclassifications out of accumulated other comprehensive income ("AOCI") into income for the three and nine months ended September 30, 2015 and 2014 (in thousands):

|

Amount

|

Affected Line Items

|

Reason for

|

|||||||

|

Reclassified

|

in the Statements

|

Reclassification

|

|||||||

|

from AOCI

|

Of Income

|

from AOCI

|

|||||||

|

Three months ended September 30,

|

|

|

|||||||

|

2015

|

2014

|

||||||||

|

$

|

-

|

$

|

316

|

Net gain/(loss) from investments

|

Realized gain on sale of AFS securities

|

||||

|

(150

|

)

|

-

|

Net gain/(loss) from investments

|

OTT impairment of AFS securities

|

|||||

|

(150

|

)

|

316

|

Income before income taxes

|

|

|||||

|

56

|

(117

|

)

|

Income tax provision

|

|

|||||

|

$

|

(94

|

)

|

$

|

199

|

Net income/(loss)

|

|

|||

|

Amount

|

Affected Line Items

|

Reason for

|

|||||||

|

Reclassified

|

in the Statements

|

Reclassification

|

|||||||

|

from AOCI

|

Of Income

|

from AOCI

|

|||||||

|

Nine months ended September 30,

|

|||||||||

|

2015

|

2014

|

||||||||

|

$

|

25

|

$

|

2,978

|

Net gain/(loss) from investments

|

Realized gain on sale of AFS securities

|

||||

|

-

|

53

|

Other operating expenses/net gain from investments

|

Realized gain on donation of AFS securities

|

||||||

|

(150

|

)

|

(69

|

)

|

Net gain/(loss) from investments

|

OTT impairment of AFS securities

|

||||

|

(125

|

)

|

2,962

|

Income before income taxes

|

||||||

|

46

|

(1,094

|

)

|

Income tax provision

|

||||||

|

$

|

(79

|

)

|

$

|

1,868

|

Net income/(loss)

|

||||

|

|

|

||||||||

The Company recognizes all equity derivatives as either assets or liabilities measured at fair value and includes them in either investments in securities or securities sold, not yet purchased on the condensed combined statements of financial condition. From time to time, the Company and/or the partnerships and offshore funds that the Company consolidates will enter into hedging transactions to manage their exposure to foreign currencies and equity prices related to their proprietary investments. At September 30, 2015, December 31, 2014 and September 30, 2014, we held derivative contracts on 170,000 equity shares, 3.8 million equity shares and 2.3 million equity shares, respectively, that are included in investments in securities or securities sold, not yet purchased on the condensed combined statements of financial condition. We had two foreign exchange contracts, one foreign exchange contract and one foreign exchange contract outstanding at September 30, 2015, December 31, 2014 and September 30, 2014, respectively, that are included in receivable from brokers or payable to brokers on the condensed combined statements of financial condition. Aside from one foreign exchange contract, these transactions are not designated as hedges for accounting purposes, and therefore changes in fair values of these derivatives are included in net gain/(loss) from investments on the condensed combined statements of operations. The one foreign exchange contract that is designated as a hedge was for a short of British Pounds to hedge the long investment that we have in our London Stock Exchange listed Gabelli Value Plus+ Trust Ltd. closed-end fund which is denominated in British Pounds. As the underlying investment that is being hedged is an available for sale security, the portion of the change in value of the closed-end fund that is currency related is recorded in net gain/(loss) from investments on the condensed combined statements of operations and not in accumulated comprehensive income.

13

The following tables identify the fair values and gains and losses of all derivatives held by the Company (in thousands):

|

|

|

Asset Derivatives Fair Value

|

|

Liability Derivatives Fair Value

|

||||||||||||||||||||||

|

Statement of Financial Condition Location

|

September 30, 2015

|

December 31, 2014

|

September 30, 2014

|

Statement of Financial Condition Location

|

September 30, 2015

|

December 31, 2014

|

September 30, 2014

|

|||||||||||||||||||

|

Derivatives designated as hedging instruments under FASB ASC 815-20

|

|

|||||||||||||||||||||||||

|

Foreign exchange contracts

|

Receivable from brokers

|

$

|

-

|

$

|

-

|

$

|

-

|

Payable to brokers

|

$

|

36,354

|

$

|

-

|

$

|

-

|

||||||||||||

|

Sub total

|

|

$

|

-

|

$

|

-

|

$

|

-

|

|

$

|

36,354

|

$

|

-

|

$

|

-

|

||||||||||||

|

Derivatives Not Designated As Hedging Instruments Under Fasb Asc 815-20

|

|

|||||||||||||||||||||||||

|

Equity contracts

|

Investments in securities

|

$

|

143

|

$

|

896

|

$

|

800

|

Securities sold, not yet purchased

|

$

|

95

|

$

|

635

|

$

|

666

|

||||||||||||

|

Foreign exchange contracts

|

Receivable from brokers

|

-

|

-

|

-

|

Payable to brokers

|

5,172

|

5,470

|

6,343

|

||||||||||||||||||

|

Sub total

|

|

$

|

143

|

$

|

896

|

$

|

800

|

|

$

|

5,267

|

$

|

6,105

|

$

|

7,009

|

||||||||||||

|

Total derivatives

|

|

$

|

143

|

$

|

896

|

$

|

800

|

|

$

|

41,621

|

$

|

6,105

|

$

|

7,009

|

||||||||||||

|

Type of Derivative

|

Income Statement Location

|

Three Months ended September 30,

|

Nine Months ended September 30,

|

||||||||||||||

|

|

|

2015

|

2014

|

2015

|

2014

|

||||||||||||

|

Foreign exchange contracts

|

Net gain/(loss) from investments

|

$

|

1,985

|

$

|

482

|

$

|

1,885

|

$

|

541

|

||||||||

|

Equity contracts

|

Net gain/(loss) from investments

|

27

|

758

|

199

|

591

|

||||||||||||

|

Total

|

|

$

|

2,012

|

$

|

1,240

|

$

|

2,084

|

$

|

1,132

|

||||||||

The Company is a party to enforceable master netting arrangements for swaps entered into as part of the investment strategy of the Company’s proprietary portfolio. They are typically not used as hedging instruments. These swaps, while settled on a net basis with the counterparties, major U.S. financial institutions, are shown gross in assets and liabilities on the condensed combined statements of financial condition. The swaps have a firm contract end date and are closed out and settled when each contract expires.

|

Gross Amounts Not Offset in the

|

||||||||||||||||||||||||

|

Statements of Financial Condition

|

||||||||||||||||||||||||

|

Gross

|

Gross Amounts

|

Net Amounts of

|

||||||||||||||||||||||

|

Amounts of

|

Offset in the

|

Assets Presented

|

||||||||||||||||||||||

|

Recognized

|

Statements of

|

in the Statements of

|

Financial

|

Cash Collateral

|

||||||||||||||||||||

|

Assets

|

Financial Condition

|

Financial Condition

|

Instruments

|

Received

|

Net Amount

|

|||||||||||||||||||

|

Swaps:

|

(In thousands)

|

|||||||||||||||||||||||

|

September 30, 2015

|

$

|

143

|

$

|

-

|

$

|

143

|

$

|

(89

|

)

|

$

|

-

|

$

|

54

|

|||||||||||

|

December 31, 2014

|

896

|

-

|

896

|

(634

|

)

|

-

|

262

|

|||||||||||||||||

|

September 30, 2014

|

$

|

800

|

$

|

-

|

$

|

800

|

$

|

(657

|

)

|

$

|

-

|

$

|

143

|

|||||||||||

|

Gross Amounts Not Offset in the

|

||||||||||||||||||||||||

|

Statements of Financial Condition

|

||||||||||||||||||||||||

|

Gross

|

Gross Amounts

|

Net Amounts of

|

||||||||||||||||||||||

|

Amounts of

|

Offset in the

|

Liabilities Presented

|

||||||||||||||||||||||

|

Recognized

|

Statements of

|

in the Statements of

|

Financial

|

Cash Collateral

|

||||||||||||||||||||

|

Liabilities

|

Financial Condition

|

Financial Condition

|

Instruments

|

Pledged

|

Net Amount

|

|||||||||||||||||||

|

Swaps:

|

(In thousands)

|

|||||||||||||||||||||||

|

September 30, 2015

|

$

|

89

|

$

|

-

|

$

|

89

|

$

|

(89

|

)

|

$

|

-

|

$

|

-

|

|||||||||||

|

December 31, 2014

|

634

|

-

|

634

|

(634

|

)

|

-

|

-

|

|||||||||||||||||

|

September 30, 2014

|

$

|

657

|

$

|

-

|

$

|

657

|

$

|

(657

|

)

|

$

|

-

|

$

|

-

|

|||||||||||

14

The following is a summary of the cost, gross unrealized gains, gross unrealized losses and fair value of available for sale investments as of September 30, 2015, December 31, 2014 and September 30, 2014:

|

|

September 30, 2015

|

|||||||||||||||

|

Gross

|

Gross

|

|||||||||||||||

|

Unrealized

|

Unrealized

|

|||||||||||||||

|

|

Cost

|

Gains

|

Losses

|

Fair Value

|

||||||||||||

|

|

(In thousands)

|

|||||||||||||||

|

Closed-end Funds

|

63,068

|

10,128

|

(2,847

|

)

|

70,349

|

|||||||||||

|

Mutual funds

|

2,510

|

1,620

|

(79

|

)

|

4,051

|

|||||||||||

|

Total available for sale securities

|

$

|

65,578

|

$

|

11,748

|

$

|

(2,926

|

)

|

$

|

74,400

|

|||||||

|

|

December 31, 2014

|

|||||||||||||||

|

Gross

|

Gross

|

|||||||||||||||

|

Unrealized

|

Unrealized

|

|||||||||||||||

|

|

Cost

|

Gains

|

Losses

|

Fair Value

|

||||||||||||

|

|

(In thousands)

|

|||||||||||||||

|

Closed-end Funds

|

21,962

|

14,398

|

(37

|

)

|

36,323

|

|||||||||||

|

Mutual funds

|

2,579

|

2,030

|

(28

|

)

|

4,581

|

|||||||||||

|

Total available for sale securities

|

$

|

24,541

|

$

|

16,428

|

$

|

(65

|

)

|

$

|

40,904

|

|||||||

|

|

September 30, 2014

|

|||||||||||||||

|

Gross

|

Gross

|

|||||||||||||||

|

Unrealized

|

Unrealized

|

|||||||||||||||

|

|

Cost

|

Gains

|

Losses

|

Fair Value

|

||||||||||||

|

|

(In thousands)

|

|||||||||||||||

|

Closed-end Funds

|

21,819

|

14,325

|

(2

|

)

|

36,142

|

|||||||||||

|

Mutual funds

|

2,603

|

2,163

|

-

|

4,766

|

||||||||||||

|

Total available for sale securities

|

$

|

24,422

|

$

|

16,488

|

$

|

(2

|

)

|

$

|

40,908

|

|||||||

Changes in net unrealized losses, net of taxes, for the three months ended September 30, 2015 and September 30, 2014 of ($4.6) million in losses and ($1.0) million in losses, respectively, have been included in other comprehensive income, a component of equity, at September 30, 2015 and September 30, 2014. Return of capital on available for sale securities was $0.3 million and $0.3 million for the three months ended September 30, 2015 and September 30, 2014, respectively. During the three months ended September 30, 2015, there were no proceeds from the sales of investments available for sale and no gross gains on the sale of investments available for sale. Proceeds from sales of investments available for sale were approximately $0.5 million for the three months ended September 30, 2014. For the three months ended September 30, 2014, gross gains on the sale of investments available for sale amounted to $0.3 million and were reclassified from other comprehensive income into net gain from investments in the condensed combined statements of operations. There were no losses on the sale of investments available for sale for the three months ended September 30, 2015 or September 30, 2014. Changes in net unrealized losses, net of taxes, for the nine months ended September 30, 2015 and September 30, 2014 of $(4.4) million in losses and $(2.1) million in losses, respectively, have been included in other comprehensive income, a component of equity, at September 30, 2015 and September 30, 2014. Return of capital on available for sale securities was $0.6 million and $0.8 million for the nine months ended September 30, 2015 and September 30, 2014, respectively. Proceeds from sales of investments available for sale were approximately $1.0 million and $4.7 million for the nine months ended September 30, 2015 and September 30, 2014, respectively. For the nine months ended September 30, 2015 and September 30, 2014, gross gains on the sale of investments available for sale amounted to $25,000 and $3.0 million, respectively, and were reclassified from other comprehensive income into net gain from investments in the condensed combined statements of operations. There were no losses on the sale of investments available for sale for the nine months ended September 30, 2015 or September 30, 2014. The basis on which the cost of a security sold is determined using specific identification.

15

Investments classified as available for sale that are in an unrealized loss position for which other-than-temporary impairment has not been recognized consisted of the following:

|

|

September 30, 2015

|

December 31, 2014

|

September 30, 2014

|

|||||||||||||||||||||||||||||||||

|

Unrealized

|

Unrealized

|

Unrealized

|

||||||||||||||||||||||||||||||||||

|

|

Cost

|

Losses

|

Fair Value

|

Cost

|

Losses

|

Fair Value

|

Cost

|

Losses

|

Fair Value

|

|||||||||||||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||||||||||||||||||

|

Closed-end Funds

|

$

|

40,537

|

$

|

(2,847

|

)

|

$

|

37,690

|

$

|

812

|

$

|

(37

|

)

|

$

|

775

|

$

|

79

|

$

|

(2

|

)

|

$

|

77

|

|||||||||||||||

|

Mutual Funds

|

303

|

(79

|

)

|

224

|

303

|

(28

|

)

|

275

|

-

|

-

|

-

|

|||||||||||||||||||||||||

|

Total available for sale securities

|

$

|

40,840

|

$

|

(2,926

|

)

|

$

|

37,914

|

$

|

1,115

|

$

|

(65

|

)

|

$

|

1,050

|

$

|

79

|

$

|

(2

|

)

|

$

|

77

|

|||||||||||||||

At September 30, 2015, there were four holdings in loss positions which were not deemed to be other-than-temporarily impaired due to the length of time that they had been in a loss position and because they passed scrutiny in our evaluation of issuer-specific and industry-specific considerations. In these specific instances, the investments at September 30, 2015 were mutual funds and closed-end funds with diversified holdings across multiple companies and across multiple industries. One holding was impaired for two months, one holding was impaired for three months, one holding was impaired for seven months and one holding was impaired for eight months at September 30, 2015. The value of these holdings at September 30, 2015 was $37.9 million.

At December 31, 2014, there were four holdings in loss positions which were not deemed to be other-than-temporarily impaired due to the length of time that they had been in a loss position and because they passed scrutiny in our evaluation of issuer-specific and industry-specific considerations. In these specific instances, the investments at December 31, 2014 were mutual funds and closed-end funds with diversified holdings across multiple companies and across multiple industries. One holding was impaired for one month, one for three months and two for four months at December 31, 2014. The value of these holdings at December 31, 2014 was $1.1 million.

At September 30, 2014, there was one holding in a loss position which was not deemed to be other-than-temporarily impaired due to the length of time that it had been in a loss position and because it passed scrutiny in our evaluation of issuer-specific and industry-specific considerations. In this specific instance, the investment at September 30, 2014 was a closed-end fund with diversified holdings across multiple companies and across multiple industries. The one holding was impaired for one month at September 30, 2014. The value of this holding at September 30, 2014 was $0.1 million.

For the three months ended September 30, 2015 there were $150,000 of losses on available for sale securities deemed to be other than temporary and a loss has been recorded in net gain from investments. There were no losses recognized on AFS securities for the three months ended September 30, 2014. For the nine months ended September 30, 2015 and September 30, 2014, there were $150,000 and $69,000, respectively, of losses on available for sale securities deemed to be other than temporary and a loss has been recorded in net gain from investments.

16

C. Fair Value

The following tables present information about the Company’s assets and liabilities by major categories measured at fair value on a recurring basis as of September 30, 2015, December 31, 2014 and September 30, 2014 and indicates the fair value hierarchy of the valuation techniques utilized by the Company to determine such fair value:

Assets and Liabilities Measured at Fair Value on a Recurring Basis as of September 30, 2015 (in thousands)

|

Quoted Prices in Active

|

Significant Other

|

Significant

|

Balance as of

|

|||||||||||||

|

Markets for Identical

|

Observable

|

Unobservable

|

September 30,

|

|||||||||||||

|

Assets

|

Assets (Level 1)

|

Inputs (Level 2)

|

Inputs (Level 3)

|

2015

|

||||||||||||

|

Cash equivalents

|

$

|

362,955

|

$

|

-

|

$

|

-

|

$

|

362,955

|

||||||||

|

Investments in partnerships

|

-

|

14,319

|

-

|

14,319

|

||||||||||||

|

Investments in securities:

|

||||||||||||||||

|

AFS - Mutual funds

|

1,174

|

-

|

-

|

1,174

|

||||||||||||

|

Trading - Gov't obligations

|

||||||||||||||||

|

Trading - Common stocks

|

86,970

|

-

|

775

|

87,745

|

||||||||||||

|

Trading - Mutual funds

|

3,180

|

-

|

-

|

3,180

|

||||||||||||

|

Trading - Other

|

263

|

143

|

317

|

723

|

||||||||||||

|

Total investments in securities

|

91,587

|

143

|

1,092

|

92,822

|

||||||||||||

|

Investments in sponsored registered investment companies:

|

||||||||||||||||

|

AFS - Closed-end Funds

|

70,349

|

-

|

-

|

70,349

|

||||||||||||

|

AFS - Mutual Funds

|

2,877

|

-

|

-

|

2,877

|

||||||||||||

|

Trading - Mutual funds

|

41,820

|

-

|

-

|

41,820

|

||||||||||||

|

Total investments in sponsored

|

||||||||||||||||

|

registered investment companies

|

115,046

|

-

|

-

|

115,046

|

||||||||||||

|

Total investments

|

206,633

|

14,462

|

1,092

|

222,187

|

||||||||||||

|

Total assets at fair value

|

$

|

569,588

|

$

|

14,462

|

$

|

1,092

|

$

|

585,142

|

||||||||

|

Liabilities

|

||||||||||||||||

|

Trading - Common stocks

|

$

|

5,482

|

$

|

-

|

$

|

-

|

$

|

5,482

|

||||||||

|

Trading - Other

|

-

|

95

|

-

|

95

|

||||||||||||

|

Securities sold, not yet purchased

|

$

|

5,482

|

$

|

95

|

$

|

-

|

$

|

5,577

|

||||||||

17

Assets and Liabilities Measured at Fair Value on a Recurring Basis as of December 31, 2014 (in thousands)

|

Quoted Prices in Active

|

Significant Other

|

Significant

|

Balance as of

|

|||||||||||||

|

Markets for Identical

|

Observable

|

Unobservable

|

December 31,

|

|||||||||||||

|

Assets

|

Assets (Level 1)

|

Inputs (Level 2)

|

Inputs (Level 3)

|

2014

|

||||||||||||

|

Cash equivalents

|

$

|

285,504

|

$

|

-

|

$

|

-

|

$

|

285,504

|

||||||||

|

Investments in partnerships

|

-

|

23,803

|

-

|

23,803

|

||||||||||||

|

Investments in securities:

|

||||||||||||||||

|

AFS - Mutual funds

|

1,368

|

-

|

-

|

1,368

|

||||||||||||

|

Trading - Gov't obligations

|

18,996

|

-

|

-

|

18,996

|

||||||||||||

|

Trading - Common stocks

|

193,735

|

1

|

1,293

|

195,029

|

||||||||||||

|

Trading - Mutual funds

|

3,498

|

-

|

-

|

3,498

|

||||||||||||

|

Trading - Other

|

513

|

897

|

294

|

1,704

|

||||||||||||

|

Total investments in securities

|

218,110

|

898

|

1,587

|

220,595

|

||||||||||||

|

Investments in sponsored registered investment companies:

|

||||||||||||||||

|

AFS - Closed-end Funds

|

36,323

|

-

|

-

|

36,323

|

||||||||||||

|

AFS - Mutual Funds

|

3,213

|

-

|

-

|

3,213

|

||||||||||||

|

Trading - Mutual funds

|

1

|

-

|

-

|

1

|

||||||||||||

|

Total investments in sponsored

|

||||||||||||||||

|

registered investment companies

|

39,537

|

-

|

-

|

39,537

|

||||||||||||

|

Total investments

|

257,647

|

24,701

|

1,587

|

283,935

|

||||||||||||

|

Total assets at fair value

|

$

|

543,151

|

$

|

24,701

|

$

|

1,587

|

$

|

569,439

|

||||||||

|

Liabilities

|

||||||||||||||||

|

Trading - Common stocks

|

$

|

9,960

|

$

|

-

|

$

|

-

|

$

|

9,960

|

||||||||

|

Trading - Other

|

-

|

635

|

-

|

635

|

||||||||||||

|

Securities sold, not yet purchased

|

$

|

9,960

|

$

|

635

|

$

|

-

|

$

|

10,595

|

||||||||

Assets and Liabilities Measured at Fair Value on a Recurring Basis as of September 30, 2014 (in thousands)

|

Quoted Prices in Active

|

Significant Other

|

Significant

|

Balance as of

|

|||||||||||||

|

Markets for Identical

|

Observable

|

Unobservable

|

September 30,

|

|||||||||||||

|

Assets

|

Assets (Level 1)

|

Inputs (Level 2)

|

Inputs (Level 3)

|

2014

|

||||||||||||

|

Cash equivalents

|

$

|

346,093

|

$

|

-

|

$

|

-

|

$

|

346,093

|

||||||||

|

Investments in partnerships

|

-

|

24,094

|

-

|

24,094

|

||||||||||||

|

Investments in securities:

|

||||||||||||||||

|

AFS - Mutual funds

|

1,389

|

-

|

-

|

1,389

|

||||||||||||

|

Trading - Gov't obligations

|

20,999

|

-

|

-

|

20,999

|

||||||||||||

|

Trading - Common stocks

|

190,215

|

-

|

724

|

190,939

|

||||||||||||

|

Trading - Mutual funds

|

3,373

|

-

|

-

|

3,373

|

||||||||||||

|

Trading - Other

|

453

|

803

|

294

|

1,550

|

||||||||||||

|

Total investments in securities

|

216,429

|

803

|

1,018

|

218,250

|

||||||||||||

|