Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION - 1ST SOURCE CORP | srce-8kx121515investorpres.htm |

INVESTOR PRESENTATION Symbol: SRCE www.1stsource.com

DISCLAIMER Forward Looking Statements Except for historical information, the matters discussed may include “forward-looking statements”. Generally, words such as “believe”, “possible”, “expect”, “intend”, “estimate”, “anticipate”, “project”, “will”, “contemplate”, “seek”, “plan”, “assume”, “targeted”, “continue”, “remain”, “should”, “indicate”, “would”, and “may” indicate forward-looking statements. Those statements are subject to material risks and uncertainties. 1st Source cautions readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. 1st Source may make other written or oral forward-looking statements from time to time. The audience is advised that various important factors could cause 1st Source’s actual results or circumstances for future periods to differ materially from those anticipated or projected in such forward-looking statements. Such factors, among others, include changes in laws, regulations or accounting principles generally accepted in the United States; 1st Source’s competitive position within its markets served; increasing consolidation within the banking industry; unforeseen changes in interest rates; unforeseen downturns in the local, regional or national economies or in the industries in which 1st Source has credit concentrations; and other risks discussed in 1st Source’s filings with the Securities and Exchange Commission (SEC), including its Annual Report on Form 10-K, which filings are available from the SEC. 1st Source undertakes no obligation to publicly update or revise any forward-looking statements. 2

FRANCHISE OVERVIEW 3

1st SOURCE CORPORATION (SRCE) $5.1 billion Community Bank with International Reach Headquartered in South Bend, IN, offering community banking services throughout Northern Indiana and Southwest Michigan, as well as operating a national and international specialty finance platform Diversified business model offering a comprehensive range of consumer and commercial banking services • Community Banking ($2.0B in loans): ― Personal and business banking, payment services, lending, mortgage, and leasing ― Investment management, trust and estate planning, and retirement planning services ― Business and consumer insurance sales • Specialty Finance ($1.9B in loans): ― Auto rental and leasing, shuttle buses, and funeral cars ― Truck rental and leasing, and environmental equipment ― Construction machinery ― Personal and corporate aircraft Company Overview Financial Highlights (2) Nonperforming assets include loans and leases past due over 90 days, nonaccrual loans and leases, other real estate, former bank premises held for sale, repossessions and other nonperforming assets we own. 4 Full Year Nine Months (dollars in thousands) 2014 9/30/15 Balance Sheet Total Assets $ 4,829,958 $ 5,105,584 Total Gross Loans 3,688,574 3,955,550 Total Deposits 3,802,860 4,019,156 Total Equity 614,473 639,221 Profitability Net Income $58,069 $43,069 Return on Average Assets 1.21% 1.16% Net Interest Margin 3.59% 3.60% Nonint. Inc./ Total Rev. 32.7% 33.6% Efficiency Ratio 60.6% 60.6% Capital Common Equity Tier 1 Ratio NA% 12.48% Total Risk Based Capital Ratio 15.89% 15.08% Tang. Book Value Per Share(1) $20.16 $21.26 Asset Quality NPAs / Assets(2) 0.88% 0.53% Reserves / Loans and Leases 2.31% 2.22% Reserves / NPLs 239% 452% (1) Adjusted for 10% stock dividend declared July 22, 2015 and issued on August 14, 2015.

DIFFERENTIATED OPERATING STRATEGY Specialty Finance Loans: $1.9 billion Community Bank Loans: $2.0 billion September 30, 2015 YTD Averages Deeply Ingrained Community Banking Footprint with an International Specialty Finance Platform 5

BUSINESS MIX (LOANS AND LEASES) Loan Portfolio (9/30/15) Specialty Finance Loans (9/30/15) 51% Community Banking 6 Specialty Finance $1.9B 49% Personal Community Banking $0.6B 15% Business Community Banking $1.4B 36% Aircraft financing $794M 41% Auto and light truck $423M 22% Construction eq ipment financing $450M 23% Medium and heavy duty truck $265M 14%

COMMUNITY BANKING FOOTPRINT Market Households 788,652 Client Households 99,897 Penetration 12.7% Businesses (approx) 74,600 Business Clients 14,545 Penetration 19.5% As of December 31, 2014 ■ 81 Banking Centers ■ 100 Twenty-four hour ATMs ■ 10 1st Source Insurance offices ■ 8 Trust & Wealth Management locations with approximately $3.8 billion of AUM Locations 17 County Market 7

COMMUNITY BANKING RECOGNITION #1 deposit share in our 15 contiguous county market Best Branch Service in the Midwest – MSR Group Best Bank for Business – Northwest Indiana Business Quarterly Best Bank for Obtaining a Business Loan – Northwest Indiana Business Quarterly A Top Bank – Post-Tribune’s Neighbors’ Choice Awards A Favorite Bank – Readers of Elkhart Truth Highest Customer Advocacy Score among Midwest banks – APECS, 2014 & 2015 Leading Market Share Leading SBA Platform Exceptional Customer Service & Experience #1 SBA Lender in every county where located #2 SBA Lender in State of Indiana SBA Great Lakes Community Lender of the Year – 2014 Indiana SBA Community Lender Award – 2014 8

SPECIALTY FINANCE GROUP SERVICES Aircraft Financing — $794MM Aircraft financing primarily for new and used general aviation aircraft (including helicopters) for private and corporate users, some for aircraft distributors and dealers, air charter operators, air cargo carriers, and other aircraft operators Auto and Light Truck Division — $423MM Auto/light truck financing for automobile rental and leasing companies, light truck rental and leasing companies, and special purpose vehicle users: shuttle buses, funeral cars, etc. Construction Equipment Financing — $450MM Construction equipment financing for infrastructure projects (i.e., asphalt and concrete plants, bulldozers, excavators, cranes, and loaders, etc.) Medium and Heavy Duty Truck Division — $265MM The medium and heavy duty truck division finances highway tractors and trailers and delivery trucks for the commercial trucking industry and trash and recycling equipment for municipalities and private businesses as well as equipment for landfills As of 9/30/15 9

EXPERIENCED AND PROVEN TEAM Executive Team ■ 7 executives with an average 37 years each of banking experience and 24 years with 1st Source Business Banking Officers ■ 39 business banking officers with an average 23 years each of lending experience and 12 years with 1st Source Specialty Finance Group Officers ■ 26 specialty finance group officers with an average 28 years each of lending experience and 12 years with 1st Source 10

FINANCIAL REVIEW 11

3rd QUARTER RESULTS SUMMARY ■ Net income of $13.9 million, or $0.53 per diluted common share, and a return on average assets of 1.09% ■ Loans and leases grew by approximately $102.9 million, or 11% annualized ■ Net interest margin remained stable at 3.57% ■ Noninterest income of $21.1 million, or approximately 33% of total revenue ■ Noninterest expense of $41.1 million, with an efficiency ratio of approximately 62% ■ Credit quality remained strong with NPAs / loans and leases of 0.66% ■ Solid capital position with Common Equity Tier 1 of 12.5% ■ Approved a cash dividend of $0.18 per share on October 22, 2015 12

$3,110 $3,079 $3,209 $3,434 $3,640 $3,796 5.53% 5.33% 5.02% 4.69% 4.42% 4.39% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2010 2011 2012 2013 2014 2015 YTD Loans & Leases Yield on Loans & Leases (%) Total Average Loans & Leases ($MM) DIVERSIFIED & GROWING LOAN PORTFOLIO Average Loans By Type (9/30/15) 13

STRONG CREDIT QUALITY % of Net Loans and Leases Loan & Lease Loss Reserve Nonperforming Assets Net Charge-Offs / (Recoveries) 2.83% 2.64% 2.50% 2.35% 2.31% 2.22% 2010 2011 2012 2013 2014 2015 YTD 2.81% 2.28% 1.25% 1.29% 1.13% 0.66% 2010 2011 2012 2013 2014 2015 YTD 0.66% 0.27% 0.13% 0.02% 0.06% (0.01%) 2010 2011 2012 2013 2014 2015 YTD 14 Stable Reserves Improving Credit Quality Limited Losses

ATTRACTIVE CORE DEPOSIT FRANCHISE $3,605 $3,555 $3,574 $3,701 $3,778 $3,914 1.24% 0.87% 0.61% 0.45% 0.30% 0.28% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2010 2011 2012 2013 2014 2015 YTD Deposits Effective Rate on Deposits (%) Total Average Deposits ($MM) Average Deposits by Type (YTD 9/30/15) 15

$41.2 $48.2 $49.6 $55.0 $58.1 $43.1 $43.1 $1.10 $1.78 $1.83 $2.03 $2.17 $1.61 $1.63 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 2010 2011 2012 2013 2014 2014 YTD 2015 YTD Net Income EPCS (Diluted) ($MM) NET INCOME & EARNINGS PER SHARE* * Note: EPCS adjusted for 10% stock dividend declared July 22, 2015 and issued on August 14, 2015. RECORD NET INCOME 16

$150.9 $150.9 $153.8 $158.6 $162.2 $120.9 $124.6 3.59% 3.69% 3.69% 3.67% 3.59% 3.59% 3.60% 0.00% 1.40% 2.80% 4.20% 5.60% 7.00% $0.0 $30.0 $60.0 $90.0 $120.0 $150.0 $180.0 2010 2011 2012 2013 2014 2014 YTD 2015 YTD Net Interest Income ($MM) Net Interest Margin (%) ($MM) STABLE NET INTEREST MARGIN (FTE) 17

DIVERSE SOURCES OF NONINTEREST INCOME Noninterest Income Composition YTD 12/31/14 = $77.9M YTD 9/30/15 = $62.4M Fair Value of Assets Under Management of $4.0B Fair Value of Assets Under Management of $3.8B 33% of Total Revenue 18 34% of Total Revenue

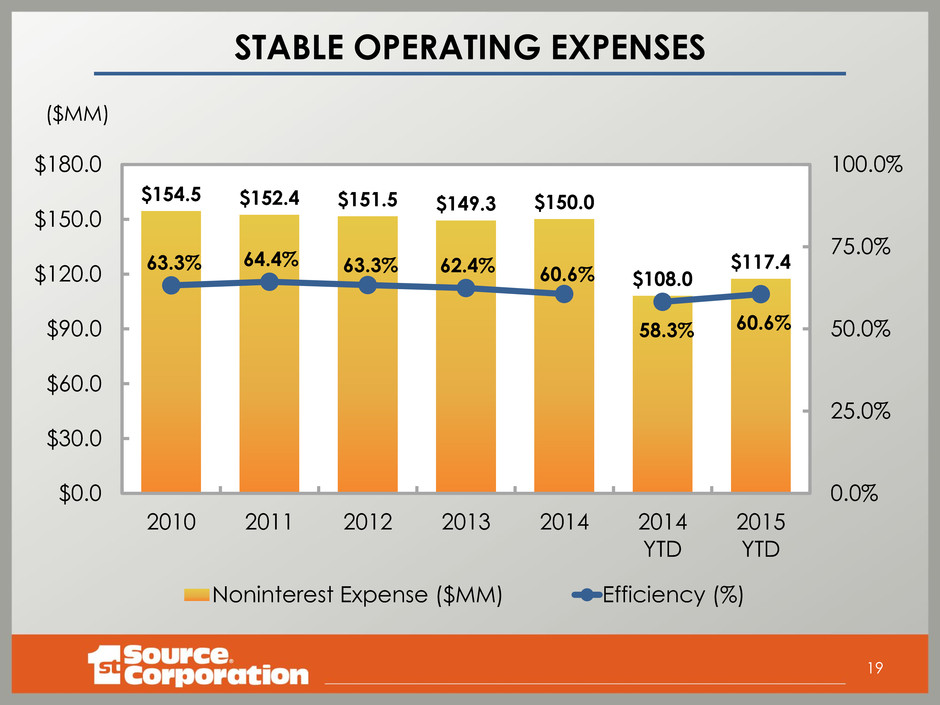

STABLE OPERATING EXPENSES $154.5 $152.4 $151.5 $149.3 $150.0 $108.0 $117.4 63.3% 64.4% 63.3% 62.4% 60.6% 58.3% 60.6% 0.0% 25.0% 50.0% 75.0% 100.0% $0.0 $30.0 $60.0 $90.0 $120.0 $150.0 $180.0 2010 2011 2012 2013 2014 2014 YTD 2015 YTD Noninterest Expense ($MM) Efficiency (%) ($MM) 19

Total Risk Based Capital Ratio Tier 1 Leverage Ratio Tier 1 Risk Based Ratio STRONG CAPITAL POSITION 15.34% 16.51% 15.57% 15.86% 15.89% 15.08% 2010 2011 2012 2013 2014 2015 YTD 10.39% 11.72% 11.47% 12.08% 12.16% 12.23% 2010 2011 2012 2013 2014 2015 YTD 20 Tangible Common Equity / Tangible Assets 9.12% 10.18% 10.56% 10.76% 11.15% 11.04% 2010 2011 2012 2013 2014 2015 YTD 14.05% 15.21% 14.26% 14.54% 14.57% 13.77% 2010 2011 2012 2013 2014 2015 YTD 10% Well Capitalized 5% Well Capitalized 8% Well Capitalized

$13.65 $14.15 $14.95 $16.38 $17.67 $18.65 $20.16 $21.26 $10.00 $15.00 $20.00 $25.00 2008 2009 2010 2011 2012 2013 2014 2015 YTD TANGIBLE BOOK VALUE PER COMMON SHARE* Consistent Growth * Note: Adjusted for 10% stock dividend declared July 22, 2015 and issued on August 14, 2015. 21

DELIVERING RETURNS TO SHAREHOLDERS * As of 12/2/15 (100%) (50%) 0% 50% 100% 150% 12/31/07 12/31/08 12/31/09 12/31/10 12/31/11 12/31/12 12/31/13 12/31/14 SRCE (113%) S&P 500 Bank (-13%) KBW Nasdaq Bank (-15%) SNL U.S. Bank (-9%) KBW Nasdaq Regional Bank (15%) NASDAQ Bank (13%) 22

INVESTMENT CONSIDERATIONS Consistent and superior financial performance with a focus on long- term earnings per share and tangible book value growth Experienced and proven team with significant investment in bank Diversification of product mix and geography with asset generation capability Leading market share in community banking markets Stable credit quality, strongly reserved Strong capital position and 27 consecutive years of dividend growth Balance Sheet is asset sensitive – positioned for rising rates over time 23

APPENDIX 24

DEPOSIT MARKET SHARE – 15 COUNTY CONTIGUOUS MARKET* $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 $4,000,000 $4,500,000 June 09 June 10 June 11 June 12 June 13 June 14 June 15 1st Source Chase Lake City Bank Wells Fargo Fifth Third PNC *Includes Allen, Elkhart, Fulton, Huntington, Kosciusko, LaPorte, Marshall, Porter, Pulaski, St. Joseph, Starke, Wells, and Whitley counties in the State of Indiana, and Berrien and Cass counties in the State of Michigan. 2015 13.66% 9.59% 8.67% 8.04% 5.22% 5.21% Data as of June 2015 – FDIC (via SNL Financial) Leading Market Share in Community Banking Markets ($000) 25

$0.409 $0.482 $0.509 $0.527 $0.536 $0.555 $0.582 $0.600 $0.618 $0.645 $0.671 $0.000 $0.100 $0.200 $0.300 $0.400 $0.500 $0.600 $0.700 $0.800 $0.900 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 YTD COMMON DIVIDENDS PER SHARE* 27 YEARS OF CONSECUTIVE DIVIDEND GROWTH * Note: Adjusted for 10% stock dividend declared July 22, 2015 and issued on August 14, 2015. 26