Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mitesco, Inc. | tnty_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Mitesco, Inc. | ex99_1.htm |

| EX-10.2 - EXHIBIT 10.2 - Mitesco, Inc. | ex10_2.htm |

| EX-10.1 - EXHIBIT 10.1 - Mitesco, Inc. | ex10_1.htm |

Exhibit 3.1

CERTIFICATION OF

DESIGNATION

of

SERIES X PREFERRED STOCK

of

TRUNITY HOLDINGS, INC.

Pursuant to Section 151 of the General Corporation Law of the State of Delaware

Trunity Holdings, Inc., a corporation organized and existing under the General Corporation Law of the State of Delaware (the “Company”), DOES HEREBY CERTIFY:

That pursuant to the authority vested in the Board of Directors of the Company (the “Board of Directors”) in accordance with the provisions of the Articles of Incorporation, Bylaws, and governing documents of the Company, the Board of Directors on December 4, 2015 adopted the following resolution creating a series of 1,000 shares of preferred stock designated as “Series X Preferred Stock”:

RESOLVED, that pursuant to the authority vested in the Board of Directors of this Company in accordance with the provisions of the Articles of Incorporation, a series of preferred stock, par value $.001 per share, of the Company be and hereby is created, and that the designation and number of shares thereof and the voting and other powers, preferences, and relative participating, optional, or other rights of the shares of such series and the qualifications, limitations, and restrictions thereof are as follows:

Series X Preferred Stock

1. Designation and Amount. There shall be a series of preferred stock that shall be designated as “Series X Preferred Stock,” and the number of shares constituting such series shall be 1,000.

2. Conversion.

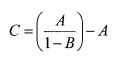

(A) The Series X Preferred Stock shall be convertible at the option of the holders thereof into the aggregate number of shares of common stock determined as follows:

Where:

"C" is the number of shares of common stock issuable upon conversion of the outstanding preferred stock

"A" is the number of shares of common stock outstanding immediately prior to the conversion of the Series X Preferred Stock, after giving effect to (1) the exercise of all outstanding options and warrants and the conversion into common stock of then outstanding convertible securities (excluding the Series X Preferred Stock), as well as all other debts and obligations, and (2) any anti-dilution adjustments occasioned by the conversion of the Series X Preferred Stock.

"B" is 90%

(B) The "Conversion Rate" shall be equal to:

Where:

"C" has the meaning set forth above

"D" is the number of shares of Series X Preferred Stock

3. Dividend Preference. The Company may not declare, pay, or set aside for payment any dividend payable in cash, property, or evidences of indebtedness, on shares of common stock unless and until the Company shall have declared and paid a dividend on the Series X Preferred Stock in an amount at least equal to an amount at least equal to the product of (A) the amount proposed to be paid in common stock, multiplied by (B) the Series X Preferred Stock Conversion Rate.

4. Voting Rights. Except as provided in paragraphs “Board of Directors” and “Class Voting” below, holders of Series X Preferred Stock shall vote together with holders of common stock as a single class on all matters submitted for consideration by holders of voting securities. Each share of Series X Preferred Stock shall entitle the holder thereof to a number of votes equal to the Conversion Rate, rounded to the next highest share.

5. Board of Directors. Holders of Series X Preferred Stock voting as a separate class shall be entitled to elect two (2) directors to the Board of Directors if there is a three (3) member board, or three (3) directors if the Board of Directors shall have more than three (3) members.

6. Class Voting. Holders of Series X Preferred Stock shall vote together as a separate class on each of the following matters:

(A) Any amendment to the Articles of Incorporation which alters, in any material respect, the rights, privileges, and preferences of Series X Preferred Stock;

(B) Any amendment to the Bylaws which alters, in any material respect, the rights, privileges, and preferences of Series X Preferred Stock;

(C) Any sale of all or substantially all of the assets of the Company, any merger, consolidation, or reorganization, in which the Company is not the survivor, or any share exchange in which the Company is not the parent entity;

(D) Creation or authorization of the creation of any additional class or series of shares of stock;

(E) Creation or authorization of the creation of any class or series of indebtedness which is convertible into or exchangeable for any class or series of equity securities of the Company or which is issued with warrants or rights to purchase any class or series of equity securities of the Company;

(F) The purchase or setting aside of any sums for the purchase of, or payment of any dividend or of any distribution on, any shares of stock other than the Series X Preferred Stock, except for dividends or other distributions payable on the common stock solely in the form of additional shares of common stock; or

(G) Redemption or other acquisition of any shares of Series X Preferred Stock or any other class or series of shares except pursuant to a purchase offer made pro rata to all holders of Series X Preferred Stock on the basis of the aggregate number of outstanding shares of Series X Preferred Stock then held by each such holder.

IN WITNESS WHEREOF, the undersigned has executed this Certificate this 9th day of December, 2015.

| Trunity Holdings, Inc. | ||

| By: | ||

| Name: | ||

| Title: |