Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SmartStop Self Storage REIT, Inc. | d105422d8k.htm |

Investor Presentation * There is no guarantee we will meet our objectives. Portfolio & Acquisition Update Presented By: H. Michael Schwartz – Chairman & CEO Exhibit 99.1

Disclaimer and Risk Factors CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS Certain statements contained in this material, other than historical facts, may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable. Such statements include, in particular, statements about our plans, strategies, and prospects and are subject to certain risks and uncertainties, including known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this material. We cannot guarantee the accuracy of any such forward looking statements contained in this material, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Any such forward-looking statements are subject to risks, uncertainties, and other factors and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations and provide distributions to stockholders, and our ability to find suitable investment properties, may be significantly hindered. All forward-looking statements should be read in light of the risks identified in our prospectus. This is an initial public offering; we have little prior operating history or established financing sources, and the prior performance of real estate investment programs sponsored by affiliates of our sponsor may not be an indication of our future results. We have incurred operating losses to date, have an accumulated deficit and our operations will not be profitable in 2015. We have paid and may continue to pay distributions from sources other than cash flow from operations, therefore we will have fewer funds available for the acquisition of property and our stock holders overall return may be reduced. There is currently no public trading market for our shares and there may never be one; therefore, it will be difficult for you to sell your shares. Our charter does not require us to pursue a liquidity transaction at any time. We established the offering price on an arbitrary basis; as a result, the actual value of your investment may be substantially less than what you pay. This is a “best efforts” offering. If we are unable to raise substantial funds, we will be limited in the number and type of investments we may make, and the value of your investment will fluctuate with the performance of the specific properties we acquire. Because this is a “blind pool” offering, you will not have the opportunity to evaluate the investments we will make with the proceeds of this offering before you purchase our shares. Our ability to operate profitably will depend upon the ability of our advisor to identify and acquire self storage properties and related self storage real estate investments and to efficiently manage our day-to-day operations and the ability of our property manager to effectively manage our properties. Because our dealer manager is affiliated with our sponsor, you may not have the benefit of an independent review of the prospectus or our company as is customarily performed in underwritten offerings. Our advisor, property manager and their officers and certain of our key personnel will face competing demands relating to their time, and this may cause our operating results to suffer. Our advisor will face conflicts of interest relating to the purchase of properties, including conflicts with our sponsor and Strategic Storage Growth Trust, Inc., and such conflicts may not be resolved in our favor, which could adversely affect our investment opportunities. Our advisor will face conflicts of interest relating to the incentive fee structure under our operating partnership agreement, which could result in actions that are not necessarily in the long-term best interests of our stockholders. Payment of fees to our advisor and its affiliates will reduce cash available for investment and distribution, and we may be required to pay our advisor a significant distribution if our advisory agreement is involuntarily terminated. Because we are focused on the self storage industry, our rental revenues will be significantly influenced by demand for self storage space generally, and a decrease in such demand would likely have a greater adverse effect on our rental revenues than if we owned a more diversified real estate portfolio. We rely on our sub-property manager to operate our self storage facilities. We will depend on on-site personnel to maximize customer satisfaction at each of our facilities; any difficulties our sub-property manager encounters in hiring, training and retaining skilled field personnel may adversely affect our rental revenues.

Disclaimer and Risk Factors 3 Other Information – SST2 An investment in shares of SST2 is not suitable for all investors. An investment in shares of SST2 involves significant risks and is only suitable for persons who have adequate financial means, desire a relatively long-term investment and will not need immediate liquidity from their investment. Investors should only purchase shares if they can afford a complete loss of their investment. Generally, a purchaser of shares must have, excluding the value of a purchaser’s home, furnishings and automobiles, either: A net worth of at least $250,000, or A gross annual income of at least $70,000 and a net worth of at least $70,000. Please see the prospectus for a full description of suitability standards. Residents of Alabama, Iowa, Kansas, Kentucky, Maine, Massachusetts, Nebraska, New Jersey, New Mexico, North Dakota, Ohio, Oregon and Tennessee should consult the prospectus for details regarding the more stringent suitability standards that apply to them based on their states of residence.

Sponsor Change - SmartStop Asset Management, LLC *There is no assurance that investors in Strategic Storage Trust II, Inc. will experience similar returns.

Strategic Storage Trust II, Inc. Investment Strategy Stabilized income producing properties – 75% or greater occupancy Investment objectives(1) Preservation of capital Income Low leverage(2) 6% current distribution (Monthly)(3) Geographic area – Moderate to High Density (top 100 MSAs) 3-5 year anticipated hold after completion of offering(4) (1) There is no assurance that these objectives will be met. (2)We intend to use less than 50% leverage. Our charter limits borrowing to 75% of the cost of our assets. At times our leverage may be greater than 50%. See page 22 of our prospectus for details of our borrowing policy. (3)Distributions are declared quarterly by the SST2 Board of Directors, calculated daily based on a 6.0% annualized rate and paid on a monthly basis. During the offering period, all or a substantial portion of the distributions may be funded from the proceeds of this offering or from borrowings in anticipation of future cash flow, some or all of which may constitute a return of capital. From our inception through September 30, 2015, all distributions have been paid from offering proceeds. We will disclose the sources of future distributions in supplements to the prospectus. Future distribution declarations are at the sole discretion of the Board of Directors. (4)The timing of our exit strategy is subject to market conditions and the discretion of our Board of Directors. There is no assurance that we will achieve one or more of the liquidity events we intend to seek within this time frame or at all.

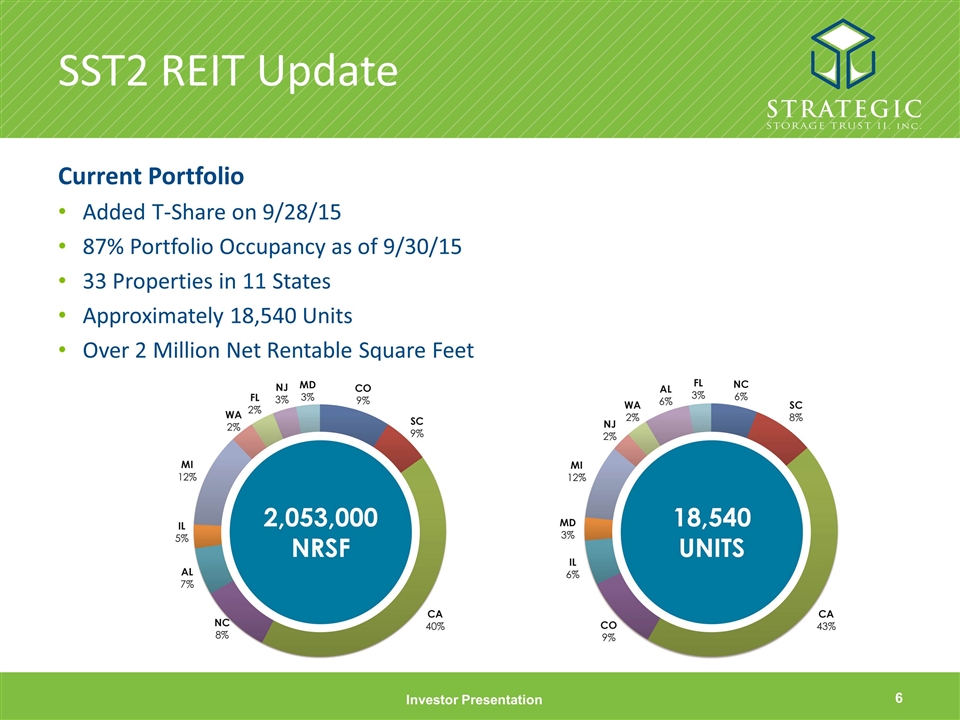

SST2 REIT Update Current Portfolio Added T-Share on 9/28/15 87% Portfolio Occupancy as of 9/30/15 33 Properties in 11 States Approximately 18,540 Units Over 2 Million Net Rentable Square Feet

Cary, NC 310 Units 62,100 NRSF 94% Occ.* Upland, CA 610 Units 56,500 NRSF 87% Occ.* Myrtle Beach II, SC 660 Units 94,500 NRSF 88% Occ.* Lancaster, CA 700 Units 64,700 NRSF 76% Occ.* Morrisville, NC 320 Units 36,900 NRSF 92% Occ.* Raleigh, NC 440 Units 60,600 NRSF 95% Occ.* Myrtle Beach I, SC 760 Units 100,100 NRSF 84% Occ.* Santa Rosa, CA 1,150 Units 116,400 NRSF 91% Occ.* *Occupancy as of 9/30/2015 Strategic Storage Trust II Portfolio Update

Fairfield, CA 440 Units 41,000 NRSF 88% Occ.* Crestwood, IL 460 Units 49,300 NRSF 80% Occ.* Littleton, CO 400 Units 45,800 NRSF 87% Occ.* Forestville, MD 530 Units 55,200 NRSF 86% Occ.* Chico, CA 360 Units 38,800 NRSF 85% Occ.* La Verne, CA 520 Units 49,800 NRSF 91% Occ.* Riverside, CA 570 Units 61,000 NRSF 85% Occ.* Vallejo, CA 510 Units 54,400 NRSF 89% Occ. * *Occupancy as of 9/30/2015 Strategic Storage Trust II Portfolio Update

Strategic Storage Trust II Portfolio Update Santa Ana, CA 840 Units 84,500 NRSF 80% Occ.* Lompoc, CA 430 Units 46,500 NRSF 91% Occ.* Huntington Beach, CA 610 Units 61,000 NRSF 92% Occ.* Aurora, CO 890 Units 87,400 NRSF 84% Occ.* Federal Heights, CO 450 Units 40,600 NRSF 88% Occ.* La Habra, CA 420 Units 51,400 NRSF 86% Occ.* Monterey Park, CA 390 Units 31,200 NRSF 90% Occ.* Everett, WA 490 Units 48,100 NRSF 90% Occ. * *Occupancy as of 9/30/2015

Bloomingdale IL 570 Units 58,200 NRSF 88% Occ.* Warren MI 490 Units 52,100 NRSF 84% Occ.* Warren MI 500 Units 63,100 NRSF 76% Occ.* Whittier, CA 510 Units 58,600 NRSF 95% Occ.* Sterling Heights, MI 460 Units 57,900 NRSF 89% Occ.* Troy, MI 730 Units 82,200 NRSF 89% Occ.* *Occupancy as of 9/30/2015 Beverly NJ 460 Units 51,000 NRSF 74% Occ.* Foley, AL 1,050 Units 142,000 NRSF 90% Occ. * Strategic Storage Trust II Portfolio Update

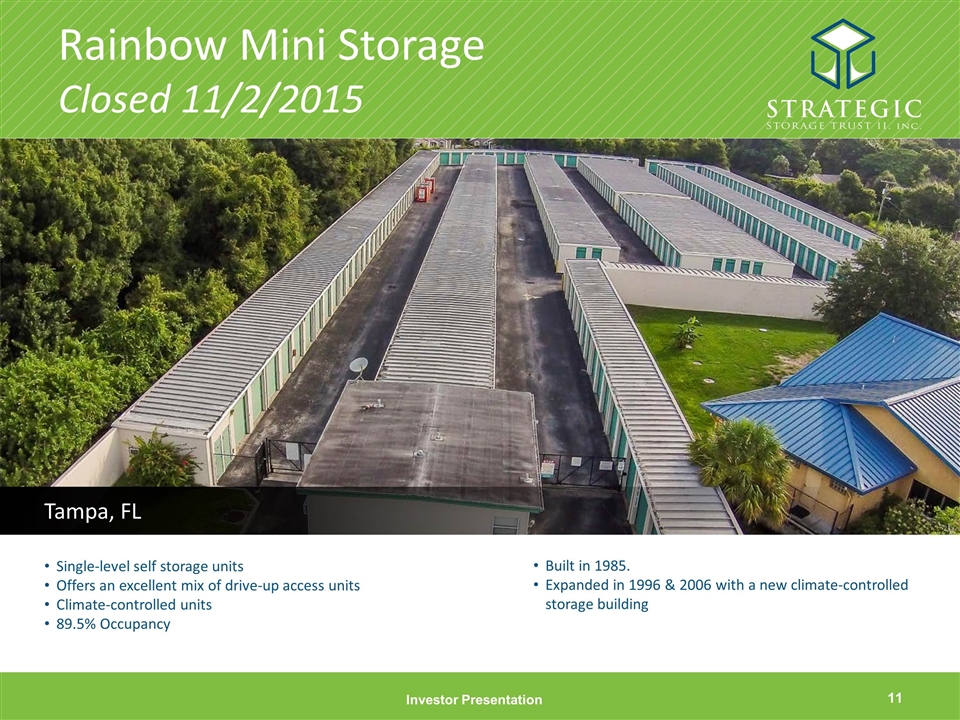

Rainbow Mini Storage Closed 11/2/2015 Single-level self storage units Offers an excellent mix of drive-up access units Climate-controlled units 89.5% Occupancy Built in 1985. Expanded in 1996 & 2006 with a new climate-controlled storage building Tampa, FL

Pending Acquisitions Boynton Beach, FL Lancaster, CA 74,800 NRSF 92% Occupied 71,900 NRSF 88% Occupied *Occupancy as of 9/30/2015

Pending Acquisitions Burlington, Ontario, Canada Milton, Ontario, Canada 79,700 NRSF 75% Occupied 70,100 NRSF 87% Occupied *Occupancy as of 9/30/2015

(NYSE: PSA) (NYSE: EXR) (NYSE: CUBE) (NYSE: SSS) (NYSE: UHAL) (NYSE: JCAP) (NYSE: NSA) Public Non-Traded Self Storage REITs Investor Presentation Publicly Traded Self Storage Companies

QUESTIONS?