Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT 5.1 - Rancho Santa Fe Mining, Inc. | rsfm1211forms1exh5_1.htm |

| EX-3.1 - EXHIBIT 3.1 - Rancho Santa Fe Mining, Inc. | rsfm1211forms1exh3_1.htm |

| EX-10.1 - EXHIBIT 10.1 - Rancho Santa Fe Mining, Inc. | rsfm1211forms1exh10_1.htm |

| EX-23.1 - EXHIBIT 23.1 - Rancho Santa Fe Mining, Inc. | rsfm1211forms1exh23_1.htm |

| EX-3.2 - EXHIBIT 3.2 - Rancho Santa Fe Mining, Inc. | rsfm1211forms1exh3_2.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Commission File Number: ___________

RANCHO SANTA FE MINING, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 1040 | 47-4674458 |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

9655 Granite Ridge Drive, Suite 200

San Diego, CA 92123

Tel. 858.717.8090

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

IncSmart.biz Inc.

1516 E. Tropicana Ave., Suite 155

Las Vegas, NV. 89119

Tel: 888.681.9777

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

From time to time after the effective date of this registration statement.

(Approximate date of commencement of proposed sale to the public)

From time to time after the effective date of this Registration Statement

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☑.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check is a smaller reporting company) | Smaller reporting company | ☑ |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered (1)(2) | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Common stock, $0.001 par value per share | 6,750,000 | $0.50 (3) | $ | 3,375,000.00 | $ | 340.00 | ||||||||||

| Common stock, $0.001 par value per share | 20,000,000 | $0.50 (4) | $ | 10,000,000.00 | $ | 1,007.00 | ||||||||||

| Total | — | $ | 13,375,000.00 | $ | 1,347.00 | |||||||||||

| (1) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | This Registration Statement includes an indeterminate number of additional shares of common stock issuable for no additional consideration pursuant to any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration, which results in an increase in the number of outstanding shares of our common stock. In the event of a stock split, stock dividend or similar transaction involving our common stock, in order to prevent dilution, the number of shares registered shall be automatically increased to cover the additional shares in accordance with Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (3) | Selling Shareholders. This Registration Statement also covers the resale under a separate resale prospectus (the “Resale Prospectus”) by selling shareholders (“Selling Shareholders”) of the Registrant of up to 6,750,000 ordinary shares previously issued to the Selling Shareholders as named in the Resale Prospectus. |

| (4) | Direct Public Offering. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed or withdrawn without notice. These securities may not be sold until this registration statement filed with the Securities and Exchange Commission (“SEC”) is declared effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated December ____, 2015

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| · | Public Offering Prospectus. A prospectus regarding our offering of up to 20,000,000 shares of our Common Stock in a direct public offering, without any involvement of underwriters or broker-dealers (the “Public Offering Prospectus”). Should all shares being offered by the Company hereunder be sold, the Company would receive an aggregate of $10,000,000. The offering price is $0.50 per share for newly issued shares. There is no minimum number of shares that must be sold and there is no guarantee that the Company will raise any funds from the direct public offering. |

| · | Resale Prospectus. A prospectus to be used for the resale by Selling Shareholders of up to 6,750,000 shares of the Registrant’s Common Stock (the “Resale Prospectus”). The offering price is a fixed price of $0.50 per share until our shares are quoted on the OTCBB and thereafter at prevailing market prices or privately negotiated prices. The Company will not receive any proceeds from the resale of shares by the Selling Shareholders. |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

· they contain different outside and inside front covers;

· they contain different Offering sections;

· they contain different Use of Proceeds sections;

· a Selling Shareholders section is included in the Resale Prospectus;

· they contain different Plan of Distribution sections;

· the Dilution section is deleted from the Resale Prospectus;

· they contain different outside back covers.

The Registrant has included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Resale Prospectus as compared to the Public Offering Prospectus.

The information in this Prospectus is not complete and may be changed. These securities may not be sold until the Registration Statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where an offer or sale is not permitted.

RANCHO SANTA FE MINING, INC.

9655 Granite Ridge Drive, Suite 200

San Diego, CA 92123

Tel. 858.717.8090

PRELIMINARY PROSPECTUS

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

20,000,000 shares of Common Stock

This is the initial offering of Common Stock of Rancho Santa Fe Mining, Inc. (the “Company”). We are offering for sale a total of 20,000,000 shares of Common Stock at a fixed price of $0.50 per share for the duration of this Offering (the “Offering”). There is no minimum number of shares that must be sold by us for the Offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. The Offering is being conducted on a self-underwritten, best efforts basis, which means our Officers and Directors, will attempt to sell the shares directly to friends, family members and business acquaintances. Our Officers and Directors will not receive commissions or any other remuneration from any such sales. In offering the securities on our behalf, our Officers and Directors will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934. We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements.

The shares will be offered for sale at a fixed price of $0.50 per share for a period of one hundred and eighty (180) days from the effective date of this Prospectus, unless extended by our Board of Directors for an additional 90 days. If all of the shares offered by us are purchased, the gross proceeds to us will be $10,000,000.00. All funds raised hereunder will become immediately available to the Company and will be used in accordance with the Company’s intended “Use of Proceeds” as set forth herein. Investors are advised that they will not be entitled to a refund and could lose their entire investment.

The Company is a development stage company and currently has limited operations. Any investment in the shares offered herein involves a high degree of risk. You should only purchase shares if you can afford a loss of your investment. Our independent registered public accountant has issued an audit opinion for the Company, which includes a statement expressing substantial doubt as to our ability to continue as a going concern.

There currently is no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our Common Stock is not traded on any exchange or on the over-the-counter market. There can be no assurance that our Common Stock will ever be quoted on a stock exchange or a quotation service or that any market for our stock will develop.

This Prospectus covers the primary public offering by the Company of 20,000,000 shares of Common Stock. The Company is concurrently conducting a resale offering for 6,750,000 shares, which is covered in a separate Resale Prospectus.

THE PURCHASE OF THE SECURITIES OFFERED THROUGH THIS PROSPECTUS INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY READ AND CONSIDER THE SECTION OF THIS PROSPECTUS ENTITLED “RISK FACTORS” BEFORE BUYING ANY SHARES OF RANCHO SANTA FE’S COMMON STOCK.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

No dealer, salesperson or any other person is authorized to give any information or make any representations in connection with this offering other than those contained in this Prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. This Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this Prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any jurisdiction in which the offer or solicitation is not authorized or is unlawful.

The date of this Prospectus is December ___, 2015.

TABLE OF CONTENTS

| Page | |

| Prospectus Summary | 5 |

| The Offering | 6 |

| Risk Factors | 6 |

| Determination of Offering Price | 10 |

| Use of Proceeds | 10 |

| Selling Security Holders | 11 |

| Plan of Distribution; Terms of the Offering | 11 |

| Dilution | 13 |

| Description of Property | 14 |

| Description of Securities | 14 |

| Description of Our Business | 16 |

| Management’s Discussion and Analysis | 20 |

| Directors, Executive Officers, Promoters and Control Persons | 22 |

| Executive Compensation | 25 |

| Security Ownership of Certain Beneficial Owners and Management | 26 |

| Certain Relationships and Related Transactions | 27 |

| Legal Matters | 27 |

| Experts | 27 |

| Commission Position of Indemnification for Securities Act Liabilities | 27 |

| Where you can find more Information | 28 |

| Index to Financial Statements | F-1 |

You should rely only on the information contained or incorporated by reference to this prospectus in deciding whether to purchase our common stock. We have not authorized anyone to provide you with information different from that contained or incorporated by reference to this prospectus. Under no circumstances should the delivery to you of this prospectus or any sale made pursuant to this prospectus create any implication that the information contained in this prospectus is correct as of any time after the date of this prospectus. To the extent that any facts or events arising after the date of this prospectus, individually or in the aggregate, represent a fundamental change in the information presented in this prospectus, this prospectus will be updated to the extent required by law.

PROSPECTUS SUMMARY

The following summary highlights material information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section, the financial statements and the notes to the financial statements. You should also review the other available information referred to in the section entitled “Where You Can Find More Information” in this prospectus and any amendment or supplement hereto. Unless otherwise indicated, the terms the “Company,” “Rancho Santa Fe Mining,” “we,” “us,” and “our” refer and relate to Rancho Santa Fe Mining, Inc.

The Company Overview

The Company was incorporated in the State of Nevada on July 24 2015. We were incorporated and our business plan called for the Company to seek out and acquire various mining assets in the State of Nevada. Rancho Santa Fe Mining Inc. is a precious metals exploration and development company with the objective of becoming a gold producer. The Company is currently focused on the advancement of its two principal projects: the Virginia and Vanity Fair patented claims.

On October 28, 2015, the Company entered into a Asset Purchase Agreement (the “Asset Purchase”) with Humboldt Mining Company, Inc., an Nevada corporation (“HMCI”). Pursuant to the Asset Purchase Agreement, the Company acquired 100% of certain assets owned by HMCI, including, but not limited to: (i) all the real property, leasehold improvements, fixtures, furniture, machinery and equipment owned by the HMCI and relating to or used in HMCI’s operations; and, (ii) all inventory, including finished goods, raw materials and work in process as well as the right to receive inventory ordered by the HMCI for use in its operations; and, (iii) in addition to the foregoing, we acquired all the books and records of HMCI, as well as all intangible assets held, owned or controlled by HMCI (collectively, (i), (ii) and (iii) are referred to hereinafter as the “Acquired Assets”. We acquired none of HMCI’s existing or future liabilities. The acquired assets herein do not constitute an active business.

In exchange for the Acquired Assets the Company issued to the HMCI shareholders Thirteen Million Five Hundred Thousand shares of the Company’s $0.001 par value common stock, which represented Fifty (50%) percent of the Company’s issues and outstanding shares at the time of issuance. A copy of the Asset Purchase Agreement may be found as an Exhibit attached to this Registration Statement.

Company now owns land and patented mining rights North of Elko, Nevada nearby the formation known as the Carlin Trend. The Carlin Trend is the second-largest known gold resource in the world and has produced over 70 million ounces of gold. The Company’s property includes two patented claims – the Virginia and Vanity Fair patented claims - comprising what is known as the Prunty Mine Area.

The importance of these patented claims cannot be underestimated, insomuch as they have been referred to independently as “unique, rare and exceptional.” The “unique, rare and exceptional” are terms used in mining to denote multidimensional associations of claims as they relate location, uniqueness and quality. Further, in accordance with the Apex Rule in Mining, along the primary axis of the claims the Company is allowed to follow and continue mining the Prunty Mine area beyond the properties presently owned by the Company.

Operationally over the next 2-5 years, the Company intends to outsource fully 100% of the exploration, site preparation and extraction operations to a third party who provides all manpower, equipment and operational expenses associated therewith. It is intended the third party pays the Company a royalty of 20% to 30% of the gold reserves recovered and sold. We have begun initial discussions with several third-party candidates. The Company plans to retain four full-time staff and lease nominal executive office facilities in Nevada. Services such as Legal, Accounting, Shareholder Relations and Geology can be outsourced to consultants as needed. Business Development is limited to developing and maintaining a website presence, and nominal travel and business entertainment expense. The primary additional operations entail Asset Development, which includes the maintenance of applicable permits and claim renewals, as well as the outsourced production of independent Reserve Reports annually.

Emerging Growth Company

We are an “emerging growth company” within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with certain regulatory requirements applicable to other public companies that are not emerging growth companies, including but not limited to: not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; being permitted to comply with reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and being exempt from the requirements of holding a non-binding advisory vote on executive compensation and securing stockholder approval of golden parachute payments. We intend to take advantage of these reduced regulatory requirements until we are no longer an emerging growth company. For a description of the qualifications and other requirements applicable to emerging growth companies, and certain elections we have made due to our status as an emerging growth company, see “Risk Factors—”As an ‘emerging growth company’ under applicable law, we will be subject to reduced disclosure requirements, which could leave our stockholders without information or rights available to stockholders of more mature companies”.

| 5 |

RISK FACTORS

An investment in our Common Stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this Prospectus before investing in our Common Stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. Currently, shares of our Common Stock are not publicly traded. In the event that shares of our Common Stock become publicly traded, the trading price of our Common Stock could decline due to any of these risks, and you may lose all or part of your investment. In the event our Common Stock fails to become publicly traded you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

We are an exploration stage company and may never be able to carry out business or achieve any revenues or profitability; at this stage, even with good faith efforts, potential investors have a high probability of losing their entire investment.

We have not earned any revenues as of the date of this current report. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates.

There is nothing at this time on which to base an assumption that our business operations will prove to be successful or that we will ever be able to operate profitably. We anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses in the foreseeable future. There can be no assurance that we will ever achieve any revenues or profitability. The revenue and income potential of our proposed business and operations is unproven, as the lack of operating history makes it difficult to evaluate the future prospects of our business.

We are dependent on our two principal projects for our future operating revenue, neither of which currently has proven or probable reserves.

The Virginia and the Vanity Fair Project do not have identified proven and probable mineral reserves. The costs, timing and complexities of upgrading either property to proven and probable reserves may be greater than we anticipate. Mineral exploration and development involves a high degree of risk that even a combination of careful evaluation, experience and knowledge cannot eliminate, and few properties that are explored are ultimately developed into producing mines. There is no assurance that our mineral exploration programs will establish the presence of any proven or probable mineral reserves. The failure to establish proven or probable reserves would severely restrict our ability to implement our strategies for long-term growth.

We cannot be certain that our acquisition, exploration and evaluation activities will be commercially successful.

We currently have no properties that produce gold in commercial quantities. Substantial expenditures are required to acquire existing mining properties, to establish ore reserves through drilling and analysis, to develop metallurgical processes to extract metal from the ore and, in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining. We cannot provide assurance that any gold or other metal reserves or mineralized material acquired or discovered will be in sufficient quantities to justify commercial operations or that the funds required for development can be obtained on a timely basis. Factors including costs, actual mineralization, consistency and reliability of ore grades and commodity prices affect successful project development, could have a material adverse effect on our future results of operations.

Actual capital costs, operating costs, production and economic returns may differ significantly from those we have anticipated and there are no assurances that any future development activities will result in profitable mining operations.

The capital costs to take our claims into production may be significantly higher than anticipated. We may ultimately base our decisions about the development of the projects based on a feasibility study. We have not prepared a feasibility study for the either, but we may use a portion of the proceeds of the offering to produce one if we deem it necessary or appropriate to do so. Our evaluations of our business and prospects are subject to change, including after any feasibility study has been conducted, which could materially adversely affect our prospects.

| 6 |

Historical production at either of our claims may not be indicative of the potential for future development.

There is currently no commercial production at either claim and, since acquiring ownership; we have never recorded any revenues from commercial production. You should not rely on the fact that there were historical mining operations at the either claim as an indication that we will ever have future successful commercial operations. In order for us to develop new mining operations, we will be required to incur substantial operating expenses and capital expenditures to refurbish and/or replace existing infrastructure.

Land reclamation and mine closure may be burdensome and costly.

Land reclamation and mine closure requirements are generally imposed on mineral exploration companies, such as ours, which require us, among other things, to minimize the effects of land disturbance. Such requirements may include controlling the discharge of potentially dangerous effluents from a site and restoring a site’s landscape to its pre-exploration form. The actual costs of reclamation and mine closure are uncertain and planned expenditures may differ from the actual expenditures required. Therefore, the amount that we are required to spend could be materially higher than current estimates. Any additional amounts required to be spent on reclamation and mine closure may have a material adverse effect on our financial performance, financial position and results of operations and may cause us to alter our operations. In addition, we are required to maintain financial assurances, such as letters of credit, to secure reclamation obligations under certain laws and regulations. The failure to acquire, maintain or renew such financial assurances could subject us to fines and penalties or suspension of our operations. Additionally, even if we cease exploration at either claim we will be required to expend cash and other resources to satisfy ongoing care and maintenance obligations.

Our operations involve significant risks and hazards inherent to the mining industry.

Our operations involve the operation of large pieces of drilling and other heavy equipment. Hazards such as fire, explosion, floods, structural collapses, industrial accidents, unusual or unexpected geological conditions, ground control problems, cave-ins, flooding and mechanical equipment failure are inherent risks in our operations. Hazards inherent to the mining industry can cause injuries or death to employees, contractors or other persons at our mineral properties, severe damage to and destruction of our property, plant and equipment and mineral properties, and contamination of, or damage to, the environment, and can result in the suspension of our exploration activities and any future development and production activities. While the Company aims to maintain best safety practices as part of its culture, safety measures implemented by us may not be successful in preventing or mitigating future accidents.

The mining industry is very competitive.

The mining industry is very competitive. Much of our competition is from larger, established mining companies with greater liquidity, greater access to credit and other financial resources, newer or more efficient equipment, lower cost structures, more effective risk management policies and procedures and/or a greater ability than us to withstand losses. Our competitors may be able to respond more quickly to new laws or regulations or emerging technologies, or devote greater resources to the expansion or efficiency of their operations than we can. In addition, current and potential competitors may make strategic acquisitions or establish cooperative relationships among themselves or with third parties. Accordingly, it is possible that new competitors or alliances among current and new competitors may emerge and gain significant market share to our detriment. We may not be able to compete successfully against current and future competitors, and any failure to do so could have a material adverse effect on our business, financial condition or results of operations.

Mining exploration, development and operating activities are inherently hazardous.

Mineral exploration involves many risks that even a combination of experience, knowledge and careful evaluation may not be able to overcome. Operations in which we have direct or indirect interests will be subject to all the hazards and risks normally incidental to exploration, development and production of gold and other metals, any of which could result in work stoppages, damage to property and possible environmental damage. The nature of these risks is such that liabilities might exceed any liability insurance policy limits. It is also possible that the liabilities and hazards might not be insurable, or, that the Company could elect not to be insured against such liabilities due to high premium costs or other reasons, in which event, significant costs could be incurred that could have a material adverse effect on our financial condition.

Reserve calculations are estimates only, subject to uncertainty due to factors including metal prices, inherent variability of ore, and recoverability of metals in the mining process.

There is a degree of uncertainty attributable to the calculation of reserves and corresponding grades dedicated to future production. Until reserves are actually mined and processed, the quantity of ore and grades must be considered as an estimate only. In addition, the quantity of reserves and ore may vary depending on metal prices. Any material change in the quantity of reserves, mineralization, grade or stripping ratio may affect the economic viability of our properties. In addition, there can be no assurance that gold recoveries or other metal recoveries in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

| 7 |

We may be unable to raise additional capital on favorable terms.

The exploration and development of our development properties will require significant capital investment to achieve commercial production. We may have to raise additional funds from external sources in order to maintain and advance our existing property positions and to acquire new gold projects. There can be no assurance that additional financing will be available at all or on acceptable terms and, if additional financing is not available, we may have to substantially reduce or cease operations.

Our exploration and eventual development operations are subject to environmental regulations, which could result in the incurrence of additional costs and operational delays.

All phases of operations are subject to environmental regulation. Environmental legislation is evolving in some jurisdictions in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulations, if any, will not adversely affect the Company’s projects. We will be subject to environmental regulations with respect to properties in Nevada, under applicable federal and state laws and regulations. Production at either claim may involve the use of sodium cyanide, which is a toxic material. Should sodium cyanide leak or otherwise be discharged from the containment system, then we may become subject to liability for cleanup work that may not be insured. While appropriate steps will be taken to prevent discharges of pollutants into the ground water and the environment, we may become subject to liability for hazards that it may not be insured against.

U.S. Federal Laws

Under the U.S. Resource Conservation and Recovery Act, mining companies may incur costs for generating, transporting, treating, storing, or disposing of hazardous waste, as well as for closure and post-closure maintenance once they have completed mining activities on a property. Mining operations may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, storage facilities, and the use of mobile sources such as trucks and heavy construction equipment which are subject to review, monitoring and/or control requirements under the Federal Clean Air Act and state air quality laws. Permitting rules may impose limitations on the Company’s production levels or create additional capital expenditures in order to comply with the rules.

The U.S. Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended (CERCLA), imposes strict joint and several liability on parties associated with releases or threats of releases of hazardous substances. The groups who could be found liable include, among others, the current owners and operators of facilities, which release hazardous substances into the environment and past owners and operators of properties who owned such properties at the time the disposal of the hazardous substances occurred. This liability could include the cost of removal or remediation of the release and damages for injury to the surrounding property. The Company cannot predict the potential for future CERCLA liability with respect to its properties.

Increased costs could affect our financial condition.

We anticipate that costs will frequently be subject to variation from one year to the next due to a number of factors, such as changing ore grade, metallurgy and revisions to mine plans in response to the physical shape and location of the ore body. In addition, costs are affected by the price of commodities such as fuel and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production at certain operations less profitable. A material increase in costs at any significant location could have a significant effect on profitability.

Difficult conditions in the global capital markets and the economy generally may materially adversely affect our business and results of operations.

Factors such as business investment, government spending, the volatility and strength of the capital markets, and inflation all affect the business and economic environment and, ultimately, the profitability of our business. In an economic downturn characterized by higher unemployment, lower corporate earnings and lower business investment, our operations could be negatively impacted. Purchasers of gold production may delay or be unable to make timely payments. Adverse changes in the economy could affect earnings negatively and could have a material adverse effect on our business, results of operations and financial conditions.

| 8 |

A shortage of equipment and supplies could adversely affect our ability to operate our business.

We will be dependent on various supplies and equipment to carry out our mining exploration and development operations. The shortage of such supplies, equipment and parts could have a material adverse effect on our ability to carry out our operations and therefore, limit or increase the cost of production.

If we lose key personnel or are unable to attract and retain additional personnel, we may be unable to establish and develop our business.

Our development in the future will be highly dependent on the efforts of key management employees. We do not have and currently have no plans to obtain key man insurance with respect to any key employees. As well, we will need to recruit and retain other qualified managerial and technical employees to build and maintain our operations. If we are unable to successfully recruit and retain such persons, then development and growth could be significantly curtailed.

Principal stockholders will be able to exert significant influence over matters submitted to stockholders for approval, which could delay or prevent a change in corporate control or result in the entrenchment of management or the Board of Directors, possibly conflicting with the interests of other stockholders.

Major shareholders and the President’s position on the Board could exert significant influence in determining the outcome of corporate actions requiring stockholder approval and otherwise control of our business. This control could have the effect of delaying or preventing a change in control or entrenching management or the Board of Directors, which could conflict with the interests of our other stockholders and, consequently, could adversely affect the market price of our common stock.

Our Articles of Incorporation exculpates our officers and directors from certain liability to our Company or our stockholders.

Our Articles of Incorporation contain a provision limiting the liability of our officers and directors for their acts or failures to act, except for acts involving intentional misconduct, fraud or a knowing violation of law. This limitation on liability may reduce the likelihood of derivative litigation against our officers and directors and may discourage or deter our stockholders from suing our officers and directors based upon breaches of their duties to our Company.

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

| · | pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; |

| · | provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and |

| · | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements. |

Our internal controls may be inadequate or ineffective, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public. Investors relying upon this misinformation may make an uninformed investment decision.

We have a “going concern” opinion from our auditors, indicating the possibility that we may not be able to continue to operate.

Our independent registered public accountants have expressed doubt about our ability to continue as a going concern. This opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. If we fail to raise sufficient capital when needed, we will not be able to complete our proposed business. As a result we may have to liquidate our business and investors may lose their investments. The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish its plan of operations described herein and eventually attain profitable operations. Investors should consider our independent registered public accountant’s comments when deciding whether to invest in the Company.

| 9 |

RISKS RELATED TO THE OFFERING

The Company’s stock price may be volatile.

The market price of the Company’s common stock is likely to be highly volatile and could fluctuate widely in price in response to various potential factors, many of which will be beyond the Company’s control, including the following:

| · | competition; |

| · | additions or departures of key personnel; |

| · | the Company’s ability to execute its business plan; |

| · | operating results that fall below expectations; |

| · | loss of any strategic relationship; |

| · | industry developments; |

| · | economic and other external factors; and |

| · | period-to-period fluctuations in the Company’s financial results. |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of the Company’s common stock.

We do not expect to pay dividends in the foreseeable future.

We do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any future earnings in the development and growth of our business. Therefore, investors will not receive any funds unless they sell their common stock, and stockholders may be unable to sell their shares on favorable terms or at all. We cannot assure you of a positive return on investment or that you will not lose the entire amount of your investment in our common stock.

We may in the future issue additional shares of our common stock which would reduce investors’ ownership interests in the Company and which may dilute our share value.

Our Articles of Incorporation authorize the issuance of 200,000,000 shares of common stock, par value $0.001 per share. The future issuance of all or part of our remaining authorized common stock may result in substantial dilution in the percentage of our common stock held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

The Financial Industry Regulatory Authority (“FINRA”) has adopted rules that relate to the application of the SEC’s penny stock rules in trading our securities and require that a broker/dealer have reasonable grounds for believing that the investment is suitable for that customer, prior to recommending the investment. Prior to recommending speculative, low priced securities to their non-institutional customers, broker/dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information.

Under interpretations of these rules, FINRA believes that there is a high probability that speculative, low priced securities will not be suitable for at least some customers. FINRA’s requirements make it more difficult for broker/dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity and liquidity of our common stock. Further, many brokers charge higher transactional fees for penny stock transactions. As a result, fewer broker/dealers may be willing to make a market in our common stock, reducing a shareholder’s ability to resell shares of our common stock.

| 10 |

DETERMINATION OF OFFERING PRICE

As a result of there being no established public market for our shares, the offering price and other terms and conditions relative to our shares have been arbitrarily determined by the Company and do not bear any relationship to assets, earnings, book value, or any other objective criteria of value. In addition, no investment banker, appraiser, or other independent third party has been consulted concerning the offering price for the shares or the fairness of the offering price used for the shares.

USE OF PROCEEDS

Our offering is being made in a direct public offering, without the involvement of underwriters or broker-dealers. We intend to disburse the proceeds from this offering in the priority set forth below within the first 12 months after successful completion of this offering.

Not taking into account any possible additional funding or revenues, we intend to use the proceeds from this offering as follows. The following chart indicates the approximate amount of funds that we will allocate to each item, but does not indicate the total fee/cost of each item. The amount of proceeds we allocate to each item is dependent upon the amount of proceeds we receive from this offering:

If we sell all of the Shares being offered, our net proceeds will be $10,000,000. We will use the net proceeds to pay development costs and to hold and maintain the asset rights, as well as complete reserve reports to guide mining efforts and secure optimum royalty streams on the mining output and such efforts will continue until we become until cash-flow positive; operating expenses (including salaries; legal, accounting and consulting fees, rent; and other general administrative expenses); and working capital. The precise amounts that the Company will devote to each of these items, and the timing of expenditures, will vary depending on numerous factors, including but not limited to the progress of development efforts relating to each project. The following table sets forth a breakdown of the estimated use of the net proceeds as we currently expect to use them, assuming the sale of 100%, 75%, 50% and 25% of the Shares offered for sale in this offering:

| Assumed Percentage of Units Sold | 100% | 75% | 50% | 25% | ||||||||||||

| Price to Public | $ | 10,000,000 | $ | 7,500,000 | $ | 5,000,000 | $ | 2,500,000 | ||||||||

| Other offering expenses | 82,900 | 82,900 | 82,900 | 82,900 | ||||||||||||

| Net proceeds | $ | 9,917,100 | $ | 7,417,100 | $ | 4,917,100 | $ | 2,417,100 | ||||||||

| Project development and commercialization | $ | 1,150,000 | $ | 1,150,000 | $ | 1,150,000 | $ | 650,000 | ||||||||

| Operating expenses | 1,000,000 | 1,000,000 | 1,000,000 | 1,000,000 | ||||||||||||

| Working capital | 350,000 | 350,000 | 350,000 | 350,000 | ||||||||||||

| Total use of proceeds | $ | 2,500,000 | $ | 2,500,000 | $ | 2,500,000 | $ | 2,000,000 | ||||||||

As indicated in the table above, if we sell only 75%, or 50%, or 25% of the Units offered for sale in this offering, we would expect to use the resulting net proceeds for the same purposes as we would use the net proceeds from a sale of 100% of the Units, and in approximately the same proportions. However, the lower our net proceeds, the less we would expect to use the funds in the expenditure category “Development and Commercialization”, and the more we would expect to use those funds for the development and commercialization of the assets we have acquired.

In the event we do not sell all of the Shares being offered, we may seek additional financing to support the intended use of proceeds discussed above. If we secure additional equity funding, investors in this offering would be diluted. In all events, there can be no assurance that additional financing would be available when needed and, if available, on terms acceptable to us.

DIVIDEND POLICY

We have not paid any dividends on our common stock since inception, and we currently expect that, in the foreseeable future, all earnings (if any) will be retained for the development of our business and no dividends will be declared or paid. Any future dividends will be subject to the discretion of our board of directors and will depend upon, among other things, our earnings (if any), operating results, financial condition and capital requirements, general business conditions and other pertinent facts.

PLAN OF DISTRIBUTION; TERMS OF THE OFFERING

Rancho Santa Fe Mining, Inc. has issued and outstanding as of the date of this Prospectus 27,000,000 shares of Common Stock. The Company is registering an additional 20,000,000 shares of its Common Stock for sale at the price of $0.50 per share. There is no arrangement to address the possible effect of the offering on the price of the stock.

| 11 |

In connection with the Company’s selling efforts in the offering, our officers and directors will not register as broker-dealers pursuant to Section 15 of the Exchange Act, but rather will rely upon the “safe harbor” provisions of SEC Rule 3a4-1, promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in the sale of the securities of such issuer.

Our officers and directors meet the conditions of the Rule 3a4-1 exemption, as: (1) they are not subject to any statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act; (2) they will not be compensated in connection with their participation in the direct public offering or resale offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities; and (3) they will not be associated persons of a broker or dealer at the time of their participation in the direct public offering and resale offering. Further, our officers and directors: (1) at the end of the offerings, will continue to primarily perform substantial duties for the Company or on its behalf otherwise than in connection with transactions in securities; (2) are not, nor have been within the preceding 12 months, a broker or dealer, and they are not, nor have they been within the preceding 12 months, an associated person of a broker or dealer; and (3) they have not participated in another offering of securities pursuant to the Exchange Act Rule 3a4-1 in the past 12 months and they have not and will not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on the Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

In order to comply with the applicable securities laws of certain states, the securities will be offered or sold in those states only if they have been registered or qualified for sale; an exemption from such registration or if qualification requirement is available and with which the Company has complied. In addition, and without limiting the foregoing, the Company will be subject to applicable provisions, rules and regulations under the Exchange Act with regard to security transactions during the period of time when this Registration Statement is effective.

Offering Period and Expiration Date

This offering will start on the date of this Prospectus and continue for a period of up to 180 days, unless extended by our Board of Directors for an additional 90 days

Concurrent Offering

The Company will be offering shares of the Company’s Common Stock under the direct public offering at the same time that the Selling Shareholders will be offering shares of the Company’s Common Stock under the resale offering. The Selling Shareholders include our officers and directors who will be selling shares on their own behalf, individually. Pursuant to our informal Code of Ethics, our officers and directors have an ethical obligation to give their loyalty to the best interests of the Company. As such, our officers and directors will first offer shares of the Company’s Common Stock under the direct public offering on behalf of the Company and will offer their individual shares in the resale offering only if the direct public offering is fully subscribed.

Procedures for Subscribing

If you decide to subscribe for any shares in this offering, you must:

| 1. | execute and deliver a Subscription Agreement; and |

| 2. | deliver a check, certified funds or cash by wire transfer of immediately available funds directly to the Company for acceptance or rejection. |

The Subscription Agreement requires you to disclose your name, address, social security number, telephone number, number of shares you are purchasing, and the price you are paying for your shares.

All checks for subscriptions must be made payable to Rancho Santa Fe Mining, Inc.

Acceptance of Subscriptions

Upon the Company’s acceptance of a Subscription Agreement and receipt of full payment, the Company shall countersign the Subscription Agreement and issue a stock certificate along with a copy of the Subscription Agreement.

| 12 |

Right to Reject Subscriptions

We have the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours after we receive them.

No Minimum Subscription

There is no minimum number of shares that must be sold under the offering. As such, there is no guarantee that the Company will raise any funds from the offering.

Penny Stock Regulation

Our Common Shares are not quoted on any stock exchange or quotation system. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange system).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC, that:

- contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

- contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties;

- contains a brief, clear, narrative description of a dealer market, including “bid” and “ask” prices for penny stocks and the significance of the spread between the bid and ask price;

- contains a toll-free telephone number for inquiries on disciplinary actions;

- defines significant terms in the disclosure document or in the conduct of trading penny stocks; and,

- contains such other information and is in such form (including language, type, size, and format) as the SEC shall require by rule or regulation.

The broker-dealer also must provide the customer with the following, prior to proceeding with any transaction in a penny stock:

- bid and offer quotations for the penny stock;

- details of the compensation of the broker-dealer and its salesperson in the transaction;

- the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and,

- monthly account statements showing the market value of each penny stock held in the customer’s account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling those securities.

Registration Rights

We have not granted registration rights to any persons.

DILUTION

Net tangible book value per share represents the amount of the Company’s tangible assets less total liabilities, divided by the 27,000,000 shares of Common Stock outstanding as of October 30, 2015 (note: the Company had 13,500,000 shares issued and outstanding as of September 30, 2015 pursuant to the financials enclosed herein). The increases in shares are attributable to the acquisition of the Company’s asset). Net tangible book value dilution per share represents the difference between the amount per share paid by purchasers of the Shares in this offering assuming the offering price of $0.50 per share of Common Stock and the pro forma net tangible book value per share of Common Stock immediately after completion of the offering.

| 13 |

After giving effect to the sale of the 20,000,000 shares offered by the Company hereunder, at an Offering Price of $.50 per share the pro forma net tangible book value of the Company at December 3, 2015, would have been $.20974 per share, representing an immediate increase in tangible book value of $.2150 per share to existing shareholders and an immediate dilution of $.29026 per share to purchasers of the Shares.

The following table illustrates the foregoing information with respect to new investors on a per share basis:

20,000,000 Shares (100%) | 15,000,000 Shares (75%) | 10,000,000 Shares (50%) | 5,000,000 Shares (25%) | 2,000,000 Shares (10%) | ||||||||||||||||

| Offering price per share | $ | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | ||||||||||||||

| Net tangible book value per share before Offering | $ | (.00526 | ) | (.00526 | ) | (.00526 | ) | (.00526 | ) | (.00526 | ) | |||||||||

| Increase per share attributable to new investors | $ | .21500 | .16125 | .10750 | .05375 | .02150 | ||||||||||||||

| Pro forma net tangible book value per share after Offering | $ | .20974 | .15599 | .10224 | .04849 | .01624 | ||||||||||||||

| Dilution per share to new investors | $ | .29026 | .34401 | .39776 | .45151 | .48376 |

DESCRIPTION OF PROPERTY

Our executive offices are located at 9655 Granite Ridge Drive, Suite 200 San Diego, CA 92123. We currently rent this space for approximately $1,500 a month. Currently, this space is sufficient to meet our needs. We do not foresee any significant difficulties in obtaining any required additional space if needed. We do not own any real property.

DESCRIPTION OF SECURITIES

Common Stock

Our Articles of Incorporation authorize us to issue two hundred million (200,000,000) shares of common stock, par value $0.001.

Preferred Stock

Our Articles of Incorporation authorize us to issue ten million (10,000,000) shares of preferred stock, par value $0.001. The shares of Preferred Stock may be issued from time to time in one or more series. The Board of Directors is authorized to provide for the issue of such series of shares of Preferred Stock.

Voting Rights

Except as otherwise required by law or as may be provided by the resolutions of the Board of Directors authorizing the issuance of Common Stock, all rights to vote and all voting power shall be vested in the holders of Common Stock. Each share of Common Stock shall entitle the holder thereof to one vote.

No Cumulative Voting

Except as may be provided by the resolutions of the Board of Directors authorizing the issuance of Common Stock, cumulative voting by any shareholder is expressly denied.

No Preemptive Rights

Preemptive rights shall not exist with respect to shares of Common Stock or securities convertible into shares of Common Stock of the Company.

Dividends

We have not paid any cash dividends on our Common Stock since inception and presently anticipate that all earnings, if any, will be retained for development of our business and that no dividends on our Common Stock will be declared in the foreseeable future. Any future dividends will be subject to the discretion of our Board of Directors and will depend upon, among other things, future earnings, operating and financial condition, capital requirements, general business conditions and other pertinent facts. Therefore, there can be no assurance that any dividends on our Common Stock will be paid in the future.

| 14 |

Rights upon Liquidation, Dissolution or Winding-Up of the Company

Upon any liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary, the remaining net assets of the Company shall be distributed pro rata to the holders of the Common Stock.

Warrants and Options

As of September 30, 2015, the Company has not issued any warrants or options.

Holders

As of October 30, 2015, we have 27,000,000 issued and outstanding shares of Common Stock, which are held by 15 shareholders of record.

Securities Authorized for Issuance Under Equity Compensation Plans

None

Transfer Agent and Registrar

Our transfer agent is Action Stock Transfer and its phone number is (801) 274-1088. The transfer agent is responsible for all record-keeping and administrative functions in connection with the common shares.

No Public Market for Common Stock

There is currently no public trading market for our Common Stock and no such market may ever develop. While we intend to seek and obtain quotation of our Common Stock for trading on the OTC Bulletin Board (“OTCBB”), there is no assurance that our application will be approved. An application for quotation on the OTCBB must be submitted by one or more market makers who: 1) are approved by the Financial Industry Regulatory Authority ("FINRA"); 2) who agree to sponsor the security; and 3) who demonstrate compliance with SEC Rule 15(c)2-11 before initiating a quote in a security on the OTCBB. In order for a security to be eligible for quotation by a market maker on the OTCBB, the security must be registered with the SEC and the company must be current in its required filings with the SEC. There are no listing requirements for the OTCBB and accordingly no financial or minimum bid price requirements. We intend to cause a market maker to submit an application for quotation to the OTCBB upon the effectiveness of this Registration Statement of which this Prospectus forms a part. However, we can provide no assurance that our shares will be traded on the bulletin board or, if traded, that a public market will materialize.

Additional Information

We refer you to our Articles of Incorporation, Bylaws, and the applicable provisions of the Nevada Revised Statues for a more complete description of the rights and liabilities of holders of our securities.

| 15 |

DESCRIPTION OF OUR BUSINESS

The Company Overview

The Company was incorporated in the State of Nevada on July 24 2015. We were incorporated and our business plan called for the Company to seek out and acquire various mining assets in the State of Nevada. Rancho Santa Fe Mining Inc. is a precious metals exploration and development company with the objective of becoming a gold producer. The Company is currently focused on the advancement of its two principal projects: the Virginia and Vanity Fair patented claims.

On October 28, 2015, the Company entered into an Asset Purchase Agreement (the “Asset Purchase”) with Humboldt Mining Company, Inc., a Nevada corporation (“HMCI”). Pursuant to the Asset Purchase Agreement, the Company acquired 100% of certain assets owned by HMCI, including, but not limited to: (i) all the real property, leasehold improvements, fixtures, furniture, machinery and equipment owned by the HMCI and relating to or used in HMCI’s operations; and, (ii) all inventory, including finished goods, raw materials and work in process as well as the right to receive inventory ordered by the HMCI for use in its operations; and, (iii) in addition to the foregoing, we acquired all the books and records of HMCI, as well as all intangible assets held, owned or controlled by HMCI (collectively, (i), (ii) and (iii) are referred to hereinafter as the “Acquired Assets”. We acquired none of HMCI’s existing or future liabilities.

In exchange for the Acquired Assets the Company issued to the HMCI shareholders Thirteen Million Five Hundred Thousand (13,500,000) shares of the Company’s $0.001 par value common stock, which represented Fifty (50%) percent of the Company’s issues and outstanding shares at the time of issuance. A copy of the Asset Purchase Agreement may be found as an Exhibit attached to this Registration Statement.

Company now owns land and patented mining rights North of Elko, Nevada nearby the formation known as the Carlin Trend. The Carlin Trend is the second-largest known gold resource in the world and has produced over 70 million ounces of gold. The Company’s property includes two patented claims – the Virginia and Vanity Fair patented claims - comprising what is known as the Prunty Mine Area.

The importance of these patented claims cannot be underestimated, insomuch as they have been referred to independently as “unique, rare and exceptional.” Further, in accordance with the Apex Rule in Mining, along the primary axis of the claims the Company is allowed to follow and continue mining the Prunty Mine area beyond the properties presently owned by the Company, even if following that mining axis extends beyond the patented claim.

Operationally over the next 2-5 years, the Company intends to outsource fully 100% of the exploration, site preparation and extraction operations to a third party who provides all manpower, equipment and operational expenses associated therewith. It is intended the third party pays the Company a royalty of 20% to 30% of the gold reserves recovered and sold. We have begun initial discussions with several third-party candidates. The Company plans to retain five full time staff and lease nominal executive office facilities in Nevada. All Legal, Accounting, Shareholder Relations and Geology can be outsourced to consultants as needed. Business Development is limited to developing and maintaining a website presence, and nominal travel and business entertainment expense. The primary additional operations entail Asset Development, which includes the maintenance of applicable permits and claim renewals, as well as the outsourced production of independent Reserve Reports annually.

Asset Analysis

Background

In 1912, Dr. Pinkard Prunty purchased 1,200 acres of Nevada wilderness from the then future President of the United States, Herbert Hoover. Gold was discovered on the land soon after. Dr. Prunty immediately employed day workers with pick axes to begin extraction, and over the next decades purchased an additional 120,000 acres with his gold revenues. After his death, the property passed to his children, who continued to successfully mine gold on the property with pick-axes. In 1979, family member Charles Leavitt reviewed the mine’s books and uncovered the fact that revenues had been mishandled, this lead to a dispute and the family closing the mine in 1980.

Since then, David Leavitt, inherited the land and the associated patented mining claims on the property. Leavitt was the Chairman of Humboldt Mining Company, Inc., which was acquired by Rancho Santa Fe Mining Inc.

| 16 |

Management believes there is persuasive evidence the geological structure of the area is potentially on a major mineralized zone, perhaps part of the Carlin Trend. The closing of the lands coincided with the introduction and adoption of industrial-scale cyanide leaching mining techniques in the nearby Carlin Trend. Following the advent of cyanide-leaching, the Carlin Trend has since produced more gold than any other mining district in the United States; over 70 million ounces of gold. Numerous sources estimate the Carlin Trend may still contain over 180 million ounces of gold.

Based on Management’s experience and all available documentation, we believe we have a “Carlin-type deposit,” this type of deposit posses what geologists call “disseminated gold.” It generally takes a microscope to see the gold in such deposits. In such deposits, the grade may be low but they make up for low-grade in high-volume. To extract gold from such low-grade deposits miners crush tons of rock, which is piled into heaps and irrigated with cyanide, an industrial-scale mining technique that was actually pioneered at the Carlin Trend. As the gold price shot up at the end of the 1970s, mining companies rushed to look for similar deposits around the world - just as the Prunty family’s lands were closed in a family dispute.

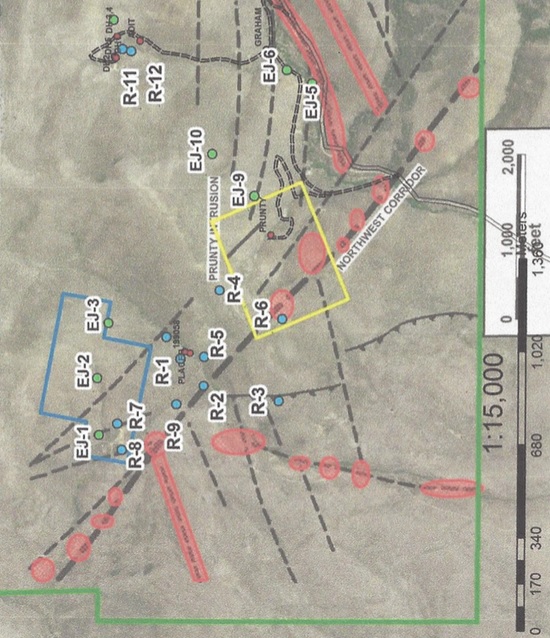

Map of the Mining Claims

| 17 |

Above indicates that the area enclosed in the yellow box represents the Virginia and Vanity Fair Patented Claims held by the Company, these lie along the broader “Northwest Corridor”. In accordance with the Apex Rule in Mining, along the primary axis of the claims, which is the Northwest Corridor, the Company believes that it will be allowed to follow and continue mining the Prunty Mine area beyond the area enclosed in yellow above, even if following that mining axis extends into properties owned by others.

According to an independent geologist opinion letter from Paul Pelke, dated September 1, 2015; “I estimate that all of the individual deposits that would be found could amount to a total possible resource of between 400,000 to 500,000 ounces of contained gold. The targets on the Prunty claim group alone could amount to 25% to 40% of the total potential resource.” Another independent geophysical, in 2011, stated that the most important target was the "Northwest Corridor". He also stated that the "beads" lying along this corridor likely are an artifact of the lines being run north-south 100 meters apart. Two of the largest "beads" lie along the Northwest Corridor and lie within the Virginia and Vanity Fair Patented claims (The Prunty Mine area). Drilling here would not require direct US Forest Service approval, just a go ahead from the Nevada Department of Environmental Protection located in Carson City, Nevada.”

Pelke Technical Evaluation Report

In addition to his September 2015 opinion letter, in August, 2011, Paul Pelke was retained as a consulting geologist to prepare a technical evaluation report (hereinafter referred to as the “Pelke Report”) on the Humboldt Mines Project in northern Elko County, Nevada. The Pelke Report was completed February 24, 2012 and details the assets, locations, geology, production and exploration history of the Company’s patented lands. The key findings of the Pelke Report are summarized below.

The property has been drilled three times; in 1984, 1986 and 2010. Results have measured concentrations of Ounces of Gold per Ton (OPT) averaging from a low of 0.013 OPT to a high of 0.84 OPT. Mr. Pelke collected 6 samples from various locations on the property and subsequently for analysis by the ALS Chemex analytical laboratory in Reno, Nevada. These returned gold traces between 0.009 ppm (parts-per-million) and 32.4ppm. A concentration of 34.2857 ppm is 1.0 OPT.

Tenneco performed the 1986 drilling. One drill hole was outstanding at 0.8ppm. In at least 7 of the drill holes there were relatively long intervals ranging from 50 feet to 105 feet averaging on the order of 100 ppb (parts-per-billion). Those lower grade intercepts are significant indicator values and could indicate the hole may have intersected the margin of a potentially larger, higher-grade gold zone.

During the early summer of 2011, Humboldt Mining commissioned a ground magnetic survey of the Claim Group. Magee Geophysical Services of Reno, Nevada, carried out the survey and Wright Geophysics of Spring Creek, Nevada, completed the interpretation. Based on this data, Wright Geophysics produced two maps showing Areas of Interest (AOI). The ground magnetic survey delineates what is interpreted as a heavily intruded sedimentary terrain dominated by two primary structural orientations. Most prominent among the structures is a Northwest Corridor traversing the entire project area for 2 kilometers. This zone should be considered to be a principal target area. Wright interprets the corridor to be composed of one large continuous structure as well as several smaller parallel structures to the northeast.

The Pelke Report recommends initial work should be done in the Prunty Mine area. The quartz with sulfides recovered from the dump returned values of 32.4 ppm (about 1.0 OPT). Consequently it may be possible to develop a high-grade underground vein deposit. In addition, the Prunty Patented Claims cover the most important parts of the Northwest Corridor based on Areas of Interest (AOI) identified by Wright Geophysics.

The next important area is the rest of the 2 kilometer long Northwest Corridor to the northwest and southeast of the Prunty Mine. The Apex Rule in Mining allows the Company to mine the primary axis of the claims – the Northwest Corridor – beyond the patented claim areas under the Company’s ownership. The area to the northwest along the Northwest Corridor is the area with highest concentration of drill holes from the 1984 and 1986 drilling programs. Many of those drill holes appear to coincide with the structures and AOI’s developed by Wright. Many of the 1984 and 1986 drill holes were along or near the structure or the AOI’s themselves. Some of these drill holes had intercepts with gold values of interest.

Robison Report on Gold Property in the Mardis Mining District, Elko Nevada

Robert Robison has worked on this project for over 40 years and he prepared an evaluation report (hereinafter referred to as the “Humboldt-Charleston Report”) on the Humboldt Mines Project encompassing the areas of interest. The Humboldt-Charleston Report summarizes the assets, locations, geology, production, and exploration history of the Company’s patented lands. The Humboldt-Charleston Report’s key findings are summarized below.

The Humboldt-Charleston report summarizes chemical analysis performed by four independent assay companies including:

| 18 |

| • | Rocky Mountain Geochemical Corp. Salt Lake City, Utah. |

| • | Analytical Services, Elko, Nevada |

| • | Monitor Geochemical Laboratory, Elko, Nevada |

| • | The Assay Lab, West Jordan, Utah |

The geochemical sampling of soils showed anomalous gold values in at least six samples as follows:

| • | Sample RP 2113, .018 oz per ton gold. |

| • | Sample DM 16, .065 oz. per ton gold. |

| • | Sample RP 2081, .083 oz. per ton gold. |

| • | Sample RP 2072, .029 oz. per ton gold. |

| • | Sample RP 2089, .013 oz. per ton gold. |

| • | Sample RP 2092, .046 oz. per ton gold. |

The Humboldt-Charleston Report also suggests more exploratory drill holes should be drilled in the vicinity of the Prunty Mines, and that priorities should include developing the Skarn deposit, additional exploratory drilling and detailed geologic mapping - but goes on to classify and suggest the following Probable Reserves:

| • | Conservative (Measured): 50,000 ounces |

| • | Realistic (Indicated): 2,000,000 ounces |

| • | At $1200/ounce; approximately $60M to $2.4B |

Mining Technique: Cyanide Heap Leaching

The geology of the Company’s assets dictate the Company use Cyanide Heap Leaching similar to the mining techniques pioneered and used at the nearby Carlin Trend. More than 90% of all gold extracted worldwide relies upon the use of cyanide. Of the 1.1 million tons of hydrogen cyanide (HCN) produced annually, only 6% is for use in the mining industry. The remaining 94% is used to produce a wide variety of products such as adhesives, computer electronics, fire retardants and nylon.

In heap leaching, a cyanide solution is dripped or sprayed onto heaps of crushed ore that is placed over impervious liners. The cyanide solution dissolves minute particles of gold and silver in the ore to form a water-soluble compound; the resulting solution containing the metals in this form is collected and processed to extract the gold and silver for further refining. The remaining cyanide solution is then recycled and reused for extraction.

Mine operators have stringent safety practices to minimize risks to workers, the environment, and communities. These include strict workplace safety measures, employee training programs and emergency response plans to prepare workers to respond quickly to exposure to cyanide or spillage. To prevent any release to the environment, mines integrate protective measures such as constructing liquid containment areas around tanks, utilizing impervious liners beneath leach pads and ponds, and installing leak detection and collection systems.