Attached files

| file | filename |

|---|---|

| 8-K - 8-K - J.G. Wentworth Co | jgw8-kdec112015.htm |

D I V E R S I F I E D C O N S U M E R F I N A N C I A L S E R V I C E S C O M P A N Y B U S I N E S S U P D A T E

NON-GAAP MEASURES 2 We use Adjusted Net Income (a non-GAAP financial measure) and as a measure of our results from operations, which we define as our net income (loss) under U.S. GAAP before non-cash compensation expenses, certain other expenses, provision for or benefit from income taxes and for our Structured Settlement and Annuity Purchasing segment amounts related to the consolidation of the securitization and permanent financing trusts we use to finance the segment’s business. We use Adjusted Net Income (Loss) to measure our overall performance because we believe it represents the best measure of our operating performance, as the operations of the associated variable interest entities do not impact the Structured Settlement and Annuity Purchasing segment’s performance. In addition, the add-backs described above are consistent with adjustments permitted under our Term Loan agreement. We also use the non-GAAP measures of Total Adjusted Revenue and adjusted unrealized gains on VIE and other finance receivables, long term debt and derivatives, net of the loss on swap termination, net (“Spread Revenue”), as measures of our revenues, which we define as those measures under U.S. GAAP before the amounts related to the consolidation of the securitization and permanent financing trusts we use to finance our business. We use these measures to measure our revenues because we believe they represent better measures of our revenues, as the operations of these variable interest entities do not impact business performance. Additionally, we have begun to use Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) to also measure our overall performance, which we as define our net income (loss) under U.S. GAAP before non-cash compensation expenses, Term Loan interest expense, debt issuance expense, depreciation and amortization, certain other expenses, provision for or benefit from income taxes and for our Structured Settlement and Annuity Purchasing segment amounts related to the consolidation of the securitization and permanent financing trusts we use to finance the segment’s business. You should not consider Adjusted Net Income, Total Adjusted Revenue, Spread Revenue, or EBITDA in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Because not all companies use identical calculations, our presentation of Adjusted Net Income, Total Adjusted Revenue, Spread Revenue and EBITDA may not be comparable to other similarly titled measures of other companies. A reconciliation of QTD Net Income (Loss) to Adjusted Net Income and EBITDA, which includes line items for Total Adjusted Revenue and Spread Revenue for the historical periods included in the year December 31, 2014 and the nine months ended September 30, 2015 are included as Exhibits to this presentation.

SAFE HARBOR Certain statements in this document constitute “forward-looking statements.” All statements, other than statements of historical fact, are forward-looking statements. You can identify such statements because they contain words such as “plans,” “expects,” or “does expect,” “budget,” “forecasts,” “ant icipates,” or “does not anticipate,” “believes,” “intends,” and similar expressions or statements that certain actions, events or results “may,” “could,” “would,” “might,” or “will,” be taken, occur or be achieved. Any statements that refer to expectations or other characterizations of future events, circumstances or results are forward-looking statements. A number of factors could cause actual results, performance or achievements to differ materially from the results expressed or implied in the forward-looking statements. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Forward-looking statements necessarily involve significant known and unknown risks, assumptions and uncertainties that may cause our actual results, performance and opportunities in future periods to differ materially from those expressed or implied by such forward-looking statements. Consideration should also be given to the areas of risk set forth under the heading “Risk Factors” in our filings with the Securities and Exchange Commission, and as set forth more fully under “Part 1, Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2014 and our form 10-Q for the period ending September 30, 2015, these risks and uncertainties include, among other things: the effects of local and national economic, credit and capital market conditions on the economy in general and on the mortgage industry in particular, and the effects of interest rates; future opportunities of the combined company; our anticipated needs for working capital; our ability to implement our business strategy; our ability to continue to purchase structured settlement payments and other assets; the compression of the yield spread between the price we pay for and the price at which we sell assets due to changes in interest rates and/or other factors; changes in tax or accounting policies or changes in interpretation of those policies as applicable to our business; changes in current tax law relating to the tax treatment of structured settlements; our ability to complete future securitizations or other financings on beneficial terms; our dependence on the opinions of certain rating agencies; our dependence on outside parties to conduct our transactions including the court system, insurance companies, outside counsel, delivery services and notaries; our ability to remain in compliance with the terms of our substantial indebtedness; changes in existing state laws governing the transfer of structured settlement payments or the interpretation thereof; availability of or increases in the cost of our financing sources relative to our purchase discount rate; changes to state or federal, licensing and regulatory regimes; unfavorable press reports about our business model; our dependence on the effectiveness of our direct response marketing; adverse judicial developments; our ability to successfully enter new lines of business and broaden the scope of our business; potential litigation and regulatory proceedings; changes in our expectations regarding the likelihood, timing or terms of any potential acquisitions described herein; the lack of an established market for the subordinated interest in the receivables that we retain after a securitization is executed; the impact of the Consumer Financial Protection Bureau inquiry and any findings or regulations it issues as related to us, our industries, or products in general; our dependence on a small number of key personnel; our exposure to underwriting risk; our access to personally identifiable confidential information of current and prospective customers and the improper use or failure to protect that information; our computer systems being subject to security and privacy breaches; the public disclosure of the identities of structured settlement holders; our business model being susceptible to litigation; the insolvency of a material number of structured settlement issuers; and infringement of our trademarks or service marks; our ability to integrate the Home Lending business, and the costs associated with such integration; adverse changes in the residential mortgage market; our ability to maintain sufficient capital to meet the financing requirements of our business; our ability to grow our loan originations volume; changes in prevailing interest rates and our ability to mitigate interest rate risk through hedging strategies; increases in delinquencies and defaults for the loans we service, especially in geographic areas where our loans are concentrated; changes in prepayments rates; changes in, and our ability to comply with, federal, state and local laws and regulations governing us; change in the guidelines of government-sponsored entities or any discontinuation of, or significant reduction in, the operation of government- sponsored entities; our ability to maintain our state licenses or obtain new licenses in new markets; our ability to originate and/or acquire additional mortgage servicing rights; the accuracy of the estimates and assumptions of our financial models; our ability to recapture loans from borrowers who refinance; potential misrepresentations by borrowers, counterparties and other third-parties; costs and potential liabilities resulting from state or federal examinations, legal proceedings, enforcement actions and foreclosure proceedings; changes in government mortgage modification programs; our ability to obtain adequate insurance; indemnification obligations to mortgage loan purchasers; our ability to timely recover servicing advances; illiquidity in our portfolio; challenges to the MERS system; technology failures; our ability to satisfy our financial covenants with our lenders; and our ability to successfully compete in the mortgage industry and real estate services business. Except for our ongoing obligations to disclose material information under the federal securities laws, we undertake no obligation to publicly revise any forward-looking statements, to report events or to report the occurrence of unanticipated events unless we are required to do so by law. 3

COMPANY OVERVIEW

A diversified consumer financial services company leveraging a distinct set of capabilities to extend our reach to consumers in search of “CASH NOW” THE J.G. WENTWORTH COMPANY® PRODUCT OFFERINGS 1. Payment Purchasing Structured Settlement Annuity & Lottery 2. Home Lending 3. Personal Lending – early stages 4. Prepaid – early stages CAPABILITIES 5 1. Strong Brand 2. Direct to Consumer 3. Funding Platforms 4. Digital & Information Management

Overall Company Become more customer-centric through data, information and processes Drive operational scale and efficiency Continue to incubate new product lines (Personal Lending and Prepaid Cards) Maintain access to cash through capital markets execution Focus on profitability Structure Settlement Payment Purchasing Re-align performance and focus on profitability Reset the marketing and operational spend to appropriate levels Implement further specialization of roles and processes Home Lending Position Home Lending for profitable growth Launch direct to consumer channel BUSINESS STRATEGY 6 Continue to evolve as a diversified consumer financial services company…

S T R U C T U R E D S E T T L E M E N T P A Y M E N T P U R C H A S I N G

STRUCTURED SETTLEMENT PAYMENT PURCHASING Industry leader Well recognized brand Strong infrastructure Direct-to-Consumer Originator Strong Regulatory Compliance Discipline Nationwide Capabilities Completed 43 Securitizations > $5 Billion A large database of customers and prospects 8 “Money!” “A respectable financial company that has been in business for a long time.” “It's your money, use it when you need it!” Quotes Source: J.G. Wentworth Q4’14 Brand Health Tracker (conducted by Horizon Media with Toluna’s consumer panel)

9 STRUCTURED SETTLEMENT DYNAMICS Present Challenges Highly competitive market Niche financial services product with modest growth of the general market Rising cost of funds / rate volatility impacts securitization & asset valuations Challenging conditions continue into Q4 2015 Traditional Approach Mix of marketing spend heavy on television (broad reach; one to many) Securitization platform three times a year Selective specialization in the payment purchasing process Targeted improvements to marketing, customer acquisition, operating and funding processes

A TARGETED APPROACH FOR THE FUTURE… 10 Enhance customer retention and loyalty strategies to improve conversion rates Transition to one to one digital marketing execution MediaCom USA Further strengthen digital, information & data to enhance marketing capabilities Improve lead acquisition costs Improve efficiency and productivity to drive $12 - $15 million in savings for 2016 Reduction of marketing expense approximately 20% from historical levels Corporate initiatives, staffing realignment and cost synergies Re-organizing production activities with a focus on specialization Capitalize on process improvement opportunities Leverage capital markets strength / reduce interest rate sensitivity Enhance access to capital markets Continue to build depth of investors More frequent securitizations in 2016 Implement Structured Settlement receivables risk management process

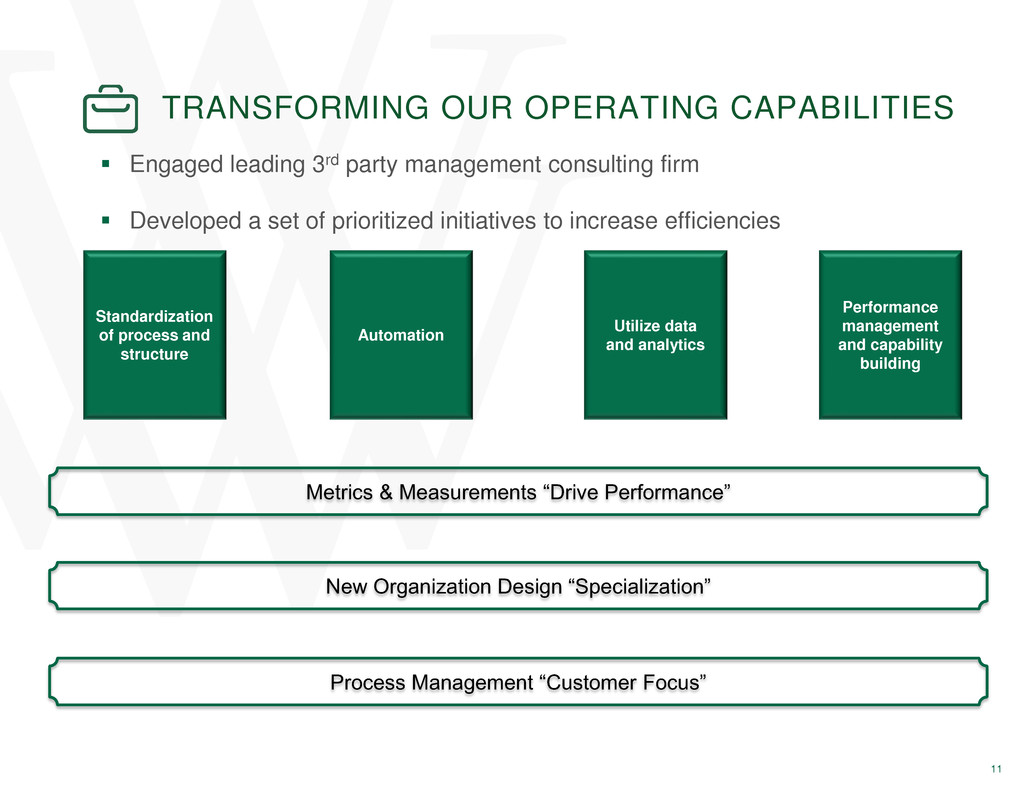

TRANSFORMING OUR OPERATING CAPABILITIES Standardization of process and structure Automation Utilize data and analytics Performance management and capability building New Organization Design “Specialization” Process Management “Customer Focus” Metrics & Measurements “Drive Performance” Engaged leading 3rd party management consulting firm Developed a set of prioritized initiatives to increase efficiencies 11

SUMMARY 12 Implement new marketing strategies and maximize spend effectiveness Improve conversion rates from new and existing customers Customer focused process improvement Pursue loyalty and retention strategies as a differentiator along the customer journey Increase operational efficiency and effectiveness Enhanced specialization activities of staff and deal pipeline Utilize deeper insights and metrics to manage the payment purchasing process The goal is to drive increased performance while improving results

H O M E L E N D I N G

EXPANSION INTO MORTGAGE INDUSTRY 14 Acquired WestStar in Q3 of 2015, including 2 months results in Q3 Accretive in 2015 Originates Conventional, VA and FHA loans, with average balance of ~$250,000 Operates in 39 states and District of Columbia (top three states: VA, CA, TX) Recognized for customer service and customer satisfaction PRODUCT MIX LARGE MARKET NEW DIRECT CHANNEL LIMITED BALANCE SHEET RISK HOME LENDING GAIN SHARE Costco Mortgage Services’ 2013 Operational Excellence Award 2014 Costco Lender of the Year Award 95% consumer satisfaction rating, based on recent Lending Tree survey

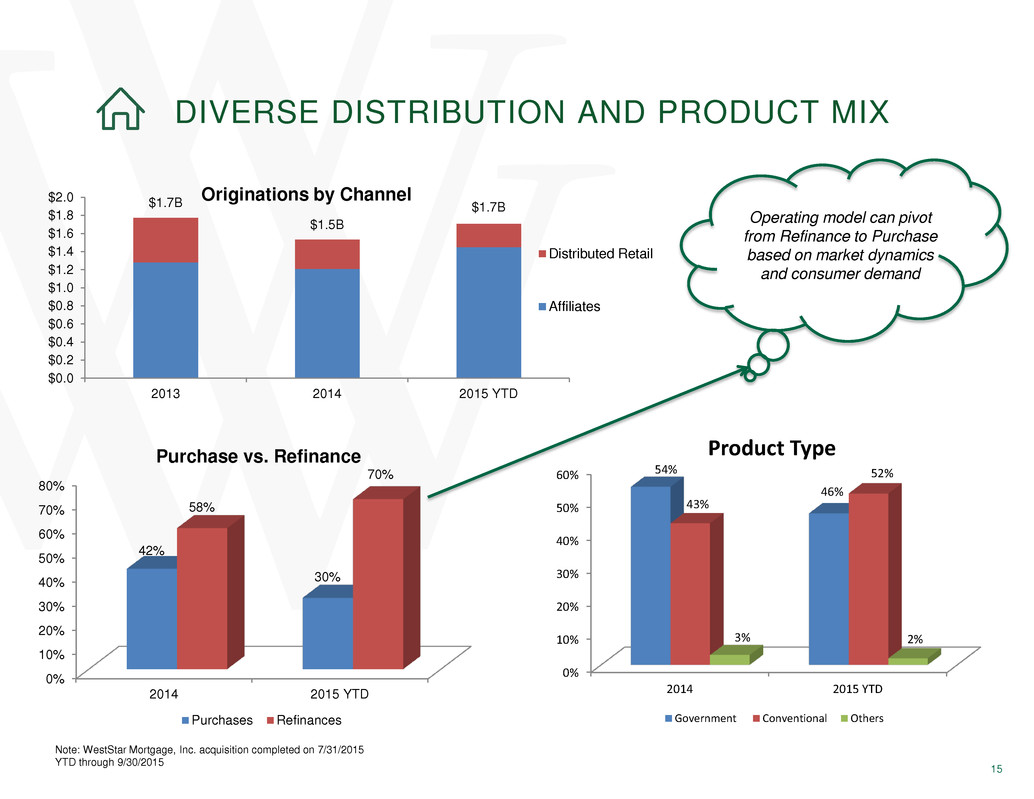

DIVERSE DISTRIBUTION AND PRODUCT MIX 0% 10% 20% 30% 40% 50% 60% 70% 80% 2014 2015 YTD 42% 30% 58% 70% Purchase vs. Refinance Purchases Refinances Operating model can pivot from Refinance to Purchase based on market dynamics and consumer demand 15 $1.7B $1.5B $1.7B $0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 $1.4 $1.6 $1.8 $2.0 2013 2014 2015 YTD Distributed Retail Affiliates Originations by Channel Note: WestStar Mortgage, Inc. acquisition completed on 7/31/2015 YTD through 9/30/2015 0% 10% 20% 30% 40% 50% 60% 2014 2015 YTD 54% 46% 43% 52% 3% 2% Product Type Government Conventional Others

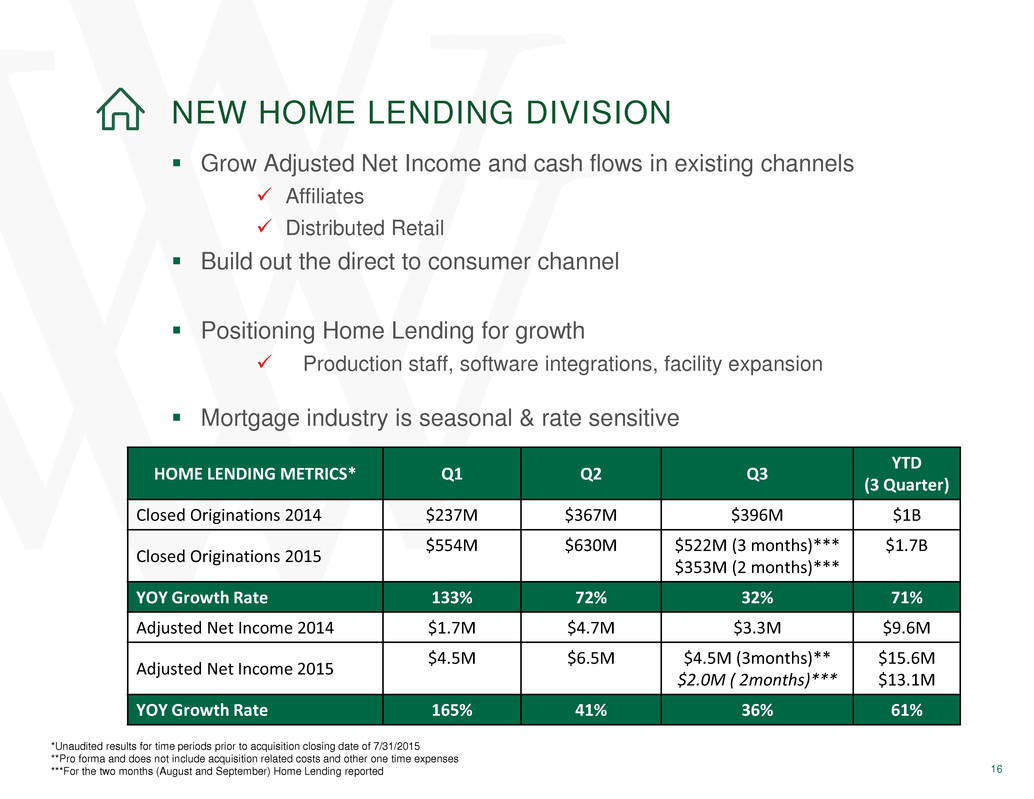

16 NEW HOME LENDING DIVISION HOME LENDING METRICS* Q1 Q2 Q3 YTD (3 Quarter) Closed Originations 2014 $237M $367M $396M $1B Closed Originations 2015 $554M $630M $522M (3 months)*** $353M (2 months)*** $1.7B YOY Growth Rate 133% 72% 32% 71% Adjusted Net Income 2014 $1.7M $4.7M $3.3M $9.6M Adjusted Net Income 2015 $4.5M $6.5M $4.5M (3months)** $2.0M ( 2months)*** $15.6M $13.1M YOY Growth Rate 165% 41% 36% 61% *Unaudited results for time periods prior to acquisition closing date of 7/31/2015 **Pro forma and does not include acquisition related costs and other one time expenses ***For the two months (August and September) Home Lending reported Grow Adjusted Net Income and cash flows in existing channels Affiliates Distributed Retail Build out the direct to consumer channel Positioning Home Lending for growth Production staff, software integrations, facility expansion Mortgage industry is seasonal & rate sensitive

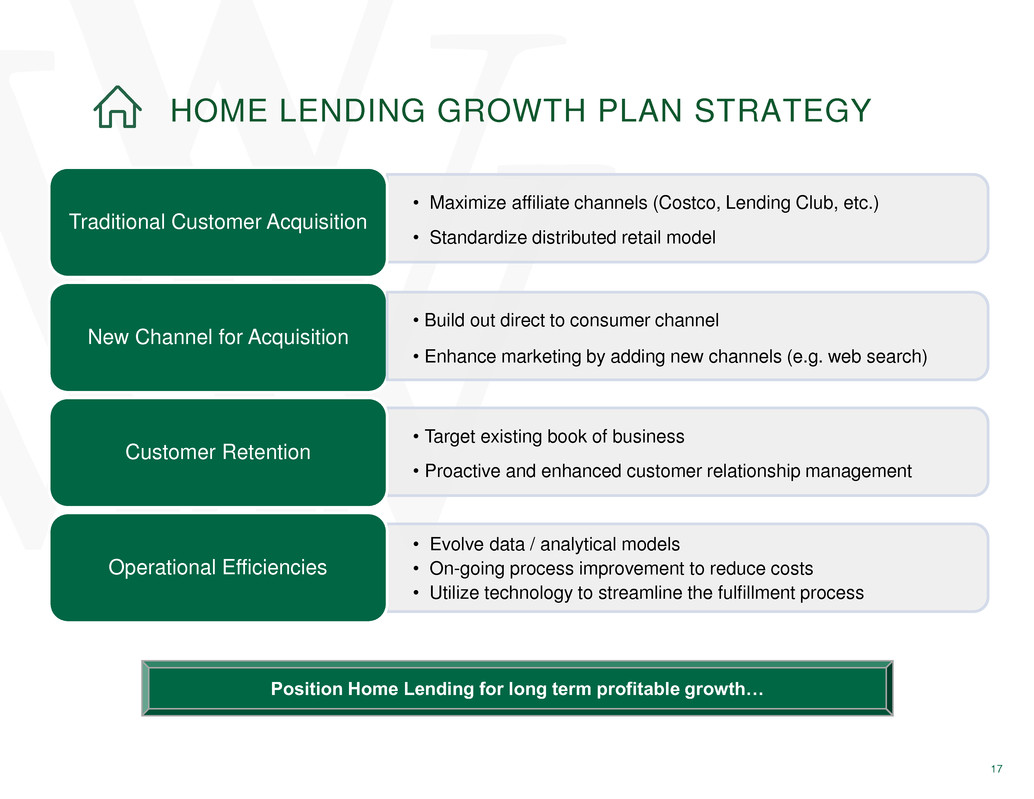

17 HOME LENDING GROWTH PLAN STRATEGY • Maximize affiliate channels (Costco, Lending Club, etc.) • Standardize distributed retail model Traditional Customer Acquisition New Channel for Acquisition • Target existing book of business • Proactive and enhanced customer relationship management Customer Retention • Evolve data / analytical models • On-going process improvement to reduce costs • Utilize technology to streamline the fulfillment process Operational Efficiencies Position Home Lending for long term profitable growth… • Build out direct to consumer channel • Enhance marketing by adding new channels (e.g. web search)

P E R S O N A L L E N D I N G & P R E P A I D C A R D S

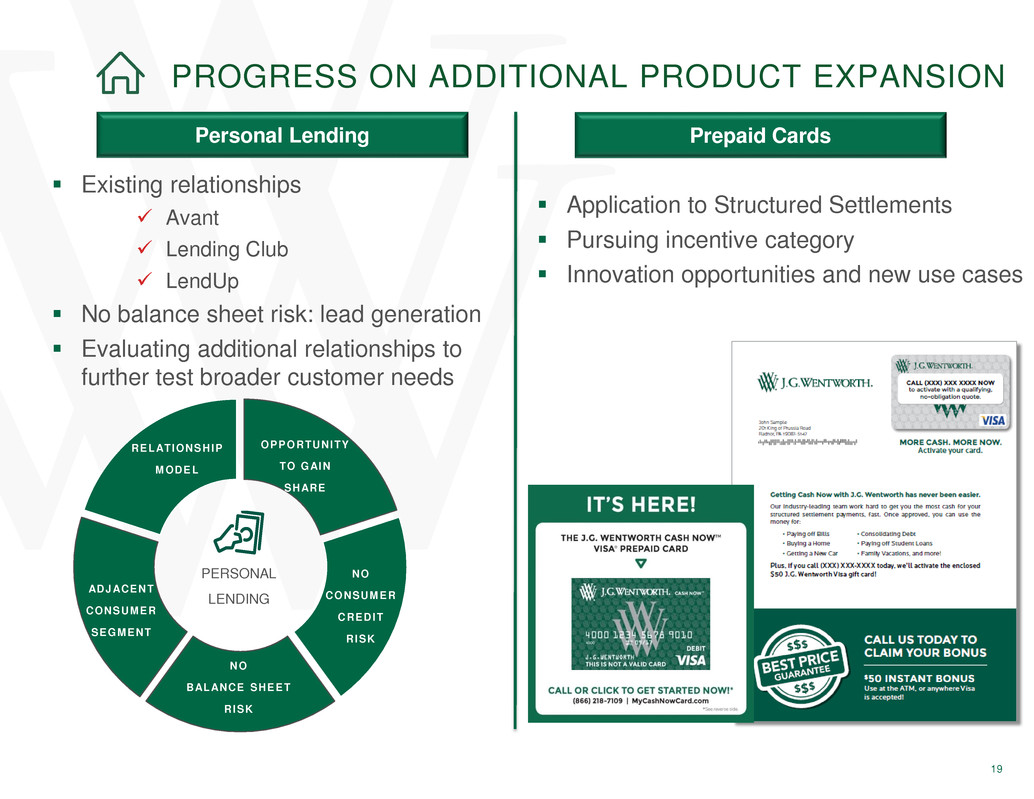

19 PROGRESS ON ADDITIONAL PRODUCT EXPANSION ADJACENT CONSUMER SEGMENT NO CONSUMER CREDIT RISK RELATIONSHIP MODEL OPPORTUNITY TO GAIN SHARE NO BALANCE SHEET RISK PERSONAL LENDING Existing relationships Avant Lending Club LendUp No balance sheet risk: lead generation Evaluating additional relationships to further test broader customer needs Application to Structured Settlements Pursuing incentive category Innovation opportunities and new use cases Personal Lending Prepaid Cards

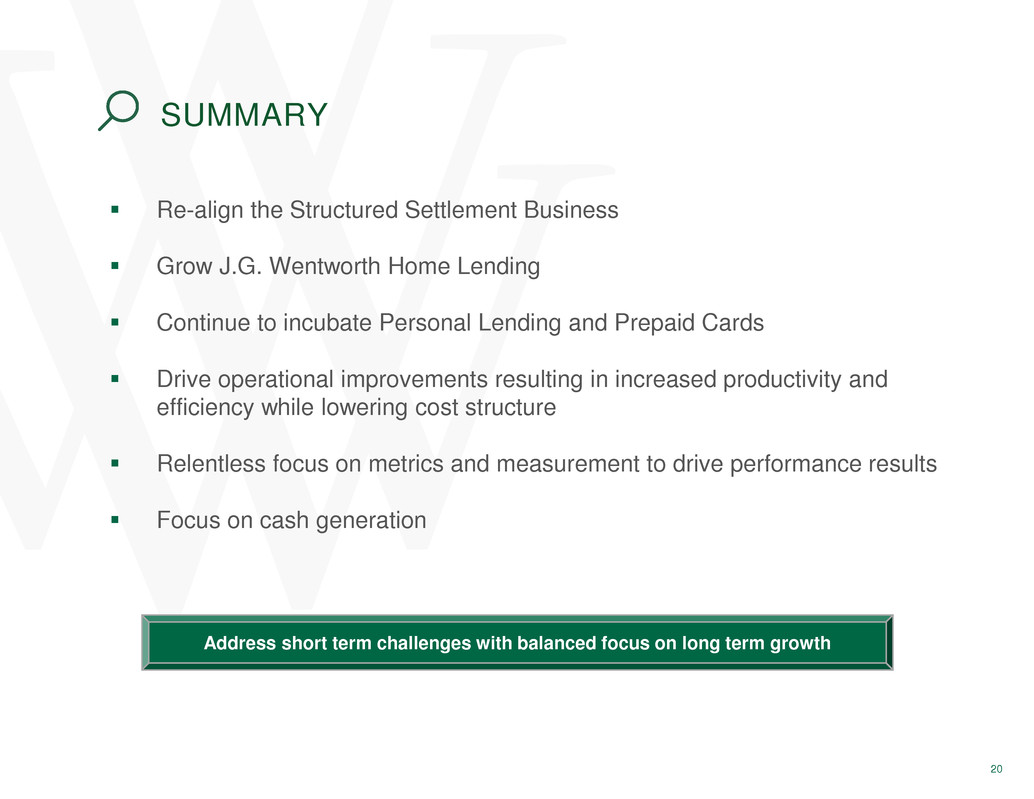

Re-align the Structured Settlement Business Grow J.G. Wentworth Home Lending Continue to incubate Personal Lending and Prepaid Cards Drive operational improvements resulting in increased productivity and efficiency while lowering cost structure Relentless focus on metrics and measurement to drive performance results Focus on cash generation SUMMARY 20 Address short term challenges with balanced focus on long term growth

F I N A N C I A L S

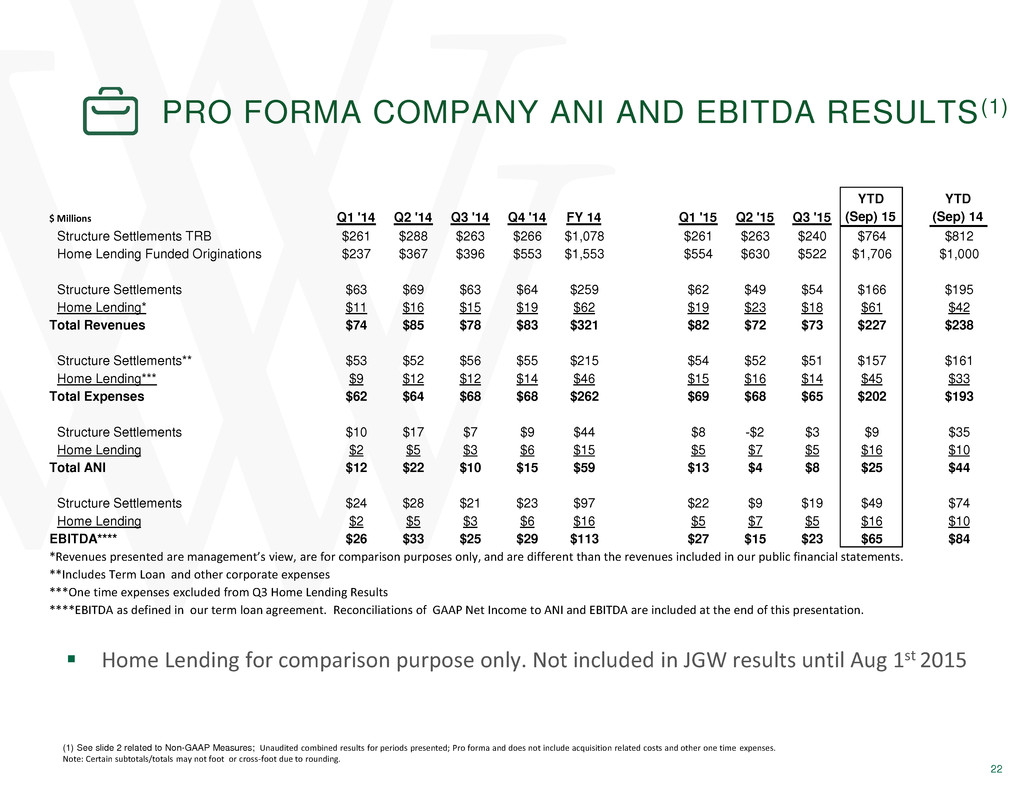

PRO FORMA COMPANY ANI AND EBITDA RESULTS (1) (1) See slide 2 related to Non-GAAP Measures; Unaudited combined results for periods presented; Pro forma and does not include acquisition related costs and other one time expenses. Note: Certain subtotals/totals may not foot or cross-foot due to rounding. Home Lending for comparison purpose only. Not included in JGW results until Aug 1st 2015 22 $ Millions Q1 '14 Q2 '14 Q3 '14 Q4 '14 FY 14 Q1 '15 Q2 '15 Q3 '15 YTD (Sep) 15 YTD (Sep) 14 Structure Settlements TRB $261 $288 $263 $266 $1,078 $261 $263 $240 $764 $812 Home Lending Funded Originations $237 $367 $396 $553 $1,553 $554 $630 $522 $1,706 $1,000 Structure Settlements $63 $69 $63 $64 $259 $62 $49 $54 $166 $195 Home Lending* $11 $16 $15 $19 $62 $19 $23 $18 $61 $42 Total Revenues $74 $85 $78 $83 $321 $82 $72 $73 $227 $238 Structure Settlements** $53 $52 $56 $55 $215 $54 $52 $51 $157 $161 Home Lending*** $9 $12 $12 $14 $46 $15 $16 $14 $45 $33 Total Expenses $62 $64 $68 $68 $262 $69 $68 $65 $202 $193 Structure Settlements $10 $17 $7 $9 $44 $8 -$2 $3 $9 $35 Home Lending $2 $5 $3 $6 $15 $5 $7 $5 $16 $10 Total ANI $12 $22 $10 $15 $59 $13 $4 $8 $25 $44 Structure Settlements $24 $28 $21 $23 $97 $22 $9 $19 $49 $74 Home Lending $2 $5 $3 $6 $16 $5 $7 $5 $16 $10 EBITDA**** $26 $33 $25 $29 $113 $27 $15 $23 $65 $84 *Revenues presented are management’s view, are for comparison purposes only, and are different than the revenues included in our public financial statements. **Includes Term Loan and other corporate expenses ***One time expenses excluded from Q3 Home Lending Results ****EBITDA as defined in our term loan agreement. Reconciliations of GAAP Net Income to ANI and EBITDA are included at the end of this presentation.

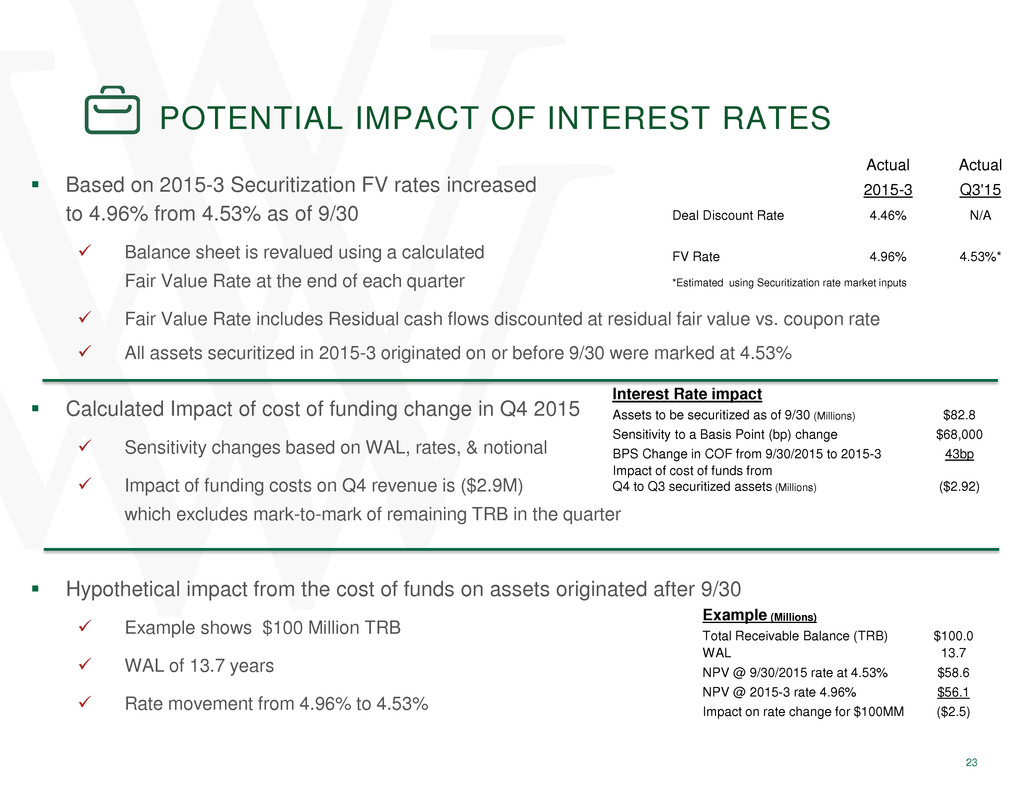

23 POTENTIAL IMPACT OF INTEREST RATES Based on 2015-3 Securitization FV rates increased to 4.96% from 4.53% as of 9/30 Balance sheet is revalued using a calculated Fair Value Rate at the end of each quarter Fair Value Rate includes Residual cash flows discounted at residual fair value vs. coupon rate All assets securitized in 2015-3 originated on or before 9/30 were marked at 4.53% Calculated Impact of cost of funding change in Q4 2015 Sensitivity changes based on WAL, rates, & notional Impact of funding costs on Q4 revenue is ($2.9M) which excludes mark-to-mark of remaining TRB in the quarter Hypothetical impact from the cost of funds on assets originated after 9/30 Example shows $100 Million TRB WAL of 13.7 years Rate movement from 4.96% to 4.53% Actual Actual 2015-3 Q3'15 Deal Discount Rate 4.46% N/A FV Rate 4.96% 4.53%* *Estimated using Securitization rate market inputs Example (Millions) Total Receivable Balance (TRB) $100.0 WAL 13.7 NPV @ 9/30/2015 rate at 4.53% $58.6 NPV @ 2015-3 rate 4.96% $56.1 Impact on rate change for $100MM ($2.5) Interest Rate impact Assets to be securitized as of 9/30 (Millions) $82.8 Sensitivity to a Basis Point (bp) change $68,000 BPS Change in COF from 9/30/2015 to 2015-3 43bp Impact of cost of funds from Q4 to Q3 securitized assets (Millions) ($2.92)

Maintain adequate liquidity (balances as of 11/30/2015) Total cash balance* - $72.8 Million: includes Home Lending Cash of $7.6M Manage adequate and cost efficient warehouse lines Term Loan and debt service Annual term loan cash interest expense of ~$30M Expense management Continue aggressive cost reduction Invest in the business CAPITAL STRUCTURE PRIORITIES 24 * Unaudited preliminary cash balance

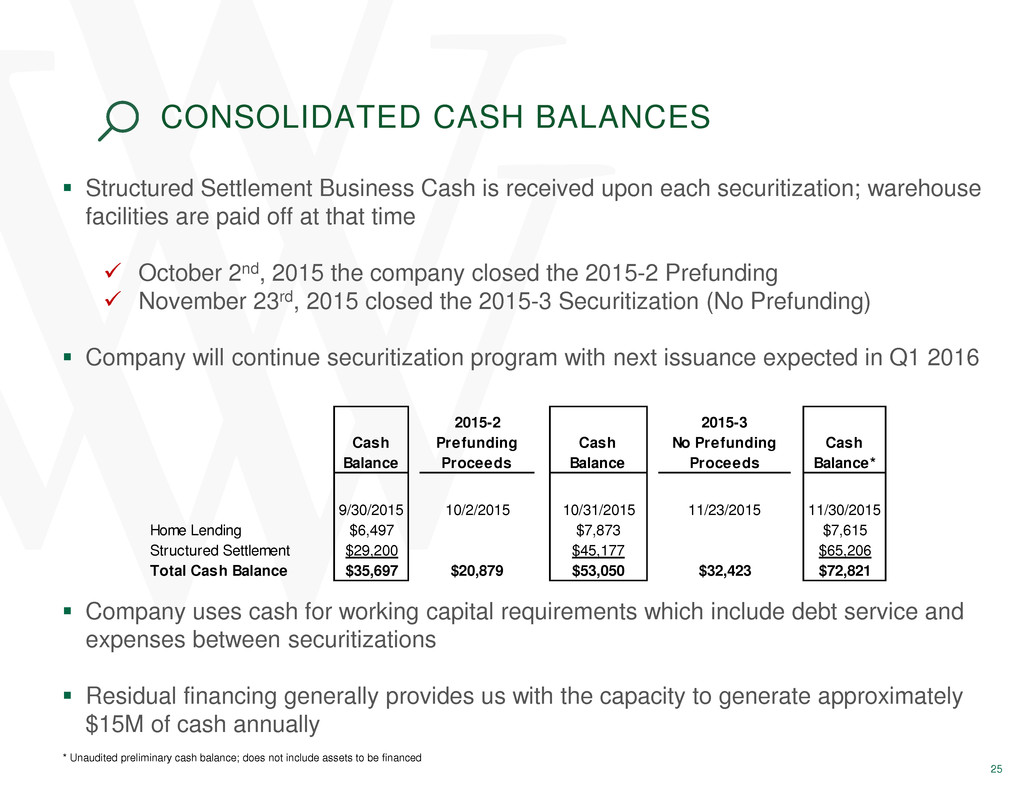

CONSOLIDATED CASH BALANCES 25 Structured Settlement Business Cash is received upon each securitization; warehouse facilities are paid off at that time October 2nd, 2015 the company closed the 2015-2 Prefunding November 23rd, 2015 closed the 2015-3 Securitization (No Prefunding) Company will continue securitization program with next issuance expected in Q1 2016 Company uses cash for working capital requirements which include debt service and expenses between securitizations Residual financing generally provides us with the capacity to generate approximately $15M of cash annually * Unaudited preliminary cash balance; does not include assets to be financed Cash Balance 2015-2 Prefunding Proceeds Cash Balance 2015-3 No Prefunding Proceeds Cash Balance* 9/30/2015 10/2/2015 10/31/2015 11/23/2015 11/30/2015 Home Lending $6,497 $7,873 $7,615 Structured Settlement $29,200 $45,177 $65,206 Total Cash Balance $35,697 $20,879 $53,050 $32,423 $72,821

STRUCTURED SETTLEMENT EXPENSE MANAGEMENT 26 Continue progress on expense discipline Marketing & Advertising continue to be optimized Interest Expense increased primarily due to incremental Residual financing Residual Term Debt of $133M: Sept YTD $6.0M (7.25%) Term Loan of $450M: Sept YTD $30.2M (7.00%) Other Interest Expense: Sept YTD $7.8M*** Includes investments made as we execute diversification strategy New website, Prepaid Card program launched, Lending platform, etc. ***Includes warehouse lines, and other ANI Expense Full Year 2014* YTD (Sep) 2014* YTD (Sep) 2015** Better / (Worse) Marketing and Advertising $68,489 $52,341 $47,799 $4,542 Interest Expense $57,891 $43,083 $44,052 ($969) Salaries and Related Cost $36,762 $27,234 $27,247 ($13) General and Administrative $18,315 $13,707 $13,682 $25 Professional and Consulting Fees $16,221 $11,954 $11,760 $194 Debt Issuance $8,683 $5,956 $5,092 $864 Bad Debt Expense $4,806 $3,273 $4,168 ($895) Depreciation and Amortization $4,168 $3,163 $2,917 $246 Other Expenses $69 $0 $0 $0 Total Stuctured Settlement Expenses $215,404 $160,711 $156,717 $3,994 *Per the respective periods' press release reconciliation of Net Income to Adjusted schedule ** Recalculated as follows: Consolidated YTD ANI Expense per Schedule F included in the 9/30/15 Press Release less Home Lending Segment's YTD expense per the 9/30/15 MD&A.

MODIFYING THE RISK MANAGEMENT APPROACH 27 More Frequent Securitization Reducing time in between deals to try to reduce investors spreads Outside forces such as Greece crisis, speculations of Feds increasing rate will always have an impact Hedging swap rates Goal is to reduce volatility from swap rate changes Increase Purchase yield Maximizing pricing in a competitive marketplace Diversifying investor base

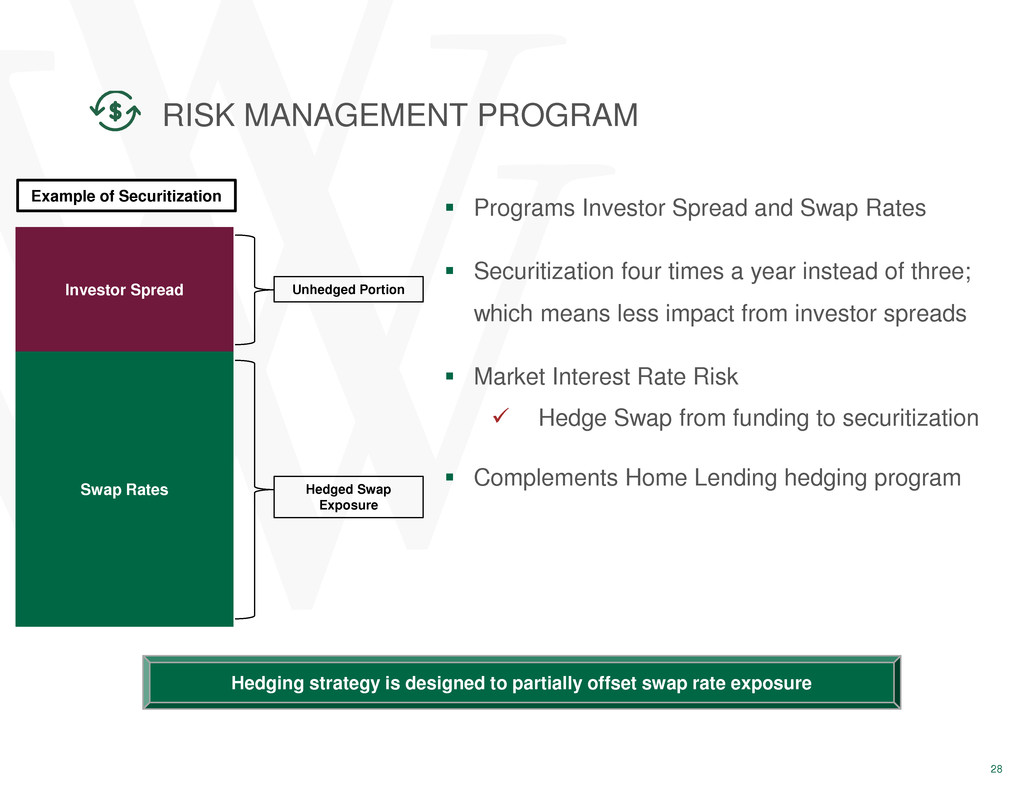

28 RISK MANAGEMENT PROGRAM Hedging strategy is designed to partially offset swap rate exposure Swap Rates Investor Spread Hedged Swap Exposure Unhedged Portion Example of Securitization Programs Investor Spread and Swap Rates Securitization four times a year instead of three; which means less impact from investor spreads Market Interest Rate Risk Hedge Swap from funding to securitization Complements Home Lending hedging program

EXHIBITS TO THE PRESENTATION

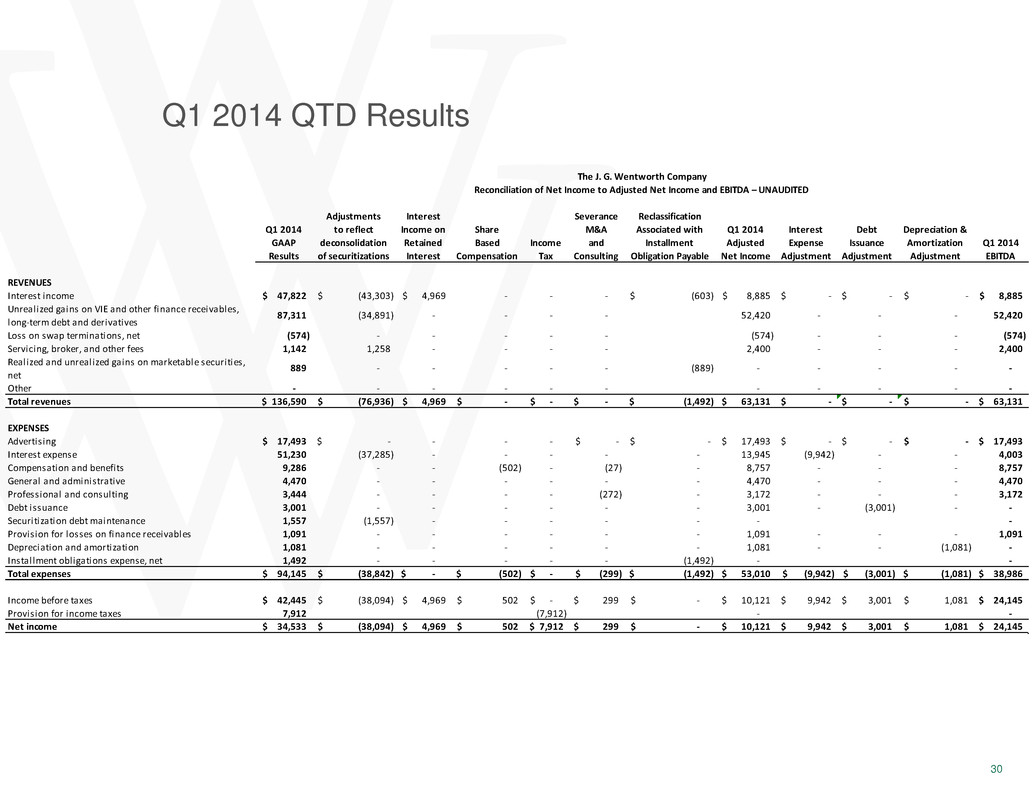

30 Adjustments Interest Severance Reclassification Q1 2014 to reflect Income on Share M&A Associated with Q1 2014 Interest Debt Depreciation & GAAP deconsolidation Retained Based Income and Installment Adjusted Expense Issuance Amortization Q1 2014 Results of securitizations Interest Compensation Tax Consulting Obligation Payable Net Income Adjustment Adjustment Adjustment EBITDA REVENUES Interest income 47,822$ (43,303)$ 4,969$ - - - (603)$ 8,885$ -$ -$ -$ 8,885$ Unrealized gains on VIE and other finance receivables, long-term debt and derivatives 87,311 (34,891) - - - - 52,420 - - - 52,420 Loss on swap terminations, net (574) - - - - - (574) - - - (574) Servicing, broker, and other fees 1,142 1,258 - - - - 2,400 - - - 2,400 Realized and unrealized gains on marketable securities, net 889 - - - - - (889) - - - - - Other - - - - - - - - - - - Total revenues 136,590$ (76,936)$ 4,969$ -$ -$ -$ (1,492)$ 63,131$ -$ -$ -$ 63,131$ EXPENSES Advertising 17,493$ -$ - - - -$ -$ 17,493$ -$ -$ -$ 17,493$ Interest expense 51,230 (37,285) - - - - - 13,945 (9,942) - - 4,003 Compensation and benefits 9,286 - - (502) - (27) - 8,757 - - - 8,757 General and administrative 4,470 - - - - - - 4,470 - - - 4,470 Professional and consulting 3,444 - - - - (272) - 3,172 - - - 3,172 Debt issuance 3,001 - - - - - - 3,001 - (3,001) - - Securitization debt maintenance 1,557 (1,557) - - - - - - - Provision for losses on finance receivables 1,091 - - - - - - 1,091 - - - 1,091 Depreciation and amortization 1,081 - - - - - - 1,081 - - (1,081) - Installment obligations expense, net 1,492 - - - - - (1,492) - - Total expenses 94,145$ (38,842)$ -$ (502)$ -$ (299)$ (1,492)$ 53,010$ (9,942)$ (3,001)$ (1,081)$ 38,986$ Income before taxes 42,445$ (38,094)$ 4,969$ 502$ -$ 299$ -$ 10,121$ 9,942$ 3,001$ 1,081$ 24,145$ Provision for income taxes 7,912 (7,912) - - Net income 34,533$ (38,094)$ 4,969$ 502$ 7,912$ 299$ -$ 10,121$ 9,942$ 3,001$ 1,081$ 24,145$ Reconciliation of Net Income to Adjusted Net Income and EBITDA – UNAUDITED The J. G. Wentworth Company Q1 2014 QTD Results

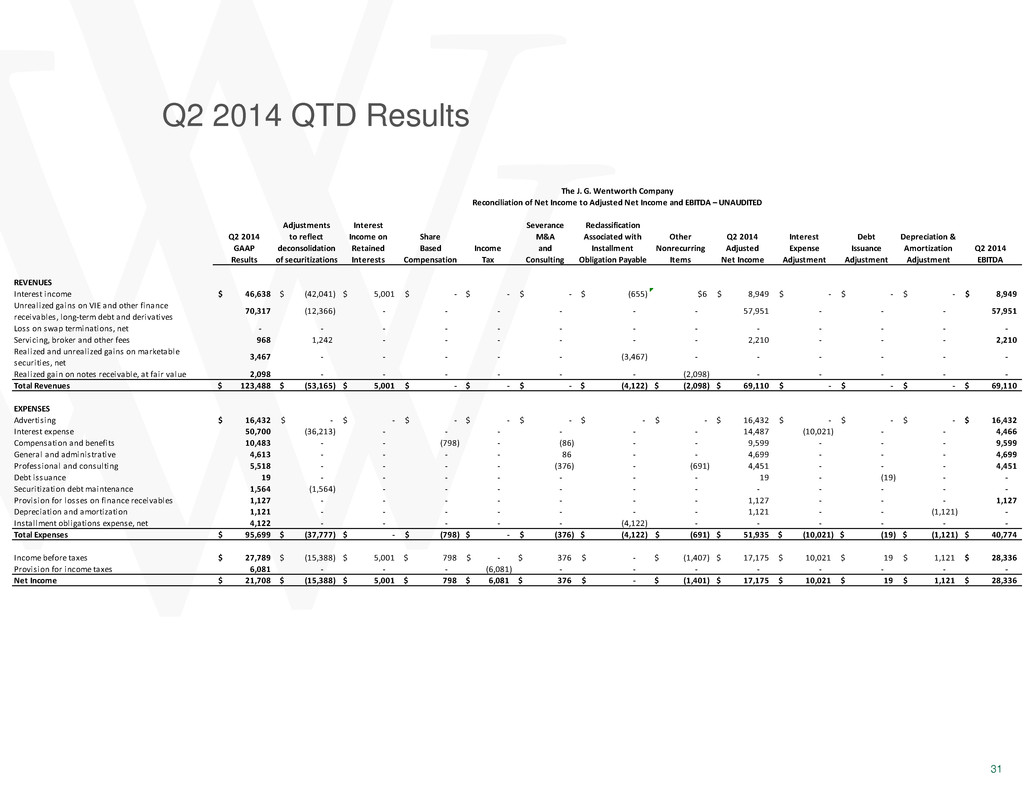

31 Q2 2014 QTD Results Adjustments Interest Severance Reclassification Q2 2014 to reflect Income on Share M&A Associated with Other Q2 2014 Interest Debt Depreciation & GAAP deconsolidation Retained Based Income and Installment Nonrecurring Adjusted Expense Issuance Amortization Q2 2014 Results of securitizations Interests Compensation Tax Consulting Obligation Payable Items Net Income Adjustment Adjustment Adjustment EBITDA REVENUES Interest income 46,638$ (42,041)$ 5,001$ -$ -$ -$ (655)$ $6 8,949$ -$ -$ -$ 8,949$ Unrealized gains on VIE and other finance receivables, long-term debt and derivatives 70,317 (12,366) - - - - - - 57,951 - - - 57,951 Loss on swap terminations, net - - - - - - - - - - - - - Servicing, broker and other fees 968 1,242 - - - - - - 2,210 - - - 2,210 Realized and unrealized gains on marketable securities, net 3,467 - - - - - (3,467) - - - - - - Realized gain on notes receivable, at fair value 2,098 - - - - - - (2,098) - - - - - Total Revenues 123,488$ (53,165)$ 5,001$ -$ -$ -$ (4,122)$ (2,098)$ 69,110$ -$ -$ -$ 69,110$ EXPENSES Advertising 16,432$ -$ -$ -$ -$ -$ -$ -$ 16,432$ -$ -$ -$ 16,432$ Interest expense 50,700 (36,213) - - - - - - 14,487 (10,021) - - 4,466 Compensation and benefits 10,483 - - (798) - (86) - - 9,599 - - - 9,599 General and administrative 4,613 - - - - 86 - - 4,699 - - - 4,699 Professional and consulting 5,518 - - - - (376) - (691) 4,451 - - - 4,451 Debt issuance 19 - - - - - - - 19 - (19) - - Securitization debt maintenance 1,564 (1,564) - - - - - - - - - - - Provision for losses on finance receivables 1,127 - - - - - - - 1,127 - - - 1,127 Depreciation and amortization 1,121 - - - - - - - 1,121 - - (1,121) - Installment obligations expense, net 4,122 - - - - - (4,122) - - - - - - Total Expenses 95,699$ (37,777)$ -$ (798)$ -$ (376)$ (4,122)$ (691)$ 51,935$ (10,021)$ (19)$ (1,121)$ 40,774$ Income before taxes 27,789$ (15,388)$ 5,001$ 798$ -$ 376$ -$ (1,407)$ 17,175$ 10,021$ 19$ 1,121$ 28,336$ Provision for income taxes 6,081 - - - (6,081) - - - - - - - - Net Income 21,708$ (15,388)$ 5,001$ 798$ 6,081$ 376$ -$ (1,401)$ 17,175$ 10,021$ 19$ 1,121$ 28,336$ Reconciliation of Net Income to Adjusted Net Income and EBITDA – UNAUDITED The J. G. Wentworth Company

32 Q3 2014 QTD Results Adjustments Interest Severance Reclassification Q3 2014 to reflect Income on Share M&A Associated with Other Q3 2014 Interest Debt Depreciation & GAAP deconsolidation Retained Based Income and Installment Nonrecurring Adjusted Expense Issuance Amortization Q3 2014 Results of securitizations Interests Compensation Tax Consulting Obligation Payable Items Net Income Adjustment Adjustment Adjustment EBITDA REVENUES Interest income 44,644$ (40,188)$ 5,168$ -$ -$ -$ (568)$ -$ 9,056$ -$ -$ -$ 9,056$ Unrealized gains on VIE and other finance receivables, long- term debt and derivatives 63,731 (12,392) - - - - - - 51,339 - - - 51,339 Loss on swap terminations, net (54) - - - - - - - (54) - - - (54) Servicing, broker and other fees 1,049 1,323 - - - - - - 2,372 - - - 2,372 Realized and unrealized losses on marketable securities, net (2,615) - - - - - 2,615 - - - - - - Realized gain on notes receivable, at fair value - - - - - - - - - - - - - Gain on debt extinguishment 270 - - - - - - - 270 - - - 270 Other (1) - - - - - - - (1) - - - (1) Total Revenues 107,024$ (51,257)$ 5,168$ -$ -$ -$ 2,047$ 62,982$ -$ -$ -$ 62,982$ EXPENSES Advertising 18,416$ -$ -$ -$ -$ -$ -$ -$ 18,416$ -$ -$ -$ 18,416$ Interest expense 48,813 (34,162) - - - - - - 14,651 (10,109) - - 4,542 Compensation and benefits 11,096 - - (431) - (1,787) - - 8,878 - - - 8,878 General and administrative 4,858 - - - - (320) - - 4,538 - - - 4,538 Professional and consulting 4,520 - - - - (189) - - 4,331 - - - 4,331 Debt issuance 2,936 - - - - - - - 2,936 - (2,936) - - Securitization debt maintenance 1,551 (1,551) - - - - - - - - - - - Provision for losses on finance receivables 1,055 - - - - - - - 1,055 - - - 1,055 Depreciation & amortization 961 - - - - - - - 961 - - (961) - Installment obligations income, net (2,047) - - - - - 2,047 - - - - - - Total Expenses 92,159$ (35,713)$ -$ (431)$ -$ (2,296)$ 2,047$ 55,766$ (10,109)$ (2,936)$ (961)$ 41,760$ Income before income taxes 14,865$ (15,544)$ 5,168$ 431$ -$ 2,296$ -$ 7,216$ 10,109$ 2,936$ 961$ 21,222$ Provision for income taxes 2,176 - - - (2,176) - - - - - - - - Net Income 12,689$ (15,544)$ 5,168$ 431$ 2,176$ 2,296$ -$ 7,216$ 10,109$ 2,936$ 961$ 21,222$ Reconciliation of Net Income to Adjusted Net Income and EBITDA – UNAUDITED The J. G. Wentworth Company

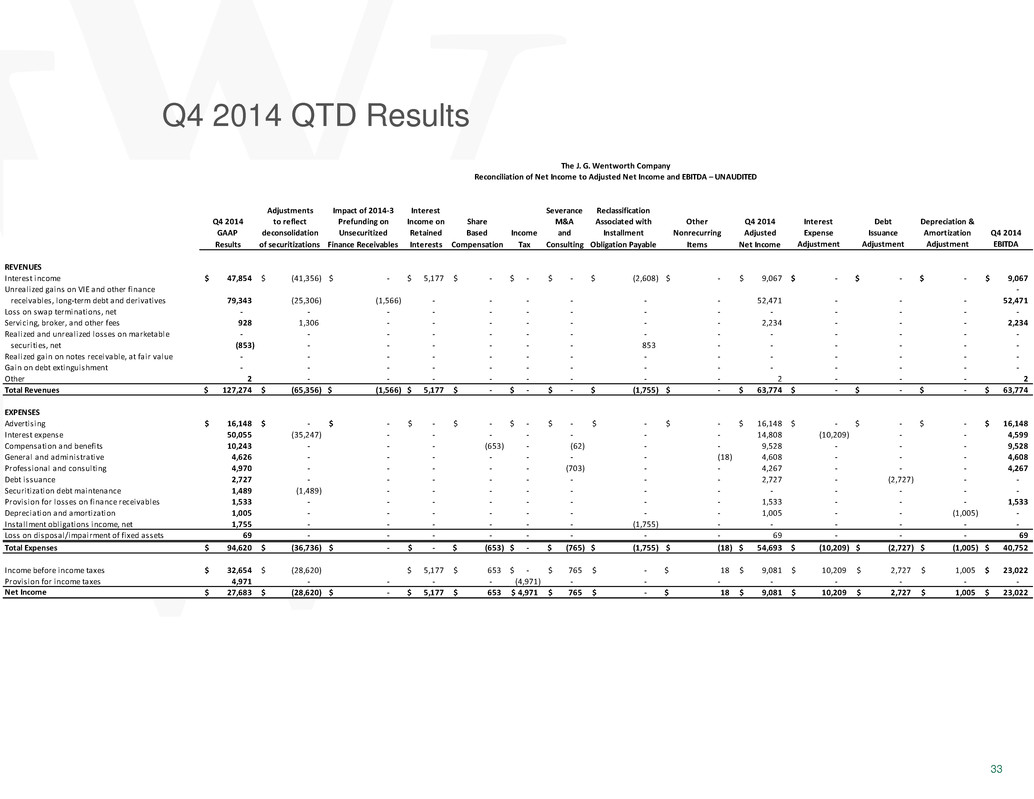

33 Q4 2014 QTD Results Adjustments Impact of 2014-3 Interest Severance Reclassification Q4 2014 to reflect Prefunding on Income on Share M&A Associated with Other Q4 2014 Interest Debt Depreciation & GAAP deconsolidation Unsecuritized Retained Based Income and Installment Nonrecurring Adjusted Expense Issuance Amortization Q4 2014 Results of securitizations Finance Receivables Interests Compensation Tax Consulting Obligation Payable Items Net Income Adjustment Adjustment Adjustment EBITDA REVENUES Interest income 47,854$ (41,356)$ -$ 5,177$ -$ -$ -$ (2,608)$ -$ 9,067$ -$ -$ -$ 9,067$ Unrealized gains on VIE and other finance - receivables, long-term debt and derivatives 79,343 (25,306) (1,566) - - - - - - 52,471 - - - 52,471 Loss on swap terminations, net - - - - - - - - - - - - - - Servicing, broker, and other fees 928 1,306 - - - - - - - 2,234 - - - 2,234 Realized and unrealized losses on marketable - - - - - - - - - - - - - - securities, net (853) - - - - - - 853 - - - - - - Realized gain on notes receivable, at fair value - - - - - - - - - - - - - - Gain on debt extinguishment - - - - - - - - - - - - - - Other 2 - - - - - - - - 2 - - - 2 Total Revenues 127,274$ (65,356)$ (1,566)$ 5,177$ -$ -$ -$ (1,755)$ -$ 63,774$ -$ -$ -$ 63,774$ EXPENSES Advertising 16,148$ -$ -$ -$ -$ -$ -$ -$ -$ 16,148$ -$ -$ -$ 16,148$ Interest expense 50,055 (35,247) - - - - - - - 14,808 (10,209) - - 4,599 Compensation and benefits 10,243 - - - (653) - (62) - - 9,528 - - - 9,528 General and administrative 4,626 - - - - - - - (18) 4,608 - - - 4,608 Professional and consulting 4,970 - - - - - (703) - - 4,267 - - - 4,267 Debt issuance 2,727 - - - - - - - - 2,727 - (2,727) - - Securitization debt maintenance 1,489 (1,489) - - - - - - - - - - - - Provision for losses on finance receivables 1,533 - - - - - - - - 1,533 - - - 1,533 Depreciation and amortization 1,005 - - - - - - - - 1,005 - - (1,005) - Installment obligations income, net 1,755 - - - - - - (1,755) - - - - - - Loss on disposal/impairment of fixed assets 69 - - - - - - - - 69 - - - 69 Total Expenses 94,620$ (36,736)$ -$ -$ (653)$ -$ (765)$ (1,755)$ (18)$ 54,693$ (10,209)$ (2,727)$ (1,005)$ 40,752$ Income before income taxes 32,654$ (28,620)$ 5,177$ 653$ -$ 765$ -$ 18$ 9,081$ 10,209$ 2,727$ 1,005$ 23,022$ Provision for income taxes 4,971 - - - - (4,971) - - - - - - - - Net Income 27,683$ (28,620)$ -$ 5,177$ 653$ 4,971$ 765$ -$ 18$ 9,081$ 10,209$ 2,727$ 1,005$ 23,022$ Reconciliation of Net Income to Adjusted Net Income and EBITDA – UNAUDITED The J. G. Wentworth Company

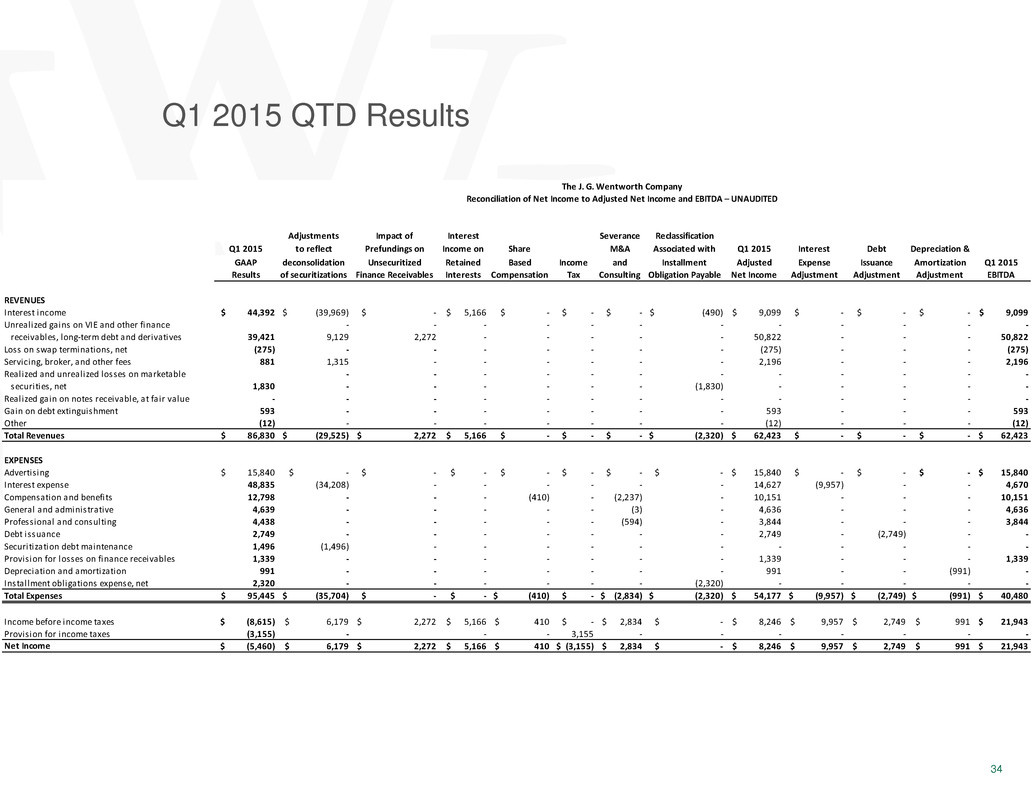

34 Q1 2015 QTD Results Adjustments Impact of Interest Severance Reclassification Q1 2015 to reflect Prefundings on Income on Share M&A Associated with Q1 2015 Interest Debt Depreciation & GAAP deconsolidation Unsecuritized Retained Based Income and Installment Adjusted Expense Issuance Amortization Q1 2015 Results of securitizations Finance Receivables Interests Compensation Tax Consulting Obligation Payable Net Income Adjustment Adjustment Adjustment EBITDA REVENUES Interest income $ 44,392 $ (39,969) $ - $ 5,166 $ - $ - $ - $ (490) $ 9,099 $ - $ - $ - $ 9,099 Unrealized gains on VIE and other finance - - - - - - - - - - - - receivables, long-term debt and derivatives 39,421 9,129 2,272 - - - - - 50,822 - - - 50,822 Loss on swap terminations, net (275) - - - - - - - (275) - - - (275) Servicing, broker, and other fees 881 1,315 - - - - - - 2,196 - - - 2,196 Realized and unrealized losses on marketable - - - - - - - - - - - - securities, net 1,830 - - - - - - (1,830) - - - - - Realized gain on notes receivable, at fair value - - - - - - - - - - - - - Gain on debt extinguishment 593 - - - - - - - 593 - - - 593 Other (12) - - - - - - - (12) - - - (12) Total Revenues $ 86,830 $ (29,525) $ 2,272 $ 5,166 $ - $ - $ - $ (2,320) $ 62,423 $ - $ - $ - $ 62,423 EXPENSES Advertising $ 15,840 $ - $ - $ - $ - $ - $ - $ - $ 15,840 $ - $ - $ - $ 15,840 Interest expense 48,835 (34,208) - - - - - - 14,627 (9,957) - - 4,670 Compensation and benefits 12,798 - - - (410) - (2,237) - 10,151 - - - 10,151 General and administrative 4,639 - - - - - (3) - 4,636 - - - 4,636 Professional and consulting 4,438 - - - - - (594) - 3,844 - - - 3,844 Debt issuance 2,749 - - - - - - - 2,749 - (2,749) - - Securitization debt maintenance 1,496 (1,496) - - - - - - - - - - - Provision for losses on finance receivables 1,339 - - - - - - - 1,339 - - - 1,339 Depreciation and amortization 991 - - - - - - - 991 - - (991) - Installment obligations expense, net 2,320 - - - - - - (2,320) - - - - - Total Expenses $ 95,445 $ (35,704) $ - $ - $ (410) $ - $ (2,834) $ (2,320) $ 54,177 $ (9,957) $ (2,749) $ (991) $ 40,480 Income before income taxes $ (8,615) $ 6,179 $ 2,272 $ 5,166 $ 410 $ - $ 2,834 $ - $ 8,246 $ 9,957 $ 2,749 $ 991 $ 21,943 Provision for income taxes (3,155) - - - 3,155 - - - - - - - Net Income $ (5,460) $ 6,179 $ 2,272 $ 5,166 $ 410 $ (3,155) $ 2,834 $ - $ 8,246 $ 9,957 $ 2,749 $ 991 $ 21,943 Reconciliation of Net Income to Adjusted Net Income and EBITDA – UNAUDITED The J. G. Wentworth Company

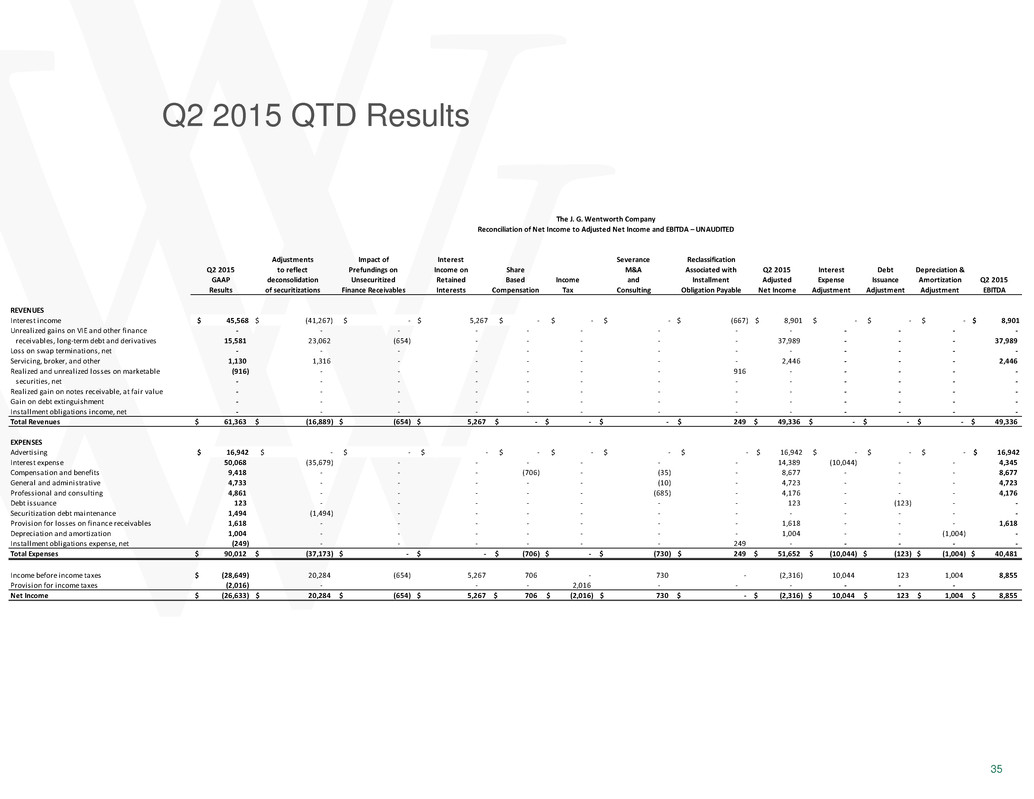

35 Q2 2015 QTD Results Adjustments Impact of Interest Severance Reclassification Q2 2015 to reflect Prefundings on Income on Share M&A Associated with Q2 2015 Interest Debt Depreciation & GAAP deconsolidation Unsecuritized Retained Based Income and Installment Adjusted Expense Issuance Amortization Q2 2015 Results of securitizations Finance Receivables Interests Compensation Tax Consulting Obligation Payable Net Income Adjustment Adjustment Adjustment EBITDA REVENUES Interest income $ 45,568 $ (41,267) $ - $ 5,267 $ - $ - $ - $ (667) $ 8,901 $ - $ - $ - $ 8,901 Unrealized gains on VIE and other finance - - - - - - - - - - - - - receivables, long-term debt and derivatives 15,581 23,062 (654) - - - - - 37,989 - - - 37,989 Loss on swap terminations, net - - - - - - - - - - - - - Servicing, broker, and other 1,130 1,316 - - - - - - 2,446 - - - 2,446 Realized and unrealized losses on marketable (916) - - - - - - 916 - - - - - securities, net - - - - - - - - - - - - - Realized gain on notes receivable, at fair value - - - - - - - - - - - - - Gain on debt extinguishment - - - - - - - - - - - - - Installment obligations income, net - - - - - - - - - - - - - Total Revenues 61,363$ (16,889)$ (654)$ 5,267$ -$ -$ -$ 249$ 49,336$ -$ -$ -$ 49,336$ EXPENSES Advertising $ 16,942 $ - $ - $ - $ - $ - $ - $ - $ 16,942 $ - $ - $ - $ 16,942 Interest expense 50,068 (35,679) - - - - - - 14,389 (10,044) - - 4,345 Compensation and benefits 9,418 - - - (706) - (35) - 8,677 - - - 8,677 General and administrative 4,733 - - - - - (10) - 4,723 - - - 4,723 Professional and consulting 4,861 - - - - - (685) - 4,176 - - - 4,176 Debt issuance 123 - - - - - - - 123 - (123) - - Securitization debt maintenance 1,494 (1,494) - - - - - - - - - - - Provision for losses on finance receivables 1,618 - - - - - - - 1,618 - - - 1,618 Depreciation and amortization 1,004 - - - - - - - 1,004 - - (1,004) - Installment obligations expense, net (249) - - - - - - 249 - - - - - Total Expenses 90,012$ (37,173)$ -$ -$ (706)$ -$ (730)$ 249$ 51,652$ (10,044)$ (123)$ (1,004)$ 40,481$ Income before income taxes (28,649)$ 20,284 (654) 5,267 706 - 730 - (2,316) 10,044 123 1,004 8,855 Provision for income taxes (2,016) - - - 2,016 - - - - - - Net Income (26,633)$ 20,284$ (654)$ 5,267$ 706$ (2,016)$ 730$ -$ (2,316)$ 10,044$ 123$ 1,004$ 8,855$ Reconciliation of Net Income to Adjusted Net Income and EBITDA – UNAUDITED The J. G. Wentworth Company

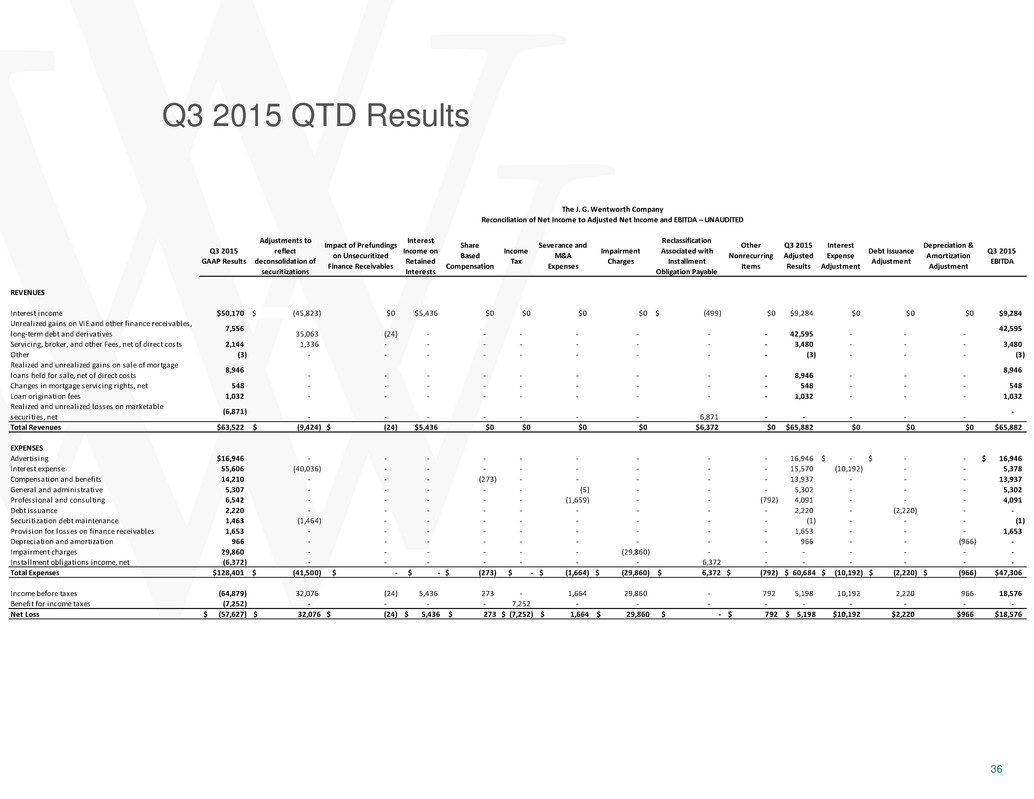

36 Q3 2015 QTD Results Q3 2015 GAAP Results Adjustments to reflect deconsolidation of securitizations Impact of Prefundings on Unsecuritized Finance Receivables Interest Income on Retained Interests Share Based Compensation Income Tax Severance and M&A Expenses Impairment Charges Reclassification Associated with Installment Obligation Payable Other Nonrecurring Items Q3 2015 Adjusted Results Interest Expense Adjustment Debt Issuance Adjustment Depreciation & Amortization Adjustment Q3 2015 EBITDA REVENUES Interest income $50,170 $ (45,823) $0 $5,436 $0 $0 $0 $0 (499)$ $0 $9,284 $0 $0 $0 $9,284 Unrealized gains on VIE and other finance receivables, long-term debt and derivatives 7,556 35,063 (24) - - - - - - - 42,595 - - - 42,595 Servicing, broker, and other Fees, net of direct costs 2,144 1,336 - - - - - - - - 3,480 - - - 3,480 Other (3) - - - - - - - - - (3) - - - (3) Realized and unrealized gains on sale of mortgage loans held for sale, net of direct costs 8,946 - - - - - - - - - 8,946 - - - 8,946 Changes in mortgage servicing rights, net 548 - - - - - - - - - 548 - - - 548 Loan origination fees 1,032 - - - - - - - - - 1,032 - - - 1,032 Realized and unrealized losses on marketable securities, net (6,871) - - - - - - - 6,871 - - - - - - Total Revenues $63,522 $ (9,424) $ (24) $5,436 $0 $0 $0 $0 $6,372 $0 $65,882 $0 $0 $0 $65,882 EXPENSES Advertising $16,946 - - - - - - - - - 16,946 -$ -$ - 16,946$ Interest expense 55,606 (40,036) - - - - - - - - 15,570 (10,192) - - 5,378 Compensation and benefits 14,210 - - - (273) - - - - - 13,937 - - - 13,937 General and administrative 5,307 - - - - - (5) - - - 5,302 - - - 5,302 Professional and consulting 6,542 - - - - - (1,659) - - (792) 4,091 - - - 4,091 Debt issuance 2,220 - - - - - - - - - 2,220 - (2,220) - - Securitization debt maintenance 1,463 (1,464) - - - - - - - - (1) - - - (1) Provision for losses on finance receivables 1,653 - - - - - - - - - 1,653 - - - 1,653 Depreciation and amortization 966 - - - - - - - - - 966 - - (966) - Impairment charges 29,860 - - - - - - (29,860) - - - - - - - Installment obligations income, net (6,372) - - - - - - - 6,372 - - - - - - Total Expenses $128,401 $ (41,500) $ - $ - $ (273) $ - $ (1,664) $ (29,860) $ 6,372 $ (792) $ 60,684 $ (10,192) $ (2,220) $ (966) $47,306 Income before taxes (64,879) 32,076 (24) 5,436 273 - 1,664 29,860 - 792 5,198 10,192 2,220 966 18,576 Benefit for income taxes (7,252) - - - - 7,252 - - - - - - - - - Net Loss $ (57,627) $ 32,076 $ (24) $ 5,436 $ 273 $ (7,252) $ 1,664 $ 29,860 $ - $ 792 $ 5,198 $10,192 $2,220 $966 $18,576 Reconciliation of Net Income to Adjusted Net Income and EBITDA – UNAUDITED The J. G. Wentworth Company