Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MEDIFAST INC | v426555_8k.htm |

Investor Presentation December 2015 Exhibit 99.1

2 2 Certain information included in this presentation may constitute forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, Section 21 E of the Securities Exchange Act of 1934 , as amended, and the Private Securities Litigation Reform Act of 1995 . These forward - looking statements generally can be identified by use of phrases or terminology such as "intend" or other similar words or the negative of such terminology . Similarly, descriptions of Medifast's objectives, strategies, plans, goals or targets contained herein are also considered forward - looking statements . Medifast believes this presentation should be read in conjunction with all of its filings with the United States Securities and Exchange Commission and cautions its readers that these forward - looking statements are subject to certain events, risks, uncertainties, and other factors . Some of these factors include, among others, Medifast's inability to attract and retain independent Health Coaches and Members, stability in the pricing of print, TV and Direct Mail marketing initiatives affecting the cost to acquire customers, increases in competition, litigation, regulatory changes, and its planned growth into new domestic and international markets and new channels of distribution . Although Medifast believes that the expectations, statements, and assumptions reflected in these forward - looking statements are reasonable, it cautions readers to always consider all of the risk factors and any other cautionary statements carefully in evaluating each forward - looking statement in this presentation, as well as those set forth in its latest Annual Report on Form 10 - K and Quarterly Report on Form 10 - Q, and other filings filed with the United States Securities and Exchange Commission, including its current reports on Form 8 - K . Safe Harbor Statement

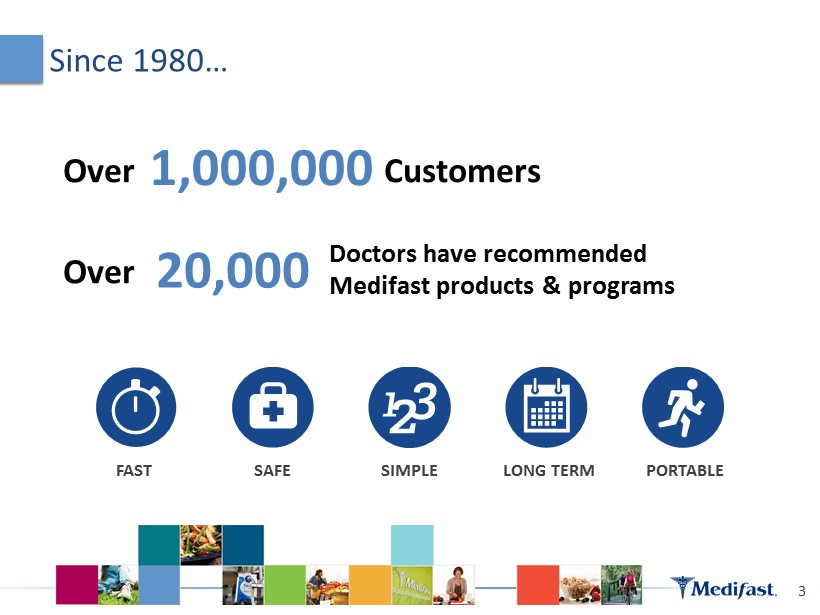

Since 1980… 3 FAST SAFE SIMPLE LONG TERM PORTABLE Over 20,000 Over Customers 1,000,000 Doctors have recommended Medifast products & programs

Medifast Today Enriching lives through innovative choices for lasting health 4 • Weight Management & Healthy Living Products C ompany • Founded in 1980 • Industry - Leading Margins • Strong Balance Sheet • 12,000 Health C oach C hannel • Direct - to - Consumer E - Commerce P latform • Franchise Weight Loss Centers • Physician Channel & Heritage • Recent Expansion into Canada • Latin America Partnership with Medix

Recent 2015 Accomplishments 5 • Each One Reach One Program attracts incremental Health Coaches to Take Shape For Life. • July Take Shape for Life National Convention attracted 2,700 Health Coaches & other attendees in Orlando, FL • Our new Optimal Health 3+3 Plan™ is launched highlighting the Optimal Health products introduced in 2014. • 3 New television spots for Medifast Direct were launched as part of our “Your Whole World Gets Better” campaign .

In 2015 6 1 2 3 DELIVER ON PROFIT GOALS EXECUTE STRATEGIC PLAN HEALTHY LIVING Health Coach expansion, Weight Control Center Support, Technology integration and other efforts under way New product launches will address consumer demand and growth opportunities 6 Cost discipline coupled with new product launches, Health Coach expansion, new marketing initiatives and other efforts under way

Obesity & Diabetes – Linked Epidemics 7 2.62% 6.95% 2012 OBESITY as BMI% Diagnosed Diabetes Rate 1985 Sources: CDC Behavioral Risk Factor Surveillance System and Diabetes Surveillance System

Diet Industry Market Size 8 Total Market Served Market 2% Medifast share of served market $ 18 Bn Served Market ‣ Diet Foods/Meals ‣ Weight Loss Centers ‣ Low Calories Programs ‣ Medical Plans & Surgery ‣ Books & Videos Unserved Market: ‣ Diet Soft Drinks ‣ Artificial Sweeteners ‣ Health Club Revenues Sources: U.S. Census Data, CDC Data, IBIS World, MarketData $ 47 Bn $ 65 Bn

Over 90 Choices! 9

Proven Business Model to Deliver Shareholder Value 10 1 0

Key Strategies 11 ‣ DELIVER profitability and enhance shareholder value long - term ‣ INNOVATE in products, programs & technology ‣ BUILD the network and reach of Take Shape For Life Health Coaches ‣ LEVERAGE our medical provider heritage & relationships ‣ GROW our online business thru best - in - class platform ‣ EXPAND business development ‣ LAUNCH extensions into h ealthy l iving ‣ EXPLORE v alue enhancing opportunities 11

4 Ways to Support Our Clients 12 1 2 12,000 Independent Health Coaches 62 Franchise locations Medical Provider Wholesale Channel Direct to Consumer E - commerce As of 9/30/2015 76% 17% 6% 1% TSFL Med Direct Franchise MWCC Medifast Wholesale Revenue by Segment *

Take Shape For Life: A Unique Model Our coaches are our success stories • Most coaches joined to achieve a healthy weight …and stayed for the business opportunity • Emphasize long term “Optimal Health” • Certification exams* Our processes are clear and transparent • 94% of orders go directly to clients, and 6% for coaches’ own use • Coaches do not hold inventory • All commissions are based on product sales 13 *Certified by Take Shape For Life, in partnership with the MacDonald Center for Obesity Prevention and Education in the College of Nursing at Villanova University Dr. Wayne Andersen NY Times Bestselling Author

Take Shape For Life Strategy 14 1 4 1 2 3 EXPAND HEALTH COACH NETWORK OPTIMIZE USE OF COMMISSION PLAN & INCENTIVES NEW PRODUCTS 12,000 Health Coaches • Renewed focus on coach growth in new demographics • New video messaging delivers consistent coaching experience • 5 Super - regionals in 1Q15 • National Convention July 2015 in Orlando • Sundance Leadership Event Integrated Plan Focuses on Growth • Enhance training to reinforce business building • Develop innovated incentives to motivate new client acquisition Extend Optimal Health Opportunity • Expand on New Lean & Green and Healthy Living products launched in 2014 • Long term innovation strategy to attract more coaches and clients

Complete e - Commerce Business & Experience 15 ‣ Full Product Line & Programs ‣ Quick Start Guides & Video How - to’s ‣ Dashboard for Tracking the Weight Loss Journey ‣ The Science Behind Medifast ‣ Programs for Diabetes, Seniors, Teens, Gluten - free, more ‣ Success Stories & “Happy Afters” ‣ MyMedifast Community & Blog ‣ Links to Medifast Social Sites & Support Channels ‣ And options for getting 1 - on - 1 support ‣ Medifast provides information, tools & support for successful self - guided weight management

Medifast Direct Strategy 16 1 2 3 ENHANCE WEB PLATFORM ADDRESS DIY TREND OPTIMIZE AD & PROMO SPEND Best in class capabilities to drive orders • Streamlined ordering experience to increase conversion • Flexibility to rapidly change and target promotions Innovate for rewarding online experience • Promote new mobile app, new online community • Expand integration with additional Activity Trackers consumers are already using • New Medifast Achieve is a simple and flexible plan with a wide variety of product options for customers on their self - guided weight loss and weight maintenance journey Execute the best mix of media & promotion • Use Analytics to deploy funds to the right media and the right discounts and promotions • New direct response techniques to improve conversion and loyalty • New Advertising campaign launch with new agency of record 16

Local, Personal, Accountable • 62 Franchise Centers* • Supervised Programs • 1:1 Personal Counseling • Dietitian Support • Body Composition Technology • Onsite Product Purchasing • Weekly Weigh - ins • Constant Contact “Care Calls” 17 * As of 9 /30/2015

MWCC – Current Status 18 0 10 20 30 40 50 60 70 80 2007 2008 2009 2010 2011 2012 2013 2014 3Q15 0 5 18 21 30 35 41 73 62 Franchised Units Successfully transitioned 17 corporate centers to Franchisees at 12/31/2014: • Dallas, TX – 9 Centers • Houston, TX – 4 centers • Baltimore, MD – 4 Centers • Franchise Footprint (as of 9 /30/2015 ) • 62 Franchise Locations • 8 Franchise Owners • 8 States • Profitable business model • Low overhead • Scalable

Current Franchise Locations 19 • 62 Franchise Locations • 8 Franchise Owners • 8 States

MWCC Strategy 20 1 2 3 CONVERT TO FRANCHISE SUPPORT INNOVATE Highly Accretive Shift to Wholesale is completed • Food revenues will decline to wholesale price. • Counseling revenues shift to Franchisees. • Operating Profit improves with SG&A reductions Provide Support for Franchise Growth • Training • Technology • Business Intelligence Evolve Franchise Model for Sustainability • Potential Medicalization • Additional products and services (i.e. supplements,) • Holistic approach to weight loss & weight management 20

Leveraging Our Medical Heritage • Obese patients spend 50% more on healthcare costs — over $7,100 more per year • Obesity screening and nutritional counseling now an “essential benefit” under Affordable Care Act • Providers seeking new revenue streams to offset increasing financial pressures 21 Market of 350K+ Primary care physicians, Chiropractors, Independent Nutritionists in U.S. Sources: Bureau of Labor Statistics; Issue Brief, Center for Healthcare Research & Transformation, January 2014

Medical Providers Strategy 22 1 2 3 EXPAND COVERAGE & TERRITORY CURRENT CLIENT REVENUE GROWTH BUSINESS MODEL ENHANCEMENTS Expand US & Establish business in Canada • Drive account acquisition with multi - touch campaigns and trade events • Streamline on - boarding process and enhance client support Drive shared growth with providers • New strategic account management practices to expand relationships • New sales & marketing tools support program expansion and growth New E - commerce technology platform • Enables direct - to - consumer ordering for each practice , reducing need for inventory • Co - branded, with ability to reach new patients and extend lifecycle 22

Strategic Growth Initiatives 23 MEXICO & LATIN AMERICA Medix investment to expand partnership Acquisition of 13 Slim Centers in prime locations across Mexico City Progressing multiple new revenue opportunities to drive business expansion Executing in Colombia and planning expansion in further LatAm countries

Medix - Medifast Partnership • Launched June 2012 • Medifast enables Medix to offer robust preventative products & programs in addition to existing nutraceutical & pharmaceutical options • Multi - channel market strategy: – Leveraging 6,000+ physician network – Medifast - branded clinics: 3 in Mexico, 1 in Colombia – 13 Slim Center acquisition to scale clinic business – Corporate Wellness, VIP Program, Nutritionists 24

Beyond Weight Loss 25 2 5 Addressable Weight Loss Market Healthy Living Market: Foods, Programs, Products Sources: U.S. Weight Loss Market Update, Marketdata, February 2014. Health and Wellness in the US, Euromonitor, August 2013 Gym, Health & Fitness Clubs in the U.S., IBISWorld, February 2014. Vitamin & Supplement Manufacturing in the US, IBISWorld, October 2013 Lose weight and keep it off Live the life I want Build my family’s health Run faster, go harder, reach the top Sleep better and have less stress and much more… Stable Growing $18 B I L L I O N $200+ B I L L I O N

Recent Product Launches 26 Meal Replacements • Garlic Mashed Potatoes • Sour Cream & Chive Mashed Potatoes • Gingerbread Soft Bake Flavors of Home® lean and green Meals • Turkey Meatball Marinara* • Chicken Cacciatore* • Chicken with Rice & Vegetables* • Beef Stew* • Cheddar & Sour Cream Popcorn • Sea Salt Popcorn • Spicy Black Bean Veggie Chips • Sea Salt & Olive Oil Veggie Chips • Multigrain Crackers • Rosemary Sea Salt Crackers Snacks • Peanut Butter Chocolate Shake • Strawberry Banana Smoothie • Pina Colada Smoothie • Salted Caramel Nut Bar • Dark Chocolate Dream Bar • Strawberry Yogurt Bar • Cookies & Cream Shake Thrive and Optimal Health (Healthy Living/Maintenance) • Lemon Energy Infuser • Mandarin Orange Infuser • Lemonade Energy Drops • Wild Strawberry Energy Drops • Pineapple Mango Energy Drops Flavor Infusers® & Energy Drops *Each Flavors of Home meal counts as one Lean & Green Meal on the Medifast Program. Not a lean food as per 9 CFR 317.362 for fat content. Habits of Healthy Sleep (TSFL) • Habits of Health Sleep Set • Melatonin • Restful Mind Herbal Sleep Tea • Far Infrared Blanket Fitness & Tracking • Fitbit ® Activity Trackers & Integration • Fitbit ® Aria Scale & Integration

27 Digital Dashboards & Apps Customized for Take Shape For Life & Medifast - Track Meals, Nutrition, Water, Weight, Exercise & More - Unique Console Allows Coaches & Center staff to work closely with Clients on Progress Trackers and Dashboards

28 Results vary. Clients may lose 2 - 5 lbs per week for the first two weeks and 1 - 2 lbs per week, thereafter.

29 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Nov-11 May-12 Nov-12 May-13 Nov-13 May-14 Nov-14 Medifast Weight Watchers Jenny Craig Nutrisystem Jun-14 Brand Awareness Study

Innovation – from Concept to Consumer 30 30

Leading Manufacturing & Distribution Infrastructure 31 • Company - owned state - of - the - art facilities • Supports industry - leading gross margins • Capacity to drive aggressive growth • Partnerships with leading suppliers

Financial Overview

2010 - 2015 Revenue 33 $239 $273 $319 $324 $285 $272 to $275 $223 $211 2010 2011 2012 2013 2014 FY 2015 Guidance First Nine Months 2014 First Nine Months 2015 Revenue from continuing operations 2010 - 2014 5% CAGR

2010 - 2015 EPS $1.23 $1.60 $1.75 $1.96 $1.89 $1.72 to $1.76 $1.50 $1.41 2010 2011 2012 2013 2014 2015 FY Guidance First Nine Months 2014 First Nine Months 2015 34 - EPS from continuing operations . - 2012 Non - GAAP EPS excludes two non - recurring items, including a FTC settlement recorded in the second quarter and a sales tax accrual in the fourth quarter . Reported EPS $ 1 . 34 . - 2014 Non - GAAP EPS excludes the net of tax items of $ 1 . 3 million accrual for franchise loan default guaranteed by Medifast and the $ 1 . 8 million in extraordinary legal and advisory expenses resulting from 13 D filings . Reported EPS $ 1 . 65 . - First Nine Months of 2014 Non - GAAP EPS excludes the net of tax impact of $ 1 . 1 million in extraordinary legal expenses resulting from 13 D filings . Reported EPS $ 1 . 42 . - First Nine Months of 2015 Non - GAAP EPS excludes the net of tax impact of $ 1 . 4 million in extraordinary legal expenses resulting from 13 D filings . Reported EPS $ 1 . 29 . 2010 - 2014 11% CAGR

Strong Cash & Balance Sheet 35 • $ 66.5M Cash & Investments • No Long Term Debt • Low Working Capital Levels • Minimal CapEx Requirements • Strong Free Cash Flows Note: As of 9 /30/2015

2015 Priority “Return to Growth” 36 1 2 3 Re - Ignite growth in Health Coach Network for Take Shape For Life Invigorate and support new franchisees to grow in 2015 Focused advertising spend on the back of sophisticated data to drive growth in Medifast Direct Continue to investigate International expansion opportunities Continued talent improvement and select addition of experienced operators Select investments to improve IT structure across channels 4 5 6

Key Investment Highlights 37 Large , addressable and growing market Differentiated scientific approach to weight loss Highly efficacious product portfolio validated by customer referrals Strong, stable cash flows Unique Multi - Channel Model State - of - the - art production capabilities and low cost vertically integrated business model Deep Management bench Highly variable cost base limits downside