Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - KBS Real Estate Investment Trust II, Inc. | kbsrii8k.htm |

KBS REIT II Revaluation December 9, 2015 1 Exhibit 99.1

Forward-Looking Statements The information contained herein should be read in conjunction with, and is qualified by, the information in KBS Real Estate Investment Trust II’s (“KBS REIT II”) Annual Report on Form 10-K for the year ended December 31, 2014, filed with the Securities and Commission Exchange (the “SEC”) on March 9, 2015 (the “Annual Report”), and in KBS REIT II’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2015 (the “Quarterly Report”), filed with the SEC on November 12, 2015, including the “Risk Factors” contained in the Annual Report. For a full description of the limitations, methodologies and assumptions used to value KBS REIT II’s assets and liabilities in connection with the calculation of KBS REIT II’s estimated value per share, see KBS REIT II’s Current Report on Form 8-K, filed with the SEC on December 9, 2015. Forward-Looking Statements Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. KBS REIT II intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of KBS REIT II and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Further, forward-looking statements speak only as of the date they are made, and KBS REIT II undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Actual results may differ materially from those contemplated by such forward- looking statements. The appraisal methodology for KBS REIT II’s real estate properties assumes the properties realize the projected net operating income and expected exit cap rates and that investors would be willing to invest in such properties at yields equal to the expected discount rates. Though the appraisals of the real estate properties, with respect to CBRE, Inc., an independent, third- party valuation firm that performed the appraisals of the real estate properties, and the valuation estimates used in calculating the estimated value per share, with respect to KBS REIT II and KBS Capital Advisors LLC, KBS REIT II’s external advisor, are the respective party’s best estimates as of September 30, 2015 or December 8, 2015, as applicable, KBS REIT II can give no assurance in this regard. The forward-looking statements also depend on factors such as: future economic, competitive and market conditions; KBS REIT II’s ability to maintain occupancy levels and rental rates at its real estate properties; the borrower under KBS REIT II’s loan investment continuing to make required payments under the loan documents; the ability of the borrower to maintain occupancy levels and lease rates at the property securing KBS REIT II’s real estate-related investment; and other risks identified in Part I, Item IA of the Annual Report. Actual events may cause the value and returns on KBS REIT II’s investments to be less than that used for purposes of KBS REIT II’s estimated value per share. 2

Portfolio Summary As of September 30, 2015 Total Acquisitions1 $3,330,210,000 Total Capital Raised in Primary Offering $1,820,569,000 Additional Capital Raised from Dividend Reinvestment Plan $298,186,000 Total Dispositions (based on gross sales price) $2,223,009,000 Total Square Feet (equity assets) 5,249,698 Total Leverage2 41% Total Occupancy 87% Total Leased3 90% 3 1 Amount also includes disposed assets. As of September 30, 2015, KBS REIT II had sold 14 equity assets and had seven debt investments that were sold or fully paid off. 2 As of September 30, 2015, KBS REIT II’s borrowings and other liabilities were approximately 41% of both the cost (before depreciation and other noncash reserves) and book value (before depreciation) of tangible assets, respectively. 3 Leased percentage includes future leases that have been executed but have not yet commenced.

• KBS REIT II followed the IPA Valuation Guidelines, which included independent third- party appraisals of all of its properties. Property values for properties are equal to their appraised values as of September 30, 2015. • Real estate-related investments, cash, other assets, mortgage debt and other liabilities were valued by the Advisor, similar to prior valuations. The estimated values of the real estate-related investments and mortgage debt are equal to the GAAP fair values as disclosed in the footnotes to KBS REIT II’s 10-Q for the period ended September 30, 2015. • The estimated values of cash and a majority of other assets and other liabilities are equal to their carrying values which approximate their fair values due to their short maturities or liquid nature. • The estimated value of KBS REIT II’s assets less the estimated value of KBS REIT II’s liabilities was then divided by the number of shares outstanding as of September 30, 2015 to arrive at the estimated value per share. Valuation Information 4 Third Party Valuation

December 2014 estimated value per share $ 5.86 Real estate Real estate properties (0.01) Properties sold through Sept. 30, 2015 (0.01) Capital expenditures on real estate (0.27) Subtotal Real Estate (0.29) Operating cash flows in excess of monthly distributions declared 2 0.04 Notes payable (0.01) Other changes, net .02 Total change in estimated value per share (0.24) December 2015 estimated value per share $ 5.62 On December 8, 2015, KBS REIT II’s Board of Directors approved an estimated value per share of $5.621 The following is a summary of the estimated value per share changes within each asset and liability group. Valuation Information 5 1Based on the estimated value of KBS REIT II’s assets less the estimated value of KBS REIT II’s liabilities, divided by the number of shares outstanding, all as of September 30, 2015. 2 Operating cash flow reflects modified funds from operations (“MFFO”) adjusted to add back the amortization of deferred financing costs. KBS REIT II computes MFFO in accordance with the definition included in the practice guideline issued by the IPA in November 2010.

Offering Price: $10.00 Valuation History: – December 20111 $10.11 – December 20122 $10.29 – December 20133 $10.29 – September 20144 (after deducting special distribution of $4.50 from $10.55) $6.05 – December 20145 $5.86 – December 20156 $5.62 6 1 Data as of 9/30/11. See KBS REIT II’s Current Report on Form 8-K filed with the SEC on December 21, 2011. 2 Data as of 9/30/12. See KBS REIT II’s Current Report on Form 8-K filed with the SEC on December 19, 2012. 3 Data as of 9/30/13, with the exception of real estate appraised as of November 30, 2013. See KBS REIT II’s Current Report on Form 8-K filed with the SEC on December 19, 2013. 4 Data as of 6/30/14. See KBS REIT II’s Current Report on Form 8-K filed with the SEC on September 23, 2014. 5 Data as of 9/30/14. See KBS REIT II’s Current Report on Form 8-K filed with the SEC on December 4, 2014. 6 Data as of 9/30/15. See KBS REIT II’s Current Report on Form 8-K filed with the SEC on December 9, 2015. Valuation Information

Portfolio Overview Portfolio Summary for December 2015 Estimated Value Per Share1 Assets: $1.800 Billion – Real Estate2 • 12 Assets • $1.537 Billion (85.4%) – Loan Investments • 1 Asset • $14.6 Million (0.8%) – Other Assets3 • $248.0 Million (13.8%) Liabilities: $0.732 Billion – Loans Payable: $704.1 Million – Other Liabilities4: $27.7 Million Net Equity at Estimated Value: $1.068 Billion 7 1 Values as of September 30, 2015. 2 Consists of the 12 appraised real estate properties held as of 9/30/2015. 3 Includes cash and cash equivalents, restricted cash, rents and other receivables, net and prepaid expenses. 4 Includes accounts payable, accrued liabilities, distributions payable, security deposits, prepaid rent and interest rate swap liability.

100, 200 Campus Significant Real Estate Value Changes 8 The September 30, 2015 appraised-value represents a $32.4 million decline vs. the appraised value as of September 30, 2014. The decline in value was primarily the result of the following: • A current tenant that is subleasing 126,000 SF of another tenant’s 199,000 sf at 100 Campus Drive notified the REIT that it no longer plans on signing a direct lease at expiration in November 2016, resulting in all 199,000 square feet expiring in November 2016. This will lead to a significant decline in operating cash flows attributable to an increase in leasing costs and reduced rental income until the space is re-leased. • The above-mentioned subleased and total space represents approximately 33% and 53% of the 100 Campus Drive building, and 21% and 34% of the 100 & 200 Campus Drive buildings. A year ago, the subleasing tenant had communicated it would renew at 100 Campus Drive. Instead, it decided to do a build-to- suit. • The assumed discount rate was increased by 100 basis points due to the significant increase in risk related to the subleasing tenant’s plans to vacate, and to a lesser extent the increased risk from other leases being one year closer to expiration and the market still being highly competitive as a result of substantial vacancy.

Willow Oaks 9 The September 30, 2015 appraised-value represents a $15.5 million decline vs. the appraised value as of September 30, 2014. The decline in value was primarily the result of the following: • Low occupancy due to a major tenant vacating; however, the majority of that space will be leased to a new tenant commencing in March 2016. • Slow rent growth at this property and the concessions (tenant improvements and free rent) remain at levels higher than anticipated. • Leasing activity has been minimal with desired lease commencement dates consistently 9-12 months after execution, which delays absorption and rental income. Significant Real Estate Value Changes

Union Bank Significant Real Estate Value Changes 10 The September 30, 2015 appraised-value represents a $23.8 million increase vs. the appraised value as of September 30, 2014. The increase in value was primarily the result of the following: • Downtown LA has experienced positive market growth on all fronts (office, retail, residential, hospitality and entertainment) and in the past year, KBS REIT II has pushed rent growth higher than projected a year earlier. • Investor demand is strong and capitalization rates have compressed further as a result. • Over the past 6 months, KBS REIT II has taken steps to further define the additional entitlement/development rights tied to Union Bank Plaza. Current rights in place allow for the addition of a 318,000-square-foot residential tower adjacent to the existing Union Bank office tower. The robust residential development activity/demand in downtown LA and the additional entitlement rights at Union Bank Plaza have helped to increase the value of the asset.

National City Tower • Acquired on December 17, 2010 for $115 million plus closing costs • 40-story Class A trophy office tower with 723,300 rentable square feet • Primarily acquired for its strong and secure cash flow, not for capital appreciation • Sold on February 13, 2015 for $124 million net of concessions and credits (cost basis at time of sale was $124.6 million) • Met KBS REIT II’s return goals and objectives in terms of both cash flow and capital appreciation Disposition 11

Summit I & II • Originated on January 17, 2012 for up to $58.8 million • Borrower exercised its prepayment option on August 4, 2015, and paid off the entire principal balance outstanding and accrued interest in the amount of $58.7 million, and paid a yield maintenance premium of $0.9 million. • The loan had an original maturity date of February 1, 2017 and bore interest at a fixed rate of 7.5%. • Received total payments from borrower of $74.7 million and total net cash flow of $15.9 million as shown below: Loan Payoff 12 Initial Origination Amount $(46,860,000) Additional Draws $(11,890,000) Principal Repayments $477,717 Interest Received $14,985,322 Yield Maintenance Premium $874,084 Final Principal Repayment $58,272,283 TOTAL $15,859,406

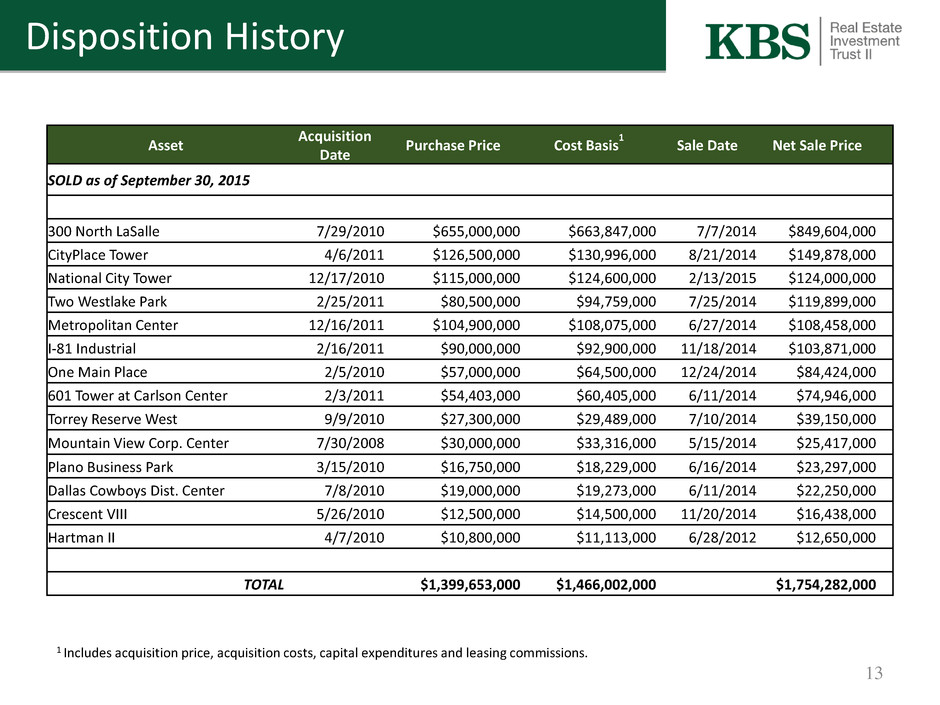

1 Includes acquisition price, acquisition costs, capital expenditures and leasing commissions. Asset Acquisition Date Purchase Price Cost Basis 1 Sale Date Net Sale Price SOLD as of September 30, 2015 300 North LaSalle 7/29/2010 $655,000,000 $663,847,000 7/7/2014 $849,604,000 CityPlace Tower 4/6/2011 $126,500,000 $130,996,000 8/21/2014 $149,878,000 National City Tower 12/17/2010 $115,000,000 $124,600,000 2/13/2015 $124,000,000 Two Westlake Park 2/25/2011 $80,500,000 $94,759,000 7/25/2014 $119,899,000 Metropolitan Center 12/16/2011 $104,900,000 $108,075,000 6/27/2014 $108,458,000 I-81 Industrial 2/16/2011 $90,000,000 $92,900,000 11/18/2014 $103,871,000 One Main Place 2/5/2010 $57,000,000 $64,500,000 12/24/2014 $84,424,000 601 Tower at Carlson Center 2/3/2011 $54,403,000 $60,405,000 6/11/2014 $74,946,000 Torrey Reserve West 9/9/2010 $27,300,000 $29,489,000 7/10/2014 $39,150,000 Mountain View Corp. Center 7/30/2008 $30,000,000 $33,316,000 5/15/2014 $25,417,000 Plano Business Park 3/15/2010 $16,750,000 $18,229,000 6/16/2014 $23,297,000 Dallas Cowboys Dist. Center 7/8/2010 $19,000,000 $19,273,000 6/11/2014 $22,250,000 Crescent VIII 5/26/2010 $12,500,000 $14,500,000 11/20/2014 $16,438,000 Hartman II 4/7/2010 $10,800,000 $11,113,000 6/28/2012 $12,650,000 TOTAL $1,399,653,000 $1,466,002,000 $1,754,282,000 Disposition History 13

Loan History 14 1Includes acquisition/origination price, acquisition/origination costs, and any subsequent loan advances. Asset Acquisition/ Origination Date Purchase Price Cost Basis1 Sale/ Payoff Date Net Sales or Repayment Proceeds LOANS SOLD/REPAID as of September 30, 2015 One Liberty Plaza 2/11/2009 $66,700,000 $67,461,000 10/11/2013 $113,091,000 One Kendall Square 11/22/2010 $87,500,000 $88,997,000 12/4/2013 $87,500,000 Northern Trust A & B Notes 12/31/08 & 6/27/12 $59,428,000 $60,172,000 6/27/2012 $84,932,000 Chase Tower 1/25/2010 $59,200,000 $59,221,000 2/14/2014 $64,117,000 Pappas Commerce 4/5/2010 $32,673,000 $32,673,000 6/9/2014 $32,673,000 Tuscan Inn 1/21/2010 $20,200,000 $19,799,000 2/7/2014 $20,200,000 Summit I & II 1/17/2012 $58,750,000 $58,272,000 8/4/2015 $59,624,000 TOTAL $384,451,000 $386,595,000 $462,137,000

15 Distribution Information History of Distribution Payments $8.75/share of total distributions paid from August 2008 through September 2015 – August 2008 – September 2014 (74 Monthly Payments) • $0.20/share distributions, on an annualized basis, for record dates from July 16, 2008 to August 15, 2008 • $0.65/share distributions, on an annualized basis, for record dates from August 16, 2008 through August 31, 2014 – February 2013 (1 Payment) • $0.05416667/share special 13th distribution funded from 2012 MFFO in excess of 2012 distributions declared – September 2014 (1 Payment) • $4.50/share special distribution funded from the proceeds from the dispositions of real estate properties between May 2014 and August 2014, as well as cash on hand resulting primarily from the repayment or sale of real estate loans − October 2014 to January 2015 (4 Payments) • $0.13328082/share total distributions paid from October 2014 through January 2015. (If converted to a daily distribution amount for the period and annualized, then this period’s $0.13328082/share distributions would equal a 7.25% annualized rate based on a $10.00 purchase price less $4.50 special distribution or 6.80% annualized rate based on the December 2014 estimated value per share of $5.86.) – February 2015 to December 2015 (11 Payments) • $0.26811507/share total distributions paid from February 2015 through December 2015 (if converted to a daily distribution amount for the period and annualized, then this period’s $0.26811507/share would equal a 5.00% annualized rate based on the December 2014 estimated value per share of $5.86 or a 5.2% annualized rate based on the December 2015 estimated value per share of $5.62.)

16 Stockholder Performance KBS REIT II is providing this estimated value per share to assist broker-dealers that participated in its initial public offering in meeting their FINRA customer account statement reporting obligations. The valuation was performed in accordance with the provisions of and also to comply with the IPA Valuation Guidelines. As with any valuation methodology, the methodologies used are based upon a number of estimates and assumptions that may not be accurate or complete. Different parties with different assumptions and estimates could derive a different estimated value per share and these differences could be significant. The estimated value per share is not audited and does not represent the fair value of KBS REIT II’s assets or the fair value of KBS REIT II’s liabilities according to GAAP. KBS REIT II can give no assurance that: • a stockholder would be able to resell his or her shares at this estimated value per share; • a stockholder would ultimately realize distributions per share equal to KBS REIT II’s estimated value per share upon liquidation of KBS REIT II’s assets and settlement of its liabilities or a sale of KBS REIT II; • KBS REIT II’s shares of common stock would trade at the estimated value per share on a national securities exchange; • an independent third-party appraiser or other third-party valuation firm would agree with KBS REIT II’s estimated value per share; or • the methodology used to calculate KBS REIT II’s estimated value per share would be acceptable to FINRA or for compliance with ERISA reporting requirements. Further, the estimated value per share as of December 8, 2015 is based on the estimated value of KBS REIT II’s assets less the estimated value of KBS REIT II’s liabilities divided by the number of shares outstanding, all as of September 30, 2015. The value of KBS REIT II’s shares will fluctuate over time in response to developments related to individual assets in KBS REIT II’s portfolio and the management of those assets and in response to the real estate and finance markets. The estimated value per share does not reflect a discount for the fact that KBS REIT II is externally managed, nor does it reflect a real estate portfolio premium/discount versus the sum of the individual property values. The estimated value per share does not take into account estimated disposition costs and fees for real estate properties that are not under contract to sell, debt prepayment penalties or swap breakage fees that could apply upon the prepayment of certain of KBS REIT II’s debt obligations or termination of related swap agreements or the impact of restrictions on the assumption of debt. KBS REIT II has generally incurred disposition costs and fees related to the sale of each real estate property since inception of 1.7% to 3.5% of the gross sales price less concessions and credits, with the weighted average being approximately 2.2%. If this range of disposition costs and fees was applied to KBS REIT II’s real estate properties, which do not include these costs and fees in the appraised values, the resulting impact on the estimated value per share would be a decrease of $0.14 to $0.28 per share. KBS REIT II currently expects to utilize the Advisor and/or an independent valuation firm to update the estimated value per share no later than December 2016.

Stockholder Performance 17 $5.62 $8.90 $14.52 Hypothetical Performance of Early and Late Investors $10.00 Share Price, All Distributions Received in Cash Estimated Value Per Share As of December 8, 2015 Cumulative Cash Distributions Received through December 8, 2015 Sum of Estimated Value Per Share as of December 8, 2015 and Cumulative Cash Distributions Received through December 8, 2015 Late Investor: Invested at Close of Public Offering (December 31, 2010) Early Investor: Invested at Escrow Break (June 24, 2008) $5.62 $7.34 $12.96 The last column above would increase by $1.36 to $15.88 for early DRIP investors and $0.53 to $13.49 for late DRIP investors.1 1Values per share are based on number of shares originally purchased, and assume full participation in dividend reinvestment plan for life of investment and no share redemptions.

Stockholder Performance 18 Hypothetical Performance of Early and Late Investors $10.00 Share Price, All Distributions Received in Cash For information about the estimated value per share for 12/11, 12/12, 12/13, 9/14, 12/14 and 12/15, see slide 6. “Cumulative Distributions” for an early cash investor assumes all distributions received in cash and no share redemptions and reflect the cash payment amounts (all distributions paid since inception) per share for a hypothetical investor who invested on or before escrow break and consequently has received all distributions paid by the REIT. “Cumulative distributions” for a late cash investor assumes all distributions received in cash and no share redemptions, and reflect the cash payment amounts (all distributions paid since investment) per share for a hypothetical investor who invested on December 31, 2010, the day offers in primary offering ended. The “offering price” of $10.00 reflects the price most investors paid to purchase shares in the primary initial public offering. $0.65 $1.30 $1.95 $6.94 $7.04 $7.34 $10.11 $10.29 $10.29 $6.05 $5.86 $5.62 $10.00 $10.76 $11.59 $12.24 $12.99 $12.90 $12.96 Offering Price 2011 2012 2013 Sept. 2014 Dec. 2014 Dec. 2015 Breakdown of Late Cash Investor Value Cumulative Distributions Estimated Value Per Share $2.21 $2.86 3 51 $8.50 $8.60 $8.90 $10.11 $10.29 $10.29 $6.05 $5.86 $5.62$10.00 $12.32 $13.15 3.80 $14.55 $14.46 $14.52 Offering Price 2011 2012 2013 Sept. 2014 Dec. 2014 Dec. 2015 Breakdown of Early Cash Investor Value Cumulative Distributions Estimated Valu Per Shar

19 2016 Goals and Objectives • Continue to strategically sell assets and make special distributions to stockholders • Strategically negotiate lease renewals or new leases that facilitate the sales process and enhance property stability for prospective buyers • Complete major capital projects, such as renovations or amenity enhancements, with the goal of attracting a greater pool of quality buyers

Thank you! KBS Capital Markets Group LLC Member FINRA & SIPC 800 Newport Center Drive, Suite 700 Newport Beach, CA 92660 (866) KBS-4CMG www.kbs-cmg.com