Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ABM INDUSTRIES INC /DE/ | t1502899_ex99-1.htm |

| 8-K - FORM 8-K - ABM INDUSTRIES INC /DE/ | t1502899_8k.htm |

Exhibit 99.2

Fourth Quarter and Full Year 2015 December 9, 2015 Teleconference

1 2 3 4 5 6 7 2 ABM Business Overview Fourth Quarter 2015 Review Fourth Quarter Segment Highlights Full Year 2015 Review Capital Structure Fiscal 2016 Outlook Q & A Forward - Looking Statements and Non - GAAP Financial Information: Our discussions during this conference call will include forward - looking statements. Actual results could differ materially fro m those projected in the forward - looking statements. Some of the factors that could cause actual results to differ are discussed in the Company’s 2014 Annual Report on Form 10 - K and in our 2015 report s on Form 10 - Q and Form 8 - K. These reports are available on our website at http:// investor.abm.com under “SEC Filings”. A description of other factors that could cause actual results to differ is also set forth at the end of this presentation. Also, the discussion during this conference call will include certain financial measures that were not prepared in accordance wi th U.S. generally accepted accounting principles (“U.S. GAAP”). Reconciliations of those non - GAAP financial measures to the most directly comparable U.S. GAAP financ ial measures can be found on the Investor Relations portion of our website at http://investor.abm.com and at the end of this presentation.

ABM Business Overview 3

Financial Results

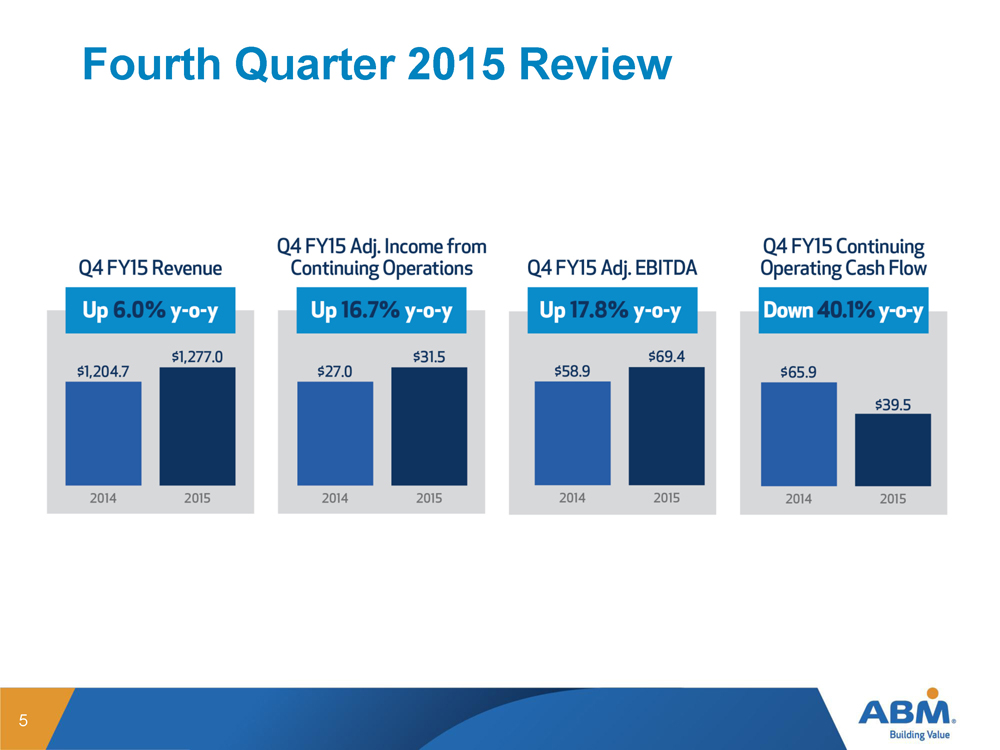

Fourth Quarter 2015 Review 5

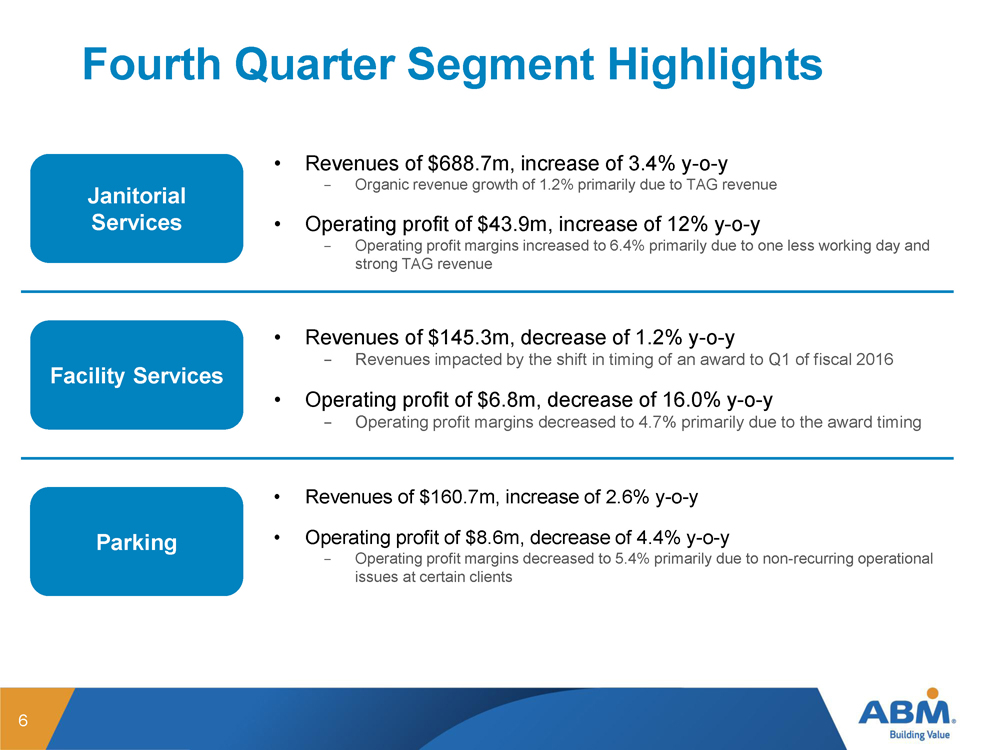

Fourth Quarter Segment Highlights 6 Janitorial Services Facility Services Parking • Revenues of $688.7m, increase of 3.4% y - o - y − Organic revenue growth of 1.2% primarily due to TAG revenue • Operating profit of $43.9m, in crease of 12 % y - o - y − Operating profit margins increased to 6.4% primarily due to one less working day and strong TAG revenue • Revenues of $145.3m, decrease of 1.2% y - o - y − Revenues impacted by the shift in timing of an award to Q1 of fiscal 2016 • Operating profit of $6.8m, de crease of 16.0% y - o - y − Operating profit margins decreased to 4.7% primarily due to the award timing • Revenues of $160.7m, increase of 2.6% y - o - y • Operating profit of $ 8.6 m, de crease of 4.4% y - o - y − Operating profit margins decreased to 5.4% primarily due to non - recurring operational issues at certain clients

Fourth Quarter Segment Highlights 7 BESG Other (Air Serv ) • Revenues of $167.7m, increase of 23.6% y - o - y − Organic revenue growth of 13.9%, primarily due to strong results in technical services (ABES) • Operating profit of $13.8m, in crease of 36.6% y - o - y − Operating profit margins increased due to the top - line growth in ABES • Revenues of $114.6m, increase of 15.6% y - o - y • Operating profit of $5.1m, increase of 50.0% y - o - y − Operating profit margins increased to 4.5%, primarily due to temporary higher margin business in the U.K and lower amortization

Fiscal Year 2015 Review 8

Capital Structure

Leverage Target 2.5x Select Cash Flow & Balance Sheet Items Leverage 10 Q4 FY15 Leverage of 1.31x Note: Chart not inclusive of all acquisitions *Decrease in FY15 Q4 leverage due to disposition of Security *

Select Cash Flow & Balance Sheet Items Shareholder Return 11 *Accelerated Q2 FY13 dividend payment in Q1 FY13

Fiscal 2016 Outlook

Fiscal Year 2016 Adjusted EPS Bridge 13 1. This guidance excludes any potential benefits associated with certain discrete tax items that would impact our effective tax rat e and could provide a benefit of up to $0.40 per diluted share in fiscal 2016. These include items such as the 2015 and 2016 Work Opportunity Tax Credits and other un recognized tax benefits 1

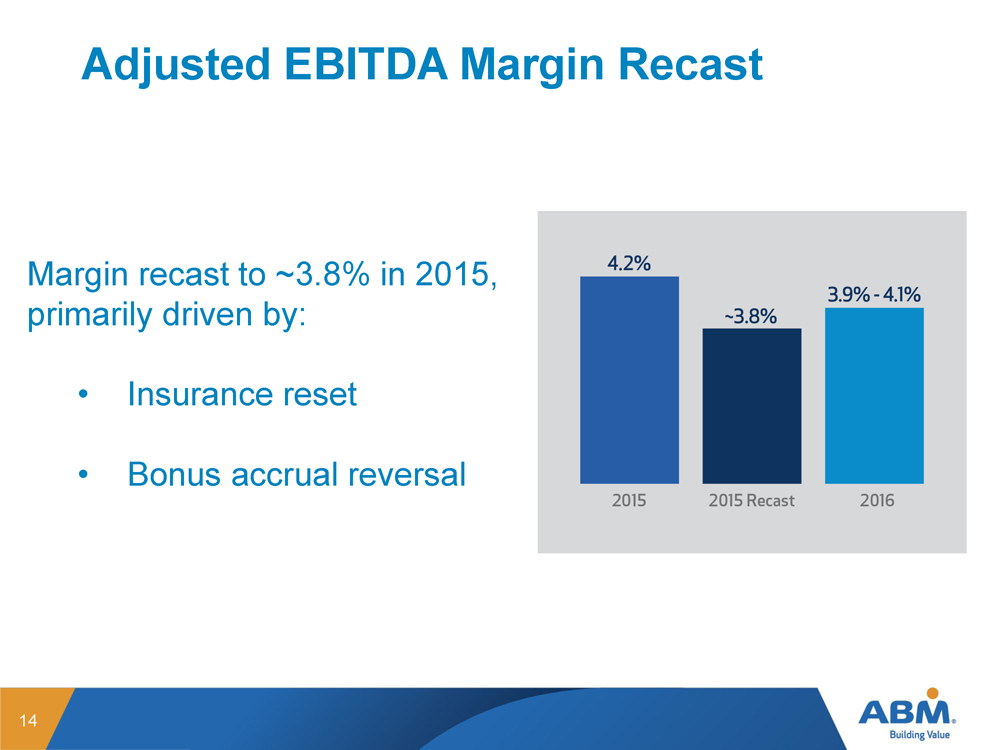

Adjusted EBITDA Margin Recast 14 Margin recast to ~3.8% in 2015 , primarily driven by: • Insurance reset • Bonus accrual reversal

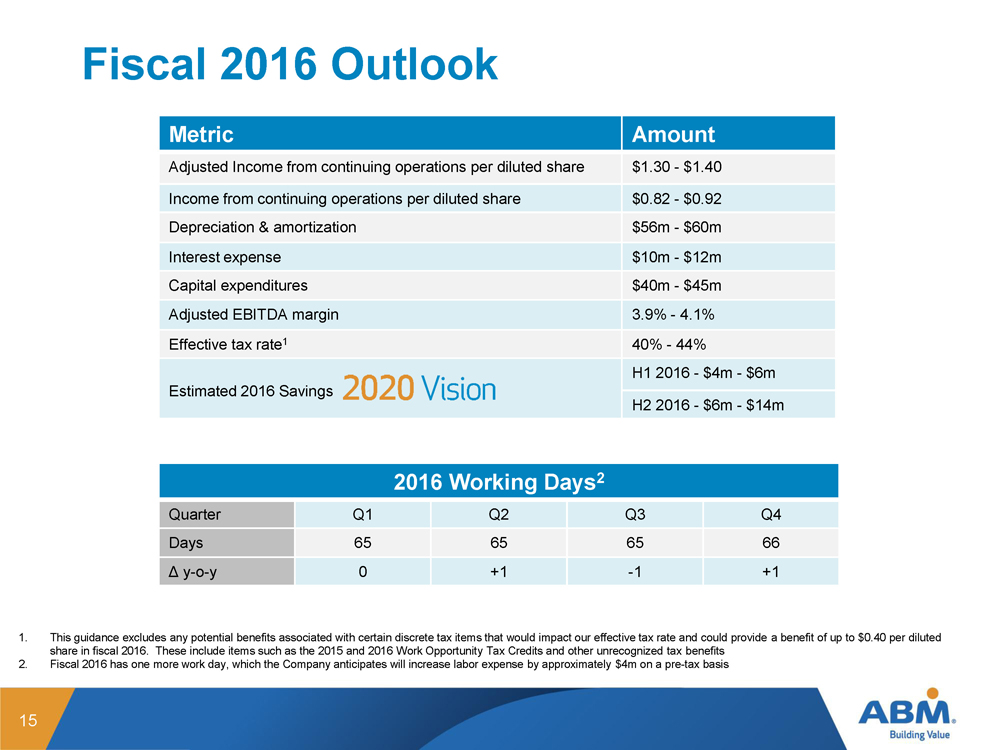

Fiscal 2016 Outlook 15 Metric Amount Adjusted Income from continuing operations per diluted share $1.30 - $1.40 Income from continuing operations per diluted share $0.82 - $0.92 Depreciation & amortization $56m - $60m Interest expense $10m - $12m Capital expenditures $40m - $45m Adjusted EBITDA margin 3.9% - 4.1% Effective tax rate 1 40% - 44% Estimated 2016 Savings H1 2016 - $4m - $6m H2 2016 - $6m - $14m 1. This guidance excludes any potential benefits associated with certain discrete tax items that would impact our effective tax rate and could provide a b enefit of up to $0.40 per diluted share in fiscal 2016. These include items such as the 2015 and 2016 Work Opportunity Tax Credits and other unrecognized tax benefits 2. Fiscal 2016 has one more work day, which the Company anticipates will increase labor expense by approximately $4m on a pre - tax basis 2016 Working Days 2 Quarter Q1 Q2 Q3 Q4 Days 65 65 65 66 Δ y - o - y 0 +1 - 1 +1

Forward - Looking Statement This presentation contains both historical and forward - looking statements. Forward - looking statements are not based on historica l facts but instead reflect our current expectations, estimates or projections concerning future results or events. These statements generally can be identified by the use of forw ard - looking words or phrases such as "believe," "expect," “will,” "anticipate," "may," "could," "intend," "belief," "estimate," "plan," "target," "should," "forecast, or other similar words o r p hrases. These statements are not guarantees of future performance and are inherently subject to known and unknown risks, uncertainties and assumptions that are difficult to predict and could cau se our actual results to differ materially from those indicated by those statements. Forward - looking statements in this presentation include, but are not limited to, statements regarding the a doption of our 2020 strategy and transformation initiative, statements regarding our future operating and financial performance, our fiscal 2016 guidance, statements regarding the cost sav ings we have projected to achieve by the realignment of our business operations and statements regarding the timing of any of the foregoing. We cannot assure you that any of our exp ect ations, estimates or projections will be achieved. Numerous factors could cause our actual results and events to differ materially from those expressed or implied by forward - looki ng statements. These factors include, but are not limited to the following ( 1) changes to our businesses, operating structure, capital structure, or personnel relating to the implementation of our 2020 Vi sion Strategic Transformation Initiative may not have the desired effects on our financial condition and results of operations; (2) we have high deductibles for certain insu rab le risks, and therefore, we are subject to volatility associated with those risks, including the possibility that our risk management and safety programs may not have the intended effect of all owing us to reduce our insurance reserves for casualty programs and that our insurance reserves may need to be materially adjusted from time to time; (3) our captive insurance comp any may not bring us the benefits we expect; (4) risks relating to our acquisition strategy may adversely impact our results of operation; (5) we are subject to intense competition th at can constrain our ability to gain business as well as our profitability; (6) increases in cost that we cannot pass on to clients could affect our profitability; (7) our business succe ss depends on our ability to preserve our long - term relationships with clients; (8) our business success depends on retaining senior management and attracting and retaining qualified personnel; (9 ) w e are at risk of losses stemming from accidents or other incidents at facilities in which we operate, which could cause significant damage to our reputation and financial loss; (10) neg ative or unexpected tax consequences could adversely affect our results of operations; (11) changes in energy prices and government regulations could adversely impact the results of ope rat ions of our Building & Energy Solutions business; (12) significant delays or reductions in appropriations for our government contracts may negatively affect our business and could hav e an adverse effect on our financial position, results of operations, and cash flows; (13) we conduct some of our operations through joint ventures, and our ability to do business may be affected by the failure of our joint venture partners to perform their obligations; (14) our business may be negatively affected by adverse weather conditions; (15) federal health ca re reform legislation may adversely affect our business and results of operations; (16) we are subject to business continuity risks associated with centralization of certain administrat ive functions; (17) our services in areas of military conflict expose us to additional risks; (18) we are subject to cyber - security risks arising out of breaches of security relating to sensitive co mpany, client, and employee information and to the technology that manages our operations and other business processes; (19) a decline in commercial office building occupancy and rental r ate s could adversely affect our revenues and profitability; (20) deterioration in general economic conditions could reduce the demand for facility services and, as a result, reduce our ear nings and adversely affect our financial condition; (21) financial difficulties or bankruptcy of one or more of our clients could adversely affect our results; (22) any future increa se in the level of our debt or in interest rates could affect our results of operations; (23) our ability to operate and pay our debt obligations depends upon our access to cash; (24) goodwill impair men t charges could have a material adverse effect on our financial condition and results of operations; (25) impairment of long - lived assets may adversely affect our operating results; (26) we are defendants in class and representative actions and other lawsuits alleging various claims that could cause us to incur substantial liabilities; (27) changes in immigration law s or enforcement actions or investigations under such laws could significantly adversely affect our labor force, operations, and financial results; (28) labor disputes could lead to lo ss of revenues or expense variations; (29) we participate in multiemployer pension plans that under certain circumstances could result in material liabilities being incurred; (30) action s o f activist investors could be disruptive and costly and could cause uncertainty about the strategic direction of our business; and (31) disasters or acts of terrorism could disrupt servic es. Additional information regarding these and other risks and uncertainties the Company faces is contained in the Company's Annu al Report on Form 10 - K for the year ended October 31, 2014, and in other reports the Company files from time to time with the Securities and Exchange Commission (the "SEC") (inclu din g all amendments to those reports). The Company urges readers to consider these risks and uncertainties in evaluating its forward - looking statements. The Company cautions readers not to place undue reliance upon any such forward - looking statements, which speak only as of the date made. The Company disclaims any obligation or undertaking to publicly release any up dates or revisions to any forward - looking statements contained herein (or elsewhere) to reflect any change in the Company's expectations with regard thereto, or any change in eve nts , conditions or circumstances on which any such statement is made, whether as a result of new information, future events or otherwise, except as otherwise required by the fe der al securities laws. 16

Appendix - Unaudited Reconciliation of non - GAAP Financial Measures

Unaudited Reconciliation of non - GAAP Financial Measures 18

Unaudited Reconciliation of non - GAAP Financial Measures 19

2015 Revised Guidance and 2016 Guidance 20