Attached files

| file | filename |

|---|---|

| 8-K - PANEX RESOURCES INC. FORM 8-K (12/08/2015) - Panex Resources Inc. | dgbf8k-12032015.htm |

Exhibit 99.1

Panex Resources Inc.

NEWS RELEASE 12 - 2015

|

Trading Symbol: DBGF

|

|

|

CUSIP No. 69841J 106

|

|

|

OTC Markets: OTC Pink

|

Panex Acquires Crackerjack Gold Project in the Kimberley Mineral Field,

Western Australia and Invests A$500,000 in Burey Gold Limited

Cape Town, South Africa – December 3, 2015 – Panex Resources Inc. (the "Company," or "Panex") (OTC Pink DBGF) is pleased to announce that it has acquired a 100% interest in the Crackerjack Gold Project, Halls Creek, Western Australia located within the highly prospective Kimberly Mineral Field. Gold has been intermitently mined from a number of historic workings within the licence boundary.

Crackerjack Gold Project

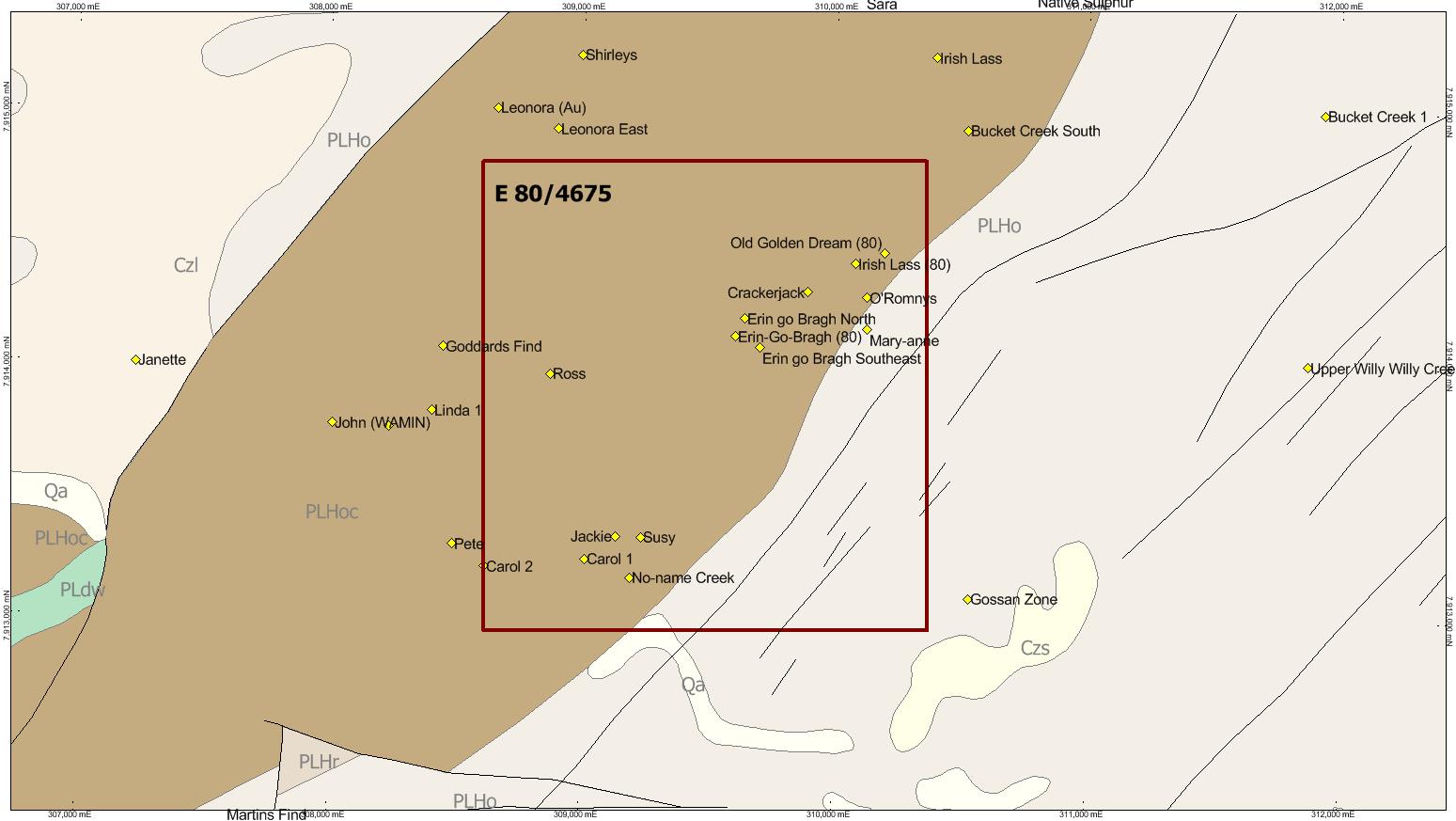

The Crackerjack Gold Project consists of a single, underdeveloped, granted exploration licence (EL80/4675) and is located 85km to the south west of Halls Creek, Kimberley Mineral field, Western Australia. The project area lays within the Halls Creek Mobile Belt, which is a major deformation, multiple fault zone bounding the eastern edge of the Kimberley Craton. Gold mineralisation is focused within felsic volcanic rocks along the boundary of the Biscay and Olympio Formations where economic mines are confined to a narrow zone along their boundary over a 15km2 area. The contact zone transgresses the entire Crackerjack licence from NE to SW as shown in Figure 1.

Gold has been mined from three distinct horizons within the licence area, namely alluvial/elluvial zone at surface, gold enriched zone at the water table interface and from the primary bedrock zone. Gold mineralisation is confined to steeply dipping, small quartz fissure veins containing pyrite and small amounts of galena, sphalerite and chalcopyrite. Most of the veins are concordant with the foliation and bedding and are commonly folded. There is strong stratigraphic control on mineralisation, without exception the between the Biscay and Olympio Formations.

Gold has been historically mined over a combined strike length of 1km within the licence area, from veins averaging 1-4m in width. Gold values from channel samples taken from various workings ranged from 0.2-16.5g/t Au. Base metals and silver reported up to 11% lead, 0.4% copper and 213g/t silver. Previous explorer, Maldon Minerals NL, drilled 2 percussion and 14 RC drill holes on the project. Best results included 3m @ 3.79g/t Au, 3m @ 19.2g/t Au, 2m @ 3.98g/t Au and 2m @ 2.45 g/t Au.

The Company believes the Crackerjack Project is underexplored and has excellent potential to host moderately sized gold resources of high grade within a mining friendly jurisdiction. Once sufficient funds have been raised the Company will commence soil sampling and channel sampling programs to better define drilling targets within the area.

Placement in Burey Gold Limited

During November the Company re-invested Aud$500,000 in Burey Gold Limited where funds will be used on Burey's Giro Gold Project in Democratic Republic of Congo. Panex agreed to buy 20,000,000 New Shares with an attached Option at an Issue price of Aud$0.02 per share (or Aud$400,000), together with 20,000,000 New Options at an issue price of Aud$0.005 per New Option (or Aud$100,000) for a total of total of Aud$500,000. Options can be exercised at Aud$0.05 and expire in July 2017. Burey will pay a 5% fee for the transaction.

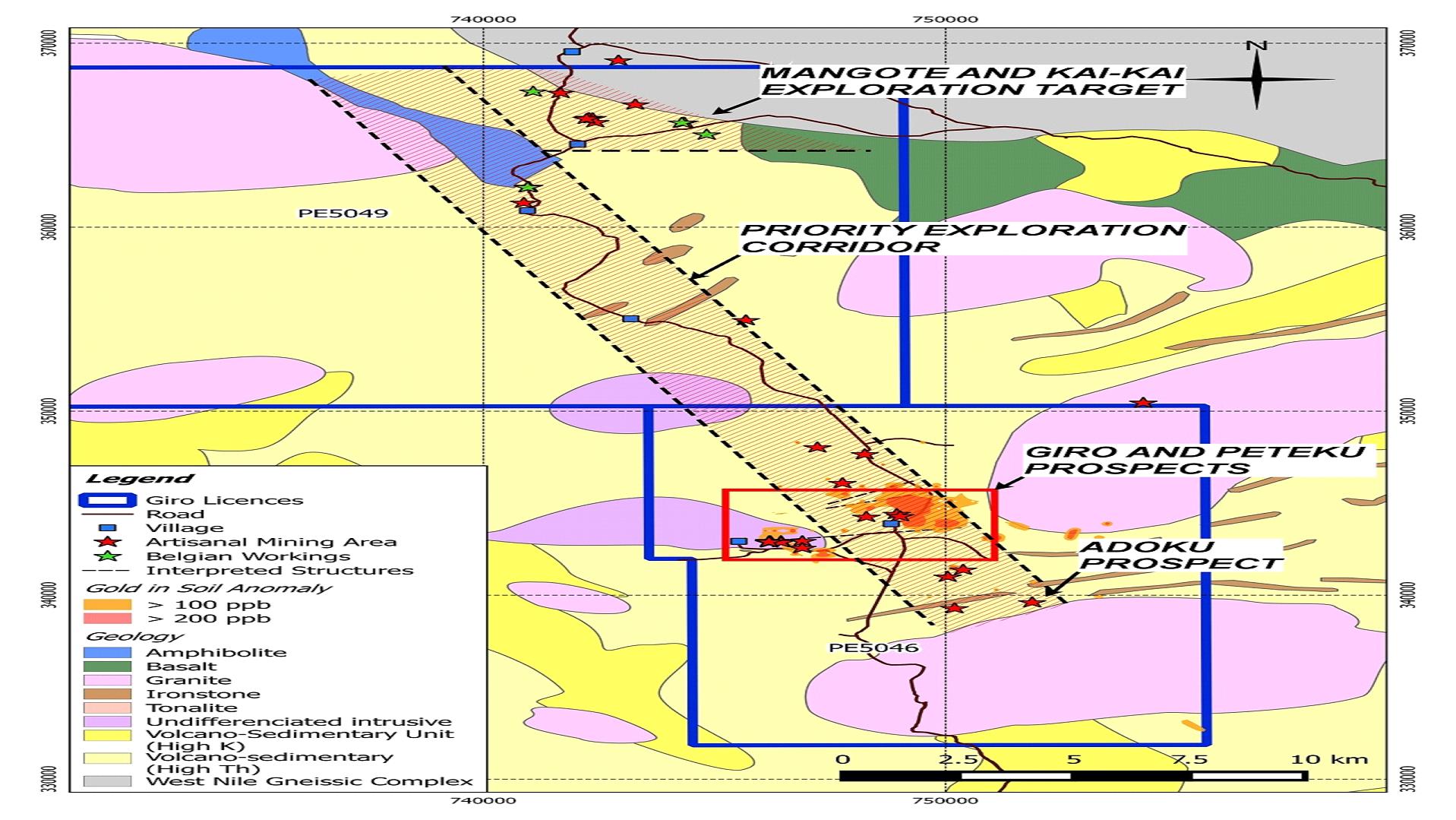

The Giro Gold Project comprises two exploitation permits covering a surface area of 610km² and lays within the Kilo-Moto Belt, a significant under-explored greenstone belt in NE Democratic Republic of Congo.

At the Giro and Peteku target areas, the focus of the exploration has been on drilling and geochemical sampling in areas mined historically during Belgian rule and in areas currently being mined by artisanal means. Soil sampling programmes carried out by Burey defined a >200ppb gold in soil anomaly over 2,000m x 900m, while best results from Burey's RC drilling programme over the main IP anomaly include:

|

o

|

GRRC058 97m at 2.56g/t Au from surface

|

|

o

|

GRRC075 47m at 4.13g/t Au from 25m, incl. 29m at 5.93g/t Au from

25m

|

|

o

|

R02 16m at 3.95g/t Au from 15m and 35m at 2.28g/t Au from

81m, incl. 13m at 4.17g/t Au from 103m

|

|

o

|

GRRC068 33m at 1.59g/t Au from surface and 56m at 2.39g/t Au

from 64m incl. 9m at 5.20g/t Au from 66m

|

Initial work supports a broad zone of mineralization associated with a strong NNW trending chargeability anomaly at the Kebigada target. The Giro Prospect is cross-cut by numerous high grade ENE trending structures currently mined by artisanal miners. One such vein at Peteku reported 4m at 21.7g/t Au within granite.

A major northwest trending structural corridor is interpreted to transgress both tenements over at least 30km (Figure 2). The Giro deposits mined historically lie within this corridor while a number of extensive alluvial workings were identified to the north within the structural corridor. Burey will expedite soil sampling programmes for complete coverage of the corridor to identify additional zones of mineralisation which potentially sourced gold in alluvial workings.

To the north, Belgian colonials mined two deposits on PE 5049 up to the end of the colonial era in the 1960's. These were the Mangote open pit where historic drilling results included 0.6m at 37g/t Au and 0.35m at 485g/t Au. There is no record of methods used to obtain these results. Only quartz veins were sampled historically by the Belgians although subsequent sampling of wall rock adjacent to quartz veins currently mined by artisanal miners confirmed potential for a broader zone of mineralization surrounding high grade quartz veins.

Other Events

On November 5th, 2015, Panex hired Nigel Ferguson as a consultant. Mr. Nigel Ferguson, is a senior geologist with over 29 years global experience including project generation, grass roots exploration, resource drill-outs management of feasibility studies and the listing and financing of junior exploration and development companies. He has over 29 years technical, corporate and finance experience, with the last 15 years at senior management level. Mr. Ferguson's areas of interest lie in developing undervalued assets, recognising investment opportunities that could be better served if presented in a different financial

arena, team and company building in the minerals industry and deal making through to project generation and development. Mr. Ferguson currently serves as executive director on the board of the unlisted entity Samba Minerals Ltd and since 2012 concentrates more on technical matters including project acquisitions and exploration. Mr. Ferguson is a Fellow of the AusIMM and a Member of the AIG.

The Board of Panex is extremely pleased with the appointment of Mr. Ferguson whose extensive experience will greatly assist in moving the Company forward.

ON BEHALF OF PANEX

Mark Gasson

Chief Executive Officer

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains statements that plan for or anticipate the future, called "forward-looking statements." In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "could," "expects," "plans," "intends," "anticipates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of those terms and other comparable terminology.

These forward-looking statements appear in a number of places in this press release and include, but are not limited to, statements about: our market opportunity; revenue generation; our strategies; competition; expected activities and expenditures as we pursue our business plan; the adequacy of our available cash resources; our ability to acquire properties on commercially viable terms; challenges to our title to our properties; operating or technical difficulties in connection with our exploration and development activities; currency fluctuations; fluctuating market prices for precious and base metals; the speculative nature of precious and base metals exploration and development activities; environmental risks and hazards; governmental regulations; and conduct of operations in politically and economically less developed areas of the world.

Many of these contingencies and uncertainties can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Forward-looking statements are not guarantees of future performance. All of the forward-looking statements made in this press release are qualified by these cautionary statements. Specific reference is made to our most recent annual report on Form 10KSB and other filings made by us with the United States Securities and Exchange Commission for more detailed discussions of the contingencies and uncertainties enumerated above and the factors underlying the forward-looking statements. These reports and filings may be inspected and copied at the Public Reference Room maintained by the U.S. Securities and Exchange Commission at 100 F Street, N.E., Washington, D.C. 20549. You can obtain information about operation of the Public Reference Room by calling the U.S. Securities and Exchange Commission at 1-800-SEC-0330. The U.S. Securities and Exchange Commission also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the U.S. Securities and Exchange Commission at http://www.sec.gov.

We disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except to the extent required by applicable laws.

This press release is for informational purposes only and is not and should not be construed as an offer to solicit, buy, or sell any security.

For further information, please contact Mark Gasson or Ross Doyle.

Panex Resources Incorporation

13 Allegro, Legato, Durbanville, South Africa

(Address of principal executive offices)

Tel (+41) 76 753 4401

www.panexresources.com

Figure 1: Crackerjack licence area on the regional geology showing historic gold

workings within the project area

Figure 1: Interpreted Geology showing Main Prospects and Priority Exploration Corridor