Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIFTH THIRD BANCORP | d33437d8k.htm |

Goldman

Sachs U.S. Financial Services Conference

Greg D. Carmichael President & Chief Executive Officer December 8, 2015 Refer to earnings release dated October 20, 2015 for further information © Fifth Third Bank | All Rights Reserved Exhibit 99.1 |

Long-term shareholder value creation

• Long-term focus • Disciplined business execution within risk appetite Through the cycle performance • Efficiency and operational leverage • Regulatory excellence • Customer-centric execution Operational Excellence • Enhance competitive advantage • Priority on organic growth • Expand product and service offers Investment for shareholder value creation 2 © Fifth Third Bank | All Rights Reserved |

Critical

components of execution Clarity on strategic priorities

— Rolling out strategies faster — Driving efficiencies quicker — Serving customers better Right talent — Hiring talented, experienced executives — Upgrading sales and credit functions Accountability — Getting good returns on every dollar invested Customer focus — Delivering services and products in a clear, value-added manner — Engaging customer in a consultative selling process Top performer through the cycle 1 2 3 4 3 © Fifth Third Bank | All Rights Reserved |

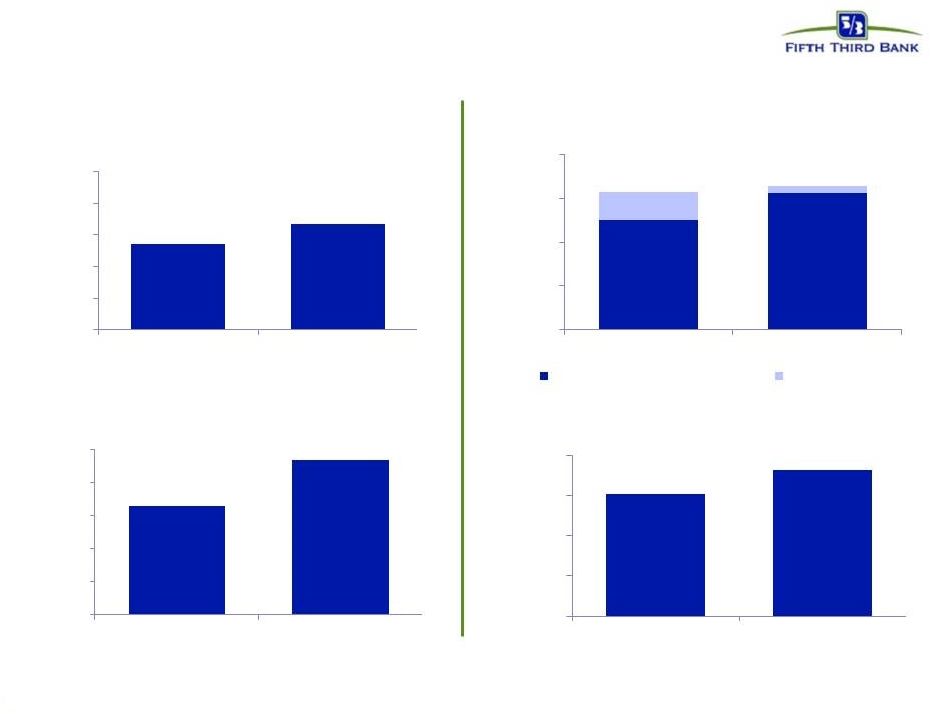

© Fifth Third Bank | All Rights Reserved 4 $93 $99 $80 $84 $88 $92 $96 $100 3Q14 3Q15 $91 $93 $80 $84 $88 $92 $96 $100 3Q14 3Q15 $576 $591 $500 $525 $550 $575 $600 3Q14 3Q15 $875 $906 $33 $9 $750 $800 $850 $900 $950 3Q14 3Q15 NII excluding Deposit Advance Deposit Advance Cornerstones of corporate performance Growth Profitability Average Portfolio Loans ($B) 1 Fee income excludes gains (losses) on the Vantiv warrant and charges from the Visa total return swap Average Core Deposits ($B) Fee Income ($MM) 1 Net Interest Income ($MM) |

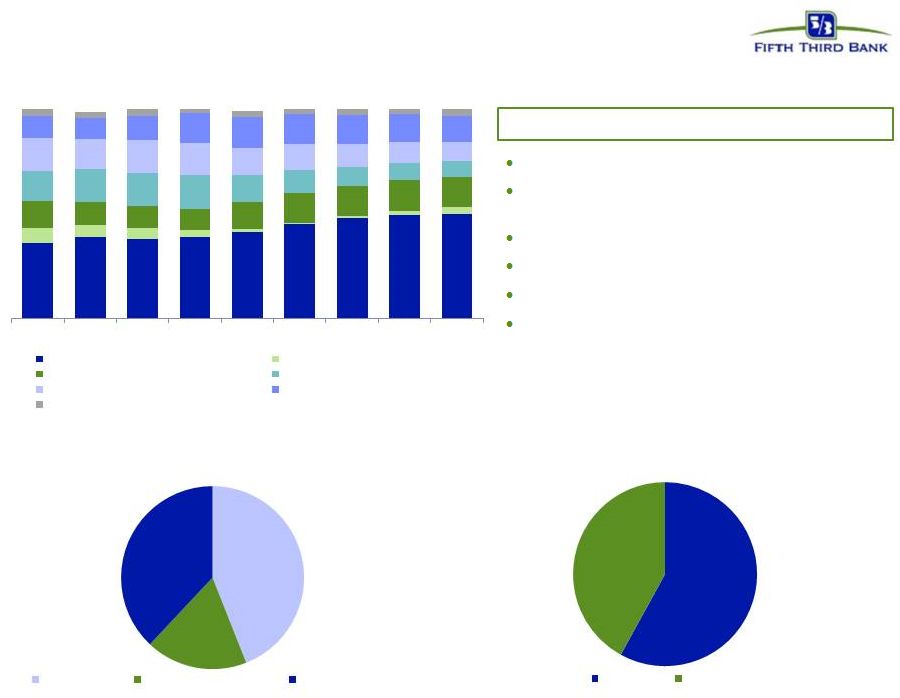

Stability

driven by risk reduction Reduced CRE exposure

Established risk/return preferences within

risk appetite Simplified consumer deposit products Achieved early LCR compliance Exited mortgage broker business Drove higher percentage of recurring fees within Wealth Management Actions Taken EOP Portfolio Loan Balances 1 Data as of 9/30/15 3% 3% 3% 3% 3% 3% 3% 3% 4% 11% 11% 10% 14% 14% 14% 15% 13% 13% 15% 15% 15% 13% 10% 16% 16% 16% 16% 12% 9% 11% 15% 13% 11% 9% 8% 8% C&I + Commercial Lease Commercial Construction Resi Mortgage Commercial Mortgage Home Equity Auto Loans Other Consumer Diversified Wealth Management revenue composition1 Continued focus on purchase originations in mortgage business1

38% 18% 44% 42% 58% Private Bank Institutional Services Retail Brokerage Purchase Refinance 7% 3% 3% 6% 5% 2% 2% 1% 1% 13% 13% 11% 10% 10% 14% 14% 14% 15% 36% 39% 39% 38% 41% 45% 48% 49% 50% 3Q07 3Q08 3Q09 3Q10 3Q11 3Q12 3Q13 3Q14 3Q15 1 1 © Fifth Third Bank | All Rights Reserved 5 |

Operational excellence and back-office efficiency 60 MM Total Annual Calls 50 MM Handled digitally 10 MM Handled by CSR ~1 MM Migrated to mobile or web self-service 9 MM Require a CSR Opportunities in legacy cost structure Leveraging technology to streamline processes, lower costs, and improve service excellence Investing in digital resolution of customer service inquires Reduce error frequency Speed up processing Reduce workload in branches Higher focus on customer-facing interactions Investing in image-based system © Fifth Third Bank | All Rights Reserved 6 |

©

Fifth Third Bank | All Rights Reserved 7

Accelerating growth in assets with higher

capital return More Capital Efficient Less Capital Efficient Portfolio 3Q07 EOP Balance 3Q15 EOP Balance 1-3 year Strategic Outlook Commercial & Industrial $22,649 $42,948 Credit Card $1,460 $2,229 Home Equity $11,737 $8,427 Residential Mortgage $9,057 $13,392 Commercial Real Estate $16,553 $10,162 Auto $10,006 $11,826 |

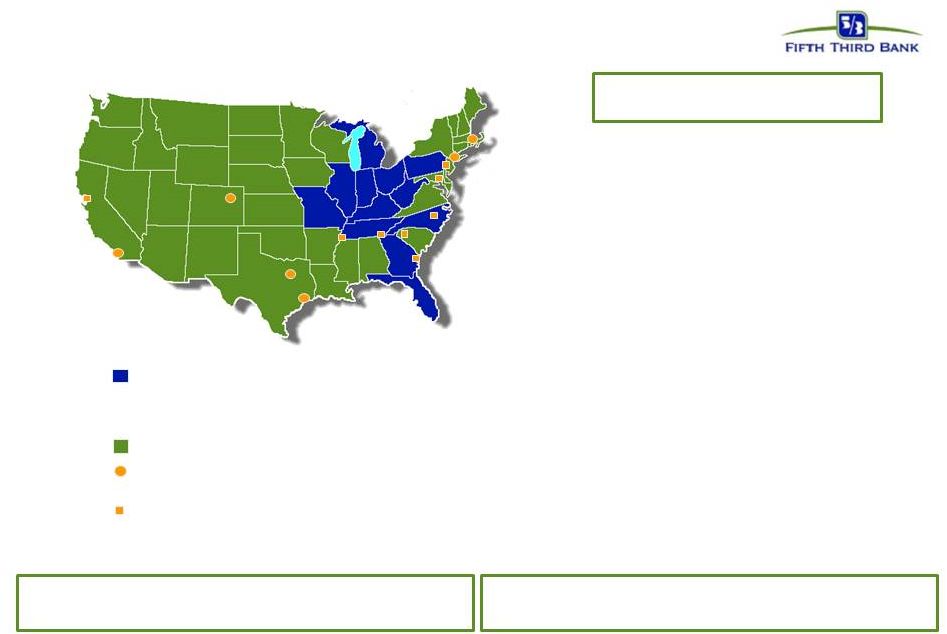

In

footprint markets •

Retail network is anchor business

National commercial banking

• Diverse business mix; growing fee income National commercial hub cities • Provide access to key markets Commercial loan production office • Expanding our reach and deepening relationships Ranked 3rd overall in a 2015 national banking study in mobile application satisfaction Ranked 2nd in J.D. Power 2015 U.S. Primary Mortgage Origination Satisfaction Study Top 10 National Commercial and Consumer Bank Source: Experian Auto Count US States originations in units 2014 through 10/31/14, Oliver Wyman 2015 Survey of Consumers, Oliver Wyman

Survey of Small Businesses 2014, SNL Financial, The 2014 Monitor 100, and

E&Y 2015 Cash Management Services Surveys #5

#8 Equipment Finance Treasury Management Commercial Deposits #8 #9 #10 #7 #9 #11 Commercial Loans Home Equity Lender Non-Captive Prime Auto Originator Retail Bank Small Business Banking Franchise Well-positioned franchise © Fifth Third Bank | All Rights Reserved rd nd 8 |

Capital

management •

Support growth of core banking franchise through continued loan

growth within risk appetite

Organic growth opportunities

• Long term sustainable dividend growth within regulatory guidance Dividends • Continued return of excess capital to shareholders • Potential Vantiv gains to enhance capital return Share repurchases • Improve market share within current low-penetration markets • Non-bank acquisitions to enhance product and service offers Strategic acquisitions 9 © Fifth Third Bank | All Rights Reserved |

Fifth

Third priorities Through the cycle performance

Operational excellence

Investment for shareholder value

creation 10 © Fifth Third Bank | All Rights Reserved |

Cautionary

statement This report contains statements that we believe are

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and

Rule 3b-6 promulgated thereunder. These statements relate to our financial

condition, results of operations, plans, objectives, future performance

or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar

expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these

statements, as they are subject to risks and uncertainties, including but

not limited to the risk factors set forth in our most recent Annual Report on Form 10-K. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make.

Moreover, you should treat these statements as speaking only as of the

date they are made and based only on information then actually known to

us. There are a number of important factors that could cause future

results to differ materially from historical performance and these forward- looking statements. Factors that might cause such a difference include, but are not limited to: (1) general economic conditions and

weakening in the economy, specifically the real estate market, either nationally or in

the states in which Fifth Third, one or more acquired entities and/or the

combined company do business, are less favorable than expected; (2) deteriorating credit quality; (3) political developments, wars or other hostilities may disrupt or increase volatility in securities markets or other economic conditions; (4) changes in

the interest rate environment reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate sources of funding and liquidity; (7) maintaining capital requirements and adequate sources of funding and liquidity may limit Fifth Third’s operations and potential growth; (8) changes and

trends in capital markets; (9) problems encountered by larger or similar financial institutions may adversely affect the banking industry and/or Fifth Third; (10) competitive pressures among depository institutions increase significantly; (11) effects of critical accounting policies and judgments; (12) changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board

(FASB) or other regulatory agencies; (13) legislative or regulatory changes or actions,

or significant litigation, adversely affect Fifth Third, one or more

acquired entities and/or the combined company or the businesses in which Fifth Third, one or more acquired entities and/or the combined company are engaged, including the Dodd-Frank Wall Street Reform and Consumer Protection Act; (14) ability to maintain

favorable

ratings from rating agencies; (15) fluctuation of Fifth Third’s stock price; (16) ability to attract and retain key personnel; (17) ability to receive dividends from its subsidiaries; (18) potentially dilutive effect of future acquisitions on current shareholders’ ownership of

Fifth Third;

(19) effects of accounting or financial results of one or more acquired entities; (20) difficulties from Fifth Third’s investment in, relationship with, and nature of the operations of Vantiv, LLC; (21) loss of income from any sale or potential sale of businesses that could

have an adverse effect on Fifth Third’s earnings and future growth;

(22) difficulties in separating the operations of any branches or other

assets divested; (23) inability to achieve expected benefits from branch consolidations

and planned sales within desired timeframes, if at all; (24) ability to

secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; and (25) the impact of reputational risk created by these developments on such matters as business

generation and retention, funding and liquidity.

You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking

statements.

© Fifth Third Bank | All Rights Reserved

11 |

Continued

monetization of Vantiv stake

Note: Carrying (book) value of the Bancorp’s investment in Vantiv Holding, LLC was $422MM as of 9/30/15 Vantiv’s recorded liability associated with TRAs is $597MM as of 9/3015. This was reduced by the sale of certain TRA cash flows totaling ~$140MM on 10/23/15. Approximately half of the sold TRA cash flows related to 2025 and later. 1 Value of 35mm VNTV B units based on 9/30 carrying value and close price on 12/2/2015 ($52.59)

Secondary offering of 13.4 million shares of Class A Common Stock on 12/2/15

Description Partial cancellation of the warrant to purchase additional ownership in Vantiv Holding, LLC Value of Transaction Remaining Position Net exercise a portion of the remaining warrant Sale of 8mm B units 4.8mm units (24% of original warrant) for $200mm cash payment 7.8mm units (38% of warrant) 5.4mm net of $15.98 strike price Pre-tax gain of $330mm ($215mm after-tax) 7.8mm units 35mm B units/18.3% ownership ~$1.5B net unrealized gain © Fifth Third Bank | All Rights Reserved 12 1 1 2 3 • In total, Fifth Third recorded a $419mm pre-tax gain, generated over $500mm of after-tax

cash proceeds, and significantly reduced market risk and volatility from Vantiv share

price fluctuations in current and projected stress

environments •

Vantiv expects to record a liability of approximately $375 million related to the TRA payable to Fifth Third as a result of this transaction — Fifth Third completed a TRA sale of $140mm in future cash flows in exchange for $49mm cash payment in October — 4Q15 TRA payment not impacted by above transactions |