Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CHOICE HOTELS INTERNATIONAL INC /DE | d89437d8k.htm |

Exhibit 99.1

Investor Presentation

December 2015

CHOICE HOTELSTM Ascend HOTEL COLLECTION CAMBRIA Comfort INN

COMFORT SUITES SLEEP INN QUALITY Clarion MainStay Suites Suburban Econo LodgE RODEWAY INN

Disclaimer

Certain matters discussed throughout all of this presentation constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, our use of words such as “expect,” “estimate,” “believe,” “anticipate,” “should,” “will,” “forecast,” “plan,” “project,” “assume” or similar words of futurity identify such forward-looking statements. These forward-looking statements are based on management’s current beliefs, assumptions and expectations regarding future events, which in turn are based on information currently available to management. Such statements may relate to projections of the company’s revenue, earnings and other financial and operational measures, company debt levels, ability to repay outstanding indebtedness, payment of dividends, and future operations, among other matters. We caution you not to place undue reliance on any such forward-looking statements. Forward-looking statements do not guarantee future performance and involve known and unknown risks, uncertainties and other factors.

Several factors could cause actual results, performance or achievements of the company to differ materially from those expressed in or contemplated by the forward-looking statements. Such risks include, but are not limited to, changes to general, domestic and foreign economic conditions; operating risks common in the lodging and franchising industries; changes to the desirability of our brands as viewed by hotel operators and customers; changes to the terms or termination of our contracts with franchisees; our ability to keep pace with improvements in technology utilized for marketing and reservations systems and other operating systems; fluctuations in the supply and demand for hotels rooms; the level of acceptance of alternative growth strategies we may implement; cyber security and data breach risks; operating risks associated with our international operations; the outcome of litigation; and our ability to effectively manage our indebtedness. These and other risk factors are discussed in detail in the Risk Factors section of the company’s Form 10-K for the year ended December 31, 2014, filed with the Securities and Exchange Commission on March 2, 2015. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

Page 2

Investor Presentation

CHOICE HOTELSTM

Company Overview

Page 3

Investor Presentation

CHOICE HOTELSTM

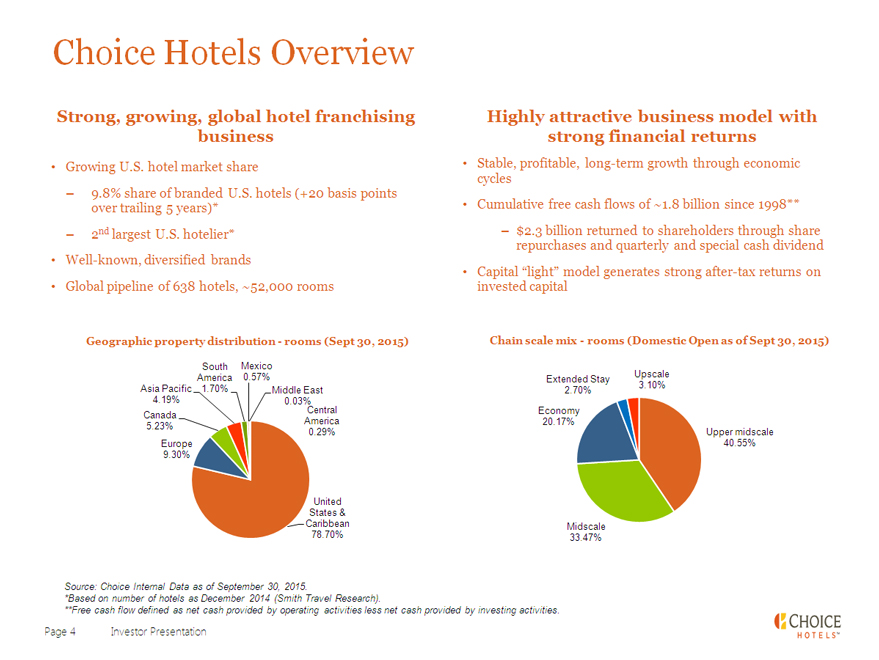

Choice Hotels Overview

Strong, growing, global hotel franchising business

Growing U.S. hotel market share

– 9.8% share of branded U.S. hotels (+20 basis points over trailing 5 years)*

– 2nd largest U.S. hotelier*

Well-known, diversified brands

Global pipeline of 638 hotels, ~52,000 rooms

Geographic property distribution - rooms (Sept 30, 2015)

South America 1.70%

Mexico 0.57%

Asia Pacific

4.19%

Canada

5.23%

Europe

9.30%

Middle East

0.03%

Central

America

0.29%

United

States &

Caribbean

78.70%

Highly attractive business model with strong financial returns

Stable, profitable, long-term growth through economic cycles

Cumulative free cash flows of ~1.8 billion since 1998**

– $2.3 billion returned to shareholders through share repurchases and quarterly and special cash dividend

Capital “light” model generates strong after-tax returns on invested capital

Chain scale mix - rooms (Domestic Open as of Sept 30, 2015)

Extended Stay Upscale

2.70% 3.10%

Economy

20.17%

Upper midscale

40.55%

Midscale

33.47%

Source: Choice Internal Data as of September 30, 2015.

*Based on number of hotels as December 2014 (Smith Travel Research).

**Free cash flow defined as net cash provided by operating activities less net cash provided by investing activities.

Page 4 Investor Presentation CHOICE HOTELSTM

Diversified global footprint

Canada

Hotels open 324 Hotels under development 39 Rooms open & under dev. 29,711

Europe

Hotels open 404 Hotels under development 31 Rooms open & under dev. 50,412

United States & Caribbean

Hotels open 5,226 Hotels under development 540 Rooms open & under dev. 438,708

Central America

Hotels open 13 Hotels under development 1 Rooms open & under dev. 1,344

Asia Pacific

Hotels open 317 Hotels under development 20 Rooms open & under dev. 23,165

Mexico

Hotels open 28 Hotels under development 4 Rooms open & under dev. 3,219

Middle East

Hotels open 1 Hotels under development 2 Rooms open & under dev. 557

South America

Hotels open 65 Hotels under development 2 Rooms open & under dev. 9,001

Source: Choice Internal Data as of September 30, 2015.

The Company includes its Caribbean properties within domestic operating statistics.

Page 5 Investor Presentation CHOICE HOTELSTM

Portfolio Overview

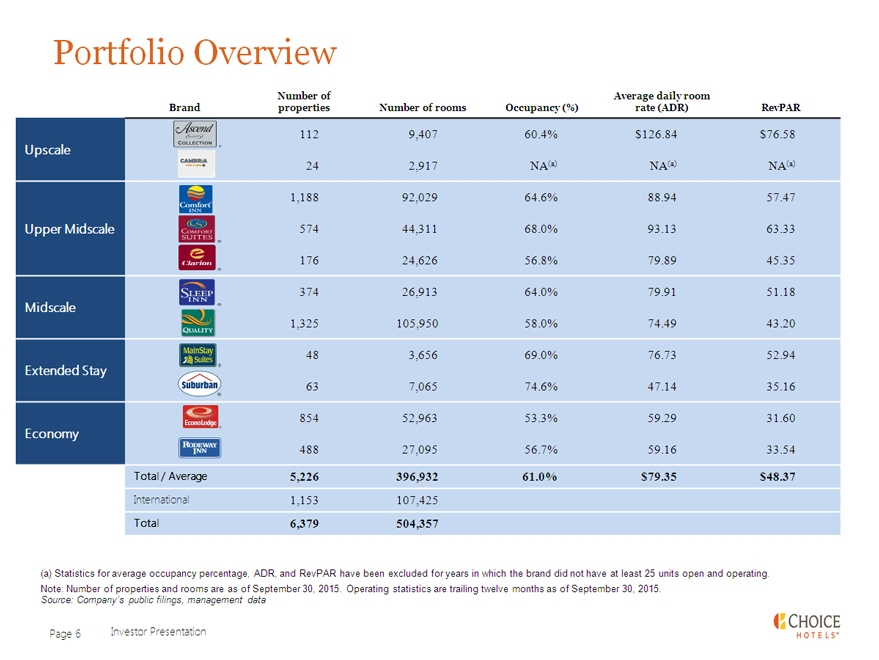

Upscale Upper Midscale Midscale Extended Stay Economy

Brand Number of properties Number of rooms Occupancy (%) Average daily room rate (ADR) RevPAR

Ascend COLLECTION 112 9,407 60.4% $126.84 $76.58

CAMBRIA 24 2,917 NA(a) NA(a) NA(a)

COMFORT INN 1,188 92,029 64.6% 88.94 57.47

COMFORT SUITES 574 44,311 68.0% 93.13 63.33

CLARION 176 24,626 56.8% 79.89 45.35

SLEEP INN 374 26,913 64.0% 79.91 51.18

QUALITY 1,325 105,950 58.0% 74.49 43.20

MAINSTAY SUITES 48 3,656 69.0% 76.73 52.94

SUBURBAN 63 7,065 74.6% 47.14 35.16

ECONOLODGE 854 52,963 53.3% 59.29 31.60

RODEWAY INN 488 27,095 56.7% 59.16 33.54

Total / Average 5,226 396,932 61.0% $79.35 $48.37

International 1,153 107,425

Total 6,379 504,357

(a) Statistics for average occupancy percentage, ADR, and RevPAR have been excluded for years in which the brand did not have at least 25 units open and operating. Note: Number of properties and rooms are as of September 30, 2015. Operating statistics are trailing twelve months as of September 30, 2015.

Source: Company’s public filings, management data

Page 6 Investor Presentation CHOICE HOTELSTM

|

|

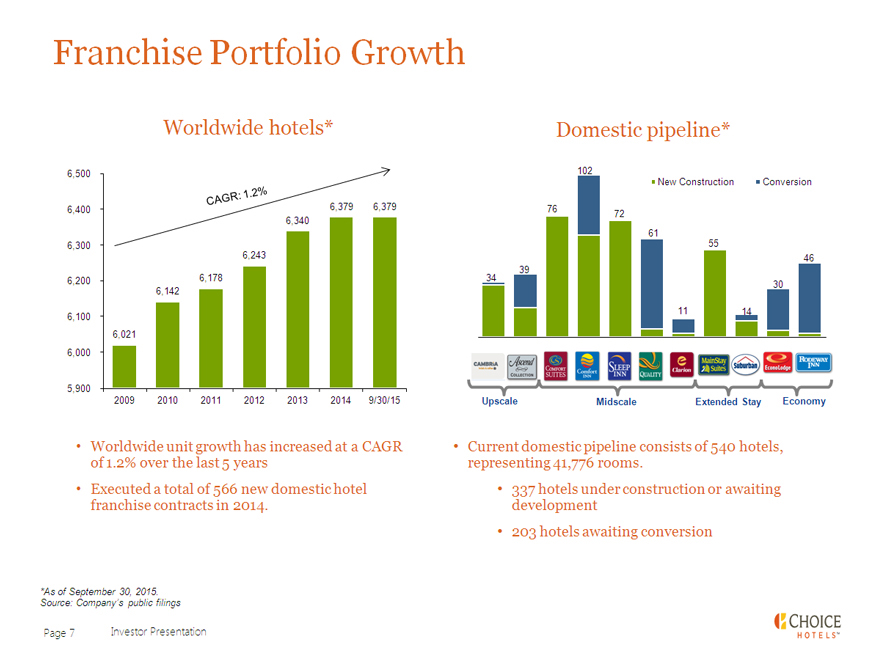

Franchise Portfolio Growth

Worldwide hotels*

6,500 6,400 6,300 6,200 6,100 6,000 5,900

6,021 2009

6,142 2010

6,178 2011

6,340 6,243 2012 2013

6,379 2014

6,379 9/30/15

Worldwide unit growth has increased at a CAGR of 1.2% over the last 5 years

Executed a total of 566 new domestic hotel franchise contracts in 2014.

Domestic pipeline*

102

New Construction Conversion

76 72

61

55

39 46

34 30

14

11

CAMBRIA Ascend COLLECTION COMFORT SUITES COMFORT INN SLEEP INN QUALITY CLARION MAINSTAY SUITES SUBURBAN ECONO LODGE RODEWAY INN

Upscale Midscale Extended Stay Economy

Current domestic pipeline consists of 540 hotels, representing 41,776 rooms.

337 hotels under construction or awaiting development

203 hotels awaiting conversion

*As of September 30, 2015. Source: Company’s public filings

Page 7 Investor Presentation CHOICE HOTELSTM

Strategy for Choice’s brands, growth and shareholders

Improve and Grow Brands

– Increase portfolio profitability of the Comfort brand family

– Refresh Sleep Inn to improve long-term brand growth potential

– Invest in and expand emerging brands/segments – Cambria, Ascend, International

Capture Greater Share of Reservations Via Central Channels

– Grow Choice Privileges loyalty program – target over 2.9 million new members in 2015, worldwide

– Continue to enhance ChoiceHotels.com to increase traffic and conversion

– Improve property-level performance by driving greater mid-week travel

Allocate Free Cash Flows To “Best And Highest” Use

– Continue effective long-term capital allocation practices by optimizing balance sheet leverage, share repurchase and dividend policy

– Leverage financial capacity/strength to support expansion of emerging brands, to improve the flagship Comfort brand and to grow the SkyTouch division

– Continue to evaluate opportunities to enter new segments that leverage core competencies

Page 8 Investor Presentation CHOICE HOTELSTM

Investment Highlights

Page 9 Investor Presentation CHOICE HOTELSTM

Investment Highlights

Established hotel franchising platform with global scale

Resilient fee-for service business model with stable cash flows

Strong and growing brand awareness

Asset light franchising model with strong returns on investment

CHOICE HOTELSTM

Strong, growing loyalty program

Strong pipeline expected to continue to grow as global economy

Effective central reservation system

improves

Page 10 Investor Presentation

CHOICE HOTELSTM

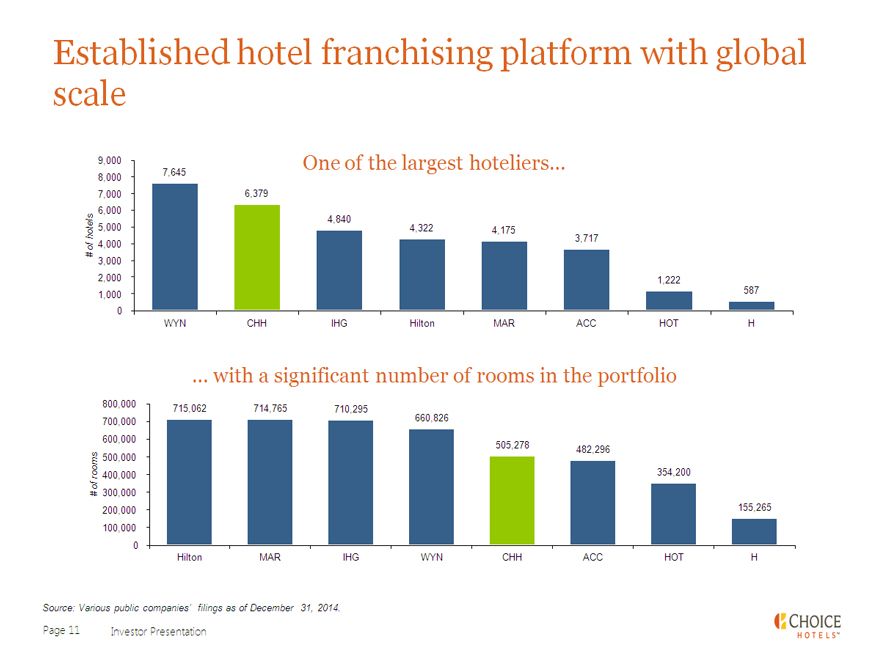

Established hotel franchising platform with global scale

9,000 One of the largest hoteliers...

8,000 7,645

7,000 6,379

6,000

# of hotels

5,000 4,840 4,322 4,175

3,717

4,000

3,000

2,000 1,222

1,000 587

0

WYN CHH IHG Hilton MAR ACC HOT H

... with a significant number of rooms in the portfolio

800,000 715,062 714,765 710,295

700,000 660,826

600,000

505,278 482,296

# of rooms 500,000

400,000 354,200

300,000

200,000 155,265

100,000

0

Hilton MAR IHG WYN CHH ACC HOT H

Source: Various public companies’ filings as of December 31, 2014.

Page 11 Investor Presentation CHOICE HOTELSTM

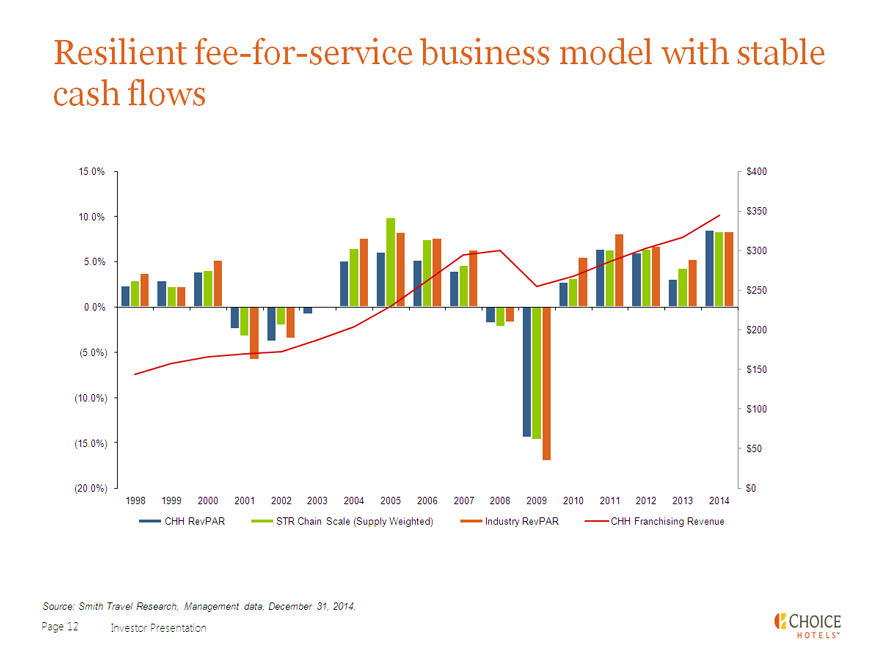

Resilient fee-for-service business model with stable

cash flows

15.0% $400

10.0% $350

$300

5.0%

$250

0.0%

$200

(5.0%)

$150

(10.0%)

$100

(15.0%) $50

(20.0%) $0

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

CHH RevPAR STR Chain Scale (Supply Weighted) Industry RevPAR CHH Franchising Revenue

Source: Smith Travel Research, Management data, December 31, 2014.

Page 12 Investor Presentation CHOICE HOTELSTM

Strong, growing loyalty program

Comprehensive loyalty rewards program

21 million members worldwide – contribute approximately 1/3 of domestic gross room revenues

~2.7 million new members added worldwide in 2014

Delivers incremental business to all Choice brand hotels

Important selling point for franchise sales

Loyalty program

84

(members in millions)

50

45 44

39

21 18 18

IHG MAR HOT Hilton WYN CHH H ACC

Choice Privileges revenue as percent

of domestic gross room revenues*

31.5% 31.0%

28.7% 28.9%

25.6% 27.1%

20.3% 22.0%

15.3% 16.2% 17.9%

12.2%

8.3% 10.0%

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Source: Company’s public filings, Management data as of December 31, 2014. * 2001-2008 Data excludes Econo Lodge and Rodeway Inn brands.

Page 13 Investor Presentation CHOICE HOTELSTM

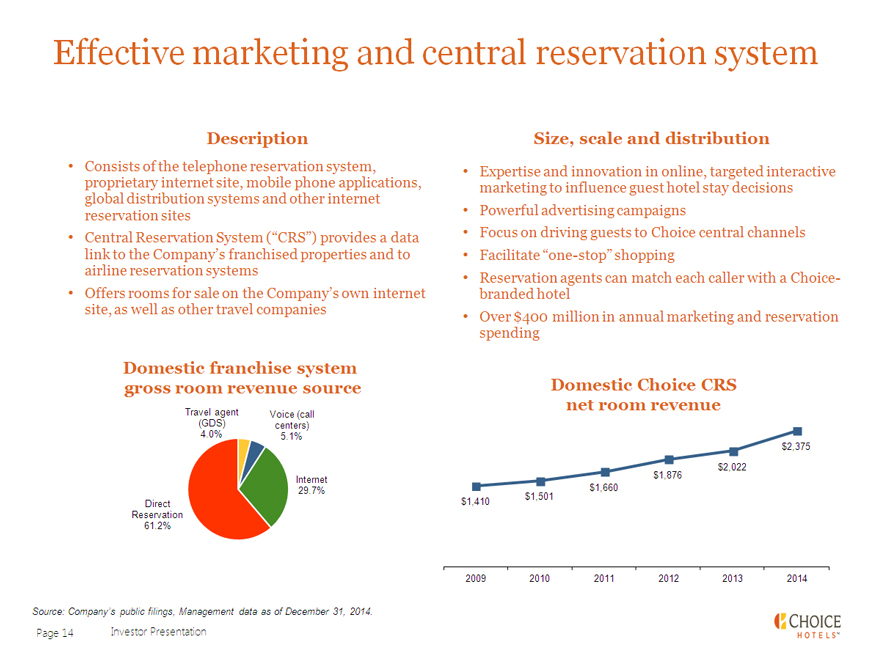

Effective marketing and central reservation system

Description

Consists of the telephone reservation system, proprietary internet site, mobile phone applications, global distribution systems and other internet reservation sites

Central Reservation System (“CRS”) provides a data link to the Company’s franchised properties and to airline reservation systems

Offers rooms for sale on the Company’s own internet site, as well as other travel companies

Size, scale and distribution

Expertise and innovation in online, targeted interactive marketing to influence guest hotel stay decisions

Powerful advertising campaigns

Focus on driving guests to Choice central channels

Facilitate “one-stop” shopping

Reservation agents can match each caller with a Choice-branded hotel

Over $400 million in annual marketing and reservation spending

Domestic franchise system gross room revenue source

Travel agent (GDS) 4.0%

Voice (call centers) 5.1%

Internet 29.7%

Direct Reservation 61.2%

Domestic Choice CRS net room revenue

$2,375

$2,022

$1,876

$1,660

$1,410 $1,501

2009 2010 2011 2012 2013 2014

Source: Company’s public filings, Management data as of December 31, 2014.

Page 14 Investor Presentation CHOICE HOTELSTM

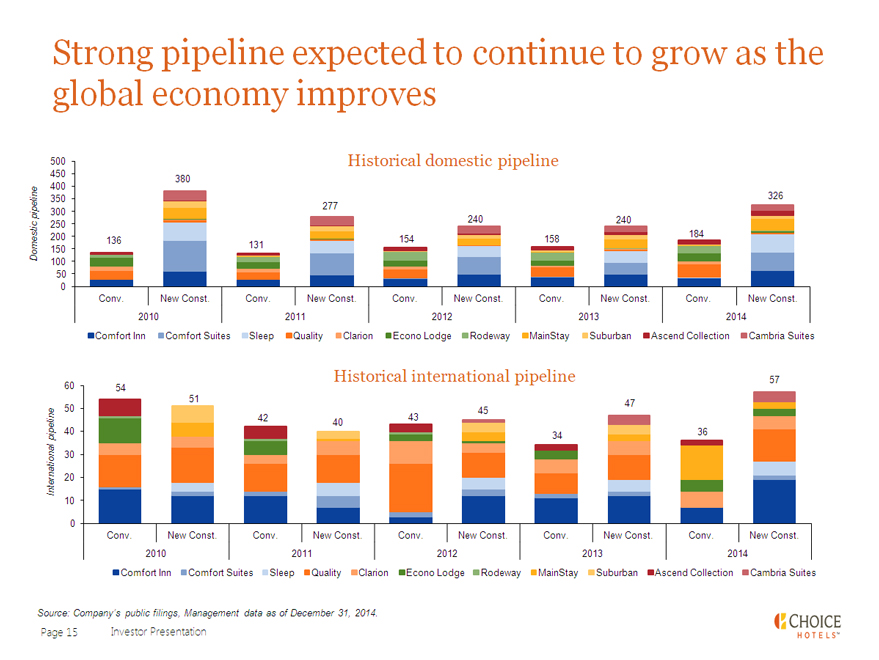

Strong pipeline expected to continue to grow as the global economy improves

500 Historical domestic pipeline

450 380

400

350 326

300 277

250 240 240

200 136 154 158 184

Domestic pipeline 150 131

100

50

0

Conv. New Const. Conv. New Const. Conv. New Const. Conv. New Const. Conv. New Const.

2010 2011 2012 2013 2014

Comfort Inn Comfort Suites Sleep Quality Clarion Econo Lodge Rodeway MainStay Suburban Ascend Collection Cambria Suites

60 54 Historical international pipeline 57

51

50 45 47

42 40 43

40 34 36

International pipeline 30

20

10

0

Conv. New Const. Conv. New Const. Conv. New Const. Conv. New Const. Conv. New Const.

2010 2011 2012 2013 2014

Comfort Inn Comfort Suites Sleep Quality Clarion Econo Lodge Rodeway MainStay Suburban Ascend Collection Cambria Suites

Source: Company’s public filings, Management data as of December 31, 2014.

Page 15 Investor Presentation CHOICE HOTELSTM

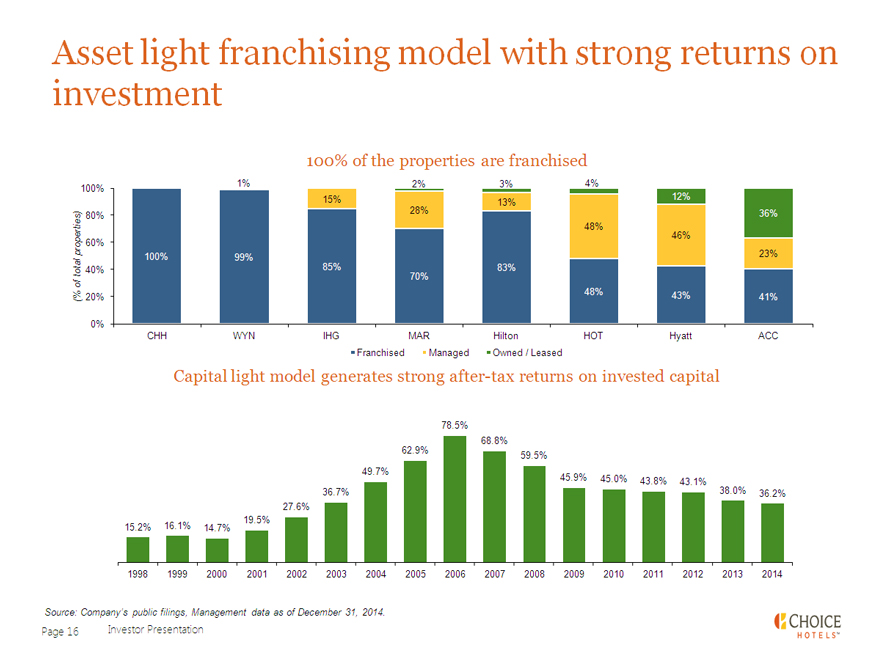

Asset light franchising model with strong returns on

investment

100% of the properties are franchised

100% 1% 2% 3% 4%

15% 13% 12%

80% 28% 36%

48%

46%

(% of total properties)

60%

100% 99% 23%

40% 85% 70% 83%

48%

20% 43% 41%

0%

CHH WYN IHG MAR Hilton HOT Hyatt ACC

Franchised Managed Owned / Leased

Capital light model generates strong after-tax returns on invested capital

78.5%

68.8%

62.9% 59.5%

49.7%

45.9% 45.0% 43.8% 43.1%

36.7% 38.0% 36.2%

27.6%

15.2% 16.1% 14.7% 19.5%

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Source: Company’s public filings, Management data as of December 31, 2014.

Page 16 Investor Presentation CHOICE HOTELSTM

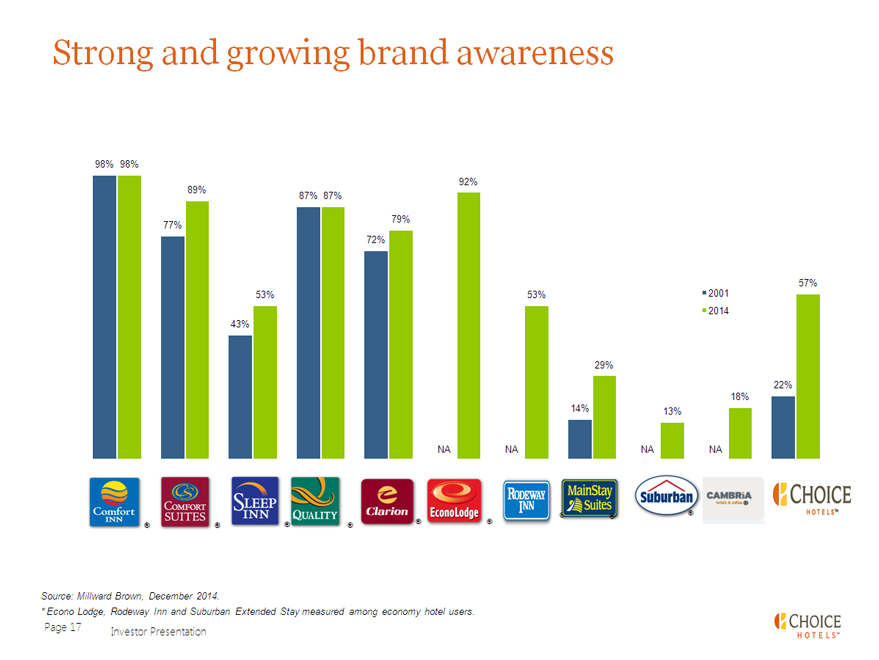

Strong and growing brand awareness

98% 98%

92%

89% 87% 87%

77% 79%

72%

57%

53% 53% 2001

2014

43%

29%

22%

18%

14% 13%

NA NA NA NA

RODEWAY INN ® MAINSTAY SUITES ® SUBURBAN ® CAMBRIA CHOICE HOTELSTM

COMFORT INN ® COMFORT SUITES ® SLEEP INN ® QUALITY ® CLARION ® ECONOLODGE ®

Source: Millward Brown, December 2014.

* Econo Lodge, Rodeway Inn and Suburban Extended Stay measured among economy hotel users.

Page 17 Investor Presentation CHOICE HOTELSTM

Financial Overview

Page 18 Investor Presentation CHOICE HOTELSTM

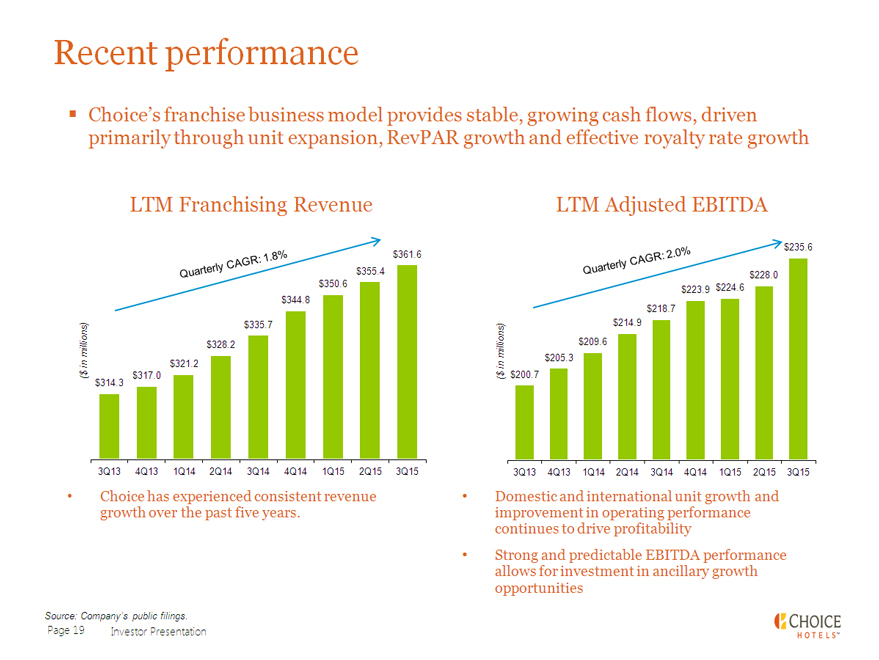

Recent performance

Choice’s franchise business model provides stable, growing cash flows, driven primarily through unit expansion, RevPAR growth and effective royalty rate growth

LTM Franchising Revenue

Quarterly CAGR: 1.8%

( $ in millions)

$361.6 $355.4 $350.6 $344.8 $335.7 $328.2 $321.2 $317.0 $314.3

3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15

Choice has experienced consistent revenue growth over the past five years.

LTM Adjusted EBITDA

($ in millions)

Quarterly CAGR: 2.0%

$235.6 $228.0 $223.9$224.6 $218.7 $214.9 $209.6 $205.3 $200.7

3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15

Domestic and international unit growth and improvement in operating performance continues to drive profitability

Strong and predictable EBITDA performance allows for investment in ancillary growth opportunities

Source: Company’s public filings.

Page 19 Investor Presentation CHOICE HOTELSTM

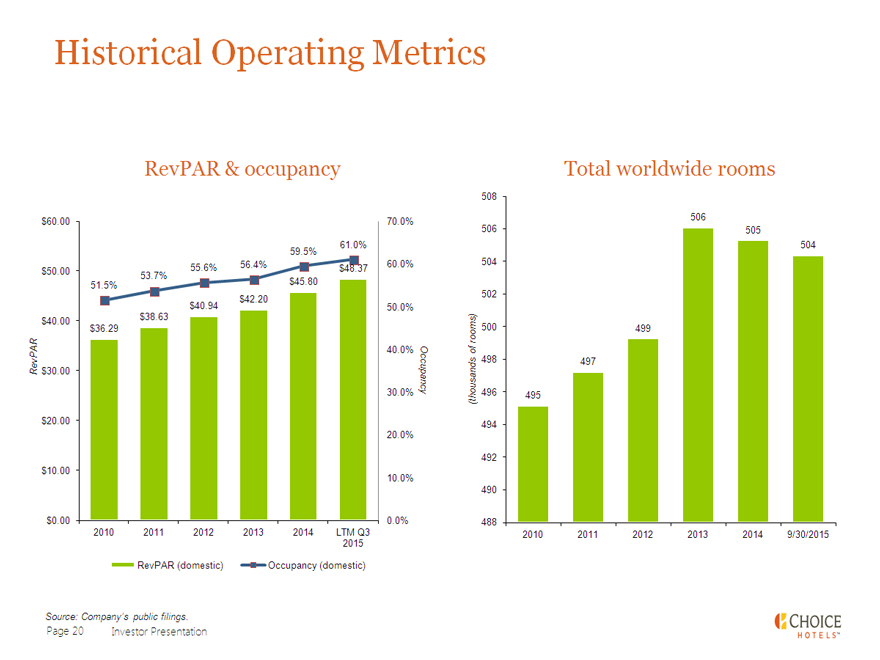

Historical Operating Metrics

RevPAR RevPAR & occupancy

$60.00 $50.00 $40.00 $30.00 $20.00 $10.00 $0.00

51.5% 53.7% 55.6% 56.4% 59.5% 61.0%

$36.29 $38.63 $40.94 $42.20 $45.80 $48.37

70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0%

2010 2011 2012 2013 2014 LTM Q3 2015

RevPAR (domestic) Occupancy (domestic) Occupancy

Total worldwide rooms

(thousands of rooms)

508 506 504 502 500 498 496 494 492 490 488

495 497 499 506 505 504

2010 2011 2012 2013 2014 9/30/2015

Source: Company’s public filings.

Page 20 Investor Presentation CHOICE HOTELSTM

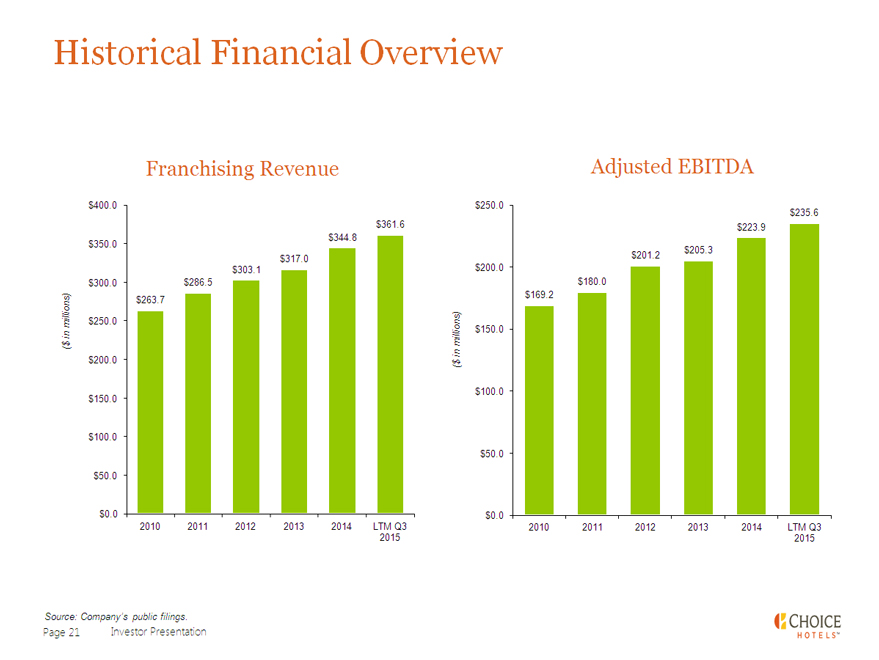

Historical Financial Overview

Franchising Revenue

($ in millions)

$400.0 $350.0 $300.0 $250.0 $200.0 $150.0 $100.0 $50.0 $0.0

$263.7 $286.5 $303.1 $317.0 $344.8 $361.6

2010 2011 2012 2013 2014

LTM Q3 2015

Adjusted EBITDA

($ in millions)

$250.0 $200.0 $150.0 $100.0 $50.0 $0.0

$169.2 $180.0 $201.2 $205.3 $223.9 $235.6

2010 2011 2012 2013 2014 LTM Q3 2015

Source: Company’s public filings.

Page 21 Investor Presentation CHOICE HOTELSTM

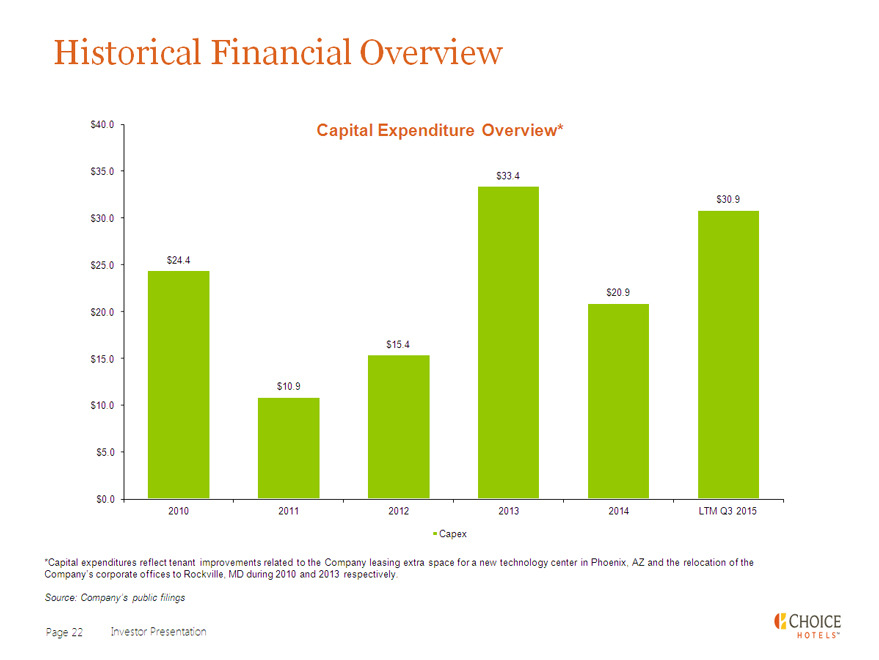

Historical Financial Overview

Capital Expenditure Overview*

$40.0 $35.0 $30.0 $25.0 $20.0 $15.0 $10.0 $5.0 $0.0

$24.4 $10.9 $15.4 $33.4 $20.9 $30.9

2010 2011 2012 2013 2014 LTM Q3 2015

Capex

*Capital expenditures reflect tenant improvements related to the Company leasing extra space for a new technology center in Phoenix, AZ and the relocation of the Company’s corporate offices to Rockville, MD during 2010 and 2013 respectively.

Source: Company’s public filings

Page 22 Investor Presentation CHOICE HOTELSTM

Questions and Answers

Page 23 Investor Presentation CHOICE HOTELSTM

Disclaimer

Adjusted earnings before interest, taxes depreciation and amortization (EBITDA), return on average invested capital (ROIC), franchising revenues and free cash flows are non-GAAP financial measurements. These financial measurements are presented as supplemental disclosures because they are used by management in reviewing and analyzing the company’s performance. This information should not be considered as an alternative to any measure of performance as promulgated under accounting principles generally accepted in the United States (GAAP), such as operating income, total revenues or net cash provided by operating activities. The calculation of these non-GAAP measures may be different from the calculation by other companies and therefore comparability may be limited. The company has included the following appendix which reconcile these measures to the comparable GAAP measurement.

Page 24 Investor Presentation CHOICE HOTELSTM

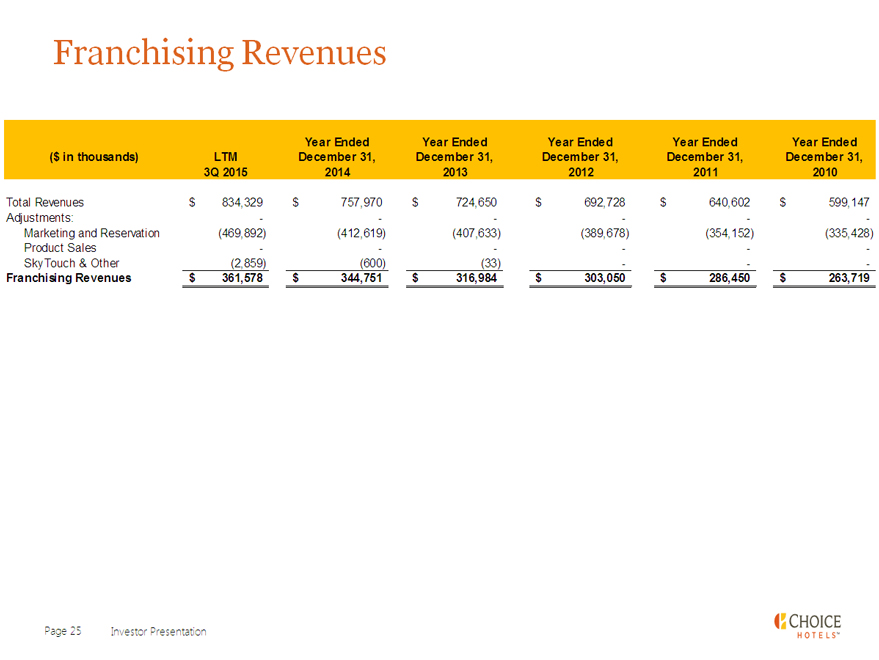

Franchising Revenues

($ in thousands)

LTM 3Q 2015

Year Ended December 31, 2014 Year Ended December 31, 2013 Year Ended December 31, 2012 Year Ended December 31, 2011 Year Ended December 31, 2010

Total Revenues $834,329 $757,970 $724,650 $692,728 $640,602 $599,147

Adjustments: - - - - - -

Marketing and Reservation (469,892) (412,619) (407,633) (389,678) (354,152) (335,428)

Product Sales - - - - - -

SkyTouch & Other (2,859) (600) (33) - - -

Franchising Revenues $361,578 $344,751 $316,984 $303,050 $286,450 $263,719

Page 25 Investor Presentation CHOICE HOTELSTM

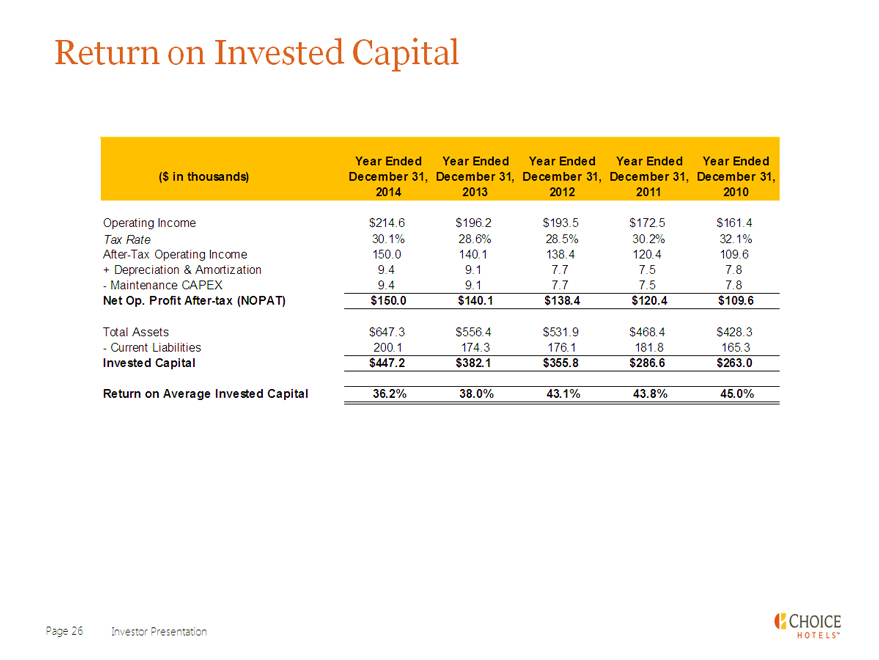

Return on Invested Capital

($ in thousands)

Year Ended December 31, 2014 Year Ended December 31, 2013 Year Ended December 31, 2012 Year Ended December 31, 2011 Year Ended December 31, 2010

Operating Income $214.6 $196.2 $193.5 $172.5 $161.4

Tax Rate 30.1% 28.6% 28.5% 30.2% 32.1%

After-Tax Operating Income 150.0 140.1 138.4 120.4 109.6

+ Depreciation & Amortization 9.4 9.1 7.7 7.5 7.8

- Maintenance CAPEX 9.4 9.1 7.7 7.5 7.8

Net Op. Profit After-tax (NOPAT) $150.0 $140.1 $138.4 $120.4 $109.6

Total Assets $647.3 $556.4 $531.9 $468.4 $428.3

- Current Liabilities 200.1 174.3 176.1 181.8 165.3

Invested Capital $447.2 $382.1 $355.8 $286.6 $263.0

Return on Average Invested Capital 36.2% 38.0% 43.1% 43.8% 45.0%

Page 26 Investor Presentation CHOICE HOTELSTM

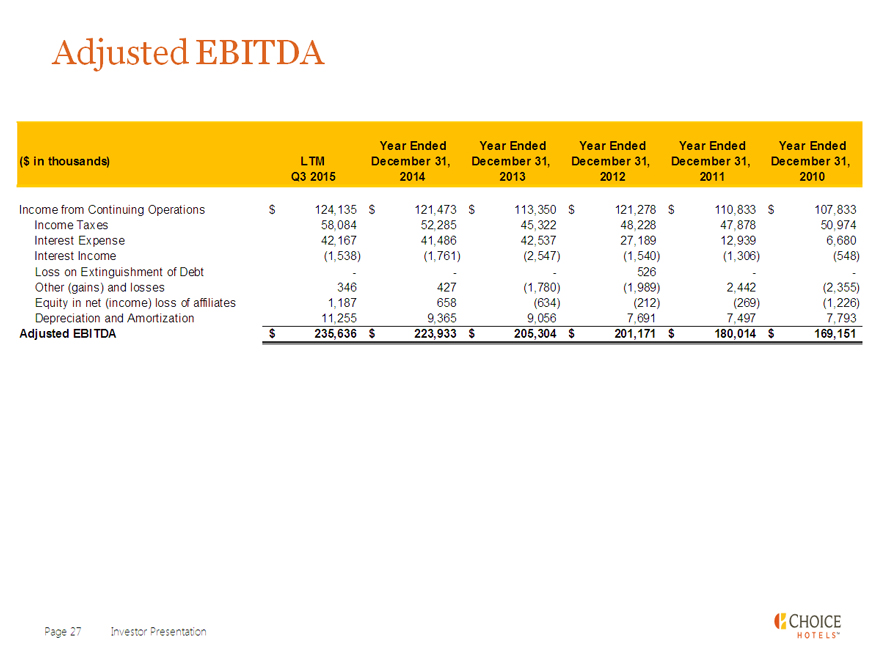

Adjusted EBITDA

($ in thousands) LTM Q3 2015 Year Ended December 31, 2014 Year Ended December 31, 2013 Year Ended December 31, 2012 Year Ended December 31, 2011 Year Ended December 31, 2010

Income from Continuing Operations $124,135 $121,473 $113,350 $121,278 $110,833 $107,833

Income Taxes 58,084 52,285 45,322 48,228 47,878 50,974

Interest Expense 42,167 41,486 42,537 27,189 12,939 6,680

Interest Income (1,538) (1,761) (2,547) (1,540) (1,306) (548)

Loss on Extinguishment of Debt - - - 526 - -

Other (gains) and losses 346 427 (1,780) (1,989) 2,442 (2,355)

Equity in net (income) loss of affiliates 1,187 658 (634) (212) (269) (1,226)

Depreciation and Amortization 11,255 9,365 9,056 7,691 7,497 7,793

Adjusted EBITDA $235,636 $223,933 $205,304 $201,171 $180,014 $169,151

Page 27 Investor Presentation CHOICE HOTELSTM