Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ally Financial Inc. | goldmansachspres8-k12x8x15.htm |

1 Ally Financial Inc. Goldman Sachs US Financial Services Conference 2015 December 8, 2015

2 Forward-Looking Statements and Additional Information The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. In the presentation that follows and related comments by Ally Financial Inc. (“Ally”) management, the use of the words “expect,” “anticipate,” “estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “explore,” “positions,” “intend,” “evaluate,” “pursue,” “seek,” “may,” “would, ” “could, ” “should, ” “believe, ” “potential, ” “continue,” or the negative of these words, or similar expressions is intended to identify forward-looking statements. All statements herein and in related management comments, other than statements of historical fact, including without limitation, statements about future events and financial performance, are forward-looking statements that involve certain risks and uncertainties. While these statements represent our current judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financial results, and Ally’s actual results may differ materially due to numerous important factors that are described in the most recent reports on SEC Forms 10-K and 10-Q for Ally, each of which may be revised or supplemented in subsequent reports filed with the SEC. Such factors include, among others, the following: maintaining the mutually beneficial relationship between Ally and General Motors (“GM”), and Ally and Chrysler Group LLC (“Chrysler”); our ability to maintain relationships with automotive dealers; our ability to realize the anticipated benefits associated with being a financial holding company, and the significant regulation and restrictions that we are now subject to; the potential for deterioration in the residual value of off-lease vehicles; disruptions in the market in which we fund our operations, with resulting negative impact on our liquidity; changes in our accounting assumptions that may require or that result from changes in the accounting rules or their application, which could result in an impact on earnings; changes in the credit ratings of Ally, Chrysler, or GM; changes in economic conditions, currency exchange rates or political stability in the markets in which we operate; and changes in the existing or the adoption of new laws, regulations, policies or other activities of governments, agencies and similar organizations (including as a result of the Dodd-Frank Act and Basel III). Investors are cautioned not to place undue reliance on forward-looking statements. Ally undertakes no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events or other such factors that affect the subject of these statements, except where expressly required by law. Reconciliation of non-GAAP financial measures included within this presentation are provided in this presentation. Use of the term “loans” describes products associated with direct and indirect lending activities of Ally’s operations. The specific products include retail installment sales contracts, lines of credit, leases or other financing products. The term “originate” refers to Ally’s purchase, acquisition or direct origination of various “loan” products.

3 Achieved Objectives from 2014 GS Conference P Facilitate U.S. Treasury Exit P Execute Path to 9-11% Core ROTCE P Improve Funding Costs − Interest expense on LT debt down over $200 million YTD P Achieve mid 40% Adjusted Efficiency Ratio P Redeploy Capital to Improve Profitability − Addressed $2.6 billion of high cost debt and $2.9 billion of preferreds P Diversify and Strengthen Leading Auto Finance Business − Fully replaced GM subvented volumes with more diversified mix − Expect to exceed targeted origination volumes P Steadily Grow Bank Franchise − Exceeded expectations with over $6.5 billion of deposit growth

4 ($ millions) $467 $396 $490 $435 $431 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 9.1% 7.1% 9.1% 8.2% 9.2% 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 Delivered Improved and Consistent Profitability Adjusted Earnings Per Share(1) Core Pre Tax Income(1) Core ROTCE(1) (1) Represents a non-GAAP financial measure. See page 15 for details Adjusted TBV Per Share(1) $0.53 $0.40 $0.52 $0.46 $0.51 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 $22.2 $22.7 $23.7 $23.7 $24.3 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15

5 Approved Actions through 2Q 16 ($ b illions) Outstanding as of 3/31/15 CCAR 2015 Subsequent Request Total Approval 2015 Actions(1)(2) Series G $2.6 ($1.3) ($1.3) ($2.6) ($2.6) Series A $1.0 ($1.0) - ($1.0) ($0.3) Trust Preferred Securities $2.7 ($0.5) - ($0.5) - Total $6.3 ($2.8) ($1.3) ($4.1) ($2.9) Capital Management • Ally expects to continue to redeploy excess capital to further enhance returns – Dividends and share buybacks, subject to CCAR approval – Growth initiatives – focused on prudent and efficient allocation of capital • Capital expected to be generated through retained earnings as well as through reduction in disallowed DTA • Ally has executed significant capital actions to drive further shareholder value – Addressed inefficiencies in liability and capital structure (1) Completed redemption of $1.3 billion of Series G preferred securities in April 2015, completed tender offer of $325 million of Series A in May 2015; remaining Series G to be redeemed in December 2015 (2) Approved capital plan includes an additional $0.2 billion of common capital reduction from the repurchase of high-cost unsecured debt and/or preferred securities; the total impact to Common equity tier 1 based on the approved capital plan will be ~$2.5 billion Capital Redeployment Actions

6 Auto Finance Update Auto Originations by Channel Auto Originations by Product • Leveraged competitive advantages to thrive despite a competitive environment and loss of GM subvented business – Strong dealer relationships – Differentiated focus on service – Opportunity to expand beyond traditional footprint • Ability to optimize business mix in competitive marketplace – Maintaining disciplined underwriting and pricing – Strong presence in multiple channels and segments – Margins have largely stabilized ($ billion ) $11.0 $3.2 $9.5 $11.7 $5.2 $7.2 $6.3 $9.6 $32.0 $31.7 -8.0 2.0 12.0 22.0 32.0 42.0 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 YTD 2014 YTD 2015 GM Subvented GM Standard Chrysler Growth +52% +39% +24% %∆ YoY ($ billions) $22.9 23 9 $20.8 $16.9 $17.9 ~$21 $3.9 $7.3 $8.4 $10.6 $11.3 ~$5 $4.7 $9.0 $9.6 $9.9 $11.7 ~$14 $31.6 $40.2 $38.7 $37.3 $41.0 ~$40 2010 2011 2012 2013 2014 2015 Est. New Lease Used

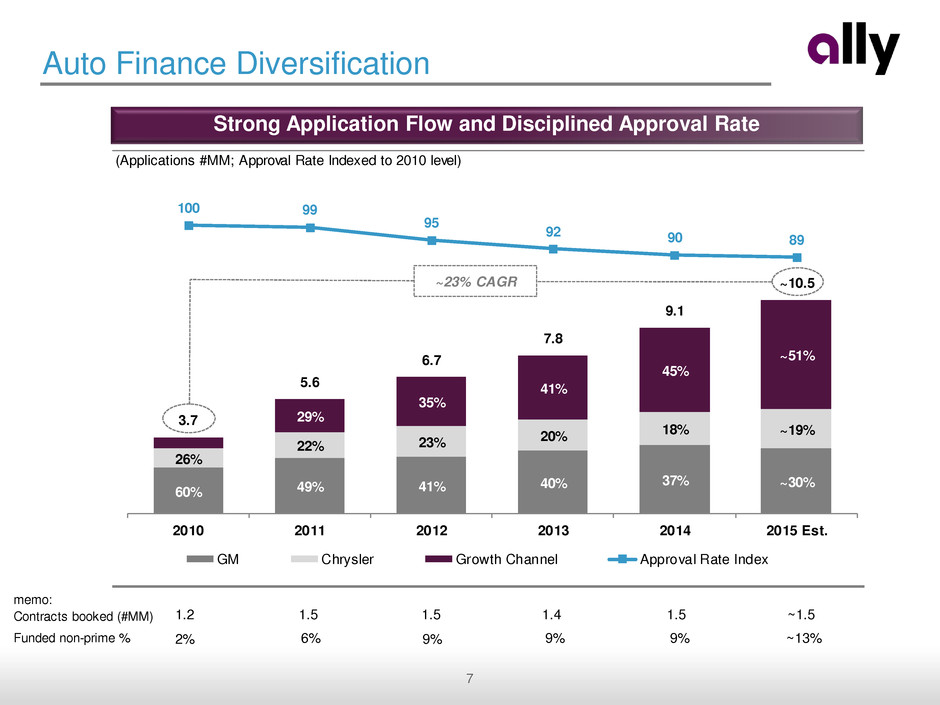

7 Auto Finance Diversification Strong Application Flow and Disciplined Approval Rate memo: Contracts booked (#MM) Funded non-prime % (Applications #MM; Approval Rate Indexed to 2010 level) 60% 49% 41% 40% 37% ~30% 26% 22% 23% 20% 18% ~19% 29% 35% 41% 45% ~51% 3.7 5.6 6.7 7.8 9.1 ~10.5 100 99 95 92 90 89 2010 2011 2012 2013 2014 2015 Est. GM Chrysler Growth Channel Approval Rate Index ~23% CAGR 1.2 1.5 1.5 1.4 1.5 ~1.5 2% 6% 9% 9% 9% ~13%

8 Predictability of Retail Auto Losses Auto loans are predictable based on various attributes Cumulative Net Losses - Example segment: 64-72 month, 660-699 FICO, 96-100 LTV 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 2011 2012 2013 2014 Note: Retail auto data excluding RV

9 Retail Auto Historical Losses Variation in losses typically driven by unemployment Note: Retail auto historical losses shown on a serviced basis, inclusive of RV, excluding Nuvell & Smartbuy; NCL%s exclude impact of 4Q 2013 accounting reclassification Source: Unemployment rate – U.S. Bureau of Labor Statistics 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Serviced Retail Annualized NCL% Current Coverage Rate Unemployment Rate 3Q 2015 coverage rate 1.27% Un e m p lo y m e n t L o ss e s Months

10 $ Secured Unsecured Deposits FHLB Secured and GHLB Total % Secured Unsecured Deposits FHLB Secured Debt 31% Unsecured Debt 17% Deposits 47% FHLB 5% Strength of Deposit Funding Deposits as a Source of Strength Note: Data as of 11/25/2015; Ally Deposit rate post 9/30/2015 held flat prior to 4Q15 results disclosed Source: Federal Reserve Bank of St. Louis (3-YR swap rate); Ally Financial (AAA ABS Spreads) Diversified Funding Profile • $1.8 billion of retail deposit growth in 3Q and expect to exceed $6.5 billion of growth in 2015 • Surpassed the 1 million customer milestone – Grew customer base 16% YoY • Continue to build strong franchise and brand – Ally Bank named “Best Online Bank” by MONEY® magazine for the 5th straight year (2011 – 2015) As of 9/30/15 Retail Deposit Customer Growth Ally Bank Retail Deposit Customers (thousands) 30.9 24.2 45.3 34.9 36.6 884.9 909.1 954.5 989.3 1,025.9 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 Net Retail Customer Growth Total Retail Customers ABS Spreads and 3-Year Swap vs. Ally Retail Deposit Rate 0.35% 0.52% 0.80% 1.25% 1.22% 1.14% 3-Year AAA Auto Fixed 3-Year Swap Rate Ally Retail Deposit Rate

11 Future of Ally Building Upon a Strong Foundation P Ally’s auto finance business and strong dealer relationships will remain the core to our success P Growing deposit base provides cost effective and stable funding P Leveraging innovative culture, strong brand and proven digital capabilities P Focused on continued customer growth, particularly “next gen” consumer P Integration of businesses can lead to better consumer profitability P Enhancing technologies – using expense efficiencies to reinvest for future P Financial re-engineering continues to strengthen financial profile

12 Positioned for Operational Expansion Expand Existing Business • Continue to expand retail auto lending – Expand dealer relationships and deepen penetration within traditional channels – Expand digital interaction – Consumer behavior and use of technology in the vehicle purchase process is evolving • Leverage Commerical Services Group capabilities to explore growth opportunities • Expand Corporate Finance business Expand New Business • Ally customers will expect additional bank products over their life cycle – Credit Card – plan to test with a partnership in 2016 – Mortgage – plan to introduce limited direct originations in 2016 • Continue to explore additional products, services and technologies for 2016 and beyond

13 Unique opportunity combining both operational growth and continued financial restructuring Dedicated to Driving Shareholder Value Improving Returns: Drive towards 10% Core ROTCE and maintain mid 40% Adjusted Efficiency Ratio EPS Growth: Expect annual EPS CAGR of 15% +/- Business Growth: Long runway to expand both existing and new products and services Capital Management: Priority to initiate dividend and share buyback program, subject to CCAR approval Despite strong results, stock currently trades near all time low multiples ~20% Discount to TBV Note: Stock price data as of 12/4/2015; adjusted tangible book value per share based on Ally’s quarterly results (1) Represents a non-GAAP financial measure. See page 15 for details YTD Ally Stock Price and Adjusted Tangible Book Value Per Share (1) $23.62 $19.98 $22.67 $24.33 Ally Stock Price Ally Adjusted TBV Per Share

14 CONFIDENTIAL Supplemental

15 Supplemental Notes on non-GAAP and other financial measures ($ in millions, unless noted otherwise) Core Pre-Tax Income Calculation 3Q 15 2Q 15 1Q 15 4Q 14 3Q 14 Net financing revenue (ex. OID) 981$ 927$ 860$ 835$ 936$ Total other revenue (ex. OID) 332 368 440 370 375 Total net revenue (ex. OID) 1,313 1,295 1,300 1,205 1,311 Provision for loan losses 211 140 116 155 102 Controllable expenses 449 448 469 478 469 Other noninterest expenses 222 272 226 176 273 Core pre-tax income, ex. repositioning 431$ 435$ 490$ 396$ 467$ Repositioning items (2) (154) (190) (167) - Core pre-tax income (loss) 428$ 281$ 299$ 229$ 467$ Core OID amortization expense 11 18 17 42 47 Income tax expense (benefit) 144 94 103 36 127 Income (loss) from discontinued operations (5) 13 397 26 130 Net income (loss) 268$ 182$ 576$ 177$ 423$ Core ROTCE Calculation Pre-tax income (loss) from continuing operations 417$ 263$ 282$ 187$ 420$ add: Core original issue discount expense 11 18 17 42 47 Repositioning items 2 154 190 167 - Core pre-tax income 431$ 435$ 490$ 396$ 467$ Normalized income tax expense at 34% 146 148 166 135 159 Core net income 284 287 323 262 308 Preferred dividends (Series A & G) 38 58 67 68 67 Operating net income available to common shareholders 246$ 229$ 256$ 194$ 241$ - Tangible common equity 13,606$ 14,053$ 14,384$ 14,012$ 13,752$ less: Unamortized original issue discount 1,322 1,333 1,345 1,369 1,411 Net deferred tax asset 1,540 1,632 1,725 1,800 1,806 Normalized common equity 10,745$ 11,087$ 11,314$ 10,843$ 10,534$ Core ROTCE 9.2% 8.2% 9.1% 7.1% 9.1% Adjusted Earnings Per Share ("EPS)" Calculation GAAP EPS (diluted) 0.47$ (2.22)$ 1.06$ 0.23$ 0.74$ Less: Discontinued operations, net of tax 0.01 (0.03) (0.82) (0.05) (0.27) Add: OID expense, net of tax 0.02 0.02 0.02 0.06 0.06 Capital Actions (Series A and G) - 2.47 - - - Repositioning items / Other 0.00 0.21 0.26 0.17 - Adjusted EPS 0.51$ 0.46$ 0.52$ 0.40$ 0.53$ Adjusted Tangible Book Value ($ billions) GAAP shareholder's equity 14.6$ 14.3$ 15.9$ 15.4$ 15.2$ Preferred equity and goodwill (0.8) (0.8) (1.3) (1.3) (1.3) Tangible common equity 13.8$ 13.5$ 14.7$ 14.1$ 13.9$ Tax-effected bond OID (tax rate of 34%) (0.9) (0.9) (0.9) (0.9) (0.9) Series G discount (1.2) (1.2) (2.3) (2.3) (2.3) Adjusted tangible book value 11.7$ 11.4$ 11.4$ 10.9$ 10.6$ Adjusted Tangible Book Value Per Share GAAP shareholder's equity 30.3$ 29.7$ 33.1$ 32.1$ 31.7$ Preferred equity and goodwill (1.7) (1.7) (2.7) (2.7) (2.7) Tangible common equity 28.6$ 27.9$ 30.4$ 29.4$ 29.0$ Tax-effected bond OID (tax rate of 34%) (1.8) (1.8) (1.8) (1.9) (1.9) Series G discount (2.4) (2.4) (4.9) (4.9) (4.9) Adjusted tangible book value per share 24.3$ 23.7$ 23.7$ 22.7$ 22.2$ Memo: Issued shares outstanding (period-end; # thousands) 481,750 481,750 481,503 480,095 479,818