Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HOPE BANCORP INC | d11108d8k.htm |

| EX-2.1 - EX-2.1 - HOPE BANCORP INC | d11108dex21.htm |

| EX-99.1 - EX-99.1 - HOPE BANCORP INC | d11108dex991.htm |

A Strategic Merger of Equals Creating the Only Super Regional Korean-American Banking Franchise Investor Presentation December 7, 2015 Filed by BBCN Bancorp, Inc. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: BBCN Bancorp, Inc. SEC Registration Statement No.: 000-50245 Exhibit 99.2

This presentation contains statements regarding the proposed transaction between BBCN Bancorp and Wilshire Bancorp, the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the proposed transaction and other statements about the future expectations, beliefs, goals, plans or prospects of the management of each of BBCN Bancorp and Wilshire Bancorp. These statements are based on current expectations, estimates, forecasts and projections and management assumptions about the future performance of each of BBCN Bancorp, Wilshire Bancorp and the combined company, as well as the businesses and markets in which they do and are expected to operate. These statements constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words such as “expects,” “believes,” “estimates,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans, “seeks,” and variations of such words and similar expressions are intended to identify such forward-looking statements which are not statements of historical fact. These forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to assess. Actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The closing of the proposed transaction is subject to regulatory approvals, the approval of the shareholders of both BBCN Bancorp and Wilshire Bancorp, and other customary closing conditions. There is no assurance that such conditions will be met or that the proposed transaction will be consummated within the expected time frame, or at all. If the transaction is consummated, factors that may cause actual outcomes to differ from what is expressed or forecasted in these forward-looking statements include, among things: difficulties and delays in integrating BBCN Bancorp and Wilshire Bancorp and achieving anticipated synergies, cost savings and other benefits from the transaction; higher than anticipated transaction costs; deposit attrition, operating costs, customer loss and business disruption following the merger, including difficulties in maintaining relationships with employees, may be greater than expected; required governmental approvals of the merger may not be obtained on its proposed terms and schedule, or without regulatory constraints that may limit growth; competitive pressures among depository and other financial institutions may increase significantly and have an effect on revenues; the strength of the United States economy in general, and of the local economies in which the combined company will operate, may be different than expected, which could result in, among other things, a deterioration in credit quality or a reduced demand for credit and have a negative effect on the combined company’s loan portfolio and allowance for loan losses; changes in the U.S. legal and regulatory framework; and adverse conditions in the stock market, the public debt market and other capital markets (including changes in interest rate conditions) which would negatively affect the combined company’s business and operating results. For a more complete list and description of such risks and uncertainties, refer to BBCN Bancorp’s Form 10-K for the year ended December 31, 2014, as amended, and Wilshire Bancorp’s Form 10-K for the year ended December 31, 2014, as well as other filings made by BBCN Bancorp and Wilshire Bancorp with the SEC. Except as required under the U.S. federal securities laws and the rules and regulations of the SEC, BBCN Bancorp and Wilshire Bancorp disclaim any intention or obligation to update any forward-looking statements after the distribution of this press release, whether as a result of new information, future events, developments, changes in assumptions or otherwise. Safe Harbor

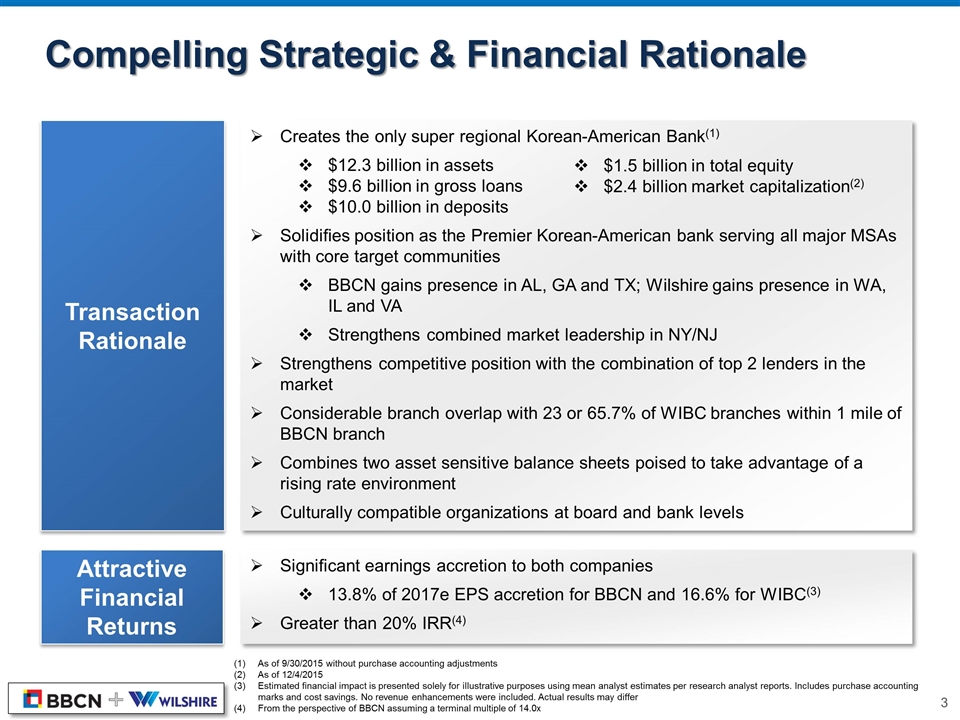

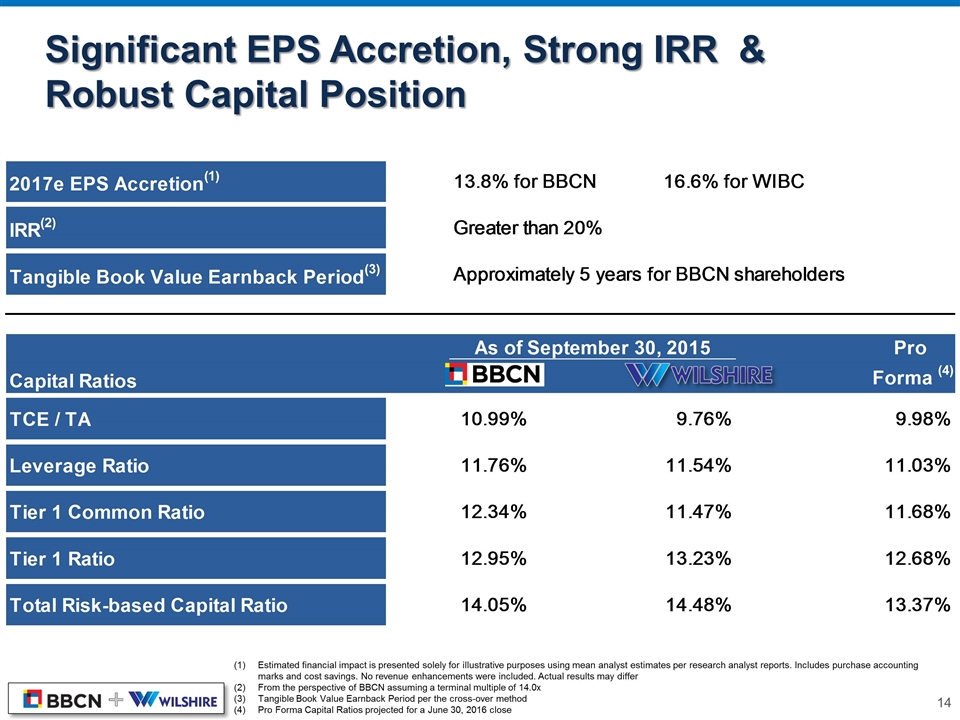

Compelling Strategic & Financial Rationale Transaction Rationale Attractive Financial Returns Creates the only super regional Korean-American Bank(1) $12.3 billion in assets $9.6 billion in gross loans $10.0 billion in deposits Solidifies position as the Premier Korean-American bank serving all major MSAs with core target communities BBCN gains presence in AL, GA and TX; Wilshire gains presence in WA, IL and VA Strengthens combined market leadership in NY/NJ Strengthens competitive position with the combination of top 2 lenders in the market Considerable branch overlap with 23 or 65.7% of WIBC branches within 1 mile of BBCN branch Combines two asset sensitive balance sheets poised to take advantage of a rising rate environment Culturally compatible organizations at board and bank levels Significant earnings accretion to both companies 13.8% of 2017e EPS accretion for BBCN and 16.6% for WIBC(3) Greater than 20% IRR(4) $1.5 billion in total equity $2.4 billion market capitalization(2) As of 9/30/2015 without purchase accounting adjustments As of 12/4/2015 Estimated financial impact is presented solely for illustrative purposes using mean analyst estimates per research analyst reports. Includes purchase accounting marks and cost savings. No revenue enhancements were included. Actual results may differ From the perspective of BBCN assuming a terminal multiple of 14.0x

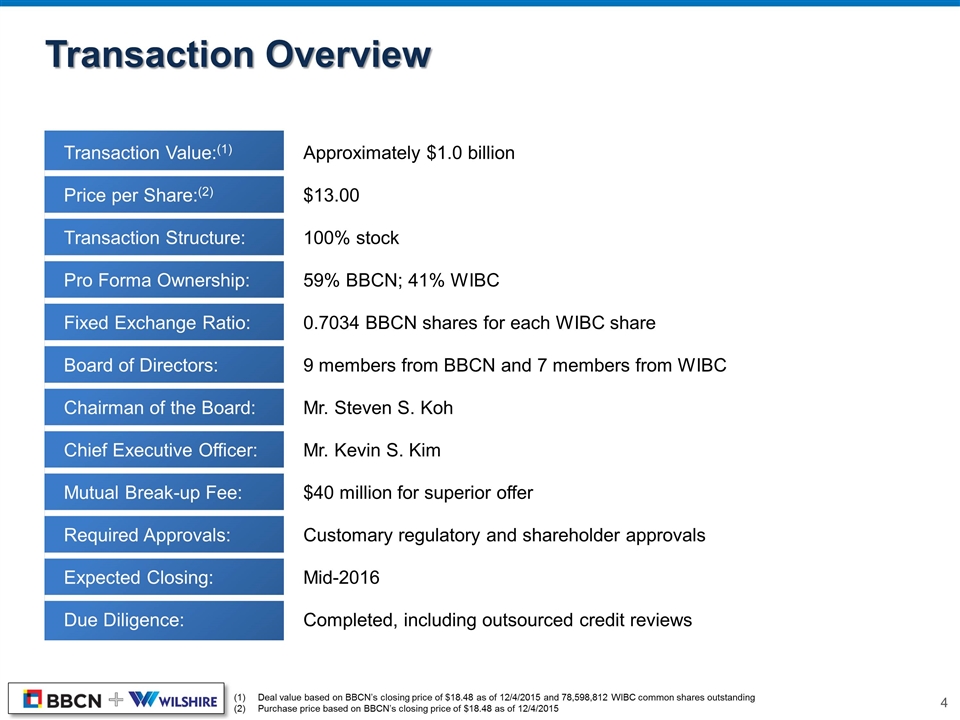

Transaction Value:(1) Approximately $1.0 billion Price per Share:(2) $13.00 Transaction Structure: 100% stock Pro Forma Ownership: 59% BBCN; 41% WIBC Fixed Exchange Ratio: 0.7034 BBCN shares for each WIBC share Board of Directors: 9 members from BBCN and 7 members from WIBC Chairman of the Board: Mr. Steven S. Koh Chief Executive Officer: Mr. Kevin S. Kim Mutual Break-up Fee: $40 million for superior offer Required Approvals: Customary regulatory and shareholder approvals Expected Closing: Mid-2016 Due Diligence: Completed, including outsourced credit reviews Deal value based on BBCN’s closing price of $18.48 as of 12/4/2015 and 78,598,812 WIBC common shares outstanding Purchase price based on BBCN’s closing price of $18.48 as of 12/4/2015 Transaction Overview

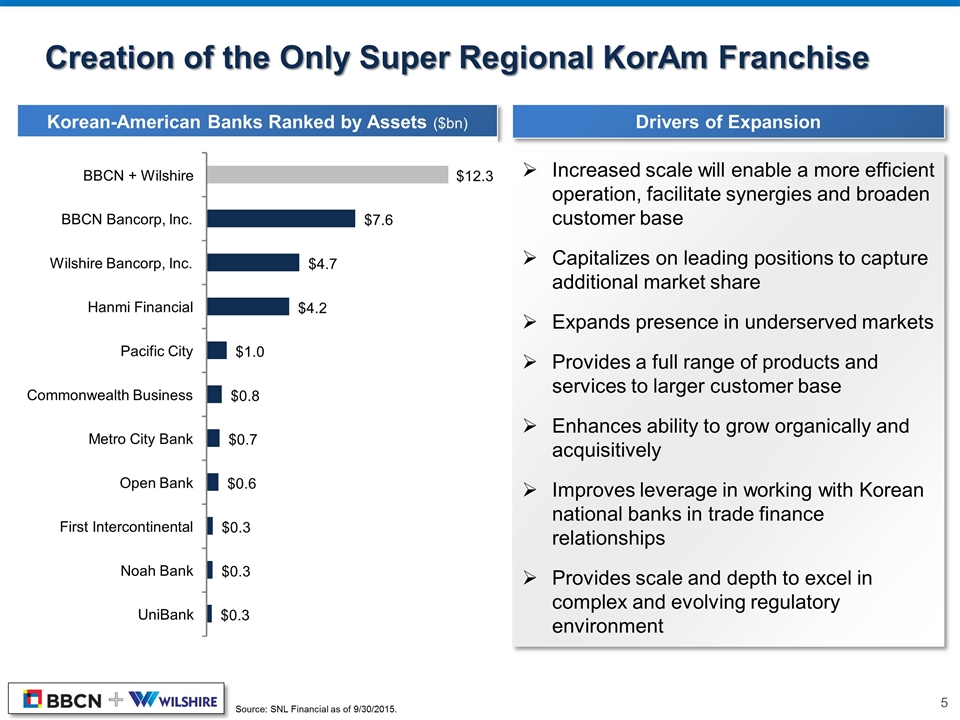

Source: SNL Financial as of 9/30/2015. Korean-American Banks Ranked by Assets ($bn) Drivers of Expansion Increased scale will enable a more efficient operation, facilitate synergies and broaden customer base Capitalizes on leading positions to capture additional market share Expands presence in underserved markets Provides a full range of products and services to larger customer base Enhances ability to grow organically and acquisitively Improves leverage in working with Korean national banks in trade finance relationships Provides scale and depth to excel in complex and evolving regulatory environment Creation of the Only Super Regional KorAm Franchise $0.3 $0.3 $0.3 $0.6 $0.7 $0.8 $1.0 $4.2 $4.7 $7.6 $12.3 UniBank Noah Bank First Intercontinental Open Bank Metro City Bank Commonwealth Business Pacific City Hanmi Financial Wilshire Bancorp, Inc. BBCN Bancorp, Inc. BBCN + Wilshire

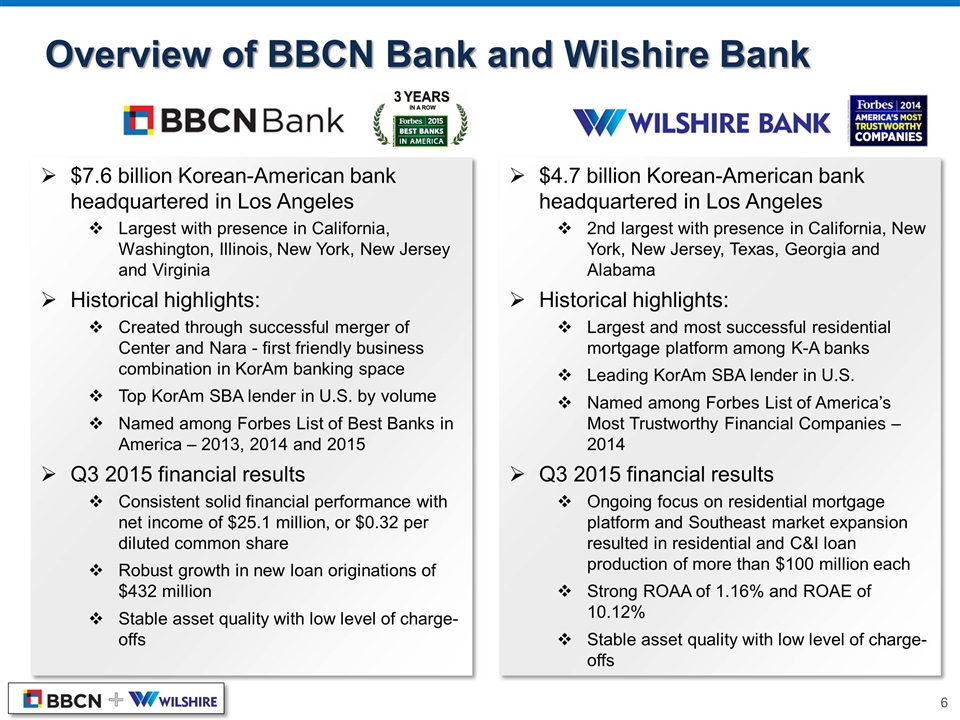

$7.6 billion Korean-American bank headquartered in Los Angeles Largest with presence in California, Washington, Illinois, New York, New Jersey and Virginia Historical highlights: Created through successful merger of Center and Nara - first friendly business combination in KorAm banking space Top KorAm SBA lender in U.S. by volume Named among Forbes List of Best Banks in America – 2013, 2014 and 2015 Q3 2015 financial results Consistent solid financial performance with net income of $25.1 million, or $0.32 per diluted common share Robust growth in new loan originations of $432 million Stable asset quality with low level of charge-offs $4.7 billion Korean-American bank headquartered in Los Angeles 2nd largest with presence in California, New York, New Jersey, Texas, Georgia and Alabama Historical highlights: Largest and most successful residential mortgage platform among K-A banks Leading KorAm SBA lender in U.S. Named among Forbes List of America’s Most Trustworthy Financial Companies – 2014 Q3 2015 financial results Ongoing focus on residential mortgage platform and Southeast market expansion resulted in residential and C&I loan production of more than $100 million each Strong ROAA of 1.16% and ROAE of 10.12% Stable asset quality with low level of charge- offs Overview of BBCN Bank and Wilshire Bank

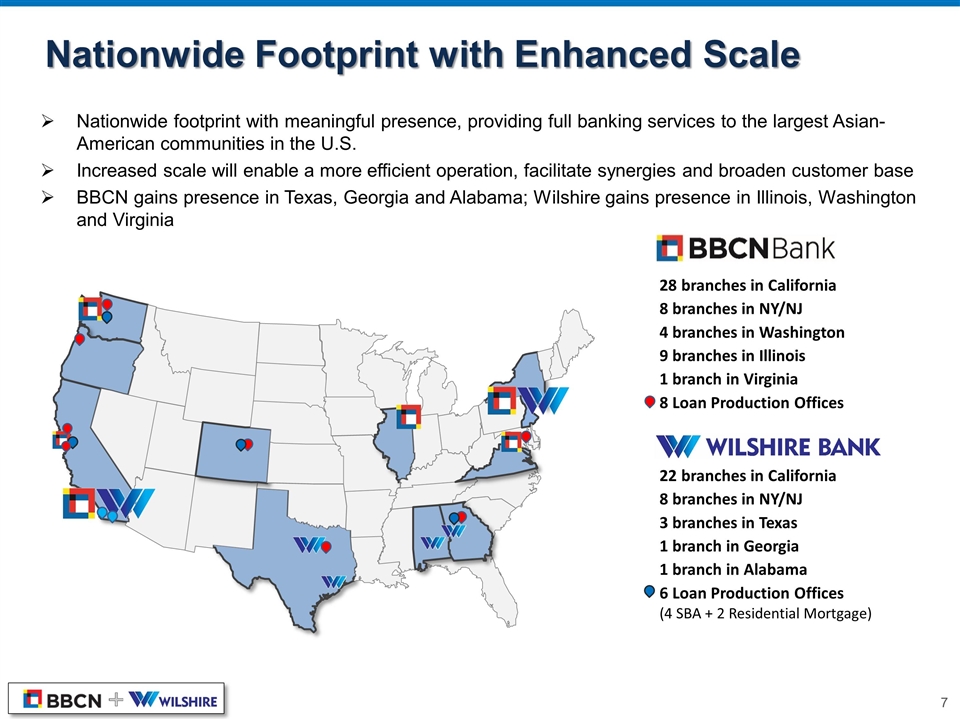

Nationwide Footprint with Enhanced Scale 28 branches in California 8 branches in NY/NJ 4 branches in Washington 9 branches in Illinois 1 branch in Virginia 8 Loan Production Offices 22 branches in California 8 branches in NY/NJ 3 branches in Texas 1 branch in Georgia 1 branch in Alabama 6 Loan Production Offices (4 SBA + 2 Residential Mortgage) Nationwide footprint with meaningful presence, providing full banking services to the largest Asian-American communities in the U.S. Increased scale will enable a more efficient operation, facilitate synergies and broaden customer base BBCN gains presence in Texas, Georgia and Alabama; Wilshire gains presence in Illinois, Washington and Virginia

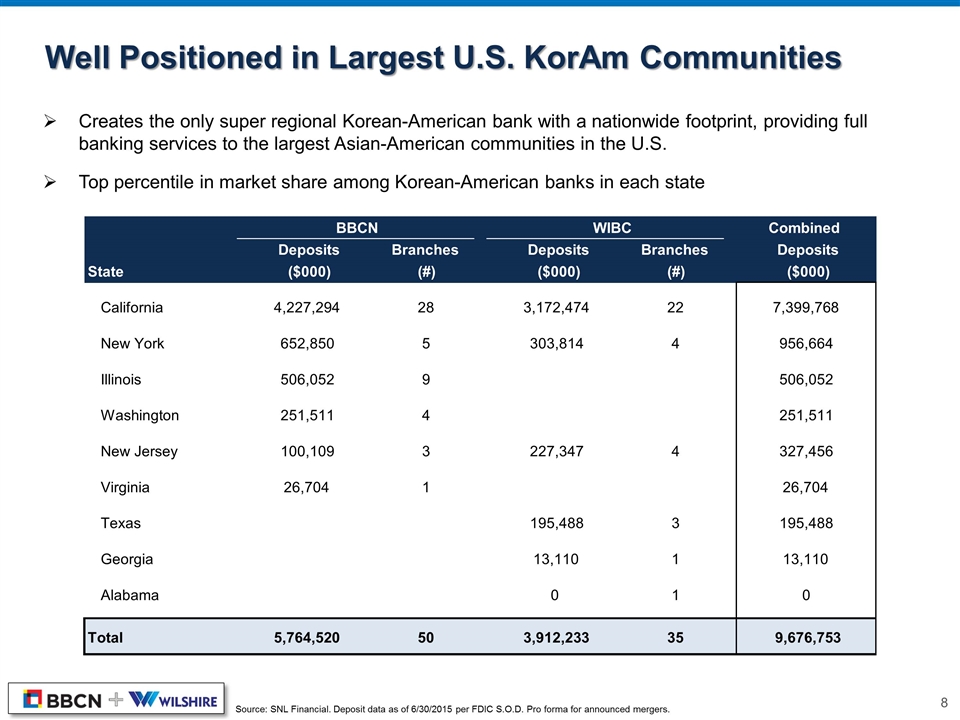

Creates the only super regional Korean-American bank with a nationwide footprint, providing full banking services to the largest Asian-American communities in the U.S. Top percentile in market share among Korean-American banks in each state Well Positioned in Largest U.S. KorAm Communities Source: SNL Financial. Deposit data as of 6/30/2015 per FDIC S.O.D. Pro forma for announced mergers. BBCN WIBC Combined Deposits Branches Deposits Branches Deposits State ($000) (#) ($000) (#) ($000) California 4,227,294 28 3,172,474 22 7,399,768 New York 652,850 5 303,814 4 956,664 Illinois 506,052 9 506,052 Washington 251,511 4 251,511 New Jersey 100,109 3 227,347 4 327,456 Virginia 26,704 1 26,704 Texas 195,488 3 195,488 Georgia 13,110 1 13,110 Alabama 0 1 0 Total 5,764,520 50 3,912,233 35 9,676,753

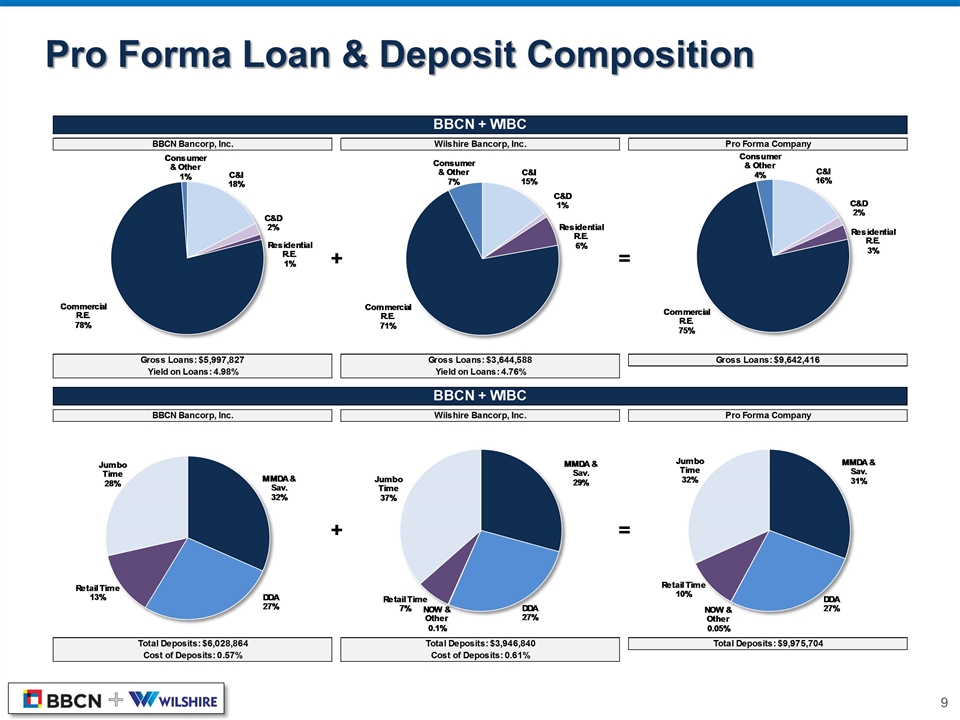

Pro Forma Loan & Deposit Composition

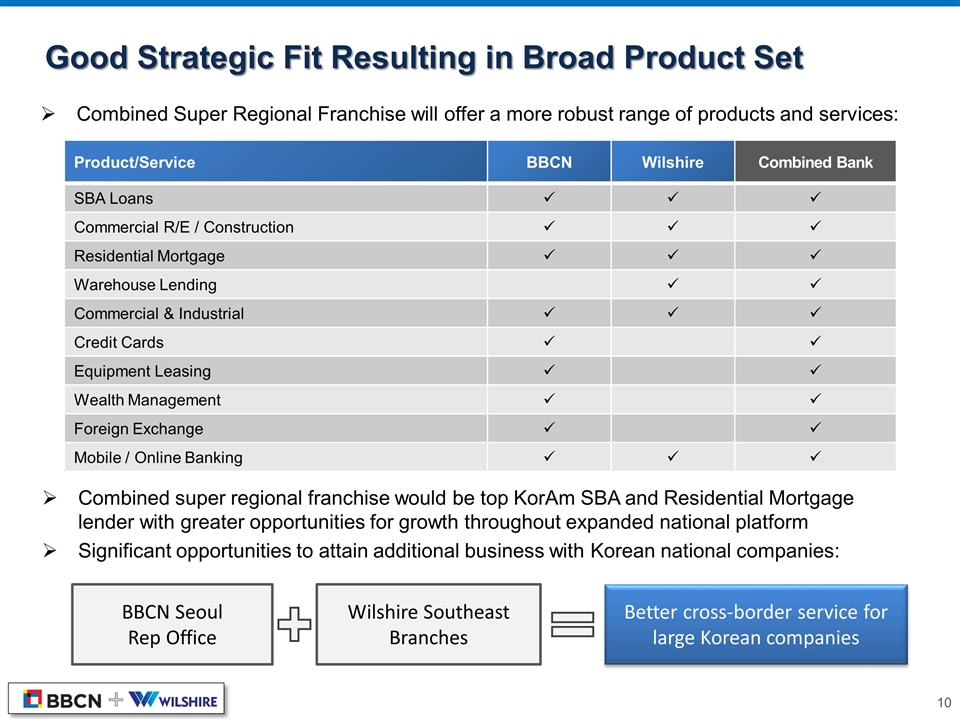

Good Strategic Fit Resulting in Broad Product Set Combined Super Regional Franchise will offer a more robust range of products and services: Product/Service BBCN Wilshire Combined Bank SBA Loans ü ü ü Commercial R/E / Construction ü ü ü Residential Mortgage ü ü ü Warehouse Lending ü ü Commercial & Industrial ü ü ü Credit Cards ü ü Equipment Leasing ü ü Wealth Management ü ü Foreign Exchange ü ü Mobile / Online Banking ü ü ü BBCN Seoul Rep Office Wilshire Southeast Branches Better cross-border service for large Korean companies Combined super regional franchise would be top KorAm SBA and Residential Mortgage lender with greater opportunities for growth throughout expanded national platform Significant opportunities to attain additional business with Korean national companies:

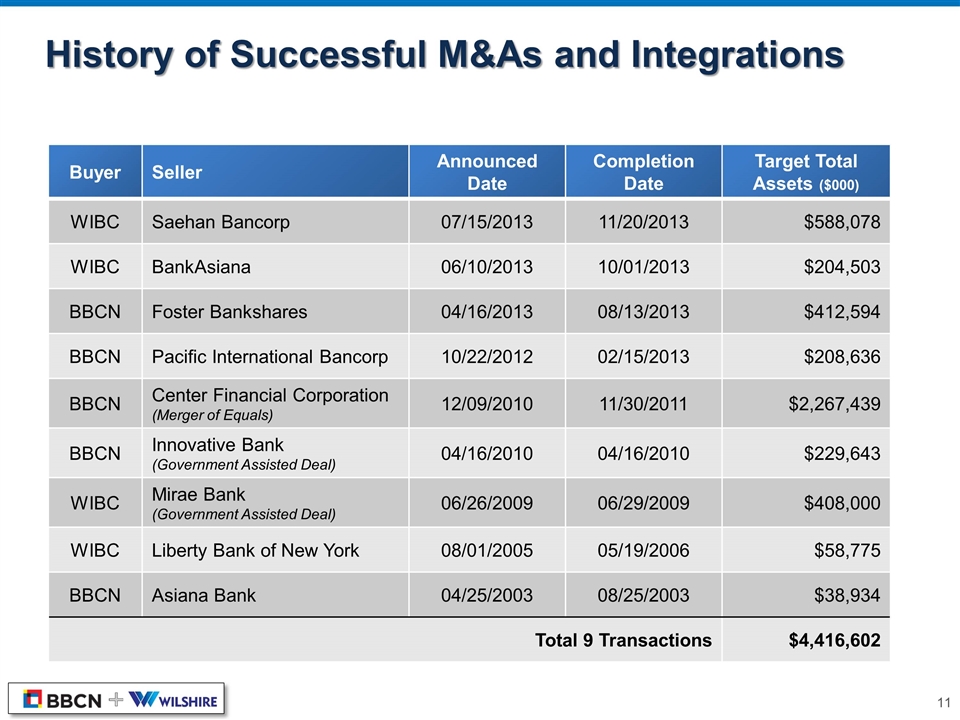

Buyer Seller Announced Date Completion Date Target Total Assets ($000) WIBC Saehan Bancorp 07/15/2013 11/20/2013 $588,078 WIBC BankAsiana 06/10/2013 10/01/2013 $204,503 BBCN Foster Bankshares 04/16/2013 08/13/2013 $412,594 BBCN Pacific International Bancorp 10/22/2012 02/15/2013 $208,636 BBCN Center Financial Corporation (Merger of Equals) 12/09/2010 11/30/2011 $2,267,439 BBCN Innovative Bank (Government Assisted Deal) 04/16/2010 04/16/2010 $229,643 WIBC Mirae Bank (Government Assisted Deal) 06/26/2009 06/29/2009 $408,000 WIBC Liberty Bank of New York 08/01/2005 05/19/2006 $58,775 BBCN Asiana Bank 04/25/2003 08/25/2003 $38,934 Total 9 Transactions $4,416,602 History of Successful M&As and Integrations

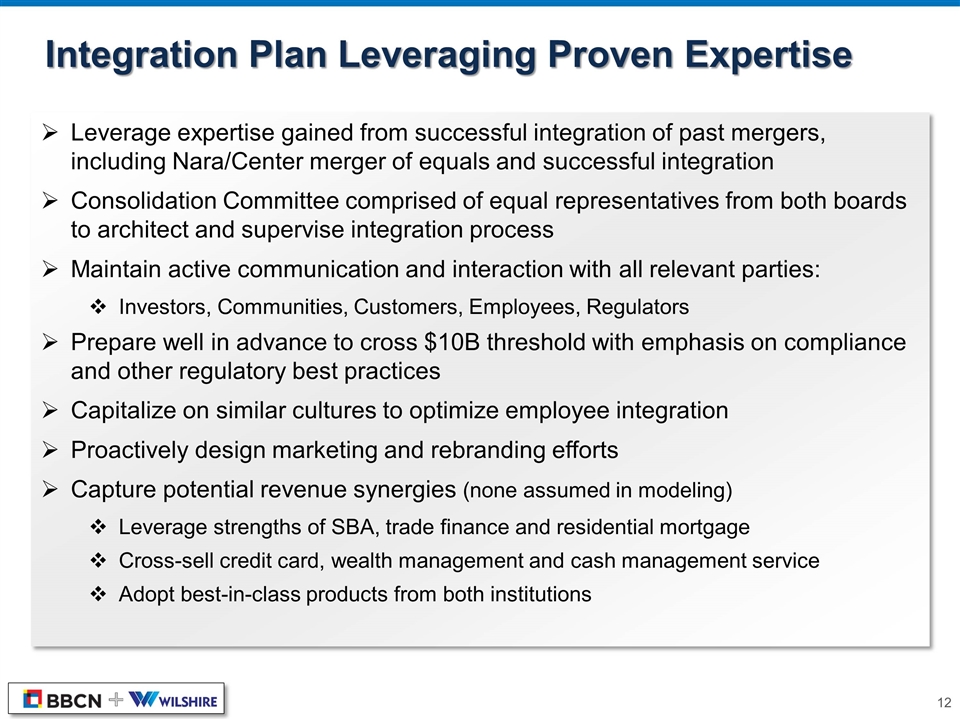

Leverage expertise gained from successful integration of past mergers, including Nara/Center merger of equals and successful integration Consolidation Committee comprised of equal representatives from both boards to architect and supervise integration process Maintain active communication and interaction with all relevant parties: Investors, Communities, Customers, Employees, Regulators Prepare well in advance to cross $10B threshold with emphasis on compliance and other regulatory best practices Capitalize on similar cultures to optimize employee integration Proactively design marketing and rebranding efforts Capture potential revenue synergies (none assumed in modeling) Leverage strengths of SBA, trade finance and residential mortgage Cross-sell credit card, wealth management and cash management service Adopt best-in-class products from both institutions Integration Plan Leveraging Proven Expertise

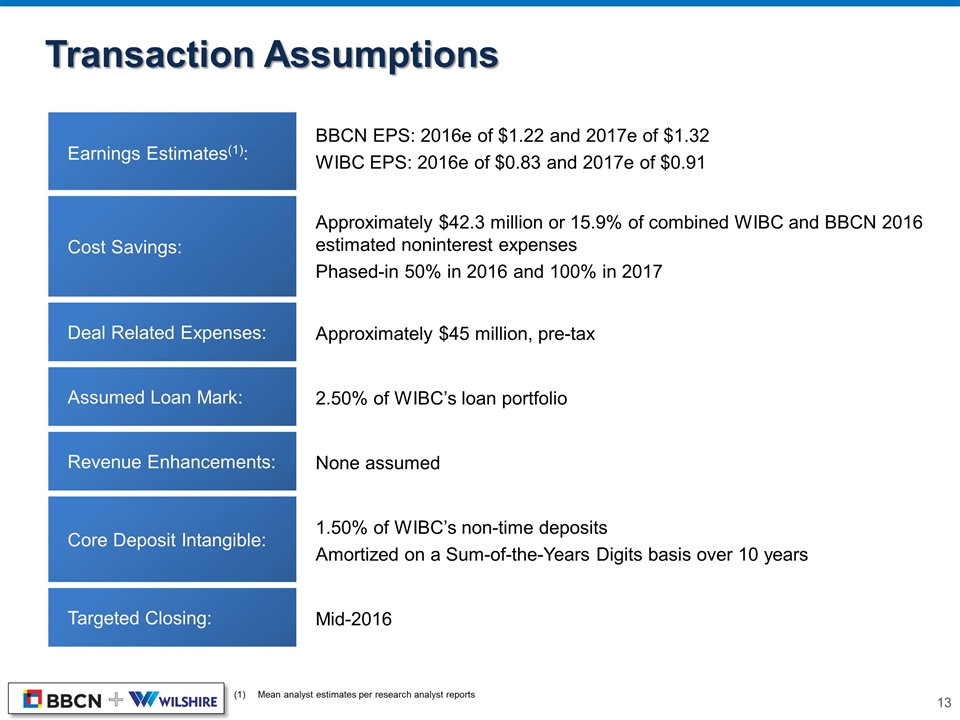

Earnings Estimates(1): BBCN EPS: 2016e of $1.22 and 2017e of $1.32 WIBC EPS: 2016e of $0.83 and 2017e of $0.91 Cost Savings: Approximately $42.3 million or 15.9% of combined WIBC and BBCN 2016 estimated noninterest expenses Phased-in 50% in 2016 and 100% in 2017 Deal Related Expenses: Approximately $45 million, pre-tax Assumed Loan Mark: 2.50% of WIBC’s loan portfolio Revenue Enhancements: None assumed Core Deposit Intangible: 1.50% of WIBC’s non-time deposits Amortized on a Sum-of-the-Years Digits basis over 10 years Targeted Closing: Mid-2016 Mean analyst estimates per research analyst reports Transaction Assumptions

Significant EPS Accretion, Strong IRR & Robust Capital Position Estimated financial impact is presented solely for illustrative purposes using mean analyst estimates per research analyst reports. Includes purchase accounting marks and cost savings. No revenue enhancements were included. Actual results may differ From the perspective of BBCN assuming a terminal multiple of 14.0x Tangible Book Value Earnback Period per the cross-over method Pro Forma Capital Ratios projected for a June 30, 2016 close

Creates the only super regional Korean-American commercial bank from the combination of the two strongest existing franchises Expands product set; deepens and expands geographic reach; strengthens already solid regulatory and compliance platforms Accretive to earnings Increased earnings potential and significantly enhanced operating leverage Financially compelling without assuming revenue enhancements Strong position / higher visibility in attractive markets Increased convenience for customers Experienced board and management focused on execution and maximizing shareholder value Premier KorAm Bank Strong Value Creation Attractive Markets Proven Leadership Significant Franchise and Shareholder Value

In connection with the proposed transaction between BBCN Bancorp, Inc. (“BBCN”) and Wilshire Bancorp, Inc. (“WIBC”), BBCN will file with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 that will include a Joint Proxy Statement/Prospectus of WIBC and BBCN, as well as other relevant documents concerning the proposed transaction. Shareholders are urged to read the Registration Statement and the Joint Proxy Statement/Prospectus regarding the merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. The Joint Proxy Statement/Prospectus, as well as other filings containing information about BBCN and WIBC, are available free of charge at the SEC’s Internet site (www.sec.gov). These documents are also available free of charge from BBCN at www.BBCNbank.com in the “Investor Relations” section under the “About” tab or from WIBC at www.wilshirebank.com in the “Investor Relations” under the “About Wilshire Bank” tab. Participants In Solicitation BBCN Bancorp, Wilshire Bancorp and their respective directors, executive officers, management and employees may be deemed to be participants in the solicitation of proxies in respect of the merger. Information concerning BBCN Bancorp’s participants is set forth in the proxy statement, dated May 1, 2015, and supplemental proxy materials, dated May 20, 2015, for BBCN Bancorp’s 2015 annual meeting of stockholders, as filed with the SEC on Schedules 14A. Information concerning Wilshire Bancorp’s participants is set forth in the proxy statement, dated April 9, 2015, for Wilshire Bancorp’s 2015 annual meeting of stockholders as filed with the SEC on Schedule 14A. Additional information regarding the interests of participants of BBCN Bancorp and Wilshire Bancorp in the solicitation of proxies in respect of the merger will be included in the registration statement and joint proxy statement/prospectus to be filed with the SEC. Forward-Looking Statements This presentation release may contain statements regarding the proposed transaction between BBCN Bancorp and Wilshire Bancorp, the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the proposed transaction and other statements about the future expectations, beliefs, goals, plans or prospects of the management of each of BBCN Bancorp and Wilshire Bancorp. These statements are based on current expectations, estimates, forecasts and projections and management assumptions about the future performance of each of BBCN Bancorp and Wilshire Bancorp and the combined company, as well as the businesses and markets in which they do and are expected to operate. These statements constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words such as “expects,” “believes,” “estimates,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans, “seeks,” and variations of such words and similar expressions are intended to identify such forward-looking statements which are not statements of historical fact. These forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to assess. Actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The closing of the proposed transaction is subject to regulatory approvals, the approval of the shareholders of both BBCN Bancorp and Wilshire Bancorp, and other customary closing conditions. There is no assurance that such conditions will be met or that the proposed transaction will be consummated within the expected time frame, or at all. If the transaction is consummated, factors that may cause actual outcomes to differ from what is expressed or forecasted in these forward-looking statements include, among things: difficulties and delays in integrating BBCN Bancorp and Wilshire Bancorp and achieving anticipated synergies, cost savings and other benefits from the transaction; higher than anticipated transaction costs; deposit attrition, operating costs, customer loss and business disruption following the merger, including difficulties in maintaining relationships with employees, may be greater than expected; required governmental approvals of the merger may not be obtained on its proposed terms and schedule, or without regulatory constraints that may limit growth; competitive pressures among depository and other financial institutions may increase significantly and have an effect on revenues; the strength of the United States economy in general, and of the local economies in which the combined company will operate, may be different than expected, which could result in, among other things, a deterioration in credit quality or a reduced demand for credit and have a negative effect on the combined company’s loan portfolio and allowance for loan losses; changes in the U.S. legal and regulatory framework; and adverse conditions in the stock market, the public debt market and other capital markets (including changes in interest rate conditions) which would negatively affect the combined company’s business and operating results. Additional Information