Attached files

| file | filename |

|---|---|

| 8-K - 8-K WELLS FARGO MLP CONFERENCE 8-K - American Midstream Partners, LP | a2015wellsfargomlpconferen.htm |

Investor Presentation December 2015

Cautionary statement 2 This presentation includes forward-looking statements. These statements relate to, among other things, projections of operational volumetrics and improvements, growth projects, cash flows and capital expenditures. We have used the words "anticipate,” "believe," "could," "estimate," "expect," "intend," "may," "plan," "predict," "project," "should," "will," "potential," and similar terms and phrases to identify forward-looking statements in this presentation. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. Our operations and future growth involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Actual results and trends in the future may differ materially from those suggested or implied by the forward-looking statements depending on a variety of factors, which are described in greater detail in our filings with the SEC. Construction of the projects described in this presentation is subject to risks beyond our control including cost overruns and delays resulting from numerous factors. In addition, we face risks associated with the integration of acquired businesses, decreased liquidity, increased interest and other expenses, assumption of potential liabilities, diversion of management’s attention, and other risks associated with acquisitions and growth. Please see our Risk Factor disclosures included in our Annual Report on Form 10-K for the year ended December 31, 2014 filed on March 10, 2015 and on Form 10-Q for the quarter ended September 30, 2015 filed on November 9, 2015. All future written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the previous statements. We undertake no obligation to update any information contained herein or to publicly release the results of any revisions to any forward-looking statements that may be made to reflect events or circumstances that occur, or that we become aware of, after the date of this presentation.

Gathering and Processing 63% Transmission 28% Terminals 9% 2015 YTD Gross Margin by Segment7 ~3,000 miles of pipelines 12 gas gathering systems 6 processing facilities1 5 major US resource plays 5 intrastate pipelines 3 interstate pipelines 3 terminal storage sites 3 fractionation facilities 2 interests in offshore Gulf of Mexico2 ~2 million barrels of storage capacity 1 crude oil pipeline system Partnership overview 3 Diversified natural gas and midstream operator 1. AMID owns a 50% non-operated interest in the Burns Point processing plant. 2. AMID owns a 66.7% non-operated interest in Main Pass Oil Gathering system (“MPOG”) and a 12.9% non-operated interest in Delta House. 3. As of 12/2/2015; enterprise value includes book value of Series B convertible units as of 9/30/2015 and market value of Series A Preferred units as of 12/2/2015. 4. As of 9/30/2015. 5. 2016 forecast as of November 9, 2015. .90% fee-based cash flow calculated as total forecast gross margin plus fee-based cash flow from Delta House. See Appendix slides 17-21 for non-GAAP financial measures reconciliation. 6. 2016 forecast EBITDA of $105 - $120 million versus 2015 forecast of $65 to $70 million. Partnership forecast as of November 9, 2015. 7. See Appendix slides 17 - 21 for information regarding non-GAAP financial measures. $930M Enterprise Value3 $9.81 unit price3 and 30.4M outstanding4 19% current yield 4.4x leverage with $750M credit facility4 >90% fee-based cash flow5 Est. Adjusted EBITDA Growth of ~65%6

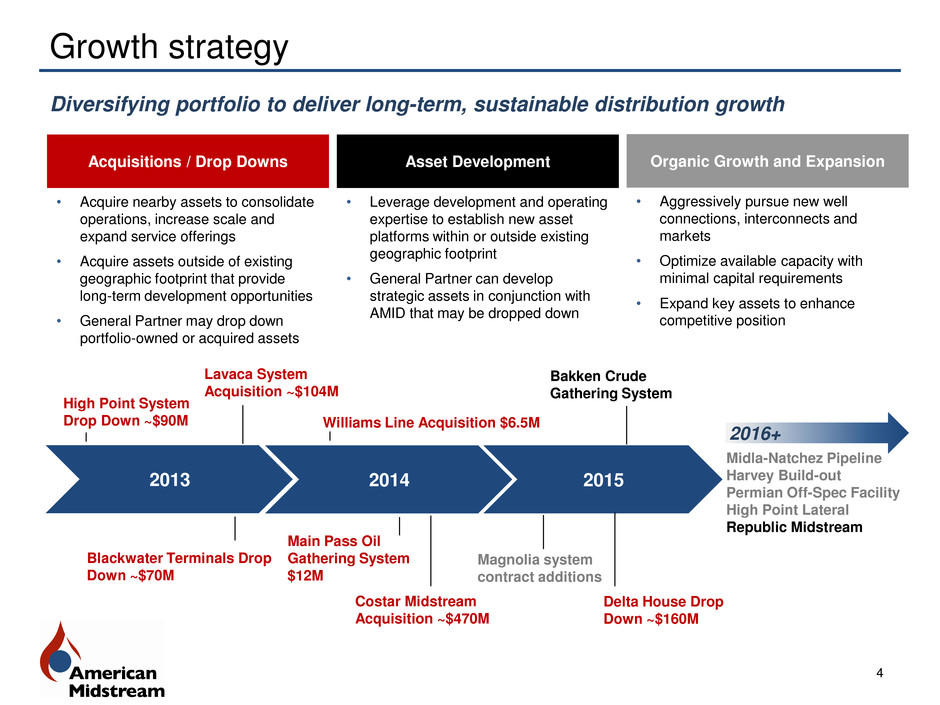

Growth strategy 4 Diversifying portfolio to deliver long-term, sustainable distribution growth Asset Development Acquisitions / Drop Downs Organic Growth and Expansion • Leverage development and operating expertise to establish new asset platforms within or outside existing geographic footprint • General Partner can develop strategic assets in conjunction with AMID that may be dropped down • Acquire nearby assets to consolidate operations, increase scale and expand service offerings • Acquire assets outside of existing geographic footprint that provide long-term development opportunities • General Partner may drop down portfolio-owned or acquired assets • Aggressively pursue new well connections, interconnects and markets • Optimize available capacity with minimal capital requirements • Expand key assets to enhance competitive position Midla-Natchez Pipeline Harvey Build-out Permian Off-Spec Facility High Point Lateral Republic Midstream Bakken Crude Gathering System 2013 2015 2014 High Point System Drop Down ~$90M Blackwater Terminals Drop Down ~$70M Main Pass Oil Gathering System $12M Costar Midstream Acquisition ~$470M Williams Line Acquisition $6.5M Delta House Drop Down ~$160M Lavaca System Acquisition ~$104M 2016+ Magnolia system contract additions

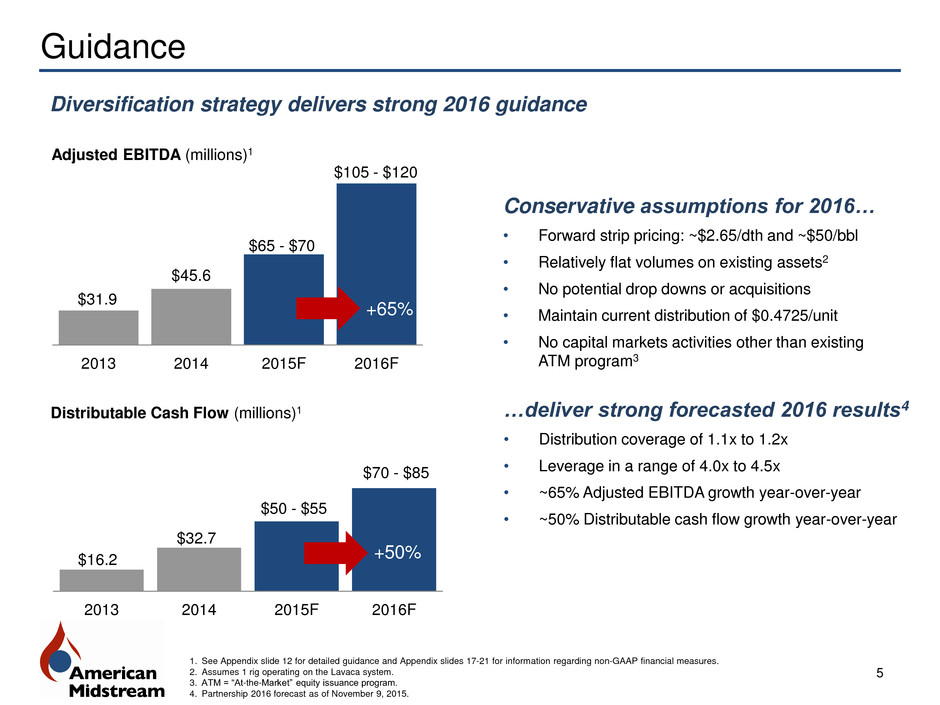

5 Guidance Diversification strategy delivers strong 2016 guidance 1. See Appendix slide 12 for detailed guidance and Appendix slides 17-21 for information regarding non-GAAP financial measures. 2. Assumes 1 rig operating on the Lavaca system. 3. ATM = “At-the-Market” equity issuance program. 4. Partnership 2016 forecast as of November 9, 2015. $31.9 $45.6 2013 2014 2015F 2016F Adjusted EBITDA (millions)1 $105 - $120 $65 - $70 +65% $16.2 $32.7 2013 2014 2015F 2016F Distributable Cash Flow (millions)1 $50 - $55 +50% $70 - $85 Conservative assumptions for 2016… • Forward strip pricing: ~$2.65/dth and ~$50/bbl • Relatively flat volumes on existing assets2 • No potential drop downs or acquisitions • Maintain current distribution of $0.4725/unit • No capital markets activities other than existing ATM program3 …deliver strong forecasted 2016 results4 • Distribution coverage of 1.1x to 1.2x • Leverage in a range of 4.0x to 4.5x • ~65% Adjusted EBITDA growth year-over-year • ~50% Distributable cash flow growth year-over-year

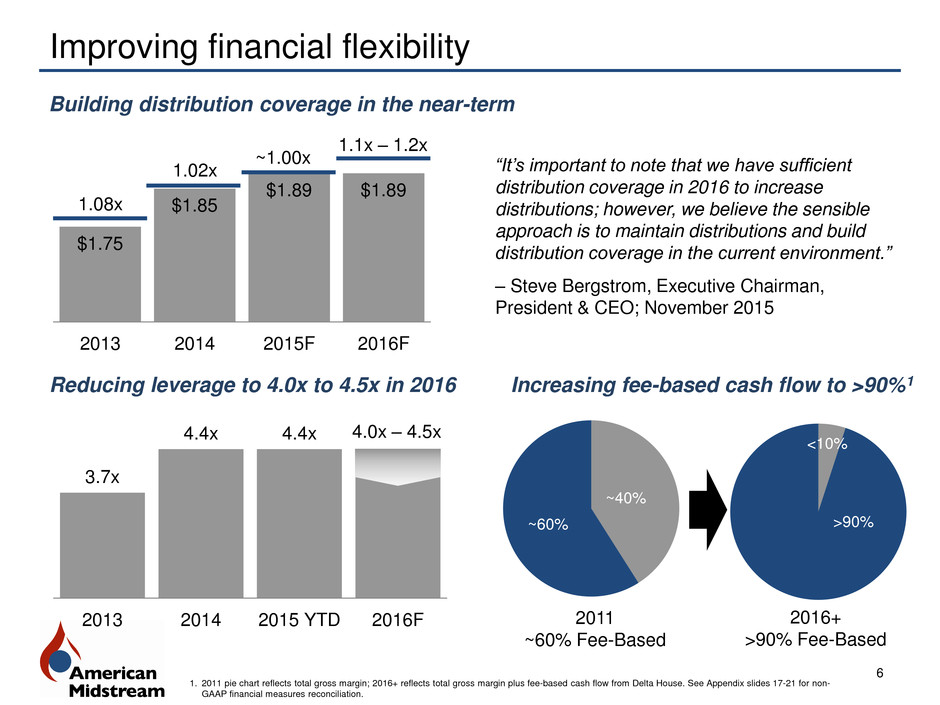

Improving financial flexibility 6 $1.75 $1.85 $1.89 $1.89 2013 2014 2015F 2016F Building distribution coverage in the near-term ~40% ~60% 2011 ~60% Fee-Based 2016+ >90% Fee-Based <10% >90% Increasing fee-based cash flow to >90%1 Reducing leverage to 4.0x to 4.5x in 2016 3.7x 4.4x 4.4x 2013 2014 2015 YTD 2016F 4.0x – 4.5x 1. 2011 pie chart reflects total gross margin; 2016+ reflects total gross margin plus fee-based cash flow from Delta House. See Appendix slides 17-21 for non- GAAP financial measures reconciliation. “It’s important to note that we have sufficient distribution coverage in 2016 to increase distributions; however, we believe the sensible approach is to maintain distributions and build distribution coverage in the current environment.” – Steve Bergstrom, Executive Chairman, President & CEO; November 2015 ~1.00x 1.02x 1.1x – 1.2x 1.08x

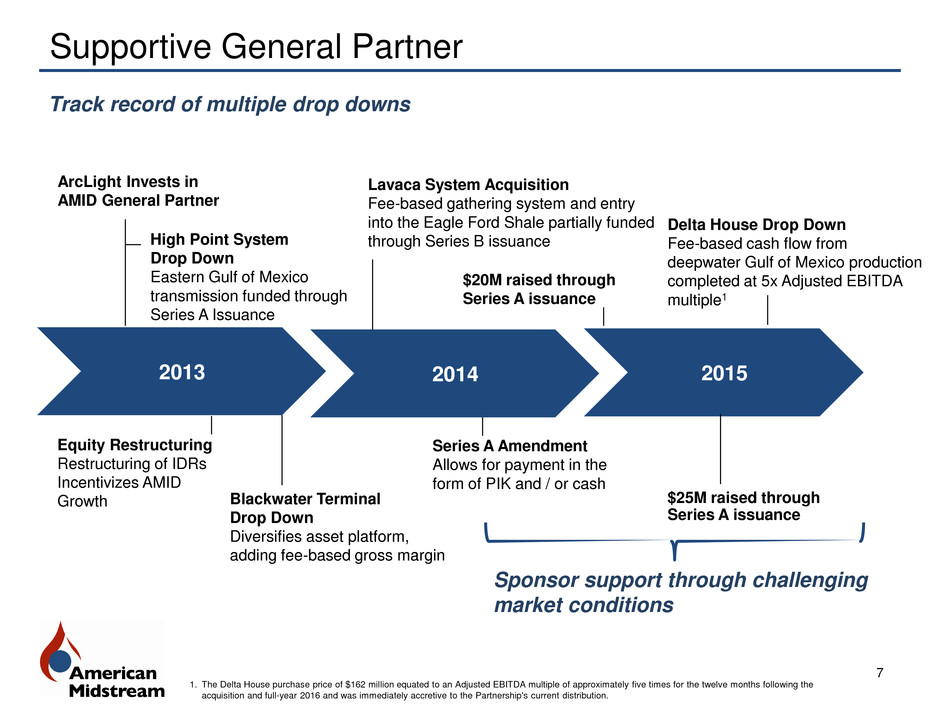

Supportive General Partner 7 Track record of multiple drop downs Sponsor support through challenging market conditions $25M raised through Series A issuance $20M raised through Series A issuance Delta House Drop Down Fee-based cash flow from deepwater Gulf of Mexico production completed at 5x Adjusted EBITDA multiple1 2013 2015 2014 Blackwater Terminal Drop Down Diversifies asset platform, adding fee-based gross margin ArcLight Invests in AMID General Partner Equity Restructuring Restructuring of IDRs Incentivizes AMID Growth Series A Amendment Allows for payment in the form of PIK and / or cash High Point System Drop Down Eastern Gulf of Mexico transmission funded through Series A Issuance Lavaca System Acquisition Fee-based gathering system and entry into the Eagle Ford Shale partially funded through Series B issuance 1. The Delta House purchase price of $162 million equated to an Adjusted EBITDA multiple of approximately five times for the twelve months following the acquisition and full-year 2016 and was immediately accretive to the Partnership's current distribution.

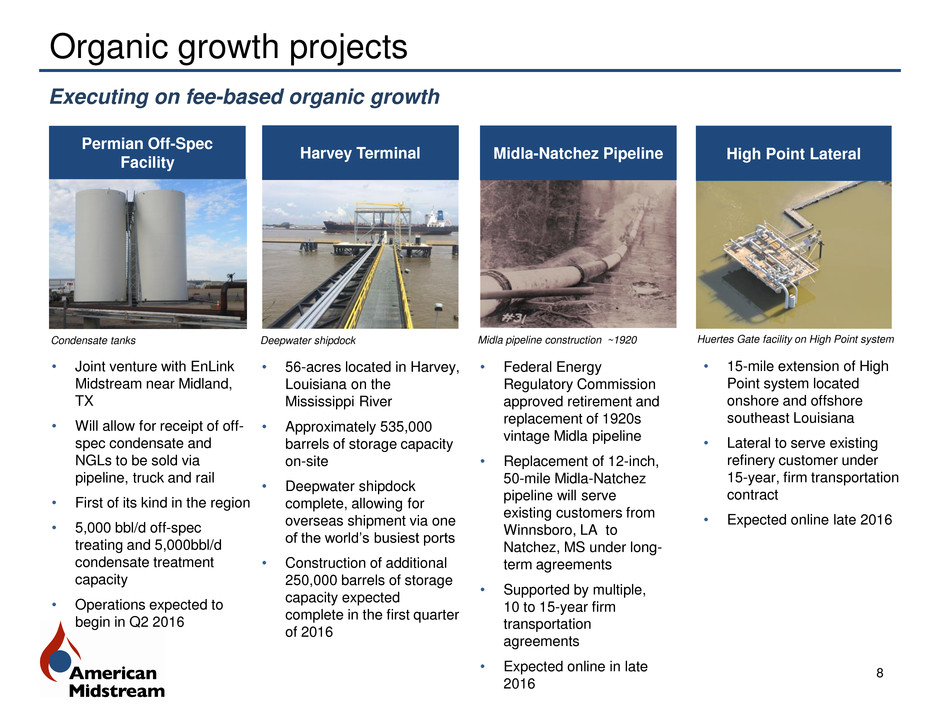

Organic growth projects Midla-Natchez Pipeline Executing on fee-based organic growth Midla pipeline construction ~1920 • Federal Energy Regulatory Commission approved retirement and replacement of 1920s vintage Midla pipeline • Replacement of 12-inch, 50-mile Midla-Natchez pipeline will serve existing customers from Winnsboro, LA to Natchez, MS under long- term agreements • Supported by multiple, 10 to 15-year firm transportation agreements • Expected online in late 2016 • 15-mile extension of High Point system located onshore and offshore southeast Louisiana • Lateral to serve existing refinery customer under 15-year, firm transportation contract • Expected online late 2016 High Point Lateral Huertes Gate facility on High Point system Harvey Terminal Deepwater shipdock • 56-acres located in Harvey, Louisiana on the Mississippi River • Approximately 535,000 barrels of storage capacity on-site • Deepwater shipdock complete, allowing for overseas shipment via one of the world’s busiest ports • Construction of additional 250,000 barrels of storage capacity expected complete in the first quarter of 2016 Permian Off-Spec Facility Condensate tanks • Joint venture with EnLink Midstream near Midland, TX • Will allow for receipt of off- spec condensate and NGLs to be sold via pipeline, truck and rail • First of its kind in the region • 5,000 bbl/d off-spec treating and 5,000bbl/d condensate treatment capacity • Operations expected to begin in Q2 2016 8

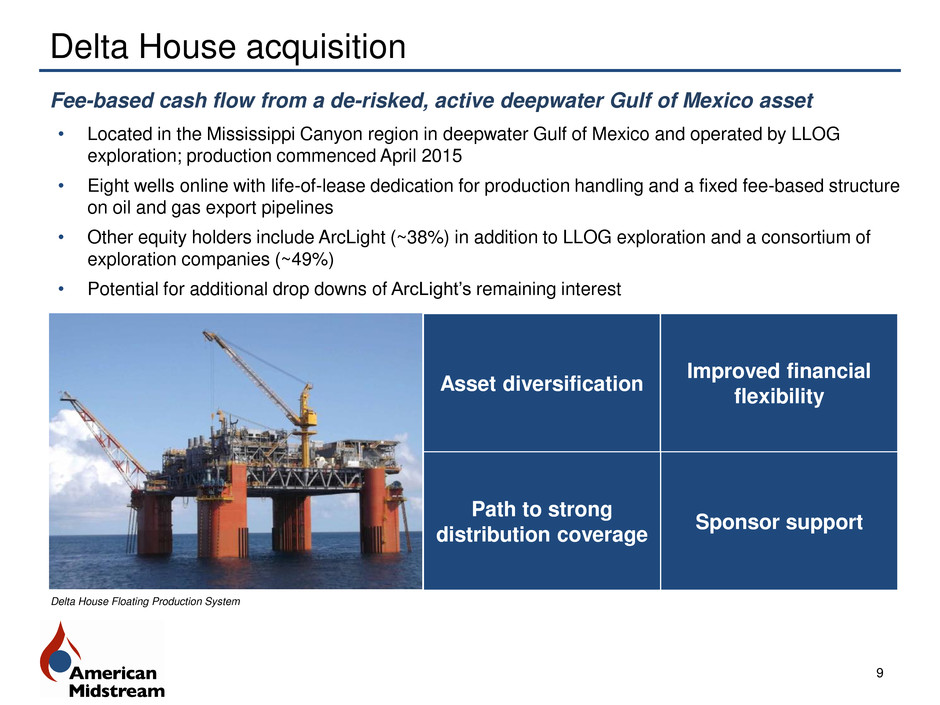

Delta House acquisition 9 Fee-based cash flow from a de-risked, active deepwater Gulf of Mexico asset • Located in the Mississippi Canyon region in deepwater Gulf of Mexico and operated by LLOG exploration; production commenced April 2015 • Eight wells online with life-of-lease dedication for production handling and a fixed fee-based structure on oil and gas export pipelines • Other equity holders include ArcLight (~38%) in addition to LLOG exploration and a consortium of exploration companies (~49%) • Potential for additional drop downs of ArcLight’s remaining interest Delta House Floating Production System Asset diversification Improved financial flexibility Sponsor support Path to strong distribution coverage

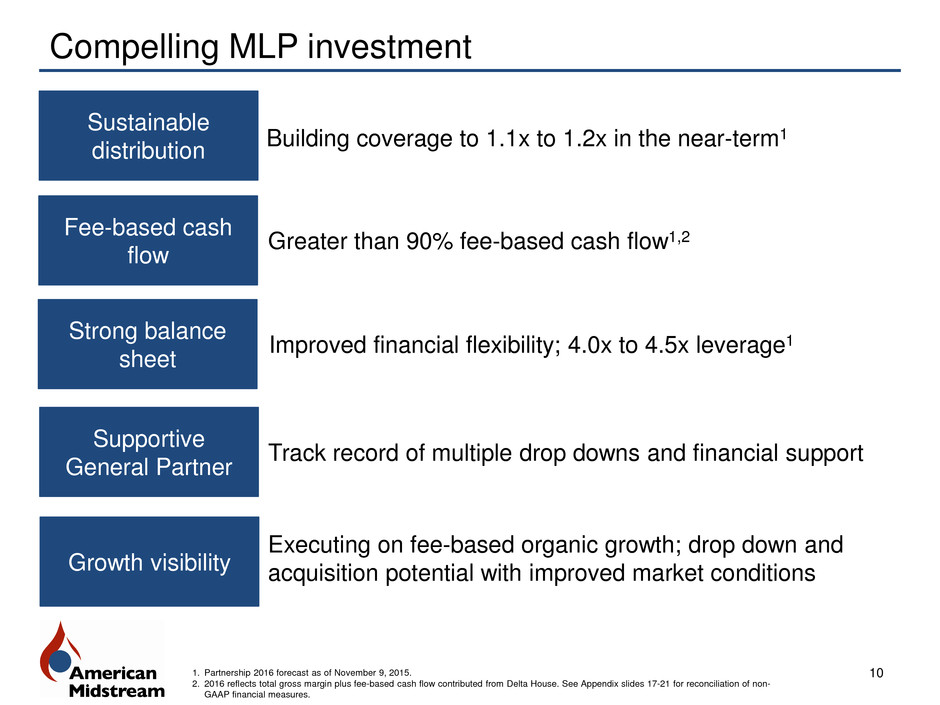

Compelling MLP investment Sustainable distribution Fee-based cash flow Strong balance sheet Supportive General Partner Growth visibility Improved financial flexibility; 4.0x to 4.5x leverage1 Greater than 90% fee-based cash flow1,2 Executing on fee-based organic growth; drop down and acquisition potential with improved market conditions Track record of multiple drop downs and financial support Building coverage to 1.1x to 1.2x in the near-term1 1. Partnership 2016 forecast as of November 9, 2015. 2. 2016 reflects total gross margin plus fee-based cash flow contributed from Delta House. See Appendix slides 17-21 for reconciliation of non- GAAP financial measures. 10

Appendix: Partnership Overview

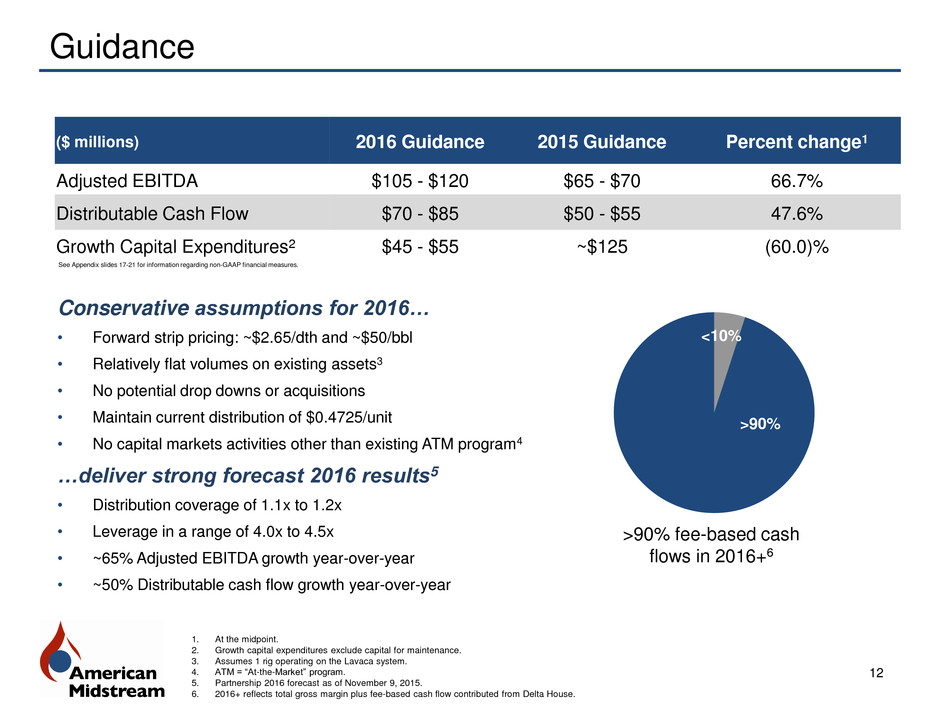

Conservative assumptions for 2016… • Forward strip pricing: ~$2.65/dth and ~$50/bbl • Relatively flat volumes on existing assets3 • No potential drop downs or acquisitions • Maintain current distribution of $0.4725/unit • No capital markets activities other than existing ATM program4 …deliver strong forecast 2016 results5 • Distribution coverage of 1.1x to 1.2x • Leverage in a range of 4.0x to 4.5x • ~65% Adjusted EBITDA growth year-over-year • ~50% Distributable cash flow growth year-over-year Guidance 12 ($ millions) 2016 Guidance 2015 Guidance Percent change1 Adjusted EBITDA $105 - $120 $65 - $70 66.7% Distributable Cash Flow $70 - $85 $50 - $55 47.6% Growth Capital Expenditures2 $45 - $55 ~$125 (60.0)% 1. At the midpoint. 2. Growth capital expenditures exclude capital for maintenance. 3. Assumes 1 rig operating on the Lavaca system. 4. ATM = “At-the-Market” program. 5. Partnership 2016 forecast as of November 9, 2015. 6. 2016+ reflects total gross margin plus fee-based cash flow contributed from Delta House. >90% fee-based cash flows in 2016+6 <10% >90% See Appendix slides 17-21 for information regarding non-GAAP financial measures.

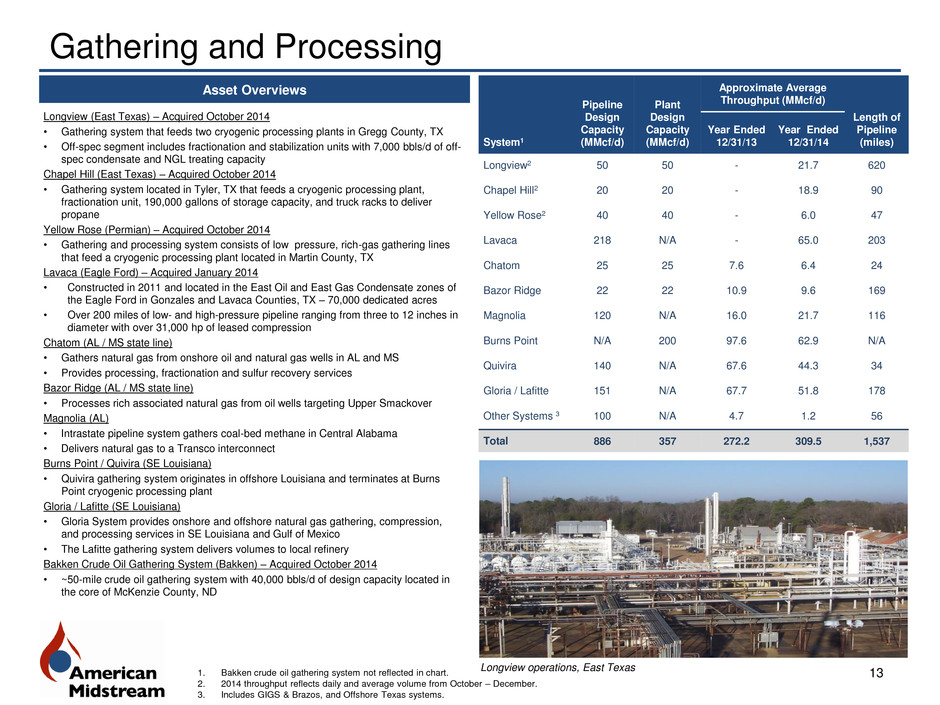

Gathering and Processing 13 Asset Overviews System1 Pipeline Design Capacity (MMcf/d) Plant Design Capacity (MMcf/d) Approximate Average Throughput (MMcf/d) Length of Pipeline (miles) Year Ended 12/31/13 Year Ended 12/31/14 Longview2 50 50 - 21.7 620 Chapel Hill2 20 20 - 18.9 90 Yellow Rose2 40 40 - 6.0 47 Lavaca 218 N/A - 65.0 203 Chatom 25 25 7.6 6.4 24 Bazor Ridge 22 22 10.9 9.6 169 Magnolia 120 N/A 16.0 21.7 116 Burns Point N/A 200 97.6 62.9 N/A Quivira 140 N/A 67.6 44.3 34 Gloria / Lafitte 151 N/A 67.7 51.8 178 Other Systems 3 100 N/A 4.7 1.2 56 Total 886 357 272.2 309.5 1,537 Longview (East Texas) – Acquired October 2014 • Gathering system that feeds two cryogenic processing plants in Gregg County, TX • Off-spec segment includes fractionation and stabilization units with 7,000 bbls/d of off- spec condensate and NGL treating capacity Chapel Hill (East Texas) – Acquired October 2014 • Gathering system located in Tyler, TX that feeds a cryogenic processing plant, fractionation unit, 190,000 gallons of storage capacity, and truck racks to deliver propane Yellow Rose (Permian) – Acquired October 2014 • Gathering and processing system consists of low pressure, rich-gas gathering lines that feed a cryogenic processing plant located in Martin County, TX Lavaca (Eagle Ford) – Acquired January 2014 • Constructed in 2011 and located in the East Oil and East Gas Condensate zones of the Eagle Ford in Gonzales and Lavaca Counties, TX – 70,000 dedicated acres • Over 200 miles of low- and high-pressure pipeline ranging from three to 12 inches in diameter with over 31,000 hp of leased compression Chatom (AL / MS state line) • Gathers natural gas from onshore oil and natural gas wells in AL and MS • Provides processing, fractionation and sulfur recovery services Bazor Ridge (AL / MS state line) • Processes rich associated natural gas from oil wells targeting Upper Smackover Magnolia (AL) • Intrastate pipeline system gathers coal-bed methane in Central Alabama • Delivers natural gas to a Transco interconnect Burns Point / Quivira (SE Louisiana) • Quivira gathering system originates in offshore Louisiana and terminates at Burns Point cryogenic processing plant Gloria / Lafitte (SE Louisiana) • Gloria System provides onshore and offshore natural gas gathering, compression, and processing services in SE Louisiana and Gulf of Mexico • The Lafitte gathering system delivers volumes to local refinery Bakken Crude Oil Gathering System (Bakken) – Acquired October 2014 • ~50-mile crude oil gathering system with 40,000 bbls/d of design capacity located in the core of McKenzie County, ND 1. Bakken crude oil gathering system not reflected in chart. 2. 2014 throughput reflects daily and average volume from October – December. 3. Includes GIGS & Brazos, and Offshore Texas systems. Longview operations, East Texas

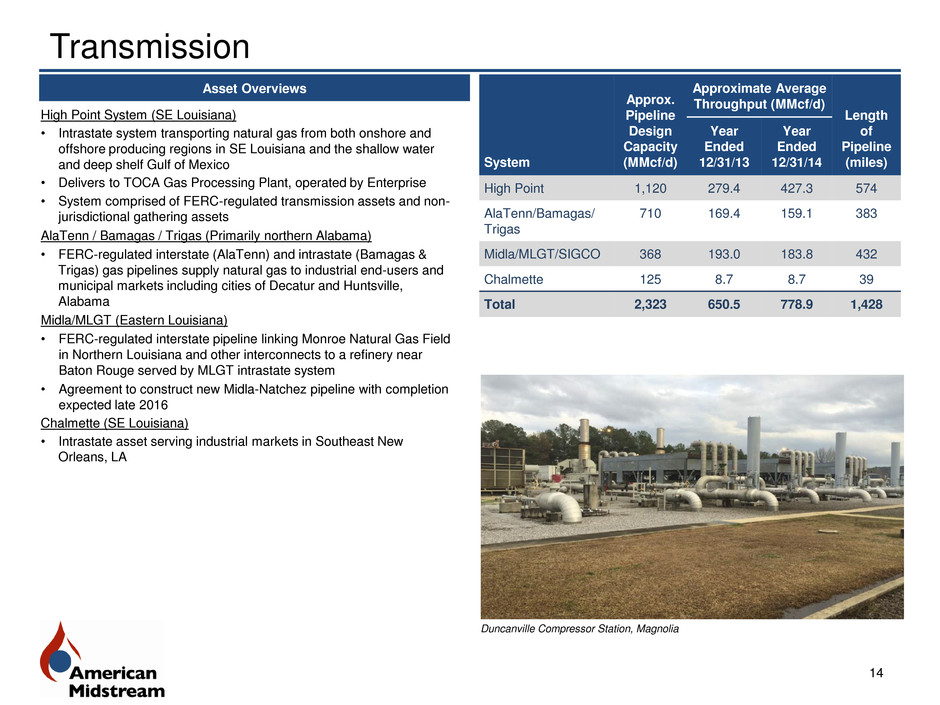

Transmission 14 Asset Overviews High Point System (SE Louisiana) • Intrastate system transporting natural gas from both onshore and offshore producing regions in SE Louisiana and the shallow water and deep shelf Gulf of Mexico • Delivers to TOCA Gas Processing Plant, operated by Enterprise • System comprised of FERC-regulated transmission assets and non- jurisdictional gathering assets AlaTenn / Bamagas / Trigas (Primarily northern Alabama) • FERC-regulated interstate (AlaTenn) and intrastate (Bamagas & Trigas) gas pipelines supply natural gas to industrial end-users and municipal markets including cities of Decatur and Huntsville, Alabama Midla/MLGT (Eastern Louisiana) • FERC-regulated interstate pipeline linking Monroe Natural Gas Field in Northern Louisiana and other interconnects to a refinery near Baton Rouge served by MLGT intrastate system • Agreement to construct new Midla-Natchez pipeline with completion expected late 2016 Chalmette (SE Louisiana) • Intrastate asset serving industrial markets in Southeast New Orleans, LA System Approx. Pipeline Design Capacity (MMcf/d) Approximate Average Throughput (MMcf/d) Length of Pipeline (miles) Year Ended 12/31/13 Year Ended 12/31/14 High Point 1,120 279.4 427.3 574 AlaTenn/Bamagas/ Trigas 710 169.4 159.1 383 Midla/MLGT/SIGCO 368 193.0 183.8 432 Chalmette 125 8.7 8.7 39 Total 2,323 650.5 778.9 1,428 Duncanville Compressor Station, Magnolia

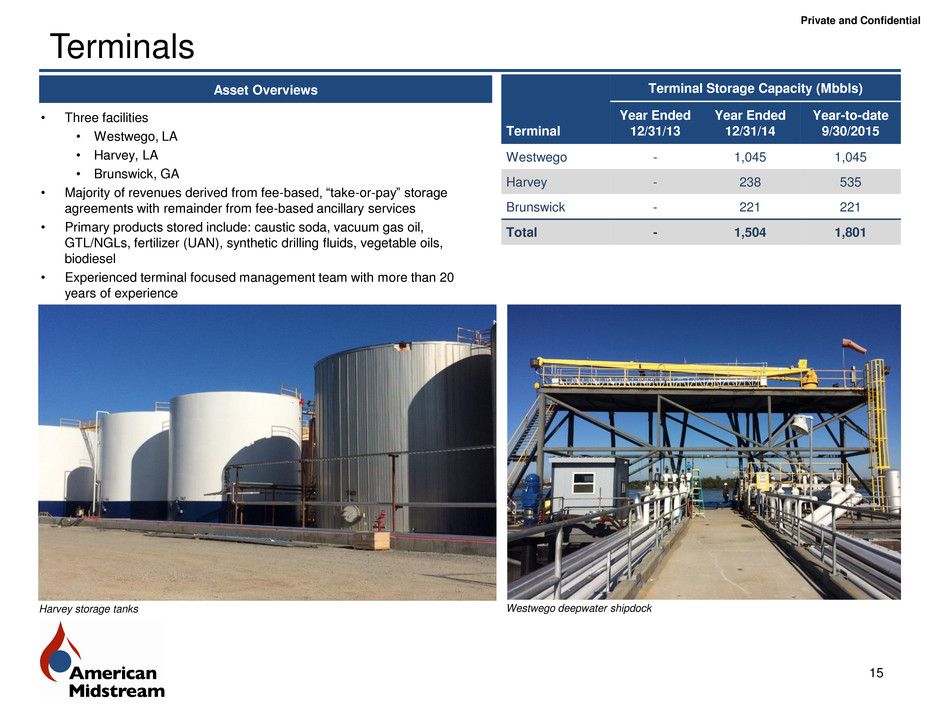

Terminals 15 Asset Overviews • Three facilities • Westwego, LA • Harvey, LA • Brunswick, GA • Majority of revenues derived from fee-based, “take-or-pay” storage agreements with remainder from fee-based ancillary services • Primary products stored include: caustic soda, vacuum gas oil, GTL/NGLs, fertilizer (UAN), synthetic drilling fluids, vegetable oils, biodiesel • Experienced terminal focused management team with more than 20 years of experience Terminal Terminal Storage Capacity (Mbbls) Year Ended 12/31/13 Year Ended 12/31/14 Year-to-date 9/30/2015 Westwego - 1,045 1,045 Harvey - 238 535 Brunswick - 221 221 Total - 1,504 1,801 Private and Confidential Harvey storage tanks Westwego deepwater shipdock

Appendix: Non-GAAP Financial Measures

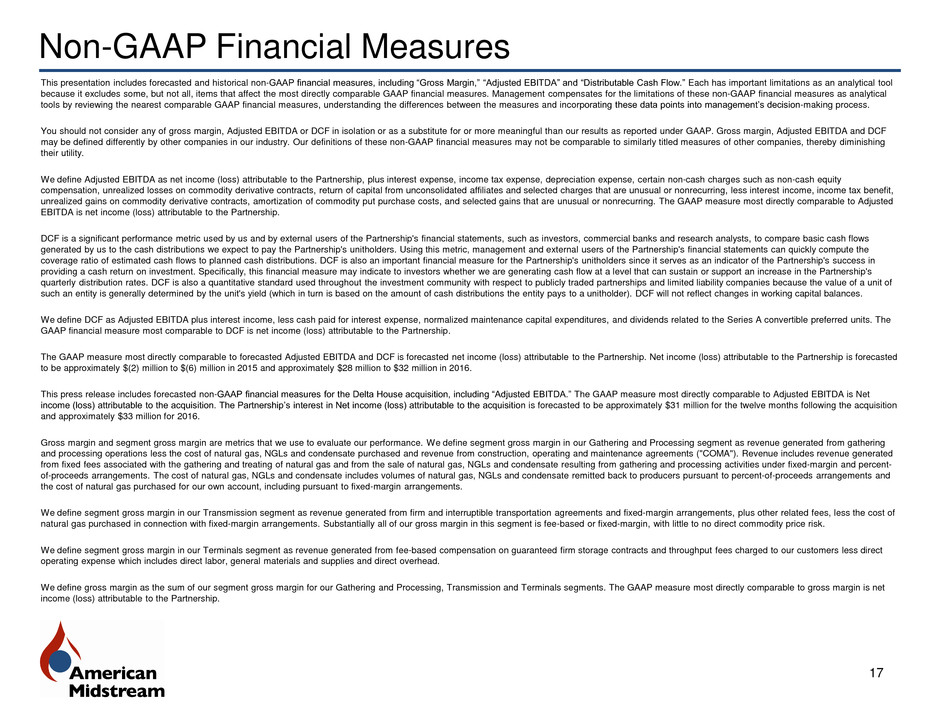

Non-GAAP Financial Measures This presentation includes forecasted and historical non-GAAP financial measures, including “Gross Margin,” “Adjusted EBITDA” and “Distributable Cash Flow.” Each has important limitations as an analytical tool because it excludes some, but not all, items that affect the most directly comparable GAAP financial measures. Management compensates for the limitations of these non-GAAP financial measures as analytical tools by reviewing the nearest comparable GAAP financial measures, understanding the differences between the measures and incorporating these data points into management’s decision-making process. You should not consider any of gross margin, Adjusted EBITDA or DCF in isolation or as a substitute for or more meaningful than our results as reported under GAAP. Gross margin, Adjusted EBITDA and DCF may be defined differently by other companies in our industry. Our definitions of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. We define Adjusted EBITDA as net income (loss) attributable to the Partnership, plus interest expense, income tax expense, depreciation expense, certain non-cash charges such as non-cash equity compensation, unrealized losses on commodity derivative contracts, return of capital from unconsolidated affiliates and selected charges that are unusual or nonrecurring, less interest income, income tax benefit, unrealized gains on commodity derivative contracts, amortization of commodity put purchase costs, and selected gains that are unusual or nonrecurring. The GAAP measure most directly comparable to Adjusted EBITDA is net income (loss) attributable to the Partnership. DCF is a significant performance metric used by us and by external users of the Partnership's financial statements, such as investors, commercial banks and research analysts, to compare basic cash flows generated by us to the cash distributions we expect to pay the Partnership's unitholders. Using this metric, management and external users of the Partnership's financial statements can quickly compute the coverage ratio of estimated cash flows to planned cash distributions. DCF is also an important financial measure for the Partnership's unitholders since it serves as an indicator of the Partnership's success in providing a cash return on investment. Specifically, this financial measure may indicate to investors whether we are generating cash flow at a level that can sustain or support an increase in the Partnership's quarterly distribution rates. DCF is also a quantitative standard used throughout the investment community with respect to publicly traded partnerships and limited liability companies because the value of a unit of such an entity is generally determined by the unit's yield (which in turn is based on the amount of cash distributions the entity pays to a unitholder). DCF will not reflect changes in working capital balances. We define DCF as Adjusted EBITDA plus interest income, less cash paid for interest expense, normalized maintenance capital expenditures, and dividends related to the Series A convertible preferred units. The GAAP financial measure most comparable to DCF is net income (loss) attributable to the Partnership. The GAAP measure most directly comparable to forecasted Adjusted EBITDA and DCF is forecasted net income (loss) attributable to the Partnership. Net income (loss) attributable to the Partnership is forecasted to be approximately $(2) million to $(6) million in 2015 and approximately $28 million to $32 million in 2016. This press release includes forecasted non-GAAP financial measures for the Delta House acquisition, including “Adjusted EBITDA.” The GAAP measure most directly comparable to Adjusted EBITDA is Net income (loss) attributable to the acquisition. The Partnership’s interest in Net income (loss) attributable to the acquisition is forecasted to be approximately $31 million for the twelve months following the acquisition and approximately $33 million for 2016. Gross margin and segment gross margin are metrics that we use to evaluate our performance. We define segment gross margin in our Gathering and Processing segment as revenue generated from gathering and processing operations less the cost of natural gas, NGLs and condensate purchased and revenue from construction, operating and maintenance agreements ("COMA"). Revenue includes revenue generated from fixed fees associated with the gathering and treating of natural gas and from the sale of natural gas, NGLs and condensate resulting from gathering and processing activities under fixed-margin and percent- of-proceeds arrangements. The cost of natural gas, NGLs and condensate includes volumes of natural gas, NGLs and condensate remitted back to producers pursuant to percent-of-proceeds arrangements and the cost of natural gas purchased for our own account, including pursuant to fixed-margin arrangements. We define segment gross margin in our Transmission segment as revenue generated from firm and interruptible transportation agreements and fixed-margin arrangements, plus other related fees, less the cost of natural gas purchased in connection with fixed-margin arrangements. Substantially all of our gross margin in this segment is fee-based or fixed-margin, with little to no direct commodity price risk. We define segment gross margin in our Terminals segment as revenue generated from fee-based compensation on guaranteed firm storage contracts and throughput fees charged to our customers less direct operating expense which includes direct labor, general materials and supplies and direct overhead. We define gross margin as the sum of our segment gross margin for our Gathering and Processing, Transmission and Terminals segments. The GAAP measure most directly comparable to gross margin is net income (loss) attributable to the Partnership. 17

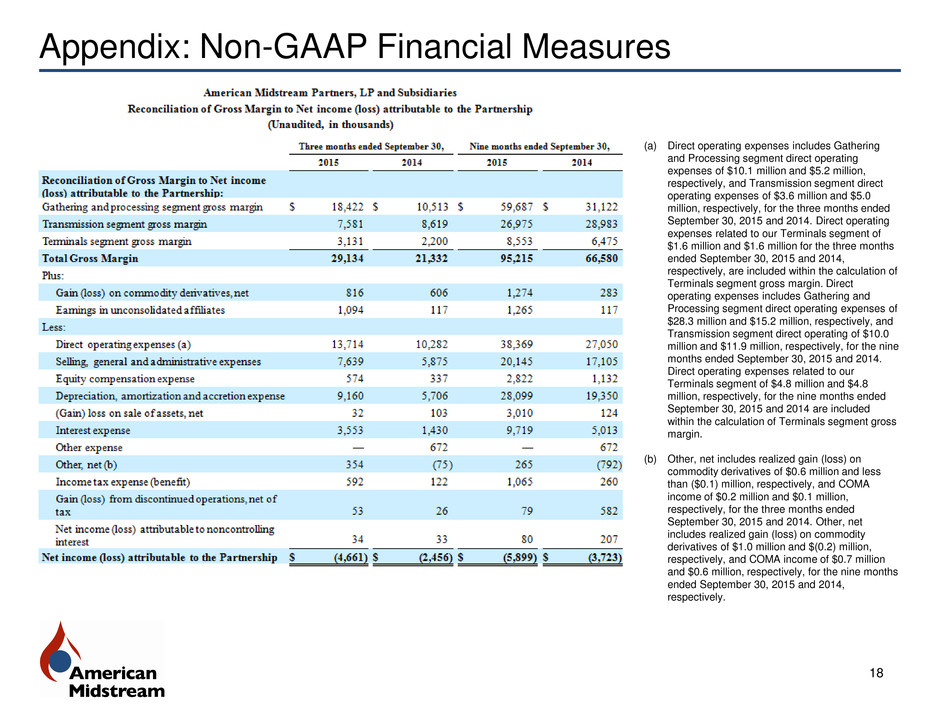

Appendix: Non-GAAP Financial Measures 18 (a) Direct operating expenses includes Gathering and Processing segment direct operating expenses of $10.1 million and $5.2 million, respectively, and Transmission segment direct operating expenses of $3.6 million and $5.0 million, respectively, for the three months ended September 30, 2015 and 2014. Direct operating expenses related to our Terminals segment of $1.6 million and $1.6 million for the three months ended September 30, 2015 and 2014, respectively, are included within the calculation of Terminals segment gross margin. Direct operating expenses includes Gathering and Processing segment direct operating expenses of $28.3 million and $15.2 million, respectively, and Transmission segment direct operating of $10.0 million and $11.9 million, respectively, for the nine months ended September 30, 2015 and 2014. Direct operating expenses related to our Terminals segment of $4.8 million and $4.8 million, respectively, for the nine months ended September 30, 2015 and 2014 are included within the calculation of Terminals segment gross margin. (b) Other, net includes realized gain (loss) on commodity derivatives of $0.6 million and less than ($0.1) million, respectively, and COMA income of $0.2 million and $0.1 million, respectively, for the three months ended September 30, 2015 and 2014. Other, net includes realized gain (loss) on commodity derivatives of $1.0 million and $(0.2) million, respectively, and COMA income of $0.7 million and $0.6 million, respectively, for the nine months ended September 30, 2015 and 2014, respectively.

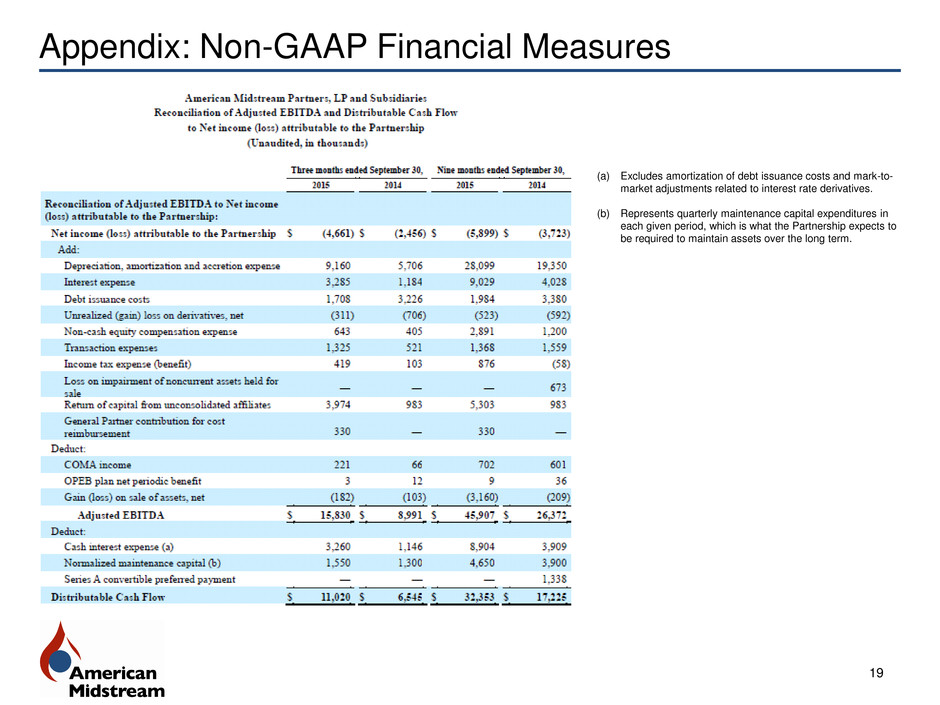

Appendix: Non-GAAP Financial Measures 19 (a) Excludes amortization of debt issuance costs and mark-to- market adjustments related to interest rate derivatives. (b) Represents quarterly maintenance capital expenditures in each given period, which is what the Partnership expects to be required to maintain assets over the long term.

Appendix: Non-GAAP Financial Measures 20 (a) Terminals segment amounts are for the period from April 15, 2013 to December 31, 2013 for the year ended December 31, 2013. (b) Direct operating expenses includes Gathering and Processing segment direct operating expenses of $8.6 million and $3.7 million, respectively, and Transmission segment direct operating expenses of $3.7 million and $4.3 million, respectively, for the three months ended December 31, 2014 and 2013. Direct operating expenses related to our Terminals segment of $1.5 million and $1.9 million, respectively, for the three months ended December 31, 2014 and 2013 are included within the calculation of Terminals segment gross margin. Direct operating expenses includes Gathering and Processing segment direct operating expenses of $23.8 million, $14.6 million, and $12.2 million, respectively, and Transmission segment direct operating expenses of $15.6 million, $13.3 million, and $5.0 million, respectively, for the twelve months ended December 31, 2014, 2013, and 2012. Direct operating expenses related to our Terminals segment of $6.3 million, $4.4 million, and $0.0 million respectively, for the twelve months ended December 31, 2014, 2013, and 2012 are included within the calculation of Terminals segment gross margin. (c) Other, net includes realized (loss) gain on commodity derivatives of $0.9 million and $0.3 million and COMA income of $0.3 million and $0.3 million for the three months ended December 31, 2014 and 2013, respectively. Other, net includes realized gain on commodity derivatives of $0.7 million, $1.1 million and $2.4 million and COMA income of $0.9 million, $0.8 million and $3.4 million for the twelve months ended December 31, 2014, 2013, and 2012, respectively.

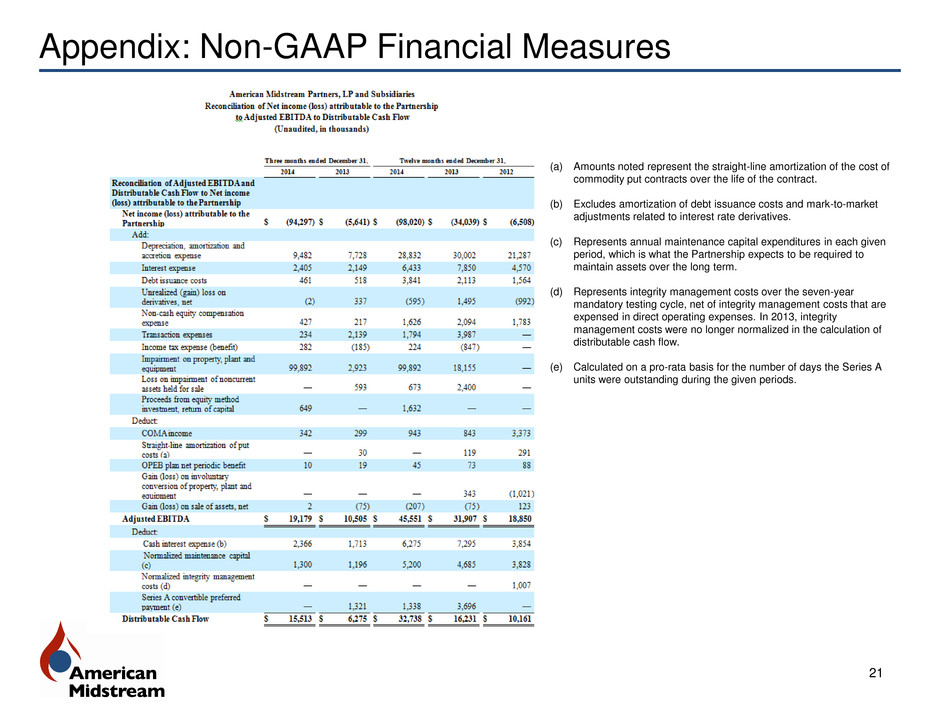

Appendix: Non-GAAP Financial Measures 21 (a) Amounts noted represent the straight-line amortization of the cost of commodity put contracts over the life of the contract. (b) Excludes amortization of debt issuance costs and mark-to-market adjustments related to interest rate derivatives. (c) Represents annual maintenance capital expenditures in each given period, which is what the Partnership expects to be required to maintain assets over the long term. (d) Represents integrity management costs over the seven-year mandatory testing cycle, net of integrity management costs that are expensed in direct operating expenses. In 2013, integrity management costs were no longer normalized in the calculation of distributable cash flow. (e) Calculated on a pro-rata basis for the number of days the Series A units were outstanding during the given periods.