Attached files

| file | filename |

|---|---|

| 8-K - 8-K - American Residential Properties, Inc. | arpi123158k.htm |

| EX-99.1 - EXHIBIT 99.1 - American Residential Properties, Inc. | amharpipressrelease12032015.htm |

December 3, 2015 Merger to Enhance Scale Advantages, Providing Unmatched Operating Efficiencies

Forward-Looking Statements and Additional Information The information in this presentation has been prepared solely for informational purposes. “We,” “AMH,” “AH4R,” “the Company,” “the REIT,” “our” and “us” refer to American Homes 4 Rent, a Maryland real estate investment trust, and its subsidiaries taken as a whole. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements generally can be identified by use of statements that include phrases such as “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “will,” “predicted,” “likely,” or other words or phrases of similar import. Such statements involve known and unknown risks, uncertainties, and other factors that may cause the actual results, performance, or achievements of AMH or American Residential Properties, Inc. (“ARPI”) to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the ability of ARPI to obtain the required stockholder approval to consummate the proposed mergers; the satisfaction or waiver of other conditions in the Merger Agreement; the outcome of any legal proceedings that may be instituted against AMH, ARPI and others related to the Merger Agreement; the ability of third parties to fulfill their obligations relating to the proposed transactions; the risk that the mergers or the other transactions contemplated by the Merger Agreement may not be completed in the time frame expected by the parties or at all; the ability of AMH to successfully integrate pending transactions and implement its operating strategy; changes in economic cycles; and competition within the single-family residential rental industry; the demand for and market acceptance of AMH’s and ARPI’s properties for rental purposes. Although AMH and ARPI believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore there can be no assurance that such statements included in this report will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by AMH or ARPI or any other person that the results or conditions described in such statements or the objectives and plans of AMH or ARPI will be achieved. Certain factors that could cause actual results to differ materially from these forward-looking statements are listed from time to time in AMH’s and ARPI’s SEC reports, including, but not limited to, in the section entitled “Item 1A. Risk Factors” in the Annual Report on Form 10-K filed by AMH with the SEC on March 3, 2015, and in the section entitled “Item 1A. Risk Factors” in the Annual Report on Form 10-K filed by ARPI with the SEC on March 16, 2015. Any forward-looking statement speaks only as of the date of this report and neither AMH nor ARPI undertakes any obligation to update or revise any forward-looking statements, whether as a result of new developments or otherwise. In connection with the proposed transactions, AMH expects to file with the SEC a registration statement on Form S-4 that will include a proxy statement of ARPI that also constitutes a prospectus of AMH. AMH and ARPI also plan to file other relevant documents with the SEC regarding the proposed transactions. INVESTORS ARE URGED TO READ THE PROSPECTUS/PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the prospectus/proxy statement (if and when it becomes available) and other relevant documents filed by AMH and ARPI with the SEC at the SEC’s website at www.sec.gov. Copies of the documents filed by AMH with the SEC will be available free of charge on its website at www.americanhomes4rent.com, or by contacting Investor Relations at (855) 794-2447. Copies of the documents filed by ARPI with the SEC will be available free of charge on its website at www.amresprop.com, or by contacting Investor Relations at (480) 474-4800. AMH and ARPI and their respective trustees, directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions. You can find information about AMH’s trustees and executive officers in AMH’s definitive proxy statement filed with the SEC on April 2, 2015 in connection with its 2015 annual meeting of shareholders. You can find information about ARPI’s directors and executive officers in ARPI’s definitive proxy statement filed with the SEC on April 17, 2015 in connection with its 2015 annual meeting of stockholders. Additional information regarding the interests of such potential participants will be included in the prospectus/proxy statement and other relevant documents filed with the SEC if and when they become available. You may obtain free copies of these documents from AMH or ARPI using the sources indicated above. This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

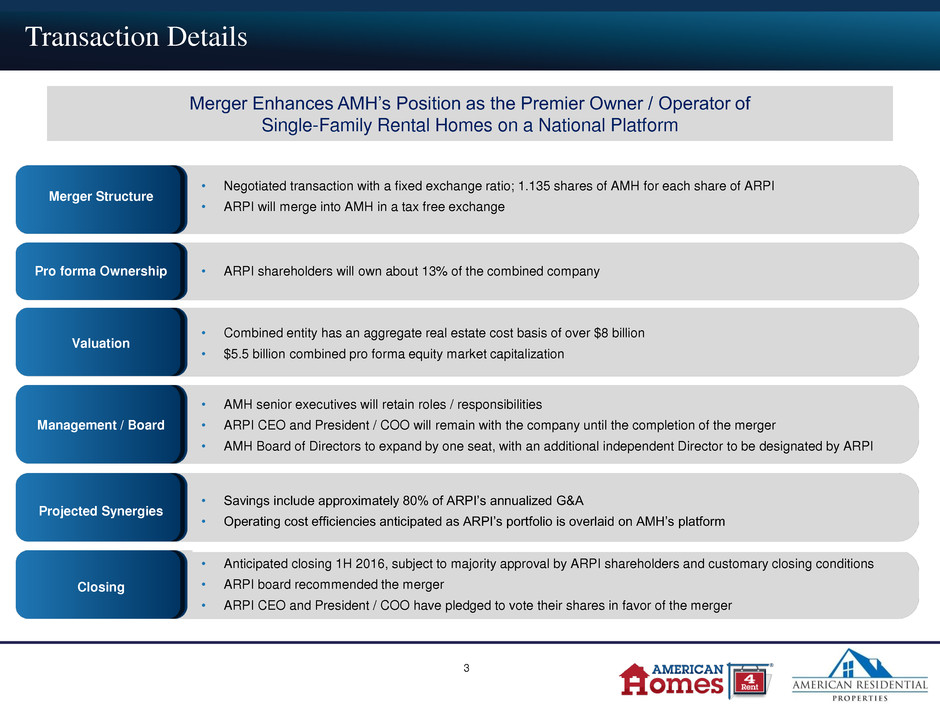

Transaction Details 3 Merger Enhances AMH’s Position as the Premier Owner / Operator of Single-Family Rental Homes on a National Platform Merger Structure • Negotiated transaction with a fixed exchange ratio; 1.135 shares of AMH for each share of ARPI • ARPI will merge into AMH in a tax free exchange Pro forma Ownership • ARPI shareholders will own about 13% of the combined company Valuation • Combined entity has an aggregate real estate cost basis of over $8 billion • $5.5 billion combined pro forma equity market capitalization Management / Board • AMH senior executives will retain roles / responsibilities • ARPI CEO and President / COO will remain with the company until the completion of the merger • AMH Board of Directors to expand by one seat, with an additional independent Director to be designated by ARPI Projected Synergies • Savings include approximately 80% of ARPI’s annualized G&A • Operating cost efficiencies anticipated as ARPI’s portfolio is overlaid on AMH’s platform Closing • Anticipated closing 1H 2016, subject to majority approval by ARPI shareholders and customary closing conditions • ARPI board recommended the merger • ARPI CEO and President / COO have pledged to vote their shares in favor of the merger

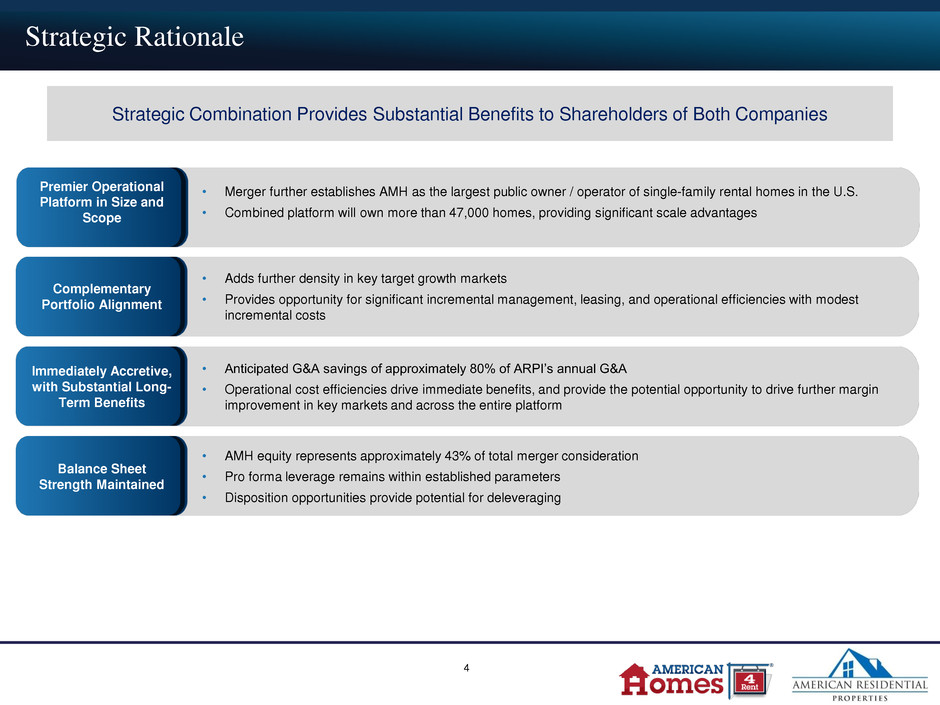

Strategic Rationale 4 Strategic Combination Provides Substantial Benefits to Shareholders of Both Companies Premier Operational Platform in Size and Scope • Merger further establishes AMH as the largest public owner / operator of single-family rental homes in the U.S. • Combined platform will own more than 47,000 homes, providing significant scale advantages Complementary Portfolio Alignment • Adds further density in key target growth markets • Provides opportunity for significant incremental management, leasing, and operational efficiencies with modest incremental costs Immediately Accretive, with Substantial Long- Term Benefits • Anticipated G&A savings of approximately 80% of ARPI’s annual G&A • Operational cost efficiencies drive immediate benefits, and provide the potential opportunity to drive further margin improvement in key markets and across the entire platform Balance Sheet Strength Maintained • AMH equity represents approximately 43% of total merger consideration • Pro forma leverage remains within established parameters • Disposition opportunities provide potential for deleveraging

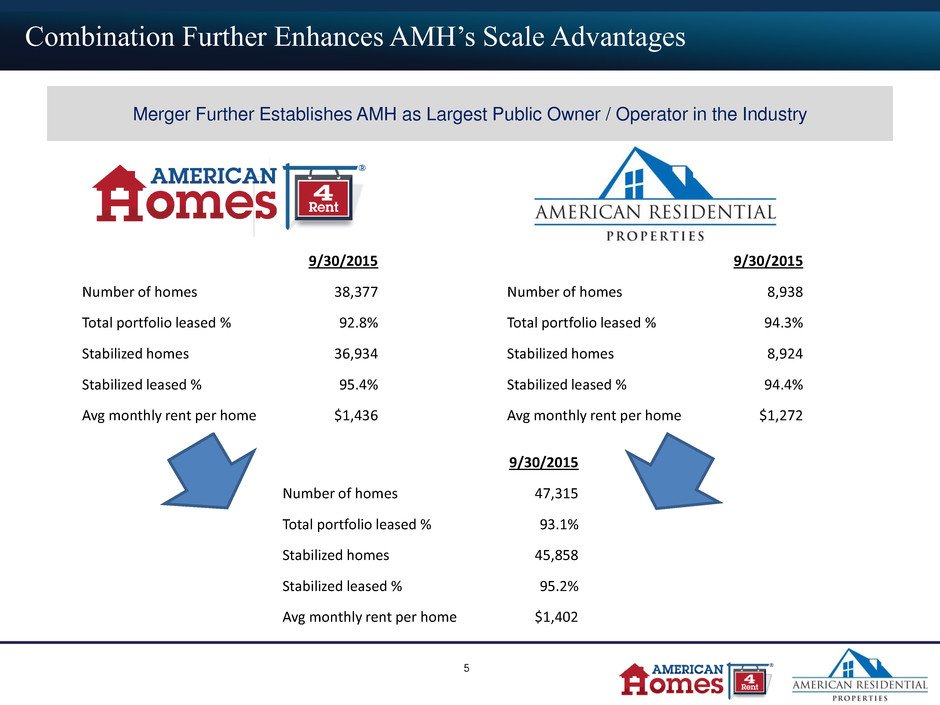

Combination Further Enhances AMH’s Scale Advantages 5 Merger Further Establishes AMH as Largest Public Owner / Operator in the Industry 9/30/2015 Number of homes 38,377 Total portfolio leased % 92.8% Stabilized homes 36,934 Stabilized leased % 95.4% Avg monthly rent per home $1,436 9/30/2015 Number of homes 8,938 Total portfolio leased % 94.3% Stabilized homes 8,924 Stabilized leased % 94.4% Avg monthly rent per home $1,272 9/30/2015 Number of homes 47,315 Total portfolio leased % 93.1% Stabilized homes 45,858 Stabilized leased % 95.2% Avg monthly rent per home $1,402

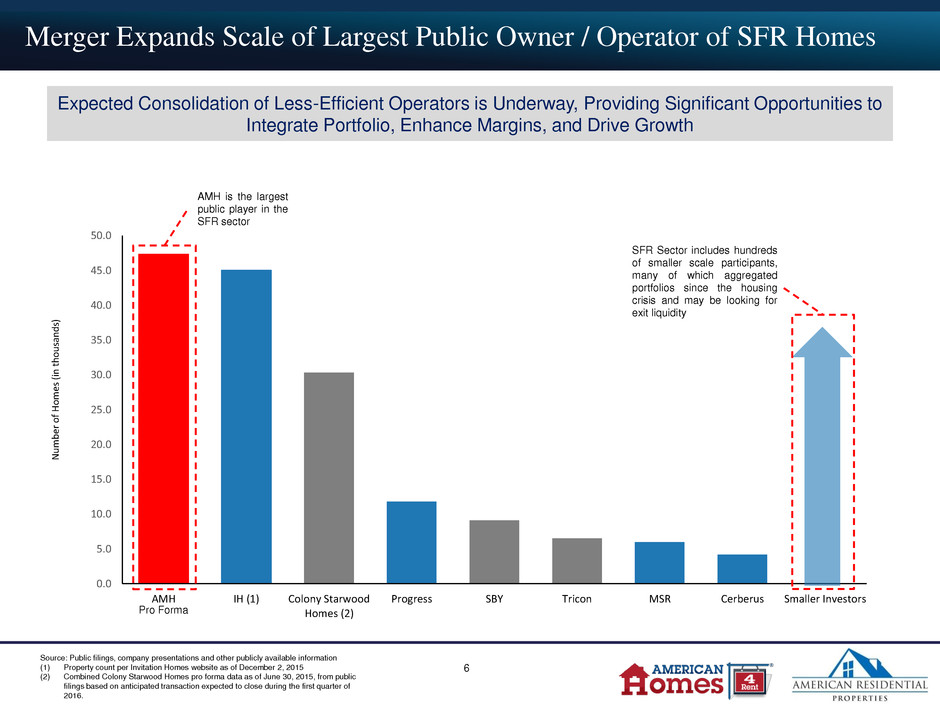

Merger Expands Scale of Largest Public Owner / Operator of SFR Homes Expected Consolidation of Less-Efficient Operators is Underway, Providing Significant Opportunities to Integrate Portfolio, Enhance Margins, and Drive Growth 6 Source: Public filings, company presentations and other publicly available information (1) Property count per Invitation Homes website as of December 2, 2015 (2) Combined Colony Starwood Homes pro forma data as of June 30, 2015, from public filings based on anticipated transaction expected to close during the first quarter of 2016. N u m b er o f H o m es ( in t h o u sa n d s) 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 45.0 50.0 AMH IH (1) Colony Starwood Homes (2) Progress SBY Tricon MSR Cerberus Smaller Investors AMH is the largest public player in the SFR sector SFR Sector includes hundreds of smaller scale participants, many of which aggregated portfolios since the housing crisis and may be looking for exit liquidity Pro Forma

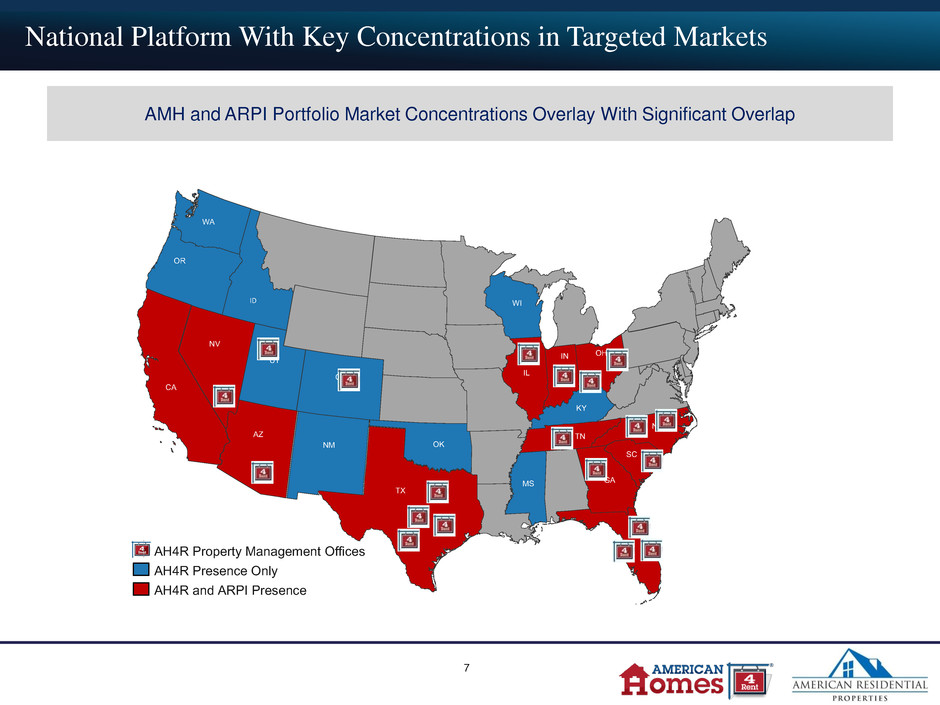

National Platform With Key Concentrations in Targeted Markets AMH and ARPI Portfolio Market Concentrations Overlay With Significant Overlap 7 SC TN WA OR CA NV UT CO AZ TX IL IN OH GA FL SC TN NC KY OK WI ID NM MS AH4R Property Management Offices AH4R Presence Only AH4R and ARPI Presence

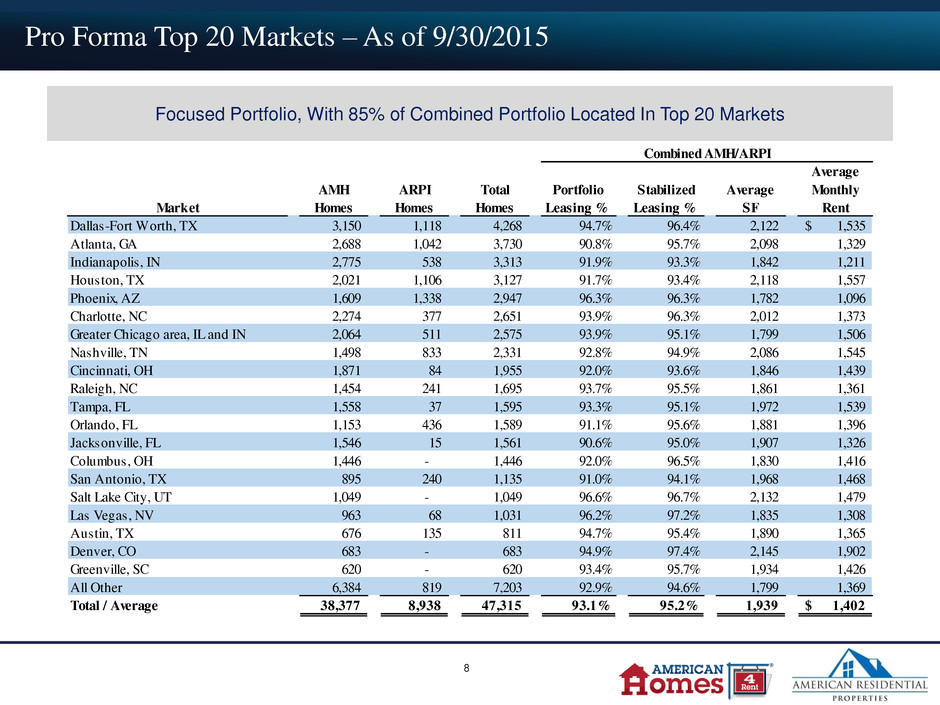

Focused Portfolio, With 85% of Combined Portfolio Located In Top 20 Markets Pro Forma Top 20 Markets – As of 9/30/2015 8 Market AMH Homes ARPI Homes Total Homes Portfolio Leasing % Stabilized Leasing % Average SF Average Monthly Rent Dallas-Fort Worth, TX 3,150 1,118 4,268 94.7% 96.4% 2,122 1,535$ Atlanta, GA 2,688 1,042 3,730 90.8% 95.7% 2,098 1,329 Indianapolis, IN 2,775 538 3,313 91.9% 93.3% 1,842 1,211 Houston, TX 2,021 1,106 3,127 91.7% 93.4% 2,118 1,557 Phoenix, AZ 1,609 1,338 2,947 96.3% 96.3% 1,782 1,096 Charlotte, NC 2,274 377 2,651 93.9% 96.3% 2,012 1,373 Greater Chicago area, IL and IN 2,064 511 2,575 93.9% 95.1% 1,799 1,506 Nashville, TN 1,498 833 2,331 92.8% 94.9% 2,086 1,545 Cincinnati, OH 1,871 84 1,955 92.0% 93.6% 1,846 1,439 Raleigh, NC 1,454 241 1,695 93.7% 95.5% 1,861 1,361 Tampa, FL 1,558 37 1,595 93.3% 95.1% 1,972 1,539 Orlando, FL 1,153 436 1,589 91.1% 95.6% 1,881 1,396 Jacksonville, FL 1,546 15 1,561 90.6% 95.0% 1,907 1,326 Columbus, OH 1,446 - 1,446 92.0% 96.5% 1,830 1,416 San Antonio, TX 895 240 1,135 91.0% 94.1% 1,968 1,468 Salt Lake City, UT 1,049 - 1,049 96.6% 96.7% 2,132 1,479 Las Vegas, NV 963 68 1,031 96.2% 97.2% 1,835 1,308 Austin, TX 676 135 811 94.7% 95.4% 1,890 1,365 Denver, CO 683 - 683 94.9% 97.4% 2,145 1,902 Greenville, SC 620 - 620 93.4% 95.7% 1,934 1,426 All Other 6,384 819 7,203 92.9% 94.6% 1,799 1,369 Total / Average 38,377 8,938 47,315 93.1% 95.2% 1,939 1,402$ Combined AMH/ARPI

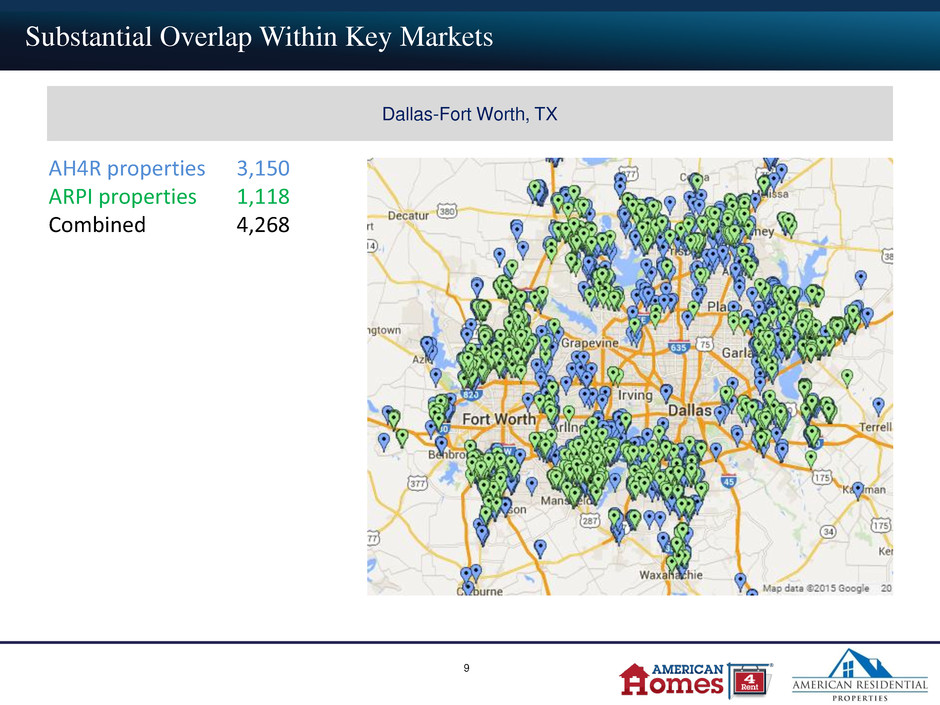

Dallas-Fort Worth, TX Substantial Overlap Within Key Markets 9 AH4R properties 3,150 ARPI properties 1,118 Combined 4,268

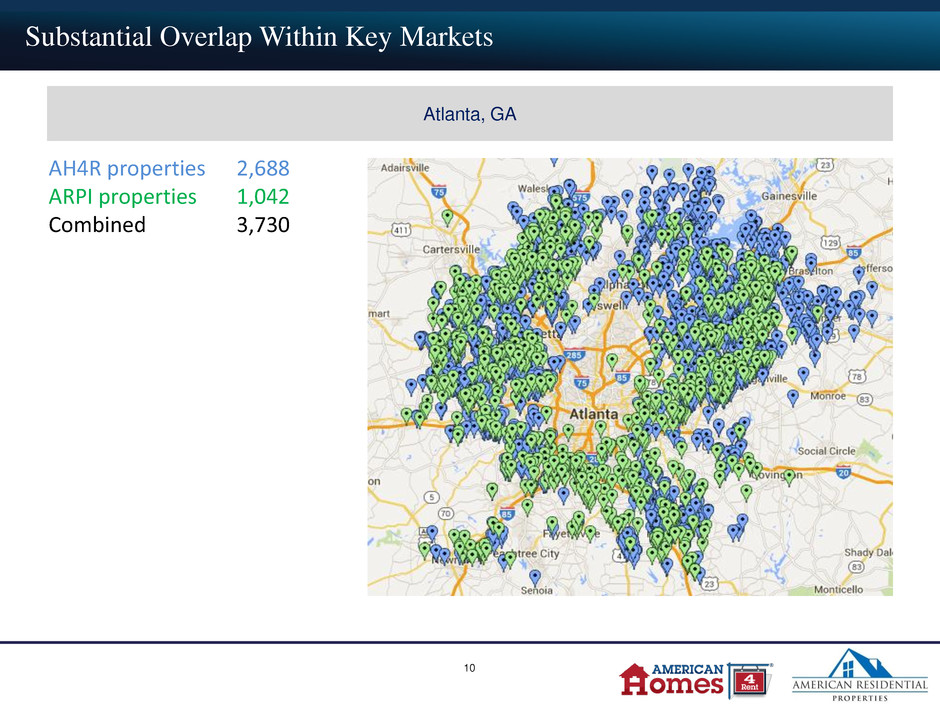

Atlanta, GA Substantial Overlap Within Key Markets 10 AH4R properties 2,688 ARPI properties 1,042 Combined 3,730

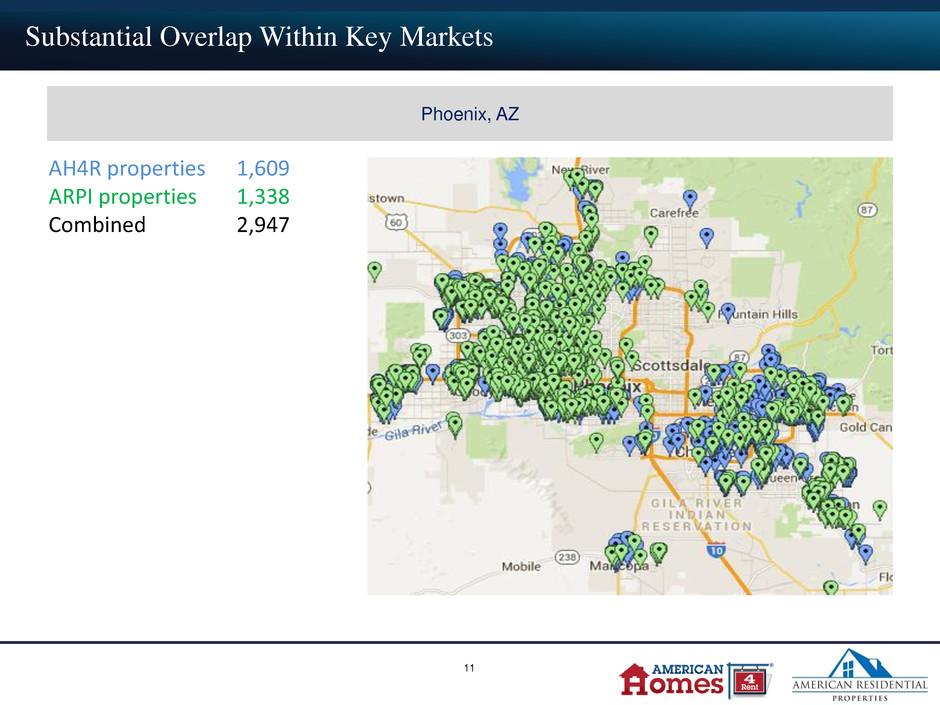

Phoenix, AZ Substantial Overlap Within Key Markets 11 AH4R properties 1,609 ARPI properties 1,338 Combined 2,947

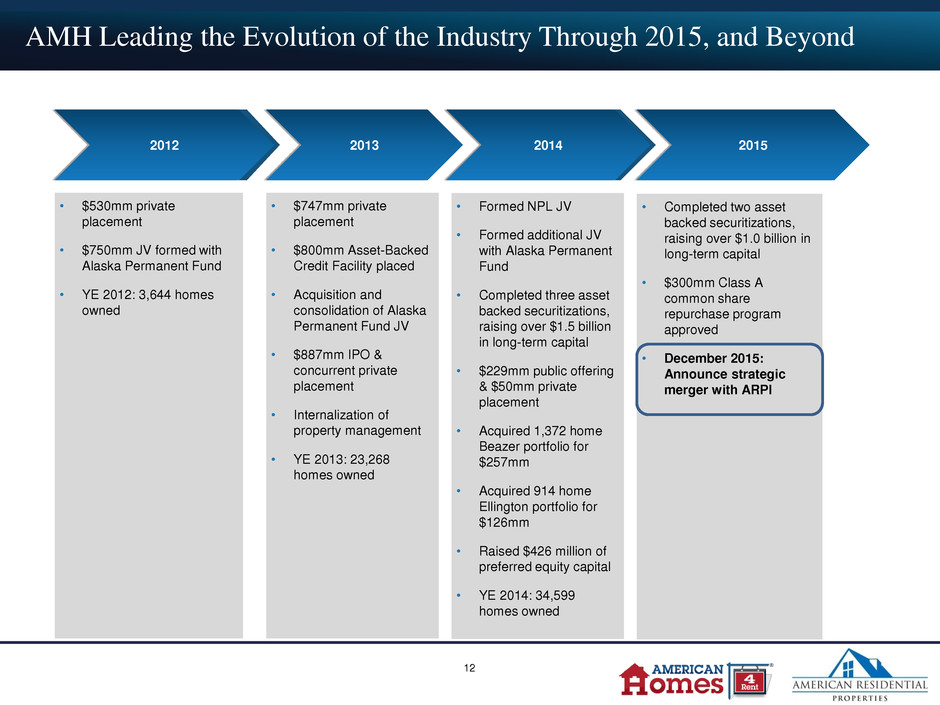

AMH Leading the Evolution of the Industry Through 2015, and Beyond 2012 2013 2014 2015 • $530mm private placement • $750mm JV formed with Alaska Permanent Fund • YE 2012: 3,644 homes owned • $747mm private placement • $800mm Asset-Backed Credit Facility placed • Acquisition and consolidation of Alaska Permanent Fund JV • $887mm IPO & concurrent private placement • Internalization of property management • YE 2013: 23,268 homes owned • Formed NPL JV • Formed additional JV with Alaska Permanent Fund • Completed three asset backed securitizations, raising over $1.5 billion in long-term capital • $229mm public offering & $50mm private placement • Acquired 1,372 home Beazer portfolio for $257mm • Acquired 914 home Ellington portfolio for $126mm • Raised $426 million of preferred equity capital • YE 2014: 34,599 homes owned • Completed two asset backed securitizations, raising over $1.0 billion in long-term capital • $300mm Class A common share repurchase program approved • December 2015: Announce strategic merger with ARPI 12

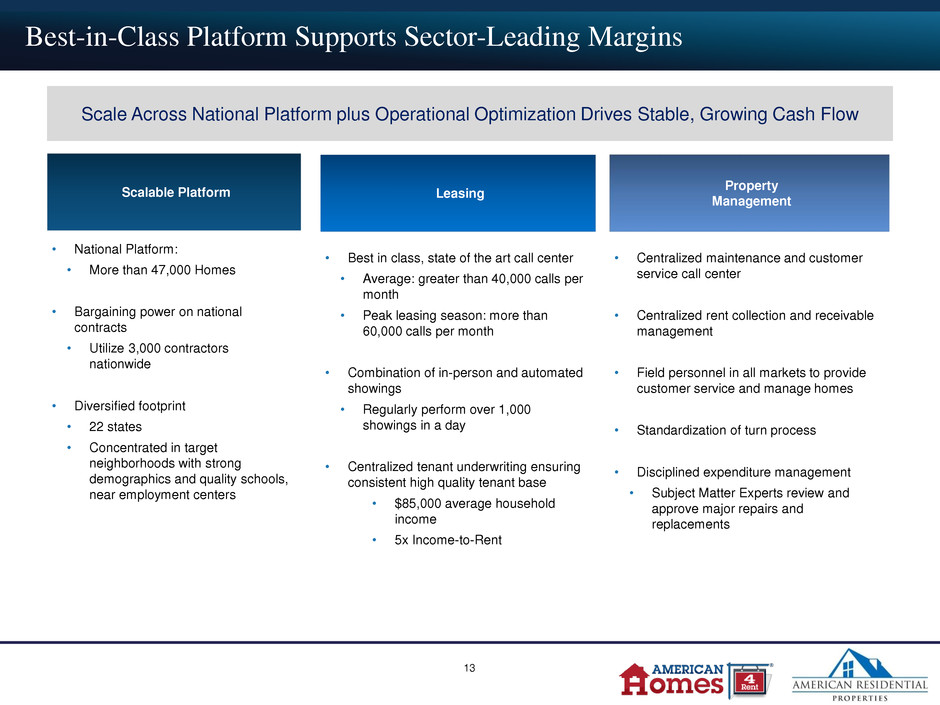

Best-in-Class Platform Supports Sector-Leading Margins Scalable Platform Leasing Property Management • National Platform: • More than 47,000 Homes • Bargaining power on national contracts • Utilize 3,000 contractors nationwide • Diversified footprint • 22 states • Concentrated in target neighborhoods with strong demographics and quality schools, near employment centers • Best in class, state of the art call center • Average: greater than 40,000 calls per month • Peak leasing season: more than 60,000 calls per month • Combination of in-person and automated showings • Regularly perform over 1,000 showings in a day • Centralized tenant underwriting ensuring consistent high quality tenant base • $85,000 average household income • 5x Income-to-Rent • Centralized maintenance and customer service call center • Centralized rent collection and receivable management • Field personnel in all markets to provide customer service and manage homes • Standardization of turn process • Disciplined expenditure management • Subject Matter Experts review and approve major repairs and replacements 13 Scale Across National Platform plus Operational Optimization Drives Stable, Growing Cash Flow

Strategic Rationale 14 Strategic Combination Provides Substantial Benefits to Shareholders of Both Companies Premier Operational Platform in Size and Scope • Merger further establishes AMH as the largest public owner / operator of single-family rental homes in the U.S. • Combined platform will own more than 47,000 homes, providing significant scale advantages Complementary Portfolio Alignment • Adds further density in key target growth markets • Provides opportunity for significant incremental management, leasing, and operational efficiencies with modest incremental costs Immediately Accretive, with Substantial Long- Term Benefits • Anticipated G&A savings of approximately 80% of ARPI’s annual G&A • Operational cost efficiencies drive immediate benefits, and provide the potential opportunity to drive further margin improvement in key markets and across the entire platform Balance Sheet Strength Maintained • AMH equity represents approximately 43% of total merger consideration • Pro forma leverage remains within established parameters • Disposition opportunities provide potential for deleveraging