UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q/A-2

[X] QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2015

Commission File No. 000-50032

OAKRIDGE GLOBAL ENERGY SOLUTIONS, INC.

(Exact name of Registrant as specified in its charter)

|

Colorado

|

94-3431032

|

|

(State or Other Jurisdiction of

|

(I.R.S. Employer Identification No.)

|

|

incorporation or organization)

|

|

3520 Dixie Highway NE

Palm Bay, FL 32905

(Address of Principal Executive Offices)

(321) 610-7959

(Registrant’s Telephone Number, including area code)

Not Applicable

(Former name, former address and former fiscal year,

if changed since last report)

Indicate by check mark whether the Registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

EXPLANATORY NOTE

The purpose of this Amendment No. 2 to the Company's Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2015, filed with the Securities and Exchange Commission on August 20, 2015 (the "Form 10-Q"), is to present the financial statements for the Quarter ended 6-30-2015 with Independent Reviewer’s Report. Further, this Amendment No. 2 removes the previously disclosed language under Item 4. Controls and Procedures Evaluation of Disclosure Controls and Procedures as the Company did not perform an assessment of internal control over financial reporting for the quarterly period ending June 30, 2015. This language is replaced with the following:

“The Company, through its principal executive and principal financial officers, or persons performing similar functions, reports that the Company’s disclosure controls and procedures as of June 30, 2015 were determined to be effective as of June 30, 2015.”

No other changes have been made to the Form 10-Q. This Amendment No. 2 to the Form 10-Q continues to speak as of the original filing date of the Form 10-Q, does not reflect events that may have occurred subsequent to the original filing date, and does not modify or update in any way disclosures made in the original Form 10-Q.

Items Amended in this Form 10-Q/A2

This Form 10-Q/A2 sets forth the Original Filing, in its entirety, as modified and superseded as necessary to reflect the removal of language disclosing an assessment of internal control over financial reporting. The following items in the Original Filing have been amended as a result of, and to reflect, the restatement:

PART I –FINANCIAL INFORMATION

Item 1. Financial Statements

RODNEY S.WHITE CPA,MBA

Accounting & Business Support Services

OAKRIDGE GLOBAL ENERGY SOLUTIONS, INC 3520 DIXIE HIGHWAY NE

PALM BAY, FL 32905

FINANCIAL STATEMENTS

FOR THE QUARTER ENDED JUNE 30, 2015 WITH

INDEPENDENT REVIEWER'S REPORT

AS REVIEWED BY:

RODNEY S. WHITE, EA, CPA, MBA (FINANCE) CERTIFIED PUBLIC ACCOUNTANT

4650 LIPSCOMB ST NE, SUITE 20 PALM BAY, FL 32905

November 20, 2015

|

4650 Lipscomb Street NE, Suite 20, Palm Bay, FL 32905

|

|

|

Office: (321) 728-9366

|

Fax: (321) 914-0842

|

| Email: rodwhitecpa@earthl ink.net | Web: rodneyswhitecpa. com |

RODNEY S.WHITE CPA,MBA

Accounting & Business Support Services

OAKRIDGE GLOBAL ENERGY SOLUTIONS, INC

FINANCIAL STATEMENTS

FOR QUARTER ENDED JUN3 30, 2015

TABLE OF CONTENTS

|

|

|

|

ACCOUNTANT'S REPORT

|

Section 1

|

|

NOTES TO FINANCIAL STATEMENTS

|

Section 2

|

|

FINANCIAL STATEMENTS REVIEWED

|

Section 3 |

| • CONDENSED CONSOLIDATED BALANCE SHEET AS OF 6/30/2015 | |

|

• CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS FOR QUARTER APRIL 1, 2015-JUNE 30, 2015

|

|

|

• CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS FOR QUARTER ENDED 6/30/2015

|

|

|

4650 Lipscomb Street NE, Suite 20, Palm Bay, FL 32905

|

|

|

Office: (321) 728-9366

|

Fax: (321) 914-0842

|

| Email: rodwhitecpa@earthl ink.net | Web: rodneyswhitecpa. com |

RODNEY S.WHITE CPA,MBA

Accounting & Business Support Services

Karen Jackson, CFO

Oakridge Global Energy Solutions, Inc.

3520 Dixie Highway NE

Palm Bay, FL 32905

Independent Accountant's Report

I have reviewed the accompanying Condensed Consolidated Balance Sheet, Condensed Consolidated Statement of Operations, and Condensed Consolidated Statement of Cash Flows of Oakridge Global Energy Solutions, Inc. as of June 30, 2015, and for the three-month and nine-month periods then ended. These interim financial statements are the responsibility of the company's management.

I conducted my review in accordance with standards established by the American Institute of Certified Public Accountants. A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with generally accepted auditing standards, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, I do not express such an opinion.

Based on my review, I am not aware of any material modifications that should be made to the accompanying interim financial statements for them to be in conformity with accounting principles generally accepted in the United States of America.

Rodney S. White, CPA

November 20, 2015

|

4650 Lipscomb Street NE, Suite 20, Palm Bay, FL 32905

|

|

|

Office: (321) 728-9366

|

Fax: (321) 914-0842

|

| Email: rodwhitecpa@earthl ink.net | Web: rodneyswhitecpa. com |

RODNEY S.WHITE CPA,MBA

Accounting & Business Support Services

Oakridge Global Energy Solutions, Inc.

Review Notes to

Condensed Consolidated Financial Statements

for Quarter Ended 6/30/2015

Note 1 - Basis of Presentation

Oakridge Global Energy Solution, Inc. is a provider of lithium ion batteries and energy storage related products. The accompanying Condensed Consolidated Financial Statements have been prepared by the Company pursuant to accounting principles generally accepted in the United States of America ("GAAP"). Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted in accordance with rules and regulations of the Securities and Exchange Commission (the "SEC"). The information furnished in the interim Condensed Consolidated Financial Statements includes normal recurring adjustments and reflects all adjustments, which, in the opinion of management, are necessary for a fair presentation of such financial statements:

In my opinion, these interim condensed consolidated financial statements include all adjustments necessary to present fairly, in all material respects, the financial position, results of operations and cash flows for all periods presented. The Company prepared these condensed consolidated financial statements in accordance with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X, using management estimates where necessary. The December 31, 2014 condensed consolidated balance sheet was derived from the audited consolidated year-end financial statements. The reader is advised to read this interim report in conjunction with the Annual Report on Form 10-K for the fiscal year ended December 31, 2014.

Note 2 - Significant Accounting Policies

The company uses the acquisition method of accounting for business combinations and recognizes assets acquired and liabilities assumed at their fair values on the date of the acquisition. While the company uses its best estimates and assumptions to value assets acquired and liabilities assumed, including contingent considerations, where applicable, such estimates are inherently uncertain and subject to refinement. As a result, during the measurement period, which may be up to one year from the acquisition date, the company may adjust the values of assets acquired and liabilities assumed with a corresponding offset to goodwill. Upon the conclusion of the measurement period, or final determination of the values of the assets acquired and liabilities assumed, any subsequent adjustments to values of such assets and liabilities are recognized in our consolidated statements of operations.

Note 3 - Fair Value Measurements

Pursuant to FASS 157 (as amended) the company determines the fair value of its assets and liabilities utilizing three levels of inputs, focusing on the most observable level of inputs when available.

Level 1 inputs use quoted prices in active markets which are unadjusted and accessible as of the measurement date for identical, unrestricted assets or liabilities.

|

4650 Lipscomb Street NE, Suite 20, Palm Bay, FL 32905

|

|

|

Office: (321) 728-9366

|

Fax: (321) 914-0842

|

| Email: rodwhitecpa@earthl ink.net | Web: rodneyswhitecpa. com |

Level 2 uses quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3 uses prices or valuations that require inputs that are unobservable and significant to the overall fair value measurement.

|

|

As of June 30, 2015, the company was in the process of verifying and determining the fair value on its acquired assets using these input levels.

|

Note 4 -Inventories

Inventories are summarized below. As of June 30, 2015, the company was in the process of verifying and determining the market value of inventories acquired in the bulk purchase of assets from Bren-Tronics Corporation. As of June 30, 2015, inventories are valued at $121,093.

Note 5 - Business Acquisition

There were no Business Acquisitions during this reporting period.

However, the acquisition of assets from Bren-Tronics has had a significant favorable financial impact on the company. Bren-Tronics assets were acquired in an Asset Purchase agreement on October 14, 2014 in the amount of $155,000 plus certain other expenses. The facility was shuttered and only a limited inventory was conducted.

|

|

As of June 30, 2015, the company felt that the actual value of capital equipment and inventories acquired had a market value far in excess of its acquisition costs.

|

|

|

As such, in accordance with fair value accounting as detailed above, as of June 30, 2015, the company is in the process of verifying and determining the value of assets.

|

Note 6 - New Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the FASB that are adopted by the Company as of the specified effective date. If not discussed, management believes that the impact of recently issued standards, which are not yet effective, will not have a material impact on the Company's consolidated financial statements upon adoption.

Note 7 - Going Concern

Oakridge Global Energy Solutions, Inc. continues to make progress on the business plan which results in increasing sales and profitable operations. During the process of implementing this plan Oakridge has incurred losses from operations. Oakridge has utilized operating capital raised through convertible debt from a shareholder and subscriptions from a related party to fund these operations and will continue to do so. If Oakridge were unable to generate profits from operations this would cause substantial doubt about the Company's ability to continue as a going concern. However, management has confidence in and continues to operate under the business plan which will result in profitable operations that ultimately eliminate these going concern issues.

Further, the company feels that it has a significant unrealized net gain on the Asset purchase agreement with Bren-Tronics. As stated above, as of June 30, 2015, the company was in the process of verifying and determining value of these assets, but felt that it will contribute to the overall ability of the company to continue as a going concern.

Note 7.a - Accounting Income vs Income Tax Income with regards to Research and Development (R&D) Expenses

Pursuant to GAAP, the company expenses R&D costs as incurred.

However, the US Internal Revenue Service (IRS) allows a choice in the treatment of Research and Development costs. Under IRS regulations, R&D expenses may either be deducted as current business expenses, amortized in equal amounts over 60 months or more, or written off in an optional 1O year period. Under the amortization approach, the amortization period begins the month that the taxpayer first receives an economic benefit from the research.

|

|

The company feels that the potential significant difference contributes to its ability to continue to operate as a going concern, and improves its overall financial position.

|

|

|

This review examined R&D expenses but did not determine if certain R&D could in fact be reclassified as work in progress or finished goods inventory which could help to reduce period costs. A further examination of specific costs included in R&D to make such a determination may be warranted.

|

Note 8 - Income Taxes

The Company accounts for income taxes under ASC 740-10-30. Deferred income tax assets and liabilities are determined based upon differences between the financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. Accounting standards require the consideration of a valuation allowance for deferred tax assets if it is "more likely than not" that some component or all of the benefits of deferred tax assets will not be realized.

The tax effects from an uncertain tax position can be recognized in the financial statements only if the position is more likely than not of being sustained if the position were to be challenged by a taxing authority. The Company has examined the tax positions taken in its tax returns and feels that there are no uncertain tax positions. As a result, the Company has recorded no uncertain tax liabilities in its condensed consolidated balance sheet as of 6/30/2015.

Income tax expense reflects the expense or benefit only on the Company's domestic taxable income. Income tax expense and benefit from the Company's foreign operations are not recognized as they have been fully reserved.

The company files as a "C" corporation pursuant to US tax law. Tax returns are current and filed as required.

Note 9 - Long-Term Debt

|

|

The only Oakridge debt is a $2,000,000 USO loan assigned to Expedia Holdings Limited, a Hong Kong organized company ("Expedia").

|

Note 10 - Net Income (Loss) Per Common Share

Basic net income (loss) per common share is based on the net income (loss) divided by the weighted average number of common shares outstanding during the period. Diluted earnings per share are computed using the weighted average number of common shares plus dilutive common share equivalents outstanding during the period using the treasury stock method. In the computation of diluted earnings per share, excess tax benefits that would be created upon the assumed vesting of unvested restricted shares or the assumed exercise of stock options (i.e., hypothetical excess tax benefits) are included in the assumed proceeds component of the treasury stock method to the extent that such excess tax benefits are more likely than not to be realized. When a loss from continuing operations exists, all potentially dilutive securities are anti-dilutive and are therefore excluded from the computation of diluted earnings per share. As the Company had losses for the three and nine month periods ended June 30, 2015, and 2014, the potentially dilutive shares were anti-dilutive and were thus not included in the net loss per share calculation.

Note 13 - Subsequent Events

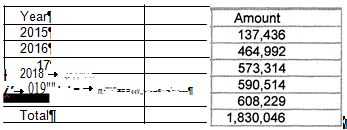

The Company entered into a Lease Agreement on July 23, 2015, with Tower Palm Bay, LLC. a Delaware limited liability company ("Tower Palm Bay"), whereby it leased certain land and a building comprising approximately 68,718 square feet situated on such land. The leased premises will become the corporate offices and small and large format cell manufacturing facility, producing battery products for electric vehicles, golf carts and electric task oriented vehicles. This lease commenced August 1, 2015, for a period of 184 months. The future minimum rental commitment under this lease is as follows:

Since the end of the quarter ended 6/30/2015, the company has changed its CFO and its legal firm, and completed its verification and determination of value for assets acquired in the Bren-Tronics Asset purchase. See financial statements and notes to the financial statements for the quarter ended 9/30/2015.

|

|

Also see Current Report on Form 8-K dated August 19, 2015, which was filed with the SEC on August 24, 2015, regarding the resignation of Mr. Mark L. Meriwether from his position as Vice President, Secretary and a director of the company

|

October 8, 2015 upon the resignation of Tami Tharp, Karen Jackson has been promoted to Chief Financial Officer. This internal promotion ensures continuity of all financial operations.

On November 9, 2015 the Registrant terminated the relationship with BOO USA, LLP ("BOO") of Orlando, Florida. On November 13, 2015 Registrant engaged the firm of Scrudato and Co., PA, Certified Public Accounting Firm, 7 Valley View Drive, Califon, New Jersey 07830.

Note 14 - Legal Matters and Indemnifications

The company does not report any legal matters or indemnifications.

RODNEY S.WHITE CPA,MBA

Accounting & Business Support Services

Oakridge Global Energy Solutions Inc.

Condensed Consolidated Balance Sheet

as of June 30, 2015

| Jun 30, 15 | ||||

| ASSETS | ||||

| Current Assets | ||||

| Checking/Savings | ||||

|

Cash and Equivalents

|

0 | |||

|

Total Checking/Savings

|

0 | |||

|

Other Current Assets

|

||||

|

Inventories

|

121,093 | |||

|

Investments

|

3,905 | |||

|

Prepaid Expenses

|

2,500 | |||

|

Total Other Current Assets

|

127,498 | |||

|

Total Current Assets

|

127,498 | |||

|

Fixed Assets

|

||||

|

Property & Equipment

|

864,883 | |||

|

Total Fixed Assets

|

864,883 | |||

|

Other Assets

|

||||

|

Deposits

|

96,847 | |||

|

Related Party Investment

|

45,315,435 | |||

|

Total Other Assets

|

45,412,282 | |||

|

. TOTAL ASSETS

|

46,404,662 | |||

See Accompanying Notes to Financial Statements

Page 1

|

4650 Lipscomb Street NE, Suite 20, Palm Bay, FL 32905

|

|

|

Office: (321) 728-9366

|

Fax: (321) 914-0842

|

| Email: rodwhitecpa@earthl ink.net | Web: rodneyswhitecpa. com |

RODNEY S.WHITE CPA,MBA

Accounting & Business Support Services

Oakridge Global Energy Solutions Inc.

Consolidated Condensed Statement of Operations

April through June 2015

|

|

Apr - Jun 15

|

|||

|

Ordinary Income/Expense

|

||||

|

Income

|

||||

|

Sales

|

1,110 | |||

|

Total Income

|

1,110 | |||

|

Cost of Goods Sold

|

736 | |||

|

Gross Profit

|

374 | |||

|

Expense

General Administrative Exps

|

10,408,974 | |||

|

Research & Development

|

5,091 | |||

|

Total Expense

|

10,414,065 | |||

|

Net Ordinary Income

|

-10,413,691 | |||

|

Other Income/Expense

|

||||

|

Other Expense

|

||||

|

lnterest Expense

|

29,918 | |||

|

Total Other Expense

|

29,918 | |||

|

Net Other Income

|

-29,918 | |||

|

Net Income

|

-10,443,609 | |||

See Accompanying Notes to Financial Statements

Page 1

|

4650 Lipscomb Street NE, Suite 20, Palm Bay, FL 32905

|

|

|

Office: (321) 728-9366

|

Fax: (321) 914-0842

|

| Email: rodwhitecpa@earthl ink.net | Web: rodneyswhitecpa. com |

RODNEY S.WHITE CPA,MBA

Accounting & Business Support Services

Oakridge Global Energy Solutions, Inc.

Condensed Consolidated Statement of Cash Flows

For Quarter Ended 6/30/2015

|

For Qtr. ended

6/30/2015

|

||||

|

Cash Flow from operating activities

|

||||

|

Net lncome/(loss)

|

$ | (11,180,010 | ) | |

|

Adjustment to reconcile net income/(loss)

|

||||

|

to net cash from operations:

|

||||

|

Depreciation and amortization

|

$ | 187,919 | ||

|

Stock Based Compensation

|

$ | 1,086,750 | ||

|

Stock options issued for services

|

$ | 7,404,250 | ||

|

(lncrease)/decrease in inventory

|

$ | 736 | ||

|

(lncrease)/decrease in security deposits

|

$ | (79,605 | ) | |

|

(lncrease)/decrease in accounts payable and accruals

|

$ | 353,241 | ||

| Net Cash from operating activities | $ | (2,226,719 | ) | |

| Cash flow from investing activities | ||||

| Related party investments | $ | 100,942 | ||

| Purchase of investments | $ | 75 | ||

| $ | 101,017 | |||

| Cash flow from financing activities | ||||

| Proceeds from issuance of ordinary shares | $ | 2,013,175 | ||

| Change in Additional Paid in Capital | $ | |||

| Net Cash from financing activities | $ | 2,013, 175 | ||

| Effect of foreign exchange rates on cash | $ | 93,435 | ||

| Net increase (decrease) in cash and cash equivalents | $ | (196,038 | ) | |

| Cash and Cash Equivalents, beginning of period | $ | 19,092 | ||

| Cash and Cash Equivalents, end of period | $ | |||

| Cash paid for taxes | $ | |||

| Cash paid for taxes | $ | |||

| Related party investment | $ | 40,262,935 | ||

See Accompanying Notes to Financial Statements

Page 1

|

4650 Lipscomb Street NE, Suite 20, Palm Bay, FL 32905

|

|

|

Office: (321) 728-9366

|

Fax: (321) 914-0842

|

| Email: rodwhitecpa@earthl ink.net | Web: rodneyswhitecpa. com |

PART II - OTHER INFORMATION

Item 4. Controls and Procedures.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this Quarterly Report to be signed on its behalf by the undersigned, thereunto duly authorized.

OAKRIDGE GLOBAL ENERGY SOLUTIONS, INC.

|

Date:

|

November 30, 2015

|

By:

|

/s/Stephen J. Barber

|

|

|

Stephen J. Barber

|

||||

|

Executive Chairman, CEO and a Director

|

Pursuant to the requirements of the Securities Exchange Act of 1934 this Quarterly Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

OAKRIDGE GLOBAL ENERGY SOLUTIONS, INC.

|

Novvember

|

||||

|

Date:

|

November 30, 2015

|

By:

|

/s/Stephen J. Barber

|

|

|

Stephen J. Barber

|

||||

|

Executive Chairman, CEO and a Director

|

|

Date:

|

November 30, 2015

|

By:

|

/s/Karen Jackson

|

|

|

Karen Jackson

|

||||

|

CFO

|