Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - PNMAC Holdings, Inc. | pfsi_8k.htm |

| EX-99.2 - PRESS RELEASE - PNMAC Holdings, Inc. | pfsi_8k-9902.htm |

Exhibit 99.1

J.P. Morgan FinTech and Specialty Finance Forum December 2015

Forward - Looking Statements 2 This presentation contains forward - looking statements within the meaning of Section 21 E of the Securities Exchange Act of 1934 , as amended, regarding management’s beliefs, estimates, projections and assumptions with respect to, among other things, the Company’s financial results, future operations, business plans and investment strategies, as well as industry and market conditions, all of which are subject to change . Words like “believe,” “expect,” “anticipate,” “promise,” “plan,” and other expressions or words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” are generally intended to identify forward - looking statements . Actual results and operations for any future period may vary materially from those projected herein, from past results discussed herein, or from illustrative examples provided herein . Factors which could cause actual results to differ materially from historical results or those anticipated include, but are not limited to : changes in federal, state and local laws and regulations applicable to the highly regulated industry in which we operate ; lawsuits or governmental actions if we do not comply with the laws and regulations applicable to our businesses ; the creation of the Consumer Financial Protection Bureau, or CFPB, and enforcement of its rules ; changes in existing U . S . government - sponsored entities, their current roles or their guarantees or guidelines ; changes to government mortgage modification programs ; the licensing and operational requirements of states and other jurisdictions applicable to our businesses, to which our bank competitors are not subject ; foreclosure delays and changes in foreclosure practices ; certain banking regulations that may limit our business activities ; changes in macroeconomic and U . S . residential real estate market conditions ; difficulties in growing loan production volume ; changes in prevailing interest rates ; increases in loan delinquencies and defaults ; our reliance on PennyMac Mortgage Investment Trust as a significant source of financing for, and revenue related to, our correspondent lending business and purchased mortgage servicing rights ; availability of required additional capital and liquidity to support business growth ; our obligation to indemnify third - party purchasers or repurchase loans that we originate, acquire or assist in with fulfillment ; our obligation to indemnify advised entities or investment funds to meet certain criteria or characteristics or under other circumstances ; decreases in the historical returns on the assets that we select and manage for our clients, and our resulting management and incentive fees ; regulation applicable to our investment management segment ; conflicts of interest in allocating our services and investment opportunities among ourselves and our advised entities ; the potential damage to our reputation and adverse impact to our business resulting from ongoing negative publicity ; and our rapid growth . You should not place undue reliance on any forward - looking statement and should consider all of the uncertainties and risks described above, as well as those more fully discussed in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time . The Company undertakes no obligation to publicly update or revise any forward - looking statements or any other information contained herein, and the statements made in this presentation are current as of the date of this presentation only .

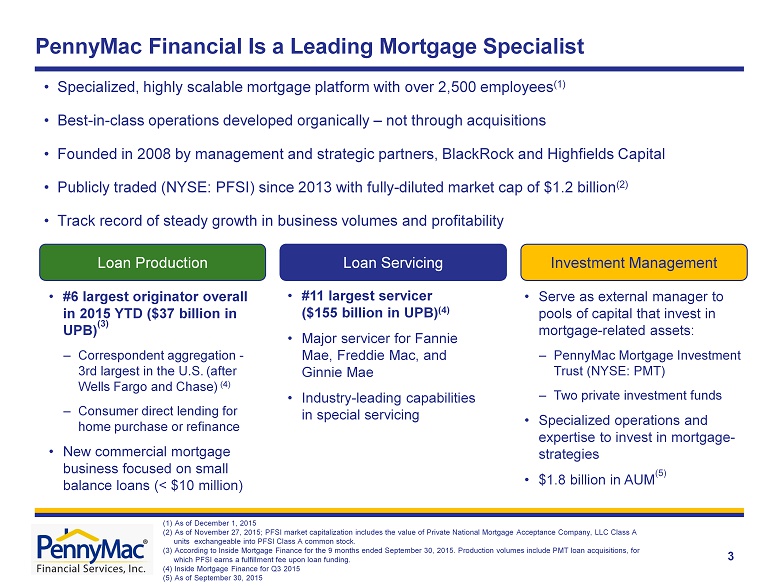

3 PennyMac Financial Is a Leading Mortgage Specialist • #6 largest originator overall in 2015 YTD ($37 billion in UPB) (3) – Correspondent aggregation - 3rd largest in the U.S. ( after Wells Fargo and Chase ) (4) – Consumer direct lending for home purchase or refinance • New commercial mortgage business focused on small balance loans (< $10 million) • Specialized, highly scalable mortgage platform with over 2,500 employees (1) • Best - in - class operations developed organically – not through acquisitions • Founded in 2008 by management and strategic partners, BlackRock and Highfields Capital • Publicly traded (NYSE: PFSI) since 2013 with fully - diluted market cap of $1.2 billion (2) • Track record of steady growth in business volumes and profitability • #11 largest servicer ($155 billion in UPB) (4) • Major servicer for Fannie Mae, Freddie Mac, and Ginnie Mae • Industry - leading capabilities in special servicing • Serve as external manager to pools of capital that invest in mortgage - related assets: – PennyMac Mortgage Investment Trust (NYSE: PMT) – Two private investment funds • Specialized operations and expertise to invest in mortgage - strategies • $1.8 billion in AUM (5) Loan Production Loan Servicing Investment Management (1) As of December 1, 2015 (2) As of November 27, 2015; PFSI market capitalization includes the value of Private National Mortgage Acceptance Company, LLC Class A units exchangeable into PFSI Class A common stock . (3) According to Inside Mortgage Finance for the 9 months ended September 30, 2015. Production volumes include PMT loan acquisitions, for which PFSI earns a fulfillment fee upon loan funding. (4) Inside Mortgage Finance for Q3 2015 (5) As of September 30, 2015

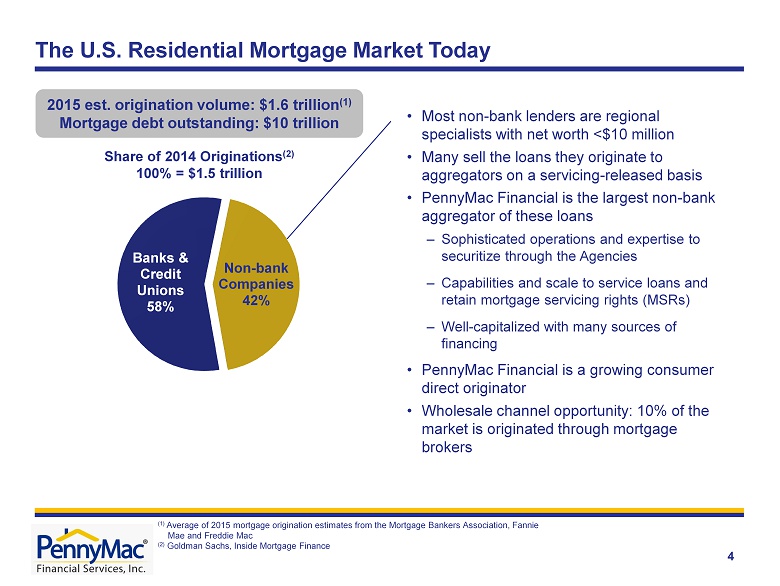

The U.S. Residential Mortgage Market Today 4 2015 est. origination volume: $1.6 trillion (1) Mortgage debt outstanding : $10 trillion • Most non - bank lenders are regional specialists with net worth <$10 million • Many sell the loans they originate to aggregators on a servicing - released basis • PennyMac Financial is the largest non - bank aggregator of these loans – Sophisticated operations and expertise to securitize through the Agencies – Capabilities and scale to service loans and retain mortgage servicing rights (MSRs) – Well - capitalized with many sources of financing • PennyMac Financial is a growing consumer direct originator • Wholesale channel opportunity: 10% of the market is originated through mortgage brokers (1) Average of 2015 mortgage origination estimates from the Mortgage Bankers Association, Fannie Mae and Freddie Mac (2) Goldman Sachs, Inside Mortgage Finance Share of 2014 Originations (2) 100% = $ 1.5 trillion Banks & Credit Unions 58% Non - bank Companies 42%

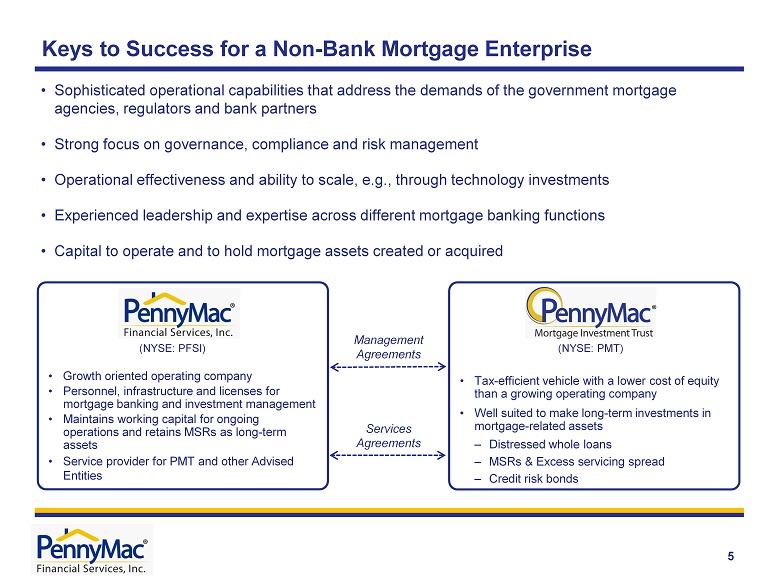

Keys to Success for a Non - Bank Mortgage Enterprise 5 • Growth oriented operating company • Personnel, infrastructure and licenses for mortgage banking and investment management • Maintains working capital for ongoing operations and retains MSRs as long - term assets • Service provider for PMT and other Advised Entities Management Agreements • Tax - efficient vehicle with a lower cost of equity than a growing operating company • Well suited to make long - term investments in mortgage - related assets – Distressed whole loans – MSRs & Excess servicing spread – Credit risk bonds (NYSE: PMT) Services Agreements (NYSE: PFSI) • Sophisticated operational capabilities that address the demands of the government mortgage agencies, regulators and bank partners • Strong focus on governance, compliance and risk management • Operational effectiveness and ability to scale, e.g., through technology investments • Experienced leadership and expertise across different mortgage banking functions • Capital to operate and to hold mortgage assets created or acquired

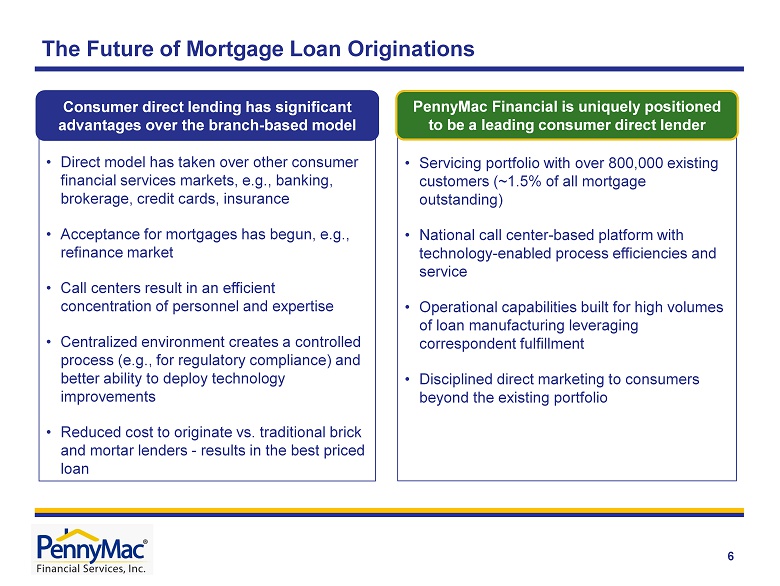

• Direct model has taken over other consumer financial services markets, e.g., banking, brokerage, credit cards, insurance • Acceptance for mortgages has begun, e.g., refinance market • Call centers result in an efficient concentration of personnel and expertise • Centralized environment creates a controlled process (e.g., for regulatory compliance) and better ability to deploy technology improvements • Reduced cost to originate vs. traditional brick and mortar lenders - results in the best priced loan • Servicing portfolio with over 800,000 existing customers (~1.5% of all mortgage outstanding) • National call center - based platform with technology - enabled process efficiencies and service • Operational capabilities built for high volumes of loan manufacturing leveraging correspondent fulfillment • Disciplined direct marketing to consumers beyond the existing portfolio 6 The Future of Mortgage Loan Originations Consumer direct lending has significant advantages over the branch - based model PennyMac Financial is uniquely positioned to be a leading consumer direct lender

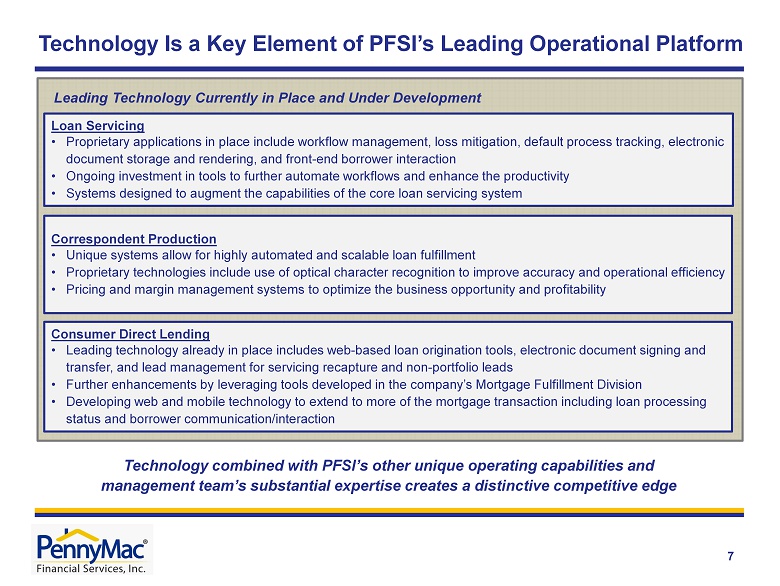

Technology Is a Key Element of PFSI’s Leading Operational Platform 7 Leading Technology Currently in Place and U nder Development Correspondent Production • Unique systems allow for highly automated and scalable loan fulfillment • Proprietary technologies include use of optical character recognition to improve accuracy and operational efficiency • Pricing and margin management systems to optimize the business opportunity and profitability Consumer Direct Lending • Leading technology already in place includes web - based loan origination tools, electronic document signing and transfer, and lead management for servicing recapture and non - portfolio leads • Further enhancements by leveraging tools developed in the company’s Mortgage Fulfillment Division • Developing web and mobile technology to extend to more of the mortgage transaction including loan processing status and borrower communication/interaction Loan Servicing • Proprietary applications in place include workflow management, loss mitigation, default process tracking, electronic document storage and rendering, and front - end borrower interaction • Ongoing investment in tools to further automate workflows and enhance the productivity • Systems designed to augment the capabilities of the core loan servicing system Technology combined with PFSI’s other unique operating capabilities and management team’s substantial expertise creates a distinctive competitive edge

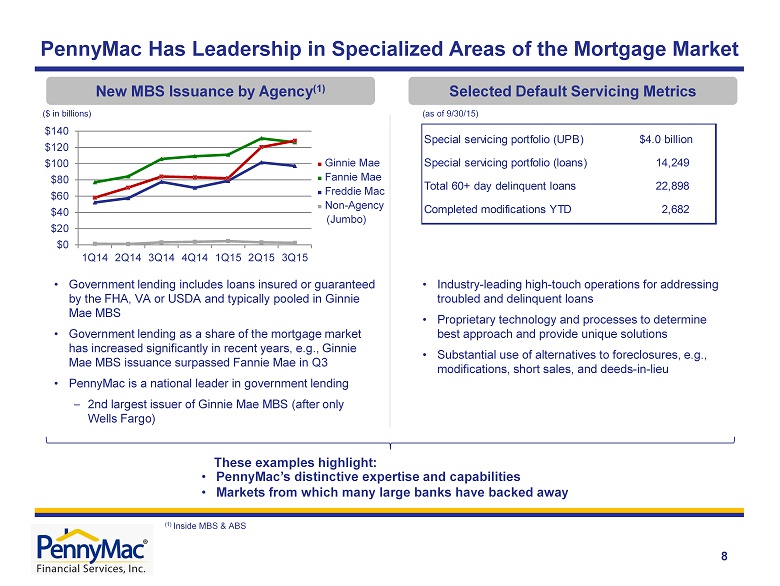

PennyMac Has Leadership in Specialized Areas of the Mortgage Market 8 New MBS Issuance by Agency (1) • Government lending includes loans insured or guaranteed by the FHA, VA or USDA and typically pooled in Ginnie Mae MBS • Government lending as a share of the mortgage market has increased significantly in recent years, e.g., Ginnie Mae MBS issuance surpassed Fannie Mae in Q3 • PennyMac is a national leader in government lending – 2nd largest issuer of Ginnie Mae MBS (after only Wells Fargo) $0 $20 $40 $60 $80 $100 $120 $140 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 ($ in billions) • Industry - leading high - touch operations for addressing troubled and delinquent loans • Proprietary technology and processes to determine best approach and provide unique solutions • Substantial use of alternatives to foreclosures, e.g., modifications, short sales, and deeds - in - lieu Selected Default Servicing Metrics (as of 9/30/15) • PennyMac’s distinctive expertise and capabilities • Markets from which many large banks have backed away These examples highlight: Ŷ Ginnie Mae Ŷ Fannie Mae Ŷ Freddie Mac Ŷ Non - Agency (Jumbo) Special servicing portfolio (UPB) $4.0 billion Special servicing portfolio (loans) 14,249 Total 60+ day delinquent loans 22,898 Completed modifications YTD 2,682 (1) Inside MBS & ABS

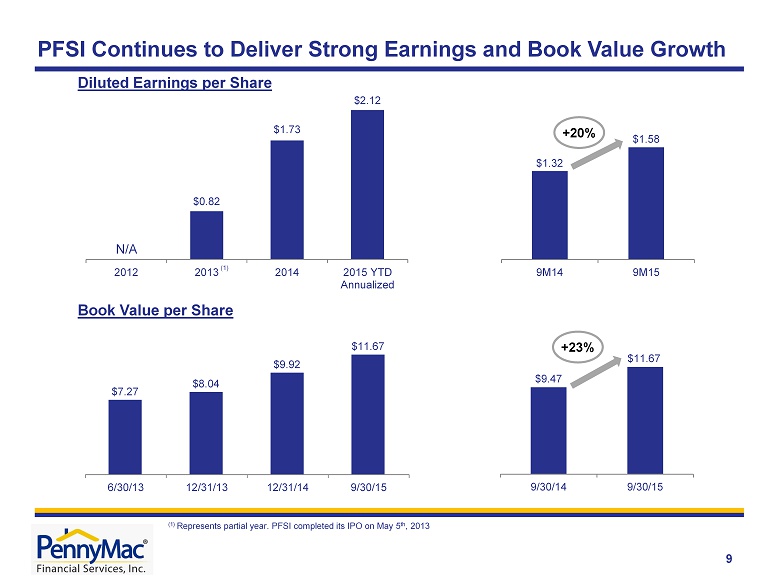

$9.47 $11.67 9/30/14 9/30/15 $1.32 $1.58 9M14 9M15 $0.82 $1.73 $2.12 2012 2013 2014 2015 YTD Annualized +23% +20% PFSI Continues to Deliver Strong Earnings and Book Value Growth Book Value per Share 9 Diluted Earnings per Share (1) Represents partial year. PFSI completed its IPO on May 5 th , 2013 (1) N/A $7.27 $8.04 $9.92 $11.67 6/30/13 12/31/13 12/31/14 9/30/15

J.P. Morgan FinTech and Specialty Finance Forum December 2015