Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GREEN DOT CORP | a2015-12x01form8xkinvestor.htm |

Investor Presentation December 2015

Disclosures About Non-GAAP Financial Measures During this presentation, references to financial measures of Green Dot Corporation will include references to non-GAAP financial measures. For an explanation to the most directly comparable GAAP financial measures, see the Appendix to these materials or the Supplemental Non- GAAP Financial Information available at Green Dot Corporation’s investor relations website at http://ir.greendot.com/ under “Financial Information.” Forward-Looking Statements This presentation contains forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include, among other things, statements regarding key initiatives planned for 2016, the outlook contained in management's commentary from the Q3 call and other future events that involve risks and uncertainties. Actual results may differ materially from those contained in the forward- looking statements contained in this presentation, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from those projected include, among other things, the impact of the Company’s supply chain management efforts on its revenue growth, the timing and impact of revenue growth activities and investments, the Company's dependence on revenues derived from Walmart and three other retail distributors, impact of competition, the Company's reliance on retail distributors for the promotion of its products and services, the rate of adoption or demand for the Company's new and existing products and services, continued and improving returns from the Company's investments in new growth initiatives, potential difficulties in integrating operations of acquired entities and acquired technologies, the Company's ability to operate in a highly regulated environment, our ability to obtain regulatory approval for new products, changes to existing laws or regulations affecting the Company's operating methods or economics, the Company's reliance on third-party vendors, changes in credit card association or other network rules or standards, changes in card association and debit network fees or products or interchange rates, instances of fraud developments in the prepaid financial services industry that impact prepaid debit card usage generally, business interruption or systems failure, and the Company's involvement litigation or investigations. These and other risks are discussed in greater detail in the Company's Securities and Exchange Commission filings, including its most recent annual report on Form 10-K and quarterly report on Form 10-Q, which are available on the Company's investor relations website at ir.greendot.com and on the SEC website at www.sec.gov. All information provided in this presentation is as of December 2, 2015, and the Company assumes no obligation to update this information as a result of future events or developments. 2

To provide a full range of affordable and accessible financial services to Our mission The Masses 3

A Deeply Entrenched Franchise Brand Mariah Carey Steve Harvey 4

Green Dot • We INVENTED THE GENERAL PURPOSE RELOADABLE PREPAID CARD industry in 1999 and today are the largest prepaid provider in the U.S. • We are a BANK HOLDING COMPANY regulated by the Board of Governors of the Federal Reserve and the State of Utah DFI • We are a TOP 20 DEBIT CARD ISSUER among all banks and credit unions in the country and A LEADER IN MOBILE BANKING with GoBank, Green Dot’s award winning mobile checking account • Our products are ACQUIRED BY MILLIONS of consumers annually through a TECH-ENABLED DISTRIBUTION NETWORK of approximately 100,000 retail locations, online and in the Apple and Android app stores • We are the LARGEST PROCESSOR OF TAX REFUNDS in the U.S. with more than ten million refunds processed annually • We are one of the LARGEST CONSUMER CASH PROCESSORS in the U.S. with more than 30 million retail cash deposit transactions processed annually 5 5

2012-Today Our Roadmap For Achieving Long Term Growth Ensure undisputed leadership in the industry we invented. Renew Walmart, diversify revenue, increase brand preference and consolidate the prepaid industry 2 Invest in new products and channels that set us up to compete & win in new growth macros outside of retail GPR Invest in the Platform To be enterprise scale, Agile, Modern, Scalable, Secure and Efficient so we can reduce opex, mitigate risk and innovate at-will Reward Investors Adopt a share repurchase program, grow revenue with higher margin products and control expenses Grow EPS Be #1 Forever The Best Products The Best Technology LONG-TERM STRATEGY KEEPING OUR EYES ON THE ROAD 6

A Detour on our Roadmap to Growth • In our private label business line, the new suite of prepaid products we launched in late 2013 did not perform as expected. (Reduced pricing didn’t deliver higher usage revenue to achieve net growth.) • In our processing business line in early 2015, we removed the MoneyPak reload product from stores until we could design and build new anti-fraud risk technologies in order to safely resume sales. Significant amount of revenue and adjusted EBITDA wiped out from these two discreet issues in 2014-2015. 7

Resuming the Roadmap to Growth Key Planned Initiatives for 2016 New Products: Prepaid MoneyPak 2.0 New Channels: GoBusiness checking account for the “on-demand” 1099 workforce GoBank and Green Dot Prepaid distribution with TPG tax partners Credit Companion Channel (through leading credit issuers) Operating Improvements: Green Dot Direct Retail Merchandising Transaction Processing Lending: Green Dot Money, a lending marketplace community Green Dot Bank Secured Credit Card (pending regulatory approval) 8

9 New Products & Initiatives

Targeted to Millennials, Fully Banked, Core Prepaid Users 10

Best Seller- New “checking account style” features 11

Secret until end of January 12

13

Green Dot Direct 14 Web, App Stores and Direct Mail

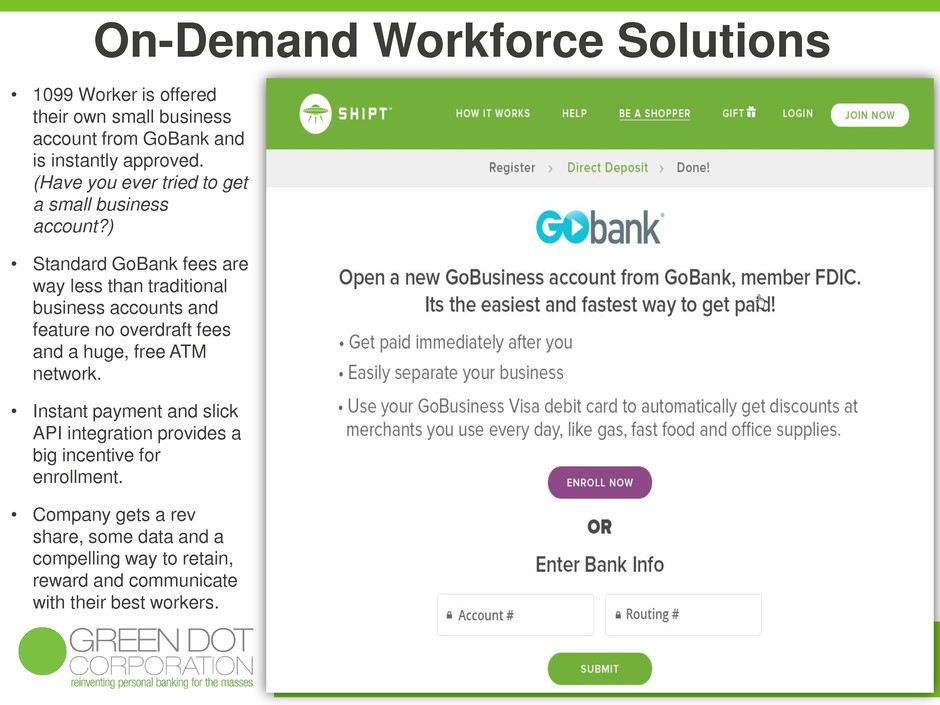

• 1099 Worker is offered their own small business account from GoBank and is instantly approved. (Have you ever tried to get a small business account?) • Standard GoBank fees are way less than traditional business accounts and feature no overdraft fees and a huge, free ATM network. • Instant payment and slick API integration provides a big incentive for enrollment. • Company gets a rev share, some data and a compelling way to retain, reward and communicate with their best workers. On-Demand Workforce Solutions 15

TPG Tax Partner Integrations 16

Credit Companion Channel • Integrated offer to help credit applicants get to a “yes.” • Declines get a pre-approved Green Dot prepaid card that, if kept in good standing for 12 months, can help the lender re-underwrite the applicant. – IE- “We weren’t able to approve you for the zyz credit card. But, we’re pleased to let you know you’re pre-approved for the Green Dot Bank prepaid card. If you use the card and keep it active in good standing for 12 months, we will re-evaluate your application at that time…” • Also offered as a debit card with the full credit card value proposition for certain affinity programs. – IE- “Apply today for the xyz Visa Card with loyalty rewards points. Whether its credit or debit, you’ll enjoy the same rewards.” – Debit is appealing to millennials and others who value the particular affinity’s reward program, but don’t want or need credit. 17

18

Green Dot Money 19 • In a typical month, Green Dot attracts more than 13 million phone inquiries,10 million online and mobile web visitors + millions more who see our ads and buy our products. • The proposed marketplace would play “matchmaker” to applicants on one side and approved lenders on the other, with Green Dot playing the role of “community gatekeeper.” • A “Yes” will be presented to the applicant for acceptance. A “No” may be offered a pre-approved Green Dot Bank Secured Credit Card. (pending regulatory approval) • Green Dot Money would provide value added services to both sides: – To the lender (marketing, risk management, basic automated loan servicing, basic compliance payment processing, appended underwriting data) – To the consumer (vets lenders, hosts complaint & resolution forum, provides credit education, shops for the “best yes.”) • Matchmaking fees/CPA paid by the lender average between 10%-15% for an average size loan of $1500 amortized over a 12 month term, based on data provided by discussions with potential participating marketplace lenders. Mission: To find a “yes” in a sea of “no’s” for America’s LMI consumers A lending marketplace community

Green Dot Bank Secured Card • Customer applies online through numerous Green Dot controlled channels and card is sent in the mail. • Customer opens account and makes a security deposit of at least $200 at any Green Dot retailer, or as a transfer from their bank account to start using the card. • Initial credit line is equal to the security deposit. • If the customer pays in good standing for a period of time, the credit line is increased gradually, becoming a largely unsecured credit card over an extended period of time. • Revenue is earned primarily from an annual fee and interest on outstanding balances. • Monthly bill can be paid online or in cash at any Green Dot retailer • Incentive is provided for auto-draft from a Green Dot Bank deposit account. (pending regulatory approval) 20

Capital Allocation • Ongoing commitment to our share repurchase program. ($150m authorization; $40m used thus far) • Keeping an eye out for accretive acquisitions that are strategic to our growth roadmap. 21

On our touchpoints, customer applies for a loan Funded loans generate deposit account sales Declined loans generate Secured Card sales Customers with loans retain longer, reload more cash and generate better RPU Open More Deposit Accounts Reloads at retail Visits us online Applies at Green Dot Money Puts loan on green dot account Applies for a Secured Card Better experience Better RPU Acquisitions Green Dot Powers Green Dot All distribution channels bring customers Customers reload cash at our retail stores Customers visit our touchpoints for service Acquisitions fuel the wheel 22

Commentary from the Q3 Call • We believe legacy declines have stabilized. • We won’t lap YoY legacy declines until 2H 2016. • As such, we expect to enter 2016 with an approximate 5% headwind that we will need to overcome to be flat YoY. • New initiatives planned for 2016 give us confidence we can achieve the needed grow-over, but there is always risk because large portfolios take time to turn-around and the prospects for new products are inherently uncertain. Incremental Commentary: • We won’t formally guide 2016 until the Q4 call, which we will schedule for late in February so we can guide with the benefit of as much data as possible on new product performance. 23