Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Macquarie Leasing Pty Ltd | d77664d8k.htm |

Exhibit 99.1

ANZ ANNUAL REPORT 2015

|

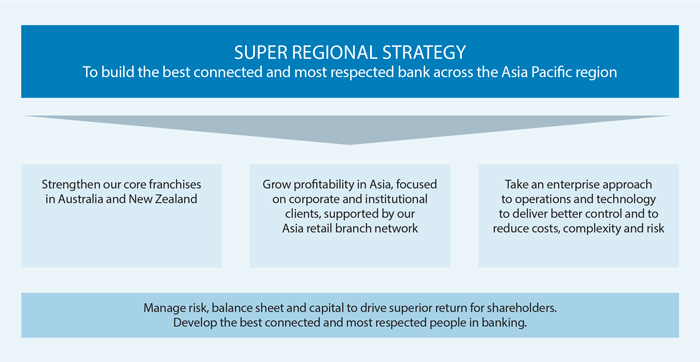

WHO WE ARE AND HOW WE OPERATE

ANZ’s history of expansion and growth stretches over 180 years. We have a strong franchise in Retail, Commercial and Institutional banking in our home markets of Australia and New Zealand and we have been operating in Asia Pacific for more than 30 years.

Today, ANZ operates in 34 countries globally. We are the fourth largest bank in Australia, the largest banking group in New Zealand and the Pacific, and among the top 20 banks in the world.

|

| 1 | Asia Pacific, Europe and America (APEA) network revenue includes income generated in Australia and New Zealand as a result of referral from ANZ’s APEA network. |

ANNUAL REPORT 2015 1

ANZ ANNUAL REPORT 2015

FINANCIAL HIGHLIGHTS

| 2015 | 2014 | |||||||

| Profitability |

||||||||

| Profit attributable to shareholders of the Company ($m) |

7,493 | 7,271 | ||||||

| Cash profit ($m)1 |

7,216 | 7,117 | ||||||

| Return on: |

||||||||

| Average ordinary shareholders’ equity2 |

14.5% | 15.8% | ||||||

| Average ordinary shareholders’ equity (cash basis)1,2 |

14.0% | 15.4% | ||||||

| Average assets |

0.88% | 0.97% | ||||||

| Net interest margin |

2.04% | 2.13% | ||||||

| Cash profit per average FTE ($)1 |

141,621 | 142,064 | ||||||

| Efficiency |

||||||||

| Operating expenses to operating income |

44.4% | 43.7% | ||||||

| Operating expenses to average assets |

1.10% | 1.17% | ||||||

| Operating expenses to operating income (cash basis)1 |

45.6% | 44.7% | ||||||

| Operating expenses to average assets (cash basis)1 |

1.10% | 1.17% | ||||||

| Balance Sheet |

||||||||

| Gross loans and advances ($b)3 |

574.3 | 525.7 | ||||||

| Customer deposits ($b) |

444.6 | 403.7 | ||||||

| Total equity ($b) |

57.4 | 49.3 | ||||||

| Gross impaired assets ($b) |

2.7 | 2.9 | ||||||

| Capital and Liquidity |

||||||||

| Common Equity Tier 1 – APRA Basel 3 |

9.6% | 8.8% | ||||||

| Common Equity Tier 1 – Internationally Comparable Basel 34 |

13.2% | 12.5% | ||||||

| Liquidity Coverage Ratio |

122% | 111% | ||||||

| Credit impairment provisioning |

||||||||

| Individual credit impairment charge ($m) |

1,084 | 1,141 | ||||||

| Collective credit impairment charge/(release) ($m) |

95 | (155) | ||||||

| Total credit impairment charge ($m) |

1,179 | 986 | ||||||

| Individual credit impairment charge as a % of average gross loans and advances |

0.19% | 0.22% | ||||||

| Total credit impairment charge as a % of average gross loans and advances |

0.21% | 0.19% | ||||||

| Ordinary share dividends |

||||||||

| Interim – 100% franked (cents) |

86 | 83 | ||||||

| Final – 100% franked (cents) |

95 | 95 | ||||||

| Total dividend (cents) |

181 | 178 | ||||||

| Ordinary share dividend payout ratio5 |

68.6% | 67.4% | ||||||

| Cash ordinary share dividend payout ratio1,5 |

71.2% | 68.9% | ||||||

| Preference share dividend ($m) |

||||||||

| Dividend paid6 |

1 | 6 | ||||||

| 1 | Statutory profit has been adjusted to exclude non-core items to arrive at cash profit, and has been provided to assist readers to understand the results for the ongoing business activities of the Group. The adjustments made in arriving at cash profit are included in statutory profit which is subject to audit within the context of the Group statutory audit opinion. Cash profit is not audited by the external auditor, however the external auditor has informed the Audit Committee that the adjustments have been determined on a consistent basis across each year. Refer to page 18 and pages 184 to 185 for analysis of the adjustments between statutory profit and cash profit. |

| 2 | Average ordinary shareholders’ equity excludes non-controlling interests and preference shares. |

| 3 | Loans and advances as at 30 September 2015 include assets classified as held for sale. |

| 4 | ANZ’s interpretation of the regulations documented in the Basel Committee publications; “Basel 3: A global regulatory framework for more resilient banks and banking systems” (June 2011) and “International Convergence of Capital Measurement and Capital Standards” (June 2006). Also includes differences identified in APRA’s information paper entitled International Capital Comparison Study (13 July 2015). |

| 5 | Dividend payout ratio is calculated using the proposed 2015 final, 2015 interim, 2014 final and 2014 interim dividends. |

| 6 | Represents dividends paid on Euro Trust Securities (preference shares) issued on 13 December 2004. The Euro Trust Securities were bought back by ANZ for cash at face value and cancelled on 15 December 2014. |

FINANCIAL HIGHLIGHTS 5

CHAIRMAN’S REPORT

A MESSAGE FROM DAVID GONSKI, AC

I am pleased to report that ANZ’s statutory profit after tax for the 2015 financial year was $7.5 billion, up 3%. The cash profit (which excludes non-core items from the statutory profit) was $7.2 billion, up 1%.

| 6 |

ANZ ANNUAL REPORT 2015

CHIEF EXECUTIVE OFFICER’S REPORT

A MESSAGE FROM MICHAEL SMITH, OBE

ANZ produced another record result in 2015. In a constrained environment, we continued to see growth in our customer franchises in Australia, in New Zealand and in key Asian markets.

| CHAIRMAN’S REPORT AND CHIEF EXECUTIVE OFFICER’S REPORT 7 |

DIRECTORS’ REPORT

The directors present their report together with the financial statements of the consolidated entity (the Group), being Australia and New Zealand Banking Group Limited (the Company) and its controlled entities, for the year ended 30 September 2015 and the independent auditor’s report thereon. The information is provided in conformity with the Corporations Act 2001.

| 8 |

ANZ ANNUAL REPORT 2015

Directors’ Qualifications, Experience and Special Responsibilities

At the date of this report, the Board comprises seven Non-Executive Directors and one Executive Director, the Chief Executive Officer. The names of the Directors, together with details of their qualifications, experience and special responsibilities are set out below.

MR D M GONSKI, AC, Chairman, Independent Non-Executive Director and Chair of the Governance Committee

| DIRECTORS’ REPORT 9 |

DIRECTORS’ REPORT (continued)

MR M R P SMITH, OBE, Chief Executive Officer and Executive Director

MS I R ATLAS Independent Non-Executive Director

MS P J DWYER Independent Non-Executive Director and Chair of the Audit Committee

| 10 |

ANZ ANNUAL REPORT 2015

MR LEE HSIEN YANG Independent Non-Executive Director and Chair of the Technology Committee

MR G R LIEBELT Independent Non-Executive Director and Chair of the Human Resources Committee

MR I J MACFARLANE, AC, Independent Non-Executive Director and Chair of the Risk Committee

| DIRECTORS’ REPORT 11 |

DIRECTORS’ REPORT (continued)

MR J T MACFARLANE Independent Non-Executive Director

Directors’ attendance at Board and Committee meetings

Details of the number of Board and Board Committee meetings held during the year and Directors’ attendance at those meetings are set out below.

| Board | Risk Committee |

Audit Committee |

Human Resources Committee |

Governance Committee |

Technology Committee1 |

Executive Committee |

Committee of the Board2 |

Shares Committee2 | ||||||||||||||||||||||||||||

|

A

|

B | A | B | A | B | A | B | A | B | A | B | A | B | A | B | A | B | |||||||||||||||||||

|

I R Atlas3 |

11 | 11 | 4 | 4 | 4 | 4 | 3 | 3 | 1 | 1 | ||||||||||||||||||||||||||

|

P J Dwyer |

11 | 11 | 8 | 8 | 6 | 6 | 6 | 6 | 4 | 4 | 1 | 1 | ||||||||||||||||||||||||

|

D M Gonski |

11 | 11 | 8 | 8 | 6 | 5 | 6 | 6 | 4 | 4 | 1 | 1 | 8 | 8 | 2 | 2 | ||||||||||||||||||||

|

Lee Hsien Yang |

11 | 11 | 8 | 8 | 6 | 6 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||

|

G R Liebelt |

11 | 11 | 8 | 8 | 6 | 6 | 4 | 4 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||

|

I J Macfarlane |

11 | 11 | 8 | 8 | 6 | 6 | 4 | 4 | 1 | 1 | ||||||||||||||||||||||||||

|

J T Macfarlane |

11 | 11 | 8 | 8 | 6 | 6 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||

|

M R P Smith |

11

|

11

|

8

|

8

|

1

|

1

| ||||||||||||||||||||||||||||||

Column A – Indicates the number of meetings the Director was eligible to attend.

Column B – Indicates the number of meetings attended. The Chairman is an ex-officio member of the Audit, Governance, Human Resources, Risk and Technology Committees.

With respect to Committee meetings, the table above records attendance of Committee members. Any Director is entitled to attend these meetings and from time to time Directors attend meetings of Committees of which they are not a member.

| 1 | During 2014/15, a root and branch review of the Technology Committee was undertaken with respect to its role, objectives and performance. The Committee did not meet while the review was underway. |

| 2 | The meetings of the Shares Committee and Committee of the Board as referred to in the table above include those conducted by written resolution. |

| 3 | Ms I R Atlas was appointed to the Board on 24 September 2014 and was a member of the Audit Committee, Human Resources Committee and Governance Committee from 1 January 2015. |

Corporate Governance Statement

ANZ is committed to maintaining high standards of Corporate Governance. ANZ confirms it has followed the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations (3rd edition) during the 2015 financial year. ANZ’s Corporate Governance Statement, together with the ASX Appendix 4G which relates to the Corporate Governance Statement, can be viewed at: http://shareholder.anz.com/our-company/corporate-governance, and has been lodged with the ASX.

12

ANZ ANNUAL REPORT 2015

| DIRECTORS’ REPORT 13 |

DIRECTORS’ REPORT (continued)

| 14 |

ANZ ANNUAL REPORT 2015

DIRECTORS’ REPORT (continued)

OPERATING AND FINANCIAL REVIEW

DIRECTORS’ REPORT 15

DIRECTORS’ REPORT (continued)

THE GROUP’S STRATEGIC PRIORITIES AND OUTLOOK1

| 1 | Statutory profit has been adjusted to exclude non-core items to arrive at cash profit, and has been provided to assist readers to understand the results for the ongoing business activities of the Group. The adjustments made in arriving at cash profit are included in statutory profit which is subject to audit within the context of the Group statutory audit opinion. Cash profit is not audited by the external auditor, however the external auditor has informed the Audit Committee that the adjustments have been determined on a consistent basis across each year. Refer to page 18 and pages 184 to 185 for analysis of the adjustments between statutory profit and cash profit. The Operating and Financial Review is reported on a cash basis unless otherwise noted. |

16

ANZ ANNUAL REPORT 2015

DIRECTORS’ REPORT 17

DIRECTORS’ REPORT (continued)

Results of the operations of the Group

| 2015 | 2014 | |||||||||||

| Income Statement | $m | $m | Movt | |||||||||

| Net interest income |

14,616 | 13,810 | 6% | |||||||||

| Other operating income |

6,455 | 6,244 | 3% | |||||||||

| Operating income |

21,071 | 20,054 | 5% | |||||||||

| Operating expenses |

(9,359 | ) | (8,760 | ) | 7% | |||||||

| Profit before credit impairment and income tax |

11,712 | 11,294 | 4% | |||||||||

| Credit impairment charge |

(1,179 | ) | (986 | ) | 20% | |||||||

| Profit before income tax |

10,533 | 10,308 | 2% | |||||||||

| Income tax expense and non-controlling interests |

(3,040 | ) | (3,037 | ) | 0% | |||||||

| Profit attributable to shareholders of the Company |

7,493 | 7,271 | 3% | |||||||||

Non-IFRS information

The Group provides an additional measure of performance which is prepared on a basis other than in accordance with the accounting standards – cash profit. The guidance provided in ASIC Regulatory Guide 230 has been followed when presenting this information.

Cash Profit

Statutory profit has been adjusted to exclude non-core items to arrive at cash profit, and has been provided to assist readers to understand the results for the ongoing business activities of the Group. The adjustments made in arriving at cash profit are included in statutory profit which is subject to audit within the context of the Group statutory audit opinion. Cash profit is not subject to audit by the external auditor, however the external auditor has informed the Audit Committee that the adjustments have been determined on a consistent basis across each year.

| 2015 | 2014 | |||||||||||

| $m | $m | Movt | ||||||||||

| Statutory profit attributable to shareholders of the Company |

7,493 | 7,271 | 3% | |||||||||

| Adjustments between statutory profit and cash profit |

(277 | ) | (154 | ) | 80% | |||||||

| Cash profit |

7,216 | 7,117 | 1% | |||||||||

| Adjustments between statutory profit and cash profit ($m) | 2015 | 2014 | Movt | |||||||||

| Treasury shares adjustment |

(16 | ) | 24 | large | ||||||||

| Revaluation of policy liabilities |

(73 | ) | (26 | ) | large | |||||||

| Economic hedging |

(179 | ) | (72 | ) | large | |||||||

| Revenue and net investment hedges |

(3 | ) | (101 | ) | -97% | |||||||

| Structured credit intermediation trades |

(6 | ) | 21 | large | ||||||||

| Total adjustments between statutory profit and cash profit |

(277 | ) | (154 | ) | 80% | |||||||

Refer pages 184 to 185 for analysis of the adjustments between statutory profit and cash profit.

| Non-financial key performance metrics1 | 2015 | 2014 | ||||||

| Employee engagement |

76% | 73% | ||||||

| Customer satisfaction |

||||||||

| – Australia (retail customer satisfaction)2 |

82.1% | 82.6% | ||||||

| – New Zealand (retail customer satisfaction)3 |

89.0% | 85.0% | ||||||

| IIB (Institutional Relationship strength index ranking)4 |

||||||||

| – APEA |

1 | 1 | ||||||

| – New Zealand |

1 | 1 | ||||||

| Women in management5 |

40.4% | 39.2% | ||||||

| 1 | The Group uses a number of non-financial measures to assess performance. These metrics form part of the balanced scorecard used to measure performance in relation to the Group’s main incentive programs. Discussion of the non-financial performance metrics is included within the Remuneration report on pages 43 to 44 of this Directors’ report. |

| 2 | Source: Roy Morgan Research. Base: ANZ Main Financial Institution Customers, aged 14+, based on six months to September for each year. |

| 3 | Camorra Research Retail Market Monitor (2015). The Nielson Company Consumer Finance Monitor (2012) excludes National Bank brand. Base: ANZ main bank customers aged 15+, rolling 6 months moving average to September. Based on responses of excellent, very good and good. |

| 4 | Source: Peter Lee Associates Large Corporate and Institutional Relationship Banking surveys, Australia and New Zealand 2015. |

| 5 | Includes all employees regardless of leave status but not contractors (which are included in FTE). |

18

ANZ ANNUAL REPORT 2015

The following analysis of the business performance is on a cash basis.

| 2015 | 2014 | |||||||||||

| Income Statement | $m | $m | Movt | |||||||||

| Net interest income |

14,616 | 13,797 | 6% | |||||||||

| Other operating income |

5,902 | 5,781 | 2% | |||||||||

| Operating income |

20,518 | 19,578 | 5% | |||||||||

| Operating expenses |

(9,359 | ) | (8,760 | ) | 7% | |||||||

| Profit before credit impairment and income tax |

11,159 | 10,818 | 3% | |||||||||

| Credit impairment charge |

(1,205 | ) | (989 | ) | 22% | |||||||

| Profit before income tax |

9,954 | 9,829 | 1% | |||||||||

| Income tax expense and non-controlling interests |

(2,738 | ) | (2,712 | ) | 1% | |||||||

| Cash profit |

7,216 | 7,117 | 1% | |||||||||

| Financial performance metrics | 2015 | 2014 | Movt | |||||||||

| Return on average ordinary shareholders’ equity1 |

14.0% | 15.4% | -140 bps | |||||||||

| Return on average assets |

0.85% | 0.95% | -10 bps | |||||||||

| Net Interest Income | 2015 | 2014 | Movt | |||||||||

| Net interest income ($m) |

14,616 | 13,797 | 6% | |||||||||

| Net interest margin (%) |

2.04% | 2.13% | -9 bps | |||||||||

| Average interest earnings assets ($m) |

718,147 | 646,997 | 11% | |||||||||

| Average deposits and other borrowings |

559,779 | 507,856 | 10% | |||||||||

| 1 | Average ordinary shareholders’ equity excludes non-controlling interests and preference shares. |

Net interest income increased $819 million (6%) with 11% growth in average interest earning assets, partly offset by a 9 basis point decrease in net interest margin. $276 million (2%) of the increase in net interest income was due to foreign currency translation. The $71.2 billion increase in average interest earning assets was due to foreign currency translation of $20.9 billion, loan growth of $26.7 billion in home loans and commercial lending, and $24.7 billion growth in Global Markets driven by the Group liquidity portfolio and cash reserves. The decrease in net interest margin was due to asset competition, lower earnings on capital and higher liquid asset holdings, partly offset by favourable deposit pricing.

Average interest earning assets (+$71.2 billion or +11%)

| } | International and Institutional Banking (+$44.5 billion or +17%): excluding foreign currency translation, growth was $25.1 billion or +9%. $24.7 billion of this increase was in Global Markets driven by a $17.0 billion increase in the Group liquidity portfolio in response to regulatory requirements, a $3.8 billion increase in reverse repos and a $2.2 billion increase in collateral paid against derivative liabilities. Lending in Global Loans increased by $4.2 billion. Global Trade volumes contracted by $4.6 billion due to the impact of lower commodity prices. |

| } | Australia (+$19.9 billion or +7%): driven by growth in home loans where market share continued to increase. |

| } | New Zealand (+$6.3 billion or +7%): excluding foreign currency translation, growth was $5.1 billion or +6% driven by market share gains in Retail, as well as Commercial loan growth. |

| } | Global Wealth and Group Centre (+$0.5 billion or 4%): broadly unchanged over the year. |

Average deposits and other borrowings (+$51.9 billion or +10%)

| } | International and Institutional Banking (+$25.6 billion or +12%): excluding foreign currency translation, deposits and other borrowings increased $5.7 billion or +2% driven by $6.7 billion growth in customer deposits in Transaction Banking, particularly in Asia, partially offset by a reduction of $1.8 billion in certificates of deposits. |

| } | Australia (+$7.3 billion or +5%): driven by growth in customer deposits within Retail and Commercial. |

| } | New Zealand (+$7.3 billion or +13%): excluding foreign currency translation, growth was $6.5 billion or +12% due to increased customer deposits across Retail and Commercial, particularly in Retail savings products. |

| } | Global Wealth and Group Centre (+$11.7 billion or 16%): growth mainly in Treasury repo borrowings. |

DIRECTORS’ REPORT 19

DIRECTORS’ REPORT (continued)

| Other Operating Income |

2015 $m |

20141 $m |

Movt | |||||||||

| Fee and commission income2 |

2,448 | 2,364 | 4% | |||||||||

| Foreign exchange earnings2 |

79 | 96 | -18% | |||||||||

| Net income from funds management and insurance |

1,425 | 1,283 | 11% | |||||||||

| Share of associates’ profit2 |

625 | 510 | 23% | |||||||||

| Global Markets other operating income |

1,185 | 1,285 | -8% | |||||||||

| Other2,3 |

140 | 243 | -42% | |||||||||

| Cash other operating income |

5,902 | 5,781 | 2% | |||||||||

| 1 | Comparative amounts have changed. Refer to note 45 for details. |

| 2 | Excluding Global Markets. |

| 3 | Other income includes a $125 million gain on sale of ANZ Trustees in July 2014 and a $21 million loss arising on sale of Saigon Securities Inc (SSI) in September 2014. |

Other operating income increased $121 million (2%) with $212 million (4%) due to foreign currency translation. Adjusting for this, other operating income decreased by $91 million (- 2%). The decrease was due to a reduction in Global Markets’ other operating income of $218 million and the one-off $125m gain on sale of Trustees in second half 2014, partially offset by a $124 million increase in net funds management and insurance income, a $64m increase in share of associates’ profit and $42m increased fee income in IIB from volume growth.

| } | Fee income increased by $84 million (4%) with $65 million positive impact due to foreign currency translation, increased fee income of $42 million in IIB from Retail Asia Pacific and Transaction Banking volume growth, partially offset by the divestment of the ANZ Trustees business in July 2014. |

| } | Net foreign exchange income decreased by $17 million. Adjusting for $12 million positive impact of foreign currency translation, the $29 million decrease was largely as a result of higher realised losses on foreign currency hedges ($61 million), these offset translation gains elsewhere in the Group, and higher unrealised gains on foreign currency balances held in IIB ($19 million). |

| } | Net income from funds management and insurance increased $142 million with $18 million positive impact of foreign currency translation, and $107 million increase in Global Wealth income due to increased funds under management and in-force premiums, as well as growth in insurance income due to improved lapse experience and a large one-off loss in 2014 due to the exit of a Group life insurance plan. |

| } | Share of associates’ profit increased by $115 million with foreign currency translation driving an increase of $51 million and the remaining increase due to: |

| – | Shanghai Rural Commercial Bank increased $53 million due to lending growth and the impairment of an investment held by SRCB in 2014. |

| – | Bank of Tianjin increased $45 million due to asset growth. |

| – | AMMB Holdings Berhad decreased $22 million mainly due to net interest margin contraction from a change in lending mix, and the divestment of its insurance business in September 2014. |

| – | P.T. Bank Pan Indonesia decreased $13 million mainly due to lower earnings and a $10 million loan recovery in 2014. |

| } | Global Markets other operating income decreased by $100 million. Adjusting for the positive impact of foreign currency translation ($118 million), income decreased by $218 million mainly driven by widening credit spreads on balance sheet trading positions and Asian and European bond holdings. |

| } | Other income decreased by $103 million. Adjusting for a $39 million positive foreign currency translation, the decrease of $142 million was mainly due to the $125 million gain on sale of ANZ Trustees recognised in 2014. |

20

ANZ ANNUAL REPORT 2015

| Operating Expenses | 2015 $m |

2014 $m |

Movt | |||||||

| Personnel expenses |

5,479 | 5,088 | 8% | |||||||

| Premises expenses |

922 | 888 | 4% | |||||||

| Technology expenses |

1,462 | 1,266 | 15% | |||||||

| Restructuring expenses |

31 | 113 | -73% | |||||||

| Other expenses |

1,465 | 1,405 | 4% | |||||||

| Total cash operating expenses |

9,359 | 8,760 | 7% | |||||||

| Key performance metrics |

||||||||||

| Operating expenses to operating income |

45.6% | 44.7% | 90 bps | |||||||

| Full time equivalent staff (FTE)1 |

50,152 | 50,328 | 0% | |||||||

The Group’s operating expenses increased $599 million (7%) with $324 million (4%) due to foreign currency translation. Key factors included:

| } | Personnel expenses increased $391 million (8%), with $214 million (4%) due to foreign exchange translation and $177 million (3%) driven by annual salary increases and related costs. |

| } | Premises expenses increased $34 million (4%), with $29 million (3%) driven by foreign exchange translation and $5 million (1%) due to the impact of rent increases linked to CPI. |

| } | Technology expenses increased $196 million (15%), with $30 million (1%) due to foreign exchange translation and $166 million (13%) due to increased depreciation and amortisation on key infrastructure projects, higher data storage and software license costs and the increased use of outsourced and managed services. |

| } | Restructuring expenses decreased $82 million (-73%), with $2 million (2%) due to foreign exchange translation and $80 million (71%) from decreased restructuring costs across all Divisions. |

| } | Other expenses increased $60 million (4%), with $49 million (3%) due to foreign exchange translation and $11 million (1%) from higher spend related to compliance and regulatory remediation activities, partly offset by GST recoveries and the write-down of intangible assets in Global Wealth in 2014. |

| Credit impairment charge | 2015 $m |

2014 $m |

Movt | |||||||

| Individual credit impairment charge |

1,110 | 1,144 | -3% | |||||||

| Collective credit impairment charge/(release) |

95 | (155 | ) | large | ||||||

| Total credit impairment charge to income statement |

1,205 | 989 | 22% | |||||||

Total credit impairment charges increased $216 million (22%) due to a $250 million increase in collective credit impairment charges, offset by a $34 million (3%) decrease in individual impairment charges. The $95 million collective charge for the year reflects lending growth in Australia, credit downgrades of a few IIB customers, partially offset by associated economic cycle releases. This compares to a $155 million release in 2014 resulting from non-recurring provision releases and credit upgrades in IIB and New Zealand, and net decreases in the economic cycle overlay.

DIRECTORS’ REPORT 21

DIRECTORS’ REPORT (continued)

FINANCIAL POSITION OF THE GROUP

| Summary Balance Sheet | 2015 $b |

2014 $b |

Movt | |||||||||

| Assets |

||||||||||||

| Cash/Settlement balances owed to ANZ/Collateral paid |

82.5 | 58.3 | 42% | |||||||||

| Trading and available-for-sale assets |

92.7 | 80.6 | 15% | |||||||||

| Derivative financial instruments |

85.6 | 56.4 | 52% | |||||||||

| Net loans and advances |

570.2 | 521.8 | 9% | |||||||||

| Investments backing policy liabilities |

34.8 | 33.6 | 4% | |||||||||

| Other |

24.1 | 21.4 | 13% | |||||||||

| Total Assets |

889.9 | 772.1 | 15% | |||||||||

| Liabilities |

||||||||||||

| Settlement balances owed by ANZ/Collateral received |

19.1 | 15.7 | 22% | |||||||||

| Deposits and other borrowings |

570.8 | 510.1 | 12% | |||||||||

| Derivative financial instruments |

81.3 | 52.9 | 54% | |||||||||

| Debt issuances |

93.7 | 80.1 | 17% | |||||||||

| Policy liabilities/external unit holder liabilities |

38.7 | 37.7 | 3% | |||||||||

| Other |

28.9 | 26.3 | 10% | |||||||||

| Total Liabilities |

832.5 | 722.8 | 15% | |||||||||

| Total Equity |

57.4 | 49.3 | 16% | |||||||||

The Group’s balance sheet continued to strengthen during 2015 with stronger capital ratios, an increased liquidity portfolio, and lower gross impaired assets.

| } | Cash, settlement balances and collateral paid increased by $24 billion, with $7 billion due to foreign exchange translation. The remaining increase was primarily driven by increased short term deposits with the US Federal Reserve and Bank of England, following the introduction of Basel 3 liquidity risk standards in Australia on 1 January 2015, and higher collateral paid on derivative liabilities with collateralised counterparties. |

| } | Trading and available-for-sale assets increased $12 billion, with $5 billion due to foreign exchange translation. The increase was primarily driven by growth in the size of the Liquidity portfolio influenced by new liquidity requirements. |

| } | Derivative financial instruments increased on higher customer demand for interest rate hedging products in light of low interest rates, along with increased customer demand for foreign exchange spot and forward products driven by volatility in the Asia market. Net derivative financial instruments increased by $1 billion primarily driven by movements in foreign exchange and interest rates, along with the impact of foreign exchange translation. |

| } | Net loans and advances increased $48 billion, with $19 billion due to foreign exchange rate translation, $26 billion growth in Australia division on home loan and non-housing term loans, a $7 billion increase in New Zealand home loans and non-housing term loans and a $3 billion decrease driven by Global Transaction Banking. |

| } | Deposits and other borrowings increased $60 billion, with $32 billion due to foreign exchange rate translation impacts, $31 billion increase in interest bearing deposits, $17 billion growth in Group Treasury certificates of deposit and commercial paper, and a $17 billion decrease in term deposits composed of $10 billion decrease in IIB and $8 billion decrease in Australia division partially offset by $1 billion increase in New Zealand. |

| } | Total equity increased $8 billion primarily due to $7.5 billion of profits generated over the year, $3 billion from an institutional placement and retail share purchase plan, and other comprehensive income of $2 billion, offset by the payment (net of reinvestment) of the 2014 final and 2015 interim dividends of $4 billion. |

| Credit Provisioning | 2015 | 2014 | Movt | |||||||||

| Gross impaired assets ($m) |

2,719 | 2,889 | -6% | |||||||||

| Credit risk weighted assets ($b) |

349.8 | 308.9 | 13% | |||||||||

| Total provision for credit impairment ($m) |

4,017 | 3,933 | 2% | |||||||||

| Individual provision as % of gross impaired assets |

39.0% | 40.7% | 170 bps | |||||||||

| Collective provision as % of credit risk weighted assets |

0.85% | 0.89% | 4 bps | |||||||||

Gross impaired assets decreased $170 million (6%) primarily driven by the continued workout of the impaired asset portfolio. The Group has an individual provision coverage ratio on impaired assets of 39.0% at 30 September 2015, down from 40.7% at September 2014.

22

ANZ ANNUAL REPORT 2015

The collective provision as a percentage of credit risk-weighted assets was 0.85% as at 30 September 2015, down from 89 bps from 30 September 2014, continuing to provide sound credit provision coverage.

| Liquidity and Funding | 2015 | 2014 | Movt | |||||||||

| Total liquid assets ($b) |

184.5 | 149.6 | 23% | |||||||||

| Liquidity Coverage Ratio (LCR) |

122% | 111% | 10% | |||||||||

The Group holds a portfolio of high quality unencumbered liquid assets in order to protect the Group’s liquidity position in a severely stressed environment, as well as to meet regulatory requirements. High quality liquid assets comprise three categories, with the definitions consistent with Basel 3 LCR:

| } | Highest-quality liquid assets (HQLA1): Cash, highest credit quality government, central bank or public sector securities eligible for repurchase with central banks to provide same-day liquidity. |

| } | High-quality liquid assets (HQLA2): High credit quality government, central bank or public sector securities, high quality corporate debt securities and high quality covered bonds eligible for repurchase with central banks to provide same-day liquidity. |

| } | Alternative liquid assets (ALA): Assets qualifying as collateral for the Committed Liquidity Facility (CLF) and eligible securities listed by the Reserve Bank of New Zealand (RBNZ). |

The Group monitors and manages the composition of liquid assets to ensure diversification by asset class, counterparty, currency and tenor. Minimum levels of liquid assets held are set annually based on a range of ANZ specific and general market liquidity stress scenarios such that potential cash flow obligations can be met over the short to medium term, and holdings are appropriate to existing and future business activities, regulatory requirements and in line with the approved risk appetite.

During the year customer funding increased by $40.7 billion (10%) and wholesale funding increased $38.1 billion (19%). Customer funding represents 60.6% of total funding. $18.8 billion of term wholesale debt (with a remaining term greater than one year as at 30 September 2015) was issued during the year ended 30 September 2015 (Sep 2014: $23.9 billion). The weighted average tenor of new term debt was 4.9 years (2014: 4.9 years).

| Capital Management | 2015 | 2014 | Movt | |||||||||

| Common Equity Tier 1 |

||||||||||||

| – APRA Basel 3 |

9.6% | 8.8% | 80 bps | |||||||||

| – Internationally Comparable Basel 3 |

13.2% | 12.5% | 70 bps | |||||||||

| Risk weighted assets ($b) (APRA Basel 3) |

401.9 | 361.5 | 40.4 | |||||||||

APRA, under the authority of the Banking Act 1959, sets minimum regulatory capital requirements for banks including what is acceptable as capital and provide methods of measuring the risks incurred by the Bank.

The Group’s Common Equity Tier 1 ratio increased 80 bps to 9.6% based upon the APRA Basel 3 standards, exceeding APRA’s minimum requirements, with cash earnings, and capital initiatives, outweighing dividends, incremental risk weighted assets and deductions.

Capital initiatives included $3.2 billion of capital raised via an institutional share placement and retail share purchase plan in response to higher capital requirements for Australian residential mortgages by APRA from 1 July 2016.

Pillar 3 information

ANZ provides information required by APS 330: Public Disclosure in the Regulatory Disclosures section of its website: shareholder.anz.com/pages/regulatory-disclosure.

This information includes disclosures detailed in the following sections of the Standard:

Attachment A: Capital disclosure template

Attachment B: Main features of capital instruments

Attachment E: Leverage ratio disclosure requirements

Attachment F: Liquidity Coverage Ratio disclosure template

RESULTS OF MAJOR SEGMENTS OF THE GROUP

The Group operates on a divisional structure with Australia, IIB, New Zealand, and Global Wealth being the major operating divisions. The IIB and Global Wealth divisions are coordinated globally. Global Technology Services and Operations (GTSO) and Group Centre provide support to the operating divisions, including technology, operations, shared services, property, risk management, financial management, strategy, marketing, human resources and corporate affairs. The Group Centre also includes Group Treasury and Shareholder Functions.

During 2015 the Merchant Services and Commercial Credit Cards businesses were transferred out of the Cards and Payments business unit in Australia Retail and split between Australia C&CB and IIB based on customer ownership.

There have been no other significant structure changes, however certain prior period comparatives have been restated to align with current period presentation as a result of changes to customer segmentation and the continued realignment of support functions.

DIRECTORS’ REPORT 23

DIRECTORS’ REPORT (continued)

Australia

Australia Division’s strategy is focused on growing customers, products per customer and cross-sell between Divisions through improving the customer proposition in all parts of our business.

In 2015, Australia Division delivered a 7% increase in cash profit and accounted for 45% of the ANZ Group Cash profit. The cost to income ratio has improved from 36.8% to 36.4% while investment has continued in key growth areas such as increasing distribution sales capacity and capability, expanding our presence in NSW and building out key customer and industry segments in our Corporate and Commercial business (C&CB).

We continue to deliver innovative and digital solutions to enhance the customer experience and allow customers to have more control over their banking needs. Digital sales have increased 30% in the year. Customer acquisition has increased by 3%, 59% of Retail customers hold multiple products with us and C&CB cross-sell has increased 5%. Margins have been well managed with lending margin pressure from competition being largely offset from deposit repricing.

In Retail, Home loan sales are up 24% nationally and on track to deliver 6 consecutive years of above system growth1. Home loan sales in NSW have grown 63% in the year. Cards momentum continues with acquisitions up 29% and market share is 20%1. Individual impairment loss rates are at their lowest level in 8 years, with increases in collective impairment charges predominantly from lending growth.

C&CB continues to grow its business, targeting key sectors and supporting customers across the region. Customer numbers grew 5%, lending growth increased by 6% with Small Business a highlight growing at 12%. Cost discipline and underlying asset quality remains sound.

| Income statement | 2015 $m |

2014 $m |

Movt | |||||||||

| Net interest income |

7,509 | 7,077 | 6% | |||||||||

|

Other operating income |

1,169 | 1,116 | 5% | |||||||||

| Operating income |

8,678 | 8,193 | 6% | |||||||||

| Operating expenses |

(3,157 | ) | (3,015 | ) | 5% | |||||||

| Profit before credit impairment and income tax |

5,521 | 5,178 | 7% | |||||||||

| Credit impairment charge |

(853 | ) | (818 | ) | 4% | |||||||

| Profit before income tax |

4,668 | 4,360 | 7% | |||||||||

| Income tax expense and non-controlling interests |

(1,394 | ) | (1,306 | ) | 7% | |||||||

| Cash profit |

3,274 | 3,054 | 7% | |||||||||

| Key performance metrics |

||||||||||||

| Number of employees (FTE) |

9,781 | 9,904 | -1% | |||||||||

| Net interest margin |

2.50% | 2.52% | -2 bps | |||||||||

| Operating expenses to operating income |

36.4% | 36.8% | -40 bps | |||||||||

| Net loans and advances ($b) |

313.7 | 287.8 | 9% | |||||||||

| Customer deposits ($b) |

169.3 | 160.7 | 5% | |||||||||

Cash profit increased 7%, with 6% income growth, a 5% increase in expenses and a 4% increase in credit impairment charges.

Key factors affecting the result were:

| } | Net interest income increased by $432 million or 6% primarily due to Home Loans and Small Business Banking lending growth of 10% and 12% respectively. Lending margin contraction from competition was partially offset by favourable deposit pricing. |

| } | Other operating income increased $53 million or 5% primarily due to increased net interchange fee revenue, and lending fee income driven by Small Business Banking lending growth. |

| } | Operating expenses increased $142 million or 5%. This was primarily due to investments supporting our sales force growth strategy (particularly in NSW and Digital), as well as wage inflation. |

| } | Credit impairment charges increased $35 million or 4%, with a lower individual impairment charge partially offsetting a higher collective charge. The lower individual charge reflected write-backs in Corporate Banking partially offset by higher charges in Personal Loans, Small Business Banking and Esanda. The collective charge increase is mainly due to lending growth in Cards and Small Business with methodology adjustments in Esanda and changes to hardship policy also contributing to the increase. |

| 1 | Source: APRA Monthly Banking Statistics 12 months to September 2015. |

24

ANZ ANNUAL REPORT 2015

International and Institutional Banking

International and Institutional Banking (IIB) division provides markets, transaction banking and lending services to Institutional clients globally, leveraging its Australian market strength, and capability to reach across Asia. The Global Banking division serves customers with multi-product and multi-geographic requirements, while International Banking serves customers with less complex needs. IIB also provides banking and wealth management services to affluent and emerging affluent retail clients across Asia Pacific. In addition, IIB manages the Group’s investment in partnerships in Asia.

IIB’s four key strategic priorities are:

| } | Connecting with more customers by providing seamless value: supporting customers’ trade and investment activities across the key Asia Pacific corridors through the provision of multi-product, integrated solutions. |

| } | Delivering leading products through insights: combining leading product excellence with industry and regional expertise to provide tailored, innovative solutions to customers. |

| } | Intensifying balance sheet discipline: accelerating performance by managing capital efficiently and prudently. |

| } | Scaling and optimising infrastructure: simplifying and focusing the business to effectively control costs. |

IIB continues to focus on growing its mix of higher returning products; Markets and Cash Management. Loans remain an important product from which to build customer relationships.

| Income statement | 2015 $m |

2014 $m |

Movt | |||||||||

| Net interest income |

4,173 | 4,009 | 4% | |||||||||

|

Other operating income |

3,246 | 3,096 | 5% | |||||||||

| Operating income |

7,419 | 7,105 | 4% | |||||||||

| Operating expenses |

(3,616 | ) | (3,275 | ) | 10% | |||||||

| Profit before credit impairment and income tax |

3,803 | 3,830 | -1% | |||||||||

| Credit impairment charge |

(295 | ) | (216 | ) | 37% | |||||||

| Profit before income tax |

3,508 | 3,614 | -3% | |||||||||

| Income tax expense and non-controlling interests |

(844 | ) | (906 | ) | -7% | |||||||

| Cash profit |

2,664 | 2,708 | -2% | |||||||||

| Key performance metrics |

||||||||||||

| Number of employees (FTE) |

7,578 | 7,749 | -2% | |||||||||

| Net interest margin |

1.34% | 1.50% | -16 bps | |||||||||

| Operating expenses to operating income |

48.7% | 46.1% | 260 bps | |||||||||

| Net loans and advances ($b) |

154.7 | 142.0 | 9% | |||||||||

| Customer deposits ($b) |

202.5 | 183.1 | 11% | |||||||||

Cash profit decreased by 2% due to an increase in operating expenses and credit impairment charges, partially offset by an increase in operating income.

Key factors affecting the result were:

| } | Net interest income increased 4%. The increase in net interest income was driven by Retail Asia Pacific, Global Markets and Global Transaction Banking, partially offset by decreases in Global Loans. Average deposits and other borrowings increased 12% and average gross loans increased 11%. Net interest margin declined 16 bps, mainly due to excess liquidity in Australia. |

| } | Other operating income increased by 5%, due to increased Global Transaction Banking fees reflecting deposit volume growth in all geographies along with income growth from Asia Partnerships, higher Investment and Insurance income in Retail Asia Pacific, higher Global Markets Sales income and increased fee income from Global Loans. These increases were offset by a decrease in Global Markets Balance Sheet Trading income which was negatively impacted by widening credit spreads towards the end of the year. |

| } | Operating expenses increased by 10%, with ongoing investment in key growth, infrastructure, and compliance-related projects. |

| } | Credit impairment charges increased 37%. Individual credit impairment charges were flat with higher provisions in Global Loans offset by lower provisions in Global Transaction Banking. Collective credit impairment charges increased due to non-recurring provision releases in Retail Asia Pacific and higher level of customer credit rating upgrades in Global Loans in the prior year. |

DIRECTORS’ REPORT 25

DIRECTORS’ REPORT (continued)

New Zealand

New Zealand is a core market and ANZ is well positioned with its market leading network coverage and super regional connections. We maintained our momentum and continued to grow our market share in key products1 during 2015, including mortgage lending, business lending, credit cards and deposits. Our gross impaired assets ratio has reduced due to improved credit quality across the portfolio and our operating expenses to operating income ratio continued to trend downwards, due to revenue growth and continued benefits from our simplification strategy. Our vision is to help New Zealanders achieve more by offering unrivalled connections across the region and the best combination of convenience, service and price. We remain well placed to deliver this.

Retail2

We have grown customer numbers in 2015 and are now the biggest mortgage lender3 across all major cities and we are earning more revenue per FTE. We delivered new digital functionality for our customers, and our mobile banking application (goMoney™) was consistently rated either 98% or 99% for customer satisfaction4. Our focus on having the best people in the right locations is paying off, with growth in the key Auckland and Christchurch markets and the migrant and Small Business Banking customer segments.

Commercial

We have continued to see lending growth in our Commercial business. Portfolio quality and supporting existing customers has been the key focus in the Agri market. Our network of frontline specialists has played a leading role in delivering business and industry specific insights. Our focus on simplification continues and projects, including loan document simplification and process reengineering, have improved efficiency for staff and made banking easier for our customers.

| Income statement | 2015 $m |

2014 $m |

Movt | |||||||||

| Net interest income |

2,316 | 2,171 | 7% | |||||||||

| Other operating income |

368 | 349 | 5% | |||||||||

| Operating income |

2,684 | 2,520 | 7% | |||||||||

| Operating expenses |

(1,064 | ) | (1,031 | ) | 3% | |||||||

| Profit before credit impairment and income tax |

1,620 | 1,489 | 9% | |||||||||

| Credit impairment (charge)/release |

(55 | ) | 8 | large | ||||||||

| Profit before income tax |

1,565 | 1,497 | 5% | |||||||||

| Income tax expense and non-controlling interests |

(438 | ) | (419 | ) | 5% | |||||||

| Cash profit |

1,127 | 1,078 | 5% | |||||||||

| Key performance metrics |

||||||||||||

| Number of employees (FTE) |

5,068 | 5,059 | 0% | |||||||||

| Net interest margin |

2.48% | 2.49% | -1 bp | |||||||||

| Operating expenses to operating income |

39.7% | 40.9% | -120 bps | |||||||||

| Net loans and advances ($b) |

95.2 | 86.1 | 11% | |||||||||

| Customer deposits ($b) |

59.7 | 51.4 | 16% | |||||||||

Cash profit increased 5%, primarily driven by an improvement in net interest income due to lending growth and disciplined expense management, partially offset by high credit impairment charges.

Key factors affecting the result were:

| } | Net interest income increased 7%, primarily due to above system growth in lending1. Average gross loans and advances grew 7%, with growth across both the housing and non-housing portfolios. Margins were broadly flat, despite competitive market conditions. |

| } | Other operating income increased 5% driven by increased sales of KiwiSaver and insurance products via the branch network. |

| } | Operating expenses increased 3% driven by inflationary impacts and investment activity partly offset by productivity measures. |

| } | Credit impairment charges increased $63 million from a net release of $8 million in 2014 to a charge of $55 million in 2015. The individual credit impairment charge decreased 14% reflecting lower levels of new and top-up provisions, partially offset by lower write-backs in Commercial. The collective provision charge was $72 million higher due to portfolio growth, a lower release of economic overlay provisions and reduced rate of improvement in credit quality compared to 2014. |

| 1 | Source: RBNZ August 2015. |

| 2 | Retail now includes Small Business Banking which was previously included in Commercial. |

| 3 | Source: Core Logic (mortgage registrations) September 2015. |

| 4 | Source: Camorra (rolling 6 month average) Retail Market Monitor. |

26

ANZ ANNUAL REPORT 2015

Global Wealth

Global Wealth provides a range of innovative solutions to customers across the Asia Pacific region to make it easier for them to connect with, protect and grow their wealth. Global Wealth serves over 2.4 million customers and manages $65 billion in investment and retirement savings. Customers can access ANZ’s wealth solutions through teams of qualified financial planners and advisers, innovative digital platforms, ANZ Private Bankers, ANZ branches and direct channels.

Global Wealth continues to deliver innovative solutions that are aligned to ANZ’s strategy to improve customer experience. We developed Grow™ – a series of innovations across the physical, digital and advice space to help our customers better connect with, protect and grow their financial well-being. These include ANZ Smart Choice Super, a simple and direct retirement savings solution; the ANZ Grow Centre, a destination that blends digital tools with physical wealth specialists, where customers can get help with everything from their digital device to financial advice; and Grow by ANZ™, our award winning digital app that brings banking, share investments, superannuation and insurance, together in one place.

Funds Management

The Funds Management business helps customers grow their wealth through investment (including direct shares via E*TRADE), superannuation and pension solutions. Global Wealth has embraced the changing regulatory environment to reshape the business, simplifying operational processes and delivering innovative solutions like ANZ Smart Choice Super and ANZ KiwiSaver.

Insurance

The Insurance business provides protection for all life stages through a comprehensive range of life and general insurance products distributed through intermediated and direct channels. Global Wealth’s focus on retail risk resulted in a 9% growth in individual in-force premiums, while continued investment in retention initiatives in Australia reduced retail lapse rates by 20 bps.

Private Wealth

Operating in six geographies across the region we continue to strengthen our Private Wealth offerings by building core investment advice capabilities and developing a suite of global investment solutions.

| Income statement | 2015 $m |

2014 $m |

Movt | |||||||||

| Net funds management and insurance income |

1,361 | 1,249 | 9% | |||||||||

| Other operating income including net interest income |

369 | 496 | -26% | |||||||||

| Operating expenses including credit provision |

(975 | ) | (1,002 | ) | -3% | |||||||

| Profit before income tax |

755 | 743 | 2% | |||||||||

| Income tax expense and non-controlling interests |

(154 | ) | (201 | ) | -23% | |||||||

| Cash profit |

601 | 542 | 11% | |||||||||

| Consisting of: |

||||||||||||

| – Funds Management |

157 | 120 | 31% | |||||||||

| – Insurance |

296 | 224 | 32% | |||||||||

| – Private Wealth1 |

93 | 181 | -49% | |||||||||

| – Corporate and Other |

55 | 17 | large | |||||||||

| Total Global Wealth |

601 | 542 | 11% | |||||||||

| Key performance metrics |

||||||||||||

| Number of employees (FTE) |

2,489 | 2,290 | 9% | |||||||||

| Operating expenses to operating income |

56.4% | 57.5% | -110 bps | |||||||||

| Funds under management ($m) |

65,392 | 61,411 | 6% | |||||||||

| In-force premiums ($m) |

2,217 | 2,038 | 9% | |||||||||

| Retail insurance lapse rates |

||||||||||||

| – Australia |

13.3% | 13.5% | -20 bps | |||||||||

| – New Zealand |

15.8% | 16.1% | -30 bps | |||||||||

| 1 | In 2014 Private Wealth included a $125 million gain on the sale of ANZ trustees. |

DIRECTORS’ REPORT 27

DIRECTORS’ REPORT (continued)

Cash profit increased by 11%. Excluding a $56 million one-off tax consolidation benefit in September 2015 and the $64 million net impact of the ANZ Trustees sale and subsequent investment in productivity initiatives in September 2014, cash profit increased by 14%.

Key factors affecting the result were:

| } | Funds Management operating income increased by 6%. This was driven by 10% growth in average FUM (excluding Private Wealth FUM) as a result of solid volume growth in the ANZ Smart Choice Super and ANZ KiwiSaver products. |

| } | Insurance operating income increased by 18%. September 2014 full year results included a one-off $47 million experience loss due to the exit of a Group Life Insurance plan. Excluding this, operating income grew by 9% reflecting solid in-force premium growth and lower lapse rates. This performance contributed to an 18% uplift in the Embedded Value (gross of transfers). |

| } | Excluding the gain on sale from ANZ Trustees and related income in September 2014, Private Wealth operating income increased by 12%. This was driven by improved volumes with strong growth in customer deposits and investment FUM, up by 33% and 22%, respectively. |

| } | Operating expenses decreased by 3%. Excluding the net impact of ANZ Trustees related expenses and the write-down of intangibles in September 2014, expenses increased by 2%. This was driven by higher regulatory and compliance expenses. |

Global Technology, Services and Operations (GTSO) and Group Centre

GTSO and Group Centre provide support to the operating divisions, including technology, operations, shared services, property, risk management, financial management, strategy, marketing, human resources and corporate affairs. The Group centre also includes Group Treasury and Shareholder Functions.

| Income statement | 2015 $m |

2014 $m |

Movt | |||||||||

| Operating income |

7 | 15 | -53% | |||||||||

| Operating expenses |

(547 | ) | (435 | ) | 26% | |||||||

| Profit/(Loss) before credit impairment and income tax |

(540 | ) | (420 | ) | 29% | |||||||

| Credit impairment (charge)/release |

(2 | ) | 35 | large | ||||||||

| Profit/(Loss) before income tax |

(542 | ) | (385 | ) | 41% | |||||||

| Income tax expense and non-controlling interests |

92 | 120 | -23% | |||||||||

| Cash profit/(loss) |

(450 | ) | (265 | ) | 70% | |||||||

| Key performance metrics |

||||||||||||

| Number of employees (FTE) |

25,236 | 25,326 | 0% | |||||||||

Key factors affecting the results were:

| } | Operating income decreased $8 million primarily due to increased realised revenue hedge losses partly offset by higher income generated from increased capital held in Group Centre. |

| } | Operating expenses increased $112 million due to increased investment in enterprise projects, higher depreciation and amortisation and investment in the Global Compliance function. |

| } | Credit impairment charges decreased $37 million primarily due to the release of an economic cycle provision held in Group Centre in 2014. |

| } | The decrease in FTE is primarily due to productivity initiatives in GTSO partly offset by the build out of the Global Compliance function. |

28

ANZ ANNUAL REPORT 2015

DIRECTORS’ REPORT 29

DIRECTORS’ REPORT (continued)

30

ANZ ANNUAL REPORT 2015

DIRECTORS’ REPORT (continued)

REMUNERATION REPORT

Contents

DIRECTORS’ REPORT 31

DIRECTORS’ REPORT (continued)

Introduction from the Chair of the Human Resources Committee

Dear Shareholder,

I am pleased to present our Remuneration Report for the year ending 30 September 2015.

Our remuneration framework is designed to create value for all stakeholders, to differentiate rewards based on performance and in line with our risk management framework, and to provide competitive rewards that attract, motivate and retain talented people.

In 2015 ANZ delivered solid results in a challenging environment and the ANZ Board has assessed the 2015 performance for each category within the balanced scorecard of measures against annual objectives and progress towards broader long term strategic goals.

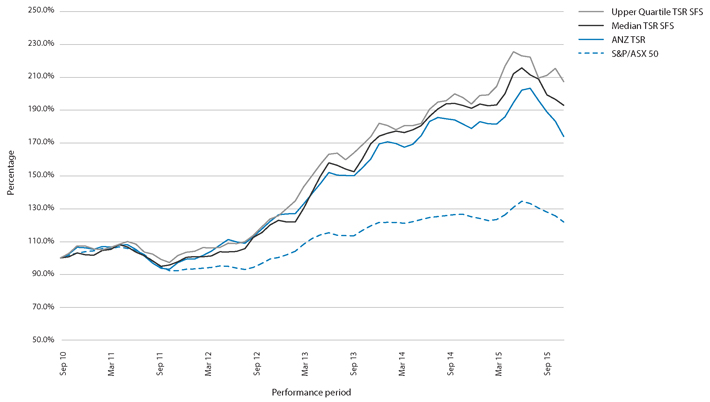

The results achieved have been reflected in the variable remuneration outcomes received by the Chief Executive Officer (CEO) and Disclosed Executives.

The Long Term Variable Remuneration (LTVR)1 awarded in 2011 was tested in late 2014. Although ANZ achieved Total Shareholder Return (TSR) of 89.65% and 87.83% over the three year performance periods for the Disclosed Executives and CEO awards respectively, ANZ’s TSR did not reach the median of the comparator group. Accordingly, the performance rights did not vest and the CEO and Disclosed Executives received no value from these awards. These awards have now lapsed.

The Human Resources (HR) Committee continues to have a strong focus on the relationship between business performance, risk management and remuneration, and regularly reviews the executive remuneration structure to ensure it remains appropriate.

During 2015 the HR Committee conducted a comprehensive review of ANZ’s variable remuneration framework, which resulted in the following changes to LTVR for the CEO and Disclosed Executives, effective for LTVR grants made from 1 October 2015:

| } | To enhance the relevance of the select financial services comparator group, it has been modified to comprise core local and global competitors. Based on their strategic focus, two regional banks are being incorporated into the comparator group along with two international banks who have similar operations to ANZ. ASX Limited and insurance companies will be removed from the comparator group as their operations are largely different to that of ANZ’s and they are not direct competitors. |

| } | To strengthen the focus of executives on growing positive returns to shareholders, Absolute Compound Annual Growth Rate (CAGR) TSR is being introduced as a third performance hurdle (in addition to relative TSR). One third of the LTVR will now be contingent on ANZ achieving or exceeding a threshold level of growth (as determined by the Board). The remaining two thirds will be split between the existing relative TSR measures. This combination provides balance to the plan, rewarding executives for performance that exceeds that of peer companies, while still ensuring there is a continued focus on providing positive growth (even when the market is declining). Absolute CAGR TSR provides executives with a more direct line of sight to the performance required to achieve shareholder value creation and provides a tighter correlation between the executives’ rewards and the shareholders’ financial outcomes. |

| } | To increase transparency and reduce volatility in the number of instruments allocated each year a face value allocation methodology is being used to determine the number of LTVR performance rights allocated to the incoming CEO and Disclosed Executives. This replaces the fair value methodology. To ensure that a similar number of instruments are granted, a one-off conversion is being undertaken. The number of instruments allocated to the incoming CEO and Disclosed Executives will be calculated based on the five trading day Volume Weighted Average Price (VWAP) of the Company’s shares traded on the ASX in the week up to and including the start of the performance period (18 November 2015). |

On 1 October 2015 the Board announced that Mr Shayne Elliott will become CEO and join the Board on 1 January 2016 succeeding Mr Michael Smith. Mr Elliott’s at target remuneration will be $6.3 million (which is 39% less than Mr Smith’s at target remuneration of $10.2 million) and will comprise of three components:

| } | Fixed remuneration of $2.1 million. |

| } | Annual Variable Remuneration (AVR)2 target of $2.1 million (100% of fixed remuneration). This will be prorated for the period from the commencement date (1 January 2016) to 30 September 2016. Mr Elliott’s AVR target for his current role as Chief Financial Officer (CFO) will apply from 1 October 2015 to 31 December 2015. |

| } | Long Term Variable Remuneration target of $2.1 million. The initial award has a current face value of $2.1 million at 50% vesting and $4.2 million at 100% vesting. Subject to shareholder approval at the 2015 Annual General Meeting this award will be delivered as three equal tranches of performance rights allocated on a face value basis, not at fair value as used previously. Each tranche will be measured over a three year performance period against the performance hurdle relevant to each tranche, as specified by the Board. |

Termination arrangements for Mr Smith are in line with his contract (as previously disclosed to shareholders).

Further detail is provided within the Remuneration Report which we hope you will find informative.

Graeme R Liebelt

Chair – Human Resources Committee

| 1 | LTVR – Also referred to as Long Term Incentive (LTI). |

| 2 | AVR – Also referred to as Short Term Incentive (STI). |

32

ANZ ANNUAL REPORT 2015

1. Basis of Preparation

The Remuneration Report is designed to provide shareholders with an understanding of ANZ’s remuneration policies and the link between our remuneration approach and ANZ’s performance, in particular regarding Key Management Personnel (KMP) as defined under the Corporations Act 2001. Individual outcomes are provided for ANZ’s Non-Executive Directors (NEDs), the CEO and Disclosed Executives (current and former).

The Disclosed Executives are defined as those direct reports to the CEO with responsibility for the strategic direction and management of a major revenue generating Division or who control material revenue and expenses that fall within the definition of KMP.

The Remuneration Report for the Company and the Group for 2015 has been prepared in accordance with section 300A of the Corporations Act 2001. Information in Table 5: Non Statutory Remuneration Disclosure has been prepared in accordance with the presentation basis set out in Section 8.5. The information provided in this Remuneration Report has been audited as required by section 308(3C) of the Corporations Act 2001, unless indicated otherwise, and forms part of the Directors’ Report.

2. Key Management Personnel (KMP)

The KMP disclosed in this year’s report are detailed in Table 1.

TABLE 1: KEY MANAGEMENT PERSONNEL

| Name | Position | Term as KMP in 2015 | ||

| Non-Executive Directors (NEDs) | ||||

| D Gonski | Chairman – Appointed Chairman 1 May 2014 (Appointed Director 27 February 2014) | Full Year | ||

| I Atlas | Director – Appointed 24 September 2014 | Full Year | ||

| P Dwyer | Director – Appointed April 2012 | Full Year | ||

| H Lee | Director – Appointed February 2009 | Full Year | ||

| G Liebelt | Director – Appointed July 2013 | Full Year | ||

| I Macfarlane | Director – Appointed February 2007 | Full Year | ||

| J T Macfarlane | Director – Appointed 22 May 2014 | Full Year | ||

| Non-Executive Directors (NEDs) – Former | ||||

| J Morschel | Chairman – Appointed Chairman March 2010 (Appointed Director October 2004), retired 30 April 2014 | -- | ||

| G Clark | Director – Appointed February 2004, retired 18 December 2013 | -- | ||

| P Hay | Director – Appointed November 2008, retired 30 April 2014 | -- | ||

| D Meiklejohn | Director – Appointed October 2004, retired 18 December 2013 | -- | ||

| A Watkins | Director – Appointed November 2008, retired 30 April 2014 | -- | ||

| Chief Executive Officer (CEO) | ||||

| M Smith | Chief Executive Officer and Executive Director – Concluding in role 31 December 2015 | Full Year | ||

| Disclosed Executives – Current | ||||

| A Currie | Chief Operating Officer | Full Year | ||

| S Elliott | Chief Financial Officer (Chief Executive Officer and Executive Director from 1 January 2016) | Full Year | ||

| A Géczy | Chief Executive Officer, International & Institutional Banking | Full Year | ||

| D Hisco | Chief Executive Officer, New Zealand | Full Year | ||

| G Hodges | Deputy Chief Executive Officer | Full Year | ||

| J Phillips | Chief Executive Officer, Global Wealth and Group Managing Director, Marketing, Innovation and Digital | Full Year | ||

| M Whelan | Chief Executive Officer, Australia – Appointed 3 April 2015 | Part Year | ||

| N Williams | Chief Risk Officer | Full Year | ||

| Disclosed Executives – Former | ||||

| P Chronican | Former Chief Executive Officer, Australia – Concluded in role 2 April 2015, ceasing employment 31 December 2015 | Full Year | ||

DIRECTORS’ REPORT 33

DIRECTORS’ REPORT (continued)

3. Role of the Board in Remuneration

The HR Committee is a Committee of the Board. The HR Committee is responsible for:

| } | reviewing and making recommendations to the Board in relation to remuneration governance, director and senior executive remuneration and senior executive succession; |

| } | specifically making recommendations to the Board on remuneration and succession matters related to the CEO, and individual remuneration arrangements for other key executives covered by the Group’s Remuneration Policy; |

| } | the design of significant variable remuneration (such as the ANZ Employee Reward Scheme (ANZERS) and the Institutional Total Incentives Performance Plan (TIPP)); and |

| } | remuneration structures for senior executives and others specifically covered by the Remuneration Policy. |

More details about the role of the HR Committee can be found on the ANZ website.1

The link between remuneration and risk is considered a key requirement by the Board. Committee membership is structured to ensure overlap of representation across the HR Committee and Risk Committee, with three NEDs currently on both committees. The HR Committee has free and unfettered access to risk and financial control personnel, and can also engage independent external advisors as needed.

Throughout the year the HR Committee and management received information from external providers including Aon Hewitt, Ashurst, Ernst and Young, Hay Group, Herbert Smith Freehills, McLagan, Mercer Consulting (Australia) Pty Ltd and PricewaterhouseCoopers. This information related to market data and market practice information, legislative requirements and interpretation of governance and regulatory requirements.

The HR Committee did not receive any recommendations from remuneration consultants during the year in relation to the remuneration arrangements of KMP. ANZ employs in-house remuneration professionals who provide recommendations to the HR Committee/Board, taking into consideration market information provided by external providers. The Board’s decisions were made independently using the information provided and having careful regard to ANZ’s strategic objectives, risk appetite and Remuneration Policy and principles.

4. HR Committee Activities

During 2015, the HR Committee met on six occasions, with remuneration matters an agenda item on each occasion. The HR Committee has a strong focus on the relationship between business performance, risk management and remuneration, with the following activities occurring during the year:

| } | annual review of the effectiveness of the Remuneration Policy; |

| } | review of key senior executive appointments and terminations; |

| } | involvement of the Risk function in remuneration regulatory and compliance related activities; |

| } | monitoring of regulatory and compliance matters relating to remuneration governance; |

| } | review of variable remuneration arrangements including changes to LTVR; |

| } | review of reward outcomes for key senior executives; |

| } | review of ANZ’s risk culture and employee engagement; |

| } | review of health and safety; |

| } | review of diversity and inclusion; and |

| } | review of succession plans for key senior executives. |

| 1 | Go to anz.com > about us > our company > corporate governance > HR Committee Charter. |

34

ANZ ANNUAL REPORT 2015

5. Remuneration Strategy and Objectives

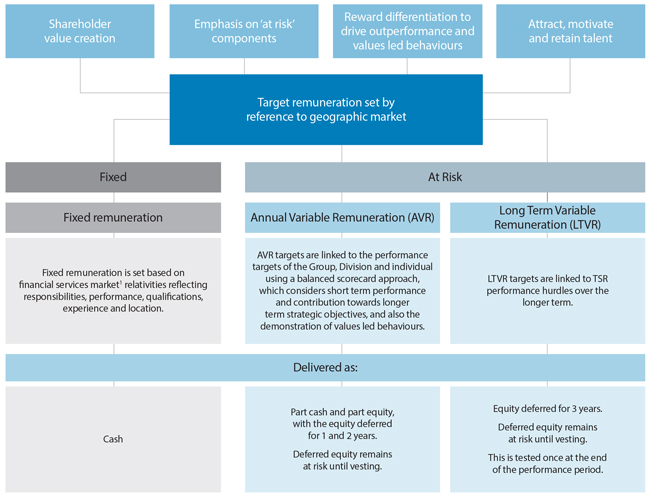

ANZ’s remuneration strategy, the Group’s Remuneration Policy and reward frameworks all reflect the importance of sound risk management. The following principles underpin ANZ’s Remuneration Policy, which is approved by the Board and applied globally across ANZ:

| } | creating and enhancing value for all ANZ stakeholders; |

| } | emphasising the ‘at risk’ components of total rewards to increase alignment with shareholders and encourage behaviour that supports the long term financial soundness and the risk management framework of ANZ, and the delivery of superior long term total shareholder returns; |

| } | differentiating rewards in line with ANZ’s culture of rewarding for outperformance and demonstration of behaviours aligned with ANZ’s values (Integrity, Collaboration, Accountability, Respect and Excellence); and |

| } | providing a competitive reward proposition to attract, motivate and retain the highest quality individuals in order to deliver ANZ’s business and growth strategies. |

Appropriate risk management is fundamental to the way ANZ operates and is therefore a key element of the way performance is measured and assessed at a Group, Division and individual level. Variable remuneration outcomes reflect performance against a balanced scorecard of financial and non-financial (including risk) measures.

The core elements of ANZ’s remuneration strategy for the CEO and Disclosed Executives are set out below:

FIGURE 1: REMUNERATION OBJECTIVES

| 1 | Considered the most relevant comparator as this is the main pool for sourcing talent and where key talent may be lost. |

DIRECTORS’ REPORT 35

DIRECTORS’ REPORT (continued)

6. The Composition of Remuneration at ANZ

The Board aims to find a balance between:

| } | fixed and at-risk remuneration; |

| } | annual and long term variable remuneration; and |

| } | cash and deferred equity. |

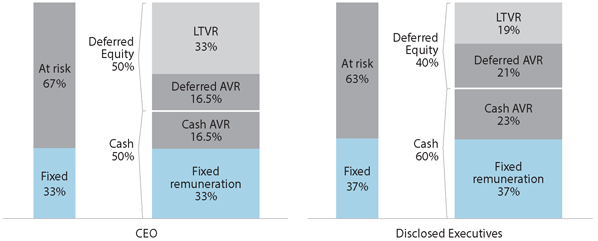

Figure 2 provides an overview of the target remuneration mix for the CEO and Disclosed Executives.

FIGURE 2: TARGET REMUNERATION MIX

The remuneration mix in Figure 2 is based on LTVR face value at 50% vesting assuming an ‘on target’ award (was based on fair value in previous reports).

The CEO’s target remuneration mix is equally weighted between fixed remuneration, AVR and LTVR, with approximately half of total target remuneration payable in cash in the current year and half allocated as equity and deferred over one, two or three years.

The target remuneration mix for Disclosed Executives is weighted between fixed remuneration (37%), AVR (44%) and LTVR (19%), with approximately 60% of total target remuneration payable in cash in the current year and 40% allocated as equity and deferred over one, two or three years.

The deferred remuneration for the CEO and Disclosed Executives remains at risk (Board has discretion to reduce downward to zero) until vesting date.

The Board has adopted this mix as an effective reward mechanism to drive strong performance and value for the shareholder in both the short and longer term.

The CEO and Disclosed Executives may be awarded amounts above or below the target for both AVR and LTVR.

ANZ’s AVR and LTVR deferral arrangements are designed to ensure that the CEO and Disclosed Executives are acting in the best long term interests of ANZ and its shareholders. Deferring part of their AVR over one and two years, and all of their LTVR over three years every year results in a substantial amount of their variable remuneration being directly linked to long term shareholder value. For example as at 30 September 2015 Mr Smith held 91,855 unvested AVR deferred shares and 759,168 unvested LTVR performance rights, the combined value1 of which was around six times his fixed remuneration. Similarly as at 30 September 2015 Disclosed Executives held unvested equity, the value1 of which was around four times their average fixed remuneration.

| 1 | Value is based on the number of unvested deferred shares and unvested rights held at 30 September 2015 multiplied by the ANZ closing share price as at 30 September 2015. |

36

ANZ ANNUAL REPORT 2015

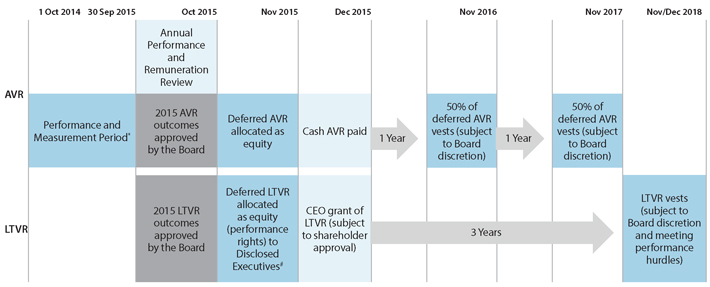

The following diagram demonstrates the time horizon associated with AVR and LTVR awards.

FIGURE 3: AVR AND LTVR TIME HORIZON RELATING TO 2015

| * | 2014 deferred AVR and deferred LTVR granted in November/December 2014 |

| # | CRO allocated deferred shared rights |

The reward structure for the CEO and Disclosed Executives is detailed below. The only exception is the Chief Risk Officer (CRO) whose remuneration arrangements have been structured differently to preserve the independence of this role and to minimise any conflicts of interest in carrying out the risk control function across the organisation. The CRO’s role has more limited AVR leverage for individual performance and none (either positive or negative) for Group performance. LTVR is delivered as unhurdled deferred share rights, with a three year time based hurdle, and is therefore not subject to meeting TSR performance hurdles.

6.1 FIXED REMUNERATION

The fixed remuneration amount is expressed as a total dollar amount which can be taken as cash salary, superannuation contributions and other nominated benefits.

6.2 VARIABLE REMUNERATION

Variable remuneration forms a significant part of the CEO’s and Disclosed Executives’ potential remuneration, providing at risk components that are designed to drive performance in the short, medium and long term. The term variable remuneration within ANZ covers both the annual variable remuneration and long term variable remuneration arrangements.

Downward adjustment

The Board has on-going and absolute discretion to:

| } | adjust deferred variable remuneration downwards, or to zero at any time, including after the grant of such remuneration, where the Board considers such an adjustment is necessary to protect the financial soundness of ANZ or to meet unexpected or unknown regulatory requirements, or if the Board subsequently considers that having regard to information which has come to light after the grant of deferred equity/cash, the deferred equity/cash was not justified; |

| } | withhold vesting until the Board has considered any information that may impact the vesting. |

Prior to any scheduled release of deferred equity/deferred cash, the Board considers whether any downward adjustment should be made. No downward adjustment was applied to the remuneration of the CEO and Disclosed Executives during 2015.

DIRECTORS’ REPORT 37

DIRECTORS’ REPORT (continued)

6.2.1 Annual Variable Remuneration (AVR)

AVR provides an annual opportunity for a variable remuneration award. It is assessed against Group, Divisional and individual objectives based on a balanced scorecard of measures and positive demonstration of values led behaviours. Many of the measures relate to contribution towards medium to longer term performance outcomes aligned to ANZ’s strategic objectives as well as annual goals.

AVR ARRANGEMENTS

| ANZ’s Employee Reward Scheme (ANZERS) structure and pool is reviewed by the HR Committee and approved by the Board. The size of the overall pool is based on an assessment of the balanced scorecard of measures of the Group. | ||||

| Performance targets | In order to focus on achieving individual, Divisional and Group performance objectives a mix of quantitative and qualitative short, medium and long term measures are assessed. | |||

| Targets are set considering prior year performance, industry standards and ANZ’s strategic objectives. Many of the measures also focus on targets which are set for the current year in the context of progress towards longer term goals. The specific targets and features relating to all these measures have not been provided in detail due to their commercial sensitivity. | ||||

| For the CEO and Disclosed Executives, the weighting of measures in each individual’s balanced scorecard will vary to reflect the responsibilities of their role. For example the CEOs of the Australia, New Zealand, Global Wealth and International and Institutional Banking divisions and also the CFO have a heavier weighting on financial measures (typically 40%) compared to other Disclosed Executives. | ||||

| The validation of performance and achievements against these objectives at the end of the year, for: | ||||

| } | the CEO involves input from the CRO, CFO and Group General Manager Global Internal Audit on risk management, financial performance and internal audit matters respectively, followed by review and endorsement by the HR Committee, with final outcomes approved by the Board; and | |||