Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Lipocine Inc. | v425544_8k.htm |

Piper Jaffray 2015 Healthcare Conference December 2015 Exhibit 99.1

Forward Looking Statements 2 This presentation contains forward - looking statements about Lipocine Inc. (the “Company”). These forward - looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward - looking stat ements relate to the Company’s product candidates, clinical and regulatory processes and objectives, potential benefits of the Compa ny’ s product candidates, intellectual property and related matters, all of which involve known and unknown risks and uncertainties . Actual results may differ materially from the forward - looking statements discussed in this presentation . Accordingly, the Company cautions investors not to place undue reliance on the forward - looking statements contained in, or made in connection with, this presentation . Several factors may affect the initiation and completion of clinical trials, the potential advantages of the Company’s product candidates and the Company’s capital needs. Among other things, the projected commencement and completion of the Company’s clinical trials may be affected by difficulties or delays. In addition, the Company’s results ma y b e affected by its ability to manage its financial resources, difficulties or delays in developing manufacturing processes for its produc t c andidates, preclinical and toxicology testing and regulatory developments. Delays in clinical programs, whether caused by competitive developments, adverse events, patient enrollment rates, regulatory issues or other factors, could adversely affect the Compan y’s financial position and prospects. Prior clinical trial program designs and results are not necessarily predictive of future cli nical trial designs or results. If the Company’s product candidates do not meet safety or efficacy endpoints in clinical evaluations, th ey will not receive regulatory approval and the Company will not be able to market them. The Company may not be able to enter into any strategic partnership agreements. Operating expense and cash flow projections involve a high degree of uncertainty, including variances in future spending rates due to changes in corporate priorities, the timing and outcomes of clinical trials, compet iti ve developments and the impact on expenditures and available capital from licensing and strategic collaboration opportunities. If the Company is unable to raise additional capital when required or on acceptable terms, it may have to significantly delay, scale ba ck or discontinue one or more of its drug development or discovery research programs. The Company is at an early stage of developm ent and may not ever have any products that generate significant revenue. The forward - looking statements contained in this presentation are further qualified by the detailed discussion of risks and uncertainties set forth in the documents filed by the Company w ith the Securities and Exchange Commission, all of which can be obtained on the Company’s website at www.lipocine.com or on the SEC website at www.sec.gov . The forward - looking statements contained in this document represent the Company’s estimates and assumptions only as of the date of this presentation and the Company undertakes no duty or obligation to update or revise publicly any forward - looking statements contained in this presentation as a result of new information, future events or changes in the Company’s expectations.

LPCN: Focused on Innovative Products for Men’s and Women’s Health 3 “Transformative“ Oral Testosterone Franchise First Oral Alternative for the Prevention of Pre - Term Birth PRODUCT (Indication) RESEARCH / PRECLINICAL PHASE 1 PHASE 2 PHASE 3 NDA UNDER REVIEW MEN'S HEALTH LPCN 1021 (Oral Testosterone Replacement Therapy ) LPCN 1111 (Next Generation Oral T) WOMEN'S HEALTH LPCN 1107 (Prevention of Preterm Birth)

Lipocine Investment Highlights ▪ Lipocine is well positioned to be a leader in Oral Testosterone – Targeting ~$2.0 Billion TRT US market – Differentiated products – LPCN 1021 has potential to be the first oral treatment option ▪ NDA PDUFA goal date of June 28, 2016 – LPCN 1111 QD option in Phase 2 as a “follow on” ▪ Orphan designated oral alternative for the prevention of preterm birth – Avoids painful injections of the only FDA approved intra - muscular drug – Multi - dose PK study results 1Q 2016 4

LPCN 1021 - First Oral TRT Option (PDUFA Goal Date of June 2016) ▪ NDA Accepted in October 2015 – Targeting Class TRT label – No “black box” warning expected – No Advisory Committee m eeting planned ▪ Potential to be the first approved oral TRT option – Demonstrated efficacy in pivotal Phase 3 clinical study (“SOAR”) – Well tolerated in 52 week safety study – Consistent T levels not sensitive to meal fat content 5

TRT Monthly TRx Trend 6 x To date, minimal TRx impact of FDA TRT label change x 2015 – monthly TRx stable around 500,000/month 1 IMS Data FDA Label Guidance

7 Issues with Current TRT Therapies Transfer potential to children and partner No freedom to use around pregnant loved ones Skin irritation potential Messy to apply and wait to dress Pulmonary embolism potential Pain from injection Needle phobia, needle fatigue Scarring/injection site reactions Risk of infection Not flexible for dose reversals Topicals Injectables / Implants

LPCN 1021 - First Oral TRT Option Challenges of Oral T Product ▪ Native testosterone has poor oral bioavailability with a very short half life (~30 min) – Impractical daily doses would be required to obtain effective levels – Inconsistent and unpredictable performance – Methyl testosterone – Liver toxicity – Unsafe for chronic use LPCN 1021 Advantage ▪ Novel product primarily directing Testosterone Undecanoate (TU) into the lymph – Maintains effective T blood levels in eugonadal range when dosed twice daily – Consistent and predictable performance – By - passes liver in first pass metabolism 8

Over 47% of Patient Respondents Are Very Likely To Ask About Oral T 14.1 19.2 38.4 32.3 47.5 48.5 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Rx < 6Mo n=99 Current Rx n=412 Percent of Respondents Likelihood to Ask Prescriber About Oral LPCN 1021 Rate 1 - 3 Rate 4 - 7 Rate 8 - 10 Q30. How likely are you to ask your doctor about this new medication when you learn it’s available and can be prescribed, where “1” equals not at all likely and “10” equals very likely? 9

LPCN 1021 (First Oral TRT Option): “Efficacy Results in Phase 3” 10 Measure FDA Targets Efficacy Population* 1 Full Analysis Set #1 Number of subjects 151 193 % subjects with C avg w ithin normal range ≥75% 87.4% 87.0% 95 % CI lower bound ≥ 65% 81.9% 82.0% x LPCN 1021 met both the primary endpoint targets Parameter Mean (CV) Mean (CV) C avg ( ng / dL ) 446 (38%) 478 (41%) * Subjects randomized into the study with at least one PK profile and no significant protocol deviations # Subjects randomized into the study with at least one post - baseline efficacy variable response 1 Missing data imputed by LOCF

11 LPCN 1021 (First Oral TRT Option): 52 Week Safety Results ▪ LPCN 1021 was well tolerated during 52 weeks of dosing ▪ No reported cardiac, hepatic or drug related serious adverse events (SAEs) ▪ Overall adverse event (AE) profile for LPCN 1021 was comparable to the active control, Androgel ® 1.62%, including GI disorders ▪ None of the cardiac AEs occurred in greater than 1% of the subjects in the LPCN 1021 arm and none were classified as severe ▪ All observed adverse drug reactions (ADRs) were classified as mild or moderate in severity and no serious ADRs occurred during the 52 - week treatment period

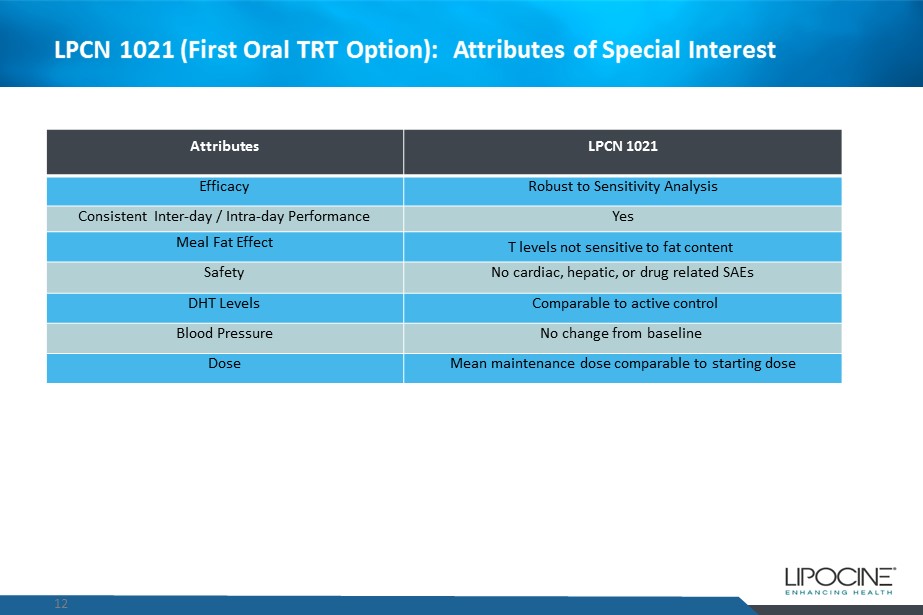

LPCN 1021 (First Oral TRT Option): Attributes of Special Interest Attributes LPCN 1021 Efficacy Robust to Sensitivity Analysis Consistent Inter - day / Intra - day Performance Yes Meal Fat E ffect T levels not sensitive to fat content Safety No cardiac, hepatic, or drug related SAEs DHT Levels Comparable to active control Blood Pressure No change from baseline Dose Mean maintenance dose comparable to starting dose 12

13 41 48 11 2 37 61 0 10 20 30 40 50 60 70 No dose change 1 dose change 2 dose changes % of Subjects LPCN 1021 Active Control x 89% of LPCN and 39% of active control subjects (Androgel® 1.62%) required ≤1 dose adjustment x Almost all subjects on active control, the market leader, required a titration visit LPCN 1021 (First Oral TRT Option): Efficient Dosing Regimen

Potential for Meaningful Oral T Sales in U.S. 14 Market Share Sales Potential ( in M) Assumptions: • $400/Rx current TRT Branded pricing; • 6 Million Annual US TRT TRx (excludes ex - US, expansion due to improved Rx retention rates due to oral introduction and physician “buy and bill” sales) For Illustrative Purposes Only

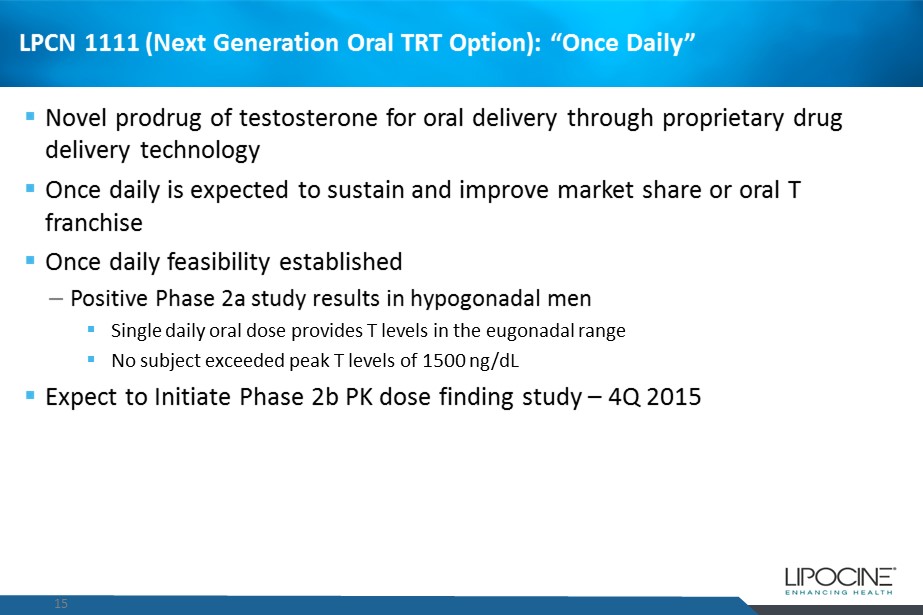

LPCN 1111 (Next Generation Oral TRT Option): “Once Daily” ▪ Novel prodrug of testosterone for oral delivery through proprietary drug delivery technology ▪ Once daily is expected to sustain and improve market share or oral T franchise ▪ Once daily feasibility established – Positive Phase 2a study results in hypogonadal men ▪ Single daily oral dose provides T levels in the eugonadal range ▪ No subject exceeded peak T levels of 1500 ng/ dL ▪ Expect to Initiate Phase 2b PK dose finding study – 4Q 2015 15

Preterm Birth (PTB) Represents a Significant Unmet Medical Need ▪ 11.7% of all US pregnancies 2 result in PTB (< 37 weeks) - a leading cause of neonatal mortality and morbidity 3 ▪ ~10x more first year medical costs are for PTB infants than for full term infants 4 ▪ ≥ $26 billion economic impact: 4 $1 billion market opportunity 5 16 1 Pediatric Research (2006) 60, 775 – 776 2 CDC (2010) 3 J . Maternal - Fetal and Neonatal Medicine, Dec. 2006, 19(12), 773 – 782 4 Institute of Medicine of the National Academies. Jul.2006 5 AMAG Pharmaceuticals presentation 09/29/2014 One preterm infant per minute in the U.S. 1

LPCN 1107 (First Oral PTB Candidate): “Addresses Unmet Need” ▪ The only FDA approved product for the prevention of PTB is an injectable hydroxyprogesterone caproate (HPC) ▪ Issues with the injectable HPC: – Weekly injection in doctor’s office or home – Injection site pain (35%), swelling (17%) ▪ LPCN 1107: An oral HPC alternative – Non - invasive ▪ No injection site reactions ▪ No potential for pulmonary embolism – Self - administered – Life - style friendly ▪ Reduced travel burden 17

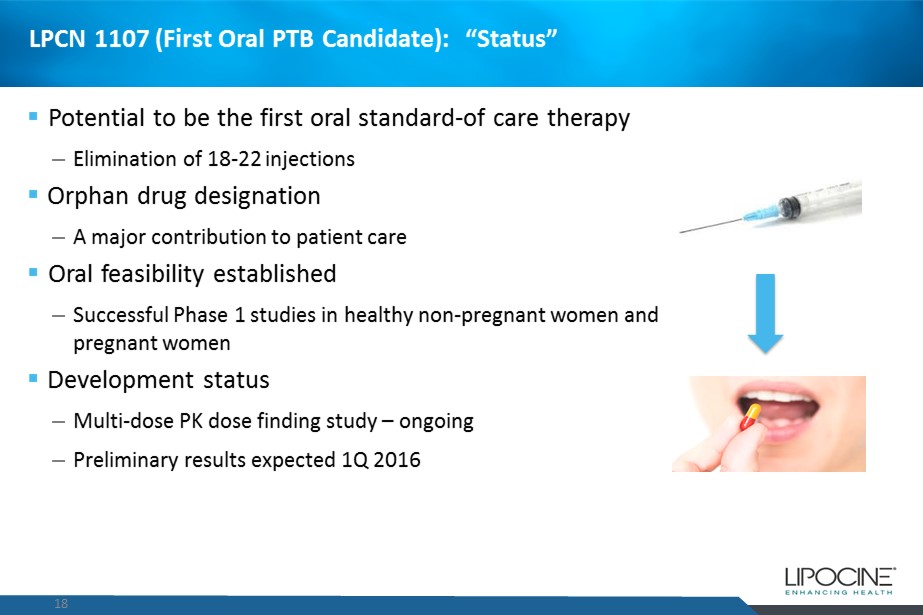

LPCN 1107 (First Oral PTB Candidate): “Status” 18 ▪ Potential to be the first oral standard - of care therapy – Elimination of 18 - 22 injections ▪ Orphan drug designation – A major contribution to patient care ▪ Oral feasibility established – Successful Phase 1 studies in healthy non - pregnant women and pregnant women ▪ Development status – Multi - dose PK dose finding study – ongoing – Preliminary results expected 1Q 2016

LPCN 1107 (First Oral PTB Candidate): Phase 1 Study Results 19 # AUCss calculated for post steady state 1 week duration Study population (N) AUC SS ( ng.h /ml) # Relative bioavailability [400 mg BID oral / IM ] Relative bioavailability [800 mg BID oral / IM] LPCN 1107/ 400 mg BID Oral LPCN 1107/ 800 mg BID Oral Intramuscular Injection / 250 mg weekly Pregnant women (7) 1074 4058 1817 59 % 223 % Non - pregnant women (10) 1348 N/A 2468 55 % N/A x Relative bioavailabilities similar between pregnant and non - pregnant women x Projected dose between 400 and 800 mg BID is expected to be comparable to marketed 250 mg weekly IM product ▪ Bioavailability in pregnant (study LPCN 1107 - 14 - 003) and non - pregnant women (study LPCN 1107 - 14 - 001)

Several Near Term Value Drivers 20 Event Expected Timing LPCN 1111: Initiate Phase 2b Study 4Q15 LPCN 1107: Top - line Results from Multi - Dose PK Study 1Q16 LPCN 1111: Top - line Results from Phase 2b Study 1Q16 LPCN 1107: End of Phase 2 Meeting 2Q16 LPCN 1111: End of Phase 2 Meeting 2Q16 LPCN 1021: FDA PDUFA Date June 28, 2016

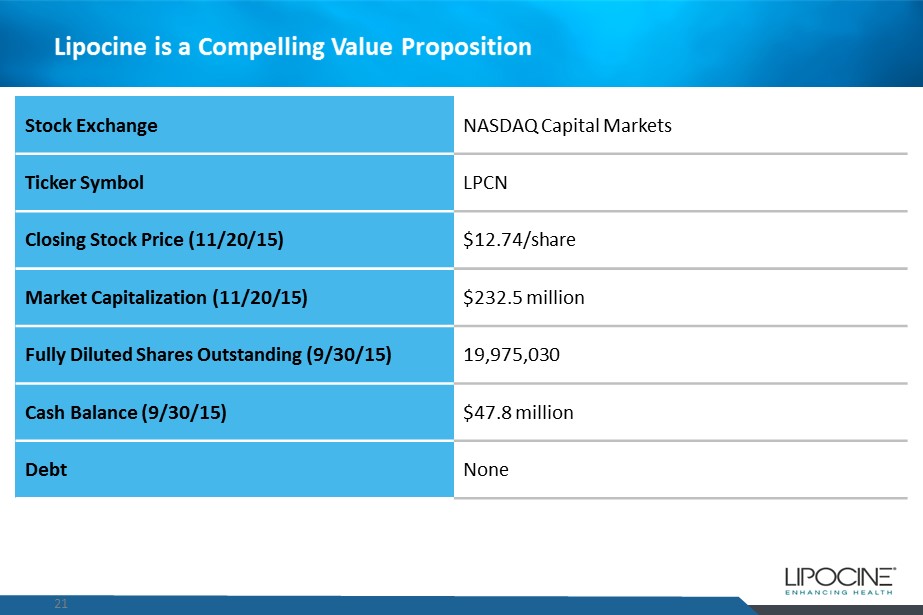

21 Lipocine is a Compelling Value Proposition Stock Exchange NASDAQ Capital Markets Ticker Symbol LPCN Closing Stock Price (11/20/15) $12.74/share Market Capitalization (11/20/15) $232.5 million Fully Diluted Shares Outstanding (9/30/15) 19,975,030 Cash Balance (9/30/15) $47.8 million Debt None

Lipocine Investment Highlights ▪ Lipocine is well positioned to be a leader in Oral Testosterone – Targeting ~$2.0 Billion TRT US market – Differentiated products – LPCN 1021 has potential to be the first oral treatment option ▪ NDA PDUFA goal date of June 28, 2016 – LPCN 1111 QD option in Phase 2 as a “follow on” ▪ Orphan designated oral alternative for the prevention of preterm birth – Avoids painful injections of the only FDA approved intra - muscular drug – Multi - dose PK study results 1Q 2016 22