Attached files

| file | filename |

|---|---|

| 8-K - 8-K - QUESTAR CORP | a8-kwexprocanyoncreekagree.htm |

| EX-99.1 - EXHIBIT 99.1 - QUESTAR CORP | exhibit991canyoncreekwexpr.htm |

Settlement Stipulation

Docket No. 30010-145-GA-15

Colleen Larkin Bell (5253)

Jenniffer Nelson Clark (7947)

Questar Gas Company

333 S. State Street

P.O. Box 45433

Salt Lake City, UT 84145-0433

(801) 324-5556

Colleen.bell@questar.com

Jenniffer.clark@questar.com

Attorneys for Questar Gas Company

BEFORE THE PUBLIC SERVICE COMMISSION OF WYOMING

IN THE MATTER OF THE APPLICATION OF QUESTAR GAS COMPANY FOR APPROVAL OF THE CANYON CREEK ACQUISITION AS A WEXPRO II PROPERTY | Docket No. 30010-145-GA-15 CANYON CREEK SETTLEMENT STIPULATION |

Pursuant to Utah Code Ann. § 54-7-1 and Utah Admin. Code R746-100-10.F.5, and pursuant to Wyoming Statute 37-2-101 et. seq. and Wyoming Procedural Rules and Special Regulations Section 119, Questar Gas Company (Questar Gas or Company); Wexpro Company (Wexpro); the Utah Division of Public Utilities (Division); the Utah Office of Consumer Services (the Utah OCS); and the Wyoming Office of Consumer Advocate (the Wyoming OCA) (collectively Parties or singly Party) submit this Settlement Stipulation. This Settlement Stipulation shall be effective upon the entry of a final order of approval by the Public Service Commission of Utah (Utah Commission) and the Wyoming Public Service Commission (Wyoming Commission) (together Commissions) as provided in the Wexpro II Agreement, Article IV-5 and Article IV-9(c).

1

Settlement Stipulation

Docket No. 30010-145-GA-15

PROCEDURAL HISTORY

1. On March 28, 2013, the Utah Commission issued its Report and Order approving the Wexpro II Agreement. On April 11, 2013, the Wyoming Commission held a hearing in the matter of the application of Questar Gas Company for approval of the Wexpro II Agreement and issued a bench ruling approving the Wexpro II Agreement. On October 16, 2013, the Wyoming Commission issued its Memorandum Opinion, Findings and Order approving the Wexpro II Agreement.

2. On January 17, 2014, the Utah Commission issued its Report and Order approving the Trail Unit Settlement Stipulation. On March 18, 2014 the Wyoming Commission issued its Memorandum Opinion, Findings and Order approving the Trail Unit Settlement Stipulation.

3. The Wexpro II Agreement and the Trail Unit Settlement Stipulation govern the requirements for Wexpro and Questar Gas relating to the Canyon Creek Acquisition. Section IV-1 of the Wexpro II Agreement provides that “Wexpro will acquire oil and gas properties or undeveloped leases at its own risk.” Section IV-1(a) provides that “Questar Gas shall apply to the Utah and Wyoming Commissions for approval to include under this Agreement any oil and gas property that Wexpro acquires within the Wexpro I development drilling areas.”

4. On December 19, 2014, Wexpro closed on its $52.7 million acquisition of an additional 30% interest in natural-gas producing properties in the Canyon Creek Acquisition Area located in the Vermillion Basin in southwest Wyoming. These properties are located within the Development Drilling Areas defined in the Wexpro Stipulation and Agreement executed October 14, 1981 and approved October 28, 1981 by the Wyoming Commission and December 31, 1981 by the Utah Commission (hereinafter Wexpro I Agreement). Wexpro already owns a 70% interest in the properties being acquired. This acquisition increases Wexpro’s ownership interest to 100%.

5. On August 31, 2015, Questar Gas filed its Confidential Applications seeking approval of the Canyon Creek Acquisition as a Wexpro II property before the Utah and Wyoming Commissions. The Canyon Creek Acquisition is an acquisition within a Wexpro I Development Drilling Area and under the terms of the

2

Settlement Stipulation

Docket No. 30010-145-GA-15

Wexpro II Agreement Questar Gas is required to bring this property before both the Utah and Wyoming Commissions for approval. The Confidential Applications were accompanied by Exhibits A through P and the direct testimony of Mr. Barrie L. McKay and Mr. Brady B. Rasmussen.

6. Questar Gas Company has submitted data in support of the Confidential Applications, including gas pricing assumptions, market data, historical production and remaining reserves of current wells, forecasted production/reserves for future wells, forecasted decline curves for current and future wells, drilling costs, operating expenses, ownership interests, taxes, gathering and processing costs, forecasted long-term cost-of-service analysis, impact on Questar Gas’ gas supply, geologic data, future development plans, applicable guideline letters, and other data as requested by the respective agencies through numerous data requests. Additionally, the Hydrocarbon Monitor’s Report regarding the Canyon Creek Acquisition was filed September 10, 2015 and September 14, 2015 in Wyoming and Utah, respectively.

7. On September 9, 2015, the Utah Commission issued its Scheduling Order setting dates for filing testimony, technical conferences, and hearings and on October 8, 2015, the Wyoming Commission issued its Scheduling Order setting dates for filing testimony and hearings.

8. On September 17, 2015, a technical conference was held in Utah to discuss and provide information to the Division, Utah OCS, and Staff of the Utah Commission on the Company’s Canyon Creek Acquisition and its proposed changes to key criteria of the Wexpro Agreements.

9. On October 8, 2015, a technical conference was held in Wyoming to discuss and provide information to the Wyoming OCA and the Staff of the Wyoming Commission on the Company’s Canyon Creek Acquisition and its proposed changes to key criteria of the Wexpro Agreements.

10. Since the Confidential Applications were filed, the Division, Utah OCS, Wyoming OCA, Utah Commission Staff, and Wyoming Commission Staff have asked and Questar Gas has responded to more than 50 data requests and inquiries.

11. On October 8, 2015, the Division and the Utah OCS filed direct testimony and on October 13, 2015, the Wyoming OCA filed direct testimony in their respective dockets.

3

Settlement Stipulation

Docket No. 30010-145-GA-15

TERMS AND CONDITIONS

12. The Parties agree for purposes of settlement that the Canyon Creek Acquisition, as identified in the Canyon Creek Application, shall be approved as a Wexpro II property.

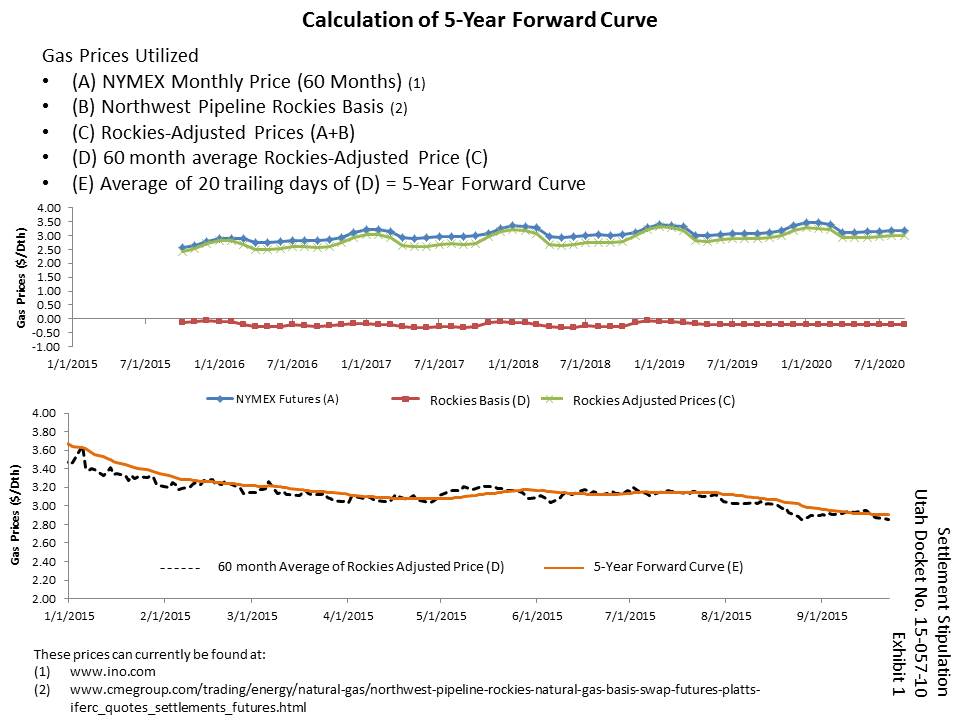

13. The Parties agree for purposes of settlement that Wexpro will design its annual drilling program or drilling programs that are more frequent than the annual cycle to provide cost-of-service production that is, at the time Wexpro incurs an obligation in connection with a drilling program, on average For purposes of this provision, average is defined as the cost-of-service for the first five years of production divided by the production volumes for the first five years1, at or below the 5-Year Forward Curve price that was agreed to in the Trail Settlement Stipulation.

14. The Parties agree for purposes of settlement that the 5-Year Forward Curve agreed to in the Trail Settlement Stipulation and used by Wexpro to determine its future drilling plans will be calculated as shown below and as illustrated in the attached Settlement Stipulation Exhibit 1.

Each day, a 60 month forward curve will be calculated as follows:

A = NYMEX price (  on graph)

on graph)

on graph)

on graph)B = Northwest Pipeline Rockies Basis (  on graph)

on graph)

on graph)

on graph)C = (A+B) = Rockies-Adjusted Price ( on graph)

on graph)

on graph)

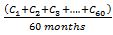

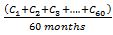

on graph)D = =  60-month average Rockies-Adjusted Price (

60-month average Rockies-Adjusted Price (  on graph)

on graph)

60-month average Rockies-Adjusted Price (

60-month average Rockies-Adjusted Price (  on graph)

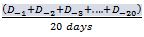

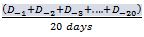

on graph)Each point on line D represents the daily calculation of the 60-month average of the Rockies-Adjusted Price. To reduce volatility in the curve, the most recent 20 trading days of line D will be used. Details of the 20-trading-day average calculation are as follows:

E =  = 5-Year Forward Curve (

= 5-Year Forward Curve ( on graph)

on graph)

= 5-Year Forward Curve (

= 5-Year Forward Curve ( on graph)

on graph)Each point on line E represents the average of the most recent 20 trading days of the 60-month average Rockies Adjusted Price (5-year Forward Curve). The point on line E on the date that Wexpro

1 For purposes of this provision, average is defined as the cost-of-service for the first five years of production divided by the production volumes for the first five years.

4

Settlement Stipulation

Docket No. 30010-145-GA-15

incurs an obligation in connection with a drilling program will be compared to the incremental cost-of-service of the drilling program to determine whether the drilling program meets the requirements established in paragraph 13 above.

15. The Parties agree for purposes of settlement that the rate of return on pre-2016 natural gas and oil Developmental Wells and Appurtenant Facilities will be governed over their remaining life as set forth in the Wexpro I and Wexpro II Agreements.

16. The Parties agree for purposes of settlement that the rate of return on post-2015 Wexpro I and Wexpro II Development Drilling or any other capital investment, and any associated AFUDC, for both natural gas and oil wells, will be the Commission-Allowed Rate of Return as defined in Section I-31 of the Wexpro II Agreement.

17. The Parties agree for purposes of settlement that for post-2015 Development Drilling, the Dry Hole and non-commercial costs, as defined in the Wexpro I and Wexpro II Agreements, will be charged and shared on a 50/50 basis between Quester Gas customers and Wexpro, subject to the limitations contained in paragraph 19 of this Settlement Stipulation. Any revenue and related expenses from non-commercial wells will be shared on a 50/50 basis, subject to the limitations contained in paragraph 19 of this Settlement Stipulation. The Parties further agree that the customers’ share of the 50/50 sharing of Dry Hole and non-commercial well costs will be limited to 4.5% of Wexpro’s annual development drilling program. Any Dry Hole or non-commercial well costs above 4.5% will be the sole responsibility of Wexpro.

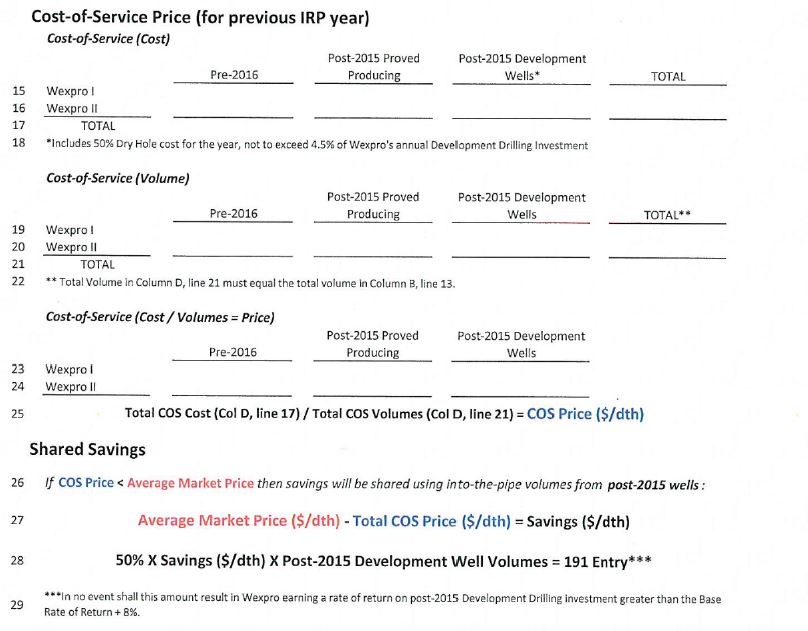

18. The Parties agree for purposes of settlement that when the actual annual cost-of-service price per decatherm (COS Price) for Questar Gas’ Integrated Resource Plan (IRP) year is less than the market price per decatherm for the IRP year (defined below), then savings will be shared 50% to Questar Gas customers and 50% to Wexpro using into-the-interstate-pipeline volumes from post-2015 Development Wells.

a. | For purposes of this calculation, cost-of-service volumes (COS Volumes) are defined as the actual decatherms supplied into the interstate pipeline under both Wexpro I and Wexpro II. |

5

Settlement Stipulation

Docket No. 30010-145-GA-15

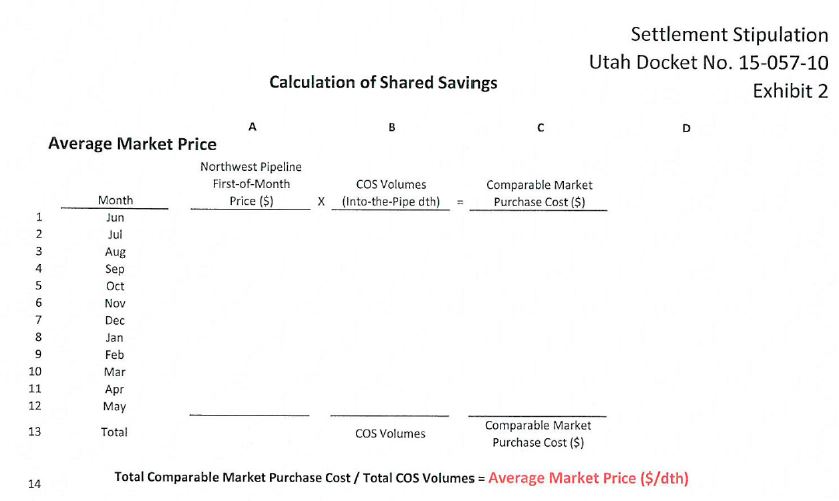

b. | The market price for an IRP year will be calculated as follows: The Northwest Pipeline first-of-month price for each month is multiplied by the actual COS Volumes for each month. These 12 months of costs are totaled and then divided by the 12-month total of into-the-interstate-pipeline volumes. The resulting price per decatherm is the Average Market Price for the previous IRP year. |

c. | The COS Price for the IRP year will include all pre-2016 Wexpro I and Wexpro II costs and volumes and all post-2015 Wexpro I and Wexpro II costs and volumes. These costs and volumes will include the customers’ portion of any Dry-Hole cost incurred during the IRP year. |

d. | Each year in June, the Average Market Price and COS Price will be calculated for the previous IRP year to determine if savings per decatherm have occurred. If savings have occurred, Wexpro will calculate the shared savings and separately identify the amount being returned to Wexpro on the July Operator Service Fee (OSF) invoice to Questar Gas. Questar Gas will separately identify the portion of the shared savings returned to Wexpro in the Company’s 191 Account. These calculations and entries are subject to review and audit by the Utah Division and the Wyoming OCA. Any dispute regarding related prices and calculations will be resolved in the Company’s 191 Account proceedings in Utah and Wyoming. |

e. | The calculation of shared savings is illustrated in the attached Settlement Stipulation Exhibit 2. Column A lines 1 - 12 show how the first-of-month price for Northwest Pipeline will be multiplied by the COS Volumes for each month shown in Column B, lines 1 - 12. Column C, lines 1 - 12 show the comparable market purchase cost by month. The 12-month total comparable market purchase cost, shown in Column C, line 13 is divided by the 12-month total COS Volumes, shown in Column B, line 13, to arrive at the Average Market Price, line 14. The COS Price for the IRP year will |

6

Settlement Stipulation

Docket No. 30010-145-GA-15

be the Wexpro I and Wexpro II costs for pre-2016, post-2015 proved producing, and post-2015 Development Wells (Col D, line 17) divided by the volumes in Wexpro I and Wexpro II for pre-2016, post-2015 proved producing, and post-2015 Development Wells (Col D, line 21). This calculation is illustrated on line 25. Line 18 notes that any Dry-Hole cost assigned to the customer that year must be included in that year’s calculation of the total COS Price. Savings per decatherm, shown on line 27, are calculated by taking the difference between the Average Market Price and the total COS Price. If this number is positive, then as shown on line 28, 50% of this savings ($/dth) is multiplied by the post-2015 Development Wells into-the-interstate-pipeline volumes (Col C, line 21) to arrive at the shared savings amount that will be included in the July entry in the 191 account.

19. The Parties agree for purposes of settlement that in no event shall this shared savings amount result in Wexpro earning a rate of return on post-2015 Development Wells greater than the Base Rate of Return (Base ROR) + 8% (Settlement Stipulation Exhibit 2, line 28). This shall be ensured with an adjustment to the Company’s 191 Account. The Parties acknowledge the effect of this adjustment may effectively increase Questar Gas’ customers’ share of savings or increase Wexpro’s proportionate share of Dry Hole or non-commercial well costs, set forth in paragraph 17 above.

20. The Parties agree for purposes of settlement that starting with the 2020 IRP year, and for each IRP year thereafter, Questar Gas and Wexpro will manage the combined cost-of-service production from Wexpro I and Wexpro II properties to: (a) 55% of Questar Gas’ annual forecasted demand identified in the IRP; or (b) 55% of the Minimum Threshold as defined in the Trail Settlement Stipulation, Section 12.c, if annual forecasted demand is below the Minimum Threshold.

21. The Parties agree for purposes of settlement that Questar Gas will maintain on its questargas.com web site a current copy of all relevant documents governing the cost-of-service arrangement between Wexpro and Questar Gas. This shall include, but is not limited to:

7

Settlement Stipulation

Docket No. 30010-145-GA-15

- | The 1981 Wexpro Stipulation and Agreement, commonly referred to as the Wexpro I Agreement |

- | Utah and Wyoming Commission Orders approving the Wexpro I Agreement |

- Wexpro II Agreement

- Utah and Wyoming Orders approving the Wexpro II Agreement

- Trail Settlement Stipulation

- Utah and Wyoming Orders approving the Trail Settlement Stipulation

- Canyon Creek Settlement Stipulation

- | Utah and Wyoming Orders approving the Canyon Creek Settlement Stipulation |

- | All Guideline Letters |

22. The Parties agree for purposes of settlement that all terms and conditions of the Wexpro I and Wexpro II Agreements and the Trail Settlement Stipulation apply unless otherwise clarified or addressed by this Settlement Stipulation. The Parties further agree that the Wexpro I Agreement, the Wexpro II Agreement, the Trail Settlement Stipulation, and this Settlement Stipulation, known as the Canyon Creek Settlement Stipulation, must be read collectively as the Wexpro Agreement. Under no circumstances will a Party to the collective Wexpro Agreement assert that any provision of the Wexpro I Agreement, the Wexpro II Agreement, the Trail Settlement Stipulation, or the Canyon Creek Settlement Stipulation is severable from the collective Wexpro Agreement.

23. The Parties agree for purposes of settlement that under no circumstance will any Party claim that this Settlement Stipulation invokes Section 11.2 of the 1981 Utah Stipulation; Section 11.2 of the Wyoming 1981 Stipulation; or Wexpro I Agreement, Article IV-6(c). The Parties further agree that nothing in this Settlement Stipulation may be interpreted or claimed by any Party under any term or combination of terms of the 1981 Utah Stipulation and the 1981 Wyoming Stipulation to allow Wexpro to either revoke any Wexpro I or Wexpro II properties, release Wexpro or the Company from their obligations under either the

8

Settlement Stipulation

Docket No. 30010-145-GA-15

Wexpro I or Wexpro II Agreements, or subject Wexpro to the jurisdiction of either the Utah or Wyoming Commissions.

GENERAL

24. The Parties agree that settlement of those issues identified above is in the public interest and that the results are just and reasonable.

25. The Parties agree that no part of this Settlement Stipulation or the formulae or methods used in developing the same, or a Commission order approving the same shall in any manner be argued or considered as precedential in any future case. All negotiations related to this Settlement Stipulation are privileged and confidential, and no Party shall be bound by any position asserted in negotiations. Neither the execution of this Settlement Stipulation nor the order adopting it shall be deemed to constitute an admission or acknowledgment by any Party of the validity or invalidity of any principle or practice of ratemaking; nor shall they be construed to constitute the basis of an estoppel or waiver by any Party; nor shall they be introduced or used as evidence for any other purpose in a future proceeding by any Party except in a proceeding to enforce this Settlement Stipulation.

26. Questar Gas, Wexpro, the Division, the Utah OCS and the Wyoming OCA each will make one or more witnesses available to explain and support this Settlement Stipulation to their respective Commissions. Such witnesses will be available for examination. As applied to the Division, the Utah OCS, and the Wyoming OCA, the explanation and support shall be consistent with their statutory authorities and responsibilities. So that the records in these dockets are complete, all Parties’ filed testimony, exhibits, and the Confidential Applications and their exhibits shall be submitted as evidence.

27. The Parties agree that if any person challenges the approval of this Settlement Stipulation or requests rehearing or reconsideration of any order of the Commissions approving this Settlement Stipulation, each Party will use its best efforts to support the terms and conditions of the Settlement Stipulation. As applied to the Utah Division, the Utah OCS, and the Wyoming OCA, the phrase “use its best efforts” means that they shall do so in a manner consistent with their statutory authorities and responsibilities. In the event

9

Settlement Stipulation

Docket No. 30010-145-GA-15

any person seeks judicial review of a Commission order approving this Settlement Stipulation, no Party shall take a position in that judicial review opposed to the Settlement Stipulation.

28. Except with regard to the obligations of the Parties under paragraphs 25, 26, and 27, of this Settlement Stipulation, this Settlement Stipulation shall not be final and binding on the Parties until it has been approved without material change or condition by the Commissions. This Settlement Stipulation is an integrated whole, and any Party may withdraw from it if it is not approved without material change or condition by the Commissions or if the Commissions’ approval is rejected or materially conditioned by a reviewing court. If the Commissions reject any part of this Settlement Stipulation or impose any material change or condition on approval of this Settlement Stipulation, or if the Commissions’ approval of this Settlement Stipulation is rejected or materially conditioned by a reviewing court, the Parties agree to meet and discuss the applicable Commission or court order within five business days of its issuance and to attempt in good faith to determine if they are willing to modify the Settlement Stipulation consistent with the order. No Party shall withdraw from the Settlement Stipulation prior to complying with the foregoing sentence. If any Party withdraws from the Settlement Stipulation, any Party retains the right to seek additional procedures before the Commission, including presentation of testimony and cross-examination of witnesses, with respect to issues resolved by the Settlement Stipulation, and no Party shall be bound or prejudiced by the terms and conditions of the Settlement Stipulation.

29. This Settlement Stipulation may be executed by individual Parties through two or more separate, conformed copies, the aggregate of which will be considered as an integrated instrument.

10

Settlement Stipulation

Docket No. 30010-145-GA-15

RELIEF REQUESTED

Based on the foregoing, the Parties request that the Commission issue an order approving this Settlement Stipulation and adopting its terms and conditions.

RESPECTFULLY SUBMITTED: October 26, 2015.

/s/ Chris Parker | /s/ Michele Beck | |

Chris Parker Director Utah Division of Public Utilities | Michele Beck Director Office of Consumer Services | |

/s/ Craig C. Wagstaff | /s/ Bryce Freeman | |

Craig C. Wagstaff President Questar Gas Company | Bryce Freeman Administrator Wyoming Office of Consumer Advocate | |

/s/ Brady B. Rasmussen | ||

Brady B. Rasmussen Executive Vice President & Chief Operating Officer Wexpro Company | ||

11

Settlement Stipulation

Docket No. 30010-145-GA-15

12

13