Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HomeStreet, Inc. | form8-kq32015investorprese.htm |

THIRD QUARTER 2015 NASDAQ:HMST

Important Disclosures Forward-Looking Statements This presentation includes forward-looking statements, as that term is defined for purposes of applicable securities laws, about our industry, our future financial performance and business activity. These statements are, in essence, attempts to anticipate or forecast future events, and thus subject to many risks and uncertainties. These forward- looking statements are based on our management's current expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, as well as a number of assumptions concerning future events. Forward-looking statements in this release include, among other matters, statements regarding our business plans and strategies (including our expansion strategies) and the expected effects of those initiatives, general economic trends, particularly those that affect mortgage origination and refinance activity, and growth scenarios and performance targets. Readers should note, however, that all statements in this presentation other than assertions of historical fact are forward-looking in nature. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings, including but not limited to our most recent Quarterly Report on Form 10-Q for the quarter ended September 30, 2015; and our Annual Report on Form 10-K for year ended December 31, 2014. Many of these factors are beyond our control. Such factors could cause actual results to differ materially from the results discussed or implied in the forward-looking statements. These risks include statements predicated on our ability to realize the expected value of our merger with Simplicity Bancorp and the combined entity resulting from that transaction; integrate our recent acquisition; continue to expand our banking operations geographically and across market sectors; grow our franchise and capitalize on market opportunities; manage our growth efforts cost-effectively and attain the desired operational and financial outcomes; manage the losses inherent in our loan portfolio; make accurate estimates of the value of our non-cash assets and liabilities; maintain electronic and physical security of customer data; respond to an increasingly restrictive and complex regulatory environment; and attract and retain key personnel. Actual results may fall materially short of our expectations and projections, and we may change our plans or take additional actions that differ in material ways from our current intentions. Accordingly, we can give no assurance of future performance, and you should not rely unduly on forward-looking statements. All forward-looking statements are based on information available to the Company as of the date hereof, and we do not undertake to update or revise any forward-looking statements, for any reason. Basis of Presentation of Financial Data Unless noted otherwise in this presentation, all reported financial data is being presented as of the period ending September 30, 2015. Non-GAAP Financial Measures Information on any non-GAAP financial measures referenced in this presentation, including a reconciliation of those measures to GAAP measures, may also be found in our SEC filings and in the earnings release available on our web site. 2

Growing Western U.S. Franchise • Seattle-based diversified financial services company founded in 1921 with concentrations in demographically desirable Pacific Northwest and Southern California • Leading Northwest mortgage lender and commercial & consumer bank with growing presence in California • 113 retail deposit branches and lending centers in the Western United States and Hawaii • Total assets of $5.0 billion 3

Strategy Build Single Family Mortgage origination market share • Organic growth opportunities Grow portfolio lending – Commercial Lending, Commercial Real Estate and Construction Increase density of retail deposit branch network • Growth via acquisition of smaller institutions in-market and in new markets • Continue opportunistic expansion (market share and footprint) of Single Family mortgage banking activities • Target major markets in Western United States • Grow earning assets while containing operating expenses to improve operating efficiencies • Long-term target efficiency ratio in the mid-to-low 60% range • Target long-term 15%+ ROE, subject to achievement of targeted segment contributions • Future potential dividend upon stabilization of earnings Expand Commercial & Consumer Banking Ongoing expense management Optimize use of capital To grow and diversify earnings by expanding our Commercial & Consumer Banking business and continue to build Mortgage Banking market share in new and existing markets 4

5 Recent Developments Results of Operations • Third quarter net income of $10.0 million or $0.45 diluted EPS • Excluding after tax merger-related items, core net income of $9.4 million or $0.42 diluted EPS • Total Assets grew to $5.0B • Continued strong credit performance including reductions in classified assets, nonperforming assets and delinquencies Strategic Growth Activity in 3Q15 • Agreed to acquire Irvine, California based Orange County Business Bank, a $200M asset commercial bank. Transaction is expected to close during 1Q16, subject to, among other things, OCBB shareholder and state and federal regulatory approvals. • Agreed to acquire the AmericanWest Bank Branch in Dayton, Washington, including (as of 6/30/15) $27.1M in deposits, and $4.4M in loans. All regulatory approvals received, and expect to close the acquisition in December 2015. • Continued Organic Growth through opening of de novo Retail Bank Branches and Home Loan Centers • Opened de novo Retail Bank Branches in the Greater Seattle areas of Issaquah and the University District • Opened Home Loan Centers in the California markets of Glendora, San Diego, San Luis Obispo, Chico, and Riverside • Company has filed an application for a conversion to a Washington State Chartered Commercial Bank

Results of Operations For the three months ended (1) Includes seven months of Simplicity’s results of operations. (2) Includes $4.6 million increase in mortgage servicing income from sale of MSRs and $4.6 million gain on sale of single family mortgage loans originally held for investment. (3) Excludes pre-tax acquisition-related expenses and bargain purchase gain. See appendix for reconciliation of non-GAAP financial measures. (4) See appendix for reconciliation of non-GAAP financial measures. (5) 2015 capital ratios under Basel III regulatory capital rules while all prior period ratios under Basel I rules. For the nine months ended 6 ($ in thousands) Sept. 30, 2015 Sept. 30, 2014 Sept. 30, 2015 (1) Sept. 30, 2014 Net interest income $ 39,634 $ 25,308 $ 108,598 $ 71,167 Provision for loan losses 700 - 4,200 (1,500) Noninterest income 67,468 45,813 215,828 134,170 (2) Noninterest expense 92,026 64,158 273,843 183,220 Net income before taxes 14,376 6,963 46,383 23,617 Income taxes 4,415 1,988 13,742 6,979 Net income $ 9,961 $ 4,975 $ 32,641 $ 16,638 Diluted EPS $ 0.45 $ 0.33 $ 1.58 $ 1.11 Core net income (3) $ 9,449 $ 5,444 $ 35,550 $ 18,046 Core EPS (3) $ 0.42 $ 0.36 $ 1.72 $ 1.21 Tangible BV/share (4) $ 19.95 $ 18.86 $ 19.95 $ 18.86 Core ROAA (3) 0.78% 0.66% 1.07% 0.77% Core ROAE (3) 8.21% 7.38% 11.05% 8.47% Core ROATE (3) 8.59% 7.76% 11.57% 8.92% Net Interest Margin 3.67% 3.50% 3.63% 3.50% Core efficiency ratio (3) 86.2% 89.2% 81.4% 88.2% Tier 1 Leverage Ratio (Bank) (5) 9.69% 9.63% 9.69% 9.63% Total Risk-Based Capital (Bank) (5) 14.15% 13.96% 14.15% 13.96% For the three months ended For the nine months ended

Results of Operations – Quarter Trend For the three months ended (1) Includes only one month of Simplicity’s results of operations. (2) Excludes pre-tax acquisition-related expenses and bargain purchase gain. See appendix for reconciliation of non-GAAP financial measures. (3) See appendix for reconciliation of non-GAAP financial measures. (4) 2015 capital ratios under Basel III regulatory capital rules while all prior period ratios under Basel I rules. (5) Quarterly average assets used to calculate Tier 1 Leverage ratio normalized for Simplicity Bank merger effective 3/1/15 For the nine months ended 7 ($ in thousands) Sept. 30, 2015 Jun. 30, 2015 Mar. 31, 2015 (1) Dec. 31, 2014 Sept. 30, 2014 Net interest income $ 39,634 $ 38,230 $ 30,734 $ 27,502 $ 25,308 Provision for loan losses 700 500 3,000 500 - Noninterest income 67,468 72,987 75,373 51,487 45,813 Noninterest expense 92,026 92,335 89,482 68,791 64,158 Net income before taxes 14,376 18,382 13,625 9,698 6,963 Income taxes 4,415 6,006 3,321 4,077 1,988 Net income $ 9,961 $ 12,376 $ 10,304 $ 5,621 $ 4,975 Diluted EPS $ 0.45 $ 0.56 $ 0.59 $ 0.38 $ 0.33 Core net income (2) $ 9,449 $ 14,541 $ 11,560 $ 6,199 $ 5,444 Core EPS (2) $ 0.42 $ 0.65 $ 0.67 $ 0.41 $ 0.36 Tangible BV/share (3) $ 19.95 $ 19.35 $ 18.97 $ 19.39 $ 18.86 Core ROAA (2) 0.78% 1.25% 1.21% 0.72% 0.66% Core ROAE (2) 8.21% 12.76% 12.50% 8.13% 7.38% Core ROATE (2) 8.59% 13.38% 13.09% 8.53% 7.76% Net Interest Margin 3.67% 3.63% 3.60% 3.53% 3.50% Core efficiency ratio (2) 86.2% 80.1% 77.7% 86.0% 89.2% Tier 1 Leverage Ratio (Bank) (4) 9.69% 9.46% 11.47% / 9.95% (5) 9.38% 9.63% Total Risk-Based Capital (Bank) (4) 14.15% 13.97% 14.57% 14.03% 13.96% For the three months ended

$25.3 $27.5 $30.7 $38.2 $39.6 3.50% 3.53% 3.60% 3.63% 3.67% 3.30% 3.40% 3.50% 3.60% 3.70% 3.80% 3.90% $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 3Q14 4Q14 1Q15 2Q15 3Q15 Ne t In ter est Ma rgi n (% ) Ne t In ter est Inc om e (i n m illio ns) Net Interest Income & Margin • 3Q NIM increased 4 bps and net interest income increased 4% from 2Q due primarily to 3% increase in average interest-earning assets – primarily from growth in residential construction, commercial construction and commercial real estate loan balances 8

Avg. Yield 3.00% 3.20% 3.40% 3.60% 3.80% 4.00% 4.20% $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 $5.0 3Q14 4Q14 1Q15 2Q15 3Q15 Av era ge Yi eld Av era ge Ba lan ce s ( in bil lio ns ) Loans Held for Sale Cash & Cash Equivalents Investment Securities Loans Held for Investment Average Yield Interest-Earning Assets • Total average interest-earning assets increased $128 million or 3% in 3Q, primarily from $114 million increase in loans held for investment • Excluding run-off, loans held for investment ending balances increased $404 million or 14% in 3Q • New commitments of $417 million in mortgage, commercial lending, commercial real estate and residential construction • Run-off continued to occur at an accelerated pace of approximately 32% annualized in 3Q Avg. Yield 3.89% 3.94% 4.01% 4.03% 4.03% 9

HomeStreet Investment Securities Portfolio Yield As of 09/30/2015 YTD 2015 Total Return (1) Yield (2) Duration (2) HomeStreet Investment Portfolio 1.78% 2.64% 3.92 Composition Adjusted Barclays US Aggregate Index (4) 1.35% 2.54% 4.15 HMST performance data: BondEdge (1) As of September 30, 2015 (2) Yield and duration Include FTE adjustment (3) Performance Trust proprietary models as of 06/30/15, YOY (4) Barclays US Aggregate Index Adjusted to reflect HMST portfolio composition • Investment Security Portfolio size is $602M • The Investment Portfolio has an average credit rating of Aa2 • The Portfolio total return ranks in the 89th percentile compared to other banks (3) 7% 14% 30% 34% 15% Investment Securities Portfolio Composition as of 9/30/2015 Treasury Corporate Municipal Mortgage CMO 10

Noninterest Income • Noninterest income declined 8% to $67.5 million in 3Q compared to 2Q, mostly from lower net gain on mortgage loan origination and sale activities • Net gain on mortgage loan origination and sale activities declined $12.1 million primarily due to 4% lower single family rate lock volume and lower composite margin • Mortgage servicing income increased $2.9 million due to higher servicing fees collected during the quarter and higher risk management results primarily related to lower prepayment speeds 11 $6.6 $6.2 $9.8 $4.3 $1.8 $4.8 $37.6 $39.2 $61.9 $70.0 $57.9 $45.8 $51.5 $75.4 $73.0 $67.5 $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 3Q14 4Q14 1Q15 2Q15 3Q15 No nin ter st Inc om e ( in mi llio ns ) Net gain on mortgage loan origination and sale activities Mortgage servicing income Bargain purchase gain Other noninterest income

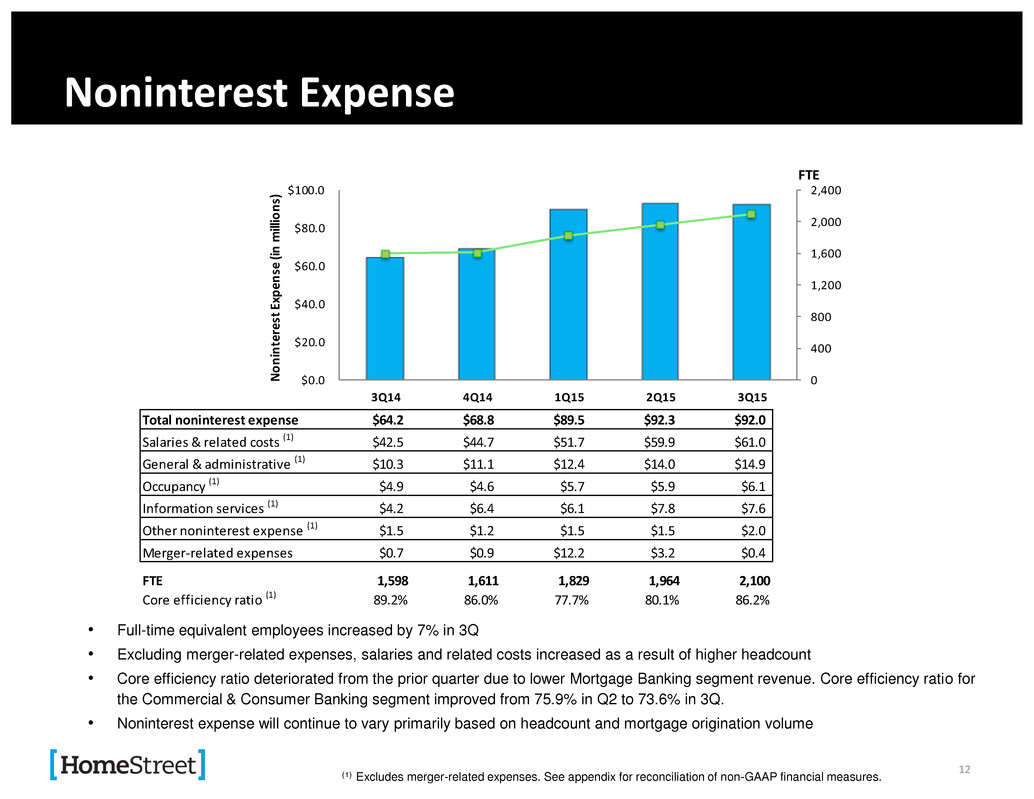

0 400 800 1,200 1,600 2,000 2,400 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 3Q14 4Q14 1Q15 2Q15 3Q15 No nin ter es t E xp en se (in m illio ns ) FTE Total noninterest expense $64.2 $68.8 $89.5 $92.3 $92.0 Salaries & related costs (1) $42.5 $44.7 $51.7 $59.9 $61.0 General & administrative (1) $10.3 $11.1 $12.4 $14.0 $14.9 Occupancy (1) $4.9 $4.6 $5.7 $5.9 $6.1 Information services (1) $4.2 $6.4 $6.1 $7.8 $7.6 Other noninterest expense (1) $1.5 $1.2 $1.5 $1.5 $2.0 Merger-related expenses $0.7 $0.9 $12.2 $3.2 $0.4 FTE 1,598 1,611 1,829 1,964 2,100 Core efficiency ratio (1) 89.2% 86.0% 77.7% 80.1% 86.2% Noninterest Expense • Full-time equivalent employees increased by 7% in 3Q • Excluding merger-related expenses, salaries and related costs increased as a result of higher headcount • Core efficiency ratio deteriorated from the prior quarter due to lower Mortgage Banking segment revenue. Core efficiency ratio for the Commercial & Consumer Banking segment improved from 75.9% in Q2 to 73.6% in 3Q. • Noninterest expense will continue to vary primarily based on headcount and mortgage origination volume (1) Excludes merger-related expenses. See appendix for reconciliation of non-GAAP financial measures. 12

Segment Overview Mortgage Banking • Regional Single Family mortgage origination platform • 100% direct retail origination • Majority of production sold into secondary market • Fannie Mae, Freddie Mac, FHA, VA lender since programs’ inception • Portfolio products: jumbo and custom home construction • Servicing retained on majority of originated loans sold to secondary markets • Build Western U.S. major market retail franchise • Dynamic personnel management in relation to changes in market conditions • Fixed/Semi/Variable cost management • Long-term targeted ROE of >25% Commercial & Consumer Banking Overview • Commercial Banking Commercial lending, including SBA All CRE property types with multifamily focus Residential construction Commercial deposit, treasury and cash management services • Consumer Banking Consumer loan and deposit products Consumer investment, insurance and private banking products and services • Expand market/grow market share in current and new markets Follow mortgage expansion • Diversify and grow loan portfolio 5% or more per quarter (1) • Manage non-interest expense increase to 1-2% per quarter • Long-term targeted ROE range of 8-12% Commercial lending – 8-12% Commercial real estate – 10-15% Residential construction – 20-30% Single Family residential – 10-15% Strategic Objectives (1) Actual growth of loan portfolio is subject to, among other things, actual loan production volumes, portfolio runoff, portfolio loan sales, portfolio credit performance and net interest margin. Other portfolio management considerations include liquidity management, capital requirements and profitability. 13

Commercial & Consumer Banking 14

Commercial & Consumer Banking Segment • 3Q15 net interest income increased 56% from 3Q14 as a result of 46% growth in average earning assets and YTD net interest income increased 46% from the prior year as a result of 37% growth in average earning assets – primarily due to the Simplicity merger 15 (1) Includes seven months of Simplicity’s results of operations. (2) Includes $4.6 million gain on sale of single family mortgage loans originally held for investment. (3) Excludes pre-tax acquisition-related expenses and bargain purchase gain. See appendix for reconciliation of non-GAAP financial measures. ($ in thousands) Sept. 30, 2015 Sept. 30, 2014 Sept. 30, 2015 (1) Sept. 30, 2014 Net interest income $ 31,509 $ 20,163 $ 87,261 $ 59,799 Provision for loan losses 700 - 4,200 (1,500) Noninterest income 6,885 3,660 20,589 13,232 (2) Noninterest expense 28,111 18,930 93,056 58,657 Net income (loss) before taxes 9,583 4,893 10,594 15,874 Income taxes 2,783 1,359 954 4,471 Net income (loss) $ 6,800 $ 3,534 $ 9,640 $ 11,403 Core net income (3) $ 6,288 $ 4,003 $ 12,549 $ 12,811 Core ROAA (3) 0.66% 0.61% 0.48% 0.67% Core ROAE (3) 7.39% 8.35% 5.55% 8.76% Core ROATE (3) 7.87% 9.04% 5.93% 9.45% Core efficiency ratio (3) 73.6% 76.4% 76.9% 77.4% Net Interest Margin 3.62% 3.41% 3.61% 3.42% Total average earning assets $3,514,496 $2,403,436 $3,244,317 $2,364,474 FTE 807 605 807 605 For the three months ended For the nine months ended

Commercial & Consumer Banking Segment – Quarter Trend • Net interest income increased 3% from 2Q as a result of 4% growth in average earning assets 16 (1) Includes only one month of Simplicity’s results of operations. (2) Excludes pre-tax acquisition-related expenses and bargain purchase gain. See appendix for reconciliation of non-GAAP financial measures. ($ in thousands) Sept. 30, 2015 Jun. 30, 2015 Mar. 31, 2015 (1) Dec. 31, 2014 Sept. 30, 2014 Net interest income $ 31,509 $ 30,645 $ 25,107 $ 22,187 $ 20,163 Provision for loan losses 700 500 3,000 500 - Noninterest income 6,885 3,624 10,081 5,434 3,660 Noninterest expense 28,111 29,280 35,666 21,155 18,930 Net income (loss) before taxes 9,583 4,489 (3,478) 5,966 4,893 Income taxes 2,783 1,635 (3,464) 2,621 1,359 Net income (loss) $ 6,800 $ 2,854 $ (14) $ 3,345 $ 3,534 Core net income (2) $ 6,288 $ 5,019 $ 1,242 $ 3,923 $ 4,003 Core ROAA (2) 0.66% 0.56% 0.16% 0.57% 0.61% Core ROAE (2) 7.39% 6.47% 2.02% 7.89% 8.35% Core ROATE (2) 7.87% 6.94% 2.16% 8.51% 9.04% Core efficiency ratio (2) 73.6% 76.1% 66.8% 73.4% 76.4% Net Interest Margin 3.62% 3.65% 3.60% 3.49% 3.41% Total average earning assets $3,514,496 $3,385,008 $2,840,601 $2,535,712 $2,403,436 FTE 807 757 768 608 605 For the three months ended

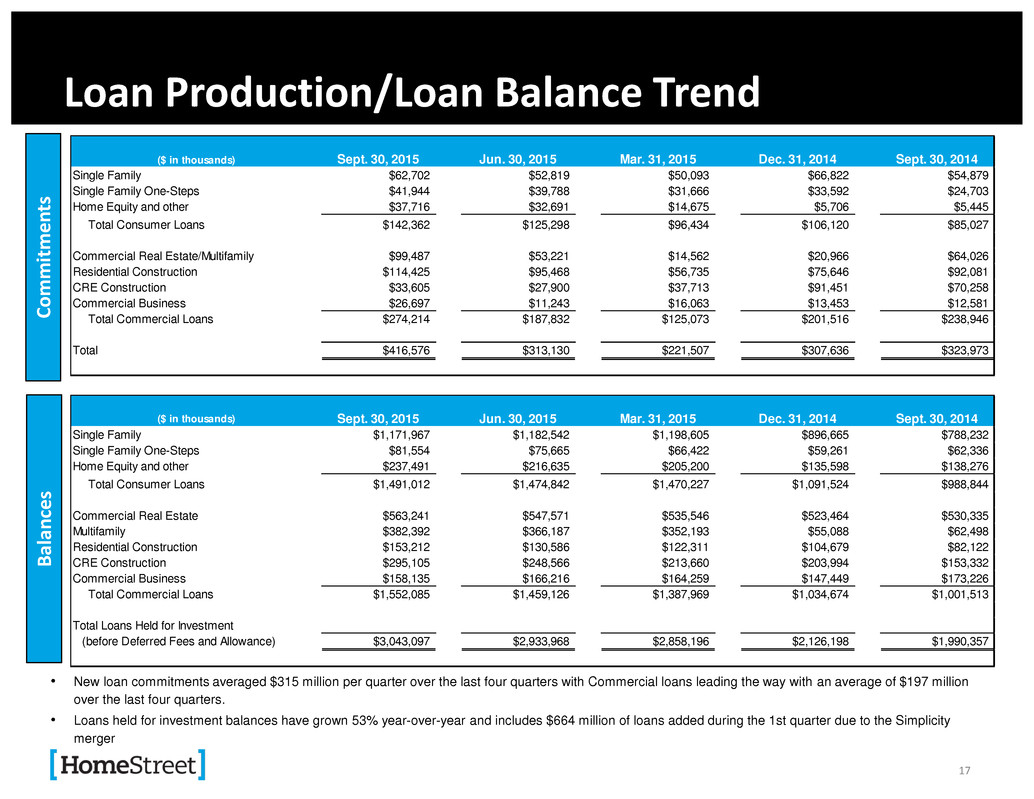

Loan Production/Loan Balance Trend 17 • New loan commitments averaged $315 million per quarter over the last four quarters with Commercial loans leading the way with an average of $197 million over the last four quarters. • Loans held for investment balances have grown 53% year-over-year and includes $664 million of loans added during the 1st quarter due to the Simplicity merger Commitme n ts B al an ce s ($ in thousands) Sept. 30, 2015 Jun. 30, 2015 Mar. 31, 2015 Dec. 31, 2014 Sept. 30, 2014 Single Family $1,171,967 $1,182,542 $1,198,605 $896,665 $788,232 Single Family One-Steps $81,554 $75,665 $66,422 $59,261 $62,336 Home Equity and other $237,491 $216,635 $205,200 $135,598 $138,276 Total Consumer Loans $1,491,012 $1,474,842 $1,470,227 $1,091,524 $988,844 Commercial Real Estate $563,241 $547,571 $535,546 $523,464 $530,335 Multifamily $382,392 $366,187 $352,193 $55,088 $62,498 Residential Construction $153,212 $130,586 $122,311 $104,679 $82,122 CRE Construction $295,105 $248,566 $213,660 $203,994 $153,332 Commercial Business $158,135 $166,216 $164,259 $147,449 $173,226 Total Commercial Loans $1,552,085 $1,459,126 $1,387,969 $1,034,674 $1,001,513 Total Loans Held for Investment (before Deferred Fees and Allowance) $3,043,097 $2,933,968 $2,858,196 $2,126,198 $1,990,357 ($ in thousands) Sept. 30, 2015 Jun. 30, 2015 Mar. 31, 2015 Dec. 31, 2014 Sept. 30, 2014 Single Family $62,702 $52,819 $50,093 $66,822 $54,879 Single Family One-Steps $41,944 $39,788 $3 ,666 $33,592 $24,703 Hom Equity and other $37 716 $3 691 $14 7 $5 706 $5 445 Total Consum r Loans $142 362 $12 298 9 34 $106 120 85 027 Commercial Real Estate/Multifamily $ 9,487 $53,221 $14,562 $20,966 $64,026 Residential Construction $114,425 $95,468 $56,735 $75,646 $92,081 RE Construction $33,605 $27,900 $37,713 $91,451 $70,258 r i l Busine s $26,697 $11,243 $16,063 $1 , 53 $12,581 Total Commercial Loans 274,214 187,832 125,07 $201,516 $238,946 Total 416 576 313 130 21 507 3 7 636 32 973

Loan Portfolio • Loans held for investment increased 3.8% to $3.04 billion from $2.93 billion at June 30, 2015, an increase of $111 million primarily due to increase in Commercial loan originations • New loan commitments totaled $417 million in the quarter compared to $313 million in the second quarter • Total Commercial loans increased to 54% of the total loans held for investment portfolio in the quarter 18

33% 8% 1% 18% 1% 3% 0% 3% 33% 28% 22% 0% 11% 4% 0% 0% 23% 12% 45% 20% 0% 2% 0% 0% 0% 32% 0% 35% 1% 2%15% 0% 9% 13% 19% 6% 20% 18% 9% 5% 0%3% 1% 30% 13% Construction Lending Overview 19 Construction lending is a broad category that includes many different loan types which are often characterized by different risk profiles. HomeStreet lends within the full spectrum of construction lending types, but is deliberate in achieving diversification among the types to mitigate risk. Additionally, recent geographical expansion has provided an opportunity to reduce concentrations in any particular market. Balance: $112M Commitments: $161M % of Balances: 21% % of Commitments: 39% 9/30/15 Balances and Commitments Loan Characteristics Construction Lending Types Custom Home Construction Multifamily Commercial Residential Construction Land & Lots •12 Month Term •Consumer Owner Occupied •Borrower Underwritten similar to Single Family Balance: $81M Commitments: $68M % of Balances: 15% % of Commitments: 17% Geographical Distribution (balances) Balance: $168M Commitments: $128M % of Balances: 32% % of Commitments: 31% Balance: $115M Commitments: $30M % of Balances: 22% % of Commitments: 7% Balance: $53M Commitments: $22M % of Balances: 10% % of Commitments: 5% Seattle Metro Puget Sound Other WA Other Portland Metro OR Other Hawaii California Utah Idaho •18-36 Month Term •≤ 80% LTC •Minimum 15% Cash Equity •≥ 1.15 DSC •Portfolio LTV ~ 65% •18-36 Month Term •≤ 80% LTC •Minimum 15% Cash Equity •≥ 1.25 DSC •≥ 50% pre-leased office/retail •Portfolio LTV ~65% •12-18 Month Term • LTC: ≤ 95% Presale & Spec •Leverage, Liquid. & Net Worth Covenants as appropriate •Portfolio LTV ~ 70% •12-24 Month Term •≤ 50% -80% LTC • Strong, experienced, vertically integrated builders •Portfolio LTV ~ 55%

Credit Quality 20 • Nonperforming assets declined to 0.56% of total assets • Nonperforming assets declined to $27.7 million compared to $32.7 million in second quarter a 15% decline. • OREO declined to $8.3 million compared to $11.4 million in second quarter a 28% decline. (1) Nonperforming assets includes nonaccrual loans and OREO, excludes performing TDRs and SBAs (2) Total delinquencies and total loans - adjusted are both net of Ginnie Mae EBO loans (FHA/VA loans) (3) Peer group revised 1Q15. Source: SNL (4) Not available at time of publishing ($ in thousands) HMST Peer Avg (3) HMST Peer Avg (3) HMST Peer Avg (3) HMST Peer Avg (3) HMST Peer Avg (3) Nonperforming assets (1) $27,743 -- $32,735 -- $32,798 -- $25,462 -- $30,384 -- Nonperforming loans $19,470 -- $21,308 -- $21,209 -- $16,014 -- $19,906 -- OREO $8,273 -- $11,427 -- $11,589 -- $9,448 -- $10,478 -- Nonperforming assets/total assets (1) 0.56% (4) 0.67% 0.83% 0.71% 0.91% 0.72% 0.98% 0.87% 1.09% Nonperforming loans/total loans 0.64% (4) 0.73% 0.72% 0.74% 0.78% 0.75% 0.82% 1.00% 0.91% Total delinquencies/total loans 2.40% (4) 2.25% 1.18% 2.37% 1.33% 3.00% 1.35% 3.29% 1.49% Total delinquencies/total loans - adjusted (2) 1.04% (4) 0.92% 1.16% 1.04% 1.31% 1.11% 1.34% 1.29% 1.47% ALLL/total loans 0.89% (4) 0.88% 1.15% 0.87% 1.16% 1.04% 1.18% 1.10% 1.23% ALLL/Nonperforming loans (NPLs) 138.27% (4) 120.97% 442.13% 117.48% 424.00% 137.51% 374.81% 109.75% 376.70% ALLL + Purchased loans discount /total loans 1.13% -- 1.13% -- 1.13% -- 1.09% -- 1.12% -- Sept. 30, 2015 Jun. 30, 2015 Mar. 31, 2015 Dec. 31, 2014 Sept. 30, 2014

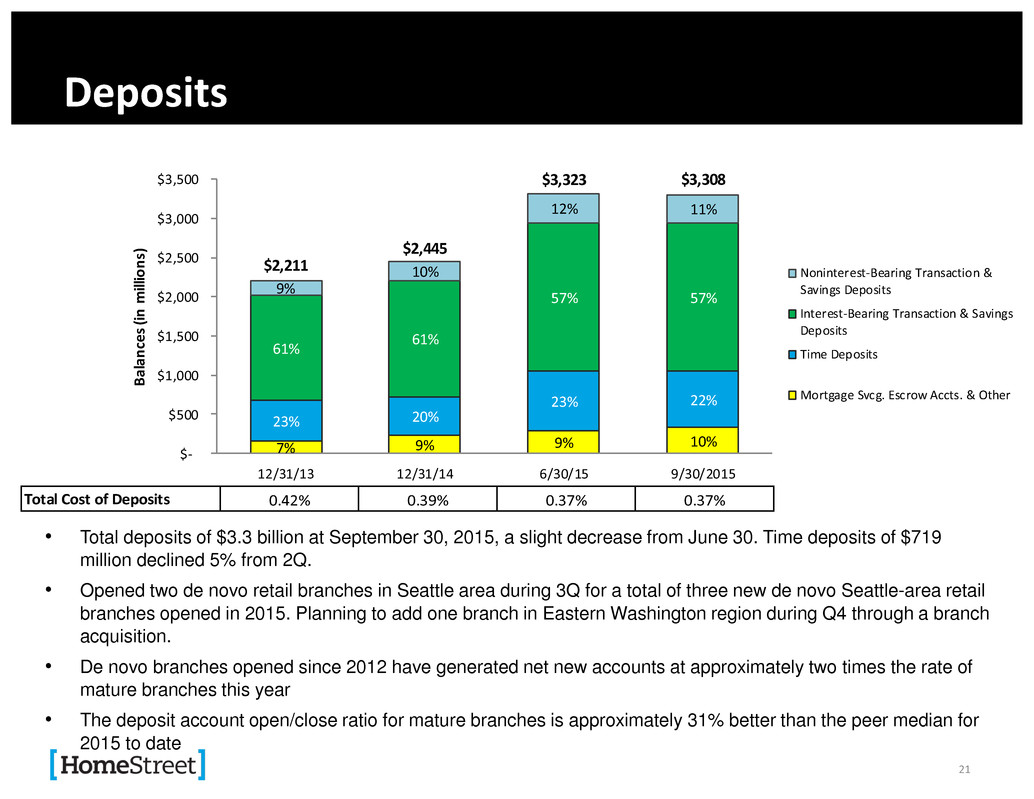

Deposits • Total deposits of $3.3 billion at September 30, 2015, a slight decrease from June 30. Time deposits of $719 million declined 5% from 2Q. • Opened two de novo retail branches in Seattle area during 3Q for a total of three new de novo Seattle-area retail branches opened in 2015. Planning to add one branch in Eastern Washington region during Q4 through a branch acquisition. • De novo branches opened since 2012 have generated net new accounts at approximately two times the rate of mature branches this year • The deposit account open/close ratio for mature branches is approximately 31% better than the peer median for 2015 to date 21 Total Cost of Deposits 7% 9% 9% 10% 23% 20% 23% 22% 61% 61% 57% 57% 9% 10% 12% 11% $2,211 $2,445 $3,323 $3,308 $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 12/31/13 12/31/14 6/30/15 9/30/2015 Bala nce s (in mil lion s) Noninterest-Bearing Transaction & Savings Deposits Interest-Bearing Transaction & Savings Deposits Time Deposits Mortgage Svcg. Escrow Accts. & Other Total Cost of Deposits 0.42% 0.39% 0.37% 0.37%

Mortgage Banking 22

Mortgage Banking Segment • 3Q15 interest rate lock commitment volume of $1.8 billion was 55% higher than in 3Q14 and closed loan volume of $1.9 billion was 49% higher than last year. YTD interest rate lock commitment volume of $5.6 billion was 76% higher than the prior year and closed loan volume of $5.6 billion was 81% higher than last year. • 3Q15 mortgage servicing income of $4.1 million decreased $1.2 million from 3Q14 and YTD mortgage servicing income of $9.1 million decreased $13.2 million from last year – primarily attributable to higher servicing value decay and a decline in risk management results 23 ($ in thousands) Sept. 30, 2015 Sept. 30, 2014 Sept. 30, 2015 Sept. 30, 2014 Net interest income $ 8,125 $ 5,145 $ 21,337 $ 11,368 Noninterest income 60,584 42,153 195,239 120,938 (1) Noninterest expense 63,916 45,228 180,787 124,563 Net income before taxes 4,793 2,070 35,789 7,743 Income taxes 1,632 629 12,788 2,508 Net income $ 3,161 $ 1,441 $ 23,001 $ 5,235 ROAA 1.11% 0.77% 3.25% 1.22% ROAE / ROATE 10.28% 5.65% 24.00% 7.56% Efficiency Ratio 93.0% 95.6% 83.5% 94.1% FTE 1,293 993 1,293 993 For the three months ended For the nine months ended (1) Includes $4.6 million increase in mortgage servicing income from sale of MSRs.

Mortgage Banking Segment – Quarter Trend • Interest rate lock commitment volume of $1.8 billion was 4% lower than in 2Q and closed loan volume of $1.9 billion was also 4% lower than in 2Q • Lower rate lock volume and decline in composite margin were the primary drivers of net gain on mortgage loan origination and sale activities of $56.0 million coming in 17% below 2Q • Mortgage servicing income of $4.1 million increased $2.9 million from the prior quarter due to higher servicing fees collected and improved risk management results primarily related to lower long-term prepayment speed expectations 24 ($ in thousands) Sept. 30, 2015 Jun. 30, 2015 Mar. 31, 2015 Dec. 31, 2014 Sept. 30, 2014 Net interest income $ 8,125 $ 7,585 $ 5,627 $ 5,315 $ 5,145 Noninterest income 60,584 69,363 65,292 46,053 42,153 Noninterest expense 63,916 63,055 53,816 47,636 45,228 Net income before taxes 4,793 13,893 17,103 3,732 2,070 Income taxes 1,632 4,371 6,785 1,456 629 Net income $ 3,161 $ 9,522 $ 10,318 $ 2,276 $ 1,441 ROAA 1.11% 3.44% 4.56% 1.15% 0.77% ROAE / ROATE 10.28% 26.84% 35.16% 8.93% 5.65% Efficiency Ratio 93.0% 81.9% 75.9% 92.7% 95.6% FTE 1,293 1,207 1,061 1,003 993 For the three months ended

Mortgage Origination (1) Represents combined value of secondary market gains and originated mortgage servicing rights stated as a percentage of interest rate lock commitments. (2) Loan origination and funding fees stated as a percentage of mortgage originations from the retail channel and excludes loans purchased from WMS. (3) Implemented a new pricing structure in the first quarter of 2015 where origination fees will no longer be charged at funding as the fee will be included in the rate/price of a loan. (4) In the second quarter of 2015, we recognized an additional $2.4 million of gain on mortgage loan origination and sale revenue related to the correction of an error in the mortgage loan pipeline valuation. The Composite Margin in the table above has been adjusted to eliminate the impact of this correction. 25 - 500 1,000 1,500 2,000 2,500 3Q14 4Q14 1Q15 2Q15 3Q15 Held for Sale Closed Loan Production ($ in millions) HMST WMS Rate locks Bps 0 50 100 150 200 250 300 350 400 3Q14 4Q14 1Q15 2Q15 3Q15 Single Family Composite Margin (bps) Secondary gains/rate locks Loan fees/closed loans 3Q14 4Q14 1Q15 2Q15 3Q15 HMST $1,150 $1,205 $1,479 $1,837 $1,768 WMS $144 $125 $127 $186 $166 Closed Loans $1,295 $1,331 $1,607 $2,023 $1,934 Purchase % 78% 68% 51% 69% 75% Refinance % 22% 32% 49% 31% 25% Rate locks $1,168 $1,172 $1,901 $1,883 $1,807 Purchase % 76% 62% 50% 73% 70% Refinance % 24% 38% 50% 27% 30% 3Q14 4Q14 Q1 15 (3) Q2 15 (4) Q3 15 Secondary gains/rate locks (1) 256 251 306 316 275 Loan fees/closed loans (2) 60 59 30 31 36 Composite Margin 316 310 336 347 311

Mortgage Servicing As of September 30, 2015 • Constant Prepayment Rate (CPR) - 12.8% for 3Q15 • W.A. servicing fee - 28.96 bps • MSRs represent 0.93% of ending UPB - 3.22 W.A. servicing fee multiple • W.A age - 27.4 months • W.A. expected life - 51.9 months as of 9/30/15 • Composition - 28.7% government • Total delinquency - 1.39% (including foreclosures) • W.A. note rate - 4.08% 26 $10,593 $11,216 $11,910 $12,980 $14,271 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 3Q14 4Q14 1Q15 2Q15 3Q15 Mortgage Servicing Portfolio ($ in millions)

Mortgage Market & Competitive Landscape Mortgage Market • MBA estimates third quarter mortgage origination nationally to decrease 4% over second quarter. HomeStreet’s originations also decreased 4% over the prior quarter. • The most recent MBA monthly forecast anticipates total originations to increase 15% in 2015 over the past year, a downward revision from its prior quarter forecast of 20%. Purchase mortgages and refinances are expected to increase 8% and 25% in 2015, respectively. • Mortgage rates continue near historic lows, and nationally purchases are expected to comprise 57% of volume this year. • Housing starts for 2015 are expected to be up 11% from 2014 levels and an additional 12% growth in 2016. Competitive Landscape • Purchases comprised 63% of originations nationally and 60% in the Pacific Northwest in the third quarter. HomeStreet continues to perform above the national and regional averages, with purchases accounting for 75% of our closed loans and 70% of our interest rate lock commitments in the quarter. • Purchase demand continues to remain strong in many of our our markets, however limited inventory continues to be a significant constraining issue. • The Pacific Northwest and the major markets in western United States are expected to continue to grow more quickly than the rest of the country, consistent with the past eighteen months. 27

Earnings Guidance 28 • Currently anticipating mortgage loan lock volumes of approximately $1.4 billion, $1.8 billion and $2.3 billion in the fourth quarter 2015 and the first and second quarters of next year, respectively (1). • Projecting mortgage closing volumes of $1.6 billion, $1.6 billion and $2.3 billion in the fourth quarter of 2015 and the first and second quarters of next year, respectively (1). • For the full year 2016, we expect mortgage loan locks and mortgage closings of $8.3 billion and $8.2 billion, respectively. • Gain on sale composite margin expected to range between 315 and 325 basis points over the next three quarters. • In our Commercial and Consumer Banking segment, over the next three quarters we continue to expect net loan portfolio growth to approximate 4 to 5% quarterly and our net interest margin to remain at roughly the 3.6% level, absent changes in market rates and prepayment speeds. • Overall, non-interest expenses are expected to increase on average by approximately 2% per quarter, varying somewhat by seasonality in our single-family closed loan volume and in relation to further investments in growth in both of our segments. (1) Estimates changed from 3Q Conference Call guidance as a result of Management’s election to portfolio non-conforming jumbo mortgages during initial 60 day implementation of TRID.

. Appendix 29

Statements of Financial Condition For the three months ended For the nine months ended 30 ($ in thousands) Sept. 30, 2015 Jun. 30, 2015 Mar. 31, 2015 Dec. 31, 2014 Sept. 30, 2014 Cash and cash equivalents $ 37,303 $ 46,197 $ 56,864 $ 30,502 $ 34,687 Investment securities 602,018 509,545 476,102 455,332 449,948 Loans held for sale 882,319 972,183 865,322 621,235 698,111 Loans held for investment, net 3,012,943 2,900,675 2,828,177 2,099,129 1,964,762 Mortgage servicing rights 146,080 153,237 121,722 123,324 124,593 Other real estate owned 8,273 11,428 11,589 9,448 10,478 Federal Home Loan Bank stock, at cost 44,652 40,742 34,996 33,915 34,271 Premises and equipment, net 60,544 58,111 49,808 45,251 44,476 Goodwill 11,945 11,945 11,945 11,945 11,945 Other assets 169,576 162,185 147,878 105,009 101,385 Total assets $ 4,975,653 $ 4,866,248 $ 4,604,403 $ 3,535,090 $ 3,474,656 Deposits $ 3,307,693 $ 3,322,653 $ 3,344,223 $ 2,445,430 $ 2,425,458 Federal Home Loan Bank advances 1,025,745 922,832 669,419 597,590 598,590 Federal funds purchased and securities sold under agreements to repurchase - - 9,450 50,000 14,225 Accounts payable and other liabilities 119,900 111,180 80,059 77,975 79,958 Long-term debt 61,857 61,857 61,857 61,857 61,857 Total liabilities 4,515,195 4,418,522 4,165,008 3,232,852 3,180,088 Preferred stock - - - - - Common stock 511 511 511 511 511 Additional paid-in capital 222,047 221,551 221,301 96,615 96,650 Retained earnings 236,207 226,246 213,870 203,566 197,945 Accumulated other comprehensive income (loss) 1,693 (582) 3,713 1,546 (538) To al shareholders’ equity 460,458 447,726 439,395 302,238 294,568 Total liabilities and shareholders’ equity $ 4,975,653 $ 4,866,248 $ 4,604,403 $ 3,535,090 $ 3,474,656

Non-GAAP Financial Measures Tangible Book Value: 31 Nine Months Ended Sept. 30, Jun. 30, Mar. 31, Dec. 31, Sept. 30, Sept. 30, Sept. 30, (dollars in thousands, except share data) 2015 2015 2015 2014 2014 2015 2014 Shareholders' equity $460,458 $447,726 $439,395 $302,238 $294,568 $460,458 $294,568 Less: Goodwill and other intangibles (20,250) (20,778) (21,324) (14,211) (14,444) (20,250) (14,444) Tangible shareholders' equity $440,208 $426,948 $418,071 $288,027 $280,124 $440,208 $280,124 Book value per share $20.87 $20.29 $19.94 $20.34 $19.83 $20.87 $19.83 Impact of goodwill and other intangibles (0.92) (0.94) (0.97) (0.95) (0.97) (0.92) (0.97) Tangible book value per share $19.95 $19.35 $18.97 $19.39 $18.86 $19.95 $18.86 Average shareholders' equity $460,489 $455,721 $370,008 $305,068 $295,229 $429,071 $284,146 Less: Average goodwill and other intangibles (20,596) (21,135) (16,698) (14,363) (14,604) (19,491) (14,291) Average tangible shareholders' equity $439,893 $434,586 $353,310 $290,705 $280,625 $409,580 $269,855 Return on average shareholders’ equity 8.65% 10.86% 11.14% 7.37% 6.74% 10.14% 7.81% Impact of goodwill and other intangibles 0.41% 0.53% 0.53% 0.36% 0.35% 0.49% 0.41% Return on average tangible shareholders' equity 9.06% 11.39% 11.67% 7.73% 7.09% 10.63% 8.22% Quarter Ended

Non-GAAP Financial Measures Core Net Income: 32 Sept. 30, Jun. 30, Mar. 31, Dec. 31, Sept. 30, Sept. 30, Sept. 30, (dollars in thousands) 2015 2015 2015 2014 2014 2015 2014 Net income $9,961 $12,376 $10,304 $5,621 $4,975 $32,641 $16,638 Impact of merger-related items (net of tax) (512) 2,165 1,256 578 469 2,909 1,408 Net income, excluding merger-related items (net of tax) $9,449 $14,541 $11,560 $6,199 $5,444 $35,550 $18,046 Noninterest expense $92,026 $92,335 $89,482 $68,791 $64,158 $273,843 $183,220 Deduct: merger-related expenses (437) (3,208) (12,165) (889) (722) (15,810) (2,166) Noninterest expense, excluding merger-related expenses $91,589 $89,127 $77,317 $67,902 $63,436 $258,033 $181,054 Diluted earnings per common share $0.45 $0.56 $0.59 $0.38 $0.33 $1.58 $1.11 Impact of merger-related items (net of tax) (0.03) 0.09 0.08 0.03 0.03 0.14 0.10 Diluted earnings per common share, excluding merger- related items (net of tax) $0.42 $0.65 $0.67 $0.41 $0.36 $1.72 $1.21 Return on average assets 0.83% 1.06% 1.08% 0.65% 0.61% 0.98% 0.71% Impact of merger-related items (net of tax) (0.05)% 0.19% 0.13% 0.07% 0.05% 0.09% 0.06% Return on average assets, excluding merger-related items (net of tax) 0.78% 1.25% 1.21% 0.72% 0.66% 1.07% 0.77% Return on average shareholders' equity 8.65% 10.86% 11.14% 7.37% 6.74% 10.14% 7.81% Impact of merger-related items (net of tax) (0.44)% 1.90% 1.36% 0.76% 0.64% 0.91% 0.66% Return on average shareholders' equity, excluding merger- related items (net of tax) 8.21% 12.76% 12.50% 8.13% 7.38% 11.05% 8.47% Return on average tangible shareholders' equity 9.06% 11.39% 11.67% 7.73% 7.09% 10.63% 8.22% Impact of merger-related items (net of tax) (0.47)% 1.99% 1.42% 0.80% 0.67% 0.94% 0.70% Return on average tangible shareholders' equity, excluding merger-related items (net of tax) 8.59% 13.38% 13.09% 8.53% 7.76% 11.57% 8.92% Efficiency ratio 85.92% 83.02% 84.33% 87.09% 90.21% 84.41% 89.23% Impact of merger-related items (net of tax) 0.23% (2.94)% (6.61)% (1.13)% (1.02)% (3.03)% (1.05)% Efficiency ratio, excluding merger-related items (net of tax) 86.16% 80.08% 77.72% 85.96% 89.19% 81.38% 88.17% Nine Months EndedQuarter Ended

Non-GAAP Financial Measures Core Net Income – Commercial & Consumer Banking: 33 Sept. 30, Jun. 30, Mar. 31, Dec. 31, Sept. 30, Sept. 30, Sept. 30, (dollars in thousands) 2015 2015 2015 2014 2014 2015 2014 Commercial and Consumer Banking Segment: Net (loss) income $6,800 $2,854 ($14) $3,345 $3,534 $9,640 $11,403 Impact of merger-related items (net of tax) (512) 2,165 1,256 578 469 2,909 1,408 Net income, excluding merger-related items (net of tax) $6,288 $5,019 $1,242 $3,923 $4,003 $12,549 $12,811 ROAA 0.71% 0.32% (0.00)% 0.49% 0.54% 0.37% 0.59% Impact of merger-related items (net of tax) (0.05)% 0.24% 0.17% 0.08% 0.07% 0.11% 0.07% ROAA, excluding merger-related items (net of tax) 0.66% 0.56% 0.16% 0.57% 0.61% 0.48% 0.67% ROAE 7.99% 3.68% (0.02)% 6.73% 7.37% 4.26% 7.79% Impact of merger-related items (net of tax) (0.60)% 2.79% 2.04% 1.16% 0.98% 1.29% 0.96% ROAE, excluding merger-related items (net of tax) 7.39% 6.47% 2.02% 7.89% 8.35% 5.55% 8.76% ROATE 8.51% 3.95% (0.02)% 7.26% 7.98% 4.56% 8.41% Impact of merger-related items (net of tax) (0.64)% 3.00% 2.18% 1.25% 1.06% 1.37% 1.04% ROAE, excluding merger-related items (net of tax) 7.87% 6.94% 2.16% 8.51% 9.04% 5.93% 9.45% Efficiency ratio 73.22% 85.44% 101.36% 76.59% 79.46% 86.28% 80.32% Impact of merger-related items (net of tax) 0.39% (9.54)% (19.07)% (3.22)% (3.03)% (9.43)% (2.97)% Efficiency ratio, excluding merger-related items (net of tax) 73.61% 75.90% 82.29% 73.37% 76.43% 76.86% 77.35% Nine Months EndedQuarter Ended