Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BANK OF THE JAMES FINANCIAL GROUP INC | d13945d8k.htm |

| EX-10.1 - EX-10.1 - BANK OF THE JAMES FINANCIAL GROUP INC | d13945dex101.htm |

| EX-99.2 - EX-99.2 - BANK OF THE JAMES FINANCIAL GROUP INC | d13945dex992.htm |

NASDAQ: BOTJ Investor Presentation PIPE Offering November 2015 Exhibit 99.1

FORWARD-LOOKING STATEMENTS This presentation contains statements that constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The words "believe," "estimate," "expect," "intend," "anticipate," "plan" and similar expressions and variations thereof identify certain of such forward-looking statements which speak only as of the dates on which they were made. Bank of the James Financial Group, Inc. (the "Company") undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those indicated in the forward-looking statements as a result of various factors. Such factors include, but are not limited to competition, general economic conditions, potential changes in interest rates, and changes in the value of real estate securing loans made by Bank of the James (the "Bank"), a subsidiary of Bank of the James Financial Group, Inc. Additional information concerning factors that could cause actual results to materially differ from those in the forward-looking statements is contained in the Company's filings with the Securities and Exchange Commission (“SEC”) available at the SEC’s Internet site (http://www.sec.gov).

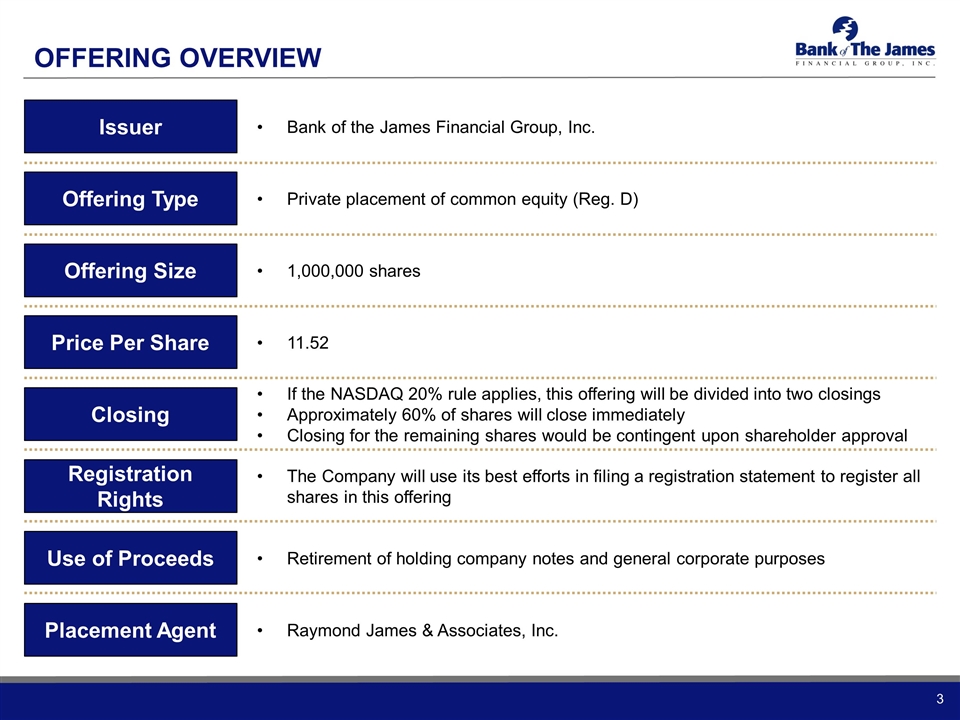

Price Per Share Issuer Bank of the James Financial Group, Inc. Closing Placement Agent Use of Proceeds Offering Type Offering Size 1,000,000 shares 11.52 If the NASDAQ 20% rule applies, this offering will be divided into two closings Approximately 60% of shares will close immediately Closing for the remaining shares would be contingent upon shareholder approval Retirement of holding company notes and general corporate purposes Raymond James & Associates, Inc. Private placement of common equity (Reg. D) OFFERING OVERVIEW Registration Rights The Company will use its best efforts in filing a registration statement to register all shares in this offering

Listed on NASDAQ: BOTJ Market Capitalization: ~ $38 million LTM EPS – 9/30/2015 – $1.13 Key Balance Sheet Metrics at 9/30/2015: Assets - $508 million Loans - $435 million Deposits - $459 million Equity - $37.2 million Our Company Formed in 1999 by a group of experienced bankers, former bankers, and community leaders to fill a void for a locally-focused institution not acquired by a larger bank The Bank is a commercial banking franchise headquartered in Central Virginia; a region also referred to as “Region 2000” Operates thirteen banking centers and two mortgage offices in the Charlottesville, Harrisonburg, Lynchburg and Roanoke MSAs Strong Virginia Franchise Bank of the James’ mission is to be the pre-eminent financial institution in our markets through superior customer service. Key Details

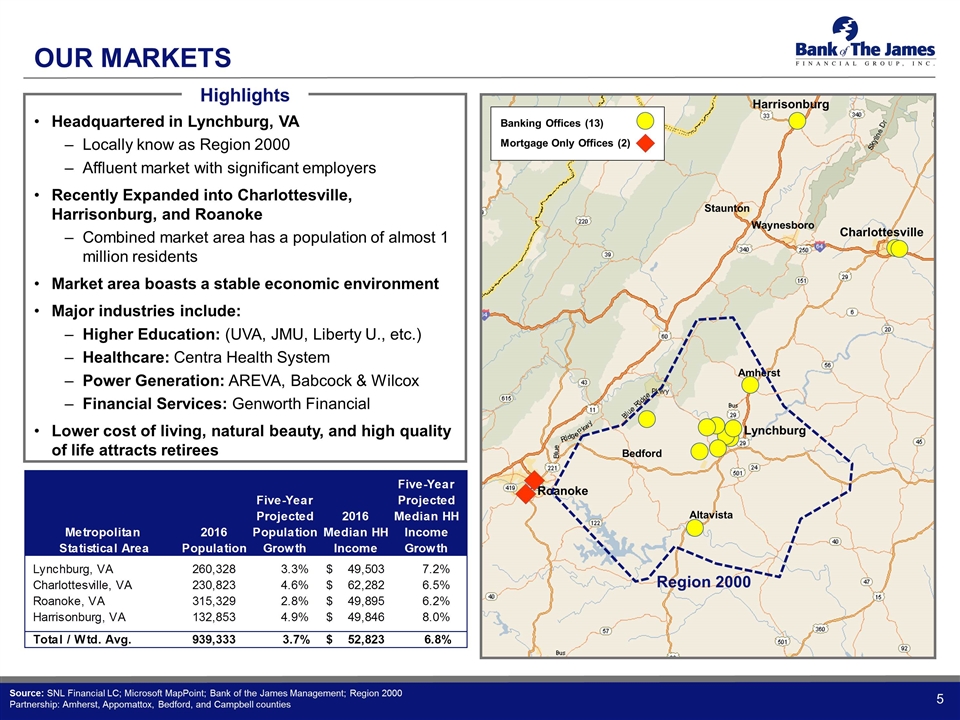

OUR MARKETS Highlights Headquartered in Lynchburg, VA Locally know as Region 2000 Affluent market with significant employers Recently Expanded into Charlottesville, Harrisonburg, and Roanoke Combined market area has a population of almost 1 million residents Market area boasts a stable economic environment Major industries include: Higher Education: (UVA, JMU, Liberty U., etc.) Healthcare: Centra Health System Power Generation: AREVA, Babcock & Wilcox Financial Services: Genworth Financial Lower cost of living, natural beauty, and high quality of life attracts retirees Source: SNL Financial LC; Microsoft MapPoint; Bank of the James Management; Region 2000 Partnership: Amherst, Appomattox, Bedford, and Campbell counties Banking Offices (13) Mortgage Only Offices (2) Roanoke Lynchburg Charlottesville Amherst Altavista Bedford Waynesboro Staunton Harrisonburg Region 2000

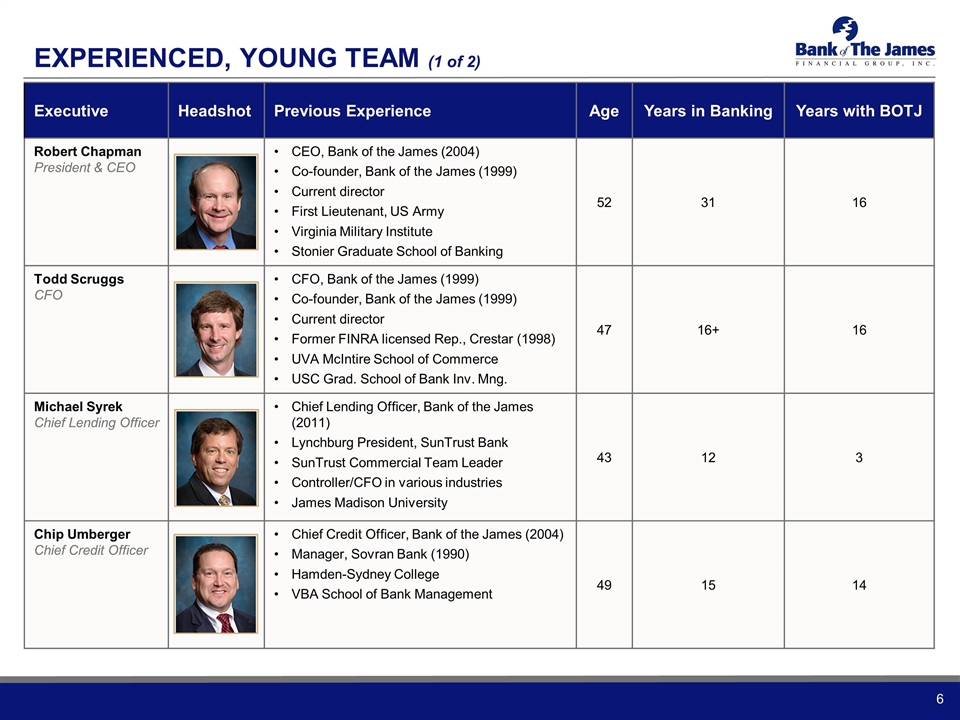

EXPERIENCED, YOUNG TEAM (1 of 2) Executive Headshot Previous Experience Age Years in Banking Years with BOTJ Robert Chapman President & CEO CEO, Bank of the James (2004) Co-founder, Bank of the James (1999) Current director First Lieutenant, US Army Virginia Military Institute Stonier Graduate School of Banking 52 31 16 Todd Scruggs CFO CFO, Bank of the James (1999) Co-founder, Bank of the James (1999) Current director Former FINRA licensed Rep., Crestar (1998) UVA McIntire School of Commerce USC Grad. School of Bank Inv. Mng. 47 16+ 16 Michael Syrek Chief Lending Officer Chief Lending Officer, Bank of the James (2011) Lynchburg President, SunTrust Bank SunTrust Commercial Team Leader Controller/CFO in various industries James Madison University 43 12 3 Chip Umberger Chief Credit Officer Chief Credit Officer, Bank of the James (2004) Manager, Sovran Bank (1990) Hamden-Sydney College VBA School of Bank Management 49 15 14

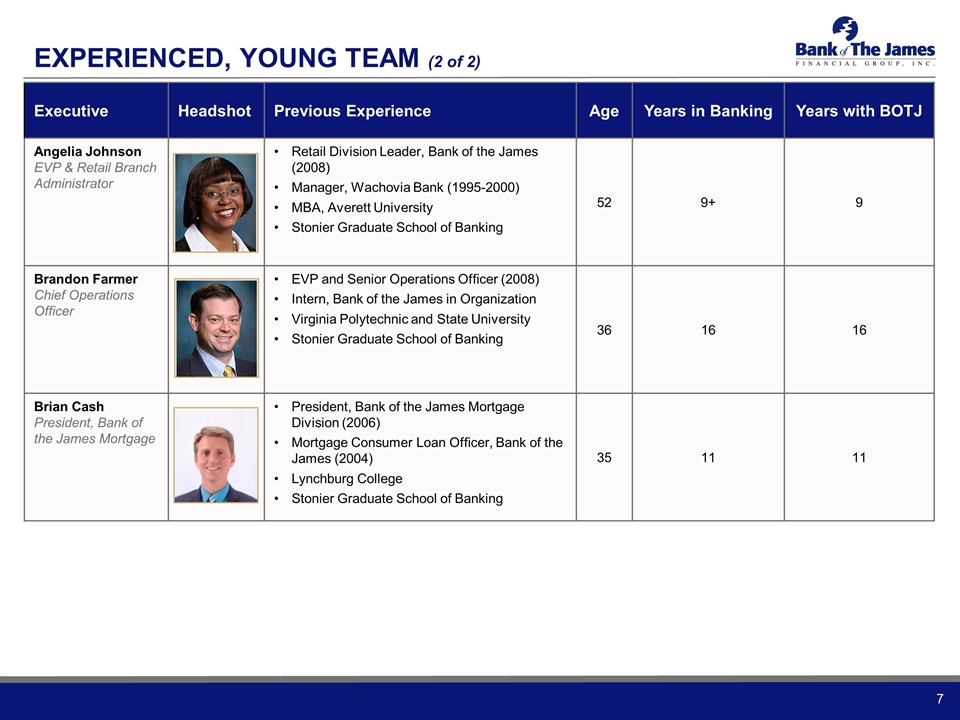

Executive Headshot Previous Experience Age Years in Banking Years with BOTJ Angelia Johnson EVP & Retail Branch Administrator Retail Division Leader, Bank of the James (2008) Manager, Wachovia Bank (1995-2000) MBA, Averett University Stonier Graduate School of Banking 52 9+ 9 Brandon Farmer Chief Operations Officer EVP and Senior Operations Officer (2008) Intern, Bank of the James in Organization Virginia Polytechnic and State University Stonier Graduate School of Banking 36 16 16 Brian Cash President, Bank of the James Mortgage President, Bank of the James Mortgage Division (2006) Mortgage Consumer Loan Officer, Bank of the James (2004) Lynchburg College Stonier Graduate School of Banking 35 11 11 EXPERIENCED, YOUNG TEAM (2 of 2)

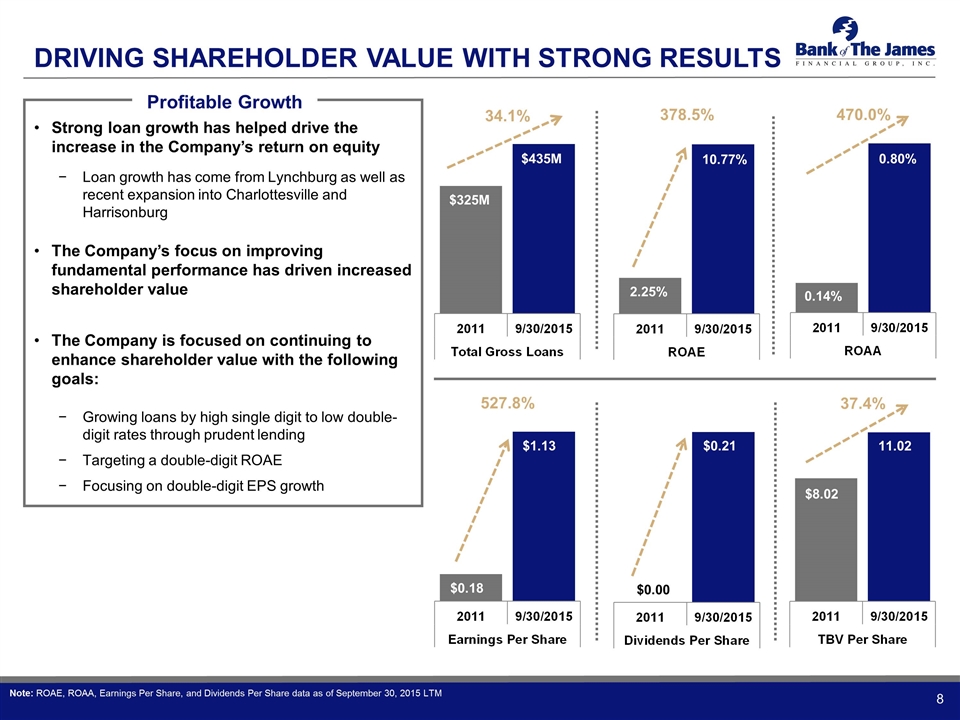

Driving Shareholder Value with strong results $427M $493M $325M $435M 2.25% 10.77% $4.40 $11.21 0.14% 0.80% $0.18 $1.13 $0.00 $0.21 Note: ROAE, ROAA, Earnings Per Share, and Dividends Per Share data as of September 30, 2015 LTM 34.1% 378.5% 470.0% 527.8% Profitable Growth Strong loan growth has helped drive the increase in the Company’s return on equity Loan growth has come from Lynchburg as well as recent expansion into Charlottesville and Harrisonburg The Company’s focus on improving fundamental performance has driven increased shareholder value The Company is focused on continuing to enhance shareholder value with the following goals: Growing loans by high single digit to low double-digit rates through prudent lending Targeting a double-digit ROAE Focusing on double-digit EPS growth $8.02 11.02 37.4%

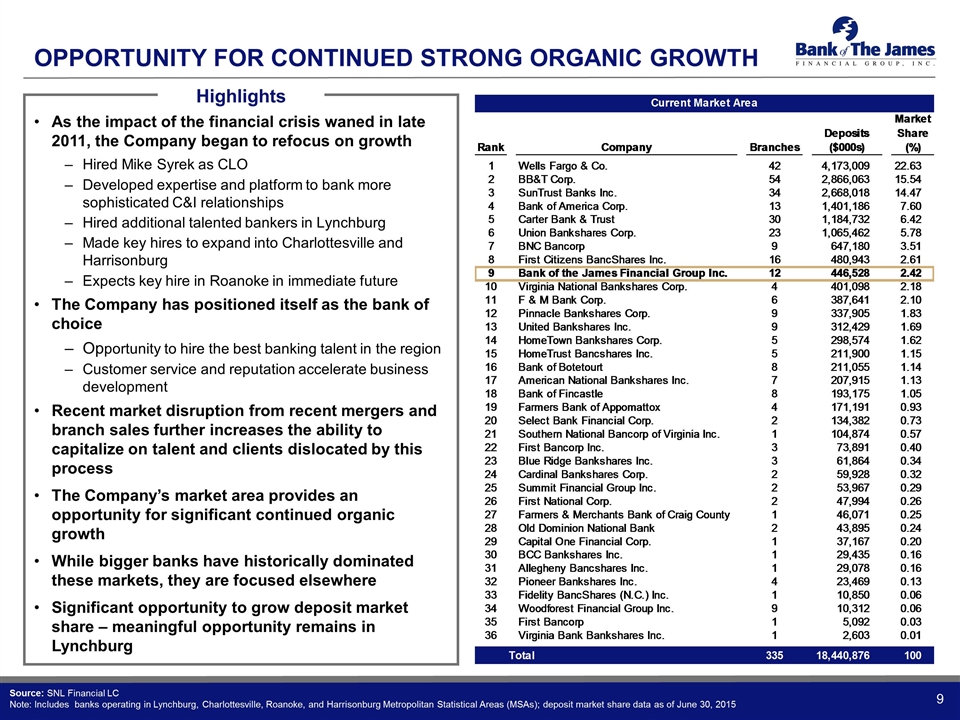

OPPORTUNITY For Continued STRONG ORGANIC GROWTH Highlights As the impact of the financial crisis waned in late 2011, the Company began to refocus on growth Hired Mike Syrek as CLO Developed expertise and platform to bank more sophisticated C&I relationships Hired additional talented bankers in Lynchburg Made key hires to expand into Charlottesville and Harrisonburg Expects key hire in Roanoke in immediate future The Company has positioned itself as the bank of choice Opportunity to hire the best banking talent in the region Customer service and reputation accelerate business development Recent market disruption from recent mergers and branch sales further increases the ability to capitalize on talent and clients dislocated by this process The Company’s market area provides an opportunity for significant continued organic growth While bigger banks have historically dominated these markets, they are focused elsewhere Significant opportunity to grow deposit market share – meaningful opportunity remains in Lynchburg Source: SNL Financial LC Note: Includes banks operating in Lynchburg, Charlottesville, Roanoke, and Harrisonburg Metropolitan Statistical Areas (MSAs); deposit market share data as of June 30, 2015

ATTRACTIVE POTENTIAL FOR STRATEGIC GROWTH Highlights There are 16 banks with under $300MM in assets operating in our target market area Many of these companies are struggling to adjust to the new business and regulatory environment for community banks Many management teams are older and looking for an opportunity to retire We will evaluate merger opportunities based on shareholder-focused metrics We believe that the Company is an attractive acquirer for the following reasons Track record of strong fundamental performance Focus on shareholder value Reputation and capabilities Experienced and energetic management team Source: SNL Financial LC; Microsoft MapPoint Note: Map includes Lynchburg, Charlottesville, Roanoke, Staunton, Harrisonburg, and Blacksburg, Virginia Metropolitan Statistical Areas (MSAs) and Rockbridge County, VA Roanoke Lynchburg Charlottesville Staunton Harrisonburg Rockbridge County Blacksburg

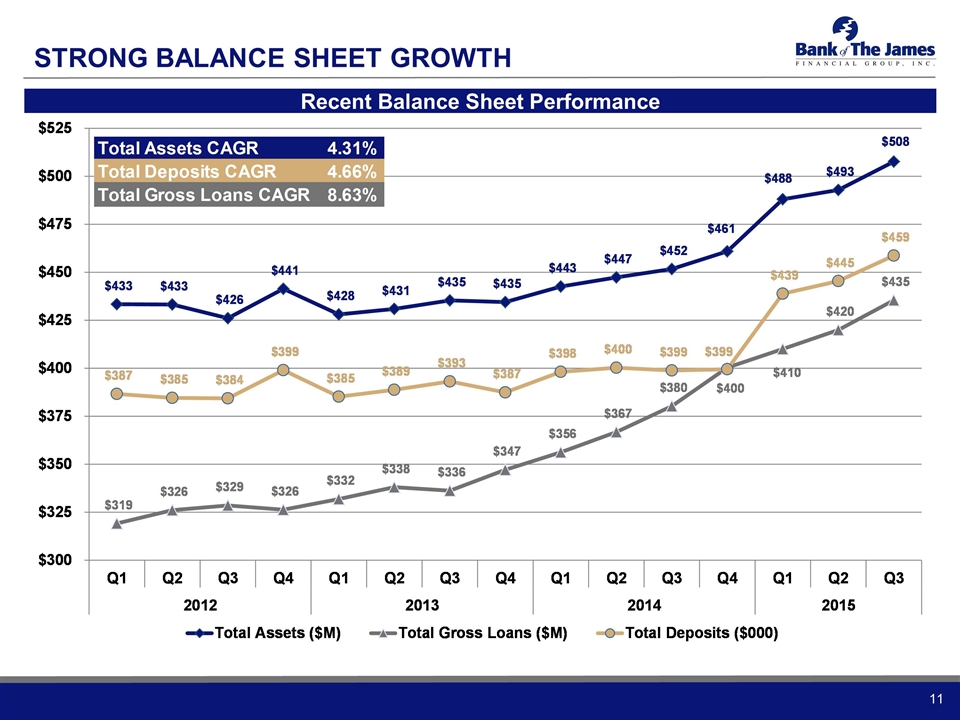

STRONG BALANCE SHEET GROWTH Recent Balance Sheet Performance

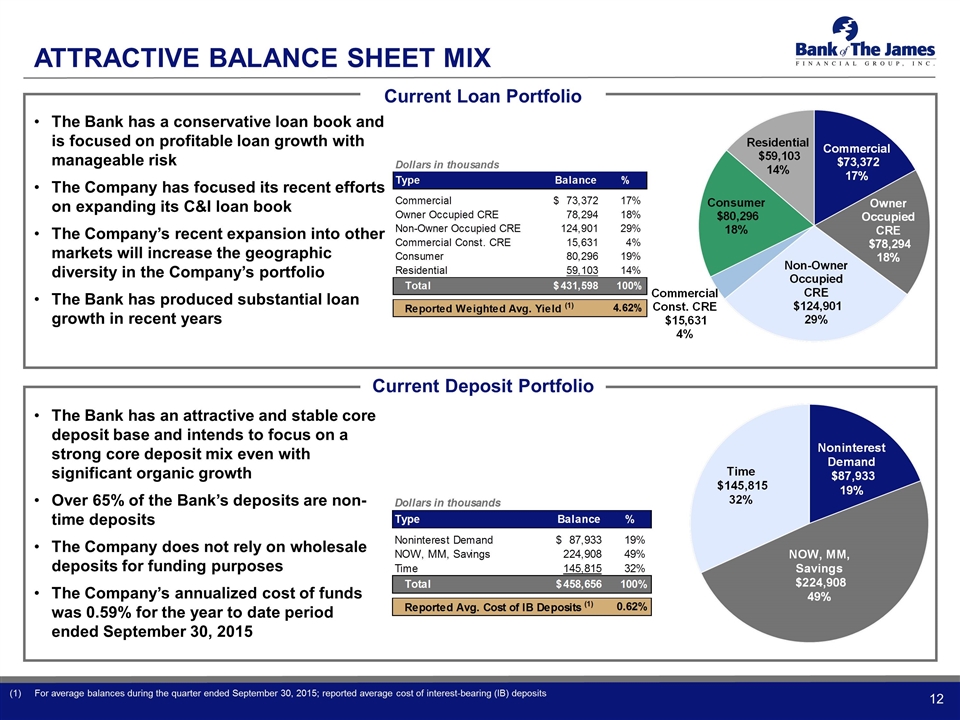

Attractive Balance Sheet Mix (1) For average balances during the quarter ended September 30, 2015; reported average cost of interest-bearing (IB) deposits Current Loan Portfolio Current Deposit Portfolio The Bank has a conservative loan book and is focused on profitable loan growth with manageable risk The Company has focused its recent efforts on expanding its C&I loan book The Company’s recent expansion into other markets will increase the geographic diversity in the Company’s portfolio The Bank has produced substantial loan growth in recent years The Bank has an attractive and stable core deposit base and intends to focus on a strong core deposit mix even with significant organic growth Over 65% of the Bank’s deposits are non-time deposits The Company does not rely on wholesale deposits for funding purposes The Company’s annualized cost of funds was 0.59% for the year to date period ended September 30, 2015

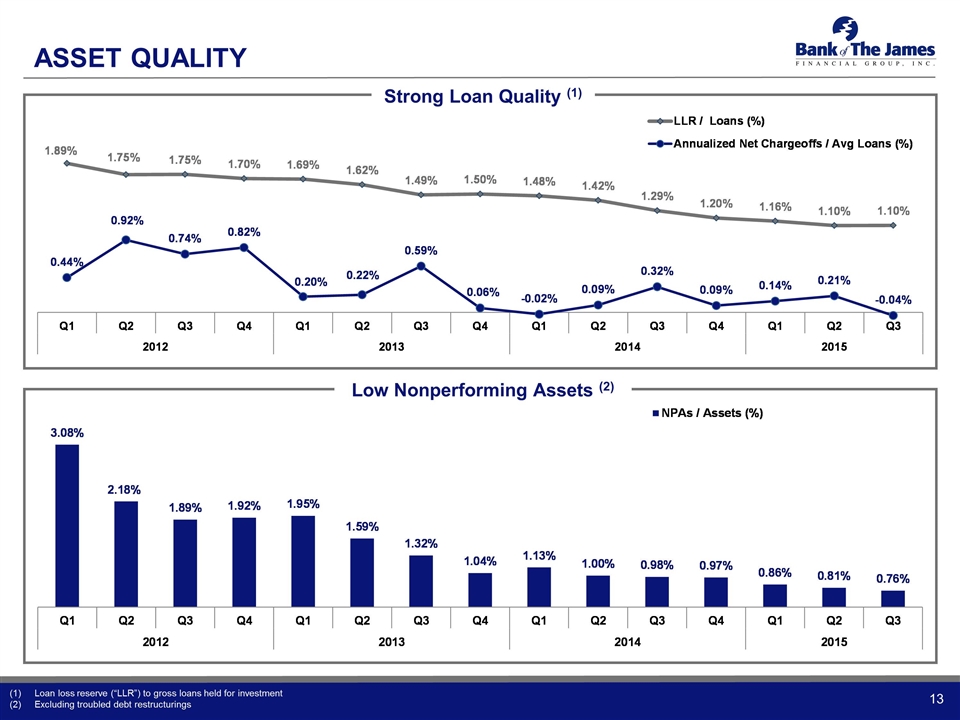

ASSET QUALITY Strong Loan Quality (1) Low Nonperforming Assets (2) (1) Loan loss reserve (“LLR”) to gross loans held for investment (2) Excluding troubled debt restructurings

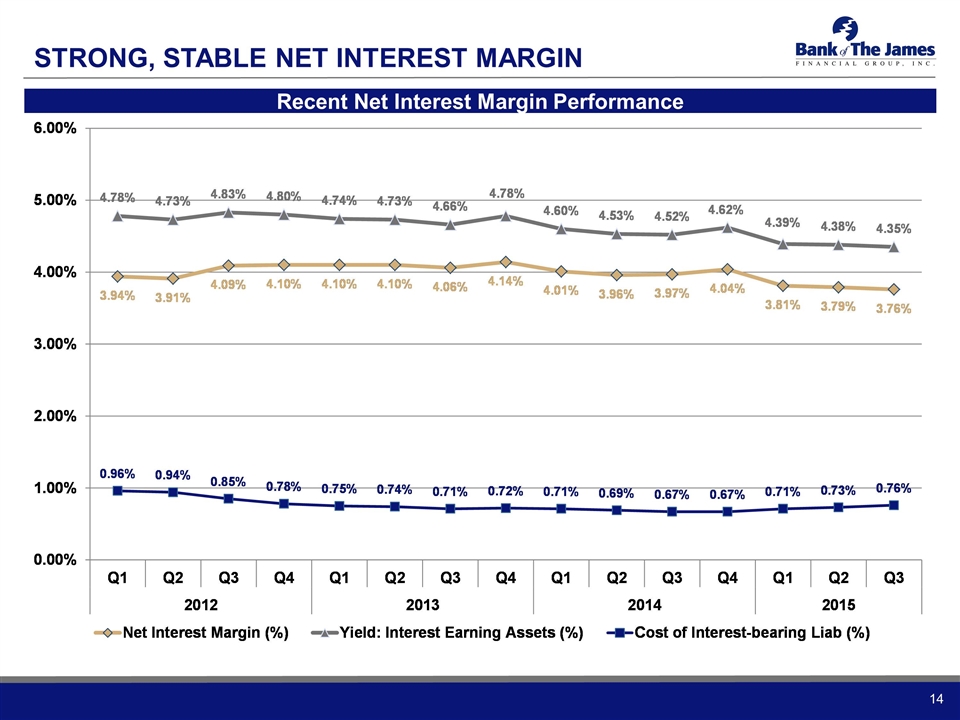

Strong, stable net interest margin Recent Net Interest Margin Performance

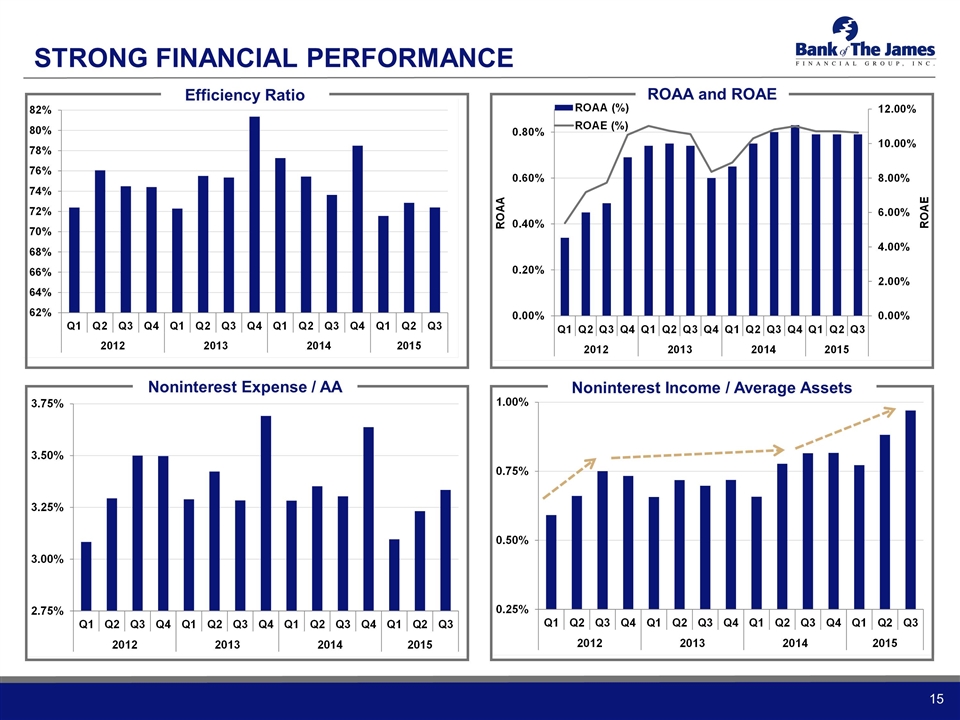

STRONG FINANCIAL PERFORMANCE Efficiency Ratio Noninterest Expense / AA Noninterest Income / Average Assets ROAA and ROAE

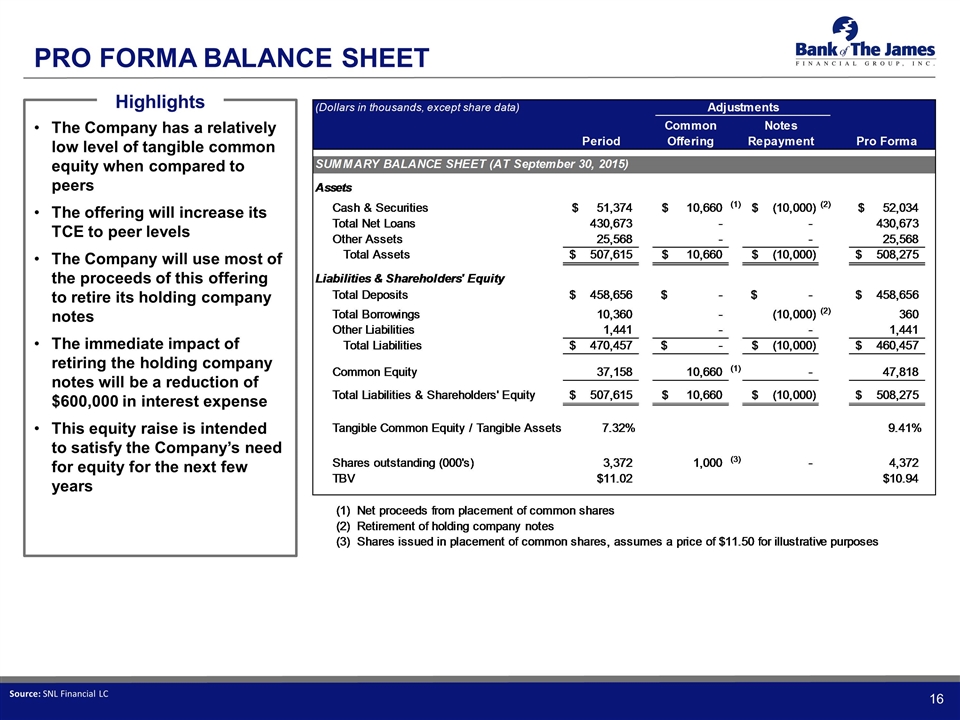

PRO FORMA BALANCE SHEET Highlights The Company has a relatively low level of tangible common equity when compared to peers The offering will increase its TCE to peer levels The Company will use most of the proceeds of this offering to retire its holding company notes The immediate impact of retiring the holding company notes will be a reduction of $600,000 in interest expense This equity raise is intended to satisfy the Company’s need for equity for the next few years Source: SNL Financial LC

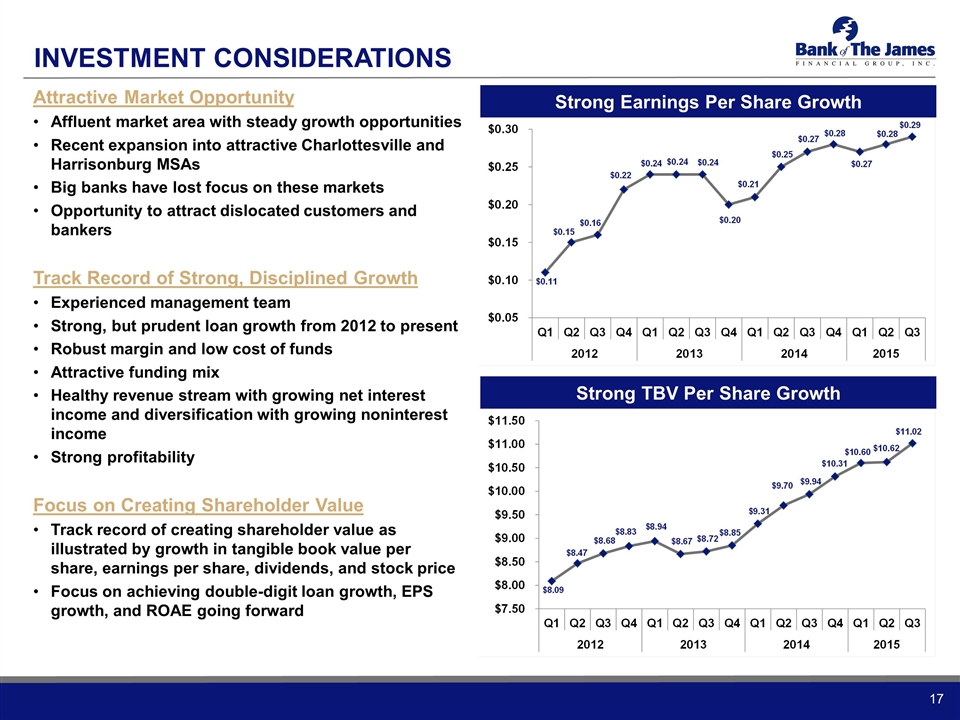

INVESTMENT CONSIDERATIONS Attractive Market Opportunity Affluent market area with steady growth opportunities Recent expansion into attractive Charlottesville and Harrisonburg MSAs Big banks have lost focus on these markets Opportunity to attract dislocated customers and bankers Track Record of Strong, Disciplined Growth Experienced management team Strong, but prudent loan growth from 2012 to present Robust margin and low cost of funds Attractive funding mix Healthy revenue stream with growing net interest income and diversification with growing noninterest income Strong profitability Focus on Creating Shareholder Value Track record of creating shareholder value as illustrated by growth in tangible book value per share, earnings per share, dividends, and stock price Focus on achieving double-digit loan growth, EPS growth, and ROAE going forward Strong Earnings Per Share Growth Strong TBV Per Share Growth

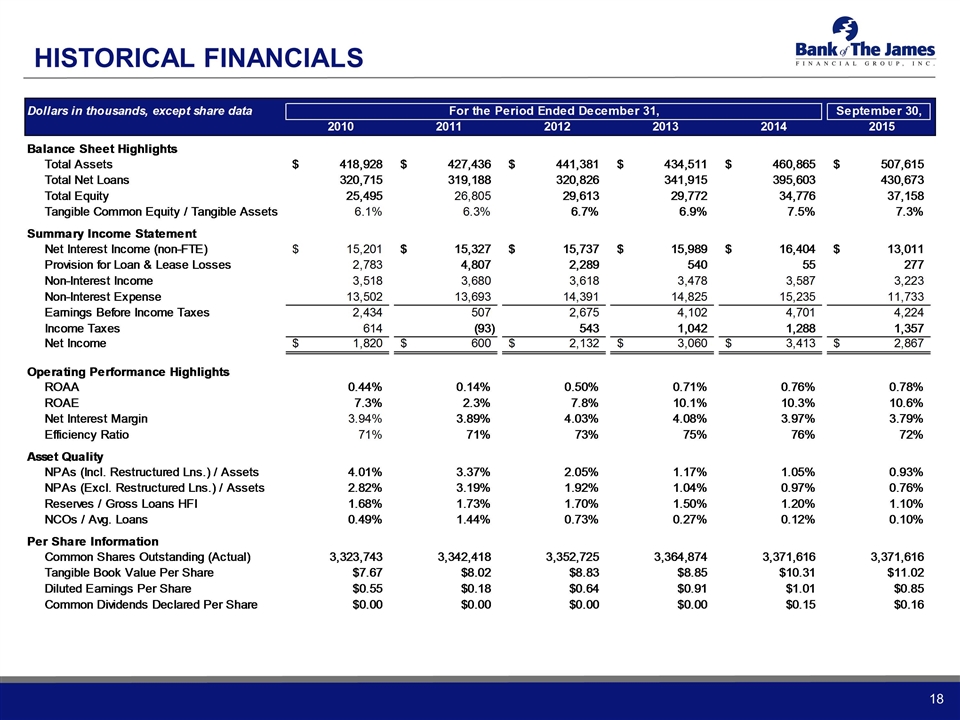

HISTORICAL FINANCIALS

NASDAQ: BOTJ Investor Presentation PIPE Offering November 2015