Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - Omagine, Inc. | f10q0915ex31i_omagine.htm |

| EX-32.1 - CERTIFICATION - Omagine, Inc. | f10q0915ex32i_omagine.htm |

| EX-10.32 - THE AMENDED OMAGINE INC. 2014 STOCK OPTION PLAN - Omagine, Inc. | f10q0915ex10xxxii_omagine.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended: September 30, 2015

Commission File Number: 0-17264

Omagine, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 20-2876380 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

350 Fifth Avenue, 48th Floor, New York, N.Y. 10118

(Address of principal executive offices)

(212) 563-4141

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non accelerated filer | ☐ | Smaller reporting company | ☒ |

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As of November 16, 2015, the Registrant had outstanding 18,728,313 shares of common stock, par value $.001 per share (“Common Stock”).

i

| Page | ||

| FORWARD LOOKING STATEMENTS | iii | |

| PART I - FINANCIAL INFORMATION | ||

| ITEM 1: | FINANCIAL STATEMENTS | F-1 |

| CONSOLIDATED BALANCE SHEETS: | ||

| SEPTEMBER 30, 2015 AND DECEMBER 31, 2014 | F-1 | |

| CONSOLIDATED STATEMENTS OF OPERATIONS: | ||

| THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2015 AND SEPTEMBER 30, 2014 | F-2 | |

| CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ DEFICIT | F-3 | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS: | ||

| NINE MONTHS ENDED SEPTEMBER 30, 2015 AND SEPTEMBER 30, 2014 | F-4 | |

| NOTES TO FINANCIAL STATEMENTS | F-5 | |

| ITEM 2: | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 1 |

| ITEM 3: | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 27 |

| ITEM 4: | CONTROLS AND PROCEDURES | 27 |

| PART II - OTHER INFORMATION | ||

| ITEM 1: | LEGAL PROCEEDINGS | 28 |

| ITEM 1A: | RISK FACTORS | 28 |

| ITEM 2: | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | 28 |

| ITEM 3: | DEFAULTS UPON SENIOR SECURITIES | 28 |

| ITEM 4: | MINE SAFETY DISCLOSURES | 28 |

| ITEM 5: | OTHER INFORMATION | 28 |

| ITEM 6: | EXHIBITS | 29 |

| SIGNATURES | 31 | |

ii

FORWARD-LOOKING STATEMENTS

Some of the statements contained in this report that are not statements of historical facts constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, notwithstanding that such statements are not specifically identified as such. These forward-looking statements are based on current expectations and projections about future events. The words “estimates,” “projects,” “plans,” “believes,” “expects,” “anticipates,” “intends,” “targeted,” “continue,” “remain,” “will,” “should,” “may” and other similar expressions, or the negative or other variations thereof, as well as discussions of strategy that involve risks and uncertainties (such as the Qatari Bank Loan discussed in this report), are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Examples of forward-looking statements include but are not limited to statements about or relating to: (i) future revenues, expenses, income or loss, cash flow, earnings or loss per share, the payment or nonpayment of dividends, capital structure and other financial items, (ii) plans, objectives and expectations of Omagine, Inc. or its subsidiary Omagine LLC or the managements or Boards of Directors thereof , (iii) the Company’s business plans, products or services, (iv) future economic or financial performance, and (v) assumptions underlying such statements. Forecasts, projections and assumptions contained and expressed herein were reasonably based on information available to the Company at the time so furnished and as of the date of this report. All such forecasts, projections and assumptions are subject to significant uncertainties and contingencies, many of which are beyond the Company's control, and no assurance can be given that such forecasts, projections or assumptions will be realized. No assurances can be given regarding the achievement of future results, as our actual results may differ materially from our projected future results as a result of the risks we face, and actual future events may differ from anticipated future events because of the assumptions underlying the forward-looking statements that have been made regarding such anticipated events.

Factors that may cause actual results, our performance or achievements, or industry results, to differ materially from those contemplated by such forward-looking statements include without limitation:

| ● | the uncertainty associated with political events in the Middle East and North Africa (the “MENA Region”) in general, including the ongoing civil disorder and military activities in the MENA Region; | |

| ● | the success or failure of Omagine’s efforts to secure additional financing, including project financing for the Omagine Project; | |

| ● | oversupply of residential and/or commercial property inventory in the Oman real estate market or other adverse conditions in such market; | |

| ● | the impact of MENA Region or international economies and/or future events (including natural disasters) on the Oman economy, on Omagine’s business or operations, on tourism within or into Oman, on the oil and natural gas businesses in Oman and on other major industries operating within the Omani market; | |

| ● | deterioration or malaise in economic conditions, including the continuing destabilizing factors associated with the recent rapid decline in the price of crude oil on international markets; | |

| ● | inflation, interest rates, movements in interest rates, securities market and monetary fluctuations; | |

| ● | threatened and ongoing acts of war, civil or political unrest, terrorism or political instability in the MENA Region; or | |

| ● | the ability to attract and retain skilled employees. |

Potential investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

iii

ITEM 1 : FINANCIAL STATEMENTS

OMAGINE, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| September 30, | December 31, | |||||||

| 2015 | 2014 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| CURRENT ASSETS: | ||||||||

| Cash | $ | 25,823 | $ | 1,113,679 | ||||

| Inventory: (Note 2) | ||||||||

| Land under development | 490,813,363 | - | ||||||

| Total inventory held for sale | 490,813,363 | - | ||||||

| Prepaid expenses and other current assets | 10,970 | 5,780 | ||||||

| Total Current Assets | 490,850,156 | 1,119,459 | ||||||

| PROPERTY, PLANT AND EQUIPMENT | ||||||||

| Real estate held for investment (Note 2) | 227,800,637 | - | ||||||

| Total investment real estate | 227,800,637 | - | ||||||

| Office and project equipment | 160,002 | 153,604 | ||||||

| Less accumulated depreciation and amortization | (147,573 | ) | (144,036 | ) | ||||

| Total Property, Plant and Equipment | 227,813,066 | 9,568 | ||||||

| OTHER ASSETS | 30,228 | 31,982 | ||||||

| TOTAL ASSETS | $ | 718,693,450 | $ | 1,161,009 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| CURRENT LIABILITIES: | ||||||||

| Convertible notes payable and accrued interest | $ | 390,997 | $ | 370,429 | ||||

| Note payable and accrued interest - YA Global Master SPV, Ltd. | ||||||||

| (less unamortized discount of $33,333 and $12,133, respectively) | 339,708 | 214,778 | ||||||

| Accounts payable | 418,527 | 257,736 | ||||||

| Accrued officers' payroll | 375,349 | 637,922 | ||||||

| Accrued expenses and other current liabilities | 128,368 | 159,332 | ||||||

| Total Current Liabilities | 1,652,949 | 1,640,197 | ||||||

| TOTAL LIABILITIES | 1,652,949 | 1,640,197 | ||||||

| STOCKHOLDERS' EQUITY (DEFICIT) | ||||||||

| Preferred stock: | ||||||||

| $0.001 par value | ||||||||

| Authorized: 850,000 shares | ||||||||

| Issued and outstanding: - none | - | - | ||||||

| Common stock: | ||||||||

| $0.001 par value | ||||||||

| Authorized: 50,000,000 shares | ||||||||

| Issued and outstanding: | ||||||||

| 17,471,718 shares in 2015 and 16,878,119 in 2014 | 17,472 | 16,878 | ||||||

| Capital in excess of par value | 467,363,870 | 32,252,954 | ||||||

| Deficit | (37,604,660 | ) | (32,669,399 | ) | ||||

| Total Omagine, Inc. stockholders' equity (deficit) | 429,776,682 | (399,567 | ) | |||||

| Noncontrolling interests in Omagine LLC | 287,263,819 | (79,621 | ) | |||||

| Total Stockholders Equity (Deficit) | 717,040,501 | (479,188 | ) | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 718,693,450 | $ | 1,161,009 | ||||

See accompanying notes to consolidated financial statements.

F-1

OMAGINE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| REVENUE: | ||||||||||||||||

| Total revenue | $ | - | $ | - | $ | - | $ | - | ||||||||

| OPERATING EXPENSES: | ||||||||||||||||

| Officers and directors compensation (including stock-based compensation of $1,880,765, $96,452, $1,957,285 and $393,294, respectively) | 1,976,515 | 172,702 | 2,240,535 | 623,294 | ||||||||||||

| Professional fees (includes stock-based compensation of $0, $0, $0 and $10,436, respectively) | 9,375 | 36,415 | 142,394 | 132,649 | ||||||||||||

| Consulting fees (including stock-based compensation of $1,343,924, $61,243, $1,355,105 and $258,747, respectively) | 1,414,848 | 95,980 | 1,745,904 | 328,872 | ||||||||||||

| Commitment fees (all stock-based compensation) | - | - | - | 150,000 | ||||||||||||

| Travel | 117,281 | 15,838 | 423,875 | 73,479 | ||||||||||||

| Occupancy | 45,683 | 37,939 | 124,419 | 114,928 | ||||||||||||

| Other selling general and administrative | 125,585 | 79,993 | 286,651 | 167,989 | ||||||||||||

| Total Costs and Expenses | 3,689,287 | 438,867 | 4,963,778 | 1,591,211 | ||||||||||||

| OPERATING LOSS | (3,689,287 | ) | (438,867 | ) | (4,963,778 | ) | (1,591,211 | ) | ||||||||

| OTHER (EXPENSE) INCOME | ||||||||||||||||

| Amortization of debt discounts | (12,500 | ) | (9,750 | ) | (28,800 | ) | (30,449 | ) | ||||||||

| Interest expense | (18,643 | ) | (16,816 | ) | (44,843 | ) | (46,522 | ) | ||||||||

| Other (Expense) - Net | (31,143 | ) | (26,566 | ) | (73,643 | ) | (76,971 | ) | ||||||||

| NET LOSS | (3,720,430 | ) | (465,433 | ) | (5,037,421 | ) | (1,668,182 | ) | ||||||||

| Add net loss attributable to noncontrolling interests in Omagine LLC | 24,752 | 9,082 | 102,160 | 38,405 | ||||||||||||

| NET LOSS ATTRIBUTABLE TO OMAGINE, INC. | $ | (3,695,678 | ) | $ | (456,351 | ) | $ | (4,935,261 | ) | $ | (1,629,777 | ) | ||||

| LOSS PER SHARE - BASIC AND DILUTED | $ | (0.21 | ) | $ | (0.03 | ) | $ | (0.29 | ) | $ | (0.10 | ) | ||||

| WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING | ||||||||||||||||

| - BASIC AND DILUTED | 17,417,560 | 16,064,928 | 17,240,703 | 15,862,554 | ||||||||||||

See accompanying notes to consolidated financial statements.

F-2

OMAGINE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' DEFICIT

| Common Stock | ||||||||||||||||||||||||||||||||

| Issued and | Committed to be | |||||||||||||||||||||||||||||||

| Outstanding | issued | Capital in | Noncontrolling | |||||||||||||||||||||||||||||

| $0.001 Par | $0.001 Par | Excess of | Interests in | |||||||||||||||||||||||||||||

| Shares | Value | Shares | Value | Par Value | Deficit | Omagine LLC | Total | |||||||||||||||||||||||||

| Balances at December 31, 2012 | 14,369,041 | $ | 14,369 | 107,500 | $ | 107 | $ | 23,996,481 | $ | (24,867,849 | ) | $ | 9,419 | $ | (847,473 | ) | ||||||||||||||||

| Issuance of Common Stock committed to stockholder relations agent for fees | 107,500 | 107 | (107,500 | ) | (107 | ) | - | - | - | - | ||||||||||||||||||||||

| Issuance of Common Stock for cash | 100,000 | 100 | - | - | 124,900 | - | - | 125,000 | ||||||||||||||||||||||||

| Stock Option expense | - | - | - | - | 1,445,744 | - | - | 1,445,744 | ||||||||||||||||||||||||

| Issuance of Common Stock for 401(k) Plan contribution | 55,253 | 55 | - | - | 76,195 | - | - | 76,250 | ||||||||||||||||||||||||

| Stock options exercised by Director's estate | 4,000 | 4 | - | - | 2,716 | - | - | 2,720 | ||||||||||||||||||||||||

| Issuance of Common Stock for cash | 71,162 | 71 | - | - | 74,929 | - | - | 75,000 | ||||||||||||||||||||||||

| Stock grant to consultant for services rendered | 5,000 | 5 | - | - | 5,325 | - | - | 5,330 | ||||||||||||||||||||||||

| Stock grants to stockholder relation agents for fees | 40,000 | 40 | - | - | 38,500 | - | - | 38,540 | ||||||||||||||||||||||||

| Issuance of Common Stock under 2011 Standby Equity Distribution Agreement | 163,094 | 164 | - | - | 204,836 | - | - | 205,000 | ||||||||||||||||||||||||

| Stock grant to IT consultants for fees | 19,988 | 20 | - | - | 18,169 | - | - | 18,189 | ||||||||||||||||||||||||

| Adjustments for noncontrolling interests in Omagine LLC | - | - | - | - | - | - | (35,371 | ) | (35,371 | ) | ||||||||||||||||||||||

| Net loss | - | - | - | - | - | (2,640,590 | ) | - | (2,640,590 | ) | ||||||||||||||||||||||

| Balances at December 31, 2013 | 14,935,038 | 14,935 | - | - | 25,987,795 | (27,508,439 | ) | (25,952 | ) | (1,531,661 | ) | |||||||||||||||||||||

| Stock grant issued to law firm in satisfaction of $15,812 of accounts payable | 34,374 | 34 | - | - | 26,214 | - | - | 26,248 | ||||||||||||||||||||||||

| Issuance of Common Stock under 2014 Standby Equity Distribution Agreement | 218,941 | 219 | - | - | 309,781 | - | - | 310,000 | ||||||||||||||||||||||||

| Issuance of Common Stock for 2014 SEDA commitment fees | 85,822 | 86 | - | - | 149,914 | - | - | 150,000 | ||||||||||||||||||||||||

| Issuance of Common Stock for 401(k) Plan contribution | 73,315 | 73 | - | - | 76,177 | - | - | 76,250 | ||||||||||||||||||||||||

| Issuance of Common Stock for cash | 1,004,629 | 1,004 | - | - | 1,486,096 | - | - | 1,487,100 | ||||||||||||||||||||||||

| Issuance of Common Stock for finders' fees on restricted Common Stock sales | 46,000 | 47 | - | - | 76,121 | - | - | 76,168 | ||||||||||||||||||||||||

| Exercise of Tempest Warrants | 490,000 | 490 | - | - | 663,010 | - | - | 663,500 | ||||||||||||||||||||||||

| Cancellation of shares issued to stockholder relations agent | (10,000 | ) | (10 | ) | - | - | (9,010 | ) | - | - | (9,020 | ) | ||||||||||||||||||||

| Stock Option expense | - | - | - | - | 3,486,856 | - | - | 3,486,856 | ||||||||||||||||||||||||

| Adjustments for noncontrolling interests in Omagine LLC | - | - | - | - | - | - | (53,669 | ) | (53,669 | ) | ||||||||||||||||||||||

| Net loss | - | - | - | - | - | (5,160,960 | ) | - | (5,160,960 | ) | ||||||||||||||||||||||

| Balances at December 31, 2014 | 16,878,119 | 16,878 | - | - | 32,252,954 | (32,669,399 | ) | (79,621 | ) | (479,188 | ) | |||||||||||||||||||||

| Issuance of Common Stock for 401(k) Plan contribution | 36,483 | 37 | - | - | 76,213 | - | - | 76,250 | ||||||||||||||||||||||||

| Stock grant to consultant for services rendered | 5,000 | 5 | - | - | 9,445 | - | - | 9,450 | ||||||||||||||||||||||||

| Issuance of Common Stock for cash | 206,281 | 206 | - | - | 219,794 | - | - | 220,000 | ||||||||||||||||||||||||

| Issuance of Common Stock to an Executive Officer in payment of salaries payable | 100,000 | 100 | - | - | 119,900 | - | - | 120,000 | ||||||||||||||||||||||||

| Stock Options exercised by former Director | 2,000 | 2 | - | - | 1,018 | - | - | 1,020 | ||||||||||||||||||||||||

| Exercise of Tempest Warrants | 158,228 | 158 | - | 249,842 | - | - | 250,000 | |||||||||||||||||||||||||

| Issuance of Common Stock for finders' fees on restricted Common Stock sales | 7,911 | 8 | - | - | 12,492 | - | - | 12,500 | ||||||||||||||||||||||||

| Issuance of Common Stock for Directors' Compensation for services September 1, 2015 to December 31, 2015 | 50,000 | 50 | - | - | 99,950 | - | - | 100,000 | ||||||||||||||||||||||||

| Issuance of Common Stock under New Standby Equity Distribution Agreement (New SEDA) | 17,696 | 18 | - | - | 24,982 | - | - | 25,000 | ||||||||||||||||||||||||

| Issuance of Restricted Common Stock for cash | 10,000 | 10 | - | - | 14,690 | - | - | 14,700 | ||||||||||||||||||||||||

| Stock Option expense | - | - | - | - | 3,001 | - | - | 3,001 | ||||||||||||||||||||||||

| Stock Option expense - Extension of Strategic Options (1,965,000 to December 31, 2016) | - | - | 915,493 | - | - | 915,493 | ||||||||||||||||||||||||||

| Stock Option expense - Extension of Strategic Options (950,000 to December 31, 2016) | - | - | 541,215 | - | - | 541,215 | ||||||||||||||||||||||||||

| Stock Option expense - Stock Appreciation Rights (1,455,000 expiring December 31, 2017) | - | - | 1,654,481 | - | - | 1,654,481 | ||||||||||||||||||||||||||

| Payment-in-Kind capital contribution of land by noncontrolling interest in Omagine LLC | - | - | 431,168,400 | - | 287,445,600 | 718,614,000 | ||||||||||||||||||||||||||

| Adjustments for noncontrolling interests in Omagine LLC | - | - | - | - | - | - | (102,160 | ) | (102,160 | ) | ||||||||||||||||||||||

| Net loss | - | - | - | - | - | (4,935,261 | ) | - | (4,935,261 | ) | ||||||||||||||||||||||

| Balances at September 30, 2015 (Unaudited) | 17,471,718 | $ | 17,472 | - | $ | - | $ | 467,363,870 | $ | (37,604,660 | ) | $ | 287,263,819 | $ | 717,040,501 | |||||||||||||||||

See accompanying notes to consolidated financial statements.

F-3

OMAGINE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Nine Months ended September 30, | ||||||||

| 2015 | 2014 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss attributable to Omagine, Inc. | $ | (4,935,261 | ) | $ | (1,629,777 | ) | ||

| Adjustments to reconcile net loss to net cash flows used by operating activities: | ||||||||

| Net loss attributable to noncontrolling interests in Omagine LLC | (102,160 | ) | (38,405 | ) | ||||

| Depreciation and amortization | 32,337 | 34,196 | ||||||

| Stock-based compensation related to stock options | 3,114,190 | 538,368 | ||||||

| Stock-based compensation related to issuance of Common Stock for stockholder investor relations, including amortization of $0 and $10,275 in 2015 and 2014 respectively, arising from grants to service providers | - | 10,275 | ||||||

| Issuance of Common Stock for finders' fees on restricted Common Stock sales | 12,500 | 36,168 | ||||||

| Issuance of Common Stock for consulting fees | 9,450 | - | ||||||

| Excess of fair value of Common Stock issued to law firm in excess of liability satisfied - charged to legal fees | - | 10,436 | ||||||

| Issuance of Common Stock for 401(k) Plan contributions | 76,250 | 76,250 | ||||||

| Issuance of Common Stock in satisfaction of SEDA commitment fees | 150,000 | |||||||

| Issuance of restricted Common Stock to two new Directors as compensation for services September 1,2015 to December 31, 2015 | 100,000 | |||||||

| Cancellation of Restricted Common Stock to stockholder relations agent | (9,020 | ) | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses, other current assets and other assets | (3,436 | ) | (12,170 | ) | ||||

| Accrued interest on convertible notes payable | 21,698 | 16,816 | ||||||

| Accounts payable | 160,791 | (84,464 | ) | |||||

| Accrued officers' payroll | (142,573 | ) | (85,940 | ) | ||||

| Accrued expenses and other current liabilities | (30,964 | ) | 1,508 | |||||

| Net cash flows used by operating activities | (1,687,178 | ) | (985,759 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchase of equipment | (6,398 | ) | (1,984 | ) | ||||

| Net cash flows used by investing activities | (6,398 | ) | (1,984 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds of issuance of 2014 note payable to YA Global Master SPV, Ltd. net of $39,000 commitment fee | 461,000 | |||||||

| Principal payments on 2014 note payable to YA Global Master SPV, Ltd. | (225,000 | ) | (170,000 | ) | ||||

| Repayment of 2013 note payable to YA Global Master SPV, Ltd. | - | (175,000 | ) | |||||

| Proceeds of issuance of 2015 note payable to YA Global Master SPV, Ltd. net of $50,000 commitment fee | 450,000 | |||||||

| Principal payments on 2015 note payable to YA Global Master SPV, Ltd. | (130,000 | ) | ||||||

| Proceeds from sale of Common Stock | 259,700 | 952,100 | ||||||

| Proceeds from the exercise of Common Stock Warrants | 250,000 | 336,000 | ||||||

| Proceeds from exercise of stock options | 1,020 | - | ||||||

| Net cash flows provided by financing activities | 605,720 | 1,404,100 | ||||||

| NET (DECREASE) INCREASE IN CASH | (1,087,856 | ) | 416,357 | |||||

| CASH BEGINNING OF PERIOD | 1,113,679 | 19,723 | ||||||

| CASH END OF PERIOD | $ | 25,823 | $ | 436,080 | ||||

| SUPPLEMENTAL CASH FLOW INFORMATION: | ||||||||

| Income taxes paid | $ | 2,197 | $ | 1,078 | ||||

| Interest paid | $ | 19,089 | $ | 24,978 | ||||

| NON - CASH FINANCING ACTIVITIES: | ||||||||

| Excess of fair value of Common Stock issued to law firm in excess of liability satisfied - charged to legal fees | $ | - | $ | 10,436 | ||||

| Issuance of Common Stock to an Executive Officer in payment of salaries payable | $ | 120,000 | - | |||||

| Payment-in-Kind capital contribution of land by noncontrolling interest in Omagine LLC pursuant to Omagine LLC Stockholder Agreement | $ | 718,614,000 | - | |||||

See accompanying notes to consolidated financial statements.

F-4

OMAGINE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 - NATURE OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of the Business

Omagine, Inc. (“Omagine”) is a holding company incorporated in Delaware in October 2004 which operates through its wholly owned subsidiary, Journey of Light, Inc., a New York corporation (“JOL”) and its 60% owned subsidiary Omagine LLC, a limited liability company incorporated under the laws of the Sultanate of Oman (“LLC”). Omagine, JOL and LLC are collectively referred to herein as the “Company”. JOL was acquired by Omagine in October 2005. LLC is the Omani real estate development company organized by Omagine to do business in Oman.

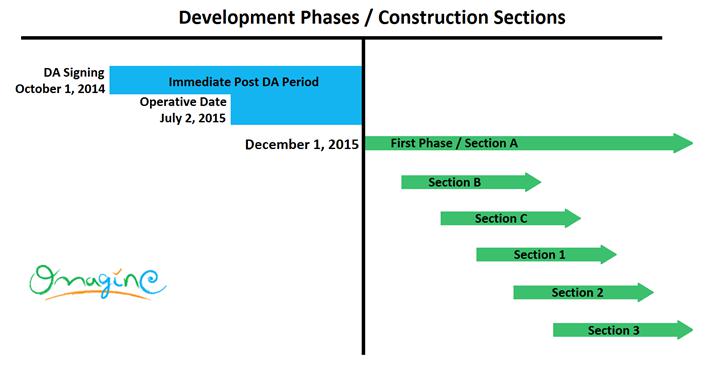

The Company is focused on entertainment, hospitality and real estate development opportunities in the Middle East and North Africa (the “MENA Region”). On October 2, 2014, LLC signed a Development Agreement with the Government of Oman (the “Government”) for the development of the Omagine Project. On July 2, 2015, a usufruct over one million square meters of beachfront land (the “Land Rights) was registered in LLCs name with the Government. LLC is in receipt of term sheet from a bank in Qatar (the “Qatari Bank”) with respect to a loan offer to finance the First Phase of the Omagine Project. The loan offer is subject to the satisfaction of certain conditions precedent and to the negotiation and execution by the Qatari Bank and LLC of a definitive agreement with respect thereto and there is no assurance therefore that the loan will be executed. Contingent upon the closing of such loan, commencement of these First Phase activities is expected to begin promptly thereafter (See: Note 9 – “Omagine Project”).

Interim Financial Statements

The consolidated balance sheet for the Company at the end of the preceding fiscal year has been derived from the audited balance sheet and notes thereto contained in the Company’s amended annual report on Form 10-K/A for the fiscal year ended December 31, 2014 and is presented herein for comparative purposes. All other financial statements are unaudited. In the opinion of management, all adjustments, which include only normal recurring adjustments necessary to present fairly the financial position, results of operations and cash flows for all periods presented, have been made. The results of operations for the interim periods presented are not necessarily indicative of the operating results for the respective full years.

Certain footnote disclosures normally included in the financial statements prepared in accordance with accounting principles generally accepted in the United States (“US GAAP”) have been omitted in accordance with the published rules and regulations of the Securities and Exchange Commission (“SEC”). These financial statements should be read in conjunction with the financial statements and notes thereto included in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2014 filed with the SEC on April 13, 2015 and the amended annual report on Form 10-K/A filed with the SEC on October 29, 2015.

Summary of Significant Accounting Policies

Principles of Consolidation - The consolidated financial statements include the accounts of Omagine, JOL and LLC. LLC is an Omani limited liability company organized under the laws of the Sultanate of Oman. All inter-company transactions have been eliminated in consolidation.

Financial Instruments - Financial instruments include cash, convertible notes payable and accrued interest, note payable and accrued interest, accounts payable, accrued officers’ payroll and accrued expenses and other current liabilities. The amounts reported for financial instruments are considered to be reasonable approximations of their fair values, based on market information available to management.

Cash and Cash Equivalents – The Company considers all highly liquid instruments with a maturity of three months or less at the time of issuance to be cash equivalents. At September 30, 2015 and December 31, 2014, cash included approximately $6,500 and $11,200 respectively in an Oman bank account not covered by FDIC insurance.

Inventory – Inventory is stated at cost. At September 30, 2015, inventory consists solely of land under development which was purchased on July 2, 2015 and which is held by LLC for sale. The cost of such land is stated at the fair value of the property at the date of acquisition. The Company’s consolidated financial statements for the period ended September 30, 2015 reflect an increase of $490,813,363 in inventory resulting from LLC’s July 2, 2015 purchase of the Land Rights. (See: Note 2 – “Inventory and Property”).

Property, Plant and Equipment - Property, plant and equipment (“PP&E”) are stated at cost. PP&E consists of land under development which is held for investment; furniture and fixtures; and office machinery and equipment. PP&E (including buildings and structures after they are completed and put into service) are depreciated on a straight-line basis over their respective useful service lives. The Company’s consolidated financial statements for the period ended September 30, 2015 reflect an increase of $227,800,637 in PP&E resulting from LLC’s July 2, 2015 purchase of the Land Rights. (See: Note 2 – “Inventory and Property”).

Stockholders’ Equity - Stockholders’ equity consists of common stock, capital in excess of par value, retained earnings, and non-controlling interests in LLC. The Company’s consolidated financial statements for the period ended September 30, 2015 reflect an increase of $718,614,000 in stockholders’ equity resulting from LLC’s July 2, 2015 acquisition of the Land Rights (a $431,168,400 increase in Omagine stockholders’ equity and a $287,445,600 increase in non-controlling interests in LLC). (See: Note 2 – “Inventory and Property”).

F-5

Estimates and Uncertainties - The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results as determined at a later date could differ from those estimates. In recording $718,614,000 in the accompanying consolidated financial statements for the period ended September 30, 2015 as the value of the non-cash consideration received by LLC as Land Rights, management relied to a great extent upon the written valuation reports of three expert valuation firms engaged by LLC to value such Land Rights. Furthermore, in allocating such Land Value to inventory and land under development, management relied to a great extent upon the written report and analysis of an expert independent accounting firm engaged by LLC to advise it on the proper accounting to record the Land Value in LLC’s financial statements and on the agreement therewith by LLC’s independent auditor. In addition, the Company’s independent auditor is in agreement with and concurs with the accounting treatment utilized to record the Land Rights in the accompanying consolidated financial statements for the period ended September 30, 2015. (See: Note 2 – “Inventory and Property”).

Revenue Recognition - The Company follows the guidelines of SEC Staff Accounting Bulletin No. 101,”Revenue Recognition in Financial Statements” (SAB101). LLC signed a development agreement for the Omagine Project with the Government of Oman in October 2014, and will recognize revenue ratably over the development period of the Omagine Project measured by methods appropriate to the services or products provided.

Income Taxes - Omagine and JOL are subject to United States (“U.S.”) income taxes at both the federal and state level and LLC is subject to income taxes in Oman. Separate state income tax returns are filed with each state in the U.S. in which Omagine or any subsidiary of Omagine is incorporated or qualified as a foreign corporation. LLC files an income tax return in Oman. Other than with respect to LLC, the Company is not presently subject to income taxes in any foreign country. The Company reports interest and penalties as income tax expense. Deferred tax assets and liabilities are recognized based on differences between the book and tax bases of assets and liabilities using presently enacted income tax rates. The Company establishes a provision for U.S. income taxes by applying the provisions of the applicable enacted tax laws to taxable income, if any, for the relevant period. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized.

Stock-based Compensation - Stock-based compensation is accounted for at fair value in accordance with Accounting Standards Codification 718, “Compensation – Stock Compensation” (“ASC 718”). For stock options granted, Omagine has recognized compensation expense based on the estimated grant date fair value method using the Black-Scholes valuation model. For such stock option awards, Omagine has recognized compensation expense using a straight-line amortization method over the requisite service period. ASC 718 requires that stock-based compensation expense be based on awards that are ultimately expected to vest. Stock option expense for the nine months ended September 30, 2015 and 2014 were $3,114,190 and $538,368, respectively. (See Note 7).

Earnings (Loss) Per Share – Basic earnings (loss) per share of Omagine’s $0.001 par value common stock (“Common Stock”) is based upon the weighted-average number of shares of Common Stock (“Common Shares”) outstanding during the relevant period. Diluted earnings (loss) per share is based upon the weighted-average number of Common Shares and dilutive securities (stock options, warrants, stock appreciation rights and convertible notes) outstanding during the relevant period. Dilutive securities having an anti-dilutive effect on diluted earnings (loss) per share are excluded from the calculation.

For the nine months ended September 30, 2015 and 2014, the Common Shares underlying the following dilutive securities were excluded from the calculation of diluted shares outstanding as the effect of their inclusion would be anti-dilutive:

| Common Shares Issuable | ||||||||

| Nine Months Ended | ||||||||

| September 30, | ||||||||

| 2015 | 2014 | |||||||

| Convertible Notes | 156,399 | 145,399 | ||||||

| Stock Options | 3,273,000 | 2,315,000 | ||||||

| Stock Appreciation Rights | 1,455,000 | 0 | ||||||

| Warrants | 6,773,896 | 7,182,124 | ||||||

| Total Common Shares Issuable | 11,658,295 | 9,642,523 | ||||||

Non-controlling Interests in Omagine LLC - As of the date of this report LLC is owned 60% by Omagine. In May 2011, Omagine, JOL and three new investors (the “New Investors”) entered into a shareholders’ agreement (the “Shareholder Agreement”) pursuant to which Omagine’s 100% ownership of LLC was reduced to 60%.

F-6

The New Investors are:

| i. | The Office of Royal Court Affairs (“RCA”), an organization representing the personal interests of His Majesty Sultan Qaboos bin Said, the ruler of Oman, and | |

| ii. | Two subsidiaries of Consolidated Contractors International Company, SAL (“CCIC”). CCIC is a 60 year old Lebanese multi-national company headquartered in Athens, Greece having approximately five and one-half (5.5) billion dollars in annual revenue, one hundred thirty thousand (130,000) employees worldwide, and operating subsidiaries in among other places, every country in the Middle East. The two CCIC subsidiaries which are LLC shareholders are: | |

| 1. | Consolidated Contracting Company S.A. (“CCC-Panama”), a wholly owned subsidiary of CCIC and is its investment arm, and | |

| 2. | Consolidated Contractors (Oman) Company LLC, CCIC’s operating subsidiary in Oman which is a construction company with approximately 13,000 employees. |

As of the date hereof, the shareholders of LLC and their associated ownership percentages as registered with the Government of Oman are as follows:

| LLC Shareholder | Percent Ownership | |||

| Omagine | 60 | % | ||

| RCA | 25 | % | ||

| CCC-Panama | 10 | % | ||

| CCC-Oman | 5 | % | ||

| Total: | 100 | % | ||

Recent Accounting Pronouncements

On August 27, 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2014-15, “Presentation of Financial Statements—Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern” (“ASU 2014-15”). ASU 2014-15 provides guidance on determining when and how reporting entities must disclose going concern uncertainties in their financial statements. The new standard requires management to perform interim and annual assessments of an entity's ability to continue as a going concern within one year of the date of issuance of the entity's financial statements (or within one year after the date on which the financial statements are available to be issued, when applicable). Further, an entity must provide certain disclosures if there is “substantial doubt about the entity's ability to continue as a going concern.” The FASB believes that requiring management to perform the assessment will enhance the timeliness, clarity and consistency of related disclosures and improve convergence with IFRSs (which emphasize management's responsibility for performing the going concern assessment). However, the time horizon for the assessment (look-forward period) and the disclosure thresholds under U.S. GAAP and IFRSs will continue to differ. This ASU 2014-15 is effective for annual periods ending after December 16, 2016, and interim periods thereafter; early adoption is permitted. The Company does not believe that this pronouncement will have a material impact on our financial statement disclosures.

In June 2014, the FASB issued ASU 2014-10, “Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable Interest Entities Guidance in Topic 810, Consolidation” (“ASU 2014-10”). ASU 2014-10 removes the financial reporting distinction between development stage entities and other reporting entities and eliminates the requirements for development stage entities to (1) present inception-to-date information in the statements of income, cash flows, and shareholder equity, (2) label the financial statements as those of a development stage entity, (3) disclose a description of the development stage activities in which the entity is engaged, and (4) disclose in the first year in which the entity is no longer a development stage entity that in prior years it had been in the development stage. The Company is required to adopt this new standard on a retrospective basis for the year ending December 31, 2015, and interim periods therein; however, early application is permitted. The Company has elected to adopt the new reporting standard for financial statements filed commencing with the 10-Q for the period ended September 30, 2014. Other than simplifying the presentation of the Company’s financial statements and needed disclosures, the adoption of ASU 2014-10 has not affected the Company’s consolidated financial statements.

In July 2013, the FASB issued ASU 2013-11, ”Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carry forward, a Similar Tax Loss, or a Tax Credit Carry forward Exists” (”ASU 2013-11”), which states that entities should present the unrecognized tax benefit as a reduction of the deferred tax asset for a net operating loss (”NOL”) or similar tax loss or tax credit carry forward rather than as a liability when the uncertain tax position would reduce the NOL or other carry forward under the tax law. The Company adopted this new standard on a prospective basis in the first interim reporting period of fiscal 2015. The adoption of ASU 2013-11 has not materially affected its consolidated financial statements.

Certain other accounting pronouncements have been issued by the FASB and other standard setting organizations which are not yet effective and therefore have not yet been adopted by the Company. The impact on the Company’s financial position and results of operations from adoption of these standards is not expected to be material.

F-7

NOTE 2 – INVENTORY AND PROPERTY

The Company’s consolidated financial statements for the period ended September 30, 2015 reflect $718,614,000 of land under development which the Company has allocated to inventory ($490,813,363) and property ($227,800,637). This $718,614,000 of land under development was purchased by LLC on July 2, 2015 pursuant to the terms of the Shareholder Agreement whereby an LLC shareholder agreed to sell the Land Rights over one million square meters of beachfront land to LLC in exchange for the issuance to such shareholder of 663,750 Omagine LLC shares (the “LLC Shares”). Since the Land Rights represented a non-cash payment-in-kind for the LLC Shares, it was necessary to value the Land Rights.

Three expert real estate valuation companies were engaged by LLC to independently value the Land Rights in accordance with the professional standards specified by the Royal Institution of Chartered Surveyors (“RICS”) and International Financial Reporting Standards (“IFRS”). The average of the three Land Rights valuations was 276,666,667 Omani Rials ($718,614,000).

LLC engaged the services of PricewaterhouseCoopers LLP (“PwC”) as its IFRS accounting consultant to definitively determine the correct method of recording the $718,614,000 average value of its Land Rights in its IFRS compliant financial statements. After receiving PwC’s written report and analysis, LLC then consulted its independent auditor, Deloitte & Touche (M.E.) & Co. LLC (“Deloitte”) with respect to the matter and received Deloitte’s written report agreeing with the PwC analysis. Both PwC and Deloitte independently concluded that the Land Rights should be recorded as capital, work-in-process (inventory) and land on LLC’s financial statements. With respect to the Company’s consolidated financial statements, the Company’s independent auditor in the U.S. has likewise concurred that, pursuant to US GAAP, the Land Rights should be recorded as capital, inventory and land.

In determining the proper amounts to be allocated to inventory and land, LLC calculated the percentage (x) by dividing (y) the area of the land LLC presently plans definitively to sell, by (z) the total area of land constituting the Omagine Site, and then multiplying that percentage (x) by $718,614,000 to get the number (N) for inventory. The amount to be allocated to land was then calculated by subtracting N from $718,614,000. Using its detailed internal financial model, management calculated (x) to be equal to 68.3%, thereby making the inventory number $490,813,363 and the land number $227,800,637. In its consolidated financial statements therefore, the Company has allocated the value of the Land Rights between land under development which is held for sale (inventory) and land under development which is held for investment (PP&E). These percentage allocations may be modified over time as the more precise land uses become apparent during and after the master planning and construction process.

NOTE 3 – PREPAID EXPENSES AND OTHER CURRENT ASSETS

Prepaid expenses and other current assets consist of:

| September 30, | December 31, | |||||||

| 2015 | 2014 | |||||||

| (Unaudited) | ||||||||

| Travel Advances | $ | 2,000 | $ | 5,000 | ||||

| Prepaid office salaries (Muscat, Oman office) | - | 780 | ||||||

| Prepaid rent (Muscat, Oman office) | 8,970 | - | ||||||

| Total | $ | 10,970 | $ | 5,780 | ||||

NOTE 4 – CONVERTIBLE NOTES PAYABLE AND ACCRUED INTEREST

Convertible notes payable and accrued interest thereon consist of:

| September 30, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Unaudited | ||||||||

| Due to an Omagine director, interest at 10% per annum, due on demand, convertible into Common Stock at $2.50 per Common Share: | ||||||||

| Principal | $ | 150,000 | $ | 150,000 | ||||

| Accrued Interest | 74,946 | 63,726 | ||||||

| Due to investors, interest at 15% per annum, due on demand, convertible into Common Stock at $2.50 per Common Share: | ||||||||

| Principal | 50,000 | 50,000 | ||||||

| Accrued Interest | 49,305 | 43,696 | ||||||

| Due to investors, interest at 10% per annum, due on demand, convertible into Common Stock at $2.50 per Common Share: | ||||||||

| Principal | 50,000 | 50,000 | ||||||

| Accrued Interest | 16,746 | 13,007 | ||||||

| Total | $ | 390,997 | $ | 370,429 | ||||

F-8

NOTE 5 –NOTES PAYABLE AND ACCRUED INTEREST – YA GLOBAL MASTER SPV, LTD.

In July 2013, Omagine borrowed $200,000 from YA Global Master SPV, Ltd. (“YA”) via an unsecured loan (the “2013 YA Loan”) and on April 23, 2014 Omagine paid off the 2013 YA Loan balance and accrued interest thereon due at April 23, 2014 and borrowed an additional $500,000 from YA via a second unsecured loan (the “2014 YA Loan”) and on April 22, 2015 Omagine paid off the 2014 YA Loan balance and the accrued interest thereon. On May 20, 2015, Omagine borrowed an additional $500,000 from YA via a third unsecured loan (the “2015 YA Loan”).

Notes payable and accrued interest thereon due to YA consist of:

| September 30, | December 31, | |||||||

| 2015 | 2014 | |||||||

| (Unaudited) | ||||||||

| 2015 YA Loan - interest at 10% per annum, due in 12 monthly installments of principal ($50,000 in July 2015, $40,000 monthly August 2015 to October 2015, $35,000 monthly November 2015 to February 2016, $40,000 monthly March 2016 to May 2016 and $70,000 on June 1, 2016) and interest. | $ | 370,000 | $ | - | ||||

| 2014 YA Loan - interest at 10% per annum, due and repaid in monthly installments of principal and interest through April 2015 | 225,000 | |||||||

| Less: Unamortized debt discount at September 30, 2015 and December 31, 2014 | (33,333 | ) | (12,133 | ) | ||||

| Principal, net | 336,667 | 212,867 | ||||||

| Accrued interest | 3,041 | 1,911 | ||||||

| Total | $ | 339,708 | $ | 214,778 | ||||

NOTE 6 – COMMON STOCK

With respect to the issuances of the Common Shares listed below:

| 1. | see Note 9 under ”Equity Finance Agreements” with respect to sales of Common Shares made to YA Global Master SPV, Ltd. (”YA”) pursuant to the SEDA. | |

| 2. | where issuances of restricted Common Shares occurred at non-discounted valuations, it is so noted and all such non-discounted valuations were based on the closing price of a Common Share on the relevant date. | |

| 3. | where issuances of restricted Common Shares occurred at discounted valuations, it is so noted and all such discounted valuations were calculated using the Finnerty Method based on the closing price of a Common Share on the relevant date less a 17% restricted stock discount for 2014 issuances and an 18% restricted stock discount for 2015 issuances. | |

| 4. | where issuances of restricted Common Shares occurred at agreed upon negotiated prices, the sale proceeds or value of services rendered are so noted. |

On January 5, 2015, Omagine contributed an aggregate of 36,483 restricted Common Shares at the non-discounted valuation of $76,250 to all eligible employees of the Omagine, Inc. 401(k) Plan.

On February 23, 2015, Omagine paid a consultant 5,000 restricted Common Shares at the discounted valuation of $9,450.

On March 26, 2015, Omagine sold 6,281 restricted Common Shares to an accredited investor for proceeds of $10,000.

On March 26, 2015, Omagine sold 200,000 restricted Common Shares to a non-U.S. person who is an accredited investor for proceeds of $210,000.

On May 16, 2015, Omagine sold 100,000 restricted Common Shares to an officer and director for proceeds of $120,000.

On June 29, 2015, the Non-US investor (described below in connection with a June 24, 2014 transaction) exercised 158,228 Tempest Warrants at an exercise price of $1.58 for proceeds of $250,000.

On June 29, 2015, Omagine paid a finder’s fee to a non-U.S. Finder in connection with the aforementioned sale of 158,228 restricted Common Shares. Such finder’s fee was satisfied by issuing such non-U.S. Finder 7,911 restricted Common Shares valued at $12,500.

On June 30, 2015, a former director exercised 2,000 stock options for proceeds of $1,020.

On September 1, 2015, two new Directors were each issued 25,000 restricted Common Shares at a value of $50,000 each for services to be rendered from September 1 to December 31, 2015.

On September 3, 2015, pursuant to the SEDA, Omagine sold 17,696 Common Shares to YA for proceeds of $25,000.

On September 14, 2015, Omagine sold 10,000 restricted Common Shares to an accredited investor for proceeds of $14,700.

F-9

On January 10, 2014, Omagine paid a law firm for legal services rendered by issuing such law firm 34,374 restricted Common Shares at the discounted valuation of $26,248, which value was $10,436 in excess of the $15,812 owed by Omagine to such law firm at that date.

On January 8, 2014 pursuant to the SEDA, Omagine sold 29,687 Common Shares to YA for proceeds of $25,000.

On January 17, 2014 pursuant to the SEDA, Omagine sold 24,912 Common Shares to YA for proceeds of $20,000.

On January 24, 2014 pursuant to the SEDA, Omagine sold 31,705 Common Shares to YA for proceeds of $25,000.

On February 13, 2014, Omagine contributed an aggregate of 73,315 restricted Common Shares at the non-discounted valuation of $76,250 to all eligible employees of the Omagine Inc. 401(k) Plan.

On February 14, 2014 pursuant to the SEDA, Omagine sold 68,493 Common Shares to YA for proceeds of $150,000.

On March 14, 2014, Omagine sold 70,000 restricted Common Shares to a non-U.S. person who is an accredited investor for proceeds of $70,000.

On March 14, 2014, Omagine paid a finder’s fee to a non-U.S. person (a “non-U.S. Finder”) in connection with the aforementioned sale of 70,000 restricted Common Shares to a non-U.S. person. Such finder’s fee was satisfied by issuing such non-U.S. Finder 3,500 restricted Common Shares at the discounted valuation of $6,101.

On March 21, 2014 pursuant to the SEDA, Omagine sold 13,597 Common Shares to YA for proceeds of $25,000.

On April 11, 2014, Omagine sold 150,000 restricted Common Shares to a non-U.S. person who is an accredited investor for proceeds of $150,000. At September 30, 2014, such non-U.S. person owned 1,195,300 Common Shares or approximately 7.4% of the Common Shares then outstanding and 441,120 Strategic Warrants (See Note 7).

On April 11, 2014, Omagine paid a finder’s fee to a non-U.S. Finder in connection with the aforementioned sale of 150,000 restricted Common Shares to a non-U.S. person. Such finder’s fee was satisfied by issuing such non-U.S. Finder 7,500 restricted Common Shares at the discounted valuation of $10,147.

On April 22, 2014, Omagine issued 85,822 restricted Common Shares to an affiliate of YA in satisfaction of a $150,000 commitment fee due in connection with the 2014 SEDA.

On May 6, 2014 pursuant to the SEDA, Omagine sold 32,270 Common Shares to YA for proceeds of $50,000.

On June 24, 2014, Omagine sold 362,308 restricted Common Shares and issued 1,000,000 Tempest Warrants (See Note 7) to a non-U.S. person who is an accredited investor (the “Non-U.S. Investor”) for proceeds of $422,100.

On June 24, 2014, Omagine paid a finder’s fee to a non-U.S. Finder in connection with the aforementioned sale to the non-U.S. Investor (See Note 7). Such finder’s fee was satisfied by paying such non-U.S. Finder $20,000 in cash and issuing such non-U.S. Finder 15,000 restricted Common Shares at the discounted valuation of $19,920.

On August 15, 2014, the Non-U.S. Investor transferred 240,000 Tempest Warrants to an affiliate of his which is also a non-U.S. person (the “Non-U.S. Affiliate”) and such Non-U.S. Affiliate exercised such 240,000 Tempest Warrants at an exercise price of $1.40 per Common Share for proceeds to Omagine of $336,000. On August 25, 2014, Omagine paid a finder’s fee of $16,800 to a non-U.S. Finder in connection with such Tempest Warrant exercise.

On September 3, 2014, in exchange for a $3,000 cash settlement payment, the Company cancelled 10,000 restricted Common Shares valued at the non-discounted valuation of $9,020 issued to a consultant for services rendered.

On October 2, 2014, the Non-U.S. Investor transferred 250,000 Tempest Warrants to the Non-U.S. Affiliate and the Non-U.S. Affiliate exercised such 250,000 Tempest Warrants at an exercise price of $1.31 per Common Share for proceeds to Omagine of $327,500. On October 6, 2014, Omagine paid a finder’s fee of $16,375 to a Non-U.S. Finder in connection with such Tempest Warrant exercise by the Non-U.S. Affiliate.

On November 7, 2014, Omagine sold 14,881 restricted Common Shares to a non-U.S. person who is a civil engineer of CCC-Oman and an accredited investor for proceeds of $30,000.

On November 10, 2014, Omagine sold 7,440 restricted Common shares to a non-U.S. person who is a civil engineer of CCC-Oman and an accredited investor for proceeds of $15,000.

On November 20, 2014, Omagine sold an aggregate of 400,000 restricted Common Shares at $2.00 per share to two non-U.S. persons who are accredited investors (150,000 shares to one investor and 250,000 shares to the other investor) for aggregate proceeds of $800,000. The two non-U.S. persons are family members of an Omagine stockholder who owns approximately 7.1% of the Common Shares outstanding at December 31, 2014.

On November 21, 2014, Omagine paid a finder’s fee to a non-U.S. Finder in connection with the aforementioned sale of 400,000 restricted Common Shares. Such finder’s fee was satisfied by issuing such non-U.S. Finder 20,000 restricted Common Shares valued at $40,000.

F-10

NOTE 7 – STOCK OPTIONS, STOCK APPRECIATION RIGHTS AND WARRANTS

Stock Options/ Stock Appreciation Rights

Omagine’s shareholders approved the reservation by Omagine of 2,500,000 Common Shares for issuance under the 2003 Omagine, Inc. Stock Option Plan (the “2003 Plan”). The 2003 Plan expired on August 31, 2013. On March 6, 2014, the Board of Directors approved the adoption of the 2014 Omagine, Inc. Stock Option Plan (the “2014 Plan”).

Both the 2003 Plan and the 2014 Plan are designed to attract, retain and motivate employees, directors, consultants and other professional advisors of Omagine and its subsidiaries (collectively, the “Recipients”) by giving such Recipients the opportunity to acquire stock ownership in Omagine through the issuance of stock options (“Stock Options”) to purchase Common Shares.

Omagine has registered for resale the 2.5 million Common Shares reserved for issuance under the 2003 Plan by filing a registration statement with the SEC on Form S-8. At September 30, 2015, there were 2,283,000 unexpired Stock Options issued but unexercised under the 2003 Plan and all such Stock Options remain valid until the earlier of their exercise date or expiration date.

Pursuant to the 2014 Plan, 3,000,000 Common Shares were reserved for issuance. The 2014 Plan was amended to increase the reservation of 3,000,000 Common Shares for issuance to 5,000,000 Common Shares and to permit issuance of stock appreciation rights (“The Amended 2014 Plan”). Omagine intends to seek its shareholders’ ratification of the adoption by Omagine of the Amended 2014 Plan. At September 30, 2015, there were 990,000 unexpired Stock Options and 1,455,000 Stock Appreciation Rights (SARs) issued but unexercised under the Amended 2014 Plan.

A summary of Stock Option and SARs activity for the nine months ended September 30, 2015 and 2014 is as follows:

| Number of Shares | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value | |||||||||||

| Outstanding at January 1, 2014 | 2,285,000 | $ | 1.72 | 1.43 | $ | 1,100 | ||||||||

| Granted in Q1 2014 | 40,000 | $ | 1.80 | 5.06 | - | |||||||||

| Outstanding September 30, 2014 | 2,325,000 | $ | 1.73 | 0.74 | $ | 68,340 | ||||||||

| Exercisable at September 30, 2014 | 2,315,000 | $ | 1.73 | 0.72 | $ | 68,340 | ||||||||

| Outstanding at January 1, 2015 | 3,275,000 | $ | 1.97 | 1.24 | $ | 1,923,170 | ||||||||

| Exercised in Q2 2015 | (2,000 | ) | $ | 0.51 | - | - | ||||||||

| Granted in Q3 2015 | 1,455,000 | $ | 2.00 | 2.29 | - | |||||||||

| Outstanding September 30, 2015 | 4,728,000 | $ | 1.98 | 1.67 | $ | 59,440 | ||||||||

| Exercisable at September 30, 2015 | 4,728,000 | $ | 1.98 | 1.67 | $ | 59,440 | ||||||||

Of the 3,273,000 Stock Options outstanding at September 30, 2015, 2,915,000 of such Stock Options were issued by Omagine in January 2012 and December 2014 as “Strategic Options” to officers, directors and consultants of Omagine whose continued service was deemed by the Board of Directors to be particularly crucial to attaining LLC’s then strategic goal of signing the Development Agreement (“DA”) with the Government of Oman and in recognition of those efforts during 2014 and beyond. The Strategic Options are fully vested, provide for a cashless exercise feature and currently expire on December 31, 2016; 1,965,000 of the Strategic Options are exercisable at $1.70 and 950,000 are exercisable at $2.55. To continue to incentivize the retention and sustained service to the Company of its mission-critical employees and consultants, the expiration date of the 1,965,000 Strategic Options issued in January 2012 was extended by Omagine in December 2012 to December 31, 2013 (the “First Extension“) and in December 2013 to December 31, 2014 (the “Second Extension”) and in December 2014 to December 31, 2015 (the “Third Extension”) and on August 12, 2015 to December 31, 2016 (the “ Fourth Extension”).

Of the 2,915,000 Strategic Options, an aggregate of 1,685,000 were granted to Omagine’s three officers, an aggregate of 125,000 were granted to Omagine’s independent directors and 1,000,000 were granted to the Deputy Managing Director of LLC who, pursuant to a March 2007 consulting agreement expiring on December 31, 2015, is also a consultant to the Company. The Deputy Managing Director of LLC also holds 160,000 Stock Options granted pursuant to his consulting agreement which are not Strategic Options, exercisable at $1.25 per share and expiring on March 31, 2017.

Of the 1,455,000 Stock Appreciation Rights, an aggregate of 750,000 were granted to three officers of Omagine, 15,000 were granted to one independent director and 675,000 were granted to the Deputy Managing Director of LLC.

The $1,373,326 estimated fair value of the First Extension was calculated using the Black Scholes option pricing model and the following assumptions: (i) $1.77 share price, (ii) 370 day term of the First Extension, (iii) 125% expected volatility, (iv) 0.16% (370 day term) risk free interest rate and such $1,373,326 was expensed evenly by Omagine over the 370 day requisite service period of the First Extension (December 27, 2012 through December 31, 2013). The estimated fair value of the issuance in 2012 of the Strategic Options was $1,685,629.

F-11

The $671,440 estimated fair value of the Second Extension was calculated using the Black Scholes option pricing model and the following assumptions (i) $0.89 share price, (ii) 378 day term of the Second Extension, (iii) 144% expected volatility, (iv) 0.13% (378 day term) risk free interest rate, and such $671,440 was expensed evenly over the 378 day requisite service period of the Second Extension (December 19, 2013 through December 31, 2014).

On December 13, 2014, Omagine granted to six persons an aggregate of 950,000 fully vested Strategic Options with a cashless exercise feature (625,000 to three officers, 25,000 to one director and 300,000 to two consultants) exercisable at $2.55 per share and expiring on December 31, 2015. The $1,277,370 estimated fair value of the 950,000 Strategic Options was calculated using the Black Scholes option pricing model and the following assumptions: (i) $2.52 share price, (ii) 368 day term, (iii) 147% expected volatility, (iv) 0.25% (368 day term) risk free interest rate and was expensed in full in the quarterly period ended December 31, 2014.

On December 29, 2014, the expiration date of the 1,965,000 Strategic Options issued in January 2012 was extended from December 31, 2014 to December 31, 2015 (the “Third Extension”). The $1,504,404 estimated fair value of the Third Extension was calculated using the Black Scholes option pricing model and the following assumptions: (i) $2.52 share price, (ii) 368 day term, (iii) 147% expected volatility, (iv) 0.25% (368 day term) risk free interest rate and was expensed in full in the quarterly period ended December 31, 2014.

On August 12, 2015, the expiration date of the 1,965,000 Strategic Options issued in January 2012 was extended from December 31, 2015 to December 31, 2016 (the “Fourth Extension”). The $915,493 estimated fair value of the Fourth Extension was calculated using the Black Scholes option pricing model and the following assumptions: (i) $1.91 share price, (ii) 507 day term, (iii) 147% expected volatility, (iv) 0.32% (507 day term) risk free interest rate and was expensed in full in the quarterly period ended September 30, 2015.

On August 12, 2015, the expiration date of the 950,000 Strategic Options issued in December of 2014 was extended from December 31, 2015 to December 31, 2016 (the “First Extension”). The $541,215 estimated fair value of the First Extension was calculated using the Black Scholes option pricing model and the following assumptions: ( i ) $1.91 share price, ( ii ) 507 day term, ( iii ) 147% expected volatility, ( iv) 0.32% (507 day term) risk free interest rate and was expensed in full in the quarterly period ended September 30, 2015.

On January 15, 2013 an Omagine independent director was granted 2,000 Stock Options exercisable at $1.38 per share and expiring on January 14, 2018.

On April 8, 2013, the estate of a former Omagine director exercised 4,000 Stock Options; 2,000 at $0.51 per share and 2,000 at $0.85 per share.

On March 28, 2014, Omagine granted to four persons an aggregate of 40,000 Stock Options exercisable at $1.80 per share and expiring on March 27, 2019. One such person is an Omagine independent director, one is an Omagine officer and two are consultants. The $55,376 estimated fair value of the 40,000 Stock Options was calculated using the Black Scholes option pricing model and the following assumptions: (i) $1.80 share price, (ii) a 5 year term, (iii) 106% expected volatility and (iv) 1.75% (5 year term) risk free interest rate. $51,914 of such estimated fair value was expensed in the year ended December 31, 2014, and $1,731 was expensed in the six months ended June 30, 2015.

On June 30, 2015, a former Omagine director exercised 2,000 stock options at $0.51 per share.

On August 31, 2015, Omagine granted an aggregate of 1,455,000 Stock Appreciation Rights (“SARs”) to six persons exercisable at $2.00 per share and expiring on December 31, 2017. Of the 1,455,000 SARs, an aggregate of 750,000 were granted to three officers of Omagine,15,000 were granted to one independent director and 675,000 were granted to the Deputy Managing Director of LLC The $1,654,481 estimated fair value of the SARs was calculated using the Black Scholes option pricing model and the following assumptions: ( i) $1.60 share price, ( ii ) 854 day term, (iii) 147% expected volatility, ( iv ) 0.28% ( 854 day term ) risk free interest rate and was expensed in full in the quarterly period ended September 30, 2015.

A summary of non-vested Stock Options and the Common Shares underlying such Stock Options for the nine months ended September 30, 2015 and 2014 is as follows:

| Number of Shares | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term (in years) | ||||||||

| Non-vested shares at January 1, 2014 | 40,000 | $ | 1.80 | 4.81 | ||||||

| Vested in Q1 2014 | (30,000 | ) | $ | 1.80 | 4.81 | |||||

| Non-vested shares at September 30, 2014 | 10,000 | $ | 1.80 | 4.30 | ||||||

| Non-vested shares at January 1, 2015 | 10,000 | $ | 1.80 | 4.30 | ||||||

| Vested in Q1 2015 | (10,000 | ) | $ | 1.80 | 4.30 | |||||

| Non-vested shares at September 30, 2015 | - | - | - | |||||||

F-12

Issued and outstanding Stock Options and SARs (all non-qualified) as of September 30, 2015 are as follows:

| Year Granted | Number Outstanding | Number Exercisable | Exercise Price | Expiration Date | ||||||||||

| 2007 | 160,000 | 160,000 | $ | 1.25 | March 31, 2017 | |||||||||

| 2008 | 150,000 | 150,000 | $ | 2.60 | September 23, 2018 | |||||||||

| 2011 | 4,000 | 4,000 | $ | 0.85 | May 16, 2016 | |||||||||

| 2012 | 1,965,000 | 1,965,000 | $ | 1.70 | December 31, 2016 | |||||||||

| 2012 | 2,000 | 2,000 | $ | 1.70 | April 12, 2017 | |||||||||

| 2013 | 2,000 | 2,000 | $ | 1.38 | January 14, 2018 | |||||||||

| 2014 | 40,000 | 40,000 | $ | 1.80 | March 27, 2019 | |||||||||

| 2014 | 950,000 | 950,000 | $ | 2.55 | December 31, 2016 | |||||||||

| 2015 | 1,455,000 | 1,455,000 | $ | 2.00 | December 31, 2017 | |||||||||

| Totals | 4,728,000 | 4,728,000 | ||||||||||||

A summary of information about Stock Options and SARs outstanding at September 30, 2015 is as follows:

| Stock Options and SARs Outstanding | Exercisable | |||||||||||||||||||||

| Range of Exercise Prices | Number of Shares | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term (in years) | Number of Shares | Weighted Average Exercise Price | |||||||||||||||||

| $ 0.50 - $1.00 | 4,000 | $ | 0.85 | 0.64 | 4,000 | $ | 0.85 | |||||||||||||||

| $ 1.01 - $2.00 | 3,624,000 | 1.80 | 1.72 | 3,624,000 | 1.80 | |||||||||||||||||

| $ 2.01 - $3.00 | 1,100,000 | 2.56 | 1.51 | 1,100,000 | 2.56 | |||||||||||||||||

| Totals | 4,728,000 | $ | 1.97 | 0.74 | 4,728,000 | $ | 1.97 | |||||||||||||||

As of September 30, 2015, there was $2,081 of unrecognized compensation costs relating to unexpired Stock Options. That cost is expected to be recognized $1,001 in 2015, $540 in 2016 and $540 in 2017.

Warrants

As of September 30, 2015 Omagine had 6,773,896 Common Stock purchase warrants (“Warrants”) issued and outstanding. The Warrants do not contain any price protection provisions that would require them to be classified as liabilities (subject to re-measurement at fair value each time a balance sheet is presented) rather than presented as a component of stockholders’ equity.

The Tempest Warrants

On June 24, 2014 in connection with the sale of 362,308 restricted Common Shares to an investor (See Note 6), Omagine issued 1,000,000 Warrants to such investor, each of which are exercisable for the purchase of one restricted Common Share at a per Common Share exercise price equal to the greater of: (a) $1.00 per Common Share, or (b) 80% of the closing sale price for a Common Share on the trading day immediately preceding the relevant exercise date (the “Tempest Warrants”). Both the exercise price of the Tempest Warrants and the number of Common Shares issuable upon exercise of the Tempest Warrants are subject to adjustment in the event of a stock split, combination or subdivision of the Common Stock, or a dividend, reclassification, reorganization, or spin off.

The Tempest Warrants and the Common Shares issuable upon exercise of the Tempest Warrants are “restricted securities” as that term is defined in the Securities Law. The Tempest Warrants expire on June 23, 2016 and are not redeemable by Omagine.

On August 15, 2014, 240,000 Tempest Warrants were transferred to an affiliate of the investor. The affiliate exercised the 240,000 Tempest Warrants at an exercise price of $1.40 per Common Share for proceeds of $336,000. On October 2, 2014, a further 250,000 Tempest Warrants were exercised by such affiliate at an exercise price of $1.31 per Common Share for proceeds of $327,500. On June 29, 2015, the investor exercised 158,228 of the Tempest Warrants at an exercise price of $1.58 per Common Share for proceeds of $250,000. In conjunction with this June 29, 2015 exercise, Omagine agreed with the investor to file a registration statement with the SEC to register all the aforementioned Common Shares presently owned by the investor and his affiliate as well as the remaining 351,772 Common Shares underlying the remaining 351,772 Tempest Warrants outstanding as of the date of this report. (See Note 11).

The Strategic Warrants

Omagine has 6,422,124 Warrants outstanding, 3,211,062 of which are exercisable for the purchase of one Common Share at a per Common Share exercise price of $5.00 and 3,211,062 of which are exercisable for the purchase of one Common Share at a per Common Share exercise price of $10.00 (collectively, the “Strategic Warrants”).

Omagine filed a post-effective amendment to its registration statement on Form S-1 (Commission File No. 333-183852) whereby the Strategic Warrants and the 6,422,124 Common Shares underlying the Strategic Warrants were registered by Omagine (the “Warrant Registration”). The Warrant Registration was declared effective by the SEC and its effective status expired. Omagine filed another post-effective amendment to the Warrant Registration on January 28, 2015 which was declared effective by the SEC on February 13, 2015. The effective status of the Updated Warrant Registration expired on November 12, 2015 and the Company plans to file another Post-Effective Amendment on Form S-1 to reinstate the effective status of the Warrant Registration. Neither the exercise prices of the Strategic Warrants nor the number of Common Shares issuable upon exercise of the Strategic Warrants are subject to adjustment in the event of a stock split, combination or subdivision of the Common Stock, or a dividend, reclassification, reorganization, or spinoff.

F-13

On August 18, 2014, pursuant to a resolution of the Board of Directors, the expiration date for all Strategic Warrants was extended for a third time to June 30, 2015 and again on January 5, 2015, pursuant to a resolution of the Board of Directors, the expiration date for all Strategic Warrants was extended to December 31, 2015. Again on August 12, 2015, pursuant to a resolution of the Board of Directors, the expiration date for all Strategic Warrants was extended to December 31, 2016. All other terms and conditions of the Strategic Warrants remained the same. All Strategic Warrants expire on December 31, 2016 unless redeemed earlier by Omagine upon 30 days prior written notice to the Strategic Warrant holders.

NOTE 8 – U.S. INCOME TAXES

Deferred U.S. tax assets are comprised of the following:

| September 30, | December 31, | |||||||

| 2015 | 2014 | |||||||

| U.S. federal net operating loss carry forwards | $ | 5,566,000 | $ | 5,293,000 | ||||

| U.S. state and city net operating loss carry forwards, net of U.S. federal tax benefit | 1,590,000 | 1,512,000 | ||||||

| 7,156,000 | 6,805,000 | |||||||

| Less: Valuation allowance | (7,156,000 | ) | (6,805,000 | ) | ||||

| Total | $ | - | $ | - | ||||

Management has determined, based on the Company's current condition, that a full valuation allowance is appropriate at September 30, 2015.

At September 30, 2015, the Company had U.S. federal net operating loss carry forwards of approximately $15,902,000 expiring in various amounts from fiscal year 2017 to fiscal year 2035.

Current U.S. income tax law limits the amount of loss available to offset against future taxable income when a substantial change in ownership occurs.

The Company believes that it has no uncertain tax positions and no unrecognized tax benefits at September 30, 2015 and December 31, 2014.

NOTE 9 – COMMITMENTS

Leases

Omagine leases its executive office in New York, New York under a ten-year lease entered into in February 2003 and extended in March 2013 and which lease now expires on December 31, 2015. LLC leases office space in Muscat, Oman from an unaffiliated third party under a one year prepaid lease which commenced in January 2015 and which provides for an annual rental of $35,880. The Company’s rent expense for the nine months ended September 30, 2015 and 2014 was $124,419 and $114,928, respectively.

At September 30, 2015, the future minimum lease payments under non-cancelable operating leases were $26,386 (all due in 2015).

Employment Agreements

The Company presently has no employment agreements with any person.

Pursuant to a prior employment agreement, Omagine was obligated to employ its President and Chief Executive Officer at an annual base salary of $125,000 plus an additional amount based on a combination of net sales and earnings before taxes. Omagine plans to enter into a new employment agreement with its President although the terms of such employment agreement have not yet been determined. Omagine had continued to accrue salary payable to its President through December 31, 2014 and on January 1, 2015 the Company recommenced its bi-monthly payroll for employees, including for its President on the basis of an annual salary of $125,000. On May 1, 2015 the Company paid its President $87,781 of accrued officer’s payroll and on May 16, 2015 the Company applied $120,000 of accrued officer’s payroll in exchange for the purchase of 100,000 restricted Common Shares of Omagine, Inc. stock at a purchase price of $1.20 per share. At September 30, 2015 and December 31, 2014, Omagine had unpaid accrued officer’s compensation due to its President of $107,891 and $310,464, respectively.

Pursuant to a prior employment agreement, Omagine was obligated to employ its Vice-President and Secretary at an annual base salary of $100,000. Omagine plans to enter into a new employment agreement with its Vice-President although the terms of such employment agreement have not yet been determined. On January 1, 2015 the Company recommenced its bi-monthly payroll for employees, including for its Vice-President on the basis of an annual salary of $100,000. On March 26, 2015 the Company paid its Vice-President $33,000 of accrued officer’s payroll and on September 9, 2015 paid an additional $2,000 of accrued officer’s payroll. At September 30, 2015 and December 31, 2014, Omagine had unpaid accrued officer’s compensation due to its Vice-President of $136,575 and $171,575, respectively.

On January 1, 2015 the Company recommenced its bi-monthly payroll for its Controller on the basis of an annual salary of $80,000. On January 14, 2015 the Company paid its Controller $25,000 of accrued officer’s payroll. At September 30, 2015 and December 31, 2014, Omagine had unpaid accrued officers’ compensation due to its Controller of $130,883 and $155,883, respectively.

F-14

Contingent Fee Payment Obligation

Depending on circumstances, LLC may execute an agreement with Michael Baker Corporation (”Baker”) to hire Baker as its Program Manager and/or Project Manager (the potential “PM Contract”). Omagine has employed Baker to provide design and engineering services through the feasibility and engineering study phases of the Omagine Project. As part of its compensation agreement with Baker, Omagine agreed that it would be obligated to pay Baker the sum of $72,000 (the “Contingent Fee”) after LLC signed the DA with the Government of Oman. Omagine paid Baker the Contingent Fee in October 2015 (See: Note 11).

Equity Financing Agreements

Omagine, Inc. and YA were parties to a Stand-By Equity Distribution Agreement (the “2011 SEDA”) which was due to expire on September 1, 2014. On July 21, 2014, the 2011 SEDA was terminated by the mutual consent of Omagine and YA.

On April 22, 2014, Omagine and YA entered into a new Standby Equity Distribution Agreement on generally the same terms and conditions as the 2011 SEDA (the”2014 SEDA“). Unless earlier terminated in accordance with its terms, the 2014 SEDA shall terminate automatically on the earlier of (i) the first day of the month next following the 24-month anniversary of the “Effective Date” (as hereinafter defined), or (ii) the date on which YA shall have made payment to Omagine of Advances pursuant to the 2014 SEDA in the aggregate amount of $5,000,000. On April 22, 2014, in satisfaction of a $150,000 commitment fee due pursuant to the 2014 SEDA, Omagine issued 85,822 restricted Common Shares to YA Global II SPV, LLC, which is an affiliate of YA (See Note 6).

Pursuant to the terms of the 2014 SEDA, Omagine may in its sole discretion, and upon giving written notice to YA (an ”Advance Notice”), periodically sell Common Shares to YA (“Shares”) at a per Share price (“Purchase Price”) equal to 95% of the lowest daily volume weighted average price (the “VWAP”) for a Common Share as quoted by Bloomberg, L.P. during the five (5) consecutive Trading Days (as such term is defined in the 2014 SEDA) immediately subsequent to the date of the relevant Advance Notice (the “Pricing Period”).