Attached files

| file | filename |

|---|---|

| 8-K - 8-K DEFINITIVE AGREEMENT - Capital Bank Financial Corp. | a8-kdefinitiveagreement.htm |

| EX-99.1 - EXHIBIT 99.1 - Capital Bank Financial Corp. | ex991definitiveagreementpr.htm |

1 Merger with November 23, 2015

Safe Harbor Statement 2 Forward-Looking Statements The information presented above may contain certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, the expected completion date, financial benefits and other effects of the proposed merger of Capital Bank or COB. Forward-looking statements can be identified by the use of the words “anticipate,” “expect,” “intend,” “estimate,” “target” and words of similar import. Forward- looking statements are not historical facts but instead express only management’s beliefs regarding future results or events, many of which, by their nature, are inherently uncertain and outside of the management’s control. It is possible that actual results and outcomes may differ, possibly materially, from the anticipated results or outcomes indicated in these forward-looking statements. Factors that may cause such a difference include, but are not limited to, the reaction to the transaction of the companies’ customers, employees and counterparties; customer disintermediation; inflation; expected synerg ies, cost savings and other financial benefits of the proposed transaction might not be realized within the expected timeframes or might be less than projected; the requisite stockholder and regulatory approvals for the proposed transaction might not be obtained; credit and interest rate risks associated Capital Bank’s or COB’s respective businesses, customer borrowing, repayment, investment and deposit practices, and general economic conditions, either nationally or in the market areas in which Capital Bank or COB operate or anticipate doing business, are less favorable than expected; new regulatory or legal requirements or obligations; and other risks and important factors that could affect Capital Bank’s or COB’s future results are identified in their Annual Report on Form 10-K for the year ended December 31, 2014 and other reports filed with the Securities and Exchange Commission (“SEC”). Forward-looking statements are made only as of the date of this presentation, and neither Capital Bank nor COB undertakes any obligation to update any forward-looking statements contained in this presentation to reflect events or conditions after the date hereof. Additional Information and Where to Find It This communication is being made in respect of the proposed merger transaction involving Capital Bank or COB. Capital Bank intends to file a registration statement on Form S-4 with the SEC, which will include a joint proxy statement of Capital Bank and COB and a prospectus of Capital Bank, and each party will file other documents regarding the proposed transaction with the SEC. A definitive joint proxy statement/prospectus will also be sent to the COB’s stockholders seeking any required stockholder approvals. Before making any voting or investment decision, investors and security holders of Capital Bank and COB are urged to carefully read the entire registration statement and joint proxy statement/prospectus, when they become available, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by Capital Bank and COB with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by Capital Bank may be obtained free of charge at Capital Bank’s website at http://investor.capitalbank-us.com/ and the documents filed by COB may be obtained free of charge at COB’s website at http://ir.community1.com/. Alternatively, these documents, when available, can be obtained free of charge from Capital Bank upon written request to Capital Bank Financial Corp., Attention: Secretary, 121 Alhambra Plaza, Suite 1601, Coral Gables, Florida 33134 or from COB upon written request to CommunityOne Bancorp, Attention: Secretary, 1017 E. Morehead Street, Suite 200, Charlotte, North Carolina 28203. Capital Bank, COB, their directors, executive officers and certain other persons may be deemed to be participants in the solicitation of proxies from Capital Bank’s and COB’s stockholders in favor of the approval of the merger. Information about the directors and executive officers of Cap ital Bank and their ownership of Capital Bank common stock is set forth in the proxy statement for Capital Bank’s 2015 annual meeting of stockholders, as previously f iled with the SEC on April 30, 2015. Information about the directors and executive officers of COB and their ownership of COB common stock is set forth in the proxy statement for COB’s 2015 annual meeting of stockholders, as previously filed with the SEC on April 7, 2015. Stockholders may obtain additional information regarding the interests of such participants by reading the registration statement and the proxy statement/prospectus when they become available.

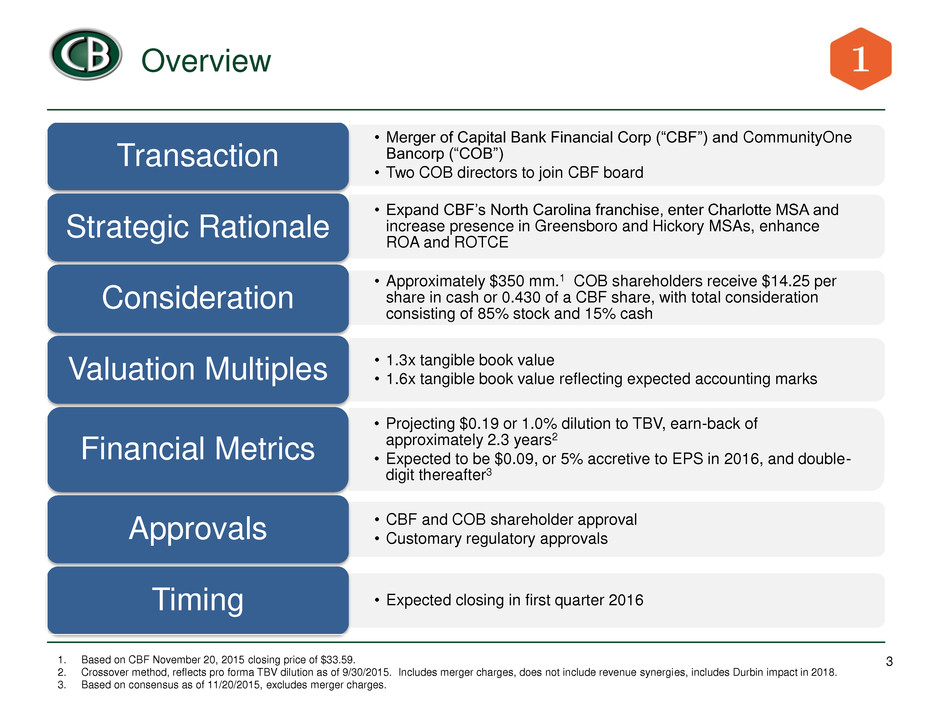

Overview 3 • Merger of Capital Bank Financial Corp (“CBF”) and CommunityOne Bancorp (“COB”) • Two COB directors to join CBF board Transaction • Expand CBF’s North Carolina franchise, enter Charlotte MSA and increase presence in Greensboro and Hickory MSAs, enhance ROA and ROTCE Strategic Rationale • Approximately $350 mm.1 COB shareholders receive $14.25 per share in cash or 0.430 of a CBF share, with total consideration consisting of 85% stock and 15% cash Consideration • 1.3x tangible book value • 1.6x tangible book value reflecting expected accounting marks Valuation Multiples • Projecting $0.19 or 1.0% dilution to TBV, earn-back of approximately 2.3 years2 • Expected to be $0.09, or 5% accretive to EPS in 2016, and double- digit thereafter3 Financial Metrics • CBF and COB shareholder approval • Customary regulatory approvals Approvals • Expected closing in first quarter 2016 Timing 1. Based on CBF November 20, 2015 closing price of $33.59. 2. Crossover method, reflects pro forma TBV dilution as of 9/30/2015. Includes merger charges, does not include revenue synergies, includes Durbin impact in 2018. 3. Based on consensus as of 11/20/2015, excludes merger charges.

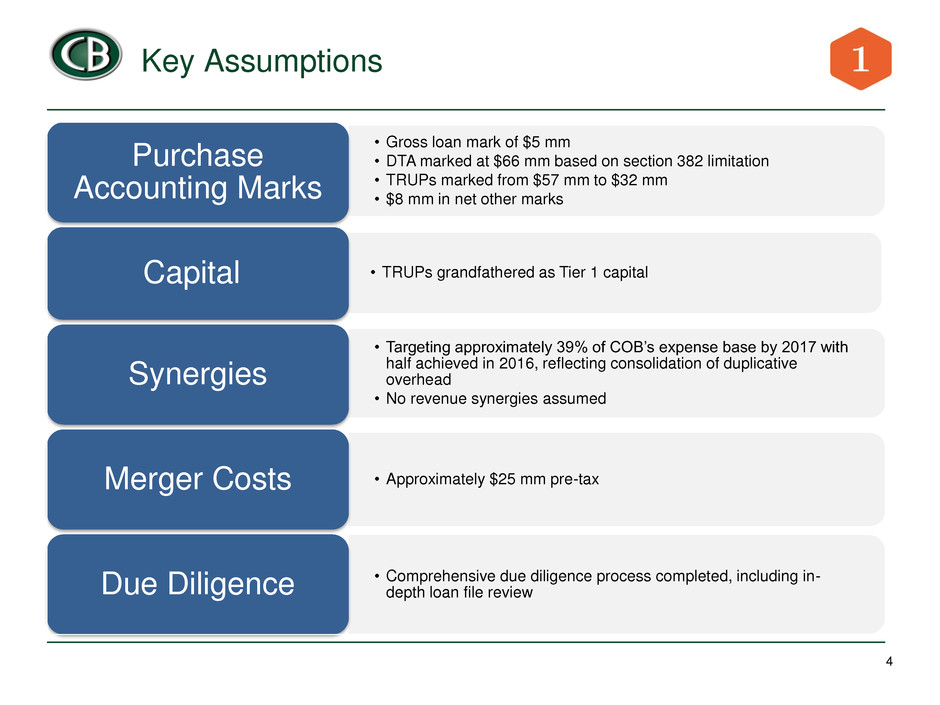

Key Assumptions 4 • Gross loan mark of $5 mm • DTA marked at $66 mm based on section 382 limitation • TRUPs marked from $57 mm to $32 mm • $8 mm in net other marks Purchase Accounting Marks • TRUPs grandfathered as Tier 1 capital Capital • Targeting approximately 39% of COB’s expense base by 2017 with half achieved in 2016, reflecting consolidation of duplicative overhead • No revenue synergies assumed Synergies • Approximately $25 mm pre-tax Merger Costs • Comprehensive due diligence process completed, including in- depth loan file review Due Diligence

Financial Metrics 5 1) 2016E excludes merger and severance expense. 2) Assumes 50% of cost savings realized in 2016, the remainder in 2017. Note: Assumes 52.8 mm pro forma average diluted shares in 2016 based on consensus forecast and 8.9 mm shares issued in the transaction. Based on 2016E consensus as of 11/20/15; 2017 based on 10% long-term EPS growth. Balance Sheet Metrics as of 9/30/2015 $ in millions CBF Pro Forma Assets 7,261 9,614 Loans 5,405 6,875 Deposits 5,566 7,462 Tier 1 Leverage Ratio 13.6% 11.6% TCE Ratio 12.3% 11.0% Loan / Deposit Ratio 97% 92% Tangible Book Value $19.75 $19.56 Core Earnings Accretion (1) $ in millions 2016E 2017E Consensus Earnings Capital Bank 69.4 76.3 per share $1.58 $1.74 CommunityOne 13.0 15.2 After-tax Adjustments Cost of financing (0.5) (0.5) Purchase accounting adjustments (2.5) (2.5) Cost savings, after-tax (2) 8.5 17.0 Pro Forma Combined 87.9 105.6 per share $1.67 $2.00 Accretion $0.09 $0.26 5.4% 15.1% Estimated ROTCE 8.3% 9.4%

Creates High-Powered Carolinas Franchise 6 CommunityOne Source: SNL Financial Capital Bank Current Pro Forma Piedmont 24% Raleigh 21% Burlington 12% Upstate SC 9% Hickory / Asheville 7% Other 27% $4bn Carolinas Deposit Franchise Piedmont 22% Hickory / Asheville 18% Charlotte 15% Raleigh 11% Burlington 8% Other 26%

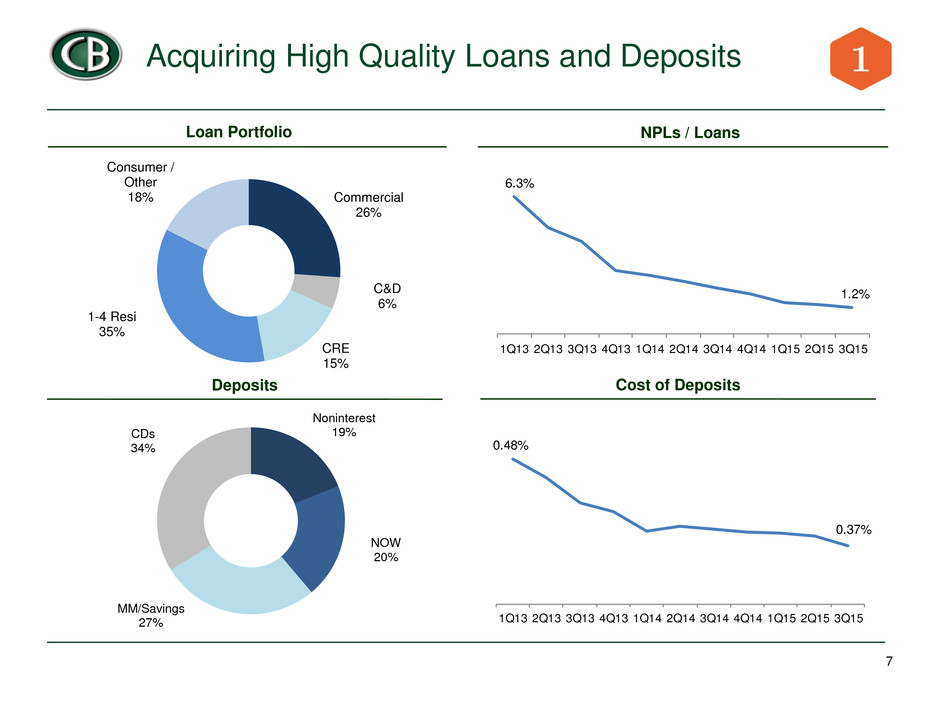

Acquiring High Quality Loans and Deposits 7 Loan Portfolio NPLs / Loans Deposits Cost of Deposits Commercial 26% C&D 6% CRE 15% 1-4 Resi 35% Consumer / Other 18% 0.48% 0.37% 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 6.3% 1.2% 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Noninterest 19% NOW 20% MM/Savings 27% CDs 34%

Pro Forma Capital Bank 8 Loans & Deposits $ bn % $ bn % Loans Carolinas 2.5 47% 4.0 58% Florida 1.7 30% 1.7 24% Tennessee 1.2 23% 1.2 18% Total 5.4 6.9 Deposits Carolinas 2.1 37% 4.0 53% Florida 2.1 38% 2.1 28% Tennessee 1.4 25% 1.4 19% Total 5.6 7.5 CBF Pro Forma

9 Capital Bank Investment Highlights ■ Experienced management team with institutional track record ■ Positioned in Southeastern growth markets ■ Disciplined and sustainable growth story ■ Focused on deploying capital and improving profitability ■ Attractive valuation