Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Business Development Corp of America | v425467_8k.htm |

Exhibit 99.1

Investing in America’s Growth THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED HEREIN . AN OFFERING IS MADE ONLY BY PROSPECTUS . THIS LITERATURE MUST BE PRECEDED OR ACCOMPANIED BY A CURRENT PROSPECTUS . AS SUCH, A COPY OF THE CURRENT PROSPECTUS MUST BE MADE AVAILABLE TO YOU IN CONNECTION WITH THIS OFFERING . YOU SHOULD READ THE CURRENT PROSPECTUS IN ORDER TO UNDERSTAND FULLY ALL OF THE IMPLICATIONS AND RISKS OF THE OFFERING OF SECURITIES TO WHICH IT RELATES . AN INVESTMENT IN THE COMPANY SHOULD BE MADE ONLY AFTER A CAREFUL REVIEW OF THE PROSPECTUS . No offering is made except by a prospectus filed with the Department of Law of the State of New York . Neither the Attorney - General of the State of New York nor any other state or federal regulator has passed on or endorsed the merits of this offering or these securities or confirmed the adequacy or accuracy of the prospectus . Any representation to the contrary is unlawful . All information contained in this material is qualified in its entirety by the terms of the current prospectus . The achievement of any goals is not guaranteed . For more complete information about investing in the Company, including risks, charges and expenses, refer to our prospectus . Investors are advised to carefully consider the investment objectives, risks and charges and expenses of the Company before investing . The prospectus contains this and other information about the Company . A Publicly Registered Non - Traded BDC

Investing in America’s Growth Important Information Regarding the Offering 2 Risk Factors Investing in our common stock involves a high degree of risk . You should purchase these securities only if you can afford a complete loss of your investment . See the section entitled “Risk Factors” in the prospectus for a discussion of the risks which should be considered in connection with your investment in our common stock . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and the fund’s prospectus for a more complete list of risk factors, as well as a discussion of forward - looking statements and other offering details.

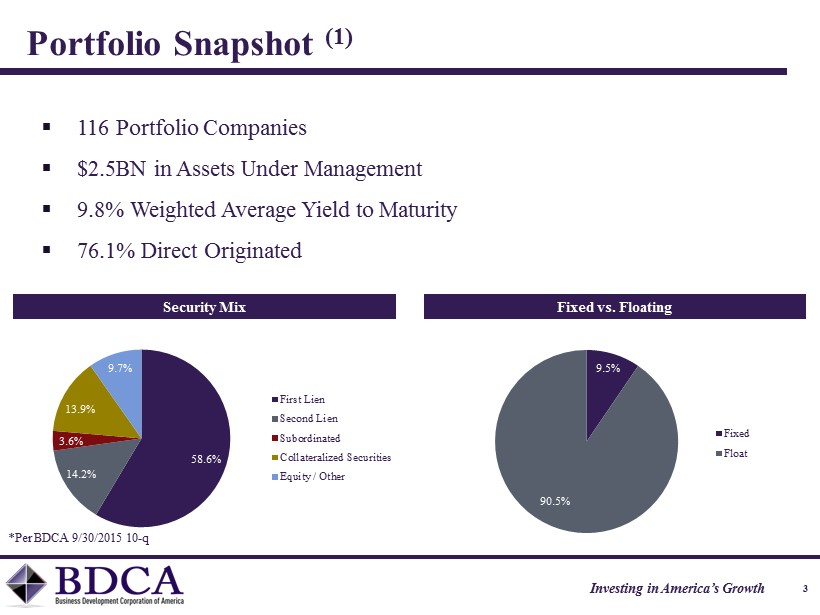

Investing in America’s Growth Portfolio Snapshot (1) 3 ▪ 116 Portfolio Companies ▪ $2.5BN in Assets Under Management ▪ 9.8% Weighted Average Yield to Maturity ▪ 76.1% Direct Originated *Per BDCA 9/30/2015 10 - q Security Mix Fixed vs. Floating 9.5% 90.5% Fixed Float 58.6% 14.2% 3.6% 13.9% 9.7% First Lien Second Lien Subordinated Collateralized Securities Equity / Other

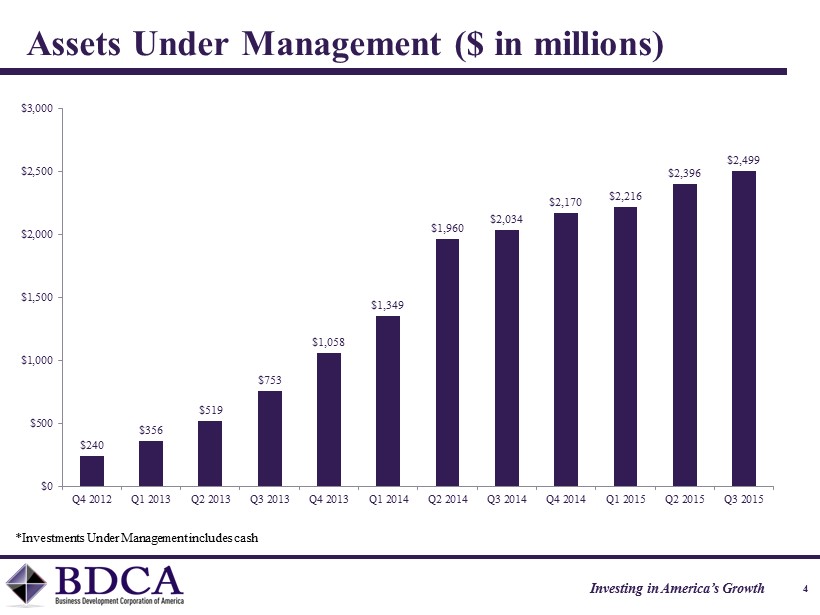

Investing in America’s Growth Assets Under Management ($ in millions) 4 $240 $356 $519 $753 $1,058 $1,349 $1,960 $2,034 $2,170 $2,216 $2,396 $2,499 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 *Investments Under Management includes cash

Investing in America’s Growth Investment Thesis 5 ▪ Focused on lending to middle market American businesses ▪ 3 Primary objectives*: - Preserve and protect capital; - Provide attractive and stable cash distributions; and - Increase the value of assets in order to generate capital appreciation *There is no guarantee these objectives will be met.

Investing in America’s Growth Capital Preservation & Monthly Cash Distributions 6 ▪ Total realized losses since inception of only $9.4 million represents a total loss rate of 0.20% on cumulative acquisitions and 0.38% on current AUM. ▪ Current annualized dividend of $0.868 per share represents an annual yield of 7.75% on highest public offering price of $11.20. Dividend has increased from $0.775/share at inception representing a 12% increase.

Investing in America’s Growth Capital Appreciation 7 The entire BDC industry (public and non - traded) has experienced NAV declines this year primarily as a result of: ▪ Dramatically reduced liquidity in loan and bond markets as a result of current regulatory environment, ▪ Concerns about potential defaults from energy and other commodity focused credits, and; ▪ Requirement of BDCs to use mark - to - market convention when reporting asset values

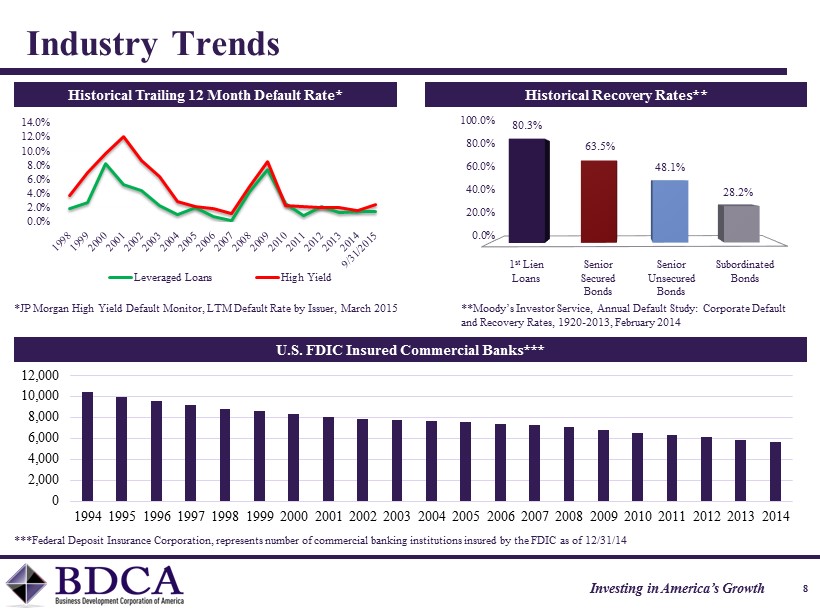

Investing in America’s Growth Industry Trends ***Federal Deposit Insurance Corporation, represents number of commercial banking institutions insured by the FDIC as of 12/31/14 8 0 2,000 4,000 6,000 8,000 10,000 12,000 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 U.S. FDIC Insured Commercial Banks*** Historical Trailing 12 Month Default Rate* Historical Recovery Rates** *JP Morgan High Yield Default Monitor, LTM Default Rate by Issuer, March 2015 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 80.3% 63.5% 48.1% 28.2% 1 st Lien Loans Senior Secured Bonds Senior Unsecured Bonds Subordinated Bonds **Moody’s Investor Service, Annual Default Study: Corporate Default and Recovery Rates, 1920 - 2013, February 2014 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% Leveraged Loans High Yield

Investing in America’s Growth ▪ Build upon our direct origination leadership position ▪ Continue to deploy capital ▪ Focus on growing Net Asset Value ▪ Utilize unused balance sheet capacity to increase ROI and dividend coverage 31 Key Initiatives 7

Investing in America’s Growth » For account information, including balances and the status of submitted paperwork, please call us at (844) 276 - 1077 » Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com » Shareholders may access their accounts at www.americanrealtycap.com Investor Services 10

Investing in America’s Growth The following is a summary of risk factors for Business Development Corporation of America . A more detailed description of the associated risks you should consider before buying shares of our common stock can be found in the prospectus . Risk Factors 11 • You should not expect to be able to sell your shares regardless of how we perform . • If you are able to sell your shares, you will likely receive less than your purchase price . • Our Adviser and its affiliates will face conflicts of interest as a result of the personnel it shares with a registered investment adviser for an affiliated business development company, and by compensation arrangements with us and our affiliates, which could result in actions that are not in the best interests of our stockholders . • We do not intend to list our shares on any securities exchange during or for what may be a significant time after the offering period, and we do not expect a secondary market in the shares to develop . • We may borrow funds to make investments . As a result, we would be exposed to the risks of borrowing, also known as leverage, which may be considered a speculative investment technique . Leverage increases the volatility of investments by magnifying the potential for gain and loss on amounts invested, thereby increasing the risks associated with investing in our securities . Moreover, any assets we may acquire with leverage will be subject to management fees payable to our Adviser ; thus our Adviser may have an incentive to increase portfolio leverage in order to earn higher management fees . • You should consider that you may not have access to the money you invest for an indefinite period of time . • An investment in our shares is not suitable for you if you need access to the money you invest . See ‘‘Share Repurchase Program,’’ ‘‘Investor Suitability Standards’’ and ‘‘Liquidity Strategy . ’’

Investing in America’s Growth Risk Factors (Continued) 12 • Because you will be unable to sell your shares, you will be unable to reduce your exposure in any market downturn . • Our distributions may be funded from offering proceeds or borrowings, which may constitute a return of capital and reduce the amount of capital available to us for investment . We have not established any limit on the extent to which we may use offering proceeds or borrowings for this purpose . Any capital returned to stockholders through distributions will be distributed after payment of fees and expenses . Our Adviser may also waive reimbursements by us for certain expenses paid by it to fund our distributions . The waived reimbursements may be subject to repayment in the future, reducing future distributions to which our stockholders may be entitled . • Portions of our distributions to stockholders are expected to be funded from expense support payments or advisory fee waivers from our Adviser that are subject to repayment or may be discontinued . These distributions, to the extent paid, will not be based on our investment performance net of fees and may not continue in the future . If our Adviser does not in the future intend to make expense support payments, a portion of these distributions, to the extent paid, may come as a return of capital . Alternatively, we may also reduce the rate of distributions to avoid making a return of capital distribution . The reimbursements of any remaining expense support payments owed to our Adviser would also reduce the future distributions to which you would otherwise be entitled .

Investing in America’s Growth ALL OTHER INQUIRIES Business Development Corporation of America 405 Park Avenue New York, NY 10022 212 - 415 - 6500 b dca.com Business Development Corporation of America