Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REGIONAL HEALTH PROPERTIES, INC | adkform8-k11x23x15.htm |

November 2015 Investor Presentation NYSE MKT: ADK AdCare Health Systems, Inc. ® Exhibit 99.1

NYSE MKT: ADK Forward-Looking Statements 2 Any forward-looking statements made in this presentation are based on management's current expectations, assumptions and beliefs about the Company’s business and the environment in which AdCare operates. These statements are subject to risks and uncertainties that could cause the Company’s actual results to materially differ from those expressed or implied in this presentation. Readers should not place undue reliance on forward-looking statements and are encouraged to review the Company’s SEC filings for more complete discussion of factors that could impact the Company’s results. Except as required by federal securities laws, AdCare does not undertake to publicly update or revise any forward-looking statements, where changes arise as a result of new information, future events, changing circumstances or for any other reason. This presentation is copyright 2015 by AdCare Health Systems, Inc.

NYSE MKT: ADK Investor Highlights AdCare Health Systems is a healthcare property holding and leasing company Portfolio of 38 operator and geographically diverse senior care properties, primarily skilled nursing facilities, with a total of 4,081 beds/units(1) Similar to REIT, portfolio consists of long-term, triple-net leases that generate predictable, recurring streams of rental payments Dividend yield of ~7.5%... based on annualized Q3 dividend payment of $0.06 per share (treated as return of capital) Growing pipeline of portfolio expansion opportunities, expect to close initial transaction in Q1 2016 Strong management team with the financial and operational experience to expand the portfolio and grow the business 3 (1) Assumes operations transfers of two facilities 7.5% Dividend Yield 38 Properties 9.1% Dividend Increase YTD $61.7M Market Cap

NYSE MKT: ADK Strategic Transition Substantially Complete 4 In July 2014, the company announced its plan to transition from an owner and operator of skilled nursing facilities to a healthcare property holding and leasing company Since that time, Leadership roles filled with seasoned executives possessing extensive long- term care / REIT industry and M&A and capital markets experience 36 of 38 properties have been fully transitioned, remainder expected to be transferred by year end Renegotiated leases and subleases; extended terms to 10+ years and secured higher escalators Board declared cash dividends on the common stock representing an annualized run-rate of $0.24 per share(1) Initial dividend was $0.05 per share Increased in subsequent quarter to $0.055 Increased to $0.06 in subsequent quarter (1) Based on Q3 2015 dividend of $0.06 / share

NYSE MKT: ADK OK AR MO OH NC SC AL GA TX Geographic Diversification 5 State # of Facilities Alabama 2 Arkansas 9 Georgia 14 North Carolina 1 Ohio 8 Oklahoma 2 South Carolina 2 Total 38 As of November 2015

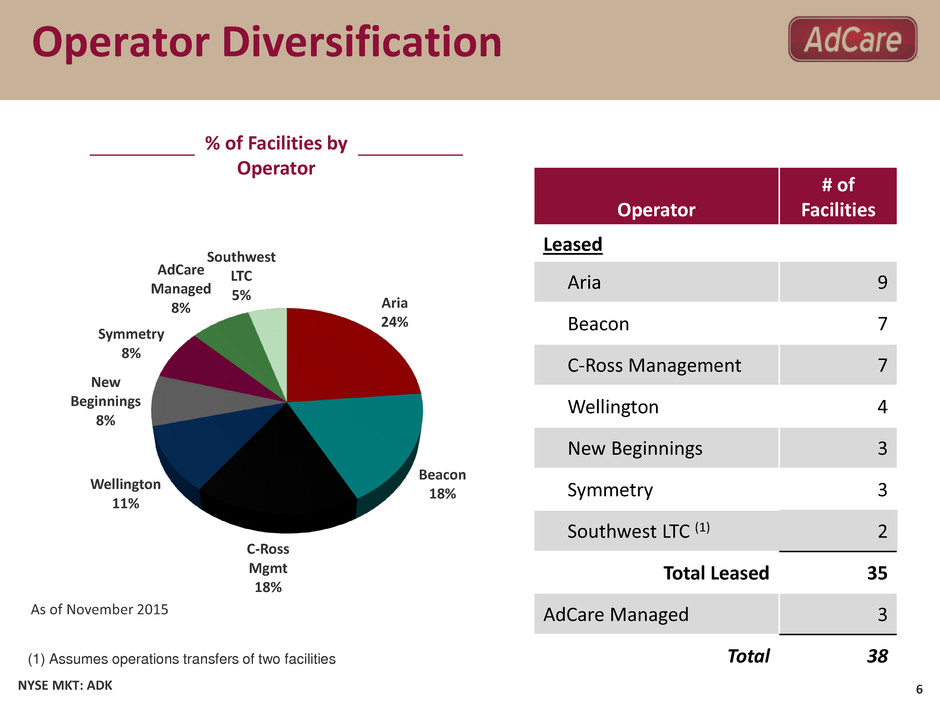

NYSE MKT: ADK Operator Diversification 6 Operator # of Facilities Leased Aria 9 Beacon 7 C-Ross Management 7 Wellington 4 New Beginnings 3 Symmetry 3 Southwest LTC (1) 2 Total Leased 35 AdCare Managed 3 Total 38 % of Facilities by Operator Aria 24% Beacon 18% C-Ross Mgmt 18% Wellington 11% New Beginnings 8% Symmetry 8% AdCare Managed 8% Southwest LTC 5% As of November 2015 (1) Assumes operations transfers of two facilities

NYSE MKT: ADK Typical Lease Structure 7 “Triple-net basis” terms; lessee is typically obligated for all liabilities of the property including: Insurance Taxes Facility maintenance Typically 10+ years in duration with renewal options Annual escalation clauses between 2 and 3% Cross collateral and cross default provisions with security deposits Profile similar to other healthcare REITs in terms of structure, terms and overall economics Lease structure favorable to AdCare

NYSE MKT: ADK Capital Structure 8 ($ in thousands) As of 9/30/2015 Non-convertible debt(1) 125,261 Convertible subordinated debt 9,200 Total Debt $134,461 Preferred stock 50,119 Total Equity / (Deficit) (17,028) Total Capitalization $167,552 (1) Includes $4.0M in liabilities of a disposal group held for sale and $5.9M in liabilities of a variable interest entity held for sale

NYSE MKT: ADK Total Capitalization (at Market Value) 9 53% 22% 25% Total debt Preferred stock (at liquidation value) Market value of equity Total Capitalization (at Market Value) ($ in thousands) As of 9/30/2015 Total Debt(1) $134,461 Preferred stock (at liquidation value) $55,084 Market value of equity(2) $63,488 Total Market Capitalization $253,033 (1) Includes $4.0M in liabilities of a disposal group held for sale and $5.9M in liabilities of a variable interest entity held for sale (2) Market value of equity as of 11/11/2015: 19,902,283 shares @ $3.19 per share In November, the Board of Directors authorized the repurchase of up to 500,000 shares of outstanding common stock over the next 12 months

NYSE MKT: ADK Positioned for Growth Diverse pipeline of portfolio expansion opportunities Entering Florida market with signing of first post-transition agreement to purchase a 55 bed skilled nursing facility for $4.8 million; transaction expected to close in Q1 2016 Targeting small to mid-sized transactions Considering individual facilities, primarily with existing operators, as well as small groups of facilities and larger portfolios Broad, national search for potential acquisitions Targeting initial “cash” lease cap rates in the 10% range Demonstrated access to capital Recent private placement of convertible debt and public offerings of preferred stock Preferred stock at-the-market program Conventional bank financings HUD refinancings 10 Expect material impact to cash flow… given the Company’s current size, modest investment activity is expected to have a significant effect on cash flow

NYSE MKT: ADK Entering the Florida Market Signed a letter of intent to purchase first property following the strategic transition Expected to be accretive to earnings and cash flow at point of sale Entry into highly attractive Florida market $4.8 million purchase price, net of reserves 55 bed skilled nursing facility Also executed letter of intent with one of AdCare’s current operators to lease the facility upon purchase Terms include a 15 year term with annual cash rent of $420,000 in year one, and a 3% annual escalator Assuming existing, attractive HUD debt associated with property 11 First of several expected transactions that expand and further diversify portfolio of properties

NYSE MKT: ADK Declaration Date Returning Capital to Shareholders Recent dividend increase of 9.1% Represents annualized dividend of $0.24 per share Dividend yield of ~7.5% (based on the closing stock price on November 11, 2015 of $3.19 per share) – attractive as compared with other healthcare REITs Conservative dividend payout ratio AdCare expects cash dividends paid to common stockholders for 2015 should be treated as return of capital to the extent available for federal income tax purposes(1) 12 $0.050 $0.055 $0.060 Cash Dividend on Common Stock 3/31/2015 6/30/2015 9/29/2015 (1) Treatment as “return of capital” may result in a higher after-tax yield. Investors should consult their tax advisor to determine how this effects their individual situation

NYSE MKT: ADK Stock Price (11/11/15) $3.19 Avg. Daily Vol. (3 mo.) 26,897 52 Week Low/High $2.95 – $4.50 Shares Outstanding (10/31/15) 19.9M Public Float, est. 17.2M Annualized Dividend Yield 7.5% Valuation Measures Market Value of Equity $63.5M Enterprise Value $248.8M Ownership Institutional, est. 22.8% Insider, est. 29.7% Key Stats 13 Balance Sheet (at 9/30/15) Unrestricted cash & equivalents $4.3M Total Debt (1) $134.5M Preferred Stock (at liquidation value) $55.1M (Sources: AdCare, Bloomberg, Big Charts) (1) Includes $4.0M in liabilities of a disposal group held for sale and $5.9M in liabilities of a variable interest entity held for sale