Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - SIRONA DENTAL SYSTEMS, INC. | t1502747_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - SIRONA DENTAL SYSTEMS, INC. | t1502747_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - SIRONA DENTAL SYSTEMS, INC. | t1502747_ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - SIRONA DENTAL SYSTEMS, INC. | t1502747_ex32-2.htm |

| EX-21.1 - EXHIBIT 21.1 - SIRONA DENTAL SYSTEMS, INC. | t1502747_ex21-1.htm |

| EX-23.1 - EXHIBIT 23.1 - SIRONA DENTAL SYSTEMS, INC. | t1502747_ex23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

| FORM 10-K |

| (Mark One) | þ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the fiscal year ended September 30, 2015 | ||

| or | ||

| ¨ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

| For the transition period from ___________to ___________ |

Commission file number 000-22673

Sirona Dental Systems, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 11-3374812 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

30-30 47th Avenue, Suite 500, Long Island City, New York |

11101 | |

| (Address of principal executive offices) | (Zip Code) |

(718) 482-2011

(Registrant’s telephone number, including area code)

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

Yes þ No ¨

|

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. |

Yes ¨ No þ

|

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

Yes þ No ¨

|

| Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | Yes þ No ¨ |

| Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | ¨ |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): |

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨ |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes ¨ No þ |

The aggregate market value of common stock held by non-affiliates of the registrant as of March 31, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $2,834,488,012. Such aggregate market value is computed by reference to the closing sale price of the Common Stock on such date.

As of November 17, 2015, the number of shares outstanding of the Registrant’s Common Stock, par value $.01 per share, was 55,896,887.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2015 annual meeting of stockholders to be filed pursuant to Regulation 14A not later than 120 days after the end of the fiscal year (September 30, 2015) are incorporated by reference into Part III of this report on Form 10-K.

FORWARD-LOOKING STATEMENTS

This Form 10-K Annual Report contains forward-looking statements that involve risks and uncertainties. All statements, other than statements of historical facts, included in this Annual Report regarding the Company, its financial position, products, business strategy, and plans and objectives of management of the Company for future operations, are forward-looking statements. When used in this Annual Report, words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “objectives,” “plans”, and similar expressions, or the negatives thereof or variations thereon or comparable terminology as they relate to the Company, its products or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Actual results could differ materially from those contemplated by the forward-looking statements as a result of various factors, including, but not limited to, those contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 of this Annual Report and the “Risk Factors” set forth in Item 1A of this Annual Report. All forward looking statements speak only as of the date of this Annual Report and are expressly qualified in their entirely by the cautionary statements included in this report. The Company undertakes no obligation to update or revise forward-looking statements which may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events other than required by law.

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

i

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

OVERVIEW

Sirona Dental Systems, Inc. ( “Sirona,” the “Company,” “we,” “us,” and “our” refer to Sirona Dental Systems, Inc. and its consolidated subsidiaries and their predecessors, except as otherwise indicated or unless context otherwise requires) is the leading global manufacturer of high-quality, technologically-advanced dental equipment, and is focused on developing, manufacturing, and marketing innovative solutions for dentists around the world. The Company is uniquely positioned to benefit from several trends in the global dental industry, such as technological innovation, the shift to digital imaging, favorable demographic trends, and growing patient focus on dental health and cosmetic appearance. The Company’s headquarters is in Long Island City, New York, and its largest facility is located in Bensheim, Germany.

Sirona has a long tradition of innovation in the dental industry. The Company introduced the first dental electric drill over 130 years ago, the first dental X-ray unit approximately 100 years ago, the first dental computer-aided design/computer-aided manufacturing (CAD/CAM) system 30 years ago, and numerous other significant innovations in dentistry. Sirona continues to make significant investments in research and development (“R&D”), and its track record of innovative and profitable new products continues today. Sirona has the broadest product portfolio in the industry and is capable of fully outfitting and integrating a dental practice.

The majority of our revenues derive from the manufacture and sale of dental equipment. In addition, we also provide sales and after-sales service support to dentists and distributors through our growing sales and service infrastructure.

Sirona manages its commercial operations on both a product and geographic basis and maintains four reporting segments: 1) Dental CAD/CAM Systems, 2) Imaging Systems, 3) Treatment Centers, and 4) Instruments. Products from each category are marketed in all geographical sales regions.

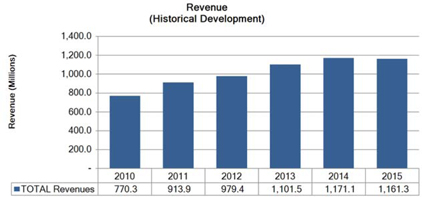

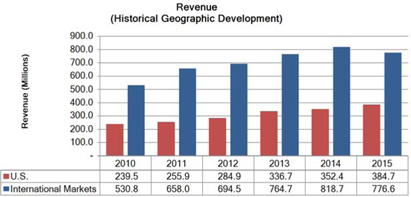

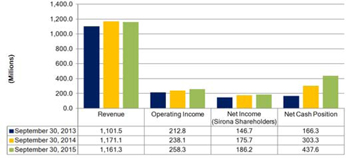

The Company’s business has grown substantially in the past several years, driven by numerous high-tech product introductions, a continued expansion of its global sales and service infrastructure, strong relationships with key distribution partners, namely Patterson and Henry Schein, and an international dealer network.

| 1 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

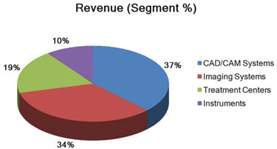

Segment and geographic breakouts of Sirona’s revenues for the fiscal year ended September 30, 2015 were as follows:

HISTORY

Sirona dates back to the establishment of Reiniger, Gebbert & Schall, which introduced the first dental electrical drill in 1882. In 1925, the Company became part of Siemens & Halske Group and in 1934 launched the smallest x-ray in the world, enabling dental x-rays for the first time. In 1956, Siemens introduced Sirona as a brand for treatment centers, and in 1958 the group developed the first ball-bearing turbine for dental drills.

In 1997, funds advised by the financial sponsor, Permira, acquired the Sirona dental business from Siemens in a leveraged buy-out transaction. Following the transaction, Sirona substantially increased its international sales and intensified its focus on product innovation. In November 2003, Permira sold Sirona to the Scandinavian financial sponsor, EQT, and management in a leveraged buy-out transaction that closed in February 2004. In April 2005, funds managed by Madison Dearborn Partners, a private equity firm, and Sirona’s management entered into an agreement to acquire Sirona in a leveraged buy-out transaction that closed in June 2005.

In September 2005, Schick Technologies, Inc. (“Schick”) entered into an Exchange Agreement with Sirona Holdings Luxco S.C.A. (“Luxco”) and Sirona Holding GmbH (“Sirona Holding”) providing for the issuance of 36,972,480 shares of Schick common stock to Luxco in exchange for Luxco’s entire economic interest in Sirona Holding, which consisted of all of the issued and outstanding share capital of Sirona Holding and the existing indebtedness of Sirona Holding owed to Luxco in the principal amount of Euro 151.0 million ($182 million) plus accrued interest (the “Exchange”). In June 2006, the Exchange closed and Schick, a Delaware corporation formed in 1997, was renamed Sirona Dental Systems, Inc. Although Sirona Holding became a subsidiary of Schick upon the completion of the Exchange, Sirona Holding was deemed the acquiring corporation for accounting purposes because Luxco received a controlling ownership interest in the Company, Sirona Holding's designees constituted a majority of the members of the Company’s board of directors and Sirona Holding's senior management represented a majority of the senior management of the Company. In May 2011, Luxco sold all of its remaining shares of Sirona common stock pursuant to an underwritten follow-on public offering.

On September 15, 2015, the Company and DENTSPLY International, Inc. (“DENTSPLY”) announced that the Board of Directors of both companies had unanimously approved a definitive Agreement and Plan of Merger (the “Merger Agreement”) under which the companies will combine in an all-stock merger (the “Merger”). DENTSPLY is a leading manufacturer and distributor of dental and other consumable medical device products. The Merger Agreement provides that, upon the terms and subject to the conditions set forth in the Merger Agreement, Sirona will merge with and into a wholly-owned subsidiary of DENTSPLY, with Sirona surviving as a wholly-owned subsidiary of DENTSPLY. Upon completion of the Merger, the combined company's name will be changed to DENTSPLY SIRONA Inc. Subject to the terms and conditions of the Merger Agreement, if the Merger is completed, each outstanding share of Sirona common stock will be converted into the right to receive 1.8142 shares of common stock of DENTSPLY, with cash paid in lieu of any fractional shares of common stock of DENTSPLY that a Sirona stockholder would otherwise have been entitled to receive.

| 2 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

The transaction, which is expected to be completed in the second quarter of Fiscal 2016, is subject to the receipt of regulatory approvals and other customary closing conditions, including the approval of stockholders of both Sirona and DENTSPLY. For additional information related to the Merger refer to DENTSPLY’S Registration Statement on Form S-4 which was filed with the SEC on October 29, 2015.

Our common stock is currently traded publicly on the NASDAQ Global Select Market under the trading symbol “SIRO”.

INDUSTRY/PRODUCTS

Overview

The global dental market encompasses the diagnosis, treatment and prevention of disease and ailments of the teeth, gums and supporting bone. This market has enjoyed steady growth, driven by a number of factors, including an increased desire for aesthetics, a demographic shift towards an aging population coupled with a desire to retain tooth structure later in life, growth in disposable income, a desire for more convenience on the part of both dentists and patients, a shift towards private pay, a greater need for dental preventative care.

The global dental market has benefited from technological innovation, which increase productivity for the dentist. This is particularly important in markets facing increased demand for dental services with little or no increase in the number of dentists servicing those markets. In addition, technological developments allow dentists to offer higher quality treatment to patients. We believe that the high-tech end of the dental market is growing at a faster pace than the overall dental market and that this trend will continue over time.

Recent technological advancements in the dental equipment industry include 3D radiography, digital radiography, CAD/CAM technology, and intra oral cameras.

Sirona serves the high-tech dental equipment and technology market for dental practitioners and laboratories. We are the only manufacturing company that can fully outfit a dental practitioner’s office with dental equipment, including treatment centers, imaging systems, dental CAD/CAM systems, and instruments. Our products represent important investments by dental practitioners, and some of these products can have a life span of 10-20 years (shorter for instruments and software), depending on the nature and quality of the product.

Products

Our principal products are generally classified into the following segments: Dental CAD/CAM Systems, Imaging Systems, Treatment Centers, and Instruments.

A brief description of each of our segments follows. See Note 11 to our consolidated financial statements for revenues and gross profit by segment for each of the last three fiscal years, and assets by segment, at September 30, 2015 and 2014.

| Segment Revenue Contribution | Year ended | |||||

| September 30, | ||||||

| (In percent) | 2015 | 2014 | 2013 | |||

| Dental CAD/CAM Systems | 37% | 37% | 37% | |||

| Imaging Systems | 34% | 34% | 35% | |||

| Treatment Centers | 19% | 19% | 19% | |||

| Instruments | 10% | 10% | 9% | |||

| Total | 100% | 100% | 100% | |||

| 3 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

Dental CAD / CAM Systems

Dental CAD/CAM Systems address the worldwide market for dental restorations, which includes several types of restorations, such as inlays, onlays, veneers, crowns, bridges, copings and bridge frameworks made from ceramic, metal or composite blocks. The global market for dental restorations can be divided into two sub-segments: in-mouth fillings and out-of-mouth pre-shaped restorations. CAD/CAM-produced ceramic restorations represent a growing portion of the out-of-mouth restoration market and the number of out-of-mouth restorations prepared with CAD/CAM systems has increased substantially over the past few years. At the same time, the number of dental practitioners and dental laboratories using CAD/CAM technology has increased. Sirona estimates that as of the end of fiscal year 2015, the market penetration for in-office CAD/CAM systems had grown to approximately 16% in the United States and Germany.

Sirona pioneered the application of high-tech CAD/CAM techniques to the traditional lab-based restoration process with the commercialization of the CEramic REConstruction, or CEREC, method. Sirona’s CEREC system is an in-office application that enables dentists to produce high quality restorations from ceramic material and insert them into the patient’s mouth during a single appointment. CEREC has a number of advantages compared to the traditional out-of-mouth pre-shaped restoration method, as CEREC does not require a physical model, restorations can be created in the dentist’s office and the procedure can be completed in a single visit. The CEREC system consists of an imaging unit and a milling unit. The imaging unit scans the damaged area, captures the image of the tooth or teeth requiring restoration and proposes the specifications for the restoration. The milling unit then mills the ceramic restoration to the required specifications based upon the captured image and the dentist’s design specifications. The result is a biocompatible, non-metallic, natural-looking restoration made of durable, high-quality ceramic materials completed in a single treatment session. Independent studies indicate that CEREC ceramic restorations are as durable as gold and can replace conventional restoration materials for most procedures. In addition, CEREC restorations are aesthetically pleasing and have the benefit of a natural-looking appearance.

Sirona offers a service contract on its CEREC product, which includes software updates and upgrades and maintenance on software-related hardware.

In addition to CEREC, Sirona also offers CAD/CAM products for dental laboratories, including the inLab restoration fabrication system and the extra-oral inEos scanner. These products are designed to improve efficiency and reduce costs for the dental laboratory. The inLab system scans the models received from the dentists and then mills ceramic or composite block restorations, such as crown copings and bridge frameworks to the specifications of the captured image.

Summary Innovation Timeline (last 10 years) | |

| Dental CAD/CAM Systems | |

| Year | Product / Event |

| 2005 | Launch of the inEos scanner, which is a high speed extra-oral scanner which produces 3D digital images from a single tooth up to a jaw, directly from the plaster model. |

| 2007 | Launch of the MC XL next generation milling unit, which produces high quality, precisely fitted restorations in about half the time that the older CEREC milling units required. |

| Introduction of Sirona’s Biogeneric software, which virtually automated the design portion of the CAD/CAM process for inlays and onlays. | |

| Launch of the next generation inLab milling unit, the inLab MC XL. The inLab MC XL milling and grinding unit opens up a broad range of production options for the dental laboratory. Milling performance and precision have been greatly enhanced, and a switch from grinding to milling can be accomplished in just a few, simple steps. | |

| 2008 | Expansion of the central restoration service business to the United States. |

| Expanded our CEREC offering with the introduction of Sirona Connect. Sirona Connect is a web-based service that facilitates the electronic transmission of digital impressions acquired with a CEREC acquisition unit to inLab laboratories. Laboratories can use the digital impression to create final restorations. This process eliminates the need to take physical impressions, resulting in increased accuracy, less reworking of restorations and productivity savings. | |

| 4 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

| 2009 | Launch of a new CEREC camera, based on the Company’s proprietary Bluecam technology, which was faster, more accurate, and improved the workflow for practitioners. |

| 2010 | Further enhancement Sirona’s Biogeneric software with the introduction of Version 3.8, which has the ability to create crowns and bridges. |

| Introduction of the CEREC AC Connect stand-alone digital impression unit. CEREC AC Connect allows dental professionals to scan digital impressions and then send them to the inLab® dental laboratory of their choice. | |

| Introduction of the successor inEos scanner, the inEos Blue. inEos Blue is based on the Bluecam technology, is easy to use, fast, precise, flexible, and its auto capture function allows for substantial time savings. | |

| 2011 | Introduction of CEREC 4.0 software, an entirely redesigned software that gives CEREC users enhanced capabilities and speeds up the restoration process. In addition, CEREC 4.0 enables dentists to design and manufacture multiple restorations simultaneously, further enhancing productivity and profitability. |

| 2012 | Launch of new CEREC Omnicam camera, which allows dentists to generate precise whole-arch scans in the shortest possible time. Three features of the CEREC Omnicam are particularly notable: video streaming, digitization of jaw structures in their natural color, and powderless scanning of tooth surfaces. This introduction further strengthens Sirona’s leadership position in the dental CAD/CAM market. |

| Introduction of inLab 4.0 software, which offers an extended spectrum of clinical applications. New design tools facilitate a customized and direct workflow. The completely revised platform provides a secure basis for integrating future applications. | |

| 2013 | Launch of updated and expanded CEREC 4.2 software, further differentiated its CAD/CAM milling product line with the units MC X and MC XL Premium, and introduced the Apollo DI digital imaging system, all in March. These introductions expanded our portfolio and enable Sirona to offer “CAD/CAM for Everyone”, an approach which seeks to address the various needs of the widest possible range of dentists. |

| Launch of enhanced inLab MC XL. | |

| Introduction of the successor inEos scanner, the inEos X5. The 5-axis in Eos X5 is unrivaled in precision and has flexible handling, quick scanning times, and a comprehensive application spectrum for all digitization tasks. | |

| Launch of inLab4.2 software, which introduced further applications, such as smart design with virtual articulation, smile design, and other features. | |

| 2014 | Launch of CEREC 4.3 software, which enables carbide milling for optimal fabrication of zirconium oxide and polymer materials. Improved and simplified workflow for Omnicam. Virtual articulation is now calculated automatically. Integrated button to automatically upload the current case in Sirona Connect. CEREC 4.3 also allows a screw-retained implant workflow. Together with the introduction of additional TiBases and Scanpost, this leads to strong growth in implantology consumables. |

| Launch of precolored inCoris TZI C blocks that remove the need to use coloring liquids, thus simplifying the operating process with an improved result. | |

| 2015 | Introduction of inLab MC X5, new milling and grinding unit for dental labs. First Sirona disc processing unit with 5 axis designed specifically for the commercial dental lab. |

| Launch of CEREC Ortho 1.1 software: CEREC can now also be used for digital impressions for orthodontic indications, e.g., for treatment with transparent aligners. The new guided scanning procedure enables precise, full-arch digital impressions. The CEREC Ortho software creates a digital model of the entire arch. The data obtained can then be sent for planning the orthodontic treatment and manufacturing the required appliances, thus eliminating the necessity to create and send a physical model. A cooperation agreement with Align Technology allows dentists to also use digital impressions for aligner therapy with Invisalign. | |

| Launch of CEREC Guide 2: the surgical guide can now be produced chairside and cost-effectively in the practice. The guide is designed based upon the ideal prosthetic and surgical positioning via combination of CEREC intra-oral digital impressions and Sirona’s 3D X-ray volume data. Once designed, the guide is then milled from PMMA on one of the CEREC MC X or CEREC MC XL Premium Package milling units. The guide can be manufactured within an hour and requires no models or a radiographic guide with reference bodies. |

| 5 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

| Launch of CEREC 4.4 software: CEREC 4.4 provides simple and user-friendly operation. The software also includes several new functions that further improve the workflow and produce more accurate results throughout the design process. The new Biojaw algorithm uses the entire scanned area as a reference for the restoration to be created and generates initial restoration proposals. The latest software uses improved algorithms that allow smoother surfaces and deeper fissures when grinding feldspathic, glass and silicate ceramics. With the new, extra-fine grinding tools of the 4-motor CEREC MC XL Premium Package in particular, designs are milled with more detail and greater precision. | |

| Introduction of CEREC AF/AI: In addition to the CEREC AC cart version, two new acquisition versions are available: the CEREC AF flexible tabletop version and the CEREC AI integrated in the treatment center TENEO. Both new models use the CEREC Omnicam powder-free color camera. |

Imaging Systems

Imaging Systems comprise a broad range of systems for diagnostic imaging in the dental practice. Sirona has developed a comprehensive range of imaging systems for 2D or 3D, panoramic, and intra-oral applications that allow the dentist to provide a full range of diagnostics and treat the patient in a more efficient manner, resulting in safer, faster, and better dentistry.

Intra-oral x-ray systems use image-capture sensor devices, which are inserted into the mouth behind the diagnostic area, and typically take images of one or two teeth. Panoramic x-ray systems produce images of the entire jaw structure by means of an x-ray tube and an image capture device, which rotates around the head.

Summary Innovation Timeline (last 10 years) | |

| Imaging Systems | |

| Year | Product / Event |

| 2006 | Expansion of our imaging system product line to include Schick's intraoral sensor portfolio based on CMOS technology, as a result of the Exchange. |

| 2007 | Introduction of the GALILEOS Comfort 3-D imaging unit. Today, three-dimensional imaging is offering dentists advanced diagnostic and therapeutic options in the fields of surgery, implantology, prosthetics, orthodontics, and restorative dentistry. GALILEOS integrates these capabilities efficiently into dental practices. |

| 2008 | Launch of GALILEOS Compact, which is specifically tailored to meet the needs of the general practitioner. |

| 2009 | Introduction of software that facilitates the integration of 3D X-ray volume (bone level data) with a CEREC AC CAD/CAM scan (surface level information). This software allows the practitioner to plan both the implant surgery and the prosthetic at the start of the implant treatment session. This integrated process reduces the number of treatment sessions, resulting in greater accuracy and superior implant alignment. With this new software, the dental practitioner can now place more focus on the desired aesthetic outcome throughout the entire treatment process. |

| 2011 | Introduction of the flagship Orthophos XG 3DReady, which provides dental practitioners with a wide variety of diagnostic possibilities and is upgradeable to a 3D unit. Other models of the family include the Orthophos XG 5 and the basic model Orthophos XG 3. |

| Launch of the Orthophos XG 3D imaging unit. This system gives the practitioner traditional 2D panoramic imaging capability and the ability to scan and view a large, 8x8 centimeter 3D field of view (a scan big enough to capture the entire jaw). Orthophos XG 3D is also available with cephalometric options, orthodontic, implant, and other specialty programs. | |

| 2012 | Launch of the next generation of intraoral digital radiography – the Schick 33 sensor and image management system. Schick 33 is the most advanced sensor in dentistry, delivering an unparalleled combination of high-resolution images and dynamic image management. |

| 2013 | Launch of the GALILEOS CompactPLUS , which is specifically tailored to meet the needs of the general practitioner, orthodontist, and oral surgeon. |

| 2014 | Launch of the SICAT function - the first software which visualizes real, patient-specific movement of the lower jaw within the 3D module of the GALILEOS. |

| 6 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

| 2015 | Introduction of the Orthophos SL imaging unit. This system ensures image quality in 2D and 3D x-rays via Sharp Layer, a capture technology that automatically adapts the panoramic curve of the sensor to the patient's individual jaw anatomy, thus producing a sharper image. The digital conversion sensor (DCS) technology generates electrical signals directly from the x-ray beams without intermediate conversion to light, thus producing highly precise x-ray images with reduced radiation doses. |

| Launch of the SIDEXIS 4 software, which based on workflows, provides access to all pertinent patient image data and acts as a central hub for the integration of diagnostic image data of any kind - not only prepared during the course of the actual treatment, but also image data received from other dentists for long-term patients. With SIDEXIS 4, the dentist is able to display a full overview of the patient's treatment history in a timeline. |

Treatment Centers

Treatment Centers comprise a broad range of products from basic dentist chairs to sophisticated chair-based units with integrated diagnostic, hygiene, and ergonomic functionalities, as well as specialist centers used in preventative treatment and for training purposes. Sirona offers specifically configured products to meet the preferences of dentists within each region in which it operates. Sirona’s treatment center configurations and system integration are designed to enhance productivity by creating a seamless workflow within the dental practice. Sirona’s centers therefore allow the dentist to both improve productivity and increase patient satisfaction, significant factors in adding value to his or her practice.

Summary Innovation Timeline (last 10 years) | |

| Treatment Centers | |

| Year | Product / Event |

| 2008 | Launch of the TENEO treatment center, which combines industry-leading technology with a timeless design that provides both patient and dentist with the ultimate in convenience and comfort. |

| 2011 | Introduction of the SINIUS treatment center, a comfort class treatment center, which enables the dentist to maximize time and flexibility of their practice. SINIUS is fully networked and is easily integrated into any dental practice. |

| 2014 | Launch of the INTEGO treatment center. INTEGO offers the design of the new generation of Sirona treatment centers with top quality and flexible configuration options at an attractive price. The fully-networked treatment center comes in two versions: INTEGO and INTEGO pro with extended functionality. |

Instruments

Sirona offers a wide range of instruments, including handheld and power-operated handpieces for cavity preparation, endodontics, periodontology and prophylaxis, which are regularly updated and improved. The instruments are supplemented by multi-function tips, supply and suction hoses, as well as care and hygiene systems for instrument preparation. Sirona’s instruments are often sold as packages in combination with treatment centers. Sirona’s unique handpiece cleaning and sterilizing machine, the DAC Universal, is the only fully automatic system for instruments hygiene – with its unique features it has defined the standard of care for infection prevention in the dental office.

Sirona intends to continue to strengthen the position of its Instruments segment as a diversified supplier of high-quality, reliable, user-friendly and cost-efficient dental instruments.

| 7 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

Summary Innovation Timeline (last 10 years) | |

| Instruments | |

| Year | Product / Event |

| 2005 | Launch of first generation SIROLaser - the smallest diode laser worldwide, redefining ergonomics in laser dentistry. |

| Launch of SIROEndo, a device for endodontic treatment with built-in APEX Location, seamlessly adaptable to the treatment center, and optimal integration into daily workflow. | |

| 2007 | Launch of SIROPure - the first handpiece not requiring any lubrication over its entire product lifetime, keeps the cavity oil-free, eliminates maintenance errors, and lowers total cost of ownership. |

| 2009 | Launch of new diode laser, SIROLaser Advance / SIROLaser Xtend. |

| Launch of 3rd generation of DAC Universal, allowing the processing of wrapped instruments. | |

| 2011 | Launch of SIROBoost high performance power turbine line with a high torque level, allowing faster, more efficient, and comfortable operation. |

| 2012 | Launch of the new handpiece program: T2 Line / T3 Line. |

| 2013 | Launch of new turbine generation (T1/T2/T3) and the T4 Line. |

| Launch of SIROInspect - fluorescence-based cavity detection device, whose safe and simple operation significantly reduces the risk of secondary cavities. | |

| 2014 | Launch of new T3 Racer, with 30 watts the most powerful turbine on the market. |

| 2015 | Launch of new SIROLaser Blue, beeing the first dental diode laser to have a blue, an infrared, and a red diode. This enables it to cover a range of 21 indications. |

Manufacturing and Suppliers

Our main manufacturing and assembly activities are located in Bensheim, approximately 60 kilometers south of Frankfurt am Main, Germany. We also operate smaller manufacturing sites in New York, Italy, Denmark and China. All of our facilities are in good condition.

All of our manufacturing facilities have established and maintain a Quality Management System that is registered to ISO 9001:2000 and ISO 13485:2003. Our New York and Bensheim facilities also maintain a Device Establishment Registration with the United States Food and Drug Administration.

Manufacturing consists primarily of assembly, systems integration and testing. We generally outsource manufacturing of parts and components used in the assembly of our products but own the design and tools used by our key component suppliers. We do, however, manufacture most of the precision parts used for our instruments.

We purchase various components for our products from a number of outside suppliers. We currently have established relationships with approximately 1,400 suppliers, of which we view approximately 160 as “key suppliers.” Each supplier is selected according to stringent quality criteria, which are reviewed regularly. We do not believe we are dependent on one or a small group of suppliers and believe we could locate alternative suppliers if needed. For reasons of quality assurance or cost effectiveness, the Company relies on single sources for certain purchased components, e.g. sensors, which we use in our imaging segment. We work closely with our suppliers to help ensure continuity of supply while maintaining high quality and reliability. We have agreements in place and use a number of techniques, including security or consignment stock commitments, to address potential disruptions of the supply chain. We also own any custom tooling used in manufacturing these components. The Company has not experienced any significant difficulty in the past in obtaining the materials necessary to meet its production schedule. However, the need to replace one of our single source suppliers could cause a disruption in our ability to timely deliver certain of our products or increase costs. See Item 1A Risk Factors — “We are dependent upon a limited number of suppliers for critical components. If these suppliers delay or discontinue the manufacture of these components, we may experience delays in shipments, increased costs and cancellation of orders for our products.”

| 8 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

Sales and Marketing

Our sales and marketing efforts are directed through regional managers who oversee our sales professionals. These professionals work closely with our distribution partners to maximize the efficiency and productivity of their sales efforts. Our marketing initiatives are focused on highlighting Sirona’s leading role as a high-tech systems provider and industry innovator. In order to promote our brand and increase client loyalty, our distribution partners are supported through wide ranging advertising activities. In addition, we have been a key presenter at all major dental exhibitions, which are critical forums for raising brand awareness and new product introductions. Lastly, our product information is actively made available to business publications, dentists, journals, professional organizations and dental schools, our website (www.sirona.com), and social media offerings (Facebook, Twitter, Sirona Blog, etc.) are important interactive platforms for end-users as well as for distributors.

Distribution

Sirona distributes its products globally to dental practices, clinics and laboratories through an international network of more than 490 distributors and increasingly through our own sales and service infrastructure. See Note 11 to our consolidated financial statements for a description of our net sales and long-lived assets by geographic region for the last three fiscal years. Because distributors typically cover both dental equipment and consumables, they have regular contact with the dentist and are therefore optimally positioned to identify new equipment sale opportunities. Sirona’s primary distributors are Patterson Companies and Henry Schein, two of the world‘s largest dental distributors. In the United States, Patterson is Sirona’s primary distributor. Outside of the United States, Henry Schein is the company‘s largest distributor. Patterson Companies and Henry Schein accounted for 33% and 14%, respectively, of Sirona’s worldwide revenue for the fiscal year ended September 30, 2015. Sirona distributes elsewhere through a well-developed network of independent regional distributors. Sirona works closely with its distributors by training their technicians and sales representatives with respect to its products. With over 10,000 sales and service professionals trained each year, Sirona seeks to ensure high standards of quality in after-sale service and the best marketing of its products. The success of Sirona’s products is evidenced by their importance to its distribution partners, and in many cases are among their best-selling offerings. The Company continues to expand its sales and service infrastructure in selected countries around the world. These investments allow us to support our distributors’ selling efforts and strengthen the Sirona brand in these key markets. These investments, and the subsequent expansion of our infrastructure, have enabled Sirona to grow revenues and profitability at a faster rate.

On April 27, 1998, Sirona and Patterson Companies entered into an exclusive distribution agreement (the ‘‘CAD/CAM Distribution Agreement’’) pursuant to which Patterson was appointed as the exclusive distributor of Sirona’s CEREC CAD/CAM products within the United States and Canada. Under the terms of the CAD/CAM Distribution Agreement, Patterson’s exclusivity was to terminate on September 30, 2007. On June 30, 2005, Sirona and Patterson entered into an amendment of the CAD/CAM Distribution Agreement which extended Patterson’s exclusivity from October 1, 2007 through September 30, 2017. As consideration for the extension of its exclusivity, Patterson agreed to make a one-time payment to Sirona in the amount of $100 million (the ‘‘Exclusivity Fee’’). In July 2005, Patterson paid the Exclusivity Fee, in its entirety, to Sirona. The full amount of the Exclusivity Fee was recorded as deferred income and has been recognized on a straight-line basis since October 1, 2007. The extension did not modify or alter the underlying provisions of the companies’ agreement through 2007, including the performance criteria necessary to maintain the exclusivity. The performance criteria are benchmark thresholds which afford Sirona the opportunity to abandon the exclusivity or to terminate the agreement with Patterson, but do not create minimum purchase obligations under a take-or-pay arrangement. The CAD/CAM Distribution Agreement was amended in May 2011 to revise the parameters for inLab sales in the United States and Canada.

In April 2000, Schick and Patterson entered into an exclusive distribution agreement (the “Schick Distribution Agreement”) covering the United States and Canada; and as of May 1, 2000, Schick began marketing and selling its CDR dental products in the United States and Canada through Patterson. This contract was amended in July 2005, March 2007, and May 2010 and expired on December 31, 2012.

In May 2012, the Company and Patterson amended and restated the terms of their business relationship set forth in CAD/CAM Distribution Agreement and the Schick Distribution Agreement with respect to distribution of certain products throughout the United States and in October 2013 entered into new distribution agreements covering Canada. The amendment and restatement of both the CAD/CAM Distribution Agreement and Schick Distribution Agreement addressed issues related to pricing, termination and annual minimum purchase quotas, and provided growth targets which, if achieved, extend the companies’ exclusivity period.

| 9 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

Sirona executes separate contracts with Henry Schein for each product group in each of the various jurisdictions in which Henry Schein distributes its products. The contracts governing most of the products distributed through Henry Schein are non-exclusive. Each of the contracts provides for minimum annual purchases, which are set annually. The contracts have terms of up to five years. Either party is entitled to terminate any of the contracts upon six months’ notice but generally not before the third anniversary of the contract. Sirona may terminate a contract upon 30 days’ notice in case of Henry Schein’s default under the terms of the contract.

Competition

Competition in the global dental market is fragmented by both geography and products. We compete with a variety of companies, including large international companies as well as smaller companies that compete regionally or on a narrower product line. Sirona competes on the basis of its comprehensive and innovative product line and its global distribution network.

Research and Development

Sirona commits significant resources to research and development, with a particular focus on developing products that offer new diagnostic and treatment options, while increasing comfort for both users and patients and streamlining process efficiency. Research and development statistics for the last three fiscal years are as follows:

| Research and Development | Year ended | |||||

| September 30, | ||||||

| (In millions, except otherwise noted) | 2015 | 2014 | 2013 | |||

| Research and development expenses | $ | 54.8 | $ | 64.6 | $ | 60.2 |

| Research and development expenses (% of revenue) | 4.7% | 5.5% | 5.5% | |||

| Number of R&D professionals employed globally | 343 | 320 | 286 | |||

Sirona also cooperates in its research efforts with partners in research facilities and dental practices around the world. In fiscal year 2011, Sirona opened the Center of Innovation in Bensheim, Germany. The Center underscores Sirona’s ongoing commitment to innovation in dentistry. Housing the majority of research and development professionals under one roof will ensure the Company maximum collaboration, creativity, technological advancement, and idea sharing.

Patents, Trade Secrets and Proprietary Rights

We seek to protect our intellectual property through a combination of patent, trademark and trade secret protection. We believe that our future success will depend in part on our ability to obtain and enforce patents for our products and processes, preserve our trade secrets and operate without infringing the proprietary rights of others.

Patents

We have an active corporate patent program, the goal of which is to secure patent protection for our technology. Sirona owns and/or maintains approximately 1,047 patents and patent applications throughout the world. The patents expire at various dates through 2031. We also license or sublicense some of the technology used in our products from third parties.

| 10 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

Trademarks

We generally attempt to build brand awareness of our products through the use of trademark registrations. “Sirona,” “CEREC,” “Orthophos,” “Heliodent,” “inLab,” “CDR,” and “Schick” are some of our key registered trademarks. In addition, we have common law trademark rights in several other names we use commercially in connection with our products.

Trade Secrets

In addition to patent protection, we own trade secrets and proprietary know-how, which we seek to protect through agreements with employees and other appropriate individuals. These agreements generally allow assignment of confidential information developed by or made known to the individual by the Company during the course of the individual's relationship with the Company as confidential and not to be disclosed to third parties, except in specific limited circumstances. The agreements also generally assign to the Company all inventions conceived by the individual in the course of rendering services to the Company. However, there can be no assurance that the Company will be successful in enforcing this policy in each case, that the Company would have adequate remedies available for any breach or that the Company's trade secrets will not otherwise become known to, or independently developed by, its competitors.

Regulation

Medical Devices

Most of our products require certain forms of regulatory clearance, including, but not limited to, marketing clearance by the United States Food and Drug Administration (the “FDA”) in accordance with the Federal Food, Drug and Cosmetic Act, as amended (the "FD&C Act") and by our Notified Body in accordance with the European Union's Medical Device Directive 93/42/EEC ("MDD").

The FDA and MDD review process typically requires extended proceedings pertaining to product safety and efficacy. We believe that our future success will depend to a large degree upon commercial sales of improved versions of our current products and sales of new products; we will not be able to market such products in the U.S. or in the European Union without FDA or MDD clearance, respectively. There can be no assurance that any products developed by us in the future will be granted clearance by applicable regulatory authorities or that additional regulations will not be adopted or current regulations amended in such a manner as to adversely affect us.

Pursuant to the FD&C Act, the FDA regulates the introduction, manufacture, advertising, labeling, packaging, marketing and distribution of, and record-keeping for, dental devices. The FDA classifies medical devices intended for human use into three classes: Class I, Class II, and Class III. The Company’s products are classified by the FDA into Class I or II that renders them subject only to general controls that apply to all medical devices, in particular regulations regarding alteration, misbranding, notification, record-keeping and good manufacturing practices.

The FD&C Act further provides that, unless exempted by regulation, medical devices may not be commercially distributed in the U.S. unless they have been cleared by the FDA. There are two review procedures by which medical devices can receive such clearance. Some products may qualify for clearance under a Section 510(k) procedure, in which the manufacturer submits to the FDA a pre-market notification that it intends to begin marketing the product, and shows that the product is substantially equivalent to another legally marketed product (i.e., that it has the same intended use and that it is as safe and effective as a legally marketed device, and does not raise different questions of safety and effectiveness than does a legally marketed device). Certain Class I devices are exempt from the 510(k) pre-market notification requirement and manufacturers of such products may proceed to market without any submission to the FDA. In some cases, the 510(k) notification must include data from human clinical studies.

Marketing in the U.S. may commence once the FDA issues a clearance letter finding such substantial equivalence. According to FDA regulations, the agency has 90 days in which to respond to a Class I or II 510(k) notification. There can be no assurance, however, that the FDA will provide a timely response, or that it will reach a finding of substantial equivalence.

| 11 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

If a product does not qualify for the 510(k) procedure (either because it is not substantially equivalent to a legally marketed device or because it is a Class III device), the FDA must approve a Pre-Market Approval ("PMA") application before marketing can begin. PMA applications must demonstrate, among other things, that the medical device is safe and effective. A PMA application is typically a complex submission that includes the results of clinical studies. Preparation of such an application is a detailed and time-consuming process. Once a PMA application has been submitted, the FDA's review process may be lengthy and include requests for additional data. By statute and regulation, the FDA may take 180 days to review a PMA application, although such time may be extended. Furthermore, there can be no assurance that the FDA will approve a PMA application.

The products that we distribute in the European Union bear the "CE Mark," a European Union symbol of compliance with the MDD. In order to market our products in the member countries of the European Union, it is necessary that those products conform to the requirements of the MDD. Our Bensheim facility which is engaged in the manufacturing of Class IIa and Class IIb medical devices as defined by the MDD is ISO 13485 certified. It is also necessary that our products comply with any revisions which may be made to these standards or the MDD.

Medical devices are subject to ongoing regulatory oversight by the FDA and a Notified Body. The FD&C Act requires that all medical device manufacturers and distributors register annually with the FDA and submit a list of those medical devices which they distribute commercially. The MDD requires that Class IIa devices or higher bear a CE mark with a Notified Body Number. The FD&C Act and the MDD also requires that all manufacturers of medical devices comply with labeling requirements and manufacture their products and maintain their documents in a prescribed manner with respect to manufacturing, testing, and quality control activities. The FDA's Medical Device Reporting regulation and the MDD subject medical devices to post-market reporting requirements for death or serious injury, and for certain malfunctions that would be likely to cause or contribute to a death or serious injury if malfunction were to recur. In addition, the FDA and the MDD prohibit a device which has received marketing clearance from being marketed for applications for which marketing clearance has not been obtained. Furthermore, the FDA generally requires that medical devices not cleared for marketing in the U.S. receive FDA marketing clearance before they are exported, unless an export certification has been granted. The FDA and the ISO Notified Bodies regularly inspect our registered and/or certified facilities.

Failure to comply with applicable regulatory requirements can, among other consequences, result in fines, injunctions, civil penalties, suspensions or loss of regulatory approvals, product recalls, seizure of products, operating restrictions and criminal prosecution. In addition, governmental regulations may be established that could prevent or delay regulatory clearance of our products. Delays in receipt of clearance, failure to receive clearance or the loss of previously received clearance would have a material adverse effect on our business, financial condition and results of operations.

Environmental, Health and Safety Matters

In addition to the laws and regulations discussed above, we are subject to government regulations applicable to all businesses, including, among others, regulations related to occupational health and safety, workers' benefits and environmental protection. The extent of government regulation that might result from any future legislation or administrative action cannot be accurately predicted. Failure to comply with regulatory requirements could have a material adverse effect on our business, financial condition and results of operations.

Employees

As of September 30, 2015, the Company had 3,458 employees. The Company believes that its relations with its employees are good. No Company employees are represented by labor unions or are subject to a collective bargaining agreement in the United States. Approximately 25% of our German employees are members of the IG Metall union. We have not experienced any work stoppages due to labor disputes.

Executive Officers

See Part III, Item 10 of this 10-K Report for information about Executive Officers of the Company.

| 12 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

Available Information

Information about the Company’s products and services, stockholder information, press releases, and filings with the Securities and Exchange Commission (“SEC”) can be found on the Company’s website at www.sirona.com. The information contained on our website is for informational purposes only and is not incorporated by reference into this report. The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other SEC filings, and any amendments to such reports and filings, are available free of charge in the Investor Relations section of the Company’s website as soon as reasonably practical after the Company’s material is filed with, or furnished to, the SEC.

| ITEM 1A. | RISK FACTORS |

INTRODUCTION

These risk factors may be important to understanding any statement in this Annual Report on Form 10-K or elsewhere. The following information should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A), and the consolidated financial statements and related notes incorporated by reference in this report.

Our businesses routinely encounter and address risks, some of which will cause our future results to be different - sometimes materially different - than we anticipate. Discussion about the material operational risks that our businesses encounter can be found in our MD&A, in the business descriptions in Item 1 of this report and in previous SEC filings. Below, we have described our present view of the material risks facing our business.

RISKS RELATED TO OUR BUSINESS

We must continue to develop new products and adapt to rapid technological change and evolving industry standards to remain competitive.

We are currently developing new products and enhancements to existing products. We cannot assure you that we will initiate, continue with and/or succeed in our efforts to develop or enhance such products. There can be no assurance that any new products will be developed by us, or if developed, will be approved by, or receive marketing clearance from, applicable domestic and/or international governmental or regulatory authorities.

The market for our products is characterized by rapid and significant technological change, evolving industry standards and new product introductions. Our products require significant planning, design, development and testing which requires significant capital commitments and investment by us. There can be no assurance that our products or proprietary technologies will not become noncompetitive or obsolete as a result of technological change, evolving industry standards or new product introductions or that we will be able to generate any economic return on our investment in product development. If our products or technologies become noncompetitive or obsolete, our business could be negatively affected.

If we cannot obtain or maintain approval from government agencies, we will not be able to sell our products.

We must obtain certain approvals by, and marketing clearances from, governmental authorities, including the FDA and similar health authorities in foreign countries to market and sell our products in those countries. These regulatory agencies regulate the marketing, manufacturing, labeling, packaging, advertising, sale and distribution of medical devices. The FDA enforces additional regulations regarding the safety of X-ray emitting devices. Our products are currently regulated by such authorities and certain of our new products will require approval by, or marketing clearance from, various governmental authorities, including the FDA. Various states also impose similar regulations.

| 13 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

The FDA review process typically requires extended proceedings pertaining to the safety and efficacy of new products. A 510(k) application is required in order to market a new or modified medical device. If specifically required by the FDA, a pre-market approval, or PMA, may be necessary. Such proceedings, which must be completed prior to marketing a new medical device, are potentially expensive and time consuming. They may delay or hinder a product’s timely entry into the marketplace. Moreover, there can be no assurance that the review or approval process for these products by the FDA or any other applicable governmental authority will occur in a timely fashion, if at all, or that additional regulations will not be adopted or current regulations amended in such a manner as will adversely affect us. The FDA also oversees the content of advertising and marketing materials relating to medical devices which have received FDA clearance. Failure to comply with the FDA’s advertising guidelines may result in the imposition of penalties.

We are also subject to other federal, state and local laws, regulations and recommendations relating to safe working conditions, laboratory and manufacturing practices. The extent of government regulation that might result from any future legislation or administrative action cannot be accurately predicted. Failure to comply with regulatory requirements could have a material adverse effect on our business.

Similar to the FDA review process, the EU review process typically requires extended proceedings pertaining to the safety and efficacy of new products. Such proceedings, which must be completed prior to marketing a new medical device, are potentially expensive and time consuming and may delay or prevent a product’s entry into the marketplace.

Our profitability may be negatively impacted by adverse general macroeconomic conditions in the geographic markets in which we sell our products.

Our profitability depends in part on the varying economic and other conditions of the global dental market, which in turn is impacted by general macroeconomic conditions in the geographic markets in which we sell our products. Growth in the global dental market over the past few years has been driven by a number of factors, including a growth in disposable income, a shift towards private pay, a greater need for dental preventative care and an increased emphasis on aesthetics. Demand for our products would be negatively impacted by a decline in the economy in general, including interest rate and tax changes, that impact the financial strength of our customers, as well as by changes in the economy in general that reduce disposable income among dental consumers in the markets we sell our products, which would in turn reduce the demand for preventative and aesthetic dental services.

The ongoing disruptions in the overall world economy and financial markets could reduce disposable income among dental consumers and negatively affect the demand for dental services, which could be harmful to our financial position and results of operations. Furthermore, there can be no assurances that government responses to the disruptions in the financial markets will stabilize the markets or increase liquidity and the availability of credit for our customers. Difficult economic conditions may also result in a higher rate of losses on our accounts receivable. As a result, our business, results of operations or financial condition could be materially adversely affected.

We are dependent upon a limited number of distributors for a significant portion of our revenue, and loss of these key distributors could result in a loss of a significant amount of our revenue.

Historically, a substantial portion of our revenue has come from a limited number of distributors. For example, Patterson Dental Company, Inc. accounted for 33% of revenue for the fiscal year ended September 30, 2015. In addition, 14% of our revenue for the fiscal year ended September 30, 2015, was attributable to sales to Henry Schein, Inc. It is anticipated that Patterson and Henry Schein will continue to be the largest contributors to our revenue for the foreseeable future. There can be no assurance that Patterson and Henry Schein will purchase any specified minimum quantity of products from us or that they will continue to purchase any products at all. If Patterson or Henry Schein ceases to purchase a significant volume of products from us, it could have a material adverse effect on our results of operations and financial condition.

| 14 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

Competition in the markets for our products is intense, and we may not be able to compete effectively.

Competition relating to our current products is intense and includes various companies, both within and outside of the United States. We anticipate that competition for our future products will also be intense and include various companies, both within and outside of the United States, Asia and Europe. Our competitors and potential competitors include large companies with substantially greater financial, sales and marketing, and technical resources, larger and more experienced research and development staffs, more extensive physical facilities and substantially greater experience in obtaining regulatory approvals and in marketing products than we have. In addition, we cannot assure you that our competitors are not currently developing, or will not attempt to develop, technologies and products that are more effective than those being developed by us or that would otherwise render our existing and new technology and products obsolete or noncompetitive. We may not be able to compete successfully and may lose market share to our competitors.

Our failure to obtain issued patents and, consequently, to protect our proprietary technology could hurt our competitive position.

Our success will depend in part on our ability to obtain and enforce claims in our patents directed to our products, technologies and processes, both in the United States and in other countries. Risks and uncertainties that we face with respect to our patents and patent applications include the following:

| · | the pending patent applications that we have filed, or to which we have exclusive rights, may not result in issued patents or may take longer than we expect to result in issued patents; |

| · | the allowed claims of any patents that issue may not provide meaningful protection; |

| · | we may be unable to develop additional proprietary technologies that are patentable; |

| · | the patents licensed or issued to us may not provide a competitive advantage; |

| · | other companies may challenge patents licensed or issued to us; |

| · | disputes

may arise regarding inventions and corresponding ownership rights in inventions and know-how resulting from the joint creation or use of intellectual property by us and our respective licensors; and |

| · | other companies may design around the technologies patented by us. |

Our revenue and operating results are likely to fluctuate.

Our quarterly and annual operating results have varied in the past, and our operating results are likely to continue to fluctuate in the future. These variations result from a number of factors, many of which are substantially outside of our control, including:

| · | the timing of new product introductions by us and our competitors; |

| · | timing of industry tradeshows, particularly the International Dental Show; |

| · | changes in relationships with distributors; |

| · | the timing of operational decisions by distributors and end users; |

| · | developments in government reimbursement policies; |

| · | changes in product mix; |

| · | our ability to supply products to meet customer demand; |

| · | fluctuations in manufacturing costs; |

| · | tax incentives; |

| · | currency fluctuations; and |

| · | general economic conditions, as well as those specific to the healthcare industry and related industries. |

| 15 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

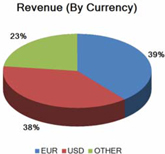

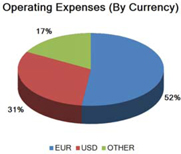

Our financial results may be adversely affected by fluctuations in foreign currency exchange rates.

We are exposed to currency exchange risk with respect to the U.S. Dollar in relation to the Euro, because a large portion of our revenue and expenses are denominated in Euros. In addition, we have an increasing portion of revenue and expenses denominated in other foreign currencies, e.g. Yen, Australian Dollar, Brazilian Real, and Yuan Renminbi. We monitor changes in our exposure to exchange rate risk. While we enter into hedging arrangements to protect our business against certain currency fluctuations, these hedging arrangements do not provide comprehensive protection, and our results of operations and prospects could be materially and adversely affected by foreign exchange fluctuations.

Our hedging and cash management transactions may expose us to loss or limit our potential gains.

As part of our risk management program, we use foreign currency exchange forward contracts. While intended to reduce the effects of exchange rate fluctuations, these transactions may limit our potential gains or expose us to loss. Should our counterparties to such transactions or the sponsors of the exchanges through which these transactions are offered fail to honor their obligations due to financial distress or otherwise, we would be exposed to potential losses or the inability to recover anticipated gains from these transactions.

We enter into foreign currency exchange forward contracts as economic hedges of trade commitments or anticipated commitments denominated in currencies other than the functional currency to mitigate the effects of changes in currency rates. Although we do not enter into these instruments for trading purposes or speculation, and although our management believes all of these instruments are economically effective as hedges of underlying physical transactions, these foreign exchange commitments are dependent on timely performance by our counterparties. Their failure to perform could result in our having to close these hedges without the anticipated underlying transaction and could result in losses if foreign currency exchange rates have changed.

We enter into interest rate swap agreements from time to time to manage some of our exposure to interest rate volatility. These swap agreements involve risks, such as the risk that counterparties may fail to honor their obligations under these arrangements. In addition, these arrangements may not be effective in reducing our exposure to changes in interest rates. If such events occur, our results of operations may be adversely affected.

Most of our cash deposited with banks is not insured and would be subject to the risk of bank failure. Our total liquidity also depends in part on the availability of funds under our Senior Facility Agreement. The failure of any bank in which we deposit our funds or that is part of our Senior Facility Agreement could reduce the amount of cash we have available for operations and additional investments in our business.

If we lose our key management personnel or are unable to attract and retain qualified personnel, it could adversely affect our results of operations or delay or hurt our research and product development efforts.

Our success is dependent, in part, upon our ability to hire and retain management, sales, technical, research and other personnel who are in high demand and are often subject to competing employment opportunities. It is possible that the loss of the services of one or a combination of our senior executives or key managers could have an adverse effect on our operations.

Work stoppages and other labor relations matters may make it substantially more difficult or expensive for us to produce our products, which could result in decreased sales or increased costs, either of which would negatively impact our financial condition and results of operations.

A significant part of our foreign employees are subject to collective bargaining agreements, and some of our employees are unionized; therefore, we are subject to the risk of work stoppages and other labor relations matters. While we have not experienced prolonged work stoppages in recent years and believe our relations with employees are satisfactory, any prolonged work stoppage or strike at any one of our principal facilities could have a negative impact on our business, financial condition, or results of operations.

| 16 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

We may experience difficulties managing our growth, which could adversely affect our results of operations.

It is expected that we will grow in certain areas of our operations as we develop and, assuming receipt of the necessary regulatory approvals, market our products. We will therefore need to recruit personnel, particularly sales and marketing personnel, and expand our capabilities, which may strain our managerial, operational, financial and other resources. To compete effectively and manage our growth, we must:

| · | train, manage, motivate and retain a growing employee base; |

| · | accurately forecast demand for, and revenue from, our product candidates; and |

| · | expand existing operational, financial and management information systems to support our development and planned commercialization activities and the multiple locations of our offices. |

Our failure to manage these challenges effectively could materially harm our business.

Since we operate in markets outside of the United States and Europe, we are subject to additional risks.

We anticipate that sales outside of the United States and Europe will continue to account for a significant percentage of our revenue. Such revenue is subject to a number of uncertainties, including, but not limited to, the following:

| · | economic and political instability; |

| · | import or export licensing requirements; |

| · | trade restrictions; |

| · | longer payment cycles; |

| · | unexpected changes in regulatory requirements and tariffs; |

| · | fluctuations in currency exchange rates; |

| · | potentially adverse tax consequences; and |

| · | potentially weak protection of intellectual property rights. |

These risks may impair our ability to generate revenue from our sales efforts. In addition, many countries outside of the United States and Europe have their own regulatory approval requirements for the sale of products. As a result, the introduction of new products into, and our continued sale of existing products in, these markets could be prevented, and/or costly and/or time-consuming, and we cannot assure you that we will be able to obtain the required regulatory approvals on a timely basis, if at all.

Our business is subject to extensive, complex, and changing laws, regulations, and orders that failure to comply with could subject us to civil or criminal penalties or other liabilities.

We are subject to extensive laws, regulations, and orders which are administered by various international, federal, and state governmental authorities, including, among others, the FDA, the Office of Foreign Assets Control of the United States Department of the Treasury ("OFAC"), the United States Federal Trade Commission, the United States Department of Justice, and other similar domestic and foreign authorities. These regulations include, but are not limited to, the U.S. Foreign Corrupt Practices Act and similar international anti-bribery laws, regulations concerning the supply of conflict minerals, various environmental regulations and regulations relating to trade, import and export controls and economic sanctions. Such laws, regulations, and orders may be complex and are subject to change.

Compliance with the numerous applicable existing and new laws, regulations and orders could require us to incur substantial regulatory compliance costs. Although the Company has implemented policies and procedures to comply with applicable laws, regulations and orders, there can be no assurance that governmental authorities will not raise compliance concerns or perform audits to confirm compliance with such laws, regulations, and orders. Failure to comply with applicable laws, regulations, or orders could result in a range of governmental enforcement actions, including fines or penalties, injunctions, and/or criminal or other civil proceedings. Any such actions could result in higher than anticipated costs or lower than anticipated revenue and could have a material adverse effect on the Company's reputation, business, financial condition, and results of operations.

| 17 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the Foreign Corrupt Practices Act could have a material adverse effect on our business.

To the extent that we operate outside the United States, we are subject to the Foreign Corrupt Practices Act (the “FCPA”) which generally prohibits U.S. companies and their intermediaries from bribing foreign officials for the purpose of obtaining or keeping business or otherwise obtaining favorable treatment. In particular, we may be held liable for actions taken by our strategic or local partners even though such partners are foreign companies that are not subject to the FCPA. Any determination that we violated the FCPA could result in sanctions that could have a material adverse effect on our business.

Regulations related to conflict minerals could adversely impact our business.

The Dodd-Frank Wall Street Reform and Consumer Protection Act contains provisions designed to improve transparency and accountability concerning the supply of certain minerals, known as conflict minerals, originating from the Democratic Republic of Congo (DRC) and adjoining countries. As a result, in August 2012 the SEC adopted annual disclosure and reporting requirements for those companies who use conflict minerals mined from the DRC and adjoining countries in their products. There are additional costs associated with complying with these disclosure requirements, including for diligence to determine the sources of conflict minerals used in our products and other potential changes to products, processes or sources of supply as a consequence of such verification activities. The implementation of these rules could adversely affect the sourcing, supply, and pricing of materials used in our products. As there may be only a limited number of suppliers offering conflict-free minerals, we cannot be sure that we will be able to obtain necessary conflict minerals from such suppliers in sufficient quantities or at competitive prices. Also, we may face reputational challenges if we determine that certain of our products contain minerals not determined to be conflict free or if we are unable to sufficiently verify the origins for all conflict minerals used in our products through the procedures we may implement.

We may be a party to legal actions that are not covered by insurance.