Attached files

| file | filename |

|---|---|

| 8-K - SHUSA Q3 IR 8-K - Santander Holdings USA, Inc. | q315shusair.htm |

Santander Holdings USA, Inc. Fixed Income Investor Update Data as of September 30, 2015 November 18, 2015

2 Disclaimer Santander Holdings USA, Inc. (“SHUSA”) cautions that this presentation may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are found in various places throughout this presentation and include, without limitation, statements concerning our future business development and economic performance. While these forward-looking statements represent our judgment and future expectations concerning the development of our business, a number of risks, uncertainties, and other important factors could cause actual developments and results to differ materially from our expectations. These factors include, but are not limited to: (1) increased regulation and regulatory developments; (2) domestic and international market, macro-economic, governmental, regulatory conditions and trends; (3) movements in local and international securities markets, currency exchange rates, and interest rates; (4) competitive pressures; (5) technological developments; and (6) changes in the financial position or creditworthiness of our customers, obligors, and counterparties. The risk factors and other key factors indicated in our past and future filings and reports, including our Annual Report on Form 10-K and that of Santander Consumer USA Holdings Inc. (“SC”) for the year ended December 31, 2014 and other filings and reports with the Securities and Exchange Commission (the “SEC”), could adversely affect our business and financial performance. Other factors could cause actual results to differ materially from those in the forward-looking statements. The information contained in this presentation is not complete. It is subject to, and must be read in conjunction with, all other publicly available information, including reports filed with or furnished to the SEC, press releases, and other relevant information. Because this information is intended only to assist investors, it does not constitute investment advice or an offer to invest, and in making this presentation available, SHUSA gives no advice and makes no recommendation to buy, sell, or otherwise deal in shares or other securities of Banco Santander, S.A. (“Santander”), SHUSA, Santander Bank, N.A. (“Santander Bank” or “SBNA”), or SC in any other securities or investments. This presentation is subject to correction, completion, and amendment without notice. It is not our intention to state, indicate, or imply in any manner that current or past results are indicative of future results or expectations. As with all investments, there are associated risks, and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal, and tax advisers to evaluate independently the risks, consequences, and suitability of that investment. The information in this presentation is not intended to constitute “research” as that term is defined by applicable regulations. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. In this presentation, we may sometimes refer to certain non-GAAP figures or financial ratios to help illustrate certain concepts. These ratios, each of which is defined in this document, if utilized, may include Pre-Tax Pre-Provision Income, the Tangible Common Equity to Tangible Assets Ratio, and the Texas Ratio. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results, among others. We believe that this additional information and the reconciliations we provide may be useful to investors, analysts, regulators and others as they evaluate the impact of these items on our results for the periods presented due to the extent to which the items are indicative of our ongoing operations. Where applicable, we provide GAAP reconciliations for such additional information. This presentation is provided for information purposes only.

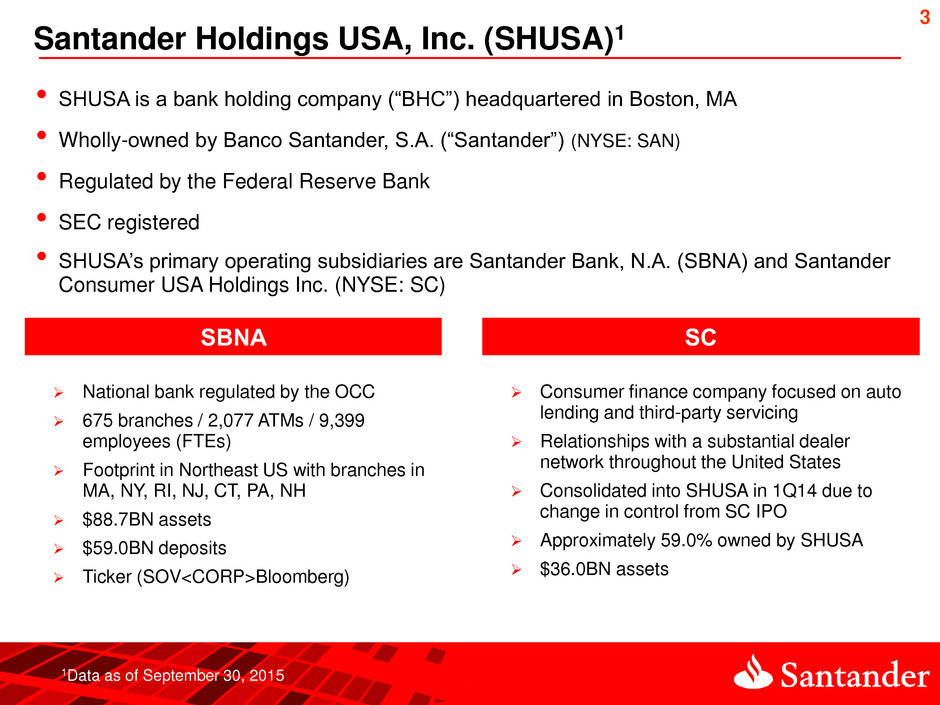

3 Santander Holdings USA, Inc. (SHUSA)1 • SHUSA is a bank holding company (“BHC”) headquartered in Boston, MA • Wholly-owned by Banco Santander, S.A. (“Santander”) (NYSE: SAN) • Regulated by the Federal Reserve Bank • SEC registered • SHUSA’s primary operating subsidiaries are Santander Bank, N.A. (SBNA) and Santander Consumer USA Holdings Inc. (NYSE: SC) SBNA SC National bank regulated by the OCC 675 branches / 2,077 ATMs / 9,399 employees (FTEs) Footprint in Northeast US with branches in MA, NY, RI, NJ, CT, PA, NH $88.7BN assets $59.0BN deposits Ticker (SOV<CORP>Bloomberg) Consumer finance company focused on auto lending and third-party servicing Relationships with a substantial dealer network throughout the United States Consolidated into SHUSA in 1Q14 due to change in control from SC IPO Approximately 59.0% owned by SHUSA $36.0BN assets 1Data as of September 30, 2015

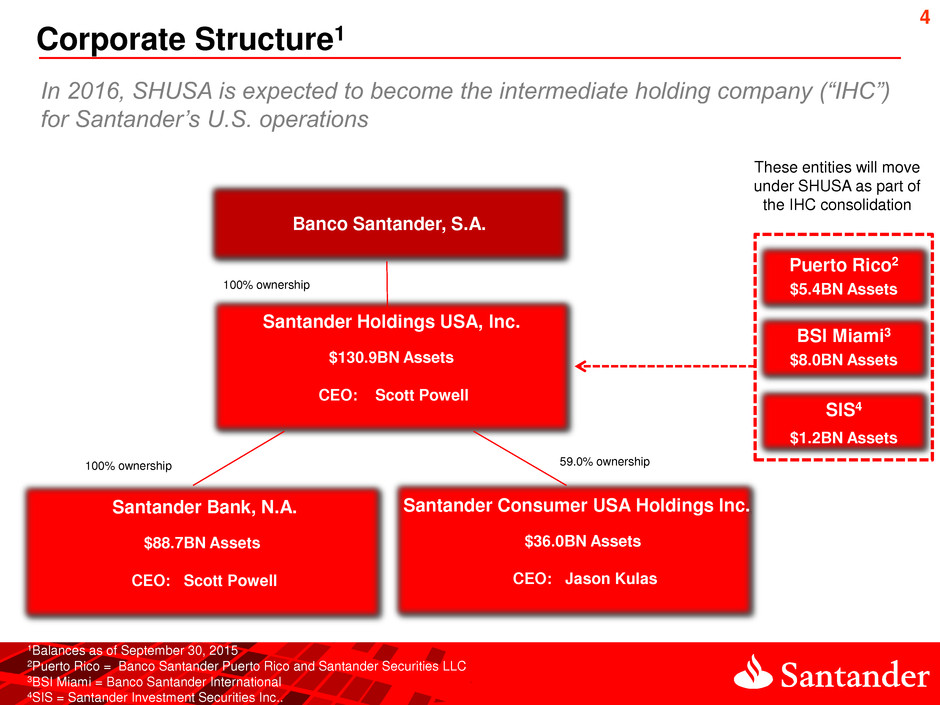

4 Corporate Structure1 Santander Holdings USA, Inc. $130.9BN Assets CEO: Scott Powell Santander Bank, N.A. $88.7BN Assets CEO: Scott Powell Santander Consumer USA Holdings Inc. $36.0BN Assets CEO: Jason Kulas In 2016, SHUSA is expected to become the intermediate holding company (“IHC”) for Santander’s U.S. operations 1Balances as of September 30, 2015 2Puerto Rico = Banco Santander Puerto Rico and Santander Securities LLC 3BSI Miami = Banco Santander International 4SIS = Santander Investment Securities Inc.. 59.0% ownership Banco Santander, S.A. Puerto Rico2 $5.4BN Assets BSI Miami3 $8.0BN Assets SIS4 $1.2BN Assets 100% ownership 100% ownership These entities will move under SHUSA as part of the IHC consolidation

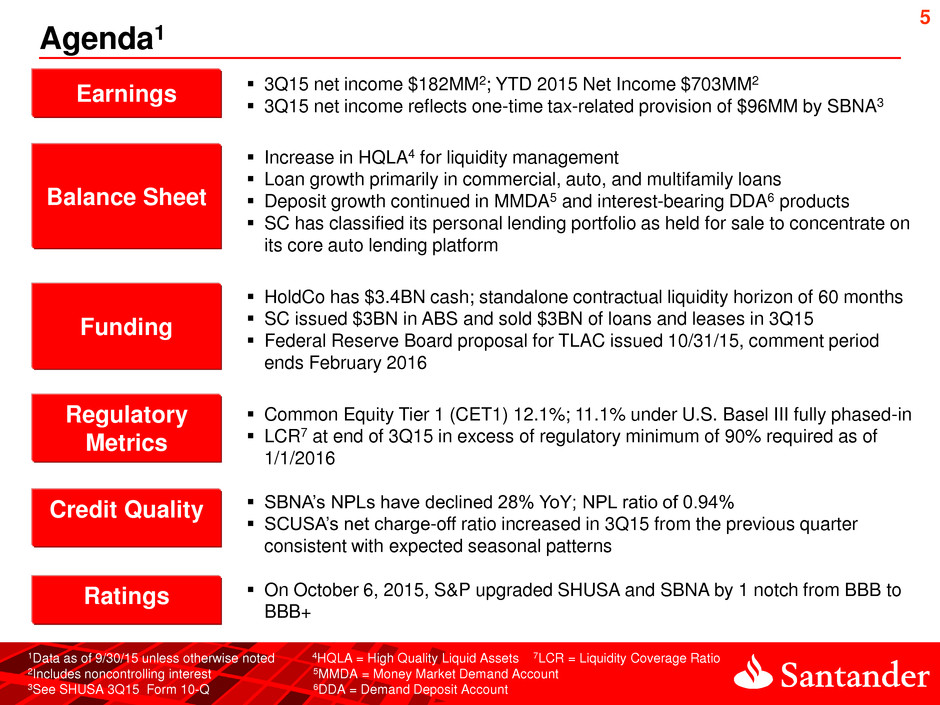

5 Agenda1 Funding Regulatory Metrics Balance Sheet 1Data as of 9/30/15 unless otherwise noted 4HQLA = High Quality Liquid Assets 7LCR = Liquidity Coverage Ratio 2Includes noncontrolling interest 5MMDA = Money Market Demand Account 3See SHUSA 3Q15 Form 10-Q 6DDA = Demand Deposit Account Earnings Credit Quality 3Q15 net income $182MM2; YTD 2015 Net Income $703MM2 3Q15 net income reflects one-time tax-related provision of $96MM by SBNA3 Increase in HQLA4 for liquidity management Loan growth primarily in commercial, auto, and multifamily loans Deposit growth continued in MMDA5 and interest-bearing DDA6 products SC has classified its personal lending portfolio as held for sale to concentrate on its core auto lending platform HoldCo has $3.4BN cash; standalone contractual liquidity horizon of 60 months SC issued $3BN in ABS and sold $3BN of loans and leases in 3Q15 Federal Reserve Board proposal for TLAC issued 10/31/15, comment period ends February 2016 Common Equity Tier 1 (CET1) 12.1%; 11.1% under U.S. Basel III fully phased-in LCR7 at end of 3Q15 in excess of regulatory minimum of 90% required as of 1/1/2016 SBNA’s NPLs have declined 28% YoY; NPL ratio of 0.94% SCUSA’s net charge-off ratio increased in 3Q15 from the previous quarter consistent with expected seasonal patterns On October 6, 2015, S&P upgraded SHUSA and SBNA by 1 notch from BBB to BBB+ Ratings

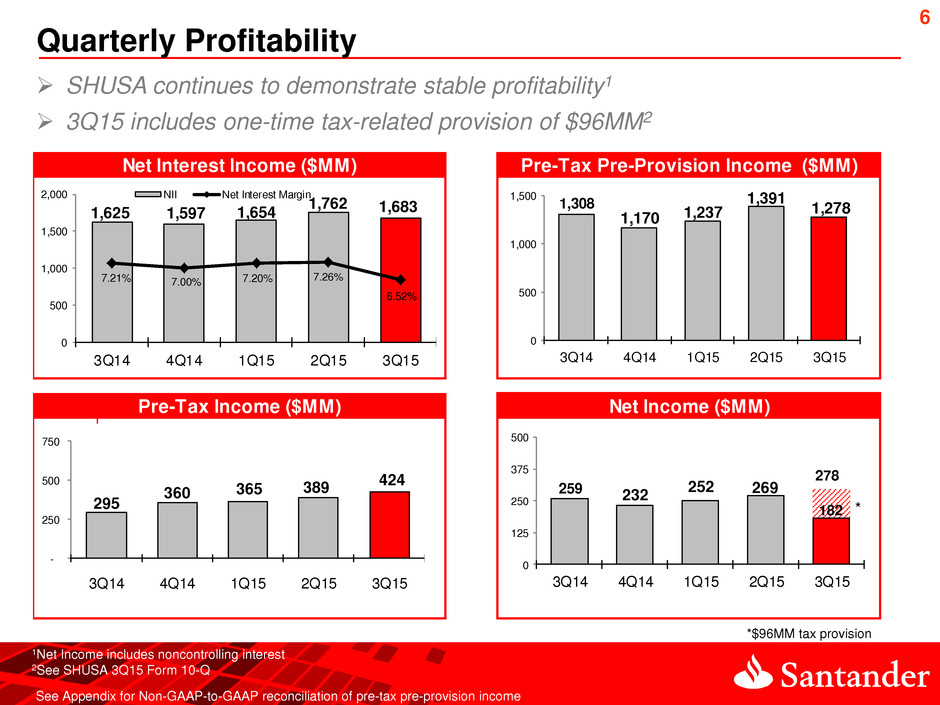

6 Quarterly Profitability 2 See Appendix for Non-GAAP-to-GAAP reconciliation of pre-tax pre-provision income 1Net Income includes noncontrolling interest 2See SHUSA 3Q15 Form 10-Q Pre-Tax Pre-Provision Income ($MM) Net Income ($MM) Net Interest Income ($MM) Pre-Tax Income ($MM) 1,308 1,170 1,237 1,391 1,278 0 500 1,000 1,500 3Q14 4Q14 1Q15 2Q15 3Q15 1,625 1,597 1,654 1,762 1,683 7.21% 7.00% 7.20% 7.26% 6.52% 0 500 1,000 1,500 2,000 3Q14 4Q14 1Q15 2Q15 3Q15 NII Net Interest Margin 295 360 365 389 424 - 250 500 750 3Q14 4Q14 1Q15 2Q15 3Q15 259 232 252 269 182 0 125 250 375 500 3Q14 4Q14 1Q15 2Q15 3Q15 SHUSA continues to demonstrate stable profitability1 3Q15 includes one-time tax-related provision of $96MM2 278 182 *$96MM tax provision *

7 2 9% 6% 3% 18% 6% 8% 15% 4% 10% 3% 18% Balance Sheet 7% 7% 5% 5% 17% 7% 7% 3% 17% 19% Investments Auto Loans 6% Non Interest- Bearing Demand Deposits Other Assets C&I CRE Residential Mortgage Other Loans Operating Lease Assets Goodwill Home Equity Multi-Family $130.9BN Assets $107.7BN Liabilities $23.2BN Equity Interest- Bearing Demand Deposits Secured Structured Financings Equity Other Liabilities FHLB Money Market Certificates of Deposit Savings All balances as of 9/30/2015 as reported in SHUSA Form 10-Q Revolving Credit Facilities Other Borrowings See SHUSA 3Q 2015 Form 10-Q for additional information on the SC consolidation SHUSA balance sheet reflects the combination of its bank subsidiary funded primarily by deposits and the consumer finance company funded by secured structured financing and supported by a solid equity base

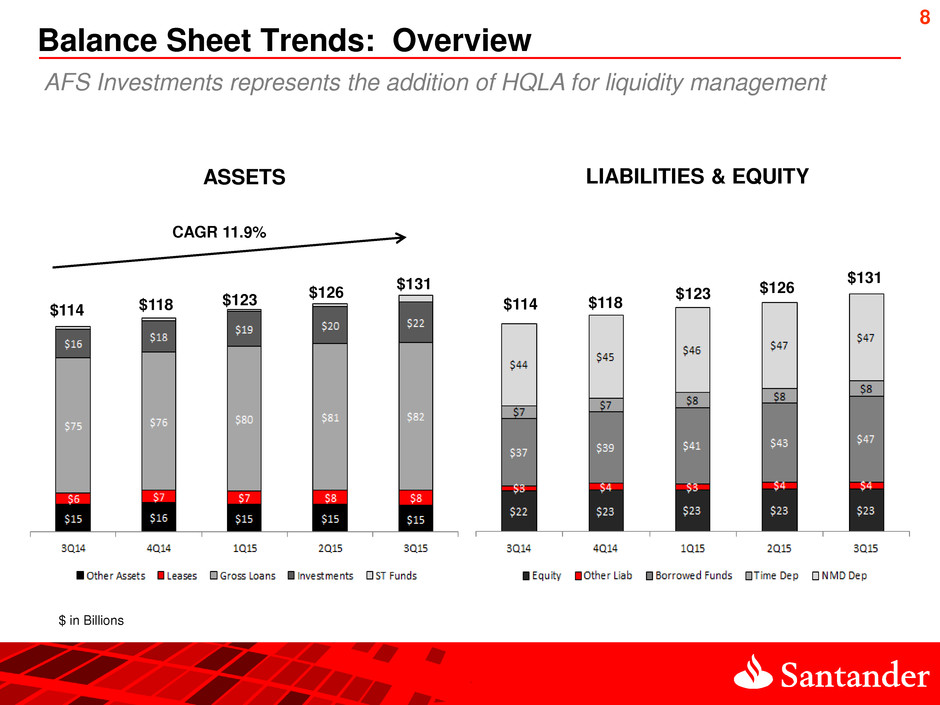

8 2 Balance Sheet Trends: Overview AFS Investments represents the addition of HQLA for liquidity management $114 $118 $123 $126 $131 $114 $118 $123 $126 $131 ASSETS LIABILITIES & EQUITY CAGR 11.9% $ in Billions

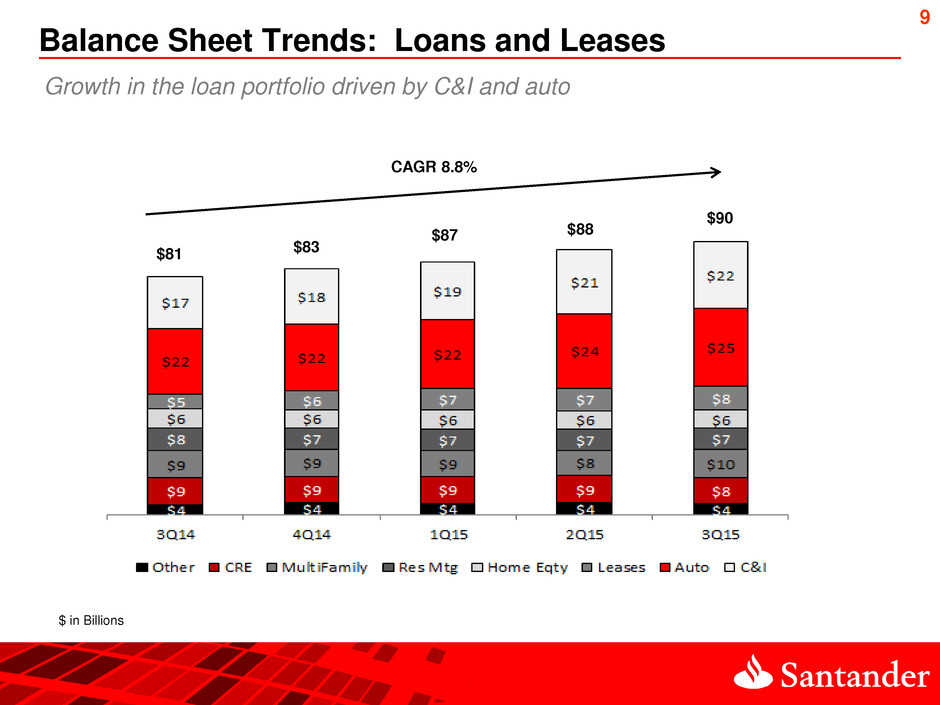

9 2 Balance Sheet Trends: Loans and Leases Growth in the loan portfolio driven by C&I and auto $81 $83 $87 $88 $90 CAGR 8.8% $ in Billions

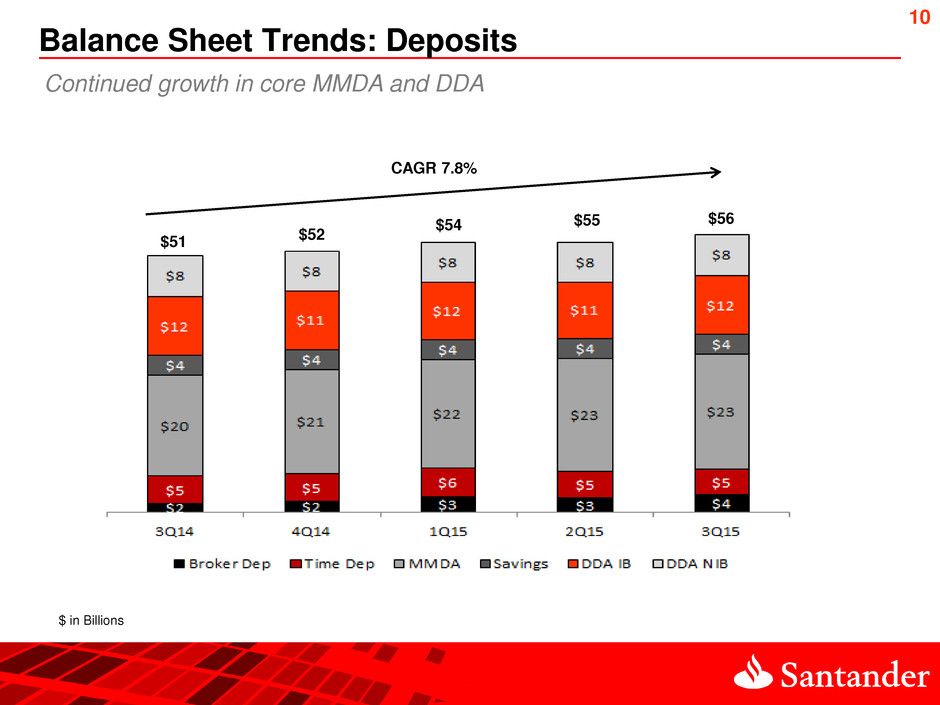

10 2 Balance Sheet Trends: Deposits Continued growth in core MMDA and DDA $51 $52 $54 $55 $56 CAGR 7.8% $ in Billions

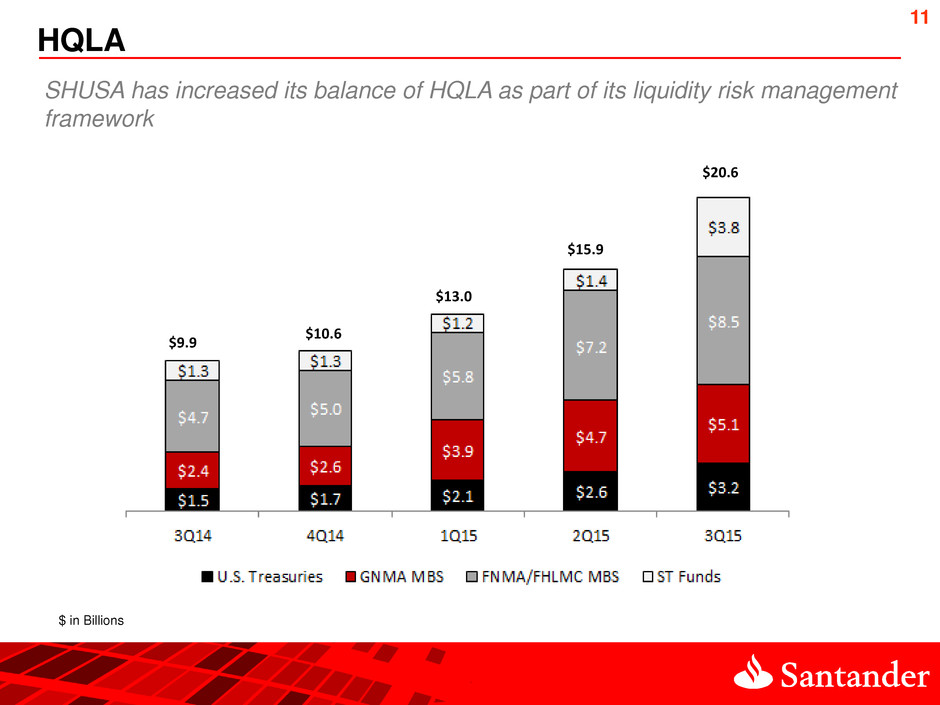

11 2 HQLA SHUSA has increased its balance of HQLA as part of its liquidity risk management framework $9.9 $10.6 $13.0 $15.9 $20.6 $ in Billions

12 2 Apr-16 … Aug-18 … Apr-20 … Jul-25 … Jun-36 Perp Wholesale Funding Profile1 Trust Pref $150 Sr Debt 4.625% Sr Debt 3.0% Sr Debt 3.45% 20 6 2017 2018 2019 Perp4.8 3.5 10.7 6.7 6.7 6.7 13.4 13.4 Santander Third-Party Revolving Private Amortizing Notes Public Securitizations Utilized $30.3 SC ($BN) Committed FHLB Bank Debt HoldCo Debt 3rd Party Rev Santander2 Trust Pref Pref Stock Sr Debt 4.62% Sr Debt 3.45% REIT Pref 12.2% FHLB 0.6% FHLB 0.9% FHLB 2.6% $0.18 $2.4 $9.1 $2.7 SHUSA’s market funding is well diversified by sources and term structure Public Sec $35.6 $0.5 $0.5 $0.22 $0.2 1As of September 30, 2015 2$0.3BN difference in Santander balance between SHUSA and SC charts reflects $0.3BN facility between SHUSA and SC that is eliminated at the consolidated level $44.4 $48.4 $1.0 Sr Debt 2.65% FHLB Private Amort. SBNA ($BN, % yield) SHUSA HOLDCO ($BN, % yield) SHUSA ($BN) $1.1 Sr Debt 4.5% Debt $0.6

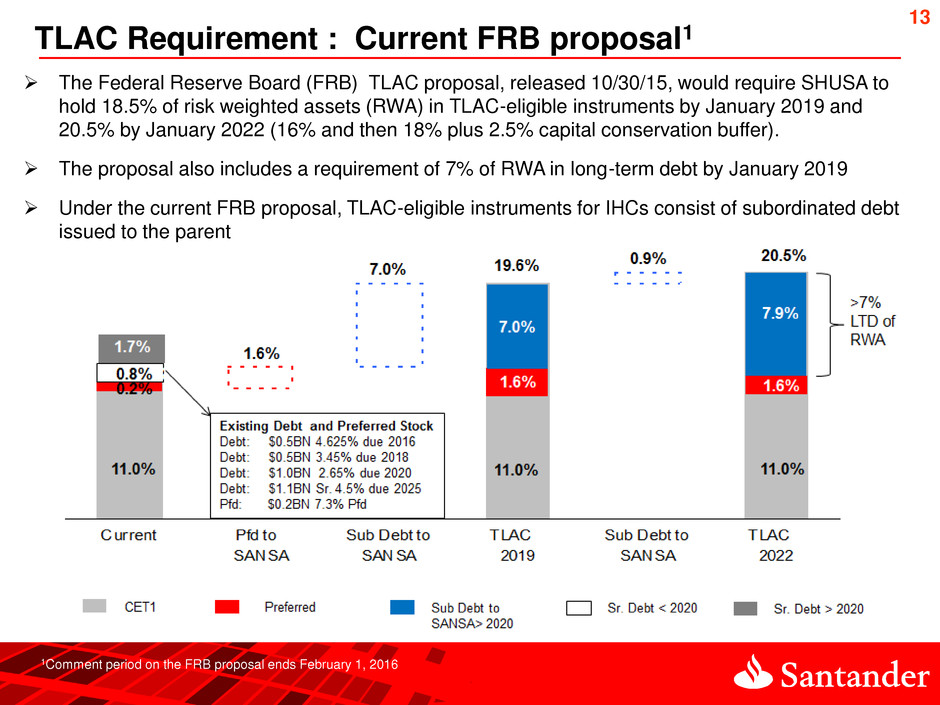

13 The Federal Reserve Board (FRB) TLAC proposal, released 10/30/15, would require SHUSA to hold 18.5% of risk weighted assets (RWA) in TLAC-eligible instruments by January 2019 and 20.5% by January 2022 (16% and then 18% plus 2.5% capital conservation buffer). The proposal also includes a requirement of 7% of RWA in long-term debt by January 2019 Under the current FRB proposal, TLAC-eligible instruments for IHCs consist of subordinated debt issued to the parent TLAC Requirement : Current FRB proposal1 1Comment period on the FRB proposal ends February 1, 2016

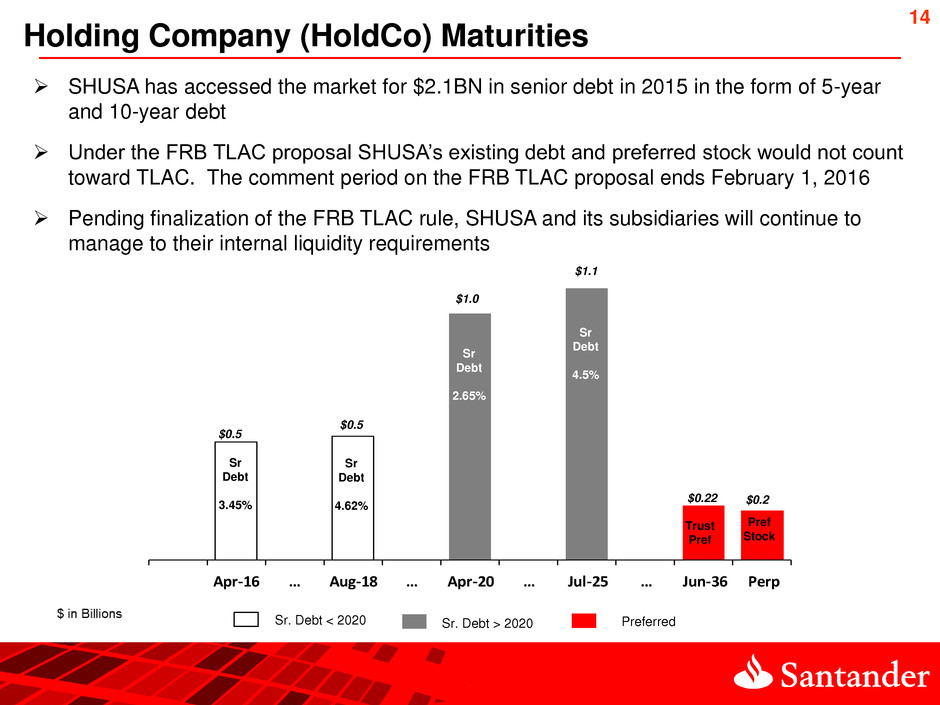

14 Holding Company (HoldCo) Maturities SHUSA has accessed the market for $2.1BN in senior debt in 2015 in the form of 5-year and 10-year debt Under the FRB TLAC proposal SHUSA’s existing debt and preferred stock would not count toward TLAC. The comment period on the FRB TLAC proposal ends February 1, 2016 Pending finalization of the FRB TLAC rule, SHUSA and its subsidiaries will continue to manage to their internal liquidity requirements Apr-16 … Aug-18 … Apr-20 … Jul-25 … Jun-36 Perp Trust Pref Pref Stock Sr Debt 4.62% Sr Debt 3.45% $0.5 $0.5 $0.22 $0.2 $1.0 Sr Debt 2.65% $1.1 Sr Debt 4.5% Sr. Debt < 2020 Sr. Debt > 2020 Preferred

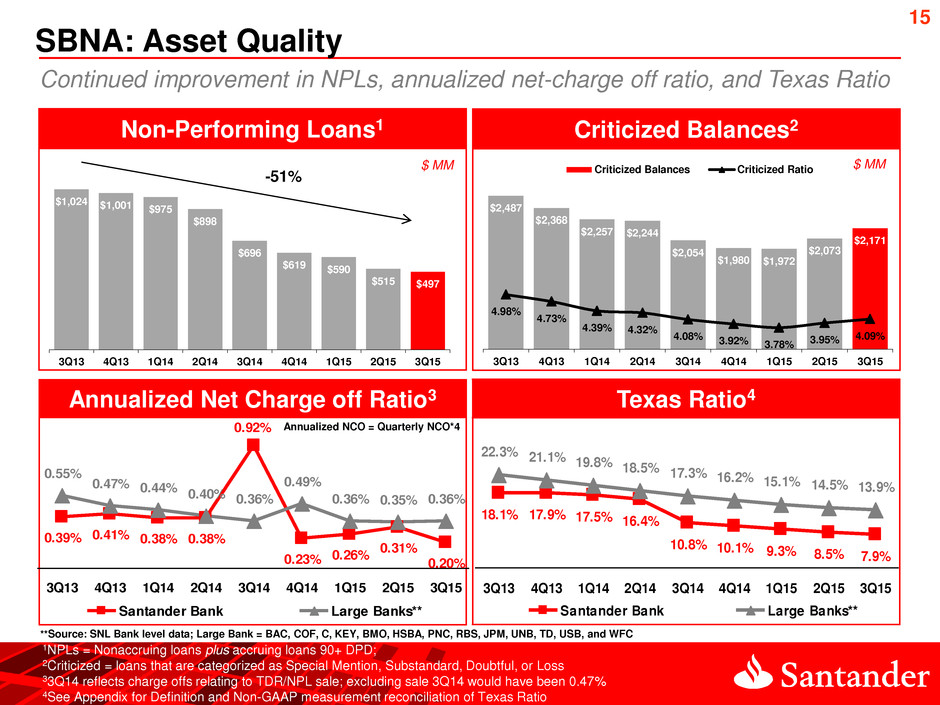

15 $2,487 $2,368 $2,257 $2,244 $2,054 $1,980 $1,972 $2,073 $2,171 4.98% 4.73% 4.39% 4.32% 4.08% 3.92% 3.78% 3.95% 4.09% 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Criticized Balances Criticized Ratio Criticized Balances2 $1,024 $1,001 $975 $898 $696 $619 $590 $515 $497 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Non-Performing Loans1 Texas Ratio4 Annualized Net Charge off Ratio3 0.20% 0.41% 0.38% 0.38% 0.92% 0.23% 0.31% 0.26% 0.39% 0.36%0.35% 0.55% 0.47% 0.44% 0.40% 0.36% 0.49% 0.36% 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Santander Bank Large Banks** SBNA: Asset Quality $ MM -51% $ MM Annualized NCO = Quarterly NCO*4 **Source: SNL Bank level data; Large Bank = BAC, COF, C, KEY, BMO, HSBA, PNC, RBS, JPM, UNB, TD, USB, and WFC 1NPLs = Nonaccruing loans plus accruing loans 90+ DPD; 2Criticized = loans that are categorized as Special Mention, Substandard, Doubtful, or Loss 33Q14 reflects charge offs relating to TDR/NPL sale; excluding sale 3Q14 would have been 0.47% 4See Appendix for Definition and Non-GAAP measurement reconciliation of Texas Ratio 15.1% 14.5% 13.9% 7.9% 17.9 17.5% 16.4% 1 .8% 10.1% 8.5%9.3% 18.1 16 2% 22.3% 21.1% 19.8% 18.5% 17 % 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Santander Bank Large Banks** Continued improvement in NPLs, annualized net-charge off ratio, and Texas Ratio

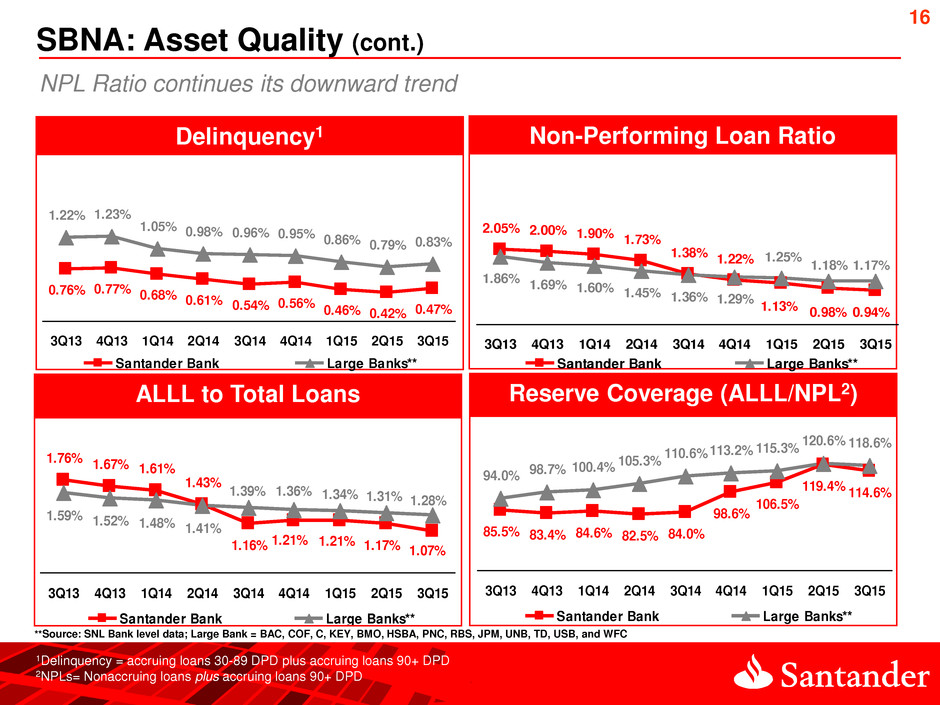

16 85.5% 106.5% 119.4% 98.6% 84.0%82.5%84.6%83.4% 114.6% 115.3%113.2%110.6% 105.3%100.4%98.7%94.0% 120.6% 118.6% 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Santander Bank Large Banks** Reserve Coverage (ALLL/NPL2) 1.76% 1.21% 1.17%1.21%1.16% 1.43% 1.61%1.67% 1.07% 1.34%1.36%1.39% 1.41%1.48% 1.52%1.59% 1.31% 1.28% 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Santander Bank Large Banks** ALLL to Total Loans Non-Performing Loan Ratio Delinquency1 0.94% 2.00% 1.90% 1.73% 1.38% 1.22% 0.98%1.13% 2.05% 1.17%1.18% 1.86% 1.69% 1.60% 1.45% 1.36% 1.29% 1.25% 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Santander Bank Large Banks** 0.76% 0.46% 0.42% 0.56%0.54%0.61% 0.68%0.77% 0.47% 0.86%0.95% 0.96%0.98%1.05% 1.23%1.22% 0.79% 0.83% 3Q13 4Q13 Q 4 2Q14 3Q14 4Q14 1Q15 2Q15 3Q 5 Santander Bank Large Banks** SBNA: Asset Quality (cont.) **Source: SNL Bank level data; Large Bank = BAC, COF, C, KEY, BMO, HSBA, PNC, RBS, JPM, UNB, TD, USB, and WFC NPL Ratio continues its downward trend 1Delinquency = accruing loans 30-89 DPD plus accruing loans 90+ DPD 2NPLs= Nonaccruing loans plus accruing loans 90+ DPD

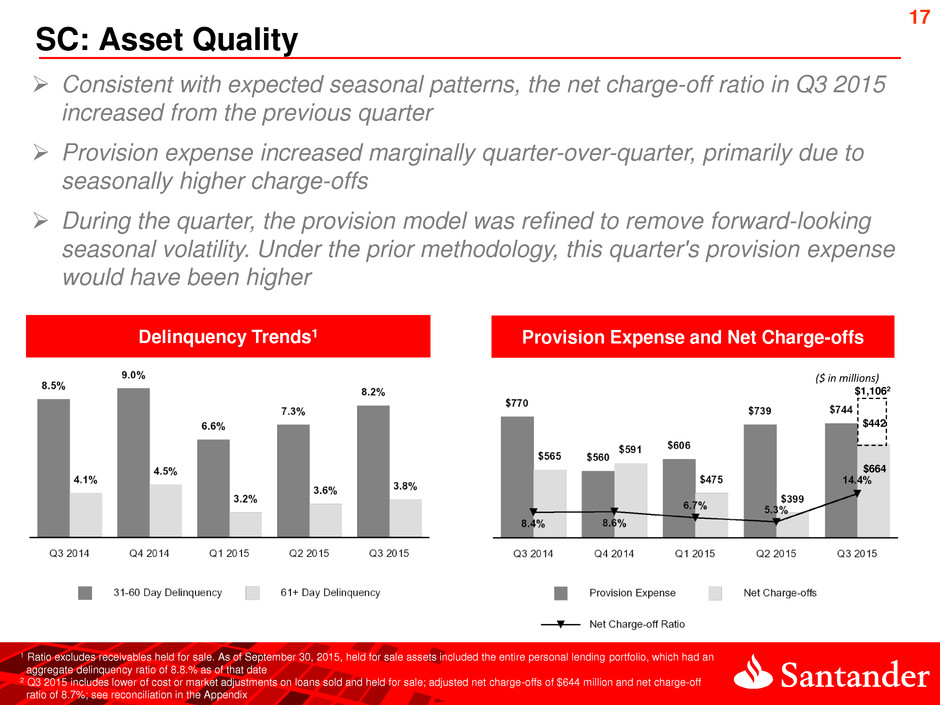

17 Consistent with expected seasonal patterns, the net charge-off ratio in Q3 2015 increased from the previous quarter Provision expense increased marginally quarter-over-quarter, primarily due to seasonally higher charge-offs During the quarter, the provision model was refined to remove forward-looking seasonal volatility. Under the prior methodology, this quarter's provision expense would have been higher ($ in millions) Delinquency Trends1 Provision Expense and Net Charge-offs SC: Asset Quality $1,1062 $442 $664 1 Ratio excludes receivables held for sale. As of September 30, 2015, held for sale assets included the entire personal lending portfolio, which had an aggregate delinquency ratio of 8.8.% as of that date 2 Q3 2015 includes lower of cost or market adjustments on loans sold and held for sale; adjusted net charge-offs of $644 million and net charge-off ratio of 8.7%; see reconciliation in the Appendix

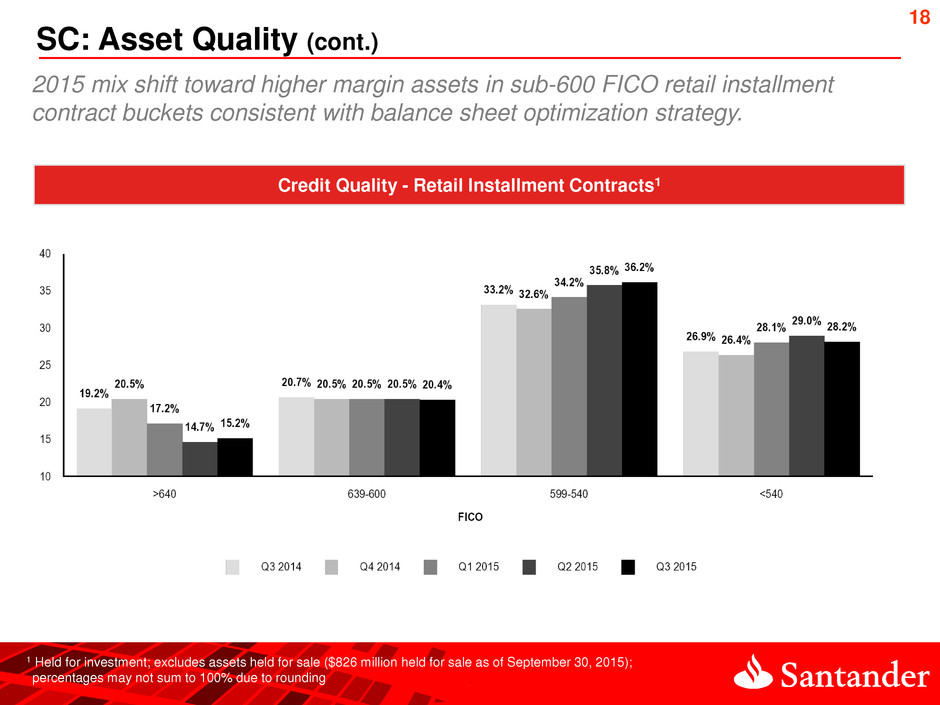

18 SC: Asset Quality (cont.) Credit Quality - Retail Installment Contracts1 1 Held for investment; excludes assets held for sale ($826 million held for sale as of September 30, 2015); percentages may not sum to 100% due to rounding 2015 mix shift toward higher margin assets in sub-600 FICO retail installment contract buckets consistent with balance sheet optimization strategy.

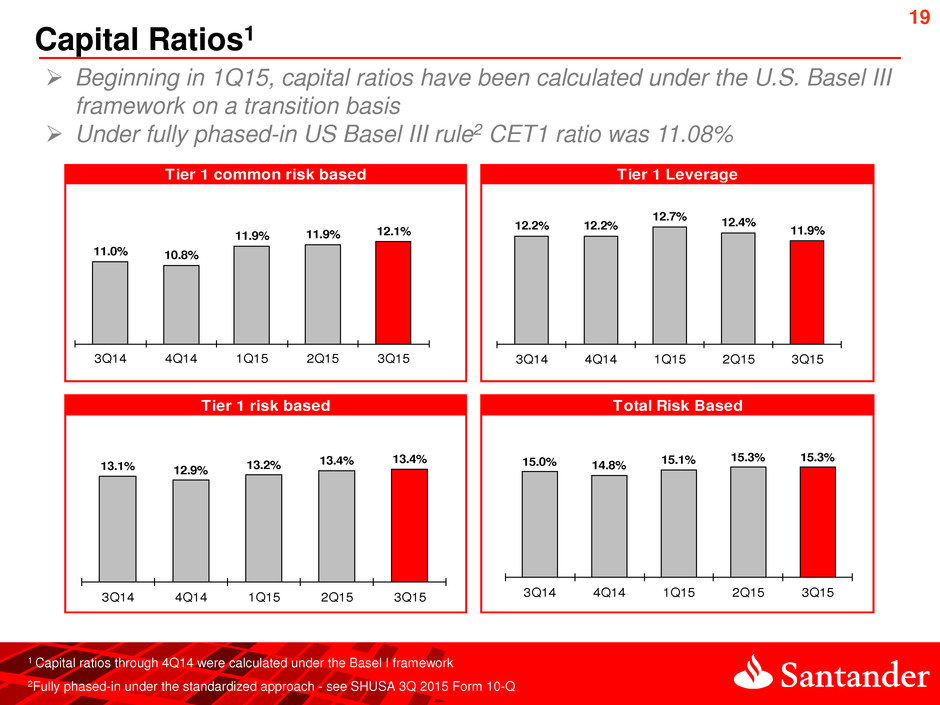

19 Capital Ratios1 1 Capital ratios through 4Q14 were calculated under the Basel I framework 2Fully phased-in under the standardized approach - see SHUSA 3Q 2015 Form 10-Q Beginning in 1Q15, capital ratios have been calculated under the U.S. Basel III framework on a transition basis Under fully phased-in US Basel III rule2 CET1 ratio was 11.08% Tier 1 Leverage Tier 1 risk based Tier 1 common risk based Total Risk Based 11.0% 10.8% 11.9% 11.9% 12.1% 3Q14 4Q14 1Q15 2Q15 3Q15 12.2% 12.2% 12.7% 12.4% 11.9% 3Q14 4Q14 1Q15 2Q15 3Q15 13.1% 12.9% 13.2% 13.4% 13.4% 3Q14 4Q14 1Q15 2Q15 3Q15 15.0% 14.8% 15.1% 15.3% 15.3% 3Q14 4Q14 1Q15 2Q15 3Q15

20 Capital Impact from SC Management Change1 On July 2, 2015, SC named Jason Kulas, formerly President and CFO, as CEO Tom Dundon stepped down as CEO and as Chairman of the SC Board. In connection with Mr. Dundon’s departure, SHUSA has a call option, pending regulatory approval and applicable law, to acquire all of the SC common stock owned by DDFS LLC, an entity solely owned by Mr. Dundon. This stock represents approximately 9.68%2 of SC stock SHUSA will assign the call to Santander which will exercise the call and then contribute the shares to SHUSA. Santander will also contribute approximately $900MM in capital to SHUSA to fund the acquisition of shares by SHUSA SHUSA’s ownership of SCUSA will increase from approximately 59% to 69% upon the completion of this transaction SHUSA’s CET1 capital ratio is projected to improve by ~50bps from the transaction Transaction currently awaiting regulatory approval 1SHUSA and SC Form 8-Ks dated July 2, 2015 2SC press release dated July 2, 2015

21 Federal Reserve Written Agreement1 On July 7, 2015, the Federal Reserve published a written agreement executed with SHUSA (the “Written Agreement”) dated July 2, 2015 Under the terms of the Written Agreement, the Company is required, among other things, to improve Board oversight of the consolidated organization, risk management, capital planning and liquidity risk management The deficiencies noted in the Written Agreement are consistent with the Federal Reserve’s qualitative comments on SHUSA’s capital plan and with the deficiencies noted by SHUSA in its Form 8-K published on November 7, 2014 regarding a future enforcement action The Written Agreement does not affect SHUSA’s ability to conduct regular business, to service its debt, or to grow organically 1SHUSA Form 8-K published July 7, 2015

22 Federal Reserve Written Agreement: SHUSA Actions SHUSA has developed plans to address the key issues identified in the Agreement. SHUSA is on track in implementing those plans to meet the requirements of the Agreement SHUSA has strengthened its management team and Board, governance, and its approach to regulatory challenges: SHUSA has named a new non-executive chairman and independent directors with experience in large U.S. financial institutions and regulatory matters have been added to the Board and the Boards of SBNA and SC Executive teams at SHUSA, SBNA, and SC have been re-enforced with experienced leaders. SHUSA has launched the Capital and Risk Transformation (CART) project. This brings under one management structure SHUSA’s many initiatives to make foundational changes in risk management, finance and technology This will be a multi-year effort and will enable SHUSA to manage its businesses in a more disciplined way consistent with regulatory expectations

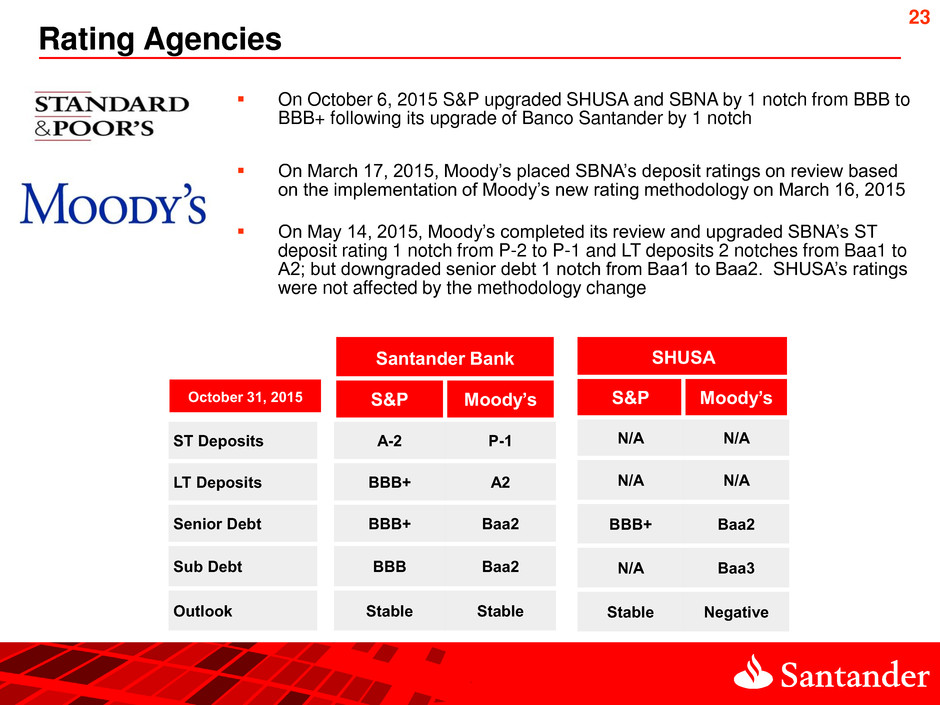

23 Rating Agencies Santander Bank Te S&P Moody’s ST Deposits A-2 P-1 LT Deposits BBB+ A2 Senior Debt BBB+ Baa2 Sub Debt BBB Baa2 Outlook Stable Stable SHUSA S&P Moody’s N/A N/A N/A N/A BBB+ Baa2 N/A Baa3 Stable Negative On October 6, 2015 S&P upgraded SHUSA and SBNA by 1 notch from BBB to BBB+ following its upgrade of Banco Santander by 1 notch On March 17, 2015, Moody’s placed SBNA’s deposit ratings on review based on the implementation of Moody’s new rating methodology on March 16, 2015 On May 14, 2015, Moody’s completed its review and upgraded SBNA’s ST deposit rating 1 notch from P-2 to P-1 and LT deposits 2 notches from Baa1 to A2; but downgraded senior debt 1 notch from Baa1 to Baa2. SHUSA’s ratings were not affected by the methodology change October 31, 2015

Appendix

25 Quarterly Trended Statement of Operations (US $ Millions) 3Q14 4Q14 1Q15 2Q15 3Q15 Interest income 1,895$ 1,875$ 1,933$ 2,060$ 1,983$ Interest expense 270 278 279 298 300 Net interest income 1,625 1,597 1,654 1,762 1,683 Fees & other income 649 720 663 793 836 Equity investment expense (5) - (7) - 2 Other non interest income - 16 10 10 (2) Net revenue 2,269 2,333 2,320 2,565 2,519 G&A expense (920) (1,020) (1,050) (1,144) (1,211) Other expenses (41) (144) (33) (30) (30) Provisions for credit losses (1,013) (810) (872) (1,002) (854) Income before taxes 295 360 365 389 424 Income tax expense (36) (127) (113) (120) (242) Net income 259$ 232$ 252$ 269$ 182$ 3Q14 4Q14 1Q15 2Q15 3Q15 Net interest margin 7.21% 7.00% 7.20% 7.26% 6.52%

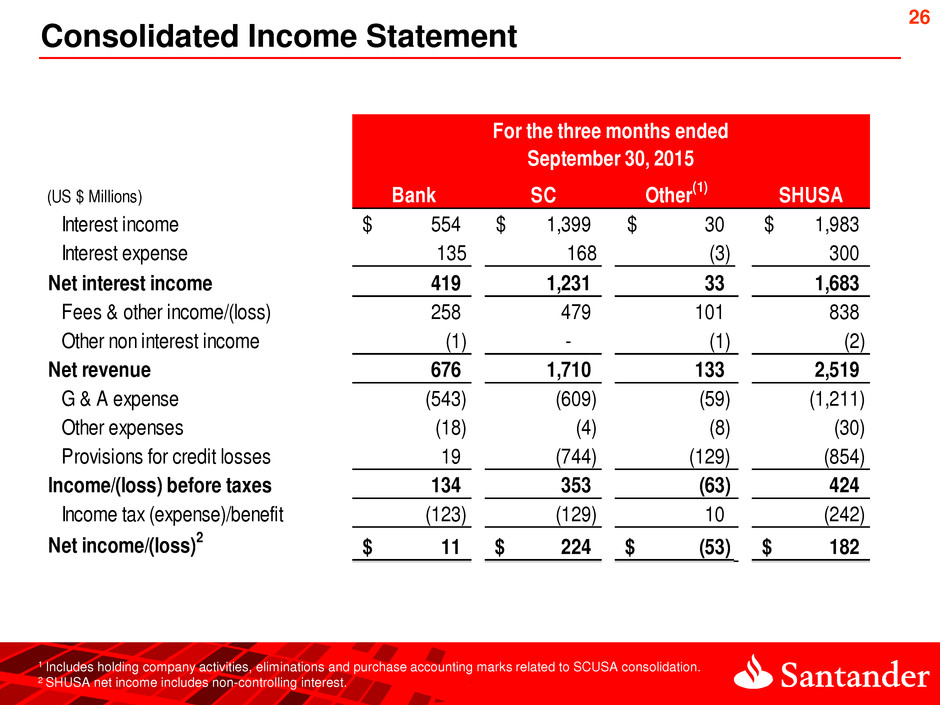

26 Consolidated Income Statement 1 Includes holding company activities, eliminations and purchase accounting marks related to SCUSA consolidation. 2 SHUSA net income includes non-controlling interest. (US $ Millions) Bank Interest income 554$ 1,399$ 30$ 1,983$ Interest expense 135 168 (3) 300 Net interest income 419 1,231 33 1,683 Fees & other income/(loss) 258 479 101 838 Other non interest income (1) - (1) (2) Net revenue 676 1,710 133 2,519 G & A expense (543) (609) (59) (1,211) Other expenses (18) (4) (8) (30) Provisions for credit losses 19 (744) (129) (854) Income/(loss) before taxes 134 353 (63) 424 Income tax (expense)/benefit (123) (129) 10 (242) Net income/(loss) 2 11$ 224$ (53)$ 182$ SC SHUSA For the three months ended September 30, 2015 Other (1)

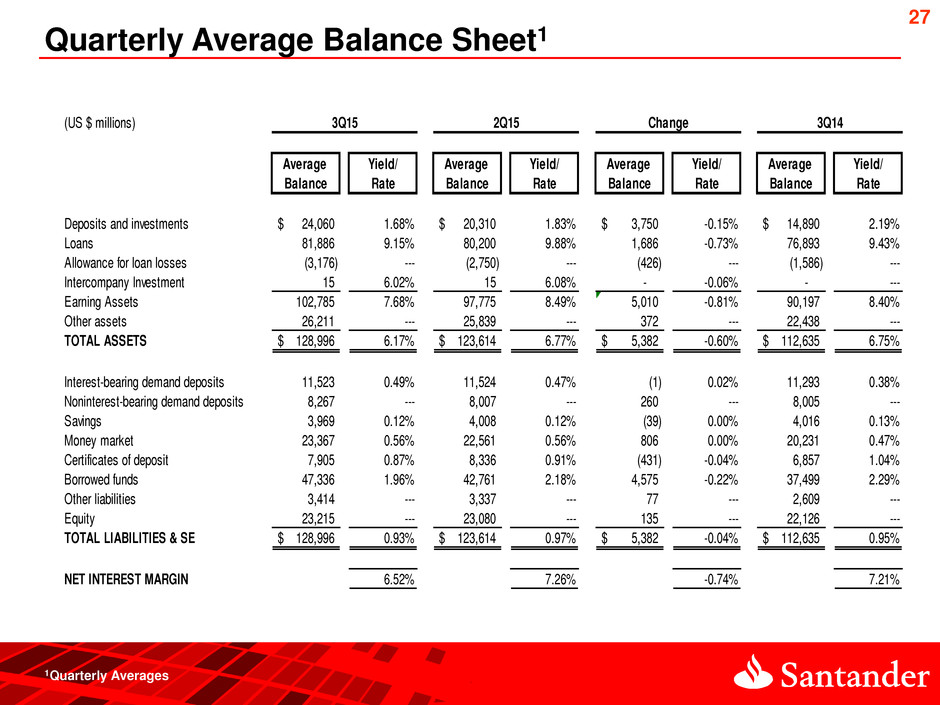

27 Quarterly Average Balance Sheet1 1Quarterly Averages (US $ millions) Average Yield/ Average Yield/ Average Yield/ Average Yield/ Balance Rate Balance Rate Balance Rate Balance Rate Deposits and investments 24,060$ 1.68% 20,310$ 1.83% 3,750$ -0.15% 14,890$ 2.19% Loans 81,886 9.15% 80,200 9.88% 1,686 -0.73% 76,893 9.43% Allowance for loan losses (3,176) --- (2,750) --- (426) --- (1,586) --- Intercompany Investment 15 6.02% 15 6.08% - -0.06% - --- Earning Assets 102,785 7.68% 97,775 8.49% 5,010 -0.81% 90,197 8.40% Other assets 26,211 --- 25,839 --- 372 --- 22,438 --- TOTAL ASSETS 128,996$ 6.17% 123,614$ 6.77% 5,382$ -0.60% 112,635$ 6.75% Interest-bearing demand deposits 11,523 0.49% 11,524 0.47% (1) 0.02% 11,293 0.38% Noninterest-bearing demand deposits 8,267 --- 8,007 --- 260 --- 8,005 --- Savings 3,969 0.12% 4,008 0.12% (39) 0.00% 4,016 0.13% Money market 23,367 0.56% 22,561 0.56% 806 0.00% 20,231 0.47% Certificates of deposit 7,905 0.87% 8,336 0.91% (431) -0.04% 6,857 1.04% Borrowed funds 47,336 1.96% 42,761 2.18% 4,575 -0.22% 37,499 2.29% Other liabilities 3,414 --- 3,337 --- 77 --- 2,609 --- Equity 23,215 --- 23,080 --- 135 --- 22,126 --- TOTAL LIABILITIES & SE 128,996$ 0.93% 123,614$ 0.97% 5,382$ -0.04% 112,635$ 0.95% NET INTEREST MARGIN 6.52% 7.26% -0.74% 7.21% 3Q15 2Q15 Change 3Q14

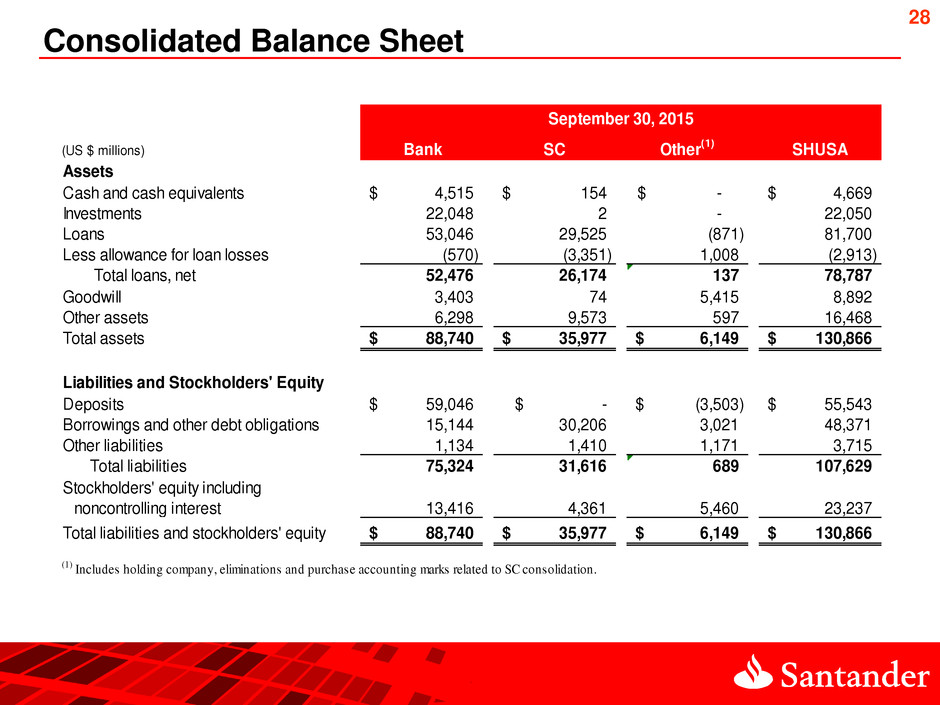

28 Consolidated Balance Sheet (US $ millions) Bank SC Other (1) SHUSA Assets Cash and cash equivalents 4,515$ 154$ -$ 4,669$ Investments 22,048 2 - 22,050 Loans 53,046 29,525 (871) 81,700 Less allowance for loan losses (570) (3,351) 1,008 (2,913) Total loans, net 52,476 26,174 137 78,787 Goodwill 3,403 74 5,415 8,892 Other assets 6,298 9,573 597 16,468 Total assets 88,740$ 35,977$ 6,149$ 130,866$ Liabilities and Stockholders' Equity Deposits 59,046$ $ - (3,503)$ 55,543$ Borrowings and other debt obligations 15,144 30,206 3,021 48,371 Other liabilities 1,134 1,410 1,171 3,715 Total liabilities 75,324 31,616 689 107,629 Stockholders' equity including noncontrolling interest 13,416 4,361 5,460 23,237 Total liabilities and stockholders' equity 88,740$ 35,977$ 6,149$ 130,866$ (1) Includes holding company, eliminations and purchase accounting marks related to SC consolidation. September 30, 2015

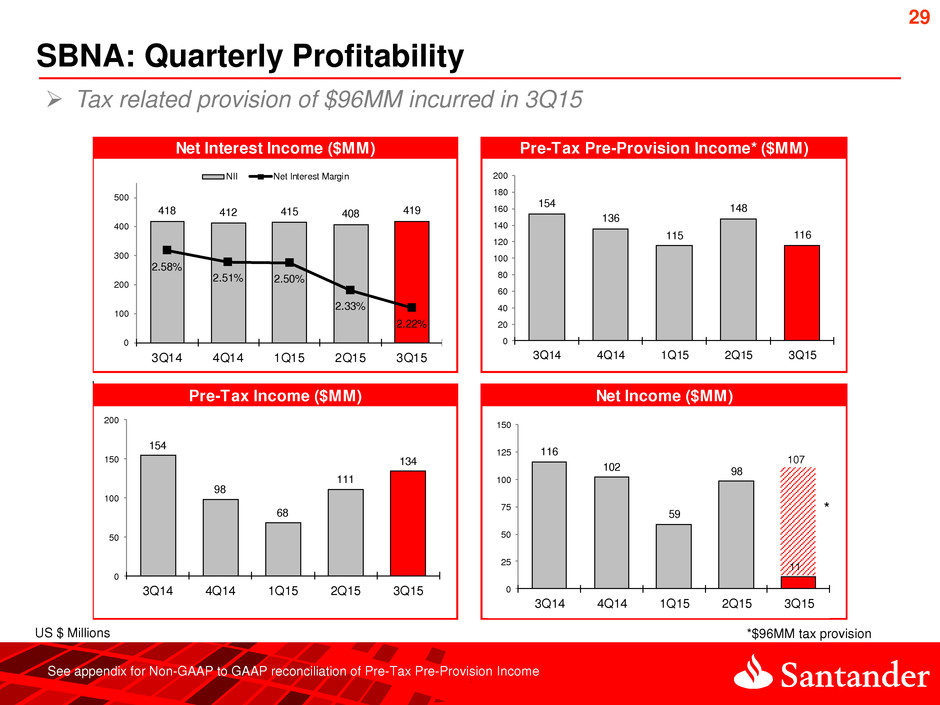

29 SBNA: Quarterly Profitability US $ Millions See appendix for Non-GAAP to GAAP reconciliation of Pre-Tax Pre-Provision Income Net Interest Income ($MM) Pre-Tax Pre-Provision Income* ($MM) Pre-Tax Income ($MM) Net Income ($MM) 154 136 115 148 116 0 20 40 60 80 100 120 140 160 180 200 3Q14 4Q14 1Q15 2Q15 3Q15 418 412 415 408 419 2.58% 2.51% 2.50% 2.33% 2.22% 0 100 200 300 400 500 3Q14 4Q14 1Q15 2Q15 3Q15 NII Net Interest Margin 154 98 68 111 134 0 50 100 150 200 3Q14 4Q14 1Q15 2Q15 3Q15 116 102 59 98 11 0 25 50 75 100 125 150 3Q14 4Q14 1Q15 2Q15 3Q15 107 11 Tax related provision of $96MM incurred in 3Q15 *$96MM tax provision *

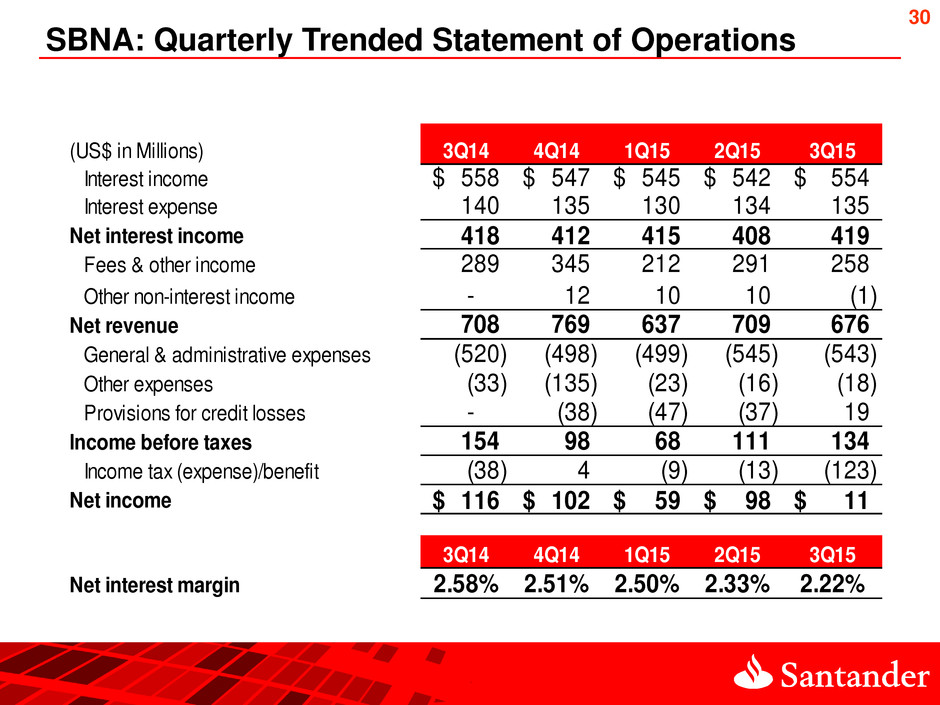

30 SBNA: Quarterly Trended Statement of Operations (US$ in Millions) 3Q14 4Q14 1Q15 2Q15 3Q15 Interest income 558$ 547$ 545$ 542$ 554$ Interest expense 140 135 130 134 135 Net interest income 418 412 415 408 419 Fees & other income 289 345 212 291 258 Other non-interest income - 12 10 10 (1) Net revenue 708 769 637 709 676 General & administrative expenses (520) (498) (499) (545) (543) Other expenses (33) (135) (23) (16) (18) Provisions for credit losses - (38) (47) (37) 19 Income before taxes 154 98 68 111 134 Income tax (expense)/benefit (38) 4 (9) (13) (123) Net income 116$ 102$ 59$ 98$ 11$ 3Q14 4Q14 1Q15 2Q15 3Q15 Net interest margin 2.58% 2.51% 2.50% 2.33% 2.22%

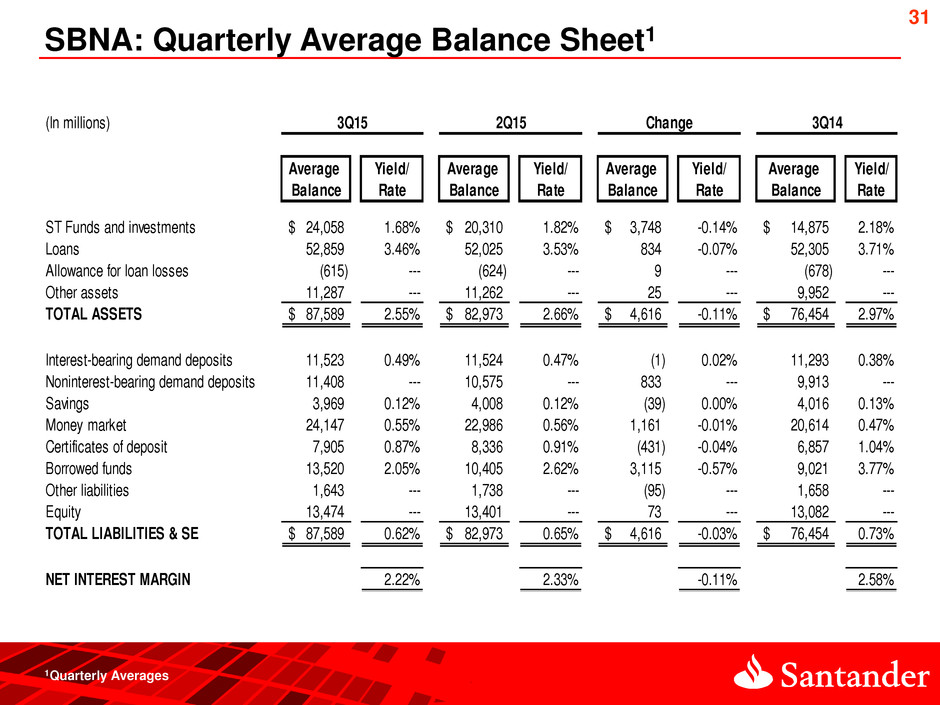

31 SBNA: Quarterly Average Balance Sheet1 1Quarterly Averages (In millions) Average Yield/ Average Yield/ Average Yield/ Average Yield/ Balance Rate Balance Rate Balance Rate Balance Rate ST Funds and investments 24,058$ 1.68% 20,310$ 1.82% 3,748$ -0.14% 14,875$ 2.18% Loans 52,859 3.46% 52,025 3.53% 834 -0.07% 52,305 3.71% Allowance for loan losses (615) --- (624) --- 9 --- (678) --- Other assets 11,287 --- 11,262 --- 25 --- 9,952 --- TOTAL ASSETS 87,589$ 2.55% 82,973$ 2.66% 4,616$ -0.11% 76,454$ 2.97% Interest-bearing demand deposits 11,523 0.49% 11,524 0.47% (1) 0.02% 11,293 0.38% Noninterest-bearing demand deposits 11,408 --- 10,575 --- 833 --- 9,913 --- Savings 3,969 0.12% 4,008 0.12% (39) 0.00% 4,016 0.13% Money market 24,147 0.55% 22,986 0.56% 1,161 -0.01% 20,614 0.47% Certificates of deposit 7,905 0.87% 8,336 0.91% (431) -0.04% 6,857 1.04% Borrowed funds 13,520 2.05% 10,405 2.62% 3,115 -0.57% 9,021 3.77% Other liabilities 1,643 --- 1,738 --- (95) --- 1,658 --- Equity 13,474 --- 13,401 --- 73 --- 13,082 --- TOTAL LIABILITIES & SE 87,589$ 0.62% 82,973$ 0.65% 4,616$ -0.03% 76,454$ 0.73% NET INTEREST MARGIN 2.22% 2.33% -0.11% 2.58% 3Q15 3Q142Q15 Change

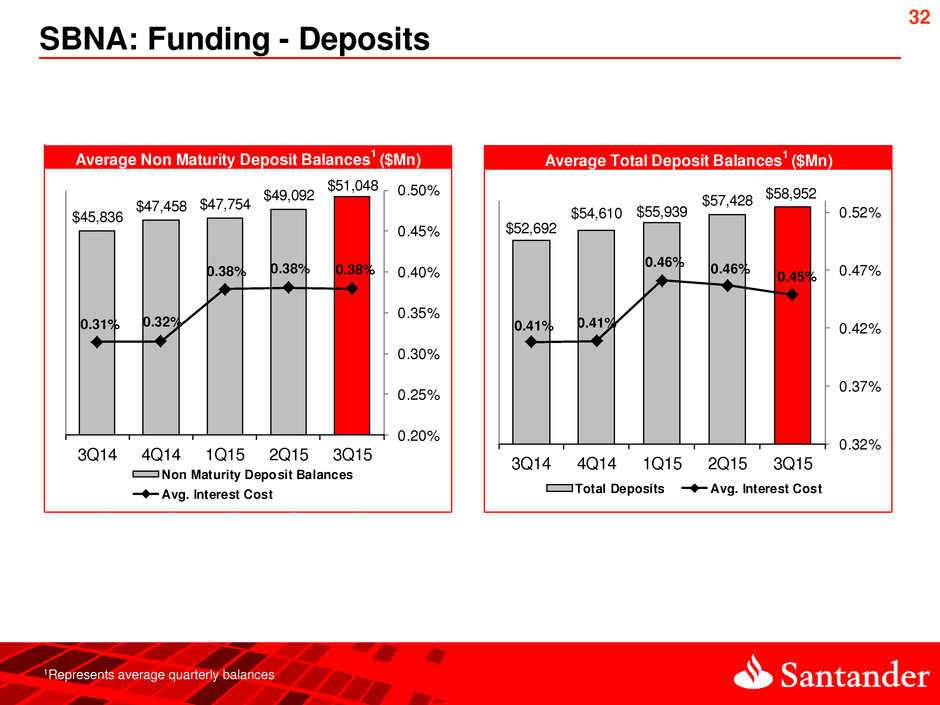

32 SBNA: Funding - Deposits 1Represents average quarterly balances Average Non Maturity Deposit Balances 1 ($Mn) $45,836 $47,458 $47,754 $49,092 $51,048 0.31% 0.32% 0.38% 0.38% 0.38% 0.20% 0.25% 0.30% 0.35% 0.40% 0.45% 0.50% 3Q14 4Q14 1Q15 2Q15 3Q15 Non Maturity Deposit Balances Avg. Interest Cost Average Total Deposit Balances 1 ($Mn) $52,692 $54,610 $55,939 $57,428 $58,952 0.41% 0.41% 0.46% 0.46% 0.45% 0.32% 0.37% 0.42% 0.47% 0.52% 3Q14 4Q14 1Q15 2Q15 3Q15 Total Deposits Avg. Interest Cost

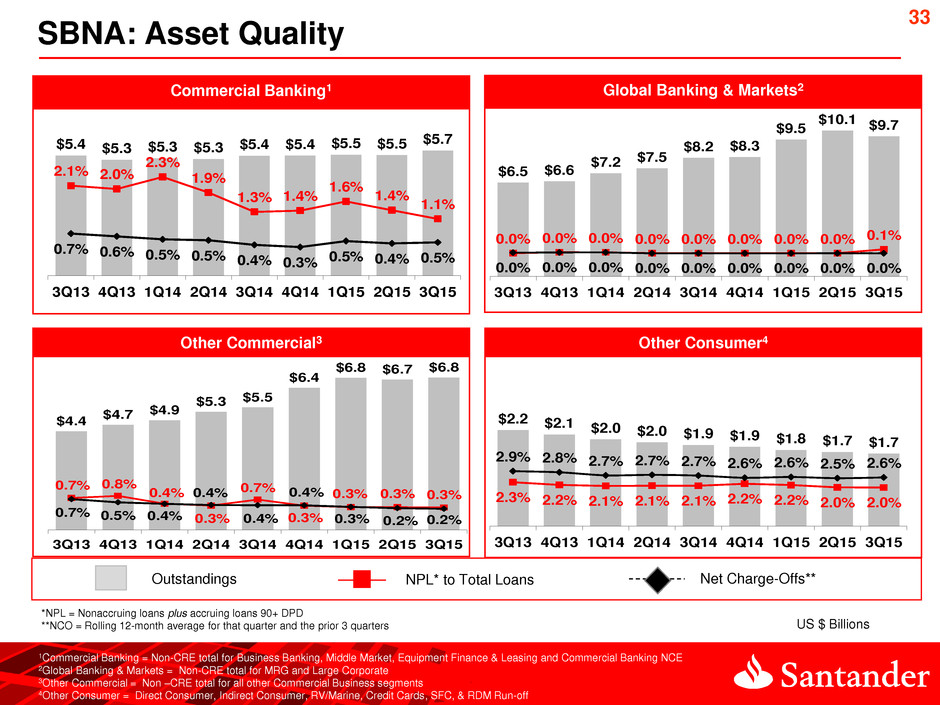

33 Global Banking & Markets2 Commercial Banking1 Other Consumer4 Other Commercial3 Outstandings NPL* to Total Loans Net Charge-Offs** SBNA: Asset Quality US $ Billions 1Commercial Banking = Non-CRE total for Business Banking, Middle Market, Equipment Finance & Leasing and Commercial Banking NCE 2Global Banking & Markets = Non-CRE total for MRG and Large Corporate 3Other Commercial = Non –CRE total for all other Commercial Business segments 4Other Consumer = Direct Consumer, Indirect Consumer, RV/Marine, Credit Cards, SFC, & RDM Run-off $5.4 $5.3 $5.3 $5.3 $5.4 $5.4 $5.5 $5.5 $5.7 2.1% 2.0% 2.3% 1.9% 1.3% 1.4% 1.6% 1.4% 1.1% 0.7% 0.6% 0.5% 0.5% 0.4% 0.3% 0.5% 0.4% 0.5% 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 $6.5 $6.6 $7.2 $7.5 $8.2 $8.3 $9.5 $10.1 $9.7 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.1% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 3Q 3 4Q13 1Q14 2Q14 3Q 4 4Q14 1Q15 2Q15 3Q15 $4.4 $4.7 $4.9 $5.3 $5.5 $6.4 $6.8 $6.7 $6.8 0.7% 0.8% 0.4% 0.3% 0.7% 0.3% 0.3% 0.3% 0.3% 0.7% 0.5% 0.4% 0.4% 0.4% 0.4% 0.3% 0.2% 0.2% 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 $2.2 $2.1 $2.0 $2.0 $1.9 $1.9 $1.8 $1.7 $1.7 2.3% 2.2% 2.1% 2.1% 2.1% 2.2% 2.2% 2.0% 2.0% 2 9 2 8 2.7 2.7 2.7 2.6 2.6 2.5 2.6 3Q13 4Q13 Q14 2Q14 3Q14 4Q14 Q15 2Q15 3Q15 *NPL = Nonaccruing loans plus accruing loans 90+ DPD **NCO = Rolling 12-month average for that quarter and the prior 3 quarters

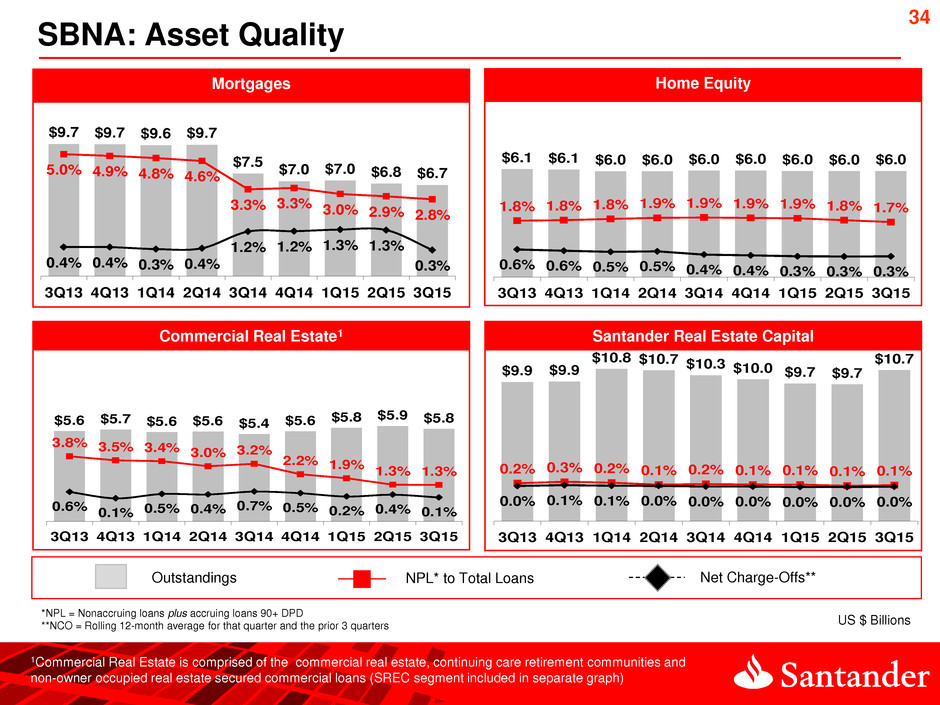

34 Santander Real Estate Capital Commercial Real Estate1 Home Equity Mortgages Outstandings NPL* to Total Loans Net Charge-Offs** SBNA: Asset Quality US $ Billions 1Commercial Real Estate is comprised of the commercial real estate, continuing care retirement communities and non-owner occupied real estate secured commercial loans (SREC segment included in separate graph) $9.7 $9.7 $9.6 $9.7 $7.5 $7.0 $7.0 $6.8 $6.75.0% 4.9% 4.8% 4.6% 3.3% 3.3% 3.0% 2.9% 2.8% 0.4% 0.4% 0.3% 0.4% 1.2% 1.2% 1.3% 1.3% 0.3% 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 $6.1 $6.1 $6.0 $6.0 $6.0 $6.0 $6.0 $6.0 $6.0 1.8% 1.8% 1.8% 1.9% 1.9% 1.9% 1.9% 1.8% 1.7% 0.6% 0.6% 0.5% 0.5% 0.4% 0.4% 0.3% 0.3% 0.3% 3Q 3 4Q13 Q14 2Q14 3Q 4 4Q14 Q15 2Q15 3Q15 $5.6 $5.7 $5.6 $5.6 $5.4 $5.6 $5.8 $5.9 $5.8 3 8 3.5 3.4 3.0% 3.2% 2.2% 1.9% 1.3% 1.3% 0.6% 0.1% 0.5% 0.4% 0.7% 0.5% 0.2% 0.4% 0.1% 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 $9.9 $9.9 $10.8 $10.7 $10.3 $10.0 $9.7 $9.7 $10.7 0.2% 0.3% 0.2% 0.1% 0.2% 0.1% 0.1% 0.1% 0.1% 0.0% 0.1% 0.1% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 3Q 3 4Q13 1Q14 2Q14 3Q 4 4Q14 1Q15 2Q15 3Q15 *NPL = Nonaccruing loans plus accruing loans 90+ DPD **NCO = Rolling 12-month average for that quarter and the prior 3 quarters

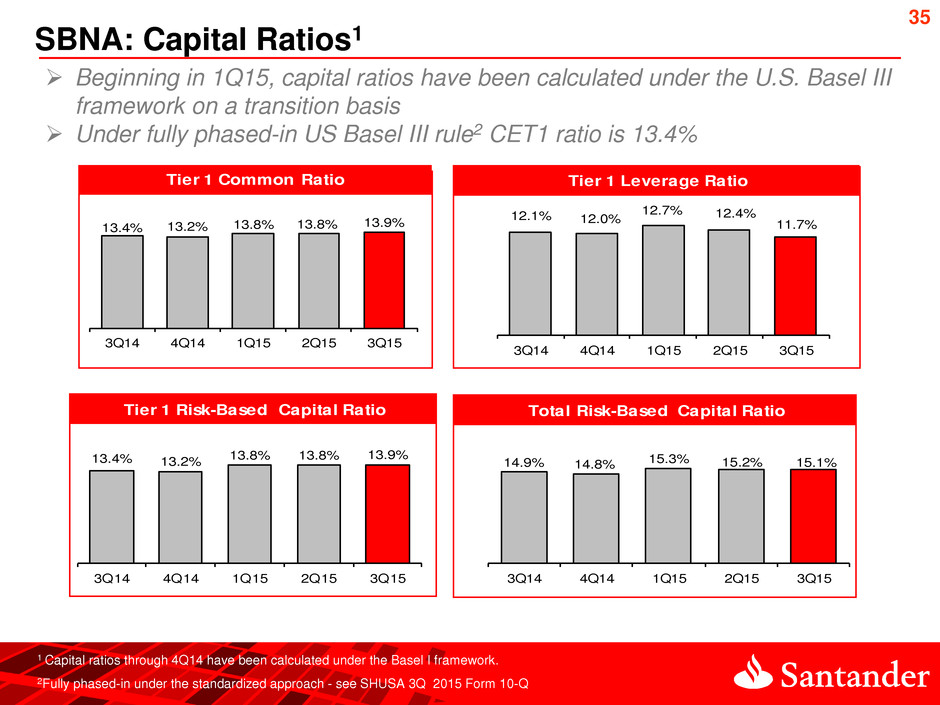

35 SBNA: Capital Ratios1 1 Capital ratios through 4Q14 have been calculated under the Basel I framework. 2Fully phased-in under the standardized approach - see SHUSA 3Q 2015 Form 10-Q Beginning in 1Q15, capital ratios have been calculated under the U.S. Basel III framework on a transition basis Under fully phased-in US Basel III rule2 CET1 ratio is 13.4% 13.4% 13.2% 13.8% 13.8% 13.9% 3Q14 4Q14 1Q15 2Q15 3Q15 13.4% 13.2% 13.8% 13.8% 13.9% 3Q14 4Q14 1Q15 2Q15 3Q15 12.1% 12.0% 12.7% 12.4% 11.7% 3Q14 4Q14 1Q15 2Q15 3Q15 14.9% 14.8% 15.3% 15.2% 15.1% 3Q14 4Q14 1Q15 2Q15 3Q15 Tier 1 Common Ratio Tier 1 Leverage Ratio Tier 1 Risk-Based Capital Ratio Total Risk-Based Capital Ratio

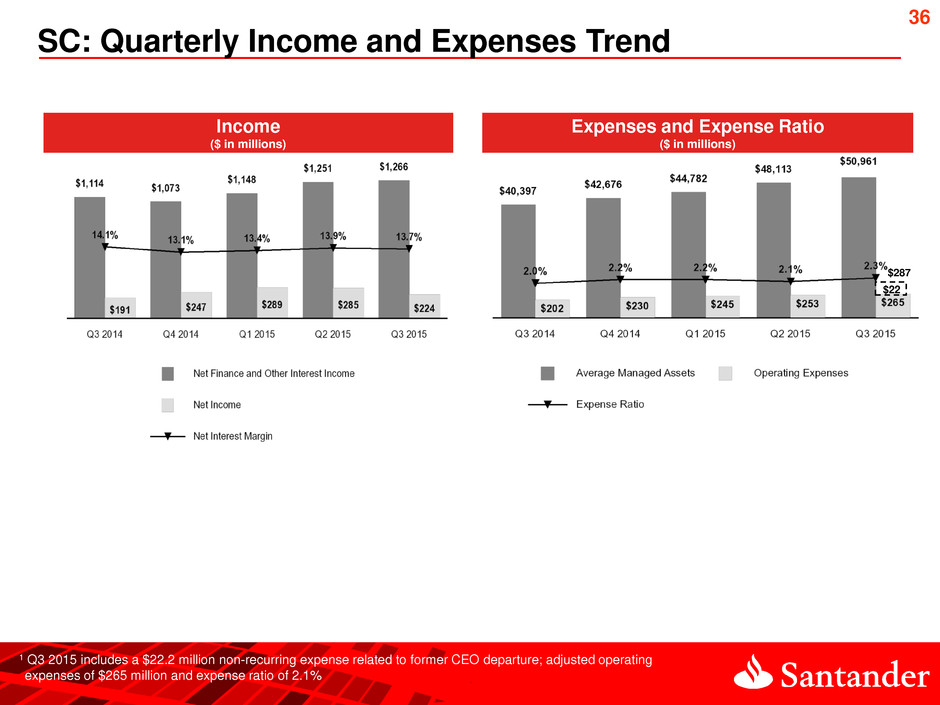

36 SC: Quarterly Income and Expenses Trend Expenses and Expense Ratio ($ in millions) Income ($ in millions) $287 1 Q3 2015 includes a $22.2 million non-recurring expense related to former CEO departure; adjusted operating expenses of $265 million and expense ratio of 2.1% $22

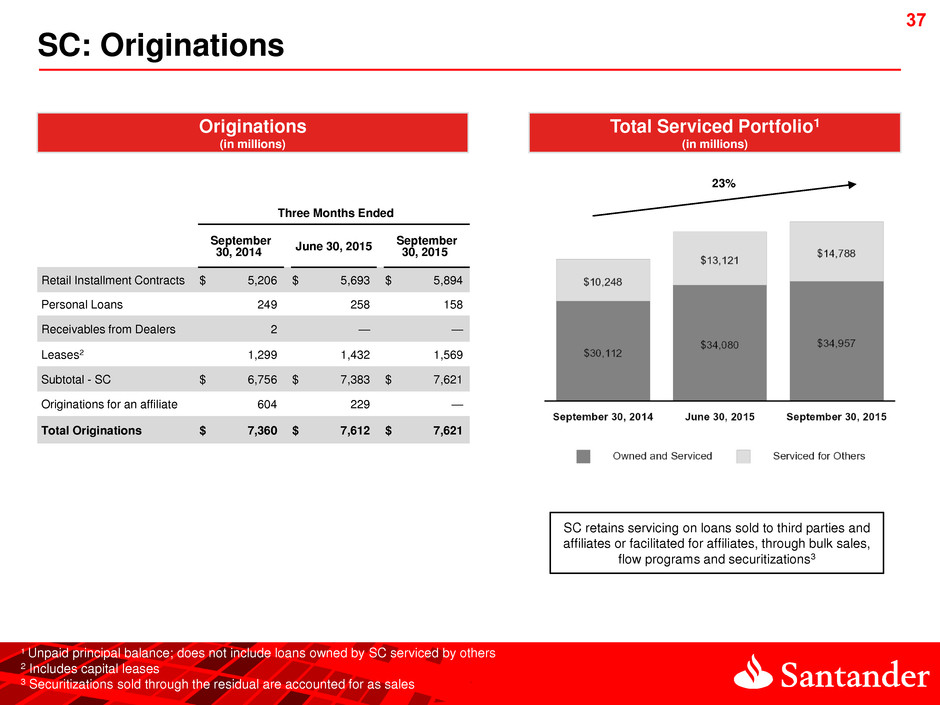

37 SC: Originations Total Serviced Portfolio1 (in millions) Originations (in millions) Three Months Ended September 30, 2014 June 30, 2015 September 30, 2015 Retail Installment Contracts $ 5,206 $ 5,693 $ 5,894 Personal Loans 249 258 158 Receivables from Dealers 2 — — Leases2 1,299 1,432 1,569 Subtotal - SC $ 6,756 $ 7,383 $ 7,621 Originations for an affiliate 604 229 — Total Originations $ 7,360 $ 7,612 $ 7,621 23% SC retains servicing on loans sold to third parties and affiliates or facilitated for affiliates, through bulk sales, flow programs and securitizations3 1 Unpaid principal balance; does not include loans owned by SC serviced by others 2 Includes capital leases 3 Securitizations sold through the residual are accounted for as sales

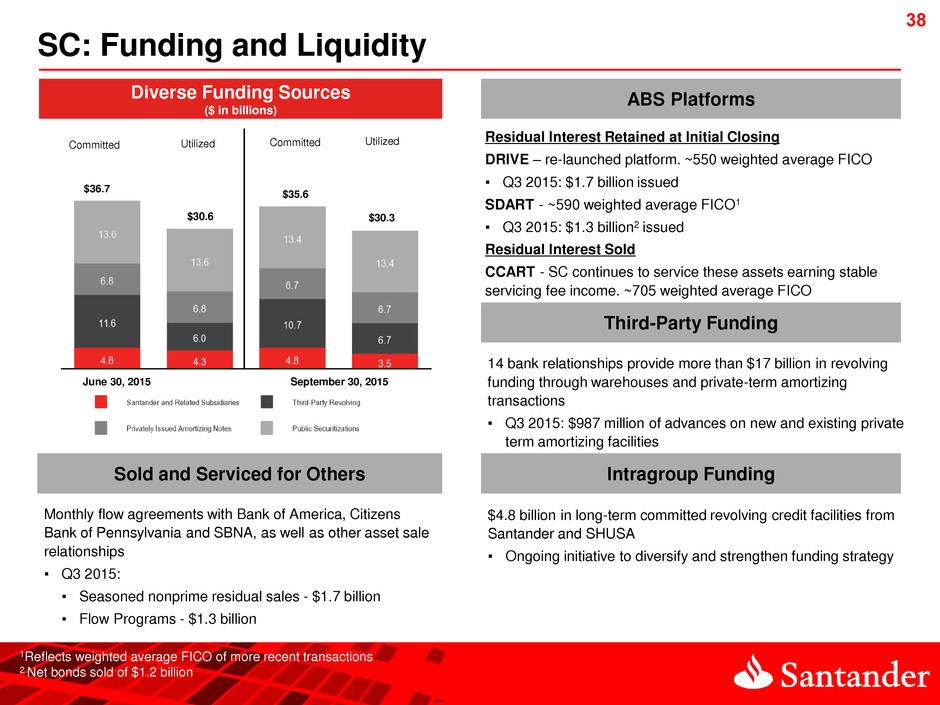

38 SC: Funding and Liquidity $4.8 billion in long-term committed revolving credit facilities from Santander and SHUSA ▪ Ongoing initiative to diversify and strengthen funding strategy Diverse Funding Sources ($ in billions) 1Reflects weighted average FICO of more recent transactions 2 Net bonds sold of $1.2 billion Committed Utilized Monthly flow agreements with Bank of America, Citizens Bank of Pennsylvania and SBNA, as well as other asset sale relationships ▪ Q3 2015: ▪ Seasoned nonprime residual sales - $1.7 billion ▪ Flow Programs - $1.3 billion Committed Utilized $36.7 $30.6 September 30, 2015 June 30, 2015 Sold and Serviced for Others $35.6 $30.3 ABS Platforms Residual Interest Retained at Initial Closing DRIVE – re-launched platform. ~550 weighted average FICO ▪ Q3 2015: $1.7 billion issued SDART - ~590 weighted average FICO1 ▪ Q3 2015: $1.3 billion2 issued Residual Interest Sold CCART - SC continues to service these assets earning stable servicing fee income. ~705 weighted average FICO Third-Party Funding 14 bank relationships provide more than $17 billion in revolving funding through warehouses and private-term amortizing transactions ▪ Q3 2015: $987 million of advances on new and existing private term amortizing facilities Intragroup Funding

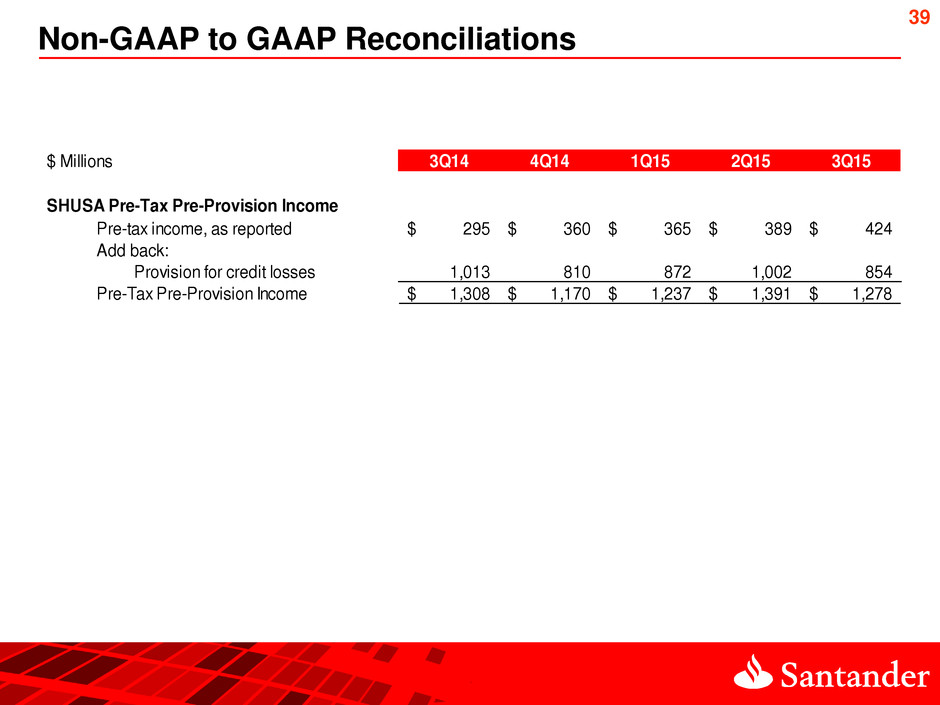

39 Non-GAAP to GAAP Reconciliations $ Millions 3Q14 4Q14 1Q15 2Q15 3Q15 SHUSA Pre-Tax Pre-Provision Income Pre-tax income, as reported 295$ 360$ 365$ 389$ 424$ Add back: Provision for credit losses 1,013 810 872 1,002 854 Pre-Tax Pre-Provision Income 1,308$ 1,170$ 1,237$ 1,391$ 1,278$

40 Basel III ratios on a transition basis under the standardized approach starting in 1Q15 $ Millions 3Q14 4Q14 1Q15 2Q15 3Q15 Tier 1 Common to Risk-Weighted Assets Tier 1 Common 10,674$ 10,853$ 12,912$ 13,037$ 13,199$ Risk-Weighted Assets 96,976 100,185 108,946 109,315 109,173 Ratio 11.0% 10.8% 11.9% 11.9% 12.1% Tier 1 Leverage Tier 1 Capital 12,661$ 12,897$ 14,333$ 14,608$ 14,678$ 103,389 105,932 112,748 117,917 123,129 Ratio 12.2% 12.2% 12.7% 12.4% 11.9% Tier 1 Risk-Based Tier 1 Capital 12,661$ 12,897$ 14,333$ 14,608$ 14,678$ Risk-Weighted Assets 96,976 100,185 108,946 109,315 109,173 Ratio 13.1% 12.9% 13.2% 13.4% 13.4% Total Risk-Based Risk-Based Capital 14,535$ 14,848$ 16,460$ 16,671$ 16,710$ Risk-Weighted Assets 96,976 100,185 108,946 109,315 109,173 Ratio 15.0% 14.8% 15.1% 15.3% 15.3% Average total assets for leverage capital Non-GAAP to GAAP Reconciliations (cont.)

41 $ Millions 3Q14 4Q14 1Q15 2Q15 3Q15 Santander Bank Texas Ratio Total Equity 13,068$ 13,192$ 13,315$ 13,330$ 13,416$ Less: Goodwill and Other Intangibles (excluding MSRs) (3,725) (3,728) (3,527) (3,709) (3,717) Preferred Stock - - - - - Add: Allowance for loan losses 585 610 629 615 570 Tangible Common Equity 9,928$ 10,074$ 10,417$ 10,236$ 10,269$ Nonperforming Assets 780$ 683$ 641$ 551$ 536$ 90+ DPD accruing 2 2 2 2 3 Accruing TDRs 285 329 321 313 268 Total Nonperforming Assets 1,067$ 1,014$ 964$ 866$ 807$ Texas Ratio 10.8% 10.1% 9.3% 8.5% 7.9% SBNA: Non-GAAP to GAAP Reconciliations

42 $ Millions 3Q14 4Q14 1Q15 2Q15 3Q15 Santander Bank Pre-Tax Pre-Provision Income Pre-tax income, as reported 154$ 98$ 68$ 111$ 134$ Add back: Provision for credit losses - 38 47 37 (19) Pre-Tax Pre-Provision Income 154$ 136$ 115$ 148$ 116$ SBNA: Non-GAAP to GAAP Reconciliations (cont.)

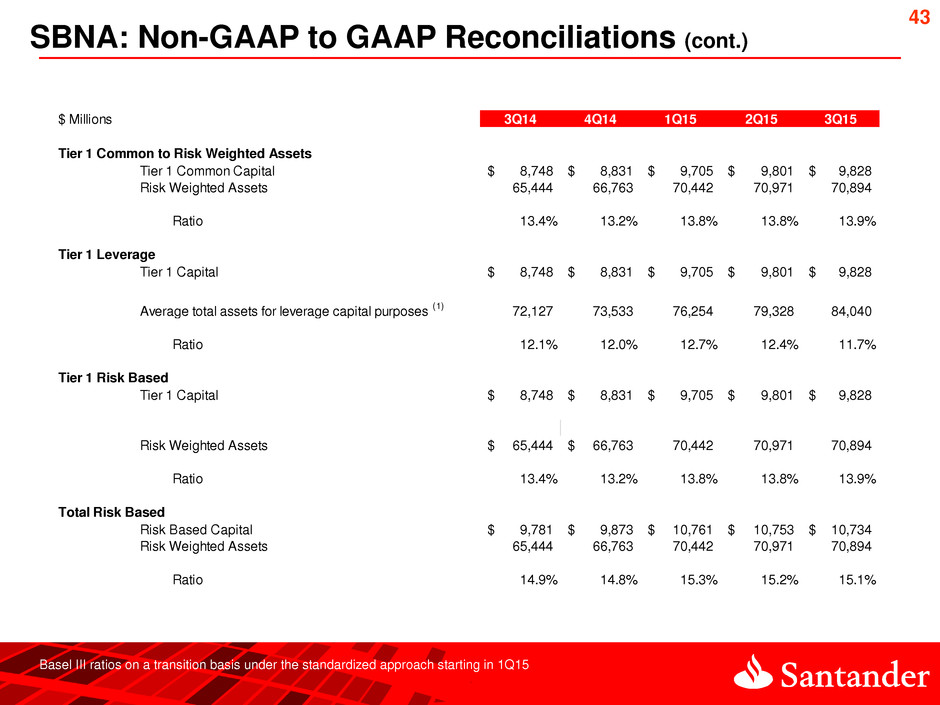

43 Basel III ratios on a transition basis under the standardized approach starting in 1Q15 $ Millions 3Q14 4Q14 1Q15 2Q15 3Q15 Tier 1 Common to Risk Weighted Assets Tier 1 Common Capital 8,748$ 8,831$ 9,705$ 9,801$ 9,828$ Risk Weighted Assets 65,444 66,763 70,442 70,971 70,894 Ratio 13.4% 13.2% 13.8% 13.8% 13.9% Tier 1 Leverage Tier 1 Capital 8,748$ 8,831$ 9,705$ 9,801$ 9,828$ 72,127 73,533 76,254 79,328 84,040 Ratio 12.1% 12.0% 12.7% 12.4% 11.7% Tier 1 Risk Based Tier 1 Capital 8,748$ 8,831$ 9,705$ 9,801$ 9,828$ Risk Weighted Assets 65,444$ 66,763$ 70,442 70,971 70,894 Ratio 13.4% 13.2% 13.8% 13.8% 13.9% Total Risk Based Risk Based Capital 9,781$ 9,873$ 10,761$ 10,753$ 10,734$ Risk Weighted Assets 65,444 66,763 70,442 70,971 70,894 Ratio 14.9% 14.8% 15.3% 15.2% 15.1% Average total assets for leverage capital purposes (1) SBNA: Non-GAAP to GAAP Reconciliations (cont.)