Attached files

| file | filename |

|---|---|

| EX-2.1 - EX-2.1 - ON SEMICONDUCTOR CORP | d46684dex21.htm |

| EX-10.1 - EX-10.1 - ON SEMICONDUCTOR CORP | d46684dex101.htm |

| EX-99.2 - EX-99.2 - ON SEMICONDUCTOR CORP | d46684dex992.htm |

| EX-99.1 - EX-99.1 - ON SEMICONDUCTOR CORP | d46684dex991.htm |

| EX-99.4 - EX-99.4 - ON SEMICONDUCTOR CORP | d46684dex994.htm |

| 8-K - 8-K - ON SEMICONDUCTOR CORP | d46684d8k.htm |

ON Semiconductor to Acquire Fairchild Semiconductor Investor Presentation November 18, 2015 Exhibit 99.3

Safe Harbor Statement, Non-GAAP Financial Measure & Confidentiality This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements related to the consummation and benefits of the acquisition by ON Semiconductor of Fairchild. These forward-looking statements are based on information available to ON Semiconductor and Fairchild as of the date of this communication and current expectations, forecasts and assumptions and involve a number of risks and uncertainties that could cause actual results to differ materially from those anticipated by these forward-looking statements. Such risks and uncertainties include a variety of factors, some of which are beyond the control of ON Semiconductor and Fairchild. In particular, such risks and uncertainties include, but are not limited to: the risk that one or more closing conditions to the transaction may not be satisfied or waived, on a timely basis or otherwise; the unsuccessful completion of the tender offer; the risk that the transaction does not close when anticipated, or at all, including the risk that the requisite regulatory approvals may not be obtained; matters arising in connection with the parties’ efforts to comply with and satisfy applicable regulatory approvals and closing conditions relating to the transaction; there may be a material adverse change of ON Semiconductor or Fairchild, or our respective businesses may suffer as a result of uncertainty surrounding the transaction; the transaction may involve unexpected costs, liabilities or delays; difficulties encountered in integrating Fairchild, including the potentially accretive and synergistic benefits; difficulties leveraging desired growth opportunities and markets; the possibility that expected benefits and cost savings may not materialize as expected; the prospect that the automotive and industrial sensor markets will not grow as rapidly as currently anticipated; the variable demand and the aggressive pricing environment for semiconductor products; the adverse impact of competitive product announcements; revenues and operating performance; changes in overall economic conditions and markets, including the current credit markets; the cyclical nature of the semiconductor industry; changes in demand for ON Semiconductor or Fairchild products; changes in inventories at customers and distributors; technological and product development risks; availability of raw materials; competitors’ actions; pricing and gross margin pressures; loss of key customers; order cancellations or reduced bookings; changes in manufacturing yields; control of costs and expenses; significant litigation, including with respect to intellectual property matters; risks associated with acquisitions and dispositions; risks associated with leverage and restrictive covenants in debt agreements; risks associated with international operations including foreign employment and labor matters associated with unions and collective bargaining agreements; the threat or occurrence of international armed conflict and terrorist activities both in the United States and internationally; changes in generally accepted accounting principles; risks related to new legal requirements; risks and costs associated with increased and new regulation of corporate governance and disclosure standards; and risks involving environmental or other governmental regulation. Information concerning additional factors that could cause results to differ materially from those projected in the forward-looking statements is contained in ON Semiconductor’s Annual Report on Form 10-K as filed with the SEC on February 27, 2015, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings of ON Semiconductor with the SEC. These forward-looking statements are as of the date hereof and should not be relied upon as representing our views as of any subsequent date and ON Semiconductor does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, except as required by law.

Compelling Strategic and Financial Rationale Creates a power management leader with strong capabilities in a rapidly consolidating industry Highly complementary product lines with minimal revenue overlap Compelling financial profile – Will drive significantly higher FCF1 with $150 million of annual synergies Immediately accretive to non-GAAP EPS and free cash flow Strengthened presence in focused strategic markets – Industrial, automotive & smartphone (1) FCF = Free Cash Flow

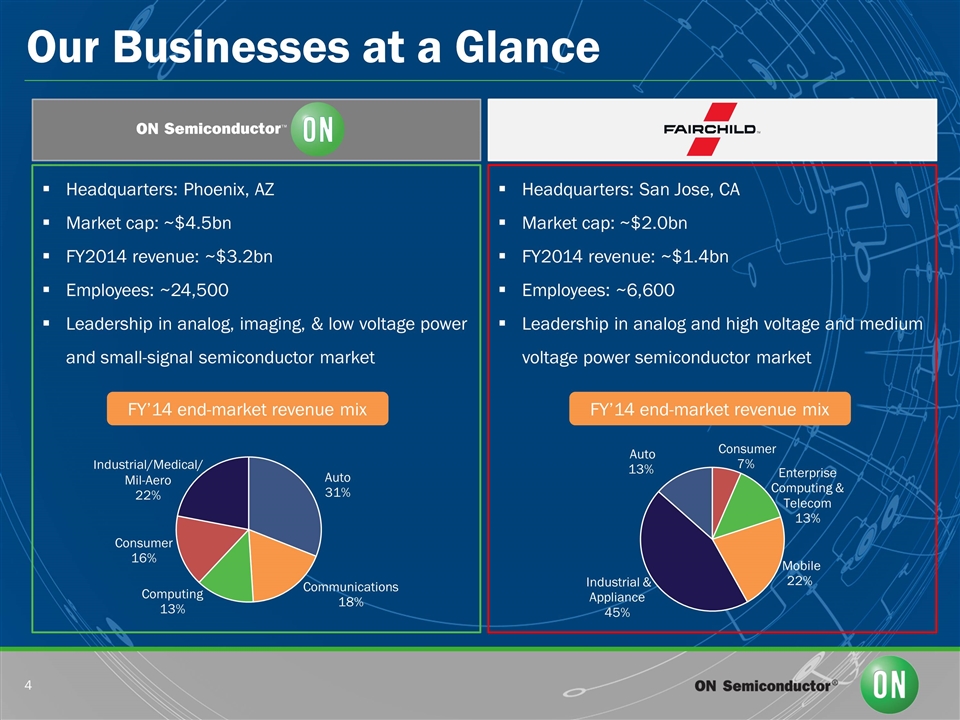

Our Businesses at a Glance Headquarters: Phoenix, AZ Market cap: ~$4.5bn FY2014 revenue: ~$3.2bn Employees: ~24,500 Leadership in analog, imaging, & low voltage power and small-signal semiconductor market Headquarters: San Jose, CA Market cap: ~$2.0bn FY2014 revenue: ~$1.4bn Employees: ~6,600 Leadership in analog and high voltage and medium voltage power semiconductor market FY’14 end-market revenue mix FY’14 end-market revenue mix

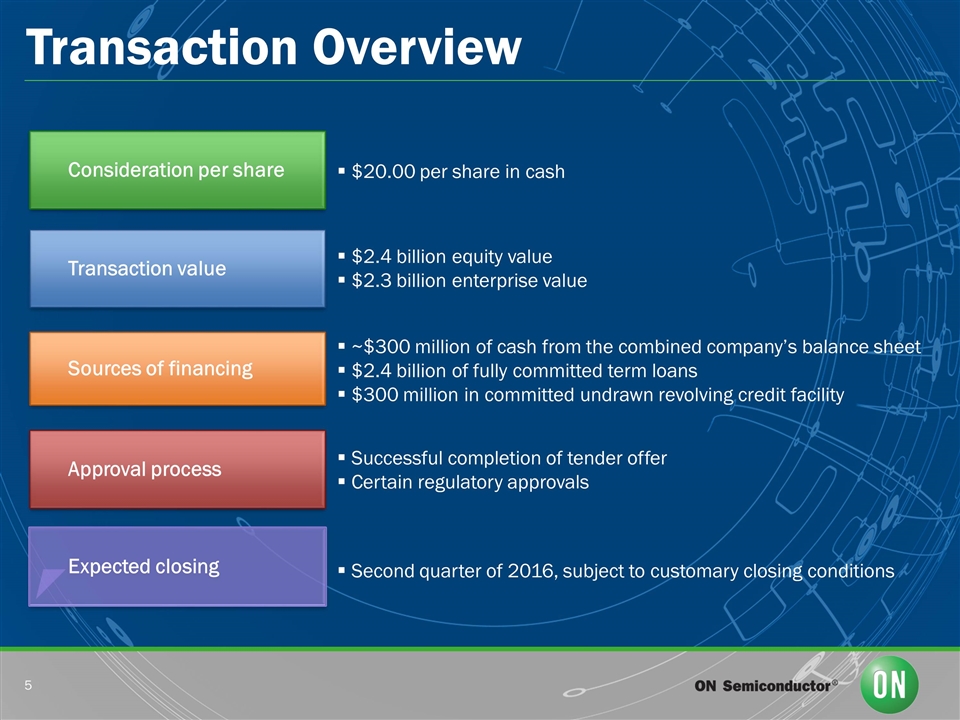

Transaction Overview Consideration per share $20.00 per share in cash Transaction value $2.4 billion equity value $2.3 billion enterprise value Expected closing Second quarter of 2016, subject to customary closing conditions Approval process Successful completion of tender offer Certain regulatory approvals Sources of financing ~$300 million of cash from the combined company’s balance sheet $2.4 billion of fully committed term loans $300 million in committed undrawn revolving credit facility

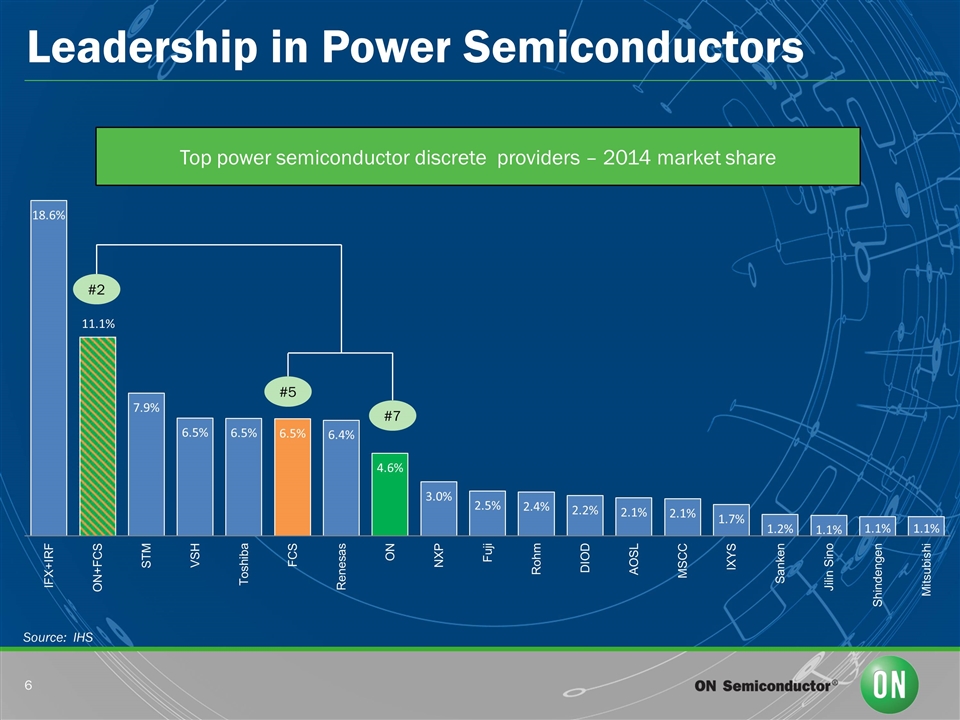

Leadership in Power Semiconductors Top power semiconductor discrete providers – 2014 market share #2 #5 #7 Source: IHS

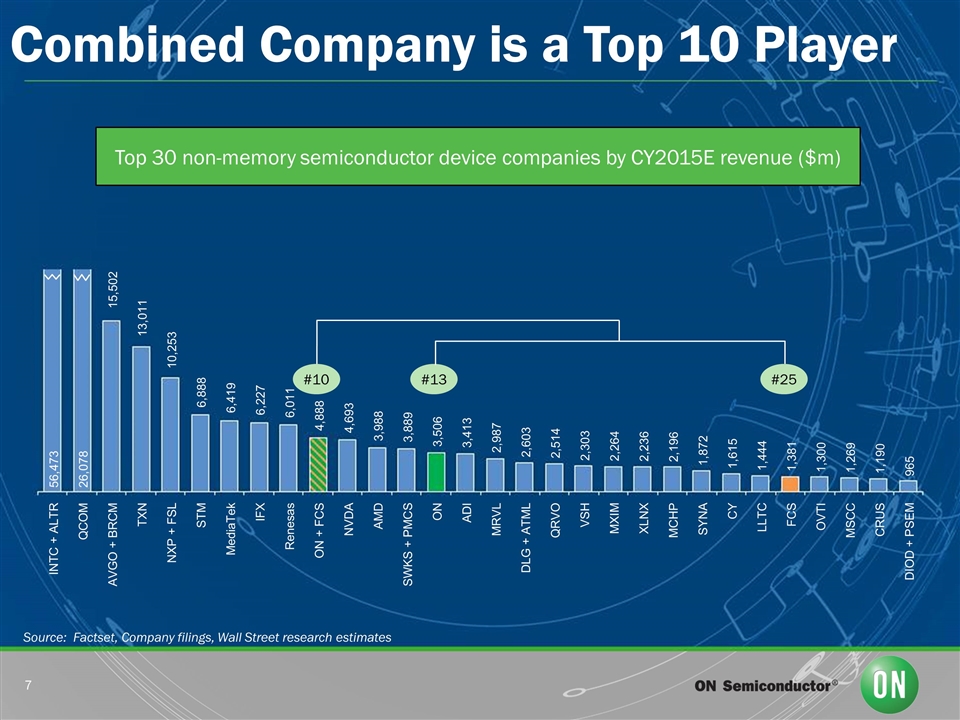

Combined Company is a Top 10 Player #10 #13 #25 Source: Factset, Company filings, Wall Street research estimates Top 30 non-memory semiconductor device companies by CY2015E revenue ($m)

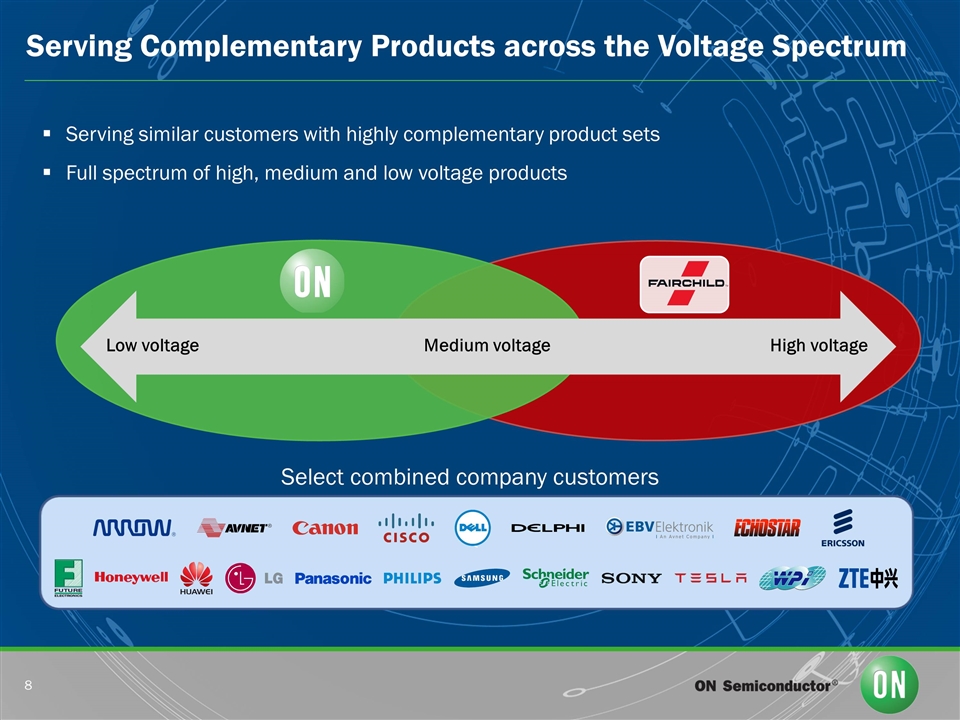

Serving Complementary Products across the Voltage Spectrum Medium voltage Low voltage High voltage Serving similar customers with highly complementary product sets Full spectrum of high, medium and low voltage products ` Select combined company customers

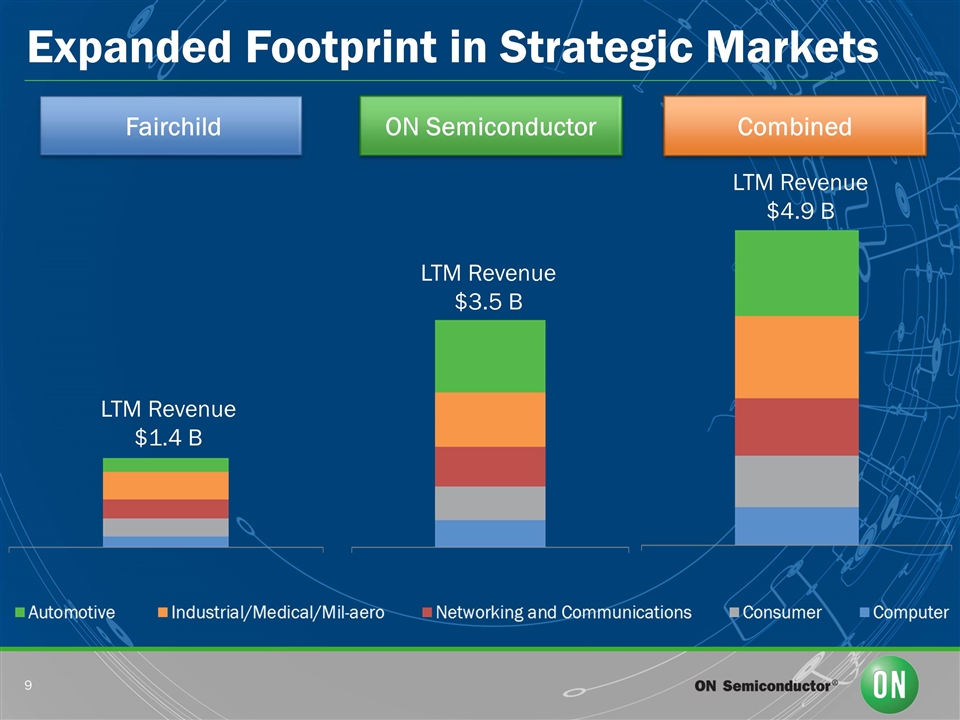

Expanded Footprint in Strategic Markets ON Semiconductor Fairchild Combined LTM Revenue $1.4 B LTM Revenue $4.9 B LTM Revenue $3.5 B

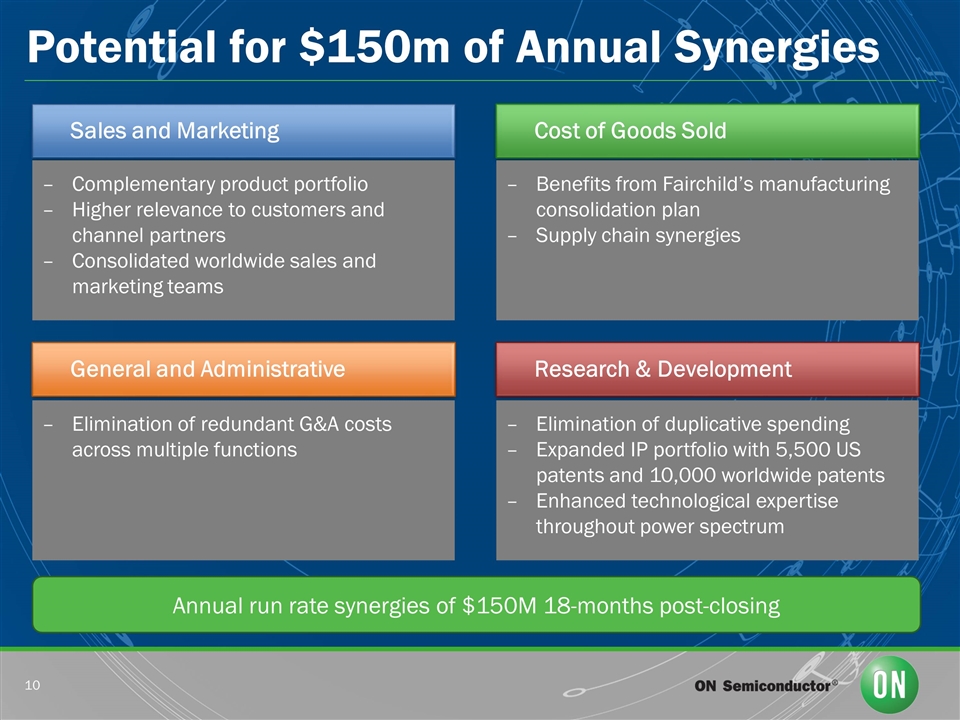

Potential for $150m of Annual Synergies Cost of Goods Sold $19.50 per share in cash Sales and Marketing General and Administrative Research & Development Benefits from Fairchild’s manufacturing consolidation plan Supply chain synergies Complementary product portfolio Higher relevance to customers and channel partners Consolidated worldwide sales and marketing teams Elimination of duplicative spending Expanded IP portfolio with 5,500 US patents and 10,000 worldwide patents Enhanced technological expertise throughout power spectrum Elimination of redundant G&A costs across multiple functions Annual run rate synergies of $150M 18-months post-closing

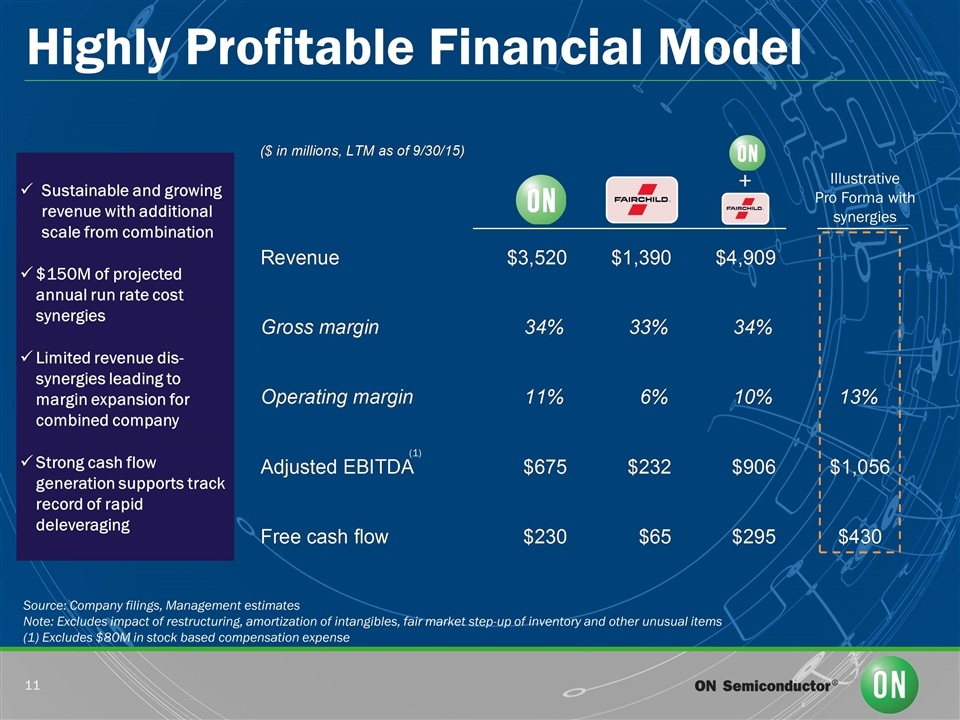

Highly Profitable Financial Model Sustainable and growing revenue with additional scale from combination $150M of projected annual run rate cost synergies Limited revenue dis-synergies leading to margin expansion for combined company Strong cash flow generation supports track record of rapid deleveraging Source: Company filings, Management estimates Note: Excludes impact of restructuring, amortization of intangibles, fair market step-up of inventory and other unusual items (1) Excludes $80M in stock based compensation expense + (1) Illustrative Pro Forma with synergies

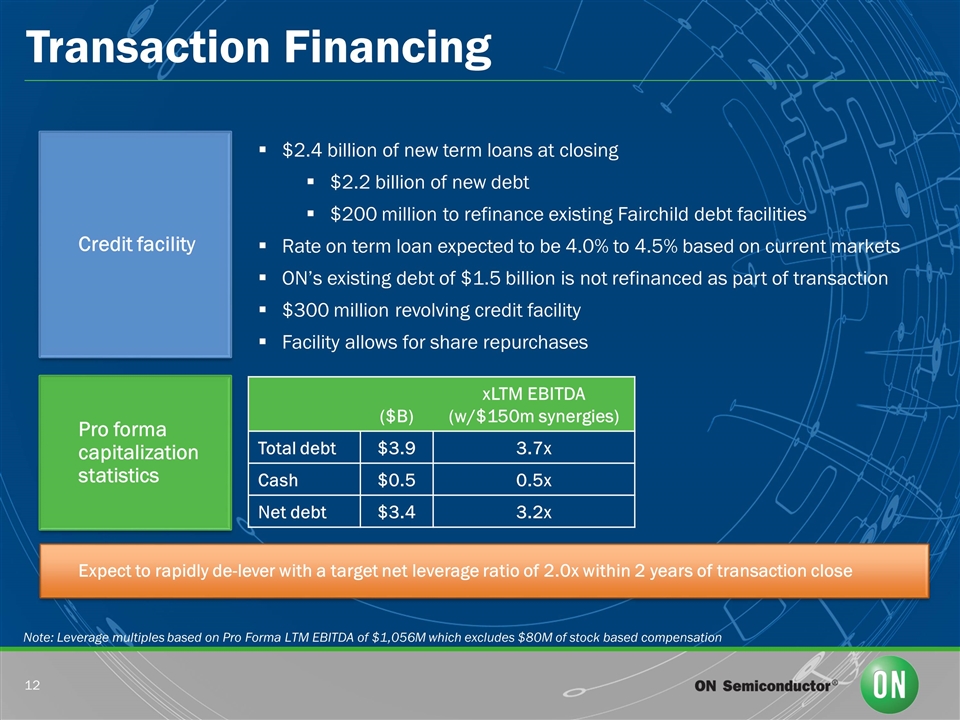

Transaction Financing Pro forma capitalization statistics $2.4 billion of new term loans at closing $2.2 billion of new debt $200 million to refinance existing Fairchild debt facilities Rate on term loan expected to be 4.0% to 4.5% based on current markets ON’s existing debt of $1.5 billion is not refinanced as part of transaction $300 million revolving credit facility Facility allows for share repurchases ($B) xLTM EBITDA (w/$150m synergies) Total debt $3.9 3.7x Cash $0.5 0.5x Net debt $3.4 3.2x Credit facility Expect to rapidly de-lever with a target net leverage ratio of 2.0x within 2 years of transaction close Note: Leverage multiples based on Pro Forma LTM EBITDA of $1,056M which excludes $80M of stock based compensation

Tender Offer The tender offer for the outstanding shares of common stock of Fairchild has not yet commenced. This communication is for informational purposes only and it does not constitute an offer to purchase or a solicitation of an offer to sell any securities. At the time the tender offer is commenced, ON Semiconductor and a wholly-owned subsidiary of ON Semiconductor will file a tender offer statement on Schedule TO with the SEC, and Fairchild will file a solicitation/recommendation statement on Schedule 14D-9 with respect to the tender offer. The tender offer statement (including an offer to purchase, a related letter of transmittal and other offer documents) and the solicitation/recommendation statement will contain important information that should be read carefully before any decision is made with respect to the tender offer. INVESTORS AND SECURITY HOLDERS OF FAIRCHILD ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Such materials will be made available to Fairchild’s stockholders at no expense to them through the Secretary, ON Semiconductor Corporation, 5005 E. McDowell Road, Phoenix, Arizona 85008. In addition, such materials (and all other offer documents filed with the SEC) will be available at no charge on the SEC’s website: www.sec.gov.