Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASPEN INSURANCE HOLDINGS LTD | form8-kinvestorpresentation.htm |

Aspen Insurance Holdings Limited INVESTOR PRESENTATION THIRD QUARTER 2015 Exhibit 99.1

AHL: NYSE 2 This slide presentation is for information purposes only. It should be read in conjunction with our financial supplement posted on our website on the Investor Relations page and with other documents filed or to be filed shortly by Aspen Insurance Holdings Limited (the “Company” or “Aspen”) with the U.S. Securities and Exchange Commission. Non-GAAP Financial Measures: In presenting Aspen's results, management has included and discussed certain “non-GAAP financial measures” as such term is defined in Regulation G. Management believes that these non-GAAP financial measures, which may be defined differently by other companies, better explain Aspen's results of operations in a manner that allows for a more complete understanding of the underlying trends in Aspen's business. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP. The reconciliation of such non-GAAP financial measures to their respective most directly comparable GAAP financial measures in accordance with Regulation G is included herein or in the financial supplement, as applicable, which can be obtained from the Investor Relations section of Aspen's website at www.aspen.co. Application of the Safe Harbor of the Private Securities Litigation Reform Act of 1995: This presentation contains written or oral "forward-looking statements" within the meaning of the U.S. federal securities laws. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as “expect,” “assume,” “objective,” “intend,” “plan,” “believe,” “do not believe,” “aim,” “project,” “anticipate,” “seek,” “will,” “likely,” “estimate,” “may,” “continue,” “guidance,” “outlook,” “trends,” “future,” “could,” “would,” “should,” “target,” "on track" and similar expressions of a future or forward-looking nature. All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in these statements. Aspen believes these factors include, but are not limited to: our ability to successfully implement steps to further optimize the business portfolio, ensure capital efficiency and enhance investment returns; the possibility of greater frequency or severity of claims and loss activity, including as a result of natural or man-made (including economic and political risks) catastrophic or material loss events, than our underwriting, reserving, reinsurance purchasing or investment practices have anticipated; the assumptions and uncertainties underlying reserve levels that may be impacted by future payments for settlements of claims and expenses or by other factors causing adverse or favorable development, including our assumptions on inflation costs associated with long-tail casualty business which could differ materially from actual experience; the reliability of, and changes in assumptions to, natural and man-made catastrophe pricing, accumulation and estimated loss models; decreased demand for our insurance or reinsurance products and cyclical changes in the insurance and reinsurance industry; the models we use to assess our exposure to losses from future natural catastrophes contain inherent uncertainties and our actual losses may differ significantly from expectations; our capital models may provide materially different indications than actual results; increased competition from existing insurers and reinsurers and from alternative capital providers and insurance linked funds and collateralized special purpose insurers on the basis of pricing, capacity, coverage terms, new capital, binding authorities to brokers or other factors and the related demand and supply dynamics as contracts come up for renewal; our ability to execute our business plan to enter new markets, introduce new products and develop new distribution channels, including their integration into our existing operations; our acquisition strategy; the recent consolidation in the (re)insurance industry; loss of one or more of our senior underwriters or key personnel; changes in our ability to exercise capital management initiatives (including our share repurchase program) or to arrange banking facilities as a result of prevailing market conditions or changes in our financial position; changes in the availability, cost or quality of reinsurance or retrocessional coverage; changes in general economic conditions, including inflation, deflation, foreign currency exchange rates, interest rates and other factors that could affect our financial results; the risk of a material decline in the value or liquidity of all or parts of our investment portfolio; the risks associated with the management of capital on behalf of investors; evolving issues with respect to interpretation of coverage after major loss events; our ability to adequately model and price the effects of climate cycles and climate change; any intervening legislative or governmental action and changing judicial interpretation and judgments on insurers’ liability to various risks; the risks related to litigation; the effectiveness of our risk management loss limitation methods, including our reinsurance purchasing; changes in the total industry losses, or our share of total industry losses, resulting from past events and, with respect to such events, our reliance on loss reports received from cedants and loss adjustors, our reliance on industry loss estimates and those generated by modeling techniques, changes in rulings on flood damage or other exclusions as a result of prevailing lawsuits and case law; the impact of one or more large losses from events other than natural catastrophes or by an unexpected accumulation of attritional losses and deterioration with loss estimates; the impact of acts of terrorism, acts of war and related legislation; any changes in our reinsurers’ credit quality and the amount and timing of reinsurance recoverables; the continuing and uncertain impact of the current depressed lower growth economic environment in many of the countries in which we operate; our reliance on information and technology and third- party service providers for our operations and systems; the level of inflation in repair costs due to limited availability of labor and materials after catastrophes; a decline in our operating subsidiaries’ ratings with S&P, A.M. Best or Moody’s; the failure of our reinsurers, policyholders, brokers or other intermediaries to honor their payment obligations; our reliance on the assessment and pricing of individual risks by third parties; our dependence on a few brokers for a large portion of our revenues; the persistence of heightened financial risks, including excess sovereign debt, the banking system and the Eurozone crisis; changes in government regulations or tax laws in jurisdictions where we conduct business; changes in accounting principles or policies or in the application of such accounting principles or policies; increased counterparty risk due to the credit impairment of financial institutions; and Aspen or Aspen Bermuda Limited becoming subject to income taxes in the United States or the United Kingdom. For a more detailed description of these uncertainties and other factors, please see the “Risk Factors” section in Aspen's Annual Report on Form 10-K as filed with the U.S. Securities and Exchange Commission on February 23, 2015. Aspen undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made. The guidance in this presentation relating to Operating Return on Equity of 11% in 2015 is made as at November 2, 2015. The outlook for 2015 assumes our expectations of normal loss experience, our current view of interest rates and our view of the insurance rate environment. Our outlook in 2015 is necessarily subject to heightened sensitivity in relation to these assumptions which are likely to be the subject of future change, amendment, update and review, as necessary. Our assumptions are based on the retention of our senior underwriters and client relationships. In addition, the models underlying our normal loss experience assumptions will produce different illustrative loss patterns if the modeling assumptions are changed. Greater decreases in pricing in certain business lines, if sustained, are also expected to have an adverse effect on Operating Return on Equity. This outlook is subject to change for many reasons, including unusual or unpredictable items, such as catastrophe losses, loss reserve development, investment results and other items. In addition, any estimates relating to loss events involve the exercise of considerable judgment and reflect a combination of ground-up evaluations, information available to date from brokers and cedants, market intelligence, initial tentative loss reports and other sources. The actuarial range of reserves and management's best estimate represents a distribution from our internal capital model for reserving risk based on our then current state of knowledge and explicit and implicit assumptions relating to the incurred pattern of claims, the expected ultimate settlement amount, inflation and dependencies between lines of business. Due to the complexity of factors contributing to the losses and the preliminary nature of the information used to prepare these estimates, there can be no assurance that Aspen's ultimate losses will remain within the stated amount. SAFE HARBOR DISCLOSURE

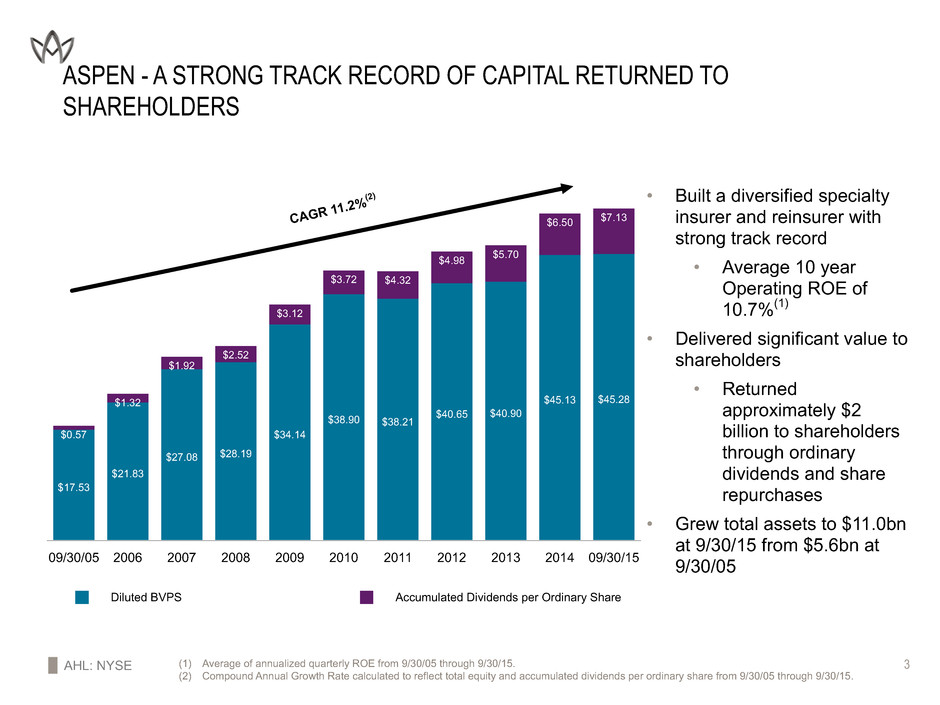

AHL: NYSE 3 Diluted BVPS Accumulated Dividends per Ordinary Share 09/30/05 2006 2007 2008 2009 2010 2011 2012 2013 2014 09/30/15 $17.53 $21.83 $27.08 $28.19 $34.14 $38.90 $38.21 $40.65 $40.90 $45.13 $45.28 $0.57 $1.32 $1.92 $2.52 $3.12 $3.72 $4.32 $4.98 $5.70 $6.50 $7.13 ASPEN - A STRONG TRACK RECORD OF CAPITAL RETURNED TO SHAREHOLDERS CAGR 11.2% (2) • Built a diversified specialty insurer and reinsurer with strong track record • Average 10 year Operating ROE of 10.7%(1) • Delivered significant value to shareholders • Returned approximately $2 billion to shareholders through ordinary dividends and share repurchases • Grew total assets to $11.0bn at 9/30/15 from $5.6bn at 9/30/05 (1) Average of annualized quarterly ROE from 9/30/05 through 9/30/15. (2) Compound Annual Growth Rate calculated to reflect total equity and accumulated dividends per ordinary share from 9/30/05 through 9/30/15.

AHL: NYSE 4 ASPEN - A RECORD OF PROMISES KEPT • 2014 Operating ROE of 10% • Delivered 2014 Operating ROE of 11.5% • 2015 Expected Operating ROE of 11%(1) • Continue to expect to achieve 11% Operating ROE in 2015(1) • Build diversified platforms for growth • Reinsurance (40% of 2015 LTM(2) Gross Written Premium) • Insurance (43% of 2015 LTM(2) Gross Written Premium) • Lloyd's (17% of 2015 LTM(2) Gross Written Premium) • U.S. Platform to achieve $600 million of Net Earned Premiums by end of 2015(1) • Net Earned Premium of $614 million in 2015 LTM(2) • U.S. platform G&A ratio of <16% by end of 2015(1) • G&A ratio of 14.9% through 9M 2015 (1) As at November 2, 2015. See " Safe Harbor Disclosure" slide 2 (2) Last twelve months ("LTM") through Q3 2015

AHL: NYSE 5 ASPEN OVERVIEW • Prudent risk management: well-run, risk aware business building value in a controlled way • Aspen Reinsurance: 40% of group GWP(1) • Deep and enduring relationships with well-chosen clients, significant industry expertise and excellent track record of performance • Innovative and thoughtful solutions; utilizing multi-line capabilities and Aspen Capital Markets to leverage third party capital • Aspen Insurance: 60% of group GWP(1) • U.S. - Growing specialty insurance business; $886m of GWP(1) and a competitive expense ratio of 14.9% of net earned premium for 2015 YTD(2) • International - Highly respected lead expertise in many niche lines; $885m of GWP(1); portfolio comprises impressive variety of specialty products with business predominantly originating in Lloyd's and the London market, hubs in Bermuda, Zurich and Dublin; growing contributions from U.K. Regional Insurance • Careful investment management: aim to deliver strong risk-adjusted return with high quality portfolio; 88% in cash and fixed income; key non-fixed income component is blue-chip equities • Judicious steward of capital: hold more than regulatory and risk capital models suggest; return capital to shareholders when it is financially more attractive to do so than deploying capital elsewhere • Expect 11% ROE in 2015(2): (1) LTM: Last Twelve Months through September 30, 2015 (2) As at November 2, 2015. See “Safe Harbor Disclosure” slide 2

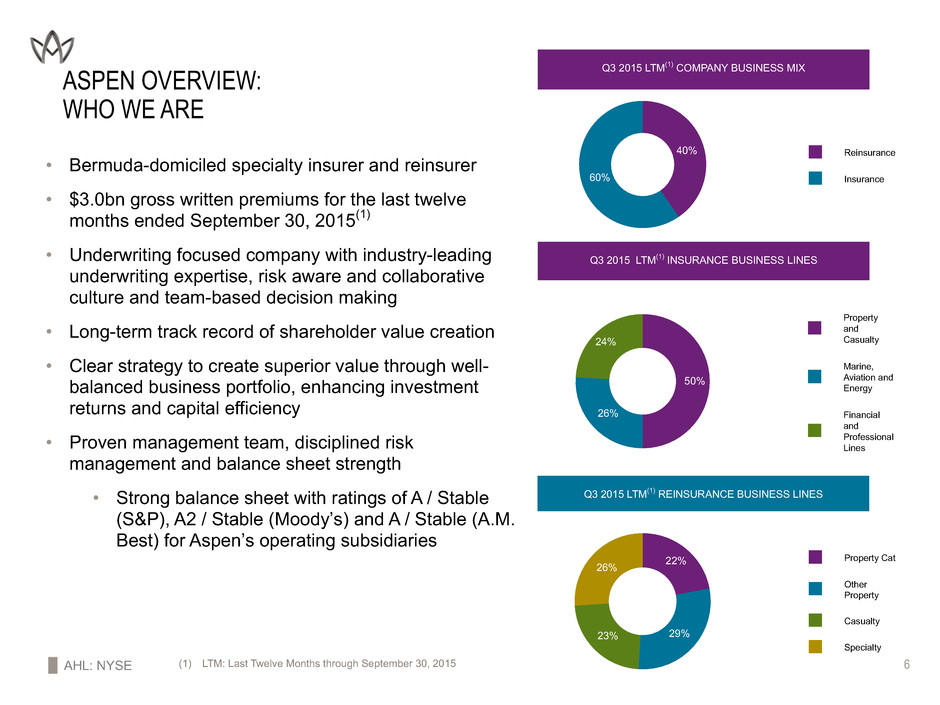

AHL: NYSE 6 Property Cat Other Property Casualty Specialty 22% 29%23% 26% Property and Casualty Marine, Aviation and Energy Financial and Professional Lines 50% 26% 24% Reinsurance Insurance 40% 60% ASPEN OVERVIEW: WHO WE ARE • Bermuda-domiciled specialty insurer and reinsurer • $3.0bn gross written premiums for the last twelve months ended September 30, 2015(1) • Underwriting focused company with industry-leading underwriting expertise, risk aware and collaborative culture and team-based decision making • Long-term track record of shareholder value creation • Clear strategy to create superior value through well- balanced business portfolio, enhancing investment returns and capital efficiency • Proven management team, disciplined risk management and balance sheet strength • Strong balance sheet with ratings of A / Stable (S&P), A2 / Stable (Moody’s) and A / Stable (A.M. Best) for Aspen’s operating subsidiaries Q3 2015 LTM(1) INSURANCE BUSINESS LINES Q3 2015 LTM(1) REINSURANCE BUSINESS LINES Q3 2015 LTM(1) COMPANY BUSINESS MIX (1) LTM: Last Twelve Months through September 30, 2015

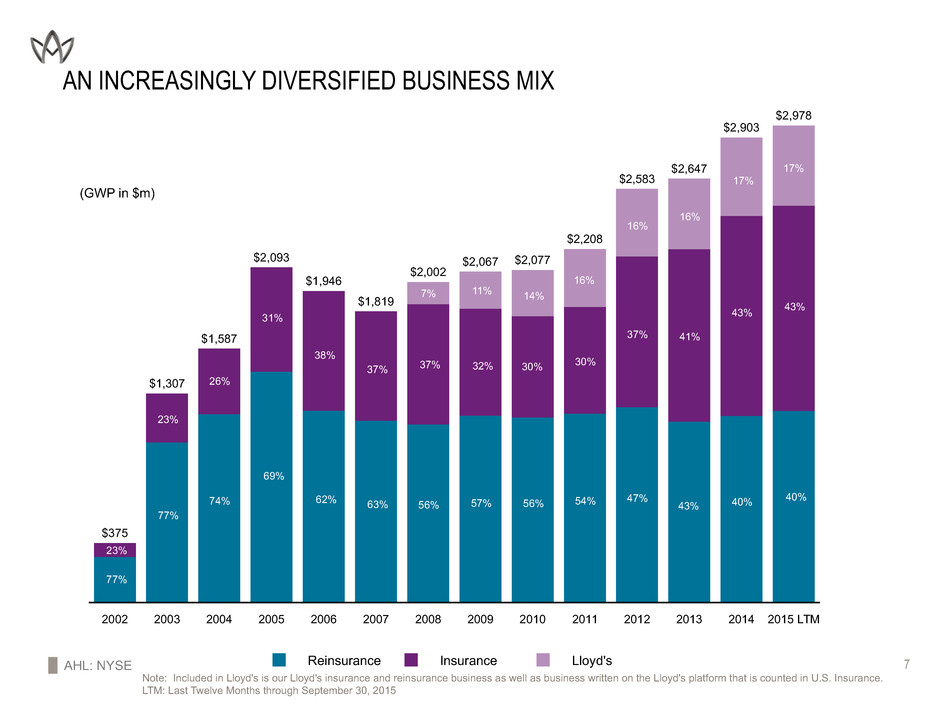

AHL: NYSE 7 AN INCREASINGLY DIVERSIFIED BUSINESS MIX Reinsurance Insurance Lloyd's 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 LTM $375 $1,307 $1,587 $2,093 $1,946 $1,819 $2,002 $2,067 $2,077 $2,208 $2,583 $2,647 $2,903 $2,978 (GWP in $m) Note: Included in Lloyd's is our Lloyd's insurance and reinsurance business as well as business written on the Lloyd's platform that is counted in U.S. Insurance. LTM: Last Twelve Months through September 30, 2015 23% 77% 23% 77% 26% 74% 69% 38% 31% 37% 62% 63% 7% 37% 54% 30% 16% 47% 37% 16% 43% 41% 16% 40% 43% 17% 40% 43% 17% 11% 57% 56% 30% 14% 32% 56%

AHL: NYSE 8 WITH CONTINUED STRENGTH AT ASPEN RE • Well-respected in the market, close to our clients, nimble and thoughtful when providing solutions to risks • Achieving profitable targeted growth in challenging but dynamic market conditions • Increasingly diversified portfolio across four sub-segments: Property Catastrophe, Other Property, Casualty and Specialty • Regional structure to meet increasing demand for local market solutions • Significant growth prospects in Asia-Pacific and Latin America, which accounted for 20% of total Reinsurance premiums in the last twelve months through Q3 2015 (1) • Continued focus on research and development of new products, bringing innovation, deep expertise and fresh thinking to our markets and operations • Successful renewals and new business opportunities reaffirm Aspen’s relevance, strategy and broad reach in a difficult market (1) Last twelve months ("LTM") through Q3 2015 premiums from APAC, LatAm and MENA (2) See "Safe Harbor Disclosure" slide 2. Aspen Re is a powerful contributor to ROE and has strong future prospects (2)

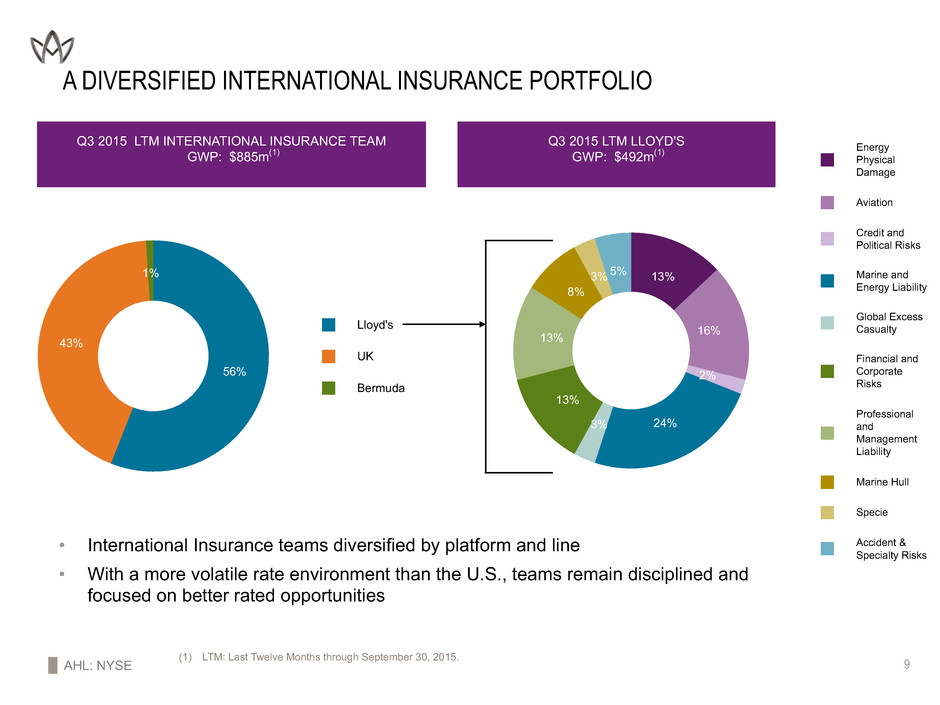

AHL: NYSE 9 A DIVERSIFIED INTERNATIONAL INSURANCE PORTFOLIO Lloyd's UK Bermuda 56% 43% 1% Energy Physical Damage Aviation Credit and Political Risks Marine and Energy Liability Global Excess Casualty Financial and Corporate Risks Professional and Management Liability Marine Hull Specie Accident & Specialty Risks 13% 16% 2% 24%3% 13% 13% 8% 3% 5% Q3 2015 LTM LLOYD'S GWP: $492m(1) (1) LTM: Last Twelve Months through September 30, 2015. Q3 2015 LTM INTERNATIONAL INSURANCE TEAM GWP: $885m(1) • International Insurance teams diversified by platform and line • With a more volatile rate environment than the U.S., teams remain disciplined and focused on better rated opportunities

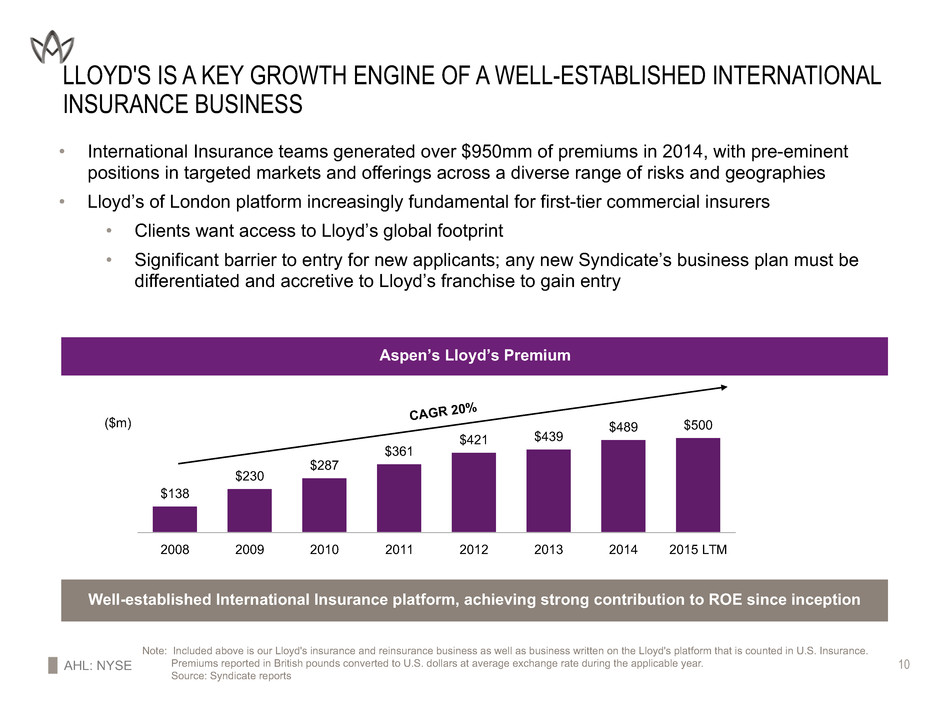

AHL: NYSE 10 2008 2009 2010 2011 2012 2013 2014 2015 LTM $138 $230 $287 $361 $421 $439 $489 $500 LLOYD'S IS A KEY GROWTH ENGINE OF A WELL-ESTABLISHED INTERNATIONAL INSURANCE BUSINESS CAGR 20% Note: Included above is our Lloyd's insurance and reinsurance business as well as business written on the Lloyd's platform that is counted in U.S. Insurance. Premiums reported in British pounds converted to U.S. dollars at average exchange rate during the applicable year. Source: Syndicate reports ($m) • International Insurance teams generated over $950mm of premiums in 2014, with pre-eminent positions in targeted markets and offerings across a diverse range of risks and geographies • Lloyd’s of London platform increasingly fundamental for first-tier commercial insurers • Clients want access to Lloyd’s global footprint • Significant barrier to entry for new applicants; any new Syndicate’s business plan must be differentiated and accretive to Lloyd’s franchise to gain entry Aspen’s Lloyd’s Premium Well-established International Insurance platform, achieving strong contribution to ROE since inception

AHL: NYSE 11 BUILT A DIVERSIFIED U.S. SPECIALTY INSURANCE PORTFOLIO 2010 U.S. INSURANCE TEAMS GWP: $167m Q3 2015 LTM U.S. INSURANCE TEAMS GWP: $886m(1) (1) LTM: Last Twelve Months through September 30, 2015 Property Casualty Professional Lines 60%25% 15% Programs Property Professional Liability Marine Energy Casualty Environmental Liability Management Liability Surety 26% 17% 15% 4% 8% 14% 8% 4%4%

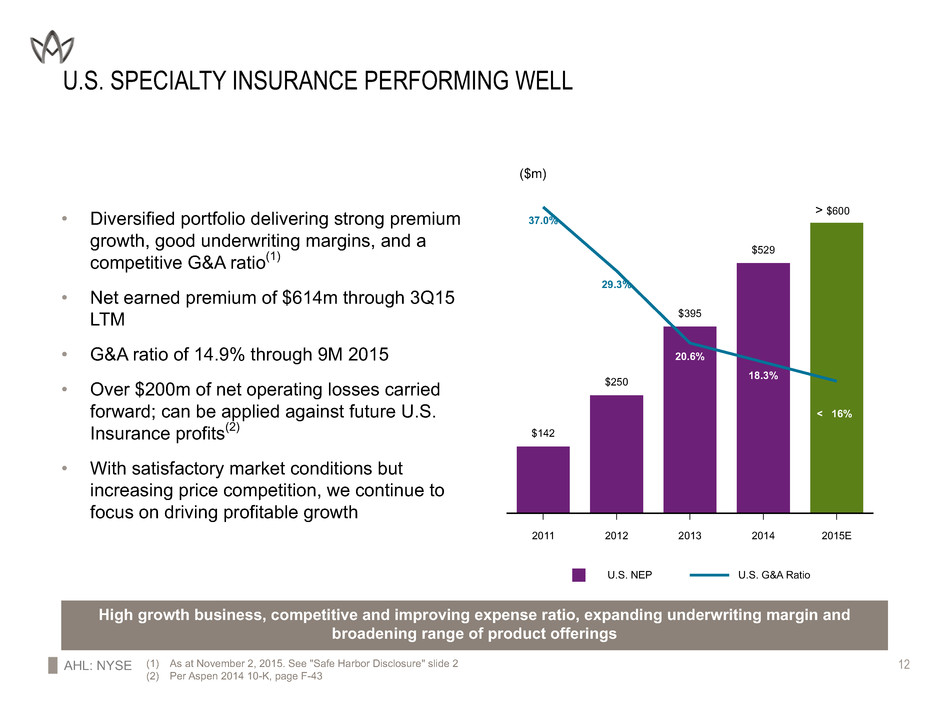

AHL: NYSE 12 ($m) U.S. NEP U.S. G&A Ratio 2011 2012 2013 2014 2015E $142 $250 $395 $529 37.0% 29.3% 20.6% 18.3% U.S. SPECIALTY INSURANCE PERFORMING WELL (1) As at November 2, 2015. See "Safe Harbor Disclosure" slide 2 (2) Per Aspen 2014 10-K, page F-43 • Diversified portfolio delivering strong premium growth, good underwriting margins, and a competitive G&A ratio(1) • Net earned premium of $614m through 3Q15 LTM • G&A ratio of 14.9% through 9M 2015 • Over $200m of net operating losses carried forward; can be applied against future U.S. Insurance profits(2) • With satisfactory market conditions but increasing price competition, we continue to focus on driving profitable growth > $600 < 16% High growth business, competitive and improving expense ratio, expanding underwriting margin and broadening range of product offerings

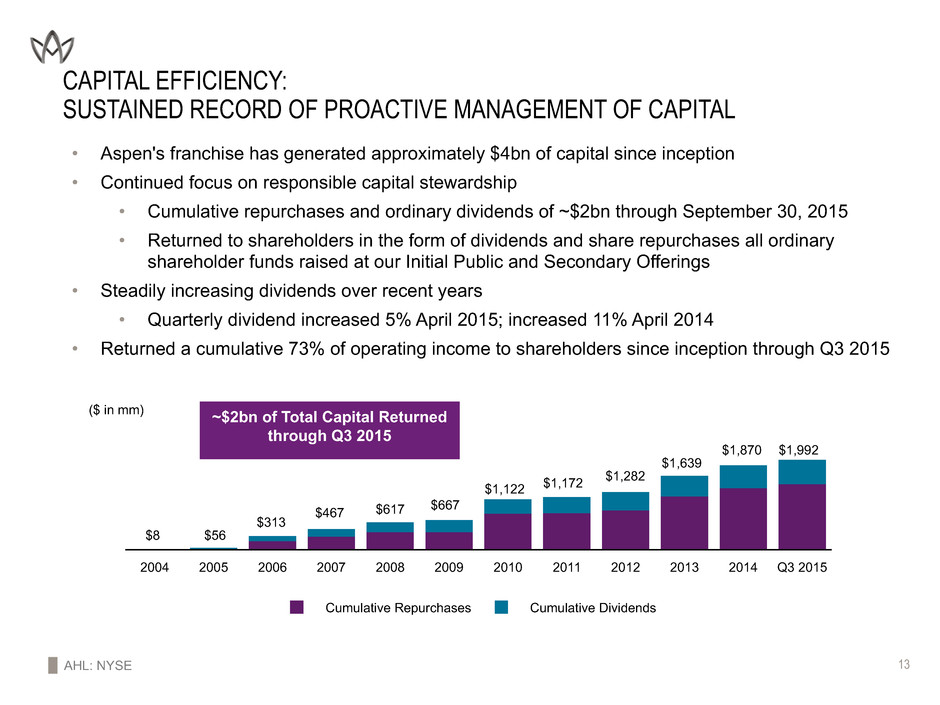

AHL: NYSE 13 CAPITAL EFFICIENCY: SUSTAINED RECORD OF PROACTIVE MANAGEMENT OF CAPITAL • Aspen's franchise has generated approximately $4bn of capital since inception • Continued focus on responsible capital stewardship • Cumulative repurchases and ordinary dividends of ~$2bn through September 30, 2015 • Returned to shareholders in the form of dividends and share repurchases all ordinary shareholder funds raised at our Initial Public and Secondary Offerings • Steadily increasing dividends over recent years • Quarterly dividend increased 5% April 2015; increased 11% April 2014 • Returned a cumulative 73% of operating income to shareholders since inception through Q3 2015 ($ in mm) ~$2bn of Total Capital Returned through Q3 2015 Cumulative Repurchases Cumulative Dividends 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Q3 2015 $8 $56 $313 $467 $617 $667 $1,122 $1,172 $1,282 $1,639 $1,870 $1,992

AHL: NYSE 14 PORTFOLIO ALLOCATIONS September 30, 2015 100% = $8.4 billion(1) • Stable investment income and total return through all market cycles • Since 2011 have tactically built the risk asset portfolio and dynamically managed the positions • 12.2% of the portfolio invested in risk assets (equities 8.3%, BBB emerging market debt 2.6%, and bank loans 1%) • Fixed income portfolio duration: 3.33 years (including swaps) (1) Excludes amounts attributable to variable interest entities; may not add to 100% due to rounding CONSISTENT INVESTMENT RETURNS 36% IG Credit 14% US Treasury 13% Cash & Short-Term 12% Agency MBS 8% Equities 7% Sovereign 3% Non US Agency 2% US Agency 2% ABS 1% Bank Loans 1% Non US Govt Guaranteed 0.4% CMBS 0.3% Munis

AHL: NYSE 15 CONCLUSION: FOCUSED ON SHAREHOLDER VALUE • Deep underwriting expertise and understanding of client needs and risks • Pursuing selective, profitable growth in exposures we know and understand, subject to market conditions • Diversified platform allows us to focus on better rated opportunities as they arise, including: • Reinsurance ▪ Agriculture, Bond, Financial, Terrorism, Marine • Insurance ▪ U.S. Professional Liability and Casualty Insurance ▪ U.K. Property and Casualty Insurance • Expected premium growth across diversified lines is projected to be greater than both growth in expenses and risk allocated capital which should equate to meaningful increased premium leverage(1) (1) As at November 2, 2015. For Expected Operating ROE in 2015, see “Safe Harbor Disclosure” slide 2 Expected Operating ROE of 11% in 2015(1)

APPENDIX

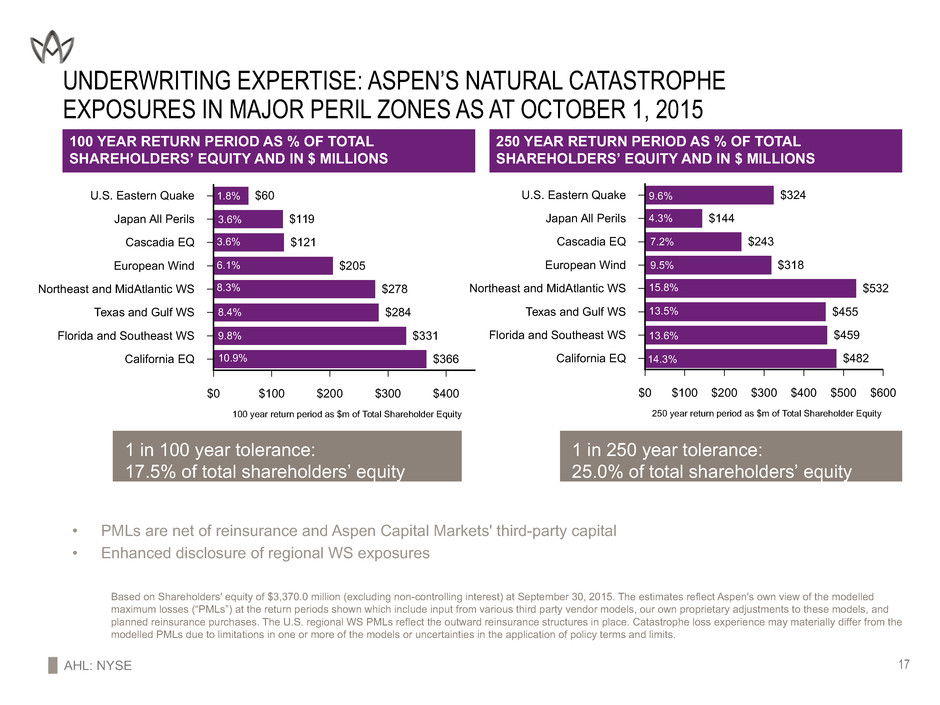

AHL: NYSE 17 UNDERWRITING EXPERTISE: ASPEN’S NATURAL CATASTROPHE EXPOSURES IN MAJOR PERIL ZONES AS AT OCTOBER 1, 2015 100 YEAR RETURN PERIOD AS % OF TOTAL SHAREHOLDERS’ EQUITY AND IN $ MILLIONS 1 in 100 year tolerance: 17.5% of total shareholders’ equity 1 in 250 year tolerance: 25.0% of total shareholders’ equity Based on Shareholders' equity of $3,370.0 million (excluding non-controlling interest) at September 30, 2015. The estimates reflect Aspen's own view of the modelled maximum losses (“PMLs”) at the return periods shown which include input from various third party vendor models, our own proprietary adjustments to these models, and planned reinsurance purchases. The U.S. regional WS PMLs reflect the outward reinsurance structures in place. Catastrophe loss experience may materially differ from the modelled PMLs due to limitations in one or more of the models or uncertainties in the application of policy terms and limits. $0 $100 $200 $300 $400 $500 $600 250 year return period as $m of Total Shareholder Equity U.S. Eastern Quake Japan All Perils Cascadia EQ European Wind Northeast and MidAtlantic WS Texas and Gulf WS Florida and Southeast WS California EQ $324 $144 $243 $318 $532 $455 $459 $482 • PMLs are net of reinsurance and Aspen Capital Markets' third-party capital • Enhanced disclosure of regional WS exposures $0 $100 $200 $300 $400 100 year return period as $m of Total Shareholder Equity U.S. Eastern Quake Japan All Perils Cascadia EQ European Wind Northeast and MidAtlantic WS Texas and Gulf WS Florida and Southeast WS California EQ $60 $119 $121 $205 $278 $284 $331 $366 1.8% 9.6% 3.6% 3.6% 4.3% 6.1% 7.2% 8.3% 9.5% 8.4% 15.8% 9.8% 10.9% 14.3% 13.5% 13.6% 250 YEAR RETURN PERIOD AS % OF TOTAL SHAREHOLDERS’ EQUITY AND IN $ MILLIONS

Aspen Insurance Holdings Limited INVESTOR PRESENTATION THIRD QUARTER 2015