Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION PURSUANT TO - MassRoots, Inc. | msrt10q111615ex32_2.htm |

| EX-31.2 - CERTIFICATION OF PRINCIPAL ACCOUNTING OFFICER - MassRoots, Inc. | msrt10q111615ex31_2.htm |

| EX-32.1 - CERTIFICATION PURSUANT TO - MassRoots, Inc. | msrt10q111615ex32_1.htm |

| EX-31.1 - CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER - MassRoots, Inc. | msrt10q111615ex31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[x] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934

For the quarterly period ended September 30, 2015

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934

For the transition period from ___________to ____________

Commission File Number 000-55431

MASSROOTS, INC.

(Exact name of business as specified in its charter)

| Delaware | 46-2612944 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1624 Market Street, Suite 201, Denver, CO 80202

(Address, including zip code, of principal executive offices)

(720) 442-0052

(Issuer’s telephone number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [x] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated Filer [ ]

Non-accelerated filer [ ] Smaller reporting company [x]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: As of November 5, 2015, the issuer had 46,158,466 shares of common stock issued and outstanding.

MASSROOTS, INC.

FORM 10-Q QUARTERLY REPORT

TABLE OF CONTENTS

| NOTE ABOUT FORWARD-LOOKING STATEMENTS | 1 | |||

| PART I. FINANCIAL INFORMATION | 2 | |||

| Item 1. Financial Statements | 2 | |||

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 17 | |||

| Item 3. Quantitative & Qualitative Disclosures about Market Risks | 23 | |||

| Item 4. Controls and Procedures | 23 | |||

| PART II OTHER INFORMATION | 25 | |||

| Item 1. Legal Proceedings | 25 | |||

| Item 1A. Risk Factors | 25 | |||

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | 25 | |||

| Item 3. Defaults upon Senior Securities | 25 | |||

| Item 5. Other Information | 25 | |||

| Item 6. Exhibits | 26 |

NOTE ABOUT FORWARD-LOOKING STATEMENTS

Statements in this report may be "forward-looking statements." Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements include, among other things, statements regarding:

| • | the growth of our business and revenues and our expectations about the factors that influence our success; |

| • | our plans to continue to invest in systems, facilities, and infrastructure, increase our hiring and grow our business; |

| • | our plans for our MassRoots for Business portal and the strategy and timing of any plans to monetize our network, including the paid conversion rates and the willingness of businesses to continue to advertise on our platform; |

| • | our user growth expectations; |

| • | our ability to attain funding and the sufficiency of our sources of funding; |

| • | our proposed partnership with Flowhub and the consummation of such a partnership and/or the results of the partnership, if created; |

| • | our expectation that our cost of revenues, development expenses, sales and marketing expenses, and general and administrative expenses will increase; |

| • | fluctuations in our capital expenditures; |

| • | as well as other statements regarding our future operations, financial condition and prospects, and business strategies. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those described above and those risks discussed from time to time in this report, including the risks described under "Risk Factors" in our Registration Statement filed and any risks described in any other filings we make with the SEC. Any forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this report. |

Management’s discussion and analysis of financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses. On an on-going basis, we evaluate these estimates, including those related to useful lives of real estate assets, cost reimbursement income, bad debts, impairment, net lease intangibles, contingencies and litigation. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. There can be no assurance that actual results will not differ from those estimates. We assume no obligation to update these forward-looking statements to reflect actual results or changes in factors or assumptions affecting forward-looking statements. You should read the following discussion and analysis in conjunction with the Financial Statements and Notes attached hereto, and the other financial data appearing elsewhere in this Quarterly Report.

Unless we have indicated otherwise or the context otherwise requires, references in the prospectus to “MassRoots,” the “Company,” “we,” “us” and “our” or similar terms are to MassRoots, Inc.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

| MASSROOTS, INC. | ||||||||

| BALANCE SHEETS | ||||||||

| AS OF SEPTEMBER 30, 2015 AND DECEMBER 31, 2014 | ||||||||

| Sep 30, 2015 | Dec 31, 2014 | |||||||

| (UNAUDITED) | (AUDITED) | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | 345,085 | $ | 141,928 | ||||

| Other receivables | 7,073 | 11,201 | ||||||

| Prepaid expense | 599,750 | 130,797 | ||||||

| TOTAL CURRENT ASSETS | 951,908 | 283,926 | ||||||

| FIXED ASSETS | ||||||||

| Computer and office equipment | 61,965 | 16,189 | ||||||

| Accumulated depreciation | (8,685 | ) | (2,027 | ) | ||||

| NET FIXED ASSETS | 53,280 | 14,162 | ||||||

| OTHER ASSETS | ||||||||

| Prepaid expense | 65,891 | 65,891 | ||||||

| Investment in Flowhub | 175,000 | 0 | ||||||

| Deposits | 35,652 | 2,550 | ||||||

| Total Other Assets | 276,543 | 68,441 | ||||||

| TOTAL ASSETS | 1,281,731 | 366,529 | ||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts Payable | 107,816 | 25,842 | ||||||

| Accrued expenses | 25,695 | 23,917 | ||||||

| Accrued payroll tax | — | 1,778 | ||||||

| Derivative liabilities | 1,329,743 | 1,099,707 | ||||||

| TOTAL CURRENT LIABILITIES | 1,463,254 | 1,151,244 | ||||||

| LONG-TERM LIABILITY | ||||||||

| Convertible debentures, net of $0 and $107,016 discount, respectively | 209,100 | 162,084 | ||||||

| TOTAL LIABILITIES | 1,672,354 | 1,313,328 | ||||||

| STOCKHOLDERS' EQUITY | ||||||||

| Common stock, $0.001 par value, 200,000,000 shares authorized; 45,928,971 and 38,909,0000 shares issued and outstanding | 45,929 | 38,909 | ||||||

| Common stock to be issued | 0 | 1,048 | ||||||

| Additional paid in capital | 8,250,078 | 2,372,867 | ||||||

| Deficit accumulated through the development stage | (8,686,630 | ) | (3,359,623 | ) | ||||

| TOTAL STOCKHOLDERS' EQUITY | (390,623 | ) | (946,799 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 1,281,731 | $ | 366,529 | ||||

| The accompanying notes are an integral part of these financial statements. | ||||||||

MASSROOTS, INC.

STATEMENT OF OPERATIONS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2015 AND 2014

| FOR THE 3 MONTHS ENDED SEPTEMBER 30, | FOR THE 9 MONTHS ENDED SEPTEMBER 30, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| (UNAUDITED) | (UNAUDITED) | (UNAUDITED) | (UNAUDITED) | |||||||||||||

| REVENUE | $ | 60,916 | $ | 5,719 | $ | 63,982 | $ | 7,458 | ||||||||

| COST OF GOODS SOLD | 8,408 | — | 8,408 | 690 | ||||||||||||

| GROSS PROFIT | 52,508 | 5,719 | 55,574 | 6,768 | ||||||||||||

| GENERAL AND ADMINISTRATIVE EXPENSES: | ||||||||||||||||

| Advertising | 157,962 | 62,371 | 421,082 | 143,301 | ||||||||||||

| Depreciation | 2,564 | 486 | 6,658 | 1,114 | ||||||||||||

| Independent contractor expense | 8,049 | 51,130 | 141,999 | 110,858 | ||||||||||||

| Legal expenses | 33,583 | 15,000 | 119,588 | 139,575 | ||||||||||||

| Accounting and Consulting | 118,590 | 8,214 | 266,244 | 32,660 | ||||||||||||

| Payroll and related expense | 394,176 | 61,967 | 916,546 | 148,957 | ||||||||||||

| Common stock issued for services | 356,635 | 13,023 | 724,735 | 17,635 | ||||||||||||

| Options issued for services | 159,809 | 26,055 | 473,380 | 33,418 | ||||||||||||

| Warrants issued for services | 41,010 | — | 67,421 | 555,598 | ||||||||||||

| Travel and related expenses | 37,824 | 7,411 | 104,436 | 14,703 | ||||||||||||

| Other general and administrative expenses | 123,544 | 20,598 | 250,542 | 51,820 | ||||||||||||

| Total General and Administrative expenses | 1,433,746 | 266,255 | 3,492,631 | 1,249,639 | ||||||||||||

| (LOSS) FROM OPERATIONS | (1,381,238 | ) | (260,536 | ) | (3,437,057 | ) | (1,242,871 | ) | ||||||||

| OTHER INCOME (EXPENSE) | ||||||||||||||||

| Change in derivative liabilities | (658,929 | ) | — | (616,192 | ) | — | ||||||||||

| Interest expense | (410 | ) | — | (4,791 | ) | — | ||||||||||

| Amortization of discount on notes payable | (56,670 | ) | (16,958 | ) | (107,016 | ) | (34,639 | ) | ||||||||

| INCOME (LOSS) BEFORE INCOME TAXES | (2,097,247 | ) | (277,494 | ) | (4,165,056 | ) | (1,277,510 | ) | ||||||||

| PROVISION FOR INCOME TAXES | — | — | — | — | ||||||||||||

| NET (LOSS) | $ | (2,097,247 | ) | $ | (277,494 | ) | $ | (4,165,056 | ) | $ | (1,277,510 | ) | ||||

| Basic and fully diluted net income (loss) per common share: | ($ | 0.05 | ) | N/A | ($ | 0.10 | ) | N/A | ||||||||

| Weighted average common shares outstanding | 44,975,905 | N/A | 42,984,431 | N/A | ||||||||||||

| The accompanying notes are an integral part of these financial statements. | ||||||||||||||||

| MASSROOTS, INC. | ||||||||

| STATEMENT OF CASHFLOWS | ||||||||

| FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2015 AND 2014 | ||||||||

| FOR THE 9 MONTHS ENDED SEPTEMBER 30, | ||||||||

| 2015 | 2014 | |||||||

| (UNAUDITED) | (UNAUDITED) | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net (loss) | $ | (4,165,056 | ) | $ | (1,277,510 | ) | ||

| Adjustments to reconcile net (loss ) to net cash (used in ) operating activities: | ||||||||

| Amortization of discounts on notes payable | 107,016 | 34,639 | ||||||

| Depreciation | 6,658 | 1,114 | ||||||

| Common stock issued for services | 724,735 | 17,635 | ||||||

| Options issued for services | 473,380 | 33,418 | ||||||

| Warrants issued for services | 67,421 | 555,598 | ||||||

| Change in derivative liabilities | 616,192 | — | ||||||

| Imputed Interest expense | 4,791 | — | ||||||

| Changes in operating assets and liabilities | ||||||||

| Other receivables | 4,128 | (2,500 | ) | |||||

| Prepaid expense | — | (13,140 | ) | |||||

| Deposit | (33,102 | ) | — | |||||

| Accounts payable and other liabilities | 204,841 | 1,297 | ||||||

| Accrued payroll tax | (1,778 | ) | (1,846 | ) | ||||

| Net Cash (Used in) Operating Activities | (1,990,774 | ) | (651,295 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Payments for equipment | (45,776 | ) | (9,184 | ) | ||||

| Investment in Flowhub | (175,000 | ) | — | |||||

| Net Cash (Used in) Investing Activities | (220,776 | ) | (9,184 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Issuance of convertible Debentures for cash | — | 269,100 | ||||||

| Issuance of common stock for cash | 2,073,707 | 310,900 | ||||||

| Warrants Exercised | 341,000 | — | ||||||

| Net Cash Provided by Financing Activities | 2,414,707 | 580,000 | ||||||

| NET INCREASE IN CASH | 203,157 | (80,479 | ) | |||||

| CASH AT BEGINNING OF PERIOD | 141,928 | 80,479 | ||||||

| CASH AT END OF YEAR | $ | 345,085 | $ | — | ||||

| NON-CASH FINANCING ACTIVITIES | ||||||||

| Common stock, Warrants, and Options issued as prepaid expense | $ | 665,641 | — | |||||

| Repayment of short term borrowing through issuance of common stock | $ | 60,000 | — | |||||

| $ | 725,641 | $ | 0 | |||||

| The report on the financial statements and accompanying notes are an integral part of these financial statements. | ||||||||

MassRoots, Inc.

Notes to Financial Statements

September 30, 2015

(Unaudited)

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

MassRoots, Inc. (the “Company”) is a social network for the cannabis community. Through its mobile applications, systems and websites, MassRoots enables people to share their cannabis-related content and for businesses to connect with those consumers. The Company was incorporated in the State of Delaware on April 24, 2013.

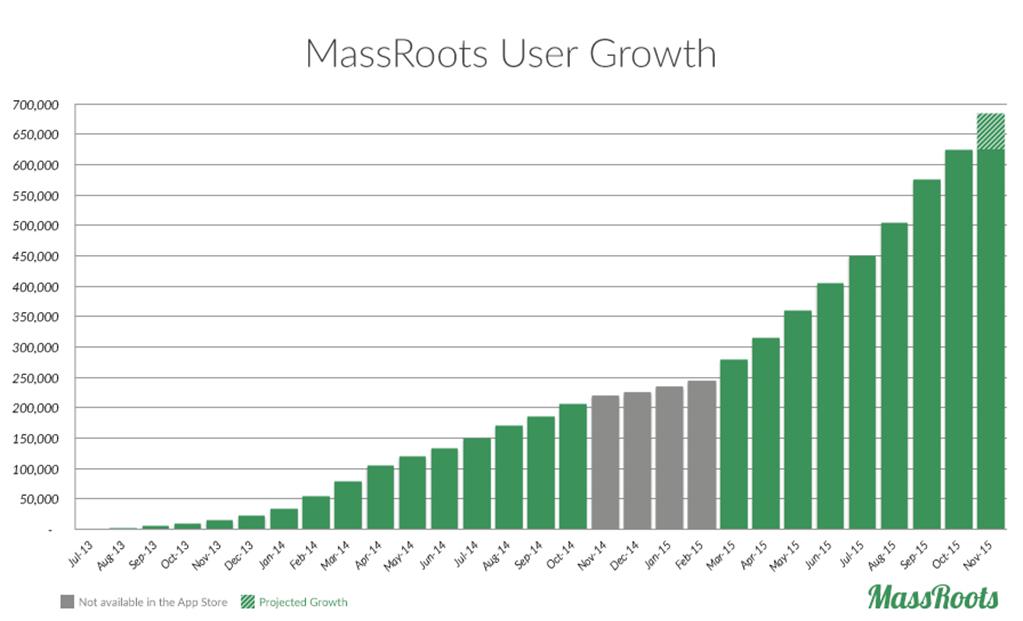

The Company’s primary focus during the first three quarters of 2015 was increasing our userbase from around 275,000 to 570,000 users. MassRoots started monetizing its userbase in mid-August 2015 through advertising, including our self-service advertising portal, MassRoots for Business. We expect to rapidly scale our revenue over the next several quarters. MassRoots’ secondary source of revenue is merchandise sales.

Basis of Presentation

The financial statements include the accounts of MassRoots, Inc. under the accrual basis of accounting.

Management’s Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates. The financial statements above reflect all of the costs of doing business.

Deferred Taxes

The Company accounts for income taxes under Section 740-10-30 of the FASB Accounting Standards Codification. Deferred income tax assets and liabilities are determined based upon differences between the financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the statements of operations in the period that includes the enactment date.

Cash and Cash Equivalents

For purposes of the Statement of Cash Flows, the Company considers highly liquid investments with an original maturity of three months or less to be cash equivalents.

Revenue Recognition

The Company applies paragraph 605-10-S99-1 of the FASB Accounting Standards Codification for revenue recognition. The Company recognizes revenue when services are realized or realizable and earned less estimated future doubtful accounts. The Company considers revenue realized or realizable and earned when all of the following criteria are met:

| (i) | persuasive evidence of an arrangement exists, |

| (ii) | the services have been rendered and all required milestones achieved, |

MassRoots, Inc.

Notes to Financial Statements

September 30, 2015

(Unaudited)

| (iii) | the sales price is fixed or determinable, and |

| (iv) | Collectability is reasonably assured. |

MassRoots primarily generates revenue by charging businesses to advertise on the network. MassRoots has the ability to target advertisements directly to a clients’ target audience, based on their location, on their mobile devices. All advertising services take between a few hours to up to one month to complete, unless otherwise noted.

MassRoots’ secondary source of income is merchandise sales. The objective with the sales is not to generate large profit margins, but to help offset the cost of marketing. Each t-shirt, sticker and jar MassRoots sells will likely lead to more downloads and active users.

Cost of Sales

The Company is subject to risks common to emerging companies in the technology and cannabis industries, including, but not limited to, the uncertain governmental regulation of cannabis, the development of new technological innovations, potential lack of funding needed to reach our business goals and dependence on key personnel.

Comprehensive Income (Loss)

The Company reports comprehensive income and its components following guidance set forth by section 220-10 of the FASB Accounting Standards Codification which establishes standards for the reporting and display of comprehensive income and its components in the financial statements. There were no items of comprehensive income (loss) applicable to the Company during the periods covered in the financial statements.

Loss Per Share

Net loss per common share is computed pursuant to section 260-10-45 of the FASB Accounting Standards Codification. Basic net loss per share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the period. Diluted net loss per share is computed by dividing net loss by the weighted average number of shares of common stock and potentially outstanding shares of common stock during each period.

Risk and Uncertainties

The Company is subject to risks common to companies in the service industry, including, but not limited to, litigation, development of new technological innovations and dependence on key personnel.

Convertible Debentures

If the conversion features of conventional convertible debt provides for a rate of conversion that is below market value at issuance, this feature is characterized as a beneficial conversion feature (“BCF”). A BCF is recorded by the Company as a debt discount pursuant to ASC Topic 470-20 “Debt with Conversion and Other Options.” In those circumstances, the convertible debt is recorded net of the discount related to the BCF, and the Company amortizes the discount to interest expense, over the life of the debt using the effective interest method.

MassRoots, Inc.

Notes to Financial Statements

September 30, 2015

(Unaudited)

Stock-Based Compensation

The Company accounts for stock-based compensation using the fair value method following the guidance set forth in section 718-10 of the FASB Accounting Standards Codification for disclosure about Stock-Based Compensation. This section requires a public entity to measure the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award (with limited exceptions). That cost will be recognized over the period during which an employee is required to provide service in exchange for the award- the requisite service period (usually the vesting period). No compensation cost is recognized for equity instruments for which employees do not render the requisite service.

Fair Value for Financial Assets and Financial Liabilities

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and paragraph 820-10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 establishes a framework for measuring fair value in accounting principles generally accepted in the United States of America (U.S. GAAP), and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three levels of fair value hierarchy defined by Paragraph 820-10-35-37 are described below:

| Level 1 | Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. | |

| Level 2 | Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. | |

| Level 3 | Pricing inputs that are generally observable inputs and not corroborated by market data. |

The carrying amounts of the Company’s financial assets and liabilities, such as cash, prepaid expense and accrued payroll tax approximate their fair values because of the short maturity of these instruments.

The derivative liabilities are stated at their fair value as a Level 3 measurement. The Company used a Black-Scholes model to determine the fair values of these derivative liabilities. See Note 4 for the Company’s assumptions used in determining the fair value of these financial instruments.

Embedded Conversion Features

The Company evaluates embedded conversion features within convertible debt under ASC 815 “Derivatives and Hedging” to determine whether the embedded conversion feature(s) should be bifurcated from the host instrument and accounted for as a derivative at fair value with changes in fair value recorded in earnings. If the conversion feature does not require derivative treatment under ASC 815, the instrument is evaluated under ASC 470-20 “Debt with Conversion and Other Options” for consideration of any beneficial conversion feature.

MassRoots, Inc.

Notes to Financial Statements

September 30, 2015

(Unaudited)

Derivative Financial Instruments

The Company does not use derivative instruments to hedge exposures to cash flow, market, or foreign currency risks. The Company evaluates all of it financial instruments, including stock purchase warrants, to determine if such instruments are derivatives or contain features that qualify as embedded derivatives. For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported as charges or credits to income.

For option-based simple derivative financial instruments, the Company uses the Black-Scholes option-pricing model to value the derivative instruments at inception and subsequent valuation dates. The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is re-assessed at the end of each reporting period.

Beneficial Conversion Feature

For conventional convertible debt where the rate of conversion is below market value, the Company records a "beneficial conversion feature" ("BCF") and related debt discount.

When the Company records a BCF, the relative fair value of the BCF is recorded as a debt discount against the face amount of the respective debt instrument (offset to additional paid in capital) and amortized to interest expense over the life of the debt.

Recent Accounting Pronouncements

In June 2014, the FASB issued ASU 2014-10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements. ASU 2014-10 eliminates the distinction of a development stage entity and certain related disclosure requirements, including the elimination of inception-to-date information on the statements of operations, cash flows and stockholders' equity. The amendments in ASU 2014-10 will be effective prospectively for annual reporting periods beginning after December 15, 2014, and interim periods within those annual periods, however early adoption is permitted for financial statements not yet issued. The Company adopted ASU 2014-10 during the fourth quarter of 2014, thereby no longer presenting or disclosing any information required by Topic 915. The Company has reviewed all recently issued, but not yet effective, accounting pronouncements up to ASU 2015-10, and does not believe the future adoption of any such pronouncements may be expected to cause a material impact on its financial condition or the results of its operations.

NOTE 2 FIXED ASSETS

Fixed assets were comprised of the following as of September 30, 2015 and December 31, 2014. Depreciation is calculated using the straight-line method over a 5 year period.

| December 31, 2014 | September 30, 2015 | |||||||

| Cost: | ||||||||

| Computers | $ | 12,134 | $ | 36,056 | ||||

| Office equipment | 4,055 | 25,909 | ||||||

| Total | 16,189 | 61,965 | ||||||

| Less: Accumulated depreciation | 2,027 | 8,685 | ||||||

| Property and equipment, net | $ | 14,162 | $ | 53,280 | ||||

MassRoots, Inc.

Notes to Financial Statements

September 30, 2015

(Unaudited)

NOTE 3 PREPAID EXPENSE

During the first quarter 2015, the Company issued 430,000 shares of its common stock, 100,000 warrants and 1,065,000 options in exchange for services, valued in the aggregate at $782,695. The $782,695 is being charged to operations over a one-year term.

On April 28, 2015, the Company entered into a consulting agreement with Torrey Hills Capital. Under the terms of the agreement, Torrey Hills Capital is to receive 75,000 shares of common stock and $5,000 per month for setting-up non-deal roadshows for the Company. The service period is 4 months.

On May 12, 2015, the Company entered into a consulting agreement with Caro Capital. Under the terms of the agreement, Caro is to receive 200,000 shares of common stock and $2,000 per month for setting-up non-deal roadshows for the Company for a period of one year.

On June 15, 2015, the Company entered into a consulting agreement with Demeter Capital. Under the terms of the agreement, Demeter Capital is to receive 100,000 shares of common stock for introductions to investors. The service period is 6 months.

On June 4, 2014, the Company issued a total of 850,000 shares of its common stock and 2,050,000 options in exchange for consulting services, valued in the aggregate at $286,818. The $286,818 is being charged to operations over a three-year term.

Compensation from equity issuances charged to operations during the nine months ended September 30, 2015 and September 30, 2014 was $1,265,536 and $606,651, respectively. The expense related to the amortization of prepaid expense is $1,084,167. The unamortized balance at September 30, 2015 and at December 31, 2014 was $665,641 and $196,688, respectively.

NOTE 4 DERIVATIVE LIABILITIES

The Company identified conversion features embedded within convertible debt and warrants issued and the Company also identified derivative liabilities embedded within warrants issued together with subscription agreements and for services. The Company has determined that the features associated with the embedded conversion option, in the form a ratchet provision, should be accounted for at fair value, as a derivative liability, as the Company cannot determine if a sufficient number of shares would be available to settle all potential future conversion transactions.

During the nine months ended September 30, 2015, the Company and the holders of warrants previously issued as part of our offering in March 2014 with an exercise price of $0.40 agreed to amend the warrants to remove the ratchet provision. This, along with the Warrant exercises that occurred during the period, reduced the Company’s derivative liability by $2,574,683.

MassRoots, Inc.

Notes to Financial Statements

September 30, 2015

(Unaudited)

As a result of the application of ASC No. 815, the fair value of the ratchet feature related to convertible debt and warrants is summarized as follows:

| Warrants with Convertible Debt | Warrants with Subscription Agreements | Warrants Issued For Services | TOTAL | |||||||||||||

| Derivative liabilities as of December 31, 2014 | $ | 517,137 | $ | 582,571 | $ | 0 | $ | 1,099,708 | ||||||||

| Derivative liabilities - generated from new issued warrants | 0 | 125,708 | 195,422 | 321,130 | ||||||||||||

| Changes in derivative liabilities | 937,189 | 1,314,158 | 232,241 | 2,483,588 | ||||||||||||

| Exercise of warrant | 0 | (584,977 | ) | 0 | (584,977 | ) | ||||||||||

| Warrant - Amendment | (1,454,326 | ) | (535,380 | ) | 0 | (1,989,706 | ) | |||||||||

| Balance as of September 30, 2015 | $ | 0 | $ | 902,080 | $ | 427,663 | $ | 1,329,743 | ||||||||

The fair value at the commitment and re-measurement dates for the Company’s derivative liabilities were based upon the following management assumptions as of September 30, 2015:

| Commitment Date | Remeasurement Date | |||||||

| Expected dividends | 0% | 0% | ||||||

| Expected volatility | 150% | 75% - 150% | ||||||

| Expected term | 3-5 years | 1.83 – 4.70 years | ||||||

| Risk free interest rate | 0.75% - 1.1% | 0.89% - 1.37% | ||||||

NOTE 5 DEBT DISCOUNT

The Company recorded the $174,378 debt discount due to beneficial conversion feature of $87,189 for the detachable warrants issued with convertible debt, and $87,189 in derivative liabilities related to the ratchet feature warrants.

The debt discount was recorded in 2014 and pertains to convertible debt and warrants issued that contain ratchet features that are required to be bifurcated and reported at fair value.

Debt discount is summarized as follows:

| September 30, 2015 | December 31, 2014 | |||||||

| Deb discount on notes payable | $ | 107,016 | $ | 174,379 | ||||

| Accumulated amortization | (107,016 | ) | (67,363 | ) | ||||

| Debt discount on notes payable | $ | 0 | $ | 107,016 | ||||

Amortization of debt discount on notes payable for the nine months ended September 30, 2015 and September 30, 2014 was $107,016 and $34,639, respectively.

NOTE 6 CONVERTIBLE DEBENTURES

On March 24, 2014, the Company issued convertible debentures to certain accredited investors. The total principal amount of the debentures is $269,100 and matures on March 24, 2016 with a zero percent interest rate. The debentures are convertible into shares of the Company’s common stock at $0.10 per share.

MassRoots, Inc.

Notes to Financial Statements

September 30, 2015

(Unaudited)

The debentures were discounted in the amount of $174,378 due to the intrinsic value of the beneficial conversion option and relative derivative liabilities of the warrants.

On January 7, 2015, one holder of a convertible debenture converted $40,000 of principal into 400,000 shares of common stock.

On April 4, 2015, one holder of a convertible debenture converted $20,000 of principal into 200,000 shares of common stock.

As of September 30, 2015, the aggregate carrying value of the debentures was $209,100 net of debt discounts of $0, while as of December 31, 2014, the aggregate carrying value of the debentures was $162,084 net of debt discounts of $107,016.

NOTE 7 CAPITAL STOCK

The Company is currently authorized to issue 21 Series A preferred shares at $1.00 par value per share with 1:1 conversion and voting rights. As of September 30, 2015, there were 0 shares of Series A preferred shares issued and outstanding.

The Company is currently authorized to issue 200,000,000 shares of its common stock at $0.001 par value per share. As of June 30, 2015, there were 44,505,238 shares of common stock issued and outstanding and 857,000 shares of common stock to be issued.

On March 18, 2014, the Company entered into a Plan of Reorganization with its shareholders in which the following was effected: (i) on March 21, 2014, the Company’s Certificate of Incorporation was amended to allow for the authorization of 200,000,000 shares of the Company’s common stock; (ii) on March 24, 2014, each of the Company’s preferred shareholders converted their shares into common stock on a one for one basis; and (iii) on March 24, 2014, each of the Company’s shareholders surrendered their shares of the Company’s common stock in exchange for the pro-rata distribution of 36,000,000 newly issued shares of Company’s common stock, based on the percentage of the total shares of common stock held by the shareholder immediately prior to the exchange (the “Exchange”).

On January 1, 2014, the Company’s directors and officers exercised all of the then outstanding 72.06 stock options and acquired 72.06 shares of common stock at $1 per share. These 72.06 shares of common stock were exchanged for 21,954,160 shares of common stock during the Exchange.

On March 18, 2014, immediately prior to the Exchange, the Company converted $4,358 accrued dividends from Series A preferred shares into 0.513 shares of common stock, which was exchanged for 156,293 shares of common stock during the Exchange.

On March 24, 2014, the Company issued 2,059,000 shares of common stock in exchange for $205,900 cash.

On June 4, 2014, the Company issued 250,000 shares of common stock to Vincent “Tripp” Keber valued at $0.10 per share in exchange for his services on the Company’s Board of Directors for three years under the 2014 Equity Incentive Plan (“2014 Plan”). These shares had a fair market value of $25,000, of which $6,223 was amortized for the nine months ended September 30, 2015.

On June 4, 2014, the Company issued 250,000 shares of common stock under the 2014 Plan to Ean Seeb valued at $0.10 per share in exchange for his services on the Company’s Board of Directors for three years. These shares had a fair market value of $25,000, of which $6,223 was amortized for the nine months ended September 30, 2015.

MassRoots, Inc.

Notes to Financial Statements

September 30, 2015

(Unaudited)

On June 4, 2014, the Company issued 250,000 shares of common stock under the 2014 Plan to Sebastian Stant valued at $0.10 per share in exchange for his services as the Company’s Lead Web Developer for one year. These shares had a fair market value of $25,000, of which $10,616 was amortized for the nine months ended September 30, 2015.

On May 1, 2014, the Company issued 100,000 shares of common stock under the 2014 Plan to Jesus Quintero valued at $0.10 per share in exchange for his services as the Company’s Chief Financial Officer for one year. These shares had a fair market value of $10,000, of which $3,315 was amortized for the nine months ended September 30, 2015.

From September 15, 2014 to March 11, 2015, we completed an offering of $866,000 of our securities to certain accredited and non-accredited investors consisting of 1,732,000 shares of our common stock at $0.50 per share. As of June 30, 2015, all 1,732,000 shares of common stock had been issued.

From January 1 to March 31, 2015, the Company issued 230,000 shares of common stock to five employees and consultants under our 2014 Employee Stock Option Program.

During April 2015, the Company issued 960,335 shares of common stock in exchange for $576,200 cash.

During April 2015, the Company compensated Chardan Capital $20,000 cash and 262,560 shares of unregistered common stock for investment banking services.

On April 28, 2015, the Company entered into a consulting agreement with Torrey Hills Capital. Under the terms of the agreement, Torrey Hills Capital is to receive 75,000 shares of common stock and $5,000 per month for setting-up non-deal roadshows for the Company.

On May 12, 2015, the Company entered into a consulting agreement with Caro Capital. Under the terms of the agreement, Caro is to receive 200,000 shares of common stock and $2,000 per month for setting-up non-deal roadshows for the Company for a period of one year.

On June 15, 2015, the Company entered into a consulting agreement with Demeter Capital. Under the terms of the agreement, Demeter Capital is to receive 100,000 shares of common stock for consulting services. The 100,000 shares have not been issued as of June 30, 2015 and were recorded as common stock to be issued and subsequently issued in July 2015.

In June 2015, the Company signed agreements to issue 607,335 shares of common stock in exchange for $455,500 cash.

During the second quarter of 2015, the Company issued 1,686,341 shares of common stocks and received $300,936 due to the exercise of warrants.

During the second quarter of 2015, the Company issued 654,050 shares of common stock which previously were classified as common stock to be issued on March 31, 2015.

In July 2015, pursuant to an Exchange and Release Agreement made by and between the Company and a shareholder, the shareholder agreed to cancel and waive all rights to 1,000,000 shares of the Company’s common stock then held by the shareholder in exchange for the Company’s issuance of a warrant to the shareholder, permitting the purchase of 1,000,000 shares of the Company’s common stock at $0.001 per share for a period of three (3) years from the date of issuance.

During the third quarter of 2015, the Company issued 757,335 shares of common stock which previously were classified as common stock to be issued on June 30, 2015.

MassRoots, Inc.

Notes to Financial Statements

September 30, 2015

(Unaudited)

In July 2015 MassRoots sold 934,004 shares of unregistered common stock for gross proceeds of $685,502. These shares were issued in August 2015.

During the third quarter of 2015, warrants to purchase 552,500 shares of our common stock, which were issued as part of our offering in March 2014, were exercised for proceeds of $161,150.

NOTE 8 STOCK WARRANTS

During the three months ended March 31, 2015, in connection to the sale of 684,000 shares of common stock, the Company granted to the same investors three−year warrants to purchase an aggregate of 342,000 shares of the Company’s common stock at $1.00 per share. The warrants may be exercised any time after the issuance through and including the third (3rd) anniversary of its original issuance. The warrants have a fair market value of $125,708. The fair market value was calculated using the Black-Scholes options pricing model, assuming approximately 1% risk-free interest, 0% dividend yield, 150% volatility, and expected life of 3 years. See Note 4 for further discussion.

On February 27, 2015, the Company sold warrants for a nominal amount to purchase 100,000 shares of common stock at $0.50 per share to certain service providers.

On April 8, 2015, the Company issued warrants to purchase 50,000 shares of common stock at $0.60 per share to certain service providers.

From April 1 to June 30, 2015, 750,000 of warrants previously issued as part of our offering in March 2014 were exercised at an exercise price of $0.40 per share for proceeds of $300,000,the third quarter of 2015.

From April 1 to June 30, 2015, warrants to purchase 936,341 shares of common stock, which were previously issued as part of our offering in March 2014, were exercised at an exercise price of $0.001 per share for proceeds of $936.34.

From July 1 to September 30, 2015, warrants to purchase 150,000 shares of common stock, which previously issued as part of our offering in March 2014, were exercised at an exercise price of $0.001 per share for proceeds of $150.00.

From July 1 to September 30, 2015, warrants to purchase 402,500 shares of common stock, which were previously issued as part of our offering in March 2014, were exercised at an exercise price of $0.40 for proceeds of $161,150.

In July 2015, pursuant to an Exchange and Release Agreement made by and between the Company and a shareholder, the shareholder agreed to cancel and waive all rights to 1,000,000 shares of the Company’s common stock then held by the shareholder in exchange for the Company’s issuance of a warrant to the shareholder, permitting the purchase of 1,000,000 shares of the Company’s common stock at $0.001 per share for a period of three (3) years from the date of issuance.

On July 30, 2015, the Company issued warrants to purchase an aggregate of 175,000 shares of common stock at $0.90 per share to certain service providers.

MassRoots, Inc.

Notes to Financial Statements

September 30, 2015

(Unaudited)

Stock warrants outstanding and exercisable on September 30, 2015 are as follows:

| Exercise Price per Share | Shares Under Warrants | Remaining Life in Years | ||||||||||

| Outstanding | ||||||||||||

| $ | 0.001 | 3,963,659 | 2 | |||||||||

| $ | 0.4 | 3,597,500 | 2 | |||||||||

| $ | 0.5 | 100,000 | 5 | |||||||||

| $ | 0.6 | 50,000 | 5 | |||||||||

| $ | 0.9 | 175,000 | 5 | |||||||||

| $ | 1 | 866,000 | 3 | |||||||||

| Exercisable | ||||||||||||

| $ | 0.001 | 3,963,659 | 2 | |||||||||

| $ | 0.4 | 3,597,500 | 2 | |||||||||

| $ | 0.5 | 100,000 | 5 | |||||||||

| $ | 0.6 | 50,000 | 5 | |||||||||

| $ | 0.9 | 175,000 | 5 | |||||||||

| $ | 1 | 866,000 | 3 | |||||||||

No other stock warrants have been issued or exercised during the three months ended September 30, 2015.

NOTE 9 EMPLOYEE EQUITY INCENTIVE PLAN

In June 2014, our shareholders approved our 2014 Equity Incentive Plan (“2014 Plan”), which provides for the grant of incentive stock options to our employees and our parent and subsidiary corporations' employees, and for the grant of nonstatutory stock options, stock bonus awards, restricted stock awards, performance stock awards and other forms of stock compensation to our employees, including officers, consultants and directors. A total of 4 million shares of common stock are reserved for issuance under our 2014 Plan.

On June 4, 2014, the Company granted options to purchase 750,000 shares at $0.10 per share to Vincent “Tripp” Keber for his services on the Company’s Board of Directors for 3 years. Under the terms of the grant, 250,000 shares shall begin vesting on October 1, 2014 such that 20,833 shares shall vest on the first of every month except for every three months, when 20,834 shares shall vest. An additional 250,000 shares shall begin vesting the later of: October 1, 2015 or the Company reaching 830,000 users such that 20,833 shares shall vest on the first of every month except for every three months, when 20,834 shares shall vest. An additional 250,000 shares shall vest immediately upon the later of: October 1, 2016 or the Company reaching 1,080,000 users. These options were issued in exchange for his services on the Company’s Board of Directors for 3 years. The options may be exercised any time after the issuance through and including the tenth (10th) anniversary of its original issuance. The options have a fair market value of $73,836. The fair market value was calculated using the Black-Scholes options pricing model, assuming approximately 2.61% risk-free interest, 0% dividend yield, 150% volatility, and expected life of 10 years. For the nine months ended September 30, 2015 $18,408 was amortized.

MassRoots, Inc.

Notes to Financial Statements

September 30, 2015

(Unaudited)

On June 4, 2014, the Company granted options to purchase 750,000 shares at $0.10 per share to Ean Seeb for his services on the Company’s Board of Directors for 3 years. Under the terms of the grant, 250,000 shares shall begin vesting on October 1, 2014 such that 20,833 shares shall vest on the first of every month except for every three months, when 20,834 shares shall vest. An additional 250,000 shares shall begin vesting the later of: October 1, 2015 or the Company reaching 830,000 users such that 20,833 shares shall vest on the first of every month except for every three months, when 20,834 shares shall vest. An additional 250,000 shares shall vest immediately upon the later of: October 1, 2016 or the Company reaching 1,080,000 users. These options were issued in exchange for his services on the Company’s Board of Directors for 3 years. The options may be exercised any time after the issuance through and including the tenth (10th) anniversary of its original issuance. The options have a fair market value of $73,836. The fair market value was calculated using the Black-Scholes options pricing model, assuming approximately 2.61% risk-free interest, 0% dividend yield, 150% volatility, and expected life of 10 years. For the nine months ended September 30, 2015 $18,408 was amortized.

On June 4, 2014, the Company granted options to purchase 550,000 shares at $0.10 per share to Sebastian Stant for his services as the Company’s Lead Web Developer for 1 year. Under the terms of the grant, 250,000 shares shall vest immediately upon the Company reaching 250,000 users. An additional 150,000 shares shall vest immediately upon the Company reaching 500,000 users. An additional 150,000 shares shall vest immediately upon the Company reaching 750,000 users. The options were issued in exchange for his services as the Company’s Lead Web Developer for 1 year. The options may be exercised any time after the issuance through and including the tenth (10th) anniversary of its original issuance. The options have a fair market value of $54,146. The fair market value was calculated using the Black-Scholes options pricing model, assuming approximately 2.61% risk-free interest, 0% dividend yield, 150% volatility, and expected life of 10 years. For the nine months ended September 30, 2015 $12,328 was amortized.

On March 9, 2015, Sebastian Stant resigned his position as Lead Developer of MassRoots and surrendered 350,000 options with a strike price of $0.10 per share back to the 2014 Plan.

From January 1 to March 31, 2015, the Company granted 230,000 shares and options to purchase 1,065,000 shares at $0.50 per share to 20 employees and consultants of the Company, with most vesting monthly over the course of one year. The fair market value of the options are $523,991.

On April 8, 2015, the Company granted options to purchase 105,000 shares at $0.6 per share to 3 employees and consultants of the Company, with most vesting monthly over the course of one year. The fair market value of the options are $114,143.

Stock options outstanding and exercisable on September 30, 2015 are as follows:

| Exercise Price per Share | Shares Under Options | Remaining Life in Years | ||||||||||

| Outstanding | ||||||||||||

| $ | 0.10 | 1,750,000 | 9 | |||||||||

| $ | 0.50 | 1,065,000 | 10 | |||||||||

| $ | 0.60 | 105,000 | 10 | |||||||||

| Exercisable | ||||||||||||

| $ | 0.10 | 750,000 | 9 | |||||||||

| $ | 0.50 | 748,721 | 10 | |||||||||

| $ | 0.60 | 42,494 | 10 | |||||||||

No other stock options have been issued or exercised during the three months ended September 30, 2015 given that that 2014 Equity Plan has been expended. The Company anticipates approving a new equity plan in the near future.

MassRoots, Inc.

Notes to Financial Statements

September 30, 2015

(Unaudited)

NOTE 10 GOING CONCERN AND UNCERTAINTY

The Company has suffered losses from operations since inception. In addition, the Company has yet to generate an significant cash flow from its business operations. These factors raise substantial doubt as to the ability of the Company to continue as a going concern.

Management’s plans with regard to these matters encompass the following actions: 1) obtain funding from new and potentially current investors to alleviate the Company’s working capital deficiency, and 2) implement a plan to generate sales. The Company’s continued existence is dependent upon its ability to translate its vast user base into sales. However, the outcome of management’s plans cannot be ascertained with any degree of certainty. The accompanying unaudited financial statements do not include any adjustments that might result from the outcome of these risks and uncertainties.

NOTE 11 SIGNIFICANT EVENTS

In July 2015, MassRoots sold 934,004 shares of unregistered common stock for gross proceeds of $685,502.00. This stock was issued in August 2015. In connection with this offering, Chardan Capital received $27,200 in cash and 80,560 shares of the Company’s common stock as commission for this placement.

NOTE 12 SUBSEQUENT EVENTS

On October 1, 2015, MassRoots, Inc. (the “Company”) entered into an agreement (the “Agreement”) with Jesus Quintero for Mr. Quintero to continue to serve as the Company’s Chief Financial Officer and provide it with financial consulting services. The Agreement creates an independent contractor relationship and has a term of one year. For this service, Mr. Quintero is paid $4,000 per month. No retirement plan, health insurance or employee benefits program was awarded to Mr. Quintero and he serves at the direction of the Chief Executive Officer and Board of Directors. The Agreement may be terminated by either party, without cause, upon ninety (90) days prior written notice to the other party. If terminated, Mr. Quintero would receive only the compensation earned, but unpaid under the Agreement.

From November 9-10, 2015, the Company raised $1,019,375 in gross proceeds from the sale of shares of the Company’s common stock, together with warrants, with one Warrant entitling the holder to purchase one share of Common Stock at a price equal to $3 per share in a registered ”best efforts” offering to certain investors pursuant to an effective registration statement (the “Offering”). The purchase price paid by the investors was $1.25 for one share of Common Stock and one half Warrant. The Warrants are immediately exercisable and expire three years from the date of issuance. The shares of Common Stock and Warrants are immediately separable and will be issued separately. The Company closed the Offering on November 10, 2015. A total of 815,500 shares of Common Stock and 407,750 Warrants were sold in the Offering and will be issued pursuant to the prospectus, dated November 9, 2015 and filed with the Securities and Exchange Commission as of the same date.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis in conjunction with our unaudited financial statements and related notes contained in Part I, Item 1 of this Quarterly Report. Please also refer to the Note About Forward Looking Statements for information on such statements contained in this Quarterly Report immediately preceding Item 1.

Overview

MassRoots, Inc. is a Delaware corporation formed on April 24, 2013. Our principal place of business is located at 1624 Market Street, Suite 201, Denver, CO 80202, our telephone number is (720) 442-0052 and our corporate website is corporate.massroots.com. The information on our website or mobile apps is not a part of this Quarterly Report on Form 10-Q.

User Growth and Social Following

During the third quarter of 2015, MassRoots expanded its userbase by 41%, from approximately 400,000 to 570,000 cannabis consumers. Our growth was primarily driven by MassRoots’ increasing popularity as one of the first national cannabis brands and word of mouth virility from our users. We believe that MassRoots’ userbase has hit critical mass and will continue to rapidly grow for the foreseeable future. Based on our current projections, we expect MassRoots to cross 1 million users in late 2015 or early 2016.

During September 2015, MassRoots generated 150 million “newsfeed impressions,” defined as a user viewing a post on MassRoots’ local, global or buds feeds.

Business Model and MassRoots for Business

We started monetizing MassRoots’ network in mid-August 2015 through advertising. We currently offer businesses the ability to sponsor post through certain MassRoots accounts, get product placement in our weekly email newsletter to over 400,000 opt-in email subscribers, and sponsor content on the MassRoots blog. We generated approximately $60,000 in revenue through these channels in the last 6 weeks of the third quarter of 2015.

We expect to significantly ramp up revenue during the fourth quarter of 2015 and in 2016 as more of our self-service advertising options begin to come online, in combination with continued user growth.

The revenue MassRoots is generating is already significantly reducing the Company’s monthly negative cash flow. During the third quarter of 2015, MassRoots burned approximately $280,000 per month, a reduction from approximately $350,000 per month during the second quarter of 2015.

Our intention is to prove MassRoots’ business model in 2015 and 2016 while the cannabis industry is still relatively small – of the 23 states with medical cannabis laws, only 4 states have active dispensary systems with wide enough set of conditions to allow a significant portion of the population to purchase cannabis (Colorado, California, Arizona and Washington). We believe the vast majority of the revenue we generate in 2015 and 2016 will come from businesses in these states. The 2016 election cycle has the potential to drastically expand the regulated cannabis market – at least 7 states are expected to have some form of cannabis legalization on the ballot that could cause the cannabis industry to grow to $10.2 billion if these initiates become law, according to ArcView Market Research.

MassRoots’ business model is designed to scale as marijuana legalization continues to spread: every state that legalizes

the medicinal or adult-use of cannabis expands the number of licensed businesses in the industry, increasing our potential revenue.

On Competitive Advantage and Network Effects

We believe network effects serve as the most powerful form of competitive advantage for all consumer-facing social networks, including MassRoots. Once a person and their friends join a social network, it is unlikely they switch their active usage to another social network in the same category. In 2011, Google+ launched to much fanfare as the, “Facebook Killer,” with the resources of Google at its disposal: billions of dollars in launch and advertising costs, immediate integration with the largest search engine in the world, and the use of the Google brand. However, it failed to gain traction because Facebook already dominated desktop-based social networking.

Similarly, Facebook launched Poke in 2013 to take out Snapchat. Poke had much more functionality and worked better than Snapchat, it was immediately pushed to millions of Facebook users and it had the backing of Facebook’s billions of dollars in assets at its disposal. However, even this failed to make a dent in Snapchat’s market share and Poke was scrapped shortly after.

We believe MassRoots’ userbase is at the size at which it will be extremely difficult for any potential competitor to enter the social networking for cannabis consumers space, a market that MassRoots created. When Apple banned all social cannabis applications from the App Store last fall, it was MassRoots’ userbase and network that successfully fought to have the policy overturned.

Product Development

During the third quarter of 2015, MassRoots introduced several features, including new user onboarding, aimed at expanding its appeal beyond the “stoner” demographic into a more mainstream audience. We also began the process of migrating the servers on which MassRoots is hosted in order to reduce load times, better organize MassRoots’ data, and allow the platform to scale to millions of users. We expect this process will conclude during the fourth quarter of 2015 and permit MassRoots’ developers to implement new features more rapidly after the migration is complete.

Additionally, MassRoots aims to introduce a new web interface in late November 2015 aimed at opening up MassRoots’ content to search engines, which we believe could draw hundreds of thousands of unique visitors per month, accelerating our user growth and adverting inventory.

Market Share

One of MassRoots’ primary objectives during 2015 has been rapidly expanding its market share of consumers and businesses in the cannabis industry. As of September 30, 2015, MassRoots had 590,000 users of an estimated 10 million Americans who consume cannabis on a regular basis and actively engage on social media, which we have defined as our target market. We have approximately 1,000 of the estimated 15,000 cannabis-related businesses in America actively posting on our network, including approximately 59% of the dispensaries in Colorado. The Company has approximately 2,200 shareholders according to an October NOBO list.

Competition

We do not believe we face any significant competition in the social network for the cannabis community niche; however, over the coming months, we expect to actively compete with dispensary locators and strain guides, such as WeedMaps and Leafly, for dispensaries' advertising budgets. Our advertising revenue is currently generated mainly from national cannabis brands; as more of our localized advertising features come online during the fourth quarter of 2015 and first quarter of 2016, we will begin to more actively compete with WeedMaps and Leafly for local advertising budgets.

Over the coming months, MassRoots plans to implement many of the utilities WeedMaps and Leafly offer as added-in features of our community. We believe that while you can replicate a map and duplicate a strain database, you cannot replicate relationships and you cannot duplicate a community. As with any social application, recurring engagement and network effects are MassRoots' primary competitive advantage.

Results of Operations

| For the Three-months ended | |||||||||||||||||

| 30-Sep-15 | 30-Sep-14 | $ Change | % Change | ||||||||||||||

| (UNAUDITED) | (UNAUDITED) | ||||||||||||||||

| Revenue | $ | 60,916 | $ | 5,719 | $ | 55,197 | 740 | % | |||||||||

| Gross profit | $ | 52,508 | $ | 5,719 | $ | 46,789 | 818.1 | % | |||||||||

| General and administrative expenses | 1,433,746 | 266,255 | 1,167,491 | 438.5 | % | ||||||||||||

| Loss from Operations | (1,381,238 | ) | (260,536 | ) | (1,120,702 | ) | 430.2 | % | |||||||||

| Other Income /(Expense) | (716,109 | ) | (16,958 | ) | (699,051 | ) | 4122.2 | % | |||||||||

| Net Loss | (2,097,247 | ) | (277,494 | ) | (1,819,753 | ) | 655.8 | % | |||||||||

| Net loss per share - basic and diluted | $ | (0.05 | ) | N/A | N/A | N/A | |||||||||||

| For the Nine-months ended | ||||||||||||||||

| 30-Sep-15 | 30-Sep-14 | $ Change | % Change | |||||||||||||

| (UNAUDITED) | (UNAUDITED) | |||||||||||||||

| Revenue | $ | 63,99892 | $ | 7,458 | $ | 56,524 | 75790 | % | ||||||||

| Gross profit | $ | 55,574 | $ | 6,768 | $ | 48,806 | 721.1 | % | ||||||||

| General and administrative expenses | 3,492,631 | 1,249,639 | 2,242,992 | 179.5 | % | |||||||||||

| Loss from Operations | (3,437,057 | ) | (1,242,871 | ) | (2,194,186 | ) | 176.5 | % | ||||||||

| Other Income /(Expense) | (727,999 | ) | (34,639 | ) | (693,360 | ) | 2001.7 | % | ||||||||

| Net Loss | (4,165,056 | ) | (1,277,510 | ) | (2,887,546 | ) | 226.0 | % | ||||||||

| Net loss per share - basic and diluted | $ | (0.10 | ) | N/A | N/A | N/A | ||||||||||

Revenues

Since inception on April 24, 2013, our business operations have been primarily focused developing our mobile applications, websites and increasing our user base. In mid-August 2015, MassRoots began to generate revenue through advertising on its mobile application and digital properties. Businesses are able to sponsor posts through certain accounts on the MassRoots App, advertise in MassRoots’ email newsletters to more than 400,000 opt-in cannabis consumers, and partner with the MassRoots brand on certain products and services. During the fourth quarter of 2015, we expect to continue the development of MassRoots’ self-service advertising portal to continue to expand the advertising services we provide to businesses.

We have generated only minimal revenues from our operations thus far. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including the financial risks associated with the limited capital resources currently available to us for the implementation of our business strategies.

For the three months ended September 30, 2015 and September 30, 2014, we generated revenues of $60,916 and $5,719, respectively, while revenues for the nine months ended September 30, 2015 and September 30, 2014 were $63,982 and $7,458, respectively. These revenues were primarily from advertising for the three and nine months ended September 30, 2015, and related primary to sales on our online store for the three and nine months period ended September 30, 2014

Cost of Goods Sold

For the three months ended September 30, 2015 and September 30, 2014, cost of goods sold was $8,408 and $0, respectively, which represents the cost of items sold from the Shop.MassRoots.com. For the nine months ended September 30, 2015 and September 30, 2014, cost of goods sold was $8,408 and $690, respectively. This represents the cost of items sold from the store.Massroots.com.

Operating Expenses

For the nine months ended September 30, 2015 and September 30, 2014, our operating expenses were $1,433,746 and $266,255, respectively. This increase is attributed mainly to an increase of $518,376 in equity issuances for services, an increase of $332,209 in payroll as the company brought on additional developers to accelerate its product pipeline, a $95,591 increase in advertising which was primarily driven by the costs of sponsoring the 420 Rally and attending conferences, In addition, we experienced an increase of $110,376 in accounting and consulting related to accounting and audit work, as well as consultants for various projects. We also experienced an increase in travel expense of $30,413 primarily related to non-deal roadshows, investor conferences, and other expenses related to fundraising activities.

For the nine months ended September 30, 2015 and September 30, 2014, our operating expenses were $3,492,631 and $1,249,639, respectively. This $2,242,992 increase is attributed mainly to $658,885 in equity issuances for services, an increase of $767,589 in payroll as the company brought on additional developers to accelerate its product pipeline, a $277,781 increase in advertising which was primarily driven by the costs of sponsoring the 420 Rally and attending conferences. In addition, we experienced an increase of $89,733 in travel, an increase of $233,584 in accounting and consulting charges for audits, accounting work and consulting for various projects. We also experienced an increase in other general administrative expenses of $198,722, mainly related to non-deal roadshows, investor conferences, and other expenses related to creating a market for our common stock.

Several of the expenses made during the nine months ended September 30, 2015 were one-time expenses: a $30,000 deposit for our new office, $25,000 for a DTC Application and OTCQB certification fees, roughly $75,000 in costs related to the 420 Rally, $35,000 in new office equipment and computers for our development team, and a $175,000 investment in Flowhub. We determined these investments were necessary to expand MassRoots’ functionality, recruit the best technical talent, and engage the Denver market.

Other Income (Expense)

For the three months ended September 30, 2015 and September 30, 2014, the Company realized loss related to the fair value mark to market adjustments of its derivative liabilities of $658,929 and $0, respectively. For the nine months ended September 30, 2015 and September 30, 2014 the company realized a loss related to the fair value of mark to market adjustments of its derivative liabilities of $616,192 and $0, respectively. These derivative liabilities were originally determined as of December 31, 2014. For the three months ended September 30, 2015 and September 30, 2014 the company recorded amortization of discount on notes payable of $56,670 and $16,958, respectively. For the nine months ended September 30, 2015 and September 30, 2014, the Company recorded amortization of discount on notes payable of $ 107,016 and $34,639, respectively. Interest expense related to the derivatives was $410 and $0 for the three months ended September 30, 2015 and September 30, 2014, respectively, while incurring interest expense related to derivatives was $4,791 and $0 for the nine months ended September 30, 2015 and September 30, 2014, respectively.

For the three months ended September 30, 2015 and September 30, 2014, we had net losses of $2,097,247 and $277,494, respectively. For the nine months ended September 30, 2015 and September 30, 2014 we had losses of $4,165,056 and $1,277,510, respectively.

Liquidity and Capital Resources

For the nine months ended September 30, 2015 and 2014, our cash flows were:

| Nine months ended | ||||||||

| September 30, | ||||||||

| 2015 | 2014 | |||||||

| (Unaudited) | ||||||||

| Net cash used by operating activities | ($ | 1,990,774 | ) | ($ | 651,295 | ) | ||

| Net cash used in investing activities | ($ | 220,776 | ) | ($ | 9,184 | ) | ||

| Net cash provided by financing activities | $ | 2,414,707 | $ | 580,000 | ||||

Net cash used in operations during the nine months ended September 30, 2015 and September 30 2014 was $1,990,774 and $651,295, respectively. For the nine months ended September 30, 2015, net cash used was attributed mainly to advertising spent scaling the MassRoots userbase and development-related expenses, slightly offset by revenue from mid-August to the end of September 2015. For the nine months ended September 30, 2014, net cash used of $651,295 was attributed mainly to advertising and the cost of going public through a Registration Statement on Form S-1.

Net cash used in investing activities was $220,776 and $9,184 for the nine months ended September 30, 2015 and September 30, 2014, respectively. The increase was primarily related to our $175,000 investment in Flowhub, a seed-to-sale system and purchase of computer equipment due to our system expansion.

Net cash provided by financing activities for the nine months ended September 30, 2015 and September 30, 2014 was $2,414,707 and $580,000, respectively. These amounts were attributed to fundraising and equity issuances throughout the periods, which increased in 2015.

Capital Resources

Our current cash on hand as of September 30, 2015 was $345,085, which will be used to meet our operational expenditures for one and a half months. Subsequent to the close of the quarter, we raised $1,019,000 through a registered offering which will be used to meet our operation expenditures through the end of 2015 and midway though the first quarter of 2016. Additionally, as of September 30, 2015, there are 3,597,500 warrants outstanding with an exercise price of $0.40 per share and 866,000 warrants outstanding with an exercise price of $1.00 per share, which, if exercised, would supply approximately $2.2 million in cash to the Company.

We currently have no external sources of liquidity such as arrangements with credit institutions or off-balance sheet arrangements that will have or are reasonably likely to have a current or future effect on our financial condition or immediate access to capital.

We are dependent on the sale of our securities to fund our operations, and will remain so until we generate sufficient revenues to pay for our operating costs. Our officers and directors have made no written commitments with respect to providing a source of liquidity in the form of cash advances, loans and/or financial guarantees.

Fundraising

In an offering occurring in July 2015, MassRoots sold 934,004 shares of unregistered common stock for gross proceeds of $685,502. This offering was closed on July 27, 2015.

Over the course of the third quarter, 402,500 of warrants previously issued as part of our offering in March 2014 were exercised at an exercise price of $0.40 for proceeds of $161,000.

Required Capital Over the Next Fiscal Year

We believe MassRoots will need to raise an additional $2.0 million over the next fiscal year to sustain operations; however, we expect to be able to raise the majority of these funds through warrant exercises. As of September 30, 2015, there were 3,597,500 warrants exercisable at $0.40 per share that if executed, will inject approximately $1.4 million into the company; there are also 866,000 warrants exercisable at $1.00 per share that if executed, will inject $866,000 into the company.

If we are unable to raise the funds we will seek alternative financing through means such as borrowings from institutions or private individuals. There can be no assurance that we will be able to raise the capital we need for our operations from the sale of our securities. We have not located any sources for these funds and may not be able to do so in the future. We expect that we will seek additional financing in the future. However, we may not be able to obtain additional capital or generate sufficient revenues to fund our operations. If we are unsuccessful at raising sufficient funds, for whatever reason, to fund our operations, we may be forced to cease operations. If we fail to raise funds we expect that we will be required to seek protection from creditors under applicable bankruptcy laws.

Our independent registered public accounting firm has expressed doubt about our ability to continue as a going concern and believes that our ability is dependent on our ability to implement our business plan, raise capital and generate revenues. See Note 10 of our financial statements.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Critical Accounting Policies and Estimates

For a discussion of our accounting policies and related items, please see the Notes to the Financial Statements, included in Item 1.

Item 3. Quantitative & Qualitative Disclosures about Market Risks

As a “smaller reporting company,” we are not required to provide the information required by this Item.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

As of the end of the period covered by this report (the “Evaluation Date”), we carried out an evaluation, under the supervision and with the participation of our management, including our Principal Executive Officer and Principal Accounting Officer (our Chief Executive Officer and Chief Financial Officer, respectively), of the effectiveness of the design and operation of our disclosure controls and procedures pursuant to Rule 13a-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Based upon this evaluation, our Chief Executive Officer concluded that, as of the Evaluation Date, our disclosure controls and procedures were not effective due to the weakness discussed below in (1) ensuring that information required to be disclosed in the reports that are filed or submitted under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified by the Securities and Exchange Commission’s rules and forms and (2) ensuring that information required to be disclosed in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management including our Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

Material Weaknesses: (i) due to the small size of its staff and limited resources, the Company did not have sufficient segregation of duties to support its internal control over financial reporting; (ii) lack of an Audit Committee, and (iii) lack of a majority of outside directors on the Board of Directors. We plan to rectify these weaknesses by hiring additional accounting personnel; changing the composition of our Board of Directors; and creating an Audit Committee, which we expect to complete over the next fiscal year.

Through the use of external consultants and the review process, management believes that the financial statements and other information presented herewith are materially correct.

Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that the Company’s disclosure controls and procedures will detect or uncover every situation involving the failure of persons within the Company to disclose material information otherwise required to be set forth in the Company’s periodic reports.

Changes in Internal Controls

There have been no changes in our internal controls over financial reporting that occurred during the our last fiscal quarter to which this report relates that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II OTHER INFORMATION

Item 1. Legal Proceedings

We are not a party to any current or pending legal proceedings.

Item 1A. Risk Factors

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

Each of the below transactions were exempt from the registration requirements of the Securities Act in reliance upon Rule 701 promulgated under the Securities Act, Section 4(a)(2) of the Securities Act or Regulation D promulgated under the Securities Act.

On July 30, 2015, the Company issued warrants to purchase an aggregate of 175,000 shares of common stock at $0.90 per share to certain service providers.

None of the foregoing transactions involved any underwriters, underwriting discounts or commissions, or any public offering, and the Registrant believes each transaction was exempt from the registration requirements of the Securities Act as stated above. All recipients of the foregoing transactions either received adequate information about the Registrant or had access, through their relationships with the Registrant, to such information. Furthermore, the Registrant affixed appropriate legends to the share certificates and instruments issued in each foregoing transaction setting forth that the securities had not been registered and the applicable restrictions on transfer.

Item 3. Defaults upon Senior Securities

None.

Item 5. Other Information

None.

Item 6. Exhibits

| 31.1 | (1) Certification of Principal Executive Officer as required by Rule 13a-14 or 15d-14 of the Exchange Act, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| 31.2 | (2) Certification of Principal Accounting Officer as required by Rule 13a-14 or 15d-14 of the Exchange Act, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| 32.1 | (1) Certification of Principal Executive Officer Pursuant to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| 32.2 | (2) Certification of Principal Accounting Officer Pursuant to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| 101.INS | XBRL Instance Document |

| 101.SCH | XBRL Taxonomy Extension Schema Document |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document |

SIGNATURES