Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - China Health Industries Holdings, Inc. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - China Health Industries Holdings, Inc. | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - China Health Industries Holdings, Inc. | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the quarterly period ended September 30, 2015

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from ____________ to ____________

Commission File Number: 000-51060

CHINA HEALTH INDUSTRIES HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 86-0827216 |

| (State or other jurisdiction of | (IRS Employer |

| incorporation or organization) | Identification No.) |

168 Binbei Street, Songbei District

Harbin City,

Heilongjiang Province

People’s Republic of China

150028

(Address of principal executive offices) (Zip Code)

86-451-88100688

(Issuer's telephone number,

including area code)

Not Applicable

(Former name, former address

and former fiscal year, if changed since last report)

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| ( Do not check if a smaller reporting company ) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

APPLICABLE ONLY TO CORPORATE ISSUERS:

As of November 11, 2015, there were 65,539,737 shares of common stock, $0.0001 par value, issued and outstanding.

TABLE OF CONTENTS

| PART I | FINANCIAL INFORMATION | Page | |

| Item 1. | Financial Statements (Unaudited) | 2 | |

| Condensed Consolidated Balance Sheets As of September 30, 2015 and June 30, 2015 (Unaudited) | 2 | ||

| Condensed Consolidated Statements of Operations and Comprehensive Income For the Three Months Ended September 30, 2015 and 2014 (Unaudited) | 3 | ||

| Condensed Consolidated Statements of Cash Flows For the Three Months Ended September 30, 2015 and 2014 (Unaudited) | 4 | ||

| Notes to Condensed Consolidated Financial Statements As of September 30, 2015 (Unaudited) | 5 | ||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 | |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 24 | |

| Item 4. | Controls and Procedures | 24 | |

| PART II | OTHER INFORMATION | 26 | |

| Item 6. | Exhibits | 26 | |

| Signatures | 27 | ||

| Exhibits/Certifications | 28 |

1

PART I

FINANCIAL INFORMATION

| Item 1. | Financial Statements |

CHINA HEALTH INDUSTRIES HOLDINGS, INC. AND SUBSIDIARIES

CONDENSEDCONSOLIDATED BALANCE SHEETS

|

|

September 30, | June 30, | ||||

|

|

2015 | 2015 | ||||

|

|

(UNAUDITED) | (AUDITED) | ||||

|

ASSETS |

||||||

|

|

||||||

|

Current assets |

||||||

|

Cash and cash equivalents |

$ | 20,835,323 | $ | 21,123,027 | ||

|

Short term investment |

7,867,078 | 8,064,516 | ||||

|

Notes receivable |

906 | 1,509 | ||||

|

Accounts receivable, net |

1,344,965 | 1,431,298 | ||||

|

Inventory |

861,689 | 841,239 | ||||

|

Other receivables, net |

39,724 | 39,852 | ||||

|

Advance to suppliers |

28,455 | 69,120 | ||||

|

Total current assets |

30,978,140 | 31,570,561 | ||||

|

|

||||||

|

Property, plant and equipment, net |

4,124,678 | 4,315,094 | ||||

|

Intangible assets, net |

4,743,348 | 5,012,297 | ||||

|

Construction in progress |

703,628 | 607,477 | ||||

|

Total assets |

$ | 40,549,794 | $ | 41,505,429 | ||

|

|

||||||

|

LIABILITIES AND EQUITY |

||||||

|

|

||||||

|

Current liabilities |

||||||

|

Short-term loans |

$ | 1,573,416 | $ | 1,612,903 | ||

|

Accounts payable and accrued expenses |

571,870 | 523,946 | ||||

|

Other payables |

28,831 | 29,684 | ||||

|

Advance from customers |

762,600 | 770,454 | ||||

|

Related party debts |

1,944,066 | 1,910,546 | ||||

|

Wages payable |

46,561 | 134,615 | ||||

|

Taxes payable |

207,608 | 178,625 | ||||

|

Total current liabilities |

5,134,952 | 5,160,773 | ||||

|

|

||||||

|

Equity |

||||||

|

Common stock, ($0.0001 par value, 300,000,000 shares authorized, 65,539,737 and 65,539,737 issued and outstanding as of September 30, 2015 and June 30, 2015, respectively) |

6,404 | 6,404 | ||||

|

Additional paid-in capital |

297,137 | 297,137 | ||||

|

Accumulated other comprehensive income |

2,364,119 | 3,263,592 | ||||

|

Statutory reserve |

38,679 | 38,679 | ||||

|

Retained earnings |

32,708,308 | 32,738,642 | ||||

|

Total stockholders' equity |

35,414,647 | 36,344,454 | ||||

|

Non-controlling interests |

195 | 202 | ||||

|

Total equity |

35,414,842 | 36,344,656 | ||||

|

|

||||||

|

Total liabilities and equity |

$ | 40,549,794 | $ | 41,505,429 |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

2

| CHINA HEALTH INDUSTRIES HOLDINGS, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE |

| INCOME |

| (UNAUDITED) |

|

|

For the Three Months Ended | |||||

|

|

||||||

|

|

September 30, 2015 | September 30, 2014 | ||||

|

|

||||||

|

REVENUE |

$ | 1,956,068 | $ | 3,160,217 | ||

|

|

||||||

|

COST OF GOODS SOLD |

1,418,964 | 2,213,963 | ||||

|

|

||||||

|

GROSS PROFIT |

537,104 | 946,254 | ||||

|

|

||||||

|

OPERATING EXPENSES |

||||||

|

Selling, general and administrative expenses |

348,879 | 464,088 | ||||

|

Depreciation and amortization expenses |

182,157 | 189,444 | ||||

|

Total operating expenses |

531,036 | 653,532 | ||||

|

|

||||||

|

INCOME FROM OPERATIONS |

6,068 | 292,722 | ||||

|

|

||||||

|

OTHER INCOME/(EXPENSES) |

||||||

|

Interest income |

18,107 | 23,927 | ||||

|

Interest expense |

(31,624 | ) | (29,958 | ) | ||

|

Other income, net |

9,519 | 38,932 | ||||

|

Total other income (expense), net |

(3,998 | ) | 32,901 | |||

|

|

||||||

|

INCOME (LOSS) BEFORE INCOME TAXES |

2,070 | 325,623 | ||||

|

|

||||||

|

Provision for income taxes |

32,406 | 102,179 | ||||

|

|

||||||

|

NET INCOME (LOSS) |

(30,336 | ) | 223,444 | |||

|

Less: net loss attributable to non-controlling interests |

(2 | ) | - | |||

|

Net income (loss) attributable to China Health Industries Holdings |

(30,334 | ) | 223,444 | |||

|

Foreign currency translation gain |

(899,478 | ) | 390,744 | |||

|

Comprehensive income/(loss) |

(929,814 | ) | 614,188 | |||

|

Less: comprehensive income attributable to non-controlling interests |

(7 | ) | 3 | |||

|

COMPREHENSIVE INCOME/(LOSS) ATTRIBUTABLE TO CHINA HEALTH INDUSTRIES HOLDINGS |

$ | (929,807 | ) | $ | 614,185 | |

|

|

||||||

|

Net income (loss) attributable to China Health Industries Holdings' shareholders per share are: |

||||||

|

Basic & diluted income per share |

$ | (0.0005 | ) | $ | 0.0036 | |

|

|

||||||

|

Weighted average shares outstanding: |

||||||

|

Basic & diluted weighted average shares outstanding |

65,539,737 | 62,239,737 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

| CHINA HEALTH INDUSTRIES HOLDINGS, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (UNAUDITED) |

|

|

For the Three Months Ended | |||||

|

|

September 30, | September 30, | ||||

|

|

2015 | 2014 | ||||

|

|

||||||

|

Cash Flows from Operating Activities |

||||||

|

Net income (loss) available to China Health Industries Holdings |

$ | (30,334 | ) | $ | 223,444 | |

|

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

||||||

|

Depreciation and amortization expenses |

233,381 | 241,791 | ||||

|

Bad debt expense |

2,765 | (433 | ) | |||

|

Non-controlling interests |

(2 | ) | - | |||

|

Changes in operating assets and liabilities |

||||||

|

Accounts receivable |

48,951 | 14,711 | ||||

|

Other receivables |

(856 | ) | (3,605 | ) | ||

|

Inventory |

(41,387 | ) | 39,397 | |||

|

Advance to suppliers, prepaid expenses and long term deposit |

(22,577 | ) | (18,066 | ) | ||

|

Accounts payables and accrued expenses |

61,205 | 5,493 | ||||

|

Advance from customers and other payables |

10,974 | (10,676 | ) | |||

|

Wages payable |

(85,462 | ) | (4,645 | ) | ||

|

Taxes payable |

33,632 | 71,965 | ||||

|

Net cash provided by operating activities |

210,290 | 559,376 | ||||

|

|

||||||

|

Cash Flows from Investing Activities |

||||||

|

Decrease in notes receivable |

571 | 7,316 | ||||

|

Purchases of property, plant and equipment |

(454 | ) | (2,440 | ) | ||

|

Increase in construction in progress |

(28,299 | ) | - | |||

|

Net cash provided by (used in) investing activities |

(28,182 | ) | 4,876 | |||

|

|

||||||

|

Cash Flows from Financing Activities |

||||||

|

Repayment to related parties |

- | (54,833 | ) | |||

|

Proceeds from related party debts |

49,181 | - | ||||

|

Net cash provided by (used in) financing activities |

49,181 | (54,833 | ) | |||

|

|

||||||

|

Effect of exchange rate changes on cash and cash equivalents |

(518,993 | ) | 293,184 | |||

|

|

||||||

|

Net decrease /( increase) in cash and cash equivalents |

(287,704 | ) | 802,603 | |||

|

|

||||||

|

Cash and cash equivalents, beginning balance |

21,123,027 | 27,232,074 | ||||

|

|

||||||

|

Cash and cash equivalents, ending balance |

$ | 20,835,323 | $ | 28,034,677 | ||

|

|

||||||

|

Supplemental cash flow information |

||||||

|

Cash paid for income taxes |

$ | 336,058 | $ | 48,622 | ||

|

Cash paid for interest expense |

$ | 31,624 | $ | 29,958 | ||

|

Non-cash investing activities: |

||||||

|

Loan from related party for the construction of a facility |

$ | 483,876 | $ | 494,797 | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

CHINA HEALTH INDUSTRIES HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONDENSEDCONSOLIDATED FINANCIAL STATEMENTS

Note 1 - ORGANIZATION AND BUSINESS BACKGROUND

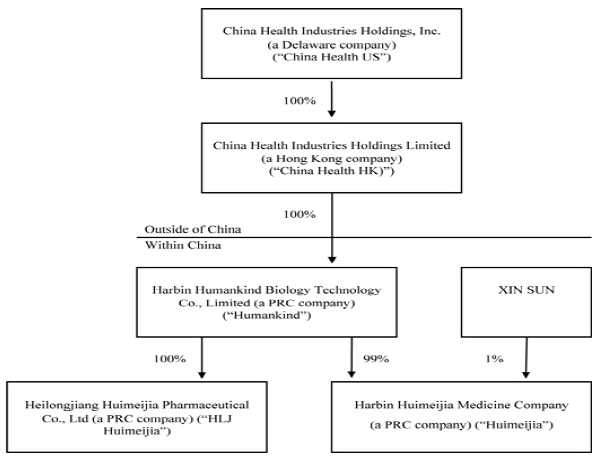

China Health Industries Holdings, Inc. (“China Health US”) was incorporated in the State of Arizona on July 11, 1996 and was the successor of the business known as Arizona Mist, Inc. which began in 1989. On May 9, 2005, it entered into a Stock Purchase Agreement and Share Exchange (effecting a reverse merger) with Edmonds 6, Inc. (“Edmonds 6”), a Delaware corporation, and changed its name to Universal Fog, Inc. Pursuant to this agreement, Universal Fog, Inc. (which has been in continuous operation since 1996) became a wholly-owned subsidiary of Edmonds 6.

China Health Industries Holdings Limited (“China Health HK”) was incorporated on July 20, 2007 in Hong Kong under the Companies Ordinance as a limited liability company. China Health HK was formed for the purpose of seeking and consummating a merger or acquisition with a business entity organized as a private corporation, partnership, or sole proprietorship as defined by FASB ACS Topic 915 (“Development Stage Entities”).

Harbin Humankind Biology Technology Co., Limited (“Humankind”) was incorporated in Harbin City, Heilongjiang Province, the People’s Republic of China (the “PRC”) on December 14, 2003, as a limited liability company under the Company Law of the PRC. Humankind is engaged in the manufacturing and sale of health products.

On August 20, 2007, the sole shareholder of China Health HK entered into a share purchase agreement (the “Share Purchase Agreement”) with the owners of Humankind. Pursuant to the Share Purchase Agreement, China Health HK purchased 100% of the ownership in Humankind for a cash consideration of $60,408 (the “Share Purchase”). Subsequent to the completion of the Share Purchase, Humankind became a wholly-owned subsidiary of China Health HK. The Share Purchase was accounted for as a “reverse merger” since the owner of Humankind owned a majority of the outstanding shares of China Health HK’s common stock immediately following the execution of the Share Purchase Agreement, it was deemed to be the acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that have been reflected in the financial statements for periods prior to the Share Purchase are those of Humankind and have been recorded at the historical cost basis. After completion of the Share Purchase, China Health HK’s consolidated financial statements include the assets and liabilities of both China Health HK and Humankind, the historical operations of Humankind, and the operations of China Health HK and its subsidiaries from the closing date of the Share Purchase.

On October 14, 2008, Humankind set up a 99% owned subsidiary, Harbin Huimeijia Medicine Company (“Huimeijia”), with its primary business being manufacturing and distributing medicine. Mr. Xin Sun, the Company’s majority owner, owns 1% of Huimeijia. Huimeijia is consolidated in the consolidated financial statements of China Health HK.

On December 31, 2008, China Health HK entered into a reverse merger with Universal Fog, Inc., a U.S. publicly traded shell company (the “Transaction”). China Health HK is the acquirer in the Transaction, and the Transaction has been treated as a recapitalization of China Health US. After the Transaction and a 20:1 reverse stock split, Mr. Xin Sun owned 61,203,088 shares of common stock, representing 98.3% of the 62,234,737 total outstanding shares of common stock of China Health US. On April 7, 2009, Mr. Sun transferred 28,200,000 shares of common stock to 296 individuals, leaving him with 33,003,088 shares of common stock of China Health US, or approximately 53.03% of the total outstanding shares of common stock. Universal Fog, Inc. changed its name to China Health Industries Holdings, Inc. on February 19, 2009.

On November 22, 2013, Humankind completed the acquisition of Heilongjiang Huimeijia Pharmaceutical Co., Ltd. (“HLJ Huimeijia”) for a total purchase price of $16,339,869 (RMB100,000,000). HLJ Huimeijia was founded on October 30, 2003, and is engaged in the manufacturing and distribution of tincture, ointments, rubber paste (including hormones), topical solution, suppositories, liniment (including traditional Chinese medicine extractions), enemas and oral liquids. HLJ Huimeijia’s predecessor is Heilongjiang Xue Du Pharmaceutical Co., Ltd., which has established its brand name in the market through its supply of high quality medical products. HLJ Huimeijia is categorized as a “high and new technology” enterprise by the Science Technology Department in Heilongjiang Province. HLJ Huimeijia has 21 products which have been approved by, and have received approval numbers issued by, the China State Food and Drug Administration (the “CFDA”). In addition, HLJ Huimeijia is the holder of one patent for utility models, five patents for external design and three trademarks in China, including the Chinese brand name of “Xue Du” which has an established reputation among customers in northeastern China.

China Health US, China Health HK, Humankind, Huimeijia and HLJ Huimeijia are collectively referred herein to as the “Company.”

5

As of September 30, 2015, the Company’s corporate structure was as follows:

Note 2 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

This summary of significant accounting policies of the Company is presented to assist in understanding the Company’s financial statements. The financial statements and notes are representations of the Company’s management, which is responsible for their integrity and objectivity. These accounting policies conform to generally accepted accounting principles in the United States ("US GAAP") and have been consistently applied in the preparation of the consolidated financial statements.

The accompanying unaudited consolidated financial statements have been prepared by Company without audit pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”). Certain information and disclosures normally included in financial statements prepared in accordance with US GAAP have been condensed or omitted as allowed by such rules and regulations, and management believes that the disclosures are adequate to make the information presented not misleading. These consolidated financial statements should be read in conjunction with the audited financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the years ended June 30, 2015 and 2014.These consolidated financial statements include all adjustments, which in the opinion of management are necessary to a fair presentation of financial position and results of operations. All such adjustments are of a normal and recurring nature. The results of operations for the three months ended September 30, 2015 may not be indicative of results that may be expected for the six months ended December 31, 2015.

Principles of Consolidation

The accompanying unaudited condensed consolidated financial statements include China Health US and its four subsidiary companies, including China Health HK, Humankind, Huimeijia, and HLJ Huimeijia. All significant intercompany balances and transactions have been eliminated in consolidation and combination.

On November 22, 2013, China Health US, through its wholly owned subsidiary Humankind, completed the acquisition of HLJ Huimeijia. HLJ Huimeijia and Humankind are under the common control of Mr. Xin Sun, the CEO of the Company before and after the date of transfer. Humankind’s accounting policy adopted the guidance in ASC 805-50-05-5 for the transfer of net assets between entities under common control to apply a method similar to the pooling-of-interests method. Under this method, the financial statements of Humankind shall report results of operations for the period in which the transfer occurs as though the transfer of net assets had occurred at the beginning of the period. Results of operations for that period will thus comprise both those of the previously separate entities combined from the beginning of the period to the date the transfer is completed and those of the combined operations from that date to the end of the period. Similarly, Humankind shall present the statements of financial position and other financial information as of the beginning of the period as though the assets and liabilities had been transferred at that date. Financial statements and financial information of Humankind presented for prior years also shall be retrospectively adjusted to furnish comparative information.

6

Segment Reporting

FASB ASC Topic 280, “Segment Reporting,” established standards for reporting information about operating segments on a basis consistent with the Company's internal organizational structure as well as information about geographical areas, business segments and major customers in financial statements for details on the Company's business segments. The Company has three reportable operating segments: Humankind, HLJ Huimeijia and others. The segments are grouped based on the types of products provided.

Fair Value of Financial Instruments

The provisions of accounting guidance, FASB ASC Topic 820 that apply to the Company requires all entities to disclose the fair value of financial instruments, both assets and liabilities recognized and not recognized on the balance sheet, for which it is practicable to estimate fair value, and defines fair value of a financial instrument as the amount at which the instrument could be exchanged in a current transaction between willing parties.

Fair Value Measurements

FASB ASC Topic 820, “Fair Value Measurements and Disclosures,” clarifies the definition of fair value for financial reporting, establishes a framework for measuring fair value and requires additional disclosures about the use of fair value measurements.

Various inputs are considered when determining the fair value of the Company’s debt. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in these securities. These inputs are summarized in the three broad levels listed below.

Level 1 – observable market inputs that are unadjusted quoted prices for identical assets or liabilities in active markets;

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.);

Level 3 – significant unobservable inputs (including the Company’s own assumptions in determining the fair value of investments).

The carrying value of financial assets and liabilities recorded at fair value is measured on a recurring or nonrecurring basis. Financial assets and liabilities measured on a non-recurring basis are those that are adjusted to fair value when a significant event occurs. The Company had no financial assets or liabilities carried and measured on a nonrecurring basis during the reporting periods. Financial assets and liabilities measured on a recurring basis are those that are adjusted to fair value each time a financial statement is prepared. The Company had no financial assets or liabilities carried and measured on a recurring basis during the reporting periods.

The availability of inputs observable in the market varies from instrument to instrument and depends on a variety of factors including the type of instrument, whether the instrument is actively traded, and other characteristics particular to the transaction. For many financial instruments, pricing inputs are readily observable in the market, the valuation methodology used is widely accepted by market participants, and the valuation does not require significant management discretion. For other financial instruments, pricing inputs are less observable in the market and may require management judgment.

Translation of Foreign Currencies

Humankind, Huimeijia and HLJ Huimeijia maintain their books and accounting records in PRC currency “Renminbi” (“RMB”), which has been determined as the functional currency. Transactions denominated in currencies other than RMB are translated into RMB at the exchange rates prevailing on the date of the transactions, as quoted by the Federal Reserve Board. Foreign currency exchange gains and losses resulting from these transactions are included in operations.

Humankind, Huimeijia and HLJ Huimeijia’s financial statements are translated into the reporting currency, the United States Dollar (“USD”). Assets and liabilities of the above entities are translated at the prevailing exchange rate at each reporting period end date. Contributed capital accounts are translated using the historical rate of exchange when capital is injected. Income and expense accounts are translated at the average rate of exchange during the reporting period. Translation adjustments resulting from the translation of these financial statements are reflected as accumulated other comprehensive income in shareholders’ equity and non-controlling interests.

7

Statement of Cash Flows

In accordance with Statement FASB ASC Topic 230, “Statement of Cash Flows,” cash flow from the Company's operations is calculated based upon the local currencies and translated to the reporting currency using an average foreign exchange rate for the reporting period. As a result, amounts related to assets and liabilities reported in the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with US GAAP requires management to make estimates and judgments that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities on the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company bases its estimates and judgments on historical experience and on various other assumptions and information that are believed to be reasonable under the circumstances. Estimates and assumptions of future events and their effects cannot be perceived with certainty and, accordingly, these estimates may change as new events occur, as more experience is acquired, as additional information is obtained and as the Company’s operating environment changes. Significant estimates and assumptions by management include, among others; useful lives of long-lived assets and intangible assets, valuation of inventory, accounts receivable and notes receivable, impairment analysis of long-lived assets, construction in progress, intangible assets and deferred taxes. While the Company believes that the estimates and assumptions used in the preparation of the financial statements are appropriate, actual results could differ from those estimates. Estimates and assumptions are periodically reviewed and the effects of revisions are reflected in the financial statements in the period they are determined to be necessary.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, deposits in banks with maturities of three months or less, and all highly liquid investments which are unrestricted as to withdrawal or use, and which have original maturities of three months or less at the time of purchase.

As of September 30, 2015 and June 30, 2015, the Company’s uninsured bank balance was mainly maintained at financial institutions located in the PRC and HK, totaled $20,835,323 and $21,123,027 respectively. The Company has no insured bank balance as of September 30, 2015 and June 30, 2015, respectively.

Accounts Receivable

Accounts receivable are recorded at the invoiced amount and do not bear interest. The Company extends unsecured credit to its customers in the ordinary course of business but mitigates the associated risks by performing credit checks and actively pursuing past due accounts. An allowance for doubtful accounts is established and determined based on management’s assessment of known requirements, aging of receivables, payment and bad debt history, the customer’s current credit worthiness, changes in customer payment patterns and the economic environment. From November 1, 2013, the Company changed its credit policy by offering ninety (90) day payment terms for sales, whereas the payment terms for sales before November 1, 2013 were thirty (30) day. As a result, as of September 30, 2015 and June 30, 2015, the balances of accounts receivable were $1,344,965 and $1,431,298, respectively. The Company determines the allowance based on aging data, historical collection experience, customer specific facts and economic conditions. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company evaluated the nature of all accounts receivable then provided allowance for doubtful accounts. As of September 30, 2015 and June 30, 2015, the balances of allowance for doubtful accounts were $47,118 and $45,453, respectively.

Advance to Suppliers

The Company periodically makes advances to certain vendors for purchases of raw materials, and records these purchases as advance to suppliers. As of September 30, 2015 and June 30, 2015, advance to suppliers amounted to $28,455 and $69,120, respectively.

Inventory

Inventory consists of raw materials, work in progress and finished goods of manufactured products.

8

Inventory is stated at lower of cost or market and consists of materials, labor and overhead. HLJ Huimeijia uses the weighted average method for inventory valuation. The other entities of the Company use the first-in, first-out (“FIFO”) method for inventory valuation. Overhead costs included in finished goods include direct labor cost and other costs directly applicable to the manufacturing process. The Company evaluates inventory for excess, slow moving, and obsolete inventory as well as inventory the value of which is in excess of its net realizable value. This evaluation includes analysis of sales levels by product and projections of future demand. If future demand or market conditions are less favorable than the Company’s projections, a write-down of inventory may be required, and would be reflected in cost of goods sold in the period the revision is made. There was no inventory allowance provided for the three months ended September 30, 2015 and 2014, respectively.

Impairment of Long-Lived Assets

The Company’s long-lived assets and other assets are reviewed for impairment in accordance with the guidance of the FASB ASC Topic 360-10, “Property, Plant, and Equipment,” and FASB ASC Topic 205, “Presentation of Financial Statements.” The Company tests for impairment losses on long-lived assets used in operations whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. Recoverability of an asset to be held and used is measured by a comparison of the carrying amount of the asset to the future undiscounted cash flows expected to be generated by the asset. If such asset is considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds its fair value. Impairment evaluations involve management’s estimates on asset useful lives and future cash flows. Actual useful lives and cash flows could be different from those estimated by management which could have a material effect on the Company’s reporting results and financial position. Fair value is determined through various valuation techniques including discounted cash flow models, quoted market values and third-party independent appraisals, as considered necessary. As of September 30, 2015 and June 30, 2015, the Company has not experienced impairment losses on its long-lived assets. However, there can be no assurances that demand for the Company’s products or services will continue, which could result in an impairment of long-lived assets in the future.

Property, Plant and Equipment

Property, plant and equipment are carried at the lower of cost or fair value. Maintenance, repairs and minor renewals are expensed as incurred, major renewals and improvements that extend the lives or increase the capacity of plant assets are capitalized.

When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in the results of operations in the reporting period of disposition.

Depreciation is calculated on a straight-line basis over the estimated useful life of the assets. The depreciable lives applied are:

| Building, Warehouse and Improvements | 20 to 30 years | ||

| Office Equipment | 3 to 7 years | ||

| Vehicles | 5 to 15 years | ||

| Machinery and Equipment | 7 to 15 years |

Intangible Assets

The Company evaluates intangible assets in accordance with FASB ASC Topic 350, “Intangibles — Goodwill and Other.” Intangible assets deemed to have indefinite lives are not amortized, but are subject to annual impairment tests. If the assumptions and estimates used to allocate the purchase price are not correct, or if business conditions change, purchase price adjustments or future asset impairment charges could be required. The value of the Company’s intangible assets could be impacted by future adverse changes such as: (i) any future declines in the Company’s operating results, (ii) a decline in the valuation of technology, including the valuation of the Company’s common stock, (iii) a significant slowdown in the worldwide economy or (iv) any failure to meet the performance projections included in the Company’s forecasts of future operating results. In accordance with FASB ASC Topic 350, the Company tests intangible assets for impairment on an annual basis or more frequently if the Company believes indicators of impairment exist. Impairment evaluations involve management estimates of asset useful lives and future cash flows. Significant management judgment is required in the forecasts of future operating results that are used in the evaluations. It is possible, however, that the plans and estimates used may be incorrect. If the Company’s actual results, or the plans and estimates used in future impairment analysis, are lower than the original estimates used to assess the recoverability of these assets, we could incur additional impairment charges in a future period. Based on such evaluations, there was no impairment recorded for intangible assets for the three months ended September 30, 2015 and 2014, respectively.

9

Construction in Progress

Construction in progress represents the costs incurred in connection with the construction of buildings or new additions to the Company’s plant facilities. Costs classified as construction in progress include all costs of obtaining the asset and bringing it to the location and condition necessary for its intended use. No depreciation is provided for construction in progress until such time as the assets are completed and are placed into service.

The Company reviews the carrying value of construction in progress for impairment whenever events and circumstances indicate that the carrying value of an asset may not be recoverable from the estimated future cash flows expected to result from its use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value of the assets, an impairment loss is recognized equal to an amount by which the carrying value exceeds the fair value of the assets. The factors considered by management in performing this assessment include current operating results, trends and prospects, the manner in which the property is used, and the effects of obsolescence, demand, competition and other economic factors. Based on this assessment, there was no impairment recorded for construction in progress for the three months ended September 30, 2015 and 2014, respectively.

Translation of Foreign Currencies

Humankind, Huimeijia and HLJ Huimeijia maintain their books and accounting records in PRC currency “Renminbi” (“RMB”), which has been determined as the functional currency. Transactions denominated in currencies other than RMB are translated into RMB at the exchange rates prevailing on the date of the transactions, as quoted by the Federal Reserve Board. Foreign currency exchange gains and losses resulting from these transactions are included in operations.

Humankind, Huimeijia and HLJ Huimeijia’s financial statements are translated into the reporting currency, the United States Dollar (“USD”). Assets and liabilities of the above entities are translated at the prevailing exchange rate at each reporting period end date. Contributed capital accounts are translated using the historical rate of exchange when capital is injected. Income and expense accounts are translated at the average rate of exchange during the reporting period. Translation adjustments resulting from the translation of these financial statements are reflected as accumulated other comprehensive income in shareholders’ equity and non-controlling interests.

Revenue Recognition

The Company recognizes revenue when it is both earned and realized or realizable. The Company’s policy is to recognize revenue when title to the product, ownership and risk of loss have transferred to the customer, persuasive evidence of an arrangement exits and collection of the sales proceeds is reasonably assured, all of which generally occur upon shipment of goods to customers. The majority of the Company’s revenue relates to the sale of inventory to customers, and revenue is recognized when title and the risks and rewards of ownership pass to the customer. Given the nature of the Company’s business and the applicable rules guiding revenue recognition, the Company’s revenue recognition practices do not contain estimates that materially affect the results of operations. The Company records revenue at the discounted selling price and allows its customers to return products for exchange or credit subject to certain limitations. A provision for such returns is recorded based upon historical experience. There has been no provision recorded for returns based upon historical experience for the three months ended September 30, 2015 and 2014, respectively.

Cost of Goods Sold

Cost of goods sold consists primarily of the costs of raw materials, freight charges, direct labor, depreciation of plants and machinery, warehousing and overhead costs associated with the manufacturing process and commission expenses.

Income Taxes

The Company adopts FASB ASC Topic 740, “Income Taxes,” which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized.

In July 2006 the FASB issued FIN 48(ASC 740-10), “Accounting for Uncertainty in Income Taxes — An Interpretation of FASB Statement No. 109 (ASC 740),” which requires income tax positions to meet a more-likely-than-not recognition threshold to be recognized in the financial statements. Under FIN 48(ASC 740-10), tax positions that previously failed to meet the more-likely-than-not threshold should be recognized in the first subsequent financial reporting period in which that threshold is met. Previously recognized tax positions that no longer meet the more-likely-than-not threshold should be derecognized in the first subsequent financial reporting period in which that threshold is no longer met.

10

As a result of the implementation of FIN 48 (ASC 740-10), the Company undertook a comprehensive review of its portfolio of tax positions in accordance with recognition standards established by FIN 48 (ASC 740-10). The Company recognized no material adjustments to liabilities or stockholders’ equity as a result of the implementation. The adoption of FIN 48 did not have a material impact on the Company’s financial statements.

The application of tax laws and regulations is subject to legal and factual interpretation, judgment and uncertainty. Tax laws and regulations themselves are subject to change as a result of changes in fiscal policy, changes in legislation, the evolution of regulations and court rulings. Therefore, the actual liability may be materially different from the Company’s estimates, which could result in the need to record additional tax liabilities or potentially reverse previously recorded tax liabilities or deferred tax asset valuation allowance.

Enterprise Income Tax

Under the Provisional Regulations of PRC Concerning Income Tax on Enterprises promulgated by the PRC (the “EIT Law”), income tax is payable by enterprises at a rate of 25% of their taxable income.

Value Added Tax

The Provisional Regulations of PRC Concerning Value Added Tax promulgated by the State Council came into effect on January 1, 1994. Under these regulations and the Implementing Rules of the Provisional Regulations of the PRC Concerning Value Added Tax, value added tax (“VAT”) is imposed on goods sold in, or imported into, the PRC and on processing, repair and replacement services provided within the PRC.

VAT payable in the PRC is charged on an aggregated basis at a rate of 13% or 17% (depending on the type of goods involved) on the full price collected for the goods sold or, in the case of taxable services provided, at a rate of 17% on the charges for the taxable services provided, but excluding, in respect of both goods and services, any amount paid in respect of VAT included in the price or charges, and less any deductible VAT already paid by the taxpayer on purchases of goods and services in the same financial year. As of September 30, 2015 and June 30, 2015, VAT payables were $248,908 and $219,553, respectively.

Sales-Related Taxes

Pursuant to the tax law and regulations of the PRC, the Company is obligated to pay 7% and 5% of the annual VAT paid as taxes on maintaining and building cities and education additional fees, both of which belong to sales-related taxes. Sales-related taxes are recorded when sales revenue is recognized. Sales-related taxes for the three months ended September 30, 2015 and 2014 were $33,901 and $55,318, respectively.

Concentrations of Business and Credit Risks

All of the Company’s manufacturing is located in the PRC. There can be no assurance that the Company will be able to successfully continue to manufacture its products and failure to do so would have a material adverse effect on the Company’s financial position, results of operations and cash flows. Also, the success of the Company’s operations is subject to numerous contingencies, some of which are beyond management’s control. These contingencies include general economic conditions, prices of raw materials, competition, governmental and political conditions, and changes in regulations. Since the Company is dependent on trade in the PRC, the Company is subject to various additional political, economic and other uncertainties. Among other risks, the Company’s operations will be subject to the risks of restrictions on transfer of funds, domestic customs, changing taxation policies, foreign exchange restrictions, and political and governmental regulations.

The Company operates in China, which may give rise to significant foreign currency risks from fluctuations and the degree of volatility of foreign exchange rates between U.S. dollars and the Chinese currency RMB. The results of operations denominated in foreign currency are translated at the average rate of exchange during the reporting periods.

Earnings Per Share

Basic earnings per common share is computed by dividing net earnings applicable to common shareholders by the weighted-average number of common shares outstanding during the period. When applicable, diluted earnings per common share is determined using the weighted-average number of common shares outstanding during the period, adjusted for the dilutive effect of common stock equivalents, consisting of shares that might be issued upon exercise of common stock options and warrants. For the three months ended September 30, 2015 and 2014, the Company had no potential dilutive common stock equivalents outstanding.

11

Potential common shares issued are calculated using the treasury stock method, which recognizes the use of proceeds that could be obtained upon the exercise of options and warrants in computing diluted earnings per share. It assumes that any proceeds would be used to purchase common stock at the average market price of the common stock during the period.

FASB ASC Topic 260, “Earnings Per Share,” requires a reconciliation of the numerator and denominator of the basic and diluted earnings per share (EPS) computations.

Recent Accounting Pronouncements

On January 9, 2015, the Financial Accounting Standards Board (FASB) published ASU 2015-01, “Simplifying Income Statement Presentation by Eliminating the Concept of Extraordinary Items.” The ASU applies to all entities and is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015. A reporting entity may apply the amendments prospectively. A reporting entity also may apply the amendments retrospectively to all prior periods presented in the financial statements. Early adoption is permitted provided that the guidance is applied from the beginning of the fiscal year of adoption. The Company does not expect the adoption of ASU 2015-01 to have material impact on the Company's consolidated financial statement.

In February 2015, FASB issued ASU No. 2015-02, “Consolidation (Topic 810): Amendments to the Consolidation Analysis,” which is intended to improve targeted areas of consolidation guidance for legal entities such as limited partnerships, limited liability corporations, and securitization structures. This ASU will be effective for periods beginning after December 15, 2015 for public companies. Management is evaluating the potential impact, if any, on the Company’s financial position and results of operations.

In April 2015, the FASB issued ASU No. 2015-03, “Interest—Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs.” The update simplifies the presentation of debt issuance costs by requiring that debt issuance costs be presented in the balance sheet as a direct deduction from the carrying amount of debt liability, consistent with debt discounts or premiums. The recognition and measurement guidance for debt issuance costs are not affected by the amendments in this update. For public companies, this update will be effective for interim and annual periods beginning after December 15, 2015, and is to be applied retrospectively. Early adoption is permitted. The Company does not expect the adoption of this guidance will have a material effect on the Company’s consolidated financial statements.

In July 2015, the FASB issued “Accounting Standard Update 2015-11: Simplifying the Measurement of Inventory.” This update requires inventory to be measured at the lower of cost or net realizable value. Net realizable value is the estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal and transportation. Subsequent measurement is unchanged for inventory measured using LIFO or the retail inventory method. This update will be effective for the Company for all annual and interim periods beginning after December 15, 2016. The amendments in this update should be applied prospectively with earlier application permitted as of the beginning of an interim or annual reporting period. The Company does not expect this update will have a material impact on the presentation of the Company's consolidated financial statements.

In August 2015, the FASB issued Accounting Standards Update (ASU) No. 2015-15, “Interest - Imputation of Interest (Subtopic 835-30): Presentation and Subsequent Measurement of Debt Issuance Costs Associated with Line-of-Credit Arrangements - Amendments to SEC Paragraphs Pursuant to Staff Announcement at June 18, 2015 EITF Meeting.” This ASU adds SEC paragraphs pursuant to the SEC Staff Announcement at the June 18, 2015, Emerging Issues Task Force meeting about the presentation and subsequent measurement of debt issuance costs associated with line-of-credit arrangements. Given the absence of authoritative guidance within ASU 2015-03 for debt issuance costs related to line-of-credit arrangements, the SEC staff would not object to an entity deferring and presenting debt issuance costs as an asset and subsequently amortizing the deferred debt issuance costs ratably over the term of the line-of-credit arrangement, regardless of whether there are any outstanding borrowings on the line-of-credit arrangement. The Company does not expect this update will have a material impact on the presentation of the Company's consolidated financial statements.

In September 2015, the FASB issued ASU 2015-16, “Business Combinations (Topic 805): Simplifying the Accounting for Measurement-Period Adjustments,” which eliminates the requirement to retrospectively account for changes to provisional amounts initially recorded in a business acquisition opening balance sheet. Prior to the issuance of ASU 2015-16, an acquirer was required to restate prior period financial statements as of the acquisition date for adjustments to provisional amounts. This guidance is effective for fiscal years beginning after December 15, 2015, including interim periods within fiscal years. The Company does not expect this update will have a material impact on the presentation of the Company's condensed consolidated financial statements.

12

NOTE 3 – ACQUISITION

On November 22, 2013, Humankind completed the acquisition of HLJ Huimeijia for a total purchase price of $16,339,869 (RMB100,000,000). HLJ Huimeijia was founded on October 30, 2003. HLJ Huimeijia is engaged in the manufacturing and distribution of tincture, ointments, rubber paste (including hormones), solution (topical), suppositories, liniment (including traditional Chinese medicine extraction), enemas and oral liquid. HLJ Huimeijia’s predecessor is Heilongjiang Xue Du Pharmaceutical Co., Ltd., which had established its brand name in the market by its medical products. HLJ Huimeijia is categorized as a “high and new technology” enterprise by the Science Technology Department in Heilongjiang Province. HLJ Huimeijia has 21 products which have been approved by, and have received approval numbers issued by, the China State Food and Drug Administration (“CFDA”). In addition, HLJ Huimeijia is a holder of one patent for utility models, five patents for external design and three trademarks in China, including the Chinese brand name of “Xue Du” that has an established reputation among customers in northeastern China.

HLJ Huimeijia and Humankind are under the common control of Mr. Xin Sun, the CEO of the Company before and after the date of the completion of the acquisition, or the transfer. Humankind’s accounting policy adopted the guidance in ASC 805-50-05-5 for the transfer of net assets between entities under common control to apply a method similar to the pooling-of-interests method. Under this method, the financial statements of Humankind shall report results of operations for the period in which the transfer occurs as though the transfer of net assets had occurred at the beginning of the period. Results of operations for that period will thus comprise those of the previously separate entities combined from the beginning of the period to the date the transfer is completed and those of the combined operations from that date to the end of the period. Similarly, Humankind shall present the statements of financial position and other financial information as of the beginning of the period as though the assets and liabilities had been transferred at that date. Financial statements and financial information of Humankind presented for prior years also shall be retrospectively adjusted to furnish comparative information.

NOTE 4 - ASSETS SALE

On December 24, 2014, Humankind entered into a stock transfer agreement (the “Agreement”) with Xiuzheng Pharmaceutical Group Co., Ltd. a company incorporated under the laws of the People’s Republic of China and located in Jilin province (“Xiuzheng Pharmacy” or the “Buyer”), Mr. Xin Sun, the CEO of the Company, and Huimeijia, pursuant to which, Humankind and Mr. Xin Sun (the “Equity Holders”), shall sell their respective equity interests in Huimeijia to Xiuzheng Pharmacy. The transfer of the 100% equity interests of Huimeijia to the Buyer was for a total cash consideration of RMB 8,000,000 (approximately $1,306,186) to the Equity Holders.

On February 9, 2015, the four parties entered into a supplementary agreement (the “Supplementary Agreement”) to modify the terms of the Agreement, pursuant to which, the Equity Holders and Huimeijia (collectively the “Assets Transferors”) shall only sell the 19 drug approval numbers (including the tablet, capsule, powder, mixture, oral liquid, syrup and oral solution under the 19 approval numbers; licenses including the original copies of Business License, Organization Code Certificate, Tax Registration Certificate, Drug Production Permit and GMP Certificate, and other documents and original copies related to the production and operation of the 19 drugs) (the “Assets”) to Xiuzheng Pharmacy. The Equity Holders will retain the equity interests in Huimeijia, but will have the equity interests pledged to Xiuzheng Pharmacy until the Assets are transferred, at which time all the cash consideration shall be paid by the Buyer. The total cash consideration remains to be the same as under the Agreement, i.e., RMB 8,000,000 (approximately $1,306,186) to the Assets Transferors. In the event that the Assets are failed to be transferred to the Buyer due to the fault of the Assets Transferors, the paid consideration shall be returned to the Buyer with interests accrued. If the failure of the transfer of the Assets is a result of the government policy changes or force majeure, the paid cash consideration shall be returned to the Buyer but without any interests.

As of September 30, 2015, the transfer of the Assets had not been completed. The Company is striving to accelerate the process of the transfer.

NOTE 5 - ACCOUNTS RECEIVABLE

The Company’s accounts receivable amounted to $1,344,965 and $1,431,298, respectively, net of allowance for doubtful accounts amounting to $47,118 and $45,453 as of September 30, 2015 and June 30, 2015, respectively.

13

NOTE 6 - INVENTORIES

Inventory consists of following:

| September 30, 2015 | June 30, 2015 | |||||

| Raw Materials | $ | 233,553 | $ | 189,004 | ||

| Supplies and Packing Materials | 142,453 | 19,565 | ||||

| Work-in-Progress | 246,337 | 261,019 | ||||

| Finished Goods | 239,346 | 371,651 | ||||

| Total | $ | 861,689 | $ | 841,239 |

For the three months ended September 30, 2015 and 2014, the Company has not made provision for inventory in regards to excessive, slow moving or obsolete items.

NOTE 7 - CONSTRUCTION IN PROGRESS

Construction in progress consisted of the following:

| September 30, 2015 | June 30, 2015 | |||||

| Plant - HLJ Huimeijia | $ | 701,740 | $ | 605,542 | ||

| Plant and Production Lines - Huimeijia | 1,888 | 1,935 | ||||

| Total | $ | 703,628 | $ | 607,477 |

On April 6, 2012, HLJ Huimeijia entered into an agreement with a contractor for the plant, the estimated total cost of construction was approximately $2.09 million (RMB 12,800,000), anticipated to be completed within 720 construction working days from April 20, 2012 to December 30, 2015. The construction did not start until August 16, 2014. As of September 30, 2015, 35% of construction had been completed and $701,740 (RMB 4,459,980) had been recorded as a cost of construction in progress.

NOTE 8 - PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consisted of the following:

| September 30, 2015 | June 30, 2015 | |||||

| Building, Warehouses and Improvements | $ | 4,535,745 | $ | 4,673,771 | ||

| Machinery and Equipment | 1,204,177 | 1,226,433 | ||||

| Office Equipment | 124,309 | 134,932 | ||||

| Vehicles | 226,819 | 232,511 | ||||

| Other | 23,601 | - | ||||

| Less Accumulated Depreciation | (1,989,973 | ) | (1,952,553 | ) | ||

| Total | $ | 4,124,678 | $ | 4,315,094 |

Depreciation expense was $85,930 and $91,012 for the three months ended September 30, 2015 and 2014, respectively. Depreciation expense charged to operations was $34,706 and $38,665 for the three months ended September 30, 2015 and 2014, respectively. Depreciation expense charged to cost of goods sold was $51,224 and $52,347 for the three months ended September 30, 2015 and 2014, respectively.

As of September 30, 2015, the building of HLJ Huimeijia with the book value of $1,753,209 has been mortgaged for the working capital loan in the principal amount of $1,573,416 (RMB 10,000,000). As of June 30, 2015, the building of HLJ Huimeijia in the book value of $1,797,209 has been mortgaged for the working capital loan in the principal amount of $1,612,903 (RMB 10,000,000).

14

NOTE 9 - INTANGIBLE ASSETS

The following is a summary of intangible assets:

| September 30, 2015 | June 30, 2015 | |||||

| Land Use Rights – Humankind | $ | 997,228 | $ | 1,022,255 | ||

| Health Supplement Product Patents – Humankind | 4,720,247 | 4,838,709 | ||||

| Pharmaceutical Patents - HLJ Huimeijia | 140,975 | 144,514 | ||||

| Land Use Rights - HLJ Huimeijia | 682,089 | 699,208 | ||||

| Less: Accumulated Amortization | (1,797,191 | ) | (1,692,389 | ) | ||

| Total | $ | 4,743,348 | $ | 5,012,297 |

All land in the PRC belongs to the State. Enterprises and individuals can pay the State a fee to obtain the right to use a piece of land for commercial purposes or residential purposes for an initial period of 50 years or 70 years, respectively. The land use right can be sold, purchased, and exchanged in the market. The successor owner of the land use right will have the right to use the land for the time remaining on the initial period.

Amortization expense charged to operations was $147,450 and $150,779 for the three months ended September 30, 2015 and 2014, respectively.

As of September 30, 2015, land use rights of HLJ Huimeijia with the book value of $682,089 have been mortgaged for a working capital loan in the principal amount of $1,573,416(RMB 10,000,000). As of June 30, 2015, land use rights of HLJ Huimeijia with a book value of $699,208 have been mortgaged for a working capital loan in the principal amount of $1,612,903(RMB 10,000,000).

NOTE 10 - SHORT-TERM LOAN

On November 20, 2014, HLJ Huimeijia entered into a short-term loan agreement with a bank for a working capital loan in the principal amount of RMB 10,000,000, at an interest rate of 7.8% from November 20, 2014 to November 19, 2015. The loan was secured by the land use right and the building of HLJ Huimeijia, with a maturity date of November 19, 2015. As of September 30, 2015 and June 30, 2015, the Company’s short-term loan was $1,573,416 and $1,612,903, respectively.

Interest expenses were $31,624 and $29,958 for the three months ended September 30, 2015 and 2014, respectively.

NOTE 11 - RELATED PARTY DEBTS

Related party debts, which represent temporary short-term loans from Mr. Xin Sun and Mr. Kai Sun consisted of the following:

| September 30, 2015 | June 30, 2015 | |||||

| Mr. Xin Sun | $ | 1,907,273 | $ | 1,872,830 | ||

| Mr. Kai Sun | 36,793 | 37,716 | ||||

| Total | $ | 1,944,066 | $ | 1,910,546 |

These loans are unsecured and non-interest bearing and have no fixed terms of repayment; therefore, they are deemed payable on demand. Mr. Kai Sun is PRC citizen and family member of Mr. Xin Sun, the CEO of the Company.

NOTE 12 - INCOME TAXES

(a) Corporate income taxes

United States

China Health US was organized in the United States. China Health US had no taxable income for US income tax purposes for the years ended June 30, 2015 and 2014, respectively. As of September 30, 2015, China Health US has a net operating loss carry forward for United States income taxes. Net operating loss carry forwards are available to reduce future years’ taxable income. Management believes that the realization of the benefits from these losses appears uncertain due to the Company’s operating history and the continued losses of the US entity. Accordingly, the Company has provided a 100% valuation allowance on the deferred tax asset to reduce the asset to zero. There were no changes in the valuation allowance for the three months ended September 30, 2015 and 2014. Management reviews this valuation allowance periodically and makes adjustments accordingly.

15

Hong Kong

China Health HK was incorporated in Hong Kong and is subject to Hong Kong taxation on its activities conducted in Hong Kong and income arising in or derived from Hong Kong. No provision for income taxes have been made as China Health HK has no taxable income in Hong Kong.

People’s Republic of China

Under the EIT Law, the standard EIT rate is 25%. The PRC subsidiaries of the Company are subject to PRC income taxes on an entity basis on income arising in or derived from the tax jurisdiction in which they operate.

The provision for income taxes on income consists of the following for the three months ended September 30, 2015 and 2014:

Provision for income taxes consisted of:

| For the Three Months Ended September 30, | ||||||

| 2015 | 2014 | |||||

| Current provision : | ||||||

| USA | $ | - | $ | - | ||

| China | 32,406 | 102,179 | ||||

| Total current provision | 32,406 | 102,179 | ||||

| Deferred provision: | ||||||

| USA | - | - | ||||

| China | - | - | ||||

| Total deferred provision | - | - | ||||

| Total provision for income taxes | $ | 32,406 | $ | 102,179 | ||

Significant components of deferred tax assets were as follows:

| September 30, 2015 | June 30, 2015 | |||||

| Deferred tax assets | ||||||

| Net operating loss carry forward | $ | 332,913 | $ | 141,735 | ||

| Allowance for doubtful accounts | - | - | ||||

| Valuation allowance | (332,913 | ) | (141,735 | ) | ||

| Deferred tax assets, net | $ | - | $ | - |

As of September 30, 2015 and June 30, 2015, the Company accrued a 100% valuation allowance on its deferred tax assets based on the assessment on the probability of future reversion.

(b) Uncertain tax positions

There were no unrecognized tax benefits as of September 30 and June 30, 2015, respectively. Management does not anticipate any potential future adjustments in the next twelve months which would result in a material change to its tax positions. For the three month ended September 30, 2015 and 2014, the Company did not incur any interest and penalties arising from its tax payments.

NOTE 13 - COMMITMENTS AND CONTINGENCIES

The Company’s assets are located in the PRC and revenues are derived from operations in the PRC.

In terms of industry regulations and policies, the economy of the PRC has been transitioning from a planned economy to market oriented economy. Although in recent years the Chinese government has implemented measures emphasizing the utilization of market forces for economic reforms, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in the PRC is still owned by the Chinese government. For example, all land is state owned and leased to business entities or individuals through the government’s granting of Land Use Rights. The granting process is typically based on government policies at the time of granting and can be lengthy and complex. This process may adversely affect the Company’s future manufacturing expansions. The Chinese government also exercises significant control over the PRC’s economic growth through the allocation of resources and providing preferential treatment to particular industries or companies. Uncertainties may arise with changing of governmental policies and measures.

16

The Company faces a number of risks and challenges not typically associated with companies in North America and Western Europe, since its assets exist solely in the PRC, and its revenues are derived from its operations therein. The PRC is a developing country with an early stage market economic system, overshadowed by the state. Its political and economic systems are very different from the more developed countries and are in a state of change. The PRC also faces many social, economic and political challenges that may produce major shocks, instabilities and even crises, in both its domestic arena and in its relationships with other countries, including the United States. Such shocks, instabilities and crises may in turn significantly and negatively affect the Company’s performance.

Since the Company terminated its rental agreement on January 9, 2013, it had no rental commitment as of September 30, 2015.

NOTE 14 - MAJOR SUPPLIERS AND CUSTOMERS

The Company had one supplier that in the aggregate accounted for 75% of the Company’s purchases for the three months ended September 30, 2015.

The Company had one supplier that in the aggregate accounted for 74% of the Company’s purchases for the three months ended September 30, 2014.

The Company had four customers that in the aggregate accounted for 42% of the Company’s total sales for the three months ended September 30, 2015, with each customer accounting for 11%, 11%, 10% and 10%, respectively.

The Company had three customers that in the aggregate accounted for 38% of the Company’s total sales for the three months ended September 30, 2014, with each customer accounting for 11%, 11% and 10%, respectively.

NOTE 15 - SEGMENT REPORTING

The Company was organized into three main business segments based on the types of products being provided to customers: HLJ Huimeijia, Humankind and others. Each of the three operating segments referenced above has separate and distinct general ledgers. The chief operating decision maker (“CODM”) receives financial information, including revenue, gross margin, operating income, and net income produced from the various general ledger systems to make decisions about allocating resources and assessing performance; however, the principal measure of segment profitability or loss used by the CODM is net loss by segment.

The following tables present summary information by segment for the three months ended September 30, 2015 and 2014, respectively:

| For the Three Months Ended September 30, 2015 | For the Three Months Ended September 30, 2014 | |||||||||||||||||||||||

| HLJ | HLJ | |||||||||||||||||||||||

| Huimeijia | Humankind | Others | Consolidated | Huimeijia | Humankind | Others | Consolidated | |||||||||||||||||

| Revenues | $ | 293,756 | $ | 1,662,312 | $ | - | $ | 1,956,068 | $ | 407,874 | $ | 2,752,343 | $ | - | $ | 3,160,217 | ||||||||

| Cost of revenues | 250,346 | 1,168,618 | - | 1,418,964 | 290,077 | 1,923,886 | - | 2,213,963 | ||||||||||||||||

| Gross profit | 43,410 | 493,694 | - | 537,104 | 117,797 | 828,457 | - | 946,254 | ||||||||||||||||

| Interest expense | 31,624 | - | - | 31,624 | 29,958 | - | - | 29,958 | ||||||||||||||||

| Depreciation and amortization | 18,792 | 163,169 | 196 | 182,157 | 22,987 | 166,457 | - | 189,444 | ||||||||||||||||

| Income tax | - | 32,406 | - | 32,406 | - | 102,179 | - | 102,179 | ||||||||||||||||

| Net income (loss) | (127,282 | ) | 97,216 | 270 | (30,336 | ) | (83,025 | ) | 306,540 | (71 | ) | 223,444 | ||||||||||||

| Total capital expenditures | - | 454 | - | 454 | 2,440 | - | - | 2,440 | ||||||||||||||||

| Total assets | $ | 3,282,095 | $ | 37,205,127 | $ | 62,572 | $ | 40,549,794 | $ | 3,640,804 | $ | 38,366,768 | $ | 27,897 | $ | 42,035,469 | ||||||||

NOTE 16 - STOCK BASED COMPENSATION

On March 27, 2015 the Board of Directors (the “Board”) adopted the Company’s 2015 Equity Incentive Plan (the “Plan”), which became effective as of such date. The Plan is intended to be construed as an employee benefit plan that satisfies the requirements for exemption from the restrictions of Section 16(b) of the Exchange Act. A summary of the principal provisions of the Plan is set forth below.

The aggregate number of shares of common stock that may be issued under the Plan is 6,000,000 shares. In the event that the Board determines that any dividend or other distribution, recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase, or exchange of Common Stock or other securities of the Company, or other corporate transaction or event affects the common stock such that an adjustment is determined by the Board, in its sole discretion, to be necessary or appropriate in order to prevent dilution or enlargement of benefits or potential benefits intended to be made available under the Plan, the Board may, in such manner as it in good faith deems equitable, adjust any or all of (i) the number of shares of common stock or other securities of the Company (or number and kind of other securities or property) with respect to which awards may be granted, (ii) the number of shares of common stock or other securities of the Company (or number and kind of other securities or property) subject to outstanding awards, and (iii) the exercise price with respect to any stock option, or make provision for an immediate cash payment to the holder of an outstanding award in consideration for the cancellation of such award.

17

Individuals eligible for awards under the Plan shall consist of employees (including officers), directors and consultants, or those who will become employees (including officers), directors and consultants, of the Company and/or its subsidiaries whose performance or contribution, in the sole discretion of the Committee, benefits or will benefit the Company or any subsidiary.

The Plan was effective upon its approval by the Board and adoption by the Company. The Plan shall terminate on March 27, 2025, except with respect to awards then outstanding. After such date no further awards shall be granted under the Plan.

On March 30, 2015, the Company granted 3,000,000 and 300,000 restricted shares to Mr. Xin Sun, Chief Executive Officer and Chief Financial Officer of the Company and an employee, respectively. The vesting periods of the restricted shares under the Plan were determined based on individual stock award agreements and would be recognized as equity compensation for the fiscal years ended June 30, 2015 and 2016. The grant was pursuant to the Plan and a Restricted Stock Award Agreement, and was based on the exemption afforded by Regulation S under the Securities Act of 1933, as amended.

18

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

FORWARD LOOKING STATEMENTS

We make certain forward-looking statements in this report. Statements concerning our future operations, prospects, strategies, financial condition, future economic performance (including growth and earnings), demand for our services, and other statements of our plans, beliefs, or expectations, including the statements contained under the captions “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business,” as well as captions elsewhere in this document, are forward-looking statements. In some cases these statements are identifiable through the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can,” “could,” “may,” “should,” “will,” “would,” and similar expressions. The forward-looking statements we make are not guarantees of future performance and are subject to various assumptions, risks, and other factors that could cause actual results to differ materially from those suggested by these forward-looking statements. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. Indeed, it is likely that some of our assumptions will prove to be incorrect. Our actual results and financial position will vary from those projected or implied in the forward-looking statements and the variances may be material. You are cautioned not to place undue reliance on such forward-looking statements. These risks and uncertainties, together with the other risks described from time to time in reports and documents that we file with the SEC should be considered in evaluating forward-looking statements.

The nature of our business makes predicting the future trends of our revenue, expenses, and net income difficult. Thus, our ability to predict results or the actual effect of our future plans or strategies is inherently uncertain. The risks and uncertainties involved in our business could affect the matters referred to in any forward-looking statements and it is possible that our actual results may differ materially from the anticipated results indicated in these forward-looking statements. Important factors that could cause actual results to differ from those in the forward-looking statements include, without limitation, the following:

- the effect of political, economic, and market conditions and geopolitical events;

- legislative and regulatory changes that affect our business;

- the availability of funds and working capital;

- the actions and initiatives of current and potential competitors;

- investor sentiment; and

- our reputation.

We do not undertake any responsibility to publicly release any revisions to these forward-looking statements to take into account events or circumstances that occur after the date of this report. Additionally, we do not undertake any responsibility to update you on the occurrence of any unanticipated events which may cause actual results to differ from those expressed or implied by any forward-looking statements.

The following discussion and analysis should be read in conjunction with our consolidated financial statements and the related notes thereto as filed with the SEC and other financial information contained elsewhere in this report.

Except as otherwise indicated by the context, references in this report to “we,” “us,” “our,” “the Registrant,” “our Company,” or “the Company” are to China Health Industries Holdings, Inc., a Delaware corporation, China Health Industries Holdings Limited, a corporation incorporated under the laws of Hong Kong, its wholly owned subsidiary in China, Harbin Humankind Biology Technology Co. Limited (“Humankind”) and indirect 99% owned subsidiary, Harbin Huimeijia Medicine Company and indirect wholly owned subsidiary, Heilongjiang Huimeijia Pharmaceutical Co., Ltd. (“HLJ Huimeijia”). Unless the context otherwise requires, all references to (i) “PRC” and “China” are to the People’s Republic of China; (ii) “U.S. dollar,” “$” and “US$” are to United States dollars; (iii) “RMB” are to Renminbi Yuan of China; (iv) “Securities Act” are to the Securities Act of 1933, as amended; and (v) “Exchange Act” are to the Securities Exchange Act of 1934, as amended.

19

Business Overview

Our principal business operations are conducted through our wholly-owned subsidiaries, Humankind and HLJ Huimeijia.

The Company owns a GMP-certified plant and facilities and has the capacity to produce 21 CFDA-approved medicines and 14 CFDA-approved health supplement products in soft capsule, hard capsule, tablet, granule and oral liquid forms. These products address the needs of some key sectors in China, including the feminine, geriatric and children’s markets.

Our business is conducted through our sales agents and sales personnel. We sell our products directly to end customers by our own sales personnel as well as our sales agents, operating primarily in Jiangsu, Zhejiang, Gansu, Shanghai, Anhui and Beijing, where most of our revenues are generated. Our sales through agents in Beijing, Zhejiang, Jiangsu and Shanghai provinces accounted for 11%, 11%, 10% and 10% of our total sales, respectively, for the three months ended September 30, 2015. Although we do not currently sell our products online, we expect to do so in the future.

Results of Operations

The following table summarizes the top lines of the results of our operations for the three months ended September 30, 2015 and 2014, respectively:

|

|

September 30, 2015 | September 30, 2014 | Variance | % | ||||||||

|

Revenues |

$ | 1,956,068 | $ | 3,160,217 | $ | (1,204,149 | ) | -38.10% | ||||