Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BNC BANCORP | v424804_8k.htm |

| EX-2.1 - EXHIBIT 2.1 - BNC BANCORP | v424804_ex2-1.htm |

| EX-99.1 - EXHIBIT 99.1 - BNC BANCORP | v424804_ex99-1.htm |

Exhibit 99.2

ACQUISITION OF and Follow On Capital Raise

• BNC is acquiring High Point Bank Corporation “HPTB” for $141.3 million in stock and cash • BNC’s cash consideration in the High Point transaction is at least $42.4 million • BNC raised $60.8 million (1) in common equity to augment pro forma capital ratios • Combined Metrics - EPS is $0.06 accretive in 2017 and $0.50 accretive to TBV • Combined these two transactions are a ccretive to all pro forma capital ratios • Estimated TBV dilution from HPTB earned back in less than one year • Nearly 26% of HPTB’s deposits are noninterest - bearing 2 High Point Bank Transaction and Capital Raise Summary (1) $52.9 million offering with assumed exercise of 15% underwriter overallotment option

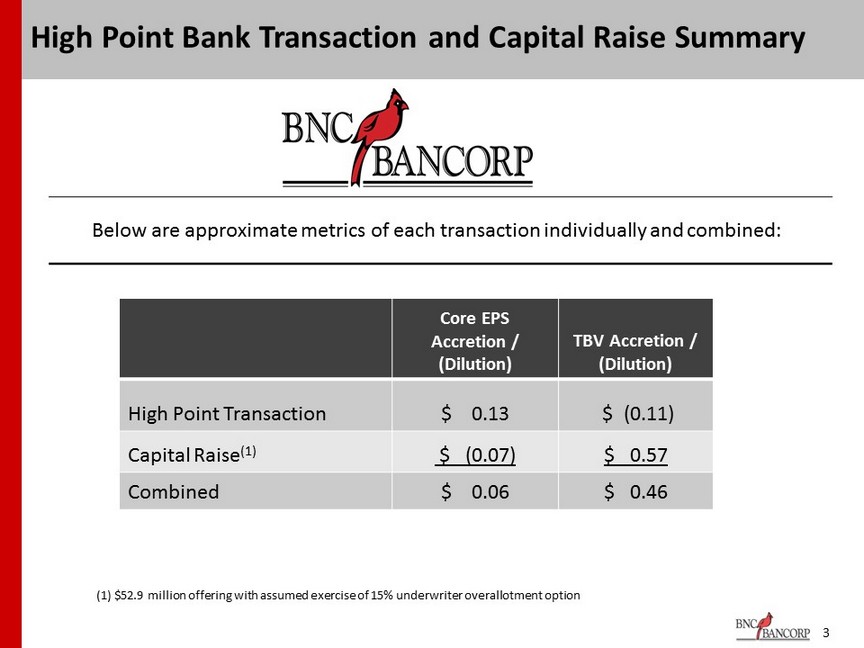

Below are approximate metrics of each transaction individually and combined: 3 High Point Bank Transaction and Capital Raise Summary (1) $52.9 million offering with assumed exercise of 15% underwriter overallotment option Core EPS Accretion / (Dilution) TBV Accretion / (Dilution) High Point Transaction $ 0.13 $ (0.11) Capital Raise (1) $ (0.07) $ 0.57 Combined $ 0.06 $ 0.46

ACQUISITION OF

Strong Core Deposit Base, Attractive In - Market Combination

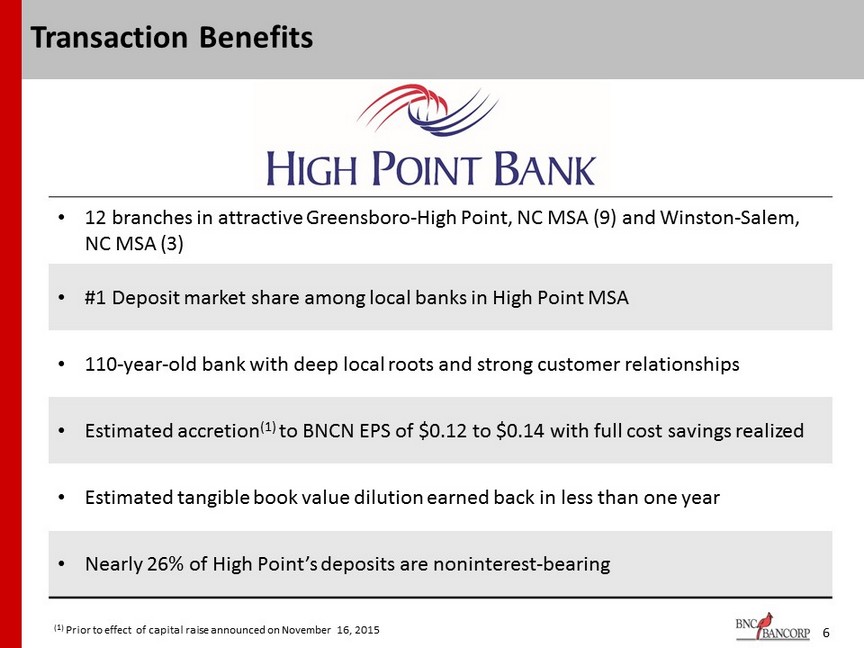

• 12 branches in attractive Greensboro - High Point, NC MSA (9) and Winston - Salem, NC MSA (3) • #1 Deposit market share among local banks in High Point MSA • 110 - year - old bank with deep local roots and strong customer relationships • Estimated accretion (1) to BNCN EPS of $0.12 to $0.14 with full cost savings realized • Estimated tangible book value dilution earned back in less than one year • Nearly 26% of High Point’s deposits are noninterest - bearing 6 Transaction Benefits (1) Prior to effect of capital raise announced on November 16, 2015

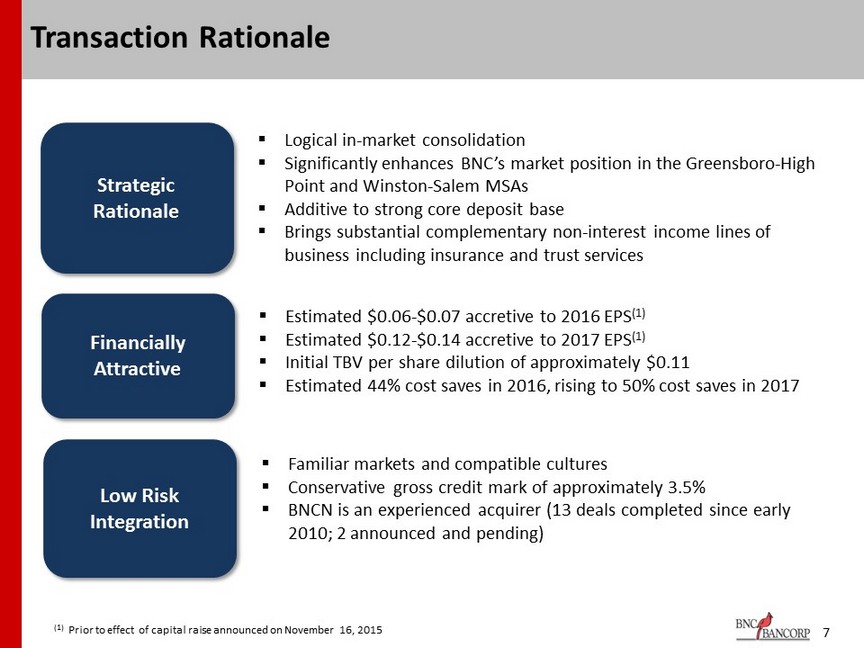

7 Transaction Rationale ▪ Logical in - market consolidation ▪ Significantly enhances BNC’s market position in the Greensboro - High Point and Winston - Salem MSAs ▪ Additive to strong core deposit base ▪ Brings substantial complementary non - interest income lines of business including insurance and trust services Strategic Rationale ▪ Estimated $0.06 - $0.07 accretive to 2016 EPS (1) ▪ Estimated $0.12 - $0.14 accretive to 2017 EPS (1) ▪ Initial TBV per share dilution of approximately $0.11 ▪ Estimated 44% cost saves in 2016, rising to 50% cost saves in 2017 Financially Attractive ▪ Familiar markets and compatible cultures ▪ Conservative gross credit mark of approximately 3.5% ▪ BNCN is an experienced acquirer (13 deals completed since early 2010; 2 announced and pending) Low Risk Integration (1) Prior to effect of capital raise announced on November 16, 2015

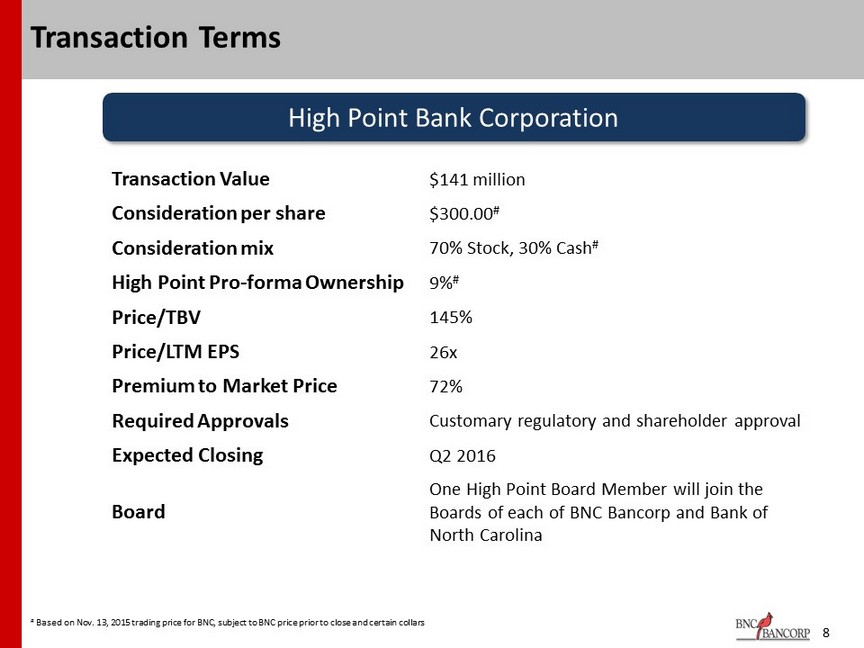

8 Transaction Terms # Based on Nov. 13, 2015 trading price for BNC, subject to BNC price prior to close and certain collars High Point Bank Corporation Transaction Value $141 million Consideration per share $300.00 # Consideration mix 70% Stock, 30% Cash # High Point Pro - forma Ownership 9% # Price/TBV 145% Price/LTM EPS 26x Premium to Market Price 72% Required Approvals Customary regulatory and shareholder approval Expected Closing Q2 2016 Board One High Point Board Member will join the Boards of each of BNC Bancorp and Bank of North Carolina

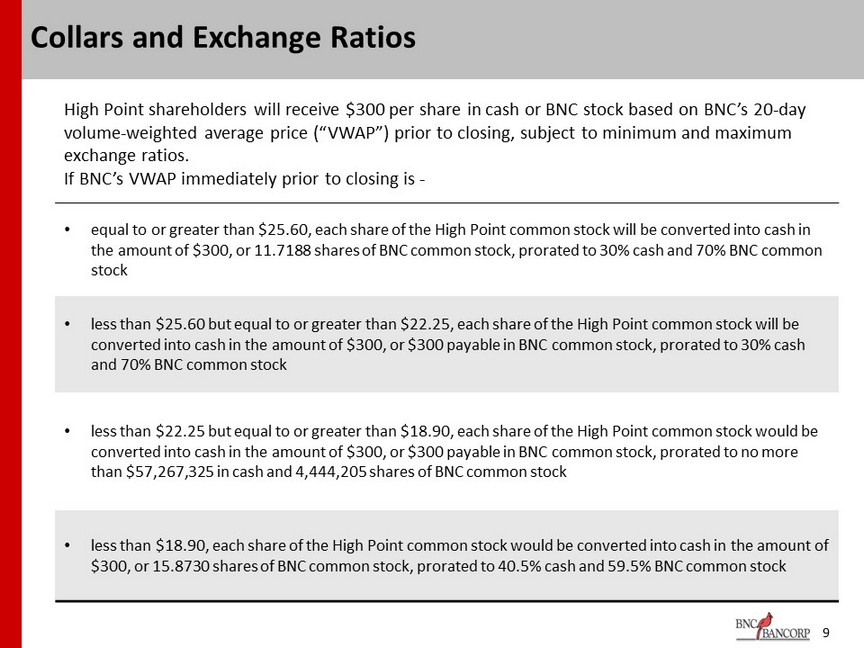

High Point shareholders will receive $300 per share in cash or BNC stock based on BNC’s 20 - day volume - weighted average price (“VWAP”) prior to closing, subject to minimum and maximum exchange ratios. If BNC’s VWAP immediately prior to closing is - • equal to or greater than $25.60, each share of the High Point common stock will be converted into cash in the amount of $300, or 11.7188 shares of BNC common stock, prorated to 30% cash and 70% BNC common stock • less than $25.60 but equal to or greater than $22.25, each share of the High Point common stock will be converted into cash in the amount of $300, or $300 payable in BNC common stock, prorated to 30% cash and 70% BNC common stock • less than $22.25 but equal to or greater than $18.90, each share of the High Point common stock would be converted into cash in the amount of $300, or $300 payable in BNC common stock, prorated to no more than $57,267,325 in cash and 4,444,205 shares of BNC common stock • less than $18.90, each share of the High Point common stock would be converted into cash in the amount of $300, or 15.8730 shares of BNC common stock, prorated to 40.5% cash and 59.5% BNC common stock 9 Collars and Exchange Ratios

10 Transaction Assumptions Cost savings % savings of HPTB’s LTM non - interest expense realized: • 44% realized in 2016 • 50% realized in 2017 Revenue synergies None assumed One - time costs $12mm, pretax Core deposit intangible $6mm Fair value marks $18mm gross credit mark; expected $2mm write - up on carrying value of bank premises High Point Bank Corporation

• High Point Trust Division: Largest Community Bank Trust Division in NC • Over $800 million in managed funds, serving approximately 500 families • Annual revenue: Trust $3.5 million; Brokerage $0.7 million • Offers Trust and estate planning, investment management, and retirement plan services • Combined Pre - tax income of over $1.0 million 11 High Point Bank Trust and Brokerage Divisions

• One of Triad’s largest independent Agencies – 30 Licensed agents • Offers Commercial (51%), Personal (37%), and Employee Benefits (12%) • Insurance Division over 100 years old having completed three prior acquisitions • Named the Best Insurance Agency in the Triad in 2013 by local paper • Revenues of over $3.5 million 12 High Point Bank Insurance Division

• Both BNC and High Point are on the same core system – JHA Silverlake • Concentration of Seasoned Talent in Support Areas proficient at JHA Silverlake • High Point has state - of - the - art Operations Center with adequate space to support future growth • Provides space and talent to combine loan and deposit operations under one roof and drive greater efficiencies • “Best of Both” talent and processes will drive greater efficiency 13 Operational Synergies

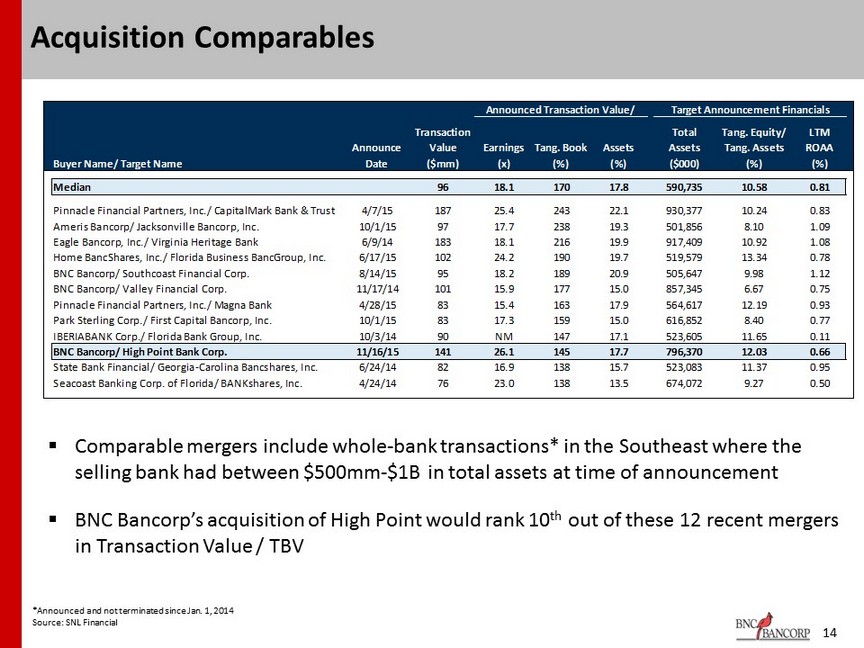

14 Acquisition Comparables ▪ Comparable mergers include whole - bank transactions* in the Southeast where the selling bank had between $500mm - $1B in total assets at time of announcement ▪ BNC Bancorp’s acquisition of High Point would rank 10 th out of these 12 recent mergers in Transaction Value / TBV * A nnounced and not terminated since Jan. 1, 2014 Source: SNL Financial Buyer Name/ Target Name Announce Date Transaction Value ($mm) Earnings (x) Tang. Book (%) Assets (%) Total Assets ($000) Tang. Equity/ Tang. Assets (%) LTM ROAA (%) Median 96 18.1 170 17.8 590,735 10.58 0.81 Pinnacle Financial Partners, Inc./ CapitalMark Bank & Trust 4/7/15 187 25.4 243 22.1 930,377 10.24 0.83 Ameris Bancorp/ Jacksonville Bancorp, Inc. 10/1/15 97 17.7 238 19.3 501,856 8.10 1.09 Eagle Bancorp, Inc./ Virginia Heritage Bank 6/9/14 183 18.1 216 19.9 917,409 10.92 1.08 Home BancShares, Inc./ Florida Business BancGroup, Inc. 6/17/15 102 24.2 190 19.7 519,579 13.34 0.78 BNC Bancorp/ Southcoast Financial Corp. 8/14/15 95 18.2 189 20.9 505,647 9.98 1.12 BNC Bancorp/ Valley Financial Corp. 11/17/14 101 15.9 177 15.0 857,345 6.67 0.75 Pinnacle Financial Partners, Inc./ Magna Bank 4/28/15 83 15.4 163 17.9 564,617 12.19 0.93 Park Sterling Corp./ First Capital Bancorp, Inc. 10/1/15 83 17.3 159 15.0 616,852 8.40 0.77 IBERIABANK Corp./ Florida Bank Group, Inc. 10/3/14 90 NM 147 17.1 523,605 11.65 0.11 BNC Bancorp/ High Point Bank Corp. 11/16/15 141 26.1 145 17.7 796,370 12.03 0.66 State Bank Financial/ Georgia-Carolina Bancshares, Inc. 6/24/14 82 16.9 138 15.7 523,083 11.37 0.95 Seacoast Banking Corp. of Florida/ BANKshares, Inc. 4/24/14 76 23.0 138 13.5 674,072 9.27 0.50 Announced Transaction Value/ Target Announcement Financials

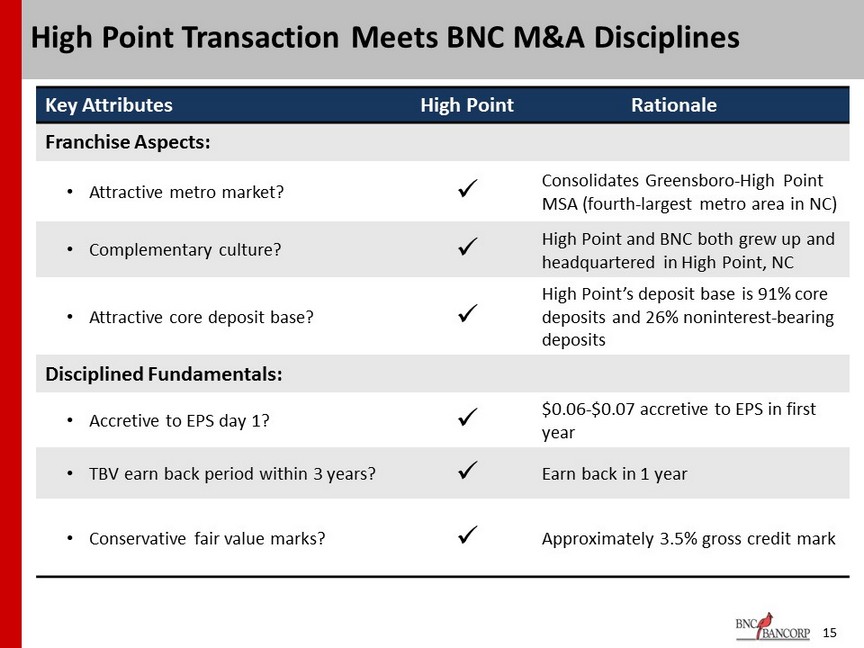

15 High Point Transaction Meets BNC M&A Disciplines Key Attributes High Point Rationale Franchise Aspects: • Attractive metro market? x Consolidates Greensboro - High Point MSA (fourth - largest metro area in NC) • Complementary culture? x High Point and BNC both grew up and headquartered in High Point, NC • Attractiv e core deposit base? x High Point’s deposit base is 91% core deposits and 26% noninterest - bearing deposits Disciplined Fundamentals: • Accretive to EPS day 1? x $0.06 - $0.07 accretive to EPS in first year • TBV earn back period within 3 years? x Earn back in 1 year • Conservative fair value marks? x Approximately 3.5% gross credit mark

Pro Forma

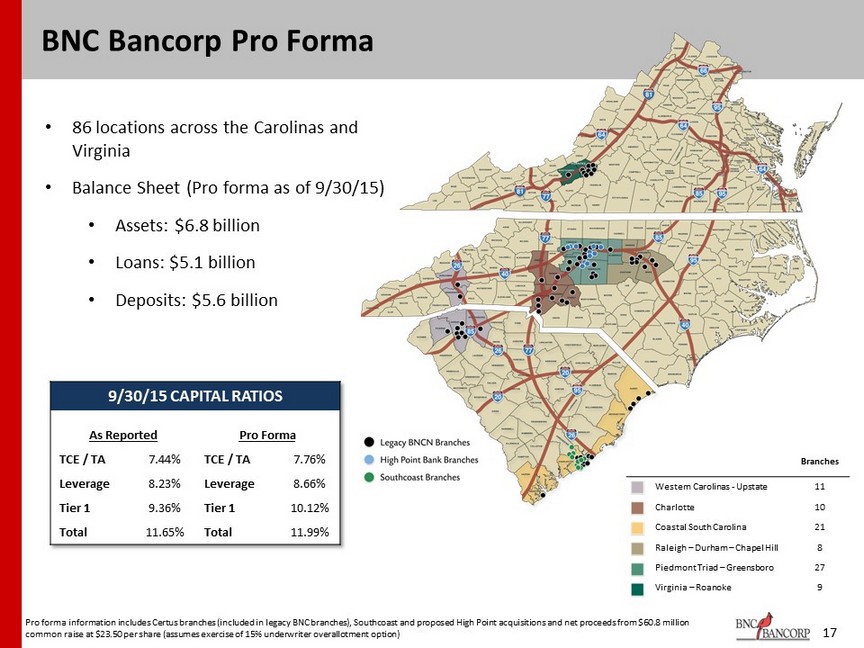

17 BNC Bancorp Pro Forma • 86 locations across the Carolinas and Virginia • Balance Sheet (Pro forma as of 9/30/15) • Assets: $6.8 billion • Loans: $5.1 billion • Deposits: $5.6 billion 9/30/15 CAPITAL RATIOS As Reported Pro Forma TCE / TA 7.44% TCE / TA 7.76% Leverage 8.23% Leverage 8.66% Tier 1 9.36% Tier 1 10.12% Total 11.65% Total 11.99% Branches Western Carolinas - Upstate 11 Charlotte 10 Coastal South Carolina 21 Raleigh – Durham – Chapel Hill 8 Piedmont Triad – Greensboro 27 Virginia – Roanoke 9 Pro forma information includes Certus branches (included in legacy BNC branches), Southcoast and proposed High Point acquisitions and net proceeds from $60.8 million common raise at $23.50 per share (assumes exercise of 15% underwriter overallotment option)

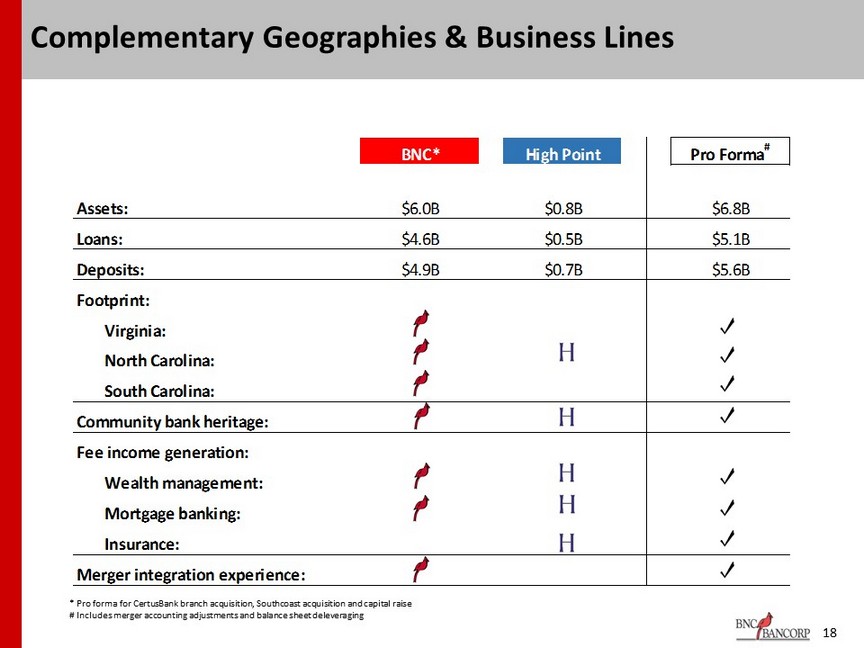

BNC* High Point Pro Forma # Assets: $6.0B $0.8B $6.8B Loans: $4.6B $0.5B $5.1B Deposits: $4.9B $0.7B $5.6B Footprint: Virginia: North Carolina: South Carolina: Community bank heritage: Fee income generation: Wealth management: Mortgage banking: Insurance: Merger integration experience: 18 Complementary Geographies & Business Lines * Pro forma for CertusBank branch acquisition, Southcoast acquisition and capital raise # Includes merger accounting adjustments and balance sheet deleveraging

19 High Point Bank Transaction Summary ▪ Transaction expected to drive earnings growth and overall shareholder value for both BNC and High Point shareholders ▪ Strategic in - market consolidation ▪ Additive to core deposit franchise ▪ Improves BNC’s non - interest income generation ▪ Complementary cultures and business lines ▪ Pro forma institution expected to be stronger, well - capitalized and remain an acquirer of choice in the Carolinas & Virginia ▪ Increases High Point’s ability to serve larger customers

High Point Bank Corporation Overview

21 High Point Bank Corporation – Overview ▪ Founded in High Point, NC in 1905 ▪ Quality core deposit franchise ▪ Current balance sheet built solely through organic growth ▪ Largest community bank trust department in North Carolina ▪ More than $800mm in managed funds, approximately 500 families ▪ Sixth - largest insurance agency in Triad market ▪ HPB Insurance Group has been in operation for over 100 years ▪ 12 branches – 9 in the Greensboro - High Point MSA and 3 in the Winston - Salem MSA

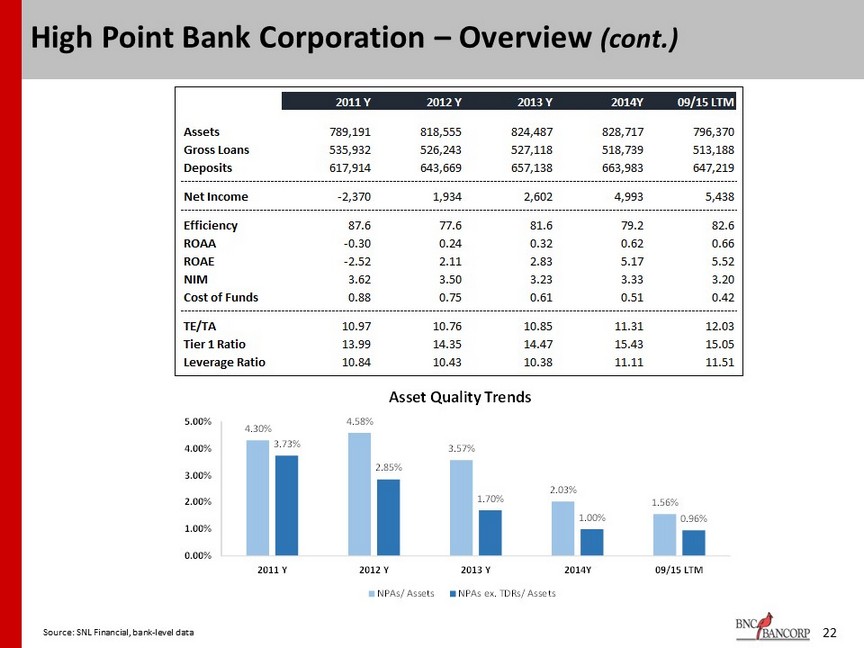

22 High Point Bank Corporation – Overview (cont.) Source: SNL Financial, bank - level data 2011 Y 2012 Y 2013 Y 2014Y 09/15 LTM Assets 789,191 818,555 824,487 828,717 796,370 Gross Loans 535,932 526,243 527,118 518,739 513,188 Deposits 617,914 643,669 657,138 663,983 647,219 Net Income -2,370 1,934 2,602 4,993 5,438 Efficiency 87.6 77.6 81.6 79.2 82.6 ROAA -0.30 0.24 0.32 0.62 0.66 ROAE -2.52 2.11 2.83 5.17 5.52 NIM 3.62 3.50 3.23 3.33 3.20 Cost of Funds 0.88 0.75 0.61 0.51 0.42 TE/TA 10.97 10.76 10.85 11.31 12.03 Tier 1 Ratio 13.99 14.35 14.47 15.43 15.05 Leverage Ratio 10.84 10.43 10.38 11.11 11.51 4.30% 4.58% 3.57% 2.03% 1.56% 3.73% 2.85% 1.70% 1.00% 0.96% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 2011 Y 2012 Y 2013 Y 2014Y 09/15 LTM Asset Quality Trends NPAs/ Assets NPAs ex. TDRs/ Assets

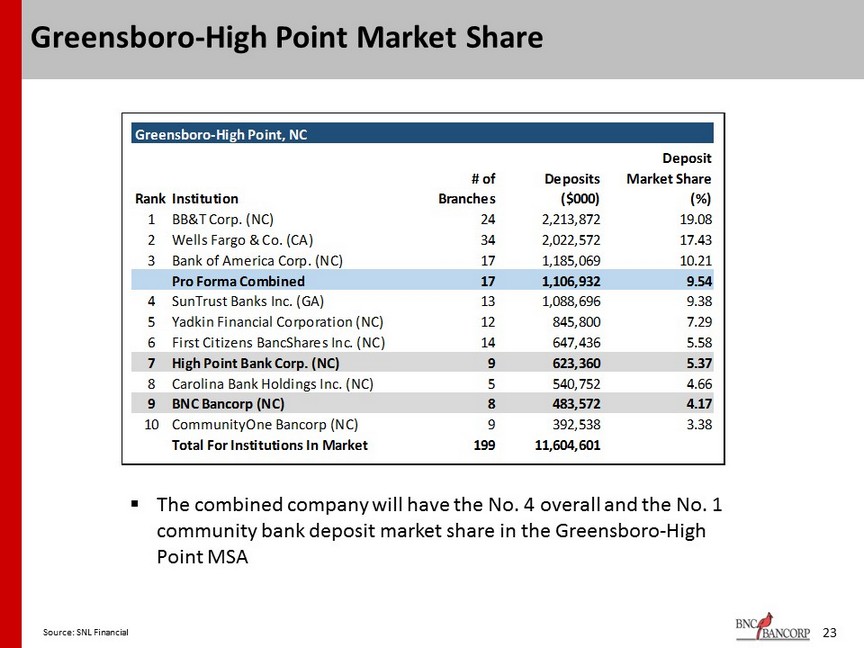

23 Greensboro - High Point Market Share ▪ The combined company will have the No. 4 overall and the No. 1 community bank deposit market share in the Greensboro - High Point MSA Source: SNL Financial Greensboro-High Point, NC RankInstitution # of Branches Deposits ($000) Deposit Market Share (%) 1 BB&T Corp. (NC) 24 2,213,872 19.08 2 Wells Fargo & Co. (CA) 34 2,022,572 17.43 3 Bank of America Corp. (NC) 17 1,185,069 10.21 Pro Forma Combined 17 1,106,932 9.54 4 SunTrust Banks Inc. (GA) 13 1,088,696 9.38 5 Yadkin Financial Corporation (NC) 12 845,800 7.29 6 First Citizens BancShares Inc. (NC) 14 647,436 5.58 7 High Point Bank Corp. (NC) 9 623,360 5.37 8 Carolina Bank Holdings Inc. (NC) 5 540,752 4.66 9 BNC Bancorp (NC) 8 483,572 4.17 10 CommunityOne Bancorp (NC) 9 392,538 3.38 Total For Institutions In Market 199 11,604,601

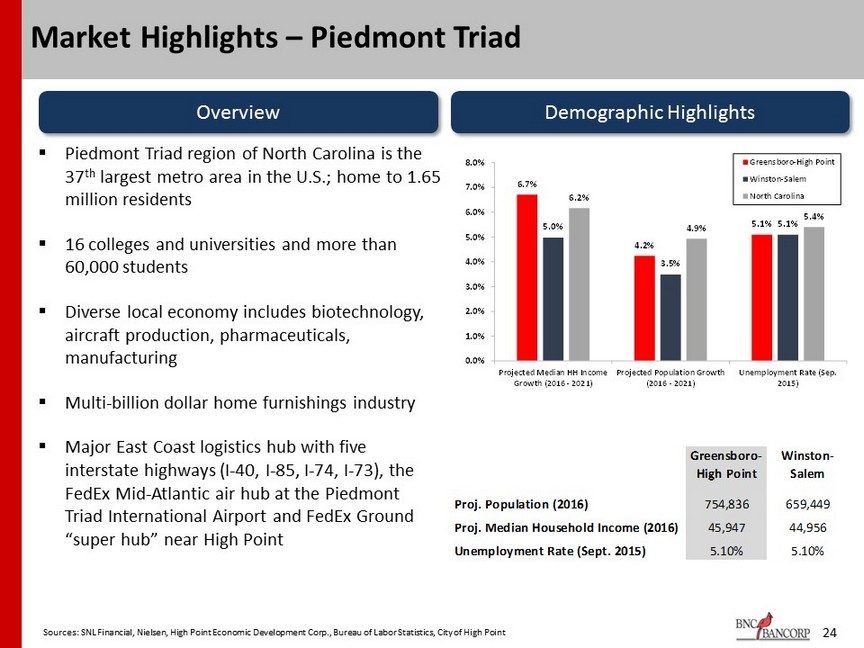

24 Market Highlights – Piedmont Triad Overview Demographic Highlights ▪ Piedmont Triad region of North Carolina is the 37 th largest metro area in the U.S.; home to 1.65 million residents ▪ 16 colleges and universities and more than 60,000 students ▪ Diverse local economy includes biotechnology, aircraft production, pharmaceuticals, manufacturing ▪ Multi - billion dollar home furnishings industry ▪ Major East Coast logistics hub with five interstate highways (I - 40, I - 85, I - 74, I - 73), the FedEx Mid - Atlantic air hub at the Piedmont Triad International Airport and FedEx Ground “super hub” near High Point Sources: SNL Financial, Nielsen, High Point Economic Development Corp., Bureau of Labor Statistics, City of High Point 6.7% 4.2% 5.1% 5.0% 3.5% 5.1% 6.2% 4.9% 5.4% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% Projected Median HH Income Growth (2016 - 2021) Projected Population Growth (2016 - 2021) Unemployment Rate (Sep. 2015) Greensboro-High Point Winston-Salem North Carolina Greensboro- High Point Winston- Salem Proj. Population (2016) 754,836 659,449 Proj. Median Household Income (2016) 45,947 44,956 Unemployment Rate (Sept. 2015) 5.10% 5.10%

Capital Raise Metrics

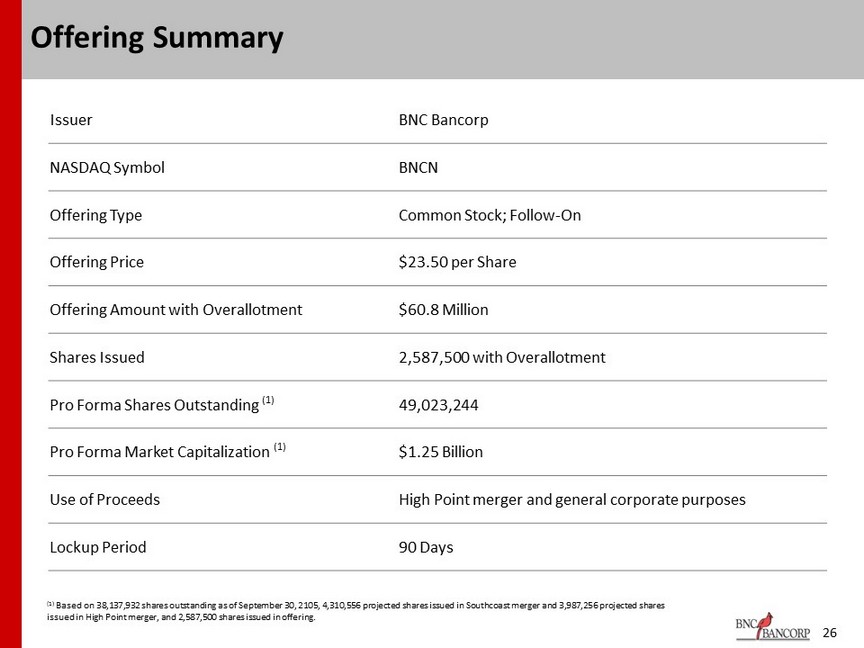

26 Offering Summary (1) Based on 38,137,932 shares outstanding as of September 30, 2105, 4,310,556 projected shares issued in Southcoast merger and 3,987,256 projected shares issued in High Point merger, and 2,587,500 shares issued in offering. Issuer BNC Bancorp NASDAQ Symbol BNCN Offering Type Common Stock; Follow - On Offering Price $23.50 per Share Offering Amount with Overallotment $60.8 Million Shares Issued 2,587,500 with Overallotment Pro Forma Shares Outstanding (1) 49,023,244 Pro Forma Market Capitalization (1) $ 1.25 Billion Use of Proceeds High Point merger and general corporate purposes Lockup Period 90 Days

Appendix

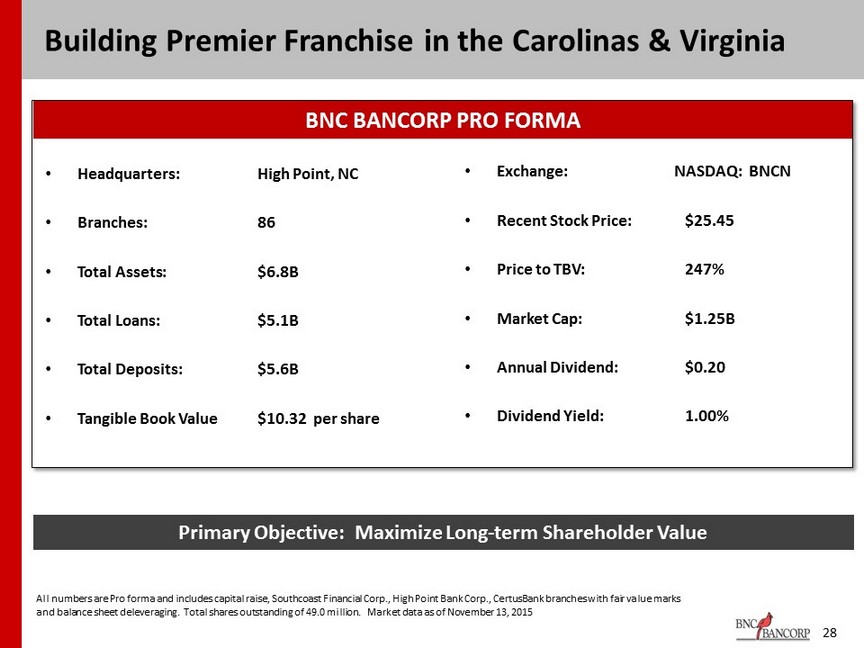

Building Premier Franchise in the Carolinas & Virginia 28 • Headquarters: • Branches: • Total Assets: • Total Loans: • Total Deposits: • Tangible Book Value High Point, NC 86 $6.8B $5.1B $5.6B $10.32 per share • Exchange: • Recent Stock Price: • Price to TBV: • Market Cap: • Annual Dividend: • Dividend Yield: NASDAQ: BNCN $25.45 247% $1.25B $0.20 1.00% Primary Objective: Maximize Long - term Shareholder Value All numbers are Pro forma and includes capital raise, Southcoast Financial Corp., High Point Bank Corp., CertusBank branches with fair value marks and balance sheet deleveraging. Total shares outstanding of 49.0 million. Market data as of November 13, 2015 BNC BANCORP PRO FORMA

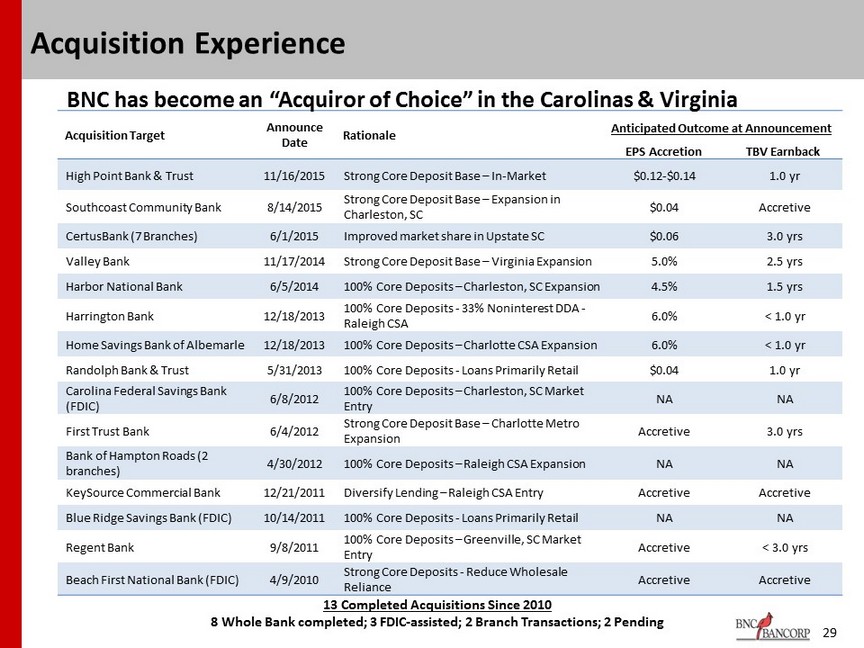

29 Acquisition Experience 13 Completed Acquisitions Since 2010 8 Whole Bank completed; 3 FDIC - assisted; 2 Branch Transactions; 2 Pending Acquisition Target Announce Date Rationale Anticipated Outcome at Announcement EPS Accretion TBV Earnback High Point Bank & Trust 11/16/2015 Strong Core Deposit Base – In - Market $0.12 - $0.14 1.0 yr Southcoast Community Bank 8/14/2015 Strong Core Deposit Base – E xpansion in Charleston, SC $0.04 Accretive CertusBank (7 Branches) 6/1/2015 Improved market share in Upstate SC $0.06 3.0 yrs Valley Bank 11/17/2014 Strong Core Deposit Base – Virginia Expansion 5.0% 2.5 yrs Harbor National Bank 6/5/2014 100% Core Deposits – Charleston , SC Expansion 4.5% 1.5 yrs Harrington Bank 12/18/2013 100% Core Deposits - 33% Non i nterest DDA - Raleigh CSA 6.0% < 1.0 yr Home Savings Bank of Albemarle 12/18/2013 100% Core Deposits – Charlotte CSA Expansion 6.0% < 1.0 yr Randolph Bank & Trust 5/31/2013 100% Core Deposits - Loans Primarily Retail $0.04 1.0 yr Carolina Federal Savings Bank (FDIC) 6/8/2012 100% Core Deposits – Charleston, SC Market Entry NA NA First Trust Bank 6/4/2012 Strong Core Deposit Base – Charlotte Metro Expansion Accretive 3.0 yrs Bank of Hampton Roads (2 branches) 4/30/2012 100% Core Deposits – Raleigh CSA Expansion NA NA KeySource Commercial Bank 12/21/2011 Diversify Lending – Raleigh CSA Entry Accretive Accretive Blue Ridge Savings Bank (FDIC) 10/14/2011 100% Core Deposits - Loans Primarily Retail NA NA Regent Bank 9/8/2011 100 % Core Deposits – Greenville , SC Market Entry Accretive < 3.0 yrs Beach First National Bank (FDIC) 4/9/2010 Strong Core Deposits - Reduce Wholesale Reliance Accretive Accretive BNC has become an “ Acquiror of Choice” in the Carolinas & Virginia

30 Investor Contacts Richard D. Callicutt II President & Chief Executive Officer David B. Spencer Senior Executive Vice President & Chief Financial Officer BNC Bancorp 3980 Premier Drive, Suite 210 High Point, NC 27265 (366) 869 - 9200 www.bncbancorp.com

31 Forward Looking Statements This presentation contains certain forward - looking information about BNC that is intended to be covered by the safe harbor for “forward - looking statements” provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, are forward - looking statements. In some cases, you can identify forward - looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should carefully read forward - looking statements, including statements that contain these words, because they discuss the future expectations or state other “forward - looking” information about BNC. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of BNC. Forward - looking statements speak only as of the date they are made and BNC assumes no duty to update such statements. In addition to factors previously disclosed in reports filed by BNC with the SEC, additional risks and uncertainties may include, but are no t limited to: the possibility that any of the anticipated benefits of the proposed merger will not be realized or will not be realized within the expected time period; the risk that integration of operations with those of BNC will be materially delaye d or will be more costly or difficult than expected; the inability to complete the merger due to the failure of shareholder approval to adopt the merger agreement; the failure to satisfy other conditions to completion of the merger, including receipt of required regulatory and other approvals; the failure of the proposed merger to close for any other reason; the effect of the announcement of the merger on customer relationships and operating results; the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; and general competitive, economic, political and market conditions and fluctuations. Additional factors affecting BNC are discussed in its Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K filed with the SEC. Please refer to the SEC’s website at www.sec.gov where you can review those documents.

32 Additional Information This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitatio n o f any vote or approval. In connection with the merger, BNC will file with the SEC a Registration Statement on Form S - 4 that will include a Proxy Statement of High Point and a Prospectus of BNC, as well as other relevant documents concerning the proposed transaction. SHAREHOLDERS ARE STRONGLY URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN IT BECOMES AVAILABLE AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about BNC, may be obtained after their respective filing at the SEC’s Internet site (http://www.sec.gov). In addition, ( i ) free copies of documents filed by BNC with the SEC may be obtained on the BNC website at www.bncbancorp.com or by requesting them in writing from Drema Michael, BNC Bancorp, 3980 Premier Drive, Suite 210, High Point, North Carolina 27265, or by telephone at (336) 869 - 9200. BNC and High Point and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from High Point’s shareholders in connection with the proposed merger. Information about the directors and executive officers of BNC and High Point and other persons who may be deemed participants in the solicitation will be included in the Proxy Statement/Prospectus. Information about BNC’s executive officers and directors can also be found in BNC’s Proxy Statement/Prospectus in connection with its 2015 Annual Meeting of Shareholders filed with the SEC on April 14, 2015. Additional information regarding the interests of those persons and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. You may obtain free copies of each document as described in the preceding paragraph.