Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Northern Power Systems Corp. | d43892d8k.htm |

| EX-99.1 - EX-99.1 - Northern Power Systems Corp. | d43892dex991.htm |

Troy

Patton – CEO

Ciel Caldwell – CFO November 13, 2015 Q3 2015 Earnings Presentation Northern Power Systems Exhibit 99.2 |

FORWARD LOOKING STATEMENT AND NON -GAAP DISCLOSURES All statements and other information contained in this document related to anticipated future events or results constitute forward-looking statements. Forward-looking statements often, but not always, are identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “forecast”, “project”, “likely”, “potential”, “targeted” and “possible” and statements that an event or result “may”, “will”, “would”, “should”, “could” or “might” occur or be achieved and other similar expressions. Forward-looking statements are subject to known and unknown business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those expressed or implied by the forward-looking statements. Forward- looking statements are based on estimates and opinions of management at the date the statements are made. Northern Power Systems does not undertake any obligation to update forward-looking statements even if circumstances or management’s estimates or opinions should change, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements. This presentation references non-GAAP financial measures with the required reconciliation referenced in the table captioned “Non-GAAP Reconciliations” to the most comparable GAAP financial measures. 2 |

Presentation Organization and Call Details

3 Q&A Session: Immediately following prepared remarks Link from IR webpage at http://www.ir.northernpower.com/events- and-presentations.aspx Troy Patton President and CEO Ciel Caldwell CFO Presentation Organization: Q3 2015 business update Q3 2015 operational and financial results review GAAP to Non-GAAP reconciliations Hosted by: |

NPS’

Business Lines Fully developed strategic

partnership approach

Successfully deployed in China

and Brazil to date

4 High-margin Development Expansion of IP portfolio NPS 2MW turbine platform Converter and Controls Systems NPS 60/100kW Technology Licensing Product Sales & Service Technology Development |

Business

Expansion Trends 5

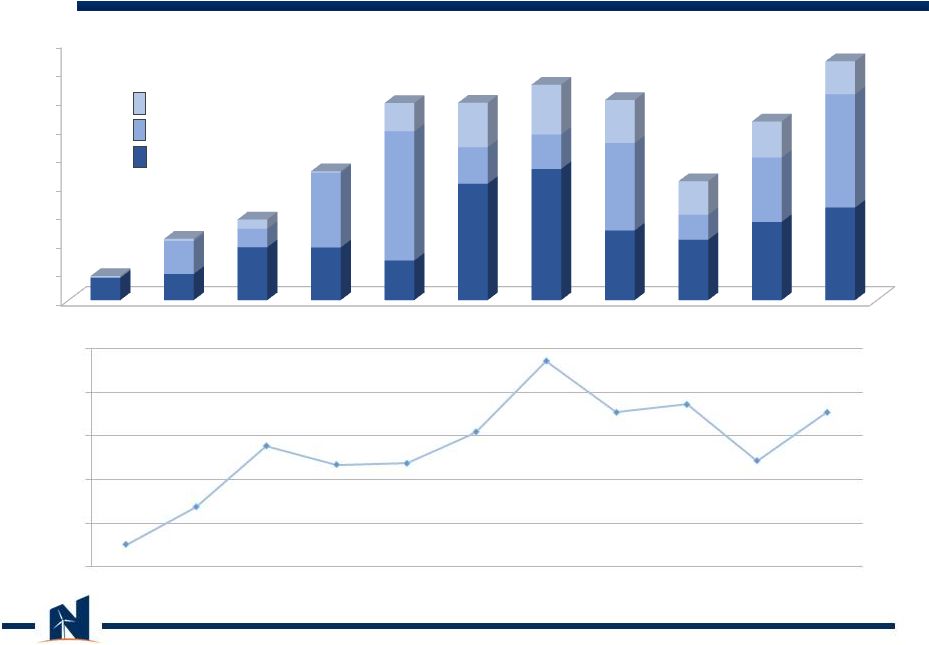

5 Bridge to Net Loss Non-GAAP EBITDA (Loss)/Income (2.2) (4.1)*** (3.1) *Includes the impact of delayed Q413 turbine deliveries ***Includes $0.6M of costs related to a considered financing transaction

$0 $2 $4 $6 $8 $10 $12 $14 $16 $0 $10 $20 $30 $40 $50 BACKLOG REVENUE ($5) ($4) ($3) ($2) ($1) $0 $1 (2.5) (1.2) 0.5 (1.6) (3.3) (2.7) 0.3 (0.3) (2.4) (3.3) (0.5) 48 40 47 41 43 41 36 ** 6.2 13.8 15 14 8.3 12.5 16.7 ** ** **Represents currency fluctuation impact

|

Q3 2015:

Product Sales and Service Update Supply: blade production meeting

needs Italian market:

Continuing strong demand

On-going clarifications of feed in tariff

policy Gaining market share UK market: Draft feed in tariff policy changes suggest that the market for 100kW turbines will be impacted Exploring a suitable adaptation of the 60kW to a 50kW option for the UK market Rest Of World markets: Korea - additional island auctions over next six months US – new financing options and cooperation with IPP’s bringing new channels to market in target states 6 NPS 2MW turbine platform Converter and Controls Systems NPS 60/100kW Product Sales & Service Distributed Turbines: |

Q3 2015:

Product Sales and Service Update NPS Flexphase

power converters well

suited for emerging Utility Battery Energy

Storage (“BESS”) Market

Rapidly expanding market driven by

mandates and increasingly affordable

storage technologies Applications include: Voltage/frequency regulation Peak shaving Grid reliability T&D deferral Flexphase is technology agnostic: works well with Li-Ion, Sodium-Sulfur and Flow chemistries North America and Europe primarily in focus in medium term 7 NPS 2MW turbine platform Converter and Controls Systems NPS 60/100kW Product Sales & Service Power Systems: |

Q3 2015:

Technology Licensing & Development Update WEG 2.1MW turbine shipments

continue steadily, fleet growing

rapidly Healthy and increasing order backlog at over 500MW Actively exploring other regions & expanded WEG relationship European partners bringing opportunities in power conversion and storage 8 Technology Licensing Fully developed strategic partnership approach Successfully deployed in China and Brazil to date Technology Development High-margin Development Expansion of IP portfolio |

Q3 2015:

Key Financial Metrics 9

Q3 2015 YTD 2015 Revenue • $16.7M • 11% y/y growth • 34% q/q growth • $37.4M • 12% y/y reduction Backlog • $36M • 23% y/y decrease • Currency fluctuation impact of approximately 5% Gross Margin • 20.4% • PY at 32.2% • Q2 9.3% • 17.1% • PY at 19.3% Net Loss • ($0.5M) • 67% y/y loss increase • ($0.02/share) • 85% q/q improvement • ($7.9M) • 44% y/y loss increase • ($0.35/share) Non-GAAP EBITDA Income/(Loss) • $0.3M • 40% y/y income decrease • $0.01/share • 112% q/q improvement • ($5.9M) • 84% y/y loss increase • ($0.26/share) |

Revenue

and Gross Margin Trends 10

Q1 ‘15 Q1 ‘14 Q3 ‘14 Q4 ‘14 $0 $2 $4 $6 $8 $10 $12 $14 $16 $18 High-wind Regimes Non-turbine Revenue Low-wind Regimes Q2 ‘13 Q1 ‘13 Q3 ‘13 Q4 ‘13 Q2 ‘14 Q2 ‘15 Q3 ‘15 -9.9% -1.3% 12.7% 8.4% 8.7% 15.9% 32.2% 20.4% 22.2% 9.3% 20.4% -15.0% -5.0% 5.0% 15.0% 25.0% 35.0% |

Q3 2015:

Other Financial Metrics Cash Flow Statement

Q3 2015 Q3 2014 Cash used in operations ($0.7M) • Change in operating assets / liab. ($0.6M) ($3.0M) • Change in operating assets / liab. ($3.4M) Cash used in investing activities ($0.7M) ($0.1M) Cash provided by financing activities $1.0M $4.0M 11 Balance Sheet Metrics September 30, 2015 September 30, 2014 Cash and cash equivalents $5.7M $16.3M Inventory $15.5M $5.0M of which or 32.3% is in transit $15.0M Working capital line $4.0M $4.0M |

Non-GAAP Reconciliations 12 |

Non-GAAP Reconciliations Non-GAAP adjusted EBITDA

13 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Net Loss $(3,124) $(2,064) $(289) $(2,417) $(4,133) $(3,298) $(485) Interest 240 37 40 26 26 71 45 Taxes 14 15 412 454 385 383 427 Depreciation 178 391 194 179 190 193 212 Stock compensation 148 454 144 141 178 190 313 Non cash implied license revenue - - - - - (243) (189) Loss on disposal of asset - - - 4 50 - - Adjusted EBITDA $(2,544) $(1,167) $501 $(1,613) $(3,304) $(2,704) $323 (All amounts in thousands) |