Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - XTERA COMMUNICATIONS, INC. | d38653dex51.htm |

| EX-23.1 - EX-23.1 - XTERA COMMUNICATIONS, INC. | d38653dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on November 12, 2015.

Registration No. 333-207288

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

XTERA COMMUNICATIONS, INC.

(Exact name of Registrant as Specified in Its Charter)

| Delaware | 3661 | 38-3394611 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

500 W. Bethany Drive, Suite 100

Allen, Texas 75013

(972) 649-5000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Jon R. Hopper

Chief Executive Officer

500 W. Bethany Drive, Suite 100

Allen, Texas 75013

(972) 649-5000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| Samer M. Zabaneh DLA Piper LLP (US) 401 Congress Avenue, Suite 2500 Austin, Texas 78701 |

Paul J. Colan Chief Financial Officer 500 W. Bethany Drive, Suite 100 Allen, Texas 75013 (972) 649-5000 |

Stanton D. Wong Heidi E. Mayon Pillsbury Winthrop Shaw Pittman LLP Four Embarcadero Center, 22nd Floor San Francisco, California 94111 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one): ¨ Large accelerated filer, ¨ Accelerated filer, x Non-accelerated filer (do not check if a smaller reporting company) or ¨ Smaller reporting company.

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities To Be Registered |

Amount to be |

Offering Price Per Share |

Aggregate Offering Price(1) |

Amount of Registration Fee(2) | ||||

| Common Stock, par value $0.001 |

5,750,000 |

$5.00 | $28,750,000 | $2,895.13 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(a) under the Securities Act. Includes offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (2) | The registrant previously paid $6,042 in connection with the initial filing of this Registration Statement. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor are we seeking an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 12, 2015

PRELIMINARY PROSPECTUS

5,000,000 Shares

Xtera Communications, Inc.

Common Stock

We are offering 5,000,000 shares of our common stock. This is our initial public offering, and no public market currently exists for our common stock. We estimate that the initial public offering price will be $5.00 per share. We have applied to list our common stock on The NASDAQ Global Market under the symbol “XCOM.”

We are an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 10.

| Per Share | Total | |||

| Public Offering Price |

$ | $ | ||

| Underwriting Discount(1) |

$ | $ | ||

| Proceeds, Before Expenses, to Xtera Communications |

$ | $ | ||

| (1) | See “Underwriting” for additional information regarding underwriting compensation. |

We have granted the underwriters the right to purchase up to 750,000 shares of our common stock to cover over-allotments.

Entities affiliated with New Enterprise Associates, The Wellcome Trust, ARCH Venture Partners and Sevin Rosen Funds, which are each holders of more than 5% of our common stock, have indicated an interest in purchasing approximately $4 million, $3 million, $1 million and $1 million, respectively, of shares of our common stock in this offering. ARCH Venture Partners and Sevin Rosen Funds are also each affiliated with a member of our board of directors. However, because indications of interest are not binding agreements or commitments to purchase, these stockholders may determine to purchase fewer shares than they indicate an interest in purchasing or not to purchase any shares in this offering. It is also possible that these stockholders or certain of our other existing stockholders, including certain of our directors and executive officers and certain stockholders affiliated with our directors, could purchase more shares of our common stock than previously indicated or may purchase shares pursuant to the underwriters’ over-allotment option, if exercised. In addition, the underwriters could determine to sell fewer shares to any of these stockholders than the stockholders have indicated an interest in purchasing or not to sell any shares to these stockholders. The underwriters will receive the same underwriting discount on any shares purchased by these stockholders as they will on any other shares sold to the public in this offering.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved of these securities or determined if this prospectus is truthful or complete. It is illegal for any person to tell you otherwise.

We anticipate that delivery of the shares of common stock will be made on or about , 2015.

| Needham & Company | Cowen and Company | BMO Capital Markets |

The date of this prospectus is , 2015

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 10 | ||||

| 29 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 35 | ||||

| 37 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

39 | |||

| 55 | ||||

| 69 | ||||

| 76 | ||||

| 83 | ||||

| 89 | ||||

| 93 | ||||

| 97 | ||||

| Material U.S. Federal Income and Estate Tax Consequences to Non-U.S. Holders Of Common Stock |

99 | |||

| 103 | ||||

| 107 | ||||

| 107 | ||||

| 107 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or in any free writing prospectus prepared by or on behalf of us and delivered or made available to you or to which we have referred you. Neither we nor any of the underwriters have authorized anyone to provide you with additional or different information. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus is accurate only as of its date, regardless of its time of delivery or any sale of our common stock.

Until (25 days after the commencement of the offering), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering, or possession or distribution of this prospectus, in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

Table of Contents

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should carefully read the entire prospectus, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, before you decide whether to invest in our common stock. If you invest in our common stock, you are assuming a high degree of risk. Unless the context otherwise requires, references to “we,” “our,” “our company,” “us,” “the company” or “Xtera” refer to Xtera Communications, Inc. and its consolidated subsidiaries. Some of the statements in this prospectus constitute forward-looking statements. See the section titled “Forward-Looking Statements” for more information.

Xtera Communications, Inc.

Overview

We are a leading provider of high-capacity, cost-effective optical transport solutions, supporting the high growth in global demand for bandwidth. We sell our high-capacity optical transport solutions to telecommunications service providers, content service providers, enterprises and government entities worldwide to support their deployments of long-haul terrestrial and submarine optical cable networks. We believe that our proprietary Wise Raman optical amplification technology allows for capacity and reach performance advantages over competitive products that are based upon conventional Erbium-Doped Fiber Amplifier, or EDFA, technology.

We believe that we differentiate ourselves from our competitors through our innovative, proprietary products and our industry-leading cost-efficient operating structure. We have developed a portfolio of intellectual property with more than 180 U.S. and foreign patents and patent applications. We have operations in the United States and the United Kingdom, with an engineering team that includes industry-recognized technical experts.

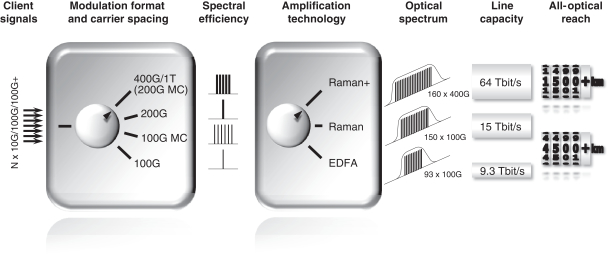

Our solutions are capable of spanning over 1,500 kilometers with capacity of 64 Terabits per second, or Tbit/s. Our solutions are purpose-built for varying customer demands of capacity, reach and cost. The modular nature of our solutions allows for capital-efficient capacity expansion over time, as the customer’s bandwidth needs grow.

We believe our leadership in high-performance optical solutions positions us to continue to win new customers, expand our footprint within existing customers and, ultimately, assist our customers in preparing for increasing demand on their networks. Our capability and expertise as a turnkey solution provider, including the supply and installation of submerged infrastructure, has been a key differentiator for us in recent years, particularly in submarine projects.

We have an extensive operating track record, having deployed our solutions for more than 10 years in 60 countries across five continents. Due to our outsourced manufacturing model, we believe that we have the capability to support high revenue growth, while controlling operating costs.

Industry Background

Optical networks are communications networks that carry voice, video and data traffic across optical fiber cables using multiple wavelengths of light. Through the use of light as a transmission medium, optical networks deliver significantly more data transport capacity and less external signal interference compared to traditional copper transport technology. Optical transport networks are classified into two segments: long-haul networks, including terrestrial and submarine networks that carry traffic between cities, countries and continents, and metro networks that carry traffic within cities or large metropolitan areas. Long-haul networks, also referred to as optical backbone networks, serve as the foundation for telecommunication and data transport services.

1

Table of Contents

Over the past 30 years, data transmission technology has evolved considerably and, today, optical networks form the backbone infrastructure for data transmission, enabling content service providers, enterprises and consumers to send and receive data rapidly. As the demand for bandwidth has increased, so have the capabilities of optical backbone infrastructure, with standard data transmission rates rising from 2.5 Gigabits per second, or Gbit/s, to 100 Gbit/s. While more recent optical backbone network deployments have taken advantage of new technologies, much of the world’s existing optical backbone infrastructure still relies heavily on older technologies. With growing demand for bandwidth, telecommunications service providers, content service providers, enterprises and government entities are actively seeking cost-efficient solutions to optimize existing fiber assets and for the development of new networks, which we believe we are well positioned to serve.

Industry Trends

We believe that a number of key trends in the optical networking industry are driving growth in demand for improved optical networking infrastructure. These trends include:

| • | Significant growth in bandwidth consumption. The continued proliferation of smart devices, the increased adoption of high-bandwidth applications, such as video and music streaming, video conferencing and big data initiatives, and the increasing prevalence of cloud computing are driving an increased demand for bandwidth. |

| • | Rising prominence of content service providers. Content service providers are investing in and developing their own high-speed optical fiber network infrastructures instead of using traditional telecommunications service providers’ networks. |

| • | Evolution of data center infrastructure. Global telecommunications network expansion has led to a shift towards multiple high-capacity distributed data centers and the development of new, dedicated data center interconnect optical networks. |

| • | Significant growth of data communications in emerging markets. Bandwidth demand in emerging markets is expected to grow and outpace the existing infrastructure within these markets as connected devices become more affordable and broadband connectivity becomes more ubiquitous. |

Industry Challenges

We believe telecommunications service providers face the following challenges as they attempt to remain responsive to the rapidly changing telecommunications landscape:

| • | Limited capacity. Telecommunications service providers are looking to maximize utilization of their existing optical cable networks in a cost-effective manner, and most of the products available to these service providers do not efficiently utilize available spectrum to provide sufficient capacity. |

| • | Legacy infrastructure. Existing infrastructure was designed to support legacy voice applications and, as a result, often struggles to support more bandwidth-intensive and cloud-based applications. |

| • | Architectural complexity. Optical communications network design, planning and engineering are intensive processes involving considerable complexity. This high level of complexity increases costs associated with the deployment and maintenance of optical networks, may slow network expansion and service delivery and could potentially result in lost revenue for telecommunications service providers. |

| • | Increasing costs and price pressures. The high cost of building, maintaining and upgrading optical communications networks impacts the profitability of bandwidth provisioning for telecommunications service providers. In order to satisfy increasing bandwidth demand and improve current network infrastructure, telecommunications service providers must continue to invest in their network infrastructures, despite a low revenue growth environment with stringent capital expenditure policies. |

2

Table of Contents

Our Solution

Our fully-integrated Wise Raman amplification technology can dramatically increase line bandwidth, allowing us to offer nearly three times more data-carrying wavelengths, or channels, than what is currently supported by EDFA-based products, and at two times the distance. This allows us to offer higher line capacity, better noise performance and higher optical power efficiency than what is currently supported by EDFA-based products. We believe we are the only vendor that offers a single, point-to-point, terrestrial and submarine platform for long-haul optical transmission. We believe that our ability to monitor third-party submarine repeaters and our user-friendly network management system further differentiates our solutions.

We believe that the key benefits of our optical solutions include:

| • | Flexible solutions. Our solutions are designed to enable our customers to determine their optimal network configuration across the variables of capacity, reach, cost and upgrade potential. |

| • | Scalable, high throughput capacity. We combine modular design, built-in monitoring capabilities and software intelligence to provide our customers with scalable, automated networking infrastructures, which we believe offer the highest capacity and reach in the industry. |

| • | Enhanced network reliability. Our optical networking capabilities help our customers manage services more easily, reduce operational complexity, increase service reliability and enable new applications, such as network virtualization. |

| • | Cost effectiveness. Our products provide capacity that allows our customers to add to or upgrade their networks in a cost-effective manner. |

| • | Ease of deployment and use. We have designed our solutions to allow us to have an organizational structure capable of deploying our solutions efficiently and in a timely manner. |

We believe that our key competitive differentiators include:

| • | Leading amplification technology solutions. Through our innovative Wise Raman technology, we believe that we offer the industry’s leading submarine and terrestrial signal amplification solutions for high-capacity, long-haul optical networks. |

| • | Innovative, field-proven technologies. Our high-capacity, long-reach and high-transmission performance solutions have been deployed in the field for over 10 years. |

| • | Rapid response time. Our partners, trained engineers and customer support staff work together to provide our customers with timely service and support. |

| • | Deep domain experience. We have deployed some of the highest capacity and longest networks and have the ability to manage challenging projects and environments. |

| • | Ease of upgrades. Our solutions enable our customers to increase the capacity of their existing systems at a fraction of the cost in comparison to installing new networks. |

Our Strategy

Our goal is to be a profitable, high-growth provider of high-capacity optical transmission technology to service providers, enterprises and government entities worldwide. Key elements of our strategy include efforts to:

| • | Capitalize on our leadership position in cost-effective optical technology. We intend to increase market share and drive revenue growth by leveraging our know-how and patented technology portfolio to provide cost-efficient solutions for new and existing networks. |

| • | Expand installed capacity at existing customers. We intend to leverage our successful deployments to expand the footprint of our product portfolio within our existing customer base. |

| • | Increase and diversify our global customer base. We intend to attract new customers and to continue to expand into new markets, such as the data center interconnect market. |

3

Table of Contents

| • | Leverage our operational efficiency. We intend to continue to invest in processes, partnerships and technologies to enhance our competitiveness while maintaining our lean organizational structure and outsourced manufacturing model. |

| • | Broaden our suite of product offerings. We intend to continue to create new products internally and pursue opportunities to add products and functionality to our existing offerings. |

Risks Affecting Us

Investing in our common stock involves significant risks and uncertainties. You should carefully consider the risks and uncertainties discussed under the section titled “Risk Factors” elsewhere in this prospectus before making a decision to invest in our common stock. If any of these risks and uncertainties occur, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock would likely decline and you may lose all or part of your investment. Below is a summary of some of the principal risks we face:

| • | We have a history of significant operating losses, anticipate increasing our operating expenses in the future and may not achieve or maintain profitability in the future. |

| • | Our operating results and gross margin may fluctuate significantly from period to period, which makes our future results difficult to predict and could cause our operating results to fall below expectations or our guidance. |

| • | We may have difficulty acquiring new customers due to the high up-front cost of switching optical network infrastructure providers or equipment. |

| • | The markets in which we compete are highly competitive, and we may be subject to aggressive business tactics by our competitors. |

| • | We rely on a limited number of customers for a substantial portion of our revenue. |

| • | In order to be successful, we must respond to technological changes and comply with evolving industry standards. |

| • | Our ability to grow depends on increased demand by service providers and enterprises for additional network capacity. |

| • | Our sales cycle can be long and unpredictable, and our sales efforts require considerable time and expense. |

| • | We may be sued by third parties for infringement or other violations of their intellectual or proprietary rights. |

Recent Developments

Although the results of our three months ended September 30, 2015 are not yet finalized, the following information reflects our preliminary expectations with respect to such results based on currently available information:

| • | For the three months ended September 30, 2015, we expect to report total revenue within the range of $14.8 - $15.0 million. |

| • | For the three months ended September 30, 2015, we expect to report an operating loss within the range of $5.3 - $5.5 million. |

| • | For the three months ended September 30, 2015, we expect to report a net loss within the range of $6.6 - $6.8 million. |

The data presented above reflects management’s estimates based solely upon information available to us as of the date of this prospectus, is not a comprehensive statement of our financial results for the three months ended September 30, 2015 and has not been audited, reviewed or compiled by our independent registered public

4

Table of Contents

accounting firm, Grant Thornton LLP. Accordingly, Grant Thornton LLP does not express an opinion or any other form of assurance with respect thereto. The preliminary financial results presented above are subject to the completion of our financial closing procedures. Those procedures have not yet been completed. Our actual fourth quarter results will not be available until after this offering is completed and may differ materially from these fourth quarter estimates. Accordingly, you should not place undue reliance upon these preliminary estimates. For example, during the course of the preparation of the respective financial statements and related notes, additional items that would require material adjustments to be made to the preliminary estimated financial information presented above may be identified. This summary is not meant to be a comprehensive statement of our unaudited financial results for this quarter and our actual results may differ from these estimates. There can be no assurance that these estimates will be realized, and estimates are subject to risks and uncertainties, many of which are not within our control. See the sections titled “Risk Factors” and “Forward-Looking Statements” for more information.

Corporate Information

We were incorporated in Delaware in January 1998 under the name Bandwith Solutions, Inc. and changed our name to Xtera Communications, Inc. in 1999. We are headquartered in Allen, Texas. Our principal executive offices are located at 500 W. Bethany Drive, Suite 100, Allen, TX 75013. Our telephone number is (972) 649-5000. Our website address is www.xtera.com. The information contained in, or that can be accessed through, our website is not part of this prospectus.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and we have elected to take advantage of certain exemptions from various public company reporting requirements, including not being required to have our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments. In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to take advantage of the extended transition period for complying with new or revised accounting standards. We may take advantage of these exemptions until we are no longer an “emerging growth company.” We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of this offering. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenue exceeds $1.0 billion or we issue more than $1.0 billion of non-convertible debt securities in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

Xtera, Nu-Wave Optima and Wise Raman are our trademarks and the property of Xtera Communications, Inc. This prospectus contains additional trade names, trademarks and service marks of other companies. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

5

Table of Contents

The Offering

| Common stock we are offering |

5,000,000 shares |

| Common stock to be outstanding after this offering |

17,110,138 shares |

| Over-allotment option of common stock offered by us |

750,000 shares |

| Use of proceeds |

We intend to use the net proceeds to us from this offering for working capital and other general corporate purposes, including to finance our expected growth, develop new products or fund capital expenditures. We may also use a portion of the net proceeds to repay borrowings under our credit facility or term loan, or to expand our existing business through acquisitions of other businesses, products or technologies. However, we do not have agreements or commitments for any specific repayments or acquisitions at this time. See the section entitled “Use of Proceeds.” |

| Proposed NASDAQ Global Market symbol |

“XCOM” |

The number of shares of our common stock to be outstanding immediately after this offering is based on 12,110,138 outstanding shares as of June 30, 2015 and excludes:

| • | 836,767 shares issuable upon the exercise of options outstanding as of June 30, 2015, having a weighted average exercise price of $1.82 per share; |

| • | 67,418 shares issuable upon the exercise of warrants outstanding as of June 30, 2015, having a weighted average exercise price of $25.22 per share; |

| • | 158,511 additional shares available after June 30, 2015 for future grant under our 2011 Stock Plan, which will be added to the number of shares reserved for issuance under our 2015 Equity Incentive Plan; and |

| • | 3,000,000 shares of common stock, subject to increase on an annual basis, reserved for future issuance under our 2015 Equity Incentive Plan. |

Except as otherwise indicated, all information contained in this prospectus assumes:

| • | the issuance of 119,881 shares of our common stock upon the exercise in September 2015 of warrants outstanding as of June 30, 2015 (leaving 67,418 shares issuable upon the exercise of warrants outstanding as of June 30, 2015) and no exercise of outstanding options or any other warrants after June 30, 2015; |

| • | no exercise of the underwriters’ over-allotment option; |

| • | the filing of our amended and restated certificate of incorporation and the effectiveness of our amended and restated bylaws, which will occur immediately prior to the completion of this offering; |

| • | the conversion of all outstanding convertible promissory notes and demand notes into 4,410,775 shares of Series E-3 preferred stock on August 25, 2015; and |

| • | the automatic conversion of all outstanding shares of our preferred stock, including our Series E-3 preferred stock, into 10,174,082 shares of common stock upon the completion of this offering. |

Unless otherwise noted, the information in this prospectus gives effect to the 26-for-one reverse stock split of our common stock effected on October 26, 2015. In connection with the reverse stock split, the conversion prices for each series of our outstanding preferred stock were proportionally increased such that after the reverse stock

6

Table of Contents

split, each share of preferred stock will convert into common stock on a 26-for-one basis with any fractional shares rounded up to the nearest whole share. For purposes of this prospectus (excluding the financial statements and notes), information concerning shares of our preferred stock, including the price per share, reflects the adjustment to the conversion prices such that, as presented in this prospectus, the shares of preferred stock will convert on a one-to-one basis into shares of common stock.

Entities affiliated with New Enterprise Associates, The Wellcome Trust, ARCH Venture Partners and Sevin Rosen Funds, which are each holders of more than 5% of our common stock, have indicated an interest in purchasing approximately $4 million, $3 million, $1 million and $1 million, respectively, of shares of our common stock in this offering. ARCH Venture Partners and Sevin Rosen Funds are also each affiliated with a member of our board of directors. However, because indications of interest are not binding agreements or commitments to purchase, these stockholders may determine to purchase fewer shares than they indicate an interest in purchasing or not to purchase any shares in this offering. It is also possible that these stockholders or certain of our other existing stockholders, including certain of our directors and executive officers and certain stockholders affiliated with our directors, could purchase more shares of our common stock than previously indicated or may purchase shares pursuant to the underwriters’ over-allotment option, if exercised. In addition, the underwriters could determine to sell fewer shares to any of these stockholders than the stockholders have indicated an interest in purchasing or not to sell any shares to these stockholders. The underwriters will receive the same underwriting discount on any shares purchased by these stockholders as they will on any other shares sold to the public in this offering. For purposes of the information presented in this prospectus, any shares that may be purchased by our existing stockholders and their affiliated entities are not included in the number of shares that will be beneficially owned by such stockholders and entities prior to or upon completion of this offering.

7

Table of Contents

Summary Consolidated Financial Data

The following tables summarize our consolidated financial data. You should read this data together with our audited financial statements and related notes included elsewhere in this prospectus and the information under the sections entitled “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our fiscal year ends on September 30. The summary consolidated statements of operations data for the fiscal years ended September 30, 2013 and 2014 are derived from our audited financial statements included elsewhere in this prospectus. The summary consolidated statements of operations data for the nine months ended June 30, 2014 and 2015, and the summary consolidated balance sheet data as of June 30, 2015, are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of results to be expected in the future, and our results for any interim periods are not necessarily indicative of the results to be expected for the full year or any future period.

| Fiscal Year Ended September 30, | Nine Months Ended June 30, | |||||||||||||||

| 2013 | 2014 | 2014 | 2015 | |||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||

| Revenue: |

||||||||||||||||

| Products |

$ | 27,121 | $ | 19,838 | $ | 14,603 | $ | 39,846 | ||||||||

| Services |

4,796 | 5,160 | 3,918 | 3,806 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

31,917 | 24,998 | 18,521 | 43,652 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cost of revenue: |

||||||||||||||||

| Products |

24,542 | 14,242 | 8,878 | 32,945 | ||||||||||||

| Services |

1,569 | 2,323 | 1,726 | 1,726 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of revenue |

26,111 | 16,565 | 10,604 | 34,671 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

5,806 | 8,433 | 7,917 | 8,981 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses: |

||||||||||||||||

| Sales and marketing |

6,346 | 5,059 | 3,969 | 3,214 | ||||||||||||

| Research and development |

13,110 | 11,140 | 8,315 | 8,198 | ||||||||||||

| General and administrative |

8,190 | 5,903 | 4,565 | 4,487 | ||||||||||||

| Goodwill impairment charge |

— | 9,019 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

27,646 | 31,121 | 16,849 | 15,899 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating loss |

(21,840 | ) | (22,688 | ) | (8,932 | ) | (6,918 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other income (expense), net |

(2,757 | ) | (3,303 | ) | (2,094 | ) | (3,121 | ) | ||||||||

| Loss from continuing operations before provision for income taxes |

(24,597 | ) | (25,991 | ) | (11,026 | ) | (10,039 | ) | ||||||||

| Income tax provision |

(5 | ) | (119 | ) | (87 | ) | (37 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (24,602 | ) | $ | (26,110 | ) | $ | (11,113 | ) | $ | (10,076 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Preferred dividend |

(13,384 | ) | (13,384 | ) | (10,011 | ) | (10,011 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss available to common stockholders |

(37,986 | ) | (39,494 | ) | (21,124 | ) | (20,087 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss per common share – basic and diluted |

(20.81 | ) | (21.77 | ) | (11.64 | ) | (11.06 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares – basic and diluted |

1,824,950 | 1,814,526 | 1,814,491 | 1,815,415 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro forma net loss attributable to common stockholders (unaudited) |

$ | (24,492 | ) | $ | (8,716 | ) | ||||||||||

|

|

|

|

|

|||||||||||||

| Pro forma net loss per common share – |

||||||||||||||||

| basic and diluted (unaudited) |

$ | (2.20 | ) | $ | (0.73 | ) | ||||||||||

|

|

|

|

|

|||||||||||||

| Weighted average pro forma common shares outstanding – |

||||||||||||||||

| basic and diluted (unaudited) |

11,147,085 | 11,898,321 | ||||||||||||||

|

|

|

|

|

|||||||||||||

8

Table of Contents

| As of June 30, 2015 | ||||||||||||

| Actual | Pro forma(2) | Pro forma as adjusted(3) |

||||||||||

| (in thousands) | ||||||||||||

| Balance sheet data: |

||||||||||||

| Cash and cash equivalents |

$ | 1,196 | $ | 1,227 | $ | 22,520 | ||||||

| Working capital(1) |

(35,458 | ) | 2,302 | 23,595 | ||||||||

| Total assets |

34,501 | 34,532 | 55,825 | |||||||||

| Current and long-term debt |

40,400 | 6,632 | 6,632 | |||||||||

| Convertible preferred stock |

151 | — | — | |||||||||

| Total stockholders’ equity (deficit) |

(27,862 | ) | 9,898 | 31,191 | ||||||||

| (1) | Working capital of $(35,458) includes $37,356 of current liabilities related to our outstanding convertible promissory notes and demand notes, which notes converted into shares of our Series E-3 preferred stock on August 25, 2015. Excluding the current liabilities related to the notes, working capital would have been $1,898. |

| (2) | The pro forma balance sheet data as of June 30, 2015 reflects (i) the conversion of our outstanding convertible promissory notes and demand notes into 4,410,775 shares of our Series E-3 preferred stock and the increase in the number of our authorized common stock to 395,000,000 on August 25, 2015; (ii) the issuance of 119,881 shares of our common stock upon the exercise in September 2015 of outstanding warrants; and (iii) the automatic conversion of all of our outstanding convertible preferred stock, including our Series E-3 preferred stock, into common stock in connection with this offering. |

| (3) | The pro forma as adjusted balance sheet data as of June 30, 2015 reflects the pro forma adjustments described in footnote (2) above as adjusted to give effect to receipt by us of the estimated net proceeds from this offering, based on an assumed initial public offering price of $5.00 per share after deducting the estimated underwriting discount and estimated offering expenses payable by us. A $1.00 increase (decrease) in the assumed initial public offering price of $5.00 per share would increase (decrease) the pro forma as adjusted amount of our cash and cash equivalents, working capital, total assets and total stockholders’ equity (deficit) by approximately $4.7 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discount and estimated offering expenses payable by us. |

9

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information contained in this prospectus, before deciding to purchase any shares of our common stock. These risks could harm our business, operating results, financial condition and prospects. In addition, the trading price of our common stock could decline due to any of these risks and you might lose all or part of your investment.

Risks Related to Our Business and Industry

We have a history of significant operating losses, anticipate increasing our operating expenses in the future and may not achieve or maintain profitability in the future.

As of June 30, 2015, our accumulated deficit was $378 million. We experienced a net loss of $26.1 million for the fiscal year ended September 30, 2014 and $10.1 million for the nine months ended June 30, 2015. We expect to continue to make significant expenditures related to the development of our business, including expenditures to hire additional personnel related to the sales, marketing and development of our products and to maintain and expand our research and development operations. In addition, as a public company, we will incur additional legal, accounting and other expenses that we did not incur as a private company. As a result of these increased expenditures, we will have to generate and sustain increased revenue, manage our cost structure and avoid significant liabilities in order to achieve future profitability. We also may incur losses in the future for a number of other unforeseen reasons. Accordingly, we may not be able to achieve or maintain profitability, and we may continue to incur significant losses in the future.

Our operating results may fluctuate significantly from period to period, which could make our future results difficult to predict and could cause our operating results to fall below investor or analyst expectations.

Our operating results may fluctuate due to a variety of factors, many of which are outside of our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful. You should not rely on our past results as an indicator of our future performance. Fluctuations in our revenue can lead to even greater fluctuations in our operating results. Our budgeted expense levels depend in part on our expectations with respect to long-term future revenue and global customers. Given relatively fixed operating costs related to our personnel, any substantial adjustment to our expenses to account for lower levels of revenue will be difficult and take time. Consequently, if our revenue does not meet projected levels, our inventory levels and operating expenses would be high relative to revenue, which would impair our operating results.

In addition to other risks discussed in this section, factors that may contribute to fluctuations in our revenue and our operating results include:

| • | fluctuations in demand, sales cycles, product mix and prices for our solutions and our services; |

| • | reductions in customers’ budgets for solutions purchases and delays in their purchasing cycles; |

| • | order cancellations or reductions or delays in delivery schedules by our customers; |

| • | timeliness of our customers’ payments for their purchases; |

| • | preparedness of customers for the installation of our solutions; |

| • | the timing of new product announcements or upgrades by us or by our competitors; |

| • | any significant changes in the competitive dynamics of our market, including any new entrants, technological advances or substantial discounting of products; |

| • | availability of third-party suppliers to provide products and services for us; |

| • | the timing of recognizing revenue in any given quarter, including the impact of revenue recognition standards in United States generally accepted accounting principles, or U.S. GAAP; |

| • | our ability to control costs, including our operating expenses, the costs of, and the lead times associated with, obtaining the components we purchase and the costs of warranty or repair work; and |

| • | general economic conditions in domestic and international markets. |

10

Table of Contents

If our revenue or operating results fall below the expectations of investors or securities analysts or below any guidance we may in the future provide to the market, the price of our common stock may decline substantially.

Our gross margin may fluctuate from period to period and may be adversely affected by a number of factors, some of which are beyond our control.

Our gross margin fluctuates from period to period and varies by product configuration. Our gross margin may continue to be adversely affected by a number of factors, including:

| • | mix of products and services sold during the period; |

| • | price discounts negotiated by our customers; |

| • | increased price competition, including competition from lower-cost suppliers in China and other markets; |

| • | changes in the price or availability of components for our products; |

| • | charges for excess or obsolete inventory; |

| • | increased warranty or repair costs; |

| • | sales volume from each customer during the period; and |

| • | the period of time over which ratable recognition of revenue occurs. |

For example, our gross margin percentage for the nine months ended June 30, 2015 was 20.6%, as compared with 42.7% for the nine months ended June 30, 2014. The decrease in gross margin percentage in the 2015 period was primarily driven by the mix of products sold during the period. In particular, our turnkey solutions have lower gross margins than our equipment sales, and to the extent we have a greater proportion of revenue from turnkey solutions in any period, our gross margin percentage will be lower. As a result of our relative size and the often large, complex nature of the projects in which we make product installations, we have limited ability to control the scheduling of the installation of our products and are often requested to reschedule installations. This rescheduling may cause us to redeploy our personnel and could result in us being unable to meet commitments to our other customers, which may negatively impact our gross margins. Further, this rescheduling could cause revenue to be recognized later than forecasted. As a result of our relatively fixed operating costs associated with our personnel, if our revenue does not meet projected levels in a particular quarter, our gross margin for that quarter will be adversely affected. Fluctuations in gross margin may make it difficult to manage our business and achieve or maintain profitability.

We may have difficulty acquiring new customers due to the high up-front costs of switching optical network providers or equipment, and if we are unable to acquire new customers, our business and operating results will be harmed.

Telecommunications service providers typically make substantial investments when deploying an optical network. Once a network operator has deployed an optical network for a particular portion of their network, it is often difficult and costly to switch to another vendor’s infrastructure. Unless we are able to persuasively demonstrate that our solutions offer performance, functionality and cost advantages that materially outweigh a customer’s expense of switching from a competitor’s product, it may be difficult for us to procure new customers and generate sales once that competitor’s equipment has been deployed. In addition, many telecommunications service providers base their deployment decisions primarily on price, and if we are unable to establish better pricing terms for our solutions, we may be unable to acquire new customers.

Aggressive business tactics by our competitors may harm our business.

Increased competition in our markets has resulted in our competitors engaging in aggressive business tactics, especially when we compete for large customers. These tactics include:

| • | selling equipment or inventory at a discount, including at or below cost; |

| • | announcing competing products prior to market availability combined with extensive marketing efforts; |

| • | offering low pricing on products competitive to ours as part of a larger, bundled product offering; |

11

Table of Contents

| • | providing financing, marketing and advertising assistance to customers; and |

| • | asserting intellectual property rights irrespective of the validity of the claims. |

If we fail to compete successfully against our current and future competitors, or if our current or future competitors continue or expand aggressive business tactics, including those described above, demand for our solutions could decline, we could experience delays or cancellations of customer orders, we could be required to reduce our prices or we may experience increased expenses.

The markets in which we compete are highly competitive, and we may lack sufficient financial or other resources to compete.

Competition in the optical networking industry is intense, and we expect such competition to increase. A number of very large companies historically have dominated the optical networking industry. Our primary competitors in the submarine market include Alcatel-Lucent Submarine Networks, SAS, Coriant GmbH, Huawei Marine Networks Co., Limited, NEC Corporation and TE Subcom, a TE Connectivity Ltd. company. In the terrestrial market, our primary competitors include Alcatel-Lucent S.A., Ciena Corporation, Huawei Technologies Co. Ltd., Infinera Corporation and Coriant GmbH. Many of our competitors are substantially larger, have greater name recognition, as well as technical, financial and marketing resources, and may have established relationships with our potential customers. Many of our competitors have more resources to develop or acquire, and more experience in developing or acquiring, new products and technologies and in creating market awareness for those products and technologies. In addition, many of our competitors have the financial resources and product portfolios to offer products competitive with ours at below market pricing levels that could prevent us from competing effectively.

In addition, some of our foreign competitors are able to compete more effectively by obtaining financing for their customers from government-sponsored sources. We also compete with low-cost suppliers in China that have the ability to increase pricing pressure on us.

Our ability to compete will depend upon our ability to provide a better solution than our competitors at a competitive price. We may be required to make substantial additional investments in research and development, sales and marketing and customer support in order to respond to competition, and there is no assurance that these investments will achieve any returns for us or that we will be able to compete successfully in the future. Increased competition could lead to fewer customer orders, price reductions, reduced margins and loss of market share, any of which could harm our business, operating results and financial condition.

Demand for our solutions depends in part on the rate that telecommunications service providers expand and enhance their optical networks and the rate that telecommunications service providers and content service providers build out new optical networks. If such service providers do not continue to expand and enhance their networks or build out new networks, it could have a material adverse effect on our business and results of operations.

Our future success as a provider of high-capacity optical transport solutions ultimately depends on the continued growth of the optical networking industry and, in particular, the continued demand for bandwidth. The amount of data transmitted over optical networks will be impacted by the growth of bandwidth demand. Increased demand by subscribers for bandwidth-intensive applications delivered over network systems will be necessary to justify capital expenditure commitments by telecommunications service providers and content service providers to invest in the improvement and expansion of their networks, or alternatively to build out new networks. Demand for improved optical networking infrastructure might not continue to increase if there is limited availability or market acceptance, if the content offered through networks does not attract widespread interest or if the quality of service available through networks does not meet user expectations. If long-term expectations for bandwidth-intensive and cloud-based applications are not realized, these service providers may not commit significant capital expenditures to upgrade their networks to improve capacity or to build out new networks, the demand for our solutions and services

12

Table of Contents

will decrease and we may not be able to sustain or increase our levels of revenue or achieve profitability in the future. Broad macroeceonomic weakness and market conditions have in the past and could in the future affect spending levels of our customers and demand for our solutions.

Our concentrated customer base increases the potential adverse effect on us from the loss of one or more customers.

We derive a significant portion of our revenue from a limited number of customers. For the fiscal year ended September 30, 2014, Cable & Wireless Communications plc, Gulf Bridge International, Inc. and OCI Group Inc. accounted for 25.9%, 22.1% and 24.1% of our revenue, respectively, and 88.7% of our revenue was generated by six customers, and for the nine months ended June 30, 2015, Cable & Wireless Communications plc, Defense Information Systems Agency and GlobeNet Inc. accounted for 17.4%, 30.4% and 33.5% of our revenue, respectively, and 96.0% of our revenue was generated by six customers. Our business and financial results are correlated with the spending of a limited number of customers and can be significantly affected by market, industry or competitive dynamics affecting their businesses. The timing of customer purchases and of their requested delivery of purchased product is difficult to predict, and our ability to continue to generate revenue from key customers will depend on our ability to maintain strong relationships with these customers and introduce new products and services that are desirable to these customers at competitive prices. In addition, in certain circumstances our customers can terminate or reduce their contracts for convenience. We expect that sales of our products to a limited number of customers will continue to contribute materially to our revenue for the next few years. The loss of, or a significant delay or reduction in purchases by, a small number of customers could harm our business, operating results and financial condition.

We must respond to technological change and comply with evolving industry standards and requirements for our products to be successful, and if we do not, it could have a material adverse effect on our business and results of operations.

The optical networking industry is characterized by technological change, changes in customer requirements and evolving industry standards. The introduction of new communications technologies and the emergence of new industry standards or requirements could render our products obsolete. Further, in developing our products, we have made, and will continue to make, assumptions with respect to which standards or requirements will be adopted by our customers and competitors. If the standards or requirements adopted by our prospective customers are different from those on which we have focused our efforts, market acceptance of our solutions would be reduced or delayed and our business would be harmed.

In response to market changes, we expect our competitors to continue to improve the performance of their existing products and to introduce new products and technologies. To be competitive, we must continue to invest significant resources in research and development, sales and marketing and customer support. We may not have sufficient resources to make these investments, we may not be able to make the technological advances necessary to be competitive and we may not be able to effectively sell our products to targeted customers who have prior relationships with our competitors.

If we fail to accurately forecast demand for our solutions, we may have excess or insufficient inventory, which may increase our operating costs, decrease our revenue and harm our business.

We are required to generate forecasts of future demand for our solutions several months prior to the scheduled delivery to our prospective customers. This requires us to make significant investments before we know if corresponding revenue will be recognized. Lead times for materials and components that we need to order for the manufacturing of our products vary significantly and depend on factors, such as the specific supplier, contract terms and demand for each component at a given time. In the past, we have experienced lengthening in lead times for certain components. If the lead times for components are lengthened, we may be required to purchase increased levels of such components to satisfy our delivery commitments to our customers. If we overestimate market demand

13

Table of Contents

for our solutions and, as a result, increase our inventory in anticipation of customer orders that do not materialize, we will have excess inventory, which could result in increased risk of obsolescence and significant inventory write-downs. Furthermore, this will result in reduced production volumes and our fixed costs will be spread across fewer units, increasing per unit costs. If we underestimate demand for our solutions, we will have inadequate inventory, which could slow down or interrupt the manufacturing of our products and result in delays in shipments and our ability to recognize revenue. In addition, we may be unable to meet our supply commitments to customers, which could result in a loss of certain customer opportunities or a breach of our customer agreements.

We are susceptible to shortages, price fluctuations and quality control risks in our supply chain. Any shortages, price fluctuations or quality concerns in components used in our products could delay shipment of our products, which could materially adversely affect our business.

Shortages in components that we use in our products are possible and our ability to predict the availability of such components may be limited. Furthermore, some of these components are available only from single or limited sources of supply. In addition, the lead times associated with certain components are lengthy and preclude rapid changes in quantity requirements and delivery schedules. Any growth in our business or the economy is likely to create greater pressures on us and our suppliers to project overall component demand accurately and to establish appropriate component inventory levels. In addition, increased demand by third parties for the components we use in our products may lead to decreased availability and higher prices for those components. We generally rely on purchase orders rather than long-term contracts with our suppliers. As a result, even if available, we may not be able to secure sufficient components at reasonable prices or of acceptable quality to build products in a timely manner, which would seriously impact our ability to deliver products to our customers, and our business, operating results and financial condition would be adversely affected. If we are unable to pass component price increases along to our customers or maintain stable pricing for components, our gross margin and operating results could be negatively impacted. Furthermore, poor quality in sole-sourced components or certain other components in our products could also result in lost sales or lost sales opportunities. If the quality of such components does not meet our standards or our customers’ requirements, if we are unable to obtain components from our existing suppliers on commercially reasonable terms, or if any of our sole source providers cease to continue to manufacture such components or to remain in business, we could be forced to redesign our products and qualify new components from alternate suppliers. Further, if components we obtain from our suppliers contain technology that infringes on a third party’s intellectual property, we could be forced to redesign our products or find alternate sources of such components. The development of alternate sources for those components can be time-consuming, difficult and costly, and we may not be able to develop alternate or second sources in a timely manner. Even if we are able to locate alternate sources of supply, we could be forced to pay for expedited shipments of such components or our products at dramatically increased costs.

We provide turnkey solutions to our customers, which subject us to additional risks inherent with being the prime contractor on a project that, if realized, may adversely affect our operating results.

In addition to providing our hardware and software products to customers, we also provide turnkey solutions for customers. We oversee project planning, partner management and installation of the projects in which our products are utilized. We anticipate turnkey solutions will represent a significant percentage of our product revenue for our fiscal years ending September 30, 2016 and 2017. As the prime contractor, we are ultimately responsible for the project, including any performance issues, damages or cost overruns. Our actual costs and any gross profit realized on a turnkey solution could vary from the estimated amounts on which our bid was originally based. This may occur for various reasons, including errors in estimates or bidding, changes in availability and cost of labor, equipment and materials and unforeseen technical and logistical challenges, including with managing our geographically widespread operations and the performance of third party subcontractors, suppliers and manufacturers. In particular, if the third party subcontractors, suppliers and manufacturers we engage are unable to perform to our requirements, we may be forced to pursue alternative strategies to obtain these goods or services, which could result in delays, interruptions, additional expenses to us and loss of customers. These variations and the risks inherent in our turnkey solutions may result in reduced profitability or losses on these projects. Depending on

14

Table of Contents

the size of a project, variations from estimated contract performance could have a material adverse impact on our operating results.

We may need additional capital in the future, which may not be available to us on favorable terms, or at all, and may dilute your ownership of our common stock.

We have historically relied on outside financing to fund our operations, capital expenditures and expansion. We may require additional capital from equity or debt financing in the future to take advantage of strategic opportunities, including more rapid expansion of our business or the acquisition of complementary products, technologies or businesses and developing new products or enhancements to existing products.

We may not be able to secure timely additional financing on favorable terms, or at all. The terms of any additional financing may place limits on our financial and operating flexibility. If we raise additional funds through further issuances of equity, convertible debt securities or other securities convertible into equity, our existing stockholders could suffer significant dilution in their percentage ownership of our company, and any new securities we issue could have rights, preferences and privileges senior to those of holders of our common stock, including shares of common stock sold in this offering. If we are unable to obtain adequate financing or financing on terms satisfactory to us, if and when we require it, our ability to grow or support our business and to respond to business challenges could be significantly limited.

Our sales cycles can be long and unpredictable, and our sales efforts require considerable time and expense, which may cause our revenue and operating results to fluctuate significantly from period to period.

Our sales efforts involve educating our customers about the use and benefit of our solutions, including their technical capabilities and potential cost savings. Customers typically undertake a significant evaluation process before making a purchase, in some cases over six months. We spend substantial time and resources in our sales efforts, and in limited cases, order inventory for potential sales without any assurance that our efforts will produce any sales. In addition, product purchases are frequently subject to budget constraints, multiple approvals and unplanned administrative, processing and other delays. Our long sales cycle may cause our revenue and operating results to fluctuate significantly.

We depend on contract manufacturers and logistics providers to manufacture and deliver a majority of our products, and changes to these relationships or their inability to obtain necessary parts may result in delays or disruptions that could harm our business.

We depend primarily on Foxconn Technology Group, as well as MC Assembly and Surface Technology International Ltd., each an independent contract manufacturer, to manufacture and assemble a majority of our products, and CEVA Logistics, an independent logistics and freight management provider, to coordinate the delivery of a majority of our products. Our reliance on these third parties reduces our control over the manufacturing and logistics processes and exposes us to risks, including reduced control over quality assurance, product costs, and product supply and timing. Our reliance on contract manufacturers could also increase the potential for infringement or misappropriation of our intellectual property rights. While we rely on a combination of purchase orders and supply contracts with these manufacturers, their ability to timely perform under their agreements with us is subject to the performance of third-party suppliers from whom our contract manufacturers order many of the components and parts necessary for the manufacturing of our products. If we are unable to manage our relationships with these third-party suppliers effectively, or if any of these suppliers suffers from increased manufacturing lead times, capacity constraints or quality control problems, work stoppages or any other reduction or disruption in output, they may be unable to meet our customers’ delivery schedules, which would result in lost revenue, additional product costs and deployment delays that could harm our business and customer relationships.

These contract manufacturers typically fulfill our supply requirements on the basis of individual orders. We do not have long-term contracts with our manufacturers that guarantee capacity, the continuation of particular

15

Table of Contents

pricing terms, or the extension of credit limits. Accordingly, they are not obligated to continue to fulfill our supply requirements, which could result in supply shortages, and the prices we are charged for manufacturing services could be increased on short notice. In addition, our orders may represent a relatively small percentage of the overall orders received by our contract manufacturers from their customers. As a result, fulfilling our orders may not be considered a priority by one or more of our contract manufacturers in the event the contract manufacture is constrained in its ability to fulfill all of its customer obligations in a timely manner.

It is time consuming and costly to qualify and implement a contract manufacturer relationship. If we are required to change contract manufacturers, whether due to an interruption in their business, quality control problems or otherwise, or if we are required to add additional contract manufacturers, our ability to ship products to our customers could be delayed or otherwise adversely affected, which could cause the loss of sales to existing or potential customers, delayed revenue or an increase in our costs that could adversely affect our gross margin.

Furthermore, if our logistics provider incurs any interruptions, delays or problems in its business, our ability to ship our products in a timely and efficient manner would be impaired, which could harm our business and customer relationships and adversely affect our business, operating results and financial condition.

We may be adversely affected by fluctuations in currency exchange rates.

A portion of our sales are to countries outside of the United States, and are in currencies other than U.S. dollars, and therefore subject to foreign currency fluctuation. Accordingly, fluctuations in foreign currency rates could have a material impact on our revenue in future periods. We also have exposure to currency exchange rates as a result of the growth in our non-U.S. dollar denominated operating expense in Europe, Asia and Canada. We may in the future enter into foreign currency exchange forward contracts to reduce the impact of foreign currency fluctuations. Any such hedging programs, if implemented, would reduce the impact of currency exchange rate movements on certain transactions, but would not cover all foreign-denominated transactions and would not entirely eliminate the impact of fluctuations in exchange rates that could negatively affect our results of operations and financial condition.

Our international sales and operations subject us to additional risks that may adversely affect our operating results.

Over the last several years, we derived a significant portion of our revenue from customers outside the United States, and we continue to expand our international operations. As of June 30, 2015, approximately 37% of our employees were located abroad, and we expect to continue to add personnel internationally. Any continued expansion into international markets will require significant resources and management attention and will subject us to additional regulatory, economic and political risks, and we cannot be sure that any further international expansion will be successful. Furthermore, in some countries, our success in selling our products and growing revenue will depend in part on our ability to form relationships with local partners. Our inability to identify appropriate partners or reach mutually satisfactory arrangements for international sales of our products could impact our ability to maintain or increase international market demand for our products. In addition, many of the companies we compete against internationally have greater name recognition and a more substantial sales and marketing presence. Among the risks we believe are most likely to affect us with respect to our international operations are:

| • | unexpected changes in regulatory requirements or in foreign policy, including adoption of domestic or foreign laws, regulations and interpretations detrimental to our business; |

| • | difficulties in enforcing contracts and collecting accounts receivable, and longer payment cycles, especially in emerging markets; |

| • | reduced protection for intellectual property rights in some countries; |

| • | new and different sources of competition; |

| • | the difficulty of managing and staffing international offices and the increased travel, infrastructure and legal compliance costs associated with multiple international locations; |

| • | increased financial accounting and reporting burdens and complexities; |

16

Table of Contents

| • | fluctuations in exchange rates; |

| • | political, social and economic instability, including wars, terrorism, political unrest, boycotts, curtailment of trade and other business restrictions, and continued economic uncertainty as a result of sovereign debt issues in Europe and Latin America; |

| • | tariffs and trade barriers, import/export controls, and other regulatory or contractual limitations on our ability to sell or develop our products in certain foreign markets; |

| • | certification requirements; |

| • | potentially adverse tax consequences; and |

| • | local laws and practices that favor local companies, including business practices that we are prohibited from engaging in by the Foreign Corrupt Practices Act and other anti-corruption laws and regulations. |

Our international operations are subject to increasingly complex foreign and U.S. laws and regulations, including but not limited to anti-corruption laws, such as the Foreign Corrupt Practices Act and the UK Bribery Act and equivalent laws in other jurisdictions, antitrust or competition laws, and data privacy laws, among others. Violations of these laws and regulations could result in fines and penalties, criminal sanctions against us, our officers, or our employees, prohibitions on the conduct of our business and on our ability to offer our products and services in one or more countries, and could also materially affect our reputation, our international expansion efforts, our ability to attract and retain employees, our business, and our operating results. Additionally, the costs of complying with these laws, including the costs of investigations, auditing and monitoring, could also adversely affect our current or future business.

As we continue to expand our business globally, our success will depend, in large part, on our ability to anticipate and effectively manage these and other risks associated with our international operations. Our failure to manage any of these risks successfully could harm our international operations and reduce our international sales, adversely affecting our business, operating results and financial condition.

Product performance problems, including undetected errors in our hardware or software, could cause us to incur additional expenses and harm our business and reputation.

Our products are highly technical and complex and when deployed, they are critical to our customers. Our products have contained and may contain undetected errors, defects or security vulnerabilities. Some errors in our products may only be discovered after a product has been installed and used by service providers. In particular, in a submarine cable network, any errors that are detected after deployment can be extremely costly and time consuming to correct. In addition, because we outsource the manufacturing of certain components of our products, we may also be subject to product performance problems as a result of the acts or omissions of third parties. Any errors or defects discovered in our products after commercial release could result in loss of revenue or delay in revenue recognition, loss of customers and increased service and warranty cost, any of which could adversely affect our business, operating results and financial condition. In addition, we could face claims for product liability, tort or breach of warranty, including claims relating to changes to our products made by our system integrators or distributors. Our contracts with customers generally contain provisions relating to warranty disclaimers and liability limitations, which may be ineffective, and provisions requiring us to indemnify our customers for product failures. Defending a lawsuit, regardless of its merit, is costly and may divert management’s attention away from the business and adversely affect the market’s perception of us and our solutions. In addition, if our business liability insurance coverage is inadequate or future coverage is unavailable on acceptable terms or at all, our operating results and financial condition could be adversely impacted.

If we fail to adequately expand our direct sales force with qualified and productive personnel, we may not be able to grow our business effectively.