Attached files

| file | filename |

|---|---|

| 8-K/A - AMENDMENT #1 TO FORM 8-K - Wheeler Real Estate Investment Trust, Inc. | d40270d8ka.htm |

Exhibit 99.1 November 2015 NASDAQ: WHLR

SAFE HARBOR Wheeler Real Estate Investment Trust, Inc. (the ”Company”) considers portions of the information in this presentation to be forward‐looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, both as amended (the “Exchange Act”), with respect to the Company's expectation for future periods. Although the Company believes that the expectations reflected in such forward‐looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. For this purpose, any statements contained herein that are not historical fact may be deemed to be forward‐looking statements. There are a number of important factors that could cause results to differ materially from those indicated by such forward‐looking statements, including, among other factors, local conditions such as oversupply of space or a reduction in demand for real estate in the area; competition from other available space; dependence on rental income from real property; the loss of, significant downsizing of or bankruptcy of a major tenant; constructing properties or expansions that produce a desired yield on investment; the Company’s ability to renew or enter into new leases at favorable rates; to buy or sell assets on commercially reasonable terms; to complete acquisitions or dispositions of assets under contract, to secure equity or debt financing on commercially acceptable terms or at all; to enter into definitive agreements with regard to financing and joint venture arrangements or the Company’s failure to satisfy conditions to the completion of these arrangements. For additional factors that could cause the results of the Company to differ materially from those indicated in the forward‐looking statements, please refer to “Risk Factors” in our filings with the Securities and Exchange Commission, pursuant to the Exchange Act, which are available for review at www.sec.gov. Readers are cautioned that forward looking statements are not guarantees of future performance, and should not place undue reliance on them. In formulating the forward looking statements contained in this presentation, it has been assumed that business and economic conditions affecting Wheeler will continue substantially in the ordinary course. These assumptions, although considered reasonable at the time of preparation, may prove to be incorrect.

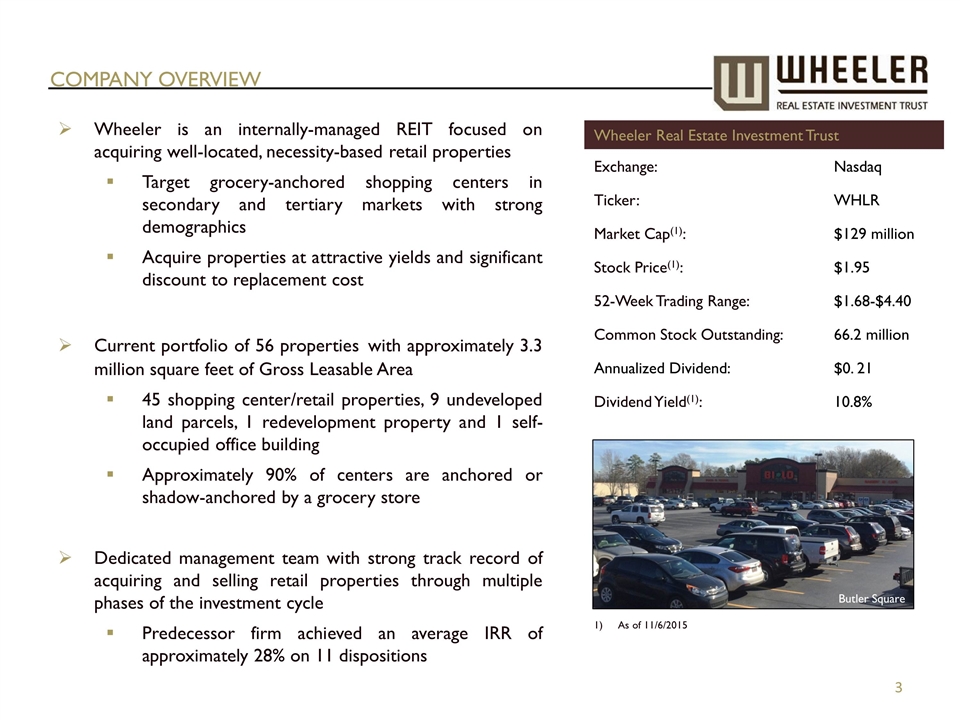

COMPANY OVERVIEW Wheeler is an internally-managed REIT focused on acquiring well-located, necessity-based retail properties Target grocery-anchored shopping centers in secondary and tertiary markets with strong demographics Acquire properties at attractive yields and significant discount to replacement cost Current portfolio of 56 properties with approximately 3.3 million square feet of Gross Leasable Area 45 shopping center/retail properties, 9 undeveloped land parcels, 1 redevelopment property and 1 self-occupied office building Approximately 90% of centers are anchored or shadow-anchored by a grocery store Dedicated management team with strong track record of acquiring and selling retail properties through multiple phases of the investment cycle Predecessor firm achieved an average IRR of approximately 28% on 11 dispositions Wheeler Real Estate Investment Trust Exchange: Nasdaq Ticker: WHLR Market Cap(1): $129 million Stock Price(1): $1.95 52-Week Trading Range: $1.68-$4.40 Common Stock Outstanding: 66.2 million Annualized Dividend: $0. 21 Dividend Yield(1): 10.8% As of 11/6/2015 Butler Square

Industry leading occupancy rate of approximately 94.3%* National and Regional merchants represent majority of Wheeler’s tenants Diversified geography and tenant base INVESTMENT HIGHLIGHTS High Quality Existing Portfolio Wheeler properties serve the essential day-to-day shopping needs of the surrounding communities Majority of tenants provide non-cyclical consumer goods and services that are less impacted by fluctuations in the economy Necessity-Based Retail Secondary and Tertiary markets have limited competition from institutional buyers and low levels of new construction Target markets experiencing selling pressure from generational transition, larger REITs shifting to core markets and expiring CMBS debt Attractive Niche Market Opportunity Ability to scale platform as the Company grows results in improved profitability Create value through intensive leasing and property expense management Deep retailer relationships provide unique market knowledge Third-party property management and development fees create additional revenue stream Internally-Managed, Scalable Platform * As of 9/30/2015

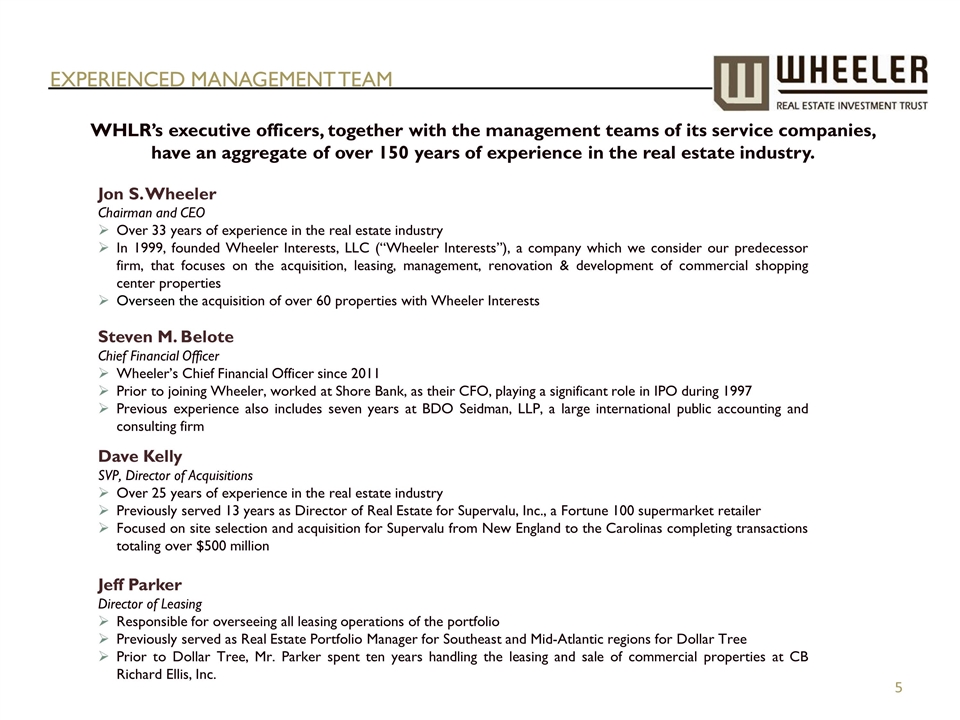

Steven M. Belote Chief Financial Officer Wheeler’s Chief Financial Officer since 2011 Prior to joining Wheeler, worked at Shore Bank, as their CFO, playing a significant role in IPO during 1997 Previous experience also includes seven years at BDO Seidman, LLP, a large international public accounting and consulting firm Jon S. Wheeler Chairman and CEO Over 33 years of experience in the real estate industry In 1999, founded Wheeler Interests, LLC (“Wheeler Interests”), a company which we consider our predecessor firm, that focuses on the acquisition, leasing, management, renovation & development of commercial shopping center properties Overseen the acquisition of over 60 properties with Wheeler Interests WHLR’s executive officers, together with the management teams of its service companies, have an aggregate of over 150 years of experience in the real estate industry. EXPERIENCED Management Team Dave Kelly SVP, Director of Acquisitions Over 25 years of experience in the real estate industry Previously served 13 years as Director of Real Estate for Supervalu, Inc., a Fortune 100 supermarket retailer Focused on site selection and acquisition for Supervalu from New England to the Carolinas completing transactions totaling over $500 million Jeff Parker Director of Leasing Responsible for overseeing all leasing operations of the portfolio Previously served as Real Estate Portfolio Manager for Southeast and Mid-Atlantic regions for Dollar Tree Prior to Dollar Tree, Mr. Parker spent ten years handling the leasing and sale of commercial properties at CB Richard Ellis, Inc.

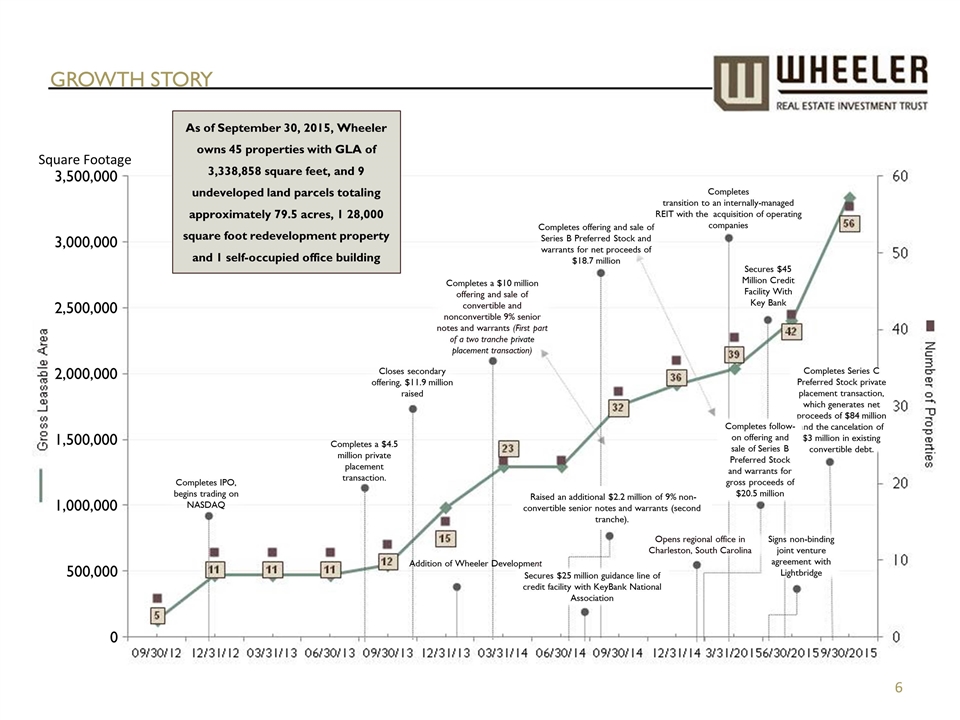

GROWTH STORY As of September 30, 2015, Wheeler owns 45 properties with GLA of 3,338,858 square feet, and 9 undeveloped land parcels totaling approximately 79.5 acres, 1 28,000 square foot redevelopment property and 1 self-occupied office building Completes IPO, begins trading on NASDAQ Completes a $4.5 million private placement transaction. Closes secondary offering, $11.9 million raised Completes a $10 million offering and sale of convertible and nonconvertible 9% senior notes and warrants (First part of a two tranche private placement transaction) Secures $25 million guidance line of credit facility with KeyBank National Association Completes offering and sale of Series B Preferred Stock and warrants for net proceeds of $18.7 million Addition of Wheeler Development Completes transition to an internally-managed REIT with the acquisition of operating companies Opens regional office in Charleston, South Carolina Completes Series C Preferred Stock private placement transaction, which generates net proceeds of $84 million and the cancelation of $3 million in existing convertible debt. Secures $45 Million Credit Facility With Key Bank Signs non-binding joint venture agreement with Lightbridge Completes follow-on offering and sale of Series B Preferred Stock and warrants for gross proceeds of $20.5 million Raised an additional $2.2 million of 9% non-convertible senior notes and warrants (second tranche). 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 Square Footage

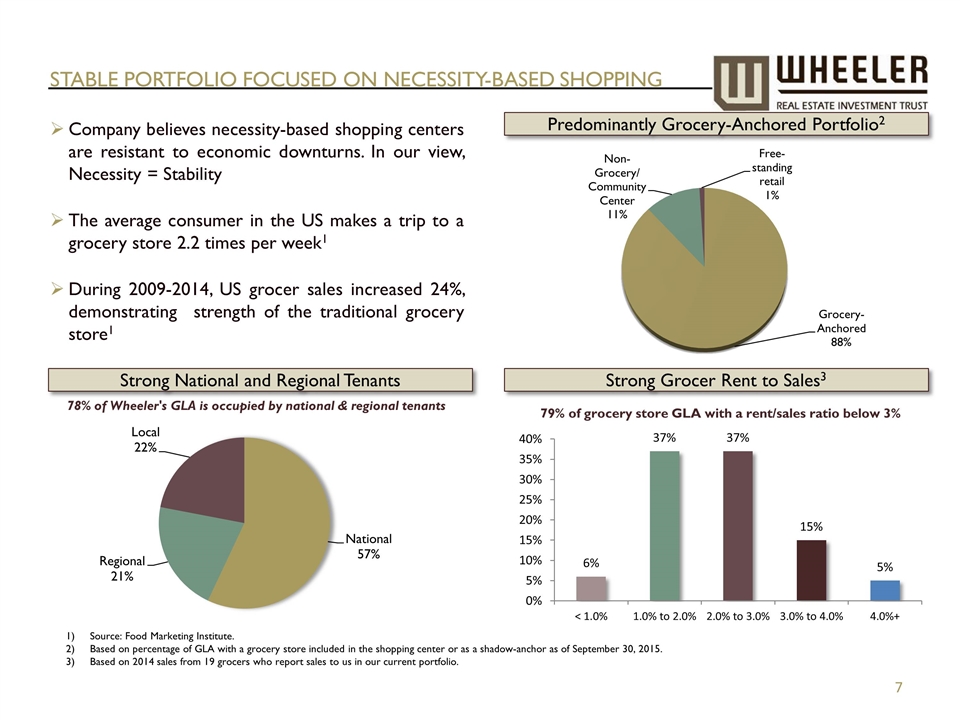

STABLE PORTFOLIO FOCUSED ON NECESSITY-BASED SHOPPING Predominantly Grocery-Anchored Portfolio2 Strong Grocer Rent to Sales3 79% of grocery store GLA with a rent/sales ratio below 3% Company believes necessity-based shopping centers are resistant to economic downturns. In our view, Necessity = Stability The average consumer in the US makes a trip to a grocery store 2.2 times per week1 During 2009-2014, US grocer sales increased 24%, demonstrating strength of the traditional grocery store1 Strong National and Regional Tenants 78% of Wheeler's GLA is occupied by national & regional tenants Source: Food Marketing Institute. Based on percentage of GLA with a grocery store included in the shopping center or as a shadow-anchor as of September 30, 2015. Based on 2014 sales from 19 grocers who report sales to us in our current portfolio.

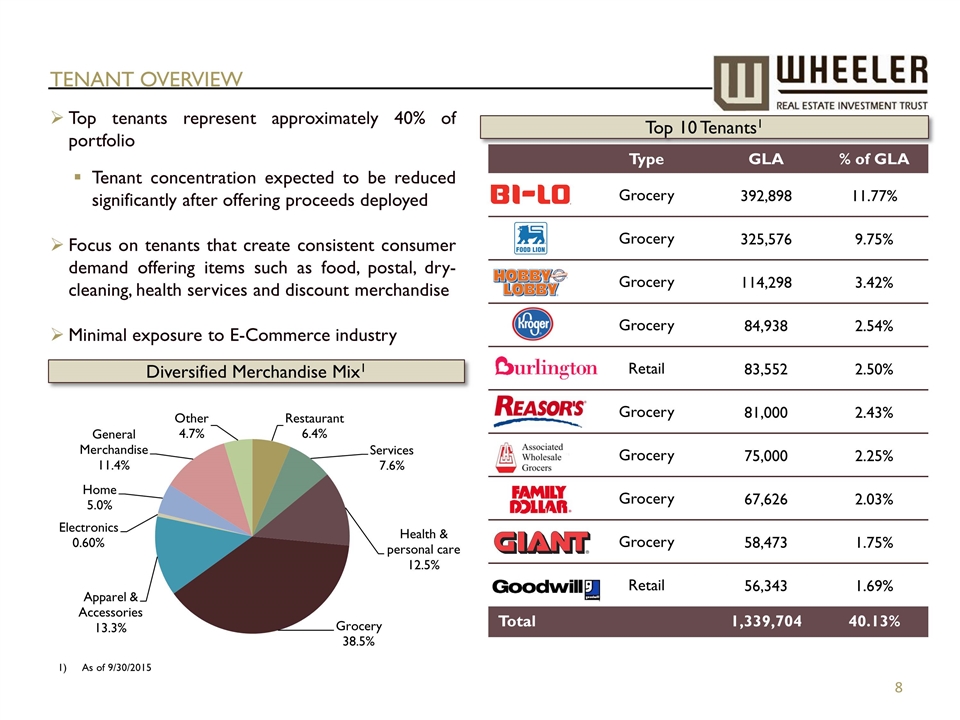

TENANT OVERVIEW Top 10 Tenants1 Top tenants represent approximately 40% of portfolio Tenant concentration expected to be reduced significantly after offering proceeds deployed Focus on tenants that create consistent consumer demand offering items such as food, postal, dry-cleaning, health services and discount merchandise Minimal exposure to E-Commerce industry As of 9/30/2015 Diversified Merchandise Mix1 Type GLA % of GLA Grocery 392,898 11.77% Grocery 325,576 9.75% Grocery 114,298 3.42% Grocery 84,938 2.54% Retail 83,552 2.50% Grocery 81,000 2.43% Grocery 75,000 2.25% Grocery 67,626 2.03% Grocery 58,473 1.75% Retail 56,343 1.69% Total 1,339,704 40.13%

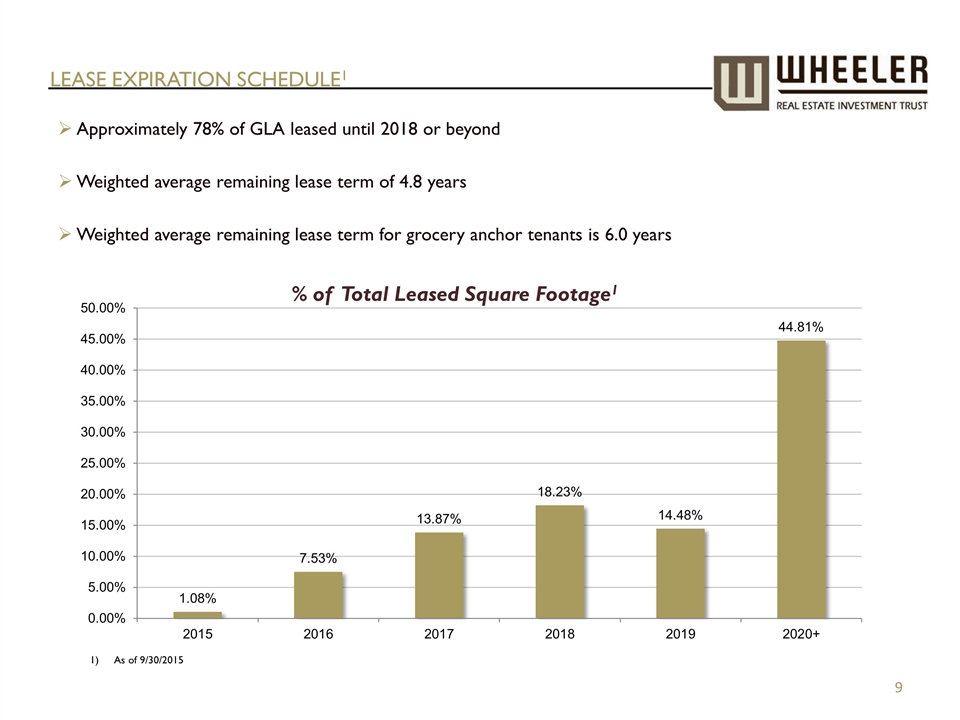

LEASE EXPIRATION SCHEDULE1 Approximately 78% of GLA leased until 2018 or beyond Weighted average remaining lease term of 4.8 years Weighted average remaining lease term for grocery anchor tenants is 6.0 years As of 9/30/2015

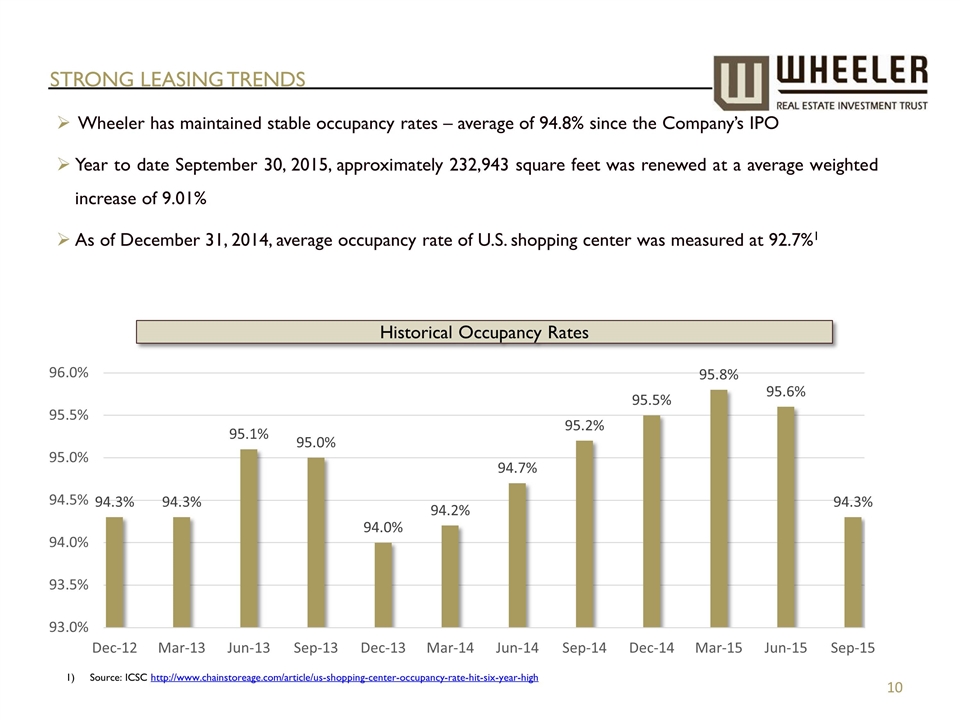

STRONG LEASING TRENDS Wheeler has maintained stable occupancy rates – average of 94.8% since the Company’s IPO Year to date September 30, 2015, approximately 232,943 square feet was renewed at a average weighted increase of 9.01% As of December 31, 2014, average occupancy rate of U.S. shopping center was measured at 92.7%1 Historical Occupancy Rates Source: ICSC http://www.chainstoreage.com/article/us-shopping-center-occupancy-rate-hit-six-year-high

Integrated Platform, Proven Success Wheeler has acquisition, leasing, property management, development and re-development services all in–house Over 50 associates Since the acquisition of Wheeler Development in January 2014, Wheeler has acquired ten undeveloped properties totaling approximately 79.5 acres of land and one redevelopment property. Development and leasing services generate significant fees from third-party contracts Extensive pipeline of third-party projects expected to break ground in 2015 and 2016 Company anticipates by year-end 2015, it will report approximately $75,000 - $150,000 in third party development fees and external leasing commissions Predecessor development segment developed nine properties in four states – seven are currently owned by Wheeler Asset Management Acquisitions & Development Leasing & Business Dev. The Shoppes at Eagle Harbor Developed by Wheeler Development in 2009 Corporate & Accounting

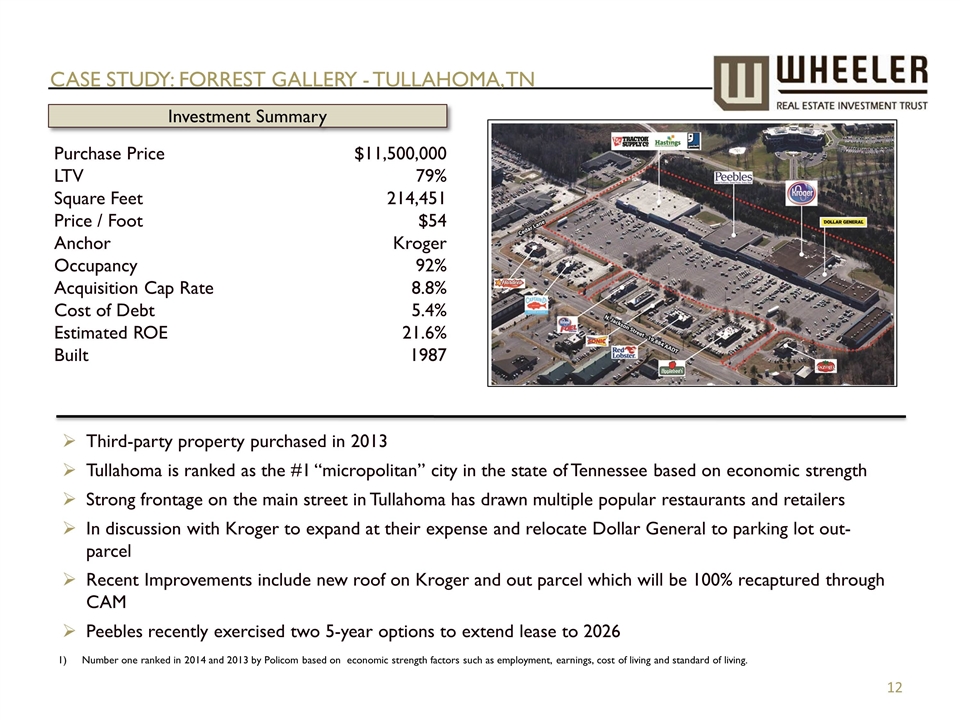

CASE STUDY: FORREST GALLERY - TULLAHOMA, TN Purchase Price LTV Square Feet Price / Foot Anchor Occupancy Acquisition Cap Rate Cost of Debt Estimated ROE Built $11,500,000 79% 214,451 $54 Kroger 92% 8.8% 5.4% 21.6% 1987 Third-party property purchased in 2013 Tullahoma is ranked as the #1 “micropolitan” city in the state of Tennessee based on economic strength Strong frontage on the main street in Tullahoma has drawn multiple popular restaurants and retailers In discussion with Kroger to expand at their expense and relocate Dollar General to parking lot out-parcel Recent Improvements include new roof on Kroger and out parcel which will be 100% recaptured through CAM Peebles recently exercised two 5-year options to extend lease to 2026 Number one ranked in 2014 and 2013 by Policom based on economic strength factors such as employment, earnings, cost of living and standard of living. Investment Summary

GROWTH STRATEGY Well located properties in secondary and tertiary markets High unlevered returns (expected cap rates of ~9%) Focus on best in market multi-tenant grocery-anchored centers with necessity-based inline tenants National & regional tenants High traffic count and ease of access Sale of non-core assets Ancillary & Specialty Income Opportunity to improve revenue through active lease and expense management Utilizing exterior parking for build to suit outparcels or pad sales Maximizing CAM reimbursement income available from existing leases Company utilizes strict underwriting guidelines and unique due diligence processes to identify key issues and uncover hidden opportunities with large potential upside

ACQUISITION UPDATE Beaver Ruin Village Year to date, the Company has closed on fifteen shopping centers for a total acquisition value of approximately $137.5 million at an average cap rate of 8.79%; an average interest rate of 4.25%; and, LTV of 55.5% In 2015, the Company acquired 4 raw land parcels totaling 15.9 acres and Columbia Fire Station, a 28,000 square foot redevelopment property Four properties under LOI or contract requiring equity investment of approximately $20 million at average cap rate of 8.27% with in place leases Company expects to use Key Bank facility for acquisition pipeline in fourth quarter At any given time, the Company is typically evaluating properties or negotiating LOI’s with total value of $75 -$100 million

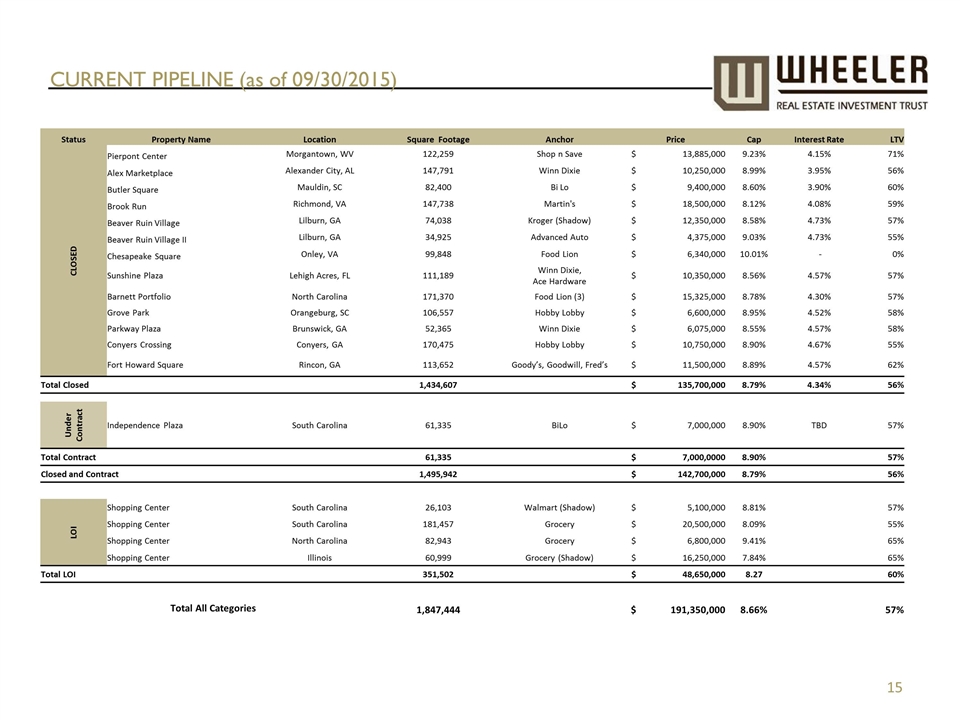

CURRENT PIPELINE (as of 09/30/2015) Status Property Name Location Square Footage Anchor Price Cap Interest Rate LTV CLOSED Pierpont Center Morgantown, WV 122,259 Shop n Save $ 13,885,000 9.23% 4.15% 71% Alex Marketplace Alexander City, AL 147,791 Winn Dixie $ 10,250,000 8.99% 3.95% 56% Butler Square Mauldin, SC 82,400 Bi Lo $ 9,400,000 8.60% 3.90% 60% Brook Run Richmond, VA 147,738 Martin's $ 18,500,000 8.12% 4.08% 59% Beaver Ruin Village Lilburn, GA 74,038 Kroger (Shadow) $ 12,350,000 8.58% 4.73% 57% Beaver Ruin Village II Lilburn, GA 34,925 Advanced Auto $ 4,375,000 9.03% 4.73% 55% Chesapeake Square Onley, VA 99,848 Food Lion $ 6,340,000 10.01% - 0% Sunshine Plaza Lehigh Acres, FL 111,189 Winn Dixie, Ace Hardware $ 10,350,000 8.56% 4.57% 57% Barnett Portfolio North Carolina 171,370 Food Lion (3) $ 15,325,000 8.78% 4.30% 57% Grove Park Orangeburg, SC 106,557 Hobby Lobby $ 6,600,000 8.95% 4.52% 58% Parkway Plaza Brunswick, GA 52,365 Winn Dixie $ 6,075,000 8.55% 4.57% 58% Conyers Crossing Conyers, GA 170,475 Hobby Lobby $ 10,750,000 8.90% 4.67% 55% Fort Howard Square Rincon, GA 113,652 Goody’s, Goodwill, Fred’s $ 11,500,000 8.89% 4.57% 62% Total Closed 1,434,607 $ 135,700,000 8.79% 4.34% 56% Under Contract Independence Plaza South Carolina 61,335 BiLo $ 7,000,000 8.90% TBD 57% Total Contract 61,335 $ 7,000,0000 8.90% 57% Closed and Contract 1,495,942 $ 142,700,000 8.79% 56% LOI Shopping Center South Carolina 26,103 Walmart (Shadow) $ 5,100,000 8.81% 57% Shopping Center South Carolina 181,457 Grocery $ 20,500,000 8.09% 55% Shopping Center North Carolina 82,943 Grocery $ 6,800,000 9.41% 65% Shopping Center Illinois 60,999 Grocery (Shadow) $ 16,250,000 7.84% 65% Total LOI 351,502 $ 48,650,000 8.27 60% Total All Categories 1,847,444 $ 191,350,000 8.66% 57%

INVESTMENT HIGHLIGHTS High Quality Existing Portfolio Attractive Niche Market Opportunity Internally-Managed, Scalable Platform Necessity-based Retail

Appendix

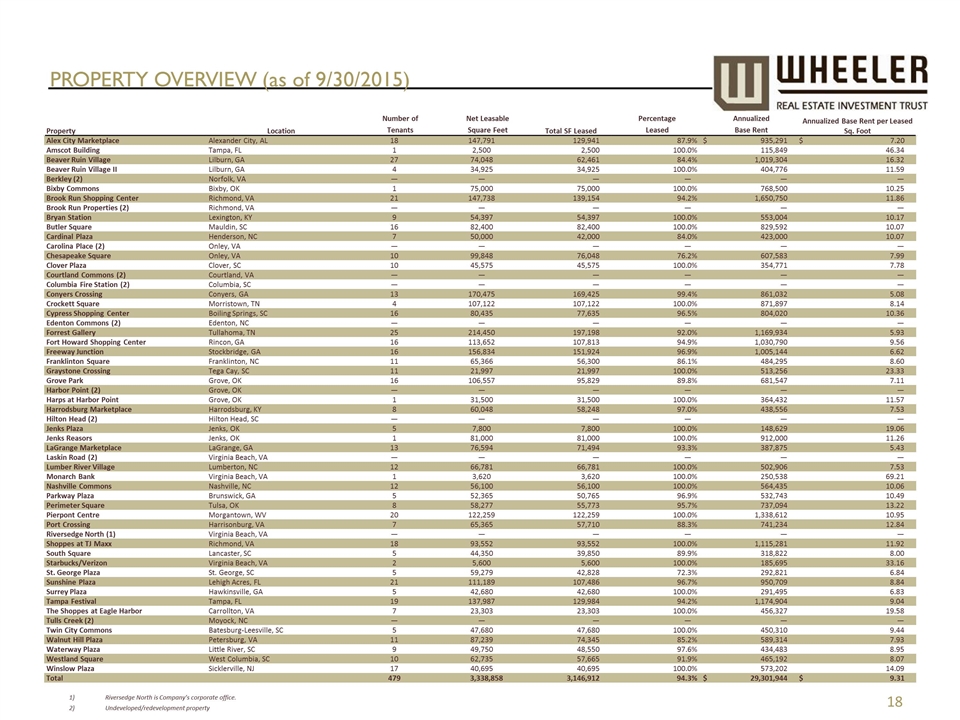

PROPERTY OVERVIEW (as of 9/30/2015) Riversedge North is Company’s corporate office. Undeveloped/redevelopment property Property Location Number of Tenants Net Leasable Square Feet Total SF Leased Percentage Leased Annualized Base Rent Annualized Base Rent per Leased Sq. Foot Alex City Marketplace Alexander City, AL 18 147,791 129,941 87.9 % $ 935,291 $ 7.20 Amscot Building Tampa, FL 1 2,500 2,500 100.0 % 115,849 46.34 Beaver Ruin Village Lilburn, GA 27 74,048 62,461 84.4 % 1,019,304 16.32 Beaver Ruin Village II Lilburn, GA 4 34,925 34,925 100.0 % 404,776 11.59 Berkley (2) Norfolk, VA — — — — — — Bixby Commons Bixby, OK 1 75,000 75,000 100.0 % 768,500 10.25 Brook Run Shopping Center Richmond, VA 21 147,738 139,154 94.2 % 1,650,750 11.86 Brook Run Properties (2) Richmond, VA — — — — — — Bryan Station Lexington, KY 9 54,397 54,397 100.0 % 553,004 10.17 Butler Square Mauldin, SC 16 82,400 82,400 100.0 % 829,592 10.07 Cardinal Plaza Henderson, NC 7 50,000 42,000 84.0 % 423,000 10.07 Carolina Place (2) Onley, VA — — — — — — Chesapeake Square Onley, VA 10 99,848 76,048 76.2 % 607,583 7.99 Clover Plaza Clover, SC 10 45,575 45,575 100.0 % 354,771 7.78 Courtland Commons (2) Courtland, VA — — — — — — Columbia Fire Station (2) Columbia, SC — — — — — — Conyers Crossing Conyers, GA 13 170,475 169,425 99.4 % 861,032 5.08 Crockett Square Morristown, TN 4 107,122 107,122 100.0 % 871,897 8.14 Cypress Shopping Center Boiling Springs, SC 16 80,435 77,635 96.5 % 804,020 10.36 Edenton Commons (2) Edenton, NC — — — — — — Forrest Gallery Tullahoma, TN 25 214,450 197,198 92.0 % 1,169,934 5.93 Fort Howard Shopping Center Rincon, GA 16 113,652 107,813 94.9 % 1,030,790 9.56 Freeway Junction Stockbridge, GA 16 156,834 151,924 96.9 % 1,005,144 6.62 Franklinton Square Franklinton, NC 11 65,366 56,300 86.1 % 484,295 8.60 Graystone Crossing Tega Cay, SC 11 21,997 21,997 100.0 % 513,256 23.33 Grove Park Grove, OK 16 106,557 95,829 89.8 % 681,547 7.11 Harbor Point (2) Grove, OK — — — — — — Harps at Harbor Point Grove, OK 1 31,500 31,500 100.0 % 364,432 11.57 Harrodsburg Marketplace Harrodsburg, KY 8 60,048 58,248 97.0 % 438,556 7.53 Hilton Head (2) Hilton Head, SC — — — — — — Jenks Plaza Jenks, OK 5 7,800 7,800 100.0 % 148,629 19.06 Jenks Reasors Jenks, OK 1 81,000 81,000 100.0 % 912,000 11.26 LaGrange Marketplace LaGrange, GA 13 76,594 71,494 93.3 % 387,875 5.43 Laskin Road (2) Virginia Beach, VA — — — — — — Lumber River Village Lumberton, NC 12 66,781 66,781 100.0 % 502,906 7.53 Monarch Bank Virginia Beach, VA 1 3,620 3,620 100.0 % 250,538 69.21 Nashville Commons Nashville, NC 12 56,100 56,100 100.0 % 564,435 10.06 Parkway Plaza Brunswick, GA 5 52,365 50,765 96.9 % 532,743 10.49 Perimeter Square Tulsa, OK 8 58,277 55,773 95.7 % 737,094 13.22 Pierpont Centre Morgantown, WV 20 122,259 122,259 100.0 % 1,338,612 10.95 Port Crossing Harrisonburg, VA 7 65,365 57,710 88.3 % 741,234 12.84 Riversedge North (1) Virginia Beach, VA — — — — — — Shoppes at TJ Maxx Richmond, VA 18 93,552 93,552 100.0 % 1,115,281 11.92 South Square Lancaster, SC 5 44,350 39,850 89.9 % 318,822 8.00 Starbucks/Verizon Virginia Beach, VA 2 5,600 5,600 100.0 % 185,695 33.16 St. George Plaza St. George, SC 5 59,279 42,828 72.3 % 292,821 6.84 Sunshine Plaza Lehigh Acres, FL 21 111,189 107,486 96.7 % 950,709 8.84 Surrey Plaza Hawkinsville, GA 5 42,680 42,680 100.0 % 291,495 6.83 Tampa Festival Tampa, FL 19 137,987 129,984 94.2 % 1,174,904 9.04 The Shoppes at Eagle Harbor Carrollton, VA 7 23,303 23,303 100.0 % 456,327 19.58 Tulls Creek (2) Moyock, NC — — — — — — Twin City Commons Batesburg-Leesville, SC 5 47,680 47,680 100.0 % 450,310 9.44 Walnut Hill Plaza Petersburg, VA 11 87,239 74,345 85.2 % 589,314 7.93 Waterway Plaza Little River, SC 9 49,750 48,550 97.6 % 434,483 8.95 Westland Square West Columbia, SC 10 62,735 57,665 91.9 % 465,192 8.07 Winslow Plaza Sicklerville, NJ 17 40,695 40,695 100.0 % 573,202 14.09 Total 479 3,338,858 3,146,912 94.3 % $ 29,301,944 $ 9.31

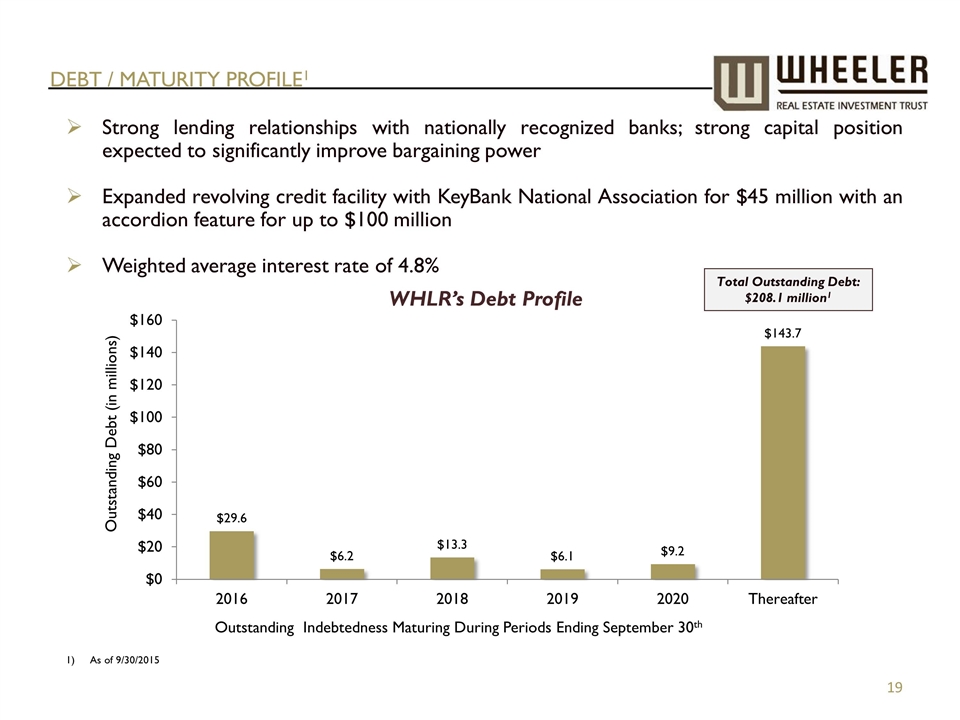

Strong lending relationships with nationally recognized banks; strong capital position expected to significantly improve bargaining power Expanded revolving credit facility with KeyBank National Association for $45 million with an accordion feature for up to $100 million Weighted average interest rate of 4.8% WHLR’s Debt Profile Debt / Maturity profile1 As of 9/30/2015 Total Outstanding Debt: $208.1 million1

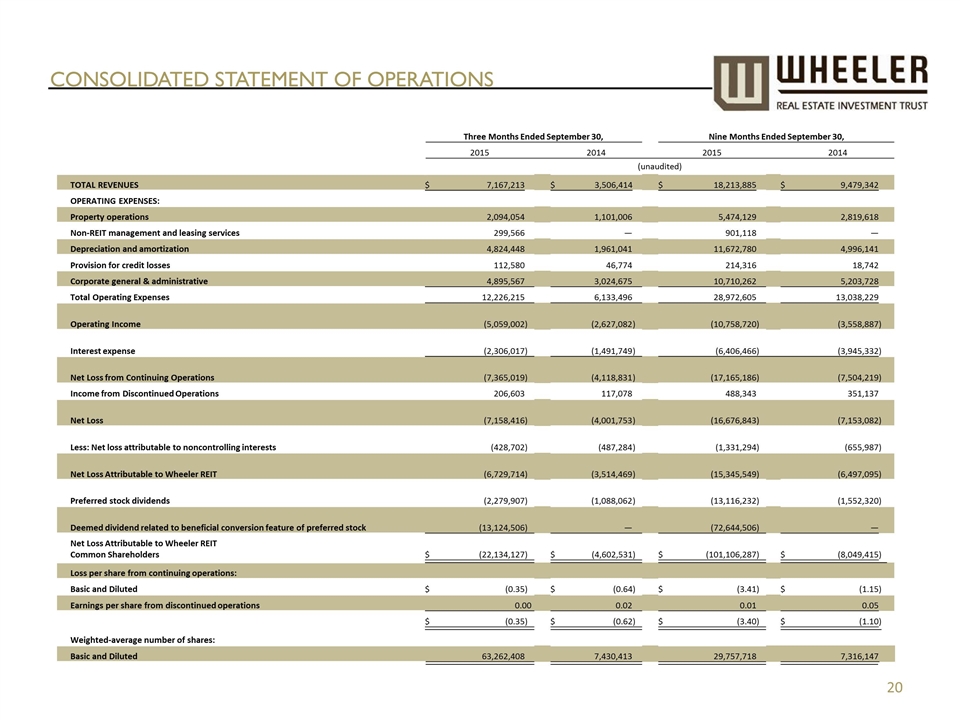

CONSOLIDATED STATEMENT OF OPERATIONS Three Months Ended September 30, Nine Months Ended September 30, 2015 2014 2015 2014 (unaudited) TOTAL REVENUES $ 7,167,213 $ 3,506,414 $ 18,213,885 $ 9,479,342 OPERATING EXPENSES: Property operations 2,094,054 1,101,006 5,474,129 2,819,618 Non-REIT management and leasing services 299,566 — 901,118 — Depreciation and amortization 4,824,448 1,961,041 11,672,780 4,996,141 Provision for credit losses 112,580 46,774 214,316 18,742 Corporate general & administrative 4,895,567 3,024,675 10,710,262 5,203,728 Total Operating Expenses 12,226,215 6,133,496 28,972,605 13,038,229 Operating Income (5,059,002 ) (2,627,082 ) (10,758,720 ) (3,558,887 ) Interest expense (2,306,017 ) (1,491,749 ) (6,406,466 ) (3,945,332 ) Net Loss from Continuing Operations (7,365,019 ) (4,118,831 ) (17,165,186 ) (7,504,219 ) Income from Discontinued Operations 206,603 117,078 488,343 351,137 Net Loss (7,158,416 ) (4,001,753 ) (16,676,843 ) (7,153,082 ) Less: Net loss attributable to noncontrolling interests (428,702 ) (487,284 ) (1,331,294 ) (655,987 ) Net Loss Attributable to Wheeler REIT (6,729,714 ) (3,514,469 ) (15,345,549 ) (6,497,095 ) Preferred stock dividends (2,279,907 ) (1,088,062 ) (13,116,232 ) (1,552,320 ) Deemed dividend related to beneficial conversion feature of preferred stock (13,124,506 ) — (72,644,506 ) — Net Loss Attributable to Wheeler REIT Common Shareholders $ (22,134,127 ) $ (4,602,531 ) $ (101,106,287 ) $ (8,049,415 ) Loss per share from continuing operations: Basic and Diluted $ (0.35 ) $ (0.64 ) $ (3.41 ) $ (1.15 ) Earnings per share from discontinued operations 0.00 0.02 0.01 0.05 $ (0.35 ) $ (0.62 ) $ (3.40 ) $ (1.10 ) Weighted-average number of shares: Basic and Diluted 63,262,408 7,430,413 29,757,718 7,316,147

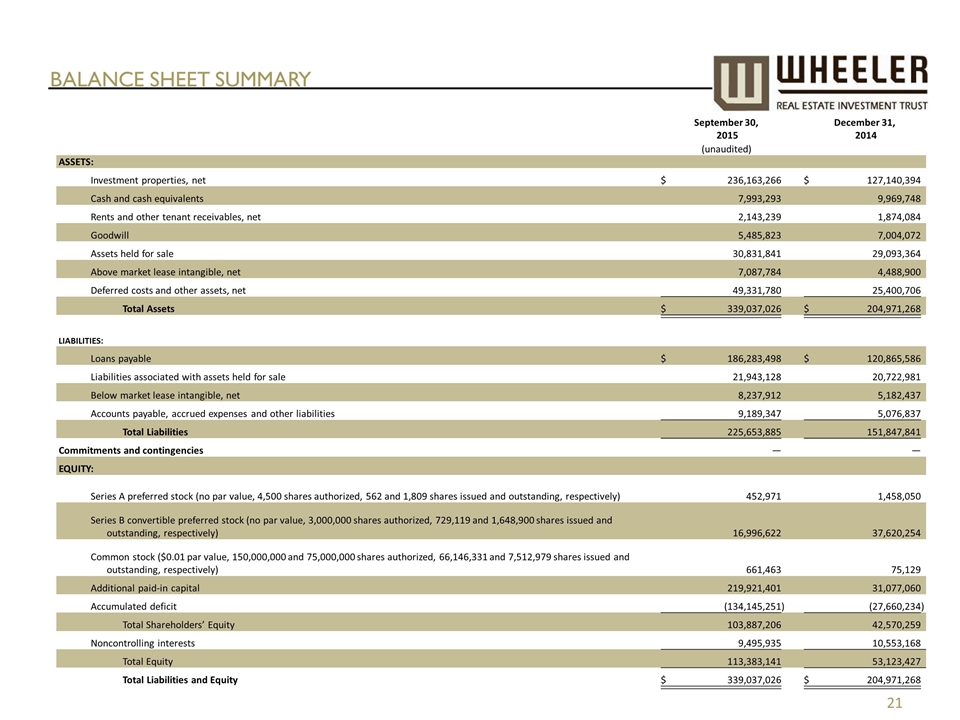

September 30, 2015 December 31, 2014 (unaudited) ASSETS: Investment properties, net $ 236,163,266 $ 127,140,394 Cash and cash equivalents 7,993,293 9,969,748 Rents and other tenant receivables, net 2,143,239 1,874,084 Goodwill 5,485,823 7,004,072 Assets held for sale 30,831,841 29,093,364 Above market lease intangible, net 7,087,784 4,488,900 Deferred costs and other assets, net 49,331,780 25,400,706 Total Assets $ 339,037,026 $ 204,971,268 LIABILITIES: Loans payable $ 186,283,498 $ 120,865,586 Liabilities associated with assets held for sale 21,943,128 20,722,981 Below market lease intangible, net 8,237,912 5,182,437 Accounts payable, accrued expenses and other liabilities 9,189,347 5,076,837 Total Liabilities 225,653,885 151,847,841 Commitments and contingencies — — EQUITY: Series A preferred stock (no par value, 4,500 shares authorized, 562 and 1,809 shares issued and outstanding, respectively) 452,971 1,458,050 Series B convertible preferred stock (no par value, 3,000,000 shares authorized, 729,119 and 1,648,900 shares issued and outstanding, respectively) 16,996,622 37,620,254 Common stock ($0.01 par value, 150,000,000 and 75,000,000 shares authorized, 66,146,331 and 7,512,979 shares issued and outstanding, respectively) 661,463 75,129 Additional paid-in capital 219,921,401 31,077,060 Accumulated deficit (134,145,251 ) (27,660,234 ) Total Shareholders’ Equity 103,887,206 42,570,259 Noncontrolling interests 9,495,935 10,553,168 Total Equity 113,383,141 53,123,427 Total Liabilities and Equity $ 339,037,026 $ 204,971,268 Balance sheet summary

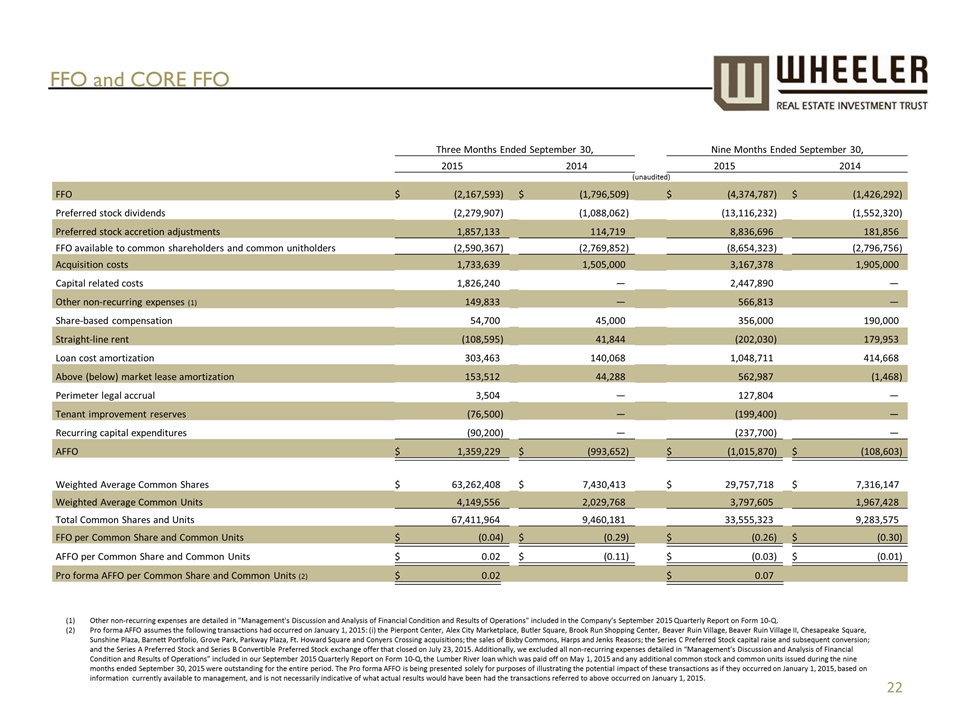

FFO and CORE FFO Other non-recurring expenses are detailed in "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in the Company’s September 2015 Quarterly Report on Form 10-Q. Pro forma AFFO assumes the following transactions had occurred on January 1, 2015: (i) the Pierpont Center, Alex City Marketplace, Butler Square, Brook Run Shopping Center, Beaver Ruin Village, Beaver Ruin Village II, Chesapeake Square, Sunshine Plaza, Barnett Portfolio, Grove Park, Parkway Plaza, Ft. Howard Square and Conyers Crossing acquisitions; the sales of Bixby Commons, Harps and Jenks Reasors; the Series C Preferred Stock capital raise and subsequent conversion; and the Series A Preferred Stock and Series B Convertible Preferred Stock exchange offer that closed on July 23, 2015. Additionally, we excluded all non-recurring expenses detailed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our September 2015 Quarterly Report on Form 10-Q, the Lumber River loan which was paid off on May 1, 2015 and any additional common stock and common units issued during the nine months ended September 30, 2015 were outstanding for the entire period. The Pro forma AFFO is being presented solely for purposes of illustrating the potential impact of these transactions as if they occurred on January 1, 2015, based on information currently available to management, and is not necessarily indicative of what actual results would have been had the transactions referred to above occurred on January 1, 2015. Three Months Ended September 30, Nine Months Ended September 30, 2015 2014 2015 2014 (unaudited) FFO $ (2,167,593 ) $ (1,796,509 ) $ (4,374,787 ) $ (1,426,292 ) Preferred stock dividends (2,279,907 ) (1,088,062 ) (13,116,232 ) (1,552,320 ) Preferred stock accretion adjustments 1,857,133 114,719 8,836,696 181,856 FFO available to common shareholders and common unitholders (2,590,367 ) (2,769,852 ) (8,654,323 ) (2,796,756 ) Acquisition costs 1,733,639 1,505,000 3,167,378 1,905,000 Capital related costs 1,826,240 — 2,447,890 — Other non-recurring expenses (1) 149,833 — 566,813 — Share-based compensation 54,700 45,000 356,000 190,000 Straight-line rent (108,595 ) 41,844 (202,030 ) 179,953 Loan cost amortization 303,463 140,068 1,048,711 414,668 Above (below) market lease amortization 153,512 44,288 562,987 (1,468 ) Perimeter legal accrual 3,504 — 127,804 — Tenant improvement reserves (76,500 ) — (199,400 ) — Recurring capital expenditures (90,200 ) — (237,700 ) — AFFO $ 1,359,229 $ (993,652 ) $ (1,015,870 ) $ (108,603 ) Weighted Average Common Shares $ 63,262,408 $ 7,430,413 $ 29,757,718 $ 7,316,147 Weighted Average Common Units 4,149,556 2,029,768 3,797,605 1,967,428 Total Common Shares and Units 67,411,964 9,460,181 33,555,323 9,283,575 FFO per Common Share and Common Units $ (0.04 ) $ (0.29 ) $ (0.26 ) $ (0.30 ) AFFO per Common Share and Common Units $ 0.02 $ (0.11 ) $ (0.03 ) $ (0.01 ) Pro forma AFFO per Common Share and Common Units (2) $ 0.02 $ 0.07

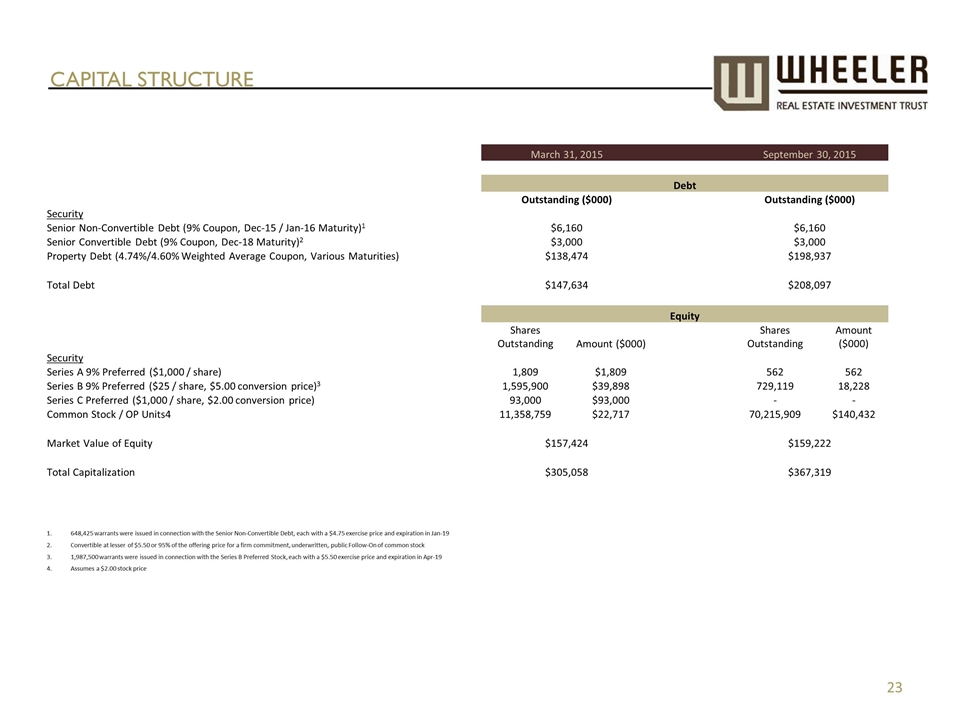

CAPITAL STRUCTURE March 31, 2015 September 30, 2015 Debt Outstanding ($000) Outstanding ($000) Security Senior Non-Convertible Debt (9% Coupon, Dec-15 / Jan-16 Maturity)1 $6,160 $6,160 Senior Convertible Debt (9% Coupon, Dec-18 Maturity)2 $3,000 $3,000 Property Debt (4.74%/4.60% Weighted Average Coupon, Various Maturities) $138,474 $198,937 Total Debt $147,634 $208,097 Equity Shares Outstanding Amount ($000) Shares Outstanding Amount ($000) Security Series A 9% Preferred ($1,000 / share) 1,809 $1,809 562 562 Series B 9% Preferred ($25 / share, $5.00 conversion price)3 1,595,900 $39,898 729,119 18,228 Series C Preferred ($1,000 / share, $2.00 conversion price) 93,000 $93,000 - - Common Stock / OP Units4 11,358,759 $22,717 70,215,909 $140,432 Market Value of Equity $157,424 $159,222 Total Capitalization $305,058 $367,319 648,425 warrants were issued in connection with the Senior Non-Convertible Debt, each with a $4.75 exercise price and expiration in Jan-19 Convertible at lesser of $5.50 or 95% of the offering price for a firm commitment, underwritten, public Follow-On of common stock 1,987,500 warrants were issued in connection with the Series B Preferred Stock, each with a $5.50 exercise price and expiration in Apr-19 Assumes a $2.00 stock price

NASDAQ: WHLR For Additional Information At the Company: Investor Relations Counsel: The Equity Group Inc. Robin Hanisch Corporate Secretary Robin@whlr.us 757-627-9088 Laura Nguyen Director of Capital Markets Laura@whlr.us 757-627-9088 Terry Downs Associate TDowns@equityny.com 212-836-9615 Adam Prior Senior Vice President APrior@equityny.com 212-836-9606 Think Retail. Think Wheeler.®